Invoice Template for Recruitment Agency Simplify Your Billing Process

Managing payments and billing can be a time-consuming and complex task for those working in the staffing industry. Without a standardized approach, handling financial transactions becomes prone to errors and delays. A well-structured document that simplifies this process is essential for maintaining professionalism and ensuring timely payments from clients.

Efficient financial management requires clear communication between service providers and their clients. This document should not only outline the agreed-upon amounts but also reflect the nature of the services provided, ensuring transparency and avoiding misunderstandings. By adopting a streamlined format, businesses can save valuable time and reduce administrative burdens.

Customized solutions help professionals cater to the unique needs of each client while keeping the process consistent. A simple, organized layout is key to maintaining a smooth workflow and improving overall client satisfaction. With the right approach, businesses can focus on what truly matters–delivering quality services and growing their operations.

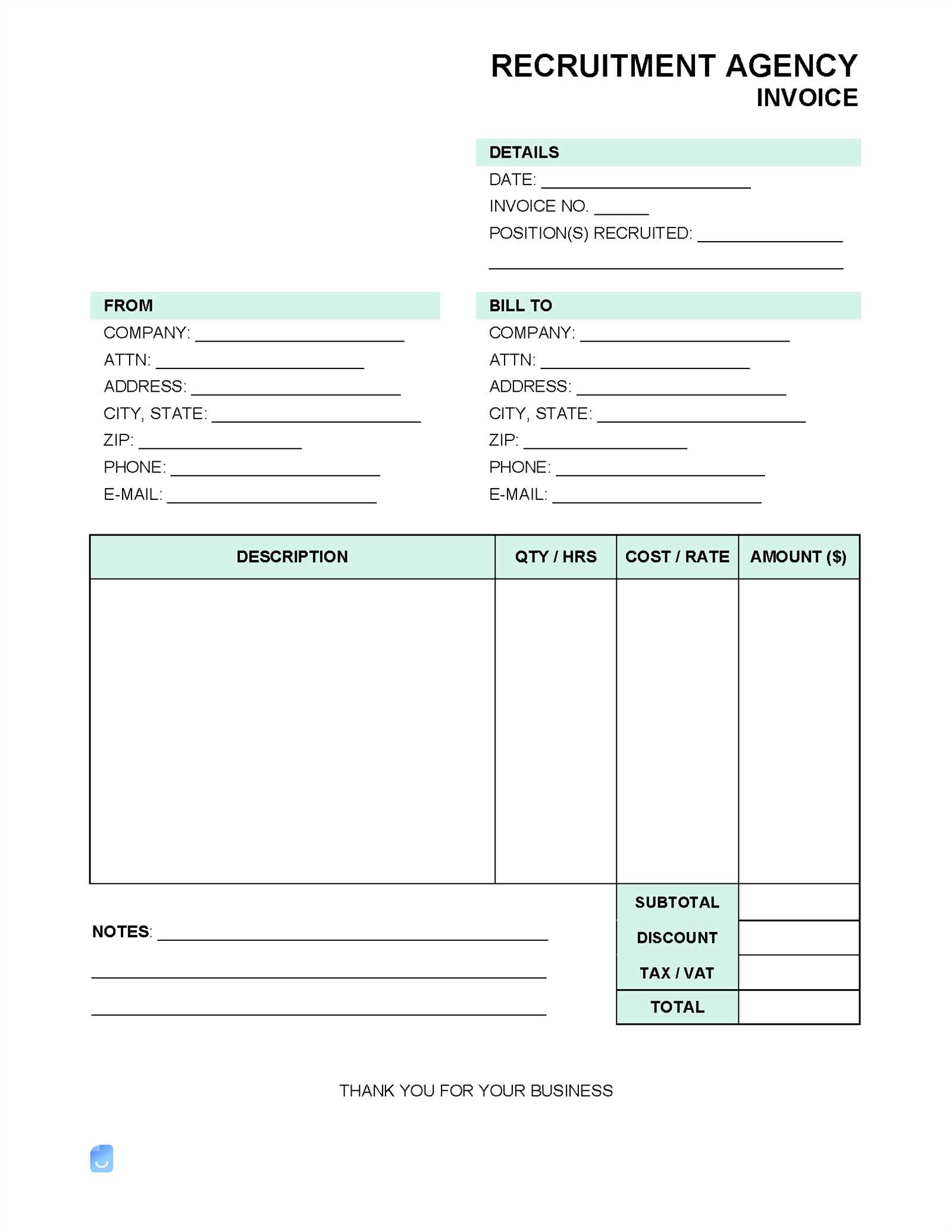

Invoice Document for Staffing Firms

When working with staffing businesses, having a standardized document for billing is essential to ensure clarity and professionalism. It allows companies to maintain a consistent process when requesting payment for services rendered. Such a document should be straightforward, clear, and easy to understand for both the service provider and the client.

Clear organization is crucial in creating a document that outlines services provided, payment terms, and due dates. The layout should be intuitive, making it simple for clients to review and process payments efficiently. This reduces the chances of errors and ensures smoother financial transactions.

Key Elements to Include

Each document should include vital details such as the total amount due, service description, payment deadlines, and contact information. Additional notes, like payment methods accepted or applicable taxes, can also be included to provide more transparency and prevent confusion.

Customizing the Document

While consistency is important, customization is equally valuable. Tailoring the format to reflect the specific needs of each client helps reinforce professionalism and build stronger relationships. It can also include personalized fields that correspond with unique business agreements or project terms.

Why Staffing Firms Need Custom Documents

Every business has its own unique way of operating, and when it comes to billing, a one-size-fits-all approach rarely works. Customizing financial documents helps businesses align with their clients’ specific needs and expectations. In the staffing industry, where the services provided can vary greatly from client to client, having a tailored document ensures accuracy and clarity in all transactions.

Customizing billing documents allows firms to reflect the complexity and details of each project or placement. This can include varying rates, service types, or payment terms, which might differ depending on the client’s requirements. By making adjustments, businesses can also stay compliant with any contractual obligations, taxes, or industry regulations.

| Standard Billing | Custom Billing |

|---|---|

| One size fits all | Tailored to each client’s needs |

| Generic terms | Clear terms that reflect the specific agreement |

| Flat rate or fixed fees | Variable fees, commission-based, or hourly rates |

| No room for personalization | Personalized fields for client-specific details |

Having a flexible billing structure can help streamline the overall process, prevent disputes, and foster long-term client relationships. By incorporating details unique to each service, staffing firms demonstrate attention to detail and a professional approach that enhances trust.

How to Create an Invoice for Staffing Services

Creating a billing document for staffing services requires careful attention to detail. The goal is to ensure that all aspects of the transaction are clearly outlined, making it easy for both the service provider and the client to understand. A well-constructed document helps avoid confusion, promotes transparency, and ensures timely payment for services rendered.

Steps to Create a Billing Document

- Start with Basic Information: Include your business name, address, and contact details, as well as the client’s information. This ensures both parties can be easily identified.

- Include a Unique Reference Number: Assigning a unique ID to each document will help you track payments and avoid duplication.

- List Services Provided: Detail the services delivered, including the type of staffing, duration, and any other relevant information.

- State the Payment Terms: Clearly outline the payment deadline, any late fees, and accepted methods of payment.

- Provide a Breakdown of Costs: If applicable, itemize the charges for each service or hour worked, ensuring the total amount is easily understood.

- Include Tax Information: Specify any taxes that apply based on your region or agreement with the client.

Additional Considerations

- Payment Instructions: Make sure to provide clear payment instructions, including bank account details or online payment links.

- Include Terms and Conditions: If necessary, add any specific terms related to cancellations, guarantees, or payment extensions.

- Review Before Sending: Double-check all details for accuracy before sending the document to ensure there are no errors that could delay payment.

By following these steps, you can create a clear, professional billing document that facilitates smooth transactions and maintains a strong working relationship with your clients.

Benefits of Using a Professional Billing Document

Utilizing a polished and standardized document for financial transactions offers several advantages for businesses in the staffing sector. A professional approach to managing payments not only improves the company’s image but also ensures that the billing process runs smoothly and efficiently. These benefits extend beyond just collecting payments–they help strengthen client relationships and build trust.

Key Advantages

- Enhanced Professionalism: A well-structured document reflects your business’s credibility and commitment to quality, making a positive impression on clients.

- Time Savings: Using a pre-designed format allows you to quickly generate documents, saving valuable time that can be focused on other aspects of the business.

- Improved Accuracy: By following a consistent format, you reduce the likelihood of errors, such as missing charges or incorrect details, which can cause confusion or delays.

- Clear Communication: A professional document ensures that the terms of the transaction, including services provided, rates, and deadlines, are clearly outlined for both parties.

- Easy Tracking and Organization: Standardized documents are easier to store and track, allowing for better organization of financial records.

Long-Term Benefits

- Faster Payment Processing: Clients are more likely to pay on time when they receive a clear, professional document outlining the agreed-upon terms.

- Consistency Across Transactions: A uniform approach to billing helps ensure that every client receives the same level of detail and care, regardless of the project.

- Strengthened Client Relationships: A well-crafted document can help demonstrate your business’s reliability and attention to detail, fostering long-term trust and loyalty.

Incorporating a professional billing system can significantly streamline operations, improve client satisfaction, and reduce administrative burdens, leading to more efficient business practices overall.

Understanding Billing Document Structure for Staffing Firms

Creating an effective document for billing purposes requires an understanding of its key components and how they interact. A well-structured financial document is more than just a request for payment–it serves as a clear record of the services provided, agreed-upon rates, and payment terms. For staffing firms, having a precise layout is crucial for maintaining transparency with clients and ensuring smooth transactions.

Key Elements of a Billing Document

- Header Information: This section includes the business name, address, and contact details, as well as the client’s information. It’s essential for both parties to be easily identifiable.

- Document Reference Number: A unique ID helps track each transaction and avoids confusion in future correspondence or payment tracking.

- Service Details: Clearly outline the nature of the services provided, including dates, hours worked, and specific roles filled or tasks performed. This ensures there is no ambiguity about what is being charged.

- Payment Breakdown: List all fees and charges associated with the service. If applicable, include separate line items for each service or task, along with their respective rates.

- Payment Terms: Specify the due date, late fees, and any early payment discounts to avoid misunderstandings and encourage prompt payment.

- Tax Information: Include the applicable tax rates based on your location and industry regulations, ensuring full compliance with legal requirements.

Organizing the Structure for Clarity

When structuring the document, prioritize clarity and simplicity. The easier it is for clients to read and understand, the more likely they are to pay on time. Using headings, bullet points, and clear sections helps break down the information in a digestible format. Keep the content concise but comprehensive, and make sure to include all relevant details to avoid confusion or delays.

By adhering to a consistent structure, businesses can create a clear and professional document that promotes effective communication and smooth payment processing.

Essential Information to Include on a Billing Document

When creating a billing document, it is crucial to ensure that all necessary information is included to avoid confusion and facilitate a smooth payment process. A complete and well-organized document not only helps clarify the transaction but also builds trust between the service provider and the client. By including all the relevant details, you ensure that there are no misunderstandings regarding the amount owed or the terms of payment.

Key Details to Include

- Business and Client Information: Both the service provider’s and the client’s full names, addresses, and contact information must be clearly listed. This ensures that the document is properly attributed and can be easily referenced later.

- Document Reference Number: A unique number helps keep track of individual transactions and provides a point of reference for both parties in case of inquiries or disputes.

- Description of Services: Be specific about the services provided, including the dates, duration, or number of hours worked, and any other relevant details about the tasks completed.

- Pricing Breakdown: Clearly list the fees associated with each service or task, including rates and quantities. This should provide a transparent overview of how the total amount was calculated.

- Payment Terms and Due Date: Specify when the payment is due, any late fees that may apply, and acceptable methods of payment. This helps set clear expectations and encourages timely settlement.

- Tax Information: If applicable, include the tax rates and the total tax amount, ensuring compliance with local tax laws and avoiding future issues.

Optional Information to Add

- Payment Instructions: Provide clients with clear instructions on how to make a payment, whether through bank transfer, check, or online payment options.

- Additional Terms and Conditions: If there are specific conditions related to payment, cancellations, or services rendered, it’s important to include them to avoid misunderstandings.

- Discounts or Special Offers: If applicable, note any discounts or special terms that were agreed upon with the client to ensure clarity regarding the final amount due.

By including these essential details, you can ensure that your billing document is comprehensive, professional, and easy for clients to process. A complete and clear document is key to maintaining positive business relationships and ensuring timely payments.

Choosing the Right Billing Format for Staffing Firms

Selecting the right structure for your financial documents is essential for maintaining consistency, professionalism, and clarity in transactions. The format you choose should align with your business model, ensuring that it effectively communicates the necessary details to your clients. Whether you are offering temporary placements, permanent hires, or other staffing solutions, the right format can streamline the billing process and reduce administrative time.

There are various formats to consider depending on the complexity of your services. A simple, straightforward layout may work for businesses offering a limited range of services, while more intricate arrangements may require detailed structures that break down different components like hourly rates, project fees, or commission structures.

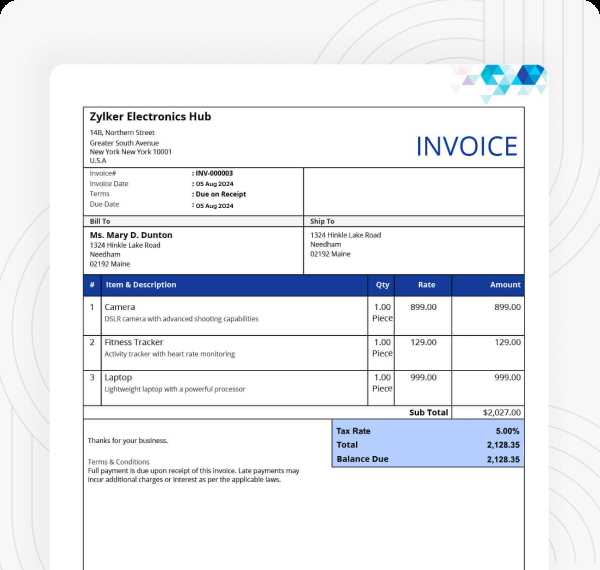

Types of Billing Formats

| Format Type | Description | Best For |

|---|---|---|

| Basic Layout | A simple, clean format with essential details like dates, services, and total fees. | Small staffing firms with straightforward service offerings. |

| Detailed Breakdown | A format that provides a line-item breakdown of various charges, including taxes and hourly rates. | Firms offering multiple types of staffing services or with complex pricing structures. |

| Project-Based Format | Focused on tracking multiple services over a longer period, with detailed project milestones and payments. | Agencies that manage long-term or large-scale staffing projects. |

| Recurring Payment Format | Designed for businesses that bill clients regularly on a set schedule, such as monthly payments. | Staffing firms offering ongoing placements or subscription-based services. |

Choosing the right format ultimately depends on the type of service you provide, the complexity of your payment structures, and the preferences of your clients. A well-organized format helps clients quickly understand charges, reducing the likelihood of disputes and improving the speed of payment processing. Whether you opt for a simple design or a more detailed layout, consistency is key to creating a professional and efficient system.

How to Personalize Your Billing Document

Customizing your financial documents to reflect your brand and meet the specific needs of each client can greatly enhance your professionalism and communication. Personalization goes beyond just adding your business name and logo–it involves adjusting the layout, details, and overall look to ensure that the document aligns with your services and strengthens client relationships. A tailored approach not only makes the document look more polished but also shows that you pay attention to detail.

Customizing the Layout

- Branding: Add your logo, business colors, and fonts to create a cohesive look that aligns with your overall branding. This helps create a professional image and makes the document easily recognizable to your clients.

- Header Information: Ensure that your business name, address, and contact details are clearly visible. Including a tagline or brief description of your services can also add a personal touch.

- Client-Specific Fields: Modify the document to include fields that reflect each client’s specific needs. For example, you can add client project numbers, unique service descriptions, or specific terms that are part of the agreement.

Adding Personal Notes and Details

- Custom Payment Instructions: Include special payment instructions or preferred methods that are specific to each client. This helps streamline the payment process and ensures that there is no confusion.

- Special Offers or Discounts: If applicable, offer personalized discounts or mention any special terms that apply to the client’s invoice. This shows that you value their business and encourages future collaboration.

- Personalized Message: Consider including a brief thank you note or a message tailored to the client’s project or service experience. A personal touch can go a long way in building stronger relationships.

Personalizing your billing documents not only makes them more professional but also demonstrates your commitment to providing high-quality services and paying attention to client needs. By customizing the layout, adding personal touches, and tailoring the content to each client, you create a more positive and memorable experience for those you work with.

Common Mistakes to Avoid in Billing Documents

While creating a billing document may seem straightforward, there are several common errors that can cause confusion or delay payments. These mistakes can negatively impact your professionalism and lead to misunderstandings with clients. By being aware of these pitfalls, you can create a more effective and reliable document that promotes timely payments and builds stronger client relationships.

Frequent Errors to Watch Out For

- Missing or Incorrect Contact Information: Failing to include accurate details for both your business and the client can lead to confusion and payment delays. Always double-check that names, addresses, and contact numbers are correct.

- Unclear Service Descriptions: Not providing a detailed breakdown of the services rendered can create misunderstandings about what is being charged. Be specific about the tasks completed, the duration, and any relevant terms to avoid ambiguity.

- Incorrect or Omitted Payment Terms: Not clearly stating when the payment is due or what methods are accepted can create unnecessary delays. Always include the due date, payment options, and any penalties for late payments to prevent confusion.

- Calculation Errors: Simple math mistakes, such as incorrect totals or missing charges, can significantly impact your bottom line. Always double-check your numbers and ensure that the totals are accurate.

- Failure to Include Taxes: Depending on the region and nature of the services, taxes may need to be applied. Failing to account for taxes or miscalculating them can lead to complications later. Always ensure that taxes are correctly calculated and clearly stated.

Additional Pitfalls to Avoid

- Lack of Consistency: Using inconsistent formats or layouts across different billing documents can confuse clients and give a disorganized impression. Use a standardized structure for all your documents to maintain professionalism.

- Leaving Out a Unique Reference Number: Not assigning a unique ID to each billing document can make tracking payments difficult and lead to lost records. Always include a reference number to easily identify each transaction.

- Not Proofreading: Sending a document with spelling errors, missing information, or confusing wording can make your business appear unprofessional. Always proofread before sending it to ensure everything is accurate and clear.

By avoiding these common mistakes, you can create a more efficient and professional process for managing financial transactions. Ensuring that all details are accurate and clearly communicated helps reduce the chance of delays or disputes, resulting in smoother client interactions and faster payments.

How Billing Documents Save Time for Recruiters

Creating detailed financial documents manually for every client can be a time-consuming task. However, by using a standardized structure, recruiters can streamline the billing process, saving time and minimizing the risk of errors. A pre-set format allows for quick customization, ensuring that the essential details are always included and the document looks professional. This efficiency not only helps recruiters focus on their core tasks but also ensures that clients receive accurate and timely billing information.

Time-Saving Benefits of Using a Pre-Designed Structure

- Consistency: A standard format ensures that every document follows the same structure, making it quicker to fill out. With a consistent layout, recruiters don’t have to spend time deciding what to include or how to organize the details for each client.

- Pre-Filled Information: Many formats allow for client details and pricing structures to be stored, so you only need to update the necessary fields. This saves time by eliminating the need to re-enter the same information for each transaction.

- Automatic Calculations: Some advanced formats include features like automatic total calculations and tax breakdowns, reducing manual calculations and minimizing errors.

- Faster Invoicing Process: With a ready-made structure, recruiters can quickly input project details, services rendered, and payment terms, allowing them to generate a document in just a few minutes.

- Reduced Administrative Work: By simplifying the process, recruiters can focus less on administrative tasks and more on their clients and placements, increasing overall productivity.

Additional Time-Saving Features

- Customization: While using a pre-designed format, recruiters can still make adjustments to match each client’s specific needs, allowing for personalized service without starting from scratch each time.

- Integration with Accounting Software: Many billing document formats can be integrated with accounting software, allowing for easy transfer of payment data and streamlined financial record-keeping.

- Improved Tracking: Using a consistent format helps recruiters track which payments have been sent, received, or are pending, saving time on follow-ups and manual tracking.

By adopting a ready-made structure, recruiters can significantly reduce the time spent on administrative tasks, ensuring they remain efficient and focused on serving clients and candidates. Whether it’s for generating client documents, tracking payments, or ensuring accuracy, using a streamlined approach improves overall productivity.

Best Practices for Sending Billing Documents to Clients

Effectively sending financial documents to clients is just as important as creating them. A well-organized and timely delivery process ensures that clients receive the necessary information to make prompt payments while maintaining a professional relationship. Implementing best practices for sending documents can reduce misunderstandings, minimize delays, and enhance client satisfaction.

Key Strategies for Efficient Delivery

- Send Documents Promptly: Always send the document as soon as the service or project is completed. Timely submission encourages clients to process the payment without unnecessary delays.

- Choose the Right Delivery Method: Ensure that you use the client’s preferred method for receiving billing information. Whether it’s via email, a secure client portal, or physical mail, consistency is key.

- Double-Check Accuracy: Before sending, carefully review the document for accuracy–check all the details, including dates, services provided, and totals. Mistakes can cause confusion and delay payment.

- Include Clear Payment Instructions: Clearly outline payment terms, due dates, and accepted methods. Clients should know exactly how and when to submit their payment, reducing the risk of delays.

- Use Professional Language: Keep the tone polite and professional. Avoid overly casual language or ambiguous terms that may cause confusion regarding payment expectations.

Additional Tips for Effective Billing Communication

- Follow Up Appropriately: If payment is not received by the due date, send a polite reminder with a copy of the original document. Timing is important, so ensure you follow up in a respectful and timely manner.

- Offer Multiple Payment Options: To make the payment process as easy as possible for your clients, offer a variety of payment methods, such as bank transfers, checks, or online payment platforms.

- Maintain Records: Keep a detailed record of all transactions, including when the documents were sent and whether payment has been received. This helps ensure transparency and avoids disputes in the future.

By following these best practices, you can improve the efficiency and professionalism of your billing process, leading to faster payments and stronger business relationships. Clear communication and prompt delivery of financial documents not only enhance client satisfaction but also help maintain a smooth flow of operations.

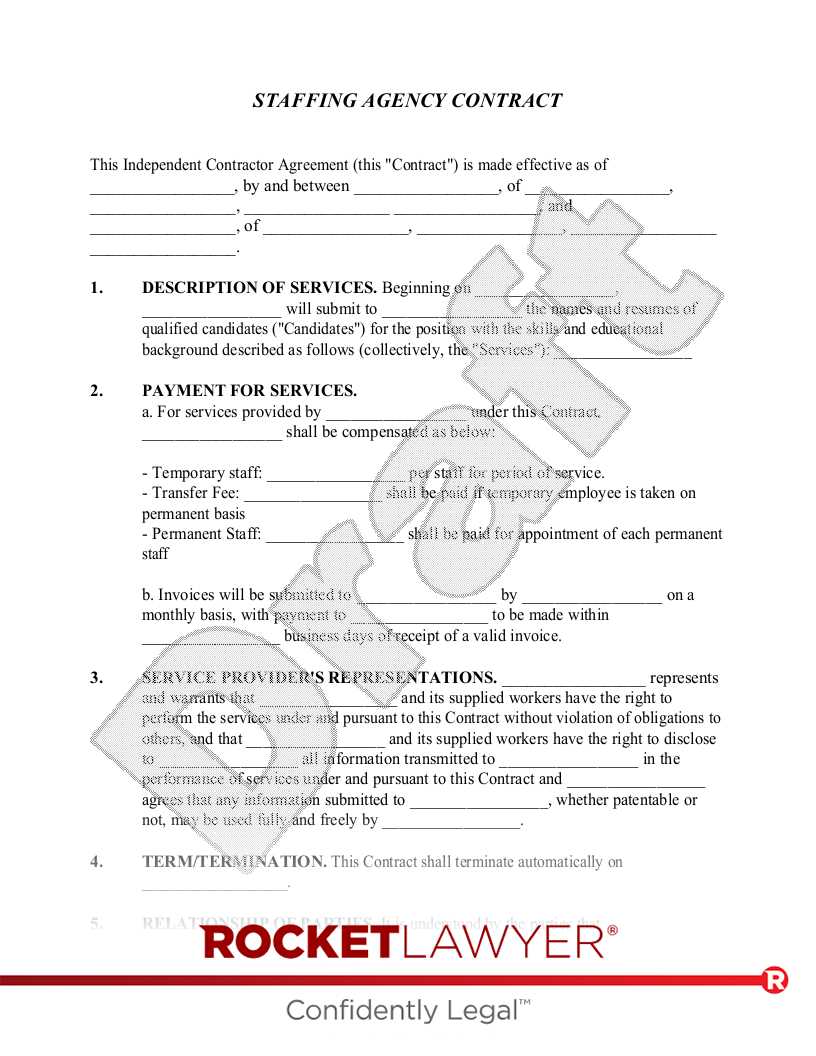

Legal Considerations When Creating Billing Documents

When preparing financial documents, it’s crucial to ensure they meet legal requirements to avoid any potential disputes or legal issues. These documents are not only a record of the transaction but also an essential tool in ensuring compliance with tax regulations, contractual obligations, and industry standards. Understanding the legal aspects of document creation can help protect your business and maintain a smooth working relationship with your clients.

Key Legal Elements to Include

| Element | Description |

|---|---|

| Client Information | Ensure the client’s full name or business name, address, and contact details are clearly stated. This helps establish the legal identity of both parties involved. |

| Tax Identification Numbers | Depending on the jurisdiction, you may be required to include your business’s tax ID and the client’s tax number. This is essential for tax reporting purposes. |

| Clear Payment Terms | Specify when payment is due, acceptable payment methods, and any late fees or penalties for overdue payments. This helps avoid legal disputes regarding delayed payments. |

| Service Description | Provide a detailed description of the services or products provided. This is vital for transparency and to avoid misunderstandings about the scope of work. |

| Legal Language and Compliance | Include any terms and conditions that are necessary under the law, such as refund policies, guarantees, or warranties. These clauses protect both you and your clients. |

Additional Legal Considerations

- Accuracy in Tax Calculations: Make sure to apply the correct tax rate and properly calculate any applicable sales tax or VAT. Incorrect tax calculations can result in legal penalties.

- Retention of Records: Keep accurate and complete records of all billing documents for the required duration as stipulated by local tax laws. This is necessary in case of an audit or tax review.

- Digital and Physical Formats: If you’re sending documents electronically, ensure they are legally acceptable in digital formats. Certain jurisdictions may require physical signatures or specific file types for documents to be valid.

- Jurisdiction Clauses: If your business operates in multiple regions, include a clause specifying the legal jurisdiction under which the agreement and any disputes will be governed.

By following these legal considerations, you ensure that your billing documents comply with applicable laws, which not only protects your business but also fosters trust with your clients. Clear legal terms and proper documentation create a solid foundation for future transactions and help

Integrating Billing Documents with Your Accounting System

Integrating your financial documents with an accounting system can significantly streamline your business operations. By automating the process of recording transactions and tracking payments, you reduce the chances of errors and save time on manual data entry. This integration ensures that your accounting system stays up-to-date with the latest transactions and provides an accurate overview of your financial health. With seamless synchronization, you can focus more on growing your business while maintaining clear financial records.

Benefits of Integration

- Improved Accuracy: Automatic data entry reduces the risk of human errors, ensuring that the financial records are always accurate and up-to-date.

- Time Savings: Automating the transfer of data means less manual work, allowing you to focus on other critical tasks such as client management and business growth.

- Real-Time Tracking: By linking your billing system with your accounting software, you can instantly track payments, monitor overdue amounts, and generate up-to-date financial reports.

- Better Cash Flow Management: With integrated systems, you can get an immediate view of outstanding payments, which helps in forecasting and managing cash flow more effectively.

- Reduced Administrative Burden: With automatic record-keeping, you no longer need to manually input every transaction, which simplifies the management of your finances and reduces administrative overhead.

How to Integrate Your Billing System

- Choose Compatible Software: Select accounting software that is compatible with your billing system. Popular options like QuickBooks, Xero, or FreshBooks offer seamless integrations with various billing platforms.

- Set Up Automation: Once your systems are connected, configure automated data transfers between your billing software and accounting platform. This step ensures that all new transactions are immediately recorded without manual intervention.

- Link Client Information: Ensure that client details, including payment terms and pricing, are consistently transferred to your accounting system. This minimizes data duplication and ensures that your records are always aligned.

- Monitor and Adjust Settings: Regularly review the integration settings to ensure the process is functioning smoothly. If any issues arise, quickly address them to avoid discrepancies in your financial records.

By linking your billing system with your accounting software, you can save time, improve financial visibility, and ensure that your records are always accurate. This integration not only improves efficiency but also provides you with the insights needed to make informed business decisions and maintain a healthy cash flow.

How to Handle Billing Disputes in Recruitment

Disputes over billing can arise in any business, and they often present challenges in maintaining a positive relationship with clients. In the context of staffing services, discrepancies may occur due to misunderstandings regarding payment terms, the scope of services provided, or the agreed-upon rates. Handling such disputes professionally and efficiently is crucial to preserving client trust while ensuring your business gets paid fairly. By addressing these issues promptly, you can turn potential conflicts into opportunities for clearer communication and stronger partnerships.

Steps to Resolve Billing Disputes

- Stay Calm and Professional: Approach the situation with a calm and professional demeanor. It’s important not to react emotionally to the dispute. Listen carefully to the client’s concerns and make sure you fully understand the issue before proceeding.

- Review the Agreement: Start by reviewing the terms of the contract or agreement you made with the client. Ensure that both parties are clear about the services provided, agreed-upon prices, and payment terms. This will be the foundation of your resolution.

- Examine the Billing Document: Double-check the financial document in question to ensure that all details–such as rates, hours, services, and payment terms–are correct. Mistakes or misinterpretations are not uncommon, and resolving these errors quickly can help smooth over the situation.

- Communicate Clearly: Reach out to the client to discuss the issue. Be transparent and provide them with any supporting documentation, such as contracts or service agreements, that clarify the situation. A direct conversation can often clear up misunderstandings more effectively than written correspondence alone.

Handling Specific Dispute Scenarios

| Scenario | Action |

|---|---|

| Disagreement on Scope of Services | Clarify the scope of services provided by referring to the original agreement. If additional services were rendered outside of the agreement, be prepared to explain how they justify the additional charges. |

| Incorrect Billing Amount | Review the calculation of the charges, ensuring the rates, hours, or project details are accurate. If an error is found, issue a corrected document promptly. |

| Late Payment Disputes | Revisit the payment terms outlined in the contract, including deadlines and penalties for late payments. Be firm yet polite in reminding the client of these terms. |

Preventing Future Disputes

- Clear Communication: Ensure both parties are fully aligned on expectations from the start. Establish clear terms and conditions in contracts and make sure clients understand payment schedules and policies upfront.

- Maintain Documentation: Keep thorough records of all communications, agreements, and transactions. This will serve as a reference if a dispute arises in the future.

- Regular Check-ins: Regularly check in with clients during the course of a project to ensure satisfaction and prevent issues from escalating into larger disputes later on.

Disputes are a natural part of business, but addressing them swiftly and professionally helps build long-term relationships with clients. By following these best practices, you can handle billing disagreements with confidence and ensure t

Tracking Payments with Billing Documents

Keeping track of payments is essential for maintaining a healthy cash flow and ensuring your business operations run smoothly. By organizing and documenting transactions effectively, you can stay on top of outstanding balances and monitor which clients have paid or are overdue. This process is not only critical for your accounting records but also for fostering clear communication with clients and ensuring timely payments.

How to Effectively Track Payments

Integrating payment tracking into your billing workflow helps you maintain accurate records and avoid missing any critical financial updates. Here’s how you can efficiently monitor payments:

- Record Payment Dates: Always include the payment due date and the date when payment was received. This helps you monitor whether clients are adhering to payment schedules and identify any overdue payments quickly.

- Highlight Payment Status: Make sure that each document clearly indicates the payment status, whether it’s “paid,” “pending,” or “overdue.” This provides an immediate overview of the financial standing of your clients.

- Include Transaction Details: Keep track of specific transaction details, such as amounts paid, payment methods (bank transfer, cheque, online payment), and any deductions or discounts applied. This information will be helpful if there are any questions or disputes about the payments later on.

- Maintain a Running Balance: Include a running balance on each document to show how much remains to be paid. This helps both you and the client keep track of what has been paid and what is still owed.

Using Payment Tracking Tools

Many accounting tools and software platforms offer built-in features to help track payments automatically. Integrating your billing system with an accounting platform can help streamline this process:

- Automated Reminders: Set up automatic reminders for upcoming payments or overdue balances to prompt clients about upcoming or missed payments.

- Payment Logs: Use software that logs payments as they are made, allowing you to easily track each payment and automatically update the balance.

- Client Dashboards: Some platforms allow clients to access a dashboard where they can view their payment history and outstanding balances, which reduces the need for frequent inquiries and ensures transparency.

By adopting efficient tracking practices and using tools to automate this process, you can ensure accurate, up-to-date records, reduce the likelihood of missed payments, and strengthen your financial management practices.

Free vs Paid Billing Solutions for Businesses

When it comes to choosing a solution for managing payment requests and financial documentation, businesses have two primary options: free or paid options. Both types offer different levels of functionality and customization, making it essential to understand the advantages and limitations of each. The choice between free and premium solutions will depend on your business needs, budget, and the complexity of your operations.

Advantages of Free Billing Solutions

- Cost-Effective: Free solutions are ideal for businesses that are just starting out or those with a limited budget. They offer essential features without any upfront costs.

- Basic Functionality: Most free options include basic features such as customizable fields, due dates, and payment tracking, which are often enough for small to medium-sized businesses with straightforward needs.

- Easy to Use: Many free options are simple to set up and use. They don’t require a steep learning curve and are often suitable for users without advanced technical skills.

- No Long-Term Commitment: Free solutions often don’t require long-term contracts, so you can try them out without any financial obligation. If your needs change, you can switch to a different solution at any time.

Benefits of Paid Billing Solutions

- Advanced Features: Paid solutions offer additional features such as automatic payment reminders, integrated payment gateways, advanced analytics, and client management tools. These features can improve efficiency and help businesses grow.

- Customization Options: Premium options often allow greater customization, enabling you to tailor the solution to your business’s unique needs. You can create professional documents with your branding and adjust them to fit various service agreements.

- Customer Support: With paid services, you often receive customer support, ensuring that you can resolve any issues or technical difficulties quickly and efficiently.

- Scalability: As your business grows, paid solutions typically offer greater scalability. You can add more features, users, and integrations as needed to support the increased complexity of your operations.

Which Option is Right for You?

- Free Solutions: Best for businesses with straightforward billing needs and limited budgets. If you’re just getting started or only need basic features, a free solution may be sufficient.

- Paid Solutions: Ideal for growing businesses that need advanced features, more customization, and customer support. If you need to handle large volumes of transactions or require specialized functionality, a paid solution may be the better choice.

Ultimately, the decision between free and paid solutions comes down to the size and scope of your business. While free options can work well for smaller operations, investing in a paid solution can offer significant long-term benefits as your business expands and your needs evolve.