Professional Invoice Template for Photography Businesses

Running a creative business requires more than just talent behind the lens or brush; it also involves handling the administrative side efficiently. One essential aspect of this process is organizing and managing client transactions in a clear and professional manner. Proper documentation of services provided helps ensure smooth financial operations and reduces the risk of misunderstandings with clients.

Whether you’re working on a one-time project or maintaining ongoing relationships with clients, having a structured method to request payments is crucial. Creating clear and well-organized documents not only shows professionalism but also ensures that both parties are on the same page regarding terms, services, and payment schedules.

By choosing the right format and tools for creating these records, you can save time, reduce errors, and keep your focus on delivering excellent work. A well-designed document simplifies tracking finances, improves communication with clients, and fosters trust. Additionally, customizing these forms to suit your business model can enhance their effectiveness and convenience.

Invoice Template for Photography

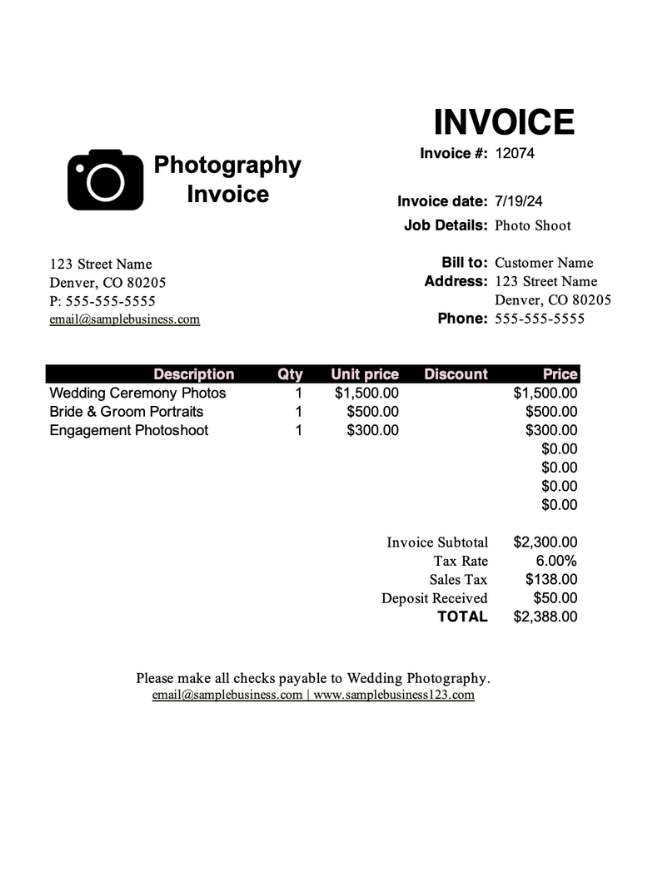

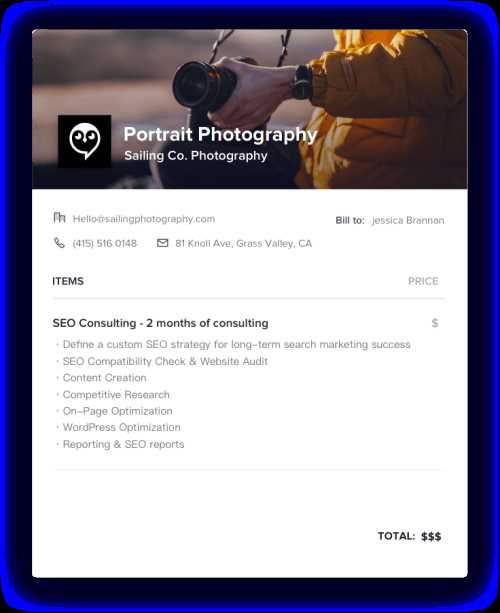

Creating a well-organized document to request payment for your creative services is a key part of running a successful business. A professional-looking record helps you maintain transparency with clients and ensures that all important details, such as pricing, services rendered, and payment terms, are clearly outlined. Having a customizable form allows you to maintain consistency and save time on every project.

Key Features to Include

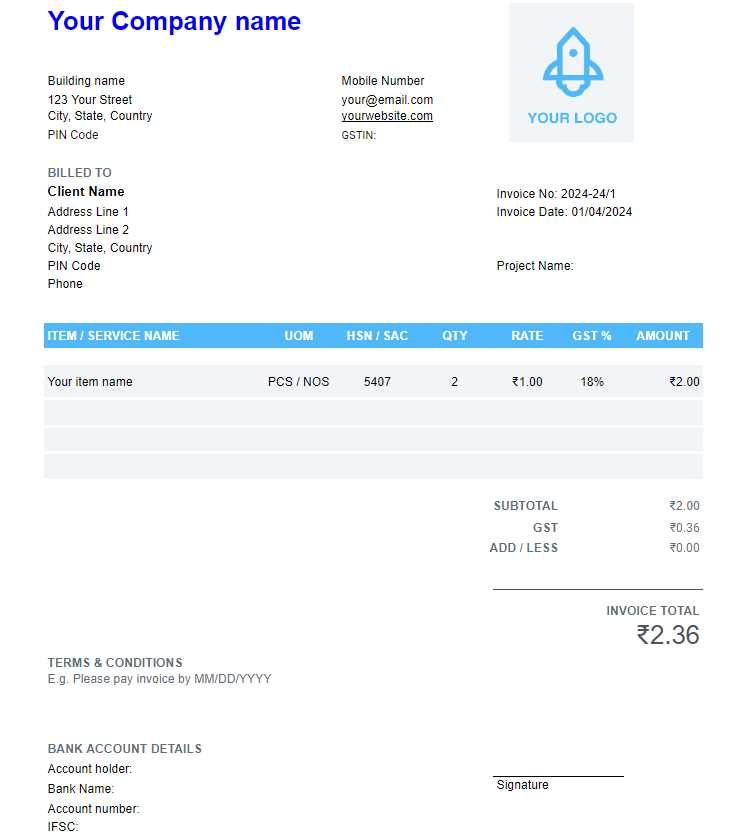

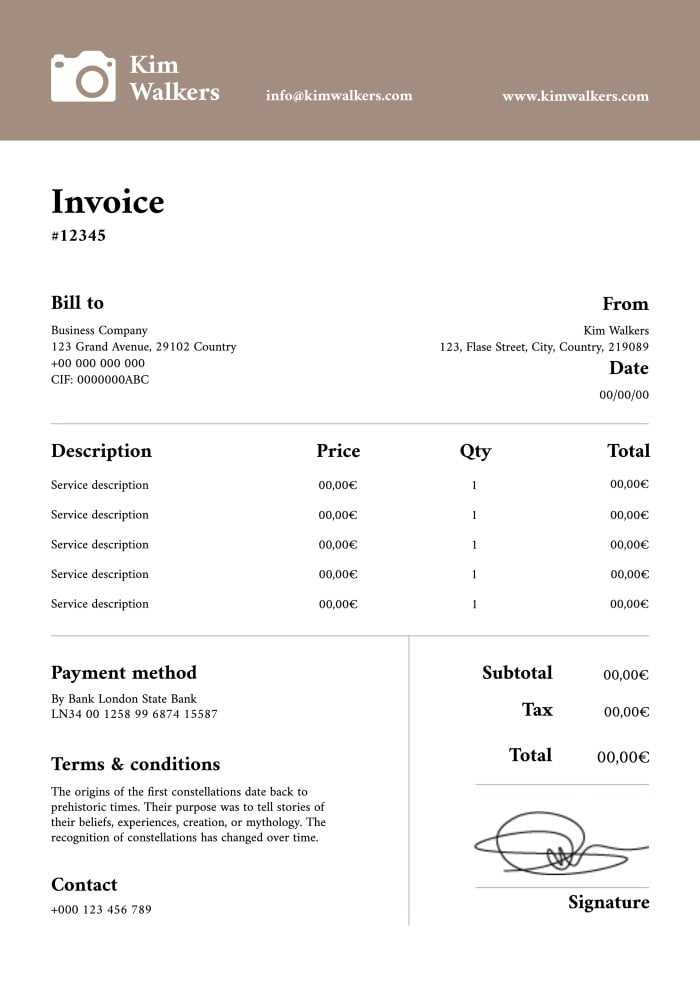

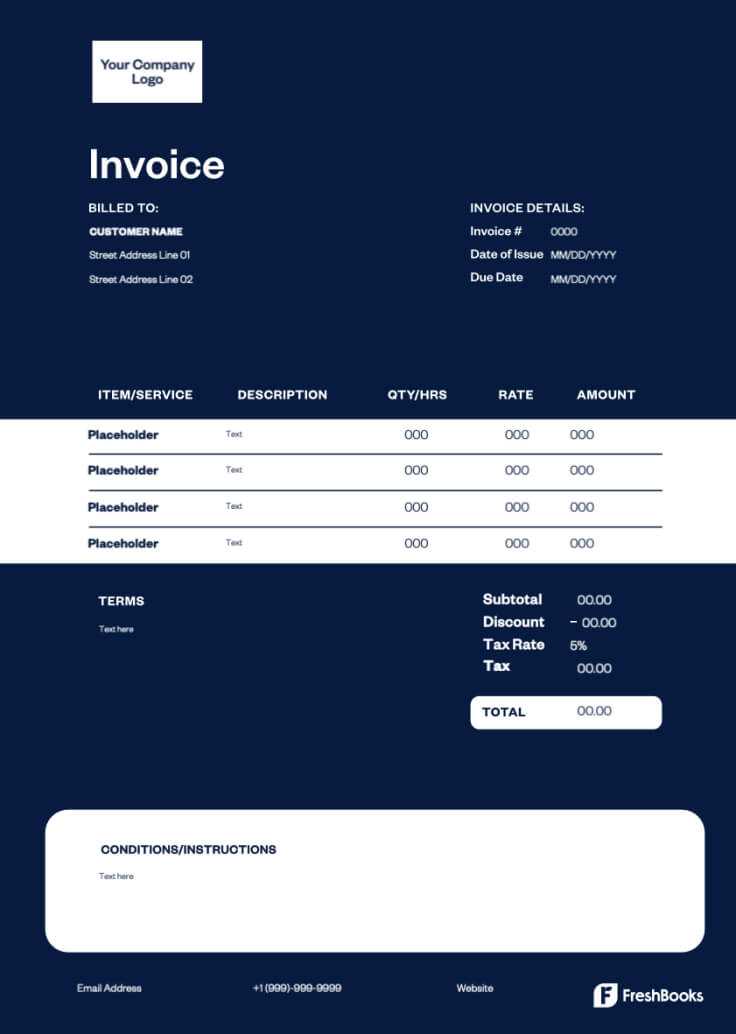

When designing a payment request document, several important elements should be present. These include a clear breakdown of services, the agreed-upon price, contact information for both parties, and any applicable taxes. Additionally, it’s crucial to have space for payment terms, including deadlines and accepted methods of payment. The format should be easy to read and follow, so clients can quickly understand the details and proceed with the transaction.

Customization Options for Your Business

Each creative business has unique needs, so it’s important to personalize your payment requests to fit your style and workflow. Customization can include adding your logo, adjusting the layout to match your branding, and including specific fields that reflect your service offerings. Whether you’re handling single projects or long-term contracts, personalizing these documents ensures that they align with your business needs and enhances your professional image.

Why Photographers Need Professional Invoices

Running a creative business involves much more than capturing moments through the lens. Managing payments and maintaining clear records of services provided are essential for maintaining smooth financial operations. A professional approach to billing ensures clarity and builds trust with clients, making it easier to handle transactions and avoid misunderstandings.

Benefits of Clear Payment Documentation

Having a properly structured record can offer several key advantages:

- Improved Professionalism: A well-designed document showcases your business as organized and trustworthy.

- Clear Payment Terms: Clearly stating payment amounts, deadlines, and methods helps avoid confusion and late payments.

- Legal Protection: A formal document serves as a legal record in case of disputes or misunderstandings.

- Better Financial Tracking: Organized payment requests help track income and expenses more effectively.

Essential Components of a Professional Record

To ensure your billing process runs smoothly, it’s crucial to include the following elements in every payment request:

- Client and Business Information: Names, contact details, and addresses for both parties.

- Detailed Service Breakdown: Clear description of the work completed or services provided.

- Payment Terms: Clear indication of payment amounts, due dates, and acceptable methods of payment.

- Tax Information: If applicable, include taxes to ensure compliance with local laws.

By incorporating these features, photographers can ensure that each transaction is handled professionally and efficiently, reinforcing their credibility with clients.

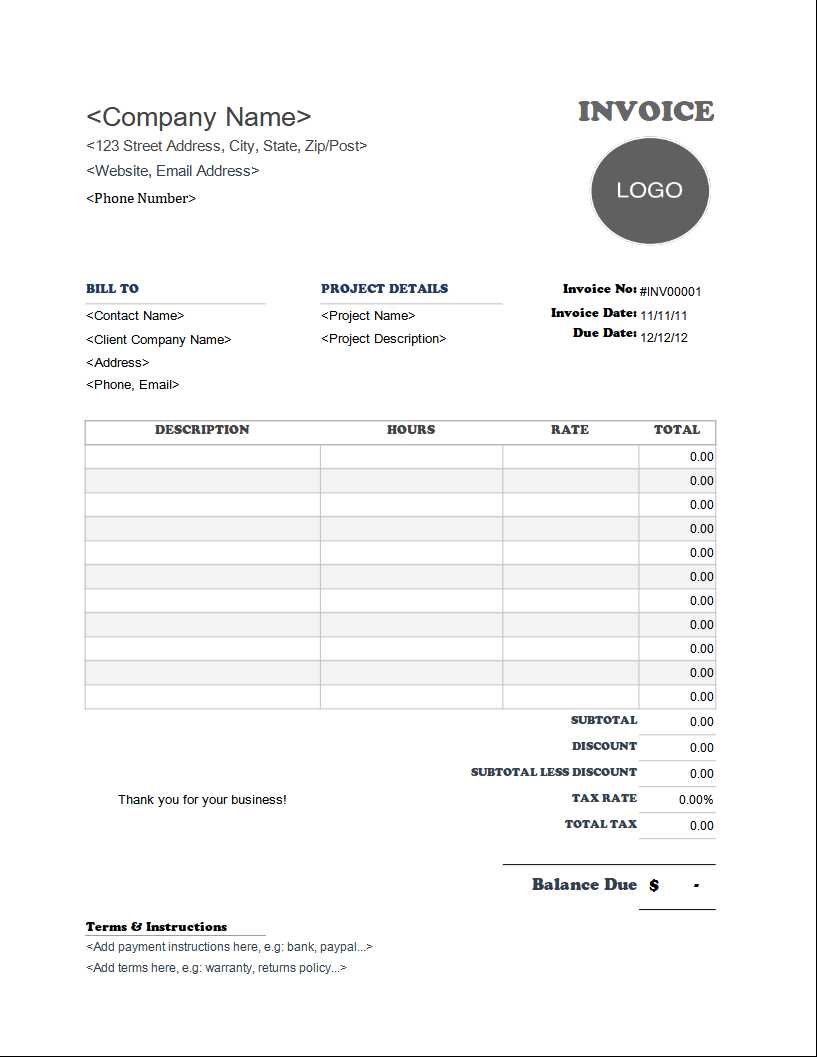

How to Customize Your Photography Invoice

Customizing your payment request forms ensures they reflect your brand and the specific services you offer. A personalized document not only makes your business appear more professional but also streamlines the billing process by aligning with your unique needs. Whether you’re working with individual clients or large projects, tailoring each form can enhance client experience and simplify financial tracking.

Here are key elements to consider when customizing your payment request:

| Element | Customization Tips |

|---|---|

| Business Branding | Include your logo, business name, and colors to match your brand identity. |

| Service Breakdown | Adjust the description of services to fit the specific work completed for each client. |

| Payment Terms | Set clear payment due dates, including any late fees or early payment discounts. |

| Client Details | Ensure each document has accurate and updated contact information for both parties. |

| Additional Notes | Leave space for any custom messages, like thank-you notes or reminders for upcoming sessions. |

By personalizing these key elements, you ensure that each request reflects your professionalism while also meeting the specific needs of your business.

Key Elements to Include in Your Invoice

Creating a clear and effective payment request document requires attention to detail. Including the right elements ensures that your clients understand the services provided and the terms of payment. Properly structured forms help avoid confusion, improve client satisfaction, and keep your financial records organized.

Important Information to Include

Here are the key details that should always be included:

- Client and Business Details: Names, contact information, and addresses of both parties.

- Unique Identification Number: A reference number for easy tracking and future correspondence.

- Service Description: A detailed list of the work completed, including quantities, hours worked, and rates.

- Payment Terms: Clear statements of due dates, payment methods, and any late fees.

- Tax Information: Relevant taxes applied to the total amount if applicable.

Additional Optional Components

To make the request even more personalized and effective, consider adding the following:

- Discounts or Promotions: If applicable, include any special offers or discounts applied to the total amount.

- Thank-You Note: A brief message expressing gratitude for the client’s business can strengthen your relationship.

- Payment Instructions: Detailed instructions on how to make payments, especially if using non-traditional methods.

By incorporating these essential elements, you ensure that your request is professional, transparent, and easy to understand for your clients.

Free vs Paid Photography Invoice Templates

When managing financial transactions in your creative business, choosing the right kind of payment request form is crucial. Both free and paid options offer different advantages, depending on your needs. While free options might seem appealing due to their zero cost, paid solutions often come with additional features that can streamline your processes and offer a more professional appearance.

Below is a comparison of the key differences between free and paid options:

| Feature | Free Options | Paid Options |

|---|---|---|

| Customization | Basic customization options | Advanced customization, branding, and unique design |

| Functionality | Limited features, often missing advanced options | Full range of features, including automatic calculations and tax integration |

| Support | Minimal or no support | Access to customer service and technical support |

| Security | Basic, often lacks encryption or privacy features | Enhanced security features, including encrypted payment systems |

| Additional Features | Mostly lacks automation and accounting integrations | Automation tools, reporting features, and accounting system integration |

Ultimately, the choice between free and paid options depends on the scale of your business and the level of professionalism you aim to present. If you’re just starting or have minimal needs, free tools may suffice. However, as your business grows, investing in paid solutions can help save time and reduce errors while providing a polished, streamlined experience for your clients.

Best Software for Photography Invoices

Choosing the right software to manage your payment requests can greatly enhance your efficiency and professionalism. With the right tools, you can automate processes, reduce errors, and keep your financial records organized. The best software options offer a combination of ease of use, customization, and integration with other business systems.

Top Features to Look For

When selecting software, consider the following features:

- Customization Options: The ability to add your logo, adjust layouts, and tailor documents to your branding.

- Automation: Automated calculations for totals, taxes, and discounts can save time and reduce mistakes.

- Client Management: Tools to easily track clients, projects, and payment history.

- Payment Integration: The ability to accept payments directly through the software or via integrated systems.

- Security: Ensuring that your documents and financial data are securely stored and shared.

Popular Software Options

Here are some of the best software tools for managing payment requests in your creative business:

- FreshBooks: Known for its easy-to-use interface and strong automation features, perfect for small businesses.

- QuickBooks: Offers a complete financial management suite, including invoicing, accounting, and payroll functions.

- Zoho Invoice: Provides excellent customization options, and integrates well with other Zoho business tools.

- Square: Ideal for those who need integrated payment solutions alongside invoicing features.

Each of these platforms can help streamline your billing process, but it’s essential to choose the one that best fits your business needs and workflow.

Design Tips for a Professional Look

Creating a visually appealing and professional-looking payment request is an essential part of building trust with your clients. The design should reflect your business identity while ensuring clarity and ease of use. A well-structured document not only makes a positive impression but also helps clients understand the terms quickly, making the process smoother for everyone.

Here are some key design tips to enhance the professionalism of your documents:

- Keep It Clean and Simple: Avoid clutter. A clean, straightforward design makes the document easier to read and understand.

- Use Your Branding: Incorporate your logo, colors, and fonts to maintain consistency with your overall business identity.

- Prioritize Readability: Use legible fonts, and ensure there is enough white space to make each section clear. Avoid overly decorative fonts that can be hard to read.

- Structure and Organization: Organize the content logically. Start with your business details, followed by the client’s info, the services provided, and payment terms. Use headings, bullet points, and tables to break up the text.

- Highlight Important Information: Make key details such as payment amount, due date, and instructions stand out using bold text or larger font sizes.

- Ensure Consistent Alignment: Keep text and columns aligned to maintain a neat and professional layout.

By following these simple design tips, you can create documents that not only look polished but also ensure smooth communication with your clients.

Understanding Invoice Terms and Language

Clear communication is key when it comes to financial documentation. Knowing and using the correct terminology ensures that both you and your clients are on the same page regarding services, payments, and terms. Understanding these terms will not only help you present your documents professionally but also help avoid confusion or misunderstandings during transactions.

Essential Terms to Know

Here are some commonly used terms you should be familiar with when creating billing documents:

- Due Date: The date by which the payment must be made to avoid late fees or penalties.

- Subtotal: The total amount for services rendered before taxes and additional charges are added.

- Taxes: Any applicable tax rates applied to the services provided, based on local laws or regulations.

- Balance Due: The total amount owed, including taxes, after any deposits or prepayments have been deducted.

- Terms and Conditions: The rules or agreements regarding payment, including late fees, accepted payment methods, and other contractual obligations.

Why Language Matters

Using precise language ensures clarity and reduces the risk of disputes. Ambiguity or incorrect terms can cause delays or confusion. For example, terms like “net 30” (meaning payment is due within 30 days) or “deposit required” should be defined clearly to avoid misunderstandings. Being consistent with your wording also helps your clients know exactly what to expect, creating a smooth transaction process.

By mastering the key terms and language used in financial documentation, you can ensure professional and transparent communication with your clients.

How to Track Payments with Invoices

Efficiently tracking payments is a crucial part of managing your finances and ensuring that your business stays organized. By using detailed billing documents, you can keep a clear record of all amounts owed and paid. Proper tracking also helps you avoid missed payments, reduces the risk of disputes, and ensures that your cash flow remains consistent.

Key Strategies for Payment Tracking

Here are some effective strategies to help you track payments:

- Unique Reference Numbers: Assign a unique number to each document. This helps you quickly locate and reference any specific transaction.

- Mark Paid Status: Clearly indicate the payment status on your document–whether it’s “Paid,” “Pending,” or “Overdue.” This can be done by including a payment section where you update the status after receiving payment.

- Record Payment Methods: Always specify how the payment was made (e.g., credit card, bank transfer, check, cash). This information is essential for both your records and your client’s reference.

- Keep a Payment Log: Maintain a separate log, spreadsheet, or database where you record all payments received. Include details such as the amount paid, payment method, and the date of payment.

Using Automation Tools

If you want to streamline your payment tracking, consider using automation tools that can sync with your billing software. Many platforms automatically mark payments as received once a transaction is processed, providing real-time updates. They can also send reminders for overdue payments and generate reports for your financial overview.

By staying organized and making use of the right tracking methods, you can ensure that every transaction is accounted for, keeping your business operations running smoothly.

Importance of Clear Payment Instructions

Clear and straightforward payment instructions are essential to ensuring timely payments and smooth transactions. When clients know exactly how to pay, it eliminates confusion and reduces the chances of delays or errors. By clearly outlining the payment process, you also establish professionalism and demonstrate that you value your clients’ time and money.

Why Clear Instructions Matter

Providing explicit payment guidelines helps both you and your clients in various ways:

- Prevents Misunderstandings: Clear instructions leave no room for confusion about how and when the payment should be made.

- Speeds Up Payment Process: When clients know exactly what to do, they are more likely to make payments promptly without needing to reach out for clarification.

- Reduces Errors: Properly defined steps lower the risk of mistakes, such as sending the wrong amount or using the wrong payment method.

- Establishes Professionalism: A detailed, easy-to-follow process shows clients that you are organized and serious about your business.

Essential Elements of Payment Instructions

To make your payment instructions as clear as possible, include the following details:

- Payment Methods Accepted: Specify whether you accept credit cards, bank transfers, checks, or other forms of payment.

- Payment Due Date: Clearly state when the payment should be made and any penalties for late payments.

- Bank or Payment Details: Include necessary information like bank account numbers, PayPal addresses, or other payment system details.

- Currency and Amount: Be specific about the amount due and the currency used, especially if you work with international clients.

- Payment Reference: Encourage clients to include a specific reference number or code when making payments for easier tracking.

By providing precise instructions, you can help clients complete the payment process quickly and correctly, leading to fewer disputes and a more efficient workflow.

Handling Taxes on Photography Invoices

When managing financial documents, it’s crucial to account for taxes correctly. Whether you’re working with individuals or businesses, understanding how to apply the right tax rate is essential for staying compliant with local and international tax laws. Properly handling taxes ensures that your documents reflect accurate pricing and helps avoid any legal complications related to underpayment or incorrect billing.

Types of Taxes to Consider

Taxes on creative services, like those related to visual work, can vary greatly depending on the location and type of service provided. Some common taxes you may need to account for include:

- Sales Tax: A tax applied to the sale of goods and services. Rates and regulations vary by state or country.

- Value-Added Tax (VAT): A consumption tax applied to services provided at each stage of production, common in many European countries.

- Service Tax: A tax specific to services offered in certain regions, which may differ based on the nature of the service.

- Local Taxes: Taxes applied by cities or regions, often based on where the work is performed or where the business is registered.

How to Include Taxes on Your Documents

Including taxes correctly on your financial documents can help maintain transparency and clarity for your clients. Below is an example of how to include taxes in your documents:

| Description | Amount | Tax Rate | Tax Amount | Total |

|---|---|---|---|---|

Pho

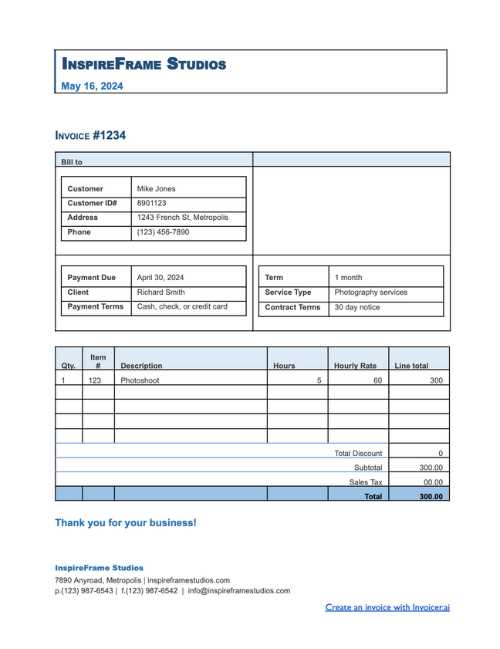

Invoicing for Different Photography ServicesWhen offering various types of visual work, it’s important to tailor your financial documents to reflect the unique aspects of each service. Whether you’re capturing weddings, portraits, events, or commercial projects, each category of service requires a slightly different approach to billing. This ensures that your clients are clear about what they are being charged for and helps you maintain professional standards across all your transactions. Wedding and Event Photography

For large events like weddings or corporate gatherings, pricing can often vary depending on the duration, location, and complexity of the shoot. Common considerations for billing these services include:

Portraits and Studio SessionsFor studio work, like family portraits or headshots, pricing can be more straightforward, but still requires careful breakdown. Here are some key components to include:

Commercial and Product PhotographyWhen dealing with businesses and product photography, billing can become more complex due to the varying scope of work. Consider these factors when drafting financial documents:

By customizing your charges and breakdowns according to the service provided, you ensure clarity in your financial communications and establish a fair pricing structure for each type of visual work. This approach not only helps maintain professionalism but also makes s How to Send Photography Invoices EfficientlySending financial documents to clients in a timely and organized manner is essential for maintaining a smooth workflow and ensuring that you get paid promptly. To achieve efficiency, it’s important to streamline your process and adopt methods that save both time and effort. Below are some practical strategies for sending billing statements efficiently while maintaining professionalism and accuracy. Use Digital Tools for Easy DeliveryIn the digital age, manual methods of sending financial statements are quickly becoming outdated. Leveraging online tools can greatly improve your efficiency. Here are some ways digital solutions can streamline the process:

Clearly Communicate Payment Terms

To avoid confusion and ensure smooth transactions, it’s important to clearly outline the payment terms in your financial documents. This includes the due date, accepted payment methods, and any late fees that might apply. Consider these key points when drafting your communications:

Track Your Transactions and Follow UpEfficient tracking and follow-up are key elements in maintaining cash flow. Keeping an eye on paid and unpaid accounts helps you stay organized. Here’s how you can stay on top of your transactions:

|