How to Use an Invoice Template for Numbers on iPad

Managing financial transactions and keeping track of payments is a crucial part of any business. With the right tools, it becomes much easier to generate accurate and professional-looking records. Whether you’re a freelancer or a small business owner, having a streamlined process for creating and managing your bills is essential for success.

Modern applications offer simple solutions to handle these tasks efficiently. By using customizable options, you can design documents that not only reflect your brand but also keep everything organized. This can save you significant time, allowing you to focus on other important aspects of your work.

With the help of easy-to-use features, you can ensure that every bill is clear, precise, and tailored to meet your specific needs. From adjusting details like fonts and colors to adding unique elements, the flexibility of these tools makes it simple to create documents that truly represent your business.

How to Create an Invoice on iPad

Creating detailed and accurate financial documents on a mobile device has never been easier. With a few simple steps, you can generate professional records directly from your tablet, streamlining the billing process and reducing the time spent on manual entries. This method is ideal for those who need to quickly prepare and send out payment requests while on the go.

Step 1: Open Your Preferred App

Begin by launching the app that offers customizable document options. Many apps provide easy-to-use tools that allow you to create and adjust your documents as needed. Once the app is open, start a new document and select the type of layout that best fits your needs.

Step 2: Add Key Information

After selecting your layout, it’s time to input essential details. This includes client information, service or product descriptions, and pricing. Make sure to adjust the font size and formatting to ensure clarity and professionalism.

| Field | Description |

|---|---|

| Client Name | Enter the full name of your client. |

| Item/Service Description | Describe the items or services provided. |

| Amount | Specify the cost for each item or service. |

| Due Date | Set the payment deadline. |

Once you’ve filled in the necessary fields, review the document to ensure all details are correct. You can also customize the layout further by adding your business logo or adjusting the color scheme to match your branding.

Finally, save the document in the desired format and send it directly to your client, or store it for future reference. With these simple steps, creating and managing your financial documents has never been more convenient.

Using Numbers for Invoice Management

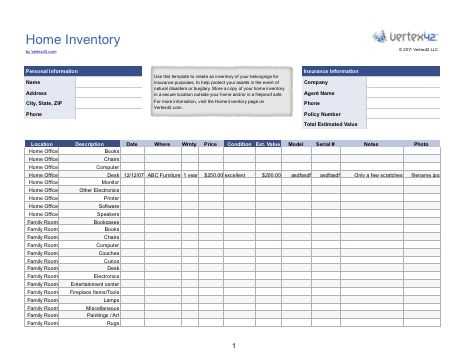

Managing your financial records efficiently is key to maintaining a smooth workflow. One of the most effective ways to handle this is by utilizing spreadsheet applications that offer customizable options for creating and organizing your billing documents. With the right tools, you can automate calculations, track payments, and maintain professional communication with clients.

By leveraging the features of a popular spreadsheet app, you can simplify the process of handling your payment requests and financial summaries. The flexibility of the app allows you to design documents tailored to your needs, making it easier to stay on top of transactions.

Benefits of Using a Spreadsheet Application

- Customizable layouts to suit your needs

- Automatic calculation of totals, taxes, and discounts

- Efficient tracking of payment status

- Easy to update and manage multiple clients

- Ability to store and retrieve documents at any time

Steps to Manage Financial Documents

- Create a new document and choose a suitable layout.

- Input client details, including the services provided and their corresponding prices.

- Use built-in functions to calculate totals and taxes automatically.

- Track the payment status of each record by updating it accordingly.

- Save and organize your documents in folders for easy access and retrieval.

With this approach, managing your business finances becomes much more streamlined. You can focus on providing quality services while ensuring that your billing system is efficient and professional.

Benefits of Digital Invoicing on iPad

Switching to digital documentation offers significant advantages for managing financial records. By using a tablet device, you can streamline the process of creating, sending, and tracking payment requests from anywhere. This not only saves time but also ensures a more organized and efficient system for handling business transactions.

With a portable solution, you can instantly generate professional documents without the need for paper or additional equipment. The ability to customize and adjust your files on the go allows you to stay flexible and responsive to clients’ needs.

Key Advantages of Digital Billing

- Increased Efficiency: Easily create, edit, and send records within minutes.

- Cost Savings: Eliminate the need for paper, ink, and physical storage.

- Eco-friendly: Reduce your business’s environmental impact by going paperless.

- Real-time Updates: Make immediate adjustments to records as changes occur.

- Access Anywhere: Manage your financial documents from any location with your tablet.

- Professional Appearance: Produce clean, clear, and branded records that represent your business well.

Improved Organization and Tracking

- Store all documents digitally for easy access and reference.

- Track payment status, set reminders for overdue amounts, and update records in real-time.

- Sync files across devices, ensuring access to your documents from multiple locations.

By embracing a digital approach, businesses can greatly enhance their efficiency while maintaining a high level of professionalism. The convenience and benefits of managing your records on a tablet device make this method an ideal choice for many entrepreneurs and small business owners.

Customize Your Invoice Template in Numbers

Personalizing your financial documents allows you to reflect your brand’s identity while ensuring all necessary details are included. The flexibility of spreadsheet applications makes it easy to adjust layouts, colors, and fonts to create documents that are not only functional but also aligned with your business style. Customization ensures your records stand out and communicate professionalism to your clients.

By modifying elements within the document, you can tailor it to suit your needs, whether you’re adjusting the layout to highlight certain details or changing the design to match your business branding. This way, each record you generate is unique and instantly recognizable as part of your brand.

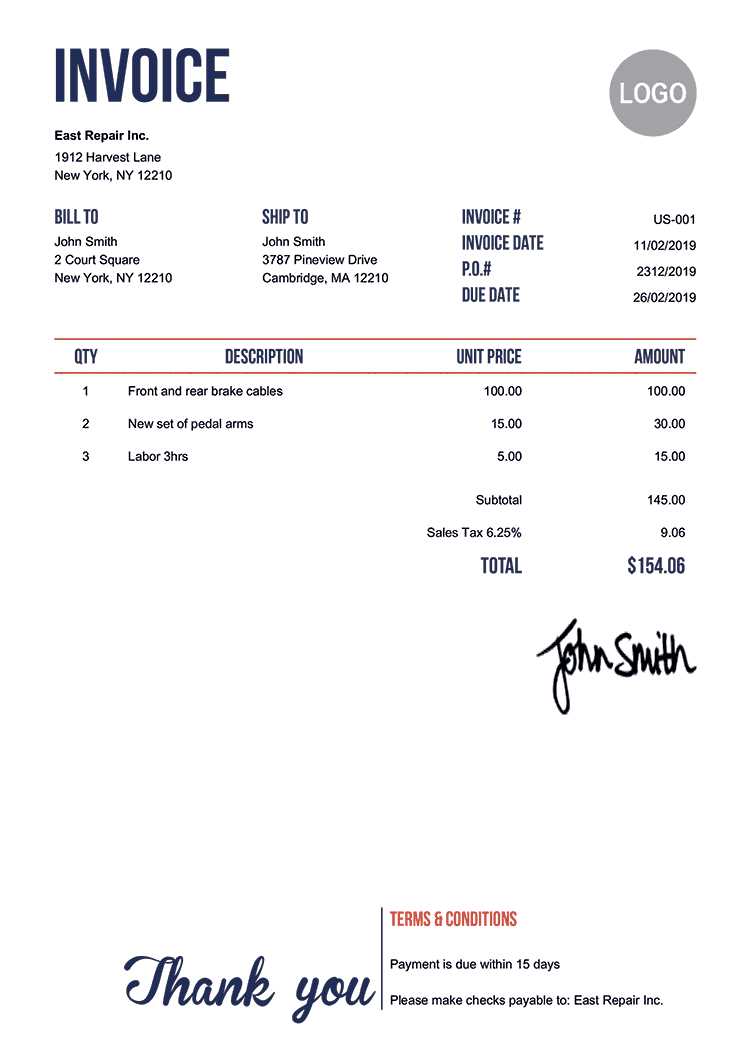

Steps to Customize Your Document

- Choose a Base Layout: Start with a layout that fits your business needs, whether it’s for a product or service.

- Edit Field Labels: Customize the field names to reflect specific information required for your records.

- Adjust Formatting: Change fonts, colors, and text sizes to match your branding or make key details stand out.

- Add Logos and Images: Include your company logo or other relevant images to give your document a professional touch.

- Set Calculation Functions: Add automatic calculations to track totals, taxes, and discounts without manual input.

Enhancing Functionality with Custom Features

- Use dropdown menus for selecting payment terms, which can speed up the process.

- Add hyperlinks to your email or website to facilitate client contact.

- Include custom fields for discount codes, payment methods, or other relevant details that might be needed.

Customizing your document layout helps ensure consistency, organization, and a personalized touch for every record you create. With these adjustments, you can manage your records more effectively while maintaining a polished and professional appearance for your business.

Streamline Billing with Numbers Templates

Automating the process of creating and managing financial documents can save valuable time and reduce the risk of errors. Using predefined structures allows you to focus on essential details without having to start from scratch each time. By utilizing ready-made structures, you can easily input client information, track payment statuses, and maintain consistency across all documents.

With the help of built-in layouts, you can quickly generate professional documents, reducing the complexity of managing finances. This method not only simplifies the billing process but also enhances the overall efficiency of your business operations.

Key Features to Simplify Billing

- Pre-built Structures: Use layouts designed to accommodate all necessary fields, reducing the setup time.

- Automated Calculations: Built-in functions handle calculations for totals, taxes, and discounts, saving you from manual work.

- Custom Fields: Easily add or remove fields to suit your specific business needs, such as payment terms or additional services.

- Instant Document Creation: Generate documents quickly by filling in the essential details, without worrying about layout design.

Improve Accuracy and Consistency

- Standardized Layout: Maintain a uniform appearance across all records to ensure professionalism.

- Efficient Data Entry: Auto-populate common fields like client names, addresses, and services to reduce errors and save time.

- Flexible Adjustments: Update documents easily to reflect changes, ensuring accuracy with each transaction.

By streamlining the billing process with predefined structures, you create a more organized and efficient system for managing financial records. This approach minimizes the risk of mistakes while ensuring that every document you create is both professional and consistent.

Key Features of Numbers Invoice Template

Utilizing a structured approach to manage financial records offers various features that make the process more efficient and organized. By incorporating preset fields and design elements, users can streamline their workflow and ensure consistency across all documents. These features also allow for flexibility and customization to fit the unique needs of each business.

The integration of essential functions and customization options empowers users to create well-organized and professional documents quickly. Below are some of the key features that help improve the overall experience of managing financial records.

Essential Functions for Efficient Management

- Automatic Calculations: Predefined formulas perform quick calculations for totals, taxes, and discounts, reducing manual work.

- Customizable Fields: Add or remove fields to match your business’s specific requirements, such as services, payment methods, or additional notes.

- Real-Time Updates: Easily adjust amounts and details, with all calculations updating instantly.

- Template Reusability: Save time by reusing the same format for multiple documents, simply updating the necessary fields.

Design and Layout Flexibility

- Professional Layout: Pre-designed sections ensure that your documents appear neat, consistent, and clear to clients.

- Branding Customization: Add your business logo, adjust colors, fonts, and other visual elements to create a personalized look.

- Clear Structure: Fields are organized logically, making it easier to input and review data without confusion.

These features provide the tools necessary to improve the speed and accuracy of your financial documentation process while maintaining a high level of professionalism. The combination of automation, customization, and organized design makes managing records both efficient and straightforward.

Step-by-Step Guide to Invoice Creation

Creating professional financial documents can be a straightforward process when you follow a simple set of steps. With the right tools, you can efficiently generate accurate and well-organized records that meet your business needs. The following guide will take you through each stage, ensuring that you capture all necessary details while maintaining consistency.

1. Select a Predefined Structure

Begin by choosing a suitable design that fits your business needs. Prebuilt designs offer a clear layout with essential fields already included. This saves time and ensures that all the necessary information is captured in a professional manner.

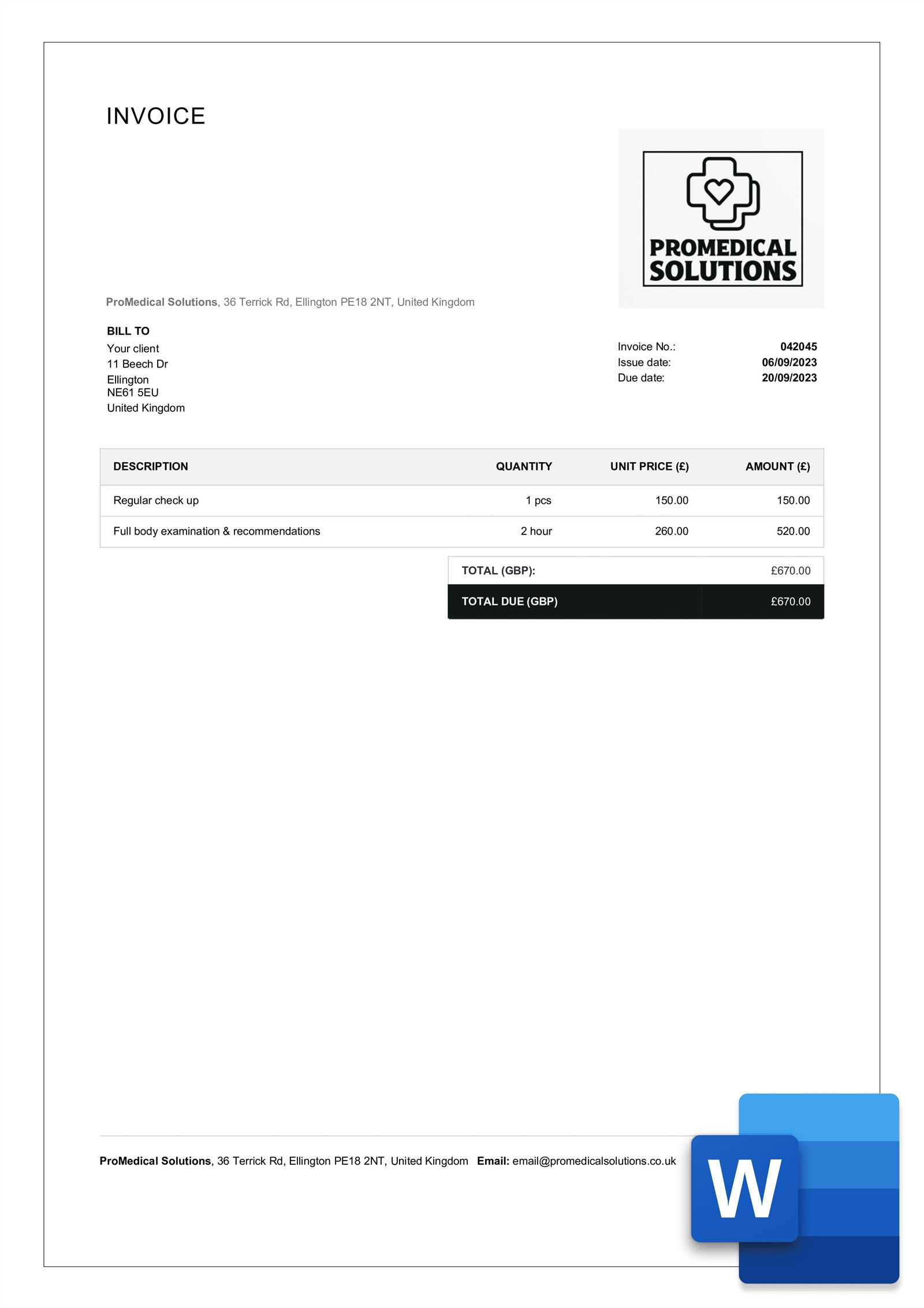

2. Add Client Information

Fill in the details of the client or customer. This typically includes:

- Client name

- Company name (if applicable)

- Contact information (address, phone number, email)

Accurate information is crucial to avoid any confusion during transactions or communications.

3. Include Service or Product Details

Specify the services rendered or products provided. Include relevant details such as:

- Item or service description

- Quantity or duration

- Unit price or hourly rate

Be clear and concise to ensure there is no ambiguity regarding the provided services or products.

4. Apply Taxes and Discounts

If applicable, include taxes or discounts. Most predefined designs will have these fields built-in, and you can simply input the rates or amounts. Make sure the calculations are correct to ensure the accuracy of the final total.

5. Set Payment Terms

Clearly outline the payment terms, including:

- Due date

- Accepted payment methods

- Any late fees or discounts for early payments

Being transparent about these terms helps ensure prompt payment and clear communication with your clients.

6. Finalize and Review

Before sending, double-check the details to ensure accuracy. Review the calculations, client details, and the overall layout to confirm that everything looks professional and is correct. Once satisfied, save the document and prepare to send it to your client.

Following these simple steps allows you to create clear and professional financial records that reflect well on your business and help streamline your administrative tasks.

Automating Invoices on Your iPad

Streamlining the creation of financial documents can save significant time and reduce errors. By automating the process, you can ensure consistency and efficiency while reducing the manual effort required for each transaction. Using advanced features on your device, you can set up automated processes that generate documents, calculate totals, and track outstanding payments with ease.

1. Use Built-In Automation Features

Many apps provide built-in automation options that allow you to set up recurring payments, schedule document generation, and automatically calculate totals. These features can be tailored to match your business needs, ensuring that your workflow becomes more efficient with minimal manual input.

2. Integrate with Other Tools

Consider integrating your financial management system with other productivity tools, such as customer relationship management (CRM) platforms. This allows for the seamless transfer of data, such as client information and payment history, which can further automate the creation and tracking of records. Integrations can also allow automatic updates for any changes in pricing or service details.

By utilizing automation, you can save time, reduce administrative work, and focus more on growing your business while ensuring that all necessary documents are handled accurately and consistently.

Free Templates for Numbers on iPad

Finding useful, pre-designed documents can greatly simplify administrative tasks. There are a variety of free resources available that offer ready-made designs to help you streamline your workflow. These free files can be tailored to suit your specific needs, saving you time while ensuring professionalism and consistency across all your documentation.

1. Access Free Designs from the App

Many applications come with built-in options, offering a collection of free, customizable layouts that you can use right away. These options are ideal for users who want a quick and easy way to start working without the need to create a document from scratch. The best part is that these layouts can be easily modified to match your branding or personal preferences.

2. Download from Online Resources

Aside from built-in options, there are numerous websites offering free downloadable files specifically created for mobile use. These resources allow you to find the perfect design without spending any money, and they often come with a range of customization options. Whether you need simple designs or more complex layouts, the internet has a wealth of choices to explore.

Utilizing these free designs can help streamline your processes, ensuring that all documents are well-organized and easy to create without starting from scratch every time.

How to Format Your Document Effectively

Creating a well-structured document is essential for clarity and professionalism. Proper formatting ensures that important information is easy to locate, making the entire document more readable and understandable. Whether you’re preparing a simple record or a detailed breakdown, organizing your content clearly can help both you and your clients stay on the same page.

Here are some tips to ensure your document is formatted effectively:

- Keep it Simple: Avoid clutter by focusing on essential details. Use clear headings and subheadings to guide the reader through the document.

- Highlight Key Information: Use bold text or color to emphasize important numbers or dates. This makes the document easier to scan.

- Use a Logical Structure: Ensure that details like contact information, amounts, and dates are grouped in a way that follows a logical sequence.

- Maintain Consistency: Use the same font, style, and layout throughout the entire document for a professional and cohesive look.

By following these tips, you can create clear, concise documents that are easy to read and understand, reducing the chance of errors and improving communication.

Tracking Payments Using iPad Invoices

Keeping track of payments is essential for managing your finances and ensuring that all transactions are properly recorded. With digital documents, it becomes easier to monitor whether clients have settled their dues, and it allows for a more streamlined approach to billing. By leveraging the capabilities of your device, you can quickly update records and check payment statuses in real-time.

Benefits of Tracking Payments Digitally

- Instant Updates: Record payments immediately after receipt, providing an up-to-date view of your financial status.

- Organization: Automatically categorize payments to ensure everything is tracked accurately and easily accessible.

- Improved Efficiency: Reduce the time spent manually managing payment data, freeing up resources for other tasks.

How to Monitor Payment Status

When managing your records, it’s crucial to keep track of the status of each transaction. You can do this by:

- Marking Paid Entries: After receiving a payment, mark it as “Paid” to easily distinguish completed transactions.

- Setting Due Dates: Clearly indicate payment deadlines to help track overdue amounts.

- Including Notes: Add notes to remind yourself of specific payment terms or discussions with clients.

By implementing these methods, you can easily stay on top of your financial transactions and ensure that all payments are tracked efficiently and accurately.

Designing Professional Invoices in Numbers

Creating clear and well-organized billing documents is essential for maintaining a professional image and ensuring that all the necessary information is included. By designing polished and structured documents, you can make a strong impression on clients and streamline the payment process. With the right tools, it becomes easy to customize and tailor your documents to meet specific needs while keeping the design simple and effective.

Key Elements of a Professional Document

- Branding: Incorporate your company logo, colors, and fonts to create a consistent and professional look that reflects your business identity.

- Clear Layout: Organize the content logically, with separate sections for client information, payment terms, and services provided. This helps clients easily review the details.

- Accurate Details: Always ensure that all the necessary information, such as dates, amounts, and descriptions, is clearly displayed. This reduces confusion and the chances of errors.

Design Tips to Improve Aesthetics

- Simplicity: Avoid overcrowding the document with unnecessary details. Focus on clean, minimalistic design to highlight the most important information.

- Alignment: Proper alignment of text and numbers ensures that your document is easy to read and visually appealing.

- Consistent Style: Use a consistent font size and style throughout the document to maintain uniformity and clarity.

By following these steps, you can create professional and well-organized billing documents that reflect positively on your business and help clients easily understand the details of their transactions.

Export and Share Invoices from iPad

Managing your documents on mobile devices offers great flexibility, especially when it comes to sending and sharing files quickly with clients. After creating a well-structured billing document, it’s essential to know how to export it and share it in the most effective format. With the right tools, this process can be done efficiently, ensuring that your documents are delivered securely and in the preferred format of your recipients.

Exporting Your Document

Exporting your billing document allows you to convert it into a universally accessible format, such as PDF. This ensures that clients can easily open and view it regardless of their device or operating system. Here’s how to do it:

- Select the document you want to export.

- Choose the “Export” option from the share menu.

- Pick the desired file format (PDF is recommended for compatibility).

- Confirm the export and save the file to your device or cloud storage for easy access.

Sharing Your Document

Once exported, sharing your document with clients or colleagues is simple. Here are some common methods:

- Email: Attach the exported document to an email and send it to the recipient’s address.

- Cloud Storage: Upload the document to a cloud service like Google Drive or Dropbox and share the link with others.

- Direct Messaging: Share the file directly via messaging apps such as WhatsApp or iMessage, if appropriate.

File Sharing in Table Format

| Method | Advantages |

|---|---|

| Direct and professional way to share documents with clients. | |

| Cloud Storage | Easy access from multiple devices and sharing via link. |

| Direct Messaging | Fast and convenient method for quick communication. |

By following these steps, you can effortlessly share your billing documents with clients, ensuring quick and secure delivery that helps maintain a professional workflow.

Handling Multiple Clients with Numbers

When managing various clients, keeping track of each project or task individually is essential to maintain an organized and efficient workflow. Whether you’re providing services or delivering products, having a structured approach helps ensure that all details are accounted for and that no client’s needs are overlooked. With the right tools, you can streamline this process, ensuring that each client receives personalized attention and accurate updates.

Organizing Client Information

To effectively handle multiple clients, organizing their information is crucial. Here’s how you can keep things in order:

- Create separate sheets: For each client, create a dedicated section or sheet within your file, ensuring that all details are easy to find.

- Use consistent categories: Set up categories for each client’s project, such as name, address, service/product details, due dates, and payment status.

- Color-code or label: Use different colors or labels for each client to make their sections visually distinct and easily navigable.

Managing Payments and Deliverables

It’s essential to track payments, due dates, and the status of deliverables for each client. Here’s how you can manage these effectively:

- Track payments: Maintain a running total of payments received, outstanding amounts, and payment due dates for each client.

- Set reminders: Use automated reminders for upcoming due dates or follow-ups, ensuring nothing is missed.

- Record service updates: Regularly update the document with progress notes and status updates for each client’s project or order.

Staying on Top of Client Interactions

- Regularly review your records: Schedule time to review each client’s file to ensure everything is up to date.

- Use filters and search functions: Make use of filters or search tools to quickly access specific client information or tasks.

By organizing and managing client information effectively, you ensure a smooth workflow that enables you to serve each client efficiently and professionally.

Tips for Efficient Invoice Management

Managing billing documents effectively is key to maintaining a smooth and organized business operation. Whether you’re dealing with multiple clients or a single project, ensuring that all details are captured, tracked, and updated regularly can save time and reduce errors. Implementing a clear system can help streamline the process, minimize confusion, and improve overall efficiency in your workflow.

Stay Organized with Clear Records

Keeping detailed and organized records is essential for easy tracking and management. Here are a few tips:

- Maintain Separate Files: Create distinct records for each client or project to easily track specific details.

- Use Descriptive Labels: Label your documents clearly with dates, client names, and any relevant reference numbers to make searching faster.

- Track Payment Deadlines: Set reminders to help ensure you follow up on payments before they become overdue.

Automate and Simplify Processes

Automation is a great way to make the management process more efficient. Consider the following strategies:

- Set Up Predefined Fields: Utilize automatic fields such as dates and amounts to reduce manual data entry.

- Automate Reminders: Use automated notifications to remind clients of upcoming payments and deadlines.

- Generate Recurring Records: For ongoing projects, create recurring records that automatically populate with the necessary information each time.

Tracking Payment Status

Accurate tracking of payments helps ensure that nothing is missed and that you can maintain up-to-date financial records. Below is an example of how to organize this:

| Client Name | Amount Due | Payment Status | Due Date |

|---|---|---|---|

| Client A | $500 | Pending | 12/01/2024 |

| Client B | $250 | Paid | 11/15/2024 |

| Client C | $1,000 | Pending | 12/05/2024 |

By regularly updating and reviewing payment statuses, you can easily track which payments have been received and which ones are still due. This proactive approach helps ensure smooth cash flow management.

Optimizing Numbers for Business Invoicing

Efficiently handling financial records and billing documents is crucial for any business. Using digital tools can greatly improve the accuracy and speed of this process. By customizing your workflow and utilizing powerful features, you can streamline the process of generating, tracking, and organizing financial records. This not only saves time but also helps maintain a more professional approach to client management.

Customizing Document Layouts

One of the key ways to enhance efficiency is by tailoring the layout of your records. Consider the following tips:

- Organized Sections: Ensure that all necessary fields such as client information, amounts, and due dates are easy to locate and fill in.

- Clear Categories: Group related items together to make documents more readable. This reduces confusion when reviewing or editing the content.

- Consistent Formatting: Use consistent font sizes, colors, and styles to create a uniform look that reflects your business professionalism.

Leveraging Automation Features

Automation is a powerful tool for reducing manual entry and ensuring consistency. Here are a few ways to optimize processes:

- Predefined Fields: Set up fields that automatically populate based on previous entries, such as client names or recurring charges, saving you time.

- Calculated Values: Use automatic calculations to determine totals, taxes, and discounts, ensuring accuracy and avoiding errors.

- Recurring Entries: If your business involves repeated transactions, set up automatic generation of new documents based on prior records.

By incorporating these strategies, you can create a more efficient, organized, and professional workflow, ultimately helping to improve your overall business operations.