Invoice Template for Mobile Phone Billing and Customization

In today’s fast-paced tech industry, efficient and organized billing practices are essential for maintaining smooth business operations. Clear and structured billing documents not only aid in accurate record-keeping but also enhance customer satisfaction by offering transparency and professionalism. A well-organized document makes it easy to outline costs, services, and payment details, creating a seamless experience for both service providers and clients.

Crafting these documents with care can save time and reduce potential errors. Using customizable layouts allows businesses to highlight essential details such as service descriptions, costs, and contact information. By ensuring clarity and precision, these documents support streamlined financial transactions and help build trust with clients.

Modern tools and

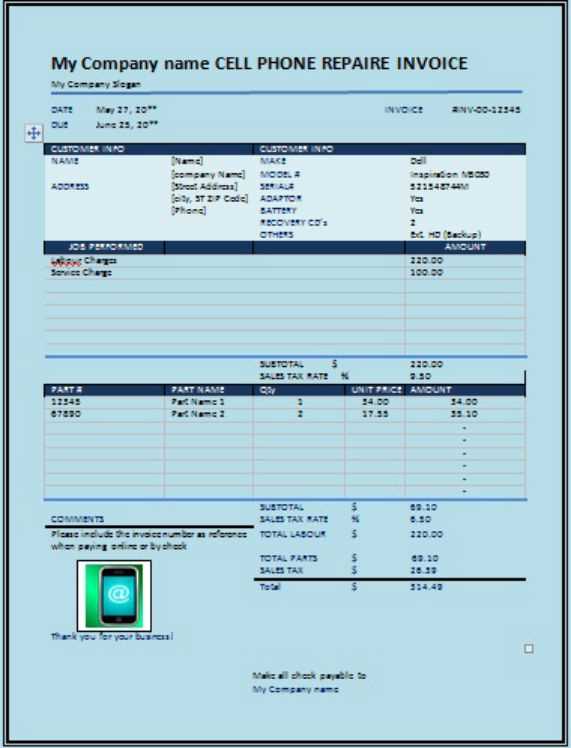

Invoice Template for Mobile Phone

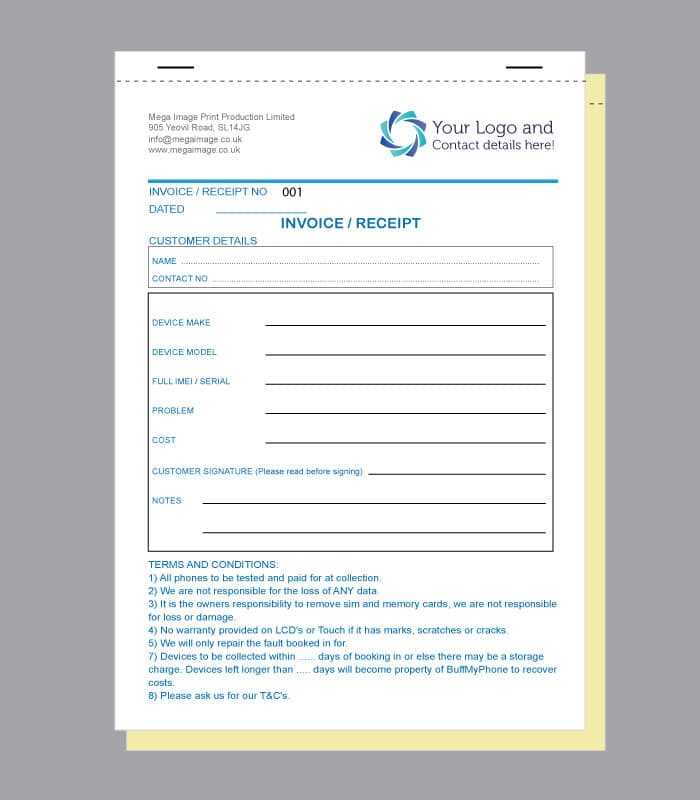

Efficient billing solutions are essential in the tech services industry, where accuracy and professionalism can greatly impact customer trust. Customized billing forms tailored to specific service sectors help businesses communicate charges clearly and concisely, ensuring that clients fully understand the costs and services they receive. These forms simplify the transaction process and enhance the clarity of financial exchanges.

Creating structured documents with essential details, such as service descriptions, pricing, and payment terms, enables businesses to maintain smooth interactions with clients. A well-organized layout helps clients track charges while allowing service providers to handle billing in a streamlined, efficient manner.

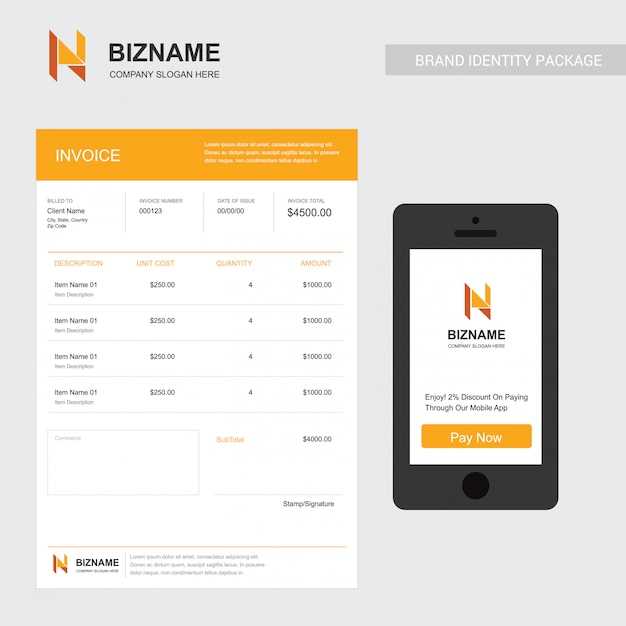

Using adaptable layouts provides flexibility, allowing service providers to add unique details or branding elements to enhance the document’s professionalism. Additionally, leveraging digital options can further optimize the billing process, making it easier to send, track, and archive records for future reference. This approach promotes

Benefits of Using an Invoice Template

Implementing standardized billing forms offers businesses a range of advantages, enhancing both efficiency and client relationships. Structured forms streamline financial documentation, helping to reduce errors and maintain clear communication. This section explores the key advantages of adopting a well-organized approach to billing, especially for tech-based services.

- Time Savings: Pre-designed billing forms save time by providing a ready-to-use structure, allowing businesses to focus more on core activities rather than paperwork.

- Enhanced Accuracy: Standardized forms minimize the risk of errors by guiding service providers in listing essential details, reducing discrepancies in costs and services.

- Professional Appearance: A clean, organized layout projects a professional image, which builds trust

How to Choose the Right Template

Selecting an effective billing format is essential for maintaining organized and professional transactions. The right choice can enhance clarity, streamline communication, and ensure that all necessary details are included. Understanding key elements to consider when choosing a structured layout will help create a seamless billing experience for both the business and its clients.

Start by identifying the specific needs of your service offerings. A well-suited format should allow space for service descriptions, pricing breakdowns, and payment terms. Ensure the layout can accommodate these details without clutter, allowing clients to easily understand the charges and deadlines.

Another important factor is customizability. A flexible design enables you to add branding elements, adjust layouts, and modify fields as needed. Lo

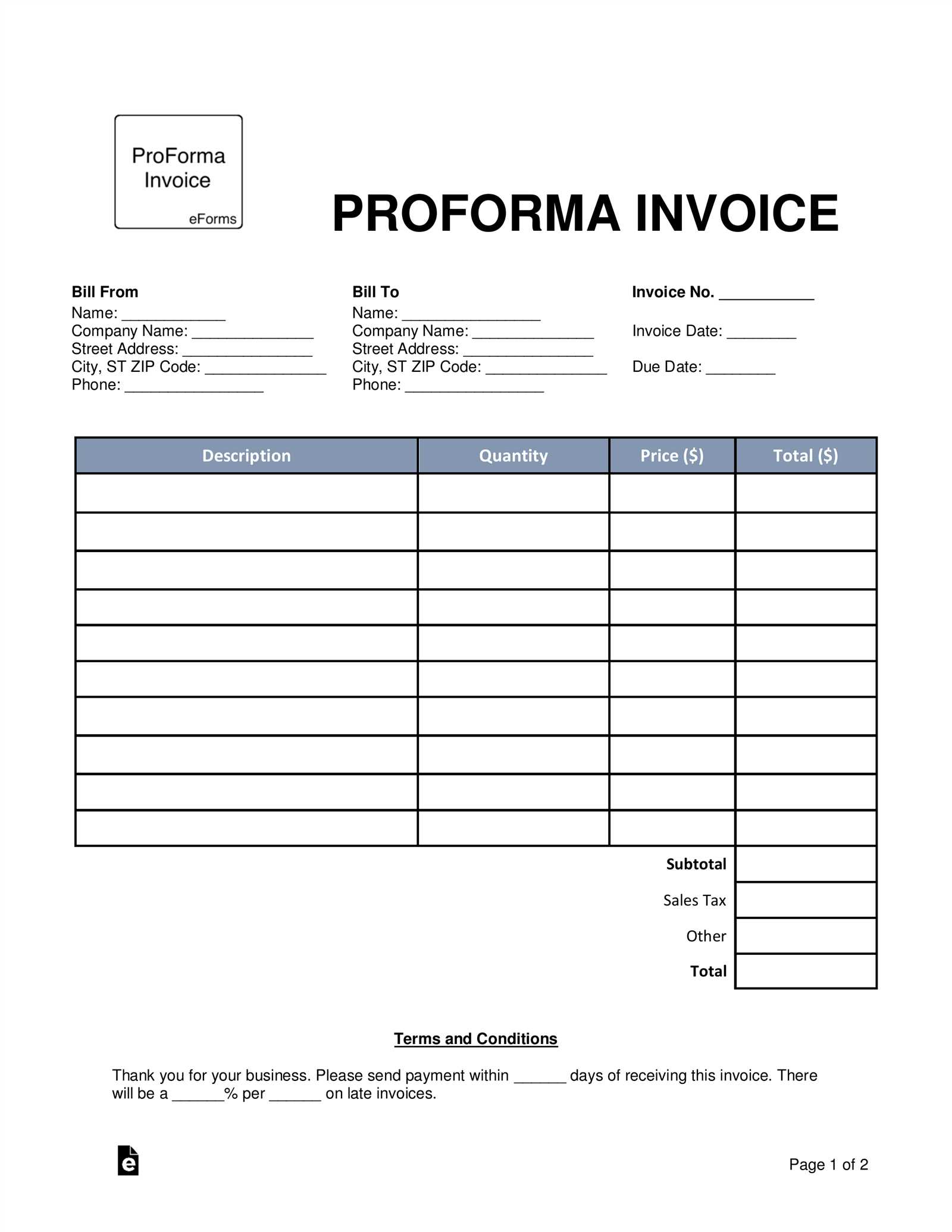

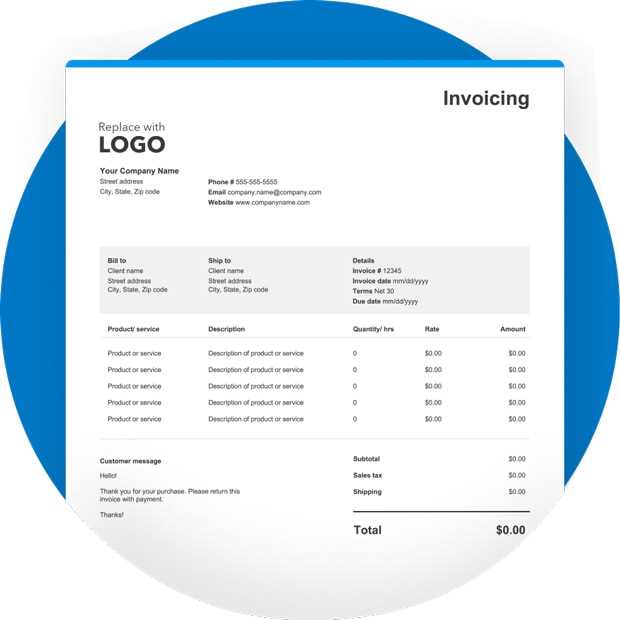

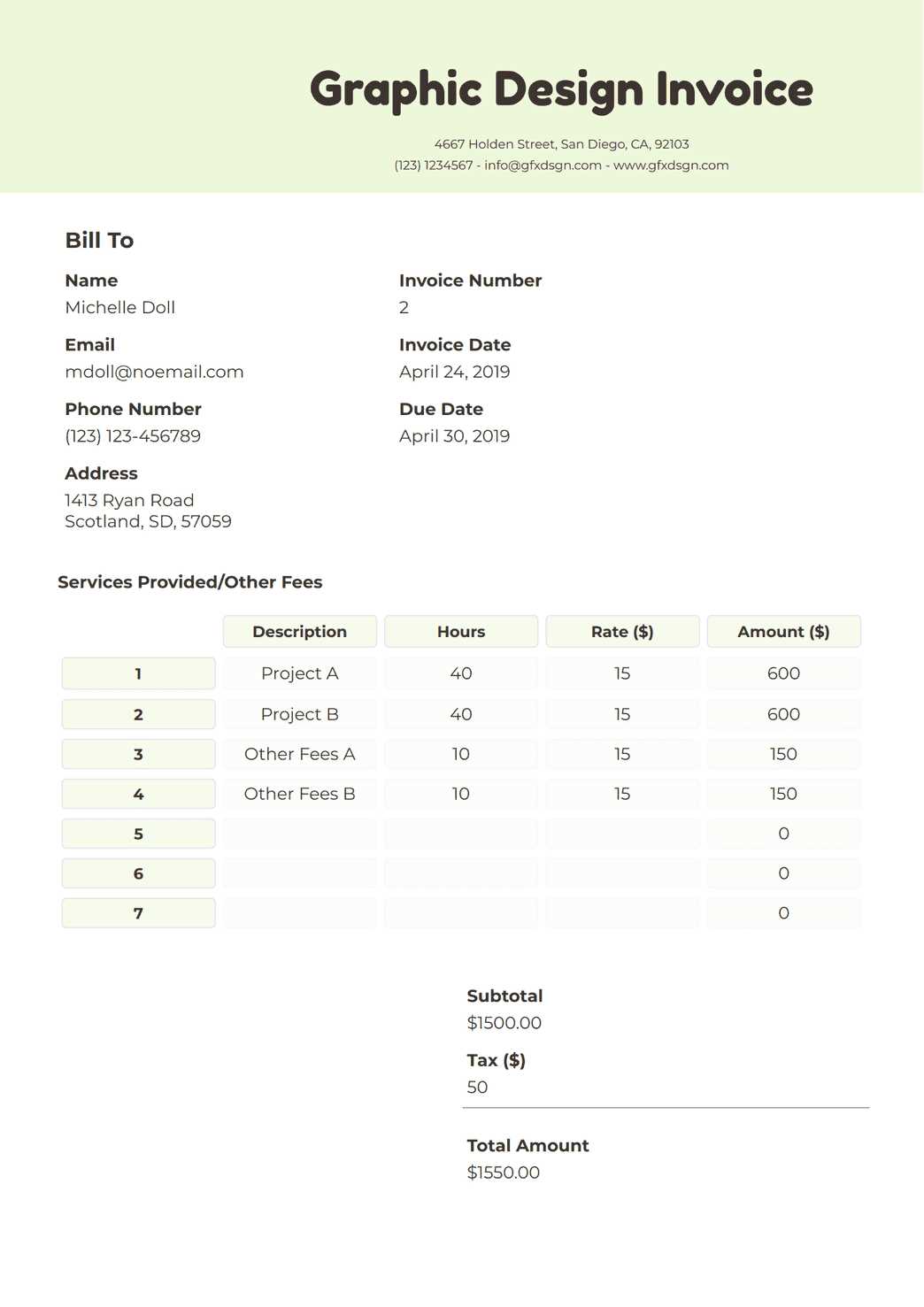

Features of a Professional Invoice

Creating a clear and structured billing document is essential for a professional appearance and efficient financial management. A well-crafted form helps clients easily understand charges, deadlines, and other critical information, ensuring smooth transactions and enhancing trust. Key components of an effective billing format are outlined below.

- Business and Client Information: Accurate contact details for both the service provider and client are crucial. This includes names, addresses, and relevant identification numbers.

- Detailed Service Descriptions: Clearly outline the services provided, including descriptions and quantities if applicable, to give clients a transparent view of what they’re being billed for.

- Itemized Costs: A breakdown of charges for each service or product, with unit prices and quantities, ensures clarity in the total amount due.

- Payment Terms: Specify payment deadlines, accepted methods, and any applicable late fees.

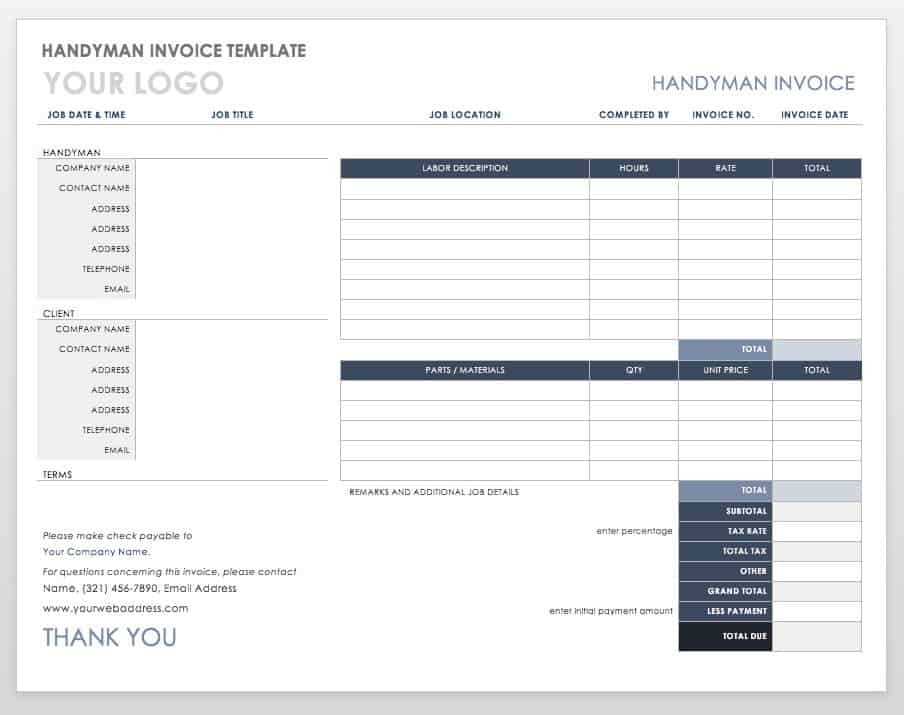

Design Tips for Mobile Phone Invoices

Creating a visually appealing and functional billing document can enhance both readability and client engagement. Effective design ensures that key information is easy to locate, understand, and act upon, making the payment process smoother. Here are some essential tips to keep your design professional and client-friendly.

Organize the layout logically, dividing sections clearly so clients can quickly find necessary details. Use tables to structure specific information, like service descriptions, costs, and dates, for a clean, easy-to-read appearance.

Service Description Quantity Unit Price Total Device Setup Essential Elements of an Invoice

Creating a well-structured document for transactions is crucial to ensure clarity and professionalism in business dealings. Each component of the document plays a significant role in providing all the necessary information to clients, ensuring smooth communication and timely payments. Below are the key elements that should be included in any billing document.

Key Information

The document must clearly feature both the service provider’s and the client’s details. This includes full names, addresses, contact numbers, and relevant identification numbers to ensure proper identification of both parties involved.

Detailed Breakdown

It’s essential to itemize the products or services provided. This allows clients to clearly understand the charges and ensures transparency in the transaction process. Each entry should include the description, quantity, unit price, and total cost.

Service Description Quantity Unit Price Total Device Repair 1 $75 $75 Battery Replacement 1 $40 $40 Software Installation 1 $30 $30 By incorporating these elements, businesses can maintain clear, professional communication, fostering trust and ensuring clients are fully informed about their obligations.

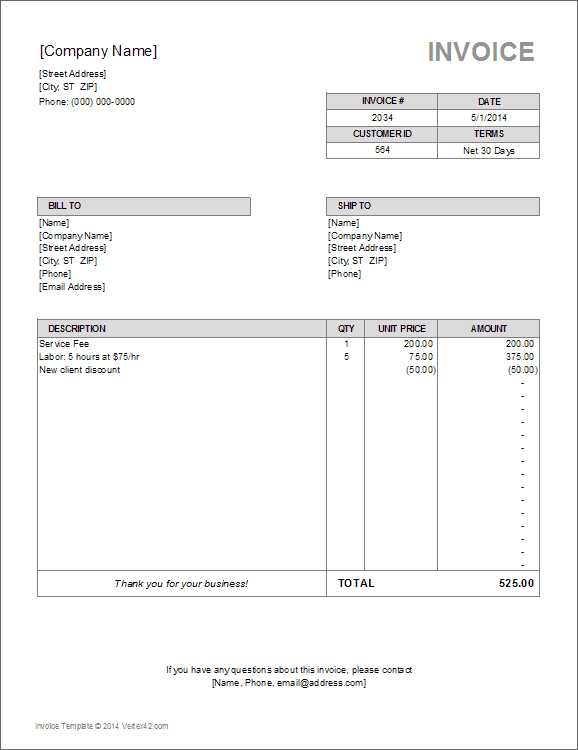

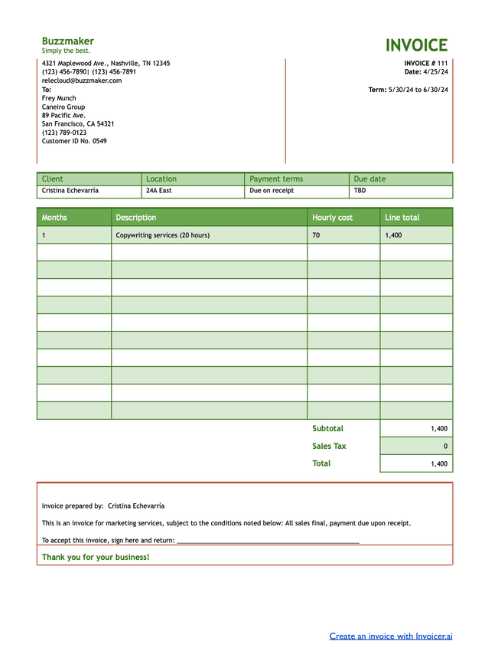

Customizing Your Invoice Template

Personalizing your billing document helps reinforce your brand identity and makes it more professional and tailored to your business needs. By adjusting the design and layout, you can highlight important details, enhance readability, and make the entire process smoother for both you and your clients.

Here are some key customization options to consider:

- Branding: Incorporate your company’s logo, colors, and fonts to create a cohesive and professional appearance that aligns with your overall brand identity.

- Layout Adjustments: Choose between a variety of layout styles, such as vertical or horizontal, depending on the type of information you want to prioritize.

- Adding Custom Fields: Include additional fields like project numbers, reference codes, or personalized notes for better tracking and communication.

- Payment Terms and Instructions: Make sure payment terms and instructions are clearly visible and easy to understand. This helps avoid confusion about deadlines or payment methods.

- Text Formatting: Use bold or italics to emphasize specific items, such as totals or important notes, ensuring they stand out for quick reference.

Customizing these elements allows you to create a professional and unique billing document that not only looks appealing but also serves your business’s specific needs effectively.

Common Mistakes to Avoid

When creating documents for billing, it’s easy to overlook certain details that can affect the professionalism and effectiveness of the process. Avoiding common errors ensures clarity, prevents confusion, and maintains a smooth transaction flow. Here are some mistakes that you should be mindful of when crafting your billing documents.

Missing or Incorrect Information

One of the most frequent mistakes is failing to include essential details. Without accurate contact information, item descriptions, or correct pricing, misunderstandings can occur. Double-check that the client’s name, address, and your own details are correct, and ensure that every item or service is properly listed with accurate quantities and prices.

Unclear Payment Terms

Another common issue is leaving payment terms ambiguous. Be specific about due dates, payment methods, and any penalties for late payments. Vague language may cause clients to delay payment or be uncertain about when and how to pay.

- Tip: Clearly state payment due dates and acceptable methods (e.g., bank transfer, credit card, etc.) in bold or highlighted text.

- Tip: Include any late fees or early payment discounts to avoid confusion down the line.

By addressing these common mistakes, you can ensure a more efficient and effective billing experience for both parties involved.

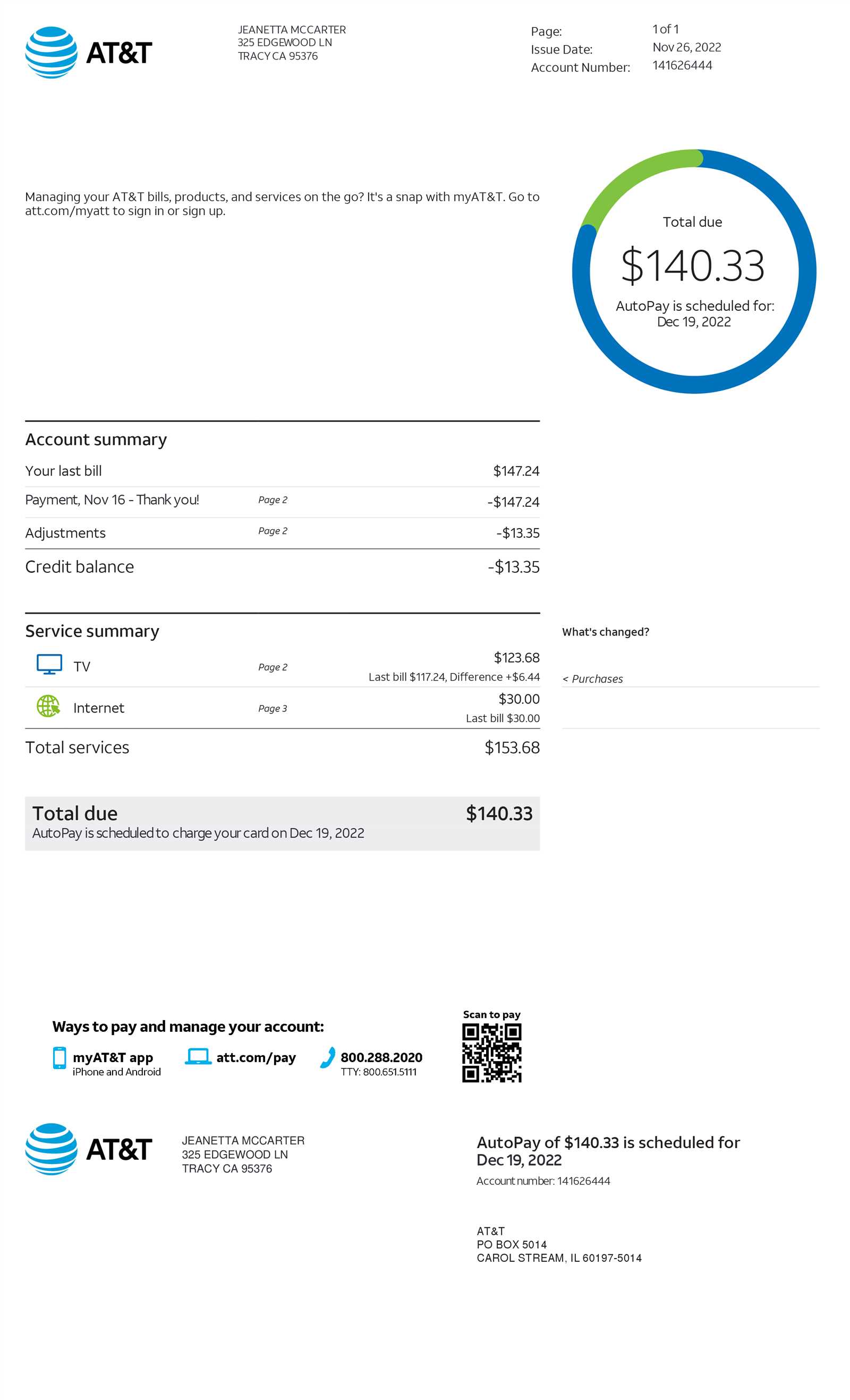

Legal Requirements for Mobile Phone Invoices

When creating billing documents, there are specific legal requirements that must be followed to ensure compliance with tax regulations and contractual obligations. These legal standards vary by country, but certain key elements are generally required to protect both the business and the customer. Understanding these essentials is crucial for maintaining lawful practices and avoiding disputes.

Essential Legal Information

In most jurisdictions, there are mandatory details that need to be included in any billing document to make it legally valid. These elements help establish transparency and provide proof of the transaction for both parties involved. Below are some of the key components required:

Element Description Business Information Include your company name, registration number, and address. This confirms your legal identity as a business entity. Client Details Ensure the recipient’s name, address, and contact details are clearly listed to identify the party receiving the goods or services. Date of Issue Specify the date the document was created, as well as the date of service or delivery. Payment Terms Include payment due date, method of payment, and any applicable late fees or discounts for early payment. Tax Information Display the applicable tax rates and the total amount of tax charged on the goods or services. Regional Variations

Be aware that the exact legal requirements may vary depending on the location of your business and the customer. For example, certain countries have stricter rules for VAT inclusion or electronic payment disclosures. Researching local regulations is essential to ensure full compliance.

By following these legal standards, businesses can ensure that their billing documents are both accurate and legally sound, reducing the risk of legal issues or disputes down the line.

How to Automate Invoicing

Automation can save time and reduce errors in the billing process. By using software tools and systems designed for managing transactions, businesses can streamline the creation and delivery of payment requests. Automation allows for consistent formatting, timely dispatch, and easy tracking of outstanding amounts, leading to improved efficiency and better cash flow management.

Choosing the Right Software

The first step in automating your billing process is selecting the right software or platform. Many solutions offer customizable options, allowing you to design documents that reflect your brand, while also adhering to legal standards. Look for platforms that integrate with your other business tools, such as accounting or CRM systems, to make the process even more seamless.

Setting Up Recurring Billing

If your business offers subscription-based services or regular deliveries, setting up recurring billing can help automate the process further. You can schedule automatic charges to your customers at predetermined intervals, ensuring that payments are processed without manual intervention.

Automated Reminders and Notifications

Many invoicing systems offer built-in features for sending automatic reminders when payments are due. These reminders can be sent through email or text messages, saving you the hassle of manual follow-ups. Customizing the frequency and tone of these reminders can also help maintain good customer relationships.

Tracking and Reporting

Automating your billing process also allows for easy tracking of paid and unpaid amounts. The software typically provides reports and dashboards that give you a real-time overview of your financial situation, helping you stay on top of cash flow and identify any issues quickly.

By incorporating automation into your payment request process, you can save valuable time, reduce administrative burdens, and ensure timely payments, allowing you to focus more on growing your business.

Top Software for Invoice Templates

Choosing the right software is essential for streamlining your billing process. The right tool can save you time and ensure that your payment requests are both professional and accurate. Here, we explore some of the top software solutions available for creating and managing documents that request payment.

1. QuickBooks

QuickBooks is one of the most popular tools for small and medium-sized businesses. It offers an easy-to-use interface and allows you to create customized payment requests that reflect your business branding. QuickBooks also integrates with various other business systems, making it a reliable choice for managing your finances and invoices.

2. FreshBooks

FreshBooks is known for its simplicity and user-friendly design. It offers customizable features for creating detailed and professional-looking payment requests. FreshBooks also supports recurring billing, so you can automate your payment process and save time.

3. Zoho Invoice

Zoho Invoice provides comprehensive tools for creating and managing payment requests. It allows for complete customization, including branding, colors, and formatting. It also offers powerful reporting features that help businesses track their finances effectively.

4. Wave

Wave offers free invoicing solutions that are ideal for freelancers and small businesses. This software allows users to create professional-looking documents with ease. Its user-friendly interface and automated features, such as recurring payments and reminders, make it a popular choice for many entrepreneurs.

5. Xero

Xero is a cloud-based solution with advanced features for businesses of all sizes. It enables users to create, send, and track payment requests, and it also integrates well with other financial tools. Xero’s real-time updates and powerful reporting capabilities make it a strong contender in the field of financial management.

6. Invoice Ninja

Invoice Ninja is an open-source software that offers a wide range of customization options. It allows businesses to create detailed payment requests with custom fields and branding. This software also supports integrations with over 40 payment gateways, making it versatile and efficient.

7. PayPal Invoicing

For businesses that already use PayPal for transactions, their invoicing system is an easy and seamless option. You can create and send payment requests directly from your PayPal account, and you can also accept payments online easily. Its simplicity and integration with PayPal make it ideal for smaller businesses or freelancers.

Software Key Features QuickBooks Customizable templates, reporting, integrations FreshBooks User-friendly, recurring billing, customization Zoho Invoice Comprehensive customization, branding, reporting Wave Free, recurring billing, simple design Xero Cloud-based, real-time updates, powerful reports Invoice Ninja Open-source, custom fields, payment gateway integrations PayPal Invoicing Seamless PayPal integration, easy payments These software options provide a range of features that can enhance your business’s billing process. Whether you are looking for simplicity, customization, or advanced reporting, there is a solution to meet your needs.

Best Practices for Invoice Management

Efficient management of billing documents is crucial for maintaining a smooth workflow in any business. Proper organization and attention to detail help ensure timely payments and minimize errors. Here are some best practices that can improve your overall approach to handling financial documents and enhance your cash flow management.

- Organize Billing Records: Keep all payment requests and related documents in a well-organized system, whether physical or digital. This will help you easily locate past transactions when needed.

- Use Clear and Consistent Formatting: Consistency in layout and structure makes it easier for clients to understand payment details. Use clear headings, itemized lists, and easily readable fonts.

- Set Clear Payment Terms: Always specify the due date, late fees, and payment methods in your financial documents. This avoids confusion and ensures your clients know exactly when and how to pay.

- Follow Up Promptly: If payments are overdue, don’t hesitate to send reminders. Timely follow-ups improve cash flow and prevent payment delays from becoming a persistent issue.

- Automate Where Possible: Automating certain processes, like recurring billing or payment reminders, can save time and reduce errors. This also ensures consistency and helps prevent missed or late payments.

- Store Documents Securely: Protect your financial records with proper security measures. Use encrypted cloud storage or secure physical storage to ensure sensitive information remains safe.

- Review and Reconcile Regularly: Regularly review your financial documents to ensure accuracy. Reconcile your records against actual payments to avoid discrepancies.

By following these practices, you can streamline the process of managing your financial documents and maintain healthy financial operations. Efficient management will not only save you time but also foster good relationships with clients through clarity and transparency.

Understanding Payment Terms and Conditions

Clear and well-defined payment expectations are essential in any business transaction. Understanding the terms and conditions related to payments can help both parties involved manage their finances better and avoid misunderstandings. These stipulations dictate how and when payments are expected, as well as any penalties or additional fees that may apply in case of late payments.

Payment Deadlines are a key part of any agreement. It’s crucial to specify the exact due date for payments to ensure that both parties know when the transaction should be completed. Clear timelines help in avoiding delays and ensure that payments are received on time.

Late Fees and Penalties are often included in payment terms to encourage timely payments. These fees, which could be a fixed amount or a percentage of the total amount due, are applied if payment is not received within the agreed period. Knowing these terms helps prevent financial strain on both sides and encourages prompt payment.

Accepted Payment Methods should also be clearly outlined. Whether payments are to be made via bank transfer, credit card, online payment systems, or other methods, specifying the accepted methods helps avoid confusion and ensures a smooth transaction process.

Discounts for Early Payments are another aspect of payment terms that some businesses offer. Offering discounts can incentivize clients to settle their bills early, benefiting both the business and the customer by reducing outstanding balances and improving cash flow.

Being clear about payment terms and conditions ensures a transparent agreement between both parties. It fosters trust, reduces conflicts, and helps maintain good business relationships. Understanding these elements is key to maintaining a healthy financial operation and avoiding any surprises down the line.

Tracking Payments and Outstanding Invoices

Effectively monitoring payments and unpaid balances is crucial for maintaining financial stability in any business. Proper tracking ensures that all due amounts are collected on time, and helps identify overdue payments that need attention. By keeping track of pending transactions, businesses can manage their cash flow, plan budgets, and maintain healthy client relationships.

Payment Tracking Systems are an essential tool in this process. These systems allow businesses to record payments, identify outstanding balances, and set reminders for overdue amounts. Automation tools can simplify the tracking process, making it easier to update records and ensure no payment is missed.

Outstanding Amounts should be monitored regularly. It’s important to check the status of any pending payments and follow up with clients when necessary. By maintaining an updated record of unpaid balances, businesses can proactively address potential issues before they escalate.

Clear Communication is key when following up on overdue payments. Regularly communicating with clients, whether through automated reminders or personal outreach, ensures that they are aware of their obligations. Setting up clear deadlines and offering payment plans or options can encourage timely payments and resolve any disputes efficiently.

Reports and Analytics also play a vital role in tracking payments. By reviewing financial reports, businesses can analyze trends, identify late payments, and gain insights into their payment collection process. This data can help businesses adjust their strategies to improve collections and avoid future issues.

In summary, tracking payments and unpaid balances effectively is essential for maintaining smooth financial operations. Using the right tools and practices can help businesses stay on top of their finances, reduce overdue payments, and maintain positive relationships with clients.

Creating a Mobile-Friendly Invoice

Designing a document that is easy to read and interact with on smaller screens is essential in today’s digital world. As more users access documents on their smartphones or tablets, it’s important to ensure that all information is accessible and well-formatted for these devices. A responsive design guarantees that your document is legible, professional, and user-friendly regardless of the device used.

Key Design Considerations:

- Simple Layout: Avoid clutter by using a clean, organized layout that ensures all elements are easily distinguishable on smaller screens.

- Readable Fonts: Use clear, legible fonts with appropriate size and contrast for easier reading on small displays.

- Mobile-Optimized Fields: Ensure that fields like totals, dates, and payment details are easily visible without scrolling excessively or zooming in.

Responsive Design Elements: The layout of the document should automatically adjust depending on the screen size, making it easier to read and navigate on both desktop and mobile devices. Key information such as amounts, payment terms, and client details should be easy to find and not require the user to zoom in.

Test Across Devices: It is crucial to test the final document on different devices to ensure it displays correctly. Consider testing on both Android and iOS devices to account for different screen resolutions and sizes.

Table Layout: When structuring financial data, using tables is essential for keeping the information organized. A simple, mobile-friendly table layout will allow users to quickly view relevant information without excessive scrolling or zooming. Here’s an example of how to format a table for optimal readability on smaller screens:

Item Price Product 1 $100 Product 2 $50 Total $150 By focusing on simplicity, clarity, and accessibility, you can create a document that works well across all devices and provides a seamless experience for the user.