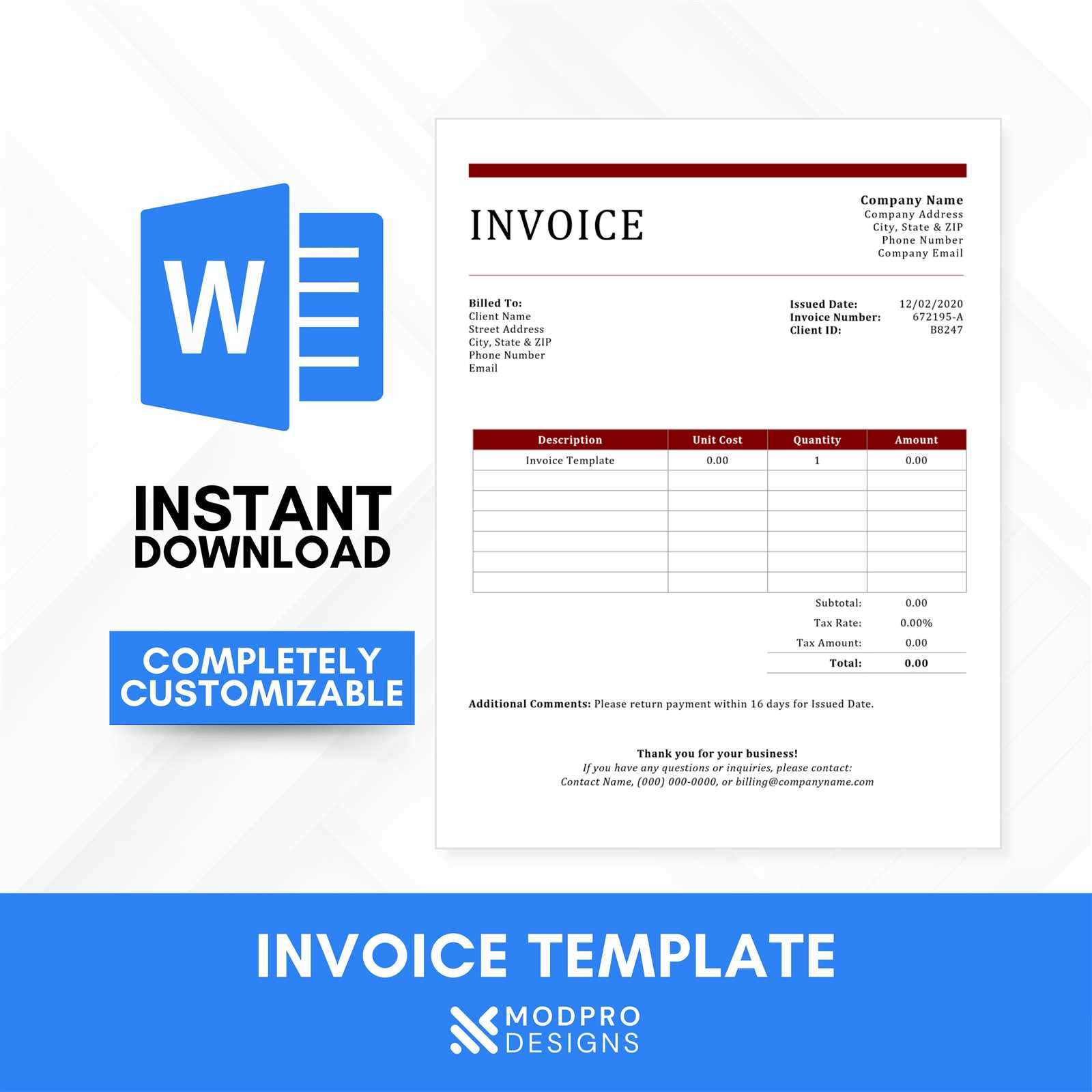

Invoice Template for Microsoft Word Customizable and Easy to Use

Managing finances efficiently is essential for any business, and having a streamlined system for generating payment requests is crucial. Whether you’re running a small business or handling freelance work, crafting clear and professional documents helps ensure smooth transactions with clients. By using pre-designed formats, you can save time and focus on delivering excellent services.

Customizing these documents to match your brand and business needs is easier than ever. The right layout and structure can make a significant difference in how clients perceive your professionalism. With a variety of options available, it’s possible to find a solution that suits both your style and functional requirements.

Designing a functional billing document should be straightforward, with sections that are easy to navigate and complete. From adding contact details to clearly outlining payment terms, having the right structure in place ensures all necessary information is conveyed efficiently. This article explores how you can create customized documents that reflect your business’s unique identity.

Invoice Template for Microsoft Word

Creating professional billing documents can save time and reduce errors. With the right design, you can easily input essential details like item descriptions, pricing, and terms of service. By using an adaptable layout, you can ensure your documents meet the needs of your business while maintaining consistency in each transaction.

Key Elements to Include in Your Billing Document

A well-organized document should highlight critical information, such as contact details, payment deadlines, and a summary of goods or services provided. This ensures clarity for both you and your clients, helping prevent misunderstandings and promoting efficient payments. Here are some of the most important elements to include:

| Section | Description |

|---|---|

| Contact Information | Your name, business name, address, and phone number should be included at the top for easy reference. |

| Client Details | List the name and address of the recipient to ensure the correct recipient is billed. |

| Itemized List | Provide a breakdown of each service or product provided with associated costs. |

| Payment Terms | Clearly state when payments are due and any late fee policies, if applicable. |

| Total Amount | Summarize the total amount due, including any taxes or additional fees. |

Customizing Your Layout for Better Organization

With the right structure, your documents will not only look professional but will also be easy to navigate. Customizing your layout is essential for ensuring that all critical details stand out and are easy to read. This allows you to maintain clarity while adapting the format to your specific business requirements.

Why Use Microsoft Word for Invoices

Choosing the right tool for creating professional billing documents is crucial for businesses of all sizes. With a simple and widely accessible software, you can generate clean and customizable payment requests without requiring specialized skills or additional software. This approach offers flexibility and ease of use, making it an excellent option for small business owners and freelancers.

Advantages of Using Word Processing Software

Word processors provide several key benefits when it comes to preparing documents, especially billing requests. They allow for quick customization, easy adjustments, and offer a range of formatting options that ensure your documents are both functional and polished. Here are some reasons why many businesses opt to use such software for their billing needs:

| Benefit | Description |

|---|---|

| Ease of Use | Most people are familiar with word processors, making them easy to navigate without extensive training. |

| Customization Options | It is simple to adjust the layout, fonts, and structure to match your business’s branding and style. |

| Compatibility | Files can be easily shared with clients, opened on different devices, or printed without compatibility issues. |

| Cost-Effective | If you already use word processing software, there is no need to purchase additional software or services. |

Simple Document Management

Another significant benefit of using a word processor is document organization. Since most word processing programs offer features like folders and cloud storage integration, keeping your billing documents organized and accessible is hassle-free. This also ensures that you can easily retrieve past documents when needed, promoting efficiency in your business operations.

Top Features of Invoice Templates

When it comes to creating professional billing documents, certain elements make a format stand out in terms of both functionality and presentation. By incorporating the right features, you ensure that all necessary information is clearly presented and easy to follow, which is essential for maintaining good business practices. Whether you’re creating a simple document or something more detailed, key components enhance readability and accuracy.

Essential Elements for Professional Documents

High-quality billing formats include several core features that help organize details efficiently. From clearly defined sections to the inclusion of business branding, these elements make the document both professional and practical. Here are some of the most important aspects:

| Feature | Description |

|---|---|

| Clear Structure | A well-organized layout makes it easier for recipients to navigate and understand the information at a glance. |

| Branding | Including your business logo and colors helps make the document look professional and reinforces your brand identity. |

| Editable Fields | Predefined areas for client details, pricing, and payment terms allow for quick and easy customization. |

| Itemized Breakdown | A detailed list of services or products helps ensure transparency and prevents confusion on both sides. |

Additional Features to Enhance Functionality

Beyond the basics, there are other advanced features that can further improve the efficiency of your billing system. These can be tailored to your specific needs, whether it’s adding payment terms or automating calculations. These elements are designed to make your billing process as smooth as possible, ensuring timely payments and reducing the risk of errors.

How to Customize Your Invoice

Personalizing your billing document is an important step to ensure that it reflects both your business style and professional standards. Customization allows you to add unique elements such as your logo, business colors, and tailored payment terms. By making these adjustments, you not only improve the document’s appearance but also enhance clarity and functionality for your clients.

Step-by-Step Guide to Personalizing Your Document

Modifying the layout and details of your document can be done easily with the right tools. Key areas to focus on include contact information, service descriptions, and payment terms. Here are the basic steps to follow:

| Step | Description |

|---|---|

| Insert Contact Information | Ensure that both your details and those of your client are correctly listed at the top, making it easy to identify the parties involved. |

| Brand Your Document | Incorporate your business logo, colors, and fonts to create a cohesive and professional look that aligns with your branding. |

| Add an Itemized List | Provide a breakdown of each product or service, including quantities, prices, and any applicable discounts or taxes. |

| Define Payment Terms | Clearly outline payment deadlines, accepted methods, and any penalties for late payments. |

Advanced Customization Tips

For further personalization, you can explore additional features such as adding custom fields for special instructions or incorporating automated calculation formulas for totals and taxes. These small adjustments can help streamline the process, save time, and reduce the chance of mistakes.

Benefits of Using Templates for Billing

Using a pre-designed format for creating financial documents offers several advantages that can enhance both the efficiency and professionalism of your business operations. These ready-made structures save valuable time, ensure consistency, and reduce the likelihood of errors, making them an ideal solution for businesses of all sizes. With a few simple adjustments, you can tailor the document to your needs without starting from scratch each time.

Time-Saving and Consistency

One of the primary advantages of using a pre-built structure is the time saved in document creation. Instead of designing a new layout or formatting each detail from the ground up, you can focus on filling in essential information. Additionally, utilizing the same structure across all documents ensures consistency, which improves your brand image and client relations.

| Benefit | Description |

|---|---|

| Quick Customization | Once you’ve chosen a layout, you can easily replace placeholders with specific details, speeding up the process. |

| Uniformity | Using a single layout guarantees that all documents have the same professional appearance and structure. |

Reducing Errors and Enhancing Professionalism

Pre-designed formats often come with built-in fields that reduce the risk of missing important information, such as payment terms, client details, and service descriptions. This built-in structure ensures that you include everything necessary in a clear and organized manner, leading to more accurate documents. A well-organized document conveys professionalism, which can positively impact your business’s reputation.

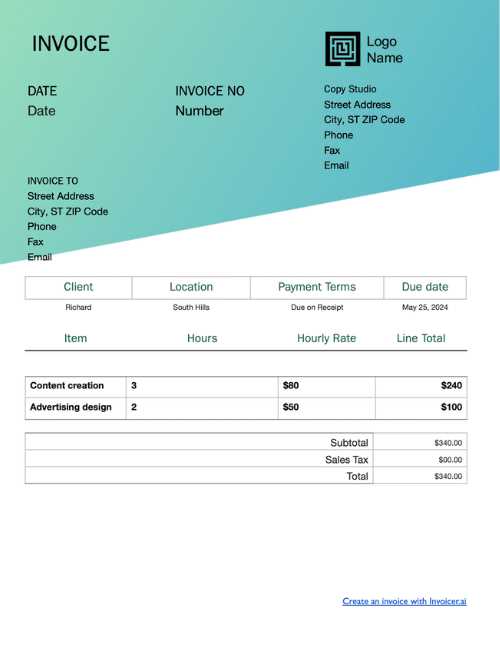

Types of Invoice Templates Available

There are several kinds of pre-designed formats that cater to different business needs, allowing you to select the one that best suits your requirements. Each design offers unique features, such as customizable fields, specific sections for product breakdowns, or specialized sections for services rendered. Choosing the right structure can make a significant difference in how well your billing documents meet both your and your clients’ expectations.

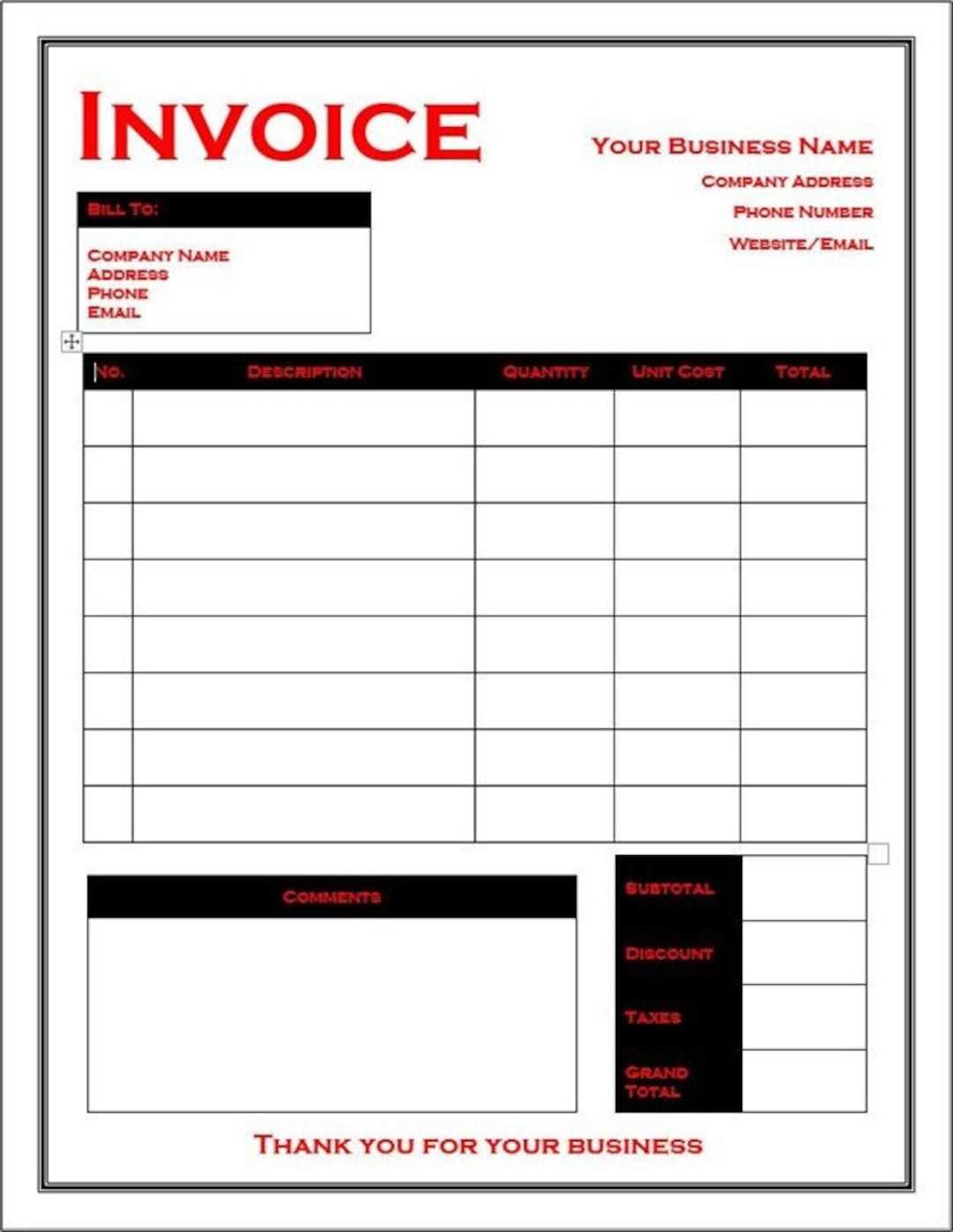

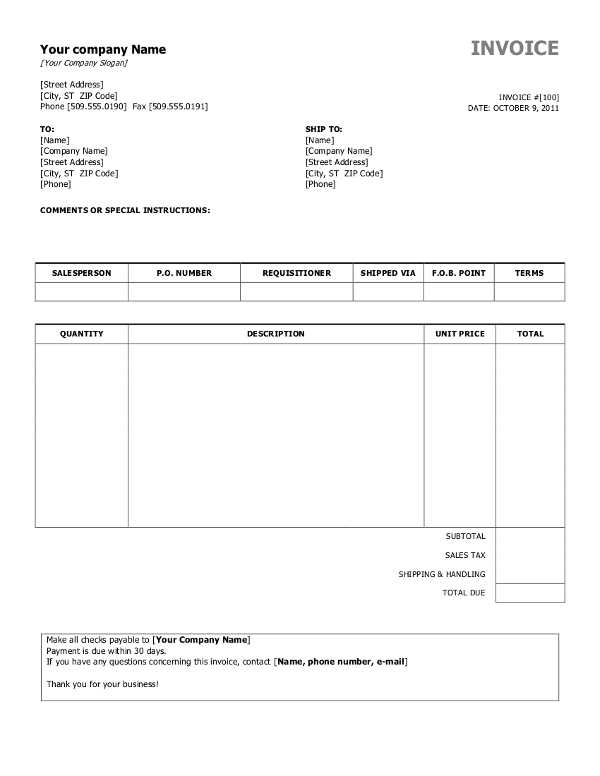

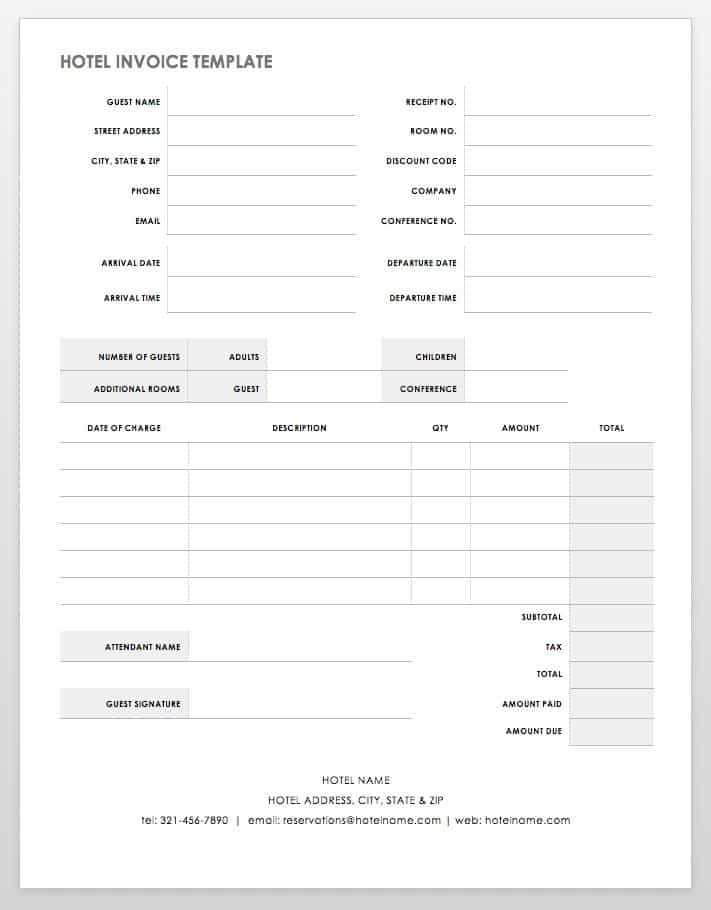

Standard Billing Formats

The most common type of layout includes sections for basic details, such as your business information, client information, a list of services or products, and total costs. These are ideal for businesses that need a straightforward approach to their financial documents. Standard designs are simple, easy to read, and typically include fields for payment due dates and contact information.

| Type | Description |

|---|---|

| Basic Layout | A simple, clean design ideal for businesses that just need to send clear, concise documents with essential information. |

| Itemized Format | This layout is suited for businesses that need to list multiple products or services in detail, making it easy for clients to review individual charges. |

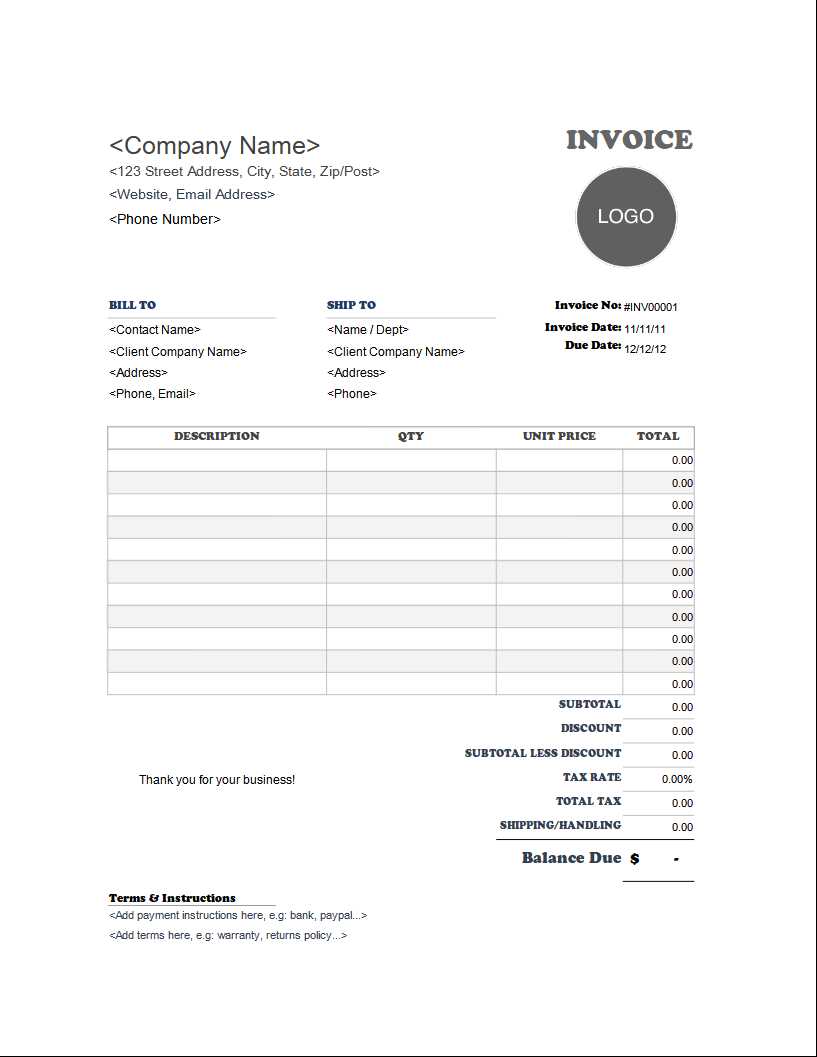

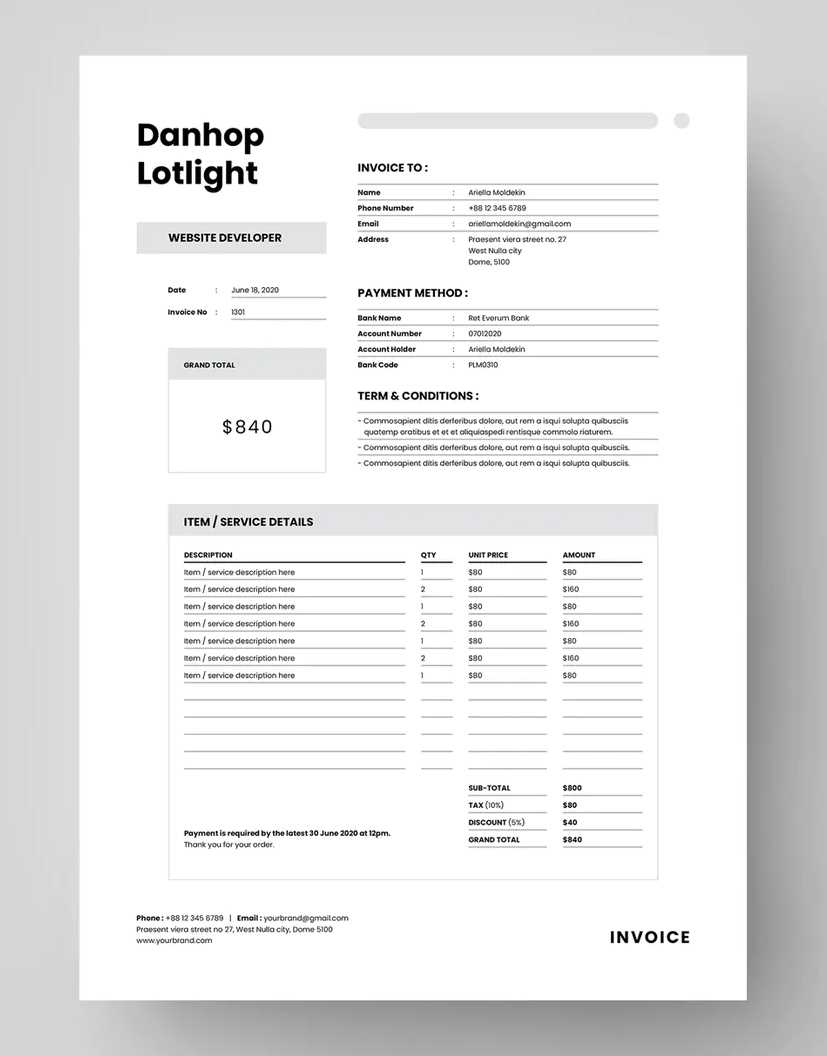

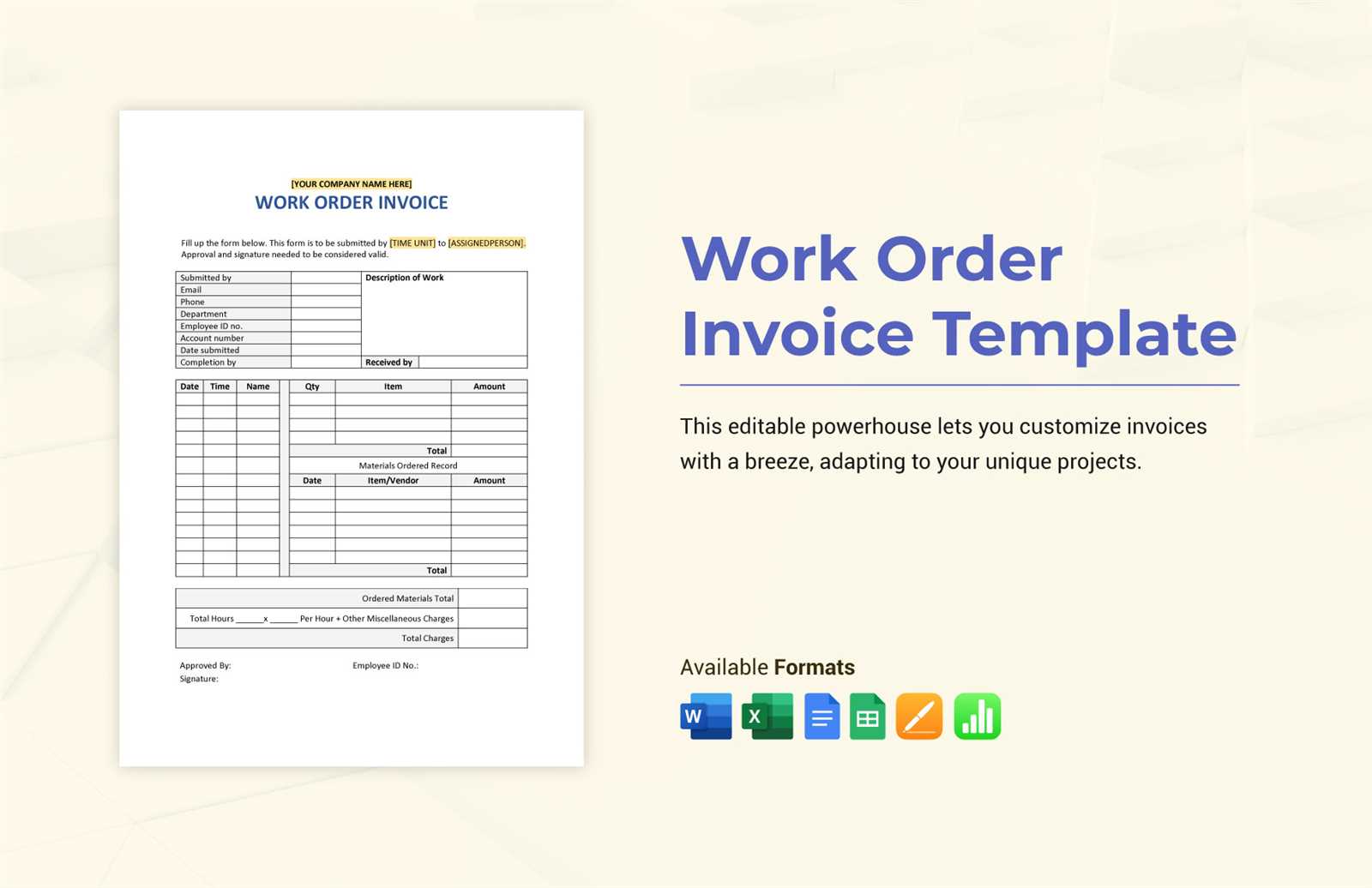

Advanced Billing Designs

For businesses with more complex needs, advanced layouts provide additional features, such as automatic calculations for taxes, discounts, and totals. These formats often include more space for notes, personalized messages, or special instructions. Advanced designs are typically suited for larger businesses, contractors, or service providers with varying rates or recurring billing cycles.

Step-by-Step Guide to Creating Invoices

Creating a well-structured billing document is a crucial task for any business, as it helps maintain transparency and ensure prompt payments. By following a simple step-by-step approach, you can easily create professional financial records that are tailored to your specific business needs. This guide will walk you through the process, from gathering necessary details to finalizing the document for sending.

Step 1: Gather Essential Information

Before you begin creating your document, it is essential to collect all necessary details. This includes your business name, contact information, and the client’s details. You’ll also need a list of the products or services provided, along with the agreed-upon prices. Having all this information on hand will make the process quicker and more efficient.

| Detail | Description |

|---|---|

| Your Business Information | Include your company name, address, and contact details so your clients can reach you easily. |

| Client Information | Make sure to add the client’s name, address, and other relevant details. |

| Services or Products | Clearly list what you are charging for, along with the quantity and price of each item. |

Step 2: Select a Layout and Fill in Details

Next, choose a layout that suits your business style. Whether you’re using a pre-designed structure or creating one from scratch, ensure there are clearly defined sections for each part of the document. After selecting your format, begin entering the collected information into the designated fields, including your payment terms and any other additional notes for the client.

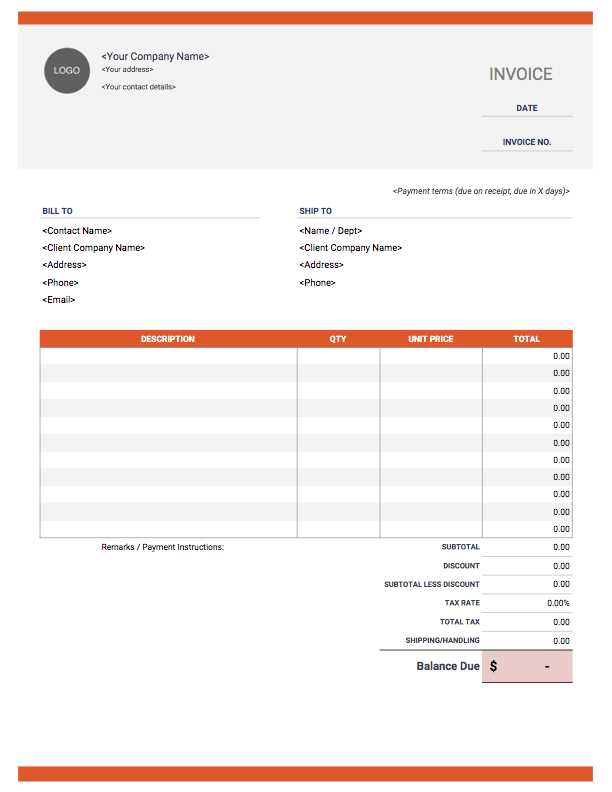

Adding Your Business Logo to Invoices

Incorporating your business logo into financial documents is an effective way to establish brand identity and enhance professionalism. Including this visual element makes your records easily recognizable to clients and adds a level of credibility. Here’s how to easily add your logo to your billing documents while maintaining a clean and organized look.

Why Include a Logo?

Having a logo in your financial documents is not just about branding; it also helps communicate trust and consistency. A well-placed logo can set the tone for your business relationship and make your documents stand out. It reinforces your company’s identity and ensures clients recognize your professional presence.

- Brand Recognition: Adding your logo helps clients remember your business, especially if they work with you regularly.

- Professional Appearance: A logo adds a polished, corporate look to your financial records, which can improve your reputation.

- Consistency: Including your logo on all documents creates a consistent brand image across all platforms and communication channels.

How to Add Your Logo

There are several ways to add your logo to your financial documents, depending on the software or method you are using. Here are the basic steps to follow:

- Choose the Right Position: Typically, logos are placed at the top of the document, either centered or aligned to the left or right. Ensure it’s not too large, so it doesn’t overshadow the content.

- Insert the Logo: If you’re working with a pre-designed layout, most programs will allow you to insert an image easily. Simply upload your logo file and resize it to fit.

- Keep it Professional: Avoid placing logos in distracting colors or using too many different types of images. Stick with your brand’s color scheme and style for consistency.

Adding a logo is a simple but impactful step in professional document creation, ensuring your business is presented in the best possible light.

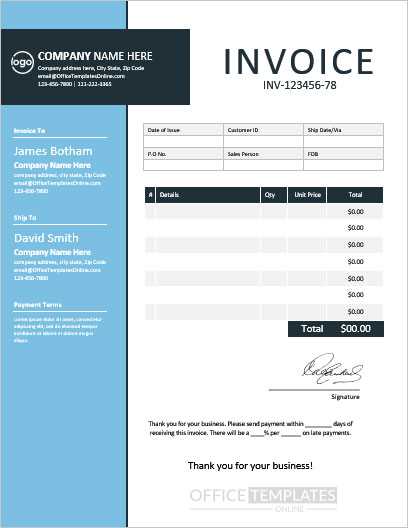

Tips for Professional Invoice Design

Designing a clean and professional financial document is essential for any business. A well-designed document not only ensures that all necessary information is clearly presented but also creates a lasting impression on your clients. By following some basic design principles, you can create documents that are both functional and visually appealing, reinforcing your business’s credibility and professionalism.

Keep It Clean and Organized

Cluttered or disorganized documents can confuse clients and delay payments. To ensure your records are easy to read, maintain a clean layout with clearly defined sections. Use plenty of white space to separate information and make the content easy to digest.

- Use Clear Headings: Each section should be clearly labeled, such as “Client Information,” “Services Provided,” and “Total Amount Due.” This will help clients quickly navigate the document.

- Maintain Consistent Fonts: Choose one or two fonts that are easy to read and use them consistently throughout the document.

- Leverage White Space: Ensure there is enough spacing between each section and around text so the content doesn’t feel cramped.

Focus on Branding and Readability

Your financial documents should reflect your brand’s identity while remaining easy to read. A simple, well-chosen color scheme can enhance your document’s appearance without overwhelming the content. Choose colors that align with your brand’s style guide and ensure sufficient contrast between text and background.

- Limit the Use of Colors: Stick to a simple color palette that complements your logo and other branding elements. Too many colors can distract from the content.

- Use Clear and Readable Fonts: Avoid overly decorative fonts that might be hard to read. Stick with simple, professional typefaces like Arial, Calibri, or Times New Roman.

- Align Information Properly: Proper alignment of text and numbers ensures the document looks neat and orderly. Always align your pricing and totals to the right to make them easy to spot.

By following these design tips, you can create documents that are not only functional but also reflect the professionalism of your business, enhancing your reputation and client relationships.

How to Format Your Invoice Correctly

Properly formatting your billing document is crucial for clarity, accuracy, and professionalism. A well-structured document ensures that clients can easily understand the charges, terms, and payment details. This section outlines key formatting principles to follow when preparing your records, ensuring both readability and compliance with industry standards.

Key Elements of a Well-Formatted Document

Each billing document should include specific details presented in a consistent and organized manner. To ensure your document is complete and easy to understand, it should contain the following components:

| Section | Details |

|---|---|

| Header | Include your company’s name, logo, contact information, and the client’s details. This section should also clearly state that it is a billing document. |

| Itemized List | Each service or product provided should be listed separately with descriptions, quantities, and prices. Ensure all items are clearly organized in rows for easy reading. |

| Total Amount | Clearly highlight the total amount due, including taxes, discounts, and any additional charges, making it easy to find at a glance. |

| Terms and Due Date | Clearly state the payment terms and the due date. Include details about any late fees or penalties if applicable. |

Formatting Tips for Clarity

To ensure that the document is visually appealing and easy to read, follow these tips for effective formatting:

- Use Headings and Subheadings: Organize content into sections with clear headings and subheadings, making it easy to find specific details.

- Align Numbers Properly: Ensure that prices, taxes, and totals are aligned properly for easy comparison. Typically, numbers should be right-aligned.

- Consistent Font Size: Use a consistent font size for body text and a slightly larger size for headings. This helps create a hierarchical structure in the document.

- Maintain Clear Spacing: Use adequate spacing between sections and items to avoid clutter and ensure that everything is easily distinguishable.

By following these formatting guidelines, your billing documents will not only look professional but also be easier for clients to navigate, reducing the chances of confusion or delays in payment.

Common Mistakes in Invoice Creation

When preparing billing documents, it’s easy to overlook important details or make mistakes that can lead to confusion and delays in payment. Whether it’s missing key information or improperly formatting certain sections, these errors can undermine your professionalism and cause unnecessary issues with clients. This section highlights common mistakes and how to avoid them to ensure smooth and efficient transactions.

Top Mistakes to Avoid

Here are some of the most frequent errors people make when creating their billing documents and tips for correcting them:

| Error | How to Fix |

|---|---|

| Incorrect or Missing Client Information | Ensure that the client’s name, address, and contact details are accurate and up to date. Verify that all information is complete before sending the document. |

| Failure to Include Payment Terms | Clearly state payment terms, including due dates and any penalties for late payments. This helps set clear expectations and reduces disputes. |

| Unclear or Missing Item Descriptions | Provide detailed descriptions for each item or service listed, including quantities and prices. This reduces confusion and helps clients understand what they are being charged for. |

| Errors in Calculations | Double-check all totals, taxes, discounts, and additional charges. Use a calculator or automated system to avoid manual errors in the final amount. |

Additional Common Mistakes

There are other mistakes that, while not always immediately obvious, can still create complications over time:

- Failure to Provide a Unique Reference Number: Each document should have a unique identifier, such as a reference number, to help keep track of transactions.

- Not Including a Thank You Note: Adding a brief “thank you” can leave a positive impression, promoting future business and improving client relationships.

- Inconsistent Formatting: Inconsistent fonts, text alignment, or spacing can make the document look unprofessional. Stick to a clean and uniform design throughout.

By avoiding these common errors, you can ensure your billing documents are clear, accurate, and professional, which helps to streamline payment processing and maintain positive client relations.

Ensuring Accuracy in Invoice Calculations

Accurate calculations are essential when preparing any type of billing document. Errors in the amounts, taxes, discounts, or totals can lead to confusion, delays in payment, or even disputes with clients. To avoid such issues, it’s important to follow clear guidelines and double-check all figures. This section provides tips for ensuring that your financial calculations are correct and transparent.

Key Factors to Verify in Calculations

To ensure your billing documents reflect the correct amounts, make sure to review the following:

- Unit Prices: Ensure that each product or service’s unit price is accurate and corresponds to the agreed-upon rates.

- Quantities: Double-check the quantities of products or services being charged. It’s easy to make mistakes when copying or entering large amounts of data.

- Tax Rates: Make sure the correct tax rates are applied based on your location or the client’s location. Review any local tax regulations to avoid discrepancies.

- Discounts and Adjustments: If any discounts or special adjustments are applied, verify that they are calculated correctly before finalizing the document.

Tips for Double-Checking Your Calculations

Here are several strategies to ensure all your calculations are accurate:

- Use Automation: If possible, use automated systems or software to perform calculations. This reduces the chances of manual errors.

- Cross-Check with Original Estimates: Compare the totals with any initial estimates or contracts to make sure everything matches.

- Break Down the Math: Clearly show how totals are calculated, especially when dealing with complex pricing or multiple items. This transparency can help avoid disputes later.

- Use a Calculator or Spreadsheet: A calculator or spreadsheet tool can quickly verify totals, tax amounts, and discounts. Cross-check each figure to catch errors.

By following these steps and paying close attention to detail, you can ensure that your billing documents are error-free and professional, making the payment process smoother for both you and your clients.

How to Include Payment Terms on Invoices

Clearly outlining payment expectations in your billing documents is crucial for maintaining professional relationships and ensuring timely payments. Payment terms specify when and how the payment should be made, helping to avoid confusion or delays. Including these terms in the appropriate section of your document makes the process transparent for both you and your clients.

Essential Payment Information to Include

When detailing payment terms, there are several key elements to consider:

| Payment Term | Description |

|---|---|

| Due Date | Clearly state when the payment is expected. This could be a specific date or a number of days after the transaction, such as “30 days after receipt.” |

| Accepted Payment Methods | Specify the methods through which payment can be made, such as bank transfer, credit card, or check. |

| Late Payment Penalties | Outline any penalties or interest rates that will be applied if payment is not received on time, such as a fixed late fee or percentage-based interest. |

| Early Payment Discounts | Consider offering incentives for early payments, such as a discount percentage if the client pays before the due date. |

Additional Considerations

In addition to the basic payment terms, it is helpful to include the following details to ensure clarity:

- Currency: Clearly state the currency in which payment is to be made, especially if you are dealing with international clients.

- Payment Instructions: Provide any specific instructions for making payments, such as account details for bank transfers or payment portal links.

- Contact Information: Ensure clients know who to contact in case they have questions about payment, such as your billing department or customer service.

By outlining these payment terms in a clear and professional manner, you can help ensure that your clients understand the expectations and avoid unnecessary delays in payment processing.

Saving and Sharing Your Invoice Templates

Once you’ve created your billing documents, it’s essential to save and organize them properly to ensure easy access and reuse. Additionally, sharing your completed documents with clients or colleagues in an efficient manner is equally important. By following a few simple steps, you can ensure that your documents are readily available whenever needed and can be shared securely.

How to Save Your Documents Efficiently

To ensure that your billing records are safe and easy to find, follow these tips when saving your documents:

- Use a Clear File Naming System: Name your files in a way that is easily identifiable, such as including the client name and the date of the transaction, e.g., “JohnDoe_Invoice_2024-04-12”.

- Organize Your Files by Client or Project: Create separate folders for each client or project. This will make it easier to track and retrieve previous documents.

- Save in Multiple Formats: Save your documents in different formats such as PDF for sharing with clients and the original editable format for future adjustments.

Sharing Your Documents with Clients

When it comes to sharing your completed documents with clients, consider the following options:

- Email: The most common way to share your documents is through email. Simply attach the saved file and ensure you include any necessary instructions for payment or clarification.

- Cloud Storage: Upload your documents to a cloud service such as Google Drive or Dropbox. This allows you to generate a shareable link and control access to the document.

- Online Payment Platforms: If you’re using an online platform to process payments, many offer direct integration to send your completed document with payment details.

By properly saving and sharing your documents, you ensure both the security of your records and a professional presentation to your clients. Whether for internal use or external communication, keeping things organized is key to maintaining smooth business operations.

Best Practices for Invoice Organization

Maintaining well-organized financial records is crucial for any business. Properly managing your billing documents can save you time, reduce errors, and ensure timely payments. By implementing a few best practices, you can streamline your workflow, improve your business operations, and stay on top of all your financial transactions.

Systematic Filing and Categorization

One of the most important aspects of organizing your financial documents is ensuring that they are categorized correctly. Here’s how you can do that effectively:

- Use Client Folders: Store each client’s documents in their own dedicated folder. This helps you easily track their history and avoid mixing up records.

- Separate Active and Closed Accounts: Keep your current transactions separate from past records to easily identify and prioritize active projects or invoices.

- Utilize Clear Naming Conventions: Ensure your files are named consistently, such as “ClientName_ProjectName_Date”. This will help you locate the necessary files quickly.

Tracking Payments and Due Dates

Keeping track of payments and due dates is vital to avoid late payments and maintain a good relationship with clients. To stay on top of your payments, consider the following methods:

- Use a Payment Schedule: Set up a payment schedule for all ongoing projects or clients, including due dates and payment terms. This will help you plan your cash flow.

- Leverage Digital Tools: Utilize accounting software or even a simple spreadsheet to track outstanding payments and alert you when payments are due.

- Keep a Record of Communications: Note any discussions regarding payment deadlines, extensions, or issues. This helps keep everything transparent and ensures you’re on the same page with your clients.

Recommended Organization Tools

Several tools can help you stay organized, whether you’re managing a few clients or handling multiple projects:

| Tool | Description | Benefits |

|---|---|---|

| Cloud Storage | Services like Google Drive or Dropbox | Access documents from any device, share easily with clients, and store securely. |

| Accounting Software | Software like QuickBooks or FreshBooks | Helps manage payments, send reminders, and integrate with your bank account. |

| Spreadsheet Tools | Google Sheets or Excel | Great for tracking payments, dates, and client information in a customizable format. |

By following these best practices, you can ensure that your financial documents are well-organized and easy to manage. This will not only help you save time but also ensure that your business remains on top of important financial deadlines.

Integrating Invoice Templates with Accounting Software

Connecting your billing documents with accounting software can significantly streamline your financial processes. By integrating the two, you can automate many aspects of billing, payment tracking, and record-keeping, saving both time and effort. This integration allows for seamless data transfer, reducing the risk of errors while keeping your financial records organized and up-to-date.

Most modern accounting software platforms support the import of pre-designed billing documents, enabling users to generate invoices directly within the system or by uploading external files. This integration ensures that key information–such as client details, amounts, and due dates–are correctly transferred to your accounting system without manual input. Additionally, it allows for real-time updates on payments and balances, which can be tracked easily from one central location.

Another advantage of this integration is that it simplifies tax preparation and reporting. When your financial data is synchronized between your documents and accounting software, you can automatically generate tax reports and summaries, making the tax filing process more efficient and accurate.

In summary, integrating billing forms with accounting software can automate processes, improve accuracy, and save time, ultimately leading to a more efficient and less error-prone financial management system.

Free and Paid Invoice Templates Comparison

When choosing a billing solution, it’s important to understand the difference between free and paid options, as each offers its own set of features and limitations. Free resources are often readily available and can serve basic needs, but paid solutions provide additional functionalities that might be crucial for growing businesses. By comparing both types, you can make a more informed decision about what works best for your needs.

Free options are typically straightforward and easy to access. They often include simple, pre-designed layouts that can be customized with basic information such as client name, dates, and amounts. While these are suitable for small businesses or freelancers with minimal needs, they might lack advanced features like automated calculations, tax integration, or branding options. The main benefit of free templates is that they require no investment, making them an ideal starting point for those just beginning.

On the other hand, paid options often come with a wide range of added benefits. These may include sophisticated design customization, built-in formulas for automated calculations, compatibility with accounting software, and enhanced security features. Paid options also tend to offer customer support, ensuring that any issues or queries can be quickly addressed. However, the downside is the cost, which might be prohibitive for some small businesses or individual users. Yet, for businesses that require more professional solutions or have complex billing needs, these additional features can justify the investment.

In conclusion, while free resources may be sufficient for basic needs, paid solutions are more suitable for those seeking advanced features and greater efficiency. Your choice will ultimately depend on your business’s size, budget, and specific requirements.