Best Invoice Template for Massage Therapists to Simplify Your Billing Process

Managing finances in a service-oriented profession requires clear and precise documentation. Proper records not only ensure smooth transactions but also help build trust with clients. A well-structured approach to invoicing can simplify the billing process and save valuable time.

Whether you run a solo practice or work in a small team, having a reliable system for tracking payments and issuing receipts is essential. Customizable billing formats offer the flexibility needed to meet various client needs while maintaining professionalism. By streamlining this aspect of your business, you can focus more on providing exceptional service and less on administrative tasks.

Emphasizing accuracy and clarity in your financial documents is key to avoiding misunderstandings. Automating this process with effective tools ensures that each client receives a transparent, organized statement that reflects your services and charges in a straightforward manner.

Billing Solutions for Health Professionals

Effective billing tools are crucial for any professional providing personalized services. Having a structured document to record payments, services rendered, and client details helps ensure accuracy and professionalism. Such documents streamline the administrative side of the business, allowing practitioners to focus more on their clients’ needs and less on paperwork.

Customizable formats are essential for adapting to different service offerings and payment structures. These documents not only track payment but also provide clients with a clear breakdown of charges, making the process transparent. A well-designed system can include additional features, such as payment due dates, itemized lists of services, and even space for notes or discounts.

Utilizing such tools can greatly reduce errors, eliminate confusion, and enhance client satisfaction. Automating the process allows health professionals to issue clear, concise records quickly and efficiently, reducing the time spent on administrative tasks and improving overall business operations.

Why Health Professionals Need Billing Documents

Having a well-organized billing system is essential for any service provider who manages direct client payments. Proper documentation ensures that both the professional and the client are on the same page regarding the services rendered and the agreed-upon charges. It not only facilitates payment tracking but also enhances the overall client experience by offering clear and transparent records.

When professionals use structured billing documents, they can avoid common errors such as miscalculations or forgotten charges. This accuracy fosters trust and helps maintain a smooth business operation. Additionally, it ensures compliance with legal requirements and serves as a helpful reference for both parties in case of future inquiries or disputes.

Utilizing a standardized format makes the entire process more efficient, reducing the time spent on paperwork and allowing more focus on delivering high-quality services. Automation tools can further streamline this process, allowing for quick generation of records that are consistent and error-free.

Key Elements of an Effective Billing Document

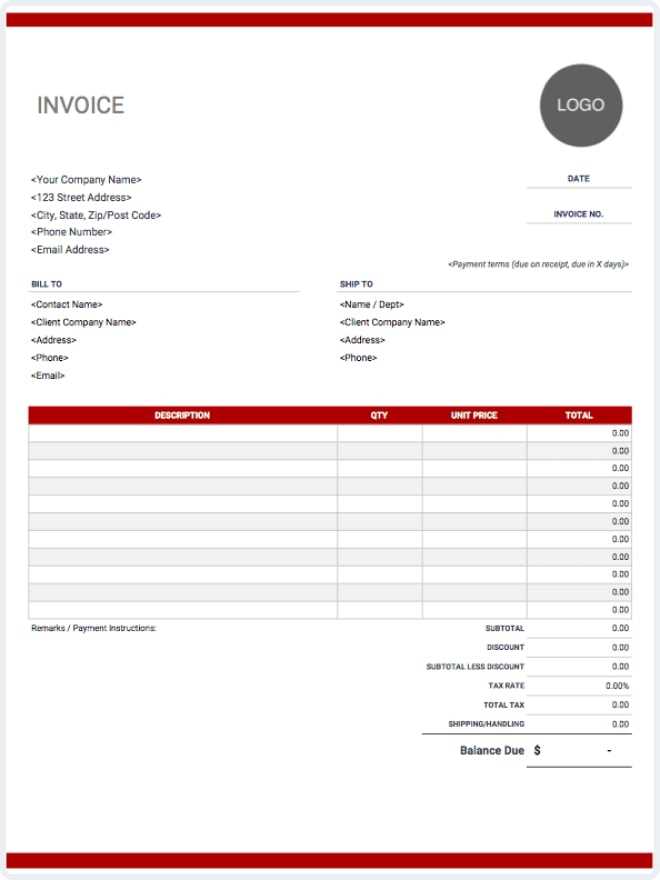

An effective billing document should include several essential components to ensure clarity, accuracy, and professionalism. These elements not only help organize the transaction but also create a transparent and reliable record for both the service provider and the client.

First, the document should clearly display both the provider’s and the client’s contact information, including names, addresses, and relevant identifiers. This helps avoid confusion and ensures that both parties can be easily reached if necessary. A unique reference number is also crucial for tracking purposes, allowing both sides to refer to the document quickly.

Additionally, it is important to detail the services provided, including the date, description, and cost of each item. This level of detail ensures that the client understands exactly what they are being charged for. Payment terms, such as due dates and accepted methods, should also be clearly stated to prevent any misunderstandings.

Having a clear payment summary and a section for any applicable taxes or discounts will further enhance the transparency of the document. Including a space for notes can also be helpful for adding special instructions or reminders related to the transaction.

Choosing the Right Billing Format

Selecting the appropriate format for your billing records is crucial for ensuring that the document is easy to understand and meets your business needs. The right structure will not only help streamline your financial processes but also make transactions more transparent and professional.

Factors to Consider

When choosing a format, it’s important to consider the complexity of the services provided and the preferences of your clients. A simple layout with basic details may be sufficient for straightforward services, while a more detailed format could be necessary for complex offerings or recurring payments. Additionally, accessibility is key–ensure that the format is easy to read and can be shared conveniently, whether electronically or in print.

Format Options

There are several format options available, including digital documents, printable forms, or online invoicing platforms. Each option has its advantages, depending on how you want to manage records and interact with clients. Digital solutions can be automated for easy tracking, while printable forms offer a traditional approach for those who prefer physical records.

| Format | Advantages | Best For |

|---|---|---|

| Digital Documents | Easy to customize, automated tracking, environmentally friendly | Tech-savvy clients, large volumes of records |

| Printable Forms | Tangible copies, simple design, no technical setup | Small businesses, clients who prefer physical copies |

| Online Platforms | Real-time tracking, automated reminders, easy payment integration | Growing businesses, recurring billing needs |

How to Customize Your Billing Document

Personalizing your billing document is an important step in creating a professional and efficient system for tracking payments. By tailoring the format to your specific needs, you can enhance both clarity and organization, making the process smoother for both you and your clients.

Essential Customizations

One of the first customizations to consider is the inclusion of your branding. Adding your business logo, name, and contact information makes the document look more professional and ensures clients can easily reach you if needed. Additionally, including your payment terms, such as due dates or accepted methods, helps set clear expectations from the start.

Advanced Customization Options

Depending on your business model, you may also want to add more advanced features. For example, if you offer various services or pricing packages, clearly listing each service with its respective cost can help avoid confusion. You may also want to incorporate discounts or promotions, making sure they are displayed in a transparent and organized way.

Including personalized notes or a section for additional comments can be useful for maintaining a connection with your clients or providing any special instructions. Ensuring all relevant details are included will make the document not only functional but also a reflection of your business professionalism.

Automating Billing with Structured Documents

Automating the billing process can significantly improve efficiency and reduce the likelihood of human error. By using automated systems, you can quickly generate accurate records, send them to clients, and track payments without needing to manually create each document.

One of the key benefits of automation is the ability to handle recurring payments. For professionals offering regular services, setting up automatic generation and delivery of billing records ensures that no payment is missed. This can be especially useful for clients with ongoing appointments, saving both time and effort.

Automated reminders for payment due dates can be set up to ensure timely settlements. This feature helps maintain a steady cash flow and prevents delays in payments. Integrating payment options directly into the system can further streamline the process, making it easy for clients to settle bills online quickly and securely.

Billing Documents for Small Practices

Small businesses often face unique challenges when it comes to managing finances. With fewer resources and clients to serve, it’s essential to have an efficient way to handle payments and maintain organized records. Using a customized billing solution can help small practices keep track of services, streamline their processes, and ensure timely payments.

For smaller operations, simplicity and flexibility are key. The billing document should be easy to create and understand while still capturing all necessary details. Here are some features that make a good billing solution for small businesses:

- Clear Service Breakdown: List each service provided with its cost for transparency.

- Client Information: Include essential details like the client’s name and contact information for easy reference.

- Flexible Payment Terms: Set clear due dates and payment methods that suit both you and your clients.

- Customization Options: Allow for quick adjustments based on the specific needs of each client.

- Automated Reminders: Send payment reminders automatically to avoid overdue bills.

In small practices, efficiency is crucial, and a well-structured billing document helps maintain smooth operations. Opting for a simple yet effective solution ensures that your financial tracking remains organized, saving time and preventing confusion.

Tracking Payments with Your Billing Record

Keeping track of payments is an essential part of managing a service-based business. A well-structured record can help you stay organized by providing a clear overview of amounts due, payments received, and any outstanding balances. This ensures that both you and your clients are always on the same page regarding financial transactions.

By incorporating payment tracking into your billing process, you can quickly identify which clients have settled their bills and which still have outstanding balances. It also provides a clear history of payment dates, helping you stay on top of your financial records. An effective record includes sections to mark payment status, making it easier to track and follow up when necessary.

| Service | Amount Due | Payment Status | Payment Date |

|---|---|---|---|

| Therapeutic Session | $100 | Paid | 2024-10-05 |

| Consultation | $50 | Unpaid | – |

| Package Deal | $450 | Paid | 2024-10-08 |

Including payment status in each record helps you monitor your cash flow and follow up promptly with clients who may have missed payments. Using such a system saves time and minimizes the risk of overlooking any payments, helping you maintain a consistent and accurate financial overview.

Best Software for Creating Billing Documents

Choosing the right software for generating professional billing records can make a significant difference in the efficiency and accuracy of your financial processes. With a variety of tools available, it’s important to select one that fits your specific needs, whether you’re running a small business or managing a growing client base.

Modern software options often include features such as easy customization, automatic calculations, and seamless integration with payment systems. The best platforms allow you to quickly create and send documents, track payments, and even manage taxes–all from a single, user-friendly interface.

Popular software options offer both free and paid versions, with advanced features for those looking to streamline their billing process. Many platforms also provide mobile apps, allowing you to send documents and track payments while on the go.

Some key features to look for include templates that are easy to personalize, options for recurring billing, automated reminders for overdue payments, and integrations with accounting software. These tools can help you stay organized and save time while ensuring that your financial records are accurate and up to date.

How Billing Documents Save Time

Creating billing records manually can be time-consuming, especially when you’re managing multiple clients or services. Having a pre-designed document structure allows you to streamline the process and significantly reduce the amount of time spent on administrative tasks. Instead of starting from scratch each time, you can quickly fill in the necessary details, saving valuable hours each week.

Efficiency Through Automation

By utilizing automated solutions, you can generate and send records with just a few clicks. Many systems allow you to input information once, such as client details and pricing, and then reuse that information in future documents. This eliminates repetitive tasks and minimizes the chance of errors, ensuring consistency and saving you from manually entering the same data multiple times.

Consistency and Accuracy

With a standardized structure, you can ensure that all important information is included, such as payment terms, services provided, and the total amount due. This consistency not only saves time but also increases the accuracy of your records. Clients will receive clear, professional documents every time, which can help prevent misunderstandings and reduce follow-up questions.

Time savings from using a structured approach means more time to focus on the work that matters, such as client care or business development. By optimizing your administrative workflow, you can maintain a more efficient practice while keeping your financial records in order.

Common Mistakes When Using Billing Documents

Even with a well-designed structure, it’s easy to make mistakes when generating billing records. Whether it’s due to rushed work, oversight, or lack of attention to detail, these errors can lead to confusion with clients and affect your cash flow. Understanding the most common mistakes can help you avoid them and maintain a smooth financial process.

Missing Essential Information

One of the most frequent mistakes is failing to include all necessary details. Leaving out crucial information such as the client’s contact details, service descriptions, or payment terms can lead to delays and misunderstandings. Each document should clearly state the following:

| Missing Information | Potential Consequences |

|---|---|

| Client Details | Difficulty in tracking payments and follow-ups |

| Service Descriptions | Confusion over what was billed |

| Payment Terms | Late payments or misunderstandings |

Incorrect Calculations

Another common error is inaccurate calculations, especially when dealing with taxes, discounts, or multiple services. This can lead to clients being charged incorrectly or receiving documents that don’t match the actual payment due. Double-checking your calculations or using automated systems can help prevent these mistakes.

Consistency is key in maintaining accurate financial records. Regularly reviewing your processes and ensuring all necessary information is included will help reduce the chances of errors and improve client satisfaction.

How to Handle Client Billing Disputes

Disagreements over payment are a common part of any service-based business. When clients question charges or payment terms, it’s essential to handle the situation professionally and efficiently. Addressing disputes in a timely and transparent manner can help maintain positive relationships and ensure that payments are settled fairly.

Clear Communication is Key

When a dispute arises, the first step is to communicate clearly with the client. Listen to their concerns, review the details of the service provided, and ensure that all terms were outlined properly. Often, misunderstandings occur when expectations aren’t aligned. It’s important to confirm whether the services delivered match what was agreed upon.

Document Everything

Having a well-documented record of transactions and agreements is crucial when resolving disputes. A structured approach to recording payments, terms, and services can provide evidence to clarify any confusion. Always ensure that both parties have a copy of the agreement, including all relevant terms, pricing, and dates.

Stay Professional throughout the resolution process. If the dispute remains unresolved after initial communication, consider offering a partial refund, credit, or additional service to meet the client halfway. Keeping the tone positive and solution-oriented can help maintain customer satisfaction while protecting your business interests.

Legal Considerations for Billing Documents

When managing billing records, it is essential to understand the legal requirements that apply to the services provided. Proper documentation can help protect both your business and your clients. In addition to ensuring clarity and accuracy, there are specific legal aspects to consider, including compliance with tax regulations, contracts, and client rights.

Compliance with Tax Regulations

One of the key legal considerations is ensuring that your billing records comply with local and national tax laws. Depending on your location, you may be required to charge specific taxes on services or products. This can vary by state, province, or country, so it’s important to research the tax laws that apply to your business. Properly itemizing taxes on your records not only ensures compliance but also avoids future issues with tax authorities.

Client Rights and Service Agreements

Each billing record should clearly outline the terms of service and payment to avoid any legal disputes. Having a formal agreement with clients, detailing the terms and conditions of services, payment schedules, and cancellation policies, can prevent misunderstandings. This agreement should be referenced in your billing records, showing both parties are on the same page.

| Legal Consideration | Importance |

|---|---|

| Tax Compliance | Avoid legal issues with tax authorities |

| Clear Payment Terms | Minimize disputes and confusion |

| Client Agreements | Ensure mutual understanding of services and payments |

By adhering to legal guidelines and maintaining transparency with your clients, you can protect your business from legal challenges while building trust and professionalism.

How to Issue Recurring Billing Documents

For businesses that provide ongoing services, issuing regular billing records is essential for ensuring timely payments and smooth operations. Setting up a system for recurring billing allows for automatic generation and dispatch of charges, minimizing the need for manual intervention. This process can save time and ensure consistent cash flow.

Setting Up a Recurring Payment Schedule

One of the first steps in issuing recurring charges is to establish a payment schedule that works for both you and your clients. This could be weekly, monthly, or quarterly, depending on the nature of the services provided. Clearly communicate this schedule with clients to ensure transparency and avoid confusion. Once agreed upon, you can set up a process to automatically generate the required billing records.

Automation Tools for Streamlining the Process

Using automation tools can significantly simplify the process of generating and sending regular billing records. Many software platforms allow you to create templates that automatically populate with client details and service information. These tools can be programmed to send out the records on specified dates, reducing the chance of human error and ensuring consistency.

| Step | Action |

|---|---|

| 1 | Agree on a payment schedule with clients |

| 2 | Set up recurring payment dates and amounts |

| 3 | Use automation tools to generate and send records |

Consistency and reliability are key when it comes to managing recurring billing. By implementing automated systems and clear schedules, you can ensure that payments are processed smoothly and efficiently every time.

Improving Client Trust with Clear Billing Records

Transparent and straightforward billing records are essential in building strong relationships with clients. When charges are easy to understand and free of ambiguity, clients feel more confident in the services provided. Clear documentation not only boosts trust but also helps avoid disputes and confusion regarding charges.

Key Components of Transparent Billing

To ensure clarity, every billing record should include the following elements:

- Detailed Breakdown – Clearly list all services provided, including individual costs.

- Clear Payment Terms – Specify due dates and payment methods to avoid misunderstandings.

- Contact Information – Ensure your contact details are visible in case of questions or concerns.

How Clear Records Promote Trust

When clients can easily see exactly what they are being charged for, they are more likely to feel satisfied and trust the professionalism of the service provider. Providing transparent records also shows that you value your clients’ time and money, which is an important part of building long-term relationships.

| Benefit | Description |

|---|---|

| Reduces Confusion | Clear and detailed records minimize the chance of misunderstandings. |

| Builds Professionalism | Presenting well-organized records reflects a professional approach to business. |