Invoice Template for MacBook Easy Download and Customization

Running a business involves various administrative tasks, one of the most important being managing customer payments. With the right tools, creating accurate billing documents can be both quick and simple, allowing you to focus on growing your business. Digital solutions have made this process much easier, especially for those who use Apple products for their everyday operations.

Streamlining your billing process can save you time and reduce the risk of errors. Many software options are available to help generate clear, professional-looking documents that can be customized to fit your specific needs. By using the right system, you can create a smooth and effective payment process that benefits both you and your clients.

Whether you’re looking for a straightforward way to document transactions or seeking a more detailed layout to track complex billing structures, there are various options to explore. By leveraging the tools at your disposal, you can ensure that your records are organized, secure, and easily accessible when needed.

Invoice Template for MacBook Overview

Creating professional billing documents has become an essential part of managing business finances. With the help of modern digital tools, crafting clear and organized payment requests is now easier than ever. These tools allow users to quickly generate customized documents, improving both efficiency and accuracy in business transactions.

Mac users have access to various solutions that streamline this process, providing flexibility and control over how financial records are generated. By using a structured document, businesses can ensure all the necessary details are included, minimizing errors and ensuring consistency across different clients and projects.

Whether you are a freelancer, small business owner, or part of a larger enterprise, utilizing a digital system for billing tasks offers significant advantages. It saves time, reduces administrative workload, and enhances the professionalism of the communication with clients. These systems are also often integrated with features that allow easy tracking, storage, and editing of financial documents as your needs evolve.

Why Choose a Template for Invoices

Using pre-designed documents to generate billing records can greatly simplify the process of requesting payments from clients. Instead of manually creating each document from scratch, you can rely on structured formats that ensure consistency and professionalism. This not only saves time but also reduces the likelihood of making mistakes that could affect business operations.

Here are several reasons why this approach is beneficial:

- Efficiency: Pre-made formats allow you to quickly fill in the necessary information, reducing the time spent on each transaction.

- Professionalism: A clean, organized layout ensures your business looks polished, helping build trust with clients.

- Consistency: Using the same format across all documents helps maintain uniformity, which is important for both internal records and client communication.

- Customization: Many systems offer customizable options, allowing you to adjust the layout and content based on your unique needs.

- Accuracy: With standardized fields, the risk of missing critical details is minimized, ensuring all relevant information is included in every document.

Overall, using a pre-built solution saves time and ensures that your financial documentation is both accurate and professional. It’s an investment that can lead to smoother business operations and fewer administrative headaches.

How to Download Invoice Templates

Finding and acquiring pre-designed documents for generating payment requests is an essential step in streamlining your billing process. Whether you’re looking for a basic format or something more detailed, downloading ready-made solutions is simple and can save you a great deal of time. The process typically involves selecting a source, choosing your preferred style, and then saving the document to your device for easy access and use.

Choosing a Reliable Source

To begin, it’s important to choose a trusted platform that offers well-designed formats. Many websites provide free and paid options, so you should consider factors such as customization capabilities and compatibility with your device. Popular sources often include productivity software providers, third-party websites, and even Apple-specific tools.

Downloading and Saving the File

Once you’ve selected the desired layout, simply click the download link and save the file to your local storage. Most systems support commonly used file formats like PDF, DOCX, or even custom formats that work with specific software. Ensure that the document is easily accessible and well-organized within your folders for future use.

With just a few steps, you can quickly access a professional solution that will help you manage your billing tasks effectively and efficiently.

Customization Options for MacBook Templates

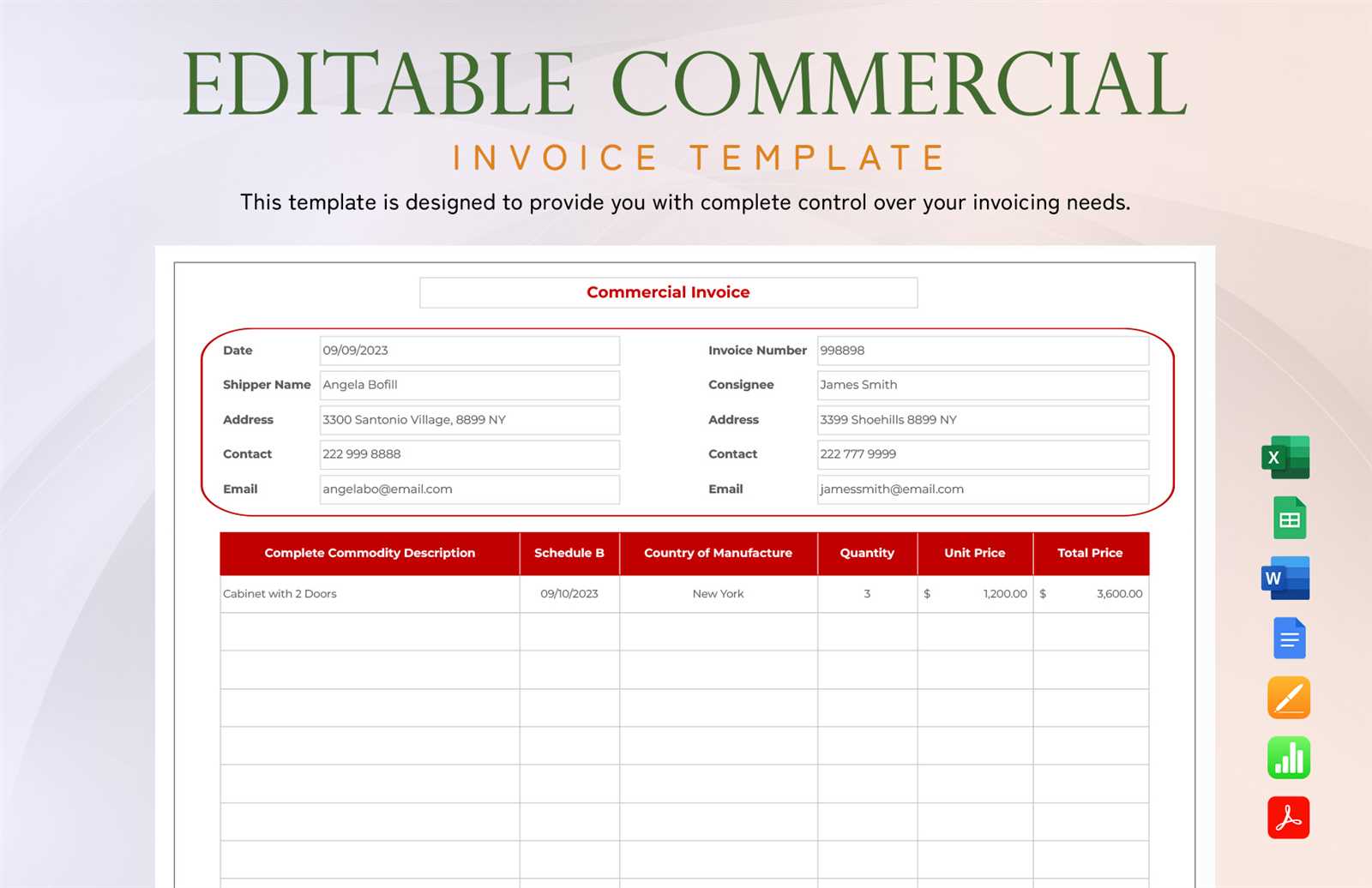

When working with pre-made layouts for creating billing records, the ability to personalize the design and content is key. Customization allows you to adapt the document to your business needs, reflecting your branding, preferred format, and specific requirements. Whether adjusting the structure, adding branding elements, or modifying text fields, tailoring the document ensures it aligns with your professional identity.

Personalizing the Design and Layout

Many platforms offer extensive options to modify the appearance of your document. You can adjust the font style, size, and color scheme to match your business branding. Layout modifications, such as moving sections or adding new fields, provide further flexibility in how information is presented, making it easier for clients to understand the details of the transaction.

Adding Business Branding and Details

One of the most important aspects of customization is incorporating your logo and business information. Most solutions allow you to insert your company’s logo at the top of the document, as well as customize contact details, payment terms, and other key information. This personalization ensures that your document looks professional and helps clients easily identify your brand.

By utilizing these options, you can create a customized solution that suits your business needs and presents a polished image to your clients.

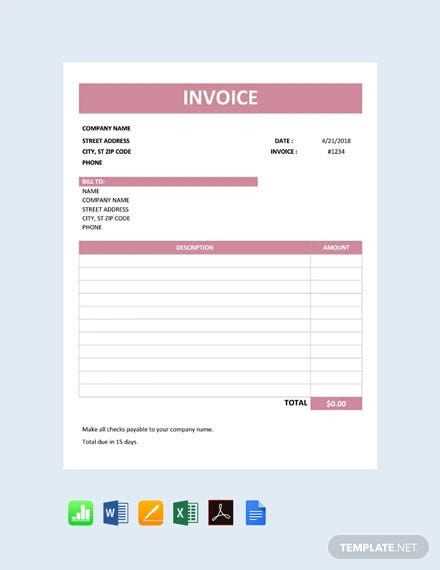

Free vs Paid Invoice Templates

When choosing a solution for creating billing documents, users often face the decision of selecting between free or paid options. Both types offer their own set of advantages and limitations, and understanding these differences can help you make the best choice based on your needs. While free formats are a great option for basic tasks, paid solutions often come with added features and more professional designs.

Advantages of Free Options

Free solutions are a popular choice for individuals or small businesses just starting out. They often provide essential features that allow you to generate simple, effective records without any upfront cost. Here are some of the key benefits:

- No cost: Free options are ideal for those on a tight budget.

- Simple to use: Most free solutions are straightforward and quick to implement.

- Basic features: They typically cover basic needs, including standard fields and layouts.

Benefits of Paid Options

Paid options, on the other hand, offer more flexibility and functionality, making them suitable for businesses with more complex requirements. These options often include a wider variety of designs, customization possibilities, and additional features like automatic calculations or integrations with other software. Some of the key advantages include:

- Advanced features: Paid solutions may include features such as payment tracking, invoicing automation, and data export options.

- Customization: These services often allow greater flexibility in design and content formatting.

- Customer support: Premium options usually offer dedicated support and regular updates to keep the system running smoothly.

Ultimately, the decision between free and paid solutions depends on your specific needs, business size, and budget. For simple use, free options may be enough, but if you require more advanced capabilities and professional designs, investing in a paid solution could prove to be more beneficial in the long run.

Using Apple Pages for Invoice Creation

Apple Pages is a versatile tool that can be used to craft professional billing documents, offering an intuitive interface and powerful features. Whether you are a freelancer or a small business owner, Pages provides a simple way to create, customize, and manage your payment requests with ease. It allows users to leverage pre-designed layouts or start from scratch, making it ideal for those who need flexibility in their document creation process.

The platform’s user-friendly design ensures that even those with minimal technical experience can quickly produce well-organized financial records. By utilizing various formatting options and built-in tools, you can create a clean, consistent layout tailored to your specific needs. With Pages, it’s easy to add essential details such as client information, services provided, payment terms, and more.

Moreover, Apple Pages supports a range of export formats, allowing you to save your document as a PDF or Word file, which can then be easily shared or printed. This makes it an excellent choice for users who need a simple yet effective solution for handling financial documentation.

How to Edit Templates on MacBook

Editing pre-designed billing layouts on your device is a simple process that allows you to personalize documents to suit your business needs. Whether you’re adjusting text, adding fields, or changing the overall design, customizing these files ensures they accurately reflect your professional requirements. With the right tools, the editing process can be quick and straightforward.

Here are the basic steps to follow when editing a document:

- Open the Document: Start by opening the file in the application you plan to use, such as Apple Pages or a compatible word processor.

- Modify Text: Edit the text fields to include the necessary information, such as client names, services provided, and payment terms.

- Adjust Layout: You can move sections around or resize fields to better fit your content. Most applications allow you to easily drag and drop elements within the document.

- Add Custom Elements: Insert your logo, change colors, or add additional fields like tax information or payment methods to make the document more specific to your business.

- Save and Export: Once you’re satisfied with the changes, save the document. You can then export it in various formats, such as PDF or Word, depending on your needs.

By following these simple steps, you can quickly personalize a ready-made solution, making it work perfectly for your billing process.

Best Software for Invoice Templates

When it comes to generating professional billing records, choosing the right software can make a significant difference. The ideal solution should provide flexibility, ease of use, and customization options. A variety of tools are available, catering to different needs, from freelancers to larger enterprises. These applications help streamline the process and ensure that every detail is included in a polished format.

Top Features to Look For

Before selecting a software, consider the following features that can enhance your billing experience:

- Customization: The ability to adjust the design and content to suit your brand.

- Ease of Use: Intuitive interfaces that simplify document creation without steep learning curves.

- Integration: Seamless connections with other business tools, such as accounting software or CRM systems.

- Export Options: The ability to save and share documents in multiple formats (PDF, Word, etc.).

- Automation: Tools that automate repetitive tasks like adding taxes or calculating totals.

Recommended Software

Here are some of the top-rated programs that can help you easily create and manage your documents:

- Apple Pages: A free and easy-to-use solution with customizable layouts, ideal for those working on a Mac device.

- Microsoft Word: Offers a wide variety of professional designs and extensive editing tools, suitable for those who prefer traditional word processors.

- QuickBooks: An all-in-one accounting tool that also includes features for creating and managing financial documents.

- Zoho Invoice: A cloud-based solution that specializes in automated billing and customizable options.

- FreshBooks: A user-friendly platform with excellent support and additional features for time tracking and invoicing automation.

Choosing the right software can greatly improve your efficiency and professionalism when managing business transactions. By using one of these top tools, you can streamline your billing process and focus on what matters most: growing your business.

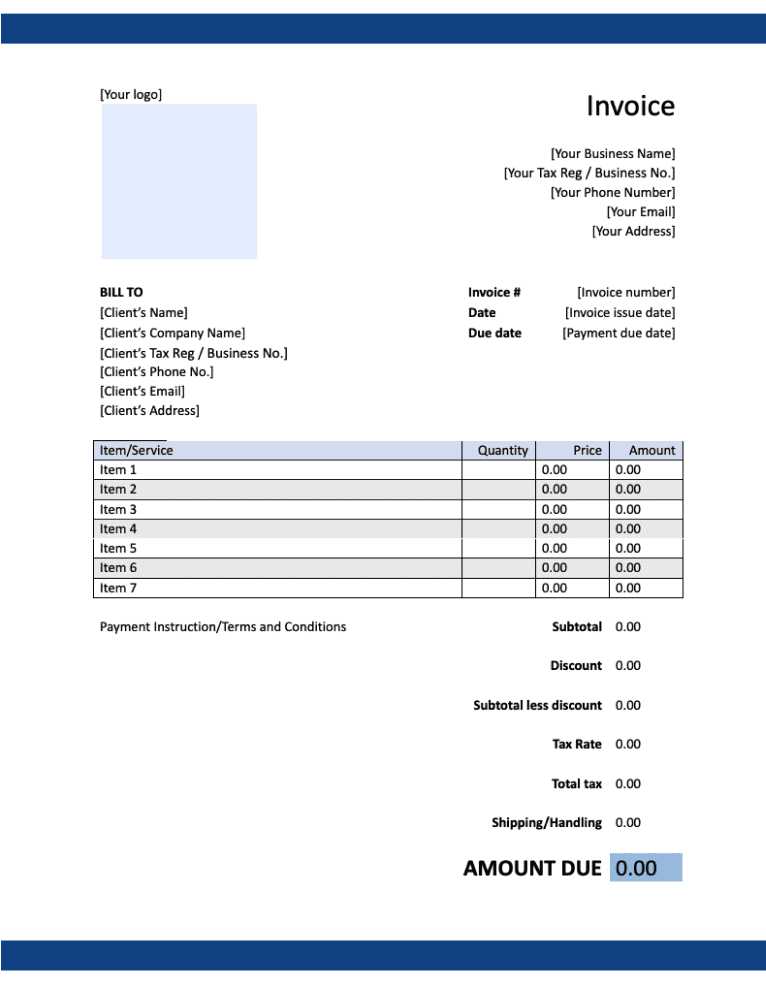

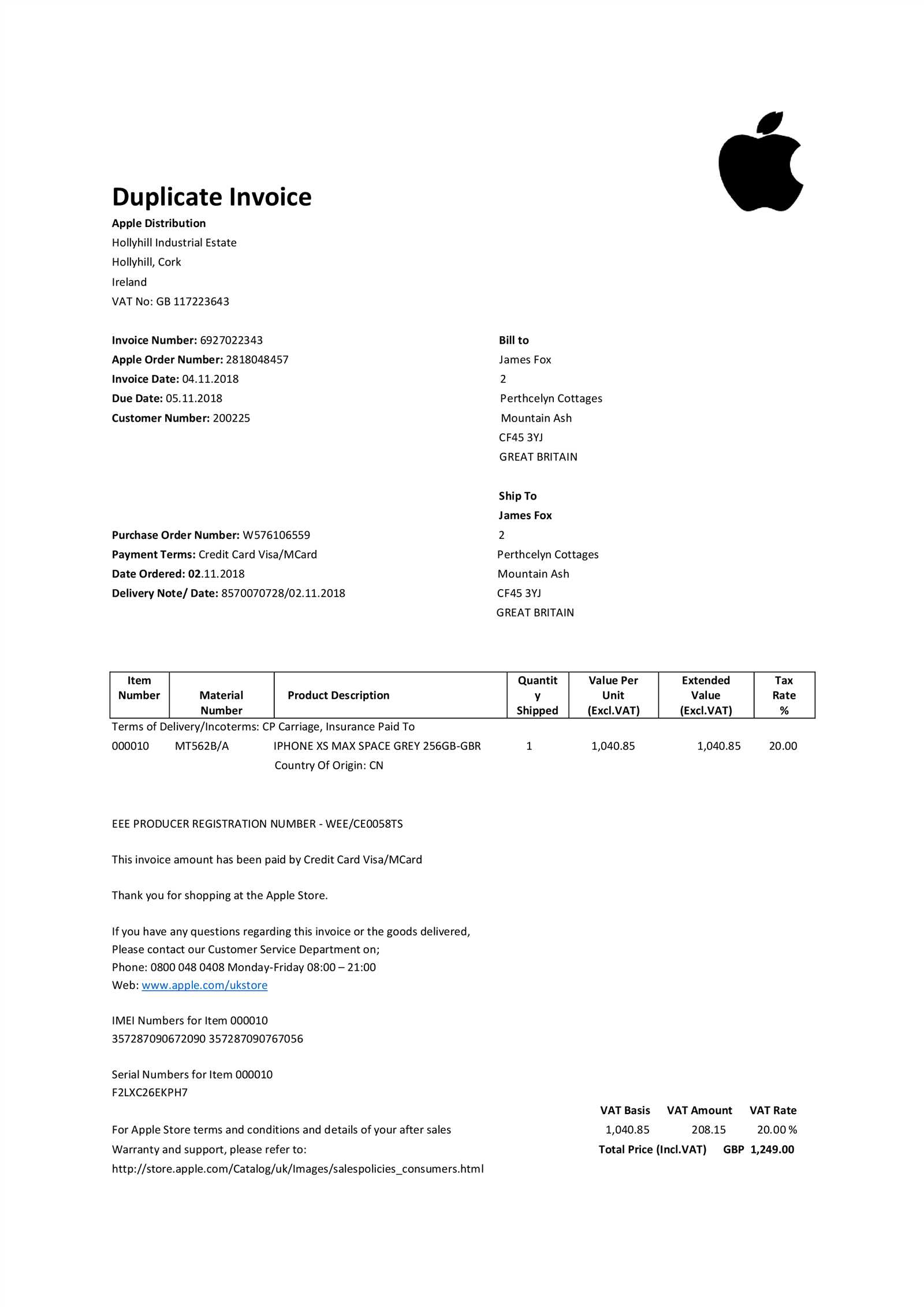

Key Features in Invoice Templates

When creating professional billing documents, certain elements are essential to ensure clarity and effectiveness. These features help organize the content, making it easy for both the creator and the recipient to understand the transaction details. Including the right components in your document is crucial for maintaining a professional image and avoiding confusion.

Below are some key aspects to consider when designing or selecting a document format:

- Contact Information: Always include the sender’s and recipient’s full details, such as name, address, and contact numbers. This ensures the document is personalized and easy to reference.

- Unique Identification Number: A unique reference number helps track and organize transactions, making it easier to search and manage records in the future.

- Itemized List: Clearly itemize services or products, including quantities, prices, and any discounts applied. This transparency prevents misunderstandings.

- Payment Terms: Include clear payment instructions and terms, such as the due date, acceptable methods of payment, and late fees if applicable.

- Tax and Totals: Properly calculate and display tax rates and totals. This ensures the document reflects the full cost of the transaction and complies with tax regulations.

- Branding Elements: Incorporating your logo, company colors, and other branding elements can enhance your business image and make the document instantly recognizable.

- Notes or Additional Information: A section for any additional notes or instructions allows you to communicate important details to the recipient, such as delivery instructions or special offers.

By incorporating these elements, you can ensure your billing documents are both professional and functional, helping to build trust and maintain clear communication with clients or customers.

Tips for Creating Professional Invoices

Creating well-organized and clear billing documents is essential for maintaining a professional reputation and ensuring timely payments. A well-crafted document not only communicates the details of a transaction but also reflects the quality of your business. By following a few simple guidelines, you can ensure your documents are effective, easy to understand, and leave a positive impression on clients.

Here are some practical tips to keep in mind when preparing your billing statements:

- Keep it Simple: Avoid clutter by focusing on essential information only. A clean, straightforward layout makes it easier for clients to read and understand the document.

- Use Clear and Consistent Formatting: Choose a clear font, consistent font size, and well-organized sections to make the document easy to follow.

- Double-Check All Information: Always verify the details, including the recipient’s name, amounts, and payment terms. Any errors could delay the process or cause confusion.

- Set Clear Payment Terms: Be sure to specify when payment is due, the accepted methods of payment, and any penalties for late payments.

- Be Transparent: List all charges in detail, including individual prices, taxes, and any discounts. This helps avoid misunderstandings and demonstrates professionalism.

- Include a Personal Touch: Adding a small thank you note or offering additional services can make a big difference in building a positive relationship with your clients.

- Stay Consistent: Use the same format and layout across all your billing documents. This consistency reinforces your brand image and makes your communication more reliable.

By following these tips, you can create billing documents that reflect your attention to detail and professionalism, helping to foster trust and positive relationships with your clients.

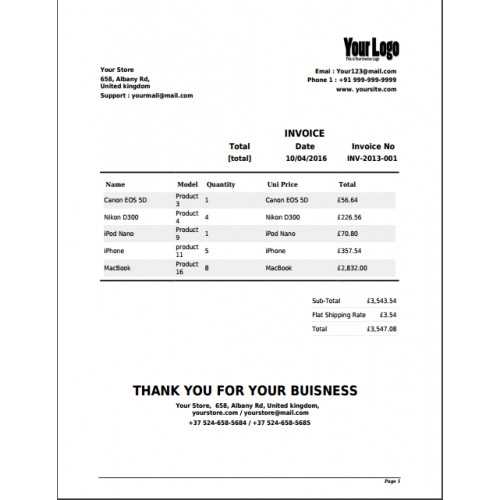

How to Add Your Logo to Invoices

Incorporating your business logo into billing documents not only helps reinforce your brand identity but also adds a professional touch. A recognizable logo at the top of your document makes it stand out and can leave a lasting impression on your clients. Whether you are using a word processor, design software, or a dedicated billing tool, adding your logo is a straightforward process.

Follow these simple steps to add your logo to your billing documents:

- Prepare Your Logo File: Ensure that your logo is high-quality and saved in a commonly used format such as PNG, JPEG, or SVG. This will ensure that it looks sharp and professional when inserted into the document.

- Choose the Right Placement: Typically, logos are placed at the top of the page, either centered or aligned to the left. This placement helps clients easily identify your business at a glance.

- Insert Your Logo: Most word processors and design tools allow you to insert an image directly. Use the “Insert” or “Image” option in the menu, select your logo file, and position it as desired.

- Resize the Logo: If your logo is too large or too small, resize it to fit the layout without overwhelming the document. Keep it proportional and avoid distorting the image.

- Ensure Consistency: Always use the same logo across all your billing documents to maintain brand consistency. This will help reinforce your brand’s professional image.

By adding your logo, you are not only enhancing the visual appeal of your billing statements but also establishing your brand’s presence in every business transaction.

Managing Multiple Invoices on MacBook

Managing a large number of billing statements efficiently is crucial for any business. Without an organized system, it can quickly become overwhelming to track outstanding payments, monitor due dates, or maintain accurate records. Thankfully, there are a variety of tools and methods available to streamline the process, especially on a MacBook.

Here are some tips to help you manage multiple billing documents efficiently:

| Method | Description |

|---|---|

| Use Spreadsheet Software | By using tools like Numbers or Excel, you can create a centralized document to track all your billing records. Include columns for client name, due dates, payment amounts, and status. |

| Organize by Folders | Keep different categories of billing records in separate folders on your device. For example, you can create folders for “Paid,” “Unpaid,” and “Pending” to easily find and manage documents. |

| Use Cloud Storage | Storing your documents in cloud storage services like iCloud or Google Drive allows you to access them from any device and share them with your team for better collaboration. |

| Set Up Reminders | To stay on top of payment deadlines, set up reminders using Apple’s Calendar or any other reminder apps available on your MacBook. |

| Track Payment Status | Make it a habit to regularly update the payment status in your records, marking documents as paid, partially paid, or overdue to maintain an accurate financial overview. |

By using these methods, you can keep your billing processes organized and ensure timely payments, ultimately making your business operations more efficient and streamlined.

Secure Storage for Invoice Files

When dealing with financial documents, it’s essential to ensure that sensitive information remains safe from unauthorized access and potential data loss. A secure storage system not only protects your files but also ensures easy access when needed. Whether you’re using local storage or cloud-based solutions, it’s important to understand the best practices for keeping your business records safe and organized.

Options for Secure Storage

There are several secure storage methods available that allow you to safeguard your business documents while maintaining easy access and retrieval options:

- Cloud Storage Services: Cloud platforms such as iCloud, Google Drive, and Dropbox offer encrypted storage solutions. They allow you to access your files from any device, ensuring that your documents are always within reach, while also providing protection against data loss.

- External Hard Drives: Storing your documents on an external drive provides an offline backup. Make sure the drive is encrypted and kept in a safe place to prevent physical theft or damage.

- Password Protection: Whether using cloud services or local storage, it’s crucial to encrypt files with strong passwords. Encryption adds an extra layer of protection, making it difficult for unauthorized individuals to access your records.

- Backup Solutions: Regularly backing up your files on a separate storage medium ensures that you can recover lost or corrupted data. Consider automating backups to make the process seamless and less prone to error.

Best Practices for File Security

Here are some additional tips for maintaining the security of your business documents:

- Enable Two-Factor Authentication: For added security on cloud platforms, enable two-factor authentication. This will require both your password and a secondary authentication method to access your account.

- Limit File Access: Only give access to the necessary individuals. Use role-based access control for team members if you’re sharing documents with others.

- Regularly Update Software: Keep your devices, software, and security tools up-to-date to protect against potential vulnerabilities.

By implementing these storage solutions and practices, you can ensure the safety and accessibility of your critical business records, keeping them secure and protected from potential threats.

Automating Invoice Generation on MacBook

Generating business documents manually can be time-consuming, especially when handling multiple clients or recurring transactions. Automating this process can save time, reduce errors, and improve overall efficiency. By using the right tools and software, you can streamline the process of creating billing statements and have them generated automatically with minimal effort.

Tools for Automation

There are various tools available that can help automate the creation of financial documents. These tools integrate with your existing systems, enabling seamless and automated generation of records:

- Accounting Software: Programs like QuickBooks, Xero, and FreshBooks are designed to automate many aspects of financial management, including document creation. With these tools, you can input client details and billing information once, and the system will generate documents automatically for each transaction.

- Excel and Spreadsheet Automation: If you prefer using spreadsheets, you can set up automated formulas and macros to generate billing records. Tools like Google Sheets and Microsoft Excel allow you to create customizable workflows that update automatically based on inputs like dates, amounts, or customer data.

- Custom Scripts: For those with more technical expertise, custom automation scripts written in languages such as Python or AppleScript can help generate documents. These scripts can be designed to pull data from databases, populate document fields, and save the files in specified formats.

Benefits of Automation

Automating the creation of business documents offers several advantages:

- Time Efficiency: Automating repetitive tasks frees up valuable time, allowing you to focus on other important areas of your business.

- Accuracy: Automation reduces the risk of human error, ensuring that all information is accurately entered and updated.

- Consistency: Automated processes ensure that all generated records follow the same structure and format, providing a professional and consistent appearance to your clients.

- Integration with Other Tools: Automation allows your documents to integrate seamlessly with accounting software, customer relationship management (CRM) systems, or payment processors, creating a more connected and efficient workflow.

By leveraging the right automation tools, you can significantly simplify the process of managing billing documents and improve your business’s overall productivity.

Sending Invoices Directly from MacBook

Once you’ve created your billing statements, the next step is to send them to your clients in a timely and professional manner. Instead of printing, scanning, or manually sending emails, you can streamline this process by sending documents directly from your device. This method is efficient, fast, and helps maintain a professional image.

Ways to Send Billing Records from MacBook

There are multiple ways to send your billing records directly from your device, depending on the software you use and your preferred method of communication:

- Email Services: The simplest and most common way to send documents is through email. You can attach your records to an email and send it directly from your email client such as Apple Mail, Gmail, or Outlook. Many programs also allow you to automate this process, so the document is sent automatically as soon as it’s generated.

- Cloud Storage Links: Storing documents in cloud services like Google Drive, Dropbox, or iCloud allows you to easily generate a shareable link. You can then send the link to your client via email or messaging services. This is especially useful for large files that may be too big to email directly.

- In-App S

Common Mistakes in Invoice Creation

When generating billing records, small mistakes can lead to confusion, delays, and even payment issues. These errors can range from missing details to incorrect calculations, affecting both your professional reputation and cash flow. Understanding the common mistakes that occur during the creation process is key to ensuring smooth transactions with clients.

Common Errors to Avoid

Here are some of the most frequent mistakes people make when creating financial documents:

- Incorrect Contact Information: Always double-check client details, such as names, addresses, and email addresses. An error in this information can delay the payment process and may even cause issues with communication.

- Omitting Payment Terms: Be clear about payment deadlines, methods, and penalties for late payments. Lack of this clarity can create confusion and lead to delayed payments or misunderstandings.

- Unclear Item Descriptions: If the products or services are not clearly described, the client might question the charges. Be specific about what is being billed, including quantities, prices, and any relevant details.

- Mathematical Mistakes: Even small calculation errors can undermine your credibility. Always double-check the sums and ensure that taxes, discounts, and totals are calculated correctly.

- Missing Due Dates: Not including a due date can lead to payment delays. Clearly indicate when payment is expected to avoid confusion and ensure timely transactions.

- Failure to Include a Unique Reference Number: A unique number for each record helps you track payments and provides a point of reference for both you and the client. This is especially important for record-keeping purposes.

- Inconsistent Formatting: A document that lacks consistency in fonts, spacing, and layout can appear unprofessional. Maintain a clean and consistent format to enhance readability and make the document easier to understand.

How to Avoid These Mistakes

To prevent these errors, consider these simple strategies:

- Use Pre-built Forms: Using professional tools and pre-designed formats can reduce human error. These resources often come with built-in fields for essential information, helping you avoid oversights.

- Proofread: Always review the document before sending it. A second look can help you catch mistakes that may have been missed during the initial creation.

- Automate Calculations: Many digital tools automatically calculate totals, taxes, and discounts, ensuring that no manual errors occur.

By being aware of these common mistakes and taking the necessary precautions, you can ensure that your documents are accurate, professional, and easy for clients to process, improving both your workflow and client relationships.

Legal Requirements for Invoices

When creating financial documents, it’s essential to comply with the legal standards and regulations set by your country or region. These documents must meet certain criteria to be legally recognized and ensure both parties are protected. Failing to include required information can result in penalties, disputes, and delays in processing payments.

Mandatory Information to Include

Below are key details that should be included to ensure that your document adheres to legal requirements:

- Business Information: Include the full legal name, business address, and contact details of both the service provider and the client. This ensures clarity regarding the parties involved.

- Unique Reference Number: Every document should have a unique identification number to track transactions. This number is important for both auditing and future reference.

- Date of Issue: The date the document is created is critical for establishing the timeline of payment and compliance.

- Payment Terms: Specify the payment method, due date, and any late fees or penalties associated with delayed payments. Clear payment terms help prevent misunderstandings.

- Tax Identification Number: Depending on your country’s laws, businesses may be required to include a tax ID number for tax purposes. This also ensures the document is valid for tax reporting.

- Description of Goods or Services: A clear breakdown of what was sold or provided, including quantities and unit prices, is necessary for legal transparency.

- Amount Due: The total amount due, with any taxes or discounts clearly stated, is a legal requirement to avoid confusion and disputes.

Regional Variations

Legal requirements can vary depending on the country or region. Here are a few examples of region-specific regulations:

- European Union: In the EU, businesses must include VAT details and ensure that their documents comply with the EU invoicing rules. Failure to comply may result in penalties or difficulties with tax authorities.

- United States: In the U.S., certain states require businesses to have a tax ID number, and tax rates must be accurately calculated and displayed on the record.

- Australia: In Australia, GST (Goods and Services Tax) must be included on the document, along with specific itemized details, when applicable.

By ensuring compliance with these legal standards, you can prevent future disputes and ensure that your transactions are legally sound and transparent.

How to Track Payments

Efficiently monitoring payments is a crucial part of managing your financial operations. Whether you’re a small business owner or an independent contractor, keeping track of what has been paid and what is still outstanding helps ensure a smooth cash flow and minimizes the risk of missed payments. Implementing a structured approach to monitor outstanding balances can save time and prevent confusion in the future.

Methods to Track Payments

There are several methods to track payments, each suited to different preferences and business sizes. Here are some of the most common options:

- Manual Tracking: Using spreadsheets (e.g., Excel or Google Sheets) allows you to manually enter payment details such as the amount paid, payment date, and any outstanding balances. This method is cost-effective but requires diligent attention to detail.

- Accounting Software: Tools like QuickBooks, FreshBooks, or Xero offer automated tracking features. These platforms sync with your bank accounts and automatically update payment statuses, making the process more efficient and accurate.

- Payment Processors: Using payment platforms such as PayPal, Stripe, or Square allows you to automatically track transactions. These systems often provide reports and dashboards that show when payments were received, making it easier to stay on top of your finances.

- Manual Receipts and Notes: If you are dealing with in-person payments or cash transactions, make sure to provide receipts and record each payment manually in a ledger or physical register.

Best Practices for Effective Payment Tracking

Adopting some best practices will help you stay organized and prevent errors or confusion:

- Regular Updates: Ensure that payment records are updated regularly. This will help avoid any backlog of untracked transactions and reduce the chances of forgetting important details.

- Clear Communication: Make sure your clients understand the payment terms and deadlines. Keep open lines of communication in case there are any delays or issues with the payments.

- Automate Reminders: Many accounting tools and platforms allow you to set up automated reminders for overdue payments. This will help you follow up with clients without manual effort.

- Use Payment Categories: Organize payments by type, such as full payments, partial payments, or deposits. This will allow you to easily identify any outstanding balances or discrepancies.

By implementing a consistent system for tracking payments, you can maintain a clear financial overview and ensure that all transactions are accounted for in a timely manner.