Invoice Template for Labour Services Easy to Customize

Creating a clear and professional document for billing is crucial for any business providing hands-on or skilled services. A well-structured form can make the payment process smoother, reduce misunderstandings, and build trust with clients. Whether you’re a contractor, technician, or freelance professional, having a standardized approach helps ensure accuracy and efficiency in the financial aspects of your work.

Customizing such documents allows you to reflect your business’s branding while also meeting the needs of your clients. The ability to quickly generate these forms means less time spent on administrative tasks and more time focusing on delivering quality results. With the right format, you can easily itemize your services, specify rates, and keep a record of completed projects.

In this guide, we’ll explore the essential components of an effective billing document, how to tailor it to your business, and the best practices for managing payments. Whether you’re just starting or looking to refine your process, having a reliable format can help keep everything organized and professional.

How to Create a Labour Invoice

Generating a professional document that outlines the details of the work completed and the corresponding charges is an essential step in getting paid for services. The goal is to provide clear, concise information that reflects the terms of the agreement and makes the payment process as smooth as possible. This document acts as a formal request for compensation and should include all necessary details to avoid confusion.

Include All Key Details

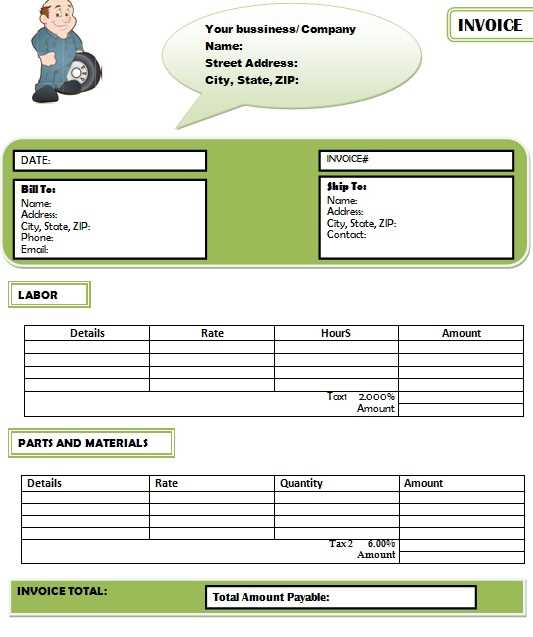

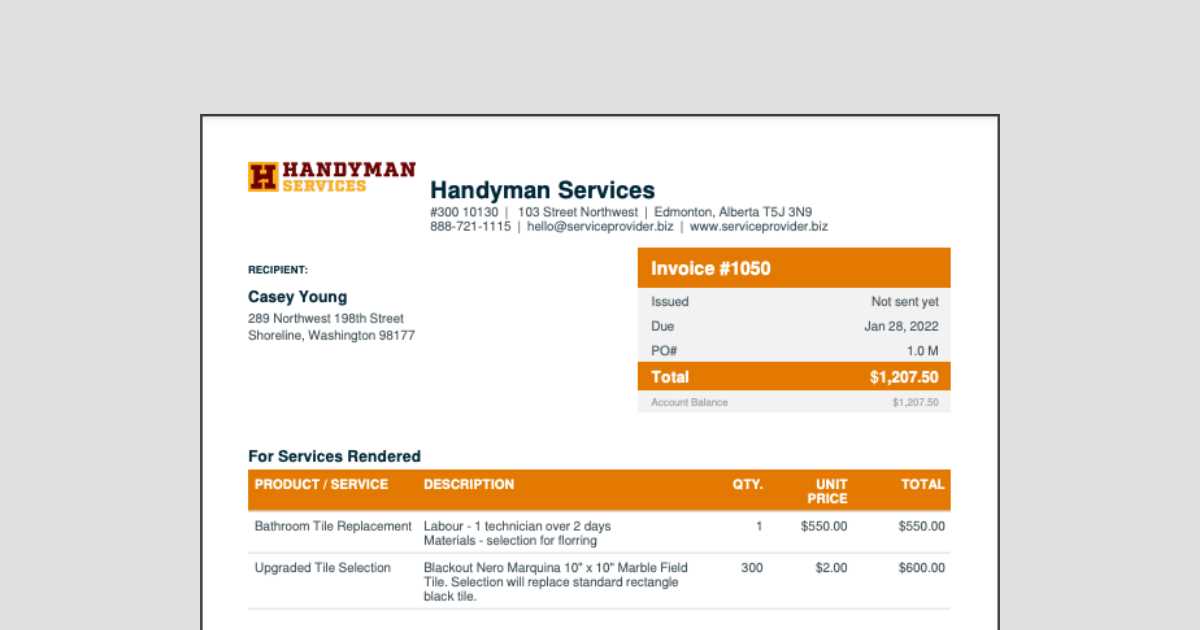

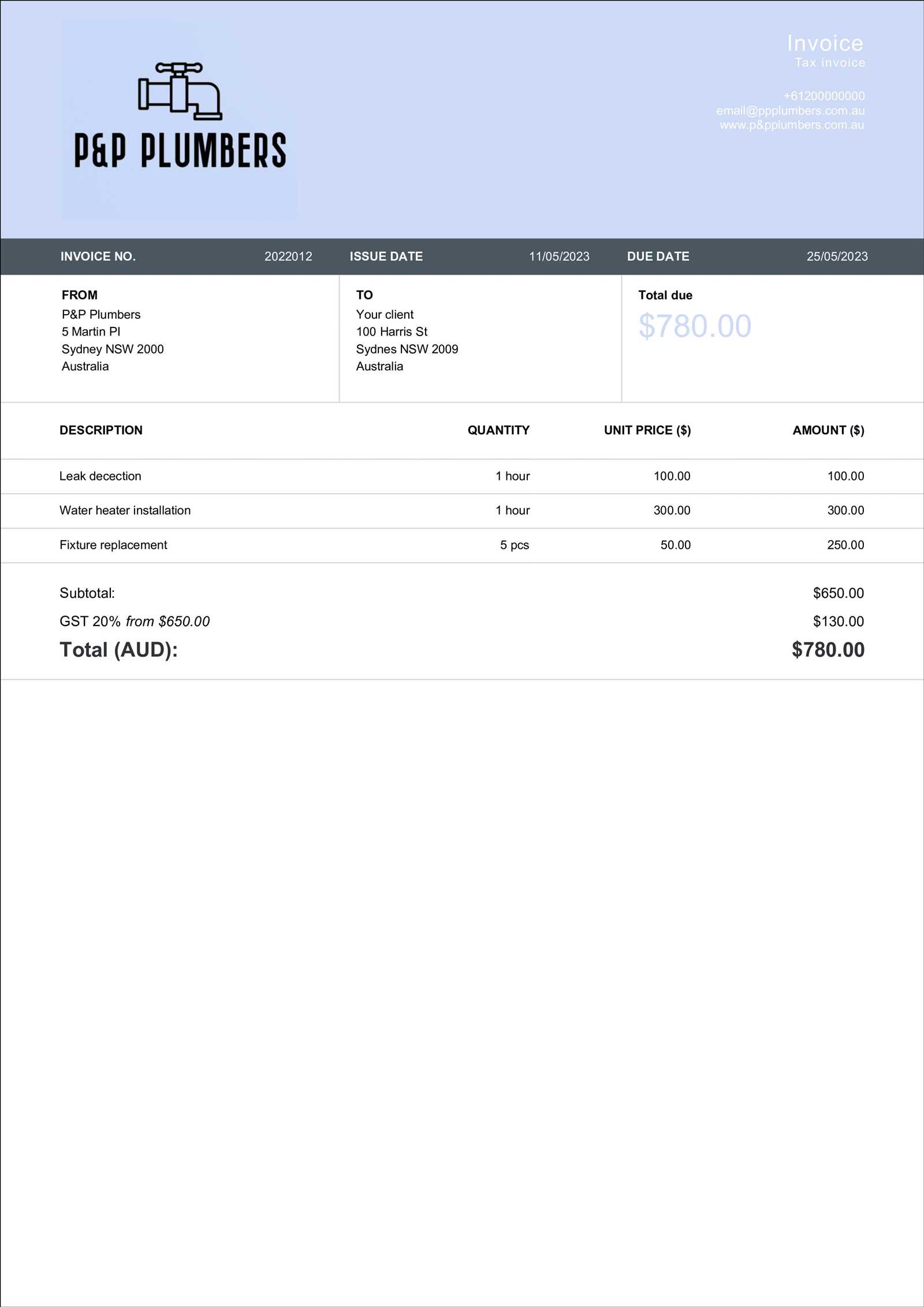

Start by including your business information at the top of the document. This should consist of your name or company name, contact details, and logo (if applicable). Then, add the client’s information, such as their name, address, and contact information. Having these details at the beginning establishes clarity and makes the document easily traceable.

Break Down the Work Completed

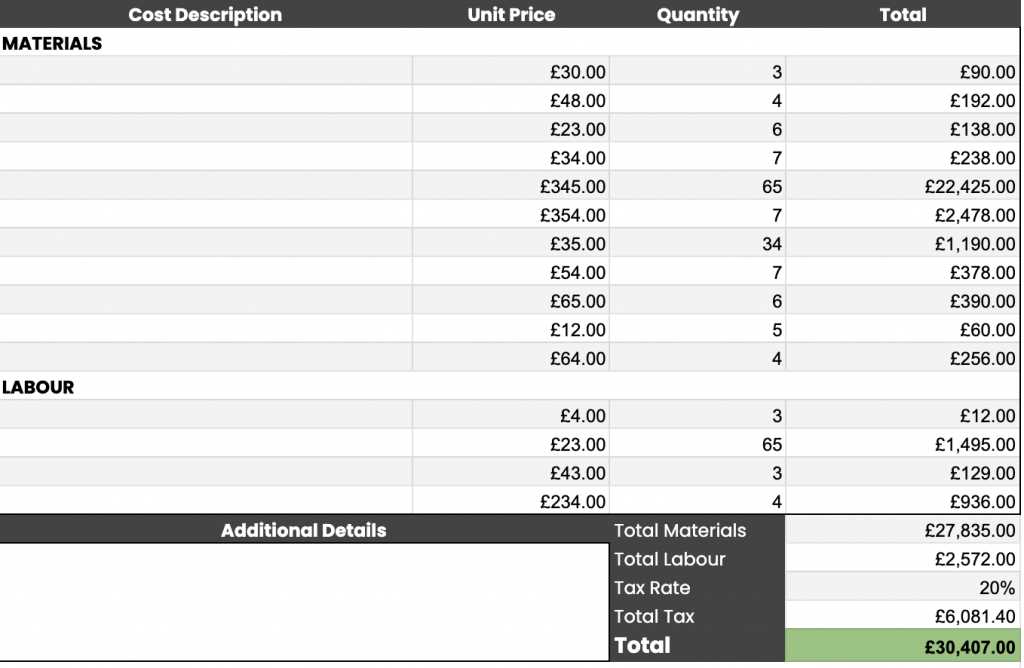

Provide a detailed description of the services rendered. This should include a breakdown of the tasks completed and the time spent on each task, if applicable. Clearly define the rate per hour or the agreed-upon cost for each specific task. This will allow clients to see exactly what they are paying for and prevent any misunderstandings later on.

Finally, include the total amount due, payment terms, and any relevant deadlines. Make sure to leave space for both your signature and the client’s acknowledgment of receipt. A well-organized document not only ensures timely payments but also demonstrates professionalism in your business practices.

Essential Information for Labour Invoices

To ensure that clients are clear about the charges and terms of the completed work, it is vital to include certain key details in the payment request. These elements help establish transparency and protect both the service provider and the client in case of any disputes or questions regarding the payment. Below are the critical pieces of information that should be included in every payment request.

| Information to Include | Description |

|---|---|

| Business Information | Your name, company name, address, and contact details. |

| Client Details | The client’s name, address, and contact information. |

| Work Description | A detailed description of the tasks completed and services provided. |

| Rate and Charges | The rate applied for each service or task, and the total cost for each item. |

| Total Amount | The total amount due for the work performed. |

| Payment Terms | Include payment due date and methods of payment accepted. |

| Payment Instructions | Clear instructions on how the client should submit the payment. |

Having this information clearly listed not only ensures proper communication but also minimizes the risk of confusion or delay in payments. Being thorough and organized builds trust and reflects professionalism in your business practices.

Customizing Your Invoice Template

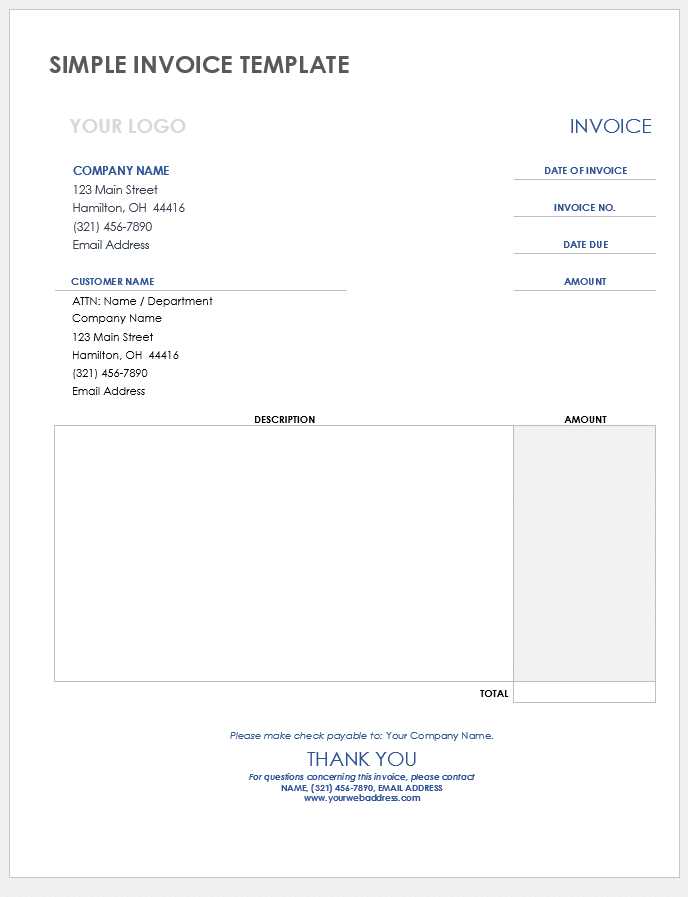

Personalizing the document you use to request payment is a simple yet effective way to enhance your professionalism and make your business stand out. Customization allows you to tailor the document to your specific needs and the preferences of your clients. The goal is to make it not only functional but also reflective of your brand identity and service style.

Here are several ways to personalize your payment request document:

- Add your logo: Incorporate your business logo at the top of the document to help strengthen your brand identity.

- Choose a color scheme: Use your business’s colors to create a cohesive look and feel.

- Include a custom message: Personalize the message section to thank your clients or provide additional instructions regarding the payment process.

- Define service categories: If you offer multiple services, include clear categories for each service or task to make the breakdown easy to understand.

- Tailor the payment terms: Adjust the payment terms and deadlines based on the nature of the work and client agreements.

By customizing the document, you ensure that it is both professional and aligned with your brand’s identity. The clearer and more personalized it is, the better your clients will understand the charges and payment process, which can help improve your cash flow and overall client satisfaction.

Design Tips for Professional Invoices

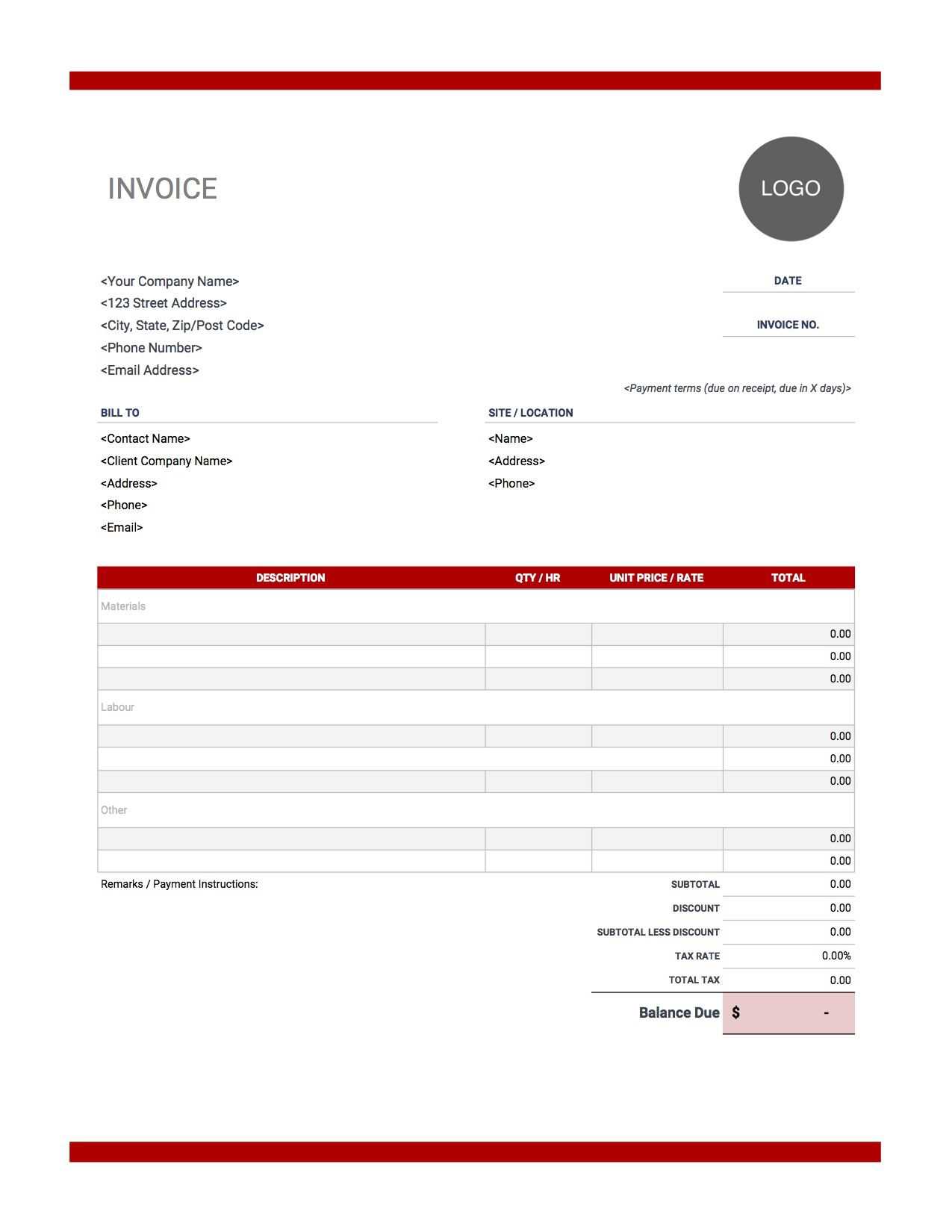

A well-designed document plays a key role in making a positive impression on your clients. The appearance of your billing request can reflect your professionalism and attention to detail. Simple yet effective design choices can make your document easier to read and help clients process the information quickly. Below are some helpful design tips to consider when creating your payment request form.

| Design Element | Tip |

|---|---|

| Layout | Ensure a clean and organized layout with clearly defined sections, making it easy to locate key details. |

| Fonts | Use professional, easy-to-read fonts such as Arial or Helvetica. Avoid overly decorative fonts. |

| Branding | Incorporate your logo and use your company’s colors to maintain consistency with your brand. |

| Spacing | Leave enough white space between sections to avoid a cluttered appearance, enhancing readability. |

| Text Alignment | Align text neatly to the left for better flow, especially when listing services and charges. |

| Highlight Important Information | Use bold or italic text to highlight the total amount due and payment instructions. |

By paying attention to these design elements, you can create a document that not only communicates the necessary details but also reinforces your professional image. A well-designed payment request can make the process smoother for your clients, encouraging timely and accurate payments.

Using Invoice Templates for Efficiency

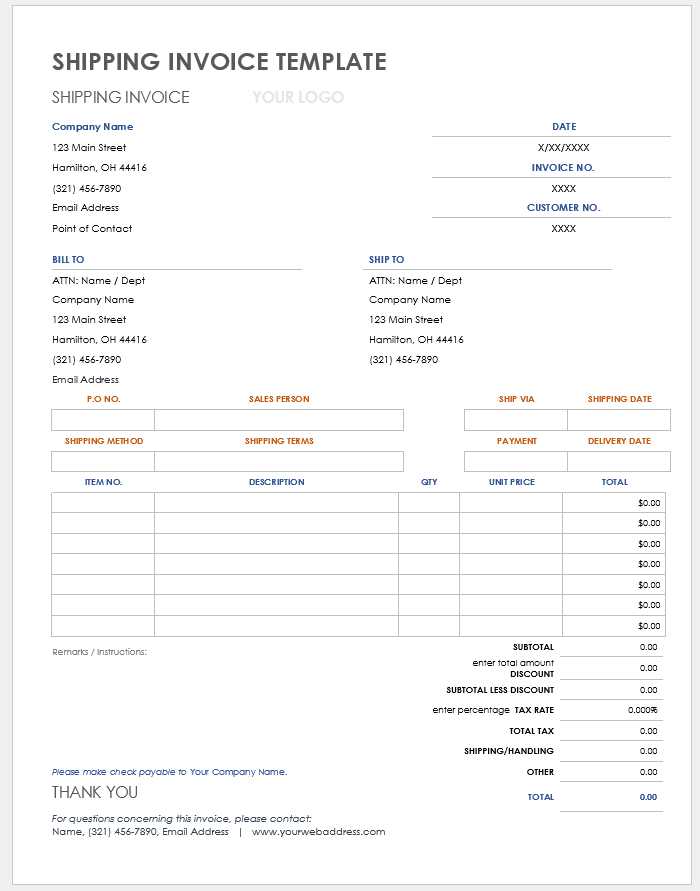

Utilizing ready-made forms to request payment can significantly streamline your billing process. Instead of creating a new document from scratch each time, these pre-designed structures allow you to fill in the necessary information quickly, saving you time and effort. By having a consistent format, you also ensure that all the essential details are included every time, reducing the chance of missing important information.

Time-Saving Benefits

When you use a predefined structure, you eliminate the need to format or rearrange the document each time you prepare a payment request. This efficiency can lead to quicker turnaround times for both you and your clients, enabling faster payments and reducing administrative workload.

Minimize Errors and Maintain Consistency

Using a consistent structure helps reduce the likelihood of errors, as each section is clearly defined and easy to fill out. The more you use the same format, the more familiar it becomes, ensuring that all critical information is included, such as service descriptions, cost breakdowns, and payment terms. This not only makes the process smoother but also helps maintain a high level of professionalism.

Overall, adopting structured documents can lead to more efficient billing cycles, improve client satisfaction, and free up more time for you to focus on other aspects of your business.

Benefits of Digital Invoice Templates

Switching to electronic forms for requesting payment brings several advantages over traditional paper-based methods. Digital documents are not only easier to create and send but also provide greater flexibility in managing and storing your records. By embracing digital solutions, businesses can streamline their processes and improve overall efficiency.

Increased Efficiency

- Quick Creation: With pre-designed structures, creating a payment request becomes a matter of filling in the details, saving time compared to starting from scratch.

- Instant Delivery: Sending the document electronically allows you to deliver it to clients immediately, speeding up the payment cycle.

- Easy Editing: Digital formats make it easy to make changes or corrections without having to rewrite the entire document.

Cost-Effective and Sustainable

- Reduced Printing Costs: There’s no need for paper, ink, or postage, cutting down on material expenses.

- Environmentally Friendly: Using electronic documents helps reduce your carbon footprint by minimizing paper waste.

Overall, embracing digital forms not only improves operational efficiency but also helps create a more sustainable and cost-effective approach to managing your business’s financial requests.

Key Elements in Labour Billing

When requesting payment for services provided, it’s essential to include specific details that ensure clarity and prevent misunderstandings. A well-organized payment request not only lists the work completed but also outlines the terms of compensation, making the entire process transparent for both the service provider and the client. Below are the key components that should be included in any professional billing document.

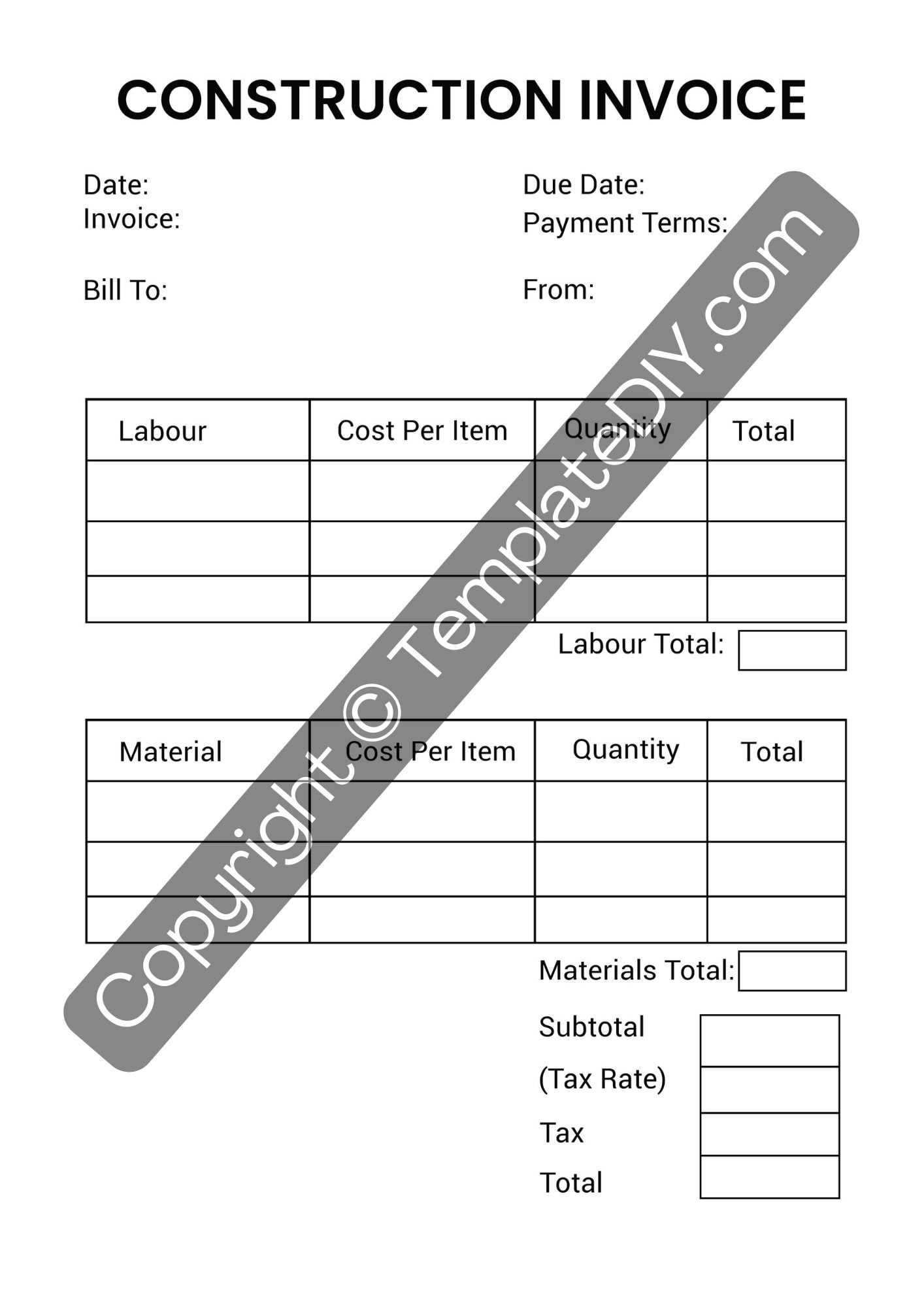

Clear Work Descriptions

One of the most important aspects is a detailed breakdown of the tasks performed. Each service or activity should be clearly listed, along with the amount of time spent on it (if applicable). This helps clients understand exactly what they are being charged for and avoids any confusion regarding the work completed.

Accurate Rate and Total Calculation

Including the rate for each service, whether it is hourly or fixed, ensures that there is no ambiguity about the costs. It’s important to also include the total amount due, clearly showing how it was calculated. This makes the payment request more professional and fosters trust between both parties.

Incorporating these key elements into your payment documents ensures that clients are fully aware of the services provided and the associated costs, helping to streamline the payment process and maintain a professional relationship.

Choosing the Right Template for Labour

Selecting the appropriate structure to request payment for services is essential for ensuring clarity and efficiency. The right document design can simplify the process, making it easier for both you and your clients to track the work completed and the payments due. By choosing a layout that aligns with your business needs and the services provided, you can enhance your professionalism and streamline your billing process.

Consider the Type of Work

Different types of services may require varying levels of detail in the payment request. For instance, simple tasks may only need a brief description and fixed cost, while more complex or time-based work may require hourly rates, time logs, or detailed project milestones. Make sure the structure you choose reflects the nature of your work and communicates the necessary information efficiently.

Keep it Simple and Professional

While it can be tempting to use a highly detailed or decorative structure, it’s essential to maintain a clean, professional appearance. Avoid unnecessary clutter, and focus on essential information such as work descriptions, charges, and payment terms. A simple, straightforward format helps prevent confusion and ensures that clients can easily understand the details of the payment request.

By carefully selecting the right structure, you can improve the accuracy of your requests and speed up the payment process, benefiting both your business and your clients.

Legal Requirements for Labour Invoices

When requesting payment for services rendered, it’s important to comply with the legal standards that ensure your documentation is valid and enforceable. Each country or region has specific regulations that govern the way payment requests must be presented to be recognized by authorities and businesses. These requirements help protect both the service provider and the client, ensuring that both parties have clear, legally sound records.

Below are some key legal elements that should be included in any service-related payment request to remain compliant:

| Element | Description |

|---|---|

| Business Details | Both the service provider’s and client’s contact information should be clearly listed, including full names, addresses, and tax identification numbers. |

| Service Description | A detailed description of the work completed, along with any relevant time logs or project milestones, should be provided to avoid misunderstandings. |

| Payment Terms | Clearly specify the due date for payment, any applicable late fees, and the accepted methods of payment. This helps avoid disputes over deadlines or payment methods. |

| Tax Information | Include any applicable tax rates, such as VAT or sales tax, to comply with local tax laws. This ensures the transaction is properly reported. |

| Unique Reference Number | Assign a unique reference number to each payment request for tracking and organizational purposes. |

By adhering to these basic legal requirements, you ensure your payment requests are both transparent and enforceable, reducing the risk of misunderstandings and legal issues in the future.

Calculating Hourly Rates in Invoices

When requesting payment based on time spent working, it’s essential to accurately calculate the amount due. The hourly rate is a fundamental aspect of this calculation, and ensuring that it reflects both your expertise and the scope of the work is key to a fair agreement. Here’s how to calculate the correct amount to charge your client based on the time worked.

To determine the correct fee, you must multiply the number of hours worked by your agreed-upon hourly rate. This calculation is straightforward, but several factors should be considered:

- Hourly Rate: This is the base charge per hour for your services. It should reflect the complexity of the work, your experience, and industry standards.

- Total Hours Worked: Carefully track the time spent on each task or project. Be sure to account for any breaks or interruptions that may affect the total time.

- Overtime Charges: If the work requires hours beyond the standard workday or week, an additional rate may apply. This should be clearly defined in advance.

For example, if your hourly rate is $50 and you worked 10 hours on a project, the total charge would be $500 (10 hours x $50 per hour). If overtime rates apply, be sure to include those in your final calculation to ensure full compensation for the additional time.

Accurate time tracking and transparent calculation of your hourly rate help ensure that you are paid fairly and that clients understand exactly what they are being charged for.

Common Mistakes in Labour Invoices

When requesting payment for services rendered, it’s easy to overlook certain details that can lead to confusion or disputes. Even small errors can cause significant delays in payment or damage professional relationships. Understanding the most common mistakes can help ensure that your billing process is smooth and efficient. Below are some frequent errors to watch out for.

1. Lack of Clear Descriptions

One of the most common mistakes is failing to provide clear and detailed descriptions of the work completed. If clients don’t understand what they are paying for, they may hesitate to make the payment. Be sure to outline each task, including any materials used, time spent, and specific outcomes achieved.

2. Missing Contact Information

Omitting important details such as your business contact information or the client’s address can lead to confusion or miscommunication. Always include accurate names, addresses, phone numbers, and email addresses to make sure everything is easy to track and follow up on if needed.

3. Not Including Payment Terms

Payment terms, such as due dates and penalties for late payments, are essential for setting clear expectations. Failing to specify these terms may result in delayed payments, as the client may not be aware of when the payment is due or any consequences for late submission.

4. Incorrect Calculations

Errors in calculating the total amount due can lead to disputes. Double-check your work to ensure that hourly rates, project fees, and taxes are correctly added up. Even minor calculation errors can make a big difference in the total amount owed.

5. Ignoring Tax Information

In many regions, taxes must be added to the final amount due. Not including this crucial detail can lead to legal issues or result in the client refusing to pay the full amount. Always account for any applicable taxes, like VAT or sales tax, and make sure they are listed clearly on the document.

By avoiding these common mistakes, you can create a more efficient billing process, reduce confusion, and ensure that you’re paid fairly and promptly for the services you provide.

How to Avoid Billing Errors

Accurate billing is crucial for maintaining professional relationships and ensuring timely payment. Mistakes in calculating charges, documenting services, or managing payment terms can result in delays and disputes. By following a few key practices, you can minimize errors and streamline the process, ensuring a smoother experience for both you and your clients.

1. Double-Check Your Calculations

Always verify the totals before sending any payment request. A simple miscalculation can lead to significant issues. Ensure that hourly rates, material costs, and any additional fees are added up correctly. Consider using software or tools that automatically calculate the totals for you, reducing the chances of human error.

2. Keep Accurate Records of Work

Be sure to track all hours worked, tasks completed, and any materials or resources used throughout the project. This will help you provide an accurate breakdown when preparing a payment request. Additionally, it ensures that you won’t forget any important details, and it provides evidence if any questions arise later on.

3. Be Clear About Payment Terms

Ensure your payment terms are well-defined and communicated upfront. Specify the due date, acceptable payment methods, and any penalties for late payments. Clearly outlining these terms helps manage expectations and avoid misunderstandings with clients.

4. Use Consistent Formatting

Consistency in the structure of your payment requests makes it easier for clients to understand and process. Use a clear and organized format, with sections for services provided, time worked, total charges, and contact information. This reduces confusion and helps clients easily verify that the document reflects the agreed-upon terms.

By being diligent in these areas, you can minimize errors and ensure that your payment requests are accurate, professional, and easy for your clients to understand and process.

Tracking Payments with Invoice Templates

Effective tracking of payments is a vital part of managing your business’s financial health. Using a structured system to monitor outstanding payments helps ensure timely settlements and provides clarity for both you and your clients. This section will explore practical methods to track payments efficiently, ensuring that no funds are overlooked and all dues are promptly paid.

1. Create a Payment Schedule

Establishing a clear payment schedule is essential to keeping track of when payments are due and which ones have been received. By setting deadlines for each payment, you can prevent overdue balances and minimize delays. Include these payment dates on your billing documents so both you and the client know what to expect.

- Include payment due dates on all documents.

- Send reminders before the payment deadline arrives.

- Specify late fees for overdue payments to encourage timely settlement.

2. Utilize a Payment Log

Maintain a payment log or ledger where you can record each payment received. This helps track outstanding balances and gives you a clear overview of paid versus unpaid amounts. A simple table or spreadsheet can be used to list details such as payment date, client name, and the amount paid.

- Record each transaction immediately after receiving payment.

- Note the payment method used (e.g., bank transfer, cheque, or cash).

- Keep track of any partial payments to adjust the balance accordingly.

3. Follow Up on Outstanding Payments

Sometimes clients may forget to make a payment or experience delays. It’s essential to follow up in a professional manner to remind them of the outstanding balance. A polite reminder email or call can help keep the payment process moving forward.

By implementing a systematic approach to tracking payments, you can ensure that your business remains financially stable and that no payments slip through the cracks.

Organizing Labour Invoices for Records

Keeping accurate and well-organized records is essential for managing your financial data, ensuring you can easily track transactions, and having the necessary documentation available when needed. By implementing a structured system for storing and categorizing payment requests, you can ensure that your business remains organized, efficient, and compliant with any financial reporting requirements.

1. Categorize Your Documents

Organizing your documents into categories based on type of service or client can save valuable time when you need to retrieve them. You can create folders or digital directories to separate different projects, payment periods, or client groups. This ensures that everything is easy to find when it’s time for tax filings, audits, or client inquiries.

- Group by project or service type.

- Label documents by date or payment period.

- Store digital copies in an easily accessible folder on your computer or cloud storage.

2. Maintain a Payment Tracking Table

A payment tracking table is a simple yet powerful tool to stay organized. It allows you to track each payment request, its status, and the amount received. This table can serve as a reliable reference for both past and current transactions, helping you stay on top of your financial records.

| Client Name | Service Date | Amount Due | Amount Paid | Status | Payment Date |

|---|---|---|---|---|---|

| Client A | 2024-10-15 | $500 | $500 | Paid | 2024-10-20 |

| Client B | 2024-10-17 | $300 | $150 | Partial | 2024-10-18 |

3. Backup Your Records

Having backups of all your financial records is crucial in case of technical issues or disasters. Ensure you back up digital files regularly and consider keeping physical copies of important documentation in a safe place. Cloud storage options or external hard drives can provide added security for your records.

By organizing and maintaining a clear system for storing records, you ensure your financial data is always up-to-date and readily available whenever necessary.

Integrating Invoices with Accounting Software

Integrating payment requests with accounting software streamlines the financial management process, enabling businesses to efficiently track income, expenses, and profits. By syncing records with specialized software, you can reduce manual entry, minimize errors, and gain real-time insights into your financial situation. This integration can save time, enhance accuracy, and provide valuable reporting capabilities that simplify decision-making.

Automation of Financial Entries

Once your payment requests are linked to accounting software, data entry becomes automated. Each transaction is recorded directly, eliminating the need for manual input. This ensures that your books are always up-to-date and accurate, reducing the risk of oversight or discrepancies.

Improved Financial Reporting

Accounting software offers various reporting tools that can automatically generate financial summaries, profit-loss statements, and tax reports. Integrating your payment requests allows you to quickly assess the overall financial health of your business and prepare for audits or tax filings with ease.

Synchronization with Payment Systems

When your payment tracking system is integrated with your accounting software, payments are automatically recorded in the system as soon as they are processed. This synchronization helps you avoid delays in updating records and ensures your accounting system reflects real-time transactions.

Easy Tax Preparation

With an integrated system, you can quickly pull up necessary financial data for tax purposes. Whether it’s tracking income, calculating deductible expenses, or generating financial reports, linking payment requests to accounting software helps ensure you have accurate and organized records when tax season arrives.

By linking your payment tracking system with accounting software, you create a more efficient, reliable, and accurate method of managing your business’s finances, helping you make smarter decisions and stay ahead of the curve.

How to Automate Labour Invoicing

Automating the process of generating and managing payment requests can significantly reduce administrative time and increase efficiency. By utilizing software solutions designed to streamline these tasks, businesses can ensure consistent, error-free billing, while freeing up time to focus on other essential activities. Automation helps ensure that requests are created promptly, correctly, and according to set schedules.

One of the first steps to automation is selecting the right software or platform that fits your needs. Many platforms offer customizable workflows where you can set parameters such as hourly rates, payment terms, and recurring billing cycles. Once set up, these tools can automatically generate payment requests based on the data you input, such as hours worked, services rendered, or materials used.

Additionally, integrating time tracking systems with your automated request generation can provide even greater efficiency. By automatically pulling hours worked from time-tracking tools, these systems can instantly calculate totals and create accurate documents without manual intervention. This helps eliminate human error and ensures accuracy in your billing.

Another advantage is the ability to schedule and send payment requests automatically. Many platforms allow you to set specific intervals (weekly, monthly, etc.) for sending documents to clients, so you never miss a deadline. You can also include automated reminders, ensuring that clients are notified when payments are due or overdue.

Finally, automating the process allows for better tracking and reporting. Many tools provide real-time tracking of the status of each payment request, enabling businesses to monitor progress and follow up when necessary. Automation can also generate reports on income, pending payments, and outstanding invoices to give you a comprehensive overview of your financial health.

Adjusting Invoices for Different Services

When providing a variety of services, it is essential to tailor the payment requests to reflect the unique aspects of each service. Each service might require different billing structures, hourly rates, or payment terms. The ability to adjust these documents based on the specifics of the task ensures clarity and fairness for both the service provider and the client.

Customizing Rates and Charges

One of the most common adjustments is modifying the rates depending on the type of work. For example, emergency services may warrant a premium rate compared to standard services. Additionally, some tasks may involve extra costs for materials or specialized equipment. When creating these requests, it’s important to clearly outline any additional charges, ensuring that clients are aware of the total cost.

Setting Payment Terms Based on Service Type

Different services may also have varying payment terms. While one-time tasks might require full payment upon completion, ongoing projects could allow for installment payments or net terms (e.g., payment due within 30 days). Adjusting the payment schedule according to the nature of the service ensures that the terms are both fair and manageable for both parties involved.

By personalizing payment requests to the specific service provided, businesses can create clear and accurate documents that leave no room for confusion. This level of customization not only reflects professionalism but also helps avoid disputes or misunderstandings over pricing or payment expectations.

Personalizing Labour Invoices for Clients

Customizing payment requests for individual clients can significantly enhance the professional image of your business and improve client satisfaction. By tailoring each document to reflect specific details relevant to the client’s project, you can create a more personal and engaging experience. Personalization not only builds trust but also ensures that all necessary information is clearly communicated.

To personalize effectively, begin by including the client’s name, business name (if applicable), and contact information. This ensures that your payment request is easily identifiable and clearly linked to the right recipient. Additionally, include a brief description of the services provided, highlighting any specific preferences or customizations requested by the client. This attention to detail makes it clear that their needs were met, reinforcing a positive relationship.

Example of personalization:

- Client’s contact information at the top of the document.

- Specific tasks completed and any unique aspects of the service provided.

- Client-specific payment terms or discounts, if agreed upon.

Furthermore, offering tailored payment options based on the client’s previous payment history or preferences can improve convenience and speed up the payment process. For example, you might offer installment payments for larger projects or provide discounts for early payments. These small adjustments can foster goodwill and loyalty, encouraging repeat business.

Ultimately, by personalizing each payment request, you not only make the process more client-centric but also demonstrate professionalism and attention to detail that can set your business apart in a competitive market.