Invoice Template for IT Consulting Services for Efficient Billing

Effective billing is essential for any business, especially when managing complex projects and diverse clients. Whether you are an individual contractor or part of a small team, having a clear and organized way to document work completed and payments due is crucial to maintaining professionalism and financial stability.

In the fast-paced world of technology, creating an accurate and well-structured payment record can save time and reduce the risk of errors. By using a well-organized system, you ensure that all relevant details are captured, helping both you and your clients stay on the same page regarding expectations and timelines. This not only builds trust but also promotes smoother transactions and quicker settlements.

Efficiency is key when it comes to invoicing, and a structured approach can streamline this process. By eliminating the guesswork and ensuring consistency across all documents, you can focus more on what you do best – providing top-notch solutions and support.

Invoice Template for IT Consulting Services

When managing projects in the technology field, having a standardized method to request payment is crucial for both efficiency and professionalism. An organized document outlining the work completed and the amount due can save time and avoid confusion. A consistent format ensures that every important detail is captured, reducing the chances of errors or missed information.

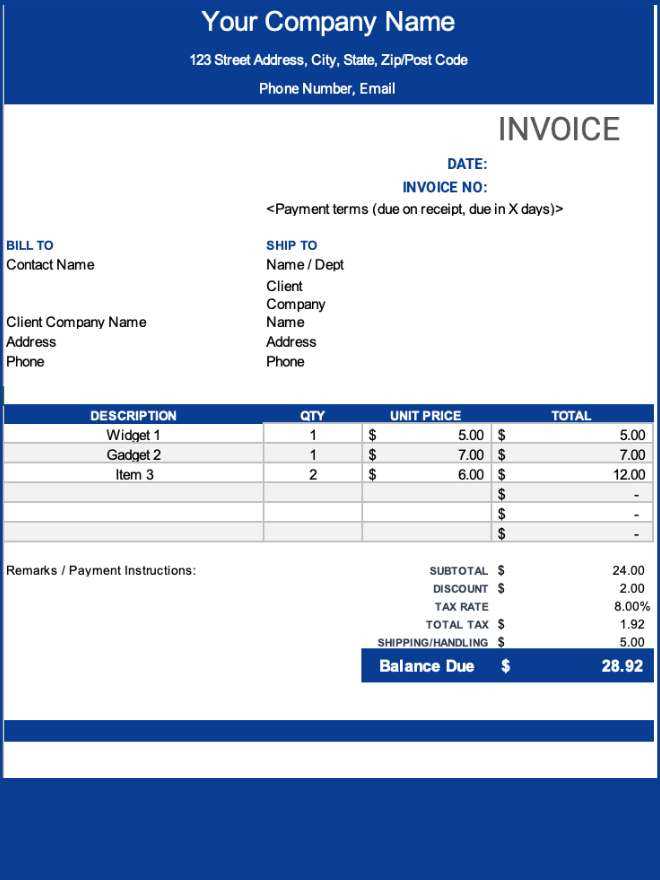

Creating a structured record for each client engagement is vital. This document should include key details such as hours worked, rates, project milestones, and any applicable taxes or discounts. With a clear and concise layout, both you and your clients can quickly review and confirm payment terms. Customization allows for flexibility, ensuring the document meets specific client needs while maintaining a professional appearance.

With the right tools and structure, professionals in the tech industry can streamline their payment processes, ensuring faster turnaround times and smoother transactions. A well-designed record not only improves your financial workflow but also enhances your reputation as a reliable and organized expert in your field.

Why Use an Invoice Template

When managing client payments, maintaining a consistent and professional format is essential. Having a pre-designed structure to record and request payment details not only saves time but also ensures accuracy. Whether you’re handling a one-off project or an ongoing contract, using a well-organized document eliminates the risk of missing critical information and streamlines the entire billing process.

Consistency and Professionalism

A well-structured payment record presents you as organized and reliable, which is key to building long-term relationships with clients. Consistency across all documents makes it easier for clients to understand what they are being charged for, reducing the likelihood of misunderstandings. Professionalism in every aspect of your work, from the services delivered to the way you request payment, enhances your reputation.

Time-Saving and Efficiency

By using a pre-designed system, you significantly cut down on the time spent creating each payment request. Instead of manually formatting each document, you can quickly input necessary details and focus on the work itself. This level of efficiency ensures timely billing, which in turn contributes to better cash flow and quicker payments.

Benefits of Customizable Invoice Formats

Having the ability to adapt your billing structure to meet the needs of different clients and projects provides significant advantages. A flexible format allows you to tailor your documents to reflect specific terms, work details, and payment conditions, enhancing both clarity and professionalism. With customization, you can address various client preferences while keeping everything organized and streamlined.

Enhanced Professional Image

Being able to modify the design and content of your billing documents helps establish a more polished image. Whether it’s adding your company logo, adjusting the layout to fit client specifications, or including personalized details, a customized format demonstrates attention to detail and a higher level of professionalism. It helps set you apart from others who may rely on generic, one-size-fits-all documents.

Flexibility for Different Client Needs

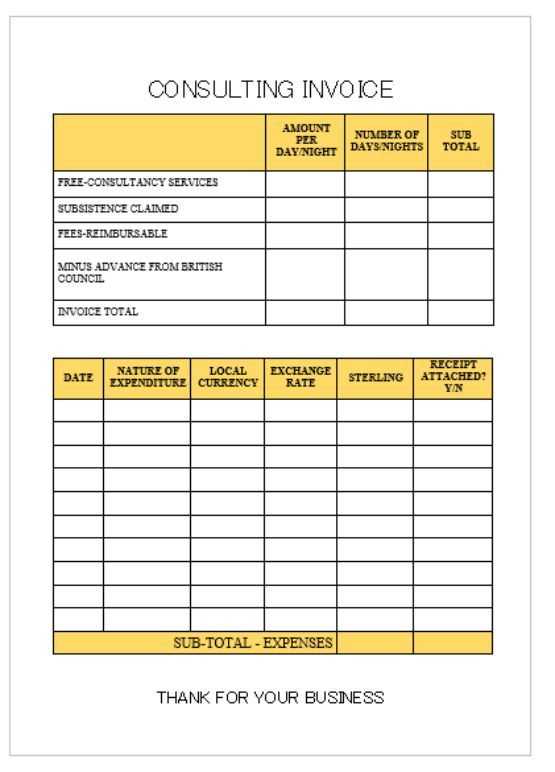

Customizable formats allow you to meet diverse client requirements by offering various payment terms, project breakdowns, or specialized tax information. This flexibility means you can handle multiple contracts with different billing conditions without starting from scratch each time. Below is an example of how customizing a payment record can improve clarity:

| Project | Hours Worked | Rate | Total Amount |

|---|---|---|---|

| Website Development | 50 | $100/hour | $5,000 |

| Maintenance | 20 | $80/hour | $1,600 |

In this example, the ability to adjust rates and hours worked for each project ensures that both you and your clients are on the same page. Customization makes it easier to track and manage various projects while maintaining a professional standard.

Key Features to Look for in an Invoice

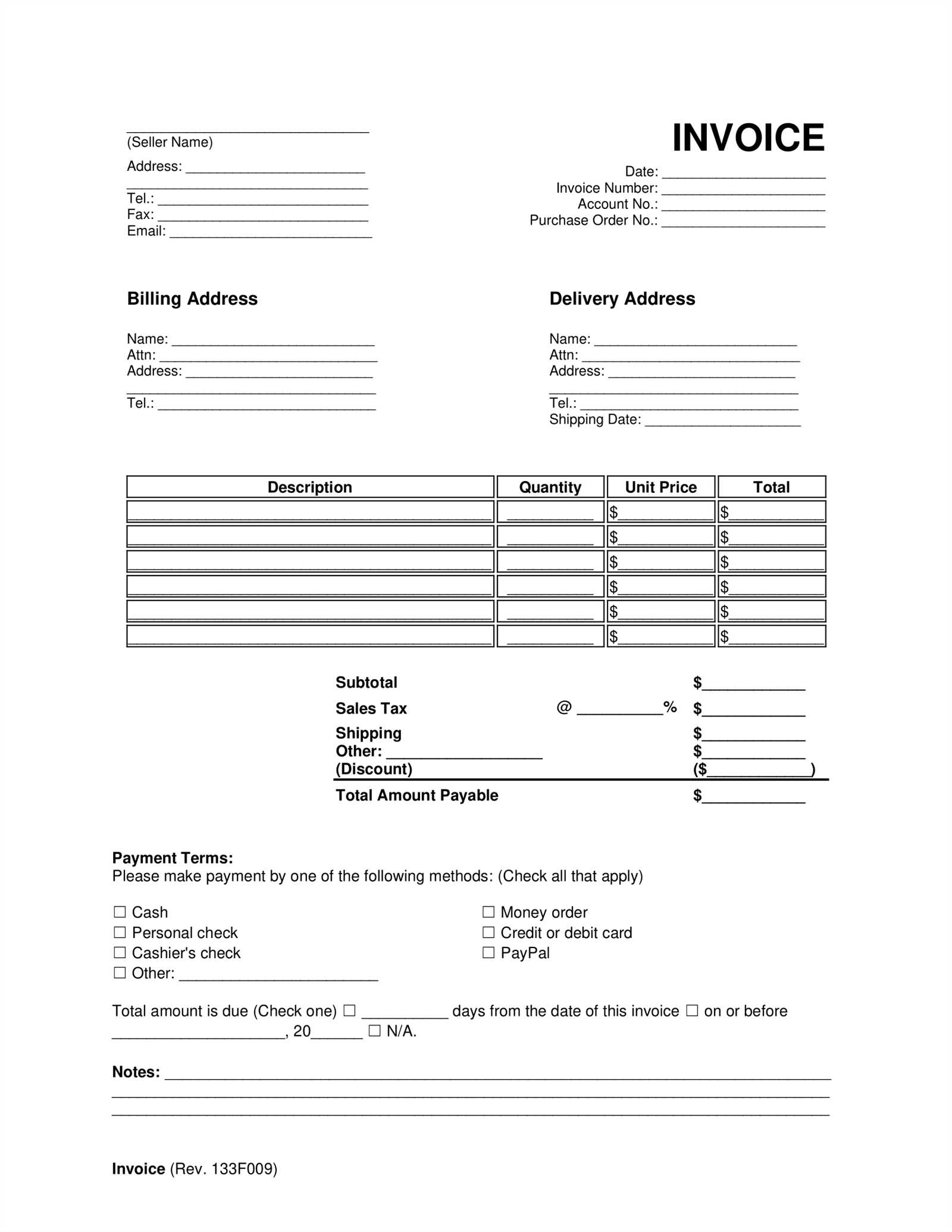

When creating a document to request payment for your work, certain elements are essential to ensure clarity, professionalism, and accuracy. Including the right information helps to avoid confusion, ensures both parties are on the same page, and facilitates faster payments. Here are the key features you should prioritize when designing your billing statement.

- Clear Contact Information – Both your details and those of your client should be easy to locate. Include names, addresses, phone numbers, and email addresses for seamless communication.

- Unique Reference Number – Assigning a specific reference number helps both you and your client track and manage payments. It also makes it easier to address issues if they arise.

- Itemized Breakdown – Clearly list the tasks completed, hours worked, and rates charged. This provides transparency and avoids any confusion about what the client is paying for.

- Payment Terms – Clearly state when payment is due, any late fees, and preferred methods of payment. This helps prevent delays and ensures prompt settlement.

- Tax Information – If applicable, include tax calculations and any other regulatory details that might apply to the transaction.

These elements not only ensure that your document is complete but also present a clear, professional picture to your client. They help reduce back-and-forth communication and ensure smoother transactions.

Additional Details to Include

- Discounts and Adjustments – If applicable, clearly mention any discounts or special adjustments made to the original amount.

- Notes or Terms – Include any additional comments, special instructions, or conditions that might be relevant to the project.

- Due Date – Ensure that the payment deadline is prominently displayed to avoid misunderstandings about when the amount is due.

Including these key features ensures that the document serves as both a legal and professional record of the work completed, protecting both you and your client.

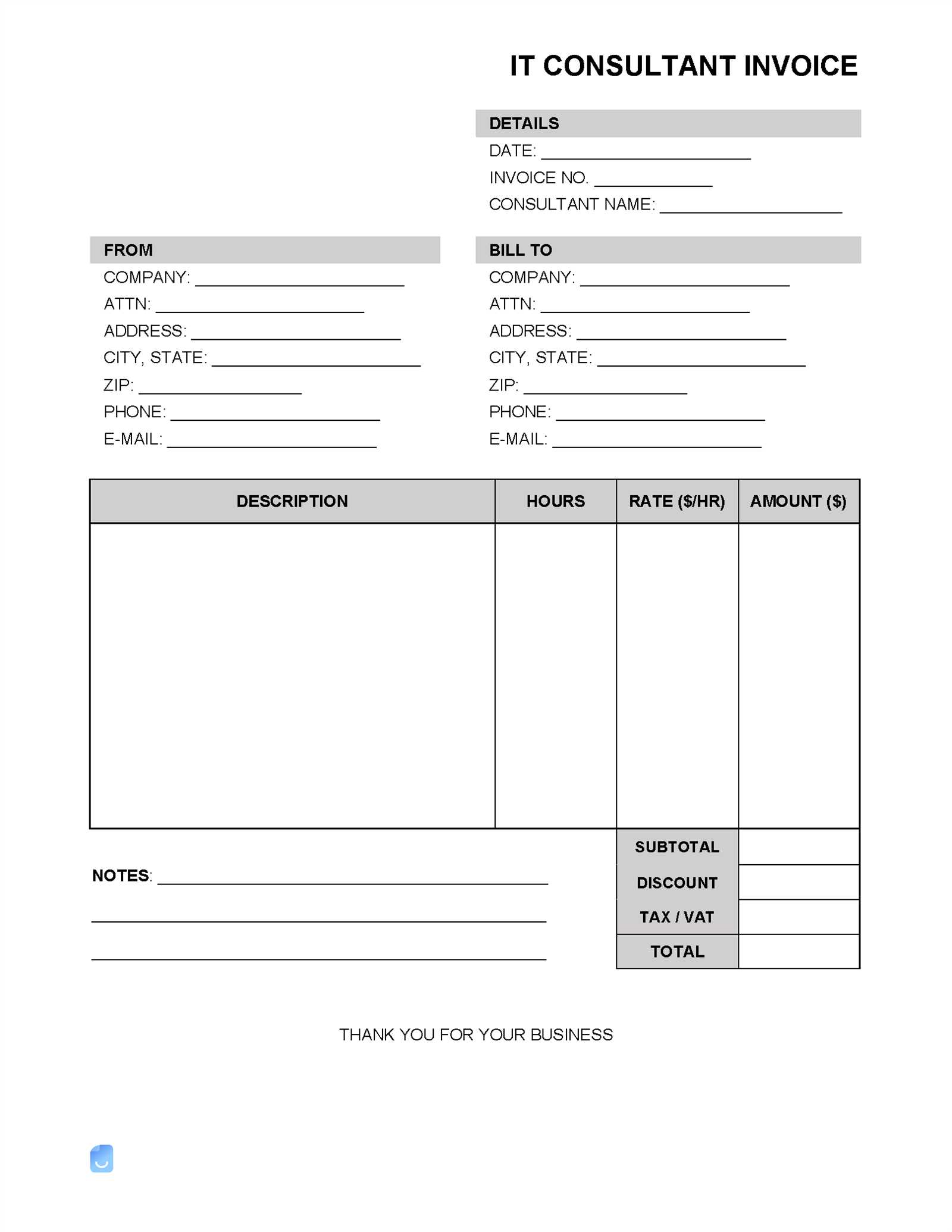

How to Create an Effective IT Invoice

Creating a payment request document that is both clear and professional is essential to maintaining good relationships with clients and ensuring timely payments. The goal is to provide all the necessary details in an organized format, making it easy for your clients to understand what they’re paying for, how much, and when payment is expected. An effective billing document reflects well on your business and promotes trust with your clients.

Essential Steps to Follow

- Start with Clear Client Information – Always include the full name, address, and contact details of both your business and the client. This ensures that there are no issues if the document needs to be referenced in the future.

- Describe the Work Performed – Break down the tasks completed or projects worked on, including the time spent and any applicable rates. The more detail provided, the clearer it will be for the client to see the value they are receiving.

- Include Dates and Deadlines – Be specific about the time frame during which the work was performed and clearly state when payment is due. This helps avoid confusion and ensures prompt payment.

- Specify Payment Terms – State the agreed-upon payment method and due date. If you offer a discount for early payment or apply late fees, make sure those details are also included.

Organizing Your Document for Maximum Clarity

- Use a Professional Layout – Ensure that the document is clean and easy to read. Avoid clutter by organizing it into logical sections: client info, work summary, and payment details.

- List All Costs Separately – If there are multiple tasks or services involved, itemize each one with its corresponding cost. This breakdown makes it easier for clients to verify the charges and understand exactly what they are paying for.

- Include a Reference Number – Assign a unique identifier to each payment request. This helps both you and your client keep track of past and future transactions.

By following these steps, you create a document that not only looks professional but also ensures that all necessary information is included to avoid any misunderstandings or delays in payment.

Choosing the Right Invoice Style for IT Consulting

Selecting the appropriate format for your payment request is an important step in presenting yourself professionally. The style of your billing document should reflect your business’s identity while being clear and easy to understand for your clients. The right format can help convey a sense of organization and attention to detail, which is vital for maintaining strong client relationships and encouraging timely payments.

Factors to Consider When Choosing a Layout

- Client Preferences – Some clients may prefer a more formal document, while others may appreciate a simpler, more straightforward approach. Understanding your client’s needs and industry standards can help you choose a style that aligns with their expectations.

- Branding Consistency – Your document should reflect your brand’s identity. This includes incorporating your logo, colors, and fonts that align with your business’s overall aesthetic. A consistent brand image strengthens your business’s credibility.

- Complexity of the Project – For large or multifaceted projects, a more detailed and organized layout is necessary. On the other hand, smaller tasks can be summarized with a more simplified design that focuses on the essentials.

Best Practices for Effective Design

- Keep It Clean and Readable – Avoid overcrowding the document with unnecessary information or complex formatting. Use clear headings, bullet points, and ample spacing to make the content easily digestible.

- Use Structured Sections – Divide the document into clear sections, such as work description, payment details, and terms. This logical flow makes it easy for clients to follow and verify the information.

- Ensure Flexibility – Choose a style that can be easily adapted for different clients, project types, or special requirements. A customizable design allows you to adjust the layout based on specific needs while maintaining a consistent look.

By taking these factors into account, you can create a payment request that is both functional and professional, helping you build trust and encourage prompt payments from your clients.

Common Mistakes to Avoid in Invoices

When creating a document to request payment for completed work, certain errors can lead to confusion, delayed payments, or even strained client relationships. Ensuring that all essential details are accurate and clear is key to preventing these issues. Below are some common mistakes to avoid when preparing payment documents, which can help streamline your billing process and improve client satisfaction.

Top Mistakes to Watch Out For

- Missing Contact Information – Failing to include your business name, address, phone number, or email address can create confusion. Always make sure both your contact details and your client’s are clearly visible.

- Unclear or Vague Descriptions – Not providing enough detail about the work done can lead to disputes. Be specific about the tasks or projects completed, including hours worked, deliverables, and rates charged.

- Incorrect Payment Terms – Not specifying when payment is due or not clarifying the preferred method can cause delays. Make sure to state the payment deadline and any late fees that may apply.

- Forgetting to Add Taxes – Omitting taxes or not properly calculating them can lead to financial discrepancies. Ensure that tax rates are clearly shown and applied where necessary.

- Mathematical Errors – Simple mistakes in adding up totals or applying discounts can cause confusion and distrust. Double-check all calculations before finalizing your document.

How to Avoid These Pitfalls

- Proofread Everything – Always review the payment request for accuracy before sending it to the client. Check that all calculations, dates, and descriptions are correct.

- Use a Consistent Format – Keeping a consistent structure ensures that nothing is overlooked and makes it easier for clients to understand and process the document.

- Communicate Clearly – If any terms or conditions are complex or unique, explain them briefly to avoid confusion. Clear communication reduces the chance of errors.

By paying attention to these details and avoiding common mistakes, you ensure that your billing process runs smoothly and your professional reputation remains intact.

Essential Information for IT Service Invoices

When preparing a document to request payment for work completed, it is crucial to include all the necessary details to avoid confusion and ensure prompt processing. A comprehensive and clear payment request should outline the specifics of the project, the terms of payment, and any additional relevant information that will help both you and your client stay aligned. Missing or vague information can delay payments and lead to misunderstandings.

Key Elements to Include:

- Client and Provider Details – Include the full names, addresses, and contact details of both your business and the client. This ensures proper identification and easy follow-up if needed.

- Project Description – Clearly outline the work completed or the results delivered. Be specific about the tasks performed and any milestones achieved. This helps the client understand the value they are paying for.

- Dates – List the dates when the work was started and completed, as well as the payment due date. This clarifies the timeline for both parties and avoids any confusion regarding the duration of the project.

- Payment Breakdown – Itemize the charges to provide transparency. Include rates, hours worked, and any additional fees or expenses. This level of detail builds trust and avoids disputes over the final amount.

- Tax Information – If applicable, include the appropriate tax rate and the total tax amount due. Ensure that taxes are calculated properly to avoid discrepancies later on.

Additional Considerations:

- Payment Terms – Clearly specify how and when the payment should be made, including accepted methods (e.g., bank transfer, credit card, etc.) and any penalties for late payments.

- Reference Number – Including a unique reference number or code helps both you and the client track and organize payments, ensuring that there are no issues with matching documents to specific projects.

- Additional Notes – If there are any special conditions, such as discounts, warranties, or ongoing maintenance agreements, be sure to mention them clearly so that both parties are aware of the terms.

By including all these essential details, you ensure that your payment requests are clear, professional, and easily understood, minimizing the risk of delays and misunderstandings.

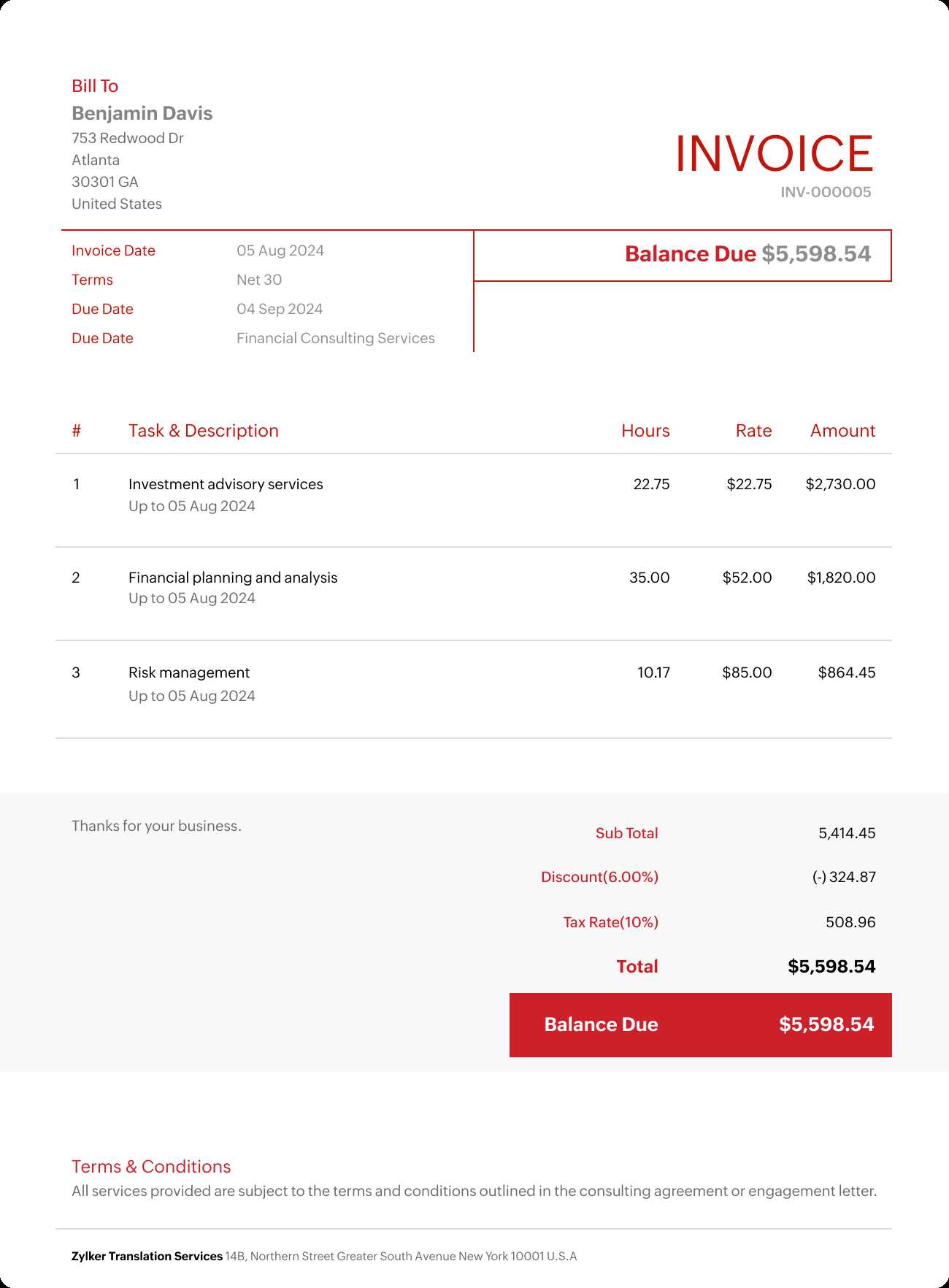

How to Add Taxes and Discounts

When creating a payment request document, it’s important to accurately calculate and display taxes and discounts. Properly including these elements ensures that the final amount is correct and transparent for both you and your client. Whether you’re applying sales tax, VAT, or offering discounts for early payment or large orders, the method of inclusion can vary depending on the project and client agreement.

Including Taxes

Sales tax or value-added tax (VAT) must be calculated based on the local regulations applicable to your business or your client’s location. This tax is generally calculated as a percentage of the total cost of the project, and it’s important to specify the tax rate, as well as the amount being charged, in your payment request document.

| Item Description | Cost | Tax Rate | Tax Amount | Total Amount |

|---|---|---|---|---|

| Website Development | $3,000 | 8% | $240 | $3,240 |

In this example, the tax is calculated as a percentage of the work performed. Ensure that you clearly display both the tax rate and the tax amount in your document to avoid confusion.

Applying Discounts

Discounts are a great way to offer clients incentives for early payment or large orders. You may offer a percentage off the total amount or a fixed discount. Be sure to clearly specify the terms of the discount, including when it applies and the percentage or amount being deducted.

| Item Description | Cost | Discount | Discount Amount | Total After Discount |

|---|---|---|---|---|

| Mobile App Development | $2,500 | 10% | $250 | $2,250 |

In this case, a 10% discount is applied, which re

Automating Invoice Generation for Efficiency

Manually preparing billing documents can be time-consuming, especially when dealing with multiple clients and complex projects. Automating the process of creating and sending payment requests can save significant time, reduce errors, and help streamline operations. By using automated tools, you can ensure that all the necessary information is accurately included and sent on time, without having to manually input the same details repeatedly.

Automation tools can integrate with your existing systems, pulling data from project management software, time tracking tools, or CRM platforms. This allows you to quickly generate payment documents based on the work completed, with little to no manual input required. Here’s how automation can benefit your workflow:

- Consistency – Automated systems ensure that all billing documents are formatted consistently, which helps maintain a professional appearance across all client interactions.

- Accuracy – By pulling data directly from your systems, automation reduces the risk of errors, such as incorrect billing amounts or missing details.

- Time Efficiency – Automation speeds up the process, allowing you to focus on other critical tasks while the system generates your documents in the background.

- Prompt Delivery – Automated processes can be scheduled to send payment requests automatically as soon as they are generated, reducing delays and improving cash flow.

Example of Automated Data Flow

| Task | Hours Worked | Hourly Rate | Total Amount |

|---|---|---|---|

| System Update | 15 | $100 | $1,500 |

| Bug Fixing | 8 | $120 | $960 |

In this example, the automation pulls data from your time tracking software and calculates the total amount due based on the number of hours worked and the rates set. This helps ensure that the final document is accurate and eliminates the need for manual calculations.

By implementing automated systems to generate your payment requests, you can increase efficiency, minimize human error, and focus more on delivering quality work to your clients.

Best Tools for IT Consulting Invoices

Managing payment requests efficiently is crucial for any business, especially in technical fields where detailed records and accuracy are important. There are numerous tools available that help streamline the creation, management, and sending of billing documents. These tools can automate many aspects of the billing process, saving time, reducing errors, and improving cash flow. The right tool can integrate with your project management and accounting systems, making it easier to generate accurate documents quickly and consistently.

Top Tools for Generating Payment Documents

- FreshBooks – A popular tool for small businesses, FreshBooks offers an easy-to-use platform to create and send customized payment requests. It allows users to track hours worked, add taxes, apply discounts, and set up recurring billing cycles. FreshBooks also integrates with many accounting and time-tracking apps.

- QuickBooks – Well-known for its accounting features, QuickBooks also provides a comprehensive solution for creating and managing billing documents. It allows for detailed time tracking, expense recording, and generates invoices with automatic calculations for taxes and discounts.

- Zoho Invoice – Zoho Invoice offers a free plan for small businesses, and it allows you to create professional invoices with a variety of templates. It also supports multiple currencies, integrates with other Zoho tools, and enables easy client communication with automatic reminders for overdue payments.

- Wave – Wave is a free invoicing tool that includes payment request creation, expense tracking, and accounting features. It’s a great option for freelancers or small businesses looking for a cost-effective way to manage their financial operations.

Comparison of Key Features

| Tool | Customization Options | Recurring Payments | Time Tracking | Integrations | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| FreshBooks | High | Yes | Yes | Multiple apps (Stripe, PayPal, etc.) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| QuickBooks | High | Yes | Yes | Multiple apps (Salesforce, Shopify, etc.) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Zoho Invoice | Moderate | Yes | Yes | Zoho apps, PayPal, Stripe | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wave | Moderate | No |

| Description | Hours Worked | Rate | Total |

|---|---|---|---|

| Website Development | 30 | $100 | $3,000 |

| SEO Optimization | 15 | $120 | $1,800 |

| Total | $4,800 |

In this example, the document provides a clear breakdown of the services rendered, hours worked, and total charges. This transparent format makes it easy for the client to understand the a

Ensuring Accurate Payment Terms and Deadlines

Clear and precise payment terms are essential for maintaining a smooth financial relationship with clients. By clearly outlining the due dates, payment methods, and any potential penalties for late payments, you can set expectations and avoid misunderstandings. When creating billing documents, it’s vital to be specific about the terms to ensure that both parties are on the same page, ultimately contributing to timely and hassle-free payments.

Key Elements of Payment Terms

When defining payment terms, consider the following aspects to avoid ambiguity:

- Due Date – Clearly state the date by which the client is expected to make payment. Having a specific due date helps prevent delays and misunderstandings.

- Accepted Payment Methods – Indicate all available methods for payment, such as bank transfers, checks, or online platforms like PayPal or credit cards.

- Late Payment Penalties – Specify any additional fees or interest that will be charged if the payment is not made on time. This helps encourage prompt payments and provides a clear consequence for delays.

- Early Payment Discounts – If applicable, mention any discounts offered for early payments. This can incentivize clients to settle their bills quickly.

Example of Clear Payment Terms

| Payment Term | Details |

|---|---|

| Due Date | 30 days from the date of the document |

| Accepted Payment Methods | Bank transfer, PayPal, Credit card |

| Late Payment Fee | 2% per month after the due date |

| Early Payment Discount | 5% discount if paid within 7 days |

In this example, the payment terms are clearly outlined, providing the client with all the necessary information regarding when and how to make payment. By specifying the due date, accepted methods, penalties for late payments, and incentives for early payment, both parties can have a mutual understanding of expectations, leading to smoother transactions and a more professional working relationship.

Invoicing Best Practices for IT Consultants

Creating and managing billing documents efficiently is key to maintaining smooth business operations, especially for IT professionals. To ensure timely payments, minimize errors, and present a professional image to clients, it’s essential to follow best practices when preparing financial requests. By adhering to these best practices, IT professionals can streamline their workflow, avoid confusion, and build stronger client relationships.

Essential Best Practices for IT Professionals

- Be Clear and Transparent – Always provide a detailed breakdown of the work completed, including hours worked, rates, and specific tasks or deliverables. This transparency helps clients understand what they are paying for and builds trust.

- Standardize Your Format – Use a consistent format for all documents, including logos, contact information, and layout. This gives a professional look and makes it easier for clients to track payments.

- Set Clear Payment Terms – Always specify payment due dates, accepted methods, and any penalties for late payments. Clear terms help manage expectations and reduce delays.

- Use Accurate Tracking Tools – Leverage time tracking software to ensure that the hours billed are accurate. This minimizes the risk of overcharging or undercharging clients and ensures you’re compensated fairly for your time.

- Include Detailed Descriptions – When detailing work, provide enough information so that clients can easily identify what they are being charged for. Avoid using vague terms or descriptions that may cause confusion.

Example of Well-Structured Billing Document

| Task | Hours | Rate | Total | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Network Setup | 10 | $120 | $1,200 | |||||||||||||||

| System Optimization | 8 | $130 | $1,040 | |||||||||||||||

| Total |

| Client | Amount Due | Due Date | Status |

|---|---|---|---|

| Client A | $1,500 | 2024-10-15 | Paid |

| Client B | $2,000 | 2024-10-20 | Overdue |

| Client C | $1,200 | 2024-10-25 | Pending |

By organizing your records in a simple table, you can easily track which clients have made payments, which ones are overdue, and which are pending. This visual system allows you to stay on top of outstanding amounts and take the necessary steps to follow up with clients who have not yet paid. Regular tracking ensures that no payment goes

Legal Considerations for IT Invoices

When preparing billing documents, it is important to be aware of the legal requirements and obligations that govern financial transactions. Ensuring compliance with relevant laws can help avoid disputes, protect your business interests, and maintain positive relationships with clients. From proper documentation to tax obligations, being mindful of legal considerations is essential for IT professionals who engage in client agreements and payments.

Key Legal Factors to Keep in Mind

- Clear Contractual Agreements – Always ensure that the terms and conditions of the project are clearly defined in a contract or agreement. This includes payment deadlines, rates, and the scope of work. Clear contracts provide a solid legal foundation in case of any disputes over payment or deliverables.

- Tax Obligations – Depending on your location and the services provided, you may be required to charge taxes on the amounts billed. Ensure that you are familiar with local tax laws and apply the correct tax rate to your financial documents to avoid penalties.

- Payment Terms and Penalties – It is essential to define payment terms, including due dates and penalties for late payments. These terms should be specified upfront and be in line with local legal standards. Penalties for overdue amounts can be enforced legally if clearly stated in the agreement.

- Proper Documentation – Maintain a record of all transactions and agreements in case they need to be referenced for legal purposes. This includes keeping copies of all signed contracts, correspondence, and completed work that was invoiced. These documents can serve as evidence in case of a legal dispute.

- Data Protection Compliance – When collecting client data for billing purposes, ensure that you are following data protection laws such as the GDPR (General Data Protection Regulation) if operating in certain regions. Secure handling of client data is a legal responsibility that should not be overlooked.

Example of Important Legal Clauses

- Late Fee Clause – “A 5% late fee will be applied to any unpaid balance after 30 days from the invoice date.”

- Tax Clause – “All amounts are subject to a 10% sales tax in accordance with state law.”

- Termination Clause – “Failure to remit payment within 60 days may result in the suspension of all ongoing work until the ou

Improving Cash Flow with Timely Invoicing

Maintaining a steady cash flow is essential for the growth and sustainability of any business. One of the most effective ways to improve cash flow is by ensuring that payment requests are sent promptly and efficiently. By reducing delays and streamlining the billing process, businesses can encourage quicker payments, avoid cash flow gaps, and better manage financial planning.

Best Practices to Ensure Timely Payment Requests

- Send Requests Immediately After Work Completion – Avoid waiting for extended periods before sending a payment request. As soon as a project is completed or a milestone is reached, promptly issue a payment request to begin the collection process.

- Clearly Define Payment Terms – Make sure payment deadlines, methods, and conditions are clearly stated from the outset. Transparent payment terms help set expectations and reduce confusion that could cause delays in payment.

- Automate the Billing Process – Using invoicing software or tools that automate the creation and delivery of payment requests can save time and ensure that nothing is overlooked. Automation also reduces the risk of human error and ensures consistent timing.

- Follow Up on Overdue Amounts – Set reminders and follow up with clients who have not made payments by the due date. A gentle reminder can often prompt clients to pay promptly without escalating the situation.

- Offer Incentives for Early Payments – Encourage clients to pay earlier by offering discounts or other incentives. This tactic can result in faster payments and improve overall cash flow.

Example of Cash Flow-Friendly Practices

- Invoice Due Date – “Payment is due within 15 days of the project completion.”

- Early Payment Discount – “5% discount for payments received within 7 days of the payment request.”

- Late Fee Policy – “A 1.5% late fee will be applied to overdue balances every 30 days.”

By consistently following these best practices, businesses can streamline their billing process, reduce delays in receiving payments, and ensure that cash flow remains steady. Timely financial requests, combined with clear terms and regular follow-ups, contribute significantly to the fin