Ultimate Invoice Template for iPad to Simplify Your Billing

Managing your financial documents efficiently is essential for any business, whether you’re a freelancer, small business owner, or large enterprise. With the right tools, you can create professional and organized records in no time. Leveraging modern technology can help simplify this process, saving you both time and effort.

Digital solutions offer a wide range of benefits, allowing users to quickly generate and customize professional invoices, track payments, and manage client information all in one place. Whether you’re working from the office or on the go, these tools provide flexibility and convenience for handling your finances.

By adopting the latest solutions, you can ensure that your financial documents not only look polished but are also easy to manage and share. This article will guide you through the process of selecting the right tools to optimize your workflow and keep your billing system running smoothly.

Invoice Template for iPad: A Complete Guide

Managing financial documents on your mobile device has never been easier. With the right tools, you can create professional billing statements, track payments, and maintain a clear record of transactions wherever you are. The key is choosing the right solution that works seamlessly with your workflow and helps you stay organized.

In this guide, we’ll walk you through everything you need to know about digital solutions that allow you to generate and customize professional billing records. From selecting the best apps to tips on personalization, you’ll learn how to create accurate, well-organized documents that meet your business needs.

Whether you’re running a small business or managing freelance work, this approach offers an efficient and streamlined way to handle your finances. With a few simple steps, you can ensure your records are always up to date and ready to be shared with clients or stakeholders.

Why Choose an iPad Invoice Template

Using mobile solutions to handle your billing documents provides a level of convenience and flexibility that traditional methods simply can’t match. When you’re managing multiple tasks, it’s essential to have a quick and reliable way to generate accurate, professional documents, especially when you’re on the move.

Opting for a digital tool on your device allows you to streamline your workflow and ensure that you always have access to your financial records. With intuitive apps and easy-to-use features, it’s easier than ever to manage your business, no matter where you are. Below are some key reasons why this method can significantly improve your operations:

| Benefit | Description |

|---|---|

| Portability | Access and create documents anywhere, whether you’re at the office, at a client meeting, or working from home. |

| Customization | Easily adjust details like logos, payment terms, or itemized lists to meet your unique business needs. |

| Time Efficiency | Quickly generate documents with pre-designed fields, saving you time compared to manual entry or spreadsheets. |

| Professional Appearance | Create clean, visually appealing documents that convey professionalism and attention to detail. |

| Tracking | Effortlessly track and update payment statuses, keeping you organized and aware of overdue accounts. |

With all these advantages, it’s clear that using a digital solution on your mobile device can simplify the entire process of managing your finances, making it an essential tool for modern businesses and professionals alike.

How to Create Invoices on iPad

Generating billing documents on your mobile device has become a seamless and straightforward process. With the right tools, you can quickly create professional, accurate records without the need for complex software or a desktop computer. Whether you’re handling client payments or documenting transactions, it’s essential to know how to use these tools effectively to save time and ensure precision.

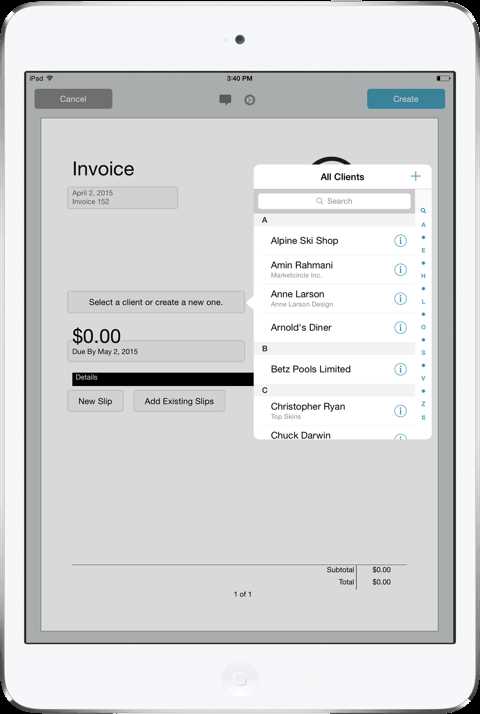

Step 1: First, choose a reliable app that meets your needs. There are several options available, each offering a range of features like customizable fields, automatic calculations, and design options. Many apps also sync with cloud storage, allowing you to access your documents from multiple devices.

Step 2: Once you’ve selected an app, open it and choose to create a new document. Most apps will offer you pre-built layouts to start with, so you don’t need to build from scratch. These layouts often include common fields like client information, product or service descriptions, and pricing.

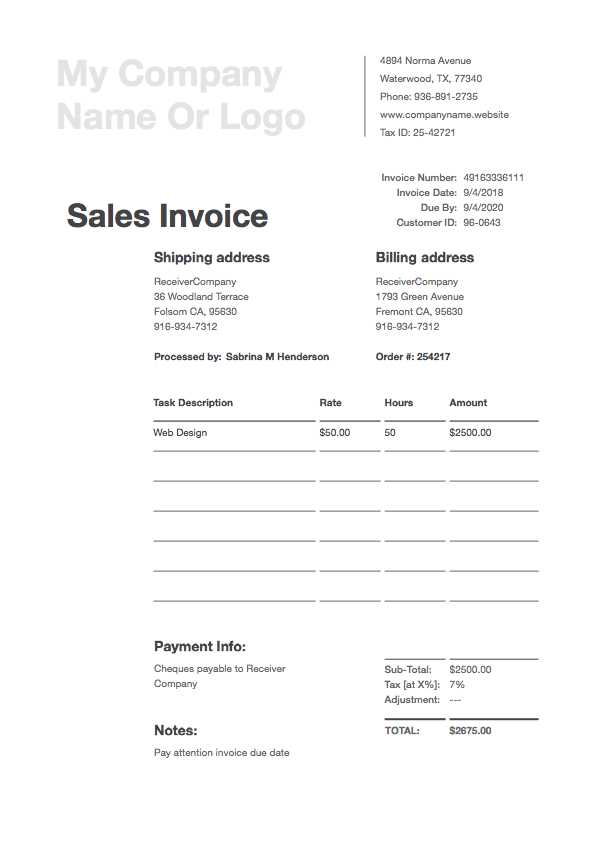

Step 3: Customize the document by filling in the necessary details. You can add your business name, logo, contact information, payment terms, and any other relevant details. Most apps allow you to personalize these sections to match your brand’s style, ensuring your records look professional.

Step 4: Double-check your entries for accuracy. Many apps offer automatic calculations for totals and taxes, so ensure all the figures are correct. If needed, adjust quantities or discounts to reflect your pricing structure.

Step 5: Save the document and export it in the desired format, such as PDF or Excel. From here, you can easily email it to clients or store it in your cloud storage for later reference.

With these simple steps, creating detailed and professional financial documents on your device is an efficient task. No matter where you are, your billing system will be quick, flexible, and always ready when you need it.

Best Invoice Apps for iPad Users

When it comes to managing billing documents on the go, having the right app can make all the difference. The right software solution can help you create, manage, and track payments quickly and efficiently. Whether you’re a freelancer, small business owner, or professional managing multiple clients, these tools offer a range of features to streamline your financial tasks directly from your device.

Below are some of the best apps available to help you generate polished records, customize them to suit your needs, and stay organized with minimal effort:

| App Name | Key Features | Price |

|---|---|---|

| QuickBooks | Customizable fields, automatic tax calculations, expense tracking, cloud sync | Subscription-based |

| FreshBooks | Time tracking, automated reminders, client management, invoice creation | Subscription-based |

| Zoho Books | Multi-currency support, inventory management, customizable invoices | Subscription-based |

| Invoice2go | Invoice creation, expense tracking, project management, offline access | Subscription-based |

| Wave | Free invoice creation, payment tracking, receipt scanning, accounting features | Free |

These apps provide everything from simple billing to full-scale financial management, allowing users to choose a solution based on their specific business needs. With the flexibility to create, send, and track documents all in one place, these tools help save time and ensure your financial processes run smoothly.

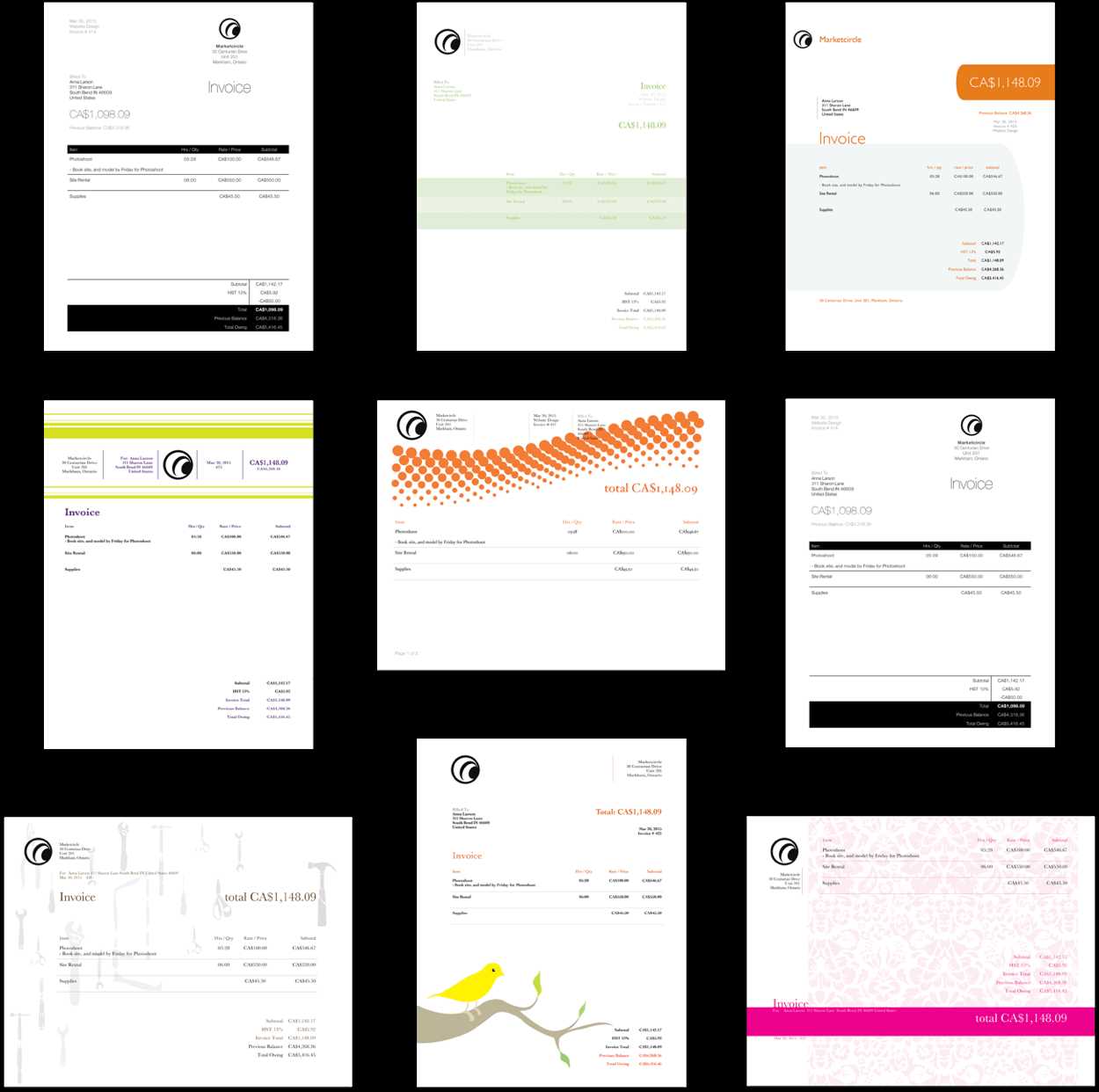

Top Features of iPad Invoice Templates

When creating professional billing documents on your mobile device, the features of the tool you use can greatly enhance your efficiency and accuracy. The right solution should provide easy customization options, automate time-consuming tasks, and deliver a polished look. Below are some of the most valuable features that can help streamline your billing process:

Customization and Personalization

- Branding Options: Easily add your company logo, business name, and contact information to make documents look professional and consistent with your brand.

- Design Flexibility: Adjust colors, fonts, and layout to match your preferred style or business requirements.

- Custom Fields: Tailor each document to your needs by adding or removing fields such as payment terms, discount options, or shipping details.

Automation and Efficiency

- Automatic Calculations: Automatically calculate totals, taxes, and discounts, ensuring accuracy without the need for manual input.

- Recurring Billing: Set up automated billing cycles to save time on repetitive tasks and ensure consistency in client payments.

- Quick Data Entry: Pre-filled fields and smart suggestions can speed up the process of entering client information, product details, and prices.

With these essential features, you can reduce the manual work involved in creating billing records and maintain a smooth, professional workflow. Whether you’re creating one-time documents or managing recurring transactions, these tools can help save valuable time and enhance the accuracy of your financial records.

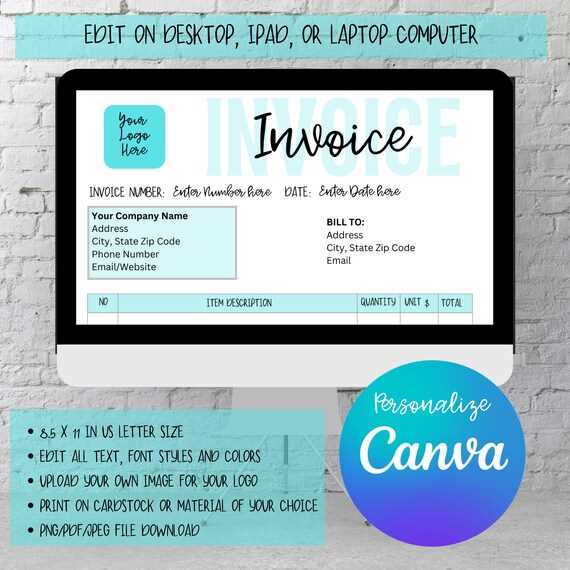

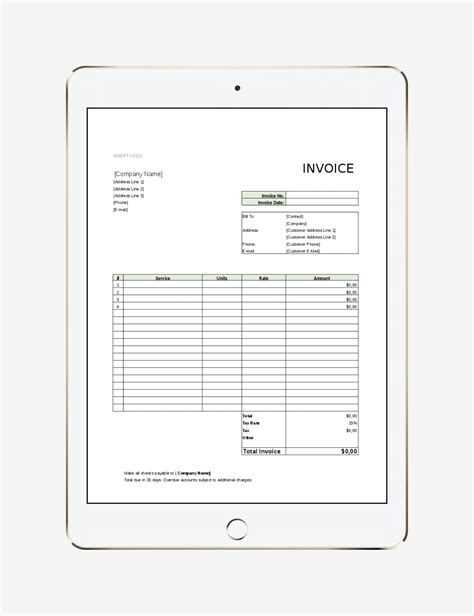

How to Customize Your Invoice Template

Customizing your billing documents allows you to ensure that they reflect your brand, meet your business needs, and present a professional appearance. Whether you’re adjusting the layout, adding specific details, or personalizing the content, the ability to modify these documents is essential for maintaining consistency across your financial records. Here’s a guide to help you make the most of these features and create tailored documents quickly and easily.

Essential Customization Options

Most apps and solutions offer various customization features that allow you to adjust both the look and the functionality of your financial documents. Below are some key elements you can personalize:

| Customization Option | Description |

|---|---|

| Logo and Branding | Upload your company logo and use your brand colors to ensure your documents reflect your business identity. |

| Fonts and Layout | Choose from various fonts and layouts to create a clean, easy-to-read document that suits your professional style. |

| Field Customization | Add, remove, or adjust fields such as payment terms, shipping details, or special notes to fit your specific needs. |

| Tax and Discount Settings | Set up custom tax rates or apply discounts to provide accurate pricing and payment information. |

How to Adjust Document Content

- Adding Client Information: Make sure to include important client details like name, address, and contact information, either manually or by linking your contact list.

- Product and Service Descriptions: Enter clear descriptions of the products or services being billed, ensuring that clients can easily identify what they’re paying for.

- Payment Terms: Customize your payment terms, such as due dates, late fees, or special instructions, to set clear expectations for clients.

By taking advantage of these customization options, you can create billing documents that not only match your brand but also provide all the necessary information in a clear and professional manner. Customization helps improve communication with clients and makes managing your business finances more efficient.

Free vs Paid iPad Invoice Templates

When selecting a tool to create your billing records, one of the key decisions you’ll face is whether to use a free or paid option. Both free and paid solutions offer their own advantages and limitations. While free options might seem appealing at first, paid solutions often provide more advanced features and greater flexibility. Understanding the differences between the two will help you choose the right solution based on your business needs and budget.

Advantages of Free Solutions

Free tools can be a great starting point for individuals or small businesses with basic needs. These options typically offer essential features, allowing you to create and send simple billing records. Here are some key benefits:

- Cost-Effective: No subscription or one-time fees, making it a budget-friendly option for startups or freelancers.

- Easy to Use: Most free tools are designed to be user-friendly with basic functionalities, ideal for those who need a simple solution.

- Quick Setup: Free apps often allow immediate use without a long setup process, making it easy to get started right away.

Benefits of Paid Solutions

While free tools may be sufficient for basic tasks, paid solutions generally offer a broader set of features that can save you time and improve the overall efficiency of your financial management. Here’s why you might consider investing in a premium tool:

- Advanced Features: Paid options often include automation, customizable designs, recurring billing, tax management, and integration with other software like accounting systems.

- Professional Support: With paid tools, you typically gain access to customer service, troubleshooting, and ongoing software updates.

- Customization: More flexibility in personalizing documents with logos, color schemes, and detailed fields, allowing you to create records that fully align with your brand.

- Security: Premium tools often offer better data security, which is important for managing sensitive client and financial information.

Ultimately, the decision between free and paid solutions depends on your specific needs. If you’re just starting out and only need to send occasional documents, a free tool may suffice. However, as your business grows or if you need more advanced features, investing in a paid solution can provide significant long-term benefits.

How to Save and Share Invoices from iPad

Once you’ve created a professional billing document, the next step is ensuring that it’s saved securely and easily shared with clients or colleagues. The ability to quickly store and send these files is crucial for maintaining an efficient workflow. Whether you’re working remotely or handling tasks in the field, knowing how to manage your documents is essential for staying organized.

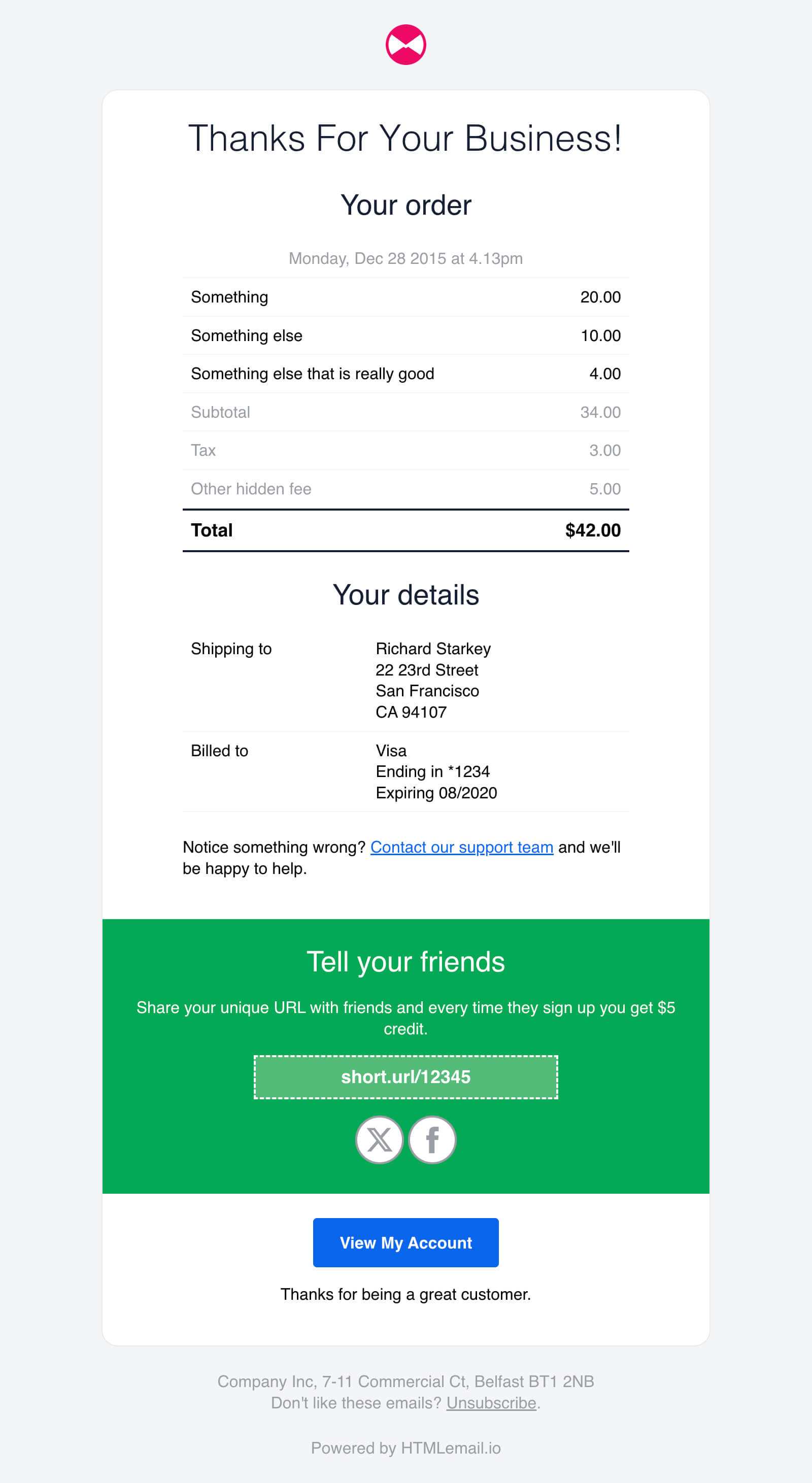

Saving your document can usually be done with just a few taps. Most apps allow you to save your completed records in various formats such as PDF or Excel. Once saved, these files are typically stored within the app or synced to cloud services, making it easy to access them from any device later on. Here’s how you can save your documents:

- Select the Save Option: After finishing your document, look for a “Save” or “Export” button. Choose the format you prefer, with PDF being the most commonly used for its universal compatibility.

- Choose Storage Location: Select where you’d like to store the file. You can save it locally on your device, or upload it to cloud storage like Google Drive, Dropbox, or iCloud for easier access across devices.

- File Naming: Give your file a clear, descriptive name to easily identify it later, especially if you’re working with multiple clients or projects.

Sharing your document is equally straightforward. Once saved, you can share your document via various methods depending on your preferences and client needs:

- Email: Attach your saved file to an email and send it directly to your client’s inbox. Many apps allow you to email the document directly from within the app, simplifying the process.

- Cloud Sharing: If you’re using a cloud storage service, simply share a link to the document with your client. This is especially useful if you want to provide easy access to large files without overwhelming email inboxes.

- Messaging Apps: For quicker communication, you can also send your document through messaging platforms like WhatsApp or Slack, depending on your client’s preference.

By mastering these basic steps, you can ensure that your billing documents are securely saved, easily accessible, and ready to be shared with clients or team members at a moment’s notice. This will help streamline your workflow and keep your business operations running smoothly.

Integrating iPad Templates with Accounting Software

Integrating your billing and financial documents with accounting software can significantly enhance your workflow and reduce the chance of errors. By linking your mobile tool to an accounting system, you streamline the process of tracking expenses, managing payments, and keeping accurate records without duplicating data entry. This integration ensures that all your financial data is up-to-date and properly organized, making tax time and financial reporting much easier.

Benefits of Integration

- Automatic Syncing: Once connected, your documents can sync directly with your accounting software, eliminating the need for manual data entry and reducing the risk of mistakes.

- Real-Time Updates: Integration ensures that any changes or updates made to a document are reflected across your accounting system in real time, allowing for accurate financial tracking at all times.

- Seamless Financial Management: With integration, all your billing, payments, and expenses are connected in one place, streamlining your overall financial management and reporting processes.

How to Integrate with Accounting Software

Connecting your mobile app to accounting software usually involves a few simple steps. Here’s how you can get started:

- Choose Compatible Software: Ensure that the billing solution you’re using supports integration with popular accounting tools like QuickBooks, Xero, or FreshBooks.

- Connect Your Accounts: Most apps will allow you to link your accounting software through an API or integration feature. Follow the on-screen instructions to authorize and connect both platforms.

- Enable Syncing: Once connected, enable automatic syncing so that your documents are updated in real time, ensuring that your financial records remain consistent and accurate.

- Test the Integration: After setting up, perform a test to ensure the data flows correctly between both systems and that all fields are syncing properly.

By integrating your mobile solution with accounting software, you create a more streamlined, efficient workflow that saves time and reduces errors. With everything connected, you can manage your finances with ease and focus on growing your business.

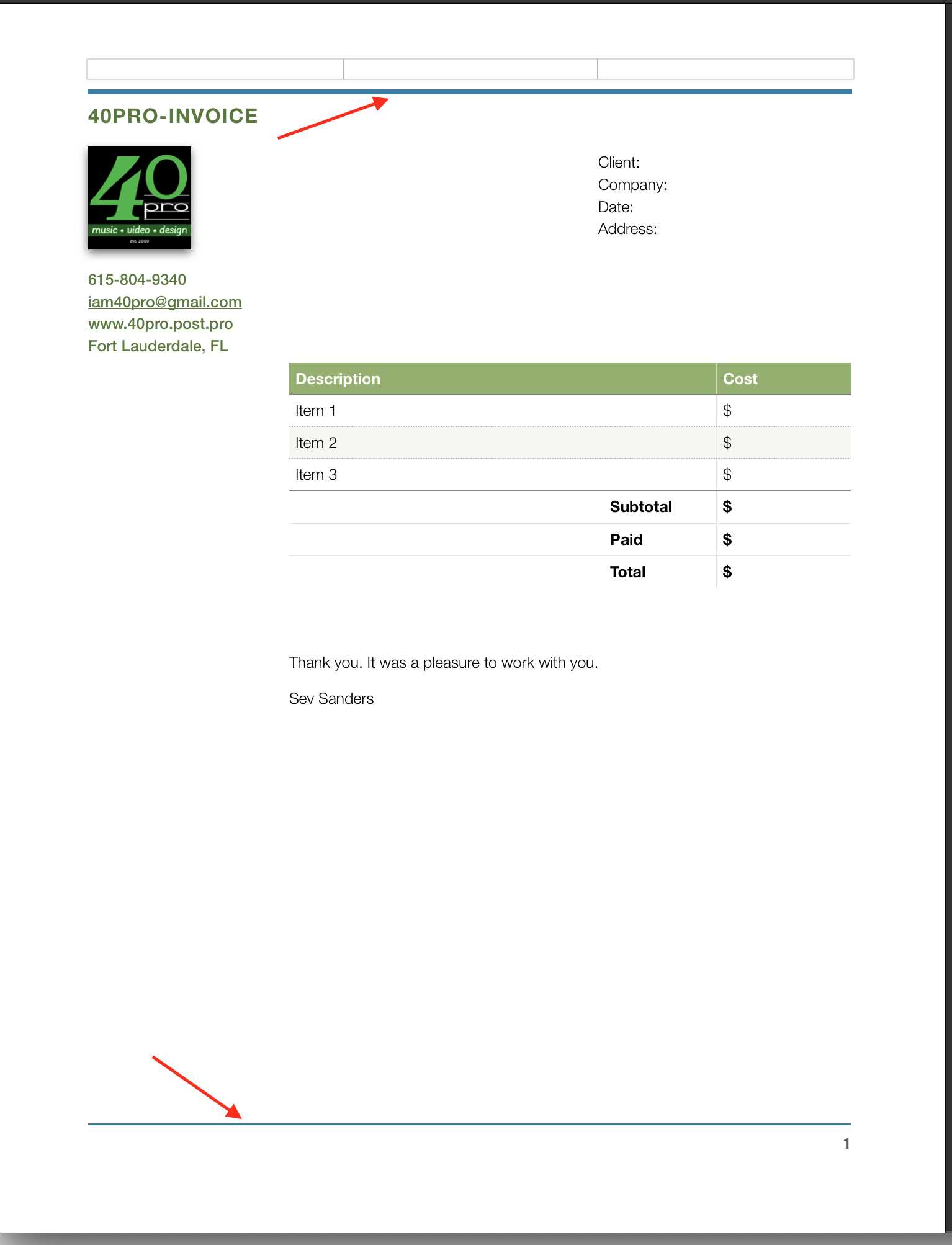

Tips for Professional-Looking Invoices on iPad

Creating polished and professional-looking billing documents is essential for maintaining a positive image with clients. Whether you’re a freelancer, small business owner, or entrepreneur, having visually appealing and well-organized records can set you apart from competitors. Even when working on a mobile device, there are several ways to ensure your documents reflect a high standard of professionalism.

Design and Layout

- Keep It Clean and Simple: Use a clear, easy-to-read font and avoid clutter. A clean layout makes your document more professional and easier for clients to understand.

- Brand Consistency: Incorporate your business logo, color scheme, and fonts to align the document with your brand identity. This adds a personal touch and makes your records stand out.

- Organize Information Clearly: Structure the document logically by grouping similar information, such as client details, itemized lists, and payment terms. This helps clients find important information at a glance.

Content and Accuracy

- Include All Relevant Details: Ensure that all necessary fields are completed, such as payment due dates, item descriptions, quantities, and total costs. Clear and complete information adds credibility to your documents.

- Use Correct Terminology: Always use professional language and ensure that terms like “payment terms,” “due date,” and “late fee” are used accurately. This not only makes your documents look more polished but also avoids confusion.

- Double-Check for Errors: Before finalizing any document, review it for typos, calculation errors, or missing information. An error-free document will build trust with your clients and show attention to detail.

By following these simple tips, you can create documents that not only look professional but also reflect your commitment to quality. Even when working from a mobile device, a little attention to design and content can go a long way in ensuring your records are effective and impactful.

Security Features for iPad Invoice Templates

When managing financial documents on a mobile device, security is a top priority. Whether you are sending records to clients, storing sensitive information, or tracking payments, it is crucial to protect your data from unauthorized access or potential threats. Many modern mobile solutions offer a variety of security features that help safeguard your records and ensure confidentiality.

Key Security Features to Look For

- Encryption: Look for solutions that offer data encryption, which ensures that any information you store or transmit is secure and protected from hackers.

- Password Protection: Many apps allow you to set a password or PIN to access your documents, preventing unauthorized users from viewing or editing your financial records.

- Two-Factor Authentication: For an added layer of security, enable two-factor authentication. This requires you to verify your identity through another method, such as a code sent to your phone, before gaining access to your app or documents.

- Cloud Storage Security: If you store documents in the cloud, ensure the service offers robust security protocols, such as secure connections (SSL/TLS) and automatic backups, to keep your data safe and accessible only to authorized users.

Additional Best Practices for Security

- Regular Backups: Regularly back up your financial documents to ensure you don’t lose important records in case of device failure or data corruption.

- Secure Sharing: When sharing your documents with clients, use secure channels such as encrypted emails or protected file-sharing services to prevent interception by third parties.

- Update Software: Keep your app and device software updated to ensure you have the latest security patches and features.

By leveraging these security features and adopting best practices, you can confidently manage your financial documents on your mobile device, knowing that your data is well protected from potential threats.

How to Handle Multiple Clients with iPad Templates

Managing multiple clients and their respective financial records can be a challenging task, especially when using a mobile device. The key is to stay organized, keep track of client-specific details, and ensure that each record is created and sent without confusion. Fortunately, with the right tools and strategies, handling multiple clients from a tablet can be a smooth and efficient process.

Organization Strategies for Multiple Clients

- Client Folders: Create separate folders or categories for each client. This will allow you to easily locate and organize all relevant documents for each individual client or project.

- Use Client-Specific Fields: Customize the fields to include client names, contact details, and specific services or products provided. This helps you avoid mistakes and ensures that each record is tailored to the right client.

- Project Management Integration: Integrate your billing system with project management tools to track the progress of each client’s work. This allows you to link billing with milestones or deliverables, making it easier to manage multiple projects simultaneously.

Best Practices for Creating Client-Specific Documents

- Templates for Common Details: Set up a base document that includes your business information, payment terms, and standard service descriptions. Then, modify it for each client to save time on repetitive tasks.

- Keep Communication Clear: Always ensure that the client’s name, project details, and pricing information are clearly displayed. This will help avoid any confusion and prevent errors when dealing with multiple clients.

- Set Up Recurring Billing: For clients with ongoing services, set up recurring billing schedules to automate the process. This can save time and ensure consistency for long-term projects or retainer agreements.

Efficient Client Communication

- Automated Notifications: Use automated email or messaging notifications to alert clients when their document has been sent or updated. This keeps communication transparent and timely.

- Digital Signatures: Enable digital signatures to streamline the approval process, ensuring that each client can sign off on the records directly from their own device.

By staying organized and leveraging mobile tools that support client-specific customizations, you can efficiently manage multiple clients, create tailored documents, and keep your workflow smooth and professional. With these strategies, you can handle a large volume of work without sacrificing attention to detail or quality.

Automating Repetitive Invoices on iPad

Handling recurring billing can be time-consuming, especially when you need to send similar documents to clients regularly. Fortunately, with the right mobile tools, you can automate this process to save time and eliminate the risk of human error. Automating repetitive tasks such as sending regular payments or subscription charges allows you to focus more on growing your business while ensuring that clients receive their documents on time without manual intervention.

Many mobile applications today offer automation features that allow you to set up recurring schedules for billing. This means that once you input the details for a client, you can set the system to automatically generate and send documents at regular intervals–whether that’s weekly, monthly, or based on another agreed timeframe. Automation tools can also track payments and update your financial records in real time.

By enabling automatic generation and delivery of documents, you can ensure timely and consistent communication with your clients, reduce administrative workload, and minimize the chances of missing deadlines or forgetting important tasks.

Setting Payment Terms in Your Invoice Template

Establishing clear payment terms is essential for maintaining a smooth financial relationship with your clients. Defining these terms within your billing records ensures both you and your clients have a mutual understanding of when payments are due, what payment methods are accepted, and any penalties for late payments. Setting these terms upfront can help prevent misunderstandings and encourage prompt payment.

Key Payment Terms to Include:

- Due Date: Specify the exact date by which payment must be made. Common options include “Net 30,” meaning the payment is due within 30 days, or “Due on Receipt,” indicating payment is expected immediately upon delivery of the document.

- Late Fees: Clarify the fees for overdue payments. This could be a flat fee or a percentage of the total amount owed. Make sure this information is visible to avoid confusion later on.

- Accepted Payment Methods: List the methods of payment you accept, such as credit cards, bank transfers, or online payment platforms like PayPal or Stripe. Providing multiple options can make it easier for clients to pay.

- Early Payment Discounts: Consider offering a discount for clients who pay ahead of schedule. For example, a 2% discount for payments made within 10 days can encourage early settlement.

Why Payment Terms Matter:

- Cash Flow Management: Clear payment terms help you plan and manage your cash flow. Knowing when to expect payments can prevent cash shortages and keep your business running smoothly.

- Professionalism: Setting transparent and reasonable terms enhances your professional image. It shows that you take your business seriously and expect the same from your clients.

- Conflict Prevention: Clear terms reduce the risk of disputes. When expectations are laid out clearly, there is less room for confusion or disagreements about payment schedules.

By carefully setting and communicating payment terms in your billing records, you create a fair and transparent process that benefits both you and your clients. This simple step can help streamline your payment collection and ensure timely compensation for your work.

Invoice Template Design Best Practices

Designing clear, organized, and professional billing records is essential for effective communication with clients. The layout of your documents plays a crucial role in how your clients perceive your business, and how easily they can review the details of their payment. A well-designed record not only looks professional but also improves the user experience, making it easier for your clients to understand the terms and make timely payments.

Here are some of the best practices to follow when designing your billing documents:

Essential Design Elements

| Element | Best Practice |

|---|---|

| Clarity | Ensure that all sections, such as client information, service details, and payment terms, are clearly separated. Use bold headings and ample white space to avoid clutter. |

| Branding | Incorporate your logo, company name, and consistent colors to align the document with your brand identity. This makes the document look polished and professional. |

| Legibility | Choose a simple, readable font like Arial or Helvetica. Avoid fancy or overly decorative fonts that may be difficult to read, especially on mobile devices. |

| Information Layout | Arrange information in a logical order–client details at the top, followed by itemized services, and then the payment summary. Make sure each section is easy to find. |

| Professional Tone | Use formal language and avoid slang or overly casual expressions. Ensure that payment terms and any late fees are communicated clearly. |

Additional Tips for Enhancing Design

- Consistency: Use a consistent layout and font style across all documents. This helps to reinforce your brand identity and makes your communications look more cohesive.

- Client Personalization: Personalize the document with your client’s name, their specific services, and any project details. This shows that you’ve tailored the document specifically for them, making it feel more professional.

- Visual Hierarchy: Use font sizes, bolding, and spacing to create a visual hierarchy. Important information like the total amount due or payment deadl

Managing Taxes and Discounts in iPad Templates

Accurately calculating taxes and applying discounts is crucial when preparing billing documents, as it directly impacts the final amount owed by the client. Whether you’re adding sales tax, offering seasonal discounts, or applying special offers, it’s important to ensure that these calculations are clear and correct. With the right tools, you can easily manage taxes and discounts within your mobile solutions, streamlining the process and reducing the chance for errors.

Managing Taxes: Most mobile apps offer features that allow you to set up tax rates based on your location or your client’s location. This helps ensure that you automatically apply the correct tax rates without needing to calculate them manually every time. You can also configure taxes for different types of products or services if required.

Applying Discounts: Discounts can be applied as either fixed amounts or percentages, depending on the agreement with the client. Many mobile solutions allow you to include a discount field where you can enter a percentage off the total or a set amount, ensuring transparency in the final total. Some systems also offer automatic discounting based on certain criteria, such as early payment or bulk purchases.

Best Practices: Always ensure that both taxes and discounts are clearly visible on the document. The breakdown of these charges should be listed separately so that the client can easily see how the final amount was calculated. This transparency can prevent confusion and disputes and promote a better client relationship.

By leveraging automation and customization tools, managing taxes and applying discounts becomes a simple and efficient process, allowing you to focus more on your business while ensuring accurate billing for your clients.

How to Track Payments on iPad

Keeping track of payments is a crucial part of managing your business finances. With the right mobile tools, you can easily monitor which clients have paid, which are still outstanding, and ensure that nothing slips through the cracks. Proper payment tracking allows you to maintain cash flow and avoid misunderstandings with clients regarding payment status.

Using Mobile Apps to Track Payments

Many mobile apps offer built-in payment tracking features that allow you to quickly update the status of each payment. These apps often let you mark invoices as paid, partially paid, or unpaid. Some even allow you to set up payment reminders or automatically update payment records when clients settle their balances. By keeping this information updated, you can easily see which accounts are current and which need follow-up.

Best Practices for Tracking Payments

- Organize by Payment Status: Categorize your records by payment status (e.g., “Paid,” “Due,” “Overdue”) to easily manage and filter outstanding payments.

- Set Up Notifications: Enable notifications to remind clients of upcoming or overdue payments. Automated alerts can help ensure payments are made on time.

- Record Payment Methods: Track the method of payment used for each transaction, whether it be credit card, bank transfer, or another method. This adds transparency and helps with financial reporting.

- Generate Reports: Many apps allow you to generate detailed payment reports, helping you monitor your overall cash flow and identify any patterns in client payments.

By integrating payment tracking into your mobile workflow, you can stay on top of your finances and maintain better control over your business transactions.

Common Mistakes to Avoid with iPad Invoices

Creating accurate and professional billing records is essential to maintaining good client relationships and ensuring timely payments. However, there are several common mistakes that can occur when preparing or sending billing statements. These errors can lead to confusion, delayed payments, and a negative impression of your business. Avoiding these mistakes can help you maintain professionalism and keep your financial operations running smoothly.

Top Mistakes to Watch Out For

Mistake Why It’s Problematic How to Avoid It Missing Client Information Omitting important client details, such as the full name or contact information, can cause confusion or delay payments. Always double-check that you have the correct client information before sending any documents. Incorrect Amounts Errors in the total amount due, tax rates, or discount application can lead to disputes and late payments. Use automated tools or double-check calculations to ensure accuracy. Unclear Payment Terms Vague or missing payment terms can result in misunderstandings regarding when and how much the client needs to pay. Clearly state due date