Invoice Template for Interior Design Services to Simplify Your Billing

Managing finances in creative fields requires efficiency and clarity. Having a well-organized document to bill clients can make a significant difference in how your business operates. Whether you’re working on a single project or juggling multiple assignments, a standardized approach ensures you stay on top of payments and maintain professionalism.

Automating the billing procedure with the right tools can save you time, reduce errors, and make your operations smoother. Instead of crafting each statement from scratch, you can customize pre-made solutions that align with your business needs, making the process both easier and faster.

Beyond the time-saving aspect, using structured billing documents helps in establishing trust with clients. A polished and consistent format reflects reliability and attention to detail, reinforcing the value of your work and ensuring clients feel confident in the process from start to finish.

Why You Need an Invoice Template

In any professional field, clear and organized documentation is essential for maintaining smooth financial operations. Having a predefined structure for billing helps save time and prevents confusion, ensuring all details are correctly presented. When dealing with multiple projects or clients, consistency is key to running an efficient business.

Here are some key reasons why using a pre-structured billing document is important:

- Time-saving: Reusing an established format reduces the effort of creating new documents for each client, speeding up the process.

- Consistency: A standardized approach helps maintain uniformity across all your transactions, which enhances professionalism.

- Accuracy: Pre-made solutions help avoid human errors, such as missing fields or incorrect calculations, ensuring precise billing every time.

- Client trust: A well-organized statement reflects your attention to detail and builds confidence with clients.

- Tax compliance: Having the right sections included in the document makes it easier to manage taxes and comply with legal requirements.

By implementing a structured billing method, you can streamline your workflow, maintain better control over finances, and provide a professional experience for your clients.

Benefits of Using Templates for Billing

Utilizing pre-structured documents for financial transactions offers numerous advantages that help streamline administrative tasks. Instead of creating new records from scratch each time, you can focus on customizing key details while ensuring consistency and professionalism across all client communications.

Time Efficiency

One of the biggest advantages of using ready-made formats is the time saved on manual entry and formatting. With a predefined structure, you can quickly generate documents without worrying about design or layout every time. This allows you to focus on the creative aspects of your work while automating repetitive tasks.

Improved Accuracy and Consistency

Pre-designed formats reduce the risk of human error, such as missing fields, incorrect calculations, or inconsistent styling. Every document looks the same, ensuring your clients receive clear and professional records that maintain the integrity of your financial communication.

| Benefit | Impact |

|---|---|

| Time-saving | Quick generation of documents without formatting concerns |

| Consistency | Uniform appearance and structure across all client records |

| Accuracy | Minimized risk of errors, ensuring correct details and calculations |

| Professionalism | Well-organized documents enhance your business reputation |

By adopting ready-made formats for your billing needs, you can save time, reduce errors, and improve your professional image. This efficient approach also makes it easier to track finances and communicate with clients, enhancing the overall experience for both you and your clients.

Benefits of Using Templates for Billing

Utilizing pre-structured documents for financial transactions offers numerous advantages that help streamline administrative tasks. Instead of creating new records from scratch each time, you can focus on customizing key details while ensuring consistency and professionalism across all client communications.

Time Efficiency

One of the biggest advantages of using ready-made formats is the time saved on manual entry and formatting. With a predefined structure, you can quickly generate documents without worrying about design or layout every time. This allows you to focus on the creative aspects of your work while automating repetitive tasks.

Improved Accuracy and Consistency

Pre-designed formats reduce the risk of human error, such as missing fields, incorrect calculations, or inconsistent styling. Every document looks the same, ensuring your clients receive clear and professional records that maintain the integrity of your financial communication.

| Benefit | Impact |

|---|---|

| Time-saving | Quick generation of documents without formatting concerns |

| Consistency | Uniform appearance and structure across all client records |

| Accuracy | Minimized risk of errors, ensuring correct details and calculations |

| Professionalism | Well-organized documents enhance your business reputation |

By adopting ready-made formats for your billing needs, you can save time, reduce errors, and improve your professional image. This efficient approach also makes it easier to track finances and communicate with clients, enhancing the overall experience for both you and your clients.

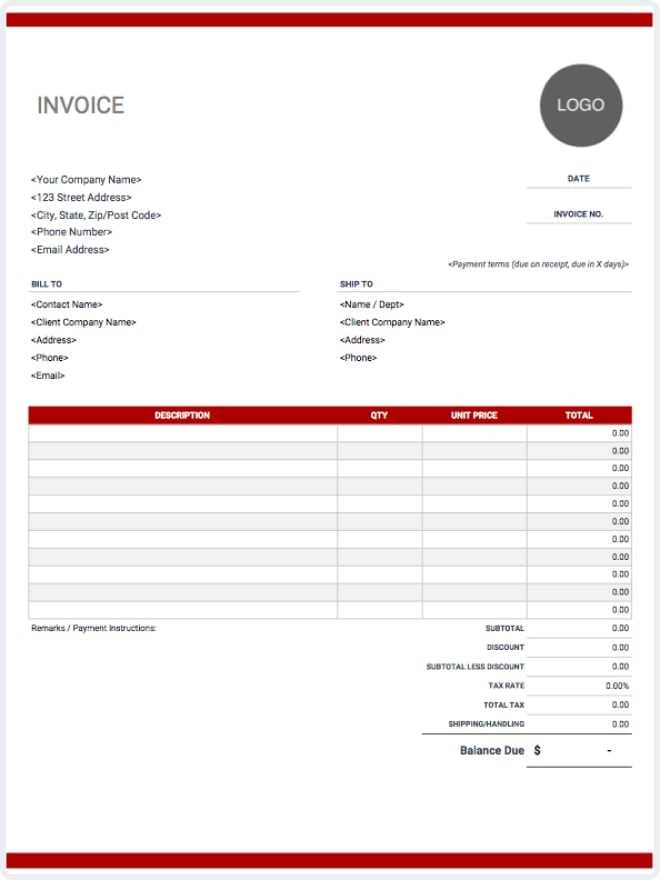

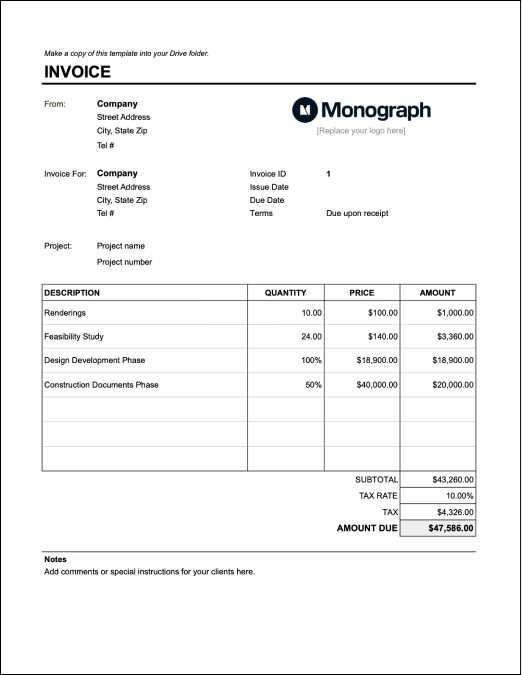

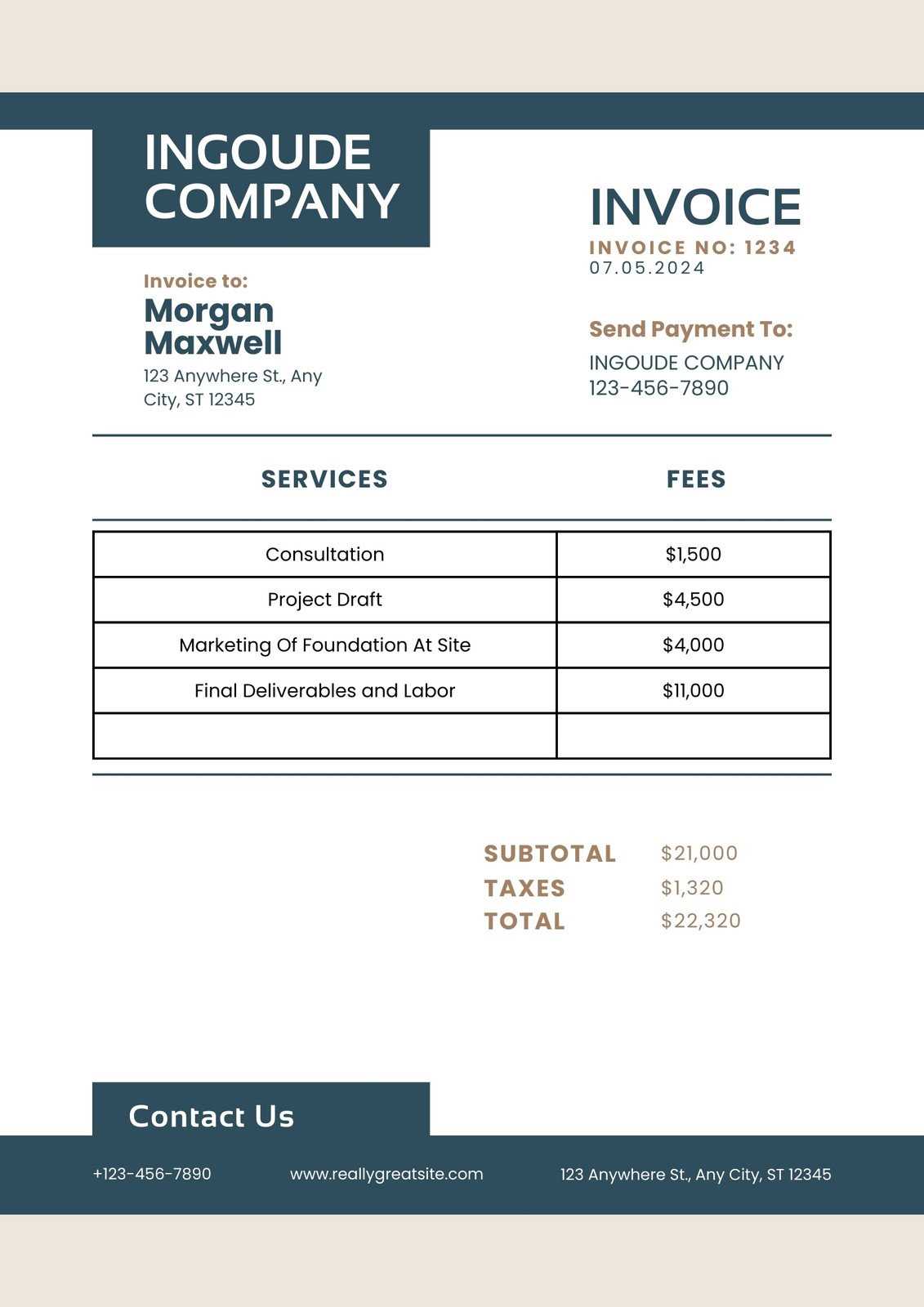

Key Elements of an Interior Design Invoice

When billing clients, it is essential to include specific details to ensure clarity and professionalism. A well-structured financial document not only outlines the cost of services but also builds trust and maintains transparency with the client. Certain components must be present to ensure the document is comprehensive and effective.

| Element | Description |

|---|---|

| Client Information | Name, address, and contact details of the client to ensure proper identification and communication. |

| Your Business Details | Your business name, address, and contact information should also be clearly stated for easy reference. |

| Project Description | A brief summary of the work completed or the scope of the project, including specific tasks or deliverables. |

| Dates | The start and completion dates of the project, as well as the date the bill was issued, for clarity. |

| Itemized Costs | A detailed breakdown of each cost or charge related to the project, including labor, materials, and any additional expenses. |

| Payment Terms | Clear instructions regarding payment deadlines, methods, and any late fees or discounts for early payment. |

| Tax Information | Any applicable taxes should be outlined separately, ensuring compliance with local laws and regulations. |

| Total Amount Due | The final sum that the client is required to pay, clearly highlighted to avoid confusion. |

Including these key components ensures that your billing documents are clear, transparent, and professional. By providing all the necessary details, you eliminate potential confusion and streamline the payment process, allowing for a smooth transaction and a positive client experience.

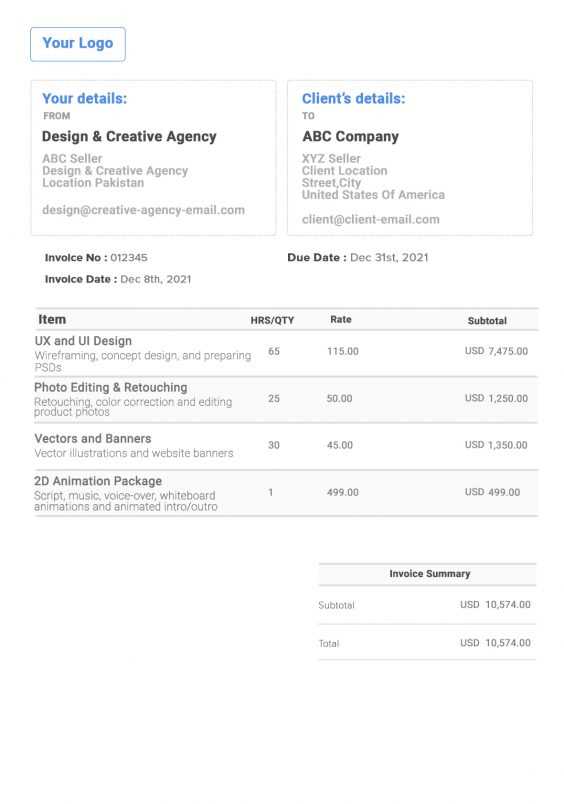

Customizing Your Invoice for Clients

Personalizing your billing documents is essential to reflect the uniqueness of your business and enhance professionalism. Tailoring each account statement can ensure clarity and build a stronger relationship with your clients. It’s not just about numbers; it’s about making the experience seamless and aligning the content with the nature of your collaboration.

Adjusting to Client Needs

One way to customize your billing is by considering the specific needs of each client. Whether it’s through adjusting terminology, adding detailed descriptions of work done, or including relevant project milestones, every detail counts. Customizations can also help to clarify complex or large-scale undertakings, making it easier for the client to understand the value of what’s been provided.

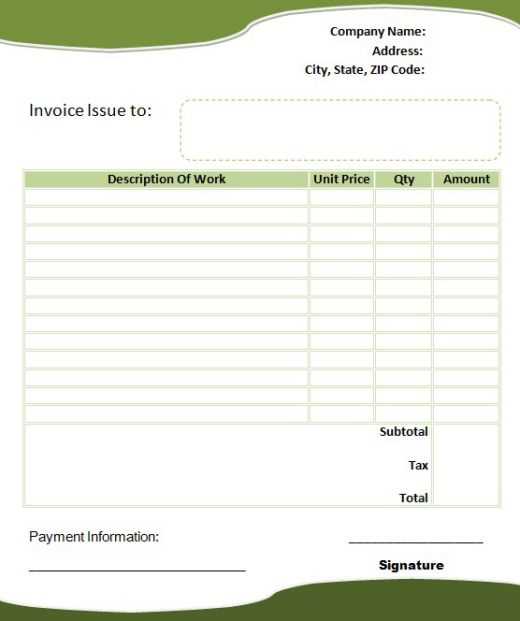

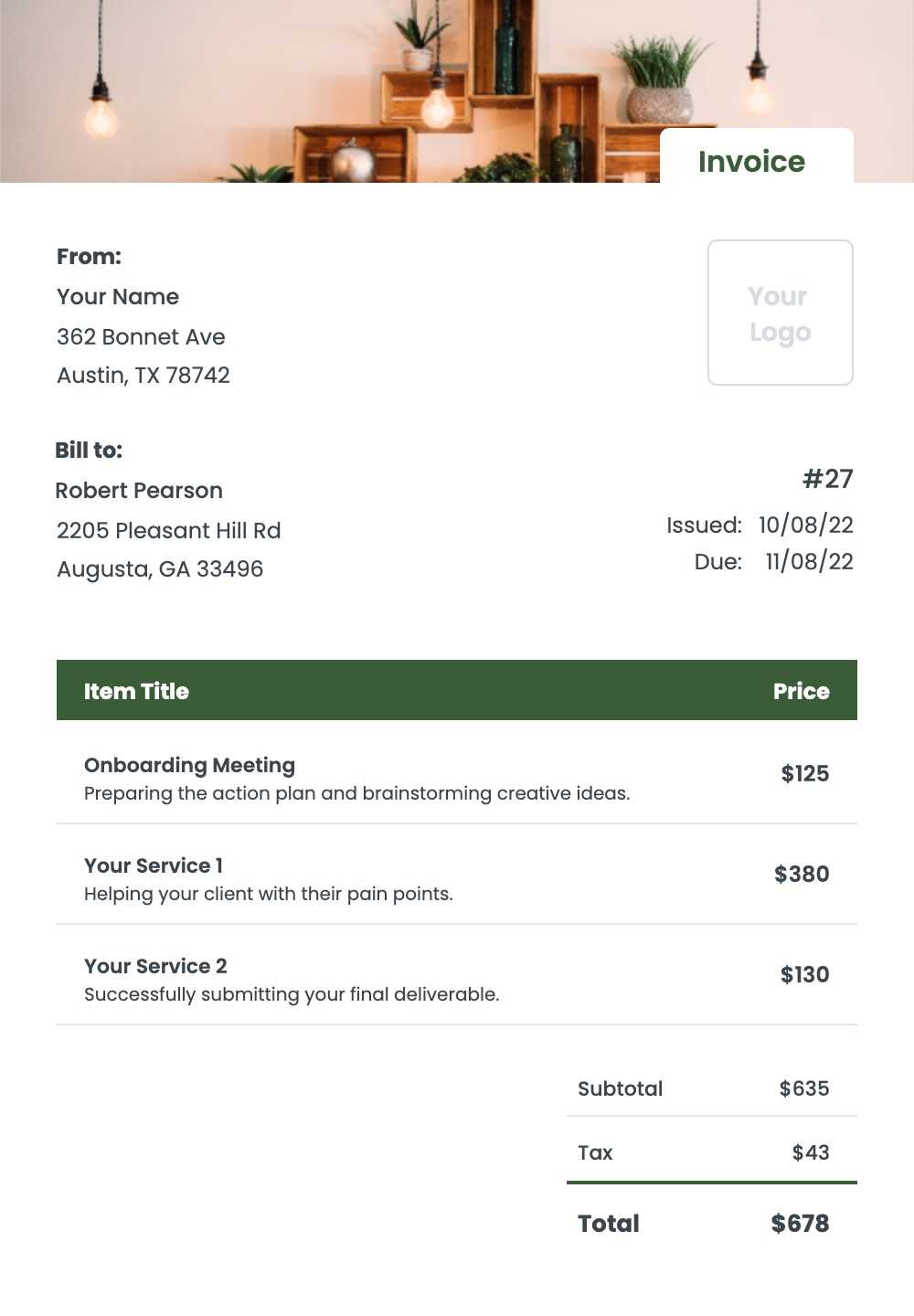

Branding and Presentation

Integrating your unique branding elements, such as your logo, business colors, or fonts, can greatly enhance the overall look of your document. Strong visuals and a well-structured format show that your work extends beyond just the physical task at hand. Personal touches like these can leave a lasting impression and demonstrate that you take pride in every aspect of your business.

By adapting these documents to each client’s needs and maintaining a polished aesthetic, you not only make the billing process smoother but also showcase your dedication to quality and detail.

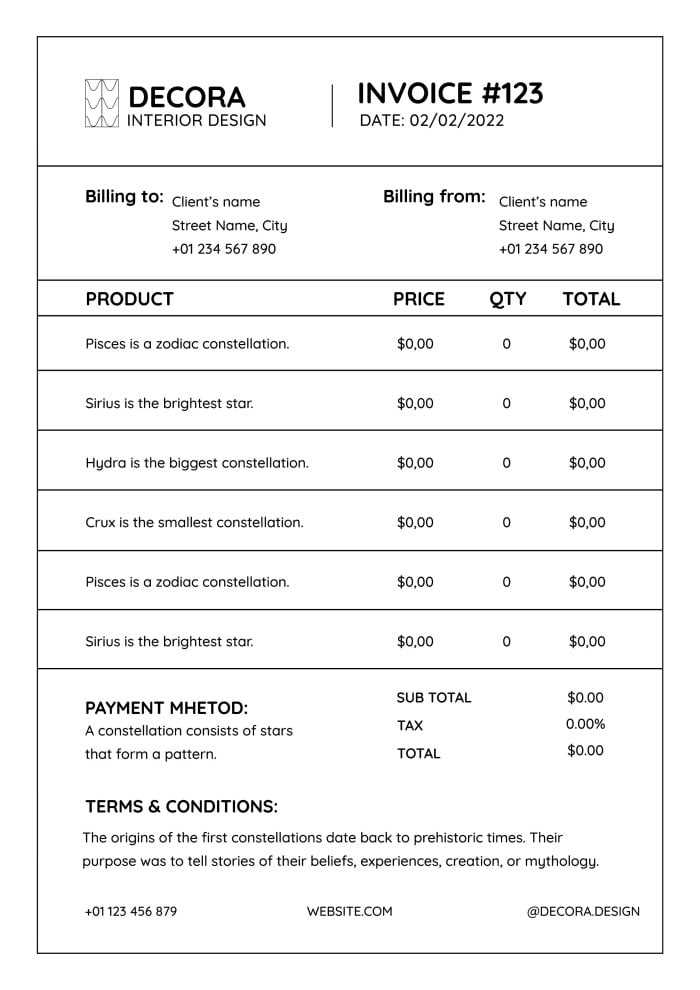

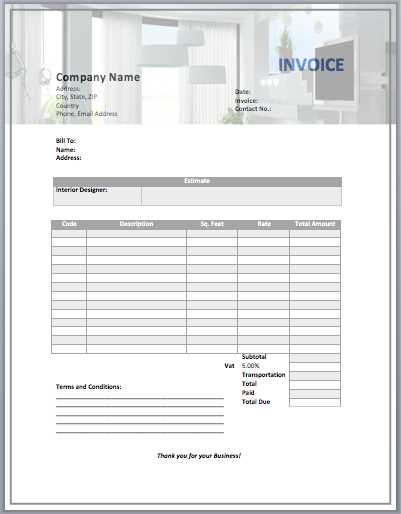

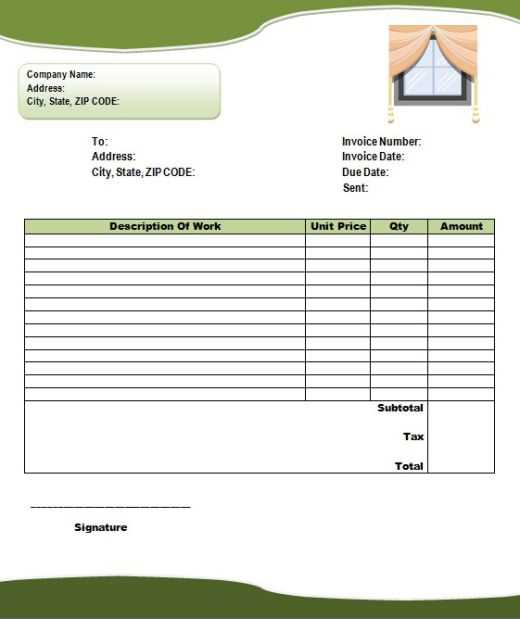

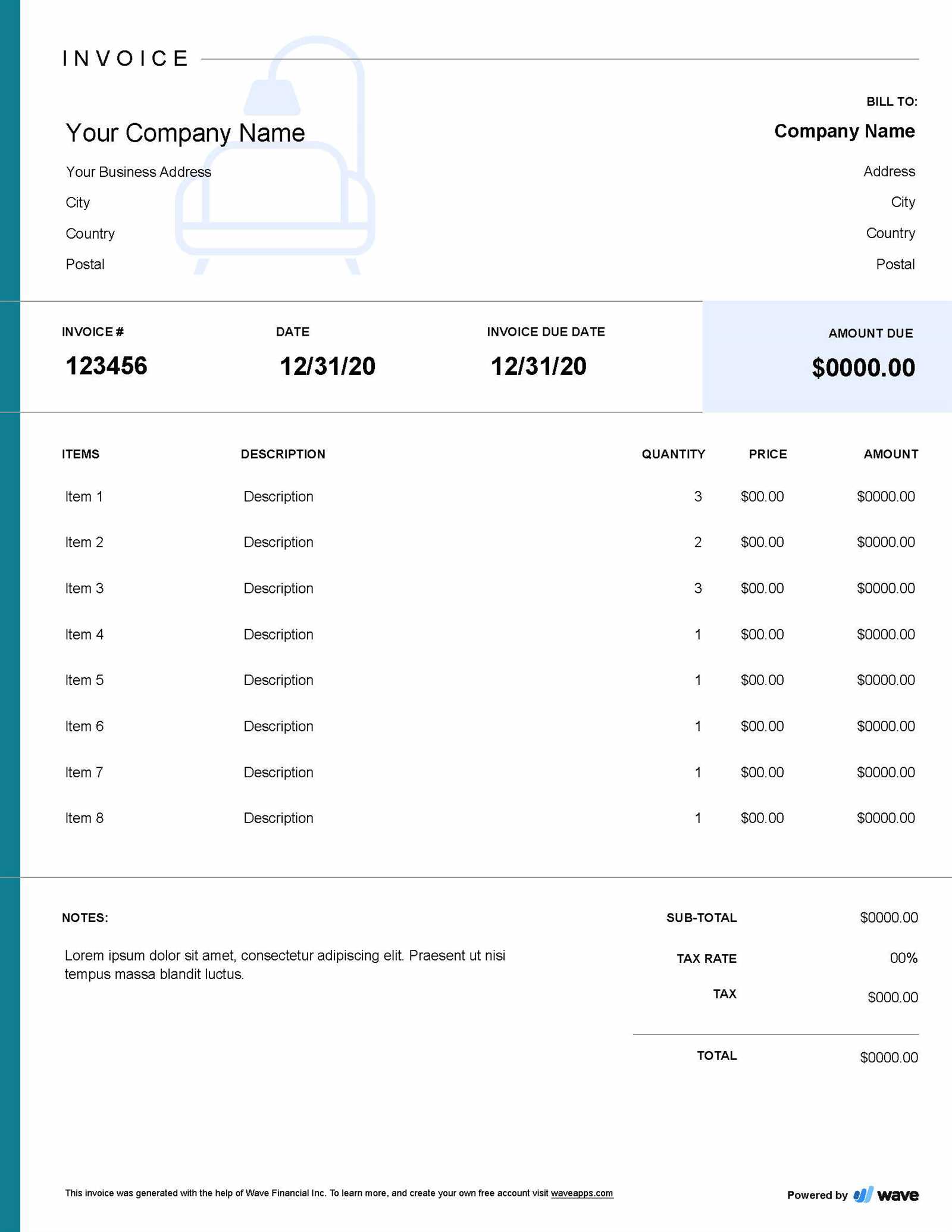

Free Invoice Templates for Interior Designers

Many professionals in creative fields find themselves needing a well-organized document to present their charges to clients. Whether you’re managing a large project or handling smaller tasks, using ready-made formats can save time and ensure consistency. Thankfully, there are numerous free resources available to help you streamline the billing process without the need for complex software or additional costs.

Benefits of Using Free Templates

Free documents offer a simple yet effective solution to keeping your finances in order. They provide a structured way to present charges, payment terms, and additional details like project timelines. These options are particularly useful for small businesses or independent contractors who might not have the budget for expensive accounting tools. The ability to customize these pre-designed structures allows for a personalized touch, while maintaining clarity and professionalism.

Where to Find Free Resources

Numerous websites offer complimentary documents that can be downloaded and edited to suit your needs. Some platforms even provide various layouts to match different business styles, ensuring that your personal brand remains evident. Additionally, many of these resources are compatible with common software like Word or Excel, allowing you to make changes with ease and speed. By choosing the right format, you can ensure that your presentation is clear, detailed, and aligns with your clients’ expectations.

By utilizing these free resources, you can focus more on the work itself, knowing that the business side is taken care of efficiently and professionally.

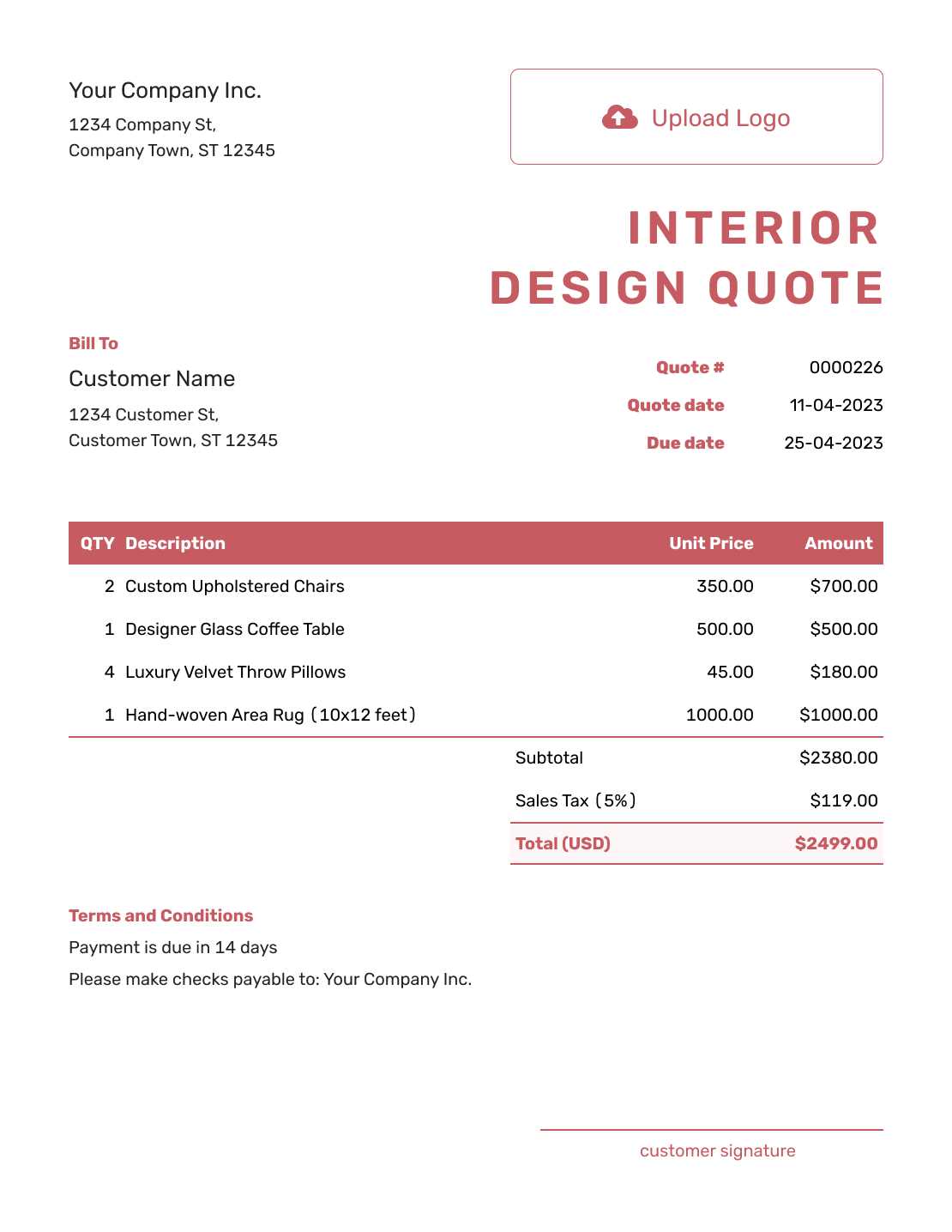

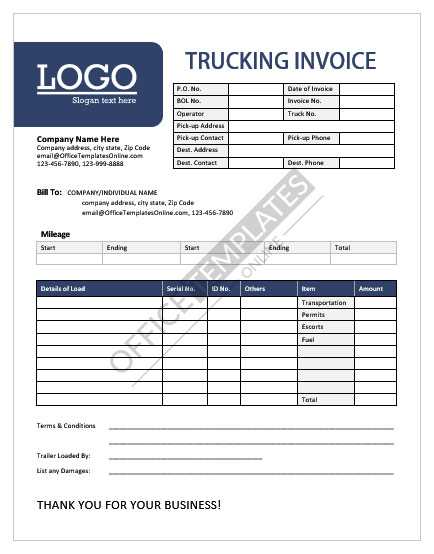

Choosing the Right Template for Your Business

Selecting the appropriate format to present your billing information is crucial to maintaining a professional appearance and ensuring clarity. The right structure not only saves you time but also helps create a streamlined and efficient process that enhances communication with clients. Choosing a style that reflects your business and aligns with your working methods can improve the overall client experience.

When picking a format, consider how detailed your billing needs are. A simple approach may work for smaller projects, while larger undertakings might require more comprehensive breakdowns, including labor costs, materials, and timelines. The right choice will depend on the complexity of the work you do and how you wish to present that information to your clients. Additionally, consider the style of your business: whether it’s minimalistic, modern, or more traditional, your documents should reflect the same tone and aesthetic.

Ultimately, selecting the right structure will help maintain consistency, ensure accuracy, and build trust with your clients. It’s important to remember that the best choice is one that both meets your needs and enhances the professional image of your business.

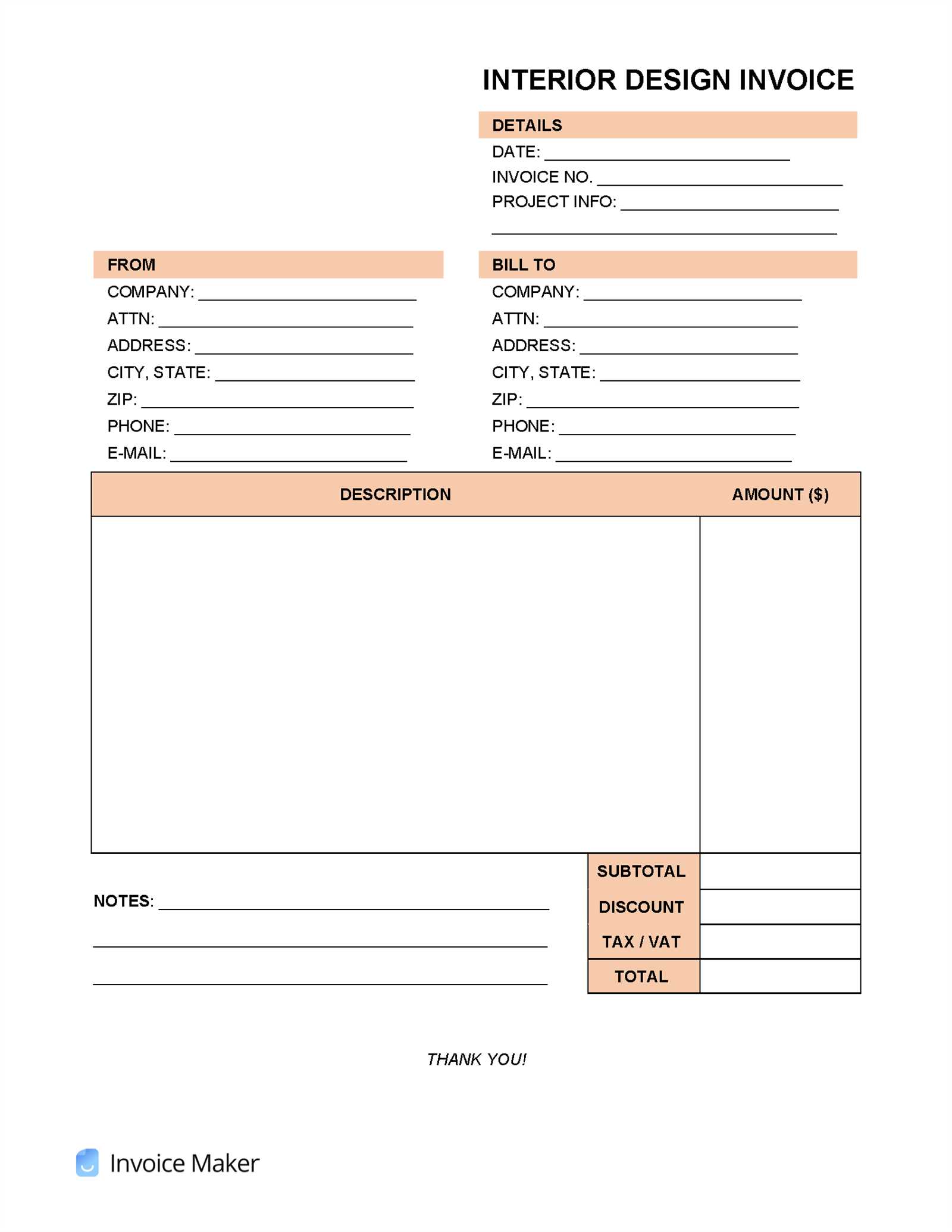

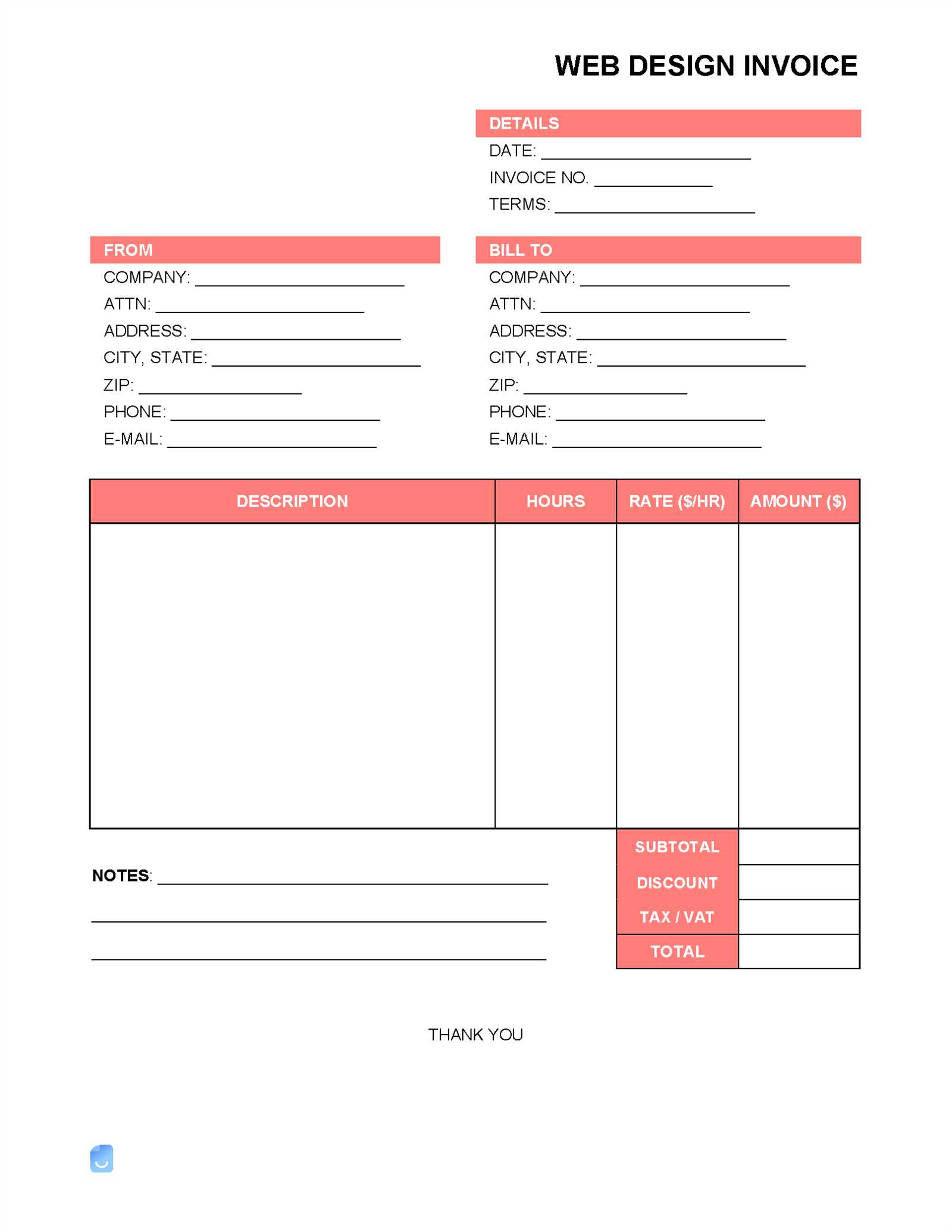

How to Add Taxes and Discounts on Invoices

Including taxes and discounts in your financial documents ensures accuracy and transparency with your clients. Properly accounting for these adjustments is essential not only for clarity but also for compliance with tax regulations. This section covers the key steps for adding these elements, ensuring your final amounts reflect the necessary charges or reductions in a straightforward and professional manner.

Adding Taxes

When calculating taxes, it’s important to clearly state the applicable rates and the total amount being charged. Typically, taxes are calculated based on the total amount of the work completed or goods provided. Be sure to include the tax rate and total tax amount separately to make the breakdown transparent for your clients. You can apply either a fixed or percentage-based rate, depending on local laws and regulations.

Applying Discounts

Discounts can be an excellent way to reward loyal clients or encourage prompt payments. When applying a discount, make sure to specify whether it is a flat amount or a percentage off the total cost. Clearly display both the discount amount and the final total after the deduction. Be transparent with the terms, such as whether the discount applies only to specific items or projects or if it’s available under certain conditions like early payment.

By clearly marking taxes and discounts on your documents, you help clients understand the pricing breakdown and maintain professionalism in all transactions.

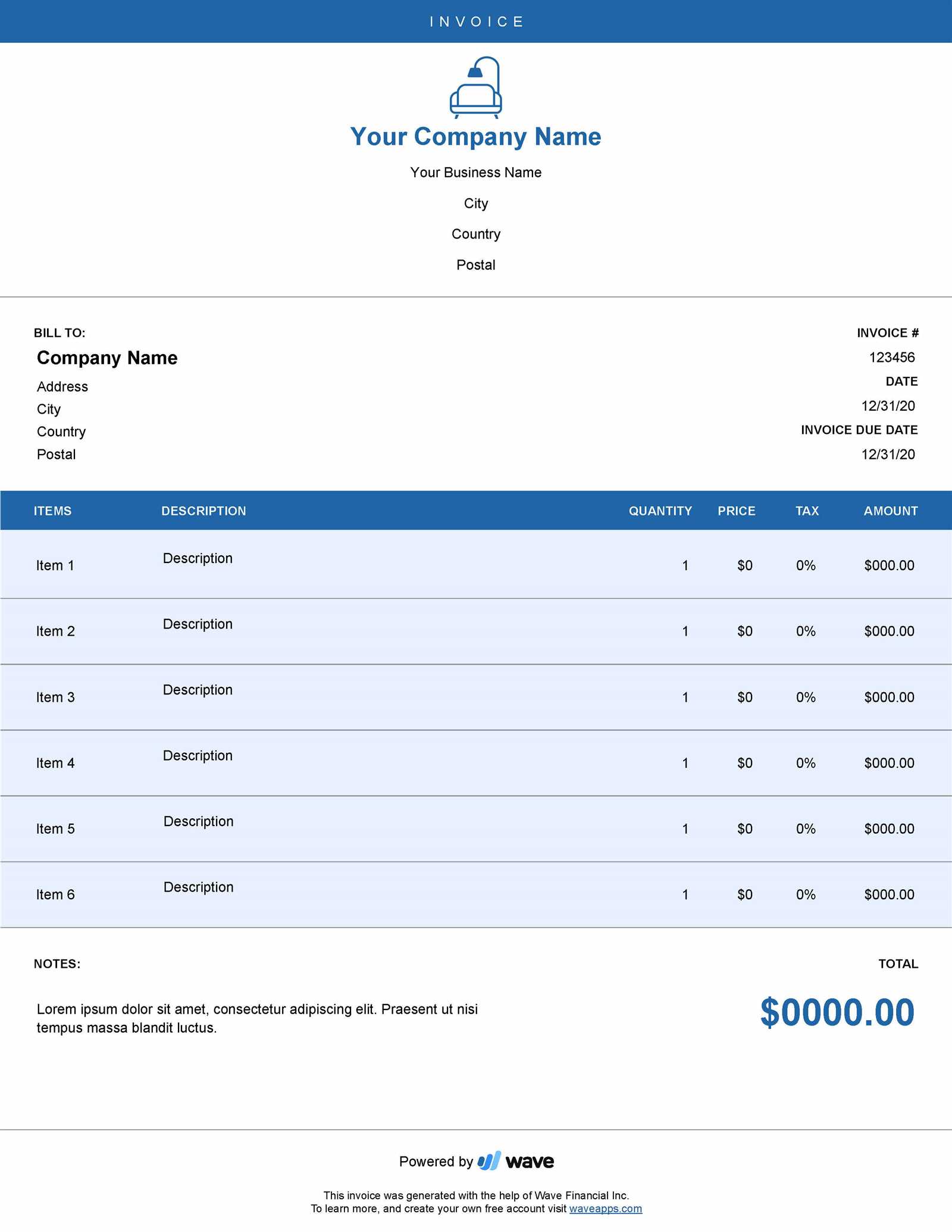

Top Features of Professional Invoice Templates

High-quality billing documents should include several key elements that enhance both clarity and professionalism. These features not only make the process of charging clients smoother but also help ensure that all essential information is communicated in a straightforward, easy-to-understand format. The following characteristics are essential for creating a polished and effective statement of charges.

Clear and Structured Layout

A well-organized layout is crucial for ensuring that all information is easily readable. A professional document should present details like dates, amounts, and descriptions in a structured way that helps clients quickly locate the information they need. A clean, simple format with enough white space and clearly defined sections creates a better user experience and minimizes the risk of errors.

Customizable Fields

One of the most important features is the ability to modify fields to suit your specific needs. Being able to add or remove sections, include extra lines for itemized charges, or adjust the layout allows you to tailor the document to any type of project or client. Whether it’s adjusting payment terms or adding a special note, customization gives you flexibility and control.

Professional Branding

Incorporating your brand’s logo, colors, and fonts can elevate the overall appearance of your documents and create a consistent visual identity across all communications. A well-branded statement not only looks more professional but also strengthens the recognition of your business by clients. Branding elements help to personalize your communication while ensuring it aligns with the look and feel of your business.

Itemized Charges and Total Breakdown

Having a detailed breakdown of charges ensures transparency and helps clients understand the value of the work provided. A professional format includes clear itemization of all work performed or goods provided, along with individual costs. This helps prevent confusion or disputes over pricing and allows clients to see exactly where their money is going.

Payment Instructions and Terms

To facilitate smooth transactions, including clear payment instructions and terms is essential. Indicate the due date, acceptable payment methods, and any late fees or discounts for early payments. This makes it easier for clients to understand how and when to settle their balances, improving cash flow and minimizing delays.

These features contribute to a seamless, efficient, and professional billing process that enhances the overall client experience while protecting your business interests.

Organizing Client Information in Invoices

Efficiently organizing client details in your financial documents is crucial for smooth communication and maintaining accurate records. Properly structuring this information not only ensures clarity but also enhances your professional image. A well-organized record makes it easier to track payments, resolve discrepancies, and build long-term client relationships.

Client Identification Details

It’s essential to include basic client identification details such as their name, address, and contact information. These elements provide a clear reference point for both parties and help avoid confusion, especially in cases where multiple clients or projects are involved. Including the client’s phone number or email address allows for easy follow-up if there are any questions or issues regarding the payment.

Project or Order Information

Along with personal details, clearly referencing the specific project or order is key to ensuring that both parties are on the same page. This can include the project name, location, or any unique identifiers that link the charges to the work completed. Organizing this information helps prevent misunderstandings and provides a quick reference for the client should they need to revisit or discuss specific tasks later.

Payment Terms and Dates

Clearly stating the payment terms and due dates is vital for establishing expectations. By organizing these details, you prevent potential conflicts and ensure that clients understand their obligations. This should include payment deadlines, accepted methods of payment, and any applicable penalties for late payments or discounts for early settlements. Being transparent with this information contributes to a smoother transaction process.

By properly organizing client information, you ensure that all communication remains clear, professional, and efficient, leading to better client relations and easier financial management.

Managing Multiple Projects with One Template

Handling several projects simultaneously can be a challenge, especially when it comes to organizing the associated billing and payment details. Using a single, well-structured format for all your projects allows for consistency and efficiency. This approach can simplify the process, ensuring that all the necessary details are included, regardless of the number of active projects or clients you’re managing.

Including Project-Specific Information

When working on multiple projects, it’s crucial to clearly distinguish between them. A single structure can be customized to include separate sections for each project, making it easy to track individual costs, timelines, and deliverables. You can add unique project identifiers or headings for each project, ensuring that all information remains well-organized and easy to navigate. This approach helps avoid confusion and ensures that each client receives a detailed, clear breakdown of their specific charges.

Standardizing Common Sections

Standardizing sections such as payment terms, client contact details, and billing instructions across all projects helps maintain uniformity. This reduces the time spent on repetitive tasks, allowing you to focus more on the unique aspects of each project. While the details will differ, having common fields in a consistent layout makes it easier to manage and cross-reference projects as they evolve.

Using Automation Tools

Consider using automation tools to streamline the process even further. Some software allows you to set up multiple entries within one document, automatically adjusting totals, taxes, and other variables based on project-specific data. This can save significant time, reduce errors, and ensure that each project is managed efficiently without having to start from scratch for each one.

By organizing multiple projects within a single framework, you can stay on top of your workload and ensure that everything is accounted for, from billing to tracking payments, in a way that minimizes confusion and maximizes efficiency.

Common Mistakes to Avoid in Invoices

While creating financial documents, there are several common errors that can lead to confusion, delays in payments, or even disputes with clients. Ensuring accuracy and clarity in every aspect of the statement is crucial to maintaining professionalism and fostering trust. Here are some of the most frequent mistakes to watch out for and how to avoid them.

Omitting Key Information

One of the most frequent mistakes is forgetting to include important details such as the client’s contact information, project description, or payment terms. This can lead to misunderstandings or delays in payment. Always ensure that each document includes the client’s name, address, and any relevant identifiers, such as project numbers or reference codes, so both parties can easily match the charges to the work completed.

Incorrect Calculations

Another common issue is making mathematical errors when calculating totals, taxes, or discounts. Even small mistakes can affect the accuracy of the entire document. Always double-check your calculations, and if possible, use automated tools or software to reduce the risk of errors. It’s also important to clearly list and separate charges, ensuring that both the subtotal and final amount are correct and easy to verify.

Missing Payment Instructions

Failure to provide clear payment instructions can lead to confusion and delays. Clients may not know how to pay or by when, which can result in late payments. Always ensure that payment methods, due dates, and any applicable fees for late payments are clearly stated. This helps clients understand their obligations and prevents avoidable issues later on.

Not Customizing for Specific Clients

Using a generic document for all clients without tailoring it to their specific needs can come across as impersonal. Be sure to personalize each statement, including details that relate directly to the work done, any special terms or agreements, and individual project milestones. This attention to detail shows professionalism and can build stronger relationships with clients.

Failure to Keep Copies

Lastly, failing to keep copies of sent documents can be a costly mistake. Always maintain a record of every document you send out, whether in digital or physical format. This will help you in case of disputes or if you need to reference past transactions for accounting purposes.

By avoiding these common errors, you can ensure that your documents are professional, accurate, and effective, leading to smoother transactions and better relationships with your clients.

How to Track Payments Using Invoices

Monitoring payments effectively is crucial for maintaining healthy cash flow and keeping your business finances in order. By using properly structured documents, you can easily track what has been paid and what remains outstanding. A clear and organized approach helps avoid confusion and ensures that clients are held accountable for their payments.

Marking Payment Status

One of the most important aspects of tracking payments is clearly indicating the payment status on each document. Always update the status to reflect whether the amount has been paid, is pending, or is overdue. Including a “paid” stamp or a similar mark can help you quickly identify completed transactions. For outstanding payments, including the due date and any late fees is important for clarity.

Using Payment References and Dates

Another effective method is including payment references, such as transaction numbers or bank details, when payments are made. By linking the payment to a specific reference number or date, both you and the client have a record that can be easily checked. This is especially useful if clients make partial payments or if multiple transactions are spread over time. Always record the exact payment date and the amount paid to keep everything in line with your records.

Organizing and Storing Records

To track payments efficiently, it’s essential to store all records–both paid and outstanding–in an organized manner. Digital tools, such as accounting software or spreadsheets, can help automate the process of updating and storing payment details. This allows for easy access to information whenever needed, ensuring that your payment tracking remains accurate and up-to-date.

By consistently marking payment statuses, using clear references, and organizing your records, you can streamline the process of managing finances, reduce errors, and ensure timely payments from clients.

Invoice Software for Interior Designers

Using specialized software for creating financial documents can save time, reduce errors, and ensure consistency in your billing process. These tools offer various features to help professionals manage their projects efficiently, allowing them to easily customize, send, and track payments for multiple clients. Whether you’re working on a single project or managing numerous accounts, such software provides a streamlined solution for managing transactions.

Key Features of Invoice Software

When selecting software for creating financial documents, it’s essential to look for tools that offer flexibility, ease of use, and comprehensive features. Below are some common features you should consider:

| Feature | Description |

|---|---|

| Customizable Formats | Allows tailoring of documents to suit specific project needs, from text descriptions to payment structures. |

| Automated Calculations | Automatically computes totals, taxes, and discounts, reducing human error and saving time. |

| Multiple Payment Methods | Supports various payment methods, such as credit cards, bank transfers, or online payment gateways. |

| Recurring Billing | Enables easy creation of recurring charges for long-term clients or ongoing projects. |

| Tracking and Reporting | Helps track payment statuses, overdue amounts, and generate reports to analyze financial health. |

Benefits of Using Software

By using dedicated software, professionals can focus more on their creative work, while the system handles all aspects of financial management. These tools provide quick access to past records, allow for easy updates, and ensure that all necessary fields are correctly filled in every time. The automation of tasks, such as sending reminders or applying taxes, further enhances efficiency.

In conclusion, using invoice software designed for your business needs can significantly improve your workflow, reduce administrative burdens, and keep your financial operations organized and accurate.

How to Ensure Timely Payments with Invoices

Ensuring that payments are received on time is a vital aspect of managing any business. By implementing clear and structured documentation, you can reduce delays and misunderstandings. Taking proactive steps to communicate payment expectations and make the process straightforward will help clients meet deadlines and maintain a steady cash flow.

First, it’s essential to set clear payment terms from the start. Outline deadlines and accepted methods of payment upfront, so clients understand what is expected. Make sure the due date is visible on the document and, if applicable, include any penalties for late payments or discounts for early settlements. This clarity helps set the tone for timely payments.

Another important aspect is sending reminders well in advance of the payment due date. By using a structured system to track outstanding amounts, you can send polite reminders before the due date, as well as follow-up notices if the payment becomes overdue. Many systems allow you to automate these reminders, saving time and effort.

Additionally, simplifying the payment process can encourage quicker action. Provide clients with multiple payment options, such as credit cards, bank transfers, or online gateways. The more convenient the payment process is, the more likely it is that clients will settle their bills promptly.

Finally, always keep a professional and courteous tone in your communications. Even when payments are overdue, maintaining a respectful approach will help preserve positive client relationships while encouraging them to fulfill their obligations.