Invoice Template for Individual Easy and Professional Solution

When managing personal or freelance work, it’s essential to have a clear and structured way to request payment. Crafting a professional billing document ensures that clients understand the terms, amounts, and due dates, making financial transactions smoother and more efficient.

By using customizable forms, you can ensure that every detail is presented in a consistent format, making it easier for both you and your clients to track payments. These documents not only offer transparency but also enhance your credibility as a business professional.

Whether you’re a freelancer or someone managing small personal projects, having a reliable billing document can save you time and reduce confusion when dealing with finances. Understanding how to create and use these forms is crucial for maintaining professionalism and ensuring timely payments.

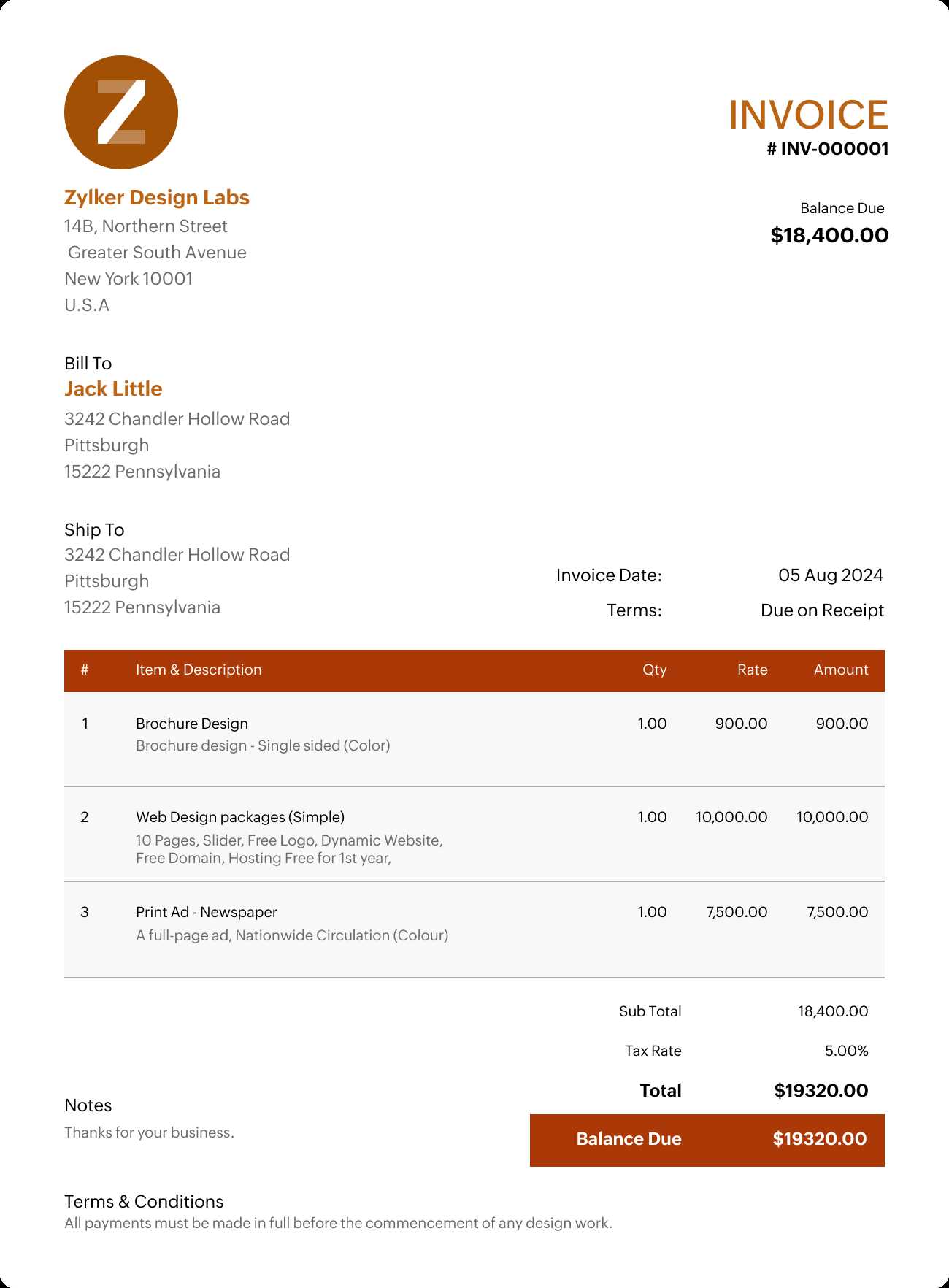

Invoice Template for Individual Use

Creating a well-structured billing document is crucial when you need to request payment for your personal or freelance services. Having a professional format helps ensure that all necessary information is included, making the process transparent and easy to understand for both parties. A carefully designed document allows you to clearly communicate the payment details and expectations.

Key Features to Include

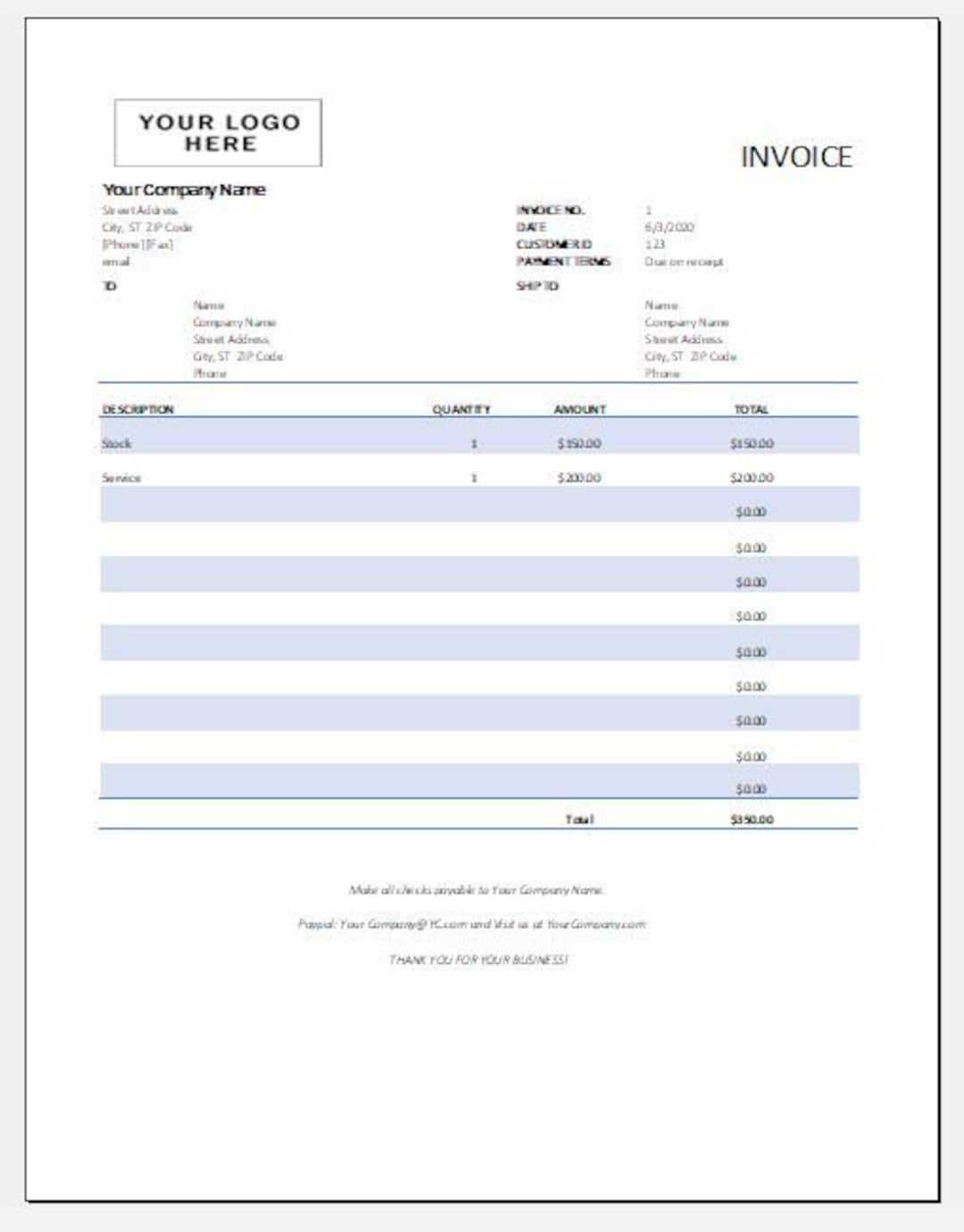

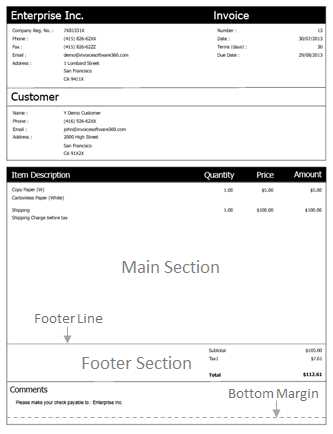

When crafting a billing form, it’s important to include basic elements such as your name or business, the client’s name, the amount due, and the payment terms. Clear sectioning of the document allows both parties to easily locate and review crucial details such as the service provided, the total amount, and any applicable taxes or discounts. Including a due date and payment instructions will further streamline the process.

Customizing Your Billing Document

Personalization is another essential feature. Tailoring the document to suit your specific needs will make it more effective. You can adjust the layout to reflect your brand’s identity or add notes that explain your pricing structure. Additionally, using tools that allow for easy modification will save you time when creating similar documents for future use.

Why Use an Invoice Template

Having a standardized document to request payment offers numerous advantages, especially when dealing with clients and managing financial transactions. A structured approach reduces the chances of missing essential details and ensures that both parties are on the same page regarding payment terms and amounts. Whether you’re working as a freelancer or handling personal projects, using a professional format helps maintain consistency and clarity.

Efficiency and Time-Saving

One of the primary reasons to use a predefined billing structure is efficiency. Instead of starting from scratch every time you need to create a document, you can use an existing design, customize it as needed, and quickly produce a finished product. This time-saving approach allows you to focus more on the actual work rather than administrative tasks.

- Quick customization for every new client or project

- Consistent layout ensures no key details are missed

- Pre-built sections reduce the chance of errors

Professional Appearance

Another compelling reason to rely on a ready-made structure is the professional appearance it provides. A well-organized document with clear sections and a neat layout enhances your credibility in the eyes of clients. It demonstrates that you take your business seriously and are committed to maintaining a high standard of professionalism.

- Clearly organized sections for easy review

- Customizable elements to reflect your branding

- Consistency that strengthens your business image

Benefits of Customizable Invoice Formats

Having the ability to modify your billing documents provides flexibility and control over how you present your services and payment terms. Customization allows you to adapt the layout and content to fit your specific needs, whether you are working with different types of clients or offering a variety of services. This level of personalization can enhance clarity, professionalism, and overall efficiency.

Tailored to Your Brand

Customizing your billing documents ensures that they align with your brand’s identity. You can incorporate your business logo, color scheme, and unique design elements, which helps reinforce your professional image. A consistent and branded approach can leave a positive impression on clients and help differentiate you from competitors.

- Incorporate logo and brand colors

- Reflect your business style and tone

- Increase recognition and consistency

Increased Flexibility and Functionality

With a customizable format, you can easily adjust the sections to reflect the unique nature of each project or service. Whether you need to include detailed descriptions, specific payment terms, or adjust the layout for different currencies, a flexible structure makes these modifications seamless. This adaptability not only saves time but also helps prevent mistakes in calculations or information presentation.

- Adjust layout for various services and needs

- Quickly modify payment terms and due dates

- Flexible fields for discounts, taxes, and additional charges

Creating Professional Invoices for Freelancers

For freelancers, issuing clear and well-organized billing statements is essential for maintaining a professional image and ensuring timely payments. A well-constructed document not only outlines the details of the services provided but also demonstrates reliability and attention to detail. By crafting professional documents, you build trust with clients and reduce misunderstandings regarding payment terms.

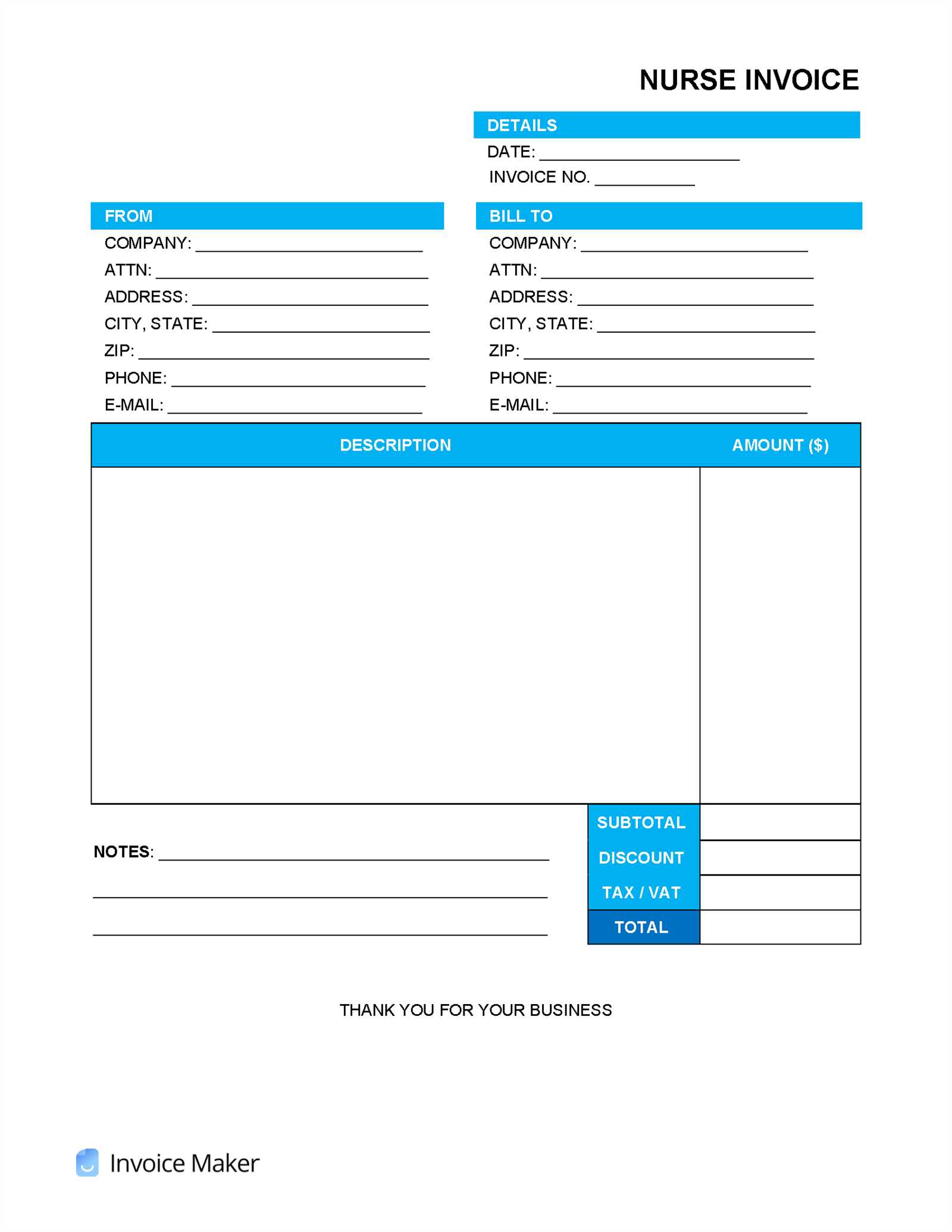

Key Elements to Include

When preparing a billing statement, it’s important to include all relevant information that will help both you and the client stay on track. Basic details such as your contact information, the client’s details, the description of services provided, the total amount due, and payment terms should always be clear and accessible.

- Your business name, contact information, and logo

- Client’s name and contact details

- Detailed description of services rendered

- Clear breakdown of charges (e.g., hourly rates, flat fees)

- Payment due date and methods accepted

Making Your Documents Stand Out

Personalizing your billing statement allows you to make a lasting impression on your clients. Adding design elements, such as your company’s branding or a professional layout, enhances your document’s appearance. Consistent formatting and well-structured sections help clients easily navigate and understand the payment terms, reducing the chances of confusion or delayed payments.

- Incorporating your logo and color scheme

- Using a clean and professional layout

- Ensuring easy-to-read fonts and clear formatting

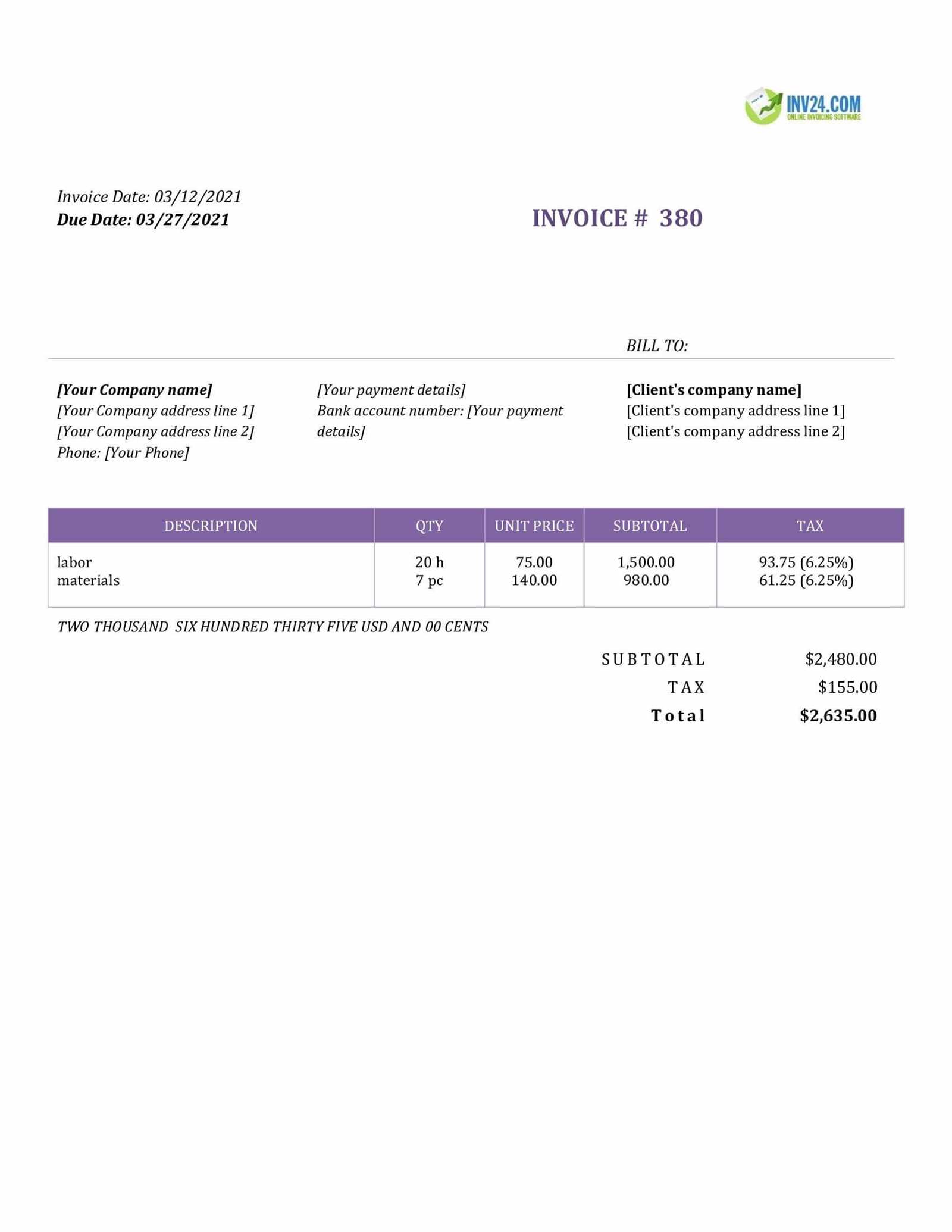

How to Fill Out an Invoice Template

Creating a document to request payment involves several key details to ensure clarity and professionalism. This guide will walk you through the necessary steps to complete the form correctly, from entering your information to specifying the services or goods provided. By following these steps, you will ensure that your request for payment is clear, complete, and legally binding.

Step 1: Include Your Personal Information

Start by listing your full name or business name, address, phone number, and email. This information is essential so the recipient can easily identify you and contact you if necessary. You will also want to include your tax identification number if relevant, depending on your local regulations.

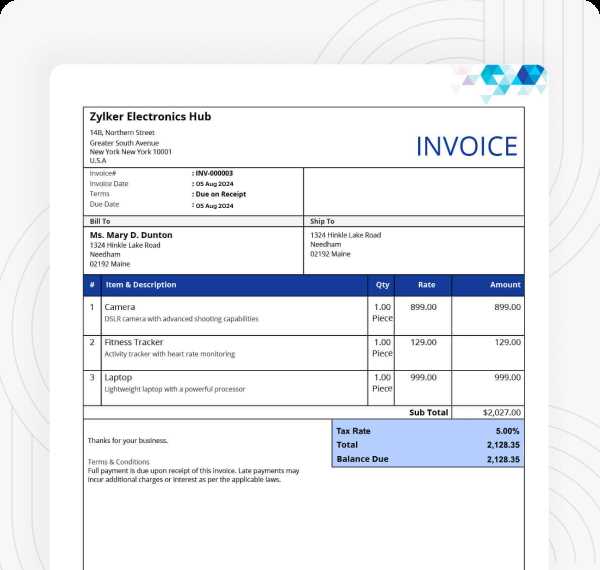

Step 2: Specify the Details of the Services or Goods

Next, clearly describe the goods or services you have provided. Be specific about the quantity, description, and the agreed-upon price for each item. This helps to avoid any confusion and provides a clear record of the transaction.

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting services | 10 hours | $50 | $500 |

| Website design | 1 project | $1500 | $1500 |

| Total | $2000 | ||

Once all items have been listed with corresponding costs, the total amount due should be calculated and clearly displayed. This ensures that both parties are aware of the final amount to be paid.

Step 3: Set Payment Terms

Finally, outline the terms for payment. This includes the due date, acceptable payment methods, and any late fees or interest that might apply if payment is delayed. Be clear and specific to avoid misunderstandings later.

Key Information to Include in Invoices

When requesting payment, it’s crucial to include specific details to ensure clarity and avoid misunderstandings. These elements not only help the recipient understand what they are paying for, but they also protect both parties in case of any future disputes. Here are the key components that should always be present in any payment request document.

Essential Details to List

Each document should contain certain information to make it clear, professional, and legally valid. The most important items to include are:

- Your Name or Business Name: Clearly state who is requesting payment.

- Recipient’s Information: Include the name, address, and contact details of the person or company making the payment.

- Unique Reference Number: Assign a unique ID to help both parties track and manage the transaction.

- Date of Issue: Specify the date when the document is created and sent to the recipient.

- Due Date: Clearly state the payment deadline to avoid confusion about when payment is expected.

- Detailed Breakdown of Services or Products: Provide a description of what was provided, including quantities, unit prices, and total amounts for each item.

- Total Amount Due: Ensure the total is clearly visible, including any taxes or additional fees.

Payment Terms and Methods

It’s also essential to specify the terms of payment and the accepted methods. This section should include:

- Accepted Payment Methods: Indicate whether payments can be made by bank transfer, credit card, PayPal, etc.

- Late Fees or Interest: If applicable, mention any penalties for overdue payments.

- Payment Instructions: Provide clear instructions on how the recipient can make the payment (e.g., bank account details, online payment link, etc.).

Free vs Paid Invoice Templates

When it comes to creating a document for requesting payment, choosing between a free or paid version can impact the ease and professionalism of the process. Both options offer benefits, but they come with their own set of limitations. Understanding the differences can help you decide which is best suited to your needs, depending on the nature of your business and your specific requirements.

Advantages of Free Versions

Free resources can be a great starting point, especially for small businesses or freelancers who are just beginning to handle transactions. While they may lack certain advanced features, they still provide the essential elements needed to request payment efficiently. Some benefits include:

- No Cost: As the name suggests, there’s no upfront fee involved.

- Quick and Easy: Simple to download and start using immediately without complicated setup or design work.

- Basic Features: Offers the essential fields, such as amounts, descriptions, and payment terms, that are sufficient for small transactions.

- Variety: A wide selection of templates is available, many of which are customizable to suit your needs.

Benefits of Paid Options

On the other hand, paid documents often provide advanced features that are more suitable for larger businesses or those with more complex requirements. These options are typically more polished and come with additional support. Key advantages include:

- Professional Designs: Paid versions often include polished, modern layouts that reflect a high standard of professionalism.

- Customization: More flexibility to adjust and personalize fields, fonts, logos, and more to create a brand-specific look.

- Advanced Features: These may include automatic calculations, integrated payment gateways, or compatibility with accounting software.

- Ongoing Support: Paid options often come with customer service or technical support, providing assistance in case of any issues.

- Legal Compliance: Some paid options include templates designed to meet specific legal or tax regulations based on your location.

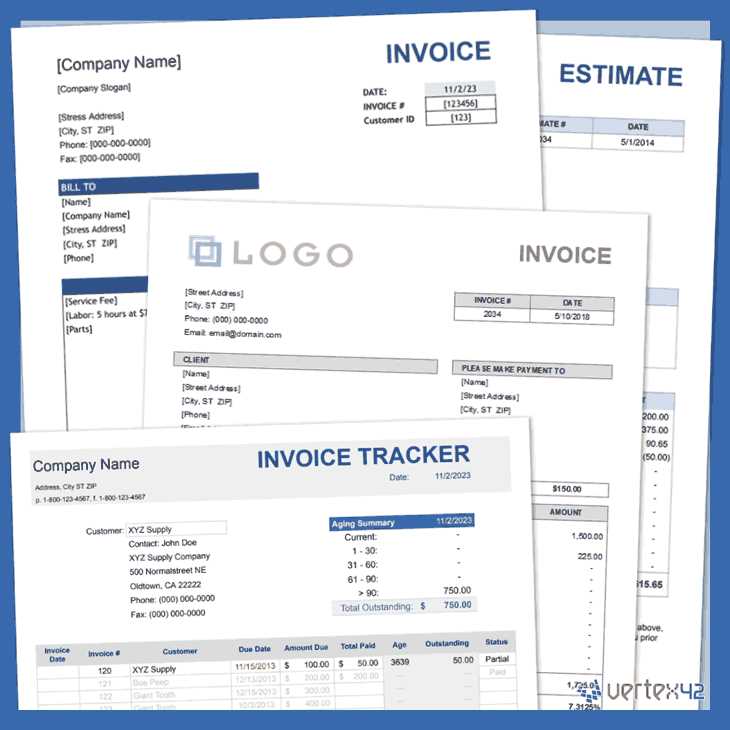

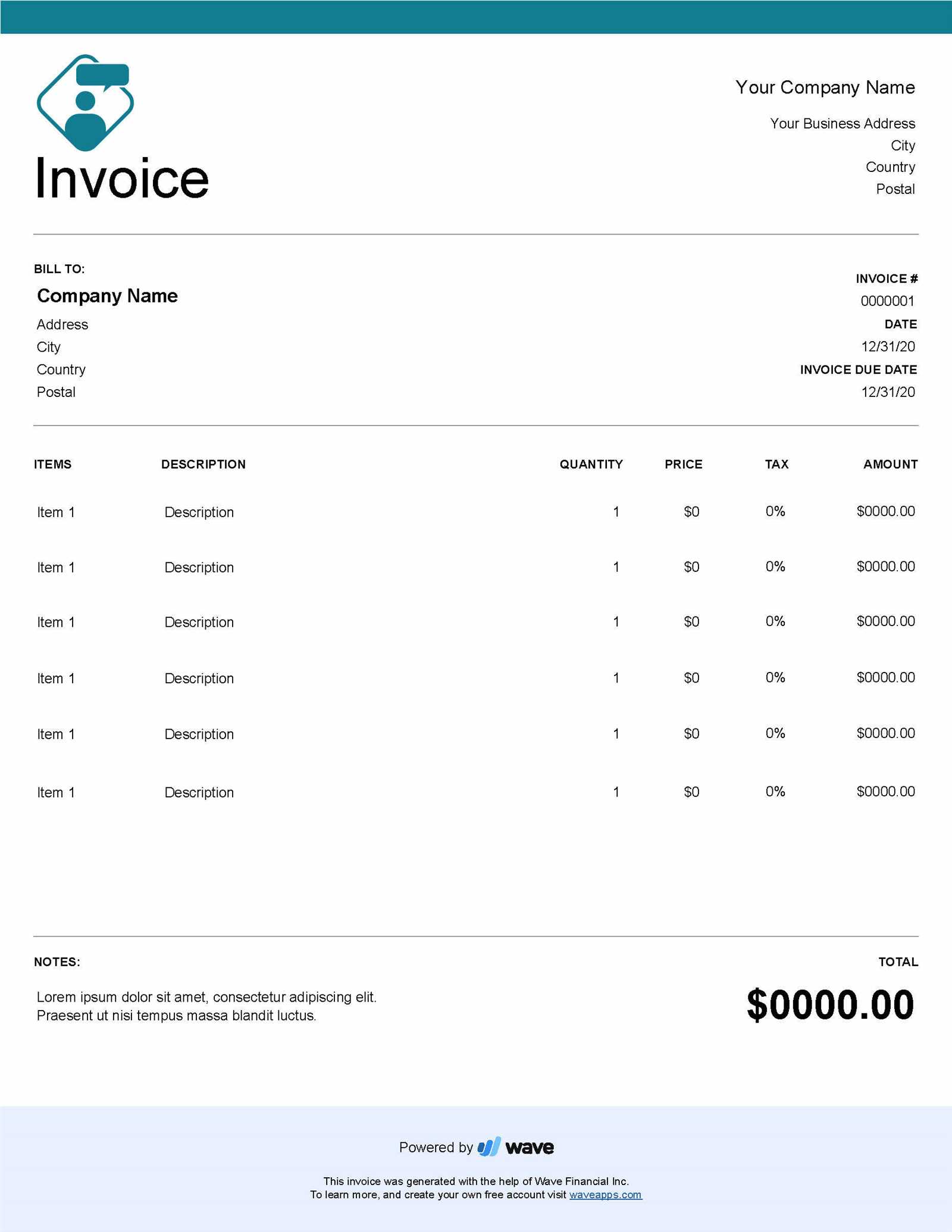

Best Tools for Designing Invoices

Creating a professional document to request payment can be made much easier with the right tools. From user-friendly software to specialized online platforms, there are various options available to help you design and manage these documents effectively. Whether you’re looking for simple customization options or advanced features, choosing the right tool is essential for ensuring accuracy and professionalism in your financial transactions.

Top Tools for Easy Design

For those looking for an intuitive and straightforward approach, there are several tools that provide quick and simple ways to create and send payment requests. These options are great for beginners or small businesses:

- Canva: Known for its easy drag-and-drop interface, Canva allows users to create visually appealing designs without needing graphic design skills. A wide variety of pre-made layouts are available for customization.

- PayPal: PayPal offers an integrated system that allows users to create a professional document and send it directly via email, making it convenient for quick transactions.

- Zoho Invoice: Zoho provides a free plan with templates that are simple to customize. It also includes basic invoicing features like automatic calculations and payment tracking.

- FreshBooks: A popular choice for small businesses, FreshBooks offers templates and a complete suite for managing clients, projects, and payments in one place.

Advanced Tools for Customization

For those who need more flexibility or advanced features, there are several professional-grade platforms that offer deep customization and integration options:

- Adobe Acrobat: Known for its powerful PDF capabilities, Adobe Acrobat allows users to create fully customized documents. You can design complex layouts, add logos, and integrate other branding elements with ease.

- QuickBooks: This comprehensive accounting software includes robust invoicing features. It automatically calculates taxes, tracks payments, and integrates with your accounting records.

- Wave: Wave offers free accounting and invoicing tools with the option to upgrade for additional features. Its easy-to-use system is ideal for businesses that need a combination of invoicing and financial management.

- Microsoft Excel: Though not an invoicing platform, Excel can be customized with formulas and templates to design payment requests with greater flexibility for businesses that prefer to build their own system.

Common Mistakes to Avoid in Invoices

When requesting payment for services or goods provided, accuracy and attention to detail are essential. Even minor errors can lead to confusion, delayed payments, or potential disputes. Understanding the common mistakes that can occur when preparing these documents can help ensure a smooth and professional transaction process. Below are some of the most frequent errors to avoid.

Frequent Mistakes to Watch Out For

These are some of the most common mistakes that can affect the clarity and effectiveness of your payment request:

- Incorrect or Missing Contact Information: Failing to include correct details like your business name, address, or payment contact can cause delays or confusion when the recipient needs to reach you.

- Failure to Include Payment Terms: Not specifying due dates or payment methods can leave room for misunderstanding, making it unclear when and how payment is expected.

- Omitting a Unique Reference Number: Without a reference number, it can be difficult to track payments and match them to the right transactions, especially when dealing with multiple clients.

- Not Detailing Services or Products: Vague or incomplete descriptions of the goods or services provided can lead to disputes about what was actually delivered.

- Inaccurate Calculations: Double-checking the numbers is crucial. Mistakes in unit prices, quantities, or totals can lead to overcharging or undercharging, causing unnecessary confusion.

- Not Including Taxes or Fees: Failing to clearly indicate taxes, shipping charges, or other additional costs can lead to disagreements about the final amount due.

- Wrong Date or Invoice Number: Using incorrect dates or duplicate invoice numbers can create confusion and make it difficult to track payments properly.

How to Avoid These Errors

Here are a few tips to help prevent these common mistakes:

- Double-check all details: Review all sections carefully before sending, including contact information, payment terms, and item descriptions.

- Use automated tools: Consider using professional software to help reduce the risk of human error, especially with calculations and formatting.

- Ask for feedback: If you’re unsure, ask a colleague or friend to review your document before sending it to ensure everything is clear and correct.

- Set reminders

Legal Requirements for Invoices

When creating a document to request payment, it’s essential to ensure that it meets legal standards. The specific requirements can vary by jurisdiction, but there are certain fundamental details that should be included to ensure the document is valid and complies with tax laws. Understanding these legal elements helps protect both the issuer and the recipient, ensuring transparency and preventing potential disputes.

Regardless of the country or region, there are several core components that must be present in a payment request document:

- Unique Identification Number: Each request should have a distinct reference number to help track the transaction. This is essential for both parties in case of any future queries or disputes.

- Date of Issuance: The date when the request is created must be clearly stated, as it marks the beginning of the payment period and may affect tax reporting.

- Recipient and Sender Information: Full legal names, business names (if applicable), and addresses of both parties should be included. This ensures that both the buyer and seller are clearly identifiable in the case of legal proceedings.

- Detailed Description of Goods or Services: A clear and accurate breakdown of what has been sold or provided, including quantities, unit prices, and any applicable discounts. This helps to avoid confusion or disputes over what was agreed upon.

- Payment Terms: Clear terms for payment, including the total amount due, any applicable taxes, and the payment due date. It is also necessary to indicate the methods of payment accepted.

- Tax Information: If applicable, the document should specify the tax rates, such as VAT or sales tax, and how they are calculated. In some regions, tax registration numbers (e.g., VAT numbers) must also be included.

Note: Failure to include these legally required elements can result in delays, fines, or even legal challenges. In some cases, improper documentation can invalidate a payment request or make it difficult to prove the legitimacy of the transaction.

It is important to research the specific legal requirements in your jurisdiction, as they may vary depending on the type of business or the location where the transaction occurs. For example, businesses in some countries are required to keep detailed records of all financial documents for a certain number of years for tax purposes.

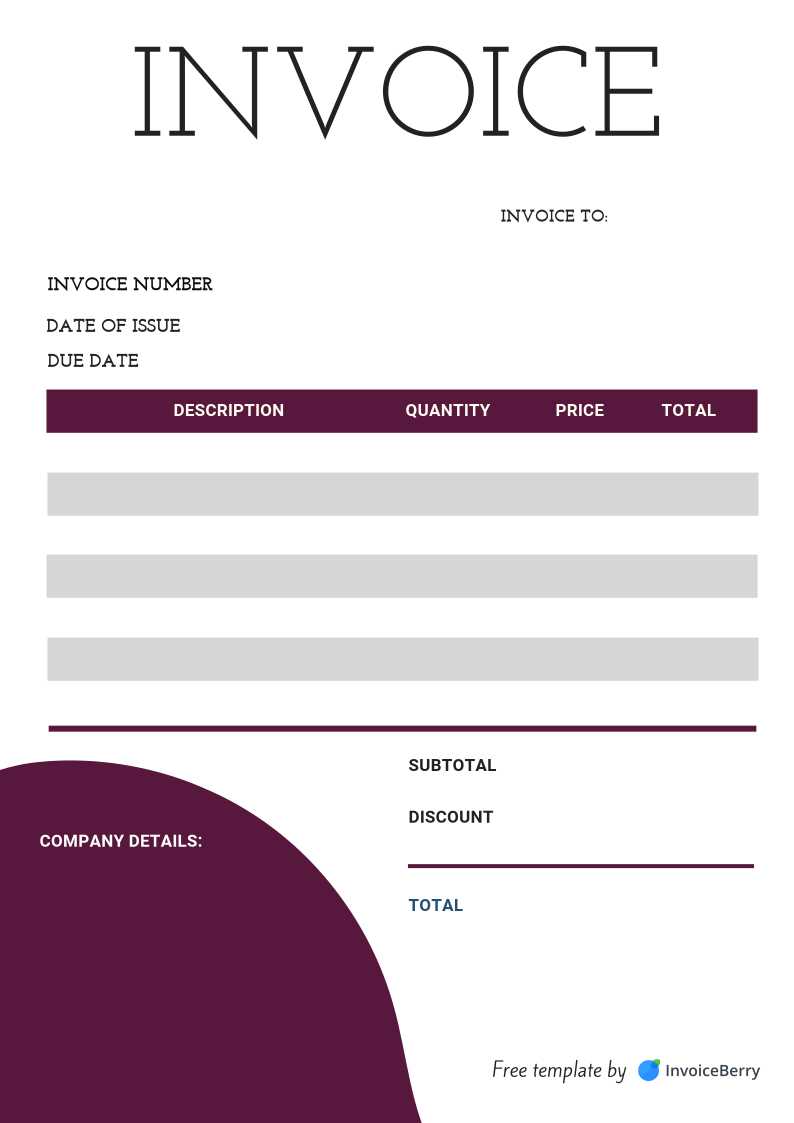

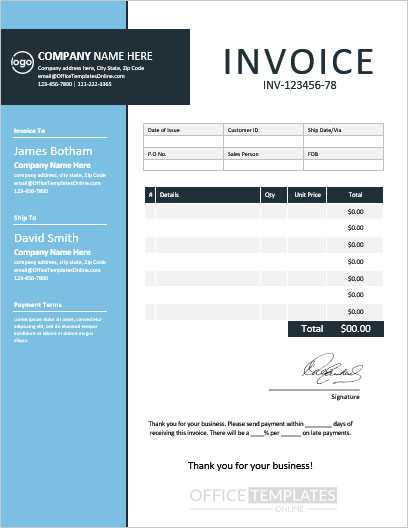

Choosing the Right Invoice Template

Selecting the right document layout is crucial to ensure professionalism and clarity when requesting payment. A well-designed form not only improves your image but also helps avoid misunderstandings between you and the client. The layout you choose should reflect your business style, while also meeting your operational needs. By considering a few key factors, you can easily find the most suitable option for your needs.

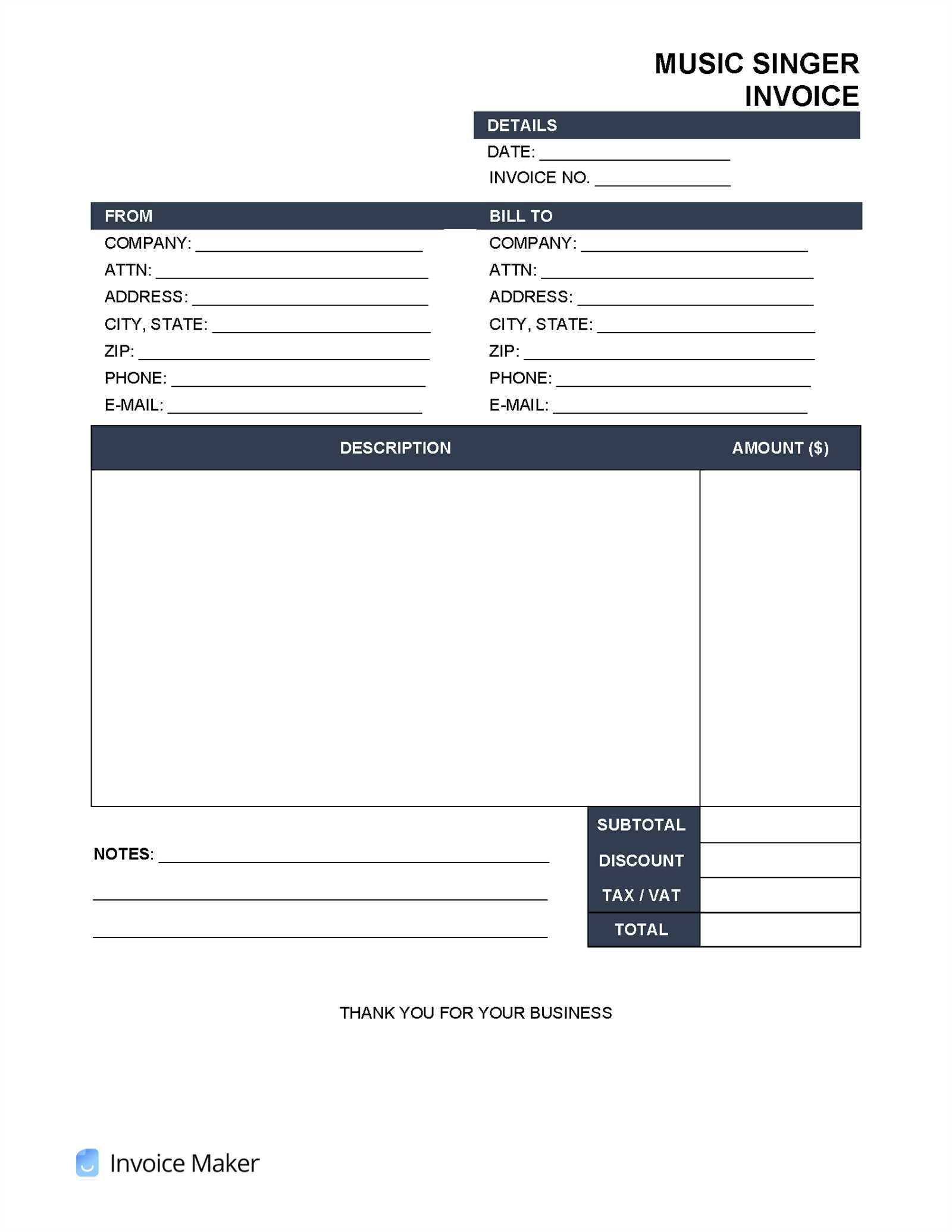

Consider the Type of Business

The first factor to consider is the nature of your business. Different industries have different requirements when it comes to payment requests. For example, a freelancer may only need a simple design, while a service provider may require a more detailed layout with hourly rates and taxes. Here are a few points to keep in mind:

- Simple Layout: If you’re a freelancer or a small business owner offering basic services, a straightforward layout with essential details will suffice.

- Detailed Breakdown: If you provide multiple services or complex products, you may want a more detailed design that breaks down each cost clearly.

- Branding: Businesses aiming for a professional look should choose a layout that allows for logos, custom fonts, and brand colors to be incorporated.

Look for Key Functional Features

When selecting a document layout, it’s important to look beyond just the aesthetics. Certain functional elements can make the process of creating and tracking payments much easier:

- Customization: Choose a layout that allows you to adjust fields, logos, and payment terms to suit your specific needs.

- Automatic Calculations: Many systems now allow automatic calculations for totals, taxes, and discounts. This feature reduces the risk of errors.

- Legal Compliance: Make sure the design includes all necessary legal information, such as tax details and reference numbers, to comply with local regulations.

- Multiple Payment Methods: Choose a design that clearly displays your accepted payment methods, whether it’s bank transfer, credit card, or online payment systems.

By carefully evaluating these factors, you can ensure that the layout you choose will help streamline your payment processes and contribute to better client relationships.

How to Save and Send Your Invoice

Once you’ve created your document requesting payment, the next step is to save it securely and send it to your client. The way you save and deliver the document can affect its professionalism and ensure that both parties have a clear record of the transaction. Here’s how to properly save and send your payment request to ensure smooth processing.

Saving Your Payment Request

Before sending your document, it’s important to save it in a proper format to ensure compatibility and security. The most common and reliable format is PDF, as it preserves the layout and prevents accidental editing. Here’s how to save it correctly:

- Choose the Right File Format: Save your document in PDF format to maintain its professional appearance and ensure the client can easily open and view it on any device.

- Name the File Appropriately: Use a clear and specific file name, such as “Payment_Request_JohnDoe_2024,” which will make it easier for both you and the recipient to locate later.

- Back Up the Document: Store a copy of the saved file in a secure location, either on your computer or in cloud storage, to prevent loss and for future reference.

Sending Your Payment Request

Once the document is saved, the next step is to send it to your client. The method you choose depends on your client’s preferences and the urgency of the payment. Here are the most common ways to send a payment request:

- Email: The most common way to send your document. Attach the PDF to a clear, concise email that includes any relevant details and a polite request for payment.

- Online Payment Platforms: If you use platforms like PayPal, Stripe, or others, these systems often allow you to create and send a payment request directly through the platform, making it quick and convenient.

- Postal Mail: For clients who prefer traditional methods, you can print the document and send it via postal mail. This is less common but might be required in certain industries or regions.

Whichever method you choose, ensure that you follow up if needed. Keeping a record of the sent document and the confirmation of receipt can help avoid any future issues with the payment process.

Tips for Faster Payment Collection

Getting paid on time is essential for maintaining smooth business operations, yet delayed payments are a common challenge for many entrepreneurs and freelancers. By implementing a few proactive strategies, you can encourage clients to settle their balances more quickly and avoid unnecessary delays. Here are some practical tips to speed up the payment process.

Clear Communication and Terms

Establishing clear and transparent payment terms from the beginning can go a long way in ensuring timely payments. Make sure your client knows exactly when and how payment is expected. Some effective strategies include:

- Set Clear Due Dates: Always specify an exact date for payment and avoid vague terms like “due upon receipt.” This creates a clear expectation and encourages timely action.

- Define Payment Methods: Indicate the available payment options (bank transfer, credit card, online payment platforms, etc.), making it easier for clients to pay through their preferred method.

- State Late Fees: Make it known that late payments will incur additional fees. This can encourage clients to prioritize your request over others.

Make the Process Simple for Your Clients

The easier you make it for clients to pay, the more likely they are to do so promptly. Some tactics to streamline payment collection include:

- Offer Multiple Payment Options: Providing several payment methods, such as credit cards, PayPal, or direct bank transfers, increases the chances that clients will pay quickly.

- Use Automated Reminders: Set up automatic reminders via email or messaging platforms to notify clients when payments are due, or when they are overdue. This gentle reminder can help keep payment top of mind.

- Provide an Online Payment Portal: Online payment systems like PayPal, Stripe, or bank transfer links can make the transaction process faster and easier for clients.

Follow Up Professionally

If payments are delayed, follow up politely but firmly. A professional reminder can help push the client to take action without damaging your relationship. Consider these tips:

- Send a Friendly Reminder: If the payment due date has passed, send a polite email or message thanking the client and gently reminding them of the overdue payment.

- Follow Up Regularly: If there’s no response after the first reminder, follow up every few days or weeks, depending on the terms. Be persistent but polite.

- Offer Payment Plans: If a client is struggling with payment, offering a structured payment plan can be an effective way to ensure you still receive the full amount without pushing the client away.

By creating a clear payment process and making it easy for clients to settle their balances, you can significantly reduce the time spent chasing payments an

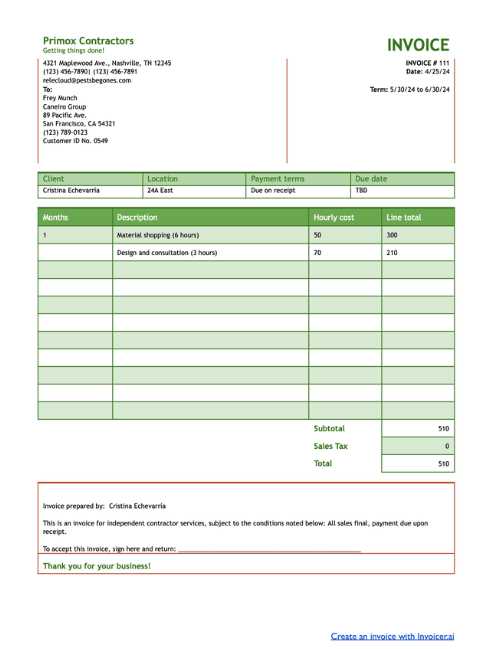

Invoice Template for Independent Contractors

When managing professional services, it’s essential to have a clear and structured way to request payment for completed work. This document serves as an official record of the agreement between the service provider and the client, outlining the work delivered, payment due, and relevant terms. It acts as both a reminder and a formal request for financial compensation, helping to avoid misunderstandings or delays in the payment process.

For freelancers and self-employed professionals, it’s crucial to present this document in a way that reflects both the quality of the work provided and the professional nature of the business. A well-crafted document includes all necessary details such as contact information, dates of service, a breakdown of tasks, and payment instructions. It should also clearly state the total amount due, including taxes or other applicable fees, and indicate the payment methods accepted.

Key Components: Include the service provider’s name, contact information, and any business identifiers (like a tax ID number). List the services performed or products delivered, along with corresponding charges. It’s important to note any agreed-upon discounts, as well as the total amount due after adjustments. Terms regarding due dates, late fees, or advance deposits should be explicitly mentioned to avoid confusion.

Creating a clear and professional request for payment is essential not only for smooth transactions but also for maintaining strong business relationships and ensuring that both parties understand their obligations.

How to Personalize Your Invoice Template

Customizing your payment request document not only enhances its professionalism but also ensures that it aligns with your brand identity. Personalization allows you to present a unique style, making your communication with clients more memorable and clear. A well-tailored document reflects your business’s values and adds a personal touch that can improve client satisfaction and trust.

Include Your Branding

One of the most effective ways to personalize a payment request is by incorporating your business’s branding elements. This can include your logo, brand colors, and fonts. Using consistent branding reinforces your professional image and makes the document instantly recognizable. A well-designed header with your business name and contact details also sets a formal tone and shows attention to detail.

Adjust Layout and Structure

Personalization also involves adjusting the layout and structure to reflect the nature of your services. Organize information clearly by grouping similar details together, such as listing the tasks completed in one section, the costs in another, and payment terms in a separate part. This makes the document easy to read and navigate. Additionally, including a personal note or message to express gratitude for the client’s business adds a human element to your communication.

Consider adding a section for feedback or a reminder of your services to foster long-term relationships. By providing the option for clients to offer input or revisit the work done, you encourage continued engagement with your business.

A personalized payment request document not only simplifies the process for your client but also helps strengthen your professional reputation and brand identity.

Managing Invoices for Small Businesses

Effective financial management is crucial for small businesses, especially when it comes to keeping track of payments and ensuring that all transactions are documented. A streamlined approach to managing payment requests not only helps with cash flow but also keeps a business organized and professional. Proper record-keeping and timely follow-ups reduce the risk of missed payments and enhance overall efficiency.

Organizing Payment Requests

Small business owners must develop a system that allows them to manage and monitor requests efficiently. One effective strategy is to categorize all outgoing documents based on their status: paid, pending, or overdue. This simple system enables quick access to any transaction record and helps prioritize follow-ups. A well-organized system reduces errors and ensures that no payments are overlooked.

Tracking Payment History

Maintaining a detailed log of all transactions is essential for both business operations and tax purposes. A table format is an excellent way to track the details of each payment request, providing clarity on amounts due, due dates, and the status of payment. This log can also serve as a reference for financial planning and analysis.

Client Name Amount Due Due Date Status John Doe $500 2024-11-10 Paid Jane Smith $750 2024-11-15 Pending ABC Corp $1,200 2024-11-20 Overdue Establishing a payment tracking system allows small businesses to stay on top of their finances and maintain positive relationships with clients by addressing overdue payments promptly.

Consistency in managing payment requests is key to maintaining healthy cash flow, fostering professionalism, and ensuring timely payments for small businesses.