Invoice Template for Independent Consultants to Simplify Your Billing

Managing payments efficiently is essential for any professional working on their own. Clear, structured billing documentation ensures smooth financial transactions and enhances credibility with clients. Having a pre-designed method to outline services rendered, rates, and payment terms can save valuable time and prevent misunderstandings.

In this guide, we will explore how a well-organized billing format can be tailored to fit the unique needs of solo professionals. Whether you’re providing specialized services or working on short-term projects, adopting a consistent approach to financial records is crucial. With the right system in place, you can focus more on your work while keeping your finances in order.

Invoice Template for Independent Consultants

Creating a professional document that clearly outlines the details of the services you’ve provided is crucial for smooth financial transactions. A well-structured billing document helps ensure that both parties have a clear understanding of the payment expectations and reduces the chances of delays or disputes. Whether you’re a freelancer or a contractor, using a standardized approach makes it easier to manage multiple clients and maintain organization.

Key Elements to Include

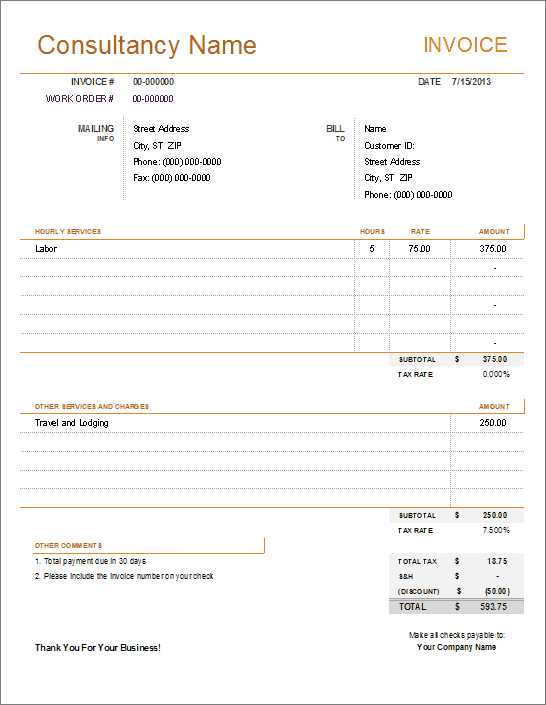

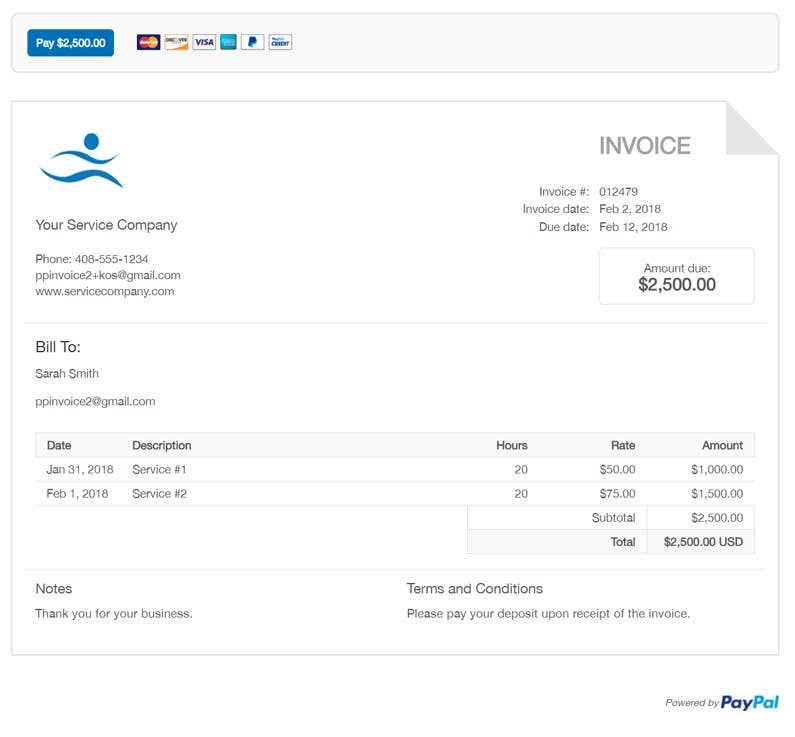

A comprehensive bill should contain essential information that leaves no room for ambiguity. It should outline the work completed, the amount due, and when the payment is expected. Additionally, a clear breakdown of hourly rates or project fees can make it easier for clients to understand the cost structure. Here are some core elements that should always be included:

| Section | Description |

|---|---|

| Contact Information | Your details, along with the client’s name, address, and phone number. |

| Work Description | A summary of the tasks or services rendered. |

| Amount Due | The total sum for the completed work, including rates or fixed fees. |

| Payment Terms | Clear instructions regarding the payment method and deadline. |

| Due Date | The date by which the payment must be made. |

Benefits of Using a Structured Document

Using a standardized format to present financial details brings several advantages. It not only provides a professional image but also helps you track payments effectively. With clearly defined sections, you can easily follow up with clients if there are any payment delays. Moreover, keeping a consistent structure helps you stay organized, making it easier to reference past transactions when needed.

Why Independent Consultants Need Invoices

Properly documenting payments and services rendered is essential for any professional working on a freelance or contractual basis. Without a clear written record, it becomes difficult to track earnings, manage finances, and maintain transparency with clients. This documentation not only helps in organizing financial details but also protects both parties in case of disputes or misunderstandings regarding the work performed.

Having a structured record of services completed, payment amounts, and agreed-upon terms allows solo professionals to maintain control over their business operations. It also provides a formal way of requesting payment and helps establish trust with clients by presenting a professional image. A clear and consistent billing method is a sign of credibility and helps streamline the process of getting paid on time.

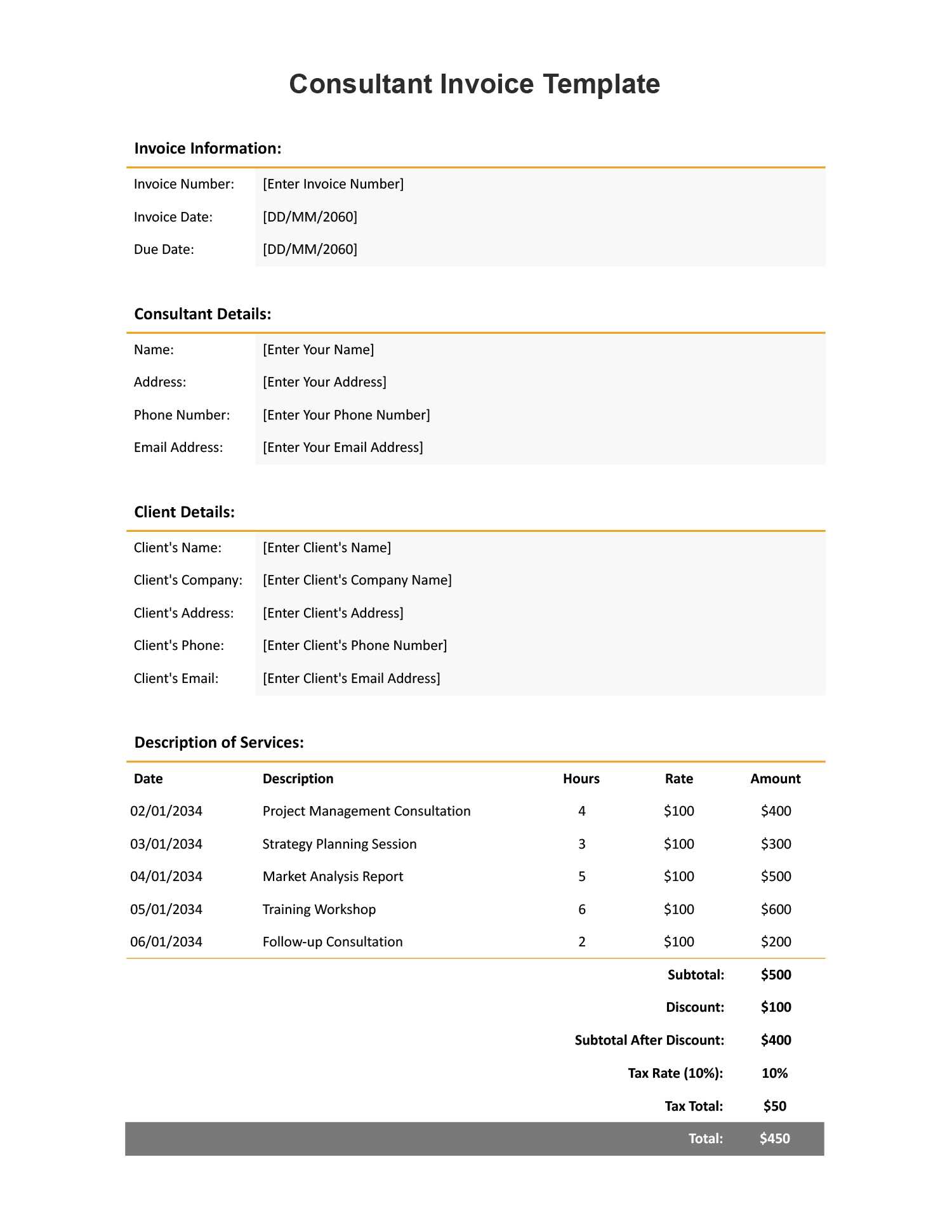

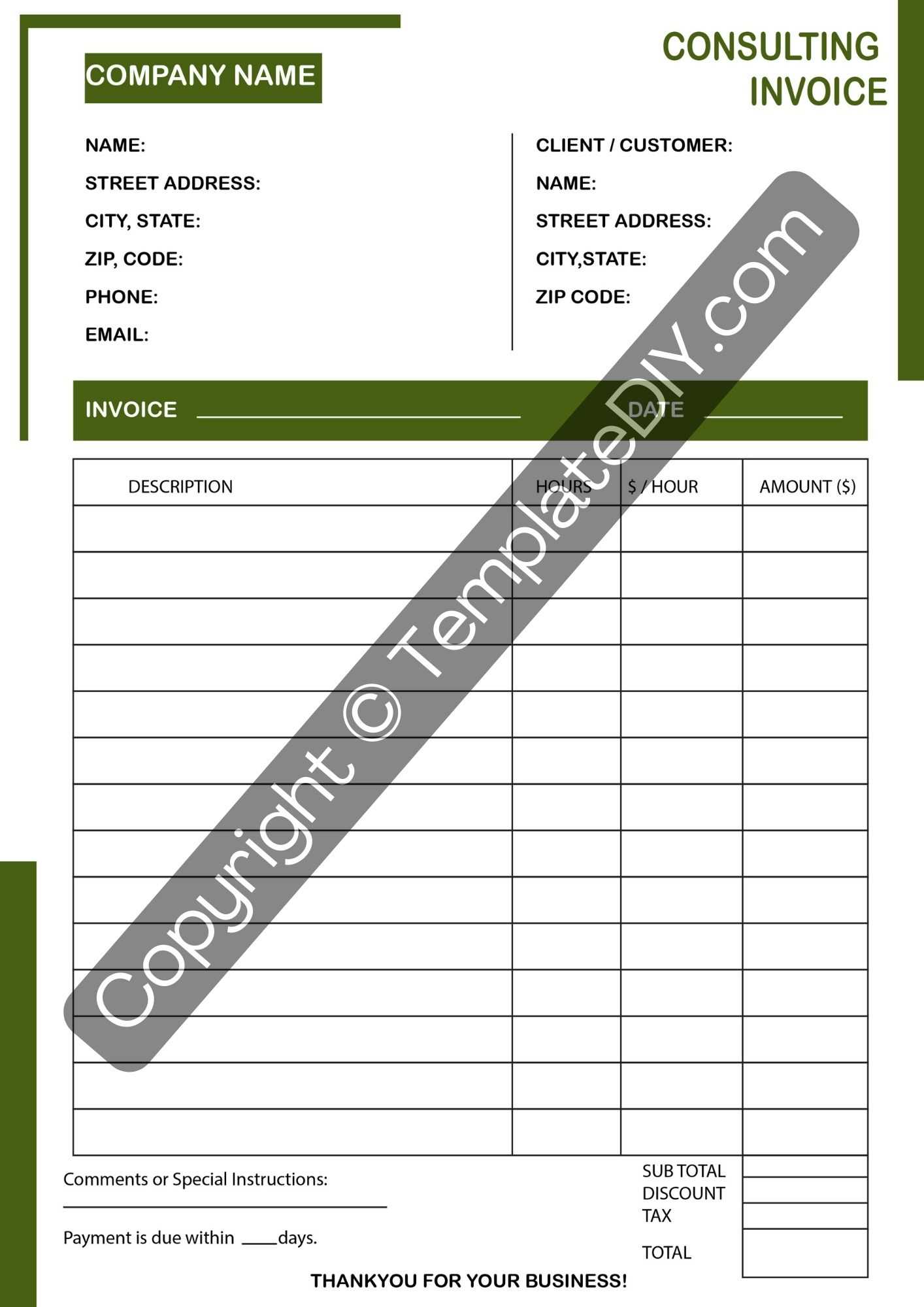

Key Elements of a Consultant Invoice

A well-organized billing document is essential for ensuring that both parties understand the scope of work and the financial expectations. A comprehensive statement provides clarity on services rendered, rates charged, and payment deadlines. Including the right components in your financial documents helps prevent confusion and ensures timely payment, creating a more professional and efficient process.

Important Sections to Include

To avoid any ambiguity, it is important to structure your document with specific sections that cover all necessary details. Key elements should include:

- Client Information: Name, address, and contact details of both you and the client.

- Services Provided: A brief description of the work completed, including any milestones or deliverables.

- Payment Breakdown: The total amount due, including any applicable rates, taxes, or additional charges.

- Due Date: The date by which payment is expected, along with any payment terms such as late fees.

Why These Details Matter

Each section serves an important purpose in maintaining transparency and reducing potential disputes. Including the full client information ensures clarity in communication. Describing the work in detail helps avoid misunderstandings, while a clear payment breakdown establishes transparency. Finally, setting a firm payment due date ensures both parties understand the timeline, helping you maintain healthy cash flow.

Benefits of Using Invoice Templates

Adopting a consistent structure for financial documents brings numerous advantages. A pre-designed format helps streamline the billing process, saves time, and ensures that all necessary details are included each time. By using a reliable system, you can focus on your work instead of worrying about creating new documents from scratch for every client. Additionally, this approach adds a level of professionalism that enhances client relationships.

Time Efficiency

One of the biggest benefits of using a pre-built structure is the time saved. Instead of starting from a blank page, you can simply update the relevant fields, such as client details and the amount due. This makes the entire process faster and more efficient, especially when managing multiple clients.

- Quick Setup: No need to design a new document each time.

- Consistency: All important details are automatically included.

- Reduced Errors: Less chance of omitting crucial information.

Professional Appearance

Using a standardized format creates a polished, business-like impression. A clear, well-organized document gives clients confidence in your professionalism and attention to detail. This helps build trust and enhances your reputation in the long run.

- Consistency: Clients will appreciate the uniformity in your documents.

- Credibility: A professional presentation boosts your business image.

- Clear Communication: Clients can easily understand the terms and amounts.

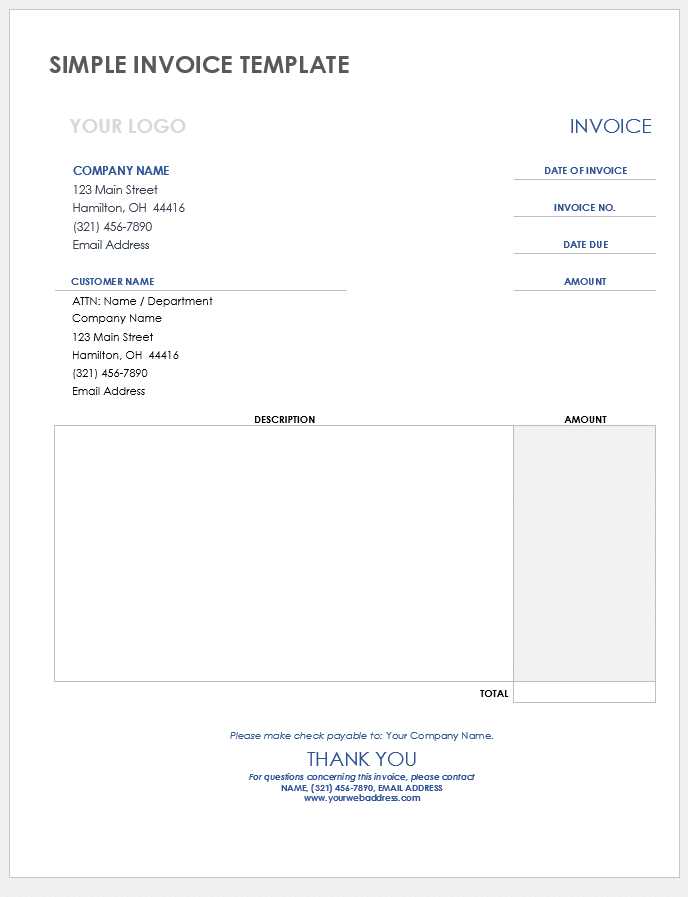

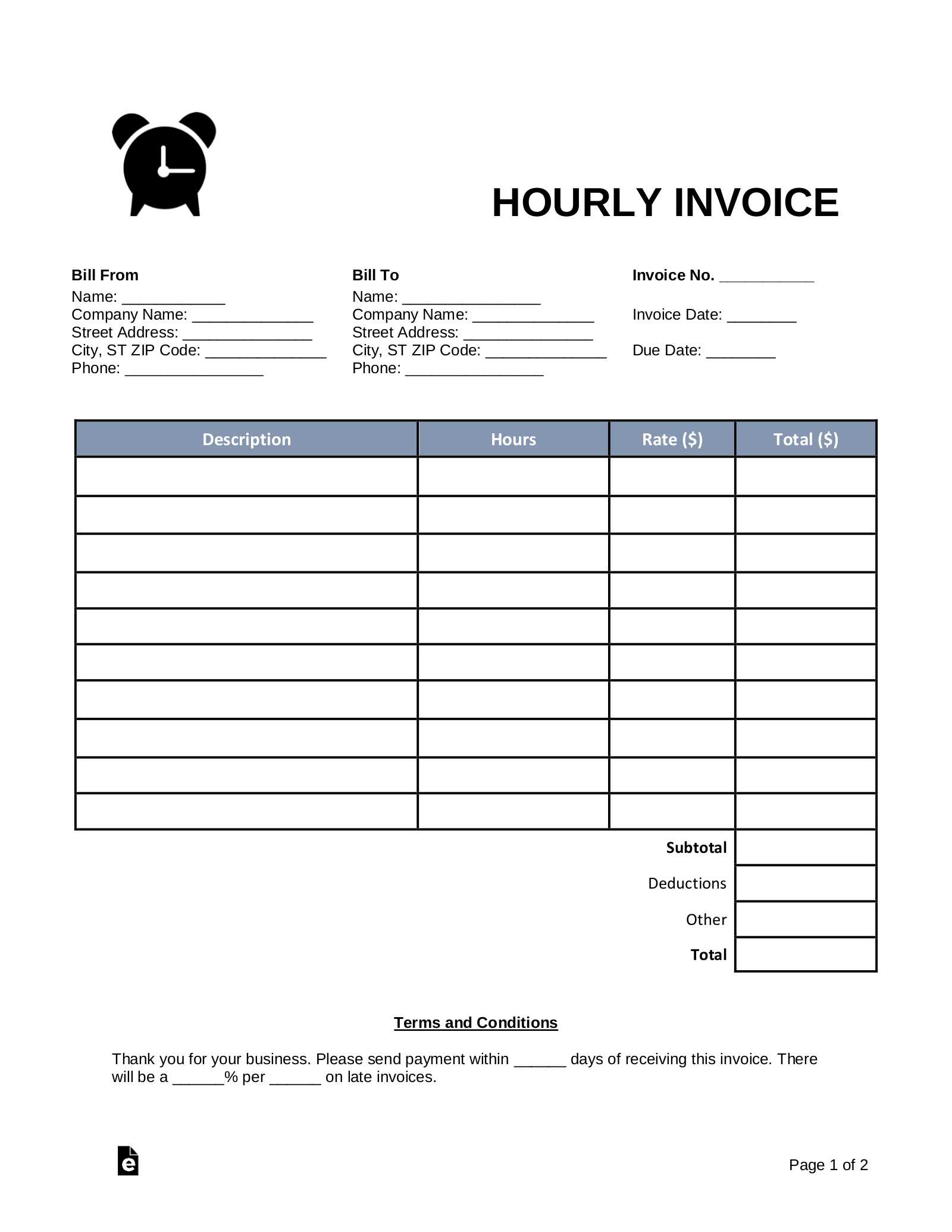

How to Create an Invoice from Scratch

Creating a professional document to request payment for your services doesn’t require specialized software or advanced skills. The process can be simple and efficient, as long as you include all the necessary details in a clear and organized manner. By following a structured approach, you can produce accurate and effective documents that help maintain smooth transactions with your clients.

To begin, gather all the relevant information you will need, such as your contact details, the client’s information, and a list of the services provided. The next step is to format these elements logically, ensuring that every key detail is easy to read and understand. Lastly, determine your payment terms, including the total amount due and the payment due date.

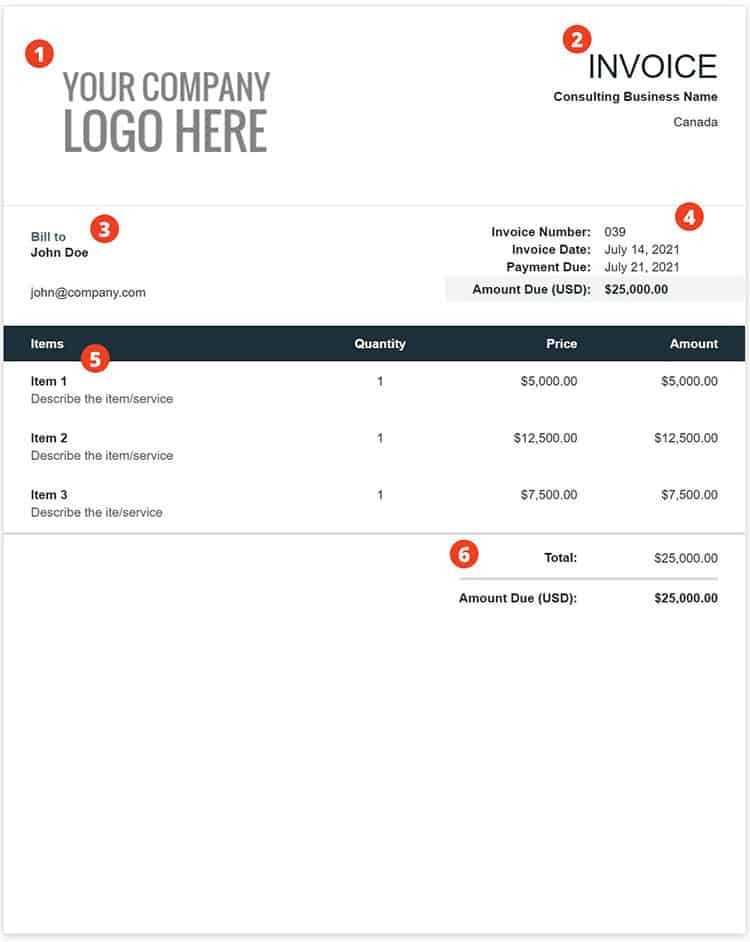

Step-by-Step Guide

- Header: Include your name or business name, address, and contact information at the top, followed by the client’s details.

- Service Description: Clearly describe the tasks or work completed, including dates and any deliverables, if applicable.

- Payment Breakdown: List the rates or fees, as well as any taxes or additional charges, along with the total amount due.

- Payment Terms: Specify when the payment is due, acceptable payment methods, and any penalties for late payment.

Final Steps

- Review: Double-check the document for accuracy and ensure all information is clear.

- Save and Send: Save the file in a format that is easy to send, such as PDF, and email it to your client.

- Follow Up: If payment is not received by the due date, send a polite reminder.

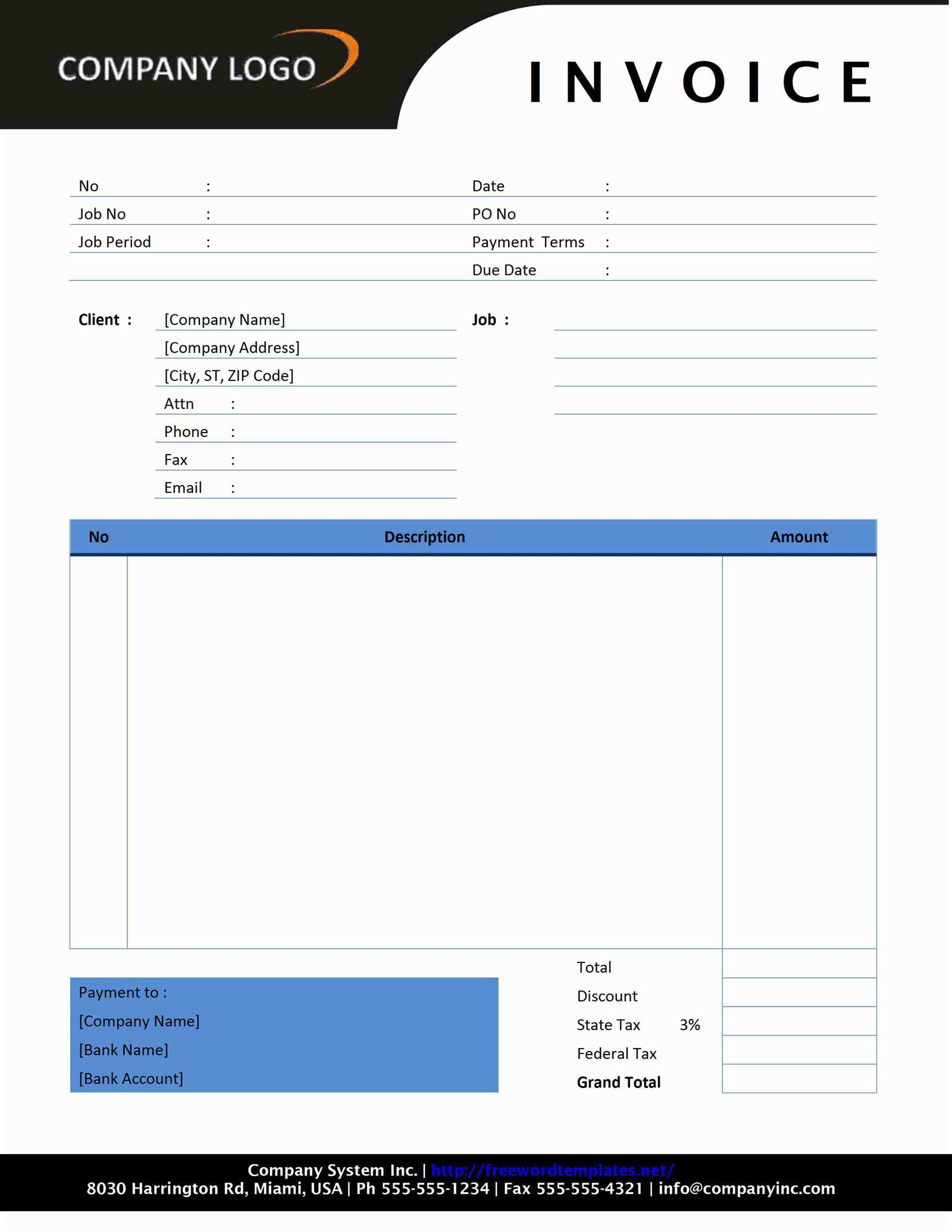

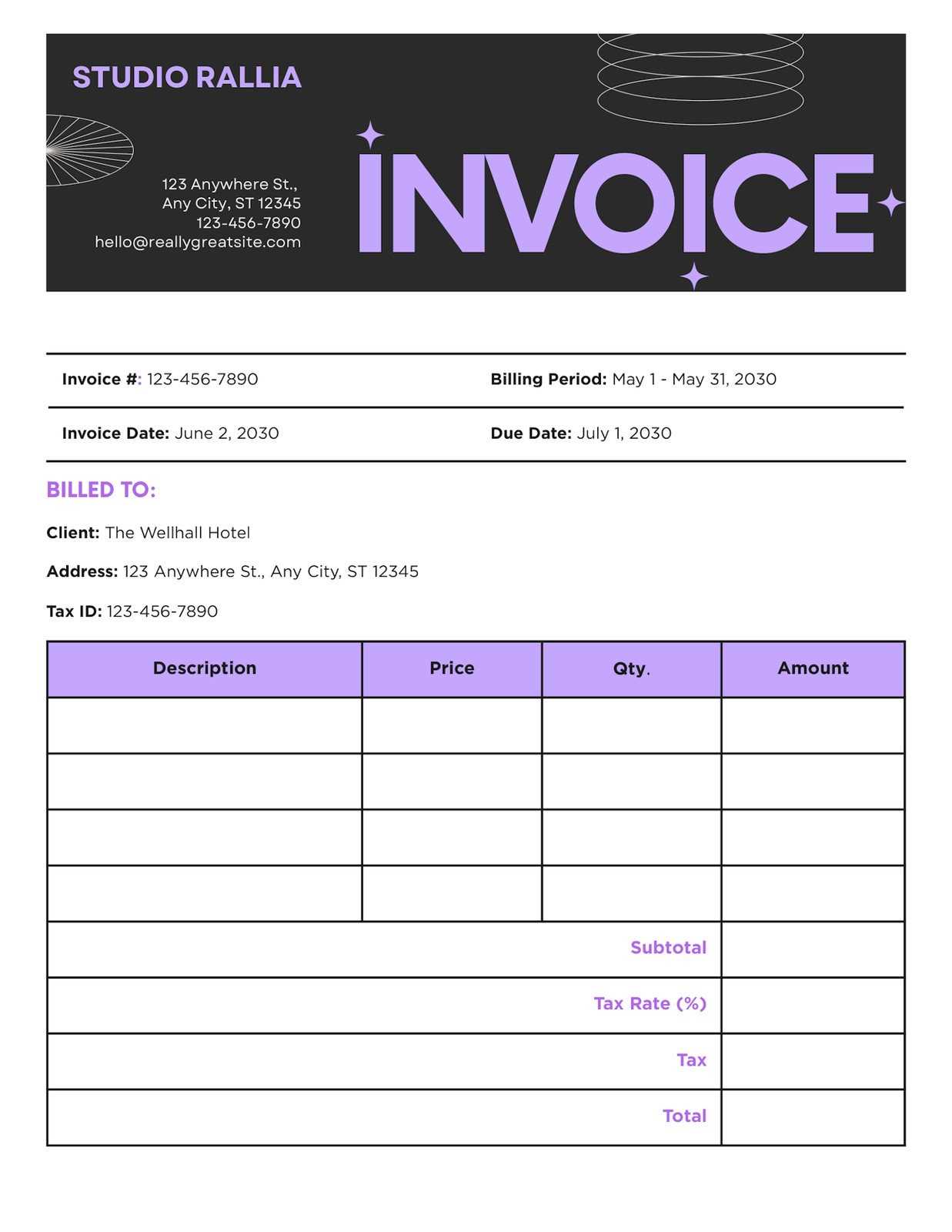

Customizing Your Invoice Template

When managing your billing process, it’s important to ensure that your financial documents reflect both your style and the specific needs of your business. Customization allows you to adapt the document to suit your branding, add any extra details relevant to your services, and streamline the information for easy understanding by your clients. A tailored approach not only makes your documents stand out but also helps create a more professional image.

Customizing your billing document is a simple yet effective way to maintain consistency while highlighting your business identity. You can adjust fonts, colors, and logos to match your branding, as well as modify the layout to emphasize key information such as payment terms or project details. The more personalized the document, the more it reinforces your professionalism and dedication to detail.

Key Customization Areas

- Branding: Add your business logo, use brand colors, and choose fonts that align with your company’s style.

- Contact Information: Ensure your full business contact details, including email, phone number, and website, are prominently displayed.

- Payment Terms: Adjust the payment terms section to reflect your specific agreements, such as deposits or late fees.

- Service Details: Modify the description section to match the type of work you provide, including specific tasks or milestones if necessary.

Advanced Customization Options

- Multiple Languages: If you work with international clients, consider creating versions in different languages.

- Discounts and Taxes: Add custom fields for discounts or specific tax rates based on the region of service.

- Payment Methods: Include options for clients to pay via bank transfer, credit card, or other preferred payment methods.

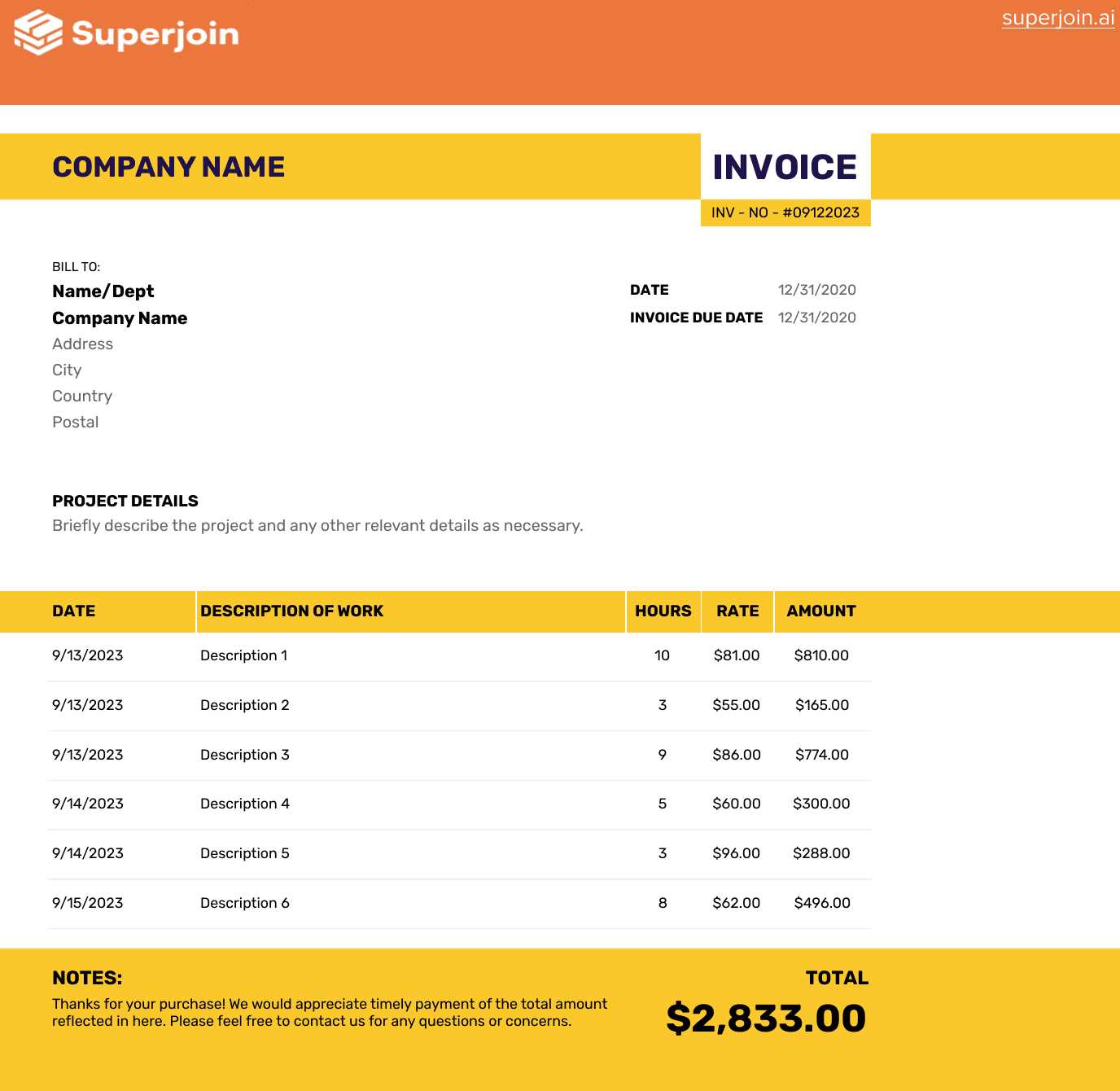

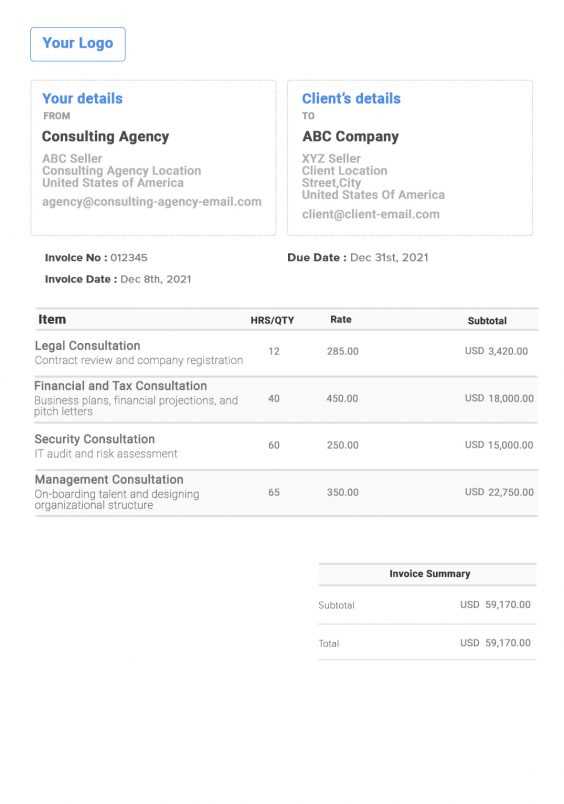

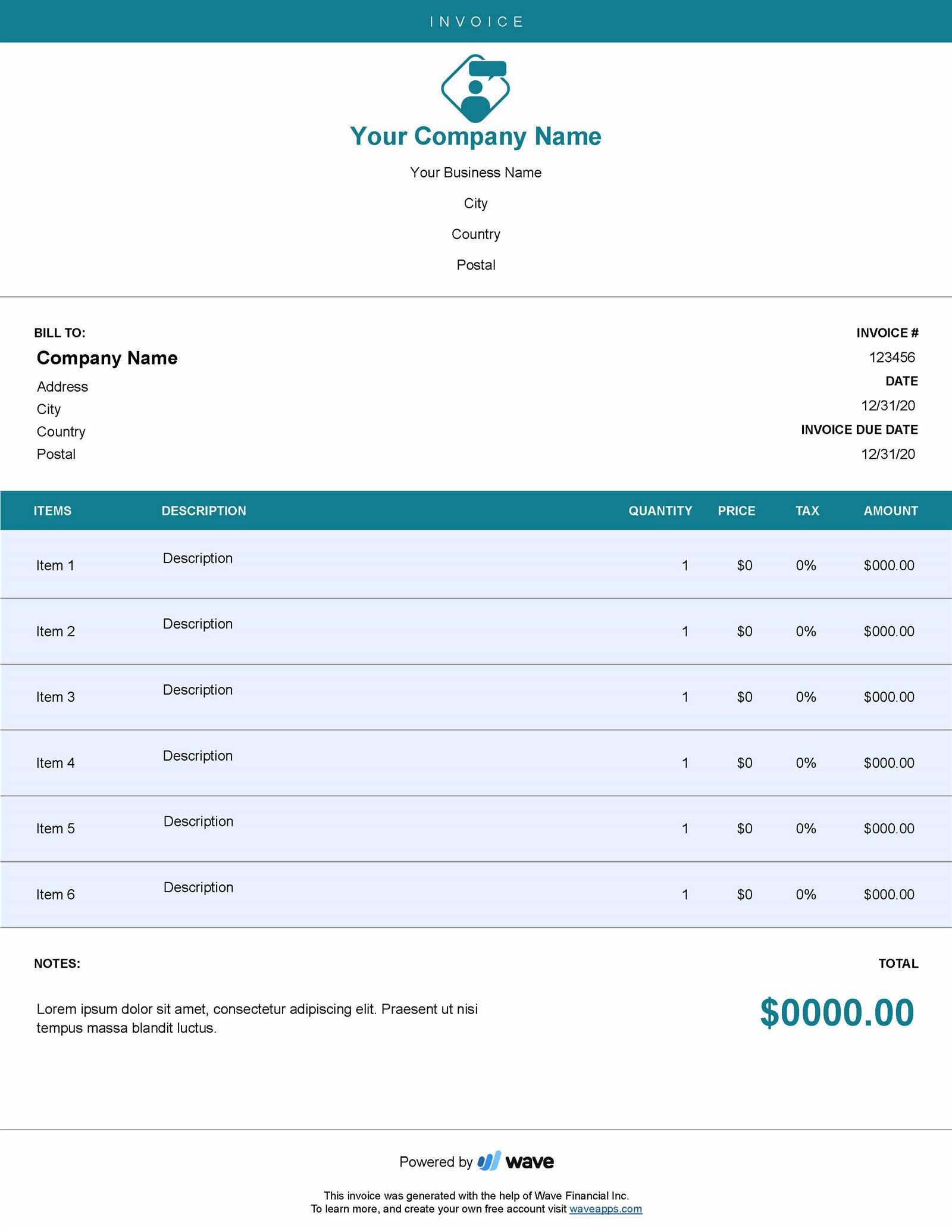

Free Invoice Templates for Consultants

Finding a reliable and customizable billing document doesn’t have to come with a cost. Many websites offer free options that are easy to adapt to your specific needs. These resources can save you time and effort by providing ready-made formats that include all the necessary sections, allowing you to focus on your work rather than creating a new document from scratch each time.

Free options are especially useful for professionals just starting their careers or those with a small client base. By using these ready-to-use formats, you can maintain a consistent and professional appearance without the need for expensive software or design skills. Whether you need simple or more detailed documents, free formats are often flexible enough to suit a wide range of services and industries.

Where to Find Free Resources

- Online Websites: Various platforms offer free downloads in multiple formats such as Word, Excel, or PDF.

- Freelancer Communities: Many forums or online groups provide templates shared by other professionals.

- Business Blogs: Blogs often provide free resources for new businesses, including customizable billing forms.

Common Features in Free Templates

| Feature | Description |

|---|---|

| Customizable Fields | Fields for client details, service description, and payment terms are easily editable. |

| Multiple Formats | Available in Word, PDF, or Excel formats to suit your preferences. |

| Professional Design | Simple, clean designs that ensure a professional appearance with minimal effort. |

| Easy to Use | User-friendly layouts make it simple to add or modify information. |

Common Mistakes in Consultant Invoices

Even a small mistake in your billing document can lead to confusion or delays in payment. While many professionals focus on the work itself, it’s easy to overlook the importance of accuracy and clarity in your financial documents. Common errors can include missing details, incorrect calculations, or unclear payment terms, all of which can complicate the payment process and damage client relationships.

Being aware of these frequent pitfalls will help you avoid problems and ensure smooth transactions with clients. It’s important to review your billing document carefully before sending it, as addressing small issues early on can prevent unnecessary back-and-forth later. Below are some of the most common mistakes that professionals make when preparing their payment requests.

Frequent Errors in Billing Documents

- Incorrect or Missing Contact Information: Failing to include full contact details for both yourself and your client can cause delays or confusion.

- Ambiguous Service Descriptions: Vague descriptions of services can lead to misunderstandings about what was provided and the corresponding fees.

- Miscalculations: Simple math errors, such as incorrect totals or overlooked taxes, can cause clients to question the accuracy of the amount due.

- Unclear Payment Terms: Not specifying the payment due date, accepted payment methods, or late fee policies can create confusion about when and how to settle the balance.

How to Avoid These Mistakes

| Error | Solution |

|---|---|

| Missing Client Information | Always double-check the client’s name, address, and contact details before sending the document. |

| Vague Descriptions | Be specific about the services provided, including dates, tasks completed, and any milestones. |

| Calculation Errors | Use a calculator or a software tool to double-check all sums and taxes before finalizing. |

| Unclear Payment Terms | Clearly state the payment deadline, any late fees, and the accepted payment methods in your document. |

Tips for Professional Invoices

Creating a polished and professional financial document is key to making a good impression on clients and ensuring smooth transactions. A well-crafted document not only helps you get paid on time but also reflects your business’s professionalism and attention to detail. By following a few simple guidelines, you can produce documents that enhance your reputation and streamline the payment process.

Here are several practical tips that will help you create clear, professional payment requests every time. These tips are designed to improve the accuracy, clarity, and overall presentation of your financial documents, making them more likely to be processed quickly and without issues.

Essential Tips for Clarity and Professionalism

- Use a Clean Layout: Keep your document simple, with clear headings and well-spaced sections to make it easy to read and navigate.

- Include All Required Information: Make sure to include all essential details, such as your business name, client information, a description of the services provided, and payment terms.

- Be Specific: Avoid vague terms and be as specific as possible when describing the work completed, the duration of services, and any additional fees or taxes.

- Professional Language: Use clear and professional language throughout, avoiding slang or overly casual terms, even if you have a friendly relationship with the client.

Formatting and Design Tips

- Branding: Include your logo and use consistent colors and fonts that match your business’s identity.

- Number the Documents: Assign a unique number to each document to help you stay organized and easily reference previous transactions.

- Check Spelling and Grammar: Typos and mistakes can harm your credibility, so always proofread your document before sending it.

- Save in PDF: Save your financial document as a PDF file to ensure the formatting remains intact when your client views or prints it.

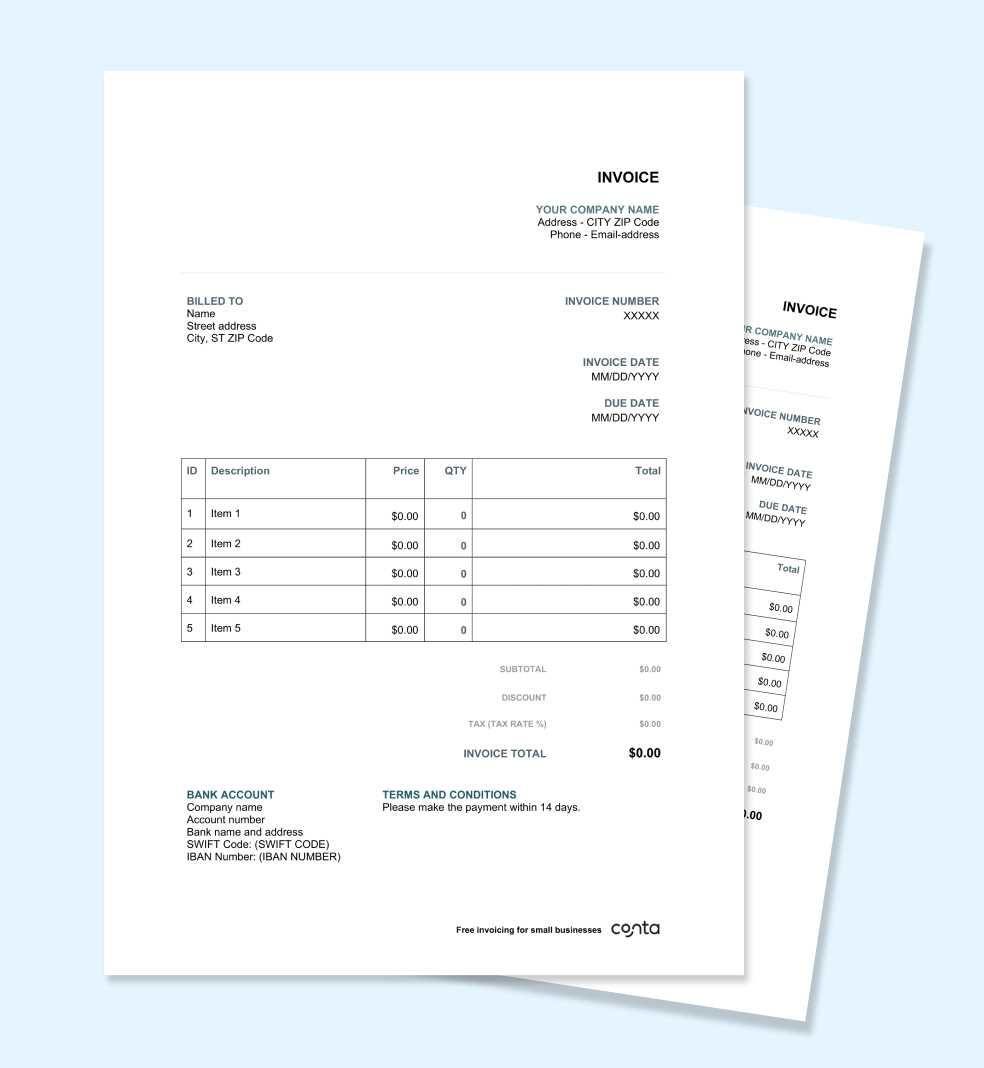

How to Include Taxes on Invoices

Including taxes in your payment requests is essential for ensuring legal compliance and transparency in your transactions. Properly accounting for sales tax, VAT, or other applicable taxes ensures that clients understand the full cost of the services provided. This process can vary depending on your location and the tax regulations that apply to your business, but the key is to present the tax information clearly and accurately.

Incorporating taxes into your billing documents involves calculating the appropriate tax rates based on the total amount due. You should clearly separate the tax from the base price, making it evident to the client how the total was derived. This helps avoid confusion and ensures that your payment request aligns with legal tax requirements.

Steps to Include Taxes Correctly

- Identify the Correct Tax Rate: Make sure to use the correct sales tax or VAT rate based on your location or the client’s location if applicable.

- Separate Tax Amount: Clearly list the tax as a separate line item on the document, so clients can easily see the amount charged for taxes.

- Include Tax Identification Number: If required by your local laws, include your tax ID number on the document for verification purposes.

- Ensure Transparency: Avoid hiding taxes in the total amount; always break them out to provide clarity on what portion of the payment is for taxes.

Example of Tax Calculation

| Description | Amount |

|---|---|

| Services Rendered | $1,000.00 |

| Sales Tax (8%) | $80.00 |

| Total Due | $1,080.00 |

In this example, the sales tax is calculated based on the base price of $1,000. The tax is clearly listed as a separate item, and the total amount due is shown at the bottom. This format ensures that your client understands the breakdown of the charges and can verify the correct tax has been applied.

Managing Payments with Invoice Templates

Efficient payment management is crucial for maintaining healthy cash flow and ensuring timely compensation for the services you provide. Using a structured format to request payments not only simplifies the process but also ensures that all necessary details are included, reducing the chance of misunderstandings. A well-designed billing document can serve as an effective tool to track payments, monitor due dates, and follow up when necessary.

By organizing your payment requests with a clear structure, you can make the process smoother for both you and your clients. The use of a consistent format helps prevent errors, ensures all critical information is present, and fosters a professional relationship. Managing payments effectively requires setting clear expectations for both payment deadlines and accepted methods, and a well-crafted document plays a pivotal role in this.

Key Elements for Managing Payments

- Clear Payment Terms: Always include the exact payment due date and any penalties for late payments to avoid confusion later.

- Breakdown of Charges: Clearly list services, rates, and any additional fees, so clients can easily understand the costs involved.

- Payment Methods: Specify all available options for payment, such as bank transfer, credit card, or online payment platforms, to provide flexibility for your clients.

- Payment Status Tracking: Keep a record of payments, including the date received and any outstanding balances, to stay organized.

Effective Follow-Up Strategies

- Timely Reminders: Send a polite reminder a few days before the payment is due to ensure that your client is aware of the upcoming deadline.

- Late Payment Notices: If payment has not been received by the due date, send a professional follow-up that includes the details of the overdue balance and any applicable late fees.

- Offer Payment Flexibility: If a client is unable to pay in full, consider offering payment plans or other arrangements to accommodate their needs while ensuring that you are compensated fairly.

Tracking Invoice History for Consultants

Maintaining an organized record of all payment requests is vital for both financial management and professional accountability. Tracking the history of your billing documents allows you to monitor payment status, ensure timely compensation, and prevent disputes with clients. It also provides you with a clear overview of your cash flow, helping you make informed decisions for your business.

Properly documenting past transactions makes it easier to reference previous agreements, verify payments, and follow up on overdue balances. Whether you prefer using digital tools or manual records, keeping a detailed history is essential for staying organized and efficient. This practice also helps you identify trends, such as clients who pay on time versus those who delay, allowing you to adjust your strategies accordingly.

Why Tracking History Matters

- Improved Cash Flow Management: By tracking your past transactions, you can get a clearer picture of when payments are due and manage your finances more effectively.

- Dispute Resolution: If there is ever a misunderstanding with a client regarding payment, having a well-documented history allows you to reference past communication and agreements.

- Tax and Financial Reporting: Keeping accurate records ensures you have the information needed for tax filing or any other financial reports required by law.

- Client Relationships: By maintaining clear records, you can easily track client payment habits, improving communication and fostering better professional relationships.

Best Practices for Tracking Payment History

- Use a Dedicated System: Whether through accounting software, spreadsheets, or a cloud-based tool, use a dedicated platform to store and organize all transaction details.

- Assign Unique Identifiers: Assign a unique number or reference code to each document to make it easier to locate specific transactions and track progress.

- Update Records Promptly: Ensure you record payments and outstanding balances immediately after they are received or missed to maintain accuracy.

- Regularly Back Up Your Data: Keep backups of your transaction history to avoid losing important information in case of technical issues.

Example of a Payment History Table

| Transaction ID | Date | Client Name | Amount | Status |

|---|---|---|---|---|

| #1001 | 2024-08-10 | ABC Corp. | $1,500.00 | Paid |

| #1002 | 2024-08-20 | XYZ Ltd. | $2,000.00 | Pending |

| #1003 | 2024-09-05 | Global Co. | $1,200.00 | Paid |

Invoice Payment Terms Explained

Clear payment terms are essential for ensuring that both parties involved in a transaction understand when and how payment should be made. By outlining these terms, you set clear expectations and help avoid misunderstandings about due dates, late fees, and acceptable payment methods. Properly stated payment terms also protect your business by ensuring timely compensation for services rendered.

Setting explicit payment terms helps streamline the financial aspect of your professional relationships. These terms may vary depending on the nature of the work, client agreements, or industry standards. However, establishing a consistent framework for payments can make transactions smoother and help maintain a positive, professional rapport with clients.

Key Payment Terms to Include

- Due Date: Clearly specify the exact date when payment should be made to avoid confusion.

- Late Fees: State any penalties that will be applied if payment is not received by the due date, such as a percentage of the total amount.

- Early Payment Discounts: Offer clients a discount if they pay before the due date, as an incentive for prompt payment.

- Accepted Payment Methods: List the methods of payment you accept, such as bank transfer, credit card, or online payment platforms.

- Partial Payments: If applicable, outline whether you allow installment payments or require full payment upfront.

Example of Payment Terms Breakdown

| Term | Details |

|---|---|

| Due Date | Payment must be received within 30 days from the date of the document. |

| Late Fee | A 5% late fee will be applied for each week the payment is overdue. |

| Early Payment Discount | A 2% discount is available if payment is made within 10 days. |

| Payment Methods | Bank transfer, PayPal, or credit card are accepted. |

These clear and concise payment terms help both you and your clients understand expectations, reducing the likelihood of delayed payments and ensuring that all financial transactions are completed smoothly and on time.

How to Send Your Consultant Invoice

Sending a clear and professional payment request is an essential step in ensuring timely compensation for your services. Whether you are sending a document to a new client or an established one, it’s important to ensure the process is straightforward and efficient. The method you use to send the request can influence how quickly and easily your client processes the payment.

There are several methods for sending payment requests, ranging from email to physical mail, each with its own advantages. Understanding the best practices for transmitting these documents will help ensure that the process goes smoothly, and payments are made on time. The key is to provide all necessary information clearly and ensure that the client knows exactly how to submit payment.

Best Methods to Send Your Payment Request

- Email: Sending a digital document via email is one of the quickest and most convenient methods. Attach the document in PDF format to ensure that the layout and formatting are preserved.

- Online Platforms: If you’re using invoicing or accounting software, you can send payment requests directly from the platform, often with the added benefit of tracking payment status.

- Postal Mail: For clients who prefer traditional methods, you can print a hard copy and send it via postal service, although this may take longer for delivery and receipt.

How to Organize Your Payment Request for Email

| Step | Action |

|---|---|

| 1 | Ensure the document is saved in PDF format to maintain the layout and prevent editing. |

| 2 | Write a brief and polite email message, explaining the attached document and its contents. |

| 3 | Double-check that all necessary details (due date, payment method, amount, etc.) are included in the attached document. |

| 4 | Send the email with the attached document and a request for confirmation of receipt. |

By following these steps, you ensure that your payment request is professionally presented and easily accessible for your client, increasing the likelihood of a swift response.

Legal Considerations for Consultant Invoices

When preparing a payment request, it is essential to consider various legal aspects to ensure that both parties are protected and the agreement remains valid. This includes making sure the document is accurate, that all applicable laws are followed, and that the terms align with the contract or service agreement you have with your client. Neglecting legal considerations can lead to disputes, delays, or even non-payment.

By understanding the legal requirements surrounding billing documents, you can ensure that you are compliant with tax laws, local regulations, and industry standards. Clear, legally sound payment requests help you maintain professionalism while safeguarding your rights and responsibilities as a service provider. Being aware of these legal aspects not only protects your business but also builds trust with your clients.

Essential Legal Elements to Include

- Business Details: Include your full name, business name (if applicable), and contact information, along with the client’s details, to clarify the parties involved in the agreement.

- Tax Identification Number: In many regions, it’s mandatory to provide a tax ID or VAT number for proper record-keeping and tax purposes.

- Clear Payment Terms: Specify the agreed-upon payment terms, including the due date, late fees, and applicable taxes, to avoid confusion or disputes.

- Service Description: Provide a detailed breakdown of the services rendered, including hours worked, project details, and agreed-upon rates to ensure transparency.

- Signature or Authorization: If required, include a space for the client’s signature or digital confirmation of receipt to ensure the document’s validity.

Understanding Jurisdiction and Tax Laws

- Local Regulations: Ensure that your payment request complies with local or regional business laws, such as tax rates, invoicing rules, and financial reporting standards.

- Sales Tax or VAT: Depending on your location, you may be required to charge sales tax or VAT. Understand how to apply these correctly and ensure that they are included in the document.

- International Considerations: If you work with clients overseas, be mindful of international tax laws and billing requirements. This may include currency conversion, payment processing fees, and export taxes.

By adhering to these legal guidelines, you ensure that your payment requests are both professional and legally sound, helping you avoid unnecessary complications in your business dealings.

Digital vs Printed Consultant Invoices

When sending a payment request, one important decision you will face is whether to choose a digital or printed format. Both methods have their pros and cons, and the right choice depends on factors such as client preferences, efficiency, and the level of professionalism you wish to maintain. Understanding the differences between these two options will help you make the best decision for your business and your clients.

While digital formats are becoming increasingly popular due to their convenience, speed, and environmental benefits, there are still instances where a printed version may be preferred. Each approach comes with unique advantages that can affect everything from the speed of payment processing to the way clients perceive your professionalism.

Advantages of Digital Payment Requests

- Speed: Sending a digital request via email or through an online platform is instantaneous, allowing clients to receive and process it immediately.

- Convenience: Digital records are easy to store, search, and organize, making it simpler to track past transactions.

- Cost-Effective: There’s no need to spend money on paper, ink, or postage, which can save you money in the long term.

- Environmentally Friendly: By opting for digital documents, you reduce paper usage, contributing to sustainability efforts.

Advantages of Printed Payment Requests

- Professional Appearance: A printed document can give a more formal and tangible impression, which some clients may prefer.

- Reliability: Not all clients are comfortable with digital communications, and some may prefer receiving a physical copy for their records.

- Less Risk of Technical Issues: Printed documents eliminate the possibility of email errors, attachments not being opened, or lost digital files.

- Better for Certain Clients: Some industries or clients may require physical documentation due to their internal processes or policies.

Comparison Table: Digital vs Printed Requests

| Factor | Digital | Printed |

|---|---|---|

| Speed | Instant delivery | Slower due to mailing |

| Cost | No cost (aside from software or internet fees) | Cost of paper, ink, and postage |

| Purpose | Benefit |

|---|---|

| Budgeting | Helps plan future expenses and manage cash flow by tracking incoming payments and pending amounts. |

| Tax Filing | Provides a complete record of income, ensuring that all necessary documents are in place when filing taxes. |

| Financial Reporting | Gives you a snapshot of your financial health, showing trends in income and expenses over time. |

| Debt Collection | Helps you keep track of outstanding payments and reminds clients of overdue amounts, improving collection efficiency. |

By implementing a consistent system for generating and organizing payment requests, you lay the foundation for stronger financial organization and a more efficient business operation. This approach helps ensure timely payments, reduces administrative headaches, and offers clear insights into your business’s financial situation.

How to Automate Your Invoicing Process

Managing billing documents manually can be time-consuming and prone to error, especially as your workload increases. Automating this process can save you time, reduce mistakes, and ensure consistency in your payments. By using specialized software or online tools, you can streamline the entire procedure–from creating and sending documents to tracking payments and sending reminders. Automation allows you to focus more on your core work while the financial side of your business runs smoothly and efficiently.

Automation tools can help you create and send payment requests in just a few clicks, and even integrate with other financial systems, making it easier to monitor cash flow and manage taxes. These tools can be customized to match your specific needs, providing a professional, error-free process for both you and your clients. Whether you’re managing a few clients or many, automating the billing process can significantly enhance your productivity and accuracy.

Benefits of Automating Billing

- Time-Saving: Automating repetitive tasks, such as creating and sending documents, reduces the time you spend on administrative work.

- Reduced Errors: Automation minimizes human error, ensuring that the details of each payment request are accurate and consistent.

- Streamlined Payment Tracking: Automation tools can track payments and outstanding balances, alerting you when payments are due or overdue.

- Consistency and Professionalism: Automated documents follow a standardized format, presenting a more polished, professional image to your clients.

- Improved Cash Flow: Automatic reminders and recurring billing options help ensure that payments are made on time, improving your cash flow.

Steps to Automate Your Payment Process

- Choose an Automation Tool: Select a tool or software that fits your business needs. There are many options available, ranging from simple invoicing systems to comprehensive financial management platforms.

- Set Up Templates: Create billing document templates that include all necessary fields such as client information, service details, payment terms, and taxes.

- Integrate Payment Options: Enable online payment systems within your automation tool to allow clients to pay directly from the payment request.

- Schedule Regular Billing: Set up recurring billing cycles for clients with ongoing projects or subscriptions, ensuring you never miss a payment cycle.

- Monitor and Adjust: Regularly review the automated system to ensure everything is working smoothly, adjusting templates and processes as needed.

By implementing an automated billing system, you simplify your financial management and reduce the time spent on repetitive tasks. This gives you more time to focus on delivering great work while ensuring that your business’s finances stay organized and up-to-date.