Download Invoice Template for House Cleaning Services

Managing financial transactions efficiently is key to maintaining a successful service-based business. When it comes to providing residential assistance, ensuring clear communication regarding charges and payment expectations is essential. By using a structured approach, you can make the process easier both for your clients and your team.

Having a structured document to summarize the details of each transaction helps establish professionalism and trust. It ensures that the agreed-upon amounts are clearly outlined, reducing misunderstandings. Additionally, it allows both parties to have a transparent record for future reference.

Whether you’re offering routine support or one-time services, it’s important to keep your records organized. A detailed breakdown of charges not only ensures timely payments but also helps with financial tracking and tax reporting. This method saves time, improves efficiency, and enhances the client experience.

Why Use an Organized Billing Document

Maintaining clarity and consistency in financial transactions is essential for any service-oriented business. An organized record helps both the provider and the customer stay aligned on the services provided and the corresponding charges. It serves as a clear, professional method of confirming payment details and expectations.

Using a well-structured record offers several benefits:

- Reduces confusion: Clients can easily see what they are paying for, minimizing misunderstandings.

- Saves time: It eliminates the need to manually create a list of services or calculate costs each time.

- Enhances professionalism: A detailed document conveys a sense of order and reliability.

- Improves tracking: Keeping records helps manage payments and monitor business growth.

Having a reliable system in place fosters trust with clients and keeps your financial records in good order. This practice is an efficient way to handle payments and can ultimately contribute to the smooth running of your business.

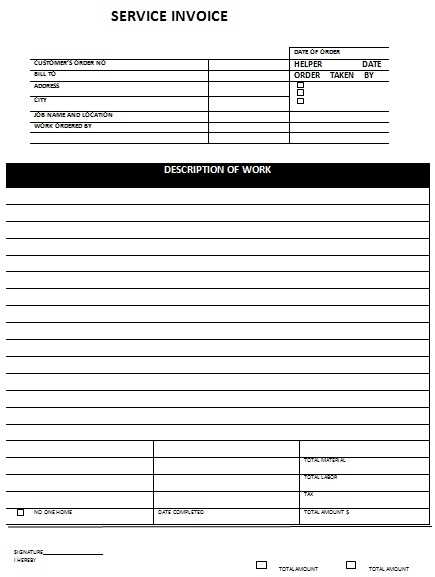

How to Create a Billing Document for Services

Creating a clear and professional record of the services provided is essential for both client satisfaction and business management. By outlining the tasks performed, the time spent, and the corresponding costs, you ensure a transparent transaction and facilitate smooth payments.

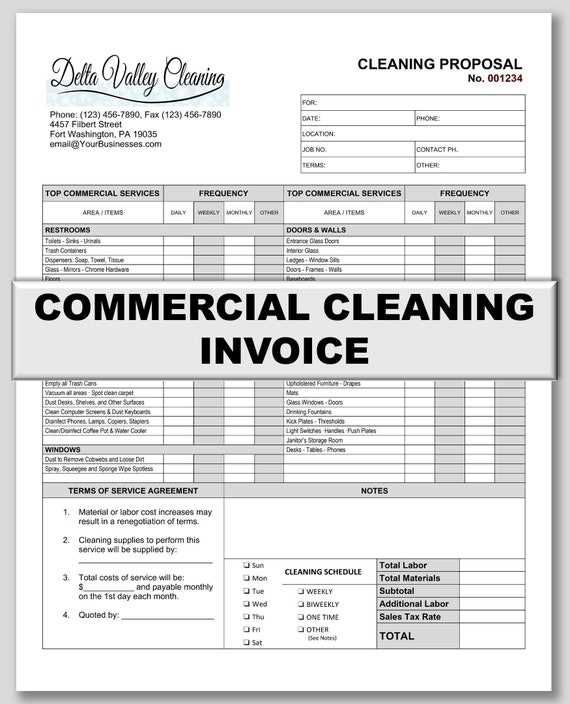

Key Information to Include

To ensure your document is comprehensive and clear, make sure to include the following details:

- Client’s Information: Name, address, and contact details for proper identification.

- Service Description: Clearly list the tasks performed, such as “vacuuming,” “dusting,” or “floor mopping.”

- Date of Service: Specify the date when the service was provided.

- Charges: Break down the pricing for each task or service and include the total cost.

- Payment Terms: State the expected payment method and due date.

Formatting Your Document

After gathering all the necessary details, it’s important to organize the information in an easy-to-read format. A clean layout not only improves readability but also presents a professional image to your clients. Consider using a simple design with clear sections, such as:

- Title or header at the top with your business name and logo (if applicable).

- Client details followed by a service description.

- Payment summary and terms listed clearly at the bottom.

By following these steps, you create a document that is clear, professional, and easy to use for both you and your client.

Key Components of a Billing Document

To ensure smooth transactions and maintain professionalism, it’s crucial to include specific elements in your payment record. These components not only provide clarity for both parties but also help establish a transparent financial arrangement. A well-structured document will cover all the essential information in an easy-to-read format.

1. Service Provider Information:

Begin by including your business name, logo, and contact details. This ensures your client can easily identify the source of the document and reach out if necessary.

2. Client Information:

Clearly list the client’s full name and contact details. This avoids any confusion, especially if there are multiple clients or businesses involved.

3. Detailed List of Services:

Provide a breakdown of the specific tasks performed. Use clear descriptions such as “window washing,” “floor scrubbing,” or “bathroom sanitation” to ensure the client understands exactly what they are paying for.

4. Date of Service:

Include the date or dates when the services were completed. This helps to track the timeline of the work provided and ensures that clients know when to expect their payment due date.

5. Payment Amount:

List the agreed-upon fees for each task or service performed. Additionally, provide the total sum due, including any applicable taxes or discounts. Be transparent and clear in your pricing to avoid confusion.

6. Payment Terms:

Outline the payment due date, acceptable payment methods, and any late fees or penalties if the payment is not made on time. Clear payment terms help avoid delays and ensure a prompt transaction.

7. Additional Notes:

Optionally, include any additional instructions, remarks, or special conditions. This section can be used to clarify anything specific about the service or the payment process, such as follow-up appointments or referrals.

Incorporating these elements ensures that your billing document is both professional and clear, allowing you to build trust and maintain smooth operations.

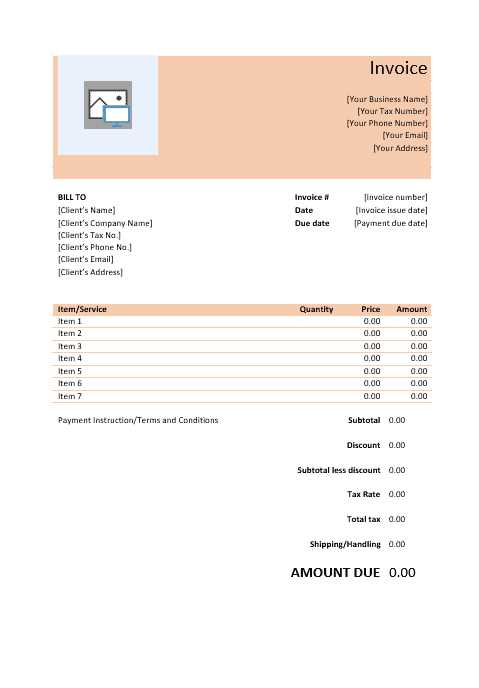

Customizing Your Billing Document

Personalizing your payment record is essential to reflect your unique business identity and streamline your workflow. By tailoring the layout and information, you can ensure that your document meets your specific needs and stands out professionally. Customization helps maintain consistency in your records and enhances client satisfaction.

Personalizing the Design

The visual aspect of your payment record plays a significant role in creating a lasting impression. Here are some ways to personalize the design:

- Branding: Add your company logo, brand colors, and fonts to make the document reflect your business identity.

- Layout: Organize sections clearly with space between client information, services provided, and payment details. A clean, well-structured design improves readability.

- Contact Details: Ensure your contact information is prominently displayed so clients can reach out easily with any questions or concerns.

Tailoring Information for Specific Services

Adjust the content to suit the specifics of your offerings. Customization allows you to reflect the scope of work accurately:

- Service Descriptions: Use precise, clear language to describe each task or service you provided.

- Pricing Adjustments: Include any special rates, discounts, or additional charges specific to the client or service provided.

- Payment Terms: Modify the terms according to your business policies, including payment methods, due dates, and late fees if applicable.

By customizing your document, you ensure it aligns with both your business operations and your client’s expectations, improving the overall efficiency of your financial transactions.

Benefits of Professional Records for Cleaners

Using a well-structured and professional payment document offers several advantages for those in the service industry. It not only improves the overall experience for clients but also contributes to better business management. By maintaining consistency and clarity in your transactions, you enhance trust, streamline operations, and ensure a smoother financial process.

Here are some key benefits:

- Builds Credibility: A polished, organized document conveys professionalism and reliability, helping to establish a trustworthy reputation with clients.

- Reduces Errors: Clearly outlined charges and services minimize the chances of mistakes or misunderstandings, ensuring that both parties are aligned on the transaction.

- Improves Cash Flow: Professional records help you track payments more efficiently, ensuring timely collections and reducing delays.

- Legal Protection: In case of disputes, having a formal document detailing the services and agreed terms can serve as a valuable reference in resolving issues.

- Streamlines Tax Reporting: Proper documentation makes it easier to keep track of earnings, simplifying tax filing and financial reporting.

By using professional records, you create a more efficient, organized system that benefits both you and your clients, fostering long-term business relationships and smoother operations.

How Payment Records Help with Tax Preparation

Proper documentation of your earnings and expenses plays a critical role when it comes to preparing taxes. Maintaining clear and organized records ensures that you can easily track income, deductions, and business-related costs. This simplifies the tax filing process and minimizes the risk of errors or missing important details.

Tracking Income and Expenses

By keeping detailed records of each transaction, you can accurately report your income. It’s also essential to track business expenses, which can help reduce taxable income. Detailed records allow you to separate personal and business expenses, ensuring compliance with tax laws.

Streamlining Deductions and Credits

When preparing your taxes, you may be eligible for deductions related to business operations, such as supplies, travel, or equipment. Well-organized records make it easier to identify and claim these deductions. The clearer your documentation, the more likely it is that you can take full advantage of available tax credits and benefits.

Incorporating accurate records into your tax preparation not only saves time but also helps ensure that you are in full compliance with tax regulations. It allows you to file confidently, knowing that everything is accounted for and in order.

Free vs Paid Billing Documents

When it comes to choosing the right tools for managing financial records, service providers often face the decision between free and paid solutions. Both options offer distinct advantages depending on your business needs, and understanding their differences can help you select the best fit for your operations.

Free Options:

Free solutions are a great starting point, especially for small businesses or those just getting started. They typically offer basic features, such as simple layouts and the ability to add service descriptions and amounts. Free tools can be a good choice for businesses with minimal invoicing needs or for those who are looking to save money. However, they may lack customization options and advanced features.

Paid Options:

Paid solutions offer more robust features and greater flexibility. These options often include a wider range of design templates, the ability to integrate with other business tools, and advanced functionalities like automatic tax calculations and recurring billing. While they require an investment, they can help save time and improve efficiency in the long run. Paid solutions also often offer customer support and security features, which are essential for larger or growing businesses.

Key Differences:

- Customization: Paid solutions usually provide more options to tailor your documents to reflect your brand.

- Features: Paid options often include advanced tools like reporting, reminders, and payment tracking.

- Support: Paid tools generally offer customer service to help resolve issues quickly.

- Cost: Free solutions are budget-friendly, while paid options require a subscription or one-time fee.

Choosing between free and paid tools ultimately depends on your business size and needs. If you have simple requirements, a free option may be sufficient, but for growing businesses or those needing advanced features, a paid solution could be the better choice.

Best Tools for Generating Payment Records

Generating accurate and professional payment documents is essential for any service provider. Using the right tools can save time, reduce errors, and ensure that all necessary details are included. Several platforms and software solutions cater to businesses, offering different features that streamline the creation and management of billing records.

Here are some of the best tools available to help generate professional payment records:

- FreshBooks: Known for its user-friendly interface, FreshBooks provides a simple way to create custom payment documents. It offers features such as automated reminders, recurring billing, and payment tracking, making it ideal for service-based businesses.

- QuickBooks: A popular choice among small businesses, QuickBooks offers powerful features for generating detailed financial records. It integrates well with accounting tools, helping users track income, expenses, and taxes easily.

- Zoho Invoice: This free tool allows users to create fully customized documents with ease. Zoho Invoice also includes features like multi-currency support and integration with payment gateways.

- Wave: Ideal for small businesses or freelancers, Wave offers free invoicing tools that include templates, payment reminders, and automatic updates. It’s an easy-to-use platform for those just starting out.

- PayPal: While primarily known as a payment processing service, PayPal also offers simple document creation tools. Users can easily generate and send payment requests directly through the platform.

By choosing the right tool, you can save valuable time, reduce errors, and improve the overall professionalism of your billing process. These solutions help you focus more on providing quality service while ensuring that your financial documentation remains clear and organized.

How to Add Service Details

Including accurate and comprehensive information about the tasks performed is essential when creating a payment document. Detailing the services provided not only helps clarify the work done for the client, but it also ensures transparency and prevents any confusion. Clearly outlining these details ensures both parties are on the same page regarding the scope and pricing of the work completed.

Breaking Down the Tasks

Start by listing each task or job you completed. This helps the client understand exactly what they are paying for. Be as specific as possible to avoid any ambiguity:

- Task Descriptions: Include detailed descriptions of each task. For example, instead of simply writing “vacuuming,” specify the areas that were vacuumed (e.g., living room, hallways, bedrooms).

- Duration: Mention how long each task took to complete, as this can influence the final price and offers clarity on the time spent.

- Materials Used: If any specific cleaning supplies or equipment were used, list them. This can also help justify the price, especially if premium products were used.

Pricing for Each Service

Break down the pricing for each service or task to give a clear understanding of the cost structure. This will also help the client assess the fairness of the pricing:

- Hourly Rate: If you charge by the hour, include the number of hours worked along with the hourly rate.

- Flat Fees: If certain tasks are charged at a flat rate, be sure to list each task along with its corresponding price.

- Discounts: If you are offering any discounts or special offers, make sure to note them clearly, along with any conditions or requirements.

Including detailed information about the services performed not only helps maintain clarity and professionalism but also ensures a smoother transaction and enhances customer satisfaction.

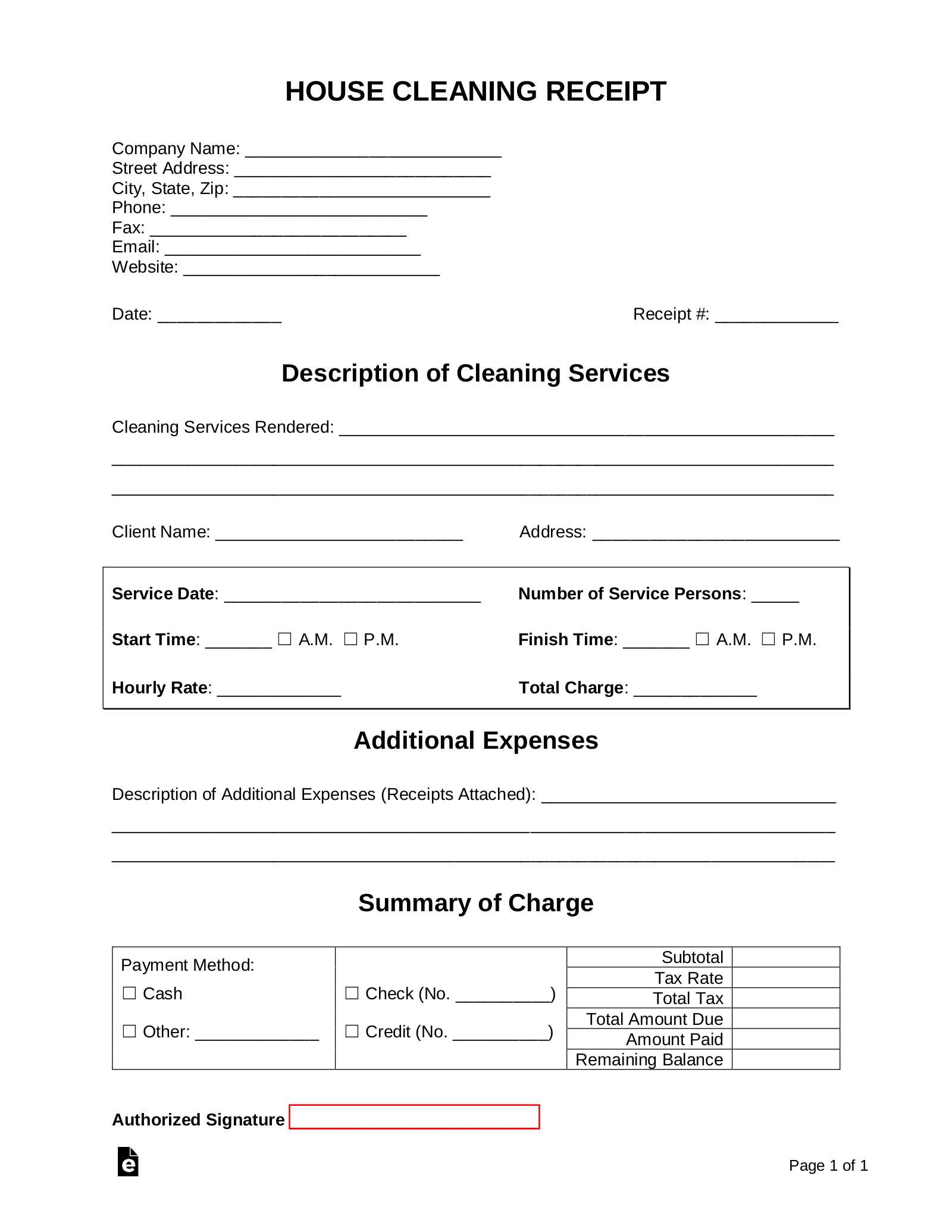

Importance of Clear Payment Terms

Setting clear and concise payment expectations is crucial for both service providers and clients. By defining the terms upfront, you ensure that both parties are on the same page regarding the timing and method of payment. This helps prevent misunderstandings and promotes a smooth transaction process.

When payment terms are clearly outlined, clients know exactly when and how they are expected to settle the amount due. Likewise, service providers can avoid delays and uncertainty when it comes to receiving payment. Well-defined terms can also protect both sides in case of disputes, ensuring that both parties know their rights and obligations.

Some key aspects to include in your payment terms are:

- Due Date: Specify the date by which payment should be made, whether it’s immediately upon completion, within a certain number of days, or after a set period.

- Payment Methods: Clarify the acceptable methods of payment, such as bank transfer, credit card, or cash.

- Late Fees: If applicable, mention any penalties for late payments and the rate at which fees will accumulate.

- Deposit Requirements: If a deposit is required before services are rendered, state the amount and the conditions under which it is refundable or non-refundable.

Having these details laid out clearly not only fosters trust but also improves the professional relationship between you and your clients. By setting realistic and transparent expectations, you help prevent payment issues and ensure timely compensation for the services provided.

Tracking Payments with Your Document

Effectively tracking payments is essential for maintaining financial accuracy and ensuring that you are paid promptly. By keeping a record of all transactions, you can monitor the status of outstanding payments and ensure no debts are overlooked. A detailed and well-organized record simplifies the process of managing your finances and provides clarity for both you and your clients.

How to Track Payments

To properly track payments, it’s important to include several key elements in your document:

- Payment Status: Always update the status of each payment, such as “paid,” “pending,” or “overdue.” This will give you a quick overview of which payments are still outstanding and which have been settled.

- Payment Date: Record the date when the payment was made. This helps you track when payments are due and gives you a reference point for future inquiries.

- Amount Paid: Clearly list the amount that has been paid against the total amount due. This ensures transparency and prevents confusion regarding partial payments.

Tools for Tracking Payments

There are several tools available that can assist you in tracking payments and managing your records more efficiently:

- Accounting Software: Platforms like QuickBooks, FreshBooks, and Zoho can automatically track payments and generate reports, saving you time and reducing the chance of errors.

- Spreadsheets: If you prefer a simpler method, you can create a custom spreadsheet in tools like Excel or Google Sheets to track payments manually. Just be sure to include columns for payment status, amounts, and dates.

By diligently tracking payments, you ensure that you stay on top of your financial obligations and avoid any confusion or missed payments. Regular monitoring of your records also helps you stay organized and makes tax preparation much easier.

Using Documents for Better Business Organization

Having a clear and structured approach to managing business transactions is crucial for maintaining smooth operations. By utilizing well-organized records of services rendered and payments due, you can keep track of all business activities. This practice not only simplifies accounting but also improves communication with clients and ensures financial transparency.

Streamlining Operations

When you consistently use detailed records, you create a more organized workflow. This allows you to track the work done, know what payments are pending, and quickly address any discrepancies. Organized financial documentation can also help you:

- Improve Efficiency: With all the relevant information in one place, you don’t waste time searching for details or chasing clients for payments.

- Enhance Client Relationships: By providing clear, professional records, clients will trust your services more, leading to repeat business and positive referrals.

- Ensure Accuracy: Properly documenting each transaction reduces the risk of errors and ensures your records are always up to date.

Making Business Growth Easier

As your business grows, it becomes even more important to stay organized. Using structured documentation ensures you don’t lose track of any important financial details. Whether you’re managing a few clients or a larger customer base, organized records will help you:

- Scale Easily: As your business expands, having a systematic approach to payments and services allows you to handle larger volumes of work without feeling overwhelmed.

- Monitor Profitability: Tracking your income and expenses helps you identify profitable services and make better business decisions in the future.

Ultimately, having a streamlined method for documenting services and payments will keep your business organized, allowing you to focus on growth and improving your services without getting bogged down by administrative tasks.

Legal Requirements for House Cleaning Invoices

When providing professional services, it’s important to follow the legal obligations associated with billing. Proper documentation not only ensures transparency but also protects both you and your clients. Adhering to legal requirements for service records can help avoid potential disputes and tax issues. Each region may have specific regulations, so it’s essential to stay informed about the necessary elements for your records.

Essential Information to Include

There are key details that must be included in any transaction document to comply with legal standards. These details vary by country or region, but typically include:

- Service Provider’s Information: Include the name, address, and contact details of the business or individual providing the services.

- Client’s Information: The full name and contact details of the client receiving the service should be clearly stated.

- Description of Services: A detailed list of services provided, including dates and timeframes, to avoid any confusion.

- Total Amount Due: Clearly outline the payment amount, any applicable taxes, and a breakdown of costs.

- Payment Terms: Specify when payments are due, any late fees, and accepted payment methods.

Tax Considerations

Depending on your jurisdiction, you may be required to include tax information on your documents. This can include details about the tax rate applied to services rendered. If your business is VAT registered or subject to sales tax, it is crucial to display the correct tax percentages on your billing documents.

By ensuring all legal requirements are met, you help protect your business, reduce the risk of legal disputes, and ensure your financial records are in order when it’s time to file taxes.

Common Mistakes to Avoid in Invoices

When documenting services and payments, it’s essential to avoid common errors that can lead to misunderstandings with clients or complications during tax season. Accurate records ensure smooth business operations and help maintain a professional image. Below are some of the most frequent mistakes people make and how to avoid them.

Incorrect or Missing Information

Omitting or incorrectly listing important details can cause confusion. Ensure that all required fields are complete, including:

| Common Errors | How to Avoid Them |

|---|---|

| Missing client or provider details | Double-check contact information and make sure everything is correctly listed. |

| Unclear or vague service descriptions | Provide a specific breakdown of the work done, including dates and timeframes. |

| Incorrect payment amount or tax rates | Verify the calculations and ensure any applicable taxes are correctly included. |

Not Setting Clear Payment Terms

Failure to specify when payments are due or any late fees can lead to confusion and delayed payments. Clearly define payment terms, including:

- Due dates: Make sure the client knows when the payment is expected.

- Accepted payment methods: Specify whether you accept checks, credit cards, or digital payments.

- Late fees: Be transparent about any penalties for late payments.

Overlooking Record Keeping

Failing to keep organized records of transactions can make it difficult to track income or file taxes. Always maintain a clear and accurate record of each transaction for accounting and legal purposes.

Avoiding these common mistakes will help you present a more professional image, ensure timely payments, and keep your business running smoothly.

How to Deliver Cleaning Invoices Efficiently

Ensuring timely and effective delivery of service payment requests is vital for maintaining a healthy cash flow and fostering good client relationships. Choosing the right method and ensuring clear communication can make the process smoother and more professional.

Choose the Best Delivery Method

There are several methods to send your payment requests, each with its own advantages. Consider the following options based on your client’s preferences and your business needs:

- Email: Fast and cost-effective, sending digital copies via email is often the preferred method for many businesses.

- Postal Mail: While less common in today’s digital age, some clients may prefer physical documents for record-keeping or legal purposes.

- Online Platforms: Using invoicing software or accounting tools can simplify the process by automatically generating and sending requests, saving time.

Key Tips for Efficient Delivery

To ensure smooth and effective delivery, consider the following best practices:

- Include All Relevant Information: Make sure the details of the work completed, payment due, and payment options are clearly stated.

- Set Clear Deadlines: Clearly mention when the payment is due to avoid any delays or confusion.

- Follow Up if Necessary: If you haven’t received payment by the due date, don’t hesitate to send a polite reminder or contact the client to confirm the status.

By following these guidelines, you can make the invoicing process easier for both you and your clients, helping to maintain an organized, professional, and efficient business operation.