Invoice Template for Hours Worked Easy and Professional Billing Solution

When offering services that are billed based on the amount of time spent, having a structured and clear billing process is essential. Whether you’re a freelancer, contractor, or consultant, ensuring that you accurately document the work done and present it professionally to clients is key to maintaining trust and smooth business operations.

Proper documentation is not only crucial for transparency but also helps in avoiding misunderstandings about the amount of time worked and the corresponding charges. Without a clear method, confusion can arise, leading to delays in payment or disputes. A streamlined approach can save you time while ensuring you get compensated fairly.

To make this process easier, many professionals turn to pre-designed solutions that allow them to quickly fill in the necessary details and send a polished, clear record of services rendered. This method offers simplicity and organization, enabling you to focus on your work while keeping financial matters in order.

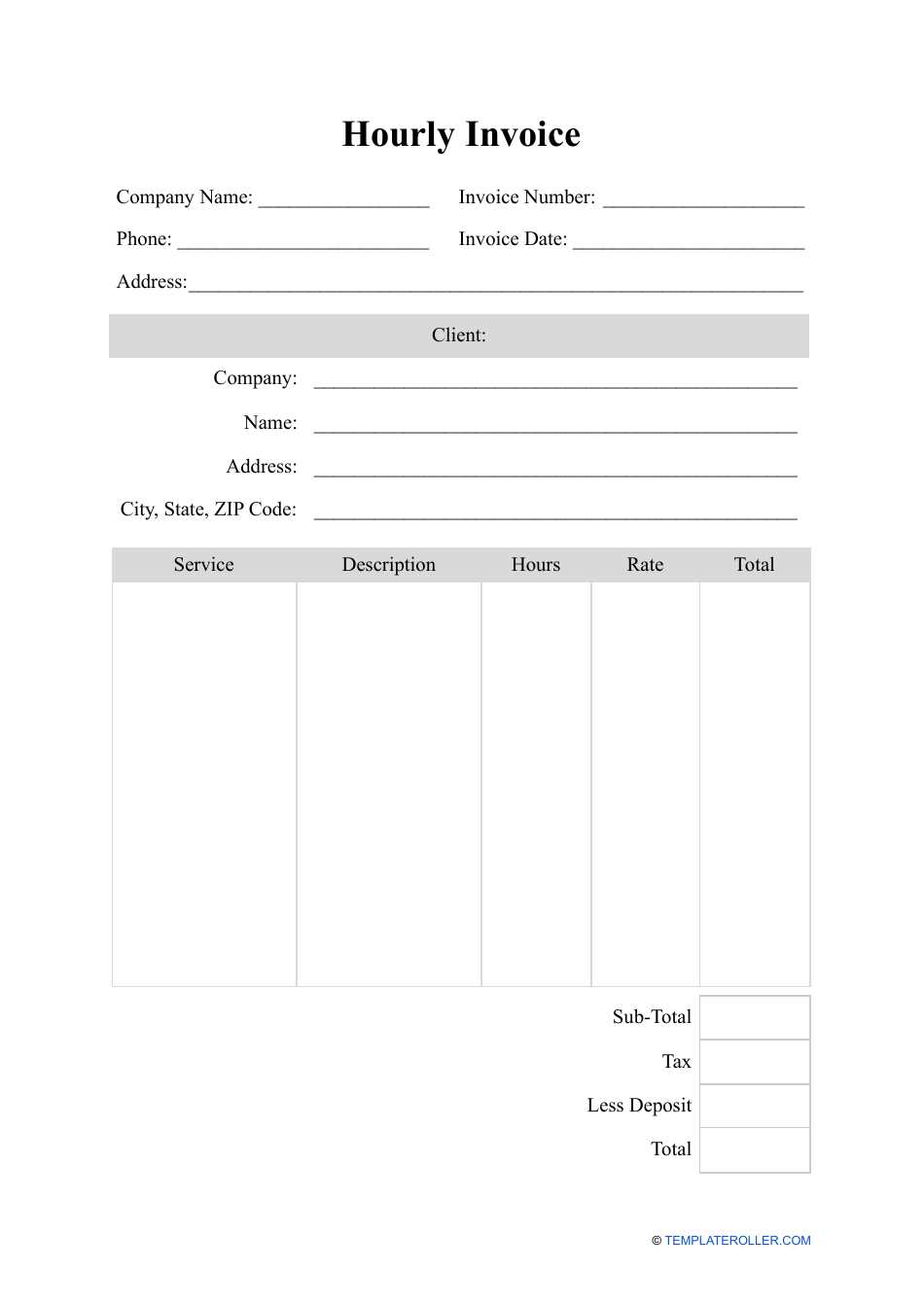

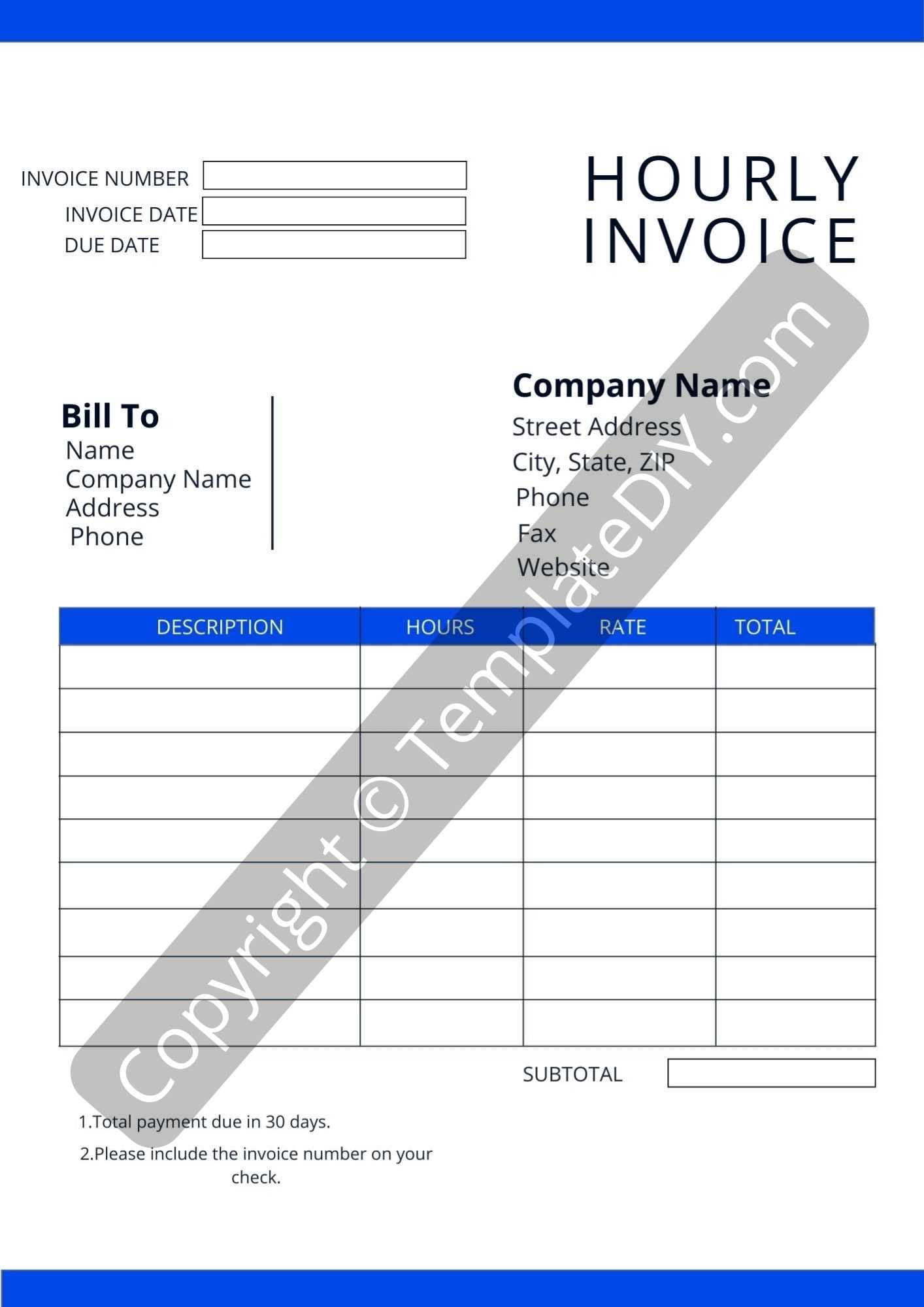

Invoice Template for Hours Worked

Having a well-organized method to record the time spent on client projects ensures clarity and professionalism. By using a clear, standardized format to outline the services provided and the time invested, you can make sure that both you and your clients understand the terms of the work. This approach not only helps in getting paid promptly but also reduces the risk of misunderstandings.

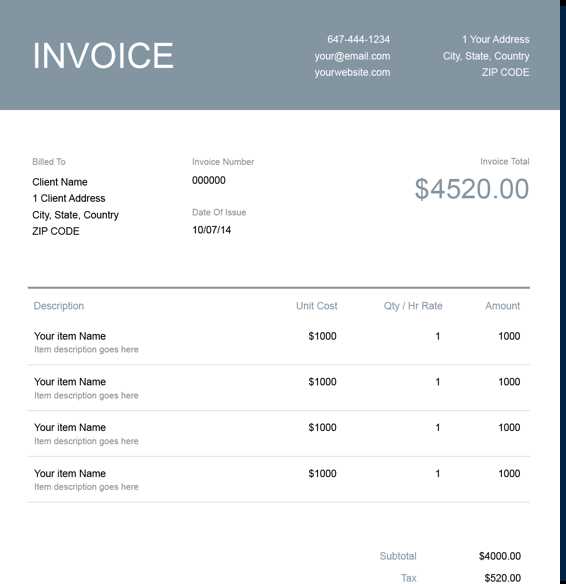

With the right structure in place, you can easily include the necessary details, such as the task description, time spent, and applicable rates. Personalizing this structure can make the process more efficient, allowing you to send clear, itemized statements in just a few steps. When done correctly, this type of record-keeping minimizes back-and-forth with clients and speeds up payment cycles.

Whether you are a freelancer, consultant, or contractor, this method offers the benefit of consistency, ensuring that all the important information is included without overlooking critical aspects. By automating or streamlining this process, you not only save time but also strengthen your professional image.

Benefits of Using an Invoice Template

Utilizing a pre-designed document to record work details and payment terms can significantly streamline your billing process. This approach helps ensure that every essential element is included, preventing the need to manually recreate the same structure for each client or project. With a standardized format, you can save time and effort, allowing you to focus on the actual work at hand.

Consistency is one of the major advantages. By using a reliable format each time, you create a professional image that clients will appreciate. It also reduces the risk of errors, as all fields are predefined and easy to fill out. Additionally, having a ready-to-go document ensures that no critical information is forgotten, which can sometimes happen when creating custom billing records from scratch.

Another key benefit is efficiency. With minimal adjustments needed, you can quickly generate and send out billing records, speeding up the payment process. This means less time spent on administrative tasks and more time dedicated to client work. In the long run, this can improve cash flow and reduce delays in receiving payments.

How to Customize Your Invoice

Adapting your billing record to reflect your specific services and brand can make a significant difference in how professional and personalized your communications appear. Customizing your document allows you to highlight important details, such as payment terms, task descriptions, and client information, in a way that suits both your needs and those of your clients. Tailoring this record can enhance clarity and ensure that no important aspects are overlooked.

Key Elements to Customize

When personalizing your billing document, it’s important to focus on a few key areas that help make the document clear and informative:

| Section | Description |

|---|---|

| Client Information | Make sure to include the client’s full name, address, and contact details for easy reference. |

| Work Description | Be specific about the tasks performed to avoid confusion about the work completed. |

| Payment Terms | Clearly state when the payment is due and any applicable late fees or discounts. |

| Rate and Total | List your hourly or project rate and calculate the total amount due. |

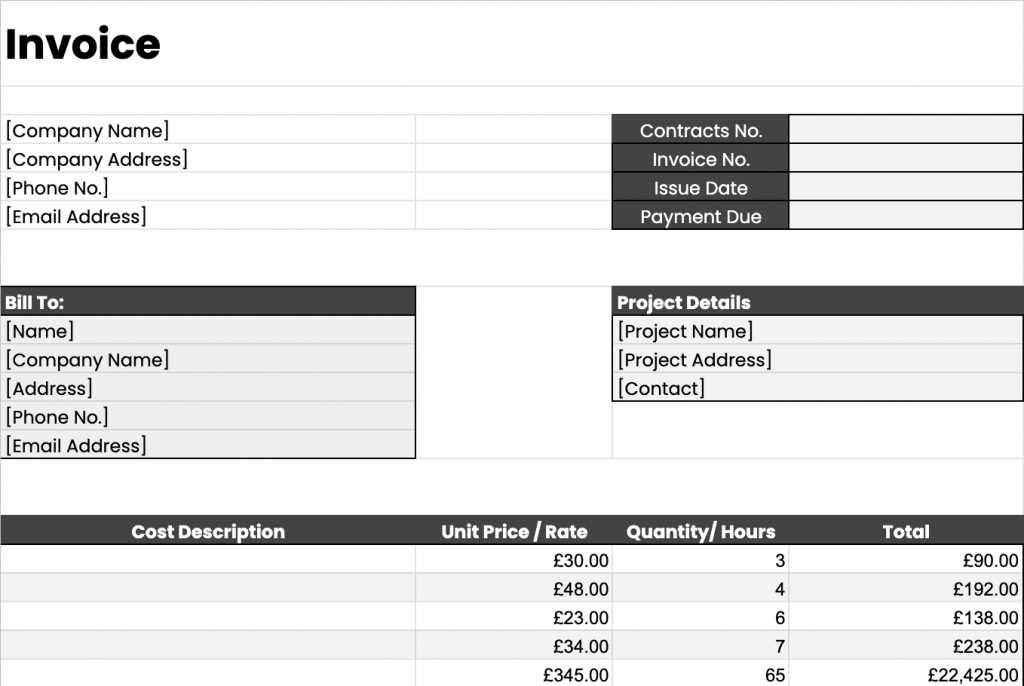

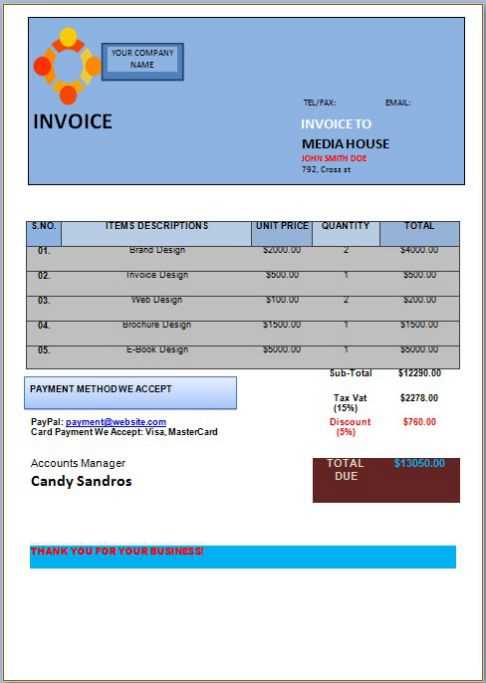

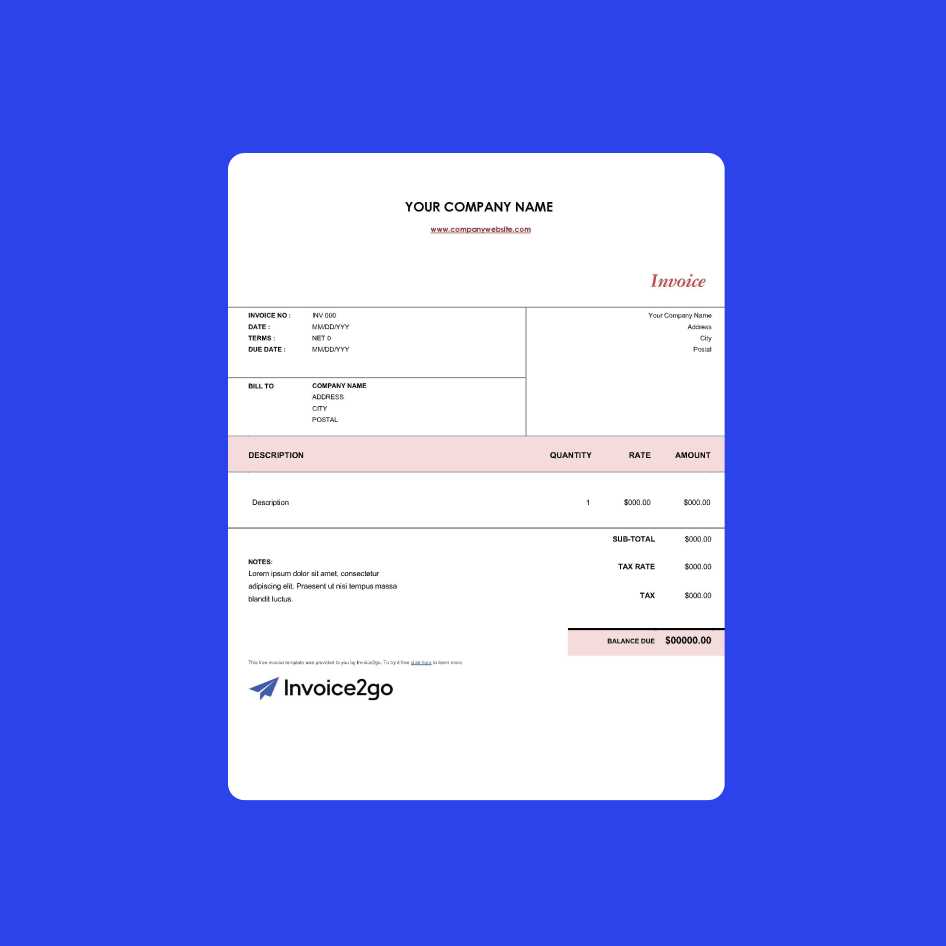

Design and Layout Adjustments

In addition to the content, consider adjusting the layout to match your branding. Using your company colors, logo, and font style can make the document look more polished. A well-organized layout with clearly separated sections improves readability and ensures that your clients can quickly find the information they need.

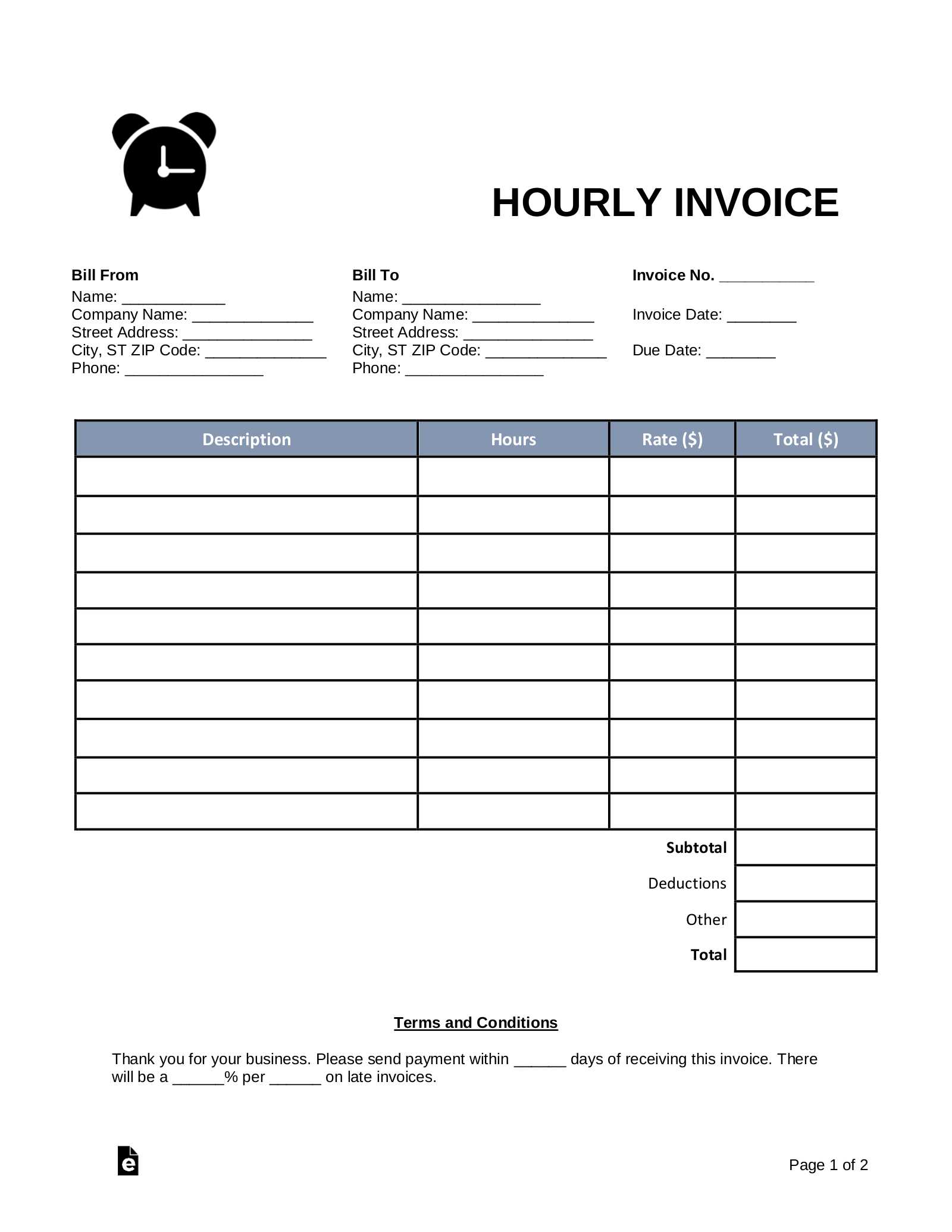

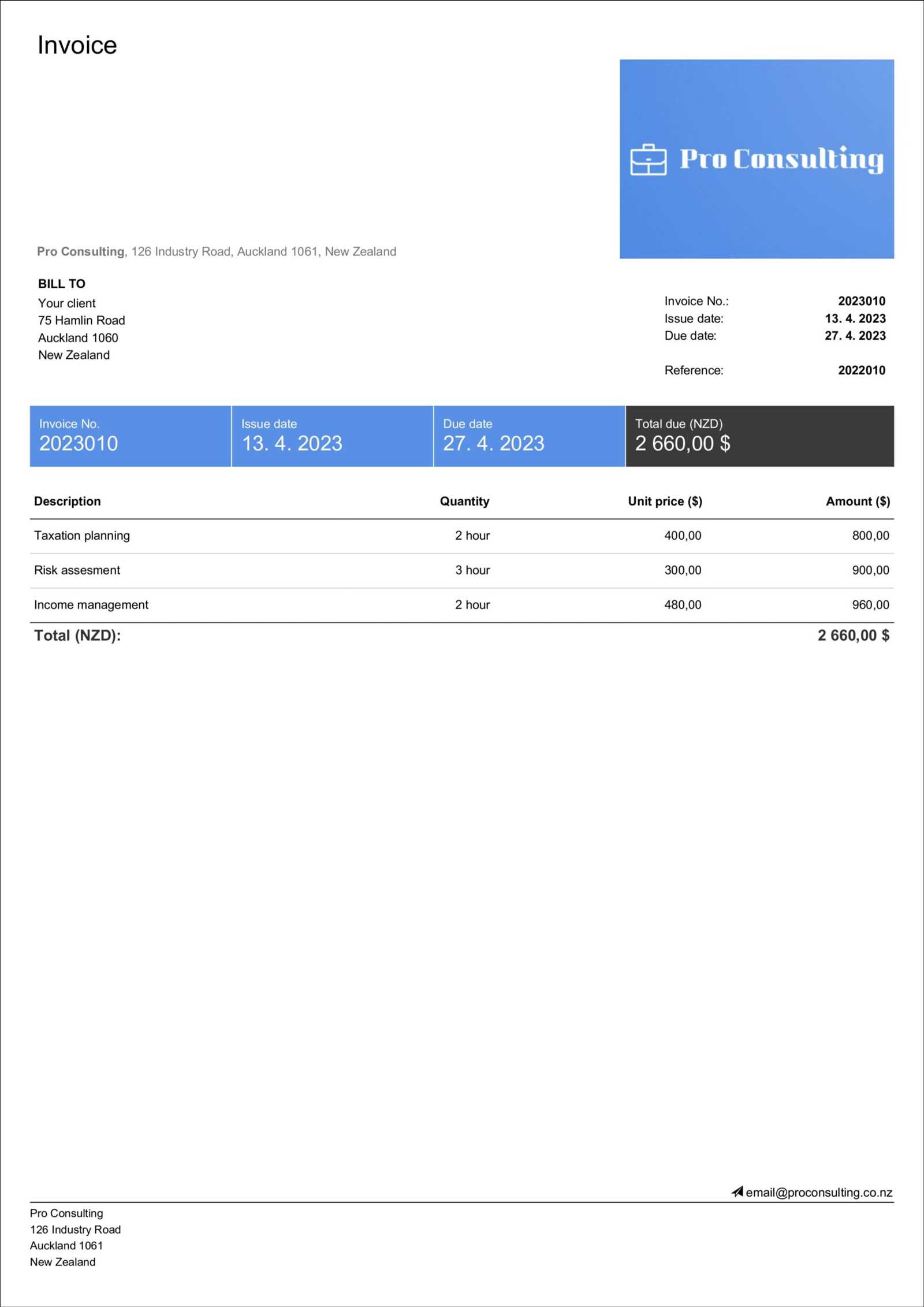

Key Elements of Hourly Invoices

Creating a clear and professional document that outlines the work completed and the amount due is crucial for maintaining positive client relationships and ensuring timely payment. When billing based on the time spent on tasks, there are certain components that must always be included to provide clarity and avoid disputes.

Here are the essential details to include in every document:

- Client Information: Always include the client’s full name or business name, address, and contact information to ensure proper identification.

- Description of Work: A brief yet detailed account of the services provided, including the specific tasks performed, makes it clear what the charges are for.

- Time Logged: Include the exact amount of time worked, specifying the start and end times or the total hours, to show a transparent breakdown of the charges.

- Rate: Clearly state your hourly rate or the cost per service rendered. Be sure to indicate whether it’s an hourly, flat, or tiered rate.

- Total Due: Calculate the total amount based on the time worked and the rate, ensuring that it’s easy to understand and accurate.

- Payment Terms: Specify when the payment is due, any applicable late fees, and accepted payment methods to avoid confusion and delays.

- Additional Details: If applicable, you can add any relevant notes such as discounts, taxes, or previous payments to ensure transparency.

Including these elements in your document not only helps maintain clarity but also protects both parties by ensuring that all the necessary information is outlined in advance.

Why Accurate Time Tracking Matters

Precise tracking of the time spent on each task is essential for both freelancers and businesses. When time is measured correctly, it ensures that clients are billed fairly and that work is compensated based on actual effort. Inaccurate time logging can lead to misunderstandings, underpayment, or overcharging, all of which can negatively affect professional relationships and trust.

Improved Client Trust

Clients appreciate transparency, and providing clear records of how much time was spent on their project shows professionalism. Accurate tracking builds trust, as clients can easily see that they are being charged for the exact amount of work completed, which can lead to repeat business and long-term partnerships.

Better Financial Management

For individuals and businesses alike, keeping precise records allows for better financial planning and forecasting. Knowing exactly how much time was dedicated to each task can help in setting more accurate pricing, assessing productivity, and planning future projects. It can also help you avoid lost income by ensuring that every minute worked is properly accounted for.

Common Mistakes in Hourly Billing

When billing based on the time worked, there are several common errors that can lead to confusion, disputes, or even loss of income. These mistakes not only affect the payment process but also can damage client relationships and your reputation as a professional. It’s essential to understand and avoid these pitfalls to ensure smooth, efficient transactions.

Here are some of the most frequent mistakes people make when charging for time spent on tasks:

- Not Tracking Time Accurately: Failing to track time in real-time or forgetting to log work can lead to inaccurate billing. This can cause discrepancies and make it difficult to justify charges later.

- Vague Task Descriptions: A general or unclear description of the work completed makes it harder for clients to understand what they’re paying for. It can also raise questions about the legitimacy of the charges.

- Overlooking Breaks or Downtime: Not accounting for breaks or non-productive time during a project can inflate the total time billed, leading to conflicts with clients over what they’re actually paying for.

- Not Setting Clear Rates: If you don’t clearly define your hourly or project rate upfront, clients may be caught off guard by the final amount. Ambiguity around costs can lead to disputes later.

- Failing to Include Payment Terms: Without clear payment terms (e.g., due dates, late fees, accepted payment methods), there can be confusion about when payments are expected, potentially delaying or complicating transactions.

- Not Providing Detailed Summaries: Without a breakdown of hours worked and tasks performed, clients may question the charges, leading to delays in payment or the need for additional clarifications.

- Underestimating Project Complexity: It’s common to underestimate how much time a task will take, which can lead to undercharging and lost income. Accurate time estimates help avoid this problem.

By paying attention to these potential errors, you can ensure that your time-based billing is transparent, fair, and professional, which will help foster long-term, positive relationships with your clients.

Best Software for Creating Invoices

Using the right software to generate billing documents can save time, reduce errors, and improve the overall professionalism of your business. The best solutions not only help you create accurate and well-organized records but also streamline the entire payment process. Whether you’re a freelancer, contractor, or business owner, the right tool can simplify tracking, organizing, and sending your records to clients.

Here are some of the top options to consider:

| Software | Key Features | Best For |

|---|---|---|

| FreshBooks | Easy-to-use, automated time tracking, customizable billing, integrates with accounting tools. | Freelancers and small businesses |

| QuickBooks | Comprehensive accounting software with robust billing features, time tracking, and expense management. | Small to medium-sized businesses |

| Zoho Invoice | Customizable documents, automated reminders, time tracking, and expense logging. | Freelancers, small businesses, and consultants |

| Wave | Free software with essential invoicing features, payment processing, and basic accounting tools. | Small businesses and startups |

| Harvest | Built-in time tracking, reporting, and integration with other tools like QuickBooks and Trello. | Freelancers, project managers, and agencies |

Each of these software options offers a unique set of features tailored to different business needs, making it easier to create and manage billing records efficiently. Choosing the right tool will depend on your specific requirements, such as the need for time tracking, payment processing, or additional accounting features.

How to Avoid Billing Disputes

Billing disputes can cause unnecessary delays, misunderstandings, and strain client relationships. Ensuring that both you and your clients are on the same page when it comes to payments is key to maintaining a smooth business operation. Clear communication, transparency, and consistency are vital in preventing disagreements over charges and work performed.

Here are some effective strategies to minimize the risk of billing disputes:

- Provide Clear Descriptions of Work: Always include a detailed breakdown of the tasks completed. The more specific you are, the less room there is for confusion.

- Agree on Terms Before Starting: Set clear expectations around pricing, payment schedules, and any additional fees before you begin working. Make sure both parties understand the scope and costs.

- Track Time Accurately: Keep accurate records of time spent on tasks. This will help you justify the charges and avoid any discrepancies later on.

- Set Payment Milestones: For larger projects, establish milestones where payments are made at key stages of the work. This keeps both parties on track and minimizes the chance of a large lump sum being disputed.

- Use a Consistent Format: By using a consistent structure for all of your billing records, clients know exactly where to find key information, making it easier to review and accept the charges.

- Communicate Regularly: Keep clients updated on the status of the work and any potential issues that might arise. This proactive approach ensures there are no surprises at the end of the project.

- Be Transparent About Changes: If the scope of the project changes, make sure to notify the client immediately and discuss how the adjustments will impact costs.

- Set Clear Payment Terms: Clearly state when payments are due and outline any late fees or penalties for overdue amounts. Make sure the terms are agreed upon at the outset.

By following these practices, you can significantly reduce the chances of disputes arising and ensure that your client relationships remain strong and professional.

Simple Ways to Automate Invoicing

Automating the billing process can save valuable time and reduce the chances of human error. By setting up automated systems, you can generate and send payment records quickly, track outstanding amounts, and ensure that clients receive timely reminders. This not only streamlines your workflow but also helps maintain consistent cash flow.

Here are a few straightforward ways to automate your billing process:

- Use Accounting Software: Invest in software that integrates time tracking, expense management, and payment processing. Many tools can automatically create and send payment requests based on the data you enter, saving you time and effort.

- Set Up Recurring Billing: If you work with long-term clients or have ongoing projects, set up recurring payments at regular intervals. This removes the need for manual updates and ensures that payments are received on time.

- Leverage Payment Gateways: Use online payment systems like PayPal or Stripe that allow automatic invoicing and easy online payment for your clients. Many gateways offer tools to create payment links that can be sent directly to clients.

- Automate Reminders: Set up automatic reminders for overdue payments. Most software tools offer the ability to send gentle reminders, which can help you avoid manually chasing clients for payment.

- Integrate with Time Tracking Tools: By linking your time tracking system with your billing software, you can have the time worked automatically transferred into the billing document, ensuring accuracy and saving you the trouble of manual entry.

By automating these aspects of the billing process, you can not only reduce the administrative burden but also ensure a more consistent and professional approach to managing payments.

Legal Requirements for Hourly Billing

When billing clients based on the time spent on their projects, it’s important to ensure that all legal and regulatory requirements are met. This not only helps maintain professionalism but also ensures that you avoid legal issues related to incorrect billing practices. Certain legal obligations, such as providing accurate records and adhering to tax laws, should be considered to protect both your business and your clients.

Key Legal Considerations

Here are the main legal requirements you should be aware of when billing for time-based services:

| Requirement | Description | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Clear Terms and Conditions |

| Service Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consultation Service | 5 hours | $100 | $500 |

| Project Development | 10 hours | $120 | $1200 |

| Total Amount Due | Understanding Taxes in Hourly Billing

When charging clients for your time and services, it’s essential to account for applicable taxes. Taxes can significantly affect the final amount clients need to pay and influence the overall financial health of your business. Understanding how to calculate, apply, and report taxes properly ensures compliance with local regulations and helps you avoid potential legal issues. Types of Taxes to ConsiderDepending on your location and the nature of your services, various types of taxes may apply. Here are the most common ones:

How to Calculate and Apply TaxesCalculating and applying taxes correctly involves the following steps:

By understanding and properly applying taxes in your payment structure, you can ensure that your business stays compliant with the law while maintaining transparent and fair pricing for your clients. |