Invoice Template for Hourly Work Simple and Effective Billing Solution

For anyone offering services based on time spent rather than a fixed rate, having a reliable system to document and request payment is essential. The right approach can make the billing process smoother, ensuring transparency and helping avoid confusion with clients. A well-structured document not only outlines the hours spent on a project but also conveys professionalism and accuracy.

Customizing the structure of such a document is key to ensuring it fits the unique needs of both the service provider and the client. By tailoring the format, you can add or remove relevant details, adjust the layout, and create a document that feels organized and easy to follow. This flexibility ensures that every transaction is clearly understood.

Using a digital tool or a pre-designed form can significantly streamline the process, saving time and minimizing the chances of error. These solutions allow you to focus on the project itself, rather than getting bogged down by administrative tasks. Whether you are a freelancer, contractor, or consultant, understanding how to properly create and manage these documents is crucial to maintaining a healthy financial relationship with your clients.

Invoice Template for Hourly Work

Creating a clear and concise document to request payment based on time spent on a project is crucial for freelancers and service providers. A well-structured format helps both parties stay organized and ensures that the billing process is transparent. By including all necessary details, such a document can prevent misunderstandings and ensure that clients are billed accurately for the time dedicated to their tasks.

Key Information to Include

To create an effective billing statement, it’s important to include several key elements. First, list the total hours worked, along with a brief description of each task or project phase. This allows clients to understand exactly what they are paying for. Additionally, make sure to note the rate agreed upon, as well as any applicable taxes or additional fees that might apply.

Customizing Your Document

Every service provider has different needs, so personalizing this document is essential. Depending on the type of client and the specific nature of the project, some may prefer a simple breakdown of hours, while others may want more detailed information. The ability to adjust the layout and content can help you present a professional and clear request for payment.

Why Hourly Invoices Are Important

Clear billing is vital for maintaining a professional relationship between service providers and their clients. A structured document that accurately reflects the time spent on a project helps ensure fair compensation and fosters trust. Without a proper system to request payment based on time, both parties may experience confusion or disagreements.

Here are some key reasons why such billing documents are essential:

- Transparency: They provide clients with a clear breakdown of time spent on specific tasks, leaving no room for misunderstandings.

- Accountability: These records act as proof of the service provided and can help resolve disputes over the amount billed.

- Professionalism: Using a formal approach to requesting payment demonstrates organization and attention to detail, reflecting well on the service provider.

- Efficiency: A standard format speeds up the process, allowing providers to focus more on their tasks rather than administrative work.

Overall, such documents contribute to smoother business transactions, enabling both the client and provider to feel confident in the financial aspects of their collaboration.

How to Create an Hourly Invoice

Creating a document to request payment based on the time spent on a project is a straightforward process that requires careful attention to detail. This ensures that both the service provider and client are on the same page, minimizing any potential conflicts. A clear and organized structure makes the process easy to understand, and provides a transparent account of services rendered.

Follow these steps to build a well-organized billing statement:

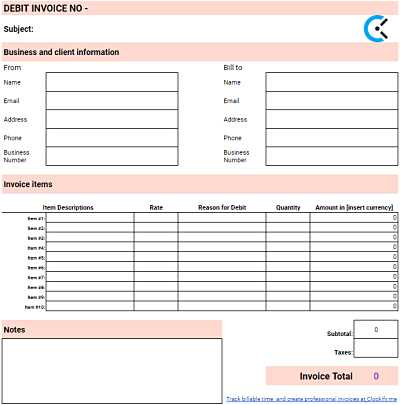

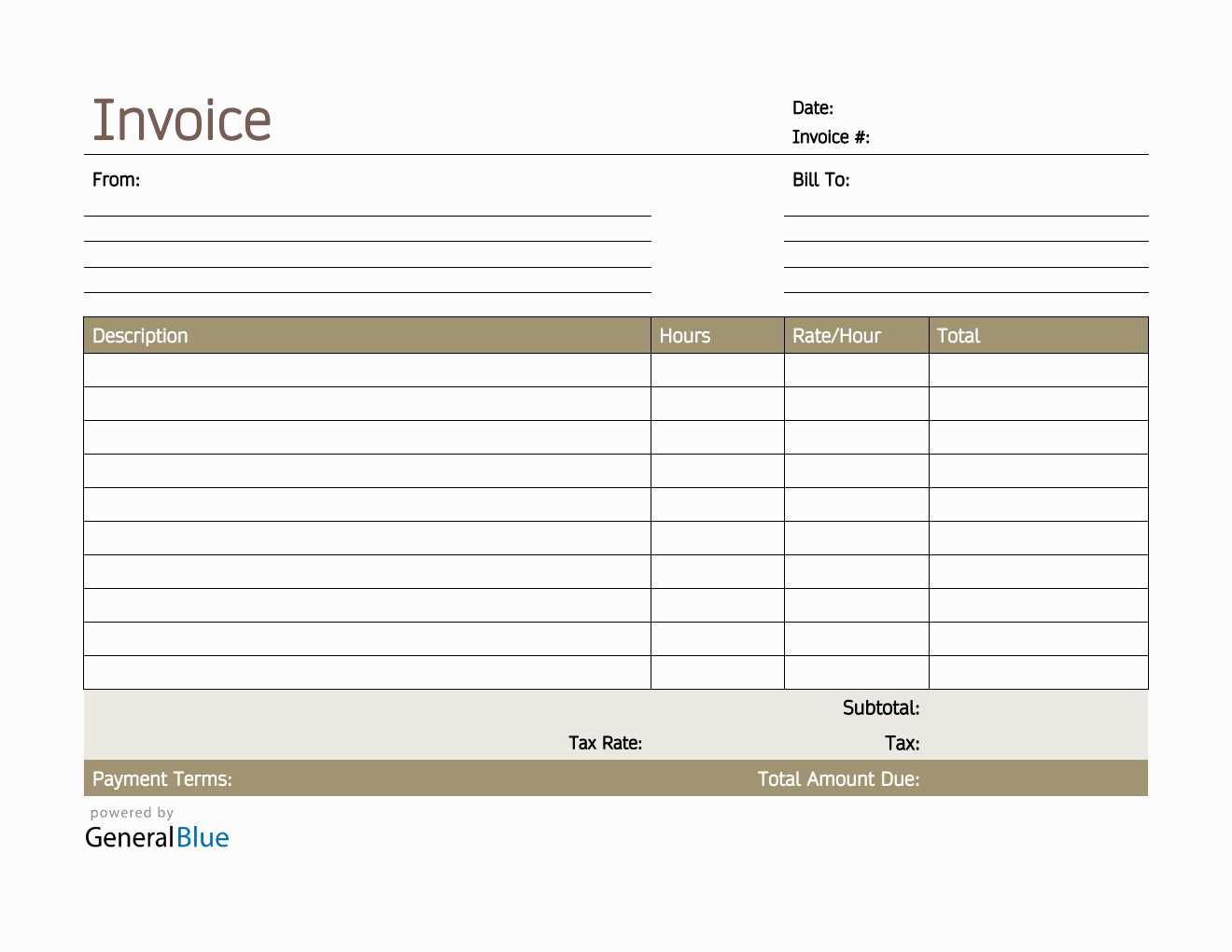

- Include your contact information: Start by listing your name, business name (if applicable), address, phone number, and email address at the top of the document.

- Provide the client’s details: Below your information, add the client’s name, company (if applicable), address, and contact details.

- Specify the project description: Include a short but detailed summary of the services provided, so the client understands the context of the charges.

- List the time spent: Break down the number of hours worked, specifying the date and a brief description of each task completed.

- State the rate: Clearly state the rate you’ve agreed upon for your services, and multiply it by the total hours to show the total amount due.

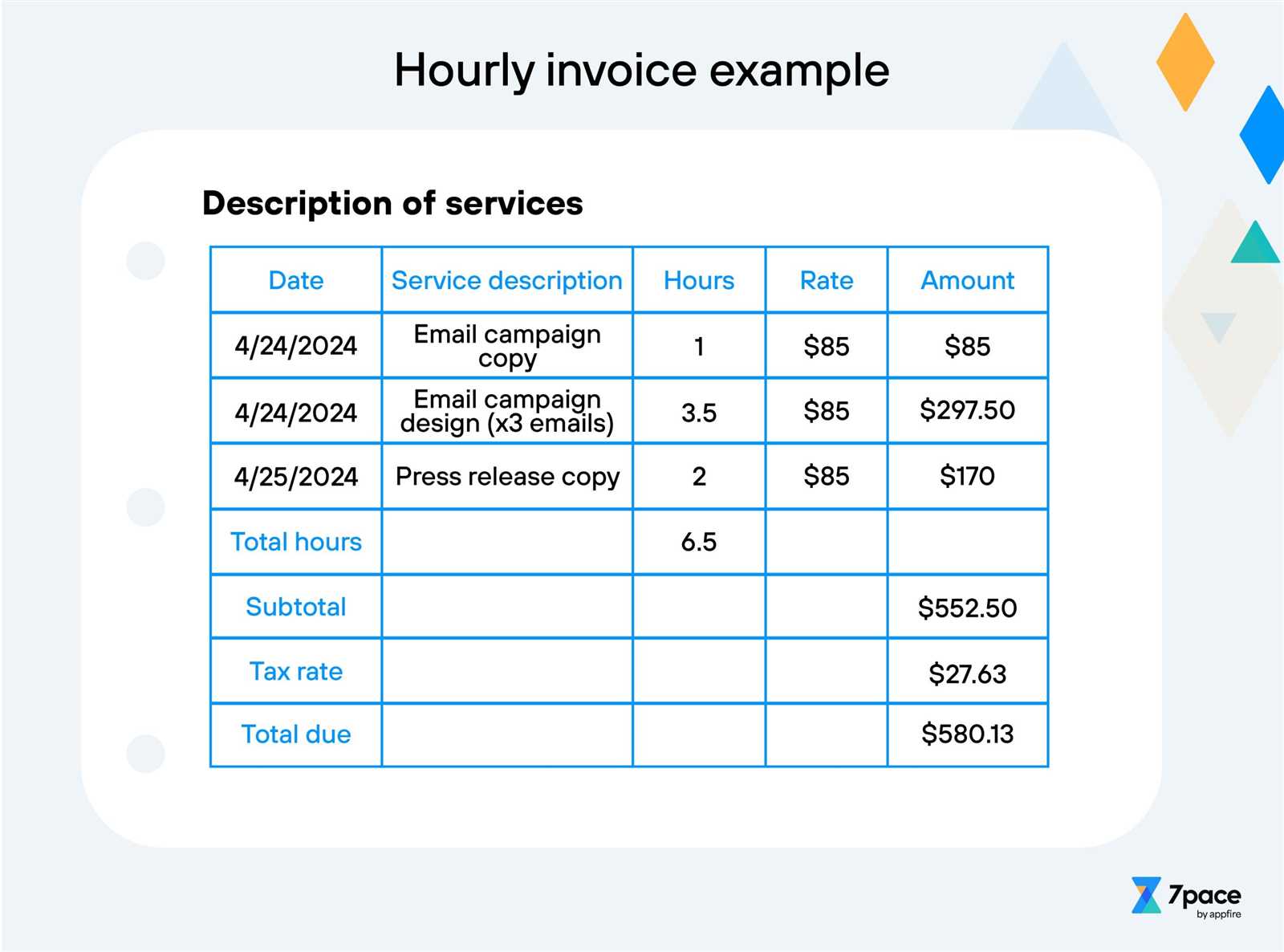

Here’s an example of how to structure the document in a clear, easy-to-read format:

| Date | Description of Services | Hours Worked | Rate | Total | ||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 01/10/2024 | Consultation and project pl

Essential Elements of an Hourly Invoice

To ensure that the billing process runs smoothly, certain components are essential when requesting payment for time-based services. These key elements provide clarity, prevent confusion, and protect both the service provider and the client. Without these necessary details, the chances of misunderstandings or payment delays increase significantly. Key Information to IncludeThe following are the most critical pieces of information to incorporate into your billing document:

Additional ConsiderationsBeyond the essential information, there are a few additional elements that can help streamline the process and further protect both parties:

By including these essential elements in your document, you ensure that both you Customizing Your Hourly Invoice TemplateCustomizing your billing document allows you to tailor it to your specific needs, creating a more professional appearance and ensuring that it meets both your and your client’s expectations. A well-designed statement not only enhances your brand image but also makes it easier to track payments, projects, and clients. Adapting the structure and content to suit your services can improve clarity and reduce the risk of errors or confusion. Here are some key customization options to consider when creating your document: Adjusting the Layout and Design

Including Additional Details

Flexibility for Different Clients

|