Professional Invoice Template for Graphic Designers

Every creative professional needs a streamlined system to request payment for their work. A well-organized billing structure not only ensures timely compensation but also reinforces professionalism. Whether you’re a freelance artist, illustrator, or visual expert, having a clear, easy-to-use document can simplify your workflow and keep your business operations running smoothly.

Efficiently managing financial transactions is essential for anyone offering services. A standardized form can help avoid confusion, reduce errors, and improve communication with clients. It’s not just about getting paid–it’s about presenting your work in a polished, business-like manner that fosters trust and credibility.

With the right approach, crafting these documents can be quick and simple, allowing you to focus on what truly matters–creating amazing visuals. By integrating essential details and maintaining consistency, you’ll ensure that your clients receive the information they need, while you stay on top of your payments and records.

Why Every Graphic Designer Needs an Invoice Template

Managing financial transactions efficiently is a crucial aspect of any creative business. Without a clear, consistent method for requesting payment, it’s easy for professionals to face confusion, delays, or even loss of revenue. Having a ready-made solution ensures that payments are processed smoothly, and that all the necessary details are communicated to clients in a professional manner.

Using a standardized document helps maintain consistency across all your projects. It saves time, reduces mistakes, and adds a level of professionalism that clients will appreciate. Instead of reinventing the wheel with each job, you can quickly customize the form to suit each project, ensuring all essential details are included.

The following table outlines the key benefits of having a structured billing document:

| Benefit | Description |

|---|---|

| Time-saving | Reduces the need to create a new format for each client, allowing you to focus on your creative work. |

| Professionalism | Enhances your image by presenting a clean, organized way to request payment, making your business look more credible. |

| Accuracy | Ensures all necessary details (like payment terms, dates, and project specifics) are included to prevent confusion. |

| Legal protection | Clearly defines payment terms, which can be important for resolving disputes or late payments. |

In short, a consistent system for financial documentation is essential for maintaining order and transparency in any business. It helps you stay organized and ensures that both you and your clients are on the same page when it comes to payment expectations.

Benefits of Using a Professional Invoice

Using a formal, well-structured billing document offers numerous advantages to anyone providing creative services. A professional approach not only ensures timely payments but also builds credibility and trust with clients. Whether you’re a freelancer or a small business, having a consistent, polished method of requesting compensation is a sign of professionalism that clients value.

Clarity and transparency are two of the most significant benefits. When you provide a clearly laid-out request for payment, there is less chance for misunderstandings or disputes. Clients can easily see the breakdown of services, associated costs, and deadlines, which leads to smoother transactions.

Consistency is another major advantage. A well-designed document allows you to maintain a uniform approach across all your projects. This consistency not only saves time but also reinforces your brand identity. With every job, you present yourself as organized and efficient, which helps build your reputation in the industry.

Additionally, using a formalized structure can help with financial tracking. By maintaining an organized system, you can easily track payments, monitor outstanding balances, and keep records of past work. This level of organization ensures that nothing falls through the cracks and helps you stay on top of your business’s financial health.

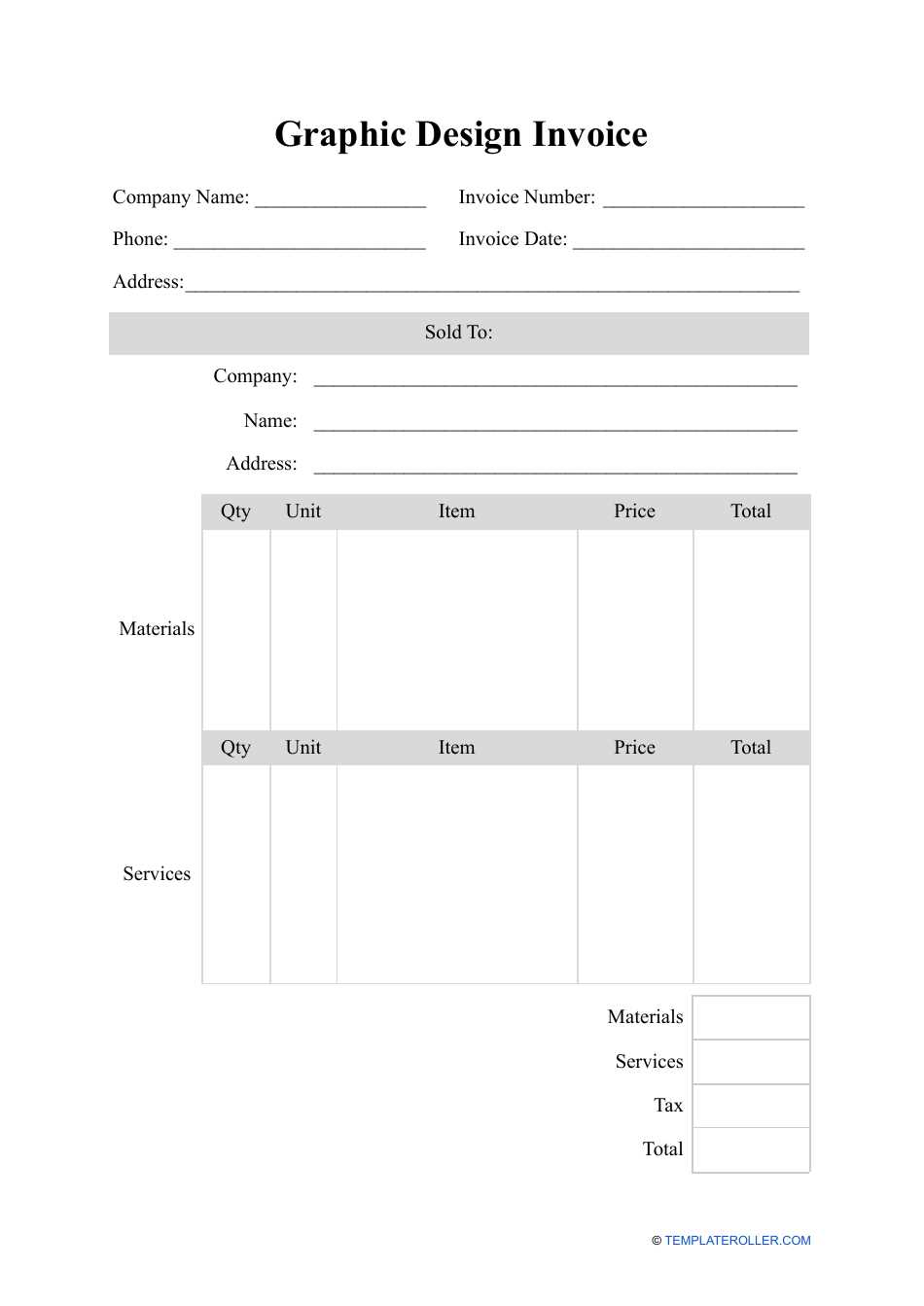

Key Elements of a Graphic Designer Invoice

When requesting payment for services rendered, it’s crucial to include all necessary details to ensure transparency and avoid confusion. A clear and organized document not only helps with client communication but also ensures that you receive the correct compensation. The following are the essential components to include in your billing document.

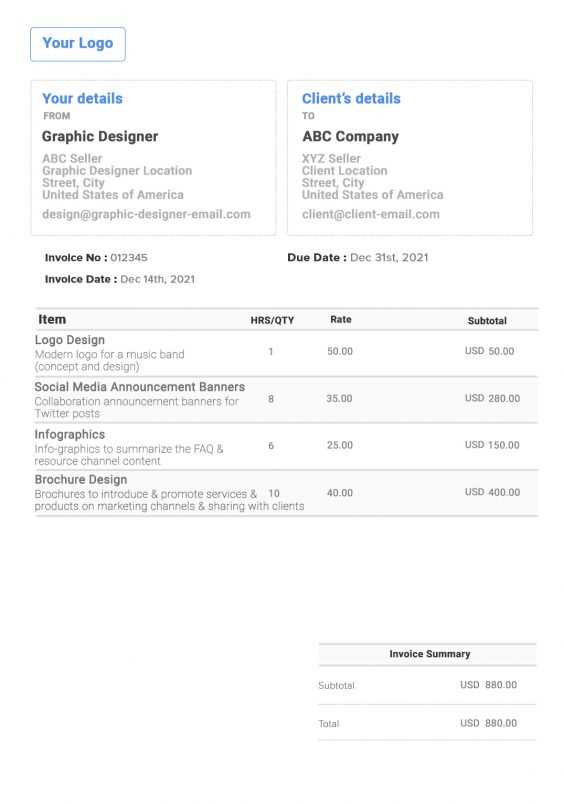

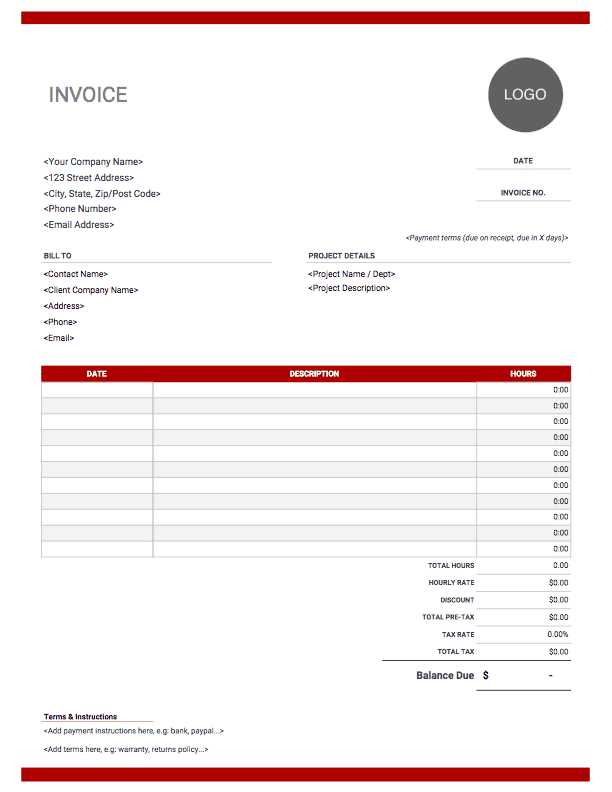

Client and Project Information

Start by including the basic details of both parties involved. This includes the name, address, and contact information of both you and your client. It’s also important to specify the project name or description, as this makes it easier to track different jobs and ensure accuracy in the billing process.

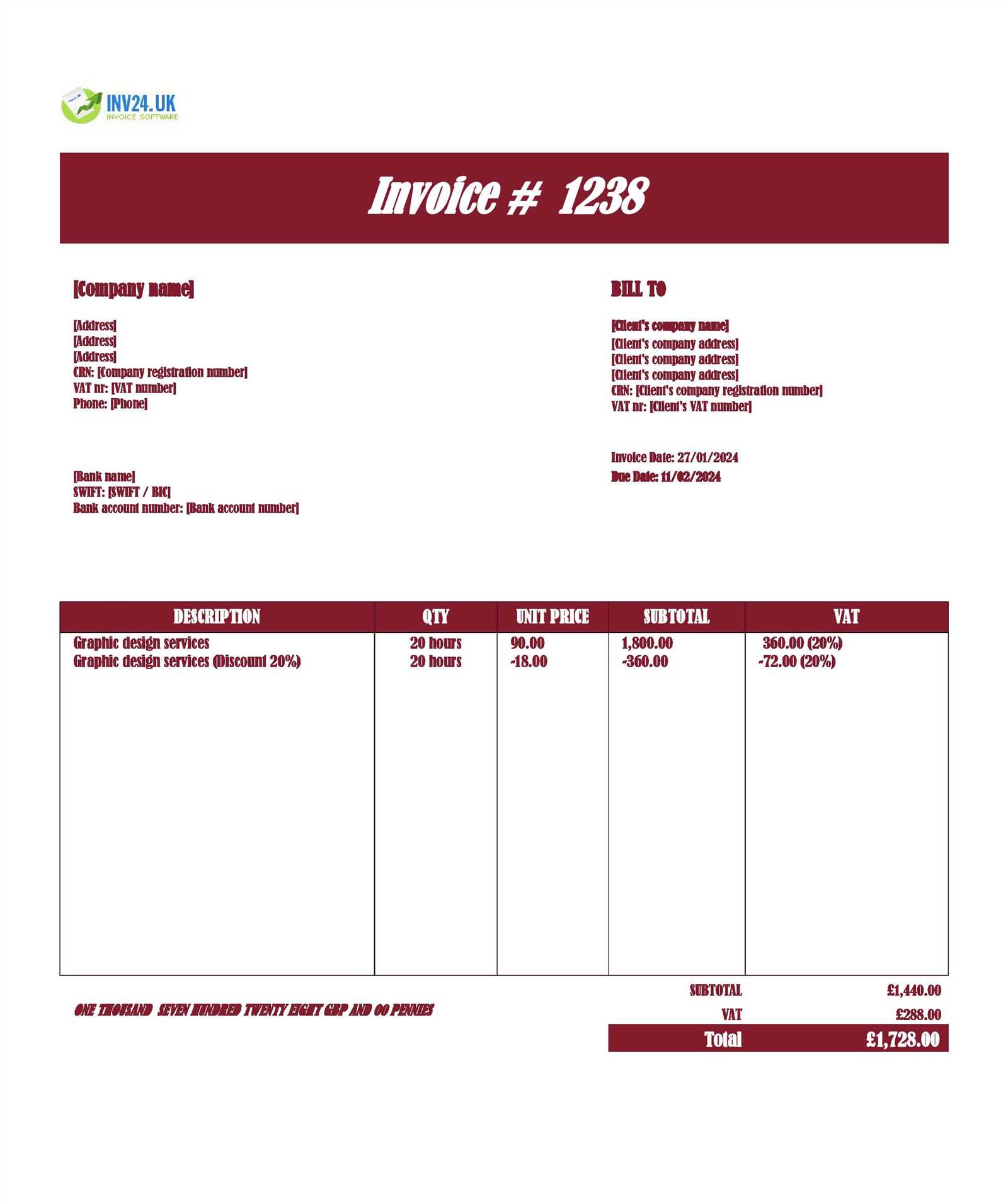

Breakdown of Services and Pricing

Clearly outline the services provided and their associated costs. This section should break down the hours worked, hourly rate (if applicable), and any additional fees or expenses related to the project. This ensures that the client understands exactly what they are being charged for and can prevent any misunderstandings.

How to Customize Your Invoice Template

Adapting a billing document to suit your specific needs is essential for streamlining your payment process. Customization allows you to personalize the layout, incorporate branding, and ensure that all relevant details are presented in a clear and professional manner. Tailoring this document to reflect your style and business approach can also help create a lasting impression on your clients.

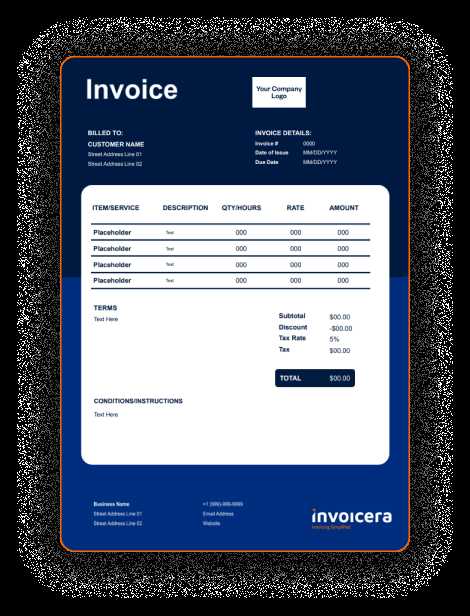

Personalizing the Layout and Design

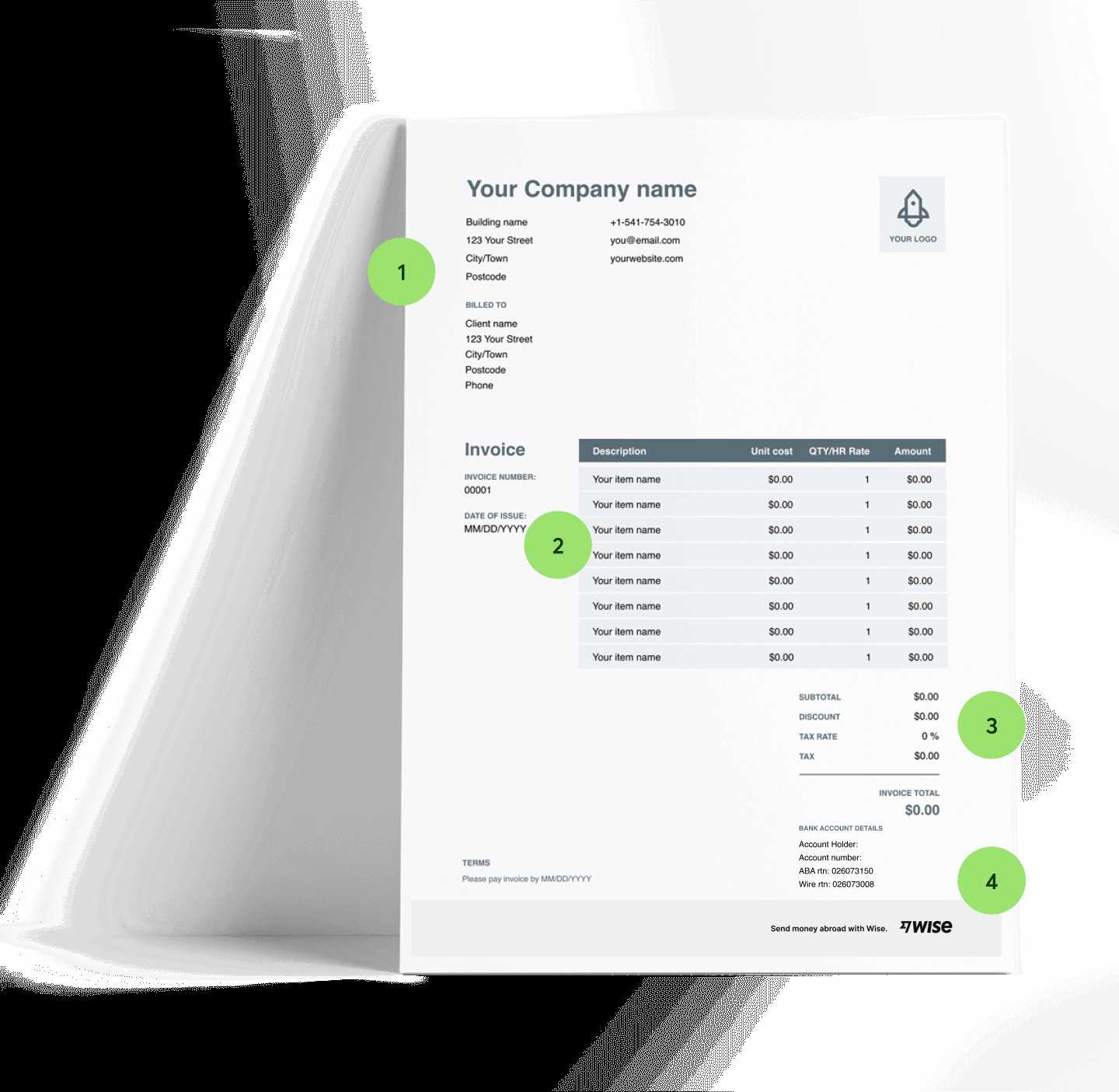

The layout of your document should be clean, simple, and easy to read. Here are some elements to consider when customizing the design:

- Logo and Brand Colors: Include your logo and use your brand’s colors to make the document reflect your business identity.

- Font Style and Size: Choose legible fonts that match your brand style. Consistency in font usage helps maintain a professional appearance.

- Header and Footer: Customize the header with your business name, logo, and contact details. The footer can include your payment terms and additional contact information.

Adjusting the Information Sections

Beyond design, you’ll need to ensure the content is tailored to fit each project. Customize the following sections to suit your needs:

- Client and Project Information: Always update the client’s details and project description. This ensures clarity and avoids confusion.

- Service Breakdown: If certain projects require specific services, make sure to include detailed descriptions of each task and their associated costs.

- Payment Terms and Methods: Clearly outline how and when you expect payment, as well as the payment methods you accept.

By making these adjustments, you ensure that your billing document is not only a tool for payment but also a representation of your professional image and approach.

Free vs Paid Invoice Templates for Designers

When managing a creative business, professionals often find themselves deciding between free or premium options for billing documents. Each choice presents unique advantages and potential drawbacks. While some may be content with basic layouts that cover fundamental needs, others might seek advanced features and customization that come with paid alternatives. Understanding the key differences can help determine the best option depending on your business model, volume of work, and desired level of professionalism.

Free Options: Simplicity and Accessibility

Free billing solutions are widely accessible and often serve as a good starting point for those just beginning their professional journey. These basic formats usually come with essential fields to fill out, such as client information, services rendered, and payment terms. They can be downloaded or accessed from various websites without any financial commitment. However, these simple tools might lack the ability to fully brand your business or accommodate advanced invoicing needs like recurring payments or multi-currency options.

Paid Solutions: Advanced Features and Customization

Investing in a premium solution often provides more flexibility and enhanced functionalities. With paid systems, you can expect to receive polished, customizable documents that reflect your business identity, including logo placement, color schemes, and personalized fonts. These advanced systems may also offer features such as automated reminders, integrated payment gateways, and detailed analytics. While they come at a cost, these extras can be invaluable for streamlining workflows and maintaining a professional image in front of clients. Ultimately, a paid option could save time and reduce the risk of errors in the long run.

Choosing the Right Format for Your Invoices

Selecting the appropriate structure for your billing documents is crucial in presenting a professional image and ensuring smooth transactions. The format should not only reflect your personal or business brand but also meet the needs of your clients. Whether you prefer a simple, minimalistic approach or a more detailed, customized layout, the design and structure play a significant role in maintaining clarity and organization throughout the payment process.

Consider whether a basic document is sufficient for your needs or if a more complex design would enhance the overall experience. A streamlined layout might work well for short-term projects, while ongoing work may require a more robust approach with additional features like recurring payment options or time-tracking fields. The choice of format can impact both your workflow and the impression you leave on your clients, making it essential to strike the right balance between functionality and aesthetic appeal.

Common Mistakes When Creating Invoices

Even seasoned professionals can overlook certain details when preparing billing documents, which can lead to confusion or delays in payments. Small errors can have a significant impact on client trust and business operations. By being aware of the most common pitfalls, you can ensure that your documents are clear, accurate, and professional.

1. Missing Key Information

One of the most frequent issues is failing to include essential details. These missing elements can cause unnecessary delays or miscommunication. Make sure to include:

- Client name and contact information

- Your business name and contact details

- A clear description of the services or products provided

- Payment terms, including due dates

- The total amount due and any taxes applied

2. Lack of Consistency in Format

Inconsistent formatting can create confusion and make your documents look unprofessional. Ensure that:

- Your layout is clear and organized, with headings and sections that are easy to read

- Fonts, colors, and design elements are consistent with your brand

- There is a uniform style for dates, numbers, and amounts

These mistakes may seem minor, but they can cause misunderstandings that harm both client relationships and cash flow.

How Invoices Improve Client Relationships

Clear and professional billing documents can play a vital role in fostering strong relationships with clients. By providing transparency, demonstrating professionalism, and ensuring clarity, these documents help build trust and establish a solid foundation for future collaborations. Well-crafted billing documents are not only essential for receiving payment but also reflect your commitment to accuracy and your client’s satisfaction.

A properly structured bill provides clients with a sense of security, knowing that they can easily understand what they are being charged for and the terms of payment. This transparency can reduce misunderstandings and prevent disputes, allowing both parties to focus on the work itself rather than financial issues.

| Benefit | How It Improves Relationships |

|---|---|

| Transparency | Clear breakdowns of services and costs build trust and prevent confusion. |

| Professionalism | Well-organized and polished documents reflect a high level of expertise. |

| Consistency | Consistent formatting and terminology provide a sense of reliability and predictability. |

| Timeliness | Sending accurate and timely documents shows respect for the client’s time and reinforces your commitment to the partnership. |

By taking the time to create thorough and precise documents, you demonstrate respect for your clients, leading to more successful and long-lasting business relationships.

Best Invoice Template Software for Designers

Choosing the right software to create billing documents can significantly enhance the workflow of creative professionals. The right tool can streamline the process, ensuring that all necessary details are included while maintaining a polished and professional look. Whether you need basic functionality or advanced features like automation and analytics, the right platform can save time and reduce errors, allowing you to focus more on your craft.

Here are some of the best tools that can help you create precise and visually appealing documents:

- FreshBooks: Known for its user-friendly interface, FreshBooks allows for easy customization and automatic tracking of payments. It’s ideal for professionals looking to create elegant documents and track their financial status in one place.

- QuickBooks: QuickBooks offers comprehensive features, including invoice creation, expense tracking, and client management. Its ability to integrate with other accounting tools makes it a great option for those who need an all-in-one financial solution.

- Zoho Invoice: With flexible design options and automation tools, Zoho Invoice helps simplify the billing process. It’s a great choice for freelancers and small business owners looking to create custom invoices with minimal effort.

- Wave: This free platform is ideal for those just starting out. It provides all the necessary features, from customizable billing documents to payment tracking, without any hidden costs.

- AND.CO: Tailored for creative professionals, AND.CO offers invoicing, time tracking, and contract management in a simple, easy-to-use interface. Its intuitive system allows for quick creation of professional billing documents.

These platforms are designed to fit various needs, from simple invoicing to advanced business management, and can greatly improve the efficiency of handling payments and financial data.

How to Organize Your Invoices Efficiently

Efficiently managing billing documents is essential for maintaining a smooth workflow and ensuring timely payments. An organized approach not only saves time but also helps you stay on top of outstanding balances, deadlines, and client records. With the right system in place, you can easily track financial transactions, reduce the risk of errors, and ensure your clients receive their statements promptly and accurately.

Here are some tips to help you keep your billing records organized:

- Create a Clear Naming System: Use a consistent naming convention for each document. For example, include the client’s name, the project or service provided, and the date in the file name (e.g., “JohnDoe_WebDesign_2024-10”). This will make it easier to find and reference specific documents.

- Use Folders or Categories: Organize your documents into specific folders or categories (e.g., “Paid,” “Unpaid,” or by client or project). This will allow you to quickly access what you need without sifting through disorganized files.

- Utilize Digital Tools: Consider using accounting software or cloud storage solutions to store and organize your files. These platforms often come with built-in features for sorting, searching, and automating processes like payment tracking and reminders.

- Track Due Dates: Set up reminders or use a calendar to track payment deadlines. This will help ensure that you follow up with clients on time and avoid overdue payments.

- Maintain a Backup System: Always keep a backup of your documents, either digitally or in physical form. This ensures that your records are safe and accessible in case of a system failure or data loss.

By implementing these simple strategies, you can save valuable time, reduce stress, and ensure that your financial records are always in order.

Integrating Payments into Your Invoice Template

Integrating payment options directly into your billing documents can simplify the process for both you and your clients. By making it easy for clients to pay upon receiving the document, you can reduce delays and streamline the payment collection process. Offering multiple payment methods and clearly indicating payment instructions ensures that clients have the flexibility to settle their balance quickly and conveniently.

Here are some effective ways to incorporate payment options into your billing documents:

- Include Clear Payment Instructions: Ensure your document clearly states how and where clients can make payments. This can include bank details, PayPal links, or other payment platforms like Stripe or Square.

- Offer Multiple Payment Methods: Providing different payment options (credit card, bank transfer, online payment systems) increases the likelihood of receiving payments quickly, as clients can choose the method most convenient for them.

- Embed Payment Links: If you use an online payment processor, consider embedding direct payment links within the document. This way, clients can simply click the link to pay their balance instantly.

- Set Clear Payment Terms: Specify the due date, late fees, or any discounts for early payment. This helps clients understand when payments are expected and the consequences of delays.

- Enable Recurring Payments: For long-term projects or clients on a subscription basis, integrate recurring payment options. This way, you can automate billing and ensure payments are processed on a set schedule.

By incorporating these payment features into your documents, you not only make it easier for clients to pay but also help speed up your cash flow, ensuring smoother financial operations.

Legal Considerations for Designer Invoices

When preparing billing documents, it is crucial to ensure they comply with legal requirements to avoid disputes or complications down the line. These records not only serve as proof of the transaction but also protect both parties by clearly outlining the terms and conditions agreed upon. Adhering to the proper legal standards ensures that your business remains professional, transparent, and in line with local regulations.

Here are some important legal factors to consider when creating billing documents:

- Include Accurate Business Information: Make sure your business name, address, tax identification number (TIN), and contact details are clearly stated. This establishes credibility and helps clients easily reach you if necessary.

- Clearly Define Payment Terms: Specify the due date, any late fees, and acceptable payment methods. Ensure that these terms are in line with your contract or agreement with the client to avoid misunderstandings.

- List All Services Provided: Itemize the services or products delivered, including quantities and pricing. This helps both you and your clients reference specific charges in case of a dispute.

- Comply with Tax Laws: Ensure that applicable taxes are included, such as VAT or sales tax. These must be calculated according to the jurisdiction in which your business operates. Failure to include the correct tax information could lead to penalties.

- Retention of Records: Keep copies of all billing documents for a specified period, as required by local laws. This is essential for tax reporting and resolving any future disputes.

- Obtain Signed Agreements: Whenever possible, attach a signed contract or agreement that outlines the terms of service. This protects both you and your client by ensuring all terms are agreed upon beforehand.

By following these legal guidelines, you can protect your business, avoid potential conflicts, and create professional records that reflect your commitment to integrity and transparency.

How to Handle Late Payments with Invoices

Late payments can be a common challenge for many professionals, especially when managing projects with multiple clients. A delayed payment can disrupt cash flow and create unnecessary tension between you and the client. Having a clear, structured approach to handling overdue payments is essential to maintaining both your financial stability and professional relationships. Establishing clear payment terms upfront and setting protocols for following up on late balances will help minimize issues and ensure smoother transactions.

1. Establish Clear Payment Terms

The first step in preventing late payments is to set clear expectations from the beginning. Make sure your clients are fully aware of the payment deadlines, accepted payment methods, and any penalties for overdue payments. Some important considerations include:

- Specify Payment Due Dates: Clearly state when payment is expected, whether it is within 30 days, 60 days, or another agreed-upon period.

- Outline Late Fees: Include any late fees or interest charges that will apply if payments are not received on time. This serves as a deterrent for delays.

- Define Payment Methods: Specify which payment methods you accept, such as bank transfer, credit card, or online payment systems, to avoid any confusion later.

2. Handle Overdue Payments Professionally

If a payment is late, it is important to address it in a professional and respectful manner. Here’s how you can approach the situation:

- Send a Friendly Reminder: Start by sending a polite reminder as soon as the payment becomes overdue. Sometimes, clients simply forget or are busy, so a gentle nudge can resolve the issue quickly.

- Follow Up with a Formal Notice: If the payment is still not made after the first reminder, send a more formal notice outlining the overdue amount, the payment deadline, and any applicable late fees.

- Set Up Payment Plans: In cases where a client is struggling to pay the full amount, offering a payment plan can help both parties avoid conflict and ensure you still receive compensation.

- Enforce Penalties: If the payment continues to be delayed despite reminders, it may be necessary to enforce late fees or interest charges as specified in your original agreement.

By having a clear strategy in place for handling late payments, you can keep your cash flow consistent while maintaining positive relationships with your clients.

How to Keep Track of Your Invoice History

Maintaining a record of past payments and client transactions is essential for managing finances effectively. Organizing records in a clear, systematic way helps to avoid any confusion about received payments, outstanding balances, or follow-up tasks. Developing an efficient tracking method allows for easy access to all past documentation whenever it’s needed.

Consider using a dedicated digital system to organize all records chronologically or by client, which makes it simple to retrieve specific data. Regularly updating and reviewing these records can ensure that no payment is overlooked and that any necessary adjustments can be made promptly. Establishing a clear, organized process from the start is key to keeping financial information consistent and accessible.

How to Create Professional Invoices Quickly

Producing well-organized and professional payment requests promptly can make a strong impression on clients and streamline your workflow. Developing a quick and effective system to generate these documents ensures that your time is spent efficiently while maintaining a polished, consistent presentation.

Use Ready-Made Layouts and Automation

One of the easiest ways to accelerate the creation process is by using pre-designed layouts or automated tools. These solutions allow you to enter the necessary details quickly and produce a finished document that looks both clean and professional. Automation can also help minimize errors, ensuring that essential details like client information and payment terms are correct and complete.

Keep Essential Details Organized

Ensuring that all essential information is easy to access helps to avoid delays. Create a centralized record of client details, payment conditions, and pricing structures, so that all you need is readily available. This approach will not only save time but also add a sense of

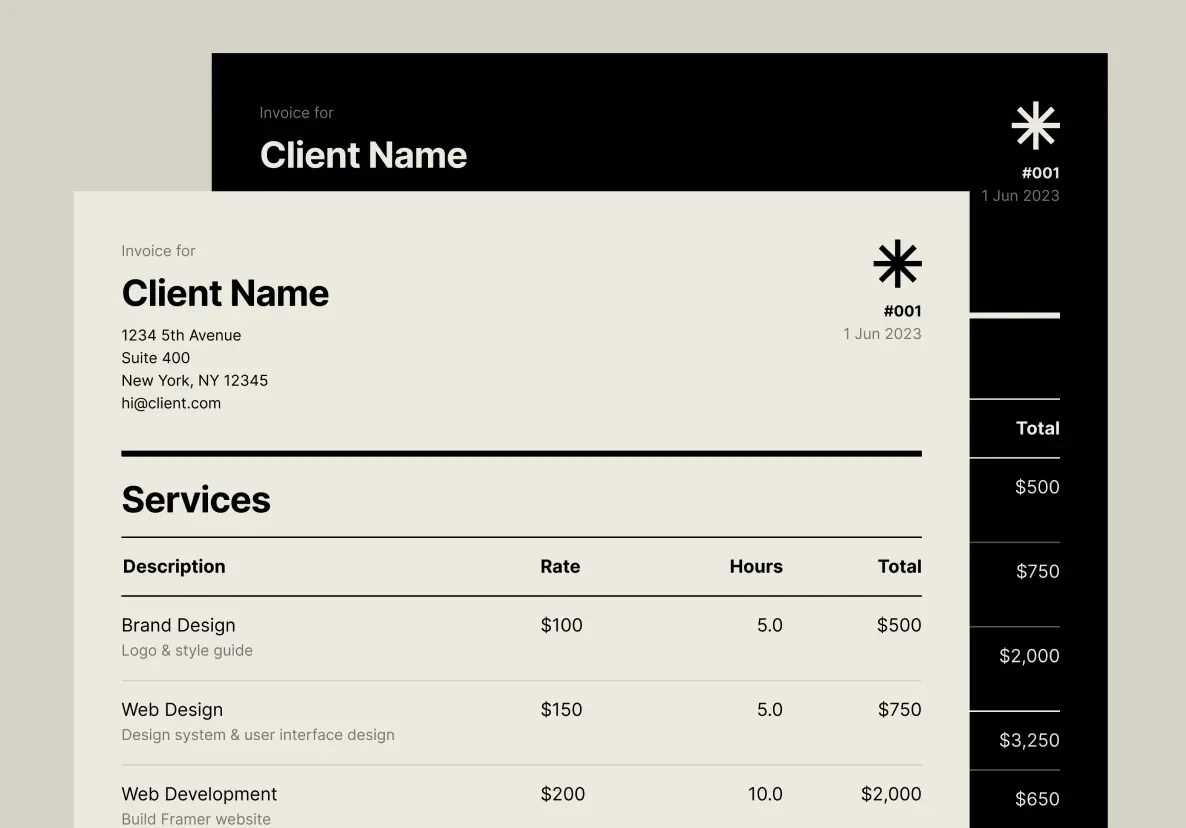

Design Tips for Visually Appealing Invoices

Crafting a visually pleasing document for client transactions can enhance the impression of professionalism and make the payment process smoother. A clear, attractive layout not only improves readability but also reflects a polished brand image, which clients will appreciate.

Choose a Clean Layout

A simple, uncluttered layout is essential. Use ample white space and organize elements logically to guide the eye through the details without overwhelming the reader.

- Headers and Sections: Break down information into distinct sections, such as contact details, payment terms, and itemized services. Clear headers help clients locate important information easily.

- Consistent Fonts and Colors: Stick to one or two fonts for a professional look. Choose colors that align with your brand, but keep them subtle to ensure clarity.

Focus on Key Elements

Highlighting