Invoice Template for Freelance Writers Simple and Professional Solutions

Managing financial transactions is a crucial part of any independent career, especially when it comes to receiving compensation for services rendered. Clear and professional documentation not only ensures timely payments but also helps maintain strong relationships with clients. Having a reliable way to outline charges and terms is essential for avoiding misunderstandings and ensuring smooth business operations.

With the right tools, invoicing becomes a streamlined task that saves time and energy. Customizable documents allow you to detail your work, rates, and deadlines in a way that reflects your professionalism. By using structured formats, you can ensure that all necessary information is communicated clearly, making the payment process easier for both you and your clients.

Effective billing methods are essential for any professional looking to maintain a high standard of service. Whether you are just starting or have years of experience, having a standardized way to request payment will set you apart and add to the overall credibility of your business.

Invoice Template for Freelance Writers

Having a clear and professional way to request payment is essential when working as an independent professional. The right document ensures you can outline services provided, agreed-upon rates, and payment terms. By using an organized structure, you can make the process simple for both you and your client, reducing the chances of misunderstandings or delays in payment.

Key Components to Include

Every payment request should contain several critical pieces of information. These details not only help clients understand the charges but also protect your interests in case of disputes. Below are the most important elements to include in your billing document:

| Section | Description |

|---|---|

| Contact Information | Your name, business name (if applicable), address, and contact details. |

| Client Information | The client’s name, company name (if relevant), and contact details. |

| Work Description | A detailed list of services provided, including project name, scope, and deliverables. |

| Payment Terms | Clearly state due dates, rates, and any late fees or discounts for early payment. |

| Amount Due | The total amount owed, broken down by service or hourly rate if necessary. |

Why Structure Matters

Why Freelance Writers Need Invoices

When working independently, it’s essential to have a formal way to request payment for the services provided. This not only ensures that you are compensated promptly but also establishes your credibility and professionalism in the eyes of clients. Without a clear method to outline the terms of payment, there could be confusion or delays that impact your cash flow and business relationships.

Here are some key reasons why having a formal payment request is important:

- Clear Communication: A well-documented payment request helps you outline the details of your work, rates, and payment terms, leaving no room for ambiguity.

- Professionalism: Sending a formal document demonstrates that you take your business seriously and expect the same level of professionalism from your clients.

- Legal Protection: In the event of a dispute, having a clear record of agreed-upon services and terms can serve as legal evidence if necessary.

- Organized Record-Keeping: By issuing payment requests consistently, you can keep track of your earnings and stay organized, making it easier to handle taxes and future business planning.

- Faster Payments: A well-structured document can help clients process your payment quickly, reducing the risk of delays.

Ultimately, using a structured approach to request payments not only helps ensure you receive the compensation you’re owed but also builds your reputation as a reliable and professional independent contractor. This simple step can make all the difference in establishing trust with clients and growing a successful business.

Essential Elements of an Invoice

A well-structured document requesting payment should contain specific details to ensure clarity and prevent misunderstandings. These key components allow both you and the client to have a clear understanding of the work completed, the amount owed, and the payment terms. Including these elements not only streamlines the process but also reflects your professionalism.

Here are the most important sections to include in your billing document:

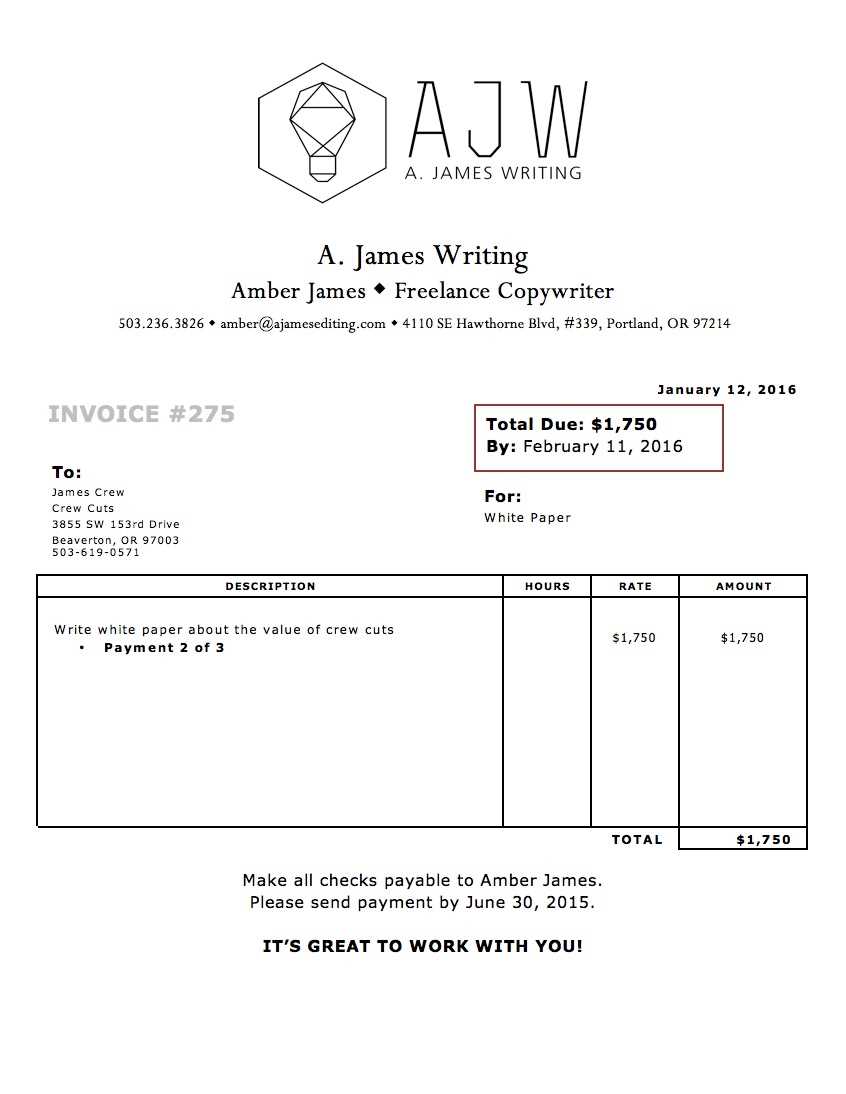

- Contact Information: Both your details and those of the client should be clearly listed at the top of the document. This includes names, addresses, phone numbers, and email addresses. Having this information easily accessible ensures that both parties know exactly who to contact if there are any questions.

- Unique Identification Number: Assigning a unique number to each request helps keep your records organized and allows both you and the client to reference specific transactions easily. This can also be helpful for tracking payments and creating a streamlined financial system.

- Work Description: This section outlines the specific services provided, along with a brief description of the scope and any key deliverables. Detailing what has been completed makes it clear what the client is paying for and helps avoid confusion.

- Payment Terms: Clearly state your payment policies, such as the due date, accepted methods of payment, and any late fees or discounts. This ensures that both you and the client are on the same page regarding expectations and timelines.

- Total Amount Due: Break down the charges clearly, whether it’s by hourly rate or fixed fee. Be transparent about how the total is calculated to avoid any discrepancies. You can also list taxe

How to Create a Simple Invoice

Creating a straightforward payment request doesn’t have to be complicated. By following a few basic steps, you can craft a document that is both professional and easy for your client to understand. A simple and clear structure will ensure you are paid on time without unnecessary confusion.

Here is a step-by-step guide to creating a basic payment document:

Step Action 1. Add Contact Information Include your full name, address, and contact details, as well as your client’s contact information. 2. Assign a Unique Number Create a unique reference number for each document, making it easier to track payments and maintain records. 3. Detail Services Provided Clearly describe the work you completed, specifying tasks, projects, or hours worked. 4. State Payment Terms Outline when the payment is due, your accepted payment methods, and any late fees if applicable. 5. List Amount Owed Break down the charges into individual items (if necessary) and include the total amount due at the bottom. By following these simple steps, you can easily create a payment request that covers all essential information. This approach will not only make the process more efficient but also enhance your professionalism in the eyes of your clients.

Common Mistakes to Avoid in Invoices

When preparing a billing document, it’s essential to ensure accuracy and professionalism. Many individuals make preventable errors that can delay payment or cause confusion. Being aware of these missteps and correcting them beforehand can save time and foster better business relationships.

1. Missing or Incorrect Contact Details

One of the most common issues is failing to provide accurate or complete contact information. Always double-check that your name, business address, and payment details are correct. Omitting or misstating these could result in delays or issues with payment processing.

2. Lack of Clear Payment Terms

Another critical point is not specifying clear terms regarding payment deadlines and methods. Without this information, clients may be unsure of when and how to make the payment, leading to misunderstandings or late payments. Make sure to include precise dates and any applicable late fees if necessary.

Benefits of Using Invoice Templates

Adopting a structured and consistent method for billing can save significant time and reduce errors. By utilizing a pre-designed document structure, one can ensure that all necessary information is included in a clear, organized manner. This not only streamlines the process but also presents a professional image to clients.

1. Time Efficiency

One of the main advantages of using a pre-made structure is the time saved on creating a new document from scratch each time. With a ready-to-use format, you can focus more on the work itself and less on administrative tasks.

- Predefined fields help quickly input important details.

- Eliminates the need for repetitive formatting and design adjustments.

- Standardized approach reduces decision fatigue, allowing faster document generation.

2. Improved Accuracy and Consistency

Another significant benefit is the consistency it brings to the billing process. Using a set structure reduces the risk of missing important details or making mistakes. Each document will include the same required elements, ensuring that everything is clear and accurate.

- Reduces the chances of omitting critical information, such as payment terms or project descriptions.

- Ensures uniformity across all documents sent to clients.

- Reduces human error by automatically filling in standard fields.

How to Customize Your Invoice Template

Tailoring your billing documents to fit your specific needs is a simple yet effective way to maintain professionalism and ensure clarity. Customizing allows you to reflect your brand, accommodate different services, and include all relevant details. Here are the key steps to make sure your document is uniquely suited to your business.

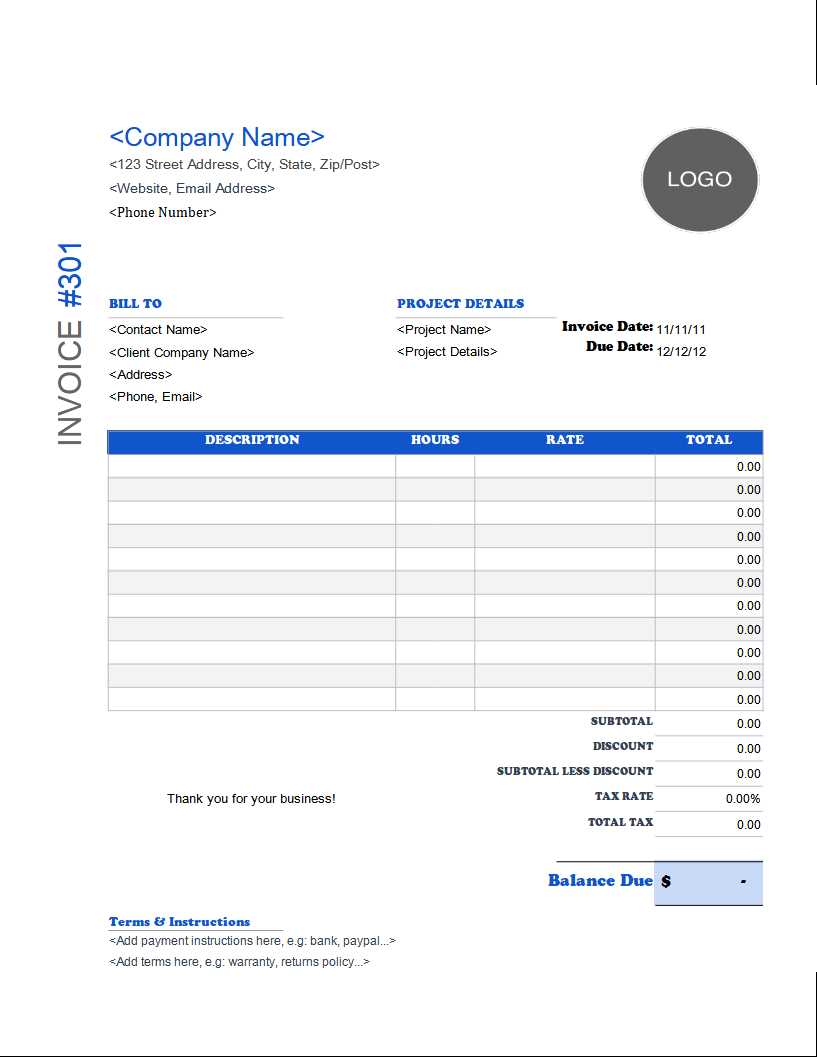

1. Adjust the Layout and Design

Start by personalizing the overall look of the document. You can modify the layout to match your branding, adding your logo or adjusting the color scheme to make it more visually appealing.

Customization Options Benefits Logo inclusion Enhances brand recognition and professionalism Color adjustments Aligns with brand identity and makes the document visually appealing Font choices Improves readability and consistency across all documents 2. Include Detailed Service Descriptions

Ensure your document clearly outlines each service provided, along with corresponding rates and quantities. You can add detailed descriptions for each task, helping clients understand exactly what they are paying for.

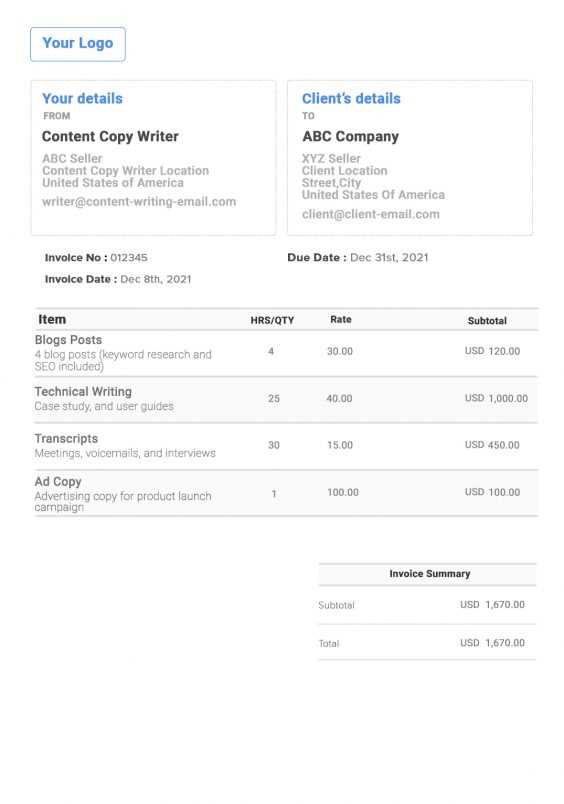

Service Description Unit Freelance Invoice Formats Explained

There are various ways to structure your billing documents, and the format you choose can impact how easily clients process payments. Each format serves different purposes, so understanding which one to use depending on the situation is crucial for smooth transactions. Below, we’ll explain the most common structures used in professional transactions.

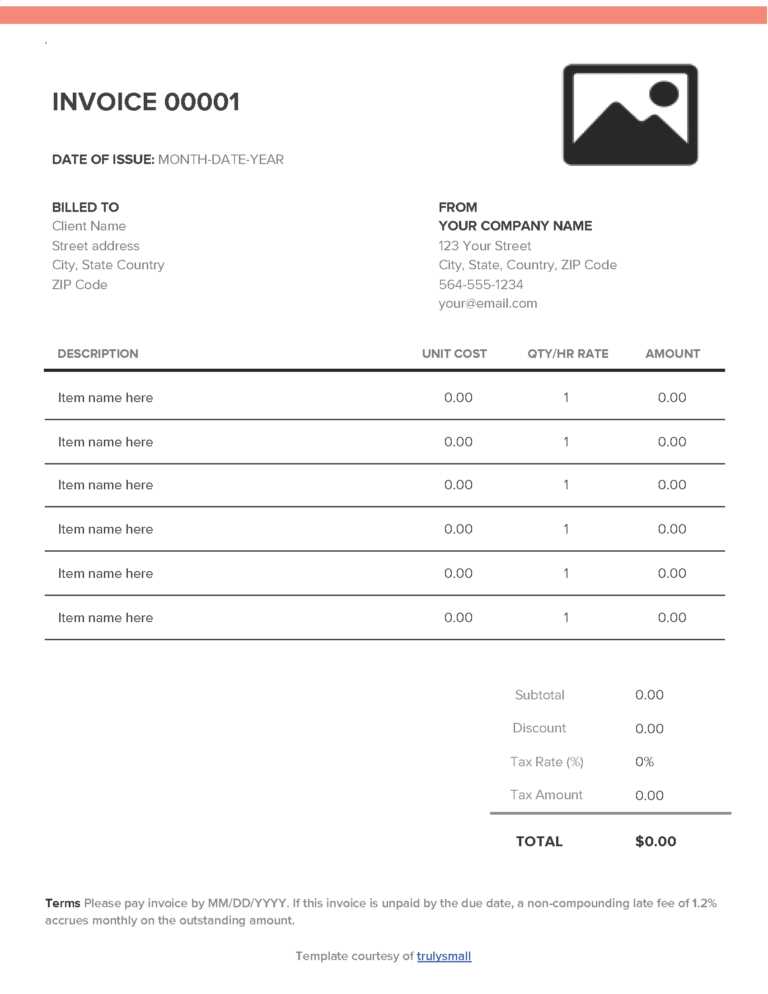

1. Basic Format

The simplest format typically includes only the essential details: your name, contact information, service description, and payment instructions. This format is straightforward and works well for short-term or one-time projects where little additional detail is needed.

- Client’s name and contact details

- Clear service breakdown

- Total cost and payment terms

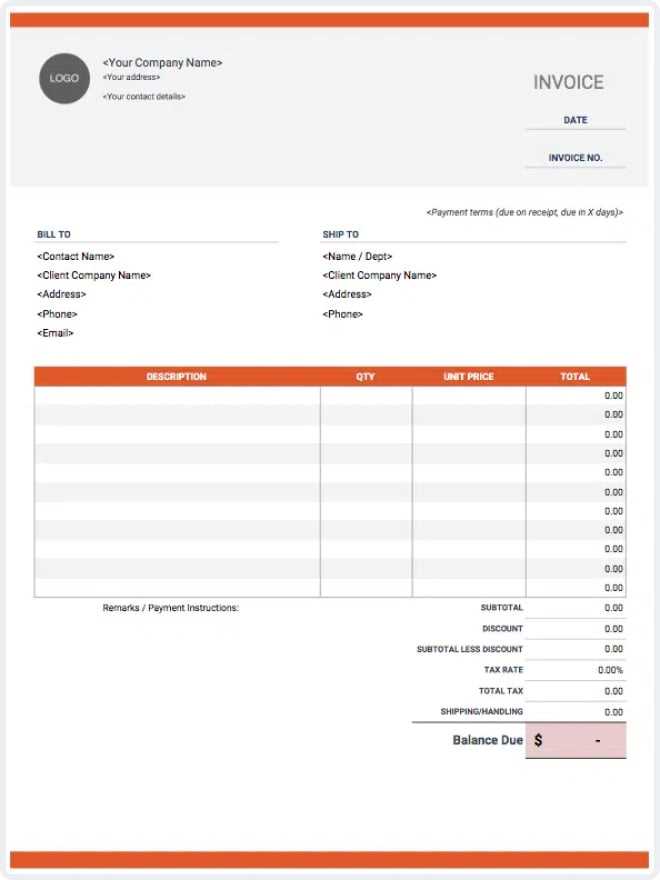

2. Itemized Format

For more complex projects, an itemized format is beneficial. This structure breaks down each task or service provided, specifying the rate and hours worked. This transparency helps clients understand exactly what they’re paying for and can reduce the likelihood of disputes.

- Detailed descriptions of each task or service

- Hourly or flat-rate charges for each item

- Subtotal for each service and a total amount

Legal Requirements for Freelance Invoices

When creating a billing document, it’s essential to ensure that it meets local legal standards. Certain information must be included to comply with tax regulations and avoid potential disputes. Understanding these requirements not only protects your business but also helps establish credibility with clients and authorities.

Depending on your location and the nature of your services, specific details should be included to ensure compliance with the law. This may include tax identification numbers, business registration details, and clear payment terms. Failure to include the necessary information could lead to issues with receiving payment or even legal consequences.

How to Track Payments with Invoices

Keeping track of payments is crucial to maintaining a steady cash flow and avoiding missed transactions. A well-organized billing system helps you monitor outstanding balances, set reminders for overdue payments, and provide clear records for both yourself and your clients. By following a consistent approach, you ensure smooth financial management and effective communication.

To track payments effectively, it’s important to include certain key details in each billing document. This includes the payment due date, unique reference number, and the amount owed. Once the payment is received, marking it as “paid” and noting the payment date can help you stay organized.

Key Steps for Tracking Payments:

- Include a unique reference number for each document.

- Clearly state the due date and total amount due.

- Mark payments as “paid” once received and record the payment date.

- Set reminders for overdue amounts and follow up with clients as needed.

By using this method, you can easily refer to past transactions, track overdue payments, and maintain a professional relationship with clients, showing that you are organized and serious about your business.

Free vs Paid Invoice Templates

When selecting a document structure for billing purposes, there are two main options: free and paid versions. Each comes with its own set of advantages and limitations, so it’s important to understand which one suits your needs best. Free options can provide basic functionality, while paid versions often offer more advanced features and customization capabilities.

Free options tend to be simple and easy to access, making them ideal for those who need a quick solution. However, they may lack advanced features, such as integration with accounting software or the ability to customize design elements. On the other hand, paid options often provide enhanced functionality, including better design flexibility, automated features, and dedicated customer support, making them more suited for those managing larger or more complex projects.

Advantages of Free Versions:

- No cost involved, accessible immediately.

- Simple and straightforward for basic needs.

- Quick to implement without requiring additional tools or subscriptions.

Advantages of Paid Versions:

- Customization options for a more professional look.

- Automated calculations and integration with other financial tools.

- Customer support and updates for ongoing improvements.

Best Software for Invoice Creation

Using the right software can simplify the process of generating professional billing documents. With the right tools, you can automate many aspects of the creation process, from calculating totals to sending and tracking payments. There are various options available, each with unique features to suit different business needs, from basic invoicing to advanced financial management.

1. QuickBooks

QuickBooks is one of the most popular tools for managing finances, and it offers a robust set of features for generating billing documents. It allows users to customize designs, automate recurring invoices, and integrate with other financial management tools. It’s perfect for individuals who need more than just a basic billing system.

Features Benefits Customizable designs Professional and personalized documents Recurring billing Saves time for regular clients Expense tracking Comprehensive financial management 2. FreshBooks

FreshBooks is another excellent tool for those who want simplicity without sacrificing essential features. It provides easy-to-use billing tools, automatic reminders for overdue payments, and the ability to accept online payments. It’s an excellent choice for those who need a straightforward solution with user-friendly features.

Features Benefits Automatic reminders Helps ensure timely payments Time tracking How to Handle Late Payments

Dealing with overdue payments is an inevitable part of managing any business. While it can be frustrating, it’s important to approach the situation with professionalism and a clear strategy. Handling late payments effectively ensures that you maintain cash flow while preserving good relationships with clients.

1. Send a Friendly Reminder

The first step in addressing a late payment is sending a polite reminder. Often, clients may simply forget, and a gentle nudge can resolve the issue quickly. Be sure to include the payment details, such as the amount due and the original due date, to refresh their memory.

- Keep the tone courteous and professional.

- Include a copy of the original agreement or service terms if necessary.

- Set a new payment deadline if possible.

2. Charge a Late Fee

If the payment continues to be delayed despite reminders, you might need to introduce a late fee. Many professionals include a clause in their contracts stating that a certain percentage will be added to the total for overdue payments. This can encourage timely payments while compensating you for the delay.

- Clearly outline the late fee policy upfront to avoid surprises.

- Keep the fee reasonable and in line with industry standards.

- Provide a final notice with the updated amount due, including the late fee.

3. Offer Payment Plans

Sometimes clients may be unable to pay the full amount at once. In these cases, offering a payment plan can be a good solution. Breaking the balance into smaller ins

Designing an Attractive Invoice

Creating a professional and visually appealing document is essential for leaving a positive impression on your clients. A well-crafted document not only conveys important information clearly but also reinforces your brand image and attention to detail. Thoughtful design can make a difference in how clients perceive your professionalism and can even contribute to timely payments.

When designing a document to request payment, it’s crucial to maintain a balance between functionality and aesthetics. The layout should be organized and straightforward, allowing clients to quickly find the details they need. At the same time, incorporating elements that reflect your personal or business style can make the document stand out and feel unique.

Key Design Elements Description Branding Incorporate logos, color schemes, and fonts that represent your business identity. Clear Structure Ensure that sections are well-defined, such as services provided, payment terms, and client details. Readable Fonts Choose fonts that are easy to read, with a clear hierarchy for headings and body text. Whitespace Utilize whitespace effectively to make the document feel less crowded and more professional. Visual Appeal Consider incorporating subtle design accents, such as borders or icons, that enhance the document’s visual appeal. By carefully considering these elements, you can craft a document that is not only functional but also a reflection of your professional standards and creativity. This attention to detail can help you stand out in a competitive marketplace and ensure that your clients have a positive experience from start to finish.

How to Send Invoices to Clients

Once the work is completed, the next step is to ensure that you are paid promptly. Sending a formal request for payment requires careful attention to timing, method, and clarity. The way you send a payment request can influence how quickly your clients respond and whether they follow through with the payment on time.

Timing plays a significant role in ensuring that clients process payments without delays. Sending the request soon after the work is completed, or as agreed upon, keeps the transaction fresh in the client’s mind. It’s important to specify a payment due date clearly, ideally within 30 days, unless otherwise agreed upon.

The method of delivery should be both professional and convenient for the client. Email is one of the most common channels used today. Sending a request as an attachment in PDF format or within the body of the email ensures accessibility. Physical mail can be used in rare cases, particularly for large projects or when specifically requested by the client.

Clarity is key. Ensure that the request is easy to read and includes all necessary details, such as the services provided, the agreed-upon price, the total amount due, and payment instructions. If your client uses an online payment system, make sure to include any relevant links or account information. The easier you make it for the client to pay, the quicker the transaction will be completed.

Sometimes, clients may have questions about the request. Being available and responsive to their inquiries ensures that there are no misunderstandings or delays in processing payments. Prompt communication reflects your professionalism and builds trust with the client.

Setting Payment Terms in Invoices

Establishing clear and transparent payment terms is essential for ensuring a smooth financial transaction. By defining these terms upfront, you set expectations for both parties and reduce the risk of misunderstandings or delays. Clear payment guidelines help clients understand when and how to pay, making the entire process more efficient and professional.

Payment Due Date is one of the most important aspects to specify. Indicating a precise due date, such as “Net 30” (payment due within 30 days), ensures that clients know when their payment is expected. If you have a different arrangement, such as payment upon completion or after a specific milestone, be sure to state this clearly to avoid confusion.

Another crucial element is specifying the accepted payment methods. Whether you prefer bank transfers, online payment platforms, or checks, it’s important to make this clear in advance. Providing multiple options can help your client choose the most convenient method, ensuring faster processing of payments.

Additionally, late fees are an important consideration. If you want to encourage timely payments, it’s helpful to include a clause outlining penalties for overdue amounts. For example, a fixed percentage or a flat fee may be charged if payment is not received by the due date. This not only motivates clients to pay on time but also underscores the importance of meeting agreed-upon deadlines.

Finally, consider adding any discounts or incentives

When to Issue an Invoice

Knowing the right time to request payment is key to maintaining a healthy cash flow. Issuing a payment request at the wrong time can lead to delays or confusion. Setting the correct timing not only helps keep your business operations smooth but also ensures clients are clear about when and how to settle their balances.

Common Scenarios for Requesting Payment

There are several common moments during a project when you may need to send a payment request. Understanding these can help you decide when to take action:

- After Completion of the Work: The most straightforward option is to send a request once the work is finished and the client is satisfied.

- Upon Reaching a Milestone: For larger projects, breaking down payment requests into phases tied to milestones can be an effective approach.

- At Regular Intervals: If you’re working on long-term projects, setting recurring intervals for requesting payment (e.g., monthly) can help maintain consistent cash flow.

- After Deliverables are Approved: Once the client has reviewed and approved the final deliverables, it’s appropriate to send a request for payment.

Factors to Consider Before Issuing a Payment Request

Before deciding when to send a payment request, consider the following factors to ensure timely and smooth transactions:

- Agreement Terms: Review the initial agreement or contract. Some clients may require a request only after a set time period or upon project completion.

- Client Payment Cycle: Understand your client’s typical payment cycle. Some businesses prefer monthly invoicing, while others may process payments after a specific deliverable.

- Urgency of Payment: If you need funds ur

Invoicing Tips for Freelancers

Managing payments effectively is crucial to ensuring that your business runs smoothly. As an independent professional, it’s important to not only complete quality work but also make sure you’re compensated fairly and on time. By following a few simple tips, you can make the payment process more efficient, reduce mistakes, and keep client relationships strong.

First, always ensure that your request for payment is clear and detailed. Including all necessary information–such as a breakdown of services, total amount due, and payment instructions–will minimize confusion. The more organized your request is, the easier it will be for your client to process it promptly.

Second, be consistent in your timing. Set clear payment terms at the outset of your relationship with a client, and stick to them. Whether you prefer to issue a request after every project, on a regular schedule, or at certain milestones, consistency will help clients know what to expect and when to expect it.

Another tip is to keep track of all payments carefully. Whether you choose a digital tool or a manual system, maintaining accurate records of each transaction ensures that you’re aware of outstanding balances and can follow up quickly when necessary.

Lastly, always remain professional and courteous in your communication. If a client is late with payment, a polite reminder goes a long way. Maintaining good relations while still being firm about your payment terms can help avoid future delays and foster trust between you and your clients.