Invoice Template for Docs Easy Customization for Your Business

Managing financial transactions smoothly and efficiently is crucial for any business. Having a streamlined method for generating detailed records of charges can save time and reduce errors. Whether you’re a freelancer, small business owner, or large enterprise, using customizable documents for financial purposes is essential for maintaining clarity and professionalism.

There are various ways to organize and structure these important papers, offering flexibility for different business needs. With the right tools, you can create a layout that not only captures all necessary information but also aligns with your branding. The ability to adjust and personalize each record according to specific requirements enhances the overall experience for both you and your clients.

Efficient financial management is key to sustaining long-term success, and utilizing well-designed records can contribute significantly to this process. In this section, we will explore how to design and optimize these essential documents, ensuring that they are both functional and presentable.

Best Invoice Templates for Docs

Choosing the right format to generate financial documents is crucial for creating clear and professional records. The best solutions offer flexibility, customization options, and ease of use, helping businesses streamline their billing processes while maintaining a polished appearance. Below are some top options that can help you craft clean, well-organized statements.

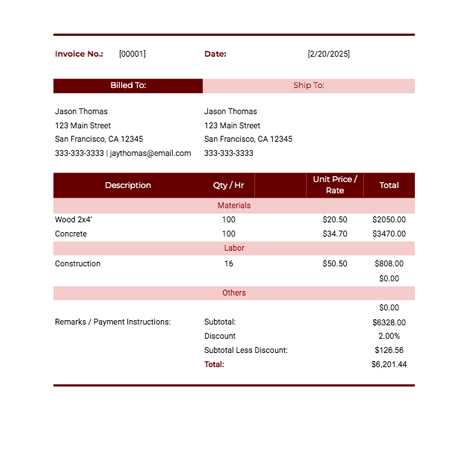

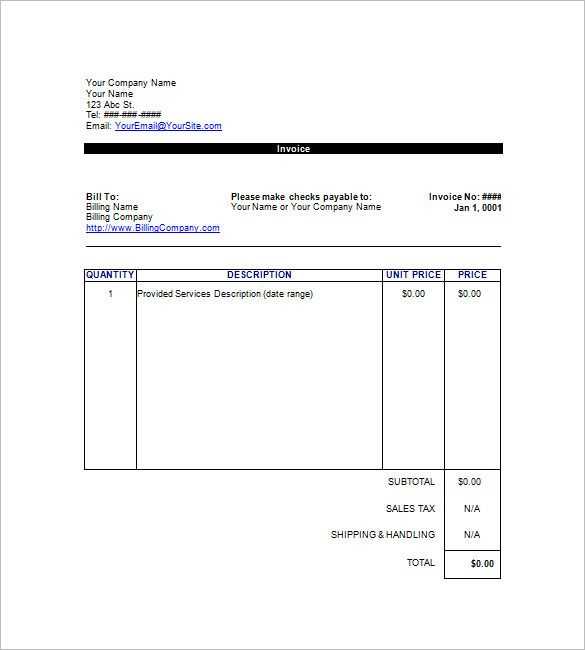

- Simple and Minimalist Layouts: These designs focus on clarity and simplicity. They include just the essential fields–such as client details, services, and payment terms–making them ideal for businesses that prefer straightforward, no-fuss documents.

- Detailed Professional Designs: For those who need to include more complex information, such as tax rates, itemized lists, or project milestones, this layout offers a polished and comprehensive approach to organizing details. It provides space for everything your client might need without looking cluttered.

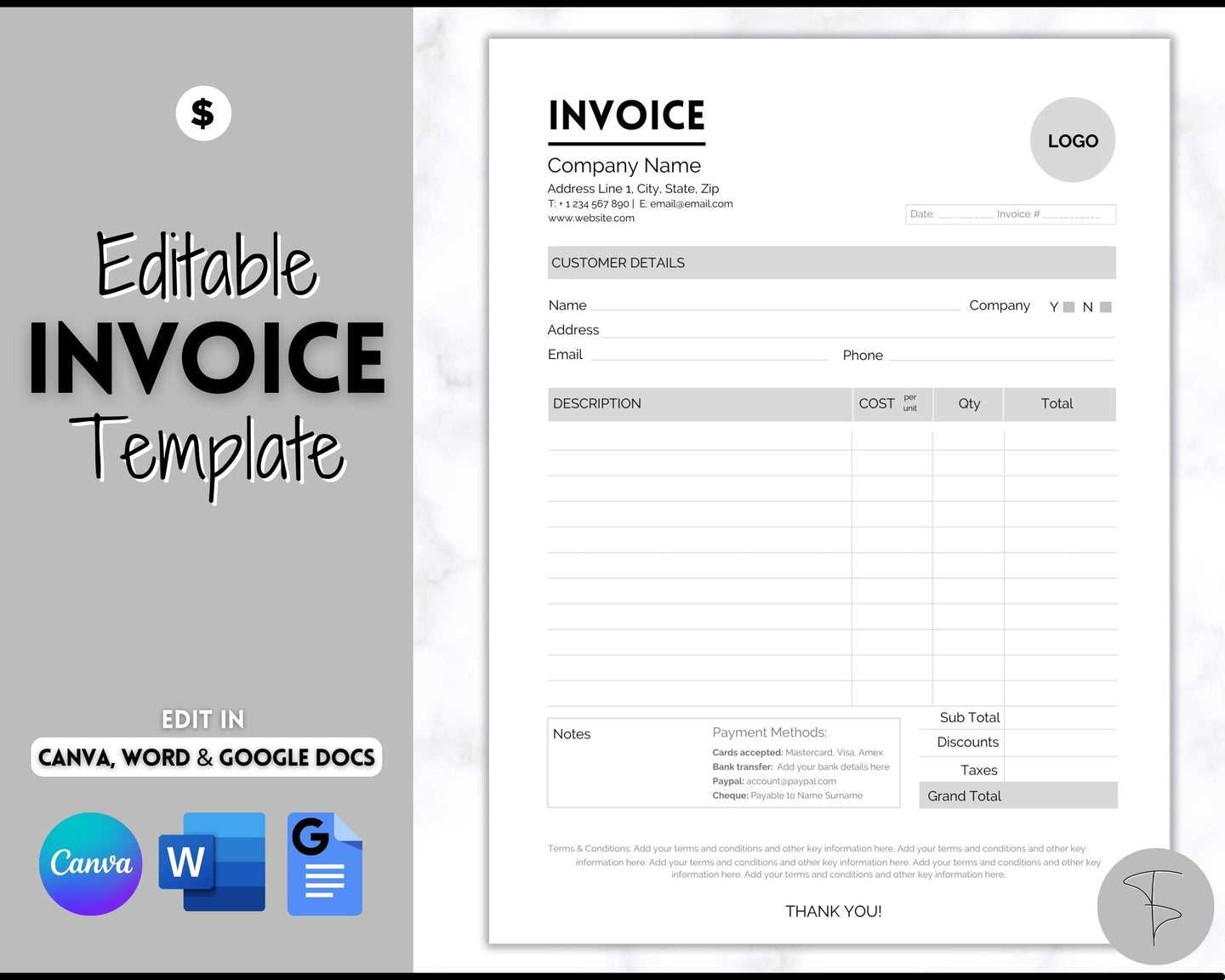

- Customizable Modern Templates: These are perfect for businesses seeking a contemporary look with plenty of room for personal branding. They often include dynamic fields that can be adjusted to fit your company’s unique needs, whether you need to add logos or adjust font sizes for better readability.

- Automated Billing Documents: Designed for users who prefer to save time and reduce errors, these formats come with automated fields and calculation tools. They allow you to easily enter data, such as hours worked or product quantities, with totals and taxes calculated automatically.

Each of these options offers distinct advantages depending on your business requirements. Whether you need something minimalist or more complex, selecting the right structure can help present your information professionally and efficiently.

How to Create Professional Invoices

Generating professional billing documents is a vital part of maintaining a reliable and efficient financial system. By following a few key steps, you can ensure that each record reflects your business’s professionalism and keeps your clients informed. Below is a guide to help you craft well-structured and clear statements that meet your specific needs.

Start by including the essential elements. A complete record should feature clear details on the service or product provided, the amount owed, and payment terms. Here is a basic structure to follow when creating your document:

| Field | Description |

|---|---|

| Business Information | Include your company name, address, and contact details at the top of the document. |

| Client Information | List the client’s name, address, and any relevant contact details. |

| Services or Products | Provide a detailed description of the goods or services delivered, including quantities and rates. |

| Amount Due | State the total amount owed, including any taxes or additional fees. |

| Payment Terms | Clarify when the payment is due and acceptable methods of payment. |

Once these basic sections are in place, consider the formatting and style. Using a clean, organized layout with consistent fonts and spacing helps create a polished appearance. Additionally, incorporating your company logo and branding elements will make the document feel more personalized and professional.

Customizing Your Invoice Design

Personalizing your billing documents is an essential step in ensuring they reflect your brand and business identity. Customization allows you to adjust the layout, color scheme, and overall style to match your company’s image, creating a more professional and cohesive experience for your clients.

Choosing the Right Layout

When customizing your design, it’s important to select a layout that suits your business type and the type of transactions you handle. For example, a simple layout with minimal design elements may work best for freelancers or service-based businesses, while a more detailed, structured layout may be necessary for those dealing with product sales or complex projects.

Adding Branding Elements

Incorporating your business logo, brand colors, and custom fonts is an effective way to create a consistent look across all your communications. These elements help reinforce your brand identity and make your documents stand out. Ensure that the visual style is professional, legible, and aligned with your overall marketing materials.

Top Features of Docs Invoice Templates

When choosing a document design for financial transactions, it’s important to select one that offers a variety of helpful features. These features should simplify your work, improve clarity, and enhance the overall presentation of your statements. Below are some of the most useful attributes to look for in an ideal document layout.

Essential Features for Effective Billing

- Predefined Fields: Templates with clearly marked fields for client details, services, and payment terms help eliminate confusion and make data entry easier.

- Customizable Layouts: The ability to adjust the format to your preferences ensures that the document suits your brand style while maintaining professionalism.

- Automatic Calculations: Some designs offer built-in formulas to automatically calculate totals, taxes, and discounts, saving time and reducing errors.

- Multiple Currency Support: For international businesses, the ability to include various currencies and tax rates is essential for global transactions.

Design Elements That Enhance Usability

- Clear Section Organization: Well-structured sections, such as separate areas for client information, services rendered, and payment details, make documents easy to read and understand.

- Mobile Compatibility: Templates that are optimized for mobile devices ensure your documents look great on all screen sizes, allowing easy access on the go.

- Professional Styling: Clean fonts, balanced spacing, and consistent alignment contribute to a polished, professional appearance that reflects your business standards.

Why Use Docs for Invoicing

Using digital platforms to create and manage billing documents has become increasingly popular due to their ease of use and flexibility. Docs provide a simple, accessible solution for creating accurate and professional records, offering a variety of tools and features that enhance the invoicing process. Here are some reasons why you should consider using this platform for your business needs.

Advantages of Using Docs for Billing

- Accessibility: Docs can be accessed from any device with an internet connection, allowing you to create and manage your financial records anytime and anywhere.

- Collaboration: Docs allows you to easily share documents with clients, team members, or accountants, making collaboration seamless and efficient.

- Customization: With a variety of customizable fields and layout options, you can tailor each document to meet your specific business needs and maintain a professional look.

- Cloud Storage: Storing your billing documents in the cloud ensures that they are securely saved and easily retrievable, reducing the risk of losing important information.

How Docs Simplifies the Billing Process

- Pre-designed Formats: Docs offers ready-made formats that make it easier to get started without the need for complex design work or formatting.

- Real-time Editing: Changes to your records can be made in real-time, ensuring that all stakeholders have the most up-to-date information.

- Easy Integration: Docs integrates well with other software tools, allowing you to streamline your workflow and save time when managing financial data.

Step-by-Step Guide to Invoice Creation

Creating accurate and professional billing records is essential for smooth financial transactions. This step-by-step guide will walk you through the process of designing and finalizing your documents, ensuring they are clear, organized, and meet your business requirements.

Step 1: Gather Necessary Information

Before you begin, make sure you have all the required details on hand. This includes:

- Your business details: Name, address, contact information, and any relevant registration numbers.

- Client information: Name, address, and contact details.

- Services or products: A detailed list of what was provided, including quantities, rates, and any additional charges.

- Payment terms: The due date, payment methods, and any other relevant conditions (such as late fees).

Step 2: Set Up the Layout

Choose a layout that best suits your needs. A simple structure usually works best, but you can adjust it based on the complexity of the details. Key areas to include are:

- Header: Your business details at the top, followed by the client’s information.

- Body: A clear breakdown of the items, services, or hours worked, along with the corresponding prices.

- Footer: Include your payment terms, due date, and contact details for any questions.

Step 3: Add Customization and Finalize

Once the structure is in place, customize the document to reflect your brand’s style. Add your logo, adjust the font, and select colors that align with your business identity. Double-check the accuracy of all entered information, especially pricing and payment terms. Finally, save the document and prepare it for sharing with your client.

Tips for Effective Invoice Formatting

Proper formatting plays a key role in creating clear and professional financial records. A well-organized layout not only ensures that the details are easy to read but also enhances the overall impression of your business. Below are some important tips to help you format your documents effectively.

Keep It Clean and Organized

Make sure your document has a simple and clean design. Avoid clutter and use enough spacing to ensure readability. Key sections should be clearly separated, such as your business details, the client’s information, and the list of goods or services provided. The following table outlines how you can structure your document:

| Section | Details |

|---|---|

| Header | Include your business name, address, phone number, and email along with the client’s details. |

| Items/Services | List the goods or services provided, including the quantity, unit price, and total for each item. |

| Total | Clearly state the total amount due, including any taxes or additional charges. |

| Footer | Include payment terms, due dates, and methods of payment. |

Use Clear Fonts and Readable Sizes

Choose fonts that are easy to read, such as Arial or Helvetica, and ensure that the font size is appropriate. For the body text, a size between 10-12px is usually ideal, while headings can be slightly larger for emphasis. Be mindful of using bold or italics sparingly, as overuse can make the document look unprofessional.

Benefits of Digital Invoices for Business

Adopting electronic billing methods offers several advantages for businesses, helping streamline operations and improve efficiency. Digital records provide greater control, reduce errors, and make financial management more accessible. Below are some key benefits of using digital billing systems for your business operations.

Increased Efficiency: With digital solutions, creating and sending financial documents becomes faster and more convenient. Automatic generation and easy customization of records save significant time compared to manual methods.

Cost Savings: By eliminating the need for paper, ink, and postage, businesses can cut down on operational costs. Digital processes also reduce the chances of errors, avoiding costly mistakes associated with physical record-keeping.

Improved Accuracy: Digital records reduce the likelihood of mistakes that can occur in manual entries. Automatic calculations and built-in validation checks help ensure that all details are correct before submission.

Easy Storage

How to Include Payment Terms

Clearly outlining payment terms is crucial in any financial document, as it sets expectations between businesses and clients. Well-defined terms ensure both parties understand when payments are due, what methods are acceptable, and any potential consequences for late payments. Here’s how you can effectively include these details in your records.

Key Information to Include

Payment terms should be simple yet comprehensive, ensuring there is no ambiguity. The following table outlines the essential components to include when specifying payment terms:

| Component | Description |

|---|---|

| Due Date | Specify the exact date when the payment is expected. Common options are “Due within 30 days” or a specific calendar date. |

| Accepted Payment Methods | List the methods through which payment can be made, such as bank transfers, credit cards, or online payment systems. |

| Late Fees | Clearly state any penalties that will be applied if payment is not made by the due date, such as a percentage of the outstanding amount. |

| Discounts for Early Payment | If offering incentives for early settlement, specify the discount percentage and the applicable time frame (e.g., “5% discount if paid within 10 days”). |

| Payment Reference | Encourage clients to include a reference or invoice number when making payments to ensure easy tracking and processing. |

Including these details in your document not only helps prevent misunderstandings but also fosters professionalism and trust in business relationships.

Managing Client Information in Docs Templates

Properly organizing and handling client details is essential in any business document. Ensuring that the necessary information is easily accessible and correctly entered can save time and prevent errors. Whether it’s contact details, billing information, or transaction history, managing client data efficiently plays a vital role in maintaining smooth operations and professionalism.

Organizing Client Information

When creating your document structure, designate a clear section for client details. Typically, this includes the client’s full name, company name (if applicable), address, phone number, and email. Using fields or placeholders makes it easier to fill in the relevant information quickly without missing any crucial details. This method ensures that all records are consistent and well-organized.

Updating Client Data

It’s important to regularly update your client database to ensure that the information is accurate. Old or incorrect contact details can lead to missed payments or miscommunication. Implementing a system to regularly review and update client information ensures that the most up-to-date data is always available when creating new records or communications.

Securing Client Information

With the increase in digital communication, safeguarding client data has become even more critical. Make sure any sensitive client information is securely stored and protected from unauthorized access. Passwords, encryption, and secure servers are essential tools for protecting privacy and complying with data protection regulations.

By effectively managing and protecting client information, you build trust and ensure a smooth process when preparing and sending financial documents.

Integrating Invoice Templates with Google Docs

Integrating your financial document structure with Google’s cloud-based tools offers a streamlined way to create, edit, and share records with clients. The ability to access and modify your files from anywhere, combined with the collaborative features of Google Docs, provides significant efficiency for businesses of all sizes. This section explores how you can use Google Docs to simplify and enhance your billing process.

Setting Up a Template in Google Docs

Creating a structured format in Google Docs allows you to design a reusable layout for your documents. Once you’ve created your initial structure, you can save it as a template. This gives you a quick way to generate new records with minimal effort. You can easily insert placeholders for client names, service details, and pricing, which can be quickly filled in when needed.

Collaboration and Sharing

One of the key advantages of using Google Docs is the ability to collaborate in real-time. You can share the document with team members or clients to review and make necessary changes instantly. This eliminates the need for back-and-forth emails or physical paperwork. You can also set permissions to control who can view or edit the file, ensuring that sensitive information is protected.

Automation and Integration

Google Docs allows you to integrate with various tools, such as Google Sheets, to automate certain tasks. For example, you can set up a system where financial figures are automatically pulled from a spreadsheet and inserted into your document. This minimizes the risk of human error and saves time on manual data entry.

By combining the simplicity of Google Docs with the power of cloud technology, businesses can manage their financial documentation more effectively, keeping everything organized and easily accessible.

Tracking Payments with Invoice Templates

Monitoring payment status is crucial for ensuring that all financial transactions are completed on time. By keeping accurate records, businesses can easily track which amounts have been paid and which remain outstanding. This not only helps in maintaining cash flow but also in ensuring that there are no missed payments or discrepancies in financial records.

Incorporating Payment Status Fields

To effectively track payments, include clear fields in your document where the payment status can be updated. Adding sections for “Amount Paid,” “Due Amount,” and “Remaining Balance” helps provide an at-a-glance overview of the financial situation. These sections should be easy to update as payments are made, ensuring that all details are current and correct.

Using Digital Tools for Tracking

Incorporating digital tools, such as Google Sheets or cloud-based accounting software, can automate the tracking process. With these tools, payments can be updated in real-time, and automated reminders can be sent to clients who have not yet settled their balances. Using these systems reduces manual errors and saves time, making the payment tracking process much more efficient.

Effective payment tracking helps ensure timely financial reconciliation and allows businesses to take proactive steps in case of delays or outstanding balances.

By integrating payment tracking into your business records, you can streamline your billing process and maintain better control over your finances.

Common Mistakes in Invoice Design

Creating a well-structured financial document is essential for smooth business operations, but there are several common errors that can lead to confusion or missed payments. These mistakes, often overlooked, can result in inefficiency, delays, or even disputes with clients. Ensuring that all elements are clear, professional, and accurate is key to avoiding these pitfalls.

Poor Layout and Organization

A disorganized or cluttered layout can make it difficult for clients to quickly identify key details such as amounts owed, payment terms, or due dates. If critical information is hidden or not easily accessible, it increases the chances of errors or late payments. A clean, structured design with clear headings and sections is vital for readability.

Missing or Incorrect Contact Information

One of the most common mistakes is failing to include accurate or complete contact details. Whether it’s your business address, phone number, or email, any missing or incorrect information can delay communication with clients and hinder payment processing. Always double-check that all contact information is up to date and visible in a prominent location.

Ensuring clarity, accuracy, and consistency in every document helps avoid confusion and fosters professional relationships with clients.

By identifying and correcting these common mistakes, businesses can create smoother, more effective transactions that improve both client satisfaction and financial management.

Best Practices for Invoice Templates

Designing professional and effective financial documents requires attention to detail and adherence to key best practices. When creating these records, it’s essential to focus on clarity, accuracy, and ease of use. Implementing these practices can help streamline your billing process, improve client communication, and ensure timely payments.

- Use a Clear and Consistent Layout – Ensure that all sections are well-organized, with distinct headings for each important part, such as amounts, due dates, and client details.

- Include Comprehensive Information – Provide all the necessary details, including a description of the services or goods provided, the total amount, due date, and any applicable taxes or discounts.

- Make Payment Instructions Easy to Find – Include clear and concise instructions on how the payment can be made, whether it’s via bank transfer, credit card, or another method.

- Maintain Professional Language and Tone – Use polite and professional language throughout the document to convey your professionalism and foster a positive relationship with clients.

- Double-Check Details – Before finalizing any document, ensure that all information, such as client details, dates, amounts, and payment terms, are accurate and up to date.

By following these best practices, businesses can create more efficient and reliable processes that lead to faster payments and fewer misunderstandings.

Incorporating these tips into your routine ensures that every financial document you create upholds the highest standards of professionalism.

Free Invoice Templates for Docs

There are a variety of free resources available online that offer customizable documents to suit various business needs. These tools allow businesses to create well-organized, professional records without the need for specialized software. Whether you’re a freelancer, small business owner, or large enterprise, these resources can help streamline your billing process without additional cost.

Benefits of Using Free Resources

- Cost-Effective – No need to invest in expensive software or design services. Free templates save you money while offering professional-looking results.

- Ease of Use – Most free tools are user-friendly and allow quick customization with minimal effort, making them ideal for those with little design experience.

- Customization Options – Many free resources provide flexible options, enabling you to adjust layout, fonts, colors, and even add your business logo.

- Time-Saving – By using pre-designed layouts, you can create well-structured documents in a fraction of the time it would take to design from scratch.

Popular Platforms Offering Free Templates

- Google Docs – Offers a selection of simple, clean designs that can be easily customized and shared with clients.

- Microsoft Office – Provides a variety of templates, including ones specifically tailored to different industries.

- Canva – An easy-to-use design tool offering customizable invoice layouts with graphic elements to enhance the professional appearance.

Using free resources can make the invoicing process quicker, more efficient, and cost-effective, providing you with professional documents that reflect the quality of your business.

How to Automate Invoice Creation

Automating your billing process can save time, reduce errors, and improve consistency. By utilizing the right tools and integrating systems, businesses can streamline the creation and sending of payment requests without manual intervention. Automation allows for faster processing, fewer mistakes, and a more professional approach to client interactions.

1. Use Accounting Software

One of the easiest ways to automate document creation is through accounting software. Many programs offer built-in features that automatically generate payment documents based on the information you input about clients, transactions, and payment terms. These tools can also store previous documents, allowing for faster generation with just a few clicks.

2. Integrate with CRM Systems

Integrating your customer relationship management (CRM) system with your billing software allows for a seamless flow of client data. This means that once a transaction occurs, the necessary information, such as customer details and pricing, can be automatically transferred to your billing tool for quick document generation.

3. Set Up Recurring Payments

If you offer subscription-based services or products, automation can ensure that your payment requests are generated and sent on a regular schedule. This eliminates the need to manually create new documents each time and ensures that your clients are billed on time every time.

4. Utilize Cloud-Based Tools

Cloud-based platforms offer the ability to automate your billing from any location. Tools such as Google Sheets or other online document generators can be set up with pre-filled data that updates in real time, allowing you to automate processes like sending reminders or generating recurring bills.

5. Use Automation Scripts

For more technical users, automation scripts can be written to create and send customized documents. These scripts can pull data from various sources, format it correctly, and email it to clients with minimal input. Such tools provide complete control over your automation and can be tailored to suit your specific business needs.

Automating document creation not only increases efficiency but also reduces the chances of human error, ensuring a smoother workflow and more satisfied clients.

Invoice Template Security and Privacy Tips

When handling sensitive financial data, it is crucial to ensure that your documents are securely created, shared, and stored. Implementing best practices for security and privacy helps protect your clients’ information from unauthorized access and potential threats. Below are some key tips to maintain the confidentiality and integrity of your payment documents.

1. Use Strong Passwords and Encryption

Securing your documents starts with using strong, unique passwords to protect access to your file storage and editing platforms. Additionally, ensure that your documents are encrypted, especially when sent over email or stored on cloud-based platforms. Encryption adds an extra layer of protection by making your data unreadable to unauthorized users.

2. Implement Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security by requiring an additional verification step, such as a code sent to your phone, when logging into your cloud storage or billing software. This makes it harder for unauthorized individuals to access sensitive documents even if they have your password.

3. Limit Access to Documents

Be mindful of who has access to your payment-related documents. Only share them with authorized individuals within your company or trusted partners. Use access control features provided by cloud platforms to limit who can view, edit, or download your files, reducing the risk of accidental exposure.

4. Regularly Back Up Files

Having regular backups ensures that your documents are not lost in case of system failure or cyberattacks. Store backups securely, preferably in a different location or on a different platform than your primary storage to ensure recovery if needed.

5. Avoid Storing Sensitive Data in Plain Text

Never store sensitive information like credit card numbers, social security numbers, or bank account details in plain text within your documents. Always use secure methods to store and handle such data, and avoid including unnecessary sensitive details in payment documents unless absolutely necessary.

6. Secure Communication Channels

When sending payment documents to clients or suppliers, always use secure channels. Avoid sending files over unsecured email. Instead, consider using encrypted email services, secure file-sharing platforms, or password-protected links for safer transmission.

7. Monitor and Audit Document Access

Keep track of who accesses your documents and monitor for any suspicious activity. Most cloud storage services offer activity logs that can help you see when and by whom a file was accessed or modified. Regular audits ensure that no unauthorized access occurs and that your files are handled securely.

By adopting these security practices, you can safeguard your financial documents and ensure your clients’ data remains private and protected.