Customizable Invoice Template for Consulting Services

When managing a freelance or independent business, clear and structured billing is essential for maintaining professional relationships with clients. A well-organized document not only reflects your professionalism but also ensures that payments are processed smoothly and on time. Streamlining this process can save you time and reduce the risk of errors, ultimately improving your business operations.

Customizable billing documents help you easily outline services rendered, rates, and payment terms, making it simpler for clients to understand their obligations. With the right approach, you can create documents that align with your branding while providing all necessary details for a transparent transaction.

Using a standardized format allows you to focus on your work rather than spending time creating a new layout every time you send a bill. Whether you’re handling one-time projects or ongoing contracts, having a reliable system in place can significantly enhance your workflow and client experience.

Invoice Template for Consulting Services

When working with clients in the professional services industry, having a clear and structured document to request payment is essential. These documents ensure both you and your clients are on the same page regarding the scope of work, pricing, and payment terms. A well-crafted document helps avoid confusion and establishes trust between parties, ensuring smooth financial transactions.

Key Elements of a Professional Document

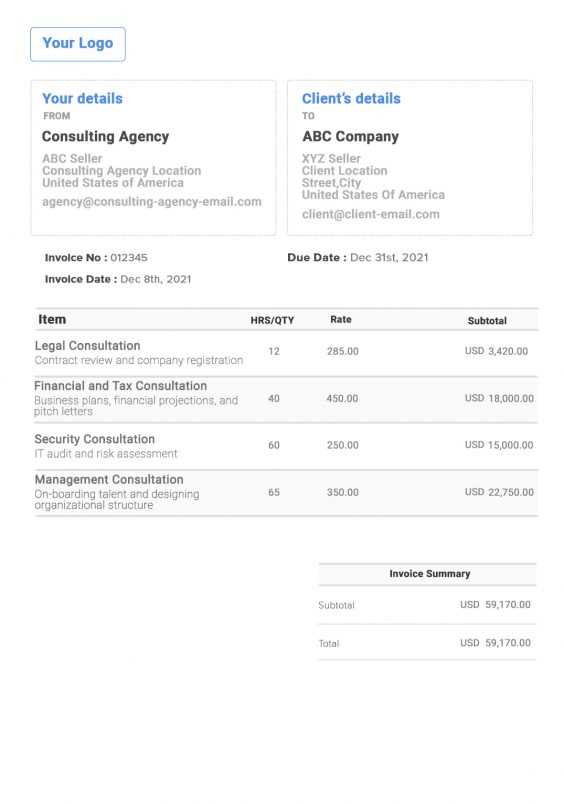

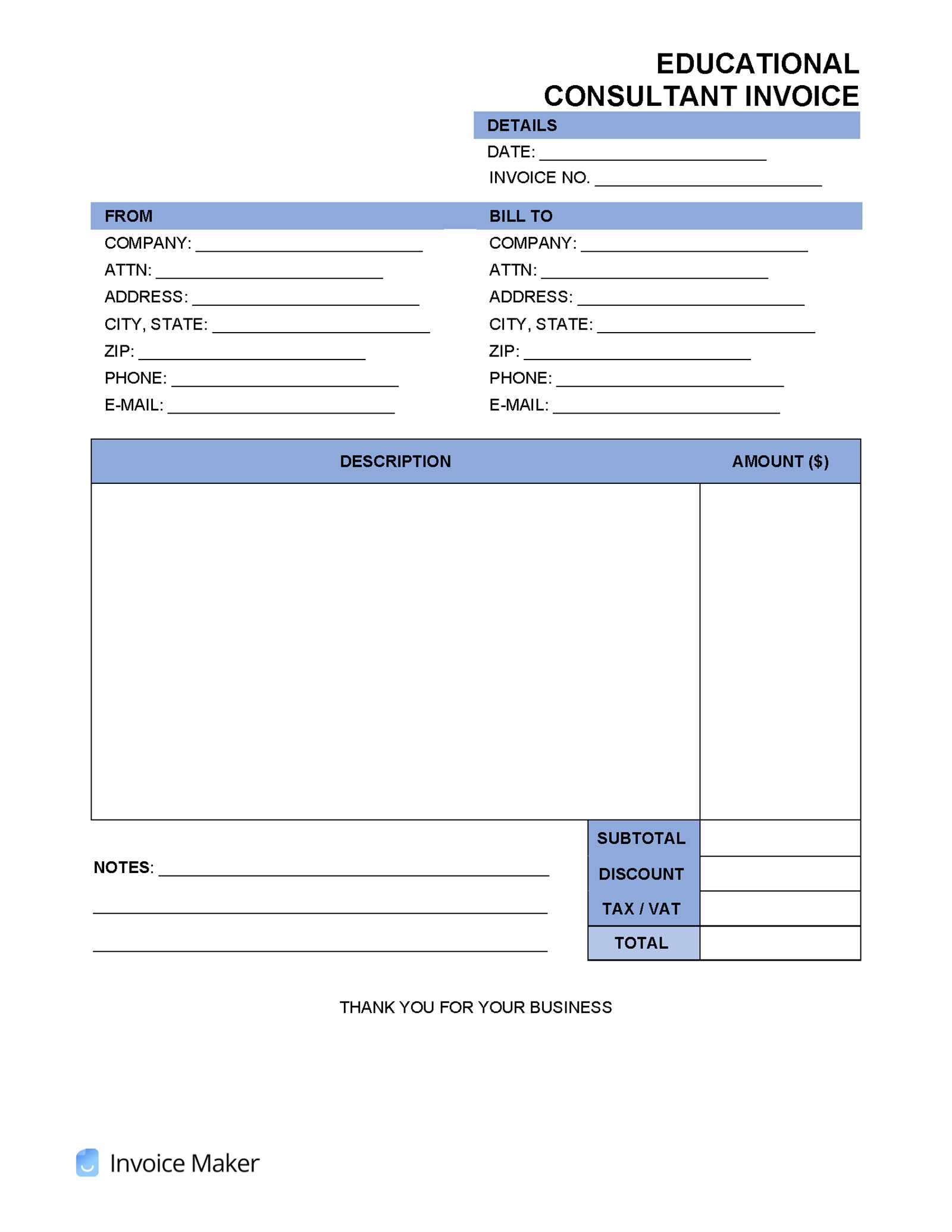

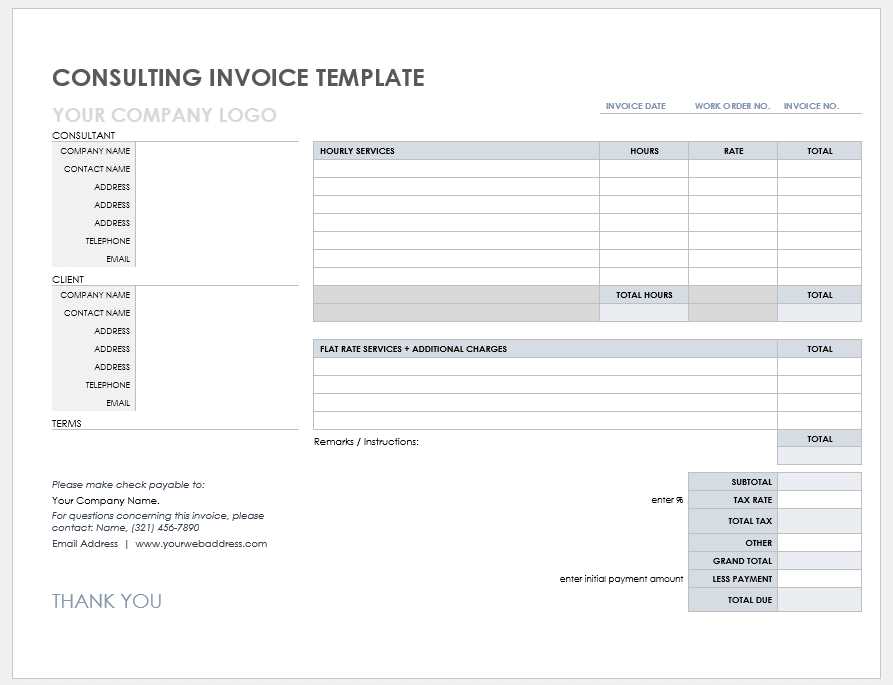

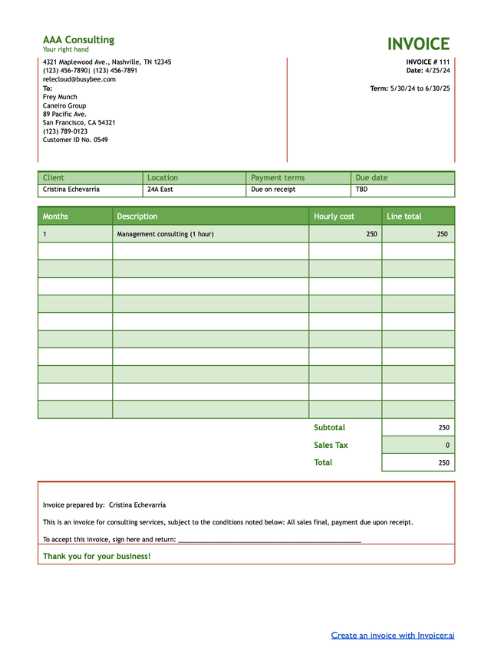

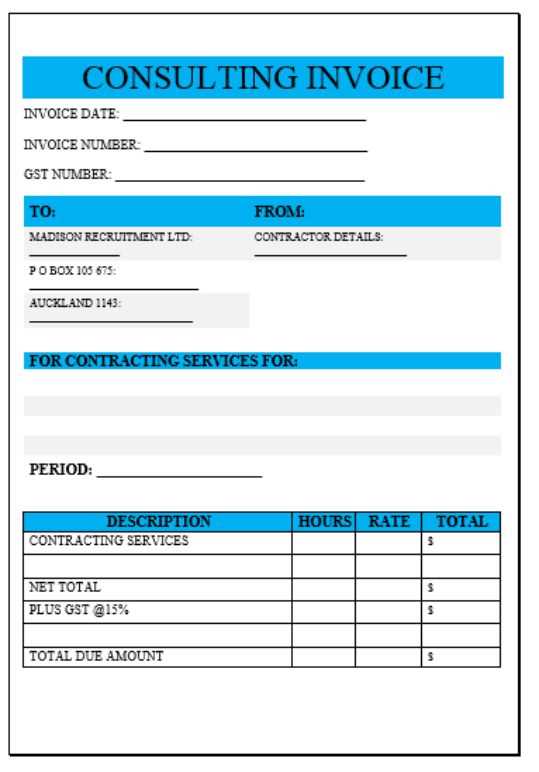

To create a functional and efficient billing document, it’s crucial to include several key components. Start by detailing the services provided, followed by the agreed-upon rates and hours worked. Accurate calculations are vital, as they ensure transparency and avoid disputes. Additionally, make sure to clearly outline the payment terms, including deadlines and accepted methods of payment.

Personalization and Branding

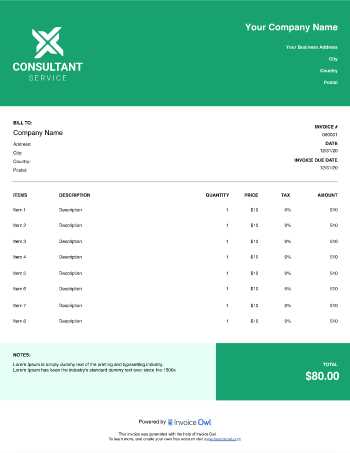

One of the benefits of using a customizable solution is the ability to incorporate your branding elements. Personalizing the layout with your company logo, colors, and font style adds a professional touch that reinforces your business identity. A consistent presentation not only strengthens your brand but also creates a cohesive experience for clients.

Why Consultants Need Professional Invoices

In the professional services industry, maintaining a clear and formal approach to payment requests is crucial. Not only does it ensure that compensation is received promptly, but it also demonstrates your professionalism and commitment to transparency. When dealing with clients, a structured document helps establish trust, avoid misunderstandings, and create a smooth financial process.

Here are several reasons why having a formalized payment document is essential for service providers:

- Clarity and Transparency: A well-structured document provides detailed information about the services provided, the agreed-upon rates, and payment terms. This reduces the chance of confusion or disputes down the line.

- Professional Image: A consistent, polished appearance helps to convey that you are serious about your business. Clients are more likely to respect and trust someone who operates in an organized and professional manner.

- Legal Protection: In the event of payment delays or disputes, a formal document can serve as a legal record of the agreed-upon terms and services rendered. It offers both parties a point of reference for resolving issues.

- Time Management: Using a pre-made structure allows you to focus on your work, rather than spending time on creating a document from scratch for each client. This improves efficiency and saves valuable time.

- Payment Tracking: Keeping consistent records helps you monitor which payments are outstanding, making it easier to follow up and ensure timely compensation.

Ultimately, incorporating a professional payment document into your business practices not only helps streamline financial processes but also reinforces your credibility as a service provider.

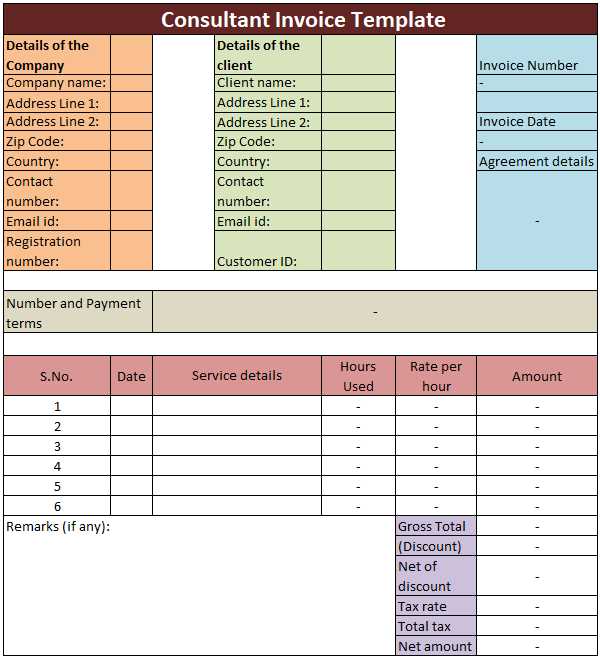

Key Features of a Consulting Invoice

A well-structured billing document is essential for service providers, as it ensures clarity between both parties and facilitates timely payment. When crafting such a document, certain key elements must be included to ensure it serves its purpose efficiently. These elements not only help you communicate the details of the work performed but also make the process of payment smoother and more transparent for the client.

Essential Elements of a Professional Document

Every formal payment request should include the following components to be effective and legally sound:

| Feature | Description |

|---|---|

| Client and Provider Information | Names, addresses, and contact details of both parties should be listed to avoid confusion. |

| Project Details | Clearly outline the services provided, including hours worked, tasks completed, and project scope. |

| Pricing and Rates | List agreed-upon rates and any additional charges, such as travel or materials, along with the total amount due. |

| Payment Terms | Specify payment methods, deadlines, and any penalties for late payments to avoid delays. |

| Unique Reference Number | Assign a unique identifier to each request for easy tracking and record-keeping. |

Why These Features Matter

Including these key features not only ensures that the client understands the scope of the agreement but also protects both parties by providing a record of the transaction. These components promote timely payment and help avoid confusion or disputes over charges, making your financial interactions much smoother and more professional.

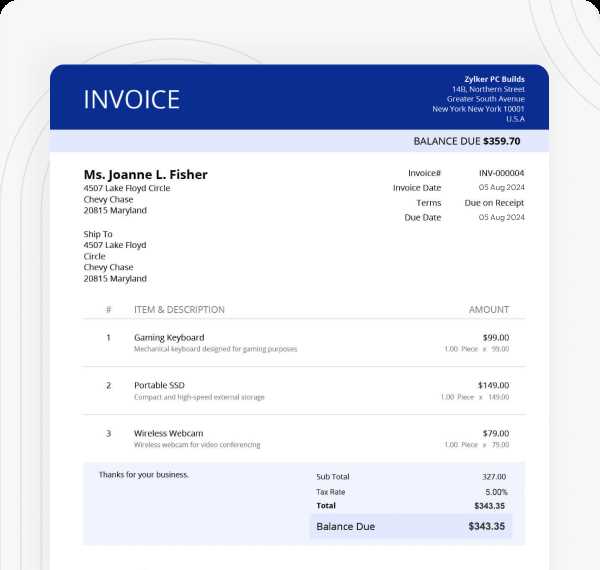

How to Customize Your Invoice Template

Creating a personalized billing document that reflects your brand and meets the needs of both you and your clients is essential for building strong professional relationships. Customizing the layout and content allows you to maintain consistency, ensure clarity, and create a polished appearance. With the right adjustments, your payment requests can be both functional and visually appealing, helping to reinforce your business identity.

Here are some key steps to customize your document effectively:

- Incorporate Your Branding: Add your logo, company colors, and font styles to make the document uniquely yours. This creates a professional image and ensures consistency across all communications with your clients.

- Choose a Clear Layout: Organize the content logically, making it easy for your clients to understand the details of the work completed and the total amount due. Group similar information, such as rates and services, for better readability.

- Adjust Sections to Fit Your Services: Depending on your business model, you may want to add specific sections. For example, you can include a breakdown of hourly rates, a description of materials used, or even project milestones.

- Modify Payment Terms: Tailor the payment terms to reflect your preferred methods and timeframes. Whether you require immediate payment or offer payment plans, make sure the terms are clearly stated to avoid confusion.

- Add Personal Notes: Consider adding a personal touch, such as a thank-you message or a reminder about your next availability. A brief note can make the document feel more personal and help you stand out.

Customizing your billing documents ensures that they meet the specific needs of your business while maintaining professionalism. By making these adjustments, you can create an experience that reflects your values and makes the payment process easier for everyone involved.

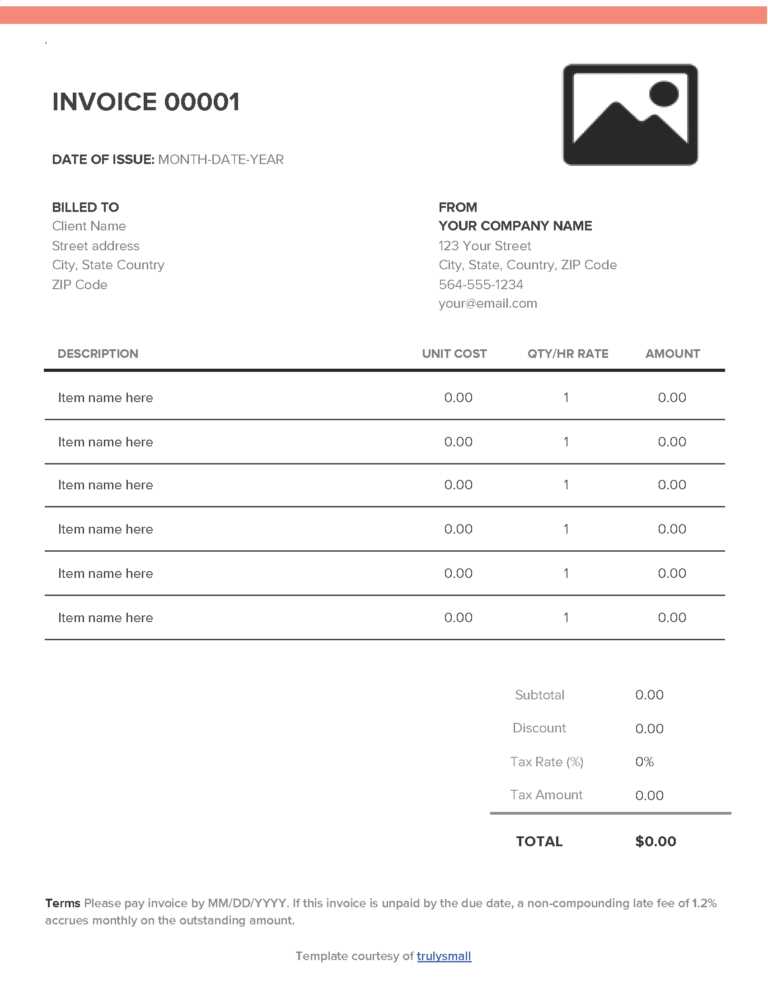

Best Formats for Consulting Invoices

When creating a billing document, choosing the right format can significantly improve both the appearance and the effectiveness of the payment request. The right layout not only makes the document easier to understand but also ensures that all necessary information is included in a way that is clear and professional. There are several formats to consider, depending on your needs and how you prefer to communicate with clients.

Here are some of the most common formats that are well-suited for service providers:

- Word Documents: Easy to edit and highly customizable, Word documents are a great option if you want flexibility in design. You can easily change fonts, colors, and layout, making them a versatile choice for those who want a personalized look.

- Excel or Google Sheets: Spreadsheets are excellent for service providers who need to track hours or calculate rates. They allow for automatic calculations and can be easily updated as needed. These formats are particularly useful for projects with complex billing structures.

- PDFs: PDFs are the most widely used and accepted format for formal payment requests. They preserve the formatting and are universally accessible, which means your client will see the document exactly as you intended. PDFs are especially useful for long-term record-keeping and professional presentation.

- Online Tools or Software: Many online platforms offer specialized tools that streamline the billing process, allowing you to generate professional-looking documents quickly. These tools often include features like recurring billing, automatic reminders, and payment tracking, which can be time-saving for service providers with regular clients.

- Customized Web Forms: Some service providers prefer using customized web forms that clients can fill out online. These forms often integrate with payment systems, allowing clients to pay directly from the document itself. This format is highly efficient for businesses that operate in digital spaces.

The best format depends on your business needs and the level of customization required. Whatever format you choose, make sure that it is easy to use, clear in presentation, and professional in appearance to maintain a high standard in your client interactions.

Benefits of Using an Invoice Template

Adopting a ready-made format for billing is an effective way to streamline financial processes and maintain consistency in your business operations. Whether you’re managing a few clients or handling a large volume of transactions, having a structured and reusable solution simplifies the task of creating payment requests and ensures they remain professional and accurate. This approach not only saves time but also reduces the likelihood of errors and omissions.

Here are some key advantages of using a structured billing document:

- Time-Saving: With a pre-designed structure, you don’t need to start from scratch each time you need to request payment. You can quickly plug in the relevant details, saving valuable time and allowing you to focus on other aspects of your work.

- Consistency: A uniform format ensures that all your payment requests look professional and are easy to understand. This consistency helps in creating a reliable image for your business and promotes trust with your clients.

- Reduced Risk of Errors: Having predefined fields and sections reduces the chance of overlooking important details, such as rates, payment terms, or client contact information. This accuracy minimizes the likelihood of misunderstandings and disputes over payments.

- Improved Professionalism: A well-structured billing document gives the impression that you take your work seriously and are committed to delivering a high standard of service. This can strengthen your reputation and client relationships.

- Easy Customization: Even though you’re using a standardized format, you can still tailor it to your business’s needs. Whether you need to add specific services, adjust rates, or include additional terms, the flexibility allows you to adapt to any situation.

- Streamlined Record Keeping: Using a consistent structure makes it easier to track past transactions, monitor outstanding payments, and manage financial records for tax or accounting purposes.

Utilizing a reliable, pre-formatted solution can enhance your billing efficiency, reduce errors, and ensure that your business maintains a high level of professionalism and organization. It’s a simple yet powerful tool to help you manage your financial communications with ease.

Essential Information to Include on Invoices

To ensure that your billing documents are clear, professional, and legally sound, it is crucial to include all necessary details. A well-organized and complete request not only helps prevent misunderstandings but also ensures smooth processing of payments. When creating such a document, there are several key elements that must be clearly stated to avoid confusion and maintain transparency.

Key Details to Include

These are the essential components you should always include when preparing a payment request:

- Your Business Information: Include your name, company name, address, email, and phone number. This ensures your client knows exactly who the payment is coming from and how to contact you if needed.

- Client’s Information: Include your client’s name or company name, billing address, and contact details. This ensures the payment is processed correctly and ties the request to the specific project or agreement.

- Document Number: Assign a unique reference number to each request. This helps both you and your client keep track of payments and makes it easier to reference the document in case of any issues.

- Service Description: Provide a clear breakdown of the services or products provided, including dates, hours worked, or quantities delivered. This ensures your client understands exactly what they are paying for.

- Pricing and Amount Due: List the agreed-upon rates and quantities, and calculate the total amount due. If applicable, break down any discounts or additional charges (e.g., for materials or travel). This transparency helps avoid disputes and ensures timely payment.

- Payment Terms: Clearly state the payment due date, any late fees or penalties for overdue payments, and accepted payment methods. This helps set expectations and encourages prompt payment.

- Tax Information: If applicable, include any taxes that need to be collected (e.g., sales tax or VAT), along with tax identification numbers if required by law.

Additional Optional Information

While the above details are essential, you may also want to include other items depending on your business needs:

- Terms and Conditions: If you have sp

Common Mistakes When Creating Invoices

Even with a well-structured approach, it’s easy to make mistakes when preparing a payment request. These errors can cause delays, confusion, and even strain professional relationships. By being aware of the most common mistakes, you can avoid them and ensure that your documents are accurate, clear, and professional.

Here are some frequent errors service providers should watch out for:

- Incorrect Client Details: Failing to correctly list the client’s name, address, or contact information can lead to confusion and delays in payment. Always double-check that the details are accurate before sending.

- Missing or Incorrect Dates: Forgetting to include the date of service or the payment due date can cause confusion. It’s essential to have both the service date and the payment deadline clearly indicated to avoid misunderstandings.

- Unclear Service Descriptions: Vague or incomplete descriptions of the work performed can lead to disputes. Always provide detailed information about the services, hours worked, and materials used, so the client knows exactly what they are paying for.

- Failing to Include a Unique Identifier: Each request should have a unique reference number to help track payments. Without this, it can be difficult to match the payment with the correct document, especially when dealing with multiple clients or transactions.

- Inaccurate Calculations: Simple mathematical errors in the rates, quantities, or total amount due can create frustration for both you and your client. Always double-check your numbers to ensure accuracy.

- Not Stating Payment Terms Clearly: Failing to specify payment methods, deadlines, or late fees can lead to misunderstandings. It’s important to clearly define the expectations to avoid delays and ensure timely payments.

- Omitting Tax Information: If applicable, not including tax details (e.g., sales tax or VAT) can lead to legal issues or confusion. Always include the correct tax rate and amount, along with your tax identification number if required.

- Using Generic or Unprofessional Language: Avoid using unclear or overly casual language. A formal tone and professional terminology are essential to maintaining your credibility and ensuring that the request is taken seriously.

By being mindful of these common mistakes, you can create clear, professional, and accurate payment requests that minimize the risk of payment delays and help you maintain strong client relationships.

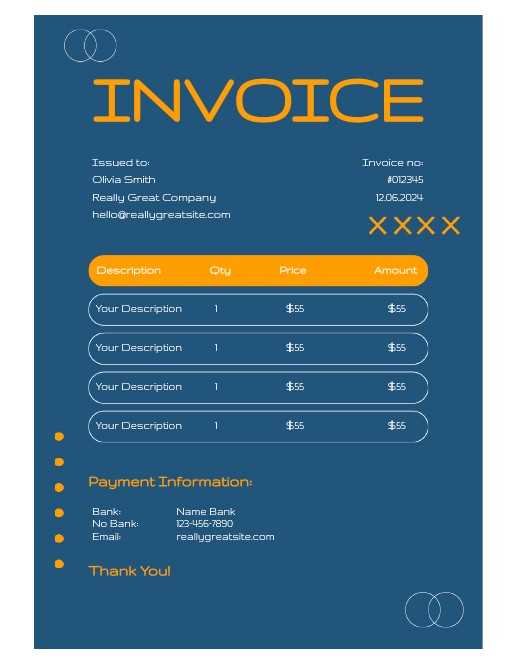

How to Make Invoices Look Professional

Creating a polished and professional payment request is crucial for maintaining a strong business reputation. A well-designed document not only ensures clarity but also demonstrates that you value your work and your client’s time. By following a few simple guidelines, you can elevate the appearance of your billing documents and make them stand out in a positive way.

Key Elements to Enhance Professionalism

Here are several important factors that contribute to a more professional and polished look for your documents:

- Use a Clean and Simple Layout: A cluttered or overly complicated design can distract from the important details. Stick to a clean, organized layout that is easy to read and understand. Use clear headings, simple fonts, and enough white space to make the content visually appealing.

- Incorporate Your Branding: Including your logo, brand colors, and fonts helps to reinforce your business identity. This adds a cohesive and professional touch, making the document feel more like an official communication rather than just a simple request for payment.

- Include Clear Contact Information: Make sure your contact details are prominently displayed at the top of the page. This includes your business name, address, email, and phone number. Having this information visible helps clients reach out if they have any questions or need clarification.

- Ensure Consistent Formatting: Use consistent formatting throughout the document–same font size for body text, aligned sections, and standardized bullet points or numbering. Consistency gives the do

Creating Recurring Invoices for Clients

For businesses that provide ongoing services, setting up a streamlined system for regular billing can save time and ensure predictable cash flow. Instead of manually creating new payment requests for each billing cycle, recurring documents automate this process, ensuring consistency and reducing administrative workload. Establishing a clear structure for these periodic requests helps maintain strong client relationships and simplifies the financial aspect of your business.

Here’s how you can set up recurring payment requests efficiently:

- Define Billing Cycle: The first step is to determine the frequency of the payment request–whether it’s weekly, monthly, quarterly, or annually. Make sure that the agreed-upon schedule aligns with the client’s needs and expectations.

- Specify Services and Charges: Clearly outline the services to be provided during each billing cycle and the corresponding costs. This helps prevent misunderstandings and ensures that the client knows exactly what to expect for each period.

- Set Clear Payment Terms: Establish payment deadlines, preferred methods, and any late fees for overdue payments. This helps ensure that the client is aware of when payments are due and what the consequences are for delays.

- Use Automation Tools: Many online tools and software allow you to set up recurring billing systems, where the document is generated automatically and sent to the client on a predetermined schedule. This reduces the need for manual input and helps maintain consistency.

- Send Reminders: It’s important to send a reminder to clients before each payment is due. This ensures that clients are prepared and reduces the likelihood of delayed payments. Include the amount due, payment methods, and a clear reminder of the payment date.

By automating recurring billing processes, you can save time, reduce errors, and improve cash flow management. Additionally, regular payment requests create a sense of structure and reliability, making it easier for both you and your clients to stay on top of ongoing services and payments.

How to Send Invoices Efficiently

Efficiently sending payment requests is crucial for ensuring that clients receive them on time, understand the details, and can pay promptly. The method and timing of delivery can have a significant impact on payment speed and overall client satisfaction. Streamlining the process not only saves you time but also improves the professionalism of your business communications.

Here are some tips to send payment requests effectively:

- Choose the Right Delivery Method: The best way to send documents depends on your client’s preferences and your business setup. Common methods include email, online payment platforms, or even physical mail for clients who prefer hard copies. Digital methods like PDFs sent via email are both fast and secure.

- Automate the Process: Using accounting software or online tools that allow for automatic document generation and delivery can save significant time. These tools can be programmed to send requests on a set schedule, reducing manual effort and the risk of forgetting to send a request.

- Ensure Clear Subject Lines and Attachments: When sending payment requests via email, ensure that the subject line clearly states the purpose of the message, such as “Payment Request for [Service] – [Invoice Number]”. Attach the document in a commonly accepted format, like PDF, to ensure your client can easily open and read it.

- Include All Relevant Information in the Body: In the body of your email or message, briefly summarize the key details, such as the amount due, the payment deadline, and any important instructions. This makes it easy for your client to quickly review the information before opening the attached document.

- Follow Up: If the payment request is not acknowledged within the specified timeframe, send a polite reminder. A follow-up email or message can help prompt action while maintaining professionalism. It’s important to set clear expectations about the timing of reminders in your payment terms.

- Track Deliveries: Use email tracking or delivery confirmation features to ensure that your request has been received. Some online invoicing platforms also offer this feature, providing a receipt of delivery and ensuring that your client has received the request.

By following these tips and choosing the most efficient delivery method for your business, you can ensure that your payment requests are sent in a timely, professional manner, reducing the likelihood of delays and improving cash flow.

Tracking Payments from Your Consulting Invoices

Keeping track of payments from your clients is essential for maintaining a healthy cash flow and ensuring timely financial reporting. Whether you’re managing a few clients or handling multiple accounts, having a system in place to monitor outstanding payments can prevent errors, reduce confusion, and help you stay on top of your financial records.

Here are some effective methods to track payments and ensure that everything is up to date:

- Use Accounting Software: Many businesses rely on accounting tools to automatically track payment status. These platforms can update your records when payments are received and even send reminders for overdue amounts. Tools like QuickBooks, Xero, or FreshBooks can help you monitor your accounts with ease.

- Create a Payment Tracking Spreadsheet: If you prefer a more hands-on approach, a well-organized spreadsheet can also do the job. List all clients, payment due dates, and amounts owed, and update it each time a payment is made. This method allows you to visualize your cash flow and spot overdue accounts quickly.

- Set Up Payment Reminders: One of the most important aspects of tracking is ensuring that you follow up on overdue payments. Setting up automatic email reminders or alerts when payment due dates approach can help you keep clients on track and reduce the chance of forgetting a payment.

- Record Payments Promptly: As soon as a payment is made, update your records. Timely data entry prevents errors and ensures that your records reflect the most current information, which is important for both financial planning and client communication.

- Track Payment Methods: It’s important to know how clients pay, whether through bank transfer, credit card, check, or an online payment service. This helps you match payments to specific documents and spot discrepancies between your records and the payment method used.

- Reconcile Accounts Regularly: Make sure to reconcile your accounts at regular intervals, whether weekly or monthly. This helps you spot any missed payments, identify discrepancies, and ensure that your financial records are accurate.

- Communicate with Clients: If a payment is overdue, don’t hesitate to reach out to the client. A polite reminder or an inquiry can go a long way in ensuring timely payment. Maintaining open communication fosters a positive working relationship while ensuring that your financial needs are met.

By implementing a system to track payments efficiently, you can improve cash flow management, reduce administrative work, and build stronger client relationships through clear and transparent financial communications.

Legal Considerations for Consulting Invoices

When preparing payment requests for services rendered, it’s essential to consider the legal implications to ensure compliance with local regulations and contractual agreements. Failing to follow proper procedures could lead to disputes, delayed payments, or even legal action. Understanding the legal aspects of these documents helps protect both the service provider and the client, fostering a transparent and professional business relationship.

Here are key legal considerations to keep in mind when preparing your payment requests:

- Clear Terms of Agreement: Always have a written contract or agreement with your client that outlines the scope of work, payment terms, and deadlines. This will serve as a reference in case of any disputes over payment or services rendered.

- Accurate and Complete Information: Ensure that all necessary details, such as your business information, the client’s details, and descriptions of the services provided, are accurately included. Incorrect or incomplete information may lead to payment delays or misunderstandings.

- Tax Compliance: Depending on your location and the services provided, you may be required to charge sales tax, VAT, or other taxes. Make sure to include the correct tax information on your payment requests and be aware of the tax rates applicable to your services.

- Payment Deadlines and Late Fees: It’s crucial to specify payment deadlines clearly in your documents. Also, including late fees or interest on overdue payments can encourage clients to pay on time and ensure you are compensated for any delays.

- Contractual Obligations: If you’ve agreed to specific payment schedules, installment plans, or retainers, these should be reflected in your payment requests. Consistently following the agreed-upon terms helps prevent potential legal issues or disputes.

- Client Authorization: In some cases, clients may need to sign off on the work completed or approve certain services before payment is requested. Always ensure that you have the necessary approvals documented before issuing a payment request.

- Record Keeping: Legally, you may be required to keep accurate records of all payments, especially for tax purposes. Store copies of all payment requests and receipts for future reference in case of audits or disputes.

Being aware of these legal aspects will help you avoid potential pitfalls and ensure that your business remains co

Automating Your Invoice Creation Process

Streamlining the process of generating payment requests can save valuable time, reduce human error, and ensure consistency across all client communications. By automating this process, businesses can focus more on delivering services rather than on administrative tasks. Automation allows for the creation of accurate, timely, and professional documents without the need for manual input every time a payment is due.

Here are some steps to automate the process of creating and sending payment requests:

- Choose the Right Software: Many accounting and invoicing tools are designed to automate the creation and delivery of payment requests. Platforms like QuickBooks, FreshBooks, or Zoho Invoice offer features like automatic billing cycles, recurring services, and customizable templates to streamline the process.

- Set Up Recurring Payment Schedules: If you offer ongoing services, automation tools allow you to set up recurring billing cycles. Once a schedule is created, the system will automatically generate and send requests on the specified dates without any manual intervention.

- Customize Your Documents: Even with automation, it’s important to customize your payment requests to reflect your branding and specific service details. Choose a platform that allows for customization of fields such as client name, service descriptions, amounts, and payment terms.

- Integrate with Payment Gateways: Many automation tools can be integrated with payment processing systems like PayPal, Stripe, or bank accounts. This allows you to automatically track payments, update records, and even send receipts once a payment is made.

- Set Up Payment Reminders: Automating follow-up reminders for unpaid amounts is another way to reduce the risk of delayed payments. Most invoicing platforms will send automatic reminders to clients before and after the due date, ensuring that no payments are overlooked.

- Monitor and Report: Automated systems often provide built-in reporting features, allowing you to track the status of payments, identify overdue amounts, and generate detailed financial reports. This gives you better control over your cash flow and client accounts.

By implementing automation in the creation and management of payment requests, businesses can not only reduce administrative workload but also improve overall efficiency and accuracy in their financial operations. With the right tools, the entire process–from generation to tracking–can be simplified, allowing you to focus on more strategic aspects of your business.

How to Avoid Invoice Disputes

Disputes over payments can harm business relationships and delay cash flow. Clear communication, well-documented agreements, and accurate details are essential in preventing conflicts. By taking proactive steps, businesses can avoid misunderstandings and ensure smooth financial transactions with clients.

Here are several strategies to minimize the risk of payment disagreements:

- Define Expectations Upfront: Before starting any project, ensure that both parties have a clear understanding of the scope of work, timelines, and payment terms. A well-drafted agreement or contract sets the foundation for avoiding disputes later on.

- Be Transparent with Costs: Make sure that all charges are itemized and explained clearly. If additional services are required or there are any changes in cost, communicate these in advance to avoid surprises when payment is due.

- Maintain Consistent Communication: Keep your clients updated throughout the process. If there are any issues or delays, discuss them openly and early to prevent confusion when it’s time to submit a payment request.

- Double-Check the Details: Always ensure that the client’s information, the services rendered, and the agreed-upon rates are accurately reflected in your payment requests. Small errors or missing details can lead to delays or disputes.

- Include Clear Payment Terms: Specify due dates, late fees, and accepted payment methods on all documents. Make sure your clients are aware of these terms upfront to avoid disagreements on payment timelines or fees.

- Get Client Approval: If possible, have your client approve the work or deliverables before sending a request. This ensures that there are no disagreements about whether the work was completed as agreed.

- Use Professional Language: Ensure that your communication is polite, professional, and free of ambiguity. Avoid using vague terms that could lead to different interpretations of the agreement.

- Document Everything: Keep thorough records of all communications, agreements, and transactions. In case a dispute arises, having a well-documented history of the project will help resolve the issue quickly.

By taking these preventive steps, businesses can reduce the likelihood of disputes and foster positive, long-term relationships with their clients. The key is clarity, transparency, and proactive communication at every stage of the project.

Top Tools for Managing Consulting Invoices

Managing payment requests efficiently is crucial for maintaining a smooth workflow and ensuring timely payments. Whether you’re a solo freelancer or running a larger business, using the right tools can help you streamline the entire process, from creation to tracking. These tools not only save time but also reduce the risk of errors and offer additional features like financial reporting and client management.

Here are some of the top tools that can help you manage payment requests effectively:

1. FreshBooks

FreshBooks is a popular tool among small businesses and freelancers. It allows you to create professional documents, track payments, and send reminders automatically. FreshBooks also integrates with various payment gateways, making it easy for clients to pay directly online.

2. QuickBooks

QuickBooks is an all-in-one accounting software solution that offers features for creating detailed payment requests, tracking expenses, and managing finances. It’s ideal for businesses looking for a comprehensive system to handle invoicing, tax calculations, and financial reports.

- Features: Recurring billing, automatic payment tracking, customizable documents.

- Best For: Businesses that need advanced accounting capabilities alongside payment request management.

3. Zoho Invoice

Zoho Invoice is a cloud-based solution for creating and managing payment requests. It offers easy-to-use features like time tracking, project billing, and integration with popular payment gateways. With Zoho, you can also set up recurring payments, which makes it ideal for clients with ongoing needs.

- Features: Multi-currency support, time-tracking, client portal, customizable templates.

- Best For: Freelancers and small businesses who need an intuitive and affordable option.

4. Xero

Xero is another comprehensive tool that provides robust features for financial management. It helps you manage payment requests, track due dates, and even send automatic reminders. Xero also allows for easy integration with bank accounts and other financial tools, making it easier to reconcile payments.

- Features: Customizable payment requests, automatic bank feeds, project tracking.

- Best For: Small to medium-sized busi