Download the Best Invoice Template for Consultancy Services

When running a business, especially one that relies on client relationships, ensuring smooth and efficient payment processes is essential. Managing finances accurately and professionally can build trust with clients and ensure a steady cash flow. A structured approach to billing can save time, reduce errors, and keep everything organized.

Utilizing a well-organized document helps professionals quickly detail the amount owed, payment terms, and the specific work completed. Whether you work on a project basis or have ongoing agreements, this method makes it easier for clients to understand their responsibilities and for you to track payments.

Customizing your billing documents allows you to reflect the unique nature of your work while maintaining a professional image. With the right format, you can present clear, concise details, ensuring both you and your clients remain on the same page financially.

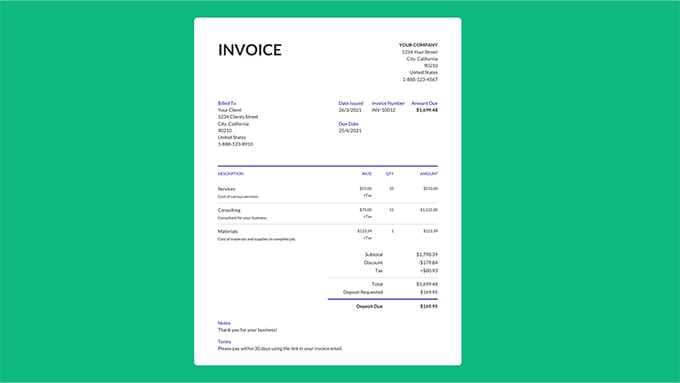

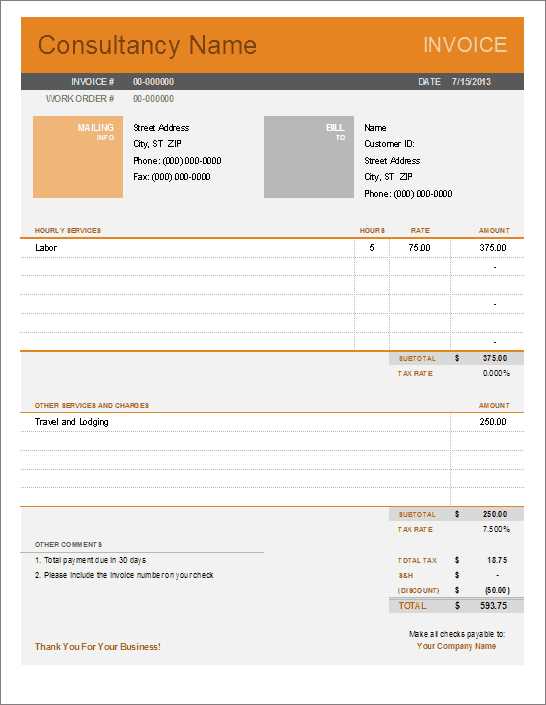

Invoice Template for Consultancy Services

A clear and well-organized document is crucial when requesting payment for completed work. Whether you’re billing a one-time project or recurring tasks, having a consistent format ensures that clients understand the charges and helps you maintain a professional appearance. A structured approach simplifies the entire payment process for both parties involved.

Key Elements to Include in Your Document

Each billing statement should contain specific details to avoid confusion. These include contact information, a breakdown of the work completed, payment terms, and due dates. Additionally, clearly defining any applicable taxes, discounts, or extra charges will help clients understand the full cost. Including a unique invoice number will also aid in tracking and record-keeping.

Customizing Your Document for Clients

Having a flexible format allows you to cater to different clients’ needs. Including a personalized message or specific payment instructions can make a significant difference in how clients perceive your professionalism. Furthermore, offering multiple payment methods and specifying any late fees for overdue amounts can encourage timely settlements.

Why Use an Invoice Template

Using a consistent structure when requesting payment ensures professionalism and accuracy. A well-designed document helps to clearly communicate charges, terms, and deadlines, reducing misunderstandings and administrative work. Having a ready-made format streamlines the process, saving both time and effort for businesses and clients alike.

Benefits of Structured Documents

When you rely on a pre-built structure, you reduce the risk of errors and ensure that essential information is never overlooked. This consistency not only helps to keep your records organized but also enhances the credibility of your business. Additionally, a clear format ensures clients can easily read and understand the breakdown of costs, fostering trust and improving payment timelines.

Comparison of Manual vs. Structured Billing

| Manual Process | Structured Document |

|---|---|

| Increased chance of missing essential details | All required fields are predefined |

| Time-consuming to create from scratch | Quick and easy to fill out |

| Risk of inconsistency across documents | Uniform appearance and information layout |

| Requires manual calculations and adjustments | Automated fields reduce errors |

Key Features of a Good Template

A well-structured document should be easy to navigate and include all necessary information in a clear and concise manner. The best formats not only help communicate the amount due but also enhance your professionalism. A good layout ensures that important details are never overlooked, and the client can easily process the request for payment.

Essential Elements to Include

- Business and Client Details: Contact information, names, and addresses are fundamental for proper identification.

- Breakdown of Charges: Clearly outlining the work completed and the corresponding cost ensures transparency.

- Payment Terms: Include due dates, accepted payment methods, and any applicable late fees.

- Unique Identification Number: Each document should have a unique reference number for tracking purposes.

- Tax Information: If applicable, clearly list any taxes or other charges related to the amount owed.

Additional Features to Consider

- Customizable Fields: A flexible structure allows you to adjust each document based on the client’s needs.

- Automated Calculations: Built-in features that automatically calculate totals and taxes reduce human error.

- Professional Design: A clean, modern layout that reflects the professionalism of your business.

- Space for Notes: A section for any additional instructions or terms can be helpful for both parties.

How to Customize Your Billing Document

Creating a unique and professional billing document allows you to reflect your brand’s personality and maintain a consistent, polished look in all client communications. Modifying the structure and appearance of your billing records can enhance clarity and ensure that all necessary details are communicated effectively.

To begin, adjust the layout by choosing fonts and colors that align with your brand’s style. Highlight key sections using bold or italicized text to make important information easily noticeable.

Next, personalize the content by including relevant information about your business, such as company name, address, and contact details. Adding a logo in the header can also help reinforce your brand identity.

Finally, consider adding custom fields tailored to your specific business needs, like project descriptions or unique client reference numbers. This allows you to make the billing process more organized and helps clients track payments efficiently.

Benefits of Digital Billing Solutions for Advisors

Switching to digital billing offers advisors numerous advantages that simplify financial interactions and streamline client communication. Modernizing payment requests digitally not only saves time but also provides added accuracy, security, and ease of record-keeping.

Improved Efficiency and Speed

Digital billing reduces the time spent on manual tasks, as automated systems allow advisors to quickly generate and send requests for payment. Clients receive these documents instantly, leading to faster payment cycles and improved cash flow.

Enhanced Organization and Tracking

Digital billing platforms offer clear organization, allowing advisors to track outstanding payments and view the status of each financial transaction. This capability reduces errors and provides a comprehensive overview of all incoming funds.

| Advantage | Description | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Section | Details | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Header | Include your company name, logo, and contact information, as well as the client’s details for clarity. | |||||||||||||||||||||

| Work Description |

| Component | Description | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Hourly Rate | Determine a fair rate based on experience, industry standards, and the specific requirements of the work. Adjust the rate if necessary to reflect the complexity of tasks. | ||||||||||||||||

| Project-Based Charges | If charging by project, establish a clear total that covers all phases of the work. This can help clients see the comprehensive value of the c

Best Practices for Sending Billing DocumentsSending payment requests effectively is crucial to maintaining smooth client relationships and ensuring prompt payments. Proper timing, clarity, and a professional approach all play key roles in the process. By following a few best practices, you can enhance the likelihood of receiving payments on time and strengthen your rapport with clients. Choose the Right TimingTiming greatly impacts the effectiveness of a payment request. Sending it promptly upon project completion or at the agreed time shows professionalism and keeps your payment cycle steady. Avoid delays, as they can disrupt cash flow and potentially cause confusion about deadlines. Use Clear and Concise LanguageEnsure that your message is clear and includes all essential details without excessive wording. Use straightforward language and a well-structured format to make it easy for clients to review and understand the required payment. Highlight due dates, payment options, and any applicable terms. Follow Up Politely What to Do if a Client Doesn’t PayOccasionally, a client may delay payment despite all prior agreements and reminders. Addressing this situation professionally can help resolve the issue while preserving a positive business relationship. The steps below outline how to handle unpaid accounts effectively and with minimal friction. Steps to Address Unpaid Accounts

|