Invoice Template for Car Rental Business

Managing financial transactions efficiently is essential for businesses offering vehicles to clients. A well-structured document helps ensure clarity and transparency, making the entire process smoother for both the provider and the customer. Whether you run a small local service or a larger operation, having a clear and effective billing method can improve your overall workflow and professionalism.

By utilizing customizable forms designed specifically for vehicle leasing, you can create consistent and organized records for every transaction. These documents are not only a way to record the costs but also an important tool in building trust with your clients. With the right format, you can ensure that all necessary details are included, such as dates, rates, and additional charges, which helps avoid confusion and disputes.

Efficient and easy-to-use templates can save you time while maintaining the quality of your financial communications. Whether you need to adjust details for individual clients or manage multiple transactions, a solid document setup can simplify these tasks. It also ensures that all legal requirements are met and that your clients receive a professional-looking receipt every time.

Invoice Template for Car Rental

When offering vehicles to clients, providing clear and professional documentation is essential to ensure smooth transactions. This kind of document serves as both a receipt and a record of the services provided, detailing all charges and terms agreed upon. Having a well-organized and easy-to-use document layout simplifies the process for both parties, enhancing customer satisfaction and ensuring accuracy in financial records.

The right structure will help you maintain consistency across all transactions and provide a reliable system for managing payments, taxes, and additional fees. Customizable fields allow you to tailor the document to your specific business needs, whether it’s a daily, weekly, or long-term service. A good setup ensures that no important detail is overlooked and that clients have a clear understanding of what they are being charged for.

Key Details to Include in the Document

Each document should contain several key elements to ensure that all necessary information is communicated clearly. These elements will not only provide clarity for the client but also help you stay organized and compliant with legal requirements. Below are the most important sections to include:

| Section | Description |

|---|---|

| Service Provider Details | Include the name, address, contact information, and business registration number. |

| Client Information | Record the customer’s name, address, and contact details to ensure correct identification. |

| Transaction Dates | Clearly state the start and end dates of the service period to avoid confusion. |

| Vehicle Information | Provide specifics about the vehicle, including make, model, registration number, and condition. |

| Charges and Fees | Break down the costs, including base rates, taxes, and any additional charges such as late fees or extra insurance. |

Why Customization Matters

Customization options allow you to adapt the document to the specific needs of your business. This can include modifying the layout to reflect your brand or adding custom fields to account for specific services, such as fuel charges or delivery fees. Being able to adjust and update your format easily will ensure that your documents are always up to date and aligned with your current pricing structure.

Why You Need an Invoice Template

Having a standardized document to record financial transactions is crucial for any business. It ensures that both the service provider and the client have a clear understanding of the terms of the agreement, including the charges and payment schedule. Without this essential tool, managing payments, tracking expenses, and maintaining accurate records becomes challenging and prone to errors.

Using a well-structured document saves time and helps maintain consistency across all transactions. It reduces the risk of mistakes and misunderstandings, which can lead to disputes or delayed payments. With a customizable layout, you can easily adapt the format to suit your specific business needs and ensure that all the necessary information is included.

Streamlining your billing process through the use of a reliable document not only boosts your professionalism but also enhances customer satisfaction. Clients appreciate clarity, and receiving a well-organized statement builds trust and confidence in your services. Additionally, having everything neatly recorded in one place makes it easier to manage finances, prepare taxes, and provide accurate reports when needed.

In industries where services are provided on a temporary or rental basis, offering this kind of documentation is not just helpful–it’s often required by law. Having a standardized approach ensures compliance with legal and tax regulations, which ultimately protects both you and your clients from potential issues down the line.

How to Customize Your Invoice Template

Personalizing your financial documents is an essential step in ensuring they meet the unique needs of your business. A customizable format allows you to include specific details that reflect your services, pricing structure, and branding. Customizing ensures that all required information is presented clearly, helping to avoid confusion and improving the overall professionalism of your transactions.

There are several key areas where customization can be applied. Here’s a breakdown of the most important aspects to consider:

Key Customization Areas

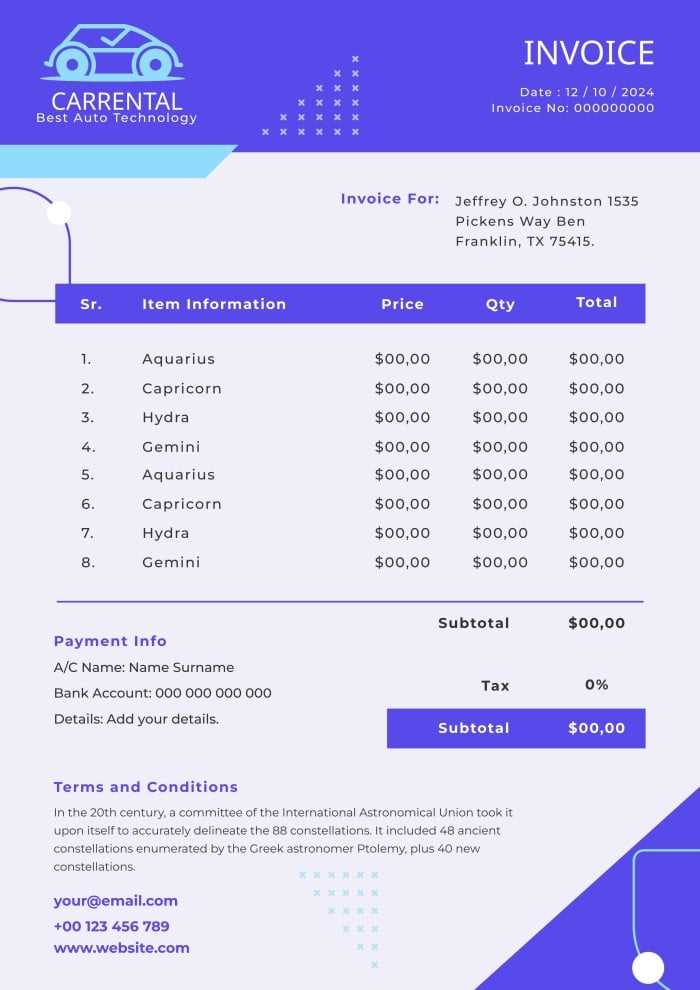

- Business Branding: Include your logo, business name, and contact details at the top of the document. This gives your clients a professional first impression and strengthens brand recognition.

- Service Description: Customize the sections for detailing the services provided. Depending on the nature of your business, you may need to add fields for specific details like vehicle model, duration, and additional features like GPS or insurance.

- Pricing Structure: Adjust the pricing breakdown to match your rates, whether they are hourly, daily, or based on a different system. Clearly itemize the charges to avoid misunderstandings.

- Legal Terms: Add necessary terms and conditions specific to your services. This could include information about security deposits, fuel policies, or penalties for late returns.

Formatting and Layout

- Consistency: Ensure that the fonts, colors, and layout are consistent with your business’s overall branding. This reinforces a professional image and makes your documents easier to read.

- Sections Order: Consider the logical flow of information. Arrange the sections in an order that makes sense to the client, starting with basic details and moving to more specific information like charges and payment instructions.

- Custom Fields: Add or remove fields as necessary. For example, you might want to include fields for optional services, customer preferences, or a space for discounts or promotions.

By customizing these elements, you create a document that is both functional and reflective of your brand, helping to build a stronger relationship with your clients and enhancing the overall customer experience.

Key Elements of a Car Rental Invoice

A well-organized financial document is essential for accurately reflecting the terms of service and ensuring transparency in business transactions. The core elements of such a document are designed to provide clarity for both the provider and the client, detailing all necessary information about the agreement, services, and costs. Understanding the key sections to include helps streamline your billing process and reduces the risk of errors or misunderstandings.

Below are the most important components to ensure your document is comprehensive, clear, and legally compliant:

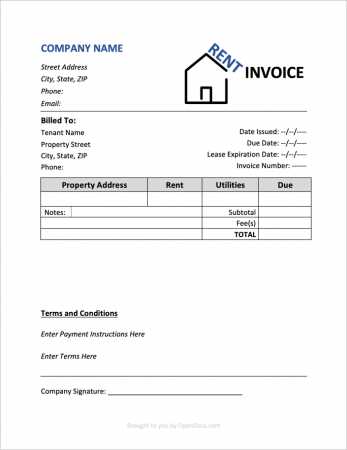

- Business Information: Include the name, address, phone number, and email of your business. This establishes the identity of the service provider and provides clients with the contact details they might need for future inquiries or issues.

- Client Details: Record the name and contact information of the customer receiving the service. This is crucial for proper identification and helps ensure that the document reaches the correct individual or entity.

- Transaction Dates: Clearly indicate the start and end dates of the service period. This helps define the duration of the service and prevents any confusion about the charges associated with it.

- Vehicle Information: Include specific details about the vehicle, such as its make, model, registration number, and any distinguishing features. This ensures that both parties are clear about what was provided.

- Pricing Breakdown: Provide a detailed list of charges, including base costs, additional fees (such as insurance or fuel), and applicable taxes. A clear breakdown helps the customer understand exactly what they are being charged for and why.

- Payment Terms: Specify payment instructions, including accepted methods (credit card, bank transfer, etc.) and due dates. It’s also useful to include late fees or penalties if payments are delayed.

- Terms and Conditions: Include any relevant policies, such as damage charges, fuel requirements, or cancellation policies. These terms help protect your business and set clear expectations with the client.

Including these key elements ensures that your financial documents are complete, transparent, and easy for customers to understand, promoting trust and helping you avoid potential disputes.

Creating a Professional Car Rental Invoice

When providing a service that involves the temporary use of a vehicle, clear and detailed documentation is essential for both the provider and the customer. The document should reflect all aspects of the transaction, ensuring both parties have a clear understanding of the terms and costs. This includes specifying the duration of use, applicable charges, and any additional fees or discounts. A well-crafted document can help prevent misunderstandings and maintain professionalism in business dealings.

Start by including essential information such as the provider’s contact details, the customer’s name, and the dates of the agreement. It’s important to list the exact terms of the agreement, including any policies regarding late returns or damage. Additionally, itemizing costs for the duration of the service, along with any supplementary fees, provides transparency. Using a clear, organized layout ensures the recipient can easily review the details of the transaction, reinforcing trust and clarity in the process.

Best Practices for Billing Customers

When handling payments for temporary vehicle usage, ensuring clarity and accuracy in the billing process is crucial. Proper communication of costs and charges helps foster trust between the service provider and the customer, minimizing potential disputes and confusion. Following best practices for billing not only enhances the customer experience but also improves operational efficiency.

Clear and Transparent Pricing

One of the key components of effective billing is ensuring customers understand the charges they are incurring. A breakdown of costs, including the base fee, any additional services, and taxes, should be clearly listed. It’s essential to avoid hidden fees that might surprise the customer later. Consider the following:

- List all charges individually, such as daily rates, insurance, fuel, or delivery fees.

- Communicate policies on cancellations, delays, and damages in advance to avoid misunderstandings.

- Offer clear terms on payment deadlines and late fees, if applicable.

Efficient Payment Processing

Ensuring a smooth and hassle-free payment process is essential for customer satisfaction. Offering multiple payment options and providing a clear path for completing transactions can enhance convenience. These practices can streamline payments:

- Provide a variety of payment methods, including credit cards, online transfers, and mobile payment options.

- Confirm payment status promptly with receipts or confirmation messages sent directly to the customer.

- Maintain a secure platform for transactions to ensure customer data is protected.

How to Format Your Invoice for Clarity

Organizing payment documents in a straightforward and readable way can greatly enhance the client’s understanding and trust in the services provided. A clear structure allows customers to easily review all details related to their transaction, minimizing confusion and potential errors. Proper formatting also contributes to a professional appearance, leaving a positive impression.

Key Information at the Top

Start by placing the most essential details at the top of the document to ensure they are noticed immediately. These typically include:

- Provider’s name, address, and contact information

- Customer’s name and relevant contact details

- Document date and unique reference number

Organized Breakdown of Charges

To make the document

How to Format Your Invoice for Clarity

Organizing payment documents in a straightforward and readable way can greatly enhance the client’s understanding and trust in the services provided. A clear structure allows customers to easily review all details related to their transaction, minimizing confusion and potential errors. Proper formatting also contributes to a professional appearance, leaving a positive impression.

Key Information at the Top

Start by placing the most essential details at the top of the document to ensure they are noticed immediately. These typically include:

- Provider’s name, address, and contact information

- Customer’s name and relevant contact details

- Document date and unique reference number

Organized Breakdown of Charges

To make the document easy to read, break down all costs in a structured format. Group related charges together and label each section clearly:

- Main Services: Specify the duration and rate of the primary service.

- Additional Costs: List any extra fees, such as for insurance, additional mileage, or equipment.

- Taxes and Discounts: Include any applicable taxes and show deductions separately if discounts were applied.

Final Amount and Payment Instructions

At the end of the document, highlight the total amount due along with clear instructions on how to complete the transaction. This section should include:

- Total Balance: Ensure the final amount is bold or separated for easy visibility.

- Due Date: Mention when the payment is expected.

- Payment Options: List acceptable methods, such as credit card, bank transfer, or online payment.

Common Mistakes to Avoid in Invoices

When issuing billing documents, small errors can lead to misunderstandings, delayed payments, and a less professional impression. Ensuring accuracy and attention to detail helps build trust and keeps the payment process smooth. Here are some common missteps to watch out for and tips on how to avoid them.

Leaving Out Essential Information

A missing detail can create confusion and result in delayed payments. Always make sure to include the following:

- Clear contact information for both parties involved

- A unique reference number to track the document

- A precise breakdown of services and charges, including dates and rates

Using Complicated Language

Overly technical or vague language can make it difficult for the customer to understand the details of the document. Instead:

- Use simple and direct terms to describe services and fees

- Avoid industry jargon that may not be familiar to the recipient

- Include brief explanations for any additional charges or policies

Adding Taxes and Fees to Invoices

Incorporating taxes and extra charges accurately into billing documents is essential to avoid confusion and ensure full transparency with clients. Detailing these costs provides a clear picture of the total amount due, helping customers understand exactly what they are paying for and why. Including taxes and additional charges in a clear format also supports compliance with legal requirements.

Identifying Applicable Taxes

First, determine which taxes are relevant based on your location and the nature of the service. Some regions may require specific types of taxes, so be sure to:

- Consult local tax regulations to understand applicable rates

- Include value-added tax (VAT) or sales tax if required

- Clearly label the tax type and rate to avoid customer confusion

Listing

Adding Taxes and Fees to Invoices

Incorporating taxes and extra charges accurately into billing documents is essential to avoid confusion and ensure full transparency with clients. Detailing these costs provides a clear picture of the total amount due, helping customers understand exactly what they are paying for and why. Including taxes and additional charges in a clear format also supports compliance with legal requirements.

Identifying Applicable Taxes

First, determine which taxes are relevant based on your location and the nature of the service. Some regions may require specific types of taxes, so be sure to:

- Consult local tax regulations to understand applicable rates

- Include value-added tax (VAT) or sales tax if required

- Clearly label the tax type and rate to avoid customer confusion

Listing Additional Charges

Sometimes, additional costs may apply based on the specifics of the service or agreement. Ensure each extra fee is clearly itemized to maintain transparency:

- Service Fees: Any extra costs for specific options or support provided during the agreement

- Late Return or Damage Fees: Charges that apply if the customer returns the vehicle late or if repairs are necessary

- Fuel Surcharges: Additional costs if fuel levels are not restored to the original level

Calculating the Final Total

After listing all taxes and fees, calculate the final amount due in a clear, organized manner. Consider the following approach:

- Summarize the base cost of the service

- Add taxes and clearly state the rate applied

- Include each additional fee with a brief explanation if necessary

Using this structured approach ensures that the final amount is both accurate and understandable, helping maintain a professional relationship with the client.

Payment Methods for Car Rental Invoices

Offering multiple ways to settle payments can enhance convenience for clients and ensure prompt transactions. By providing a variety of options, you cater to different preferences, making it easier for clients to complete their payments securely and on time. Clear instructions for each method can also help avoid delays and misunderstandings.

Popular Payment Options

Consider integrating a mix of traditional and digital options to accommodate various client needs. Common choices include:

- Credit and Debit Cards: Accepted worldwide, cards offer a fast and familiar way to process payments. Ensure secure handling to protect customer data.

- Bank Transfers: Ideal for larger transactions, direct bank transfers are a reliable choice, though they may take a few days to process depending on the bank.

- Online Payment Platforms: Services like Pay

How to Track Outstanding Invoices

Maintaining an organized system to monitor unpaid bills is crucial for healthy cash flow and efficient business operations. Tracking outstanding amounts ensures that no payments slip through the cracks and helps in following up with clients on overdue balances. Here are some effective strategies to keep all transactions in check.

Set Up a Tracking System

An organized tracking system can help manage due dates and outstanding amounts effectively. Consider using:

- Accounting Software: Many platforms provide features to categorize, track, and set reminders for upcoming or past due balances.

- Spreadsheets: For smaller operations, customized spreadsheets with columns for dates, amounts, and client details can also be effective.

Automate Reminders and Notifications

Automated reminders help maintain timely communication with clients about upcoming due dates or overdue amounts. Benefits of setting up reminders include:

- Timely Follow-Ups: Automated emails or texts can notify clients a few days before the payment is due.

- C

Legal Requirements for Car Rental Invoices

Ensuring compliance with legal standards is essential when creating billing documents. Including the correct details not only provides transparency but also protects both the business and the client in any financial transaction. Understanding the necessary components can help avoid disputes and potential penalties.

Mandatory Information to Include

Various details must be clearly listed to meet regulatory requirements. Here is a general guideline of the information commonly required:

Required Detail Description Business Name and Contact Information Include the official name, address, phone number, and email of your company. Client Details List the customer’s name and contact information to ensure clear identification. Transaction Date Specify the date when the agreement was made and when the service period begins and ends. Detailed Service Description How to Manage Multiple Invoice Templates

Keeping various document formats organized can streamline the billing process and help meet the specific needs of different clients or service types. When handling multiple layouts, implementing a structured approach can save time, reduce errors, and improve consistency across all transactions.

Organize Your Templates Effectively

A systematic approach to storing and accessing different formats can simplify your workflow. Consider the following methods:

- Create a Folder Structure: Organize files by categories such as service type or client, using folders and subfolders for quick access.

- Use Descriptive File Names: Name files with clear identifiers, like client name or transaction type, so each is easy to locate.

- Version Control: Keep track of updates to ensure you’re always using the most recent document format.

Utilize Digital Tools

Automating

Benefits of Digital vs Printed Invoices

Choosing between digital and paper-based billing documents impacts efficiency, cost, and environmental footprint. Each method has unique advantages that cater to different business needs, client preferences, and operational goals.

Advantages of Digital Billing

Electronic formats are increasingly popular due to their convenience and adaptability. Key benefits include:

- Speed and Efficiency: Digital documents can be created, sent, and received almost instantly, accelerating the payment process.

- Lower Costs: By eliminating printing and mailing expenses, digital solutions reduce overall costs and save time.

- Eco-Friendly Option: Going paperless reduces paper waste and minimizes a business’s carbon footprint.

- Easy Access and Storage: Electronic records are simple to organize and retrieve, reducing clutter and improving documen

Improving Customer Experience with Invoices

The way billing documents are presented can have a significant impact on customer satisfaction. Clear, well-organized statements not only reflect professionalism but also contribute to a smoother, more transparent transaction process. Enhancing this aspect of your business can improve trust and foster positive relationships with your clients.

Clarity and Transparency

One of the key factors in providing a better customer experience is ensuring that all details are easy to understand. Here are some ways to achieve this:

- Clear Breakdown of Charges: Providing a detailed list of services, fees, and applicable taxes helps customers understand exactly what they are paying for.

- Easy-to-Read Layout: A clean, well-organized format with headings, bullet points, and logical flow makes it easier for clients to quickly navigate the document.

- Highlighting Key Information: Important details, such as payment due dates, amounts owed, and contact information, should be easy to find.

Personalization and Customer Engagement

Including personalized elements in billing statements can make clients feel more valued. This approach can lead to greater satisfaction and customer loyalty:

- Custom Notes: Adding a thank-you message or personalized note can help build rapport and show appreciation.

- Tailored Communication: Address clients by name and consider including specific references to their unique transaction details.

By focusing on clarity, transparency, and personalization, you create a better experience for your clients, encouraging repeat business and fostering long-term relationships.