Simple and Effective Invoice Template for Apartment Rental

Managing monthly payments effectively is essential in any rental arrangement. Clear and concise billing documents help ensure a smooth transaction, minimize misunderstandings, and provide both parties with a reliable record of transactions. Such documents not only serve as a reminder of upcoming payments but also help landlords and tenants alike keep track of agreed-upon terms.

When it comes to leasing, having a structured payment record simplifies life for property managers and independent landlords. A well-organized document communicates all the necessary details in one place, from the payment due date to contact information, which can help resolve any questions quickly. This also makes it easier to manage finances and meet reporting needs.

Using a ready-to-fill document makes the process more efficient, especially if designed to capture es

Creating an Effective Rental Invoice

Designing a reliable billing document is crucial in establishing transparent financial arrangements between tenants and property owners. A well-structured document not only ensures accurate payments but also promotes trust and professionalism in the leasing relationship. By including essential details in a clear format, both parties gain a dependable reference for all transactions.

Key Components of a Billing Document

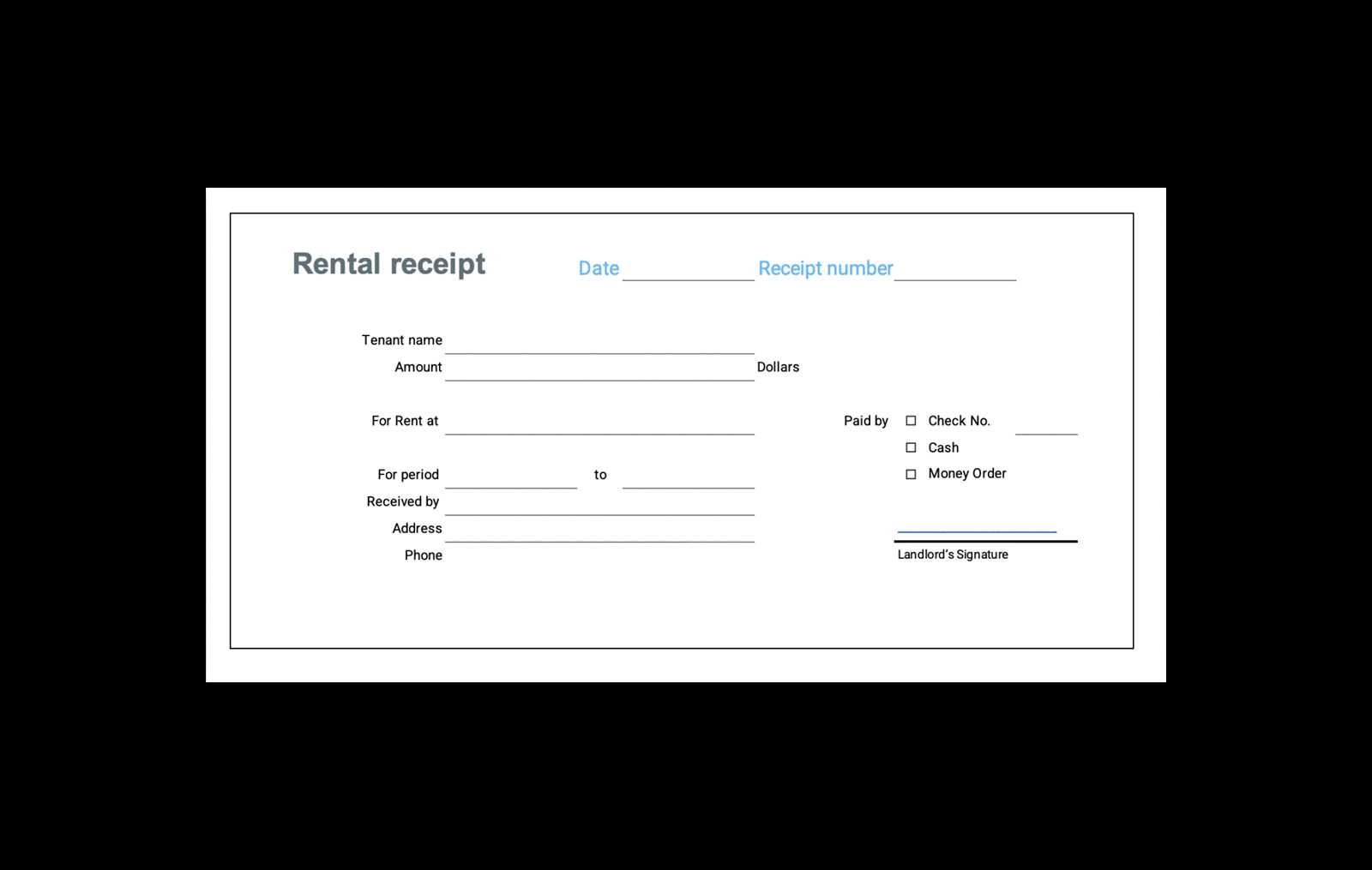

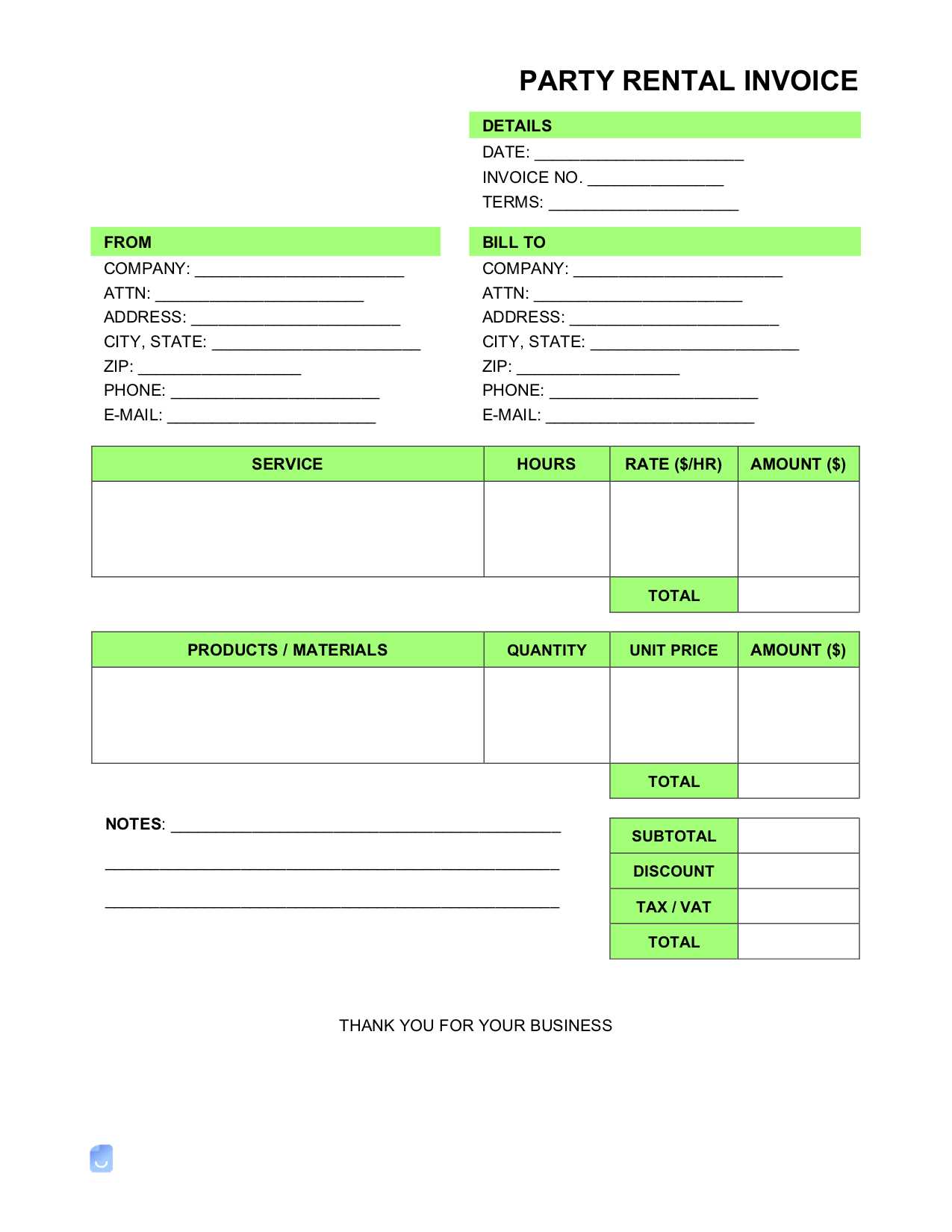

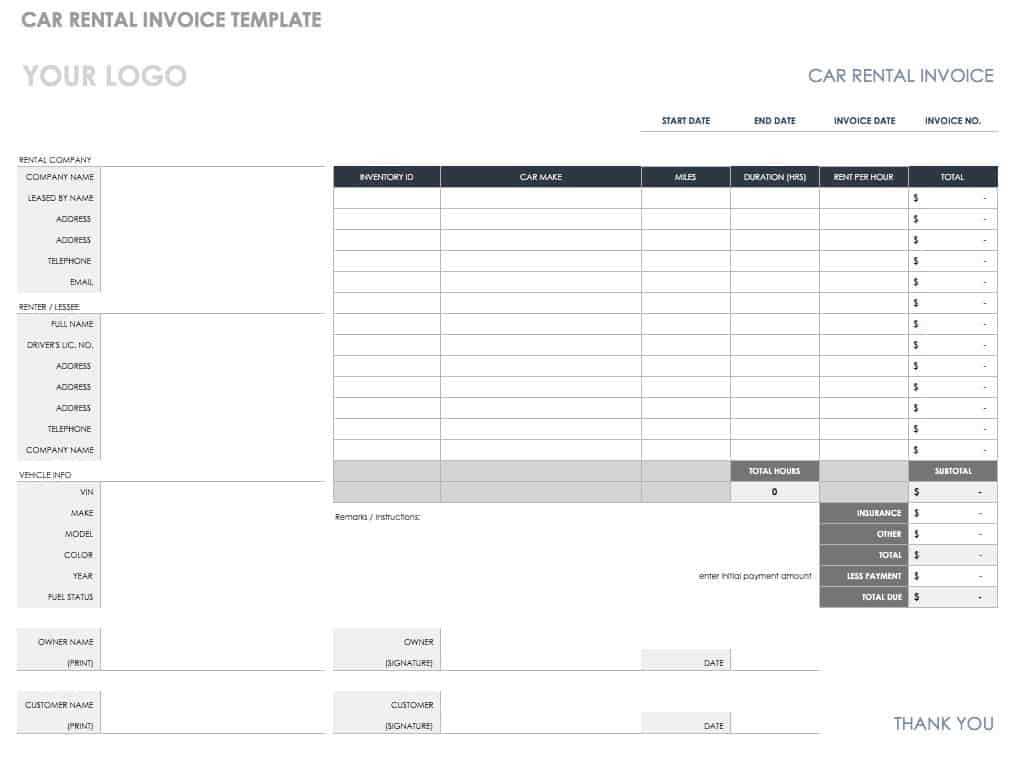

An effective billing document should contain several key elements to avoid misunderstandings and simplify payment processing. At the top, include the payer and payee names along with any contact information. Clearly stating the total amount due, payment due date, and accepted payment methods is essential. Including a brief breakdown of any additional fees or charges provides clarity and helps prevent disputes.

Making Your Document User-Friendly

To enhance readability, choose a layout that organizes information logically. Grouping details in separate sections, such as payment terms and contact details, allows readers to find what they need quickly. Usi

Benefits of Using an Invoice Template

Organizing payment records efficiently can greatly simplify the management of monthly transactions and keep both landlords and tenants informed. Using a pre-designed document makes it easy to standardize payment requests and ensures that all necessary details are presented clearly, reducing misunderstandings and saving time for everyone involved.

A structured billing document provides consistency across transactions, which is particularly helpful when handling multiple tenants or properties. With all key information laid out in a uniform way, property owners can track payments more accurately, and tenants benefit from a clear, predictable format. This approach also helps ensure that legal and financial details are documented properly, aiding in record-keeping and compliance.

Using a ready-made format saves time by eliminating the need to recreate essential details each month. This lets property managers focus on other responsibilities, knowing their payment documents are reliable and professional. A consistent document format also makes it simpler to spot any discrepancies or outstanding balances quickly, ensuring smoother interactions between tenant

How to Structure a Rental Invoice

Setting up a well-organized billing document is essential to ensure all payment information is communicated clearly and effectively. A logical structure not only helps tenants understand their obligations but also allows landlords to manage records efficiently. By arranging details in a consistent, easy-to-follow layout, you create a professional document that serves both parties.

Start with Clear Contact Information at the top. Include names, addresses, and any additional contact details of both the tenant and the landlord. This section serves as an official identification, providing a point of reference for both parties should any questions arise about the payment.

Specify the Amount Due and break down any charges if applicable. Clearly state the total owed, due date, and acceptable payment methods. Listing each fee separately–such as base payment, utility costs, or

Essential Information for Rental Invoices

Creating a thorough and organized payment document ensures that all necessary details are presented clearly. Including the right elements not only simplifies monthly transactions but also helps prevent disputes and ensures accuracy in record-keeping. A complete document serves as a trusted reference point, covering all aspects of the payment agreement.

Key Details to Include

- Payer and Payee Information: Include full names and contact information of both parties. This establishes clear identification, making it easy to reach out if there are questions or updates.

- Billing Period: Clearly define the time frame covered by the payment. Indicating this period helps prevent misunderstandings about which dates the payment covers.

- Total Amount Due: State the exact amount owed. If there are multiple charges, a breakdown of each is recomm

Essential Information for Rental Invoices

Creating a thorough and organized payment document ensures that all necessary details are presented clearly. Including the right elements not only simplifies monthly transactions but also helps prevent disputes and ensures accuracy in record-keeping. A complete document serves as a trusted reference point, covering all aspects of the payment agreement.

Key Details to Include

- Payer and Payee Information: Include full names and contact information of both parties. This establishes clear identification, making it easy to reach out if there are questions or updates.

- Billing Period: Clearly define the time frame covered by the payment. Indicating this period helps prevent misunderstandings about which dates the payment covers.

- Total Amount Due: State the exact amount owed. If there are multiple charges, a breakdown of each is recommended for transparency.

- Payment Due Date: Specify the deadline by which the amount should be paid. This helps tenants stay on track and minimizes the need for reminders.

Additional Information for Clarity

- Payment Method Options: List accepted forms of payment, such as bank transfers or checks, to make it easy for tenants to fulfill the amount owed.

- Late Fee Policies: If applicable, mention any penalties for overdue payments. This can encourage timely transactions and keeps expectations clear.

- Confirmation of Receipt: Consider adding a section that acknowledges payment once received. This provides both the tenant and landlord with a documented receipt for future reference.

Including these essential details ensures that every payment document is professional, transparent, and efficient, creating a reliable process for everyone involved.

Why Landlords Need Professional Invoices

Using well-structured billing documents is essential for property owners to manage payments efficiently and maintain clear communication with tenants. A professional approach to payment requests not only enhances transparency but also reflects a commitment to organized business practices, ensuring that both parties are on the same page regarding financial expectations.

Building Trust with Tenants

A professionally crafted payment document reinforces trust between the landlord and the tenant. When tenants receive a clear, organized breakdown of costs and due dates, they are more likely to feel confident about the fairness and accuracy of each charge. This clarity minimizes misunderstandings and helps foster a positive relationship built on transparency.

Improving Financial Record-Keeping

Accurate financial records are vital for property owners, especially those managing multiple leases. A standardized billing document provides a consistent reference for tracking payments, outstanding balances, and any applicable fees. This organization simplifies tax preparation, makes it easier to address potential disputes, and ensures a professional a

Customizing Your Invoice for Easy Use

Adapting payment documents to suit your specific needs can streamline the entire process, making it more convenient for both you and your tenants. By customizing your billing structure, you ensure that all essential information is easy to find, reducing the chances of confusion or error. A well-tailored document can significantly improve the efficiency of your financial management system.

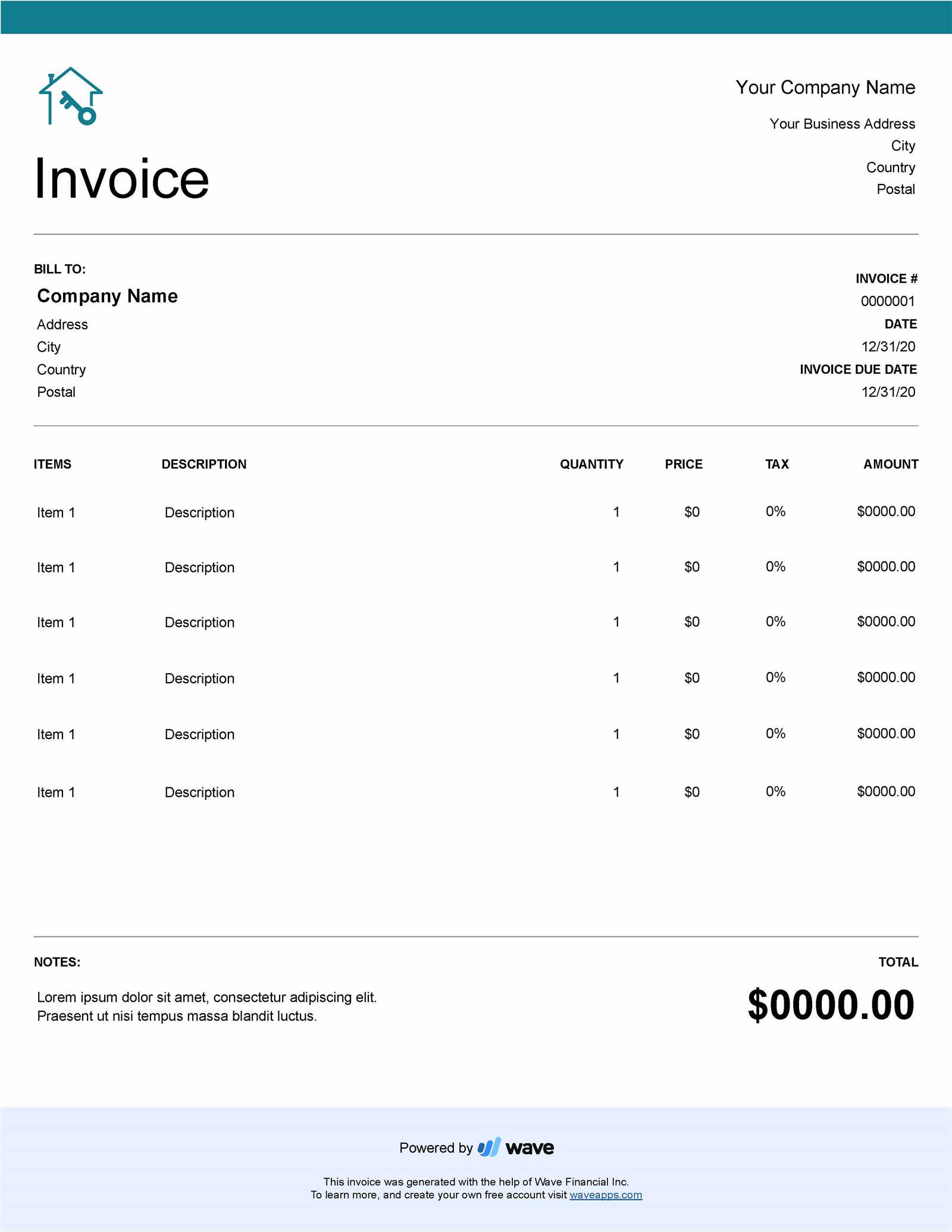

Simple Layout for Clear Communication

A clean, straightforward layout can make a big difference in how easily your tenants can understand the charges. Use sections that clearly label each part of the payment breakdown, making it intuitive for tenants to follow. Avoid clutter and focus on providing only the necessary details to ensure that the document remains user-friendly.

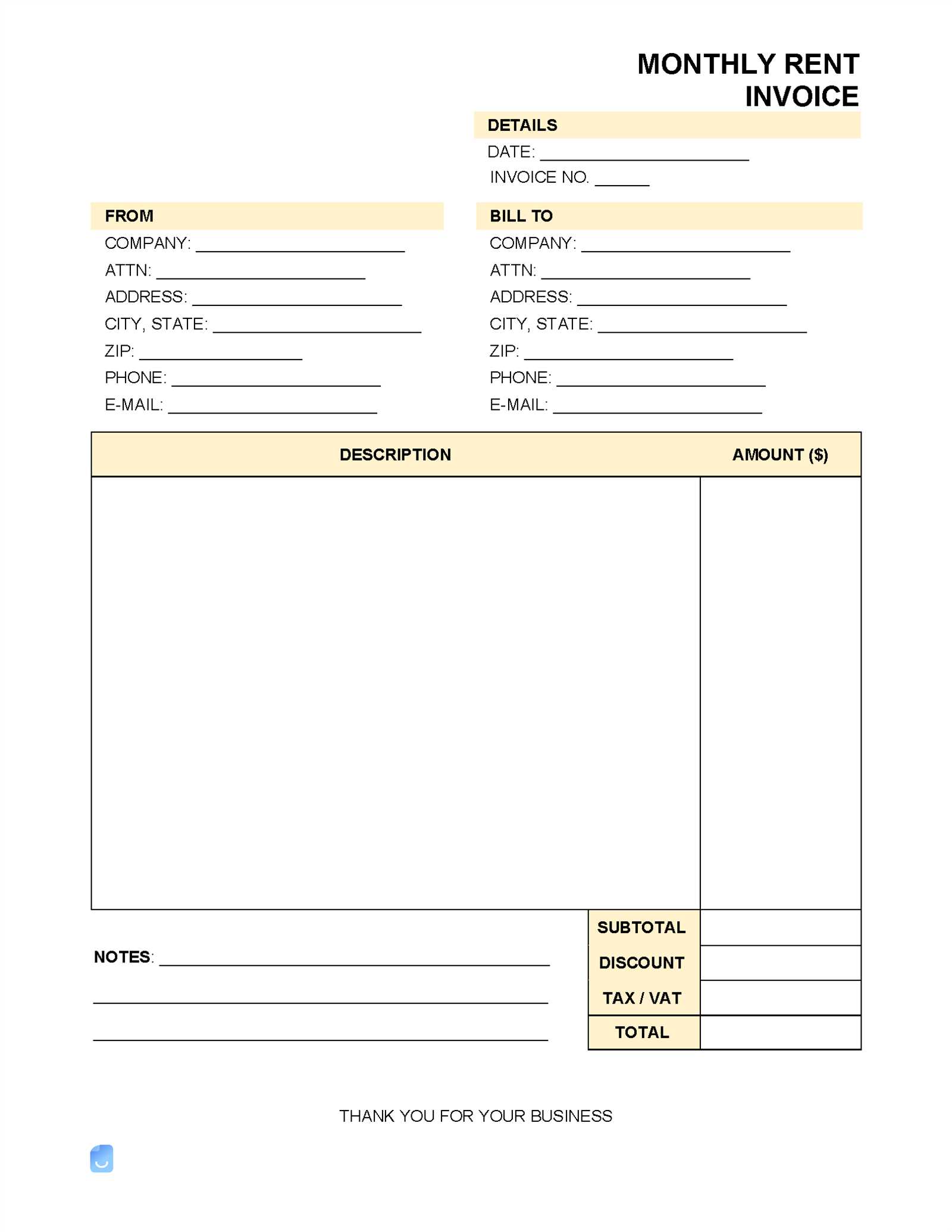

Using Tables for Easy Organization

Tables are a great tool for organizing costs in an easy-to-read format. Here’s an example of how you can structure your payment breakdown:

Description Amount Base Charge $1,000.00 Utilities $150.00 Late Fee (if applicable) $50.00 Total Amount Due $1,200.00 Customizing your payment document in this way not only ensures all necessary details are included but also makes the document more approachable. Simple adjustments can make it more functional and efficient, saving you time and reducing errors in your financial management process.

Legal Considerations for Rental Invoices

When managing property transactions, it’s important to ensure that payment documents adhere to legal requirements. Proper documentation not only ensures compliance with local laws but also protects both parties in case of disputes. A clear and legally sound payment record serves as crucial evidence in any legal proceedings related to property agreements.

First and foremost, payment documents must include all essential details to be legally valid. This includes the full names and addresses of both the property owner and the tenant, along with a clear breakdown of the charges. It’s also necessary to specify the payment due date and any consequences of late payments, such as additional fees or interest.

In addition, it’s important to be aware of specific rules regarding tax regulations. In many regions, property owners are required to report income from leasing activities, and accurate records help ensure compliance. Keeping clear and consistent payment documentation also supports any potential audits or reviews by tax authorities.

Understanding Local Laws

Local and regional regulations vary, and it’s crucial to familiarize yourself with the laws that govern leasing agreements in your area. These laws often specify the minimum requirements for payment documents and may also address specific concerns such as rent control or tenant protections. Keeping up to date with these rules ensures that you remain in compliance and avoid legal complications.

Ensuring Transparency

Clear communication and transparency are vital to preventing misunderstandings. Legal requirements often mandate that landlords provide tenants with a detailed account of charges, and failure to do so could result in disputes or legal challenges. Ensuring your payment documents meet these standards can help avoid unnecessary legal issues and maintain a positive landlord-tenant relationship.

Common Mistakes to Avoid in Invoices

When managing financial documents, it’s important to avoid common mistakes that can lead to confusion, delayed payments, or legal complications. Simple errors in the structure or information provided can create misunderstandings between landlords and tenants. By understanding what to avoid, you can ensure your payment documents are clear, accurate, and professional.

Omitting Essential Information

One of the most frequent errors is neglecting to include all necessary details. A payment document should contain information such as the full names of both parties, the property address, a breakdown of charges, and the payment due date. Without these elements, it becomes difficult for tenants to understand their obligations, and this can lead to delays or disputes.

Inaccurate or Unclear Pricing Details

Another mistake to avoid is providing unclear or incorrect cost breakdowns. If a payment document doesn’t clearly outline the charges, tenants may not know what they are paying for or may dispute the amount. Below is an example of how to structure a payment document properly:

Description Amount Monthly Charge $1,200.00 Utilities $150.00 Late Payment Fee $50.00 Total Due $1,400.00 In this example, the charges are broken down clearly, with each item separated into its own row. The total due is also highlighted for clarity, ensuring the tenant understands exactly how much is owed.

By avoiding these common mistakes, you can make the payment process smoother for both you and your tenants, leading to better communication and fewer errors in the long run.

Top Software for Rental Invoices

Managing financial documents efficiently is crucial for property owners, and using the right tools can save time and minimize errors. With the advancement of technology, there are now various software options available to streamline the process of creating, sending, and tracking payments. These platforms not only help with documentation but also ensure that all required details are accurately captured for each transaction.

Key Features of Rental Billing Software

Choosing the right software depends on your specific needs, such as ease of use, customization, and additional features. Many of these programs allow you to automate calculations, track payments, and generate reports. Here’s a look at some of the most popular software options for managing payment documents:

Software Key Features Best For QuickBooks Automated calculations, recurring payments, customizable reports Landlords with multiple properties FreshBooks Easy-to-use interface, mobile access, tracking of unpaid balances Small property owners or individual managers Rentec Direct Online payment collection, tenant communication, detailed expense tracking Property managers and larger rental portfolios TenantCloud Cloud-based solution, rental property management, online payments Independent landlords or small property management companies Choosing the Right Solution

When selecting a software tool, consider the size of your property portfolio and your specific needs. For larger portfolios, platforms like QuickBooks or Rentec Direct offer more robust features, while FreshBooks or TenantCloud may be more suited for smaller operations. Each option comes with different pricing tiers and customization options, allowing you to find the best fit for your business.

Using software specifically designed to handle financial transactions related to property management not only saves time but also reduces the likelihood of errors, helping you maintain a professional approach to managing payments and documentation.

Tracking Payments with Billing Documents

Effectively monitoring payments is a key part of managing financial transactions related to property leasing. By keeping detailed records of each payment made, landlords can ensure they have a clear overview of their cash flow, identify outstanding balances, and stay organized. A structured approach to documenting payments ensures no detail is overlooked and reduces the risk of errors.

Using customized billing formats helps streamline the process of tracking incoming payments. These formats provide a professional way to keep records, making it easier to match payments with the corresponding amounts due. Regularly updating these records allows property owners to stay on top of their finances and maintain transparency with tenants.

Key Benefits of Tracking Payments

- Clear Overview: You can quickly review the status of all payments, including any outstanding debts or paid amounts.

- Efficient Record-Keeping: It simplifies the organization of payment history and provides an easy way to reference past transactions.

- Reduced Risk of Errors: Accurate documentation ensures that mistakes in payment tracking are minimized.

- Better Cash Flow Management: By staying updated with payments, property owners can make informed decisions about budgeting and expenses.

Tracking payments through organized records not only boosts the professional image of property managers but also helps maintain smooth financial operations. With each payment documented properly, you can reduce misunderstandings, keep tenants informed, and maintain a solid financial strategy.

How to Make Billing Statements Tenant-Friendly

Creating a tenant-friendly billing document is crucial for fostering positive relationships and ensuring clear communication. A well-structured statement makes it easier for tenants to understand their financial obligations and helps prevent confusion or disputes. By focusing on clarity, simplicity, and transparency, landlords can ensure that tenants are satisfied with the process and are more likely to pay on time.

To make these documents more approachable, it’s essential to use clear language and organize the information in a way that is easy to follow. Highlighting important details like payment due dates, amounts, and any additional charges will help tenants quickly understand what they owe and by when. Additionally, offering multiple payment options can improve the experience and convenience for tenants, making the entire process more user-friendly.

Key Tips for Tenant-Friendly Billing

- Clear and Simple Language: Avoid using complex terms. Ensure the document is straightforward and easy to comprehend.

- Itemized Charges: Break down the costs to show tenants exactly what they are being charged for.

- Clear Due Dates: Highlight the payment deadline to avoid confusion and late payments.

- Contact Information: Provide clear contact details in case tenants have questions or concerns.

- Multiple Payment Methods: Offering several payment options makes it easier for tenants to settle their dues.

By following these strategies, landlords can create billing documents that are not only professional but also easy for tenants to navigate. Ensuring that tenants have all the information they need to understand their payment responsibilities is key to reducing misunderstandings and maintaining a positive rental experience.