Free Excel Invoice Template for Easy and Professional Billing

Managing payments and keeping track of transactions is a crucial aspect of any business. Having a structured approach to documenting financial exchanges helps maintain clarity and prevents errors that can affect cash flow. Fortunately, there are simple yet effective ways to organize these records, even without advanced software or complex systems.

By using a straightforward document, business owners can create clear and professional records for their clients. These records not only provide an easy way to track amounts due but also ensure that each entry is precise, transparent, and consistent. Such documents can be customized to suit specific needs, making them adaptable across industries and scalable for businesses of all sizes.

With the right tools, the process of managing payments becomes more efficient, allowing you to focus on growing your business while keeping financial matters organized and under control. A well-designed structure can make a significant difference in both your workflow and client relationships, ensuring that all financial details are handled smoothly and professionally.

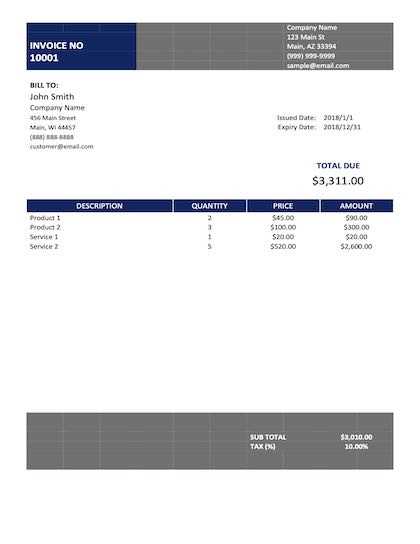

Invoice Template Excel for Small Businesses

For small businesses, managing financial records and ensuring accurate billing can often be a daunting task. Simplifying this process is essential for maintaining smooth operations and keeping customers satisfied. With the right tools, small business owners can efficiently track payments, manage accounts, and ensure timely transactions without requiring specialized accounting software.

Why Small Businesses Benefit from Simple Billing Solutions

Many small enterprises operate on limited budgets and resources, making it difficult to invest in complex systems. However, an easy-to-use document for creating detailed financial records can be just as effective. A well-organized sheet allows businesses to quickly input information, track amounts due, and send professional payment reminders. It also helps avoid errors that could arise from manually calculating totals or missing crucial details.

Customization for Every Business Need

Whether you’re offering services, selling products, or both, these solutions can be easily adjusted to fit any business model. From adding tax rates and discounts to including payment terms, each document can be tailored to meet your specific needs. This flexibility not only saves time but also ensures that every transaction is accurately represented, helping you stay on top of your financials.

Why Use Excel for Invoices

When it comes to managing financial records, using a simple and versatile tool can significantly streamline the process. Many small business owners turn to familiar software for creating detailed payment documents due to its flexibility and ease of use. By relying on a commonly available program, you can eliminate the need for complex accounting systems while still maintaining professional-looking and accurate records.

One of the key advantages of using this software is its ability to automate calculations and simplify tracking. Whether it’s adding taxes, calculating totals, or adjusting for discounts, you can set up formulas to handle these tasks instantly. This reduces the risk of manual errors and ensures that the final amount is always accurate.

Additionally, it provides a high degree of customization. You can easily design the structure of your records to fit the needs of your business, and make adjustments whenever necessary. This adaptability, combined with a straightforward interface, makes it an ideal choice for those looking to manage finances without the complexity of specialized tools.

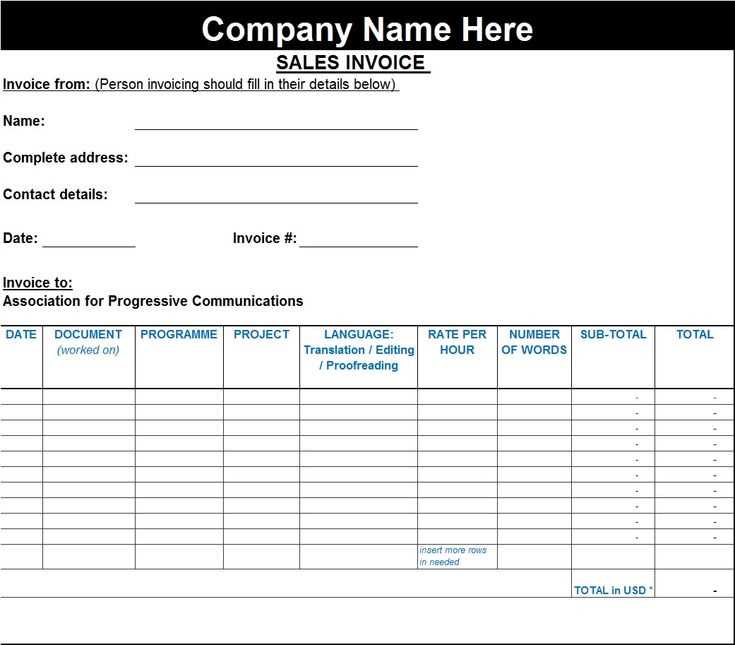

How to Create a Custom Invoice

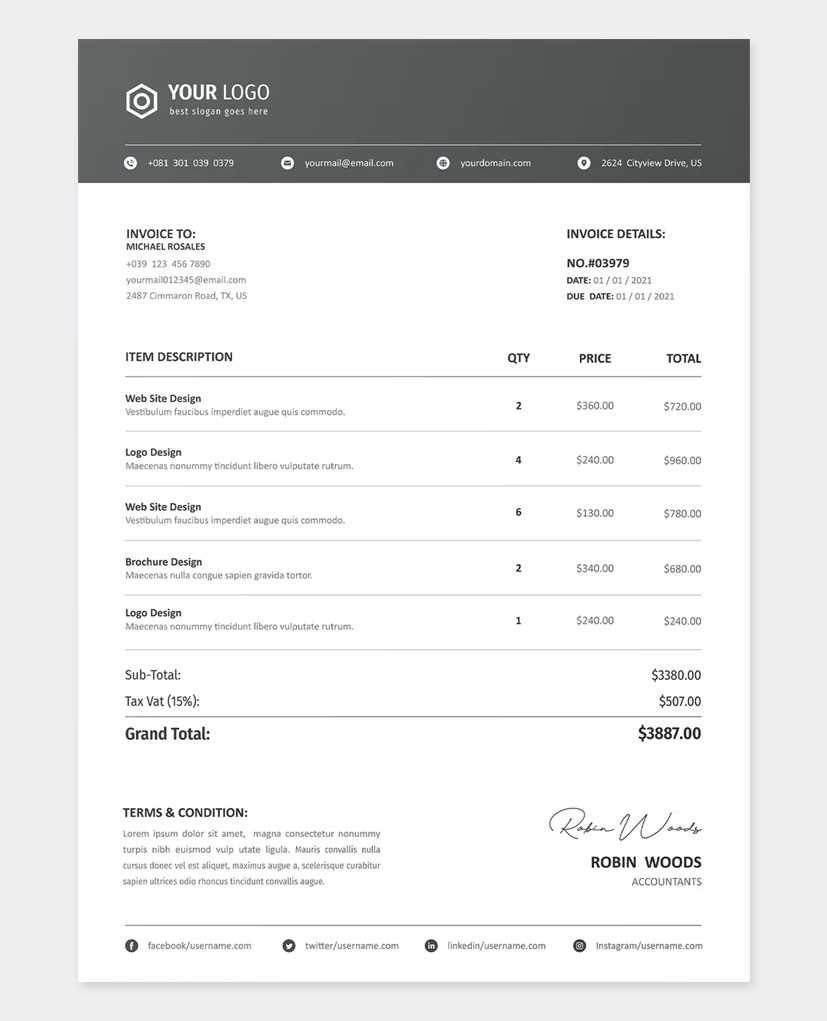

Designing a professional document for recording payments is a straightforward process that can be tailored to suit the unique needs of your business. The key is to ensure clarity, accuracy, and ease of use. By following a few simple steps, you can create a personalized layout that effectively captures all necessary details while maintaining a clean, organized appearance.

First, begin by deciding on the structure. Most businesses include sections such as contact information, item descriptions, quantities, and amounts due. These fields are essential for keeping everything clear and transparent. Ensure that each section is clearly labeled and easy to read. You can also add payment terms or deadlines to avoid confusion.

Next, consider incorporating formulas to automate calculations such as totals, taxes, or discounts. This will save time and prevent errors, especially if you’re processing multiple transactions. Customizing the layout to reflect your branding with your company logo or colors can also add a professional touch, making the document more recognizable and reinforcing your brand identity.

Top Features of an Excel Invoice Template

A well-designed document for managing payments offers a range of useful features that can simplify billing and ensure accuracy. These tools are built to streamline the process, making it easier to track payments, calculate totals, and keep your business organized. Below are some of the top features that make these tools particularly effective for small businesses and freelancers.

1. Automatic Calculations

One of the main advantages of using this solution is the ability to automatically calculate totals, taxes, and discounts. By setting up basic formulas, you can eliminate the risk of manual errors and save time on basic arithmetic. The document can instantly update totals whenever you modify quantities or rates, ensuring that your calculations are always correct.

2. Customizable Fields

Another great feature is the flexibility to customize the fields. You can easily add or remove sections to meet your specific needs. Whether you need to include extra information, such as service descriptions or payment terms, or adjust for different pricing models, customization ensures the document is tailored to your business.

| Feature | Description |

|---|---|

| Automatic Totals | Calculates final amounts based on inputs like quantities and rates. |

| Customizable Fields | Adjusts sections like item descriptions or payment terms according to your needs. |

| Professional Design | Allows for easy branding with logos, fonts, and color schemes. |

| Easy Record Keeping | Provides a simple format for tracking payments and managing finances. |

Free Invoice Templates for Entrepreneurs

For entrepreneurs just starting out, managing financial records can feel overwhelming. Thankfully, there are plenty of free resources available that provide a simple and efficient way to create professional payment documents. These resources help ensure that small businesses can maintain clarity and accuracy without the need for expensive software or tools.

Free tools come with several advantages, such as:

- Cost-effectiveness: No need for expensive software or subscriptions.

- Ease of use: Simple formats that anyone can adapt, even with minimal experience.

- Professional designs: Pre-designed layouts that create a polished, credible look for your business.

- Customization options: Easily modify details to fit your specific needs and industry requirements.

With just a few clicks, entrepreneurs can download these resources and start organizing their financial transactions right away, helping to ensure smooth cash flow and professional communication with clients.

Advantages of Excel over Other Tools

When it comes to managing financial records and creating detailed documents, many businesses are faced with a wide array of software options. While specialized tools can offer advanced features, simpler solutions often provide a more accessible and flexible way to stay organized. Using a widely available program can give businesses significant advantages in terms of customization, ease of use, and cost-effectiveness.

1. Flexibility and Customization

One of the standout features of this software is its ability to be fully customized to meet specific business needs. Unlike more rigid solutions, you can easily adjust the layout, formulas, and fields to suit your unique requirements. Whether you need to add extra details or remove unnecessary sections, the software can adapt to any changes, making it a versatile choice for entrepreneurs.

2. Cost-Effectiveness and Accessibility

Another major advantage is the low cost of using this program. While many specialized tools come with expensive subscription fees, this software is often part of existing office suites, reducing costs significantly. Its widespread availability also means that no additional software needs to be purchased, and employees or contractors can use it without requiring specialized training.

Ease of use is another key factor. With a familiar interface and user-friendly features, it allows even individuals with minimal technical knowledge to create and manage documents with ease. Additionally, the ability to automate calculations and track details ensures that the process is both accurate and efficient, saving valuable time and reducing errors.

Step-by-Step Guide to Designing Invoices

Creating a clear and professional payment document is essential for maintaining accurate financial records and fostering good relationships with clients. The process of designing such a document can be straightforward, allowing you to customize it to meet your business needs. By following a few simple steps, you can craft a professional layout that is both functional and visually appealing.

Start by defining the essential sections that every record should include. Typically, you will need fields for your business details, client information, a list of goods or services provided, payment terms, and totals. These sections ensure that the document captures all necessary information and remains organized. Customizing these sections to reflect your specific needs is key to creating a document that works best for you.

Next, focus on the structure of the document. Keep the design clean and simple, with ample space for text and numbers to be easily readable. Use headings or bold text to differentiate between different sections, and consider adding gridlines or borders for clarity. Organizing the information in a logical flow will make it easier for both you and your clients to navigate the document.

Finally, don’t forget to automate calculations for things like totals, taxes, and discounts. Setting up basic formulas will ensure that these values are updated automatically as you input new information. This not only saves time but also minimizes the chance of human error, making your documents more accurate and professional.

How to Automate Invoice Calculations in Excel

Automating calculations in your financial documents is an effective way to save time and reduce errors. By using built-in functions, you can streamline the process of totaling amounts, applying taxes, and calculating discounts. This ensures that the numbers are accurate and consistently updated as you enter new data, improving the efficiency of your workflow.

1. Setting Up Basic Formulas

To begin automating calculations, you’ll first need to set up simple formulas for basic operations like multiplication and addition. For example, you can multiply the quantity of items by the price per unit to get the total cost for each item. Then, use the SUM function to add up all the individual totals to get a grand total. These functions can be entered into cells that automatically update as you change any of the inputs.

2. Applying Tax and Discounts Automatically

Another key feature of automation is calculating taxes and discounts without having to manually adjust the numbers. To calculate tax, you can use a formula like =amount*tax_rate to apply a specific percentage to the total amount. Similarly, discounts can be applied automatically by multiplying the subtotal by the discount rate and subtracting it from the total. These calculations will adjust dynamically as the numbers change, ensuring accuracy every time.

Advanced automation techniques can also help with other common tasks, such as rounding figures to a certain number of decimal places or converting between currencies. By taking full advantage of the program’s built-in features, you can create a fully automated financial document that is quick, accurate, and easy to update.

Common Invoice Mistakes to Avoid

Creating payment documents may seem straightforward, but it’s easy to make mistakes that could lead to confusion, delays, or even lost revenue. Even small errors can have a significant impact on your business, whether it’s from incorrect amounts, missing details, or formatting issues. Avoiding these common mistakes ensures that your records remain professional, accurate, and effective in managing transactions.

1. Missing or Incorrect Contact Information

One of the most common errors is failing to include accurate contact details, whether it’s your business address, phone number, or email. If any of this information is wrong or omitted, it could delay communication or make it difficult for clients to reach you regarding payment. Always double-check that the information is up-to-date and clearly visible at the top of your document.

2. Errors in Calculations

Another frequent mistake is incorrect calculations, especially when manually adding up totals or applying discounts and taxes. Even small miscalculations can result in confusion and disputes. This is where automating calculations can be particularly helpful. Setting up formulas that update totals automatically ensures that your figures are always accurate and consistent.

3. Lack of Clear Payment Terms

Sometimes, businesses fail to clearly specify the payment terms, such as due dates, late fees, or accepted methods of payment. This can lead to misunderstandings and delayed payments. Make sure your document includes clear terms, so clients know exactly when and how to pay. This also helps avoid disputes later on.

4. Forgetting to Include a Unique Identifier

Each financial record should have a unique identifier, whether it’s a number or code, to keep track of transactions. Forgetting to assign one can lead to confusion when reviewing or referencing past payments. Make sure to include a unique identifier for each record to ensure easy tracking and proper documentation.

Tips for Organizing Your Invoices Efficiently

Maintaining a well-organized system for tracking payments is essential for smooth financial management. A cluttered or disorganized process can lead to missed deadlines, errors, or lost documents. By adopting a few simple practices, you can ensure that your records are easy to find, update, and review when needed.

1. Use a Consistent Naming Convention

One of the easiest ways to keep your records organized is by using a consistent naming system. Each document should have a unique identifier, such as a number or date, and you should apply this system across all records. For example, you could name documents with a combination of the client name and the date of issue, making it easy to sort and retrieve them. Consistency helps keep everything in order, particularly as your business grows.

2. Implement a Digital Filing System

Storing physical copies of records can become overwhelming, especially as the volume of transactions increases. A digital filing system allows you to store, categorize, and search for records quickly. Organize your files into clearly labeled folders, such as by client or month, so that you can easily locate specific documents. Cloud-based storage solutions also provide the advantage of remote access and easy sharing, further improving your workflow.

Additionally, regularly backing up your files ensures that you never lose important records in case of hardware failure or other issues. A well-structured system makes it easier to stay on top of payments and track your financial health at any time.

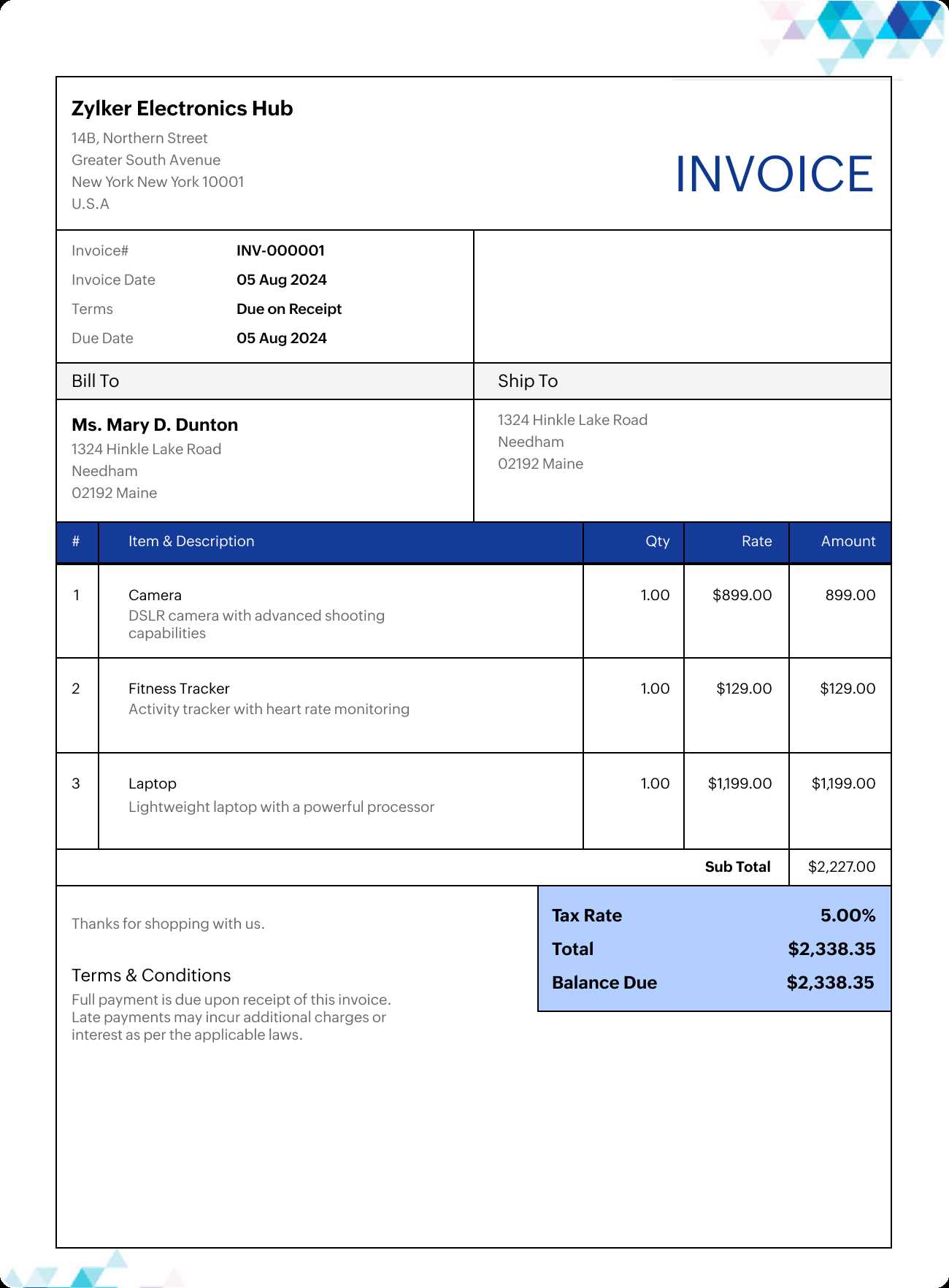

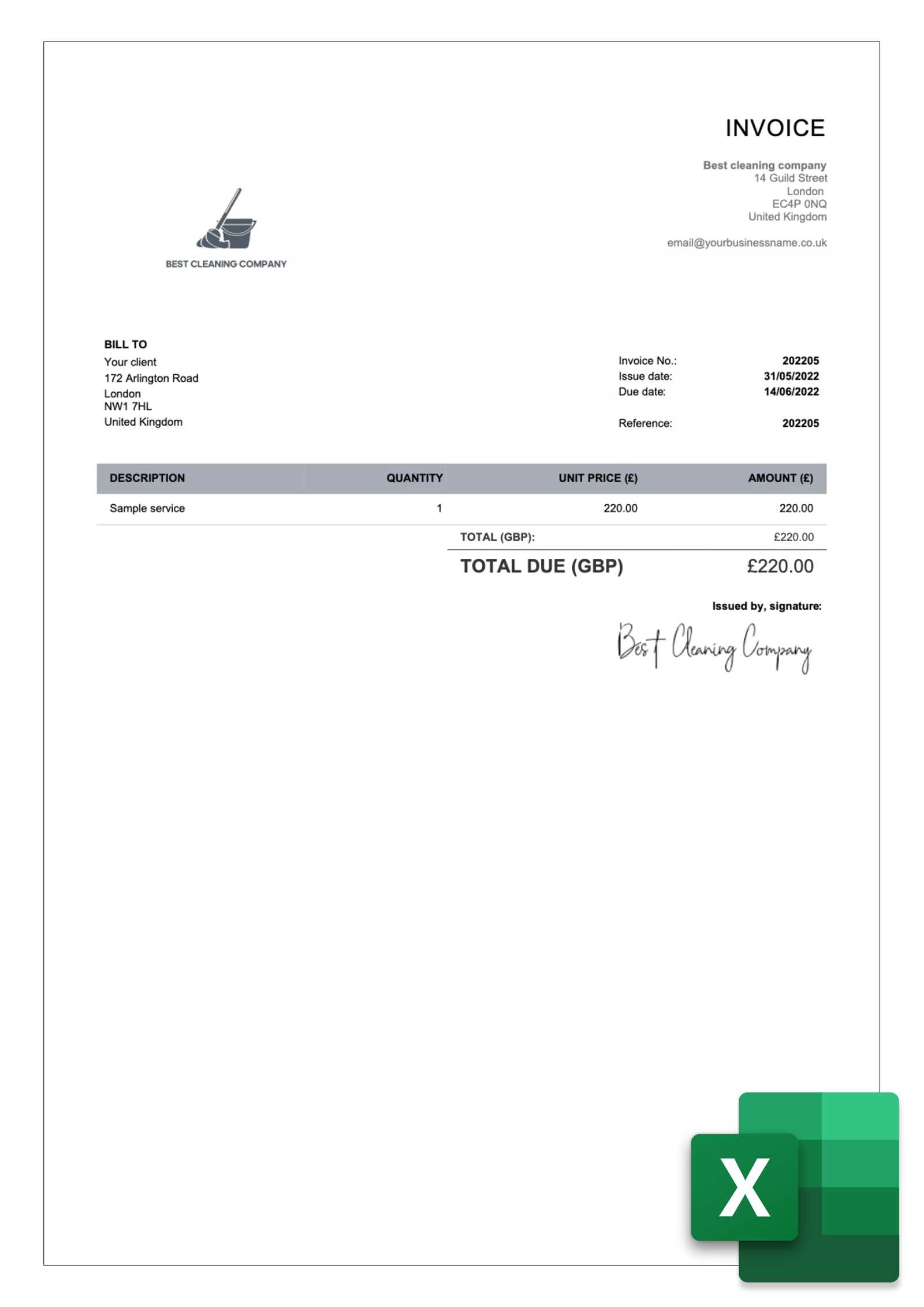

Customizing Excel Templates for Different Industries

Every industry has its own set of requirements when it comes to documenting transactions and managing financial records. Whether you are in retail, consulting, construction, or any other field, it’s important to tailor your documents to suit the specific needs of your business. Customizing your financial records can help ensure that all necessary details are captured and that the layout fits your workflow efficiently.

For example, a retail business may require detailed sections for item descriptions, quantities, and unit prices, while a service-based business might focus more on hourly rates, project descriptions, and payment schedules. By adjusting the fields, formulas, and design, you can make your financial documents more effective in tracking your sales or services, as well as ensuring a professional presentation for your clients.

Customizing your records also means you can include industry-specific terms, such as contract terms for consultants, shipping details for e-commerce businesses, or labor charges for construction projects. This flexibility not only streamlines your workflow but also reduces the risk of overlooking important details. Tailored solutions ensure your financial documentation meets the unique needs of your business while maintaining clarity and accuracy.

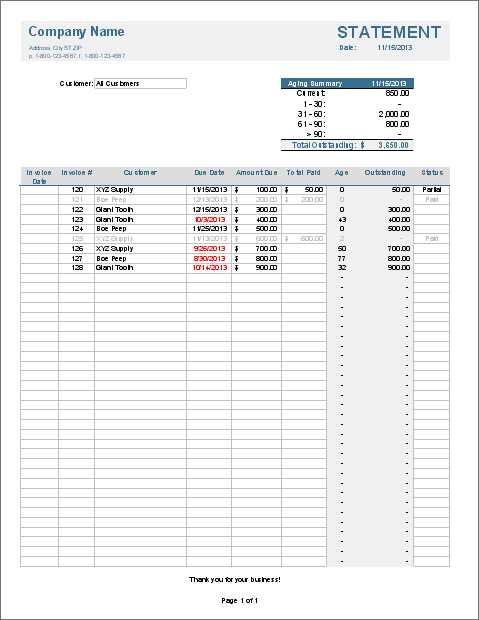

How to Track Payments with Excel Templates

Tracking payments is a crucial aspect of managing business finances. Having an organized and efficient method for monitoring payments ensures that you stay on top of due amounts, prevent overdue accounts, and maintain healthy cash flow. By using a customized record-keeping system, you can easily monitor which payments have been made and which are still outstanding, allowing for better financial planning.

To track payments effectively, set up a structured document that includes key details such as client names, due dates, amounts due, and payment statuses. You can then update the status as payments are received. This helps you keep accurate records without missing any essential details.

| Client Name | Due Date | Amount Due | Amount Paid | Status |

|---|---|---|---|---|

| Client A | 2024-11-15 | $500.00 | $500.00 | Paid |

| Client B | 2024-11-20 | $300.00 | $0.00 | Outstanding |

| Client C | 2024-11-18 | $750.00 | $750.00 | Paid |

By using a table like the one above, you can quickly update the payment status and review outstanding balances. Additionally, setting up formulas to calculate totals and balance amounts can help you automatically track the remaining balance once a payment is made. This streamlined approach saves time and reduces the chance of errors in your records.

Excel Formulas to Simplify Invoice Creation

When creating financial documents, using formulas can greatly streamline the process and reduce the likelihood of errors. By automating calculations, you can ensure that your records are both accurate and efficient. This section highlights key formulas that can simplify various aspects of creating payment documents, from calculating totals to applying taxes and discounts.

1. Basic Calculation Formulas

The most fundamental use of formulas in payment documentation is performing basic calculations, such as adding up totals or multiplying quantities by prices. These simple formulas ensure that numbers are calculated correctly every time you update any values.

- SUM: Adds up a range of numbers. Example: =SUM(B2:B10) will total the values in cells B2 to B10.

- PRODUCT: Multiplies numbers. Example: =PRODUCT(A2, B2) will multiply the values in A2 and B2 (e.g., quantity * price).

- SUBTOTAL: Adds values but allows you to exclude hidden rows. Example: =SUBTOTAL(9, B2:B10) will calculate the sum while considering filtered data.

2. Advanced Formulas for Taxes and Discounts

To make your documents even more efficient, you can set up formulas for calculating taxes or discounts that update automatically based on other values. This is especially helpful for maintaining accuracy and preventing manual errors in complex transactions.

- Tax Calculation: Multiply the amount by the tax rate to calculate tax. Example: =A2 * 0.05 will calculate 5% tax on the amount in cell A2.

- Discount Calculation: Multiply the total by the discount rate to calculate a discount. Example: =A2 * 0.10 will calculate a 10% discount on the total in cell A2.

- Final Amount After Discount and Tax: Subtract the discount from the total and then apply tax. Example: =(A2 – A2 * 0.10) * 1.05 will first apply a 10% discount and then add 5% tax to the result.

By using these formulas, you can ensure that your payment documents are both accurate and efficient, saving time and reducing the risk of mistakes.

Best Practices for Invoice Formatting in Excel

When it comes to creating professional payment documents, presentation plays a key role in ensuring clarity and reducing confusion. A well-structured layout not only makes your document look more professional but also ensures that important details are easy to find. Formatting your records correctly can help clients quickly understand the amounts due, payment terms, and other key information.

1. Organize Information Clearly

The first step in formatting your financial documents is to ensure that the information is well-organized. Group similar details together, such as your business information, client details, and payment terms. Use headings or bold text to separate these sections clearly. This makes it easier for clients to review the document and quickly find the information they need.

- Business Information: Place your company name, address, and contact details at the top.

- Client Information: Ensure the client’s name, address, and contact information are easy to identify.

- Payment Details: Include clear item descriptions, quantities, prices, totals, and any applicable taxes or discounts.

2. Use Consistent Fonts and Colors

Maintaining consistency in fonts and colors enhances the readability of your document. Stick to professional fonts such as Arial or Times New Roman, and avoid using too many different font styles or sizes. This will keep the document looking neat and ensure that the focus remains on the content, not on excessive formatting.

- Font Size: Use larger font sizes for headings and smaller sizes for content. Typically, headings should be around 14-16 pt, while the body text can be 10-12 pt.

- Bold for Emphasis: Use bold text to highlight important sections, such as totals or due dates, but avoid overusing it.

- Subtle Colors: Choose muted or professional colors for headings or accents to maintain a clean and polished look.

By following these best practices, you can create payment documents that are both functional and visually appealing, ensuring smooth communication with clients and reducing the risk of errors or misunderstandings.

How to Save Time Using Excel Invoices

Efficiently managing financial records is essential for any business, and automation plays a big part in saving time. By using automated calculations and organized structures, you can reduce the time spent on creating and tracking payment documents. Streamlining these processes not only helps you stay organized but also allows you to focus on other critical aspects of your business.

1. Automate Calculations and Totals

One of the most significant time-saving benefits of using a spreadsheet for financial records is the ability to automate calculations. Instead of manually adding up totals or calculating taxes, you can use built-in functions to update amounts instantly. This eliminates the need for manual entry and reduces the risk of errors.

- Use SUM: Automatically calculate totals by adding up columns of amounts.

- Apply Tax and Discounts: Set up formulas to calculate tax and discounts based on percentages, ensuring accurate and quick updates.

- Automatic Totals: Use the SUM function to total itemized charges without having to re-enter calculations each time.

2. Reuse and Customize for Future Use

Instead of creating new documents from scratch, you can save time by customizing and reusing existing files. With a structured format, you can easily update specific details like client names, item descriptions, or payment amounts, while keeping the core layout intact. This eliminates the need to rebuild the format for each new client or project.

- Save Custom Files: Save a base version that you can adjust for each new transaction.

- Pre-fill Common Information: Include standard fields such as your business information and payment terms so you don’t need to enter them repeatedly.

- Use Dropdown Menus: Set up dropdown menus for items, clients, or payment terms to quickly fill in repetitive information.

By using automation and reusable structures, you can significantly reduce the time spent managing your financial documents, allowing you to focus more on growing your business.

Why Excel is Ideal for Invoicing Needs

When it comes to managing financial records, having a tool that combines flexibility, functionality, and ease of use is essential. Many businesses rely on spreadsheet software to create and track payment documents due to its ability to adapt to various needs and provide accurate results quickly. The power of a spreadsheet lies in its ability to handle complex calculations while offering a straightforward, customizable interface.

One of the key reasons this software is ideal for invoicing is its flexibility. It allows you to set up your documents in a way that fits your specific business requirements. Whether you’re in retail, consulting, or any other industry, you can easily create a format that includes all necessary details such as client information, services or products sold, payment terms, and amounts due.

Moreover, it’s highly efficient for performing automatic calculations. You can set up formulas to calculate totals, apply taxes or discounts, and track payments, which helps eliminate the possibility of manual errors. The software’s built-in functions also allow you to easily update and adjust records, making it an excellent solution for businesses with fluctuating or high-volume transactions.

Another advantage is the ability to reuse and modify documents as needed. Once you have a basic structure set up, you can quickly adjust it for future clients or projects. This level of customization, combined with the tool’s vast functionality, makes it an indispensable resource for streamlining your financial management process.