Invoice Template Excel India for Simplified Billing and GST Calculation

Efficient financial management is crucial for any business, and proper documentation plays a significant role in simplifying processes. Creating clear and professional billing records can save time, minimize errors, and ensure smooth transactions with clients. Whether you are a small business owner or managing a larger enterprise, having a reliable system for tracking payments and taxes is essential.

Using digital tools to generate financial documents allows for better organization and customization to suit specific business needs. With the right solution, you can quickly create professional-looking records, manage tax calculations, and avoid manual mistakes. Leveraging accessible software options makes these tasks both efficient and cost-effective.

In this guide, we will explore how to optimize your financial documentation process using versatile tools that can simplify your workflow and help you maintain accurate records. By following a few best practices, you can ensure your business stays compliant and operates smoothly.

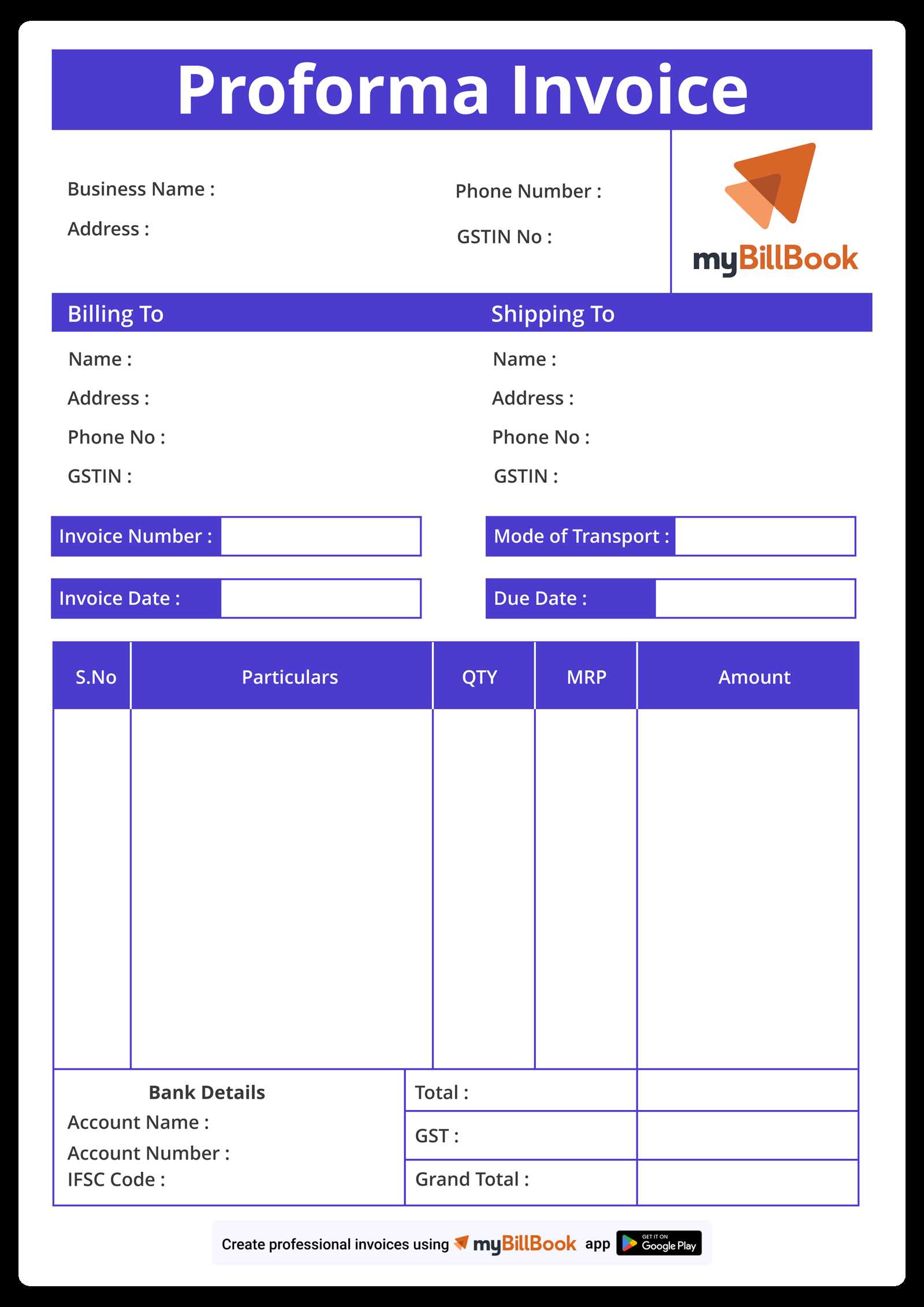

Best Invoice Template for Indian Businesses

For businesses looking to streamline their billing process, using an organized and efficient document layout is essential. A well-structured record allows for easy tracking of transactions, ensuring transparency and minimizing errors. Choosing the right format for your financial paperwork is a crucial step in simplifying business operations and staying compliant with regulations.

In India, it is particularly important to consider specific requirements such as tax calculations, including GST, and maintaining clear details of both products and services rendered. A reliable document setup will help you manage these details accurately and efficiently. Here are some features that make for the most effective and practical billing system for businesses:

| Feature | Description |

|---|---|

| Customizable Fields | Ability to adjust columns for business name, client info, items, and rates. |

| GST Calculation | Automatic calculation of Goods and Services Tax based on rates for different categories. |

| Professional Layout | Clean design for easy readability and a polished look for client-facing documents. |

| Tracking Payments | Options for tracking outstanding payments and payment due dates. |

| Currency and Date Formats | Supports local currency symbols and standard date formats used in your region. |

By utilizing such features, businesses can ensure their documents are both functional and compliant with legal standards, allowing them to focus on growth and customer relationships rather than paperwork.

How to Create an Excel Invoice

Creating an efficient billing document for your business is a simple process that can be done using spreadsheet software. A well-organized document not only ensures professionalism but also helps in tracking payments, managing taxes, and reducing errors. The key is to have all necessary details properly arranged and easily accessible.

Here are the steps to create a well-structured billing document:

- Set Up Your Document

Start by opening a new file in your spreadsheet software. Adjust the sheet to include necessary rows and columns for the essential details such as client information, products or services provided, quantities, rates, and total amounts.

- Insert Business and Client Information

In the first section, enter your business name, address, and contact details. Include the client’s name and their contact information to ensure clear communication.

- Add Items and Prices

Create a table to list the products or services. Include columns for item descriptions, quantity, unit price, and total amount. Each entry should be clearly marked with the appropriate calculations.

- Include Tax Calculations

Depending on your location, you’ll need to add tax calculations to the document. Make sure to include a row for the applicable tax rate and another for the final total after taxes have been applied.

- Include Payment Terms

Specify the payment due date, acceptable payment methods, and any late fees or discounts for early payments. This section helps set clear expectations for both parties.

- Design and Formatting

Ensure that your document is easy to read. Use bold headers, clear fonts, and proper alignment. You can also add your company logo for a more professional appearance.

- Save and Distribute

Once the document is complete, save it in a format that is easy for your clients to open and view, such as PDF. You can then email or print the document as needed.

By following these steps, you can quickly create a professional and effective billing document that simplifies the payment process and enhances your business’s financial organization.

Benefits of Using Excel for Invoices

Using a spreadsheet program to manage your billing records offers several advantages that can make financial tasks more efficient and less time-consuming. These benefits range from ease of customization to advanced calculation capabilities, all of which simplify the entire billing process.

Here are some key reasons why spreadsheets are a great tool for generating professional billing documents:

- Easy Customization

Spreadsheets allow you to tailor your documents according to your specific business needs. You can easily adjust columns, add rows, and change designs without being constrained by fixed formats.

- Automation of Calculations

One of the most powerful features is the ability to automate calculations, such as item totals, tax rates, and final amounts. This helps reduce errors and speeds up the process.

- Time-Saving Templates

Once you have created a document structure, you can reuse it for future billing, saving you time and effort. Spreadsheets allow you to quickly input new data while maintaining the same format.

- Cost-Effective

Unlike specialized software, spreadsheet programs are generally inexpensive or even free, making them a cost-effective solution for small businesses and freelancers.

- Data Organization and Analysis

Spreadsheets enable you to store and organize data efficiently. You can also use built-in functions to analyze payment history, track overdue amounts, and generate reports.

- Easy Integration with Other Tools

Many spreadsheet programs offer integration with accounting and financial software. This makes it easy to sync data and maintain accurate records across platforms.

- Secure and Accessible

Documents can be easily saved, backed up, and shared. Cloud-based options also allow for access from multiple devices, ensuring your records are always available when needed.

By leveraging these benefits, businesses can streamline their financial processes, improve accuracy, and save valuable time, ultimately enhancing overall productivity and client relationships.

Key Features of a Good Invoice Template

A well-designed billing document should be clear, easy to understand, and capable of organizing essential details in a structured manner. The right features not only make the process of issuing records smoother but also help maintain professionalism and accuracy. Below are the critical elements that make an effective financial document:

| Feature | Description |

|---|---|

| Clear Identification | Includes business name, logo, and contact details at the top, ensuring clients can easily identify the document’s origin. |

| Client Information | Fields for client name, address, and contact details help personalize the document and avoid confusion. |

| Detailed List of Products or Services | A table that clearly lists the items or services provided, including quantity, description, unit price, and total cost for each entry. |

| Tax Information | Includes fields for applying tax rates, ensuring compliance with local tax laws and making calculations transparent. |

| Payment Details | Clearly defines payment methods, due dates, and any late fees or discounts, helping clients understand the terms. |

| Professional Layout | Organized and clean design, with proper spacing and alignment, making the document easy to read and understand. |

| Due Date and Invoice Number | Provides a unique identification number and specifies when the payment is due, helping with future reference and tracking. |

| Additional Notes Section | Allows space for any additional information, such as payment instructions or terms, to clarify specific conditions or agreements. |

Including these features ensures that your billing document is both functional and professional, improving communication with clients and making the payment process smoother for both parties.

Customizing Excel Invoices for Your Needs

Tailoring your billing document to match your business requirements can significantly enhance your workflow and ensure all relevant details are included. Customization not only makes the document more professional but also allows you to streamline the process, adding or removing sections based on your specific needs.

Steps to Customize Your Billing Document

Here are a few practical ways to personalize your financial records:

- Adjust Layout and Structure

Modify the overall layout to align with your branding. Change fonts, colors, and position elements such as your company name, logo, and contact details for a more cohesive look.

- Define Custom Fields

Identify the most relevant fields for your business, such as additional services or special discount codes. Create new columns or rows to accommodate unique product categories or service types.

- Set Up Tax and Currency Preferences

Ensure that the tax rate and currency symbol are automatically applied based on the location or region, making the document more relevant and efficient for local clients.

- Payment Terms and Notes

Include custom payment instructions, terms, or special requests for your clients in a dedicated section. This can help clarify any unique agreements you have with them.

- Automate Calculations

Set up automatic formulas for calculating totals, taxes, and discounts to ensure that your documents are accurate every time, reducing the risk of errors.

Saving and Reusing Your Custom Billing Records

Once you’ve made the necessary changes, save the document as a master copy. This way, you can reuse the customized format for future transactions, saving both time and effort. For consistency, always make sure the document includes all essential details relevant to your business, such as payment instructions, item descriptions, and tax information.

Customizing your records in this way ensures that every transaction reflects your unique business needs while maintaining a professional appearance and streamlining your financial processes.

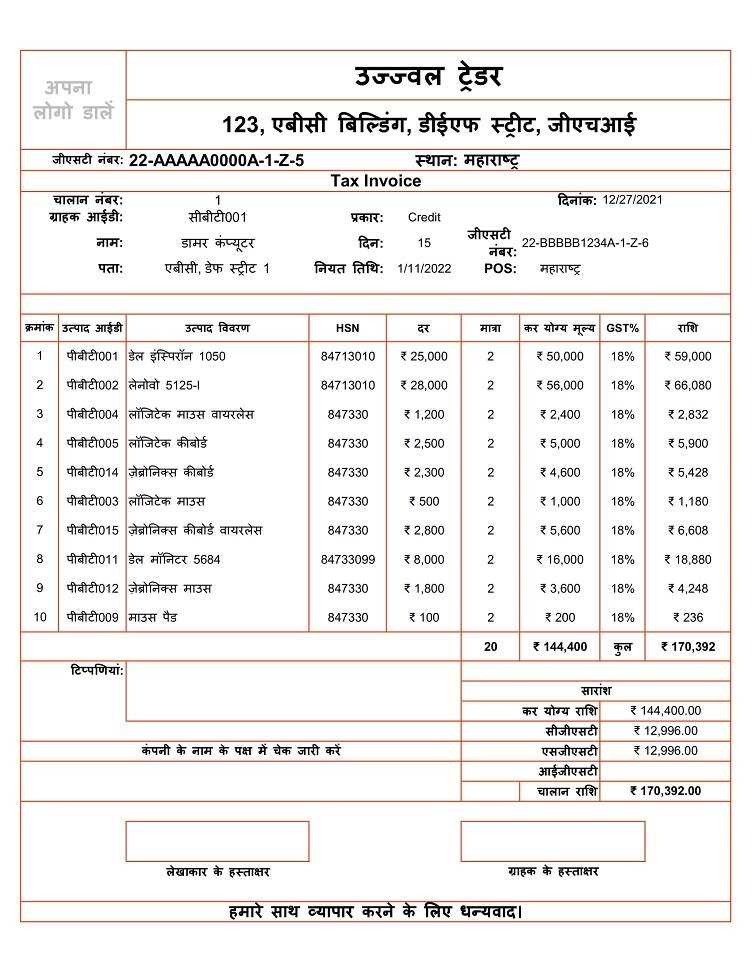

Automating GST Calculations in Excel

Calculating taxes manually can be time-consuming and prone to errors, especially when handling multiple transactions. Automating tax calculations helps streamline the process, ensures accuracy, and saves time. By setting up your document correctly, you can easily calculate taxes such as the Goods and Services Tax (GST) without needing to input values manually each time.

Here are the steps to automate GST calculations in your document:

Steps to Automate GST Calculations

- Set Up Columns for GST

Create dedicated columns for GST rates, tax amounts, and total amounts. This will help you organize the calculations clearly and keep them separate from other information such as product details and quantities.

- Define the GST Rate

Enter the GST rate in a separate cell. This can be a fixed value (for example, 18%) or variable depending on the product or service category. You can even add different GST rates for different items if necessary.

- Use Formulas for Tax Calculation

Set up formulas to automatically calculate the tax for each item. For instance, if the price is in column D and the GST rate is in cell E1, the formula for calculating the tax would look like this:

=D2*$E$1. - Calculate Total with Tax

Once the tax is calculated, you can add it to the base price to get the total amount. Use another formula like

=D2+F2, where D2 is the base price and F2 is the calculated tax amount. - Apply GST to Multiple Items

Copy the formulas for other rows to apply the same calculation logic to different items. This will automatically update the tax and total amounts for all listed products or services.

Additional Tips for GST Automation

- Use Data Validation

To avoid errors, you can set up data validation to ensure that only valid GST rates are entered in the GST column.

- Conditional Formatting

Highlight cells that require attention, such as items with missing or incorrect tax values, using conditional formatting rules.

- Custom Tax Rates for Different Categories

Set up different GST rates for different categories of products or services, making sure each item is taxed according to its classification.

Automating GST calculations not only reduces the chances of human error but also speeds up the process, allowing you to focus more on growing your business and less on administrative tasks.

Free Invoice Templates for Indian Entrepreneurs

Starting a business can be a challenging task, but managing your finances doesn’t have to be. Many entrepreneurs in India seek efficient and cost-effective ways to keep their financial records organized. One of the simplest solutions is using ready-made billing documents that are easy to adapt and free to use. These resources can help you streamline your administrative tasks and focus more on growing your business.

For Indian entrepreneurs, there are numerous free options available that cater specifically to local business needs, such as tax calculations, GST, and customizable fields for different industries. Here’s how using a free billing document can benefit you:

- Cost Savings

Free resources help you avoid the need for expensive software. With basic tools like spreadsheets, you can create professional and efficient financial records without incurring additional costs.

- Ease of Use

These documents are simple to fill out and require no technical skills. Entrepreneurs can easily input their data and make necessary updates for each transaction.

- Compliance with Local Regulations

Many free resources are designed with Indian tax regulations in mind, such as GST. They come pre-configured with fields for tax rates and necessary calculations, helping you stay compliant with the law.

- Customization Options

Most free billing resources allow for customization, so you can modify the layout, add branding elements, or include additional fields to suit your business needs.

- Time Efficiency

By using a pre-designed document, you can quickly generate billing records for clients, saving valuable time on administrative tasks that could be better spent on business development.

For entrepreneurs, taking advantage of these free resources can greatly enhance productivity, help maintain professional standards, and simplify the overall billing process. Whether you’re just starting or have an established business, finding the right solution that fits your needs can make a big difference.

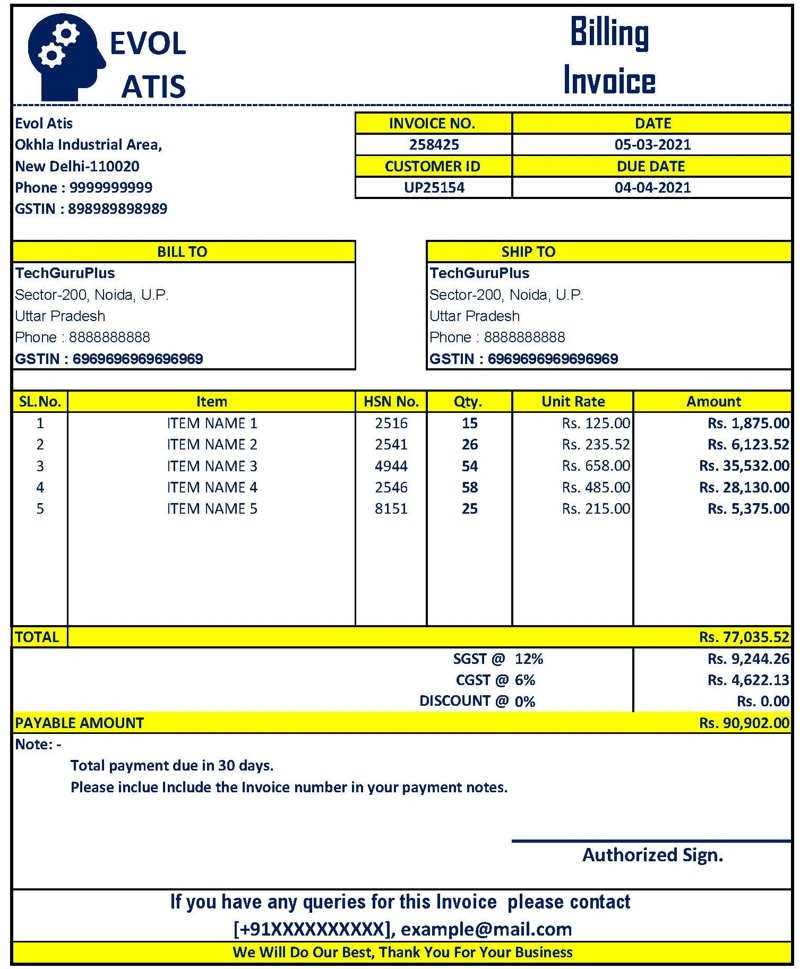

Understanding Invoice Formatting in India

Proper document formatting is essential for businesses to maintain professionalism and comply with regulatory requirements. In India, specific guidelines and standards must be followed when creating financial records, especially when dealing with transactions involving goods and services. Adhering to the correct format not only ensures clarity and transparency but also makes it easier to manage tax reporting and client communication.

In India, the structure of a billing document should be clear and well-organized, with particular attention to detail. The key aspects of formatting include:

- Business Information

Your business name, address, contact details, and GSTIN (Goods and Services Tax Identification Number) should be prominently displayed at the top of the document. This helps establish your identity and ensure compliance with local regulations.

- Client Information

The recipient’s name, address, and contact information should be included, along with their GSTIN, if applicable. This is necessary for clear identification and proper record-keeping, especially for GST filings.

- Unique Identification Number

Each document should have a unique serial number for easy tracking and reference. This is essential for both internal organization and regulatory purposes.

- Itemized List of Products or Services

Clearly list the goods or services provided, including descriptions, quantities, unit prices, and total amounts. This helps ensure that the details are transparent and easy to verify by both parties.

- GST and Tax Calculation

Include fields for the applicable tax rate and total tax amount. GST should be calculated based on the prevailing rates for each product or service category. This section must be accurate to comply with tax reporting regulations.

- Total Amount Due

The total amount, including taxes, should be clearly stated at the bottom. This ensures there is no confusion about the final payment required from the client.

- Payment Terms

Clearly state the payment due date, acceptable payment methods, and any additional terms or conditions, such as penalties for late payments or discounts for early settlement.

By following these formatting guidelines, businesses in India can create documents that are professional, legally compliant, and easy to process for both clients and authorities. Properly formatted documents not only enhance business credibility but also simplify tax filings and financial management.

Tracking Payments with Excel Invoices

Managing payments efficiently is crucial for any business, as it ensures a steady cash flow and minimizes the risk of overdue accounts. By using a structured document, you can easily track outstanding payments and monitor which transactions have been completed. Leveraging spreadsheet tools allows you to automate this process and keep detailed records that are easily accessible and up-to-date.

Steps to Track Payments Effectively

Tracking payments with your financial records can be done seamlessly by following these steps:

- Include a Payment Status Column

Adding a column for payment status allows you to track whether each transaction has been paid, is pending, or is overdue. You can mark the status as “Paid,” “Pending,” or “Overdue” for easy reference.

- Enter Payment Dates

For every payment received, record the date it was made. This helps you keep track of when payments are due and monitor whether clients are meeting deadlines.

- Automate Payment Calculations

Use formulas to automatically update the total amount due after a payment is received. For example, you can subtract the payment amount from the total, allowing you to instantly see the remaining balance.

- Track Multiple Installments

If a client is paying in installments, create separate rows for each payment and track the balance after each installment. This will give you a clear picture of how much is left to be paid.

- Set Up Conditional Formatting

Use conditional formatting to highlight overdue payments or unpaid balances. This visual aid helps quickly identify where attention is needed, allowing you to follow up with clients as necessary.

Using Reports for Better Payment Management

To streamline the process further, you can create reports that summarize your payments. By grouping records by client, due date, or status, you can generate insights into your cash flow. This helps you identify trends, such as frequent late payments or clients who pay on time, and enables you to make informed business decisions.

Tracking payments using a structured approach not only keeps your financials organized but also improves your ability to manage cash flow, handle overdue payments, and maintain strong client relationships.

Common Mistakes in Invoice Creation

Creating a well-structured and accurate financial document is essential for ensuring timely payments and maintaining a professional image. However, many businesses make common errors that can lead to confusion, delayed payments, or even legal issues. Identifying and avoiding these mistakes is crucial for smooth financial operations and strong client relationships.

Here are some of the most frequent mistakes people make when preparing their billing documents:

- Incorrect or Missing Contact Information

Failing to include or incorrectly entering your business and client contact details can cause confusion. Always ensure that your name, address, and contact information are accurate, along with your client’s information, to avoid communication breakdowns.

- Failure to Include Unique Identification Number

Not assigning a unique number to each document is a common error. This number is essential for tracking transactions, referring to past payments, and complying with record-keeping regulations.

- Omitting Payment Terms

Not clearly specifying payment terms such as due dates, acceptable payment methods, or late fees can lead to misunderstandings. Always outline when payment is due and any consequences for delayed payments.

- Inaccurate Tax Calculations

Tax errors are one of the most significant mistakes in billing documents. Incorrectly applying tax rates or failing to update them based on current laws can lead to financial discrepancies or even legal trouble. Always double-check tax amounts and ensure that you apply the right rates for each item.

- Missing or Incorrect Item Details

Listing vague or incorrect descriptions of products or services can lead to disputes. Always provide clear, accurate, and complete descriptions of the goods or services being billed, along with the quantity and price for each entry.

- Not Using Clear Payment Status

Leaving out payment status, such as whether a payment is pending or completed, can result in confusion and missed follow-ups. Clearly mark whether the amount is paid, pending, or overdue.

- Not Double-Checking the Total Amount

Mathematical errors in the total can lead to misunderstandings and payment delays. Always verify that the subtotal, tax, and final amount are correct before sending the document.

- Neglecting to Include Notes or Additional Details

For some transactions, you may need to add specific notes or terms. Neglecting to include these can lead to confusion or clients not fully understanding the agreement. Always leave space for any important information or special conditions.

By carefully reviewing your documents and avoiding these common mistakes, you can ensure that your billing process runs smoothly, improving

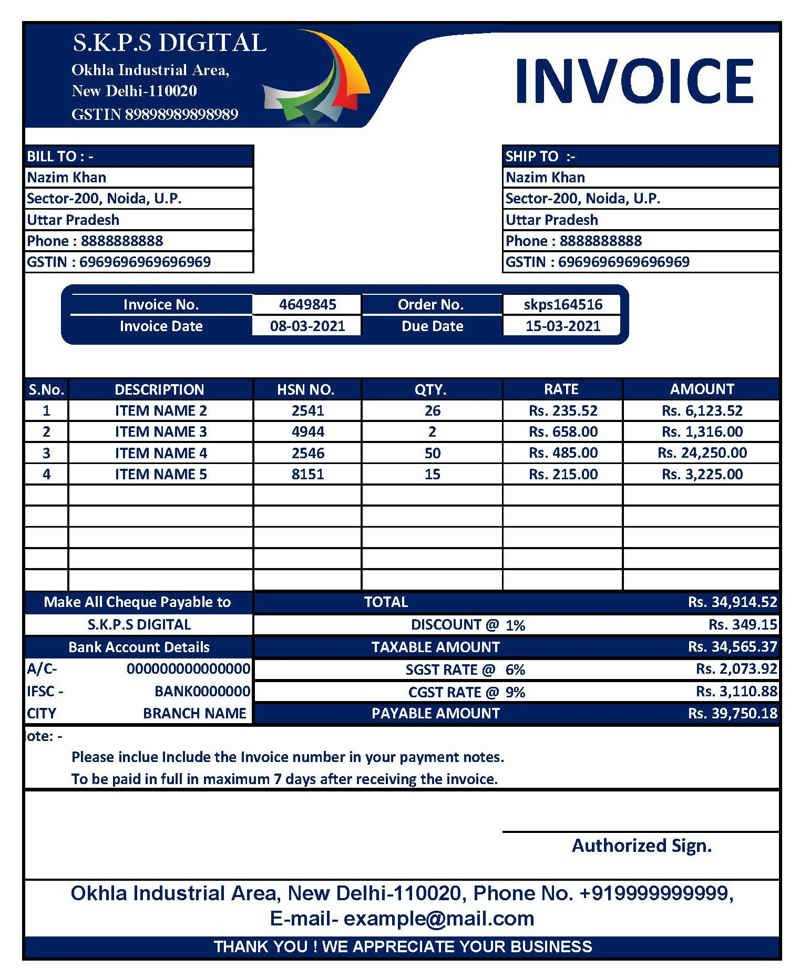

How to Include Tax Details in Invoices

Properly documenting tax information is a critical aspect of financial records, ensuring transparency, accuracy, and compliance with local regulations. Including tax details in your financial statements not only helps in maintaining clear records but also prevents confusion for both the business and the customer. Below are the key elements to include and steps to follow when incorporating tax details in your documents.

Steps to Include Tax Information

To effectively incorporate tax details into your financial records, follow these guidelines:

- Specify the Tax Rate

Clearly mention the applicable tax rate(s) for the products or services you are billing. Depending on your business, you may need to apply different rates for different categories. Ensure that you reference the correct rate, whether it’s a standard rate or a reduced rate.

- Break Down the Tax Amount

List the tax amount separately for each item or service. This helps to show the customer exactly how much of the total price is attributed to tax. You can do this in a distinct row or column for clarity.

- Include Tax Identification Number

For businesses that are registered for tax purposes, including your Tax Identification Number (TIN) or GSTIN is essential. This adds credibility and ensures that your records are compliant with local laws.

- State the Tax Breakdown

If you apply multiple taxes (e.g., GST, service tax), ensure that each tax type is broken down and listed separately. This provides clear visibility into how each tax contributes to the total amount due.

- Show Total Tax Amount

Summarize the total tax amount at the bottom of the billing record. This should include all applicable taxes, helping your customer easily see how the final amount was calculated.

- Clarify the Taxable and Non-Taxable Items

If certain items are exempt from tax, clearly mark them as non-taxable or exempt. This prevents confusion and ensures that the correct tax rates are applied only where necessary.

Best Practices for Tax Information

- Use Clear Labels

Label the tax-related fields clearly and in simple language (e.g., “GST @18%” or “Sales Tax”). This makes it easier for your clients to understand the breakdown of the charges.

- Double-Check Tax Calculations

Before finalizing the document, double-check that the tax calculations are correct. A simple mistake in tax rates or amounts can lead to complications or disputes with clients.

- Advantages of Digital Invoices in India

With the rise of digital tools and technology, businesses now have the opportunity to streamline their financial processes and improve efficiency. Moving away from traditional paper-based billing systems to digital formats offers numerous benefits, especially when it comes to managing transactions, reducing errors, and improving overall productivity. The shift towards digital financial documentation is becoming increasingly important for businesses in India as they adapt to the digital age.

Key Benefits of Digital Billing

- Improved Efficiency

Digital billing reduces the time spent on manually preparing, printing, and sending physical documents. Automation tools can quickly generate financial records, saving businesses valuable time that can be better spent on other tasks.

- Reduced Errors

Manual errors such as incorrect calculations or missing details are minimized when using digital systems. Built-in formulas and pre-designed structures ensure accuracy and consistency across all financial documents.

- Cost Savings

By eliminating the need for paper, printing, and postage, businesses can significantly reduce their operational costs. Digital records are easy to store and share, eliminating the need for physical storage space and reducing paper-related expenses.

- Faster Transactions

Digital documents can be instantly sent via email or online platforms, ensuring that clients receive their records immediately. This speeds up the payment process, improving cash flow for businesses.

- Better Organization and Accessibility

Digital records are easy to organize and store in a secure, centralized location. Businesses can quickly search and retrieve past documents, reducing the time spent looking through physical records. Cloud-based storage also ensures access from anywhere, at any time.

- Environmental Benefits

Switching to digital reduces the environmental impact of printing, paper waste, and transportation. Businesses that prioritize sustainability can contribute to a greener future by adopting digital solutions.

Compliance and Transparency

- Tax Compliance

Digital billing systems can be integrated with tax management tools, making it easier to stay compliant with the latest tax laws, including GST. These systems automatically calculate taxes and generate reports, reducing the risk of errors and non-compliance.

- Enhanced Security

Integrating Payment Methods in Invoice Templates

Including payment options in your billing documents is essential for ensuring smooth transactions between businesses and their clients. By clearly stating the available payment methods, businesses can facilitate quicker payments, enhance customer experience, and avoid confusion. Integrating payment details effectively can help streamline your accounts receivable process, reduce delays, and improve cash flow management.

How to Add Payment Methods to Your Financial Documents

- List Available Payment Options

Clearly specify the payment methods that you accept, such as bank transfers, credit card payments, online wallets, or cash. Listing multiple options increases the chances of receiving prompt payments and gives clients flexibility.

- Provide Payment Instructions

For each payment method, include step-by-step instructions. For example, if you accept bank transfers, provide the necessary bank details, such as account number, IFSC code, and bank branch name. For digital payments, include links to payment gateways or QR codes for easy transactions.

- Include Payment Terms

Clearly define the payment terms, such as the due date, late payment penalties, or early payment discounts. This provides clients with a clear understanding of when payments are expected and any additional charges they may incur.

- Specify Currency

If you deal with clients in different regions, be sure to state the currency in which payments should be made. This prevents any confusion about conversion rates and ensures the payment process is seamless.

Best Practices for Payment Integration

- Use a Payment Reference Field

Adding a field for payment reference numbers helps clients identify their transactions. This is especially useful when processing bank transfers or digital payments, as it ensures that payments are attributed to the correct account or service.

- Offer Multiple Payment Gateways

Integrate popular online payment gateways (such as PayPal, Stripe, or local payment providers) to offer clients a convenient way to pay. Having a variety of payment methods increases the likelihood of receiving payments on time.

- Ensure Mobile Accessibility

Ensure that your payment options are mobile-friendly. With the growing trend of mobile payments, having payment links, QR codes, or easy-to-use mobile apps integrated into your documents can facilitate faster transactions.

How to Protect Invoice Data in Excel

Ensuring the security of your financial data is a crucial aspect of maintaining business integrity and protecting sensitive information. Whether it’s customer details, payment history, or transaction amounts, safeguarding these records from unauthorized access or corruption is essential. By implementing the right security measures, you can ensure that your data remains protected and confidential.

Steps to Protect Financial Data

- Password Protection

The first line of defense against unauthorized access is setting a strong password for your files. Use a unique and complex password, combining uppercase and lowercase letters, numbers, and special characters. Always ensure that the password is kept confidential and is not shared with unauthorized individuals.

- Encrypt Files

Encryption provides an added layer of protection for your financial records. Encrypting your files makes them unreadable to anyone without the decryption key, thus securing the information even if the file is shared or intercepted. Most spreadsheet programs offer built-in encryption features that can be easily activated.

- Limit Access to Authorized Users

Only provide access to the file to those who absolutely need it. By restricting access, you can reduce the risk of unauthorized individuals making changes to the data. Implement user roles and permissions where possible, ensuring that only authorized personnel can view or edit specific sections of the document.

- Regular Backups

Backing up your files regularly ensures that you do not lose critical data in the event of a technical failure or corruption. Store backups in a secure location, such as encrypted cloud storage or an external hard drive, and regularly update these backups to reflect the latest changes.

- Audit Trails

Enable audit trails if your system allows for it. An audit trail records all changes made to the file, providing a detailed log of who made the changes and when. This can help you track any unauthorized modifications and take corrective action if needed.

Best Practices for Ongoing Protection

- Update Software Regularly

Ensure that the software you use is up to date, including any security patches and updates. Outdated software can be vulnerable to security breaches and data leaks, so always install the latest versions of your programs.

- Use Secure Storage Solutions

Storing your files in secure cloud storage platforms that offer encryption and multi-factor authentication (MFA) can greatly reduce the risk of unauthorized access. Be mindful of where you store your sensitive financial data, and opt for trusted platforms with strong security protocols.

- Track Access to Files

Monitor who accesses the file and when. This can be done by tracking login activity, file access history, or by using document management systems that log these details. Regular monitoring helps detect any suspicious activity early on.

By following these best practices and taking a proactive approach to data security, you can protect your financial information from unauthorized access or damage. Keeping your records safe not only ensures compliance with privacy laws but also strengthens the trust and security of your business operations.

Using Templates for Multiple Clients

Managing transactions for multiple clients can be a complex and time-consuming task, especially when each client has different billing requirements and preferences. To streamline this process, businesses often rely on pre-designed structures that can be easily customized for each client. This not only saves time but also ensures consistency in the information provided while offering flexibility for specific client needs.

Benefits of Using Pre-Designed Structures

- Time Efficiency

Pre-built structures allow you to quickly generate financial documents for different clients without starting from scratch each time. You can save valuable hours by simply filling in the necessary details, like client names, services provided, and amounts due.

- Consistency

Using the same layout for all clients ensures that your financial documents are consistent in format, making it easier for both you and your clients to understand the information. A standardized structure minimizes the chance of missing key details and helps maintain professionalism.

- Customization

While pre-designed structures offer a consistent format, they can also be customized for each client’s specific needs. Whether it’s adjusting payment terms, adding discounts, or modifying tax rates, you can easily tailor the document to meet the requirements of each client.

- Improved Accuracy

By using a predefined structure, the likelihood of errors is significantly reduced. Fields that are required can be pre-filled or marked, ensuring all necessary details are included before sending the document to the client.

Best Practices for Managing Multiple Clients

- Create Client-Specific Profiles

For each client, maintain a profile that includes essential details such as payment terms, contact information, and any customizations required for their financial documents. This will make the process of generating documents faster and more organized.

- Automate Repetitive Tasks

For clients who require regular transactions, automate recurring entries such as payment amounts, services rendered, or scheduled dates. This can save time and ensure that each document is generated without missing any details.

- Track Client History

Keep a

- Password Protection

- List Available Payment Options

- Improved Efficiency