Best Invoice Template Excel Format for Quick and Professional Invoicing

Managing finances efficiently is a cornerstone of any successful business. When it comes to requesting payments, having a well-structured document that outlines the details of the transaction is essential. A well-crafted document can help both businesses and clients stay organized, ensure clarity, and speed up the payment process.

Using a structured, easy-to-use system to generate these documents can save time and reduce errors. With the right tools, creating and customizing such forms becomes simple and effective, allowing you to focus on the core aspects of your work. Additionally, these forms can be adapted to meet various industry needs, making them versatile and practical for any professional.

Tailoring these forms to fit your specific requirements not only improves the professional look but also enhances accuracy in your billing. By taking advantage of user-friendly platforms, you can easily create custom layouts that suit your business style while maintaining all necessary legal and financial information.

Understanding Invoice Templates in Excel

Creating clear and professional billing documents is crucial for maintaining smooth financial operations in any business. The ability to generate well-organized records quickly and accurately helps businesses manage their payments more effectively. These structured documents typically include fields for details such as services rendered, payment terms, and due dates, making it easier for both parties to understand the transaction.

One of the most efficient ways to design such records is by utilizing digital tools that offer flexibility and customization. With the right platform, users can adjust the layout, content, and style to fit their specific needs, while keeping the core information intact. This approach not only saves time but also minimizes the risk of errors, helping businesses avoid common mistakes in manual calculations or formatting.

Furthermore, the ability to reuse and modify these documents means that businesses can streamline their invoicing process, ensuring consistency across all transactions. With a properly structured document, even small businesses or freelancers can present a polished and professional appearance to their clients, boosting credibility and trust in their services.

Why Use Excel for Invoices?

Managing financial records requires a tool that combines flexibility, ease of use, and accuracy. When it comes to generating billing documents, having a platform that allows for quick customizations and efficient calculations can make the entire process smoother. Using a spreadsheet program offers these advantages and more, making it an ideal choice for creating professional financial statements.

Customizable Layouts

One of the main benefits of using spreadsheets is the ability to easily customize the structure of each document. Whether you need to add specific fields, adjust column widths, or create additional sections, the options are virtually limitless. This level of control ensures that your documents meet all of your unique needs without being constrained by predefined templates.

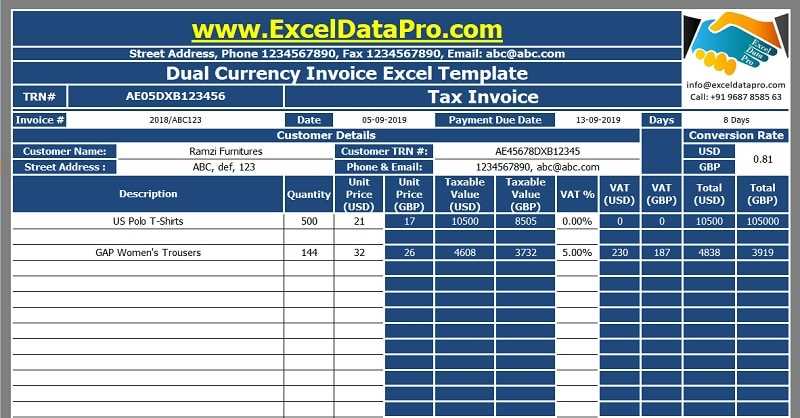

Automated Calculations

Spreadsheets also allow for the automation of calculations, eliminating the need for manual math and reducing the chance of errors. By setting up basic formulas, such as multiplying quantities by unit prices or applying taxes, users can instantly generate accurate totals, helping to streamline the overall process. This feature not only saves time but ensures that your financial documents are precise every time.

Advantages of Excel Invoice Templates

Using a digital tool to create billing documents offers a range of benefits that significantly improve efficiency and accuracy. A well-structured document can simplify the process of tracking payments, reduce errors, and make the entire workflow more streamlined. These advantages are amplified when you take advantage of customizable features that allow for personal adjustments based on business needs.

One of the key benefits of using spreadsheet-based solutions is the ability to automate various aspects of the document. With built-in formulas, users can instantly calculate totals, apply taxes, and track discounts without having to manually input numbers. This automation saves time and minimizes human error, leading to more accurate and consistent records.

Another significant advantage is the ease of customization. Whether you’re a freelancer or running a large business, the ability to modify layouts, add specific fields, and adjust the document’s design ensures that the final product aligns with your brand and meets your professional needs. Additionally, these documents can be easily stored, updated, and shared, making them accessible at any time without hassle.

How to Customize Your Invoice Template

Customizing your billing documents is essential for ensuring they meet your business’s specific needs while maintaining a professional appearance. With the right platform, you can easily adjust various elements, from the overall design to the content, ensuring that every detail is tailored to your preferences. Customization helps create a unique style that aligns with your brand identity and business requirements.

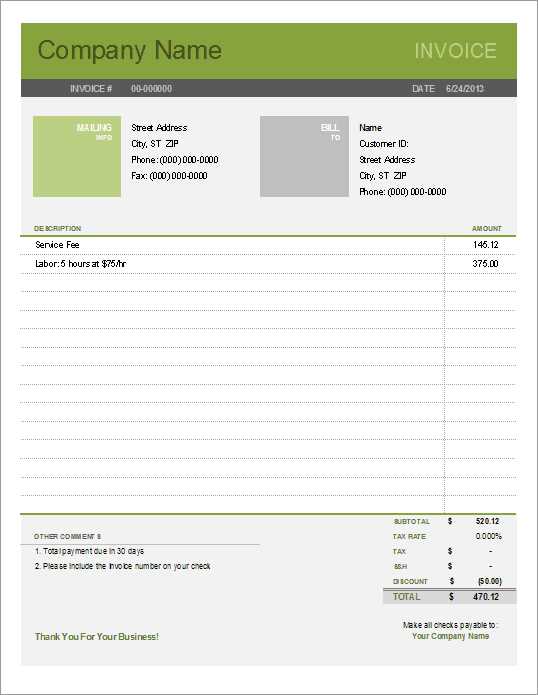

Adjusting Layout and Design

The layout of your document plays a crucial role in how easy it is to read and understand. Most digital tools allow you to modify columns, rows, and fonts to suit your style. You can resize fields, add new sections for additional information, and even choose colors or borders that match your company’s branding. A clean, well-organized design will make it easier for clients to process the information quickly.

Adding Essential Details

Adding personalized information, such as your business logo, contact details, and payment terms, can make your documents look more professional. It’s also important to include sections for the description of services or products, pricing, and tax information. These elements can be customized to fit your business’s offerings, ensuring that the document accurately reflects the services rendered or goods delivered.

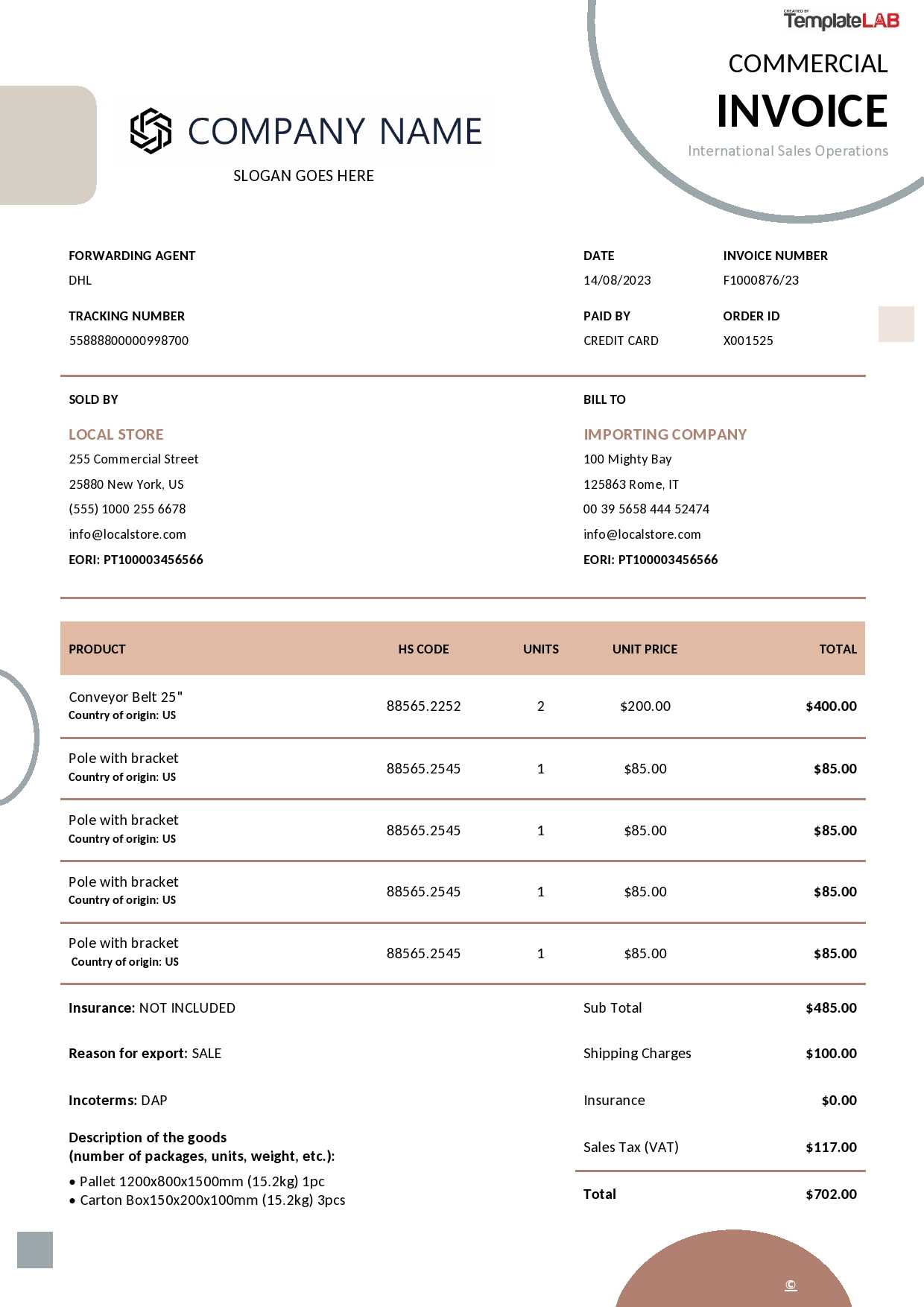

Essential Elements of an Invoice

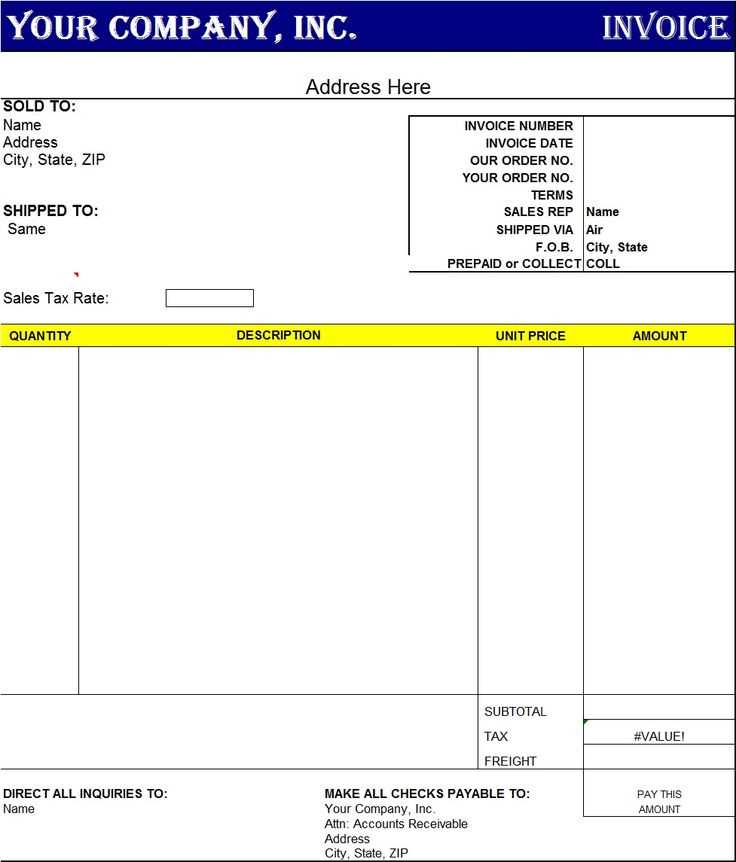

For any billing document to be effective, it must include several key components that ensure clarity and accuracy. These elements not only help communicate the transaction details but also establish a professional tone and reduce the chances of confusion between businesses and clients. Including all necessary information is crucial for both legal and operational purposes.

First and foremost, your document should clearly display the contact information of both parties involved, including names, addresses, and phone numbers. This ensures that each party can easily reach out if there are any questions or issues. Additionally, it’s vital to include a unique reference number for each document, which helps with organization and tracking of payments.

Another important element is a detailed description of the products or services provided. This section should include the quantity, unit price, and any applicable taxes or fees. Finally, the due date and total amount should be prominently displayed to prevent any confusion regarding payment expectations. By including these essential elements, you ensure that your documents are comprehensive, professional, and easy to understand.

Free Invoice Templates for Small Businesses

Small businesses often need an efficient way to handle financial transactions without investing in expensive software or complex systems. Fortunately, there are numerous free tools available that provide customizable billing documents, allowing businesses to generate professional-looking statements quickly and easily. These free resources make it easier to manage cash flow and maintain accurate records while saving time and money.

Benefits of Using Free Tools

One of the main advantages of using no-cost solutions is the ease of access. Many online platforms offer downloadable files or editable spreadsheets that require minimal setup. These documents come pre-designed with essential fields and calculations, so you don’t have to start from scratch. Moreover, they are often compatible with other software, allowing for seamless integration with your existing systems.

Sample Free Billing Layout

| Item Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Services | 5 hours | $50 | $250 |

| Website Design | 1 | $1000 | $1000 |

| Subtotal | $1250 | ||

| Tax (10%) | $125 | ||

| Total Due | $1375 | ||

As shown in the example above, free solutions often provide a clear, organized layout with the ability to calculate totals automatically, ensuring accuracy. These layouts can be tailored to fit specific services, product offerings, and pricing structures, making them an ideal choice for small business owners.

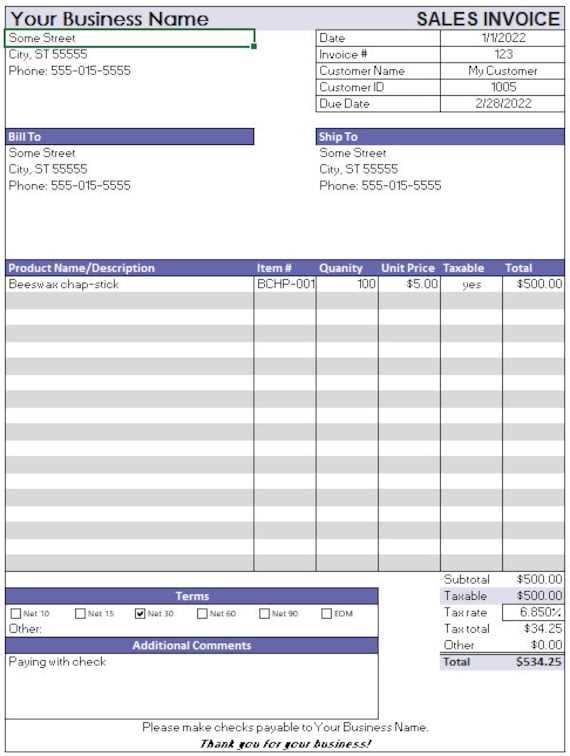

Creating a Professional Invoice in Excel

Designing a polished and professional billing document doesn’t have to be a complicated process. By using the right digital tools, you can quickly create a clear, well-organized statement that communicates all necessary details, ensuring your client understands the terms of the transaction. A professional layout not only makes your document look more legitimate but also helps you maintain consistency and accuracy in your financial records.

When building such a document, it’s essential to focus on the layout, ensuring the key elements are easily visible and well-structured. A clean design with clearly defined sections for payment terms, amounts, and services provided helps prevent misunderstandings and establishes your credibility. Below is a simple example of how to structure your billing document:

| Service Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Graphic Design | 3 hours | $75 | $225 |

| Web Development | 5 hours | $100 | $500 |

| Subtotal | $725 | ||

| Sales Tax (8%) | $58 | ||

| Total Due | $783 | ||

As shown, the structure is simple but effective. The document clearly lists the services, quantities, pricing, and total due. You can customize the design by adjusting the columns and rows to fit your business needs. The use of bold for important totals helps to emphasize critical information and ensure your client quickly understands the amount to be paid.

Best Practices for Invoice Design

Designing a clear and professional billing document is essential for creating a positive impression and ensuring smooth financial transactions. A well-structured statement not only conveys the necessary details but also reflects your brand’s professionalism and attention to detail. Adhering to certain best practices can enhance both the readability and functionality of your document.

Here are some key considerations when designing your billing document:

- Keep the Layout Simple and Clean: Avoid cluttering the document with unnecessary information. A clean, straightforward design helps the reader focus on key details such as the total amount due, services provided, and payment terms.

- Use Clear Headings: Clearly labeled sections such as “Service Description,” “Quantity,” “Total,” and “Due Date” allow your client to navigate the document easily.

- Highlight Important Information: Use bold or larger font sizes to emphasize crucial details, such as the total amount due or payment deadline. This ensures your client does not miss critical information.

- Include Your Branding: Your business logo, colors, and contact details should be included at the top of the document. This helps reinforce your brand identity and makes your document look more official.

- Stay Consistent with Fonts: Use no more than two font types to keep the document visually appealing. A clear, easy-to-read font for the body text and a bolder style for headings is a good rule of thumb.

- Include Payment Terms: Clearly state the payment terms, such as due dates, late fees, and accepted payment methods. This prevents confusion and establishes clear expectations.

By following these best practices, you can create a professional, well-organized document that not only improves the client experience but also helps you maintain efficient financial records. Keeping your designs simple, clear, and consistent is key to ensuring that your billing documents serve their intended purpose effectively.

Automating Invoices with Excel Functions

Automation is a powerful tool that can save you time and reduce errors when creating financial documents. By leveraging built-in functions in spreadsheet software, you can automate repetitive tasks such as calculating totals, applying taxes, or updating prices. This ensures that your documents are always accurate and up-to-date without requiring manual input for each transaction.

Here are some ways to automate tasks when generating financial records:

- Automatic Calculations: Using functions like

SUM,PRODUCT, andIFcan instantly calculate totals based on quantities and unit prices, eliminating the need to perform manual math. - Dynamic Pricing: By referencing a price list or creating conditional formulas, you can automatically update prices depending on the product or service selected, ensuring consistent and accurate pricing across documents.

- Tax Calculations: Using simple formulas, you can apply tax rates to the subtotal and update the total due automatically. For example, multiplying the subtotal by a fixed tax rate can instantly calculate the amount due for tax.

- Due Date Tracking: You can use date functions to automatically calculate the payment due date based on the transaction date, making it easy to ensure timely payments and avoid late fees.

- Discounts and Coupons: Automatically apply discounts based on predefined rules. For example, if a client purchases more than a certain amount, you can set up a formula that applies a discount to the subtotal before calculating the final total.

By incorporating these automated functions, you can create streamlined, error-free financial records in a fraction of the time it would take to complete them manually. This not only enhances the efficiency of your billing process but also helps maintain consistency across all your documents.

Common Mistakes to Avoid in Invoicing

Creating accurate and professional financial documents is key to maintaining healthy business relationships and ensuring timely payments. However, many businesses make common errors that can lead to confusion, delays, or disputes. Avoiding these mistakes can help streamline the billing process and improve overall efficiency.

Frequent Errors in Billing Documents

- Missing or Incorrect Contact Information: Failing to include your business name, address, or client’s details can cause delays or confusion. Always double-check that contact information is up-to-date and correctly entered.

- Failure to Include Unique Reference Numbers: Without a unique identifier for each transaction, it becomes difficult to track payments or reference specific transactions. Each document should have a clear, sequential number for easy identification.

- Unclear Payment Terms: Ambiguity in payment terms can lead to confusion. Always specify the payment due date, late fees, and accepted methods of payment. Clear terms prevent misunderstandings and ensure that both parties are on the same page.

- Not Accounting for Taxes: Omitting taxes or miscalculating them can result in financial discrepancies. Ensure that tax rates are correctly applied, and the final total reflects the tax amount.

- Incorrect Pricing or Totals: Mistakes in pricing or arithmetic can harm your business’s credibility. Use automated calculations to reduce the chances of human error and ensure that all totals are accurate.

Design and Formatting Pitfalls

- Poor Layout or Cluttered Design: A messy or hard-to-read document can confuse the recipient and lead to delays in payment. Keep the design clean and organized, using sections and headings to separate key information.

- Missing Descriptions for Products or Services: Failing to provide detailed descriptions can result in confusion about what was delivered. Ensure each item or service is clearly defined to avoid disputes.

- Not Including a Payment Deadline: Forgetting to mention when the payment is due can lead to delays. Always highlight the due date prominently to ensure timely payments.

By being aware of these common mistakes and taking steps to avoid them, you can improve the accuracy, clarity, and professionalism of your financial documents, which will help you get paid faster and maintain positive client relationships.

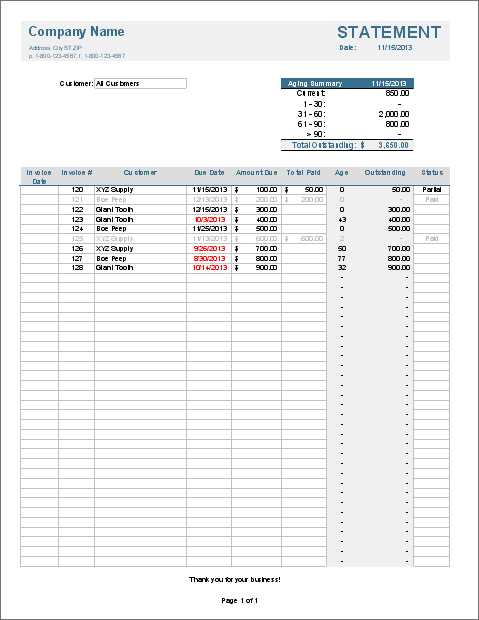

How to Track Payments Using Excel

Tracking payments efficiently is essential for maintaining a healthy cash flow and ensuring that all outstanding balances are settled in a timely manner. By using a well-organized system, businesses can easily monitor which transactions have been paid and which are still pending. With the right tools, this process becomes streamlined, helping you stay on top of your financial records and reduce the risk of errors or missed payments.

Setting Up a Payment Tracking System

To begin tracking payments, create a dedicated spreadsheet that includes essential columns such as the client name, payment due date, amount due, payment received, and payment status. This basic structure allows you to easily input and update information as payments are processed. You can add additional columns to track payment methods, transaction references, or notes for specific cases.

For example, a simple tracking system might look like this:

| Client Name | Amount Due | Amount Paid | Payment Date | Status |

|---|---|---|---|---|

| John Doe | $500 | $500 | 01/10/2024 | Paid |

| Jane Smith | $250 | $0 | Pending | Unpaid |

| ABC Corp | $750 | $375 | 03/10/2024 | Partial |

Using Formulas for Automated Updates

Automating calculations and updates is one of the most powerful features of using a spreadsheet for payment tracking. You can use basic functions to calculate outstanding amounts, track partial payments, and determine the status of each transaction.

- Outstanding Amount: Use a simple subtraction formula to automatically calculate the remaining balance (e.g.,

=Amount Due - Amount Paid). - Status Updates: You can set up a conditional formula to automatically update the payment status based on the amount paid. For example, if the amount paid is equal to or greater than the amount due, the status can read “Paid”; if less, it can show “Partial”; or if no payment has been received, it can display “Unpaid.”

By setting up this kind of system and utilizing formulas for automatic calculations and updates, you can effortlessly track payments, maintain accurate record

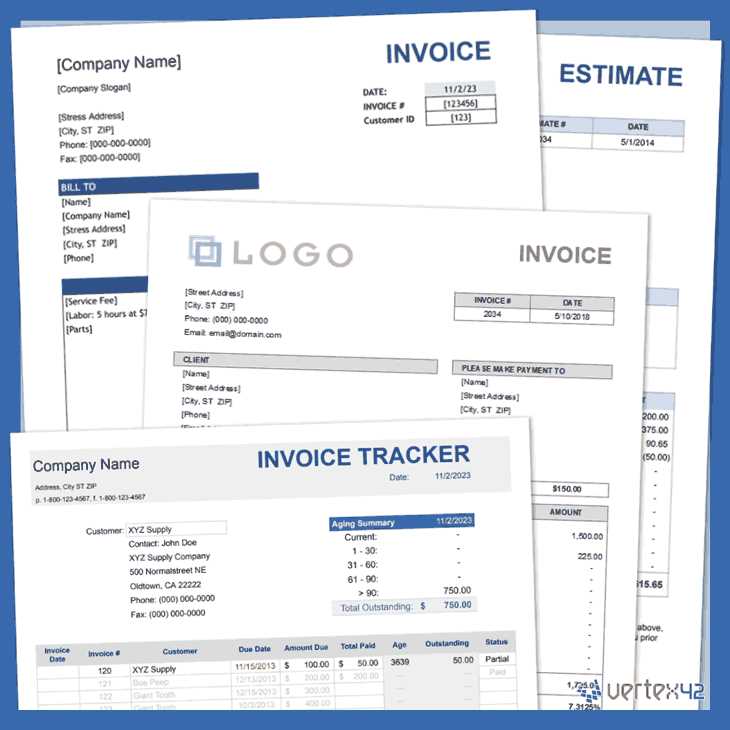

Invoice Templates for Different Industries

Different industries have unique requirements when it comes to billing documents. The services provided, pricing structures, and even the way transactions are processed can vary significantly from one sector to another. As a result, businesses often need specialized documents that can accommodate their specific needs. Understanding the types of details required for each industry ensures that your documents are not only accurate but also meet legal and professional standards.

For example, businesses in creative fields may need a layout that highlights project milestones, hours worked, or specific deliverables, whereas those in retail may focus more on product descriptions, quantities, and unit prices. Similarly, industries like construction or consulting may require space for itemized services, materials, and labor costs. Tailoring your documents to suit your industry helps streamline your billing process and creates a more professional experience for your clients.

Here are a few examples of how different industries may benefit from customized billing structures:

- Creative and Freelance Services: These businesses often provide detailed descriptions of each project, listing hours worked, specific tasks, and milestones achieved. A simple but clear layout that can break down hourly rates and project timelines is ideal.

- Retail and E-commerce: In these industries, billing documents typically list each item sold, along with quantity, unit price, and total cost. Sales tax and shipping fees should also be clearly outlined to avoid confusion.

- Construction: For construction projects, detailed line items that specify materials, labor, and subcontractor costs are essential. These documents may also need to include project phases or stages, making it easy to track progress and payments.

- Consulting and Professional Services: Consulting businesses often need invoices that itemize services provided, hours worked, and specific terms of agreement. The document should allow for clear breakdowns of services rendered and payment schedules.

By customizing your documents to meet the needs of your industry, you can improve communication with clients and ensure that every detail is captured accurately. A tailored billing document not only reflects professionalism but also helps maintain clarity and consistency in your business transactions.

How to Save and Share Your Invoice

Once your financial document is complete and all details are correct, the next step is to save and share it with your client. Properly saving the document ensures that you have an accessible and organized record for future reference. Sharing it securely and efficiently allows your client to receive the necessary information without delay, helping to maintain smooth business operations.

Saving your document is crucial for maintaining organized records. You should store the document in a safe, easily accessible location on your device or cloud storage. It is also important to name the file appropriately, using a clear naming convention that includes the client’s name and the date, such as “JohnDoe_Invoice_10-2024.” This makes it easy to locate the document later and avoid confusion with other records.

When sharing the document, consider these methods:

- Email: This is the most common and professional way to send billing documents. Attach the file to the email and include a brief message explaining the contents, the due date, and any other necessary instructions. Always ensure the file size is manageable, and consider compressing large files.

- Cloud Storage Links: If the document is too large to email, or if you want to provide clients with ongoing access to multiple records, cloud storage services like Google Drive, Dropbox, or OneDrive are great options. You can generate a shareable link that provides your client with easy access to the file.

- Invoice Management Software: If you’re using billing software or an online platform, these tools often offer built-in features to create and send documents directly to clients. These services can also track when the client has viewed or paid the document, adding an extra layer of transparency.

Ensure confidentiality and professionalism by using secure methods of sharing. When sending documents over email, always use PDF format to prevent any accidental edits or alterations. If your client requires a physical copy, consider sending it via postal mail or courier for added security.

By properly saving and sharing your billing document, you not only keep accurate records but also maintain clear communication with your clients, ensuring timely payments and smooth business operations.

Securing Your Invoice Data in Excel

When dealing with financial records, it’s essential to protect sensitive data to prevent unauthorized access, data loss, or theft. Safeguarding your billing information not only ensures that your business operations remain confidential but also helps maintain trust with clients. Fortunately, there are several ways to secure your documents while working with spreadsheets, providing peace of mind when handling such important details.

One of the primary methods to secure your files is by using password protection. This ensures that only authorized individuals can access your document. Most spreadsheet software allows you to set a password to open the file, preventing unauthorized users from viewing or editing it. Be sure to choose a strong, unique password to enhance security.

Encryption is another effective way to protect your data. By encrypting your file, you add an extra layer of security that prevents anyone from opening the document without the correct password or decryption key. Encryption ensures that even if your file is accessed by unauthorized users, the contents will remain unreadable.

Here are a few other tips for securing your financial documents:

- Limit Access: Only share your files with individuals who absolutely need them. Be cautious about who you grant access to, and regularly review who has permission to view or edit your documents.

- Backup Your Files: Always create regular backups of your important records. Use cloud storage services or external drives to keep copies of your files in case your primary document is lost or corrupted.

- Use Secure Sharing Methods: When sending documents electronically, use secure channels such as encrypted email or trusted cloud services. Avoid sharing sensitive information through unsecured platforms or public networks.

- Enable Auto-Save and Version Control: Many modern spreadsheet applications offer automatic saving features and version control. These tools help you recover previous versions of your document in case of accidental loss or edits.

By implementing these security measures, you can ensure that your financial records remain safe from unauthorized access, keeping both your business and your clients’ information secure.

Integrating Excel with Accounting Software

Many businesses rely on accounting software to track and manage their financial data. However, spreadsheets remain a powerful tool for organizing and analyzing data. By integrating these two systems, you can combine the flexibility of spreadsheets with the automation and features of accounting platforms. This integration streamlines processes, reduces the chance of errors, and improves the overall efficiency of financial management.

Connecting spreadsheets with accounting software allows for seamless data transfer, eliminating the need for manual entry. For example, you can import financial records from the accounting platform directly into a spreadsheet for further analysis, or export data from the spreadsheet to your accounting system. This integration ensures that your financial data stays consistent and up-to-date across both platforms, saving time and reducing mistakes.

How to Integrate Spreadsheets with Accounting Software

To integrate your spreadsheet system with accounting software, follow these general steps:

- Choose Compatible Software: Ensure that the accounting software you are using supports data import and export with spreadsheets. Many popular platforms, such as QuickBooks, Xero, and FreshBooks, offer direct integration with spreadsheet applications.

- Use Import/Export Functions: Most accounting platforms allow you to export financial data as CSV files, which can be opened and edited in a spreadsheet program. Similarly, you can import spreadsheet data into your accounting software, ensuring that both systems are in sync.

- Automate Data Transfer: Some advanced accounting software solutions offer automatic syncing with spreadsheet tools. This feature helps eliminate manual steps and ensures that your financial records are always updated in real-time.

Example of Exporting Data to Accounting Software

If you have a table in your spreadsheet listing payments or transactions, you can export this data to your accounting software. Here’s an example of how the data might be organized:

| Transaction ID | Date | Amount | Client Name | Status |

|---|---|---|---|---|

| 12345 | 10/01/2024 | $500 | John Doe | Paid |

| 12346 | 10/02/2024 | $250 | Jane Smith | Pending |

Once this data is entered into your accounting software, you can generate reports, track balances, and reconcile accounts without manually re-entering the same information. This integration ensures your financial records remain accurate and saves you time.

By integrating your spreadsheet system with accounting tools, you combine the power of both platforms, streamlining financial management and reducing the potential for errors.

How to Handle Late Payments in Excel

Late payments can disrupt cash flow and create unnecessary stress for businesses. Tracking overdue payments effectively is essential for managing finances and ensuring timely follow-up with clients. Using a spreadsheet to monitor outstanding amounts and payment deadlines can help streamline this process, keeping you organized and proactive when it comes to resolving late payments.

When managing overdue payments, it is important to have a clear system in place. By adding specific columns and formulas in your spreadsheet, you can quickly identify late payments, calculate any applicable late fees, and send reminders to clients. This method ensures that you stay on top of your financial records and reduce the risk of missed payments.

Steps to Track Late Payments

Here are a few steps to help you handle overdue payments using a spreadsheet:

- Set Up Payment Due Dates: In your document, include a column for the payment due date. This will make it easy to spot any payments that are overdue and need attention.

- Use Conditional Formatting: Apply conditional formatting to highlight overdue payments. For example, you can use red formatting for any payments that are past due. This makes overdue amounts more visible, helping you prioritize follow-ups.

- Calculate Late Fees: If you charge late fees, you can use simple formulas to calculate the additional charges. For instance, if the payment is 10 days overdue, you can set up a formula to apply a specific percentage to the outstanding amount.

- Track Payment Status: Use a “status” column to indicate whether the payment is paid, partial, or overdue. This column helps you track the progress of each payment and follow up as needed.

Example of Late Payment Tracking Table

Below is an example of how to set up a table in your spreadsheet to track overdue payments:

| Client Name | Amount Due | Due Date | Amount Paid | Late Fee | Status |

|---|---|---|---|---|---|

| John Doe | $500 | 10/01/2024 | $500 | $0 | Paid |

| Jane Smith | $300 | 10/05/2024 | $0 | $30 | Overdue |

| ABC Corp | $750 | 10/10/2024 | $375 | $50 | Partial |

In this table, you can see how the overdue amounts and late fees are clearly marked, helping you keep track of each client’s payment status and ensuring you follow up on overdue balances promptly.

By creating a system in your spreadsheet for tracking overdue payments, you can minimize delays, ensure timely follow-ups, and ultimately improve your cash flow management. This approach allows you to handle late payments more efficiently and professionally, keeping your business running smoothly.

Updating and Maintaining Your Templates

Keeping your billing documents up to date is crucial for ensuring that they are accurate, professional, and meet the evolving needs of your business. Over time, you may find that you need to make adjustments to your layouts, terms, or included information. Regular updates to your documents can help prevent errors, improve clarity, and streamline your financial processes. Additionally, maintaining consistency in the design and content ensures that you are presenting a cohesive image to clients.

To maintain an effective system, it’s important to periodically review your documents and make adjustments based on business changes or client feedback. This will help you avoid outdated information and keep your records aligned with your current business practices.

How to Keep Your Documents Updated

Here are a few tips for maintaining and updating your billing documents:

- Review Terms and Conditions: Periodically check if your payment terms, due dates, or late fees need adjustments. Ensure that all legal and financial terms are current and compliant with any regulatory changes.

- Design Consistency: If you make changes to your branding, be sure to update your documents with the latest logos, fonts, and color schemes. This will keep your documents aligned with your company’s visual identity.

- Track and Archive Versions: Keep a record of older versions of your documents for reference or audit purposes. This can be easily done by saving new versions under distinct file names (e.g., “Client_Invoice_v2”) and maintaining an archive for easy access.

- Update Client Information: Ensure that all client details, such as addresses, contacts, and billing preferences, are up to date. An out-of-date address or incorrect contact information can cause delays and confusion.

Example of Document Maintenance Log

It’s useful to track changes and updates to your financial documents. Below is an example of how you might log these changes in a simple table:

| Version | Date of Update | Changes Made | Responsible Person |

|---|---|---|---|

| 1.0 | 01/01/2023 | Initial setup of document structure | John Doe |

| 2.0 | 05/01/2023 | Added new payment terms and updated branding | Jane Smith |

| 3.0 | 10/01/2023 | Updated client contact details and address format | John Doe |

B