Best Invoice Template in English for Easy Customization and Use

Every business, large or small, needs a reliable way to request payment for goods or services rendered. A well-organized and clear billing document not only helps ensure timely payments but also reflects the professionalism of your company. Whether you’re a freelancer or running a larger enterprise, having a standardized format for these documents can streamline the process and avoid misunderstandings.

Setting up a customized billing structure allows you to maintain consistency in your financial communication with clients. By using the right format, you ensure that all necessary information is included, such as payment terms, service descriptions, and contact details. Additionally, a well-designed layout enhances the customer experience and can make the payment process smoother.

Understanding how to create and use these documents effectively is crucial for maintaining healthy business relationships. A properly designed bill not only facilitates smooth transactions but also ensures that your clients can easily process payments. This article will guide you through creating effective billing documents that suit your specific business needs and help you maintain a professional image.

What is an Invoice Template

A standardized document used for requesting payment for goods or services is essential for smooth business transactions. It provides a clear structure, ensuring that all the necessary information is included in a consistent and organized manner. By using a pre-designed format, businesses can save time and reduce errors, ensuring professionalism and accuracy in their financial communication.

This type of document typically contains fields for essential details such as the payer’s information, the amount due, a description of the services or products provided, payment terms, and other relevant data. The goal is to create a clear, easy-to-understand statement that helps clients process payments efficiently while maintaining a professional business image.

Benefits of Using Invoice Templates

Utilizing a pre-structured document for billing offers several advantages for businesses. It simplifies the process of requesting payment, ensuring that all necessary details are included without the need to start from scratch each time. By adopting a consistent approach, businesses can streamline their operations and minimize the risk of missing important information.

Time-saving efficiency is one of the key benefits. Instead of creating a new billing document from zero for each transaction, a standardized format allows for quick customization and immediate use. This ensures that the process is faster, especially for businesses that handle multiple payments regularly.

Additionally, using a predefined structure helps reduce errors. By relying on a consistent layout, you are less likely to omit essential details or make formatting mistakes that could delay payments. This accuracy also promotes professionalism, reflecting positively on your brand and improving client trust.

How to Choose the Right Template

When selecting a format for your billing documents, it’s important to consider both functionality and design. The right structure will not only help you collect payments quickly but also create a professional impression. Choosing the best fit depends on the nature of your business, your branding needs, and the level of customization you require.

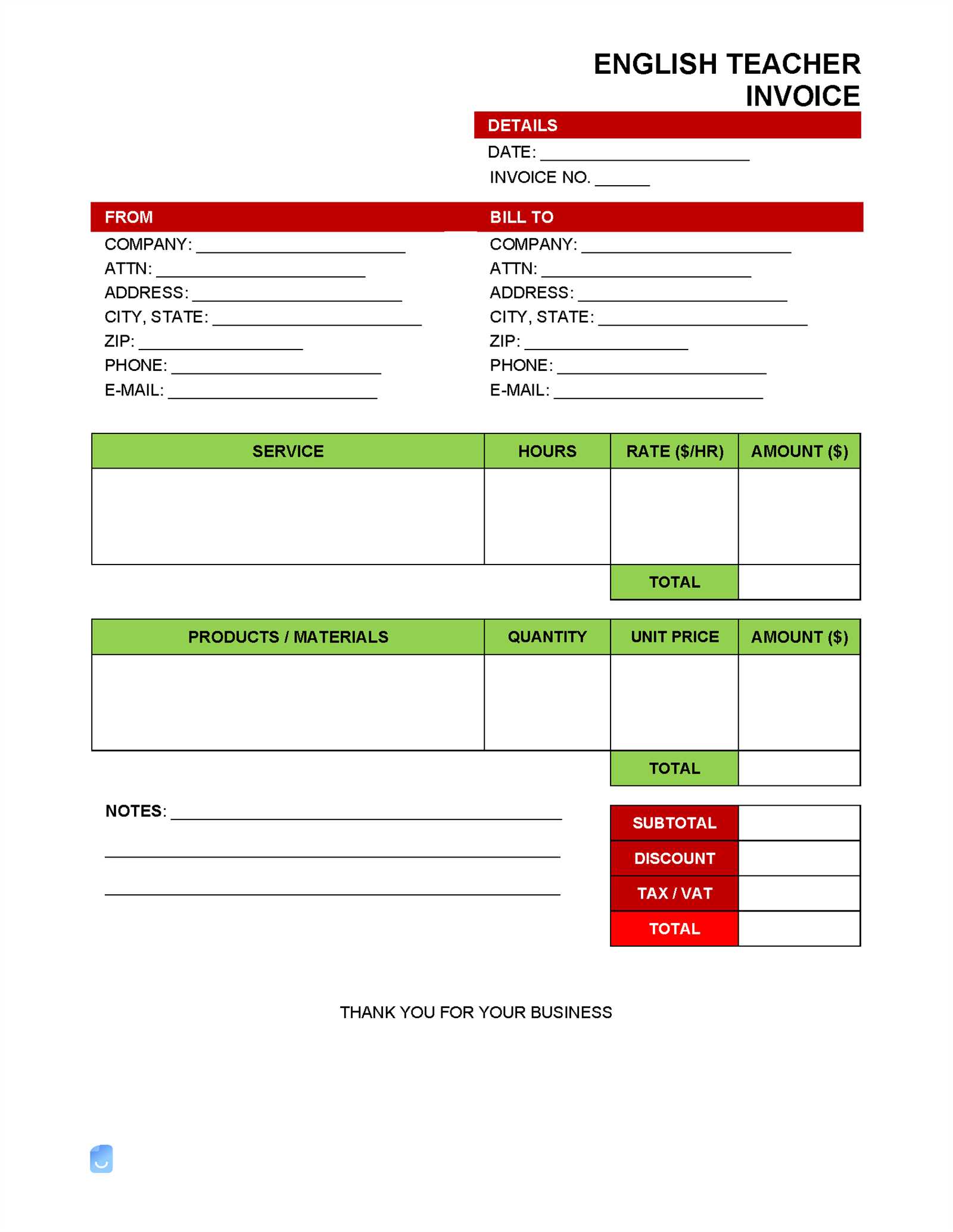

Consider Your Business Type

Different businesses have different billing needs. For example, a freelancer may need a simple and clean format, while a service-based company might require more detailed descriptions of the work performed. Choose a format that accommodates the specific details relevant to your products or services while remaining clear and concise.

Look for Customization Options

Make sure the structure you choose offers flexibility to adapt to your unique requirements. Whether you need to add your company logo, adjust payment terms, or include taxes and discounts, the ability to easily modify the design will save you time and ensure that your documents align with your branding and legal requirements.

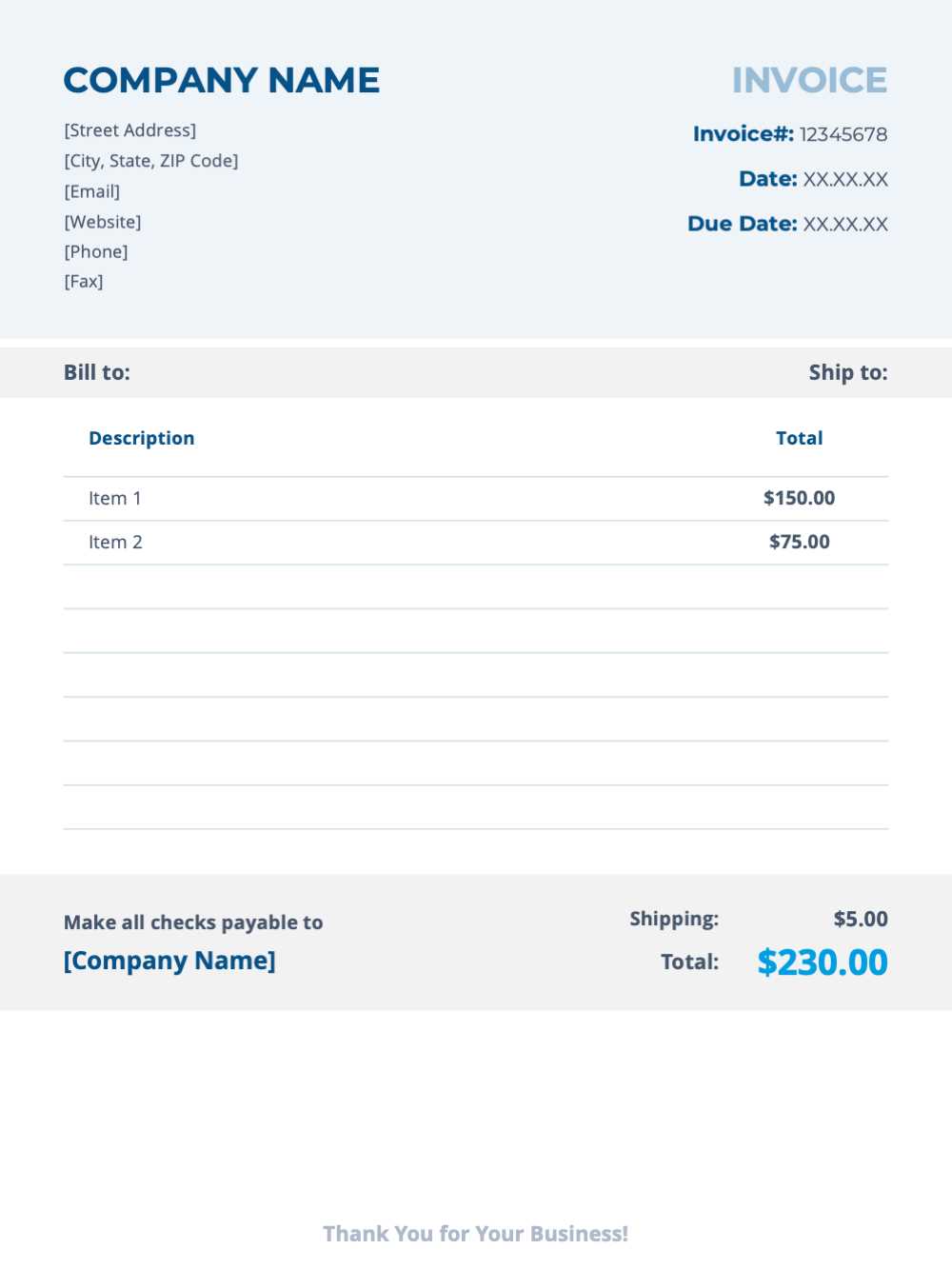

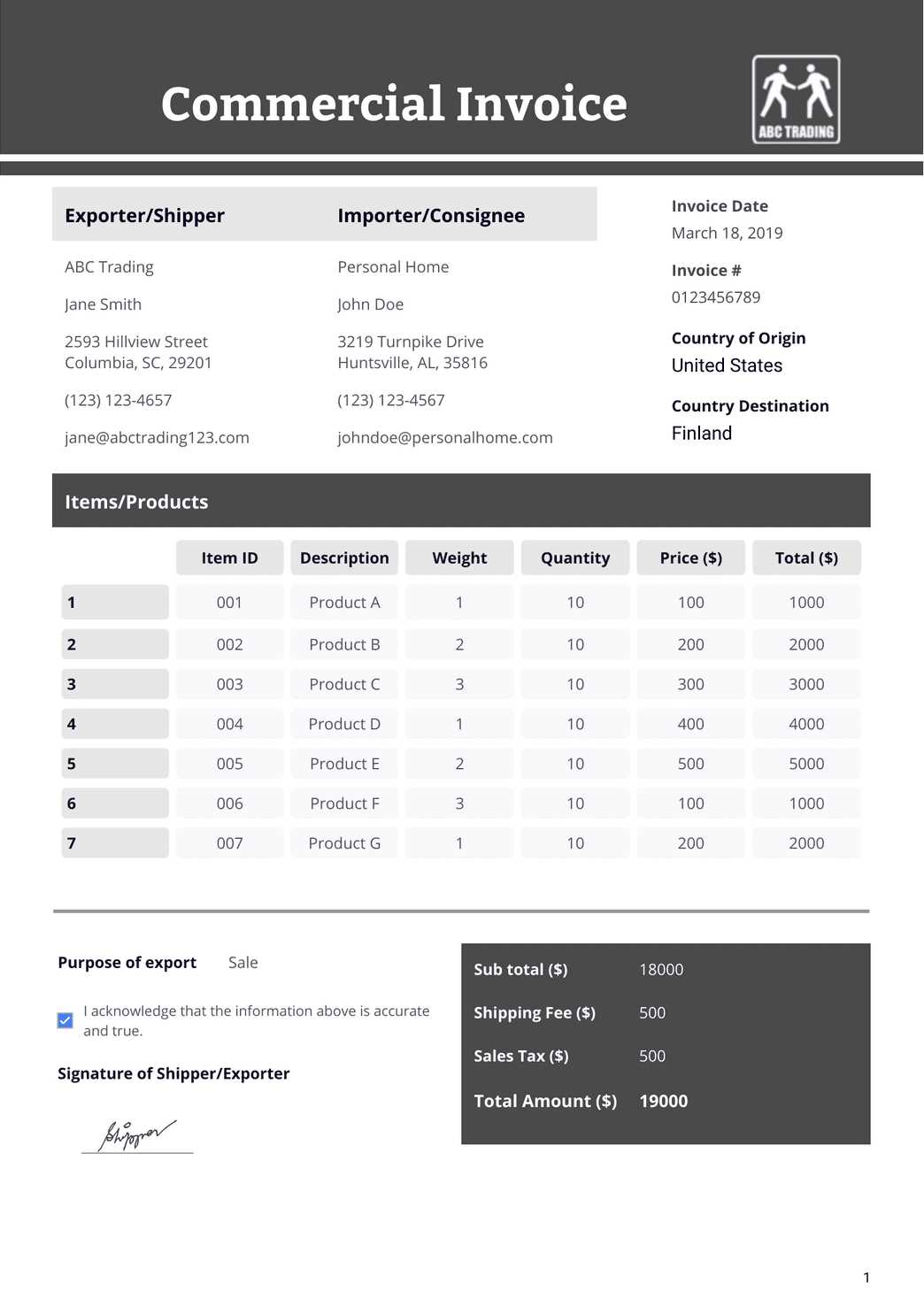

Essential Elements of an Invoice

To ensure smooth and effective billing, certain key components must be included in every request for payment. These elements not only help clarify the details of the transaction but also provide the necessary information for timely and accurate payments. A well-structured document leaves no room for confusion, benefiting both the sender and the recipient.

Key Information for Identification

Each document should include both the sender’s and recipient’s details. This includes the name, address, and contact information for both parties, as well as any identifying numbers, such as client or order numbers. Accurate contact information ensures that any questions or issues can be addressed quickly, reducing the chance of payment delays.

Breakdown of Goods or Services Provided

It is crucial to list the products or services provided, along with a brief description, quantity, and price for each item. A clear breakdown not only justifies the total amount due but also helps clients verify the charges. Additionally, including payment terms, such as due dates and late fees, ensures transparency in the billing process.

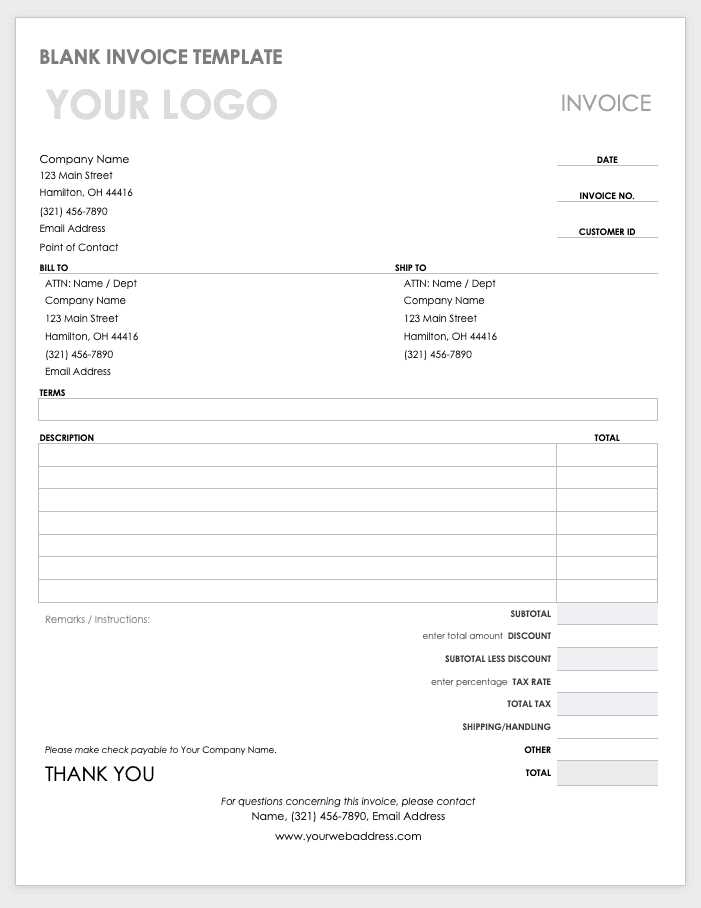

Customizing Your Invoice Template

Personalizing your billing document allows you to reflect your brand identity while ensuring that the information is clear and tailored to your business needs. Customization can range from simple design adjustments, such as adding your logo and company colors, to more complex changes like altering the layout or adding specific fields relevant to your services.

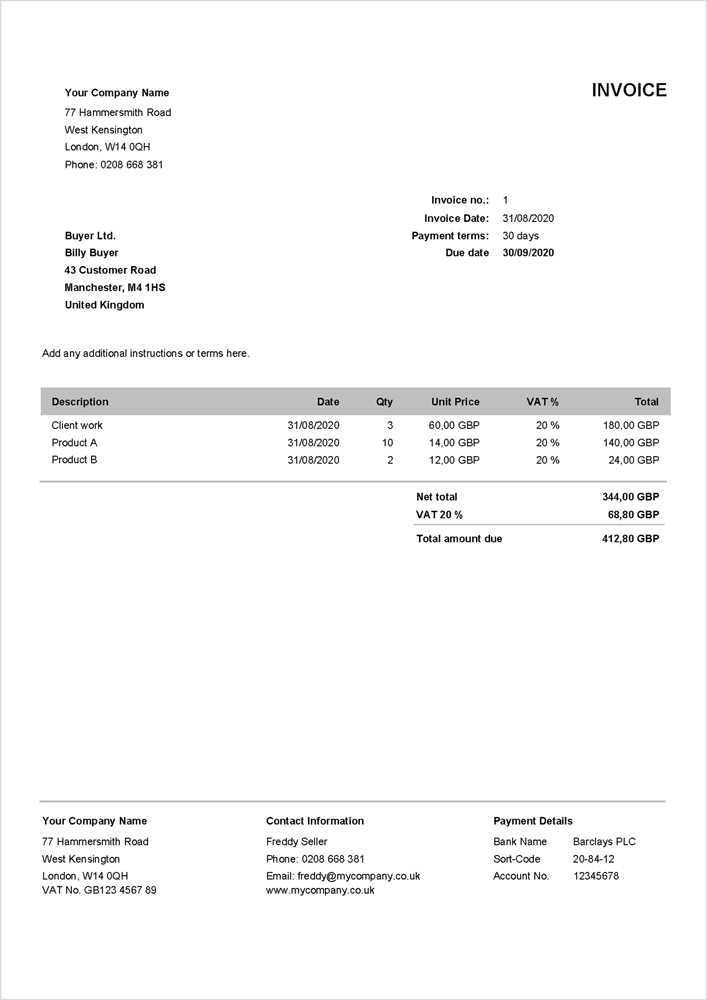

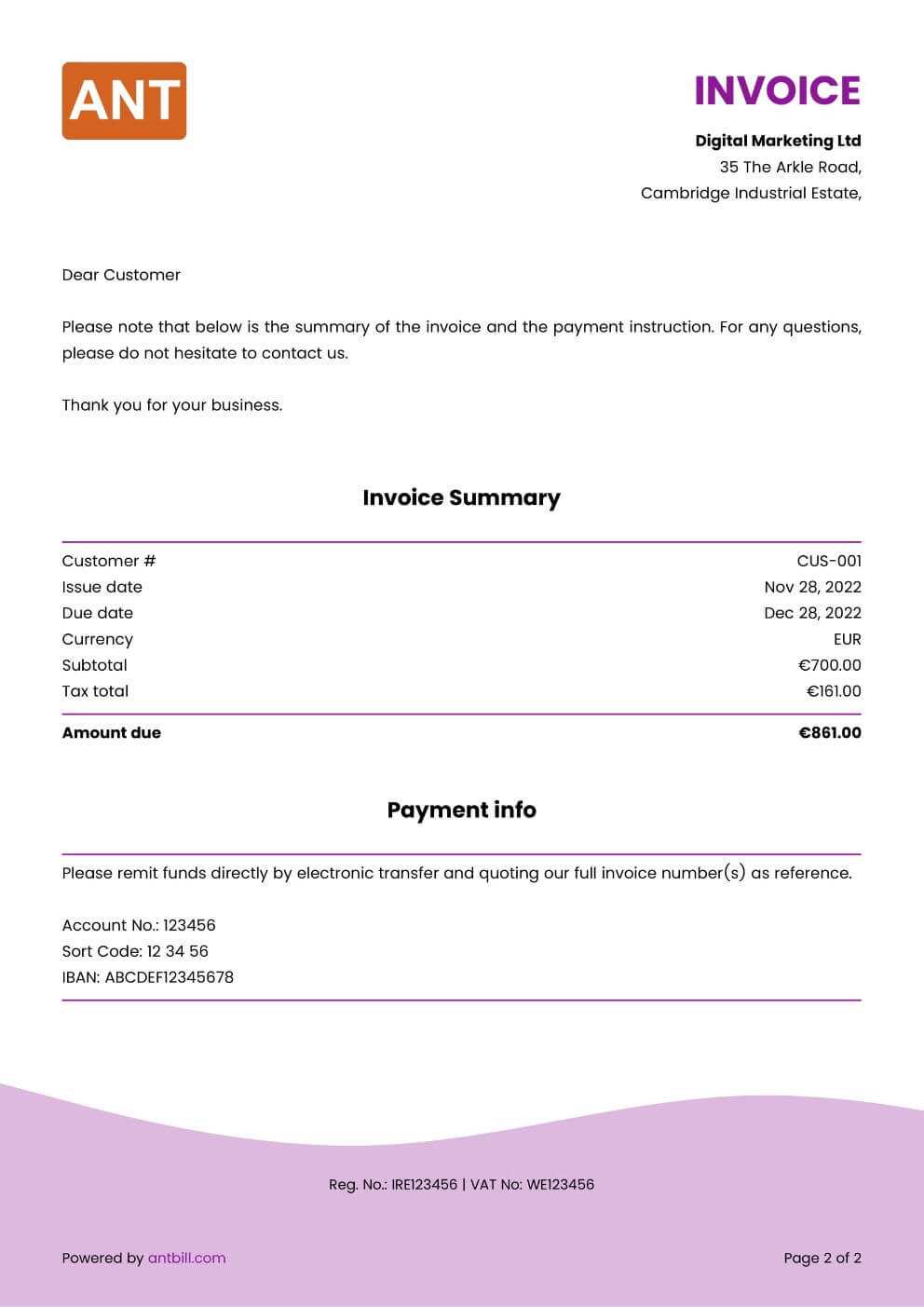

One of the most important aspects of customization is making sure that all necessary fields are included, and unnecessary ones are removed. Here’s an example of how a customized layout might look:

| Field | Description |

|---|---|

| Company Logo | Brand your document with your company’s logo for a professional touch. |

| Service Description | Clearly list the services or products provided with a brief explanation. |

| Payment Terms | Specify payment deadlines, methods, and any late fees to avoid confusion. |

| Contact Information | Ensure your business contact details are easy to find for follow-up questions. |

By customizing your documents in this way, you create a more professional and efficient experience for your clients while maintaining consistency across all communications.

Common Mistakes to Avoid in Invoices

When creating billing documents, small errors can lead to misunderstandings, delayed payments, or even damaged business relationships. It’s important to pay attention to details and ensure that all the required information is accurate and complete. Avoiding these common mistakes can make a significant difference in the efficiency and professionalism of your payment requests.

One frequent issue is the omission of essential details, such as contact information or a clear breakdown of services rendered. Without these elements, clients may struggle to understand the charges or reach out to you if there are any questions. Another mistake is failing to clearly specify payment terms, such as due dates, accepted payment methods, or penalties for late payments. Not including this information can lead to confusion and delays.

Additionally, inconsistent formatting or unclear language can make it difficult for your client to quickly review the document. Keeping the layout clean, simple, and well-organized is crucial for clarity. Always double-check for typographical errors or incorrect pricing, as these can cause unnecessary disputes and damage your credibility.

Free Invoice Templates vs Paid Versions

When it comes to creating billing documents, businesses often face the decision between using free resources or investing in premium versions. Both options have their pros and cons, and the choice depends on your specific needs, budget, and the level of customization required. While free formats are accessible and convenient, paid options offer additional features that can enhance the billing process and save time.

Advantages of Free Templates

Free billing formats are an excellent starting point, especially for small businesses or freelancers. Here are some of the main benefits:

- Cost-effective: No need to spend money on a format, making it a budget-friendly option.

- Quick and easy to use: Most free formats are simple to download and start using immediately without any setup.

- Basic features: Free versions usually include essential fields like service descriptions, prices, and payment terms, which are sufficient for basic transactions.

Benefits of Paid Versions

Premium versions offer enhanced functionality and customization options that might be essential for growing businesses. Here are some reasons to consider upgrading:

- Customization: Paid versions allow more flexibility to adjust the design, add logos, and incorporate custom fields specific to your business needs.

- Advanced features: Some paid options offer features such as automated calculations, recurring billing, and integration with accounting software.

- Professional design: Premium formats are often better designed, giving your documents a more polished and professional look that can improve your business’s image.

Ultimately, the choice between free and paid options comes down to the scale of your business, your specific requirements, and how much you’re willing to invest in a more streamlined process.

Where to Download Invoice Templates

Finding the right format for your billing documents is easier than ever, thanks to a wide variety of online resources. Whether you’re looking for a simple layout or a more complex design, there are many platforms that offer downloadable options. The key is knowing where to look and what suits your specific needs, whether it’s a free or paid solution.

Popular Free Resources

If you’re on a tight budget, free sources can provide excellent basic designs. Here are some places where you can download no-cost versions:

- Microsoft Office Templates: Microsoft offers free formats through Word and Excel that can be easily customized to fit your business needs.

- Google Docs: Google provides a variety of customizable documents through their template gallery, perfect for those who prefer working in cloud-based software.

- Invoice Generator Websites: Websites like Invoice Simple and Invoicely allow you to generate and download customized billing documents for free.

- Template Sharing Platforms: Platforms like Template.net offer both free and paid options, often with various formats suited to different industries.

Paid Options for More Features

If you need more customization and advanced features, premium platforms might be worth considering. Here are some options that come with additional functionalities:

- Canva: Known for its design flexibility, Canva offers paid options with premium templates that include customization tools and professional layouts.

- FreshBooks: This invoicing software offers premium templates with features like recurring billing, tax calculations, and integration with accounting software.

- Zoho Invoice: A cloud-based solution offering paid templates with a range of customizable features and client management tools.

With the variety of options available online, you can easily find a format that fits your budget and business requirements. Whether you choose a free or paid version, the important thing is ensuring that the final result reflects your business’s professionalism and meets all your billing needs.

Design Tips for Professional Invoices

A well-designed billing document can make a significant impact on your business’s professionalism and client trust. The layout, typography, and overall visual appeal not only convey essential information but also influence how your company is perceived. A clean, organized, and visually appealing design helps clients process the payment quickly and reduces the likelihood of misunderstandings.

Here are some tips to help you design professional-looking billing documents:

- Keep it Simple: A cluttered layout can confuse clients. Focus on clear sections and limit unnecessary details. Use white space effectively to ensure the document is easy to read.

- Use Consistent Branding: Include your company logo and match the colors and fonts with your overall brand identity. This helps to reinforce your business’s image and gives a more polished look.

- Choose Readable Fonts: Select clean and legible fonts, such as Arial or Helvetica, to ensure your content is easy to read. Avoid overly decorative fonts that may distract from the important details.

- Highlight Key Information: Make sure the amount due, payment terms, and due date stand out. Use bold or larger font sizes to draw attention to these critical details.

- Include Clear Section Headers: Organize the document into distinct sections such as “Client Details,” “Description of Services,” and “Payment Terms.” This allows clients to quickly find the information they need.

- Use a Consistent Layout: Maintain alignment and spacing throughout the document. A uniform layout contributes to clarity and makes the document look professional.

By focusing on design elements that prioritize readability and organization, you create a positive impression with your clients and make it easier for them to process payments promptly.

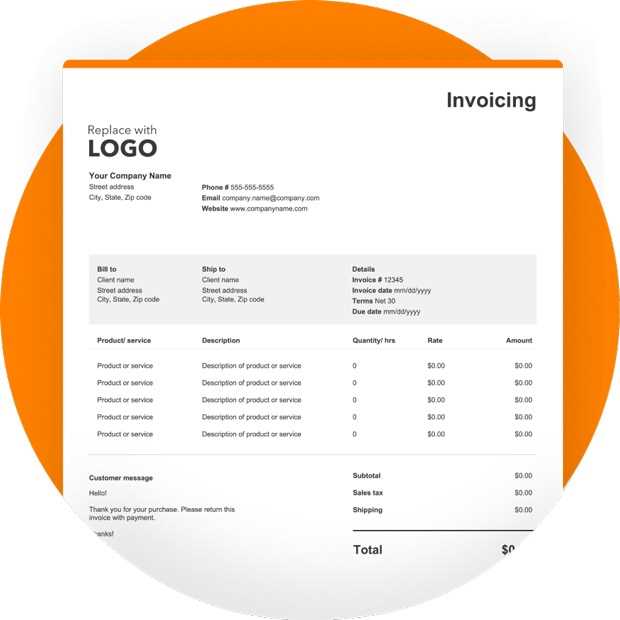

How to Format Your Invoice in English

Proper formatting is essential when creating a document to request payment, especially when communicating with clients who speak English. The goal is to present all the necessary details in a clear, organized manner, ensuring that the document is both professional and easy to understand. By following a standard structure, you can make it easier for your clients to review the charges and process the payment quickly.

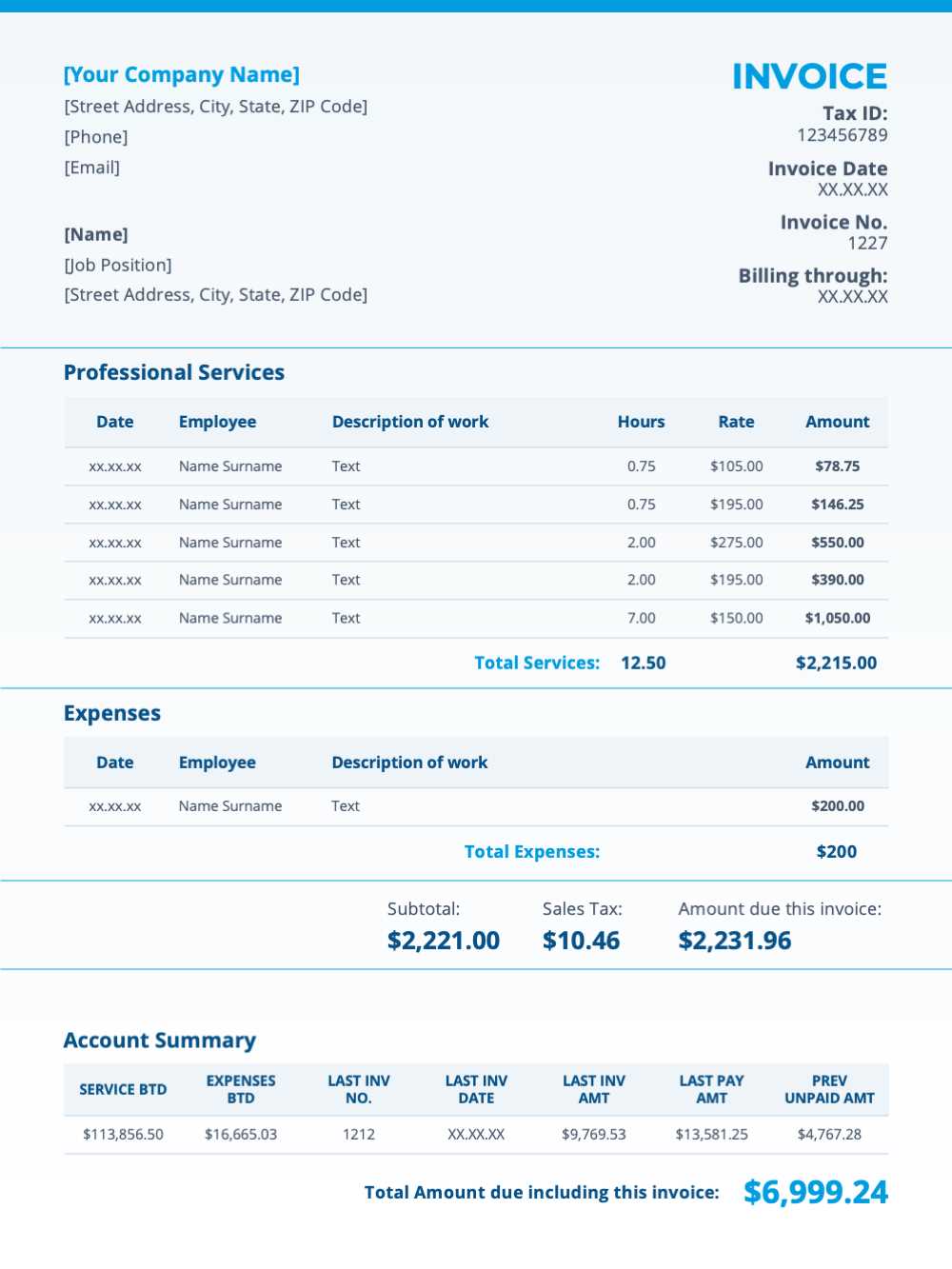

Start by organizing the document into sections that highlight key information such as the client’s contact details, the services or products provided, and the payment terms. Here are some formatting tips to follow:

- Clear Header: Include your business name, logo, and contact details at the top. This immediately identifies the source of the document and makes it more professional.

- Title: Use a clear title such as “Payment Request” or “Billing Statement” that indicates the purpose of the document.

- Client Details: Include the name, address, and contact information of the client to whom the payment is due. This ensures the document is properly addressed.

- Description of Products or Services: List each item or service provided along with a brief description, quantity, and price. Make sure this section is easy to read by using bullet points or tables.

- Payment Terms: Clearly state the amount due, due date, and accepted payment methods. If applicable, include late fees or discounts for early payment.

- Footer: Add any additional information, such as tax identification numbers or your terms and conditions, at the bottom of the document for reference.

By following these formatting guidelines, your documents will appear more professional and be easier for clients to understand, improving the overall payment experience.

Adding Branding to Your Invoice

Incorporating your business’s branding into your billing documents is a powerful way to create a cohesive and professional image. Adding your logo, brand colors, and consistent fonts can help reinforce your identity and make your documents stand out. This not only enhances your business’s professionalism but also builds trust with your clients, as they can instantly recognize the document as coming from your company.

Here are a few simple ways to add branding to your billing documents:

- Company Logo: Place your logo at the top of the document, preferably near the header. This helps establish brand recognition from the moment the document is opened.

- Brand Colors: Use your company’s color scheme for headers, borders, and section dividers. This creates a visual link to your business’s identity.

- Consistent Fonts: Use the same fonts that appear on your website or marketing materials. This ensures consistency across all touchpoints with your clients.

Additionally, you can include the following table for a more organized and branded structure:

| Section | Branding Element |

|---|---|

| Header | Company logo, brand colors for text and background |

| Body | Consistent font styles and color accents that match your brand |

| Footer | Business contact information and any relevant legal disclaimers in brand fonts |

By adding these simple elements, your billing documents will align with your overall branding, contributing to a more professional and cohesive client experience.

Best Software for Creating Invoices

Choosing the right software for generating billing documents can significantly simplify the process of managing finances and improve overall efficiency. The right tool allows you to create professional, accurate requests for payment while offering features like automation, easy customization, and integration with accounting systems. With so many options available, it’s important to select software that meets your business’s needs and budget.

Top Software Options

Here are some of the best tools to consider when looking for a solution to generate your billing documents:

- FreshBooks: Known for its user-friendly interface, FreshBooks provides customizable formats, automatic calculations, and easy client management features. It is ideal for small businesses and freelancers looking for simplicity and functionality.

- QuickBooks: A comprehensive accounting solution, QuickBooks allows you to create billing documents while integrating seamlessly with your accounting and tax reports. It’s perfect for businesses looking for all-in-one financial management.

- Wave: This free software offers an intuitive platform to generate professional-looking documents. It’s a great option for small businesses or startups on a tight budget.

- Zoho Invoice: With customizable designs, multiple language support, and integration with other Zoho applications, this platform is ideal for growing businesses that need scalability.

- Bill.com: This tool is particularly useful for businesses that need to handle payments electronically. It allows you to create billing documents and send them directly to clients with integrated payment options.

Features to Look For

When choosing software for creating your payment requests, consider these essential features:

- Customization: The ability to adjust the layout, add logos, and tailor fields according to your business needs.

- Automation: Automatic reminders for overdue payments and recurring billing for regular clients can save you time.

- Integration: Integration with accounting or payment systems ensures smooth data transfer and reduces the risk of errors.

- Multi-Device Support: Ensure the software works across various devices, including mobile, to manage your billing on the go.

By selecting the right tool for generating your payment requests, you can streamline your billing process, maintain professionalism, and improve client relationships.

Automating Invoices for Efficiency

Automating the creation and sending of billing documents can greatly improve efficiency, reduce errors, and save valuable time for businesses. Instead of manually generating each request for payment, automation tools can handle repetitive tasks, allowing you to focus on more important aspects of your business. By setting up systems to automatically generate, customize, and send payment reminders, you can streamline your entire billing process.

Here are some key benefits of automating your payment requests:

- Time Savings: Once set up, automated systems can generate and send requests without any additional input, freeing up time to focus on other areas of your business.

- Consistency: Automation ensures that each billing document is generated in a consistent format, maintaining professionalism and reducing the risk of errors.

- Reduced Human Error: By removing manual input, automation helps eliminate common mistakes such as incorrect pricing, missing information, or formatting issues.

- Faster Payments: With automated reminders and recurring billing, you can prompt clients to pay on time, improving cash flow and reducing overdue payments.

Many accounting and billing software platforms, such as QuickBooks and FreshBooks, offer built-in automation features, including scheduled billing, automatic payment reminders, and easy-to-use workflows. Setting up automation in these platforms is typically straightforward and can be tailored to your specific needs. With a few simple steps, you can have a fully automated billing process that enhances your business’s efficiency.

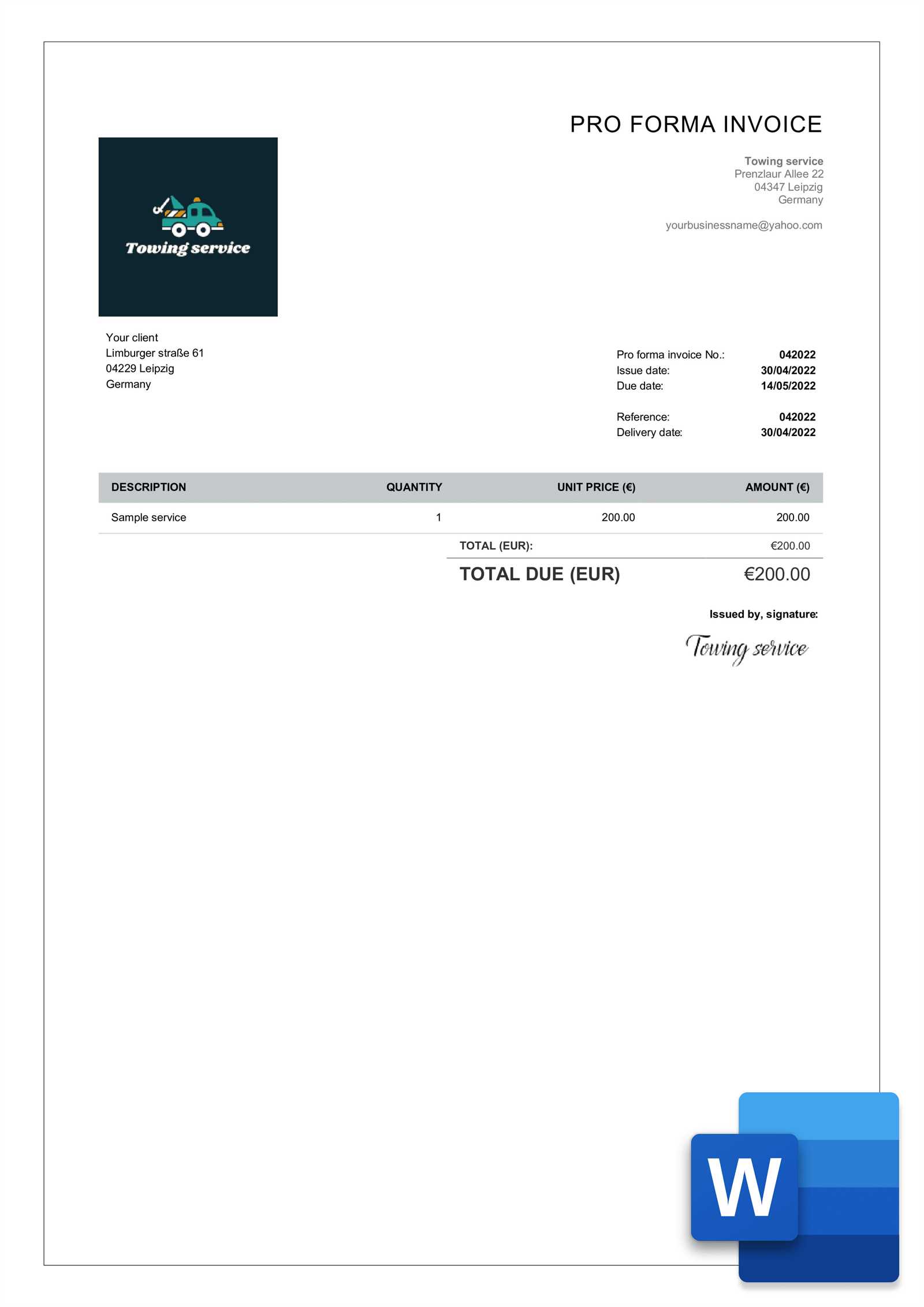

How to Handle International Invoices

When dealing with clients and businesses across borders, managing payment requests can become more complex. Different countries have varying rules, currencies, and payment methods that must be considered. Understanding how to properly handle international billing documents is crucial to ensure timely payments, avoid confusion, and maintain strong business relationships with global clients.

Here are some key considerations when handling billing documents for international clients:

- Currency and Payment Methods: Make sure to specify the currency in which the payment should be made. Include payment methods that are commonly used in the client’s country, such as international bank transfers, PayPal, or credit cards.

- Language and Localization: If necessary, provide a version of the billing document in the client’s native language. Also, localize the format of dates, addresses, and tax rates to align with the country’s standards.

- Clear Payment Terms: Be very specific about payment terms, including due dates and any late fees. When working internationally, be sure to factor in any potential delays caused by time zones or bank processing times.

- Tax Considerations: Different countries have varying tax laws, such as VAT or sales tax. Clearly indicate whether taxes are included in the amount or need to be paid separately. Consult a tax professional to ensure you are compliant with international tax laws.

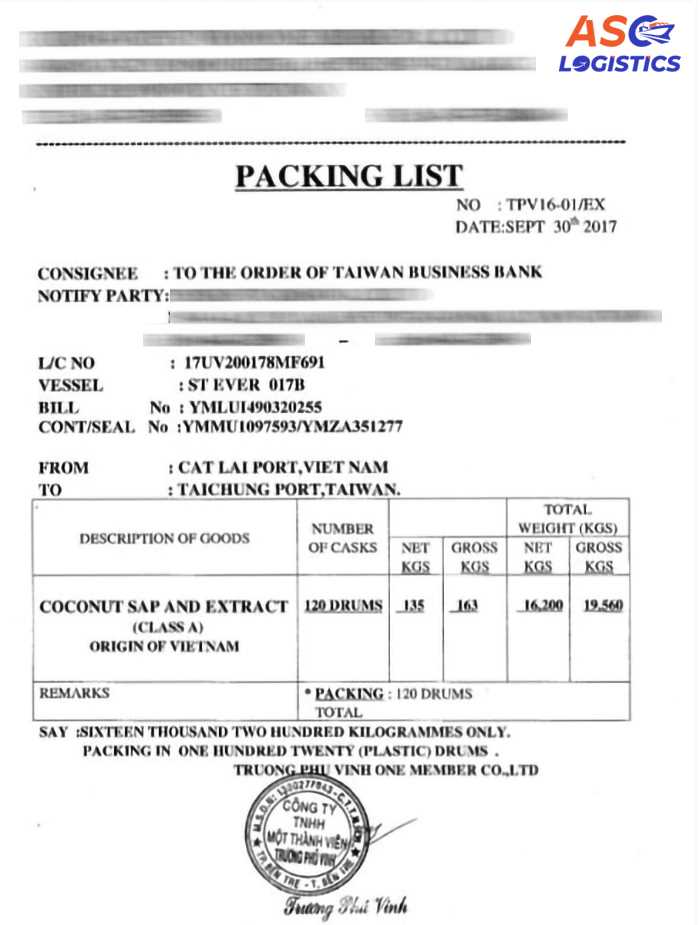

- Legal Information: Include any legal or regulatory requirements specific to international business transactions, such as tax identification numbers, customs information, or export licenses.

By being mindful of these factors, you can ensure that your international payment requests are accurate, clear, and aligned with local standards. This not only helps in smoother transactions but also enhances your credibility and professionalism with clients from around the world.

Legal Considerations for Invoices

When creating payment requests, it’s essential to be aware of the legal requirements that govern business transactions. A properly formatted document is not just a tool for requesting payment, but also a legal record that can be used in case of disputes or audits. Ensuring that your document complies with local laws and regulations is crucial to avoid potential legal issues.

Here are several important legal considerations to keep in mind when preparing your billing documents:

- Clear Terms and Conditions: Clearly outline payment terms, including due dates, accepted payment methods, and penalties for late payments. Having these terms explicitly stated can protect you in case of non-payment.

- Tax Information: Depending on the country or region, you may be required to include specific tax details such as tax identification numbers (TIN), VAT registration numbers, or sales tax rates. This ensures compliance with local tax laws.

- Legal Language: Use precise language in your document to avoid ambiguity. Words like “payment due,” “net,” or “amount payable” should be clear and unambiguous to prevent misunderstandings.

- Client Information: Ensure that the client’s details, such as business name, contact information, and address, are accurate. Incorrect information can lead to legal complications and delays in payment processing.

- Record Keeping: Maintain copies of all billing documents for your records. In many jurisdictions, businesses are legally required to keep financial documents for a certain period, such as seven years, for audit and tax purposes.

- Dispute Resolution Clauses: Include a clause specifying how disputes over payment will be resolved. This can be important in preventing legal battles by providing a clear process for handling disagreements.

By addressing these legal aspects, you protect both your business and your clients, ensuring smooth and lawful transactions. It is advisable to consult with a legal professional to ensure that your documents comply with specific laws that apply to your industry or location.

Invoice Template Best Practices

Creating well-structured and professional billing documents is essential for maintaining good client relationships and ensuring timely payments. By following best practices, you can ensure that your payment requests are clear, accurate, and effective. A carefully designed document not only helps communicate important details but also promotes trust and professionalism.

Key Best Practices

- Keep It Simple and Clear: Avoid cluttering your document with unnecessary information. Focus on essential details like itemized descriptions, amounts due, and payment terms. A clean, easy-to-read layout ensures that clients can quickly understand the charges.

- Include All Necessary Information: Ensure that your billing request includes your business name, contact details, client information, a unique reference number, due date, and payment methods. Missing information can cause confusion or delays in payment.

- Set Clear Payment Terms: Specify the due date for payment, as well as any late fees or discounts for early payments. Make sure these terms are easy to locate on the document so the client knows exactly what to expect.

- Use Professional Formatting: Maintain a consistent style by using your company’s branding, including fonts, colors, and logos. This not only looks professional but also makes the document feel like an official business communication.

- Double-Check for Accuracy: Before sending out any billing documents, carefully review all the details for accuracy. Incorrect amounts, miswritten client names, or missing contact information can lead to delays or disputes.

Additional Considerations

- Make It Customizable: Ensure that your document is flexible enough to accommodate changes, such as different payment methods, varying tax rates, or special conditions for individual clients.

- Automate When Possible: Use software that can automate recurring billing, reminders, and calculations to save time and reduce errors.

- Maintain Professional Language: Use polite, formal language to convey professionalism, especially when communicating payment terms or overdue amounts.

By following these best practices, you create a streamlined process for requesting payments that enhances client satisfaction and supports your business’s financial stability.