How to Create the Perfect Invoice Template Email

Effective billing communication is crucial for maintaining professionalism and ensuring timely payments. In today’s fast-paced business world, sending clear, structured requests for payment can make a significant difference in how quickly clients respond. Having a well-organized format for these requests not only saves time but also reflects positively on your brand’s image.

When crafting a payment request, consistency and clarity are key. A well-designed communication that clearly outlines the amount owed, payment terms, and contact details can eliminate confusion and reduce the need for follow-up messages. Utilizing a standardized structure for all billing messages can streamline the process, making it easier to manage and track financial transactions.

Whether you’re a freelancer or managing a growing company, investing in efficient methods to handle financial correspondence will ensure that you stay organized and on top of payments. By leveraging modern tools and customizable formats, it becomes easier to tailor these communications to suit different client needs while maintaining a professional tone throughout.

Invoice Template Email Overview

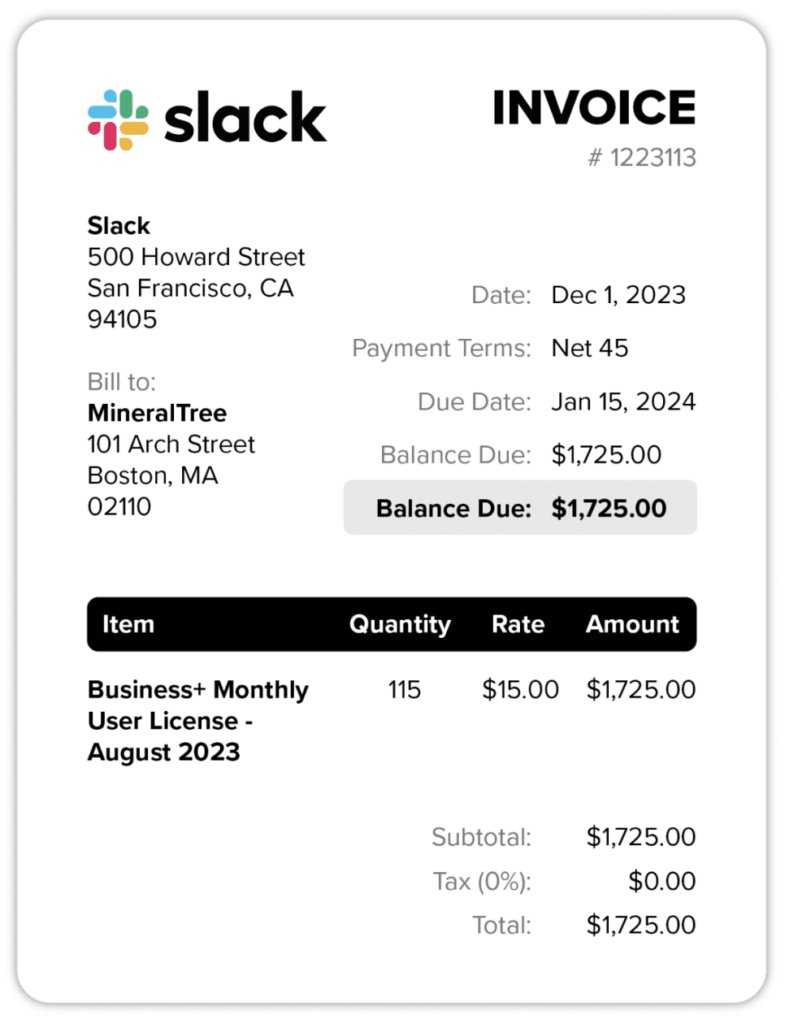

In business transactions, clear and professional requests for payment are essential for ensuring timely and smooth financial exchanges. The process of sending a well-organized document that requests payment can greatly improve cash flow and help avoid misunderstandings with clients. Such documents typically include key details, such as the amount owed, payment deadlines, and contact information for any inquiries, all presented in a structured and easy-to-read format.

Key Components of a Payment Request

A successful payment request should include specific elements that help the recipient easily understand the details. These include the total amount due, a breakdown of services or goods provided, payment terms, and a call to action that clearly directs the recipient on how to proceed with the payment. Ensuring these details are clear and accessible enhances the likelihood of prompt payments.

Why Structure Matters

The design and structure of such communications play a critical role in how the message is received. A clean, professional layout not only reinforces trust but also minimizes the chances of mistakes. When clients can quickly identify the information they need, they are more likely to act swiftly, reducing the back-and-forth often seen with poorly structured payment requests.

Importance of Professional Invoicing

In any business, maintaining a professional approach to financial communication is crucial for establishing credibility and ensuring smooth operations. How you request payment can greatly influence the perception of your business, as well as the speed at which payments are made. Clear, organized, and consistent communication regarding amounts due can prevent delays and disputes while building trust with clients.

A well-structured financial request can help demonstrate your attention to detail and reinforce the professionalism of your services. Clients are more likely to respond positively when they receive clearly formatted documents that reflect an organized approach to business transactions.

- Improves client trust and confidence

- Reduces the risk of payment delays

- Ensures clarity regarding financial details

- Promotes a professional business image

- Helps maintain long-term client relationships

By presenting financial requests in a professional manner, businesses not only make it easier for clients to process payments but also enhance the overall client experience. An organized and transparent approach to billing is key to fostering positive business relationships and ensuring timely cash flow.

Key Elements of an Invoice Email

To ensure smooth and efficient payment processing, it is essential that a financial request includes all the necessary details in a clear and professional manner. The success of such a communication depends on the inclusion of specific elements that help both the sender and recipient stay organized and on the same page. These details allow the recipient to quickly understand the amounts owed, the services provided, and how to proceed with the payment.

- Sender Information: Include your business name, address, and contact details to ensure the recipient knows where to direct questions.

- Recipient Information: Clearly state the name and address of the client to avoid confusion.

- Unique Reference Number: A reference number or invoice number allows both parties to track and refer to the transaction easily.

- Breakdown of Charges: List all services, products, or tasks completed along with their corresponding charges to provide transparency.

- Total Amount Due: Clearly state the amount the client owes, ensuring it’s easy to identify.

- Payment Terms: Specify the payment due date, accepted methods, and any late fees or discounts for early payment.

- Call to Action: Provide instructions for how the recipient can make the payment, including payment options and links if applicable.

- Thank You or Closing Statement: End the communication with a polite and professional closing to maintain positive relations.

Including these elements ensures that all the necessary information is available to the recipient, making it easier for them to process the payment efficiently. By being clear and organized, you can reduce the chances of miscommunication and payment delays.

Design Tips for Effective Invoices

The appearance and layout of a payment request can significantly impact how quickly and efficiently it is processed. A well-designed document not only makes it easier for the recipient to understand the details but also reflects positively on your professionalism. An organized, visually appealing format helps ensure that all necessary information is easily accessible and reduces the likelihood of confusion or errors.

Keep It Clean and Simple

Clarity is key when designing a financial request. Keep the layout clean and straightforward, using plenty of white space to separate sections. Avoid clutter and unnecessary text that could distract from the most important details. A minimalist design ensures that the recipient can quickly identify the key information, such as the amount due, payment terms, and service details.

Use Consistent Branding

Incorporating your brand’s colors, logo, and fonts into your design can help maintain a consistent and professional image across all communications. Using consistent branding not only reinforces your business identity but also adds credibility to the document. However, make sure that the design elements don’t overwhelm the content or distract from the critical details.

By following these design tips, you can create financial communications that are not only professional but also efficient and easy to process, leading to quicker payments and improved client relationships.

Common Mistakes in Invoice Emails

Even the most experienced businesses can sometimes make errors when preparing financial requests. These mistakes, whether small or large, can lead to confusion, delays, or even disputes with clients. Identifying and addressing common pitfalls in payment communications is essential for maintaining professionalism and ensuring timely payments.

- Missing Key Information: Failing to include important details, such as payment terms or the total amount due, can cause confusion and delay the payment process. Always double-check that all necessary elements are included.

- Unclear Payment Instructions: Ambiguous or missing instructions on how to make the payment can frustrate clients and lead to delays. Be explicit about how payments can be processed and any options available.

- Incorrect Contact Information: Providing outdated or incorrect contact details can make it difficult for clients to reach you in case of questions or issues, potentially delaying resolution.

- Overcomplicating the Design: While a visually appealing layout is important, overly complex designs or excessive use of colors and fonts can make the document harder to read and detract from key information.

- Failing to Personalize: Sending generic, impersonal financial

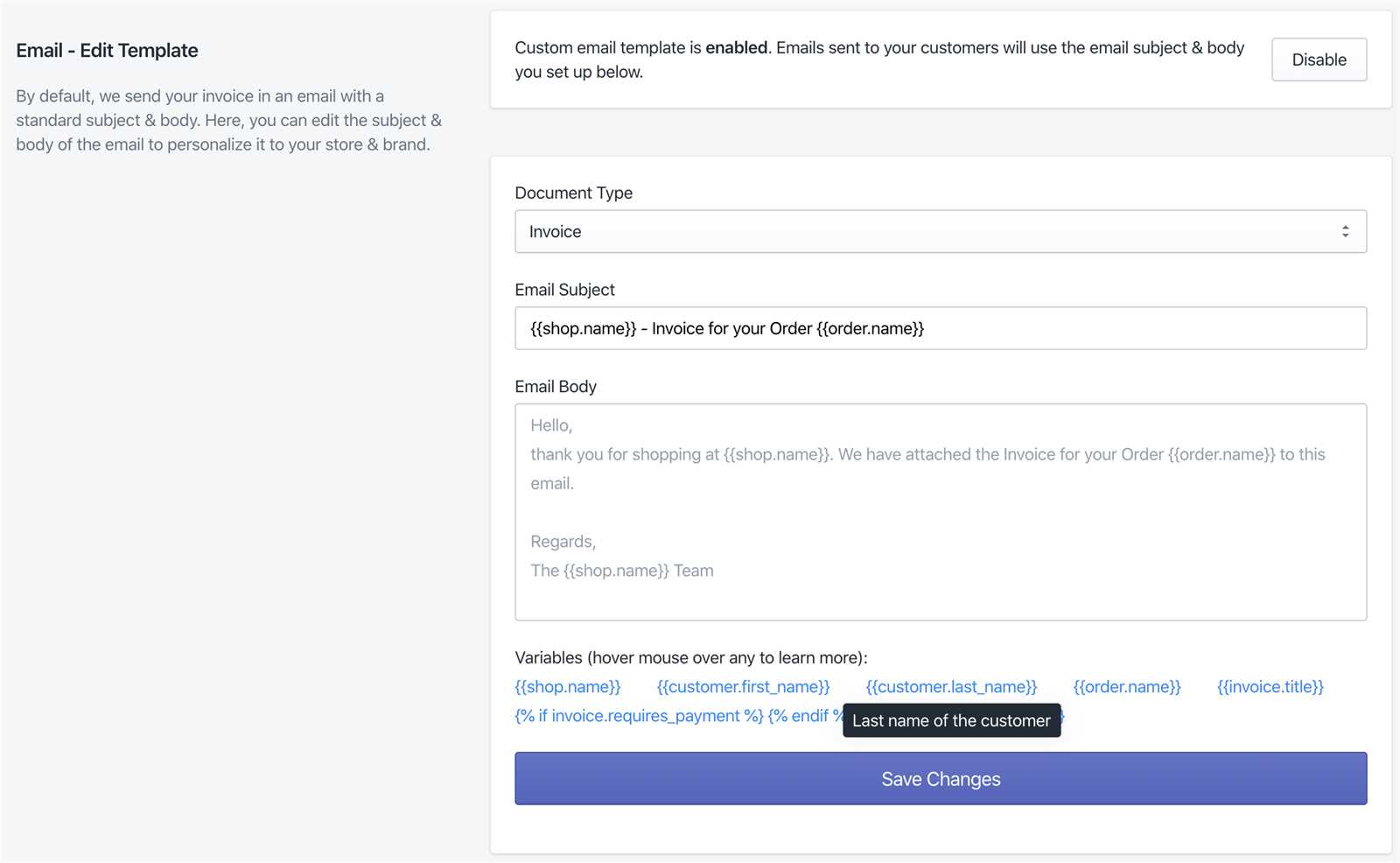

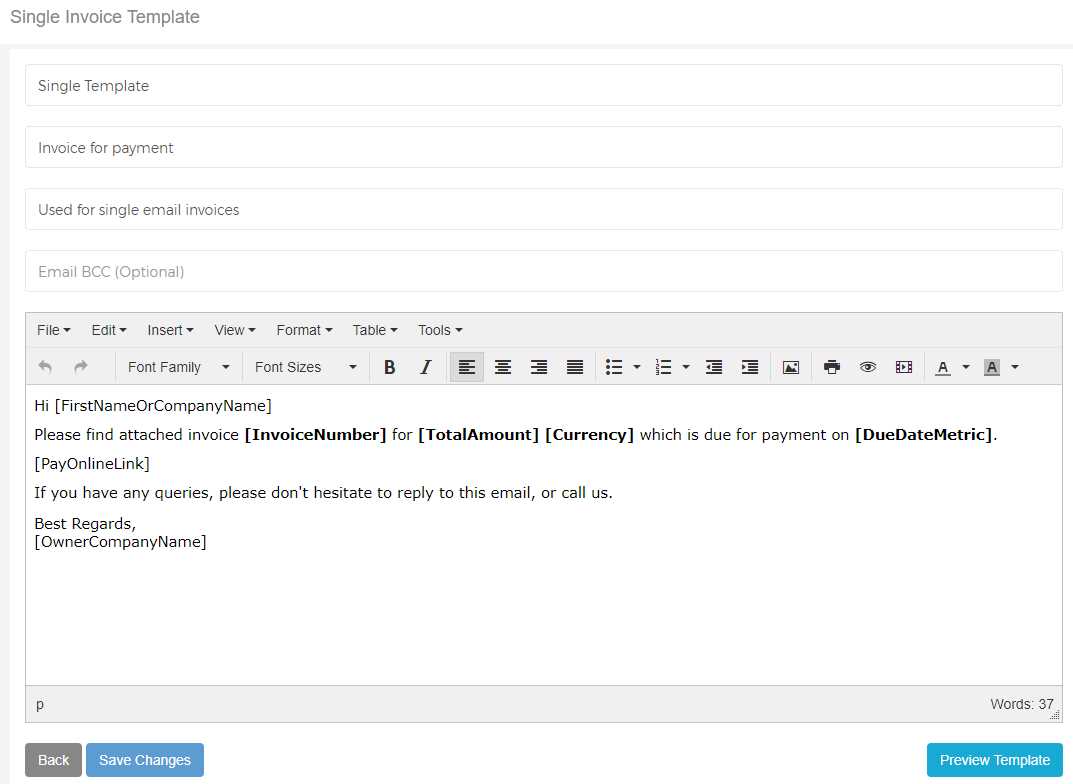

How to Personalize Invoice Emails

Personalizing financial requests can make a significant difference in the way clients perceive your business and in how quickly they respond. A personalized approach goes beyond simply addressing the recipient by name; it reflects your attention to detail and fosters stronger client relationships. Tailoring each communication can create a more professional and engaging experience for the client, making them feel valued and more likely to process payments promptly.

Here are a few ways to add a personal touch to your payment communications:

Personalization Element Why It Matters Client’s Name Using the recipient’s name instead of a generic greeting creates a more personal connection. Custom Message A brief, personalized note expressing appreciation for the client’s business or highlighting specific services shows thoughtfulness. Detailed Service Description Including a detailed breakdown of the work completed for that particular client emphasizes transparency and professionalism. Payment Terms Tailored to Client Customizing payment terms based on previous interactions (e.g., special discounts or extended deadlines) adds flexibility and shows attentiveness to the client’s needs. Incorporating these elements into your communication will not only make your requests feel more personal but also demonstrate your commitment to providing excellent service, which can encourage faster and more positive responses from your clients.

Best Practices for Timely Invoicing

Receiving payments on time is crucial for maintaining a healthy cash flow and ensuring the smooth operation of any business. To achieve this, it’s essential to follow best practices that promote prompt payment processing. By adhering to effective strategies, you can reduce the risk of delayed payments and ensure your clients are clear about when and how to settle their balances.

Set Clear Payment Expectations

One of the most effective ways to ensure timely payment is by clearly defining payment terms right from the start. This helps set expectations and prevents misunderstandings later on. Here are some key practices:

- Specify Due Dates: Clearly state the exact payment due date to avoid confusion about when payment should be made.

- Highlight Late Fees: If applicable, mention any late fees that will be charged if the payment is not received on time.

- Offer Multiple Payment Options: Providing several payment methods (e.g., bank transfer, credit card, PayPal) increases convenience for clients and can speed up payment processing.

Send Payment Requests Promptly

Sending your payment request as soon as possible after completing a job or delivering goods ensures that clients have enough time to process the payment. The sooner they receive the details, the sooner they can take action. Consider these tips:

- Send Requests Immediately: Don’t wait too long to send your request. Ideally, send it within a few days after the service or product delivery.

- Follow Up Timely: If payment isn’t received by the due date, follow up with a polite reminder or a thank-you note for prompt payment, depending on the situation.

- Automate Reminders: Automating payment reminders for due or overdue payments can save time and reduce administrative burden.

By implementing these best practices, you can help ensure that payments are received on time, which will improve your financial stability and enhance your business’s reputation.

Automating Invoice Emails for Efficiency

Streamlining the process of sending payment requests can save time and reduce human error, leading to faster and more accurate transactions. By automating the generation and sending of financial communications, businesses can ensure that they never miss a due date and that clients receive their payment details promptly. This level of efficiency not only enhances cash flow but also improves overall client satisfaction.

- Set Up Automatic Reminders: Automating reminders for upcoming, due, or overdue payments ensures that clients are consistently notified without manual intervention.

- Use Scheduling Tools: Scheduling tools can send payment requests at the optimal time, such as immediately after service completion or during the client’s preferred business hours.

- Customize Pre-Defined Messages: Many automation platforms allow for customizable templates that can be personalized with client-specific details, making communications more efficient without losing the personal touch.

- Integrate Payment Systems: Linking your automated system with an online payment gateway can provide clients with easy, immediate access to pay, reducing barriers and speeding up the payment process.

- Track Status Automatically: Automation tools can track whether a payment has been made, and send follow-up messages when necessary, all while keeping records updated in real-time.

By implementing automated systems, businesses can significantly improve the efficiency of their financial processes, ensuring that the right people are contacted at the right time with accurate, consistent, and timely information. This approach not only saves time but also contributes to a more organized and effective business operation.

Ensuring Payment Clarity in Invoices

Clarity is essential when requesting payment for services rendered or goods delivered. A well-structured request not only helps clients understand the details of what they are being asked to pay for but also prevents confusion and disputes. Ensuring that all necessary information is presented clearly and concisely will help facilitate timely payments and strengthen client relationships.

Here are the key elements to ensure payment clarity:

Key Element Why It Matters Clear Itemization of Charges Breaking down each charge helps clients understand exactly what they are paying for and reduces the likelihood of questions or misunderstandings. Specific Payment Terms Clearly stating due dates, late fees, and acceptable payment methods provides transparency and sets expectations for the client. Simple Language Using straightforward language without jargon ensures that all clients, regardless of their financial background, can easily comprehend the details. Accurate Contact Information Including up-to-date contact details ensures that clients can reach out for clarification or assistance with payments if needed. By ensuring that all these aspects are clearly addressed, you make the payment process smoother and more efficient for both you and your clients. Clear communication fosters trust and helps avoid payment delays or disputes.

Choosing the Right Invoice Template

Selecting the appropriate format for your payment requests is crucial for ensuring professionalism and efficiency in your financial communications. The right design not only reflects your brand but also ensures that all essential details are easy to understand and access for your clients. A well-organized request can speed up the payment process and reduce the chance of misunderstandings or delays.

When choosing the right format, consider the following factors:

- Professional Appearance: Choose a layout that looks polished and consistent with your brand’s identity. A clean, visually appealing format makes a positive impression and inspires trust.

- Clear Structure: Select a design that clearly separates key sections such as contact details, service descriptions, payment terms, and totals. A structured approach makes it easier for clients to process and pay.

- Customization Options: Ensure the format you choose allows you to customize fields like client name, payment due date, and services rendered. Tailoring each request for individual clients adds a personal touch and ensures accuracy.

- Compatibility: Consider choosing a format that works seamlessly across different devices and platforms. Whether your client is using a phone, tablet, or computer, the layout should remain intact and user-friendly.

- Legibility: Avoid overly complicated designs or fonts that might hinder readability. The simpler and clearer the presentation, the easier it is for the client to understand the request.

By considering these factors, you can ensure that your payment communications are not only effective but also professional and easy to navigate. A thoughtfully chosen format will help expedite payments and improve client relationships.

Mobile-Friendly Invoice Email Templates

With an increasing number of clients accessing financial communications on mobile devices, it’s essential to ensure that your payment requests are optimized for smaller screens. A design that adapts well to mobile devices not only improves readability but also enhances the user experience, making it easier for clients to review and process payments on the go.

Here are key factors to consider when designing mobile-optimized payment requests:

- Responsive Layout: Ensure that the design adjusts automatically to different screen sizes. A responsive layout guarantees that all the details are displayed correctly, whether viewed on a phone, tablet, or desktop.

- Legible Text: Use larger fonts and adequate spacing to make text easy to read on smaller devices. Avoid tiny fonts that can make important details hard to decipher.

- Clickable Links: Make payment links and contact information easy to click on mobile devices by ensuring they are large enough and well spaced. This improves usability and convenience for the client.

- Minimalist Design: Avoid clutter by keeping the layout simple and focused. Prioritize essential information such as payment amount, due date, and payment methods to ensure they stand out.

- Mobile-Friendly Buttons: Use large, easily tappable buttons for actions such as “Pay Now” or “Contact Us.” This will make it more convenient for clients to take action directly from their phones.

By implementing these design principles, you can create payment requests that are not only visually appealing but also functional across devices. Mobile-friendly formats make it more likely that your clients will pay promptly, improving overall efficiency and satisfaction.

Using Invoice Templates in Business

In any business, streamlining administrative tasks is crucial for maintaining efficiency and ensuring that operations run smoothly. One such task is generating payment requests, which are essential for receiving timely payments. Using pre-designed structures for these requests allows businesses to save time, reduce errors, and maintain consistency in their communications.

Here’s why incorporating structured formats into your business processes is beneficial:

Benefit Why It Matters Time-Saving Using predefined formats speeds up the process, allowing you to focus on other important tasks while ensuring accuracy in your documents. Consistency Consistency in communication helps build trust with clients, making your business appear more professional and reliable. Minimizing Errors Predefined formats reduce the likelihood of missing important details, ensuring that all relevant information is included every time. Customizable Despite their standardized nature, these structures can be easily customized to fit the unique needs of your business or clients. By utilizing these structures, businesses can not only save time but also improve the overall client experience by presenting clear, consistent, and professional payment requests. The time invested in choosing the right format pays off in terms of operational efficiency and customer satisfaction.

Free Invoice Template Resources

For businesses looking to create professional payment requests without the need for expensive software or design expertise, free resources can provide the perfect solution. These tools offer various pre-built structures that can be easily customized to suit different business needs. By utilizing these free resources, businesses can streamline their billing process while maintaining a polished and professional image.

Here are some of the benefits of using free resources for creating payment requests:

- Cost-Effective: Free resources eliminate the need for paid software, allowing small businesses and startups to access professional tools without a financial commitment.

- Ease of Use: Many of these resources are designed for simplicity, making it easy for anyone to create and customize payment requests without technical knowledge.

- Customization: Free tools often allow users to tailor designs to match their brand, including adding logos, custom colors, and business-specific details.

- Variety of Options: There is a wide selection of designs and formats to choose from, catering to different industries and business needs.

- Instant Access: Most free resources are available online, enabling users to access and download them immediately without waiting for approval or installation.

By leveraging these free resources, businesses can improve their administrative efficiency, maintain a professional image, and save on costs, all while ensuring that clients receive clear and accurate payment requests.

Legal Considerations in Invoice Emails

When sending payment requests, it’s important to ensure that all communications are legally sound to avoid potential disputes or issues down the line. Whether you’re a freelancer, a small business owner, or a large enterprise, understanding the legal aspects of your payment reminders and requests is essential for protecting your rights and maintaining professional relationships with clients.

Key Legal Aspects to Consider

Here are some critical factors to keep in mind when preparing your payment communications:

- Clear Payment Terms: Ensure that the terms, such as the due date and payment methods, are clearly stated. Lack of clarity could lead to misunderstandings and delays in payment.

- Accurate Details: Double-check all amounts, services, and billing details. Any errors can lead to disputes or legal complications regarding the validity of your request.

- Compliance with Local Laws: Be aware of the laws and regulations in your region or your client’s location. This includes knowing if you are required to add tax information or specific legal disclaimers to the payment request.

- Client Consent: In some jurisdictions, you must have prior consent from the client for the method of billing, especially for recurring charges. Ensure that all terms are agreed upon upfront.

- Record Keeping: Keep a copy of all communications and documents related to payments for future reference or legal purposes. Proper documentation can serve as evidence in case of disputes.

Best Practices for Legal Compliance

To ensure your payment requests are legally sound, consider implementing these practices:

- Use Formal Language: A professional tone can help establish the seriousness of the communication and reduce the risk of misunderstandings.

- Include Contract References: If the payment is related to a contract or agreement, reference the specific terms in the communication to reinforce the legal basis for the request.

- Specify Penalties: If applicable, outline late fees or other penalties for overdue payments. Be sure that such terms are in accordance with the law in your jurisdiction.

By keeping these legal considerations in mind, you can ensure that your payment communications are both professional and legally secure, helping to maintain smooth business transactions and avoid potential conflicts.

Tracking Payments with Invoice Emails

Managing payments efficiently is crucial for any business. By keeping track of outstanding and received payments, businesses can ensure financial stability and reduce the risk of missed or late payments. Utilizing payment requests effectively allows for clear documentation of transactions and improves cash flow management. This process can be greatly enhanced by integrating tracking features into the communication sent to clients.

Effective Methods for Payment Tracking

To ensure smooth tracking of payments, businesses should consider the following practices:

- Payment Status Updates: Include a clear section in your payment communication that indicates whether the payment is due, paid, or overdue. This ensures that both parties are aware of the status at any given time.

- Unique Reference Numbers: Assigning unique numbers to each request allows both the business and the client to easily identify specific transactions. This number can be used for reference when tracking payments in the future.

- Automated Payment Reminders: Setting up automatic reminders for clients who have not paid by the due date helps reduce the manual effort of follow-ups and improves the likelihood of timely payments.

- Integration with Accounting Systems: Linking your payment requests to accounting software ensures that all payment records are automatically updated. This can help businesses track payments in real-time without manual intervention.

Benefits of Payment Tracking Integration

Integrating payment tracking into your communication process brings several advantages, including:

- Reduced Errors: Automating the tracking process reduces the likelihood of human error when recording payments or following up with clients.

- Faster Payments: Clear tracking information and regular reminders often lead to quicker payments, as clients are more likely to respond when they understand the status of their account.

- Better Financial Planning: With accurate tracking, businesses can better forecast cash flow and manage expenses, ensuring that funds are available when needed.

By incorporating these practices into your payment process, you can streamline tracking and ensure that payments are monitored efficiently, leading to smoother financial operations.

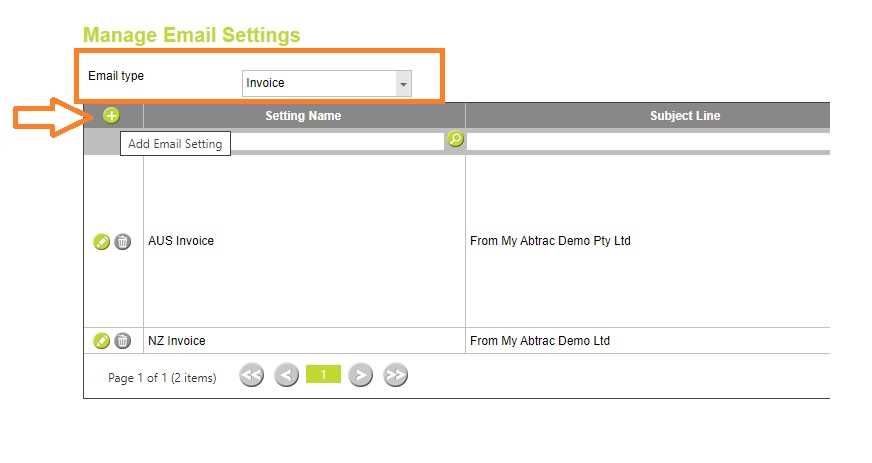

Managing Multiple Invoice Templates

For businesses with diverse needs or different types of services, managing various forms of payment requests can be a challenge. Having different formats for specific purposes, whether for recurring payments, one-time services, or even customized billing, allows for greater flexibility and professionalism. Efficient management of these different formats ensures that clients receive the appropriate document tailored to their transaction type, which can enhance communication and payment accuracy.

Organizing Different Formats

When dealing with multiple billing formats, organization is key. Here are a few strategies to keep everything running smoothly:

- Clear Naming Conventions: Adopt a consistent and intuitive naming system for each type of document. This will make it easier to find and select the right format when needed.

- Storage Solutions: Keep all formats organized in a central location, either on a cloud platform or within your business’s file management system. This way, documents are easily accessible and retrievable at any time.

- Template Management Software: Consider using software tools that allow you to create, store, and manage multiple formats efficiently. This can streamline your workflow and reduce the risk of errors.

Standardizing Key Information Across Formats

While each document may vary in appearance or structure, certain elements should remain consistent to maintain clarity and professionalism. These essential details should appear across all your different forms:

Key Element Description Business Name Ensure your business name is clearly displayed on every document for easy identification. Contact Information Include phone numbers, email addresses, and physical addresses to ensure clients can reach you easily. Due Dates Clearly highlight payment due dates so clients are aware of their obligations. Payment Methods Provide various payment methods for convenience, and make sure this information is consistent across formats. By implementing these practices, businesses can efficiently manage multiple payment request formats, ensuring consistency and professionalism across all communications. The proper organization and streamlined processes can make a significant difference in overall clien

Customizing Invoice Templates for Branding

For businesses aiming to project a cohesive and professional image, customizing payment request forms is essential. These documents are more than just functional tools–they also serve as a representation of your brand. By aligning these communications with your brand identity, you reinforce your company’s values, style, and professionalism with every interaction. Tailoring these forms can help ensure that clients immediately recognize your business and feel confident in your services.

Incorporating Your Brand Elements

One of the most effective ways to customize documents is by integrating your company’s visual identity. This creates a consistent experience for your clients across various touchpoints. Here are some key elements to consider:

- Logo Placement: Position your logo prominently on the document. This immediately identifies your business and enhances recognition.

- Color Scheme: Use your company’s brand colors to create a visually cohesive document. This can make the communication feel more personalized and aligned with your business’s overall aesthetic.

- Typography: Select fonts that reflect your brand’s personality. Whether it’s modern, classic, or playful, the typography should complement your other marketing materials.

- Design Layout: Ensure the layout is clean and professional, aligning with your brand’s visual style. A well-structured document fosters trust and credibility.

Personalizing Content for Client Experience

In addition to visual customization, personalizing the content within the document is another important way to enhance the client’s experience. Tailor your messaging to fit the context of the transaction and your brand’s tone of voice. Some effective ways to personalize include:

- Personalized Salutations: Address clients by name to create a more personal connection.

- Customizable Notes: Include personalized messages or thank-you notes based on the service or product provided, adding a human touch to the document.

- Clear Call-to-Action: Make the payment process easy by including a prominent, clear call-to-action. Whether it’s a link or a phone number, make it easy for clients to follow through with their payment.

By integrating your brand elements and tailoring the content, these documents can not only look professional but also enhance the client experience, reinforcing your brand identity at every step of the way.

How to Follow Up on Unpaid Invoices

Chasing overdue payments can be a delicate process. It requires a balance of professionalism, persistence, and tact. Ensuring that clients or customers are aware of their outstanding balance without damaging your relationship is essential for maintaining long-term business connections. The following steps can help you effectively follow up on unpaid balances and encourage timely payments.

1. Send a Reminder Promptly

It’s important to act quickly once a payment becomes overdue. Waiting too long can send the wrong message and make the process more difficult. Consider sending a polite reminder immediately after the due date has passed.

- Friendly Reminder: Keep the tone polite and professional. Acknowledge that mistakes happen, and gently remind them of the due balance.

- Clear Details: Include clear information about the due amount, the due date, and any relevant transaction details to make it easy for the recipient to understand the payment status.

- Contact Information: Provide a clear way for them to reach you in case they have questions or need clarification.

2. Follow Up with a Second Request

If your first reminder doesn’t yield a response, follow up after a few days. This follow-up should be firmer but still courteous. Reiterate the details and express urgency without being overly aggressive.

- Firm but Polite: Let the client know that you are expecting payment soon and outline any consequences, such as late fees or service disruptions, that may apply if payment is not made.

- Offer Solutions: If the client is facing financial difficulty, offer a payment plan or extended terms. This shows your willingness to work with them while still ensuring that the payment is made.

- Highlight Past Agreements: Reference any agreements, contracts, or terms that were previously discussed and outline the importance of adhering to these terms.

3. Send a Final Notice

If the payment remains unpaid after multiple reminders, it’s time to send a final notice. This communication should be more formal and convey the seriousness of the situation.

- State the Consequences: Clearly outline any legal or contractual steps you may take if the balance remains unpaid, including the possibility of involving collection agencies or legal action.

- Last Chance for Resolution: Give the client one final opportunity to settle the debt before taking further action. Be firm but respectful.

4. Consider Using Collection Services

If all else fails, it may be time to involve professionals. Collection services can assist in recovering the outstanding