Invoice Template for Deposit Paid Customizable and Easy to Use

Managing financial transactions efficiently is crucial for any business, especially when dealing with partial payments. A well-organized system for recording and tracking these payments ensures clarity and helps avoid misunderstandings with clients. By using a structured approach to document upfront payments, businesses can maintain transparency and improve their cash flow management.

Clear documentation of initial payments sets the stage for a smoother process in completing the remaining balance. It provides a reference point for both the service provider and the customer, making it easier to track progress and fulfill financial obligations. This approach not only enhances professionalism but also protects both parties from potential disputes.

With the right tools in place, companies can streamline the process of managing these transactions, making it easier to generate clear and concise records. Whether you’re a freelancer, a small business owner, or a large enterprise, adopting a standardized method for handling upfront payments can simplify your billing procedures and ensure that both you and your clients stay on the same page throughout the entire transaction process.

Understanding the Importance of Deposit Invoices

When it comes to securing upfront payments for services or goods, clear and reliable documentation is key. These documents provide a formal record of the initial financial commitment made by a client, ensuring both parties are on the same page. By setting clear expectations from the start, businesses can minimize misunderstandings and enhance trust with their clients.

Building Trust and Professionalism

Requesting an initial payment helps to establish professionalism and protects the business from potential losses. It ensures that both the service provider and the customer are committed to the agreement. For clients, seeing a clear acknowledgment of their financial commitment can instill confidence in the service, while for businesses, it mitigates the risk of non-payment or delayed funds.

Ensuring Smooth Transaction Management

Effective record-keeping of these financial commitments simplifies the management of accounts. Businesses can track progress, monitor cash flow, and maintain organized financial documentation. With this structured approach, the remainder of the payment process becomes more predictable and transparent for both parties involved.

Clear documentation of initial payments not only helps businesses plan and allocate resources more efficiently but also provides a solid foundation for any future financial agreements. By properly recording these payments, companies can improve their overall financial stability and client relationships.

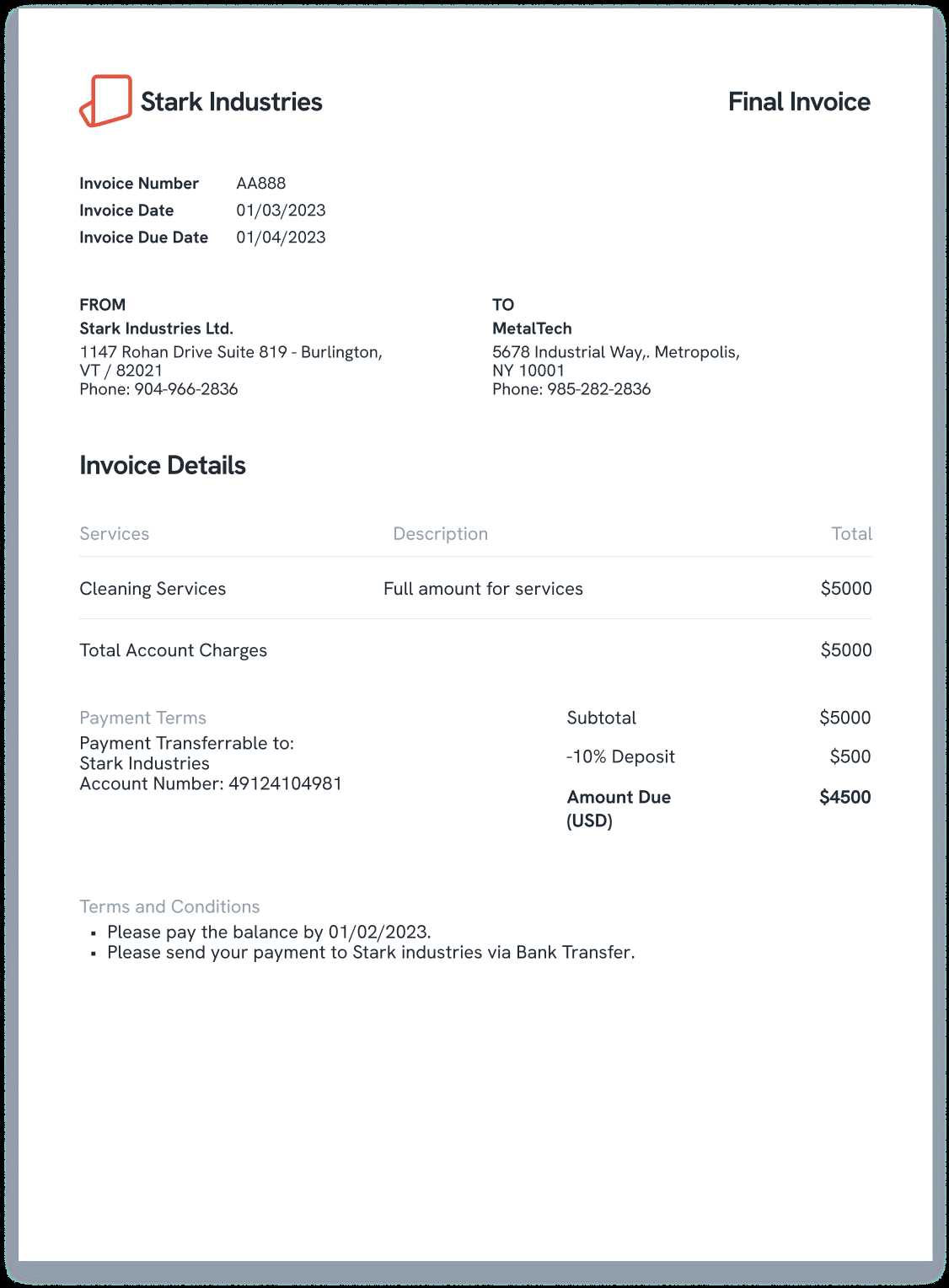

What is a Deposit Paid Invoice Template

A document used to record an initial financial contribution from a client serves as an official acknowledgment of a partial payment towards a larger transaction. This record typically outlines the amount received, the agreed-upon balance, and other key details relevant to the agreement. It acts as both a receipt and a reminder for both parties about their remaining obligations.

The structure of such a document allows businesses to track the progress of payments, ensuring that clients are aware of their commitments and the current standing of their financial balance. By using a standardized format, companies can ensure consistency and professionalism in their transactions, making it easier to manage multiple agreements simultaneously.

In essence, this document provides clarity for both the client and the business, helping to prevent confusion or misunderstandings about the payment terms. It can also serve as a reference point if disputes arise, offering proof of the agreed-upon financial terms and showing that the client has made a partial commitment to the full payment.

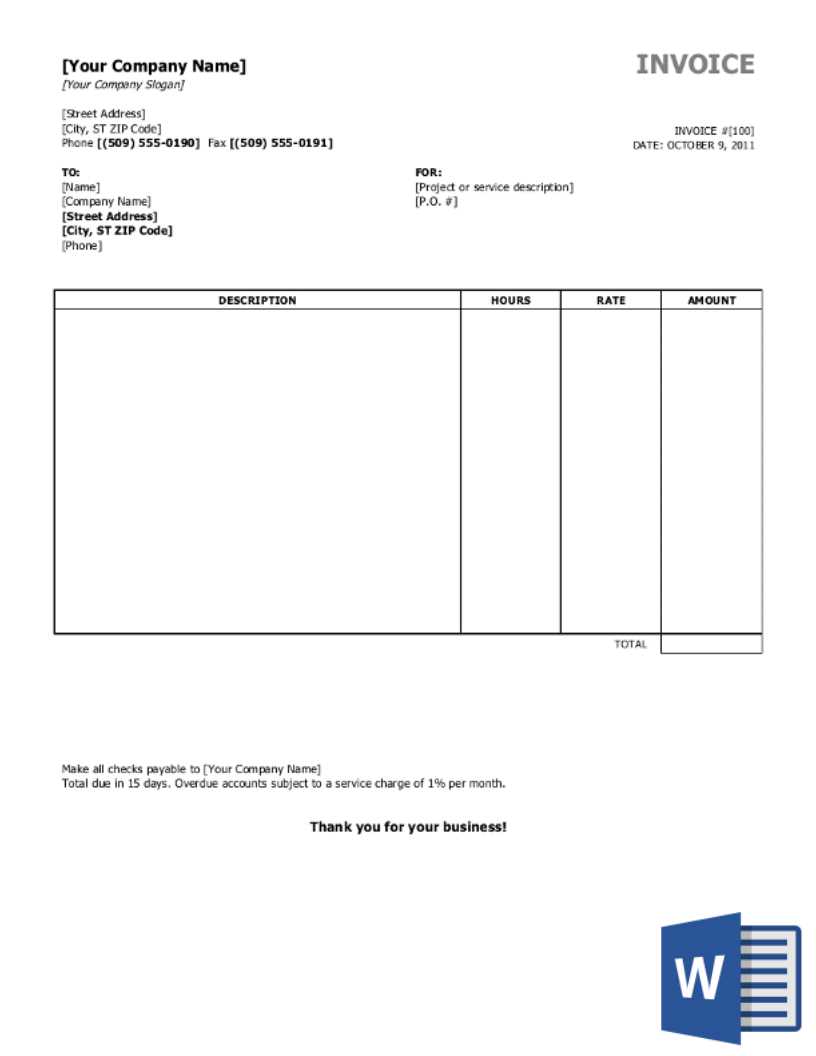

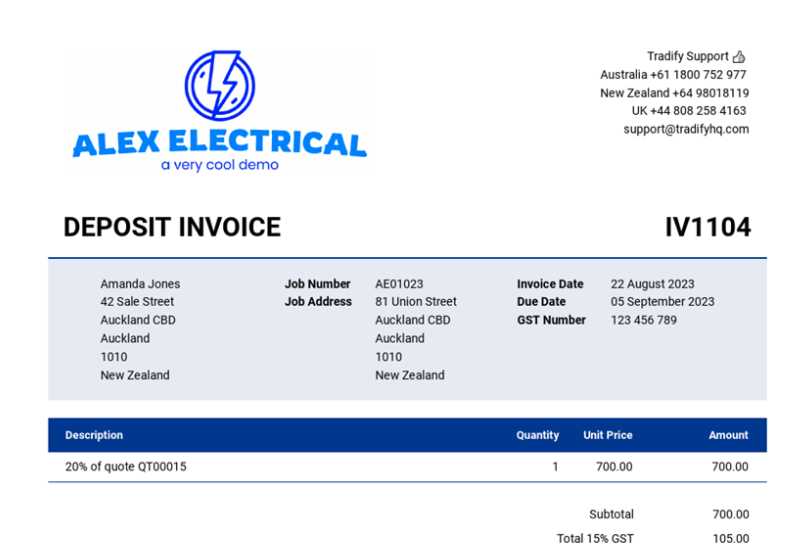

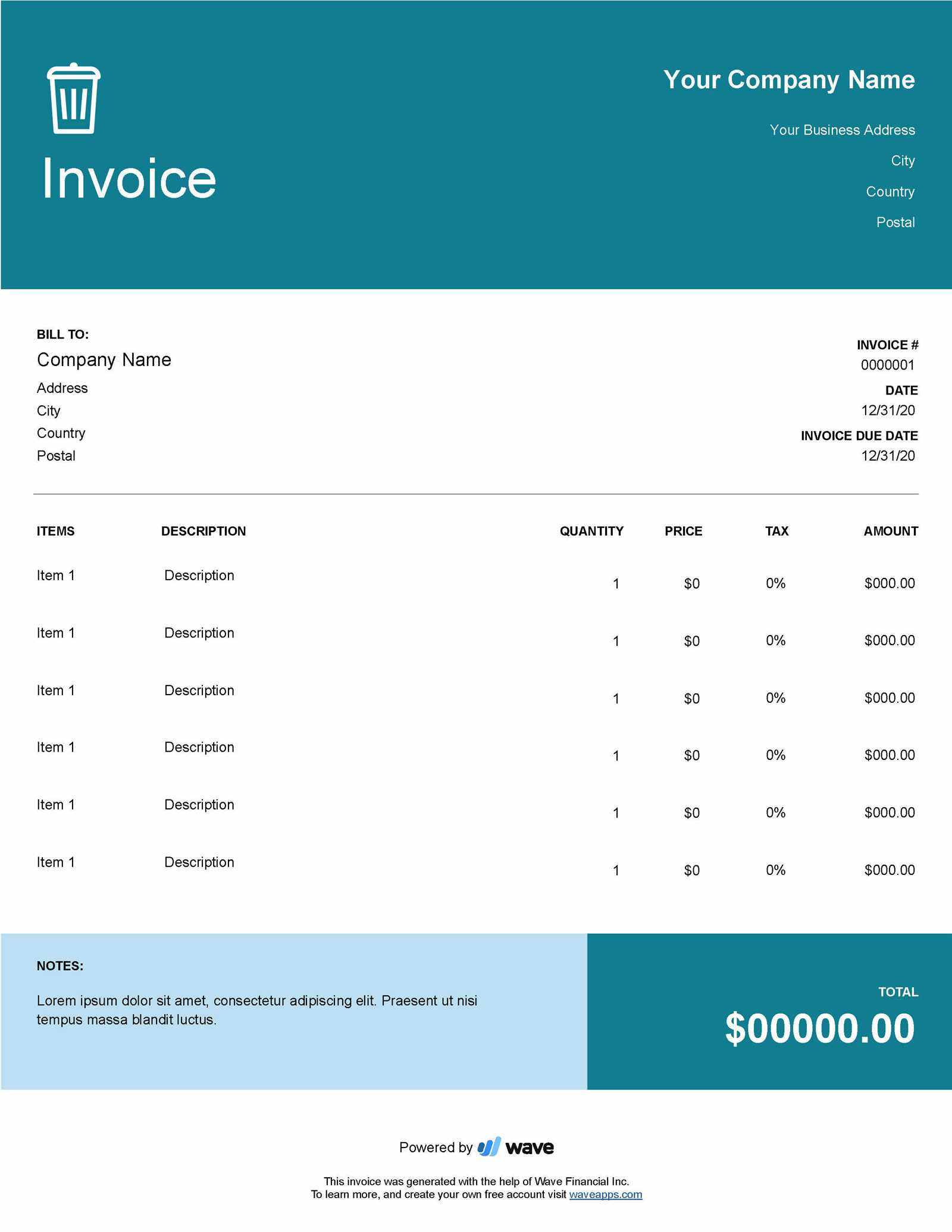

How to Create a Deposit Invoice

Creating a document to record an initial payment is an essential part of managing client transactions. This process ensures that both parties have a clear understanding of the financial terms and helps track the status of the remaining balance. Whether you are offering services or selling products, it’s important to outline the necessary details in a structured manner. Below are the steps to effectively create this type of record.

Step 1: Gather Key Information

Before you begin, ensure you have all the necessary details for the transaction. This information will form the basis of your document:

- Client Details: Name, address, and contact information.

- Payment Amount: The amount the client has already paid.

- Total Amount: The full cost of the product or service.

- Balance Due: The remaining amount the client owes.

- Due Dates: When the remaining payment is expected.

Step 2: Choose a Structured Format

The next step is to decide on the format that will best present this information. A clean, organized layout helps both you and the client easily track the financial status. Ensure that all relevant sections are clearly marked, such as the payment breakdown, dates, and client details. Having a consistent structure will make future records easier to generate and reference.

Step 3: Add Terms and Conditions

To avoid misunderstandings, always include clear terms regarding payment schedules, late fees, or any other conditions related to the transaction. This ensures transparency and sets the expectations for both parties. Make sure your terms are concise and easy to understand.

Step 4: Review and Send

Once you’ve filled in the necessary details and structured the document, take a moment to review it for accuracy. Double-check the amounts, dates, and client information. After confirming everything is correct, send the document to the client, either electronically or in printed form, based on your preferred method of communication.

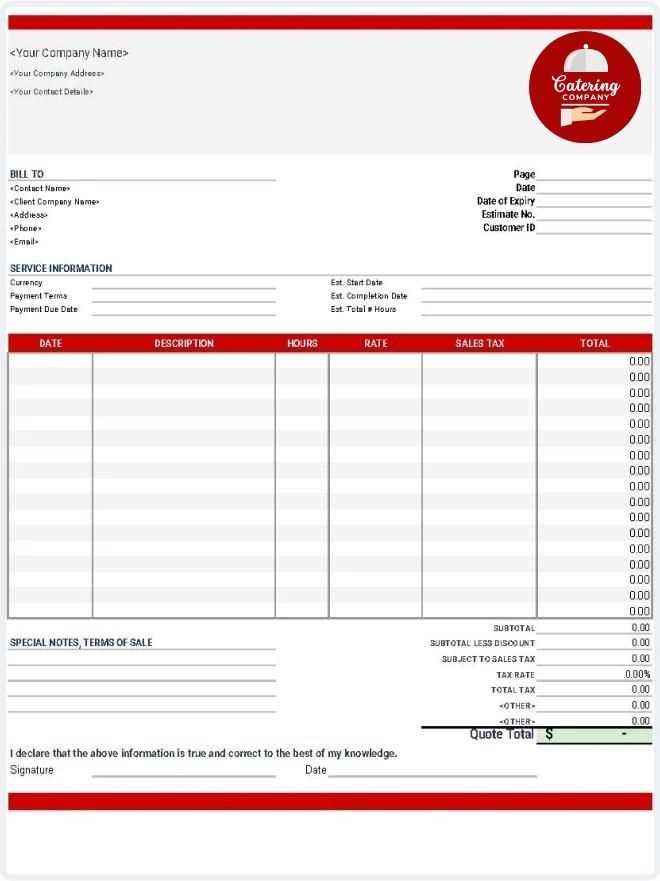

Key Elements of a Deposit Invoice

To ensure smooth and transparent financial transactions, it’s important to include several key components in any document that records partial payments. These elements help to clearly define the agreement between both parties and provide a reference point for future financial interactions. By outlining the terms and details in a precise manner, businesses can avoid confusion and maintain a professional relationship with their clients.

Essential Details to Include

The following components are crucial for creating a comprehensive record of an initial payment:

- Client Information: Include the full name, address, and contact details of the client for easy identification.

- Business Information: The name, address, and contact details of the service provider or business receiving the payment.

- Payment Amount: Clearly state the amount the client has already paid upfront.

- Total Amount Due: Specify the total cost of the service or product, showing the client how much remains to be paid.

- Balance Remaining: Highlight the outstanding balance that needs to be cleared, including due dates for the remaining payments.

- Date of Transaction: The date when the partial payment was received should be documented.

Additional Information for Clarity

Including extra details can further clarify the terms of the agreement and help both parties stay on track:

- Payment Terms: Specify when the remaining amount is due and any penalties for late payments.

- Reference Number: Provide a unique reference or order number to help identify the transaction easily in your system.

- Services or Products Provided: A brief description of what the initial payment covers, including any relevant terms, delivery schedules, or milestones.

By including all of these essential elements, you create a clear, professional document that helps avoid confusion and protects both parties’ interests throu

Why Use a Deposit Paid Template

Having a standardized way of documenting partial payments offers numerous advantages for businesses and clients alike. A structured format ensures that both parties have clear records of what has been paid and what remains outstanding. It helps avoid confusion, improves transparency, and makes financial tracking easier, especially when managing multiple agreements or clients.

Efficiency and Time-Saving

Using a pre-designed system to record initial payments significantly reduces the time spent on creating custom documents for every transaction. Instead of drafting each record from scratch, businesses can quickly fill in the necessary details, such as amounts, dates, and client information. This streamlined process saves valuable time, enabling business owners to focus on more important tasks.

Improved Professionalism and Consistency

Consistently using a structured format for documenting financial transactions creates a more professional image for your business. Clients will appreciate the clarity and organization, knowing they will receive well-organized documentation each time they make a payment. Furthermore, the use of a standard format ensures that every document is uniform, reducing the chances of errors or omissions.

Increased accuracy is another key benefit, as the structure prompts the inclusion of all essential details, minimizing the risk of missing important information. By using this approach, businesses also maintain better financial records, which can be crucial for audits, taxes, or future reference.

Common Mistakes to Avoid in Invoicing

Accurate documentation of financial transactions is vital to maintaining smooth business operations and client relationships. However, certain mistakes can lead to confusion, delays, or even disputes. Recognizing and avoiding common errors when recording initial payments can help businesses maintain professionalism and ensure timely payments. Below are some of the most frequent pitfalls to watch out for.

Failure to Include Key Information

One of the most common mistakes is not including all the necessary details, which can cause misunderstandings or delays in payment. Essential information such as payment terms, amounts due, or the service description should always be clearly stated. Without these details, clients may be unclear about their obligations, leading to payment delays or confusion.

| Missing Information | Consequences |

|---|---|

| Client’s contact information | Difficulty in reaching out for follow-up |

| Full breakdown of amounts | Clients may dispute the charges |

| Due date and payment terms | Missed or late payments |

Not Tracking Payments Properly

Another common mistake is failing to properly track initial contributions, which can lead to confusion when clients pay off the remaining balance. Always ensure that each payment is recorded in a clear and organized manner. If multiple clients are involved, keeping accurate records for each transaction will help prevent errors and allow for quick follow-ups if needed.

Inconsistent record-keeping can result in incorrect balances or missed payments, which could impact the financial health of your business. A systematic approach to tracking these records ensures everything is accounted for, and both you and your clients have a clear understanding of the financial agreement.

How Deposit Invoices Benefit Your Business

Documenting initial payments provides several key advantages for businesses of all sizes. By recording upfront financial commitments, companies can reduce financial risks and improve cash flow management. These documents not only ensure that payments are properly tracked, but they also serve as a safeguard against potential non-payment or delays in the future. Below are some of the main benefits of using structured payment records in your business operations.

Improved Cash Flow Management

When you secure a portion of the payment at the beginning of a project or sale, it helps maintain a steady flow of income. This is especially important for businesses that rely on timely payments to cover operational costs and reinvest in their growth. Having an initial payment allows you to fund the resources or services needed to complete the order or project, minimizing financial strain.

- Upfront Funds: Helps cover initial costs before the full payment is received.

- Stable Revenue: Ensures that income is consistent, reducing cash flow issues.

- Reduced Financial Risk: Protects the business against the possibility of non-payment for the entire service or product.

Enhanced Professionalism and Trust

Requesting and documenting an initial financial commitment shows your clients that you are serious about the business arrangement. It establishes a professional tone for the transaction and builds trust between you and your clients. When clients see that there are clear terms and a formal process for handling payments, it increases their confidence in your ability to deliver on your promises.

- Clear Expectations: Both parties understand the terms from the start, reducing potential conflicts.

- Transparency: Clients appreciate knowing where they stand financially throughout the project.

- Better Client Relationships: A professional a

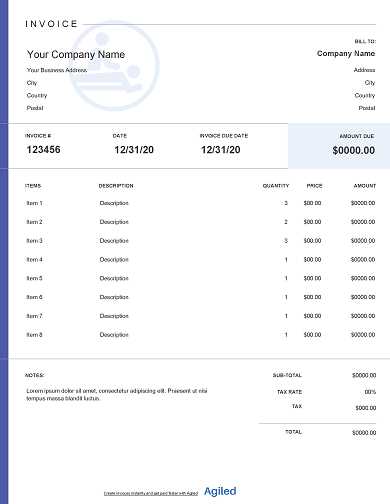

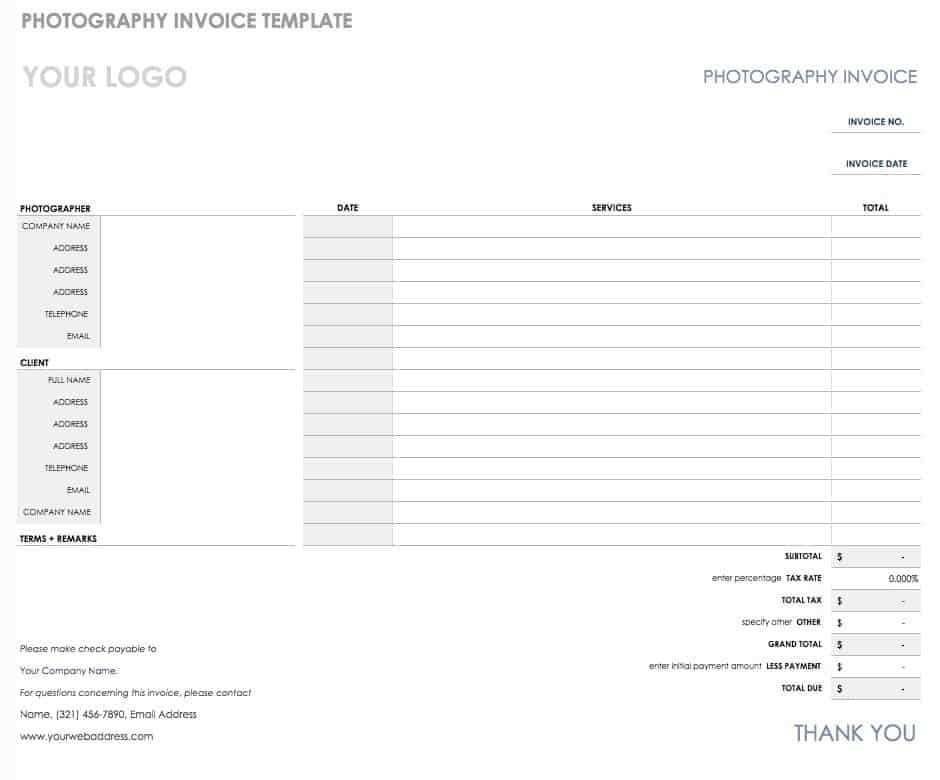

Customizing Your Deposit Invoice Template

Personalizing the document used to record upfront payments is essential for businesses looking to maintain a professional and efficient billing system. By customizing these records to fit your specific business needs, you can ensure they reflect your branding, clarify payment terms, and provide all necessary details to both you and your clients. Customization helps make the document more intuitive, easily recognizable, and aligned with your business identity.

Branding and Design

One of the first areas to focus on when customizing your payment record is the design. Incorporating your business logo, colors, and fonts creates a cohesive brand experience. This enhances professionalism and ensures that clients immediately recognize the document as official correspondence from your business.

- Logo: Place your company logo at the top of the document for instant recognition.

- Brand Colors: Use your brand colors in headings or borders to create a visually appealing format.

- Fonts: Choose clear, legible fonts that match your company’s style for consistency.

Adjusting for Specific Needs

Every business has unique requirements when it comes to billing. Customizing your document allows you to adjust the layout, content, and payment terms according to what works best for you and your clients. You may want to include additional sections such as payment methods, early-bird discounts, or specific milestones for larger projects. Customization helps make sure that all the necessary information is included while keeping the document simple and straightforward.

- Additional Payment Terms: Include payment plans, deadlines, or incentives for early payments.

- Service Details: Customize the service description section to align with your offerings, whether it’s a product or service.

- Payment Methods: Specify available methods of payment for your clients to choose from.

By tailoring this document to fit your unique business nee

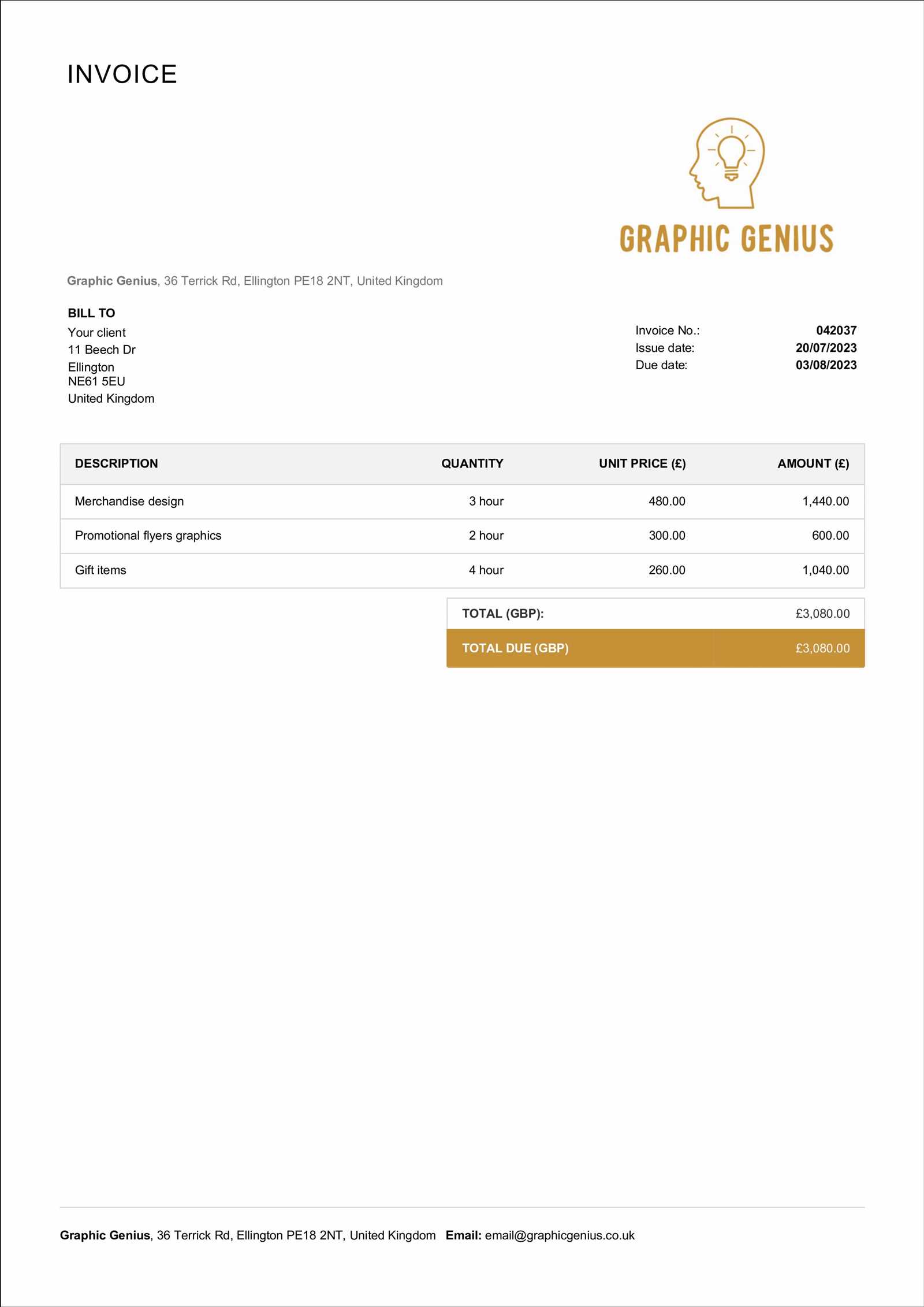

Essential Information to Include in Invoices

To ensure smooth financial transactions and avoid misunderstandings, it’s important to include specific details in the documents that record client payments. These details help both the service provider and the client understand the terms of the agreement and keep track of payment schedules. Below are the key elements that should always be included in any payment record.

Client Information: Always include the full name, address, and contact information of the client. This ensures that both parties are correctly identified, especially in the case of disputes or future communications.

Business Details: Clearly state your business name, address, and contact details. This helps the client easily recognize the source of the document and provides an official point of contact for any questions or follow-up regarding the payment.

Payment Breakdown: Always list the amount that has been received, the total amount due, and any outstanding balance. It’s also helpful to break down any additional charges or discounts that apply to the total sum.

Payment Terms: Specify the agreed-upon payment schedule, including the amount due and any deadlines. If applicable, include information about penalties for late payments or discounts for early settlement.

Transaction Date: Clearly state the date when the partial payment was made. This helps both parties track the timeline of the transaction and serves as a reference point for future payments.

Unique Reference Number: Assign a reference number to each document to make it easier to track and identify. This is especially useful when dealing with multiple clients or transactions, and for organizing financial records.

Detailed Description of Goods or Services: Include a brief but clear description of what the client is paying for. This might include the nature of the service, product quantities, or project milestones, depending on the nature of the agreement.

By including all of these elements in your payment records, you ensure that both parties have a clear understanding of the transaction, which reduces confusion and helps maintain a professional relationship throughout the process.

Choosing the Right Invoice Software for Deposits

When managing financial transactions, especially those involving upfront payments, using the right software can significantly streamline your processes. The right tool helps ensure accuracy, save time, and maintain consistency in handling transactions. As businesses increasingly rely on digital solutions, selecting software that accommodates specific payment structures, such as partial payments, is essential for smooth operations and client satisfaction.

Key Features to Look For

Not all software solutions are created equal, so it’s important to choose one that supports your business’s unique needs. Below are some essential features to look for when selecting the right software for managing upfront payments:

- Payment Tracking: Look for software that allows you to easily track partial payments and outstanding balances. This will help you avoid confusion and ensure that all transactions are properly recorded.

- Customizable Fields: The ability to customize forms for different types of transactions is important. You should be able to add fields specific to your business, such as service descriptions or payment plans.

- Automated Reminders: Choose a platform that sends automated reminders to clients for remaining payments. This helps reduce late payments and maintain cash flow without constant manual follow-ups.

- Integration with Accounting Systems: Ensure the software integrates seamlessly with your accounting tools to keep your financial records accurate and up to date.

Consideration for Ease of Use

Another critical factor when selecting software is its usability. The software should be user-friendly, allowing you to quickly crea

Legal Requirements for Deposit Invoices

When documenting partial payments for goods or services, it’s crucial to understand the legal requirements that govern such records. Compliance with these regulations ensures that your business remains in good standing with tax authorities and that you avoid potential disputes with clients. Proper documentation not only protects your interests but also provides clear evidence of agreed-upon terms between you and your clients.

First and foremost, all payment records should include accurate details of the transaction, such as the amount paid, the total cost, and any remaining balance. These details help ensure transparency and provide a clear reference in case of legal or financial audits. In many jurisdictions, businesses are required to issue documents that contain specific information, such as both the buyer’s and seller’s contact details, transaction dates, and clear payment terms.

Additionally, your records should comply with local tax regulations. This includes specifying the correct tax rate for the goods or services provided and ensuring that the document reflects the proper tax amount. In some cases, failure to include tax information can lead to penalties or audits. Always check local laws to determine whether taxes must be included at the time of the partial payment or if they are calculated later, at the time of the final payment.

Another important legal aspect is ensuring that payment terms are clearly outlined. This includes the agreed-upon payment schedule, deadlines, and any applicable late fees or discounts. Some countries have specific requirements for how this information should be presented, and it’s important to adhere to these guidelines to avoid potential legal issues.

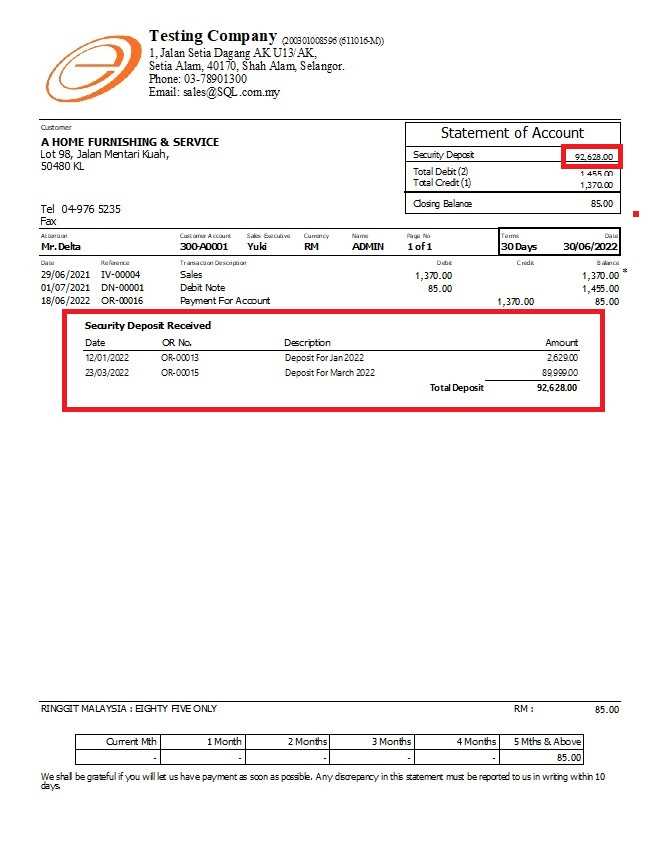

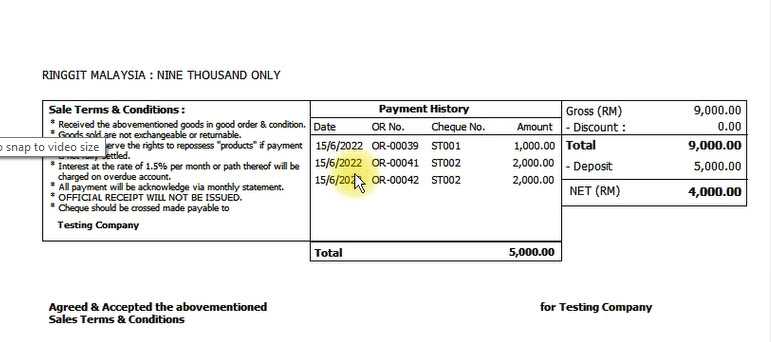

How to Track Deposit Payments Effectively

Accurately tracking upfront payments is crucial for businesses to maintain smooth financial operations. It ensures that all received funds are properly documented and that any remaining balances are easily identifiable. By implementing effective tracking systems, you can minimize the risk of missed payments, prevent confusion with clients, and keep your finances well-organized.

The first step in tracking initial payments is to have a clear and organized method for recording each transaction. This involves noting the details of the payment, including the amount, client, date, and any remaining balance. Using spreadsheets, accounting software, or manual ledgers can help keep this information well-maintained and easy to reference when needed.

Creating a Payment Tracking Table

One effective way to track payments is by creating a table that includes all the essential details. Here’s a simple example of how such a table might look:

Client Name Transaction Date Amount Paid Total Amount Balance Due Payment Status John Doe 2024-10-10 $500 $1,000 $500 Pending Jane Smith 2024-10-12 $200 $800 $600 Pending By maintainin

Automating Your Deposit Invoicing Process

Automating the process of recording and tracking upfront payments can significantly enhance the efficiency and accuracy of your business operations. By leveraging automation tools, you can save time, reduce human error, and ensure that your financial records are always up to date. Automation not only helps streamline the workflow but also improves client communication and payment tracking.

There are several key areas where automation can be implemented to optimize the process of handling initial payments:

1. Automatically Generate Payment Records

Automation software allows you to create and send payment records automatically once a client makes an upfront commitment. This ensures that all necessary details, such as amounts, services rendered, and deadlines, are consistently included in each document without the need for manual input.

- Pre-built templates: Set up templates that automatically pull in client and project details, reducing manual data entry.

- Custom payment structures: Adjust settings for different payment schedules and amounts, whether for fixed amounts or percentage-based payments.

- Scheduled delivery: Automatically send payment records to clients as soon as a transaction is made.

2. Integrate Payment Processing and Tracking

Many automation tools integrate seamlessly with online payment platforms, so you can automatically record and track initial payments as soon as they are received. This integration reduces the need for manual input, ensuring that all payments are promptly recorded and accounted for.

- Payment synchronization: Sync with payment processors to track incoming payments in real-time.

- Update balance automatically: Once a payment is made, the system will update the outstanding balance and notify both you and your client.

- Real-time alerts: Set up alerts to notify you when a payment has been received or when a balance is due.

3. Streamline Client Communications

Automating client notifications regarding their upfront payment status helps maintain transparency and minimizes misunderstandings. Automated emails or reminders can be sent to clients when an initial payment is due or when a balance remains unpaid.

- Payment reminders: Send automated reminders for upcoming or overdue payments without manually tracking each client.

- Customizable templates: Customize automated communication to include specific details like due dates, amounts, and payment methods.

- Follow-up notifications: Automatically follow up if a payment has not been made within the agreed timeframe.

By automating these key steps, you can save valuable time, reduce errors, and improve your financial management processes. Automation allows you to focus on other areas of your business while ensuring that client payments are tracked and

Design Tips for Professional Invoices

The appearance and layout of financial documents play a critical role in shaping your business’s professionalism. A well-designed document not only makes it easier for clients to understand their payment terms but also helps reinforce your brand identity. By paying attention to key design elements, you can create documents that are both visually appealing and functional.

1. Maintain Clear Structure and Layout

One of the most important design tips is to ensure that your document has a clean and organized structure. A clear layout helps clients quickly find the information they need, minimizing confusion and potential delays. Below are a few ways to keep your documents structured:

- Headings and Subheadings: Use bold and larger font sizes for headings to break down the document into easily readable sections, such as client details, payment breakdown, and terms.

- Consistent Alignment: Keep text and figures aligned in a way that is easy to follow, especially in tables listing payment details.

- Whitespace: Avoid overcrowding the document with too much text. Use enough space between sections to make it visually appealing and easy to read.

2. Use Your Branding Elements

Incorporating your business’s branding into your financial documents helps to reinforce your identity and adds a personal touch. It also makes your documents look more professional and trustworthy. Here are a few ways to include branding:

- Logo: Place your company logo at the top of the document to make it instantly recognizable.

- Brand Colors: Use your brand colors for headings, borders, or sections to create a cohesive and visually appealing design.

- Fonts: Choose professional and legible fonts that align with your company’s visual identity. Avoid using

How to Manage Partial Payments with Invoices

Managing partial payments can be complex, but it is an essential part of many business transactions. When clients pay in installments or make upfront contributions, keeping track of these payments is crucial to ensure financial clarity and maintain good client relationships. It’s important to establish a clear process for tracking outstanding balances and ensuring timely follow-up on remaining amounts.

To effectively manage these types of payments, it is essential to break down the total amount into clear segments, outlining each payment and its due date. A well-organized system allows you to track what has been paid, what is still due, and when further payments are expected. This not only ensures that you get paid on time but also helps clients understand their obligations clearly.

1. Clearly Outline Payment Terms

Before any payment is made, ensure that the terms are clearly outlined in the initial agreement or document. This should include the total amount, the agreed-upon payment schedule, and any milestones. Here’s what to include:

- Payment Schedule: Specify the exact dates or phases when payments are due.

- Installment Amounts: Break down the total amount into specific installment amounts.

- Balance Remaining: Keep track of the balance after each payment is made to avoid confusion.

2. Keep Track of Payments and Balances

Regularly updating payment records is key to successful managemen

Integrating Deposit Invoices with Accounting Systems

Integrating your financial documents with accounting software can streamline your business processes and ensure accurate record-keeping. When payments are made upfront or in installments, it’s important to have these transactions seamlessly integrated into your broader financial system. This integration not only saves time but also reduces the likelihood of errors and inconsistencies in your accounting records.

By automating the process of recording these payments, you can easily track balances, generate reports, and maintain a clear overview of your financial health. This integration allows for better management of cash flow, easier reconciliation, and more efficient reporting for tax and financial purposes.

1. Benefits of Integration

Integrating financial transactions directly with your accounting system offers several key advantages:

- Accuracy: Reduces the risk of manual errors by automatically syncing payment details and balances.

- Time-saving: Eliminates the need for repetitive data entry, allowing you to focus on other areas of your business.

- Real-time updates: Keep your financial data up-to-date instantly when a payment is made or a balance changes.

- Improved reporting: Access detailed financial reports at any time without manually calculating outstanding payments or tracking statuses.

2. Steps to Integrate Financial Documents with Accounting Software

There are a few key steps to integrate your payment tracking and records into your accounting system effectively:

- Select compatible software: Choose accounting software that supports integration with your payment processing or billing platform.

- Automate data syncing: Set up automatic syncing between your financial documents and the accounting system to ensure real-time updates.

- Map payment categories: Categorize upfront payments or installments correctly within the accounting system to track them separately from regular transactions.

- Regular reconciliations: Periodically review and reconcile your accounts to ensure that all payments have been correctly recorded and there are no discrepancies.

By integrating your financial transactions into your accounting

Best Practices for Sending Deposit Invoices

When managing upfront payments or installment plans, sending clear and professional financial documents is essential. These documents serve as formal records of the transaction and set clear expectations for your clients regarding their payments. To ensure the process runs smoothly and clients are well-informed, following best practices when sending these documents is crucial.

By adopting effective strategies, you can enhance your professionalism, avoid payment delays, and improve client satisfaction. Below are some key practices to keep in mind when sending financial documents for upfront or partial payments.

1. Send Documents Promptly and Professionally

Timeliness and professionalism are key when sending any financial document. It is important to send the document as soon as possible after an agreement is made. This sets the tone for the transaction and provides your client with the necessary details to make their payment on time.

- Send promptly: Issue the document shortly after confirming the payment terms to avoid confusion or delays.

- Use professional language: Ensure that the language in the document is formal and clear, avoiding slang or informal phrases.

- Use branded materials: Include your company logo and contact details to reinforce professionalism and brand consistency.

2. Clearly Outline Payment Terms

One of the most important aspects of any financial document is the clarity of the payment terms. Clients should have a clear understanding of when and how they are expected to make their payments. This includes specifying due dates, payment amounts, and any applicable taxes or fees.

- Detail payment amounts: Spe

Improving Client Communication Through Invoicing

Effective communication with clients is vital for maintaining strong business relationships and ensuring the smooth flow of financial transactions. Financial documents are not only tools for recording payments but also serve as an opportunity to enhance transparency and reinforce professional interactions. Clear, well-structured documents can help reduce misunderstandings and provide clients with the necessary information to make timely payments, thus improving overall communication.

By focusing on the clarity and details of the documents you send, you create a more open line of communication. These documents can serve as a bridge between you and your clients, addressing concerns, answering questions, and clarifying payment expectations. With the right approach, you can strengthen trust and foster better collaboration with your clients.

1. Provide Clear Payment Instructions

One of the key elements in enhancing client communication is ensuring that the payment process is simple and clear. Clients should know exactly how to make their payments, what methods are accepted, and when payments are due. Providing this information in a straightforward manner eliminates confusion and encourages prompt action.

- Specify payment methods: Clearly list the acceptable ways to make a payment, such as bank transfers, online payments, or checks.

- Include due dates: Clearly state the payment deadlines to avoid delays.

- Provide contact information: Offer easy ways for clients to reach you in case of questions or issues regarding payments.