Cool Invoice Template for Stylish and Professional Billing

For businesses of all sizes, presenting clear and professional documents for transactions is essential. Whether you are a freelancer, a startup, or an established company, how you present your charges can say a lot about your professionalism. A polished, well-structured document not only makes a strong impression but also ensures smooth communication with clients and partners.

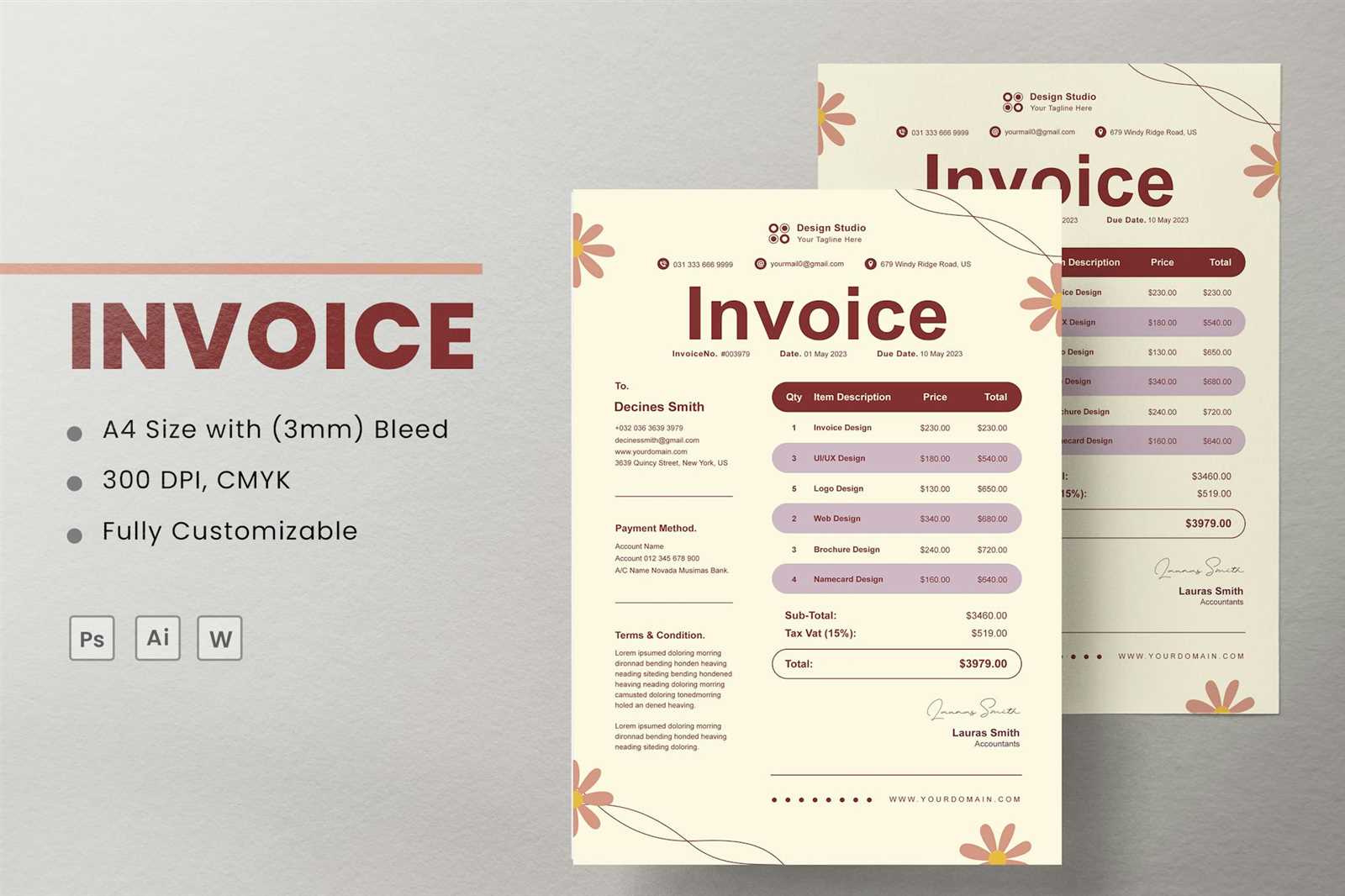

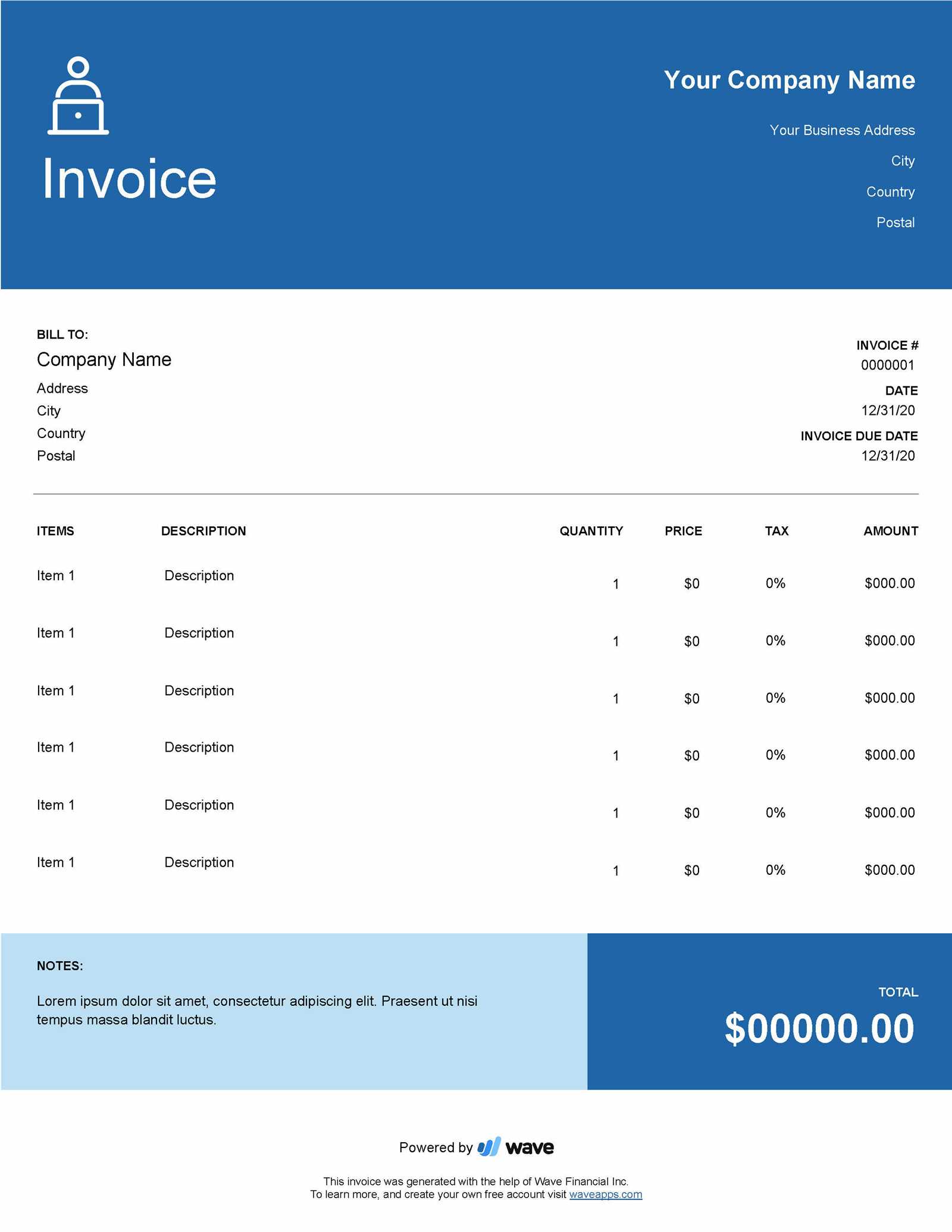

Creating a sleek and functional document from scratch can be time-consuming and tedious. Fortunately, many tools offer ready-to-use formats that allow you to focus on what matters most–your work. By customizing these pre-made designs, you can create personalized paperwork that aligns with your brand and enhances your overall business image.

In this guide, we will explore the essential elements of an effective billing document, how to design one that reflects your business’s personality, and the benefits of using digital formats for efficiency and professionalism. Whether you’re new to business or looking to refine your current approach, these insights will help you make the right choice for your needs.

Cool Invoice Template for Modern Business

In today’s fast-paced business world, presenting your financial documents in a visually appealing and professional manner is essential. Whether you’re working with clients, customers, or partners, clear and attractive billing paperwork not only ensures that your charges are understood but also leaves a positive, lasting impression. A modern design can elevate the client experience, making your company appear more organized and reliable.

Gone are the days of plain, cluttered forms that look outdated and unprofessional. With the right approach, you can create a streamlined, minimalistic layout that reflects your brand identity while being functional and easy to read. Clean lines, bold typography, and the smart use of colors can turn a simple document into a reflection of your business’s values.

For a modern approach, incorporating features such as digital signatures, payment links, and even automated reminders within your documents can greatly enhance the user experience. This level of sophistication not only saves time but also adds a layer of convenience for both you and your clients, ultimately improving cash flow and client satisfaction.

Why You Need a Stylish Invoice

In the competitive world of business, first impressions matter. The way you present your financial documents can significantly influence how clients perceive your professionalism and attention to detail. A well-designed billing statement not only helps ensure clarity but also reflects your brand’s values and commitment to quality.

When your documents are visually appealing and easy to navigate, clients are more likely to take them seriously and process payments promptly. A polished, modern design can make your business stand out and communicate that you are organized, reliable, and capable of delivering top-notch service.

Furthermore, a thoughtfully designed document enhances the overall client experience. By incorporating your logo, using clean layouts, and choosing the right typography, you create a sense of consistency across all aspects of your business communication. This small but impactful detail fosters trust and reinforces your brand identity with every transaction.

Design Tips for Professional Invoices

Creating a polished and effective billing document goes beyond just listing charges. The design should make it easy for clients to read and understand all the necessary information, while maintaining a professional look that aligns with your brand identity. A well-structured document can help reinforce your credibility and encourage timely payments.

Here are some design tips to consider when crafting your documents:

| Tip | Details |

|---|---|

| Clarity | Ensure all information is easy to read and organized. Use clear headings and sections to separate different types of data (e.g., item descriptions, totals, and payment terms). |

| Brand Consistency | Incorporate your logo, brand colors, and fonts to create a cohesive look that reflects your company’s identity and professionalism. |

| Simplicity | Avoid clutter. Stick to a clean, minimal design that highlights the essential details, ensuring clients can quickly find the information they need. |

| Whitespace | Use adequate spacing between sections to prevent the document from feeling crowded, allowing each section to breathe and stand out on its own. |

| Typography | Choose fonts that are easy to read, with a professional appearance. Avoid overly decorative fonts that may detract from the overall clarity. |

By focusing on these key elements, you can ensure that your billing statements not only serve their functional purpose but also enhance the professionalism and efficiency of your business operations.

How to Create a Cool Invoice Template

Designing a professional and visually appealing billing document can greatly enhance your brand’s image and help you stand out from competitors. A well-crafted statement not only ensures clarity but also communicates your business’s attention to detail and commitment to quality. Here’s how to design one that will impress your clients and streamline your billing process.

Choose the Right Layout

The first step in creating an effective document is selecting a clean, organized layout. Avoid clutter and focus on ensuring that the key information, such as payment amounts, due dates, and service descriptions, is easy to locate. Use sections and headings to break up the document and guide the reader’s eye. Make sure there’s enough space between elements to avoid a cramped, overwhelming look.

Incorporate Your Branding

Your document should reflect your business’s personality and values. Incorporate your company’s logo, color scheme, and fonts to create a consistent experience for your clients. Using brand-specific elements helps reinforce your identity and adds a professional touch that enhances the overall aesthetic. Keep the design balanced and cohesive, avoiding excessive decoration that might distract from the essential information.

By combining these design principles with a focus on functionality, you can create a billing statement that is both stylish and practical, improving your business’s image while making the process easier for your clients.

Top Features of an Effective Invoice

Creating a professional and functional billing document requires attention to both design and content. An effective statement not only helps ensure timely payments but also fosters trust and clarity between you and your clients. To achieve this, certain elements should be included to make the document both informative and easy to navigate.

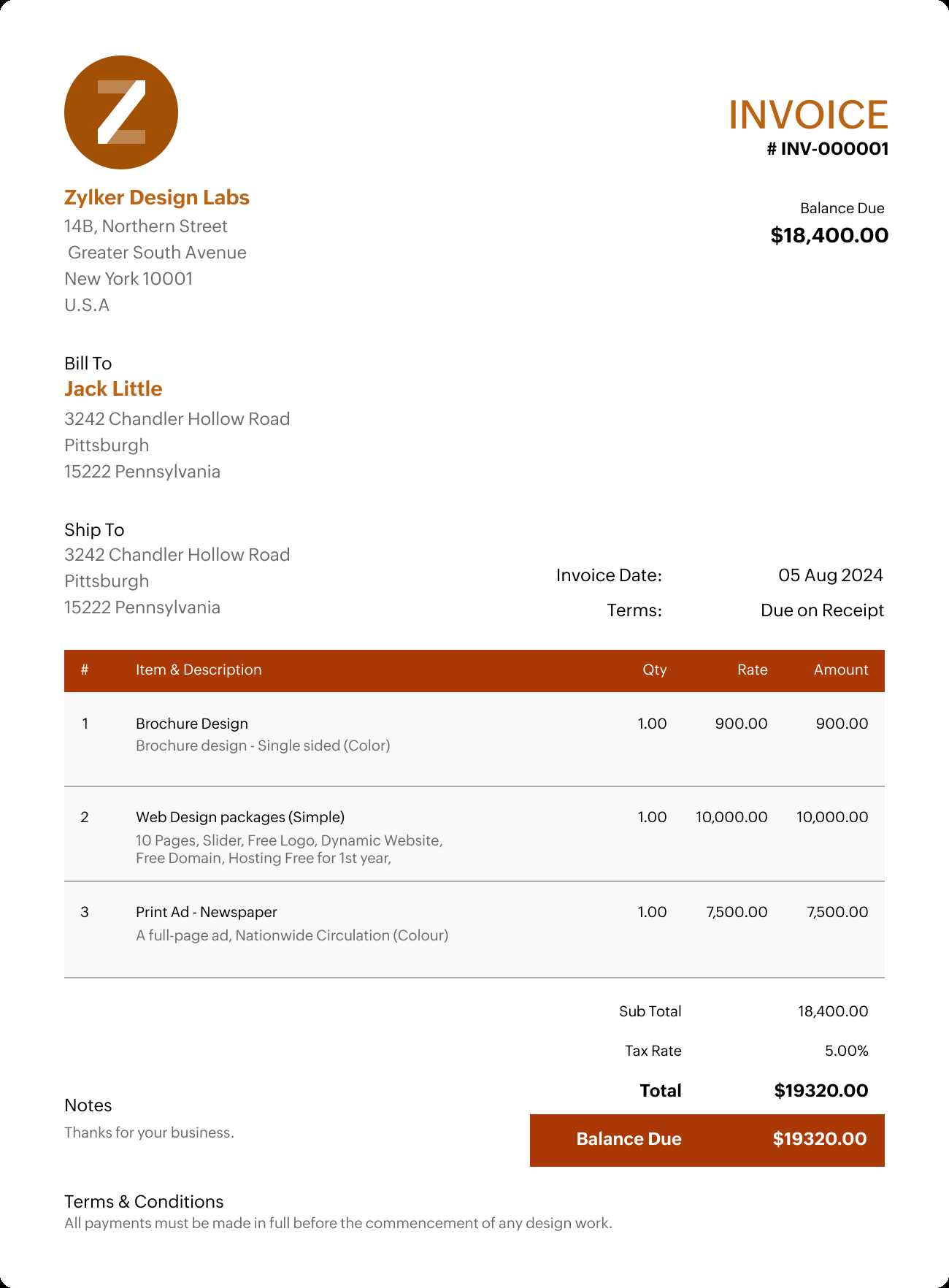

Clear and Organized Layout

One of the most important features is a well-organized structure. A clear layout allows clients to quickly find key details such as the amount due, payment terms, and itemized charges. Use headings, bold fonts, and appropriate spacing to separate different sections. The easier it is for clients to read, the more professional your document will appear.

Essential Details and Accuracy

Accurate and complete information is critical. Include your company name, contact details, and payment instructions. Additionally, always double-check that amounts, dates, and any other specific data are correct. Any inconsistencies can lead to confusion and delayed payments. Strong attention to detail is essential for maintaining a good relationship with clients.

Other helpful features include offering multiple payment methods, including links to online payment systems, and clearly stating your payment terms. These elements not only make transactions easier for clients but also streamline the process for you, helping to avoid delays and potential disputes.

Choosing Colors for Your Invoice Design

The use of color in business documents plays a crucial role in setting the tone and reinforcing your brand identity. When it comes to billing paperwork, the colors you choose can influence how your client perceives your professionalism and the overall quality of your services. The right color scheme can enhance the readability of the document and create a cohesive visual experience, while the wrong one can make it feel chaotic or difficult to navigate.

It’s important to select colors that align with your brand’s identity. For example, if your company’s logo primarily uses shades of blue and gray, using those colors in your documents will help maintain consistency across all communications. A well-chosen color palette can also evoke certain emotions–blue often conveys trust and reliability, while green might suggest growth and sustainability. However, always ensure that the colors you use enhance, rather than hinder, readability. Avoid using too many contrasting or bright colors that could distract from the essential information.

Additionally, consider using softer tones for the background and bolder colors for key elements like headings or totals. This contrast will make important details stand out without overwhelming the reader. By thoughtfully selecting a balanced and appropriate color scheme, you can create a polished and professional appearance that reinforces the value of your services.

Best Fonts for Clear Invoices

Choosing the right font is essential for ensuring that your financial documents are easy to read and professional. The typeface you select can significantly affect the clarity and overall presentation of the information. A clean, legible font makes it easier for clients to quickly understand the details of the document, while a poor choice can create confusion and detract from your brand’s image.

For maximum readability, it’s best to stick with simple, sans-serif or serif fonts that offer clear distinction between characters. Avoid overly decorative fonts that can make the document look cluttered and hard to interpret. Some of the most popular and reliable fonts include Arial, Helvetica, and Times New Roman, all of which are known for their legibility in both digital and printed formats.

While choosing a primary font, it’s also important to ensure there is a good balance between the headings, body text, and totals. Use a slightly larger or bolder font for headings to guide the reader’s eye and create a clear structure. Remember, clarity and simplicity are key when selecting fonts for professional documents.

Customizing Templates for Your Brand

Personalizing your billing documents is an excellent way to reinforce your brand’s identity and create a cohesive experience for your clients. By customizing pre-made formats to reflect your company’s colors, logo, and style, you can elevate the overall impression and ensure that your documents feel uniquely yours. A well-branded document communicates professionalism and attention to detail, helping you stand out in a competitive market.

Here are a few key ways to customize your billing documents for your brand:

- Logo Integration: Place your company logo prominently at the top of the document. This not only helps with brand recognition but also adds a professional touch.

- Brand Colors: Use your company’s color scheme throughout the design. Whether it’s in headings, borders, or background elements, consistent use of your colors enhances brand identity.

- Typography: Choose fonts that match your company’s branding. Stick to a combination of readable, professional fonts for both headers and body text.

- Personalized Footer: Include your business’s contact information, website, and social media links in the footer to make it easy for clients to get in touch or learn more about your services.

By incorporating these brand elements, you ensure that every document you send out is consistent with your overall brand image, making your communications feel more polished and reliable.

How a Good Template Saves Time

Efficiency is key in any business, and streamlining your processes can save you valuable time and resources. When it comes to handling financial documents, using a well-structured and pre-designed format can significantly reduce the time spent on administrative tasks. By eliminating the need to start from scratch each time, you can focus on what truly matters–running your business and providing excellent service.

Automating Repetitive Tasks

One of the biggest time-savers is automation. A solid document format allows you to quickly input the necessary details–such as client information, services provided, and pricing–without having to format the document each time. Predefined fields and sections enable you to create new documents faster while ensuring consistency across all your communications.

Reducing Errors and Corrections

Another advantage of using a structured layout is the reduction of human error. With a set framework, you’re less likely to miss important details or make mistakes in calculations. This minimizes the need for corrections, saving time in back-and-forth communications and ensuring that your clients receive accurate and reliable information.

| Benefit | How It Saves Time |

|---|---|

| Consistency | A reusable design ensures that all documents are uniform, which eliminates the need for repetitive editing and formatting. |

| Faster Creation | Pre-built fields allow you to enter data quickly and easily, without having to reformat or rearrange the layout each time. |

| Fewer Errors | With structured sections and calculations, the chance of mistakes is reduced, saving time that would otherwise be spent correcting errors. |

In the long run, using an efficient format not only cuts down on the time spent creating documents but also boosts your overall productivity and professionalism.

Invoice Template vs Manual Billing

When it comes to creating billing documents, businesses often face the decision between using automated, pre-designed formats or handling everything manually. While manual billing can offer flexibility, it is time-consuming and prone to errors. In contrast, a structured, pre-made format provides numerous benefits, particularly in terms of efficiency and consistency. Let’s explore the differences between these two approaches and the advantages of using a streamlined, automated method for your business.

Manual Billing: Flexibility with Drawbacks

Manual billing allows for complete customization, but it often requires more time and effort. Each document must be created from scratch, with the details entered by hand. While this approach gives you full control, it can lead to inconsistency and human error. Some common challenges include:

- Time-Consuming: Writing up each bill from scratch takes valuable time, especially when managing multiple clients or projects.

- Risk of Mistakes: Manual entry increases the likelihood of errors in calculations, descriptions, or client information.

- Lack of Consistency: Each document may look different, which can affect your business’s professional image.

Using a Pre-Designed Format: Efficiency and Precision

On the other hand, using a pre-designed format offers a faster and more reliable way to create billing documents. By utilizing a template, you can quickly generate new documents with all the essential information already structured. Some of the key advantages include:

- Speed: Reusable formats allow you to create documents in just a few clicks, saving time and effort.

- Accuracy: Pre-designed fields and automated calculations minimize the risk of mistakes, ensuring consistency and correctness.

- Professional Appearance: A well-designed document helps maintain brand consistency, enhancing the overall look of your communications.

Ultimately, while manual billing may offer more flexibility, using a structured design format is a more efficient, accurate, and professional choice for most businesses. By reducing time spent on administrative tasks, you can focus on growing your business and delivering high-quality services.

Popular Tools for Creating Invoices

In today’s digital age, creating professional billing documents has never been easier. Several online tools and software are designed to streamline the process, offering both free and paid options. These tools help businesses automate the creation, customization, and delivery of their financial documents, saving time and reducing the risk of errors. Let’s take a look at some of the most popular platforms that can help you craft clean, efficient documents for your clients.

Many of these tools come with pre-designed formats that you can personalize to match your business’s branding. Some offer additional features like recurring billing, automatic reminders, and integrated payment options, making them valuable for businesses of all sizes.

- FreshBooks: A user-friendly accounting software that includes customizable billing options, automated reminders, and payment tracking.

- QuickBooks: A comprehensive platform offering a range of invoicing features, from easy creation to online payments and expense tracking.

- Zoho Invoice: A versatile tool with a variety of customization options and integration capabilities with other Zoho apps and third-party tools.

- Wave: A free, cloud-based software that offers invoicing, accounting, and receipt scanning, ideal for small businesses and freelancers.

- Invoice Ninja: A tool offering both free and paid plans, featuring invoice creation, time tracking, and project management tools.

By using these platforms, businesses can not only save time but also ensure that their financial documents are always professional, accurate, and aligned with their brand’s image. Many of these tools also integrate with accounting software, helping you keep track of your finances seamlessly.

Free Invoice Templates for Entrepreneurs

For entrepreneurs, managing finances efficiently is crucial, and using the right tools to create professional financial documents is a big part of that. Thankfully, there are many free resources available online that offer pre-designed formats, making it easier to create polished billing statements without starting from scratch. These free options are especially beneficial for small business owners or freelancers looking to maintain professionalism while keeping costs low.

These free options allow for customization, enabling you to adjust the design, add your business details, and even include your branding elements, such as your logo and company colors. With a few clicks, you can generate a document that looks as though it was professionally designed, all while saving time and effort.

Top Free Resources for Entrepreneurs

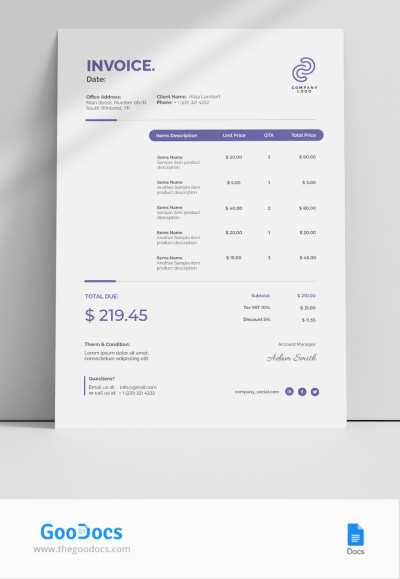

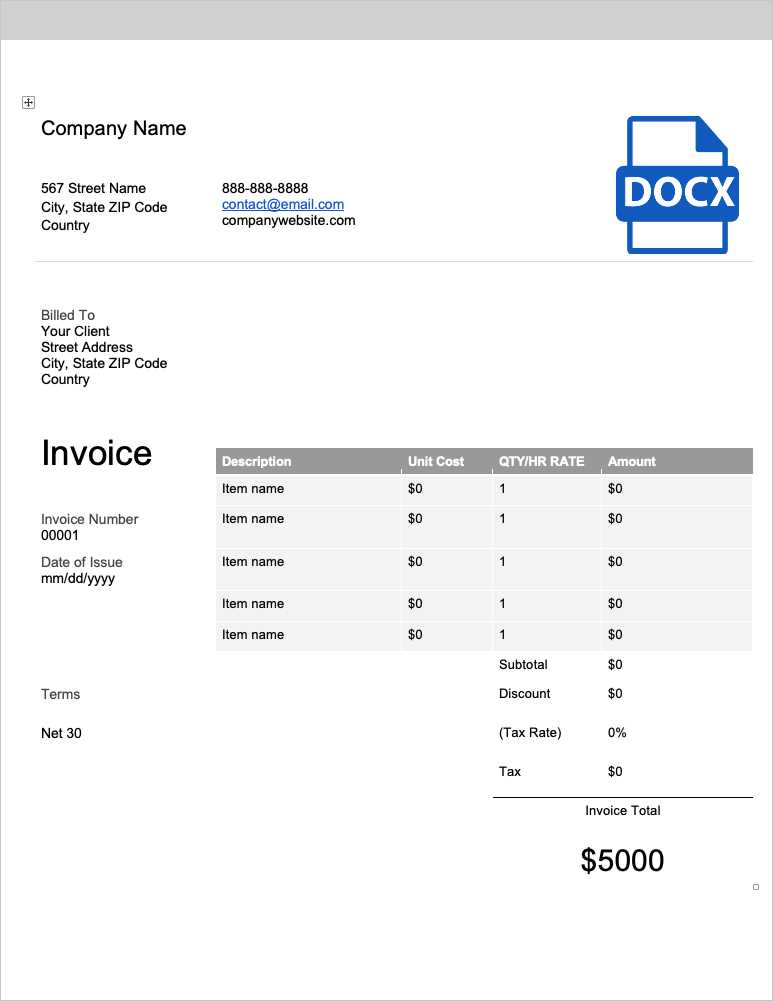

- Microsoft Office Templates: A collection of free, customizable designs available for Word or Excel that can be easily tailored to your needs.

- Canva: An online design tool with a variety of free billing layouts, allowing entrepreneurs to create professional documents with drag-and-drop functionality.

- Google Docs: A simple, cloud-based option that offers basic layouts for creating billing statements, all customizable to suit your needs.

- Invoice Generator: A fast and simple tool that allows you to fill in your information and generate a professional-looking document within seconds.

- FreshBooks Free Invoice Generator: A free online tool from FreshBooks that lets you quickly create and send professional billing statements.

Benefits of Using Free Resources

- Cost-Effective: Perfect for entrepreneurs just starting out who want to save on expensive software or services.

- Ease of Use: Most tools have a simple, user-friendly interface, allowing you to create documents quickly and without hassle.

- Customization: Free platforms typically allow you to adjust details like payment terms, tax rates, and item descriptions.

- Professional Appearance: Free resources can still help you maintain a polished and businesslike look for your financial communications.

By utilizing free online tools, entrepreneurs can generate accurate, clear, and professional financial documents with minimal effort, helping to improve business operations while keeping costs in check.

Incorporating Logos into Invoice Templates

Adding your company’s logo to financial documents is an essential part of branding and professionalism. The inclusion of a logo not only reinforces your identity but also creates a cohesive experience for your clients. Whether you’re sending a payment request or a billing statement, a well-placed logo can convey trust, reliability, and attention to detail, all of which are important for building strong client relationships.

When incorporating a logo into your financial documents, it’s important to ensure that it doesn’t overwhelm the content or detract from key details. The placement and size of your logo should strike a balance between visibility and subtlety, ensuring it complements the overall design of the document without becoming the focal point. The right positioning enhances the document’s professional appearance and supports your branding without drawing attention away from the essential information.

Best Practices for Logo Placement

- Top Left or Right Corner: Placing the logo in the top corner allows it to be immediately noticeable without taking up too much space. This is a common, unobtrusive location for logos in business documents.

- Centered at the Top: Centering the logo at the top of the page is a bold choice that places your brand front and center. This works well for more formal documents, but be mindful of balancing the space around it.

- Size Consideration: Keep the logo size proportional to the document layout. A logo that is too large may dominate the page, while one that is too small may not be noticeable enough.

Tips for Effective Logo Use

- Consistent Branding: Ensure your logo matches the colors and style of your business’s branding. Consistency across all communications strengthens your brand identity.

- High-Resolution Image: Use a high-quality image to avoid pixelation. A sharp, clear logo reflects professionalism and attention to detail.

- Avoid Overcrowding: Keep the space around the logo clean to avoid a cluttered look. Leave sufficient margins so the logo has room to “breathe” within the document.

By thoughtfully integrating your logo into billing documents, you can create a more polished, professional appearance while reinforcing your brand’s identity in every communication.

Optimizing Invoice Templates for Mobile Use

In today’s fast-paced world, many clients and business owners access important documents on their mobile devices. With the growing trend of mobile business management, it’s essential to ensure that your financial documents are mobile-friendly. By optimizing your documents for mobile use, you can improve readability and user experience, allowing clients to view and interact with them easily on smaller screens.

When designing financial documents for mobile use, it’s important to keep the layout simple and responsive. Complex designs with too many elements or large files can make it difficult for recipients to read and navigate the document on their phones or tablets. Ensuring that your documents are streamlined, easy to view, and function well on mobile devices can enhance your professional image and improve client satisfaction.

Key Considerations for Mobile-Friendly Documents

- Simple Layout: Avoid overly complex or crowded designs. Use clear sections with enough white space to keep the document clean and legible on smaller screens.

- Responsive Formatting: Choose a layout that automatically adjusts to different screen sizes. This ensures that the content appears properly regardless of the device.

- Large Fonts and Readable Text: Use larger font sizes for headings and body text to ensure readability on mobile screens. Keep the font style clear and simple for better legibility.

- Minimalistic Design: Keep elements such as logos, images, or decorations to a minimum. Too many visuals can make the document harder to navigate on a small screen.

- Accessible Links and Buttons: If the document contains links or action buttons (e.g., “Pay Now”), ensure they are large enough to be clicked on easily with a mobile device.

Best Practices for Mobile Optimization

- Test on Multiple Devices: Before sending documents, test them on various mobile devices to ensure they display correctly on different screen sizes.

- Limit the Use of Tables: While tables can be useful for organizing data, they can be difficult to read on mobile devices. Consider using simpler formats where possible.

- Compress the File Size: Large file sizes can slow down load times, especially on mobile networks. Compress the file to ensure quick loading without compromising quality.

By focusing on these key elements, you can create documents that are not only visually appealing but also practical and easy to use on mobile devices, ensuring a seamless experience for your clients wherever they are.

Benefits of Digital Invoices for Business

In today’s digital world, moving away from paper-based financial documents to electronic formats can provide significant advantages for businesses of all sizes. Digital documents not only streamline administrative tasks but also offer a range of benefits that improve efficiency, accuracy, and client satisfaction. By embracing electronic billing systems, businesses can save time, reduce costs, and enhance their overall operations.

With the growing need for quicker, more efficient processes, businesses are increasingly turning to digital methods for managing financial documentation. These digital formats allow for faster processing, easier storage, and better integration with other business systems, all of which contribute to smoother operations and more streamlined workflows.

Key Advantages of Using Digital Documents

- Time Efficiency: Digital documents can be generated, sent, and tracked instantly, eliminating the time spent printing, mailing, and manually processing paper forms.

- Cost Savings: By reducing the need for paper, ink, and postage, businesses can significantly lower their overhead costs. Digital solutions also reduce administrative labor costs.

- Improved Accuracy: Automation and error-checking features in digital systems help to eliminate mistakes that often occur in manual data entry, leading to more accurate financial documentation.

- Faster Payments: Digital invoices can include links to online payment systems, making it easier for clients to pay immediately, which can improve cash flow for your business.

- Environmentally Friendly: Reducing paper usage helps your business adopt more sustainable practices, contributing to a lower carbon footprint.

Additional Benefits for Business Operations

- Easy Tracking and Organization: Electronic documents can be stored and organized in cloud-based systems, making it easy to retrieve past transactions and track overdue payments.

- Customization Options: Digital formats can be easily customized to reflect your business’s brand, ensuring consistent professional communication.

- Integration with Accounting Systems: Digital systems can integrate with accounting software, automating the reconciliation process and saving time on bookkeeping tasks.

Overall, switching to digital documents can enhance operational efficiency, improve cash flow, and reduce the environmental impact of your business. The benefits of this transition make it a wise choice for businesses looking to stay competitive and future-proof their processes.

How to Stay Professional with Invoices

Maintaining a professional image is essential for any business, and this extends to the financial documents you send to your clients. Whether you’re a freelancer or a small business owner, sending clear, polished, and well-organized billing statements helps establish credibility and trust. The way you communicate your financial details says a lot about your business practices and can significantly impact your relationships with clients.

By focusing on presentation, accuracy, and clarity, you ensure that your financial communications reflect the level of professionalism your clients expect. It’s important to remember that a professional-looking document not only helps with getting paid on time but also enhances your brand image and strengthens client confidence in your business operations.

Best Practices for Professional Financial Documents

- Consistent Branding: Ensure that your documents match the look and feel of your business. Use your company’s logo, colors, and fonts consistently to create a cohesive image across all communications.

- Clear and Concise Information: Make sure that all essential details, such as payment terms, amounts due, and deadlines, are easy to read and understand. Avoid jargon or overly complex language.

- Organized Layout: Use a clean, structured layout that guides the reader through the document. Group related information together and leave enough white space to avoid visual clutter.

- Accurate Details: Double-check the information for any errors before sending out the document. Accuracy in pricing, dates, and contact information is crucial to avoid misunderstandings.

- Timely Delivery: Always send your documents promptly and ensure they arrive on time. Late or missed communications can be seen as unprofessional and may delay payment.

Additional Tips for Building Trust

- Personalized Messages: A brief, polite note thanking your client for their business and providing payment details can go a long way in establishing a strong relationship.

- Follow-Up Reminders: If a payment is overdue, send a courteous reminder. Always remain professional, even in follow-up communications, to maintain positive rapport.

- Use Digital Solutions: Take advantage of digital platforms that allow you to track and send documents efficiently, ensuring they arrive intact and can be easily accessed by your clients.

By implementing these strategies, you can ensure that your financial documents are not only functional but also enhance your professional image, fostering stronger relationships with your clients and promoting smoother business operations.