Best Invoice Template for Contractors to Simplify Your Billing

Managing payments efficiently is crucial for anyone running their own business. Whether you’re a freelancer, a small business owner, or a service provider, having a reliable system for invoicing can streamline your operations and improve cash flow. It not only saves time but also ensures that clients receive clear and accurate billing details, fostering trust and transparency.

Creating structured documents that outline the work completed, amounts due, and payment terms is essential. These documents are more than just a means of requesting payment; they reflect the professionalism of your business and set the tone for your client relationships. Using the right format can make the entire process smoother and more efficient.

In this guide, we will explore how to create well-structured billing documents, what key information they should include, and how to customize them to fit your business needs. By the end, you will have a clear understanding of how to manage your financial transactions with ease and professionalism.

Why Professionals Need a Structured Billing System

For anyone offering services or completing projects for clients, having a standardized way to request payment is essential. A consistent method helps ensure that all necessary details are communicated clearly, preventing misunderstandings and delays. Without a reliable system, professionals can risk confusion, missed payments, and disorganization in their financial records.

Benefits of Using a Structured Billing System

- Time efficiency: A ready-to-use format reduces the time spent creating documents from scratch.

- Clear communication: A well-organized document ensures clients understand exactly what they are paying for.

- Professionalism: Presenting a polished, consistent billing statement enhances your business reputation.

- Accuracy: A set structure minimizes the chance of errors or omitted information.

- Improved cash flow: A clear, prompt request for payment helps ensure quicker processing of funds.

How a Structured Billing System Supports Your Business

- Ensures clarity: Properly formatted documents reduce confusion, outlining all work completed, fees, and payment terms.

- Simplifies financial tracking: Having all bills in one format makes it easier to track outstanding payments and monitor cash flow.

- Facilitates tax reporting: Well-documented financial records make it easier to manage taxes and report income during filing.

- Reduces disputes: When clients receive clear, consistent billing, the likelihood of disagreements is reduced.

How to Create a Professional Billing Statement

Creating a clear and professional payment request is a key part of maintaining smooth business operations. A well-structured document not only helps clients understand what services were provided but also ensures timely payments. By including all necessary details in a systematic format, you can avoid confusion and streamline your cash flow.

Key Information to Include

- Your contact details: Always include your name or business name, address, and phone number for easy communication.

- Client information: List the client’s name, company (if applicable), and contact details to ensure the document reaches the right person.

- Description of services: Clearly explain the work performed, including dates, tasks, and any materials used. Be specific to avoid misunderstandings.

- Payment terms: Specify the agreed-upon amount, payment due date, and accepted payment methods.

- Additional fees: If applicable, outline any extra charges such as late fees or additional services provided beyond the initial agreement.

- Unique reference number: This helps both you and the client track the transaction in case of future questions or disputes.

Steps to Creating a Payment Request

- Choose a format: Decide if you will create the document manually, use software, or rely on an online service.

- Fill in the details: Enter the required information as mentioned above, ensuring all sections are clear and accurate.

- Review and double-check: Before sending, review the document for any mistakes, such as incorrect figures or missing information.

- Send the document: Deliver the document to the client promptly, ensuring they have everything they need to make a payment.

Key Elements of a Professional Payment Request

A well-crafted payment request is essential for ensuring clarity and minimizing disputes. It should contain all the necessary details that both you and your client need to understand the terms of payment. Including the right information in a structured manner not only enhances your professionalism but also ensures that your financial transactions are processed smoothly.

Essential Components of a Payment Request

- Business information: Your name or business name, contact address, phone number, and email. This allows the client to easily reach out if needed.

- Client details: Include the full name, company name (if applicable), address, and phone number of the client or recipient of the payment.

- Unique reference number: A specific number for each payment request helps both parties track and reference the document easily.

- Description of work: Provide a clear, concise breakdown of the services or tasks completed, including dates and specific details to avoid confusion.

- Amount due: Clearly state the total amount owed, ensuring it matches the agreed-upon price for the work completed.

- Payment terms: Include payment due date, accepted payment methods, and any late fees or penalties if applicable.

- Tax information: If applicable, include tax rates, tax numbers, or any deductions to ensure compliance with local regulations.

Formatting and Presentation Tips

- Professional layout: Use a clean, organized structure to ensure easy readability. Clear headings and sections are essential.

- Consistent fonts and styles: Choose legible fonts and sizes, and avoid cluttering the document with unnecessary graphics or text.

- Accurate calculations: Double-check all figures for accuracy before sending to prevent any issues with payments.

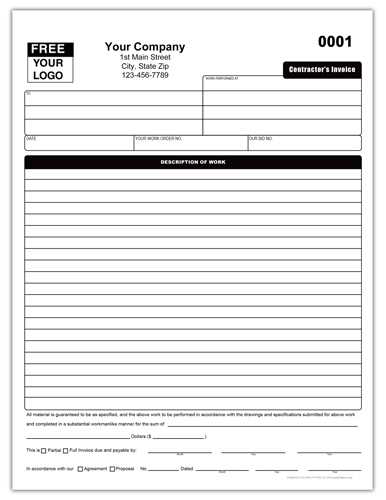

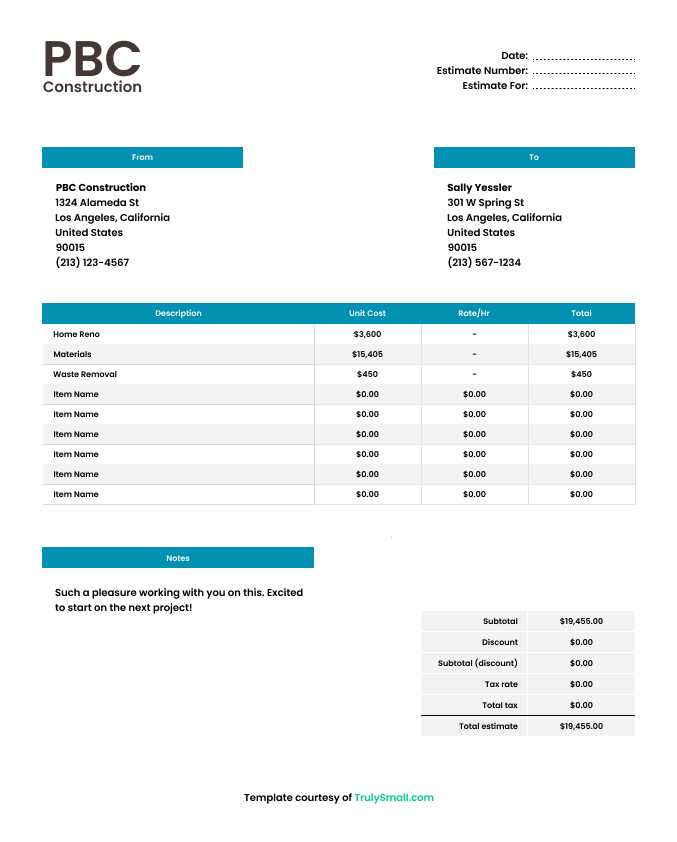

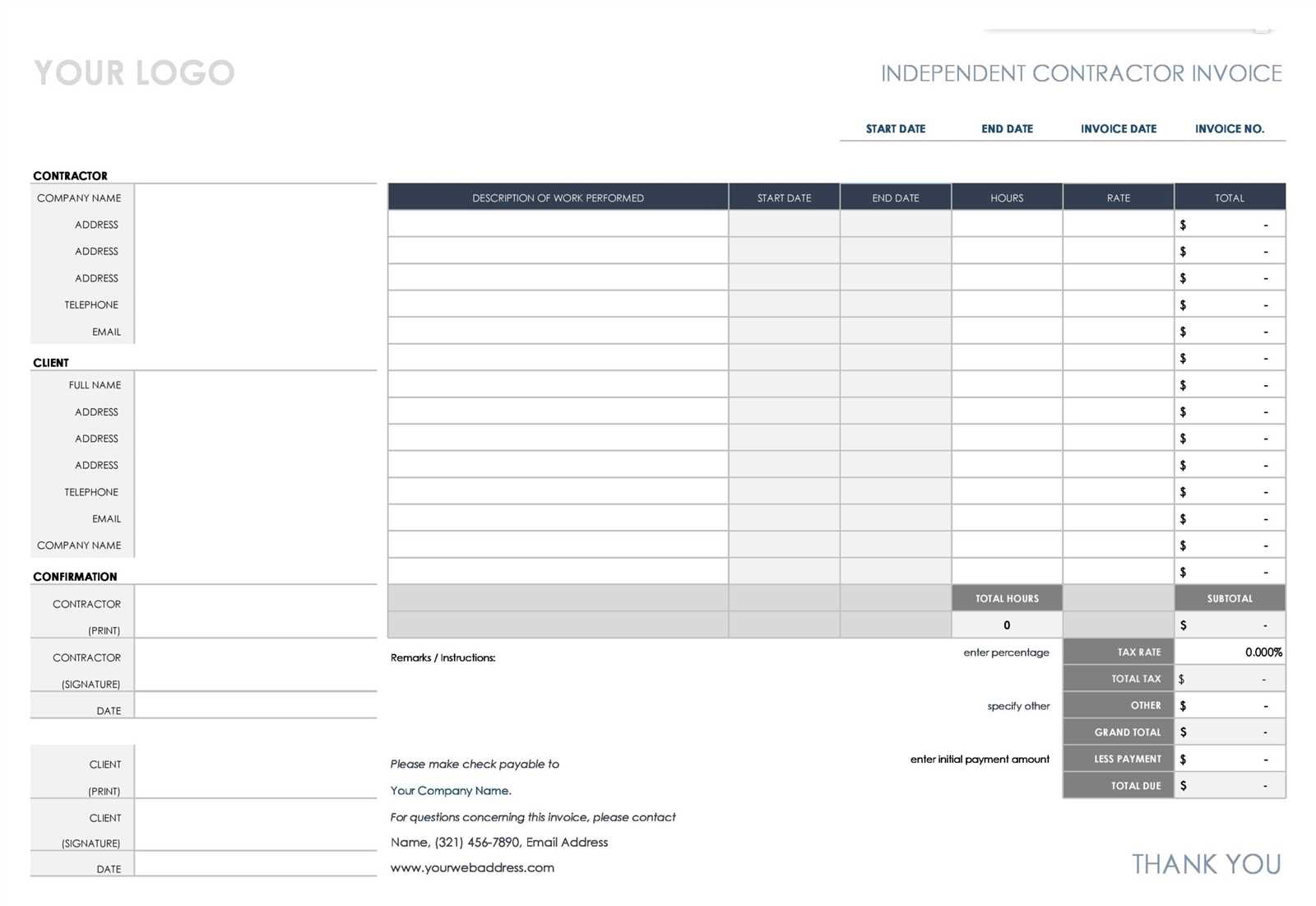

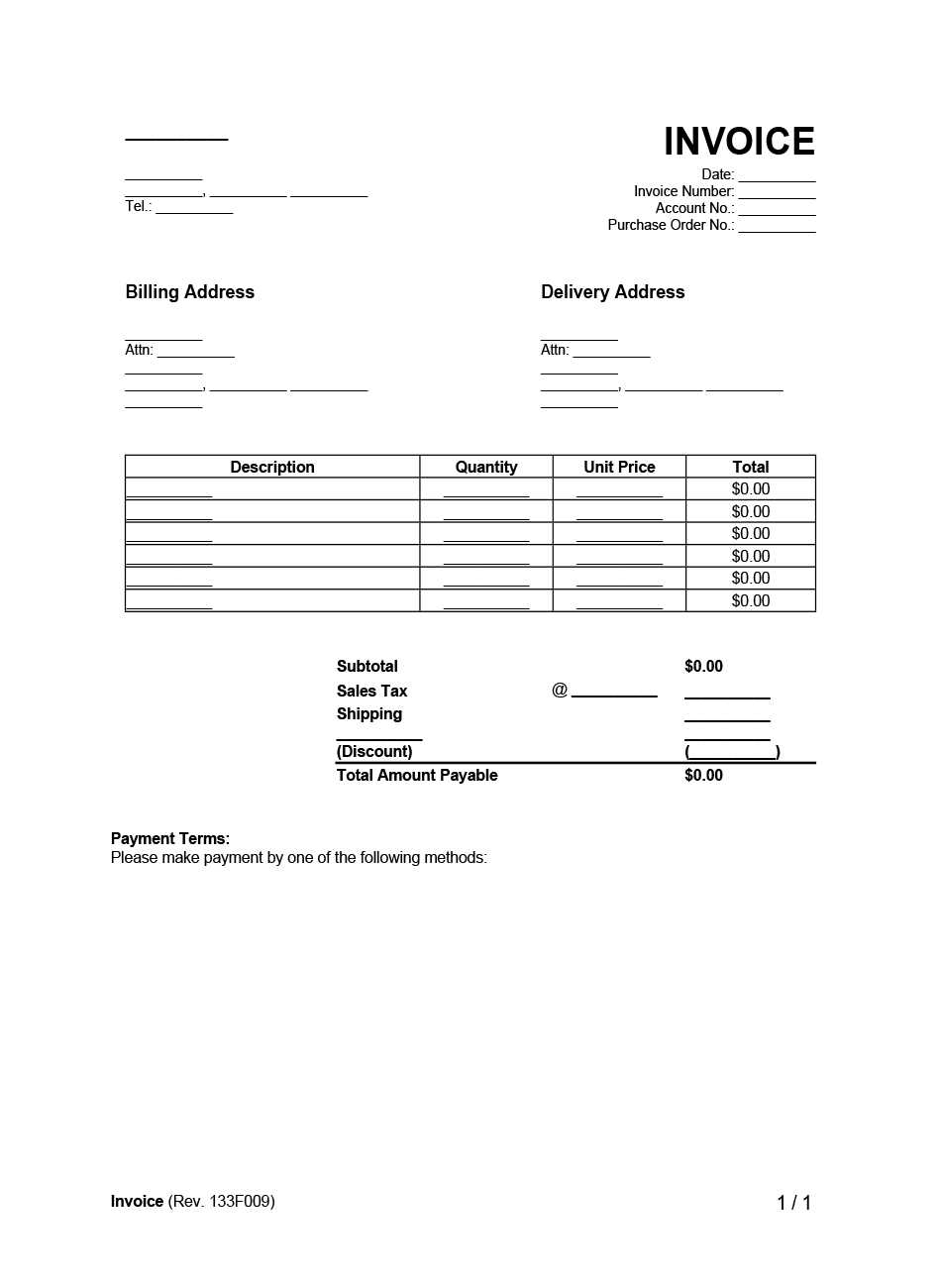

Free Billing Documents for Professionals

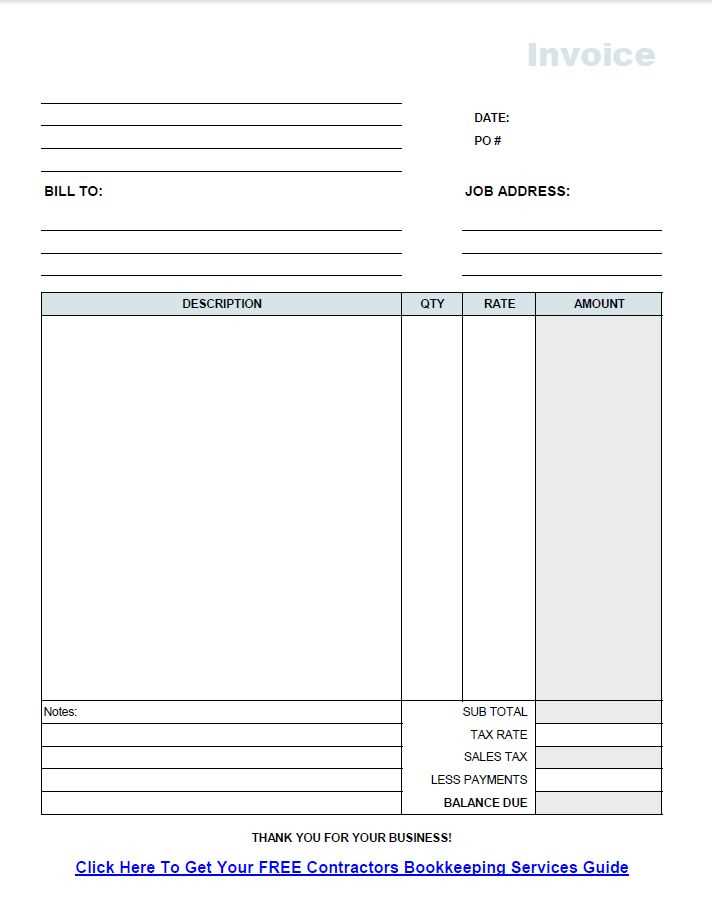

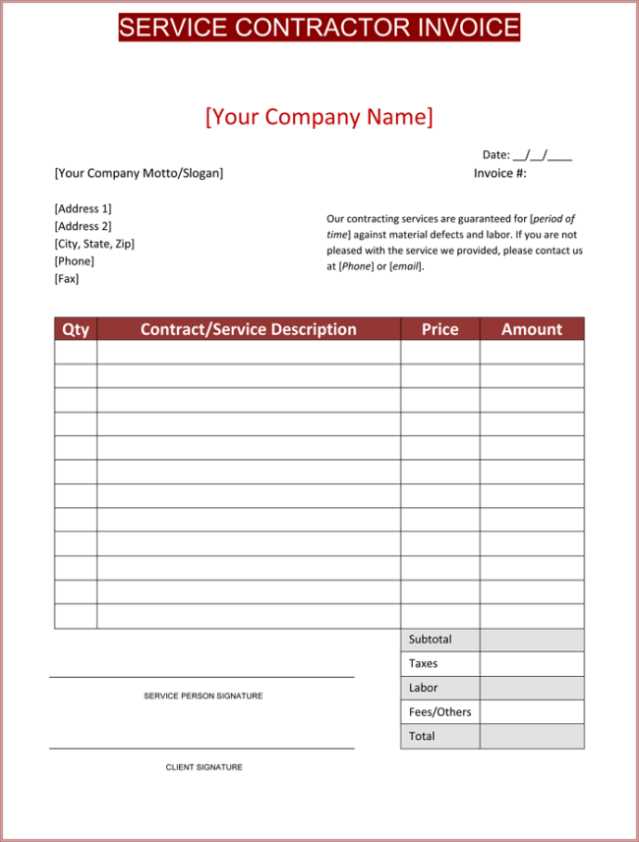

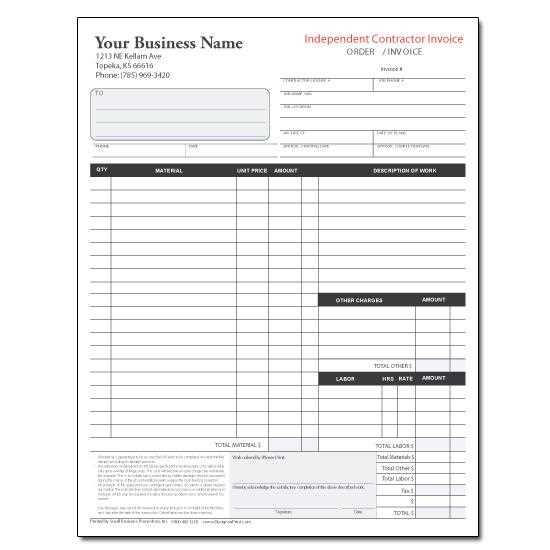

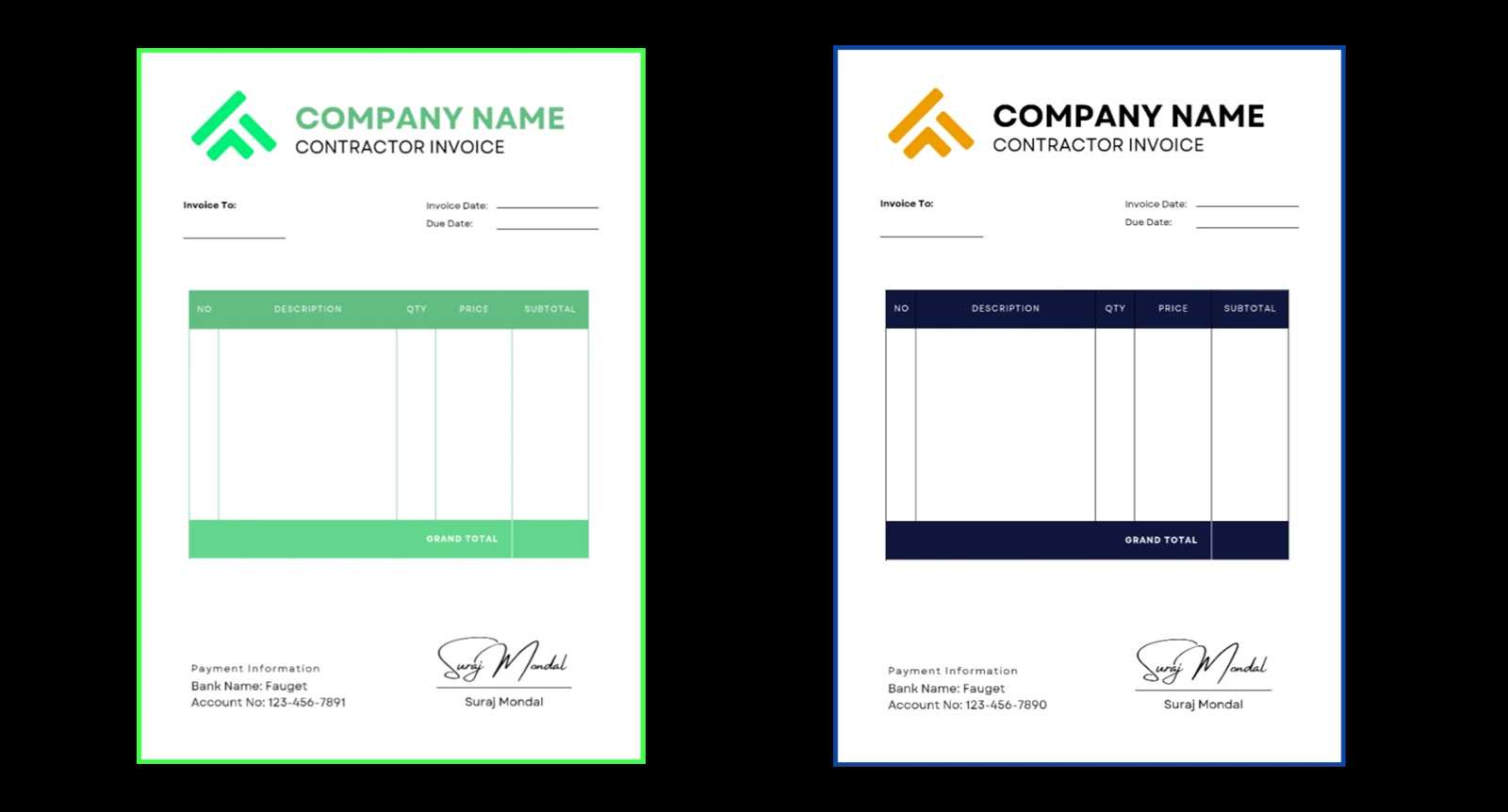

For professionals offering services or completing projects, having access to ready-made billing documents can save time and ensure consistency. Free resources are available that allow you to easily generate well-structured payment requests without the need for complicated software or design skills. These pre-made options allow you to focus on your work rather than spending time on administrative tasks.

These free billing documents often come in a variety of formats, from basic designs to more detailed versions that include additional sections for taxes, payment terms, and late fees. Many online platforms offer downloadable versions that are customizable, enabling you to adjust them to fit your specific needs. Using these resources ensures that your payment requests are both professional and clear.

Here are some common places where you can find free billing documents:

- Online invoicing platforms: Websites like Zoho, Wave, or PayPal offer free tools to create and send professional payment requests.

- Document-sharing websites: Platforms such as Google Docs or Microsoft Office provide free downloadable and editable billing forms that can be personalized to suit your needs.

- Freelance resource sites: Many sites catering to freelancers and small business owners offer free templates designed specifically for independent professionals.

By using these resources, you can streamline your payment process and maintain a professional image, without investing in expensive software or spending time on complex designs. Choose the one that best suits your business style and requirements, and customize it to reflect the work you’ve completed for each client.

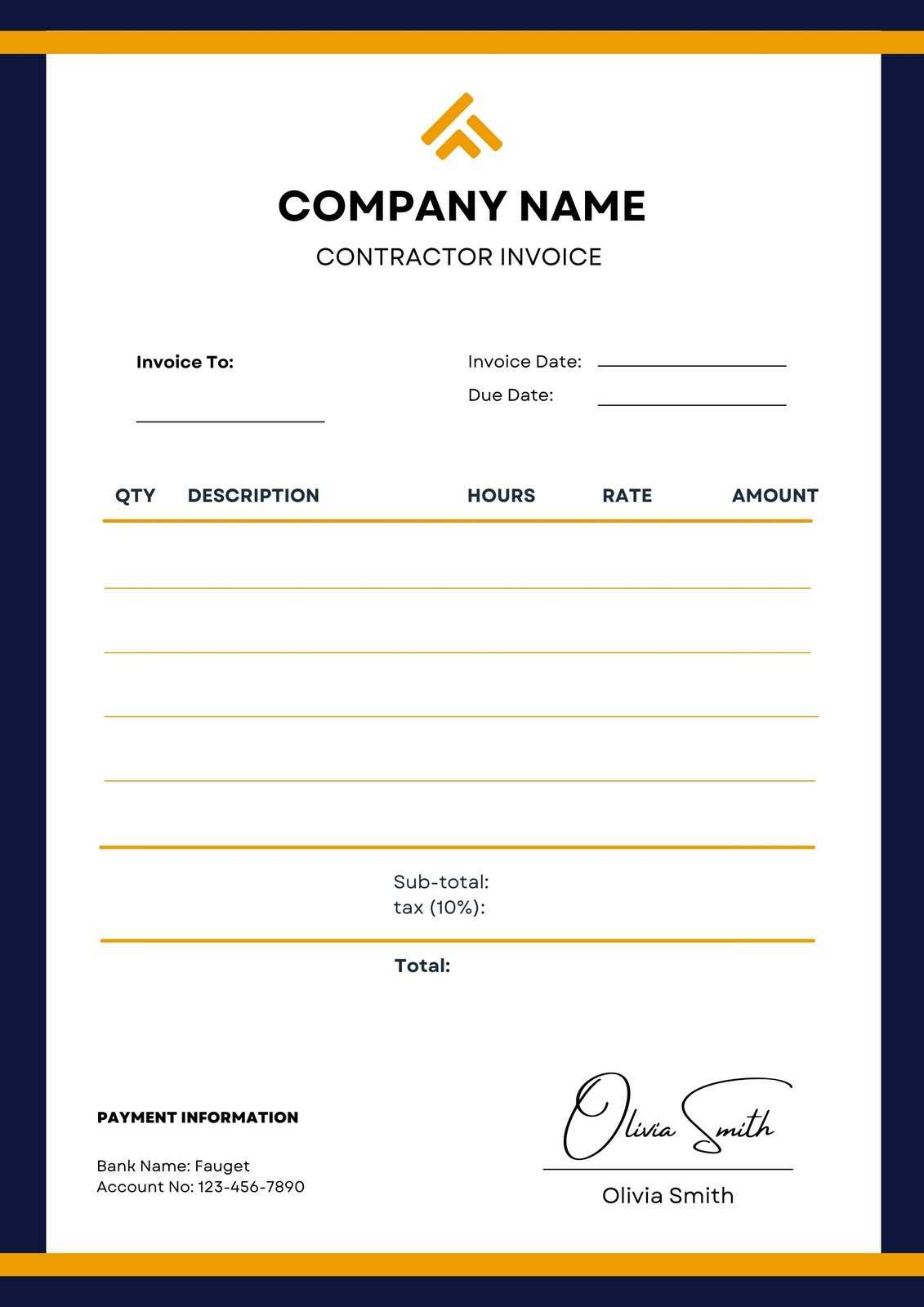

Customizing Your Billing Document

Tailoring your payment request to fit your specific business needs is an essential step in maintaining professionalism and clarity with clients. A customized billing document ensures that all the necessary information is included, while also reflecting your brand’s identity. By making adjustments to the layout, content, and style, you can create a document that aligns with your business operations and client expectations.

Important Customization Options

- Branding: Add your business logo, color scheme, and contact details at the top to make the document feel more personal and professional.

- Service details: Adjust the sections where you describe the work completed. Include specific job details or hourly rates if applicable, so clients clearly understand what they are paying for.

- Payment terms: Modify payment terms to suit your agreements with clients. Specify due dates, penalties for late payments, or any discounts for early payment.

- Currency and tax information: Make sure the correct currency is displayed and tax information is included if relevant to your region or business type.

- Additional notes: Add a section for any special instructions or personalized messages, such as “Thank you for your business” or reminders about future work.

Tools for Customizing Your Documents

- Online software: Platforms like Zoho, QuickBooks, or FreshBooks allow you to easily create and customize payment requests with user-friendly design options.

- Word processing programs: Microsoft Word and Google Docs provide customizable documents with flexible formatting options to suit your style.

- Spreadsheet software: Programs like Excel or Google Sheets let you create a structured payment document with formulas for automatic calculations, saving time on manual entries.

By customizing your payment requests, you create a more personalized experience for your clients, which can help strengthen business relationships and ensure that all financial transactions run smoothly.

Best Software for Professional Billing

When it comes to managing payments and creating professional billing documents, using the right software can save time and reduce errors. Specialized tools offer features that simplify the entire process, from generating payment requests to tracking overdue amounts. These programs can automate many aspects of the billing cycle, providing a more efficient and reliable way to handle finances.

Top Software Options for Creating Billing Documents

| Software | Key Features | Best For |

|---|---|---|

| QuickBooks | Customizable templates, expense tracking, and tax calculations. | Small business owners and freelancers who need full financial management. |

| Zoho Books | Cloud-based invoicing, recurring billing, and real-time expense tracking. | Business owners looking for an affordable, all-in-one accounting solution. |

| FreshBooks | User-friendly interface, time tracking, and project management features. | Freelancers and service-based businesses that need easy invoicing and project management. |

| Wave | Free invoicing, accounting, and receipt scanning. | Small businesses or independent professionals on a budget. |

| Harvest | Time tracking, team collaboration, and detailed reporting. | Service providers and consultants who need to track billable hours and expenses. |

Choosing the Right Tool

When selecting software, consider the specific needs of your business. If you require detailed financial reports or multi-client billing, an all-in-one accounting solution like QuickBooks might be best. For those focused on simple, straightforward billing, a more user-friendly platform like FreshBooks or Wave could be the ideal choice. Regardless of the tool, the goal is to streamline your billing process, reduce errors, and enhance the professionalism of your financial communications.

How to Avoid Common Billing Mistakes

Creating accurate and professional payment requests is crucial for maintaining smooth financial transactions. Small errors in your billing documents can lead to confusion, delayed payments, and damaged relationships with clients. By paying attention to detail and following best practices, you can avoid common pitfalls and ensure that your billing process is efficient and effective.

Common Mistakes to Avoid

- Missing or incorrect contact information: Always double-check that both your and your client’s contact details are accurate. Mistakes here can cause confusion or delay payment processing.

- Ambiguous descriptions of services: Be specific and clear when describing the work done. Vague descriptions can lead to misunderstandings or disputes about what was actually provided.

- Failure to include payment terms: Always specify when payment is due, accepted methods of payment, and any late fees. Not doing so can create confusion about when and how clients should pay.

- Forgetting to add taxes: If applicable, ensure that taxes are included and calculated correctly. Omitting them can cause financial issues or lead to legal complications.

- Incorrect amounts or calculations: Double-check all figures for accuracy, including hourly rates, total amounts, and discounts. Incorrect calculations can result in delayed payments and erode trust.

- Not numbering documents: Failing to assign a unique reference number to each payment request can create confusion for both you and your client, especially when tracking payments or resolving disputes.

Tips for Ensuring Accuracy

- Use automated tools: Many invoicing platforms offer automated calculations and pre-set templates that reduce the chance of manual errors.

- Review before sending: Always take a final look at your billing document before sending it to ensure all the details are correct and complete.

- Ask for feedback: If a client mentions an error or misunderstanding, use it as an opportunity to improve your future documents and billing practices.

By avoiding these common mistakes and implementing simple checks, you can create clear, accurate, and professional payment requests that help maintain strong business relationships and ensure timely payments.

Tracking Payments with Billing Documents

Efficiently tracking payments is crucial for maintaining cash flow and ensuring that you get paid on time for the work completed. By using a structured approach to record and monitor each transaction, you can easily identify outstanding amounts and avoid missing payments. A well-organized billing document makes it easier to track the status of each payment and provides clarity in case of any disputes.

Using a consistent format allows you to maintain a clear record of each job, including payment due dates, amounts received, and any pending balances. You can also set up a simple system to track payments as they are made, ensuring that all financial transactions are up to date and easily accessible.

How to Track Payments Effectively

| Client Name | Amount Due | Amount Paid | Payment Date | Balance | Status |

|---|---|---|---|---|---|

| Client A | $500 | $500 | 2024-10-05 | $0 | Paid |

| Client B | $800 | $400 | 2024-10-07 | $400 | Partial Payment |

| Client C | $300 | $0 | 2024-10-10 | $300 | Unpaid |

This simple table helps track payments, display amounts still owed, and identify the current status of each transaction. By updating this document as payments are made, you can stay on top of your finances and follow up with clients promptly if any payments are overdue.

Using a tracking system like this helps ensure that your records are up to date and organized, allowing for better financial planning and timely follow-ups on outstanding balances.

Setting Payment Terms in Your Billing Document

Clearly defined payment terms are essential for ensuring timely payments and avoiding misunderstandings with clients. By specifying when and how you expect to be paid, you set the foundation for a smooth financial transaction. Establishing clear terms protects both parties and ensures that expectations are aligned from the start of the project.

Payment terms should include critical details such as the due date, accepted payment methods, and any penalties for late payments. When these terms are clearly outlined, clients know exactly what is expected of them and when, reducing the chances of delays or disputes. Additionally, including such information helps reinforce professionalism and builds trust with clients.

Key Components to Include

- Due Date: Clearly state when the payment is due. Common terms include “Net 30” (30 days from the date of the document) or a specific calendar date.

- Accepted Payment Methods: Indicate which forms of payment you accept, such as bank transfers, credit cards, checks, or online payment platforms like PayPal.

- Late Fees: Specify any late fees that may apply if the payment is not received by the due date. This can act as an incentive for timely payments.

- Early Payment Discounts: If you offer discounts for early payments, make sure to note the percentage and timeframe, such as “2% discount if paid within 10 days.”

- Partial Payments: If clients are allowed to make partial payments, outline how much is due upfront and when subsequent payments are expected.

Best Practices for Setting Terms

- Be clear and concise: Keep the terms simple and easy to understand. Avoid overly complicated language that could confuse clients.

- Stay consistent: Use the same terms for all clients to avoid confusion and ensure fairness.

- Communicate up front: Discuss payment terms before starting a project to ensure both parties agree on the terms before work begins.

By setting clear and professional payment terms, you ensure that clients know exactly when and how to pay, and you can avoid unn

How to Handle Late Payments as a Professional

Late payments can disrupt cash flow and create unnecessary stress, but they are a common challenge for many professionals. Whether you’re working on a one-time project or an ongoing service, knowing how to handle overdue payments can help maintain positive client relationships while ensuring you’re compensated for your work. Having a clear system in place for managing late payments is essential for protecting your business interests.

When payments are overdue, it’s important to stay professional and calm. Taking proactive steps to address the situation can lead to a faster resolution, while preserving your reputation as a reliable and fair business. Here are some strategies for dealing with late payments effectively.

Steps to Handle Overdue Payments

- Send a friendly reminder: As soon as the payment deadline has passed, send a polite reminder to the client. Sometimes, clients simply forget, and a gentle nudge is all that’s needed.

- Contact the client directly: If the payment is still not received after the reminder, reach out to the client via phone or email. Have a conversation about the overdue payment and try to understand if there are any issues.

- Offer flexible payment options: If the client is facing financial difficulties, consider offering a payment plan. This shows flexibility and understanding, while still ensuring you get paid.

- Apply late fees: If your original payment terms included late fees, don’t hesitate to enforce them. Be transparent about the charges and remind the client of your agreed-upon terms.

- Consider suspending services: For ongoing projects, it may be necessary to suspend further work until the payment is received. Make sure this is clearly communicated in advance to avoid surprises.

When to Take Further Action

- Send a formal demand letter: If previous attempts to collect the payment have failed, sending a formal letter outlining the amount due and potential legal consequences can prompt the client to act.

- Consider legal action: As a last resort, if the payment is significantly overdue and all other options have been exhausted, consulting with a lawyer or taking legal action may be necessary.

By following these steps, you can address late payments effectively while maintaining professionalism. Always ensure that your payment terms are clearly stated upfront, and take proactive measures to prevent delays in the future.

Billing Document Format: Pre-made vs. Manual Creation

When managing payments for your services, there are two main approaches to creating billing documents: using pre-designed formats or crafting them manually. Both methods have their advantages and drawbacks, depending on your business size, the complexity of your work, and the level of personalization required. Understanding the differences between these options can help you decide which method best suits your needs.

Pre-made formats, typically available online or through software platforms, provide a structured and streamlined way to generate payment requests quickly. These options often include essential sections and automatic calculations, which can save time and reduce the risk of errors. On the other hand, manually creating documents allows for full customization, giving you complete control over the content and design. However, this method may be more time-consuming and prone to mistakes if not managed carefully.

Advantages of Using Pre-made Formats

- Efficiency: Pre-designed documents can be filled out and sent quickly, reducing the time spent on administrative tasks.

- Consistency: Using the same format for all your payment requests helps maintain a professional and consistent appearance.

- Accuracy: Automated calculations and predefined fields help minimize errors in pricing and totals.

- Customization: Many pre-made formats can be adjusted to include your branding, payment terms, and other business-specific details.

Benefits of Manual Document Creation

- Full control: Manual creation allows for complete flexibility in formatting, structure, and content, enabling you to tailor each document to specific client needs.

- Personal touch: Handcrafted billing documents can convey a more personalized, bespoke experience for clients.

- No dependency on external tools: With manual creation, you don’t rely on any software or online platforms, which might require subscriptions or internet access.

- Adaptability: If you have unique business needs or complex projects, you can easily modify your documents without being restricted by a predefined structure.

Ultimately, the choice between using pre-made formats and manually creating documents depends on your business requirements and preferences. Pre-designed options are perfect for speed and efficiency, while manual creation offers more control and customization. For many professionals, a combination of both methods may work best depending on the task at hand.

Printable vs. Digital Billing Documents

When it comes to managing payment requests, one key decision professionals face is whether to use physical or digital documents. Both methods offer distinct benefits and drawbacks, depending on the needs of the business and the preferences of the client. Understanding the differences between printed and electronic billing documents can help you choose the best option for your workflow and ensure smooth financial transactions.

Printable documents are often favored for clients who prefer physical paperwork or for those who require signed copies for record-keeping. On the other hand, digital documents offer the convenience of faster delivery and easier storage, reducing the need for physical space and the risks of lost paperwork. Choosing between the two depends largely on the nature of your business, client expectations, and how you want to handle document management.

Advantages of Printable Billing Documents

- Physical record: Printed documents can be signed and physically archived for future reference, providing a tangible record of transactions.

- Client preference: Some clients may prefer receiving paper copies for their own filing or due to internal processes that require physical documentation.

- Formal presentation: Printed documents can sometimes feel more official, especially if delivered in person or mailed with a cover letter.

- Legal requirements: In certain industries or jurisdictions, printed documents may be necessary for compliance or tax purposes.

Benefits of Digital Billing Documents

- Faster delivery: Sending documents electronically allows for instant delivery, speeding up the billing process and reducing wait times.

- Eco-friendly: Digital documents eliminate the need for paper, ink, and postage, making them a more environmentally friendly option.

- Cost-effective: There are no costs associated with printing, paper, or mailing, which can be especially beneficial for businesses operating on tight margins.

- Easy storage and access: Digital files can be easily stored in the cloud or a local drive, allowing for quick access and better organization without physical clutter.

- Security and backup: Electronic files can be backed up and encrypted, providing additional security compared to physical documents that can be lost or damaged.

Ultimately, the choice between printable and digital documents depends on your specific needs and how your clients prefer to receive and manage their payment requests. Many professionals opt for a combination of both methods, using digital documents for convenience and printable copies when a physical record is needed.

How to Send Payment Requests Professionally

Sending well-crafted payment requests is a key element of maintaining professionalism in business transactions. It’s not just about the accuracy of the details, but also how you communicate your payment expectations. A professional approach to sending these documents helps reinforce trust with clients, ensures clarity about due amounts, and encourages timely payments. Whether you’re using email, physical mail, or online platforms, following best practices will elevate the way you manage financial exchanges.

When sending payment requests, the presentation and tone matter just as much as the content. Using a formal and polite tone, ensuring the document is clear and complete, and delivering it through the proper channels are all part of maintaining a professional image. Additionally, timely follow-ups and providing the right amount of detail help avoid confusion and build long-term business relationships.

Steps to Send Payment Requests Professionally

- Ensure accuracy: Double-check the details such as amounts, payment terms, and deadlines. Mistakes can harm your credibility and lead to delays in payment.

- Use a clear subject line: If sending via email, use a subject line like “Payment Due for [Service/Project Name]” to make the purpose of the communication clear immediately.

- Choose the right medium: For businesses or clients who prefer digital communication, sending via email or an online platform is often the fastest and most efficient. For clients who prefer hard copies, mailing the document may be the best choice.

- Attach supporting documentation: If needed, include relevant project details, timesheets, or contracts as attachments. This ensures transparency and clarity about the work completed.

- Be polite and professional: Even if the payment is overdue, maintain a courteous tone in your communication. Phrases like “I kindly remind you” or “Please let me know if there are any issues” help maintain a positive relationship.

- Send reminders: If payment isn’t received by the due date, send a polite follow-up reminder. Give the client enough time to process the payment before following up again.

Best Practices for Email Communication

- Personalize the message: Use the client’s name and specific details about the project in your email to make the communication feel more personal and less transactional.

- Include payment details: Ensure th

Legal Considerations for Payment Requests

When creating and sending payment requests, there are several legal aspects that should be carefully considered to ensure compliance and protect both parties involved. These considerations include adhering to tax regulations, ensuring proper documentation of work, and understanding the laws surrounding late payments. Taking the time to familiarize yourself with these legal requirements not only helps prevent potential disputes but also promotes professionalism and transparency in your business practices.

For professionals, including necessary legal details in every payment request is essential. This includes having the correct business information, payment terms, and applicable taxes outlined clearly. Failing to follow legal requirements can result in delays, non-payment, or legal complications, so it’s important to stay informed and accurate.

Key Legal Elements to Include

- Business Information: Ensure your name, business name, address, and contact information are clearly stated. This helps establish your business identity and is necessary for legal and tax purposes.

- Contractual Terms: Clearly outline the agreed-upon terms, including payment deadlines, the scope of work, and any specific conditions. This reduces the chance of misunderstandings and potential legal issues.

- Applicable Taxes: Make sure to include any sales tax or VAT that applies to your services, depending on your jurisdiction. This ensures compliance with local tax laws and helps clients understand the full payment amount.

- Late Fees and Penalties: If your payment terms include late fees, make sure they are clearly outlined in your documents. Legal language should specify the amount or percentage charged for overdue payments and the consequences of non-payment.

Legal Protections for Both Parties

- Record Keeping: Keep copies of all documents related to payment requests, including communications with clients, contracts, and any payment receipts. This can be critical in case of disputes.

- Jurisdiction Clauses: Include a clause specifying the jurisdiction under which disputes will be handled. This ensures clarity regarding where legal matters will be resolved if a situation arises.

- Professional Contracts: Always have a clear written agreement in place before starting any project. A contract helps clarify expectations, deliverables, and payment schedules, offering legal protection for both parties.

By understanding and incorporating these legal considerations into your payment requests, you can protect your business and ensure smoother financial transactions with client

How to Organize Payment Requests for Tax Time

When tax season arrives, organizing all your financial documents is crucial for accurate reporting and avoiding potential issues with tax authorities. For freelancers and small business owners, managing payment records throughout the year ensures that you have everything you need when it’s time to file your taxes. Proper organization can help streamline the process, reduce stress, and ensure that you don’t miss any deductions or payments that need to be reported.

Keeping track of the payment requests you’ve sent and the amounts you’ve received is essential for accurate income reporting. It’s also important to categorize these records in a way that aligns with tax regulations. Whether you use physical files, spreadsheets, or digital accounting software, a consistent and methodical approach will help you stay on top of your finances and make tax filing much easier.

Steps to Organize Payment Records

- Keep detailed records: Maintain copies of all payment requests and receipts. Include the date, the amount requested, the client’s information, and any additional terms such as payment due dates and late fees.

- Track payments received: Record when payments are made and keep a log of the amounts and methods used. This helps ensure that you report the correct income and avoid discrepancies.

- Use categories for easy tracking: Organize your documents by month, client, or project. This will make it easier to find specific records and track how much income you’ve earned from each source.

- Keep digital backups: Use accounting software or cloud storage to keep digital copies of all your records. Digital backups provide an added layer of security in case physical documents are lost or damaged.

Utilizing Accounting Software

- Automate record-keeping: Accounting software can automatically track payments and generate reports, saving you time and effort during tax season.

- Generate reports: Many software options allow you to generate year-end summaries, which can simplify tax preparation and give you a clear view of your income and expenses.

- Sync with bank accounts: Linking your accounting software with your business bank accounts can ensure that your income and expenses are recorded accurately in real-time.

By staying organized and keeping accurate records of all your transactions, you can reduce the risk of errors when filing your taxes and ensure that your financial situation is clear and transparent. This proactive approach will help make tax time smoother and more manageable.