Invoice Template Consulting Services for Streamlined Billing

In today’s fast-paced business environment, maintaining efficient financial operations is crucial for long-term success. A well-organized billing structure ensures that companies receive payments on time, reduces the risk of errors, and improves client satisfaction. However, many organizations still rely on outdated or overly complex methods, which can lead to confusion and delays.

By focusing on streamlined solutions for creating and managing financial documents, businesses can simplify this process and free up valuable time. Customizing and refining these essential documents not only enhances accuracy but also adds a professional touch to client communications. With the right approach, businesses can build a system that aligns perfectly with their operational needs.

Adopting tailored solutions can make a significant difference in the way a company handles its billing cycle. From improving consistency to enabling faster transactions, these tools play a pivotal role in reducing administrative burden and fostering better client relationships. The right framework empowers businesses to focus on growth rather than getting bogged down in paperwork.

Invoice Template Consulting Overview

Efficient financial documentation is essential for businesses of all sizes. The process of creating, managing, and optimizing these key business records can be overwhelming without the proper guidance and tools. By seeking professional advice, companies can significantly improve the way they handle their billing processes, ensuring accuracy, consistency, and compliance with industry standards.

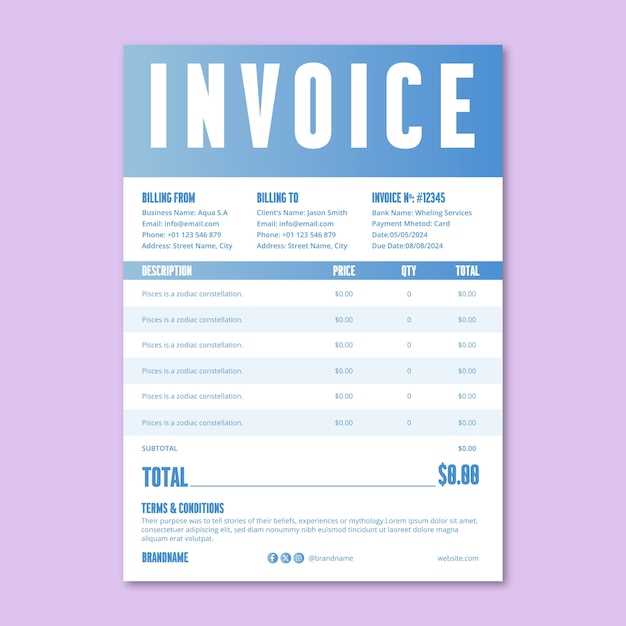

Customized solutions provide businesses with the flexibility to align their financial documents with specific needs and preferences. Experts in this field offer tailored strategies, focusing on creating streamlined, user-friendly systems that help reduce errors and save time. By incorporating best practices and modern design principles, businesses can develop clear and professional records that make a lasting impression on clients.

With the right approach, businesses can move away from generic formats and adopt a structure that enhances both functionality and aesthetics. This process is not just about simplifying operations; it’s also about improving the overall experience for both clients and internal teams. Through personalized strategies, companies can achieve greater efficiency while maintaining the integrity of their financial reporting.

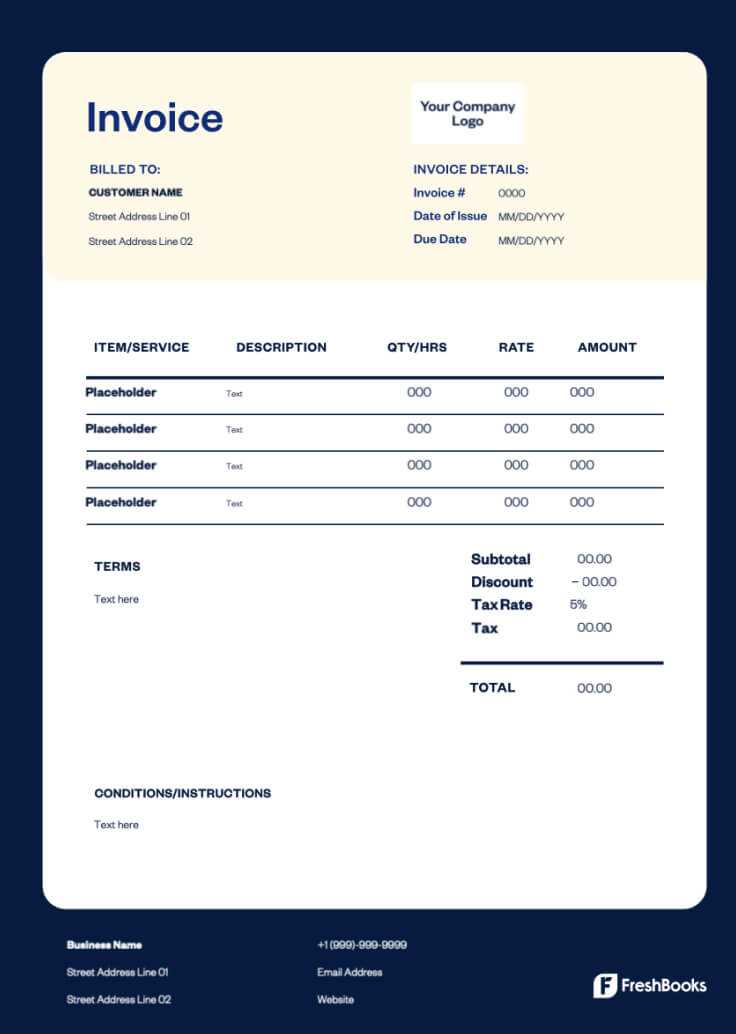

Why Businesses Need Custom Invoice Templates

For any business, maintaining clear, consistent, and professional financial records is essential for smooth operations and long-term success. Using generic billing formats often leads to confusion, errors, and inefficiencies that can affect cash flow and client relationships. Customizing these critical documents to fit the specific needs of a business not only improves accuracy but also enhances the overall image and credibility of the company.

Improved Accuracy and Efficiency

Personalized solutions allow businesses to create documents that reflect their unique operational needs. By removing unnecessary fields and adding relevant ones, companies can streamline their billing process. This reduction in complexity minimizes the risk of errors and ensures that every detail is captured correctly, resulting in faster and more efficient transactions.

Enhanced Professional Image

Customizing your financial documentation demonstrates a commitment to quality and professionalism. A tailored approach reflects the brand identity of the business and helps create a stronger connection with clients. Clear, well-structured records leave a positive impression and show that the business is organized and attentive to detail, which can ultimately lead to greater trust and loyalty.

Benefits of Professional Invoice Template Design

When businesses invest in expert-designed financial documents, they gain more than just functionality. A professionally crafted billing structure not only enhances operational efficiency but also boosts the company’s image. By focusing on aesthetics, usability, and clarity, businesses can experience a wide range of advantages that go beyond simple paperwork management.

- Increased Accuracy: A well-organized design reduces the chance of mistakes, ensuring that all details are correctly displayed and easy to review.

- Improved Cash Flow: Clear and concise records speed up the billing process, making it easier for clients to understand charges and remit payment promptly.

- Consistency in Branding: Custom financial documents that match a company’s branding help establish a professional, cohesive identity across all client interactions.

- Time Savings: A streamlined, intuitive structure saves time for both clients and internal teams, reducing the need for revisions and follow-up communications.

- Better Client Relationships: Professional-looking records help foster trust and reliability, promoting smoother, long-term business relationships.

By adopting well-designed, tailored solutions, companies can not only increase their efficiency but also present themselves as reliable and organized to their clients. This investment pays off in smoother transactions and improved business growth in the long run.

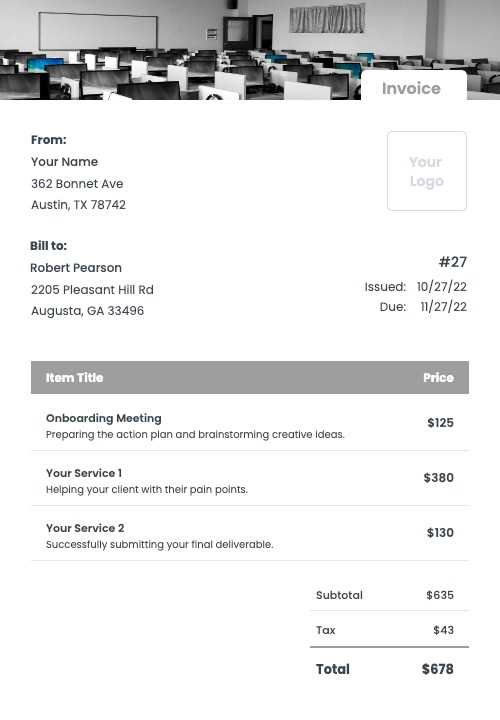

How to Choose the Right Invoice Template

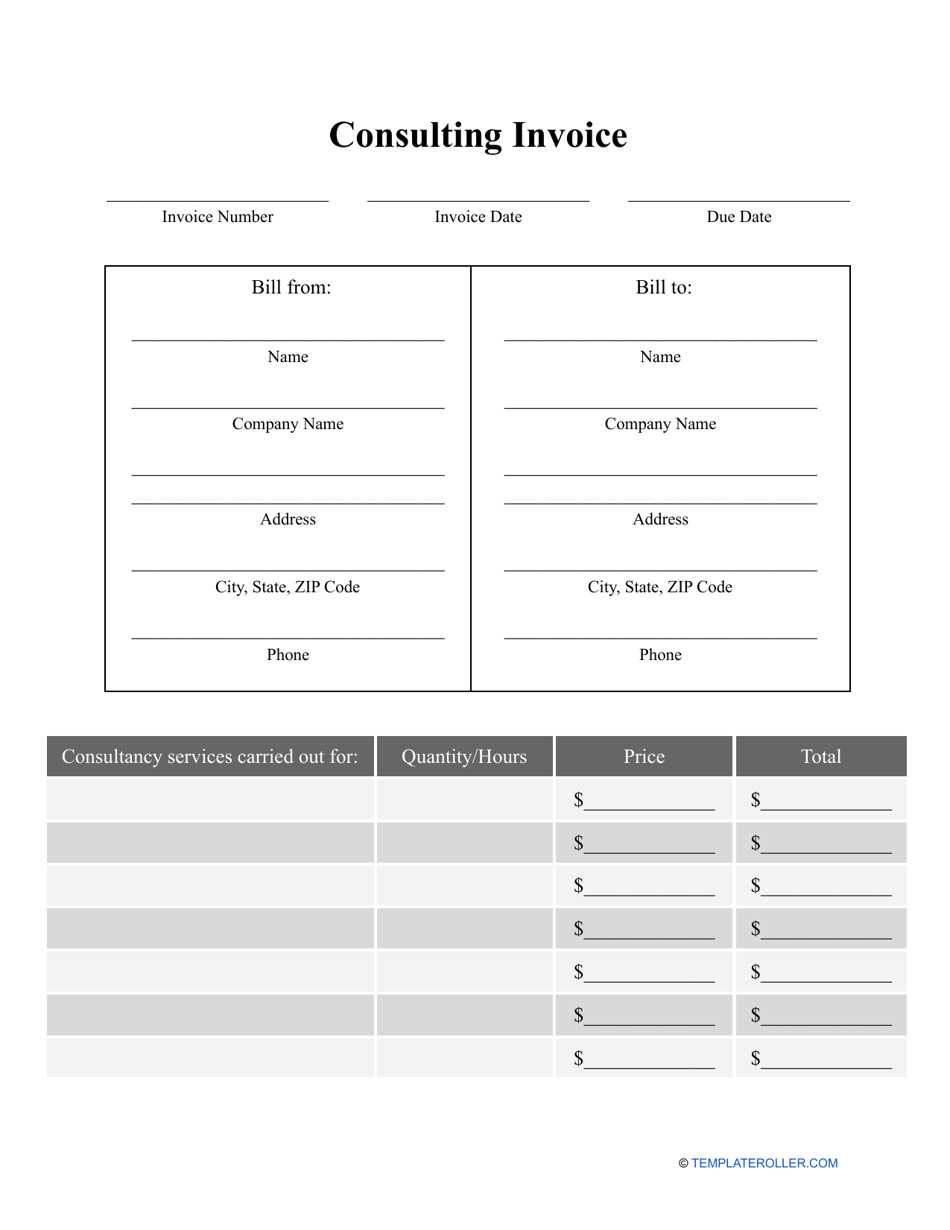

Selecting the right financial document design is a crucial step for any business aiming to streamline its billing process. A well-chosen format not only simplifies internal workflows but also enhances communication with clients. When making a decision, it’s important to consider factors such as functionality, visual appeal, and alignment with the business’s needs.

First, identify the specific requirements of your business. Consider the volume of transactions, the complexity of the services or products offered, and any industry-specific details that should be included. A simple and clear structure might work best for a small business, while larger organizations may require more detailed records to account for various departments or payment terms.

Next, ensure that the chosen design is adaptable to your accounting software and integrates seamlessly with other tools you use. The ability to automatically generate and track records will save time and reduce the likelihood of human error. Finally, don’t overlook the importance of a professional, polished look. Customizing the design to reflect your brand identity will help build trust and maintain consistency in client communications.

Common Mistakes in Invoice Creation

Creating accurate and professional financial documents is essential for maintaining smooth operations and healthy cash flow. However, many businesses make critical mistakes when drafting these records, which can lead to confusion, delayed payments, and strained client relationships. Understanding these common pitfalls and how to avoid them is key to improving your financial processes.

Missing or Incorrect Information

One of the most frequent errors businesses make is leaving out essential details or entering incorrect information. Missing dates, client names, or payment terms can lead to confusion and delays in payment. Always ensure that every field is complete and accurate before sending out any document.

Unclear Payment Instructions

Failure to provide clear and concise payment instructions can result in delayed transactions. It’s important to specify the accepted payment methods, due dates, and any late fees clearly to avoid misunderstandings.

| Common Mistake | Consequences | Prevention Tips | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Missing Client Information | Confusion, delayed payments | Double-check client details before finalizing | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Incorrect or Inconsistent Pricing | Loss of trust, disputes over charges | Ensure pricing matches contracts or agreements | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Ambiguous Payment Terms | Late payments, misunderstandings |

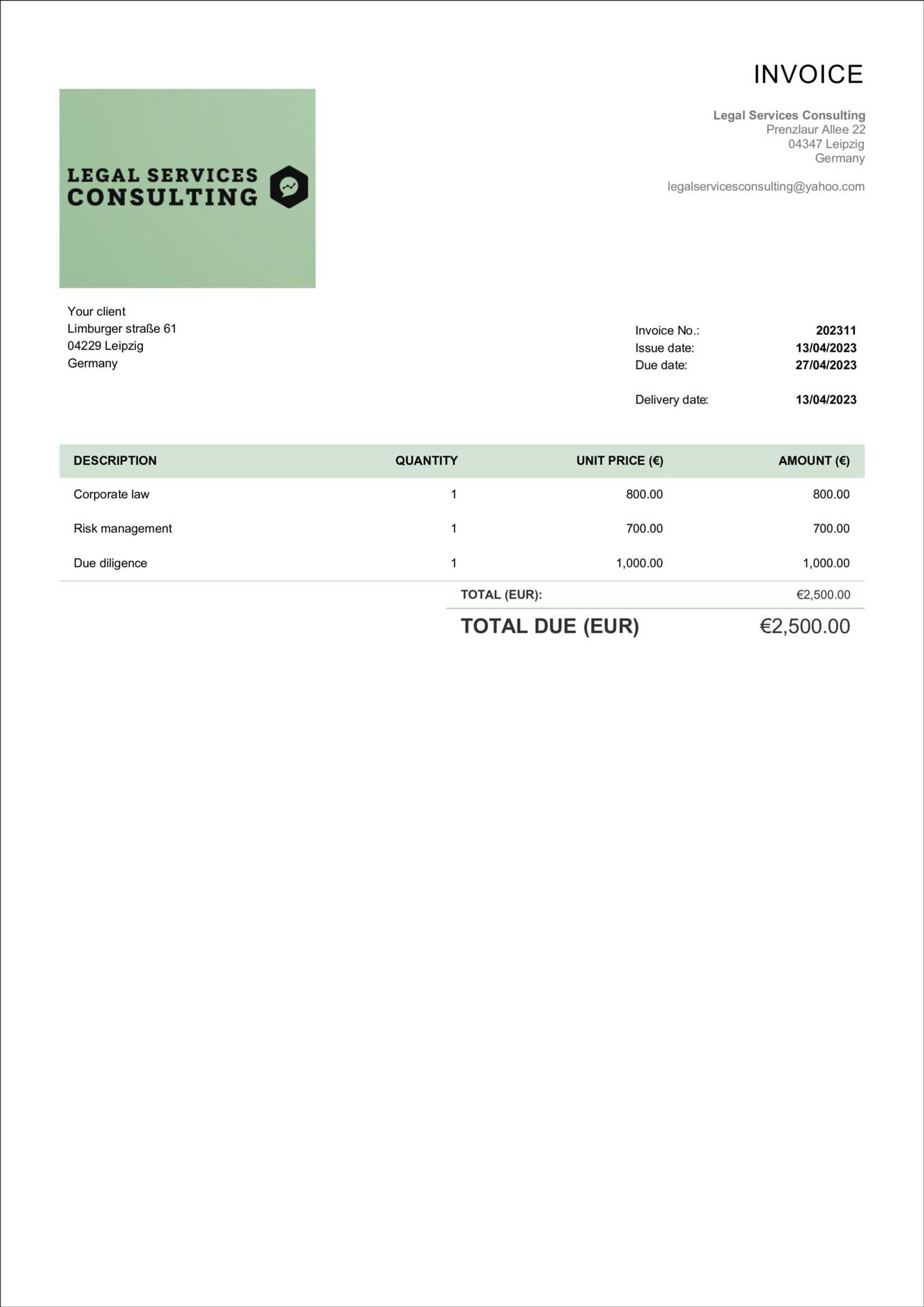

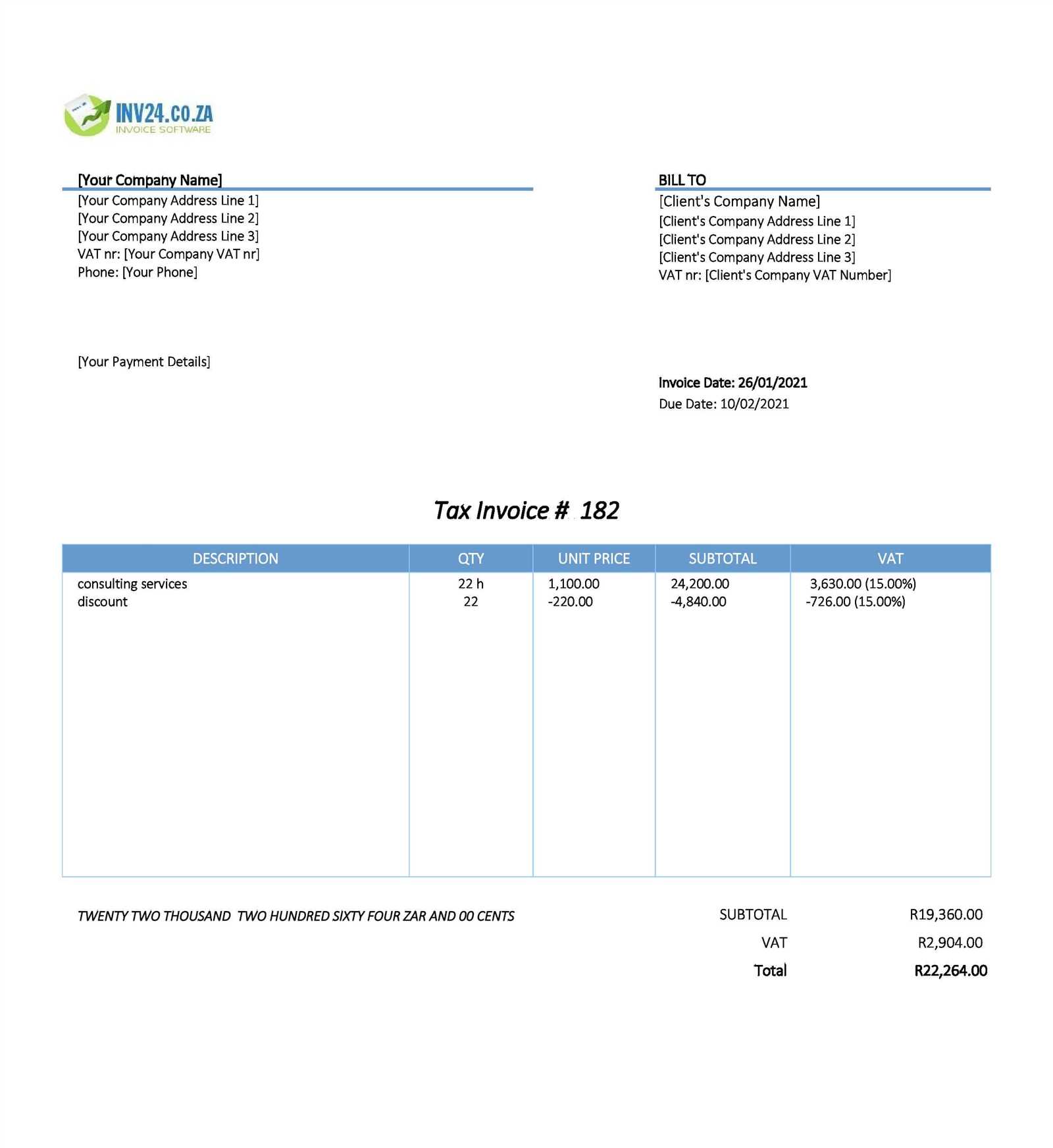

| Legal Element | Purpose | Example |

|---|---|---|

| Business Information | Identification of the issuing business | Company name, address, and tax ID |

| Payment Terms | Clear guidelines on when and how payment should be made | Net 30, due on receipt |

| Tax Information | Compliance with local tax laws | Sales tax rate or VAT number |

| Legal Disclaimers | Clarify late fees or penalties | Late payment subject to 2% monthly fee |

Industry-Specific Compliance

Different industries may have additional legal requirements that must be incorporated into financial documentation. For instance, in the construction sector, contracts might dictate how certain costs are outlined, or in healthcare, specific billing codes and patient information might be required. Customizing the design to meet both general and industry-specific legal standards helps businesses avoid legal complications and maintain a professional, compliant standing.

By ensuring that your financial documents meet all legal requirements, businesses can protect themselves from potential disputes, enhance their reputation, and ensure smoother, more efficient transactions with clients and partners.

How Invoice Templates Improve Cash Flow

Effective financial documentation plays a critical role in managing a company’s cash flow. By creating streamlined and professional records, businesses can ensure quicker payment cycles, reduce administrative overhead, and avoid common errors that might delay financial transactions. Well-structured formats that include all necessary details enable clients to process payments faster, which ultimately leads to improved liquidity and more predictable cash flow.

Faster Payments

When records are clear, concise, and properly formatted, clients are more likely to pay promptly. A clean, professional layout reduces confusion and ensures that all necessary information is readily available, making it easier for clients to understand the payment requirements. This clarity helps to avoid delays due to questions or disputes, leading to faster processing times.

- Clearly stated due dates ensure that clients know exactly when payment is expected.

- Transparent pricing eliminates confusion about what is being charged.

- Payment methods and details are easy to find, reducing friction in the payment process.

Reduced Errors and Disputes

Using a consistent and tailored structure minimizes the chance of errors in billing, which can lead to disputes or delayed payments. With all details laid out in a structured manner, businesses can avoid miscalculations, missing information, and unclear terms. This reduces the time spent on follow-ups, clarifications, and corrections, allowing companies to receive payments faster and more efficiently.

- Accurate records prevent confusion and unnecessary delays.

- Clear

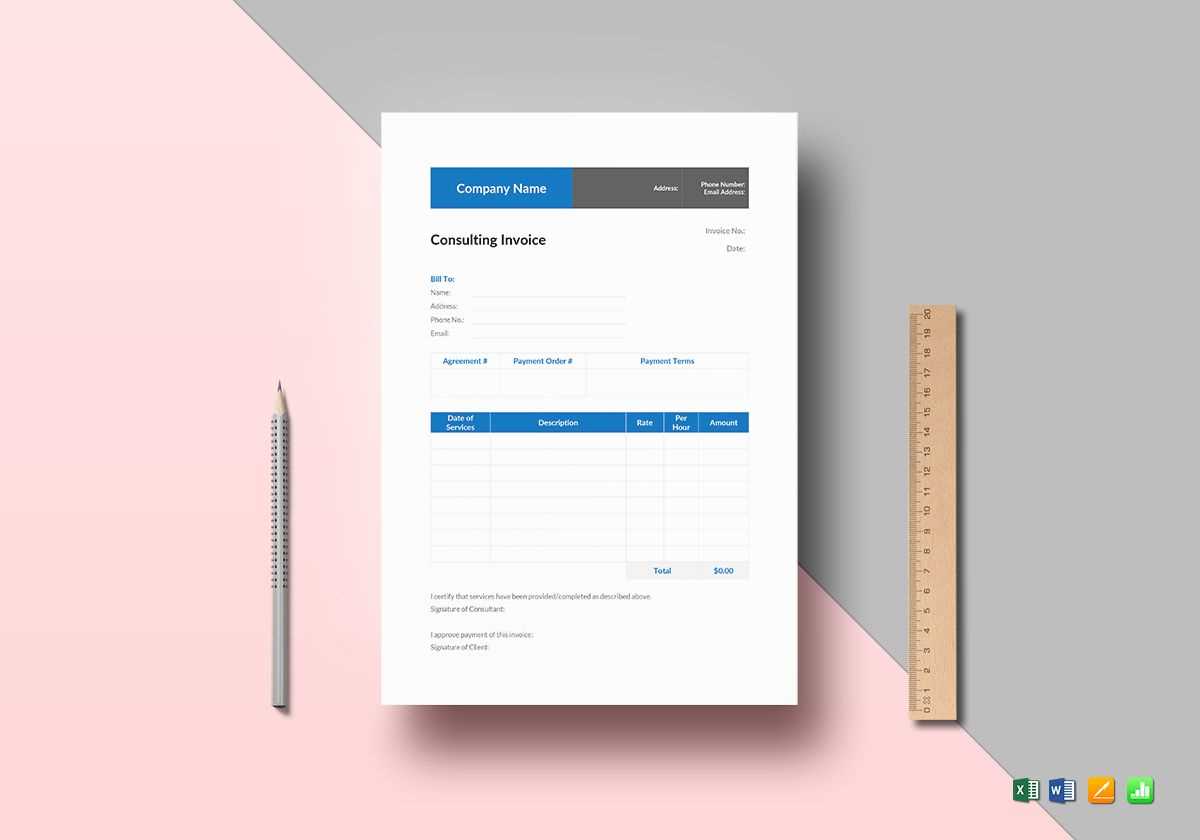

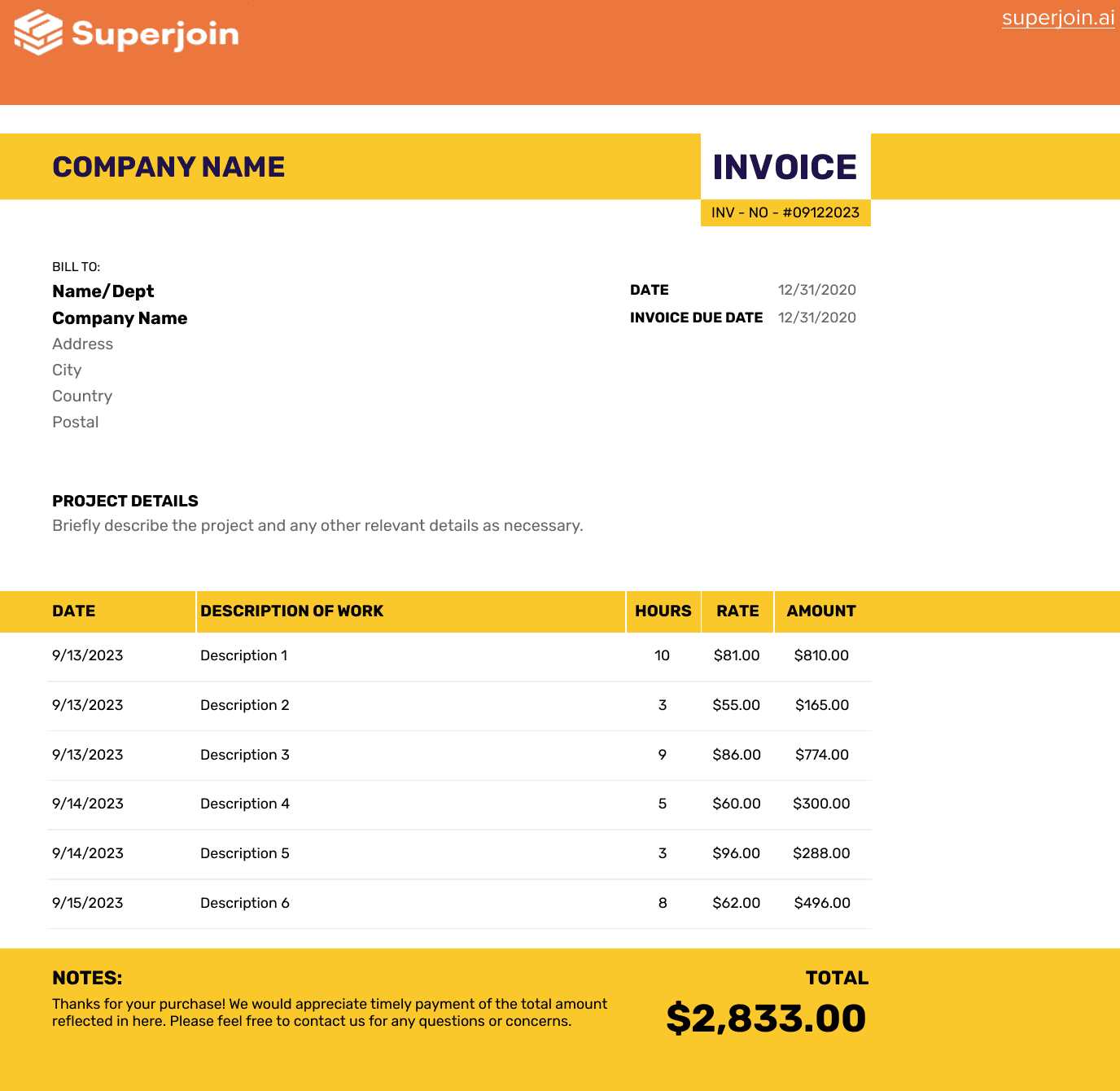

Designing User-Friendly Invoice Layouts

A well-designed financial document is not only about aesthetics but also functionality. An intuitive and user-friendly layout can make a significant difference in how easily clients understand charges and make payments. The key to an effective design lies in simplicity, clarity, and logical organization. When key information is easy to find, clients are more likely to process payments quickly, and businesses can reduce follow-up queries or disputes.

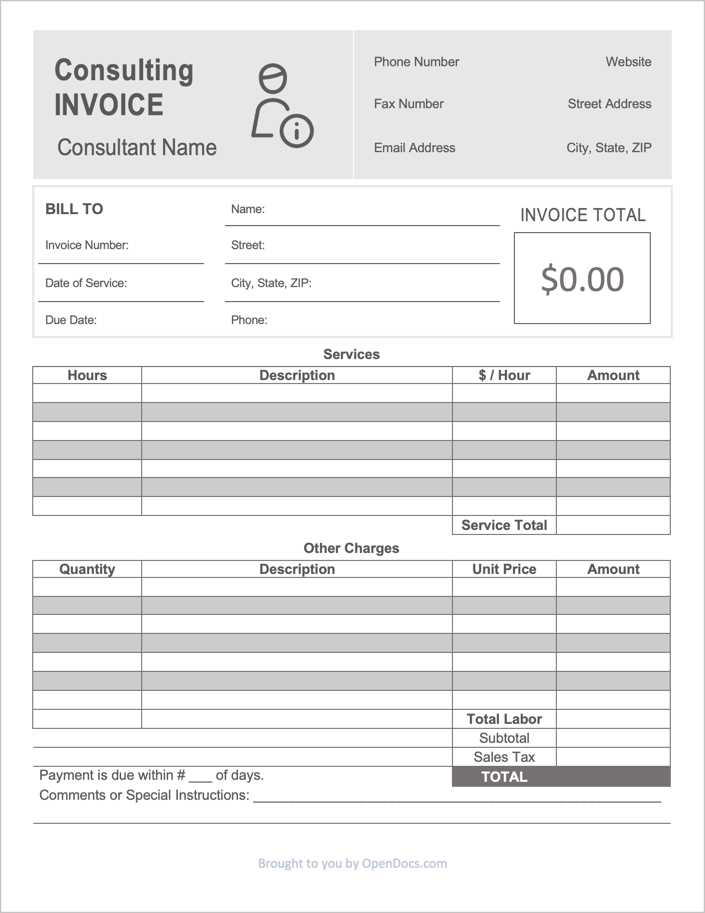

Key Elements of a User-Friendly Design

The layout should prioritize essential details, using clear sections and labels to avoid confusion. The design should be simple but informative, enabling both the client and business to quickly locate the necessary information. This approach ensures that the document is not only aesthetically pleasing but also practical and efficient for both parties.

Design Element Purpose Example Clear Structure Helps users find essential details quickly Header, body, footer sections Consistent Font and Colors Improves readability and keeps the document visually appealing Standard font type and size, limited color palette Logical Grouping of Information Ensures related data is grouped for easy reference Client info in one section, itemized charges in another Clear Payment Instructions Reduces ambiguity and ensures easy payment processing Payment methods, due date, late fees Design Tips for Better Client Experience

Incorporating a few design tips can elevate the user experience. For example, grouping related information, such as client details and payment instructions, in clearly defined sections can make it easier for clients to process the information. Furthermore, using readable fonts and proper spacing between sections can significantly improve the document’s overall usability.

By keeping the design clear and structured, businesses can reduce confusion, improve payment speed, and foster better relationships with clients. A simple yet well-organized document can help streamline the financial process and ensure a smoother transaction every time.

Tips for Managing Invoice Templates Effectively

Effectively managing financial documentation is crucial for any business, as it ensures consistency, accuracy, and efficiency in the billing process. With a well-organized system, businesses can avoid errors, speed up payment cycles, and maintain professional communication with clients. Proper management allows companies to quickly generate necessary documents, track outstanding payments, and update information as needed without wasting time.

Tip Description Benefit Centralize Your Files Store all documents in one place for easy access and organization. Improves efficiency and reduces the chance of misplaced files. Use Version Control Ensure updates and changes are tracked to avoid confusion. Helps maintain consistency and clarity across all documents. Automate Where Possible Use software tools to automate the generation and tracking of documents. Saves time and reduces human error in the billing process. Set Up Standard Formats Establish a consistent structure to be used across all records. Ensures uniformity and professionalism in every transaction. Keep Templates Updated Regularly review and update formats to reflect any business or legal Automation Tools for Invoice Templates

Automation tools have become a crucial part of modern business operations, particularly when it comes to streamlining administrative tasks such as creating financial documents. These tools help reduce the time spent on repetitive tasks, increase accuracy, and ensure consistency across all records. By automating the creation and tracking of documents, businesses can improve workflow efficiency, reduce human error, and speed up the overall billing process.

Key Features of Automation Tools

Automation tools offer a wide range of features that can enhance your document management process. Here are some of the most valuable functionalities:

- Automatic Data Entry: Automatically fills in client details, pricing, and other relevant information from your database, saving time and reducing errors.

- Recurring Billing: Set up automated invoicing for regular clients or subscriptions, reducing manual effort for repeat transactions.

- Customizable Workflows: Tailor the automation process to your business needs, ensuring that each document aligns with your specific requirements.

- Payment Tracking: Integrates with payment systems to automatically track and update the status of each transaction.

- Real-time Notifications: Sends reminders to clients or alerts to your team when payments are overdue or actions are required.

Benefits of Using Automation Tools

Incorporating automation tools into your billing process offers numerous advantages:

- Time Efficiency: Automates repetitive tasks, allowing employees to focus on more strategic activities.

- Improved Accuracy: Reduces the likelihood of human error in data entry and calculations.

- Consistency:

Integrating Invoices with Accounting Software

Integrating financial records with accounting software is a powerful way to streamline business operations. By linking the creation and management of financial documents with your accounting system, you can automate data entry, ensure accurate financial reporting, and save valuable time. This integration helps maintain a unified view of your business’s finances, making it easier to track payments, generate financial reports, and stay on top of your cash flow.

Benefits of Integration

When your financial documentation system is integrated with accounting software, several key benefits arise, including:

- Seamless Data Syncing: Automatic syncing between financial records and accounting systems ensures that all information is up-to-date and accurate.

- Faster Reconciliation: Integration makes it easier to reconcile accounts by automatically categorizing and matching transactions.

- Reduced Errors: With data entry handled automatically, there is less room for human error, ensuring that your financial reports are more reliable.

- Real-Time Insights: Integration allows you to access real-time financial data, improving decision-making and providing a clearer picture of your company’s financial health.

- Improved Efficiency: By eliminating the need to manually transfer data between systems, businesses can save time and reduce administrative overhead.

Steps to Successfully Integrate Systems

Successfully integrating your financial documents w

Best Practices for Invoice Template Security

Ensuring the security of financial documents is a critical aspect of running any business. Protecting sensitive information such as payment details, business data, and client information from unauthorized access or tampering is essential for maintaining trust and compliance. By implementing security measures for your financial records, you can safeguard your business from fraud, data breaches, and potential legal issues. Below are some best practices to follow when securing your documents.

Key Security Measures

To maintain the integrity and confidentiality of your financial documents, consider the following security practices:

- Use Strong Passwords: Ensure that all documents are password-protected with strong, unique passwords to prevent unauthorized access.

- Encrypt Files: Encrypt documents before sharing or storing them to ensure that even if intercepted, the data cannot be read.

- Limit Access: Only allow authorized personnel to access or modify the records, reducing the risk of internal security breaches.

- Use Secure Storage: Store sensitive financial documents in a secure cloud service with strong encryption protocols or on a protected local server.

- Regular Backups: Perform regular backups of all important records to avoid data loss in case of hardware failure or cyberattacks.

- Monitor Access Logs: Regularly review who has accessed the financial documents and track any unauthorized or suspicious activity.

Additional Tips for Enhanced Security

Aside from basic protective measures, there are additional steps you can take to further bolster security:

- Multi-Factor Authentication (MFA): Implement multi-factor authenti

Tracking Payments with Invoice Templates

Efficiently tracking payments is essential for maintaining a healthy cash flow and ensuring that all transactions are properly recorded. By leveraging well-structured financial records, businesses can easily monitor outstanding balances, keep track of payments received, and identify overdue amounts. A good payment tracking system simplifies this process, enabling businesses to stay organized and take proactive measures to follow up on any outstanding payments.

One of the main advantages of a structured document system is the ability to track each payment’s status in real time. This can help businesses ensure that no payment goes unnoticed and avoid discrepancies between what’s owed and what’s been received.

Methods for Effective Payment Tracking

To ensure efficient payment tracking, consider the following methods:

- Include Clear Payment Terms: Specify due dates, payment methods, and late fees upfront. This clarity helps clients understand their obligations and minimizes delays.

- Mark Payment Status: Indicate whether a payment is “Paid,” “Pending,” or “Overdue” on each document. This helps track the payment progress easily.

- Automate Payment Reminders: Set up automated reminders for clients with overdue balances to help speed up collections and reduce manual follow-ups.

- Record Partial Payments: In cases where clients make partial payments, make sure to update the document to reflect the remaining balance due.

- Integrate with Accounting Software: Integrate your financial record-keeping system with accounting software to automatically update payment statuses and maintain accurate financial reports.

Benefits of Tracking Payments Effectively

Proper payment tracking provides several key benefits for businesses:

- Better Cash Flow Management: By staying on top of payments, businesses can predict cash flow more accurately and make better financial decisions.

- Reduced Risk of Late Payments: Tracking payment status enables businesses to act quickly on overdue payments and minimize the risk of financial strain.

- Improved Client Relationships: Sending timely reminders and keeping clear records can improve communication with clients and encourage timely payments.

- Accurate Financial Reporting: Regularly updating payment statuses ensures that financial reports are always up to date, helping with budgeting, tax reporting, and audits.

By implementing these strategies for tracking payments, businesses can improve their financial management, reduce outstanding debts, and maintain strong relationships with clients, ultimately leading to more consistent revenue streams.

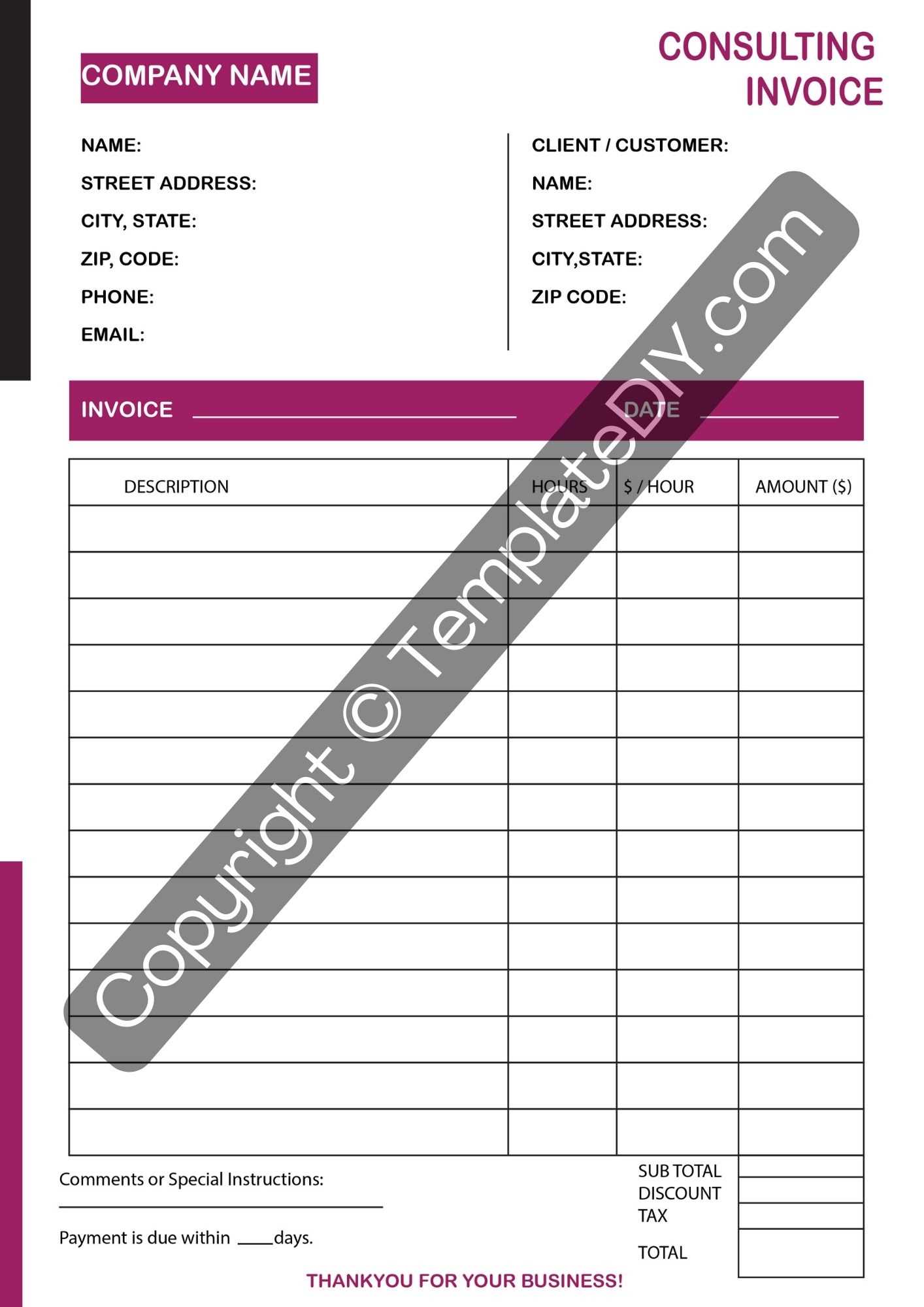

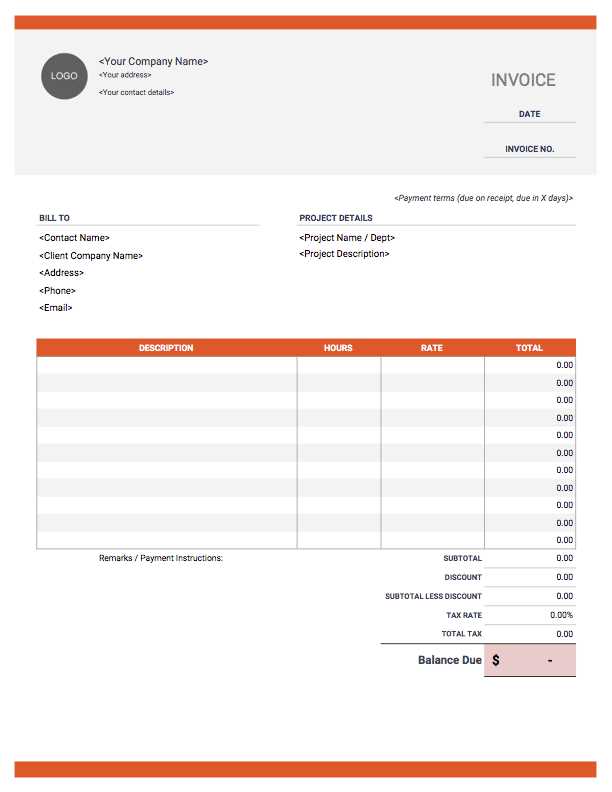

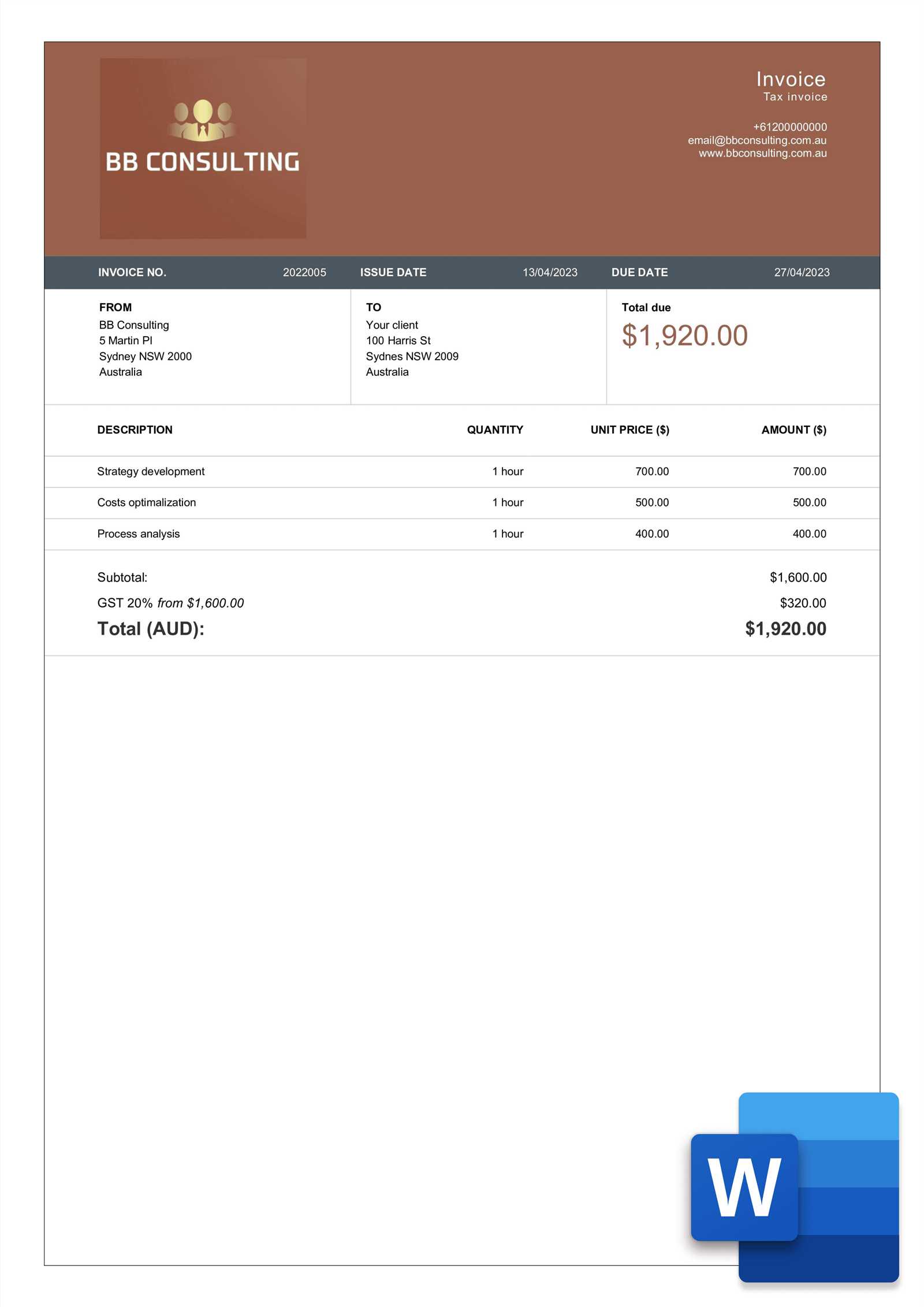

How to Make Invoices Look Professional

Presenting financial documents in a professional manner is essential for maintaining trust and credibility with clients. A well-designed record not only reflects the professionalism of your business but also makes it easier for clients to understand the details of their transactions. By following a few simple design principles and ensuring clarity, you can ensure that your documents project a polished, organized image that reinforces your brand identity.

Key Elements for Professional-Looking Records

To create polished and clear financial documents, focus on the following key elements:

Element Description Why It Matters Clear Branding Include your logo, business name, and contact information prominently. Helps clients identify your business quickly and reinforces brand recognition. Structured Layout Use a clean and easy-to-read layout with clearly defined sections such as items, amounts, and totals. Improves readability and helps clients navigate the document easily. Consistent Fonts and Colors Choose professional fonts and a cohesive color scheme that aligns with your brand. Creates a visually appealing document that is consistent with your branding and looks polished. Precise Information Ensure that all the necessary details are included, such as dates, payment terms, and breakdowns of charges. Provides clarity and transparency, reducing the chances of confusion or disputes. Additional Tips for Creating Professional Documents

- Use High-Quality Paper or Digital Format: Whether physical or digital, use high-quality materials or formats for better presentation.

- Maintain Consistency: Ensure all documents follow a similar design and format to create a uniform appearance across all communications.

- Double-Check for Errors: Proofread the document to ensure there are no typos or inaccuracies that could damage your professional image.

- Offer Multiple Payment Methods: Include various payment options to make the process easier for clients and reduce delays in payments.

By incorporating these elements into your financial documents, you can ensure that every communication with clients looks polished and professional. This not only enhances the perception of your business but also helps in maintaining clear, organized, and transparent financial transactions.

Optimizing Invoice Templates for Mobile Devices

In today’s fast-paced business environment, it’s essential to ensure that financial records are easily accessible and readable on mobile devices. With more professionals accessing documents on smartphones and tablets, optimizing the design and layout for smaller screens has become a necessity. Ensuring that your documents are mobile-friendly improves client experience and helps streamline payment processing, especially for on-the-go users.

Design Considerations for Mobile-Friendly Documents

To ensure that your financial records look great on mobile devices, consider the following design principles:

Design Element Recommendation Why It Matters Responsive Layout Ensure your documents automatically adjust to fit different screen sizes. Improves readability and user experience on mobile devices without needing zooming or scrolling. Simple Formatting Avoid excessive use of columns, small fonts, or complex tables. Stick to simple, easy-to-read formats. Mobile users have limited screen space, so a clean, uncluttered layout ensures better readability. Large, Legible Fonts Use larger font sizes for essential information like totals, dates, and payment instructions. Helps users quickly identify key details without having to zoom in or struggle to read small text. Concise Information Limit the amount of text and focus on the essential details: amounts, terms, and dates. Long paragraphs and excessive information can overwhelm users on mobile, so keeping it concise enhances clarity. Best Practices for Mobile Optimization

In addition to basic design changes, here are some best practices to ensure optimal viewing on mobile devices:

- Test Across Devices: Regularly test your documents on various mobile devices to ensure compatibility and readability across platforms.

- Utilize Mobile-Friendly File Formats: Use PDF files or responsive formats that display well on smaller screens without distortion.

- Prioritize Important Information: Place key details such as the total due and payment instructions at the top or in easy-to-locate sections.

- Minimize the Need for Scrolling: Keep the document as compact as possible to avoid excessive scrolling on mobile screens.

By optimizing your financial documents for mobile devices, you provi

Cost-Effective Invoice Template Solutions

Finding affordable solutions for creating professional financial documents can significantly reduce operational costs while maintaining efficiency. Whether you’re a small business owner or an independent freelancer, there are various tools and strategies available that allow you to streamline document creation without breaking the bank. The key is to identify simple, yet effective approaches that save both time and money, while ensuring that your records remain accurate and professional.

By leveraging cost-effective solutions, you can avoid the need for expensive software or hiring external services, while still providing clear and polished documentation to clients.

Affordable Options for Creating Professional Documents

- Free Online Tools: Many platforms offer free access to templates that allow businesses to easily create and manage their financial records. These tools often include customizable fields and predefined layouts, saving time in document creation.

- Open-Source Software: For businesses that prefer more control over the design and functionality of their documents, open-source software can be an excellent option. Programs like LibreOffice or OpenOffice provide free alternatives to traditional paid software, with the flexibility to design personalized documents.

- Cloud-Based Services: Cloud platforms like Google Docs or Zoho Docs provide free or low-cost services for creating and managing financial documents. They often offer easy access across devices, automatic updates, and real-time collaboration, which can be especially useful for businesses with remote teams.

- Spreadsheet Solutions: Many businesses use simple spreadsheet software, such as Excel or Google Sheets, to track and manage their financial data. With the right formulas and formatting, you can create organized, professional records without any added cost.

- Customizable Free Templates: