Top Invoice Template Co for Streamlined Billing and Business Efficiency

Managing payments and maintaining financial records can be a time-consuming and complex task for any business. However, with the right tools and systems, this process can be streamlined, saving both time and effort. One of the most effective ways to handle billing is through ready-made documents designed to automate and simplify this crucial part of business operations.

Pre-designed billing formats can help companies of all sizes issue accurate, professional invoices quickly. These documents not only ensure consistency but also reduce the chances of errors, which can otherwise lead to delays or disputes. With the right setup, businesses can focus more on growth and less on paperwork.

Whether you run a small freelance business or manage a larger enterprise, having access to customizable solutions can significantly improve your workflow. By using these ready-made tools, you can create documents that are tailored to your specific needs and preferences, making the entire billing cycle more efficient and effective.

Why Use an Invoice Template Co

Managing financial transactions efficiently is crucial for any business. Having a system in place to create and track payments can save time and reduce the risk of errors. By using pre-designed billing documents, companies can ensure that their invoicing process is both professional and consistent, helping to maintain a smooth cash flow.

Time Efficiency and Consistency

With a ready-made solution, businesses can generate and send documents without starting from scratch each time. This significantly speeds up the process of issuing payment requests, allowing you to focus on other important aspects of your business. Consistency is another key benefit, as it ensures that every client receives the same high-quality and professional format, reducing the chances of confusion or misunderstandings.

Customization for Specific Needs

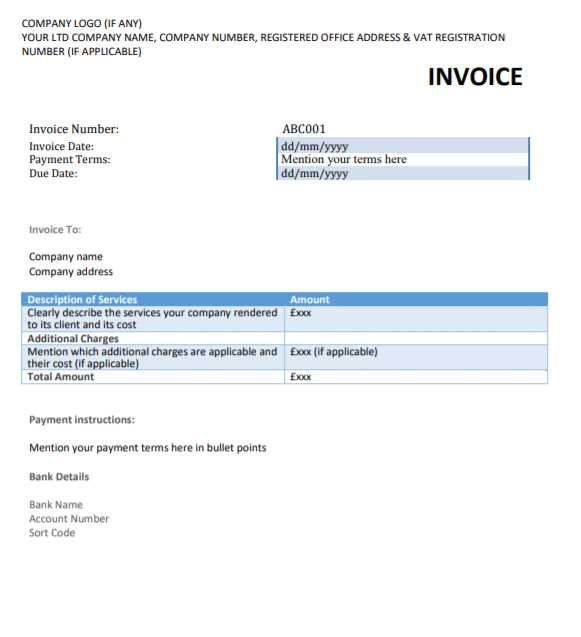

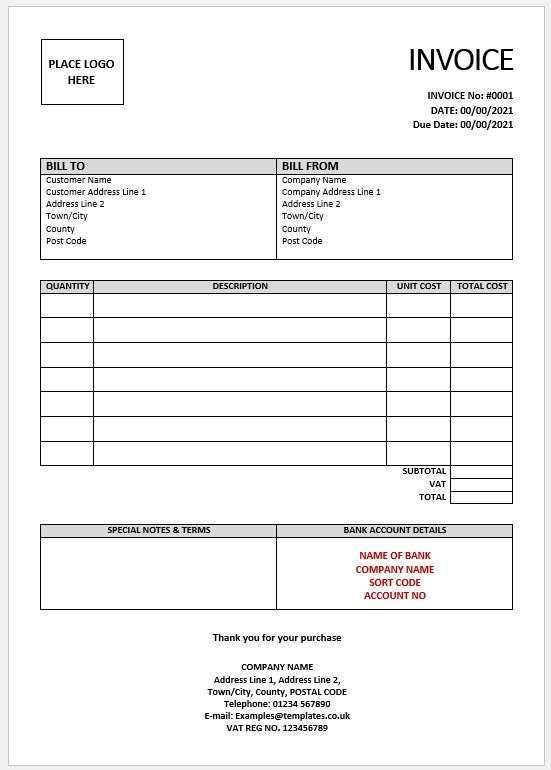

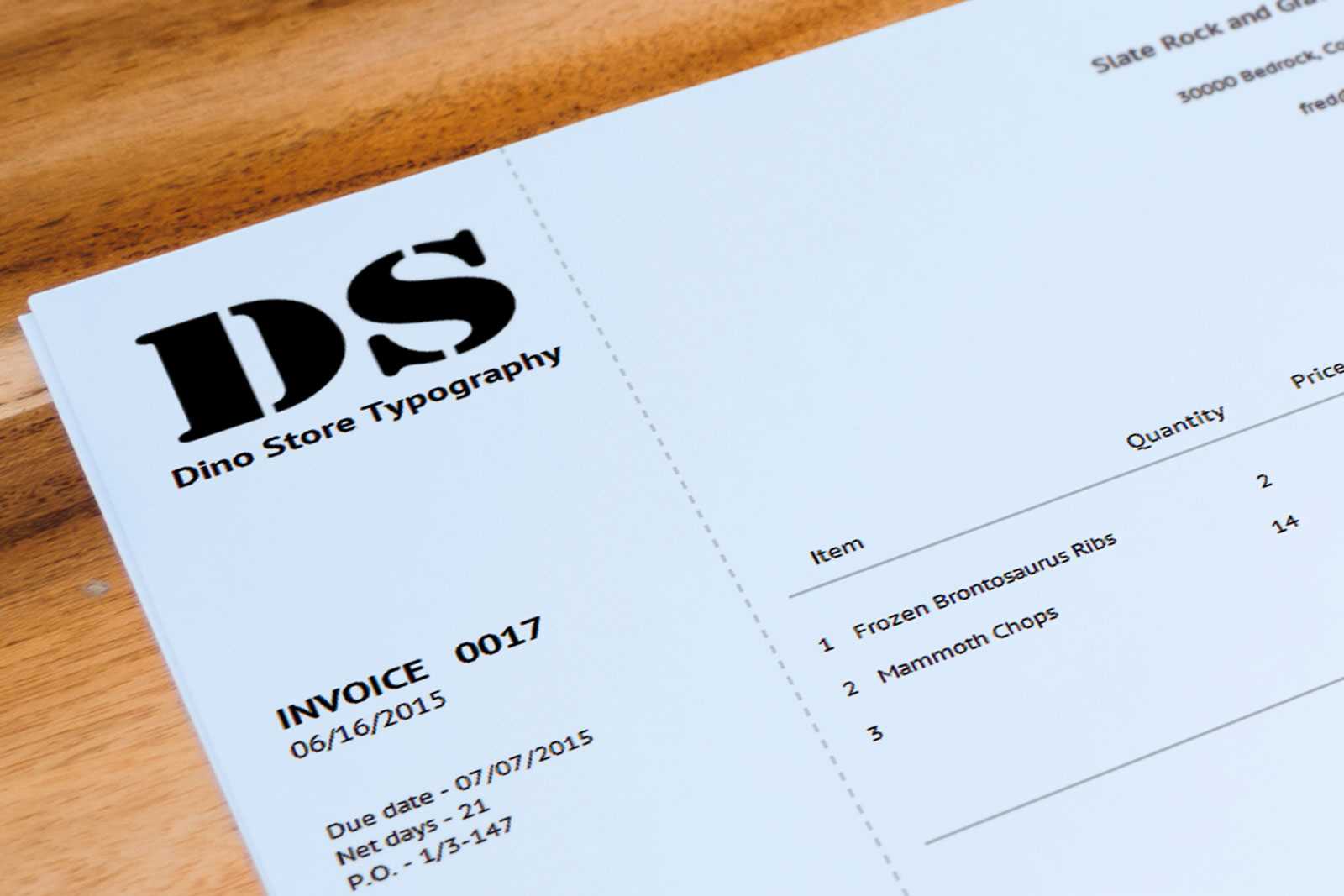

One of the major advantages of using a pre-built solution is the ability to easily modify it according to your specific requirements. Whether you need to add additional fields, include your company’s logo, or adjust the layout, these documents can be customized to fit your business needs perfectly. This flexibility ensures that your financial communication aligns with your brand identity and operational requirements.

How to Choose the Right Invoice Template

Selecting the appropriate billing format is essential for ensuring smooth and professional transactions. The right solution will not only save time but also align with your business needs, presenting a clean and consistent appearance. The goal is to find a tool that simplifies your process while still meeting your specific requirements.

Consider Your Business Type

Your industry and the services or products you provide will largely determine the type of document you need. For example, a freelancer may have different needs compared to a larger enterprise. Some businesses might require more detailed billing with multiple line items, while others may only need a simple document to request payment.

Customization and Features

The ability to adjust the layout and include additional fields can be a deciding factor. You may need to add your business logo, tax information, or specific terms and conditions. The best solution will offer flexibility to modify details without requiring significant design skills.

| Feature | Small Business | Freelancer | Enterprise |

|---|---|---|---|

| Customizable Fields | ✔ | ✔ | ✔ |

| Multiple Payment Methods | ✔ | ✔ | ✔ |

| Branding Options | ✔ | ✔ | ✔ |

| Complex Pricing Breakdown | ❌ | ❌ | ✔ |

By considering your specific needs and features, you can confidently choose a solution that enhances your billing process and supports your business goals.

Top Features of Invoice Templates

The right billing solution can make a significant difference in how efficiently and professionally you manage payments. A well-designed document can streamline the process, reduce errors, and help maintain a consistent image for your business. The most useful tools come with several key features that enhance usability and adaptability to various business needs.

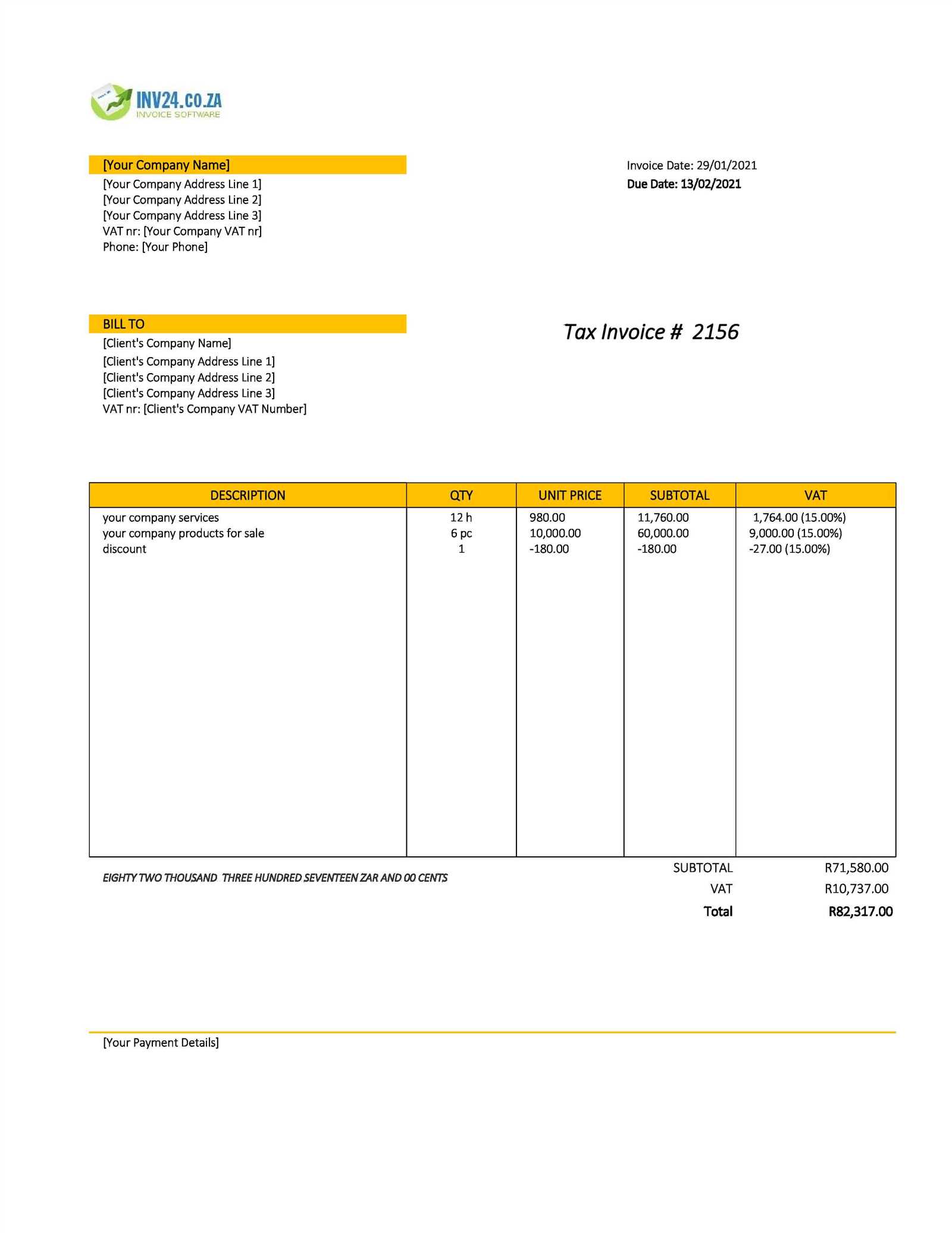

Essential Features for Efficiency

To ensure smooth billing, it’s important to have features that simplify data entry and make documents clear and easy to understand. Key functions like auto-calculation for totals, tax inclusion, and clear itemization of services or products are essential for any business looking to streamline its financial processes.

Customization and Professionalism

Customization options are crucial for branding and ensuring that your documents align with your business identity. The ability to add your company logo, adjust fonts, and modify colors can give your billing documents a polished, professional look that reinforces your brand image.

| Feature | Small Business | Freelancer | Enterprise |

|---|---|---|---|

| Automatic Calculations | ✔ | ✔ | ✔ |

| Tax and Discount Fields | ✔ | ✔ | ✔ |

| Custom Branding Options | ✔ | ✔ | ✔ |

| Multi-currency Support | ❌ | ❌ | ✔ |

These features ensure that your billing process is not only efficient but also visually appealing and in line with your brand’s image, no matter the size or scope of your business.

Benefits of Using Invoice Templates for Small Businesses

For small businesses, staying organized and efficient is key to long-term success. Having a structured approach to billing and payments is one of the best ways to ensure smooth financial transactions. Using pre-designed billing documents offers numerous advantages, helping small business owners save time and maintain professionalism without the need for complicated software or systems.

Key Advantages for Small Business Owners

- Time-saving: Ready-made documents allow business owners to create and send billing statements quickly, reducing the time spent on administrative tasks.

- Consistency: Using a standardized format ensures that all payment requests look professional and uniform, which is crucial for maintaining a good business reputation.

- Reduced Errors: With predefined fields and calculations, the chances of making mistakes are minimized, which helps avoid payment disputes or delays.

Cost-effective Solution

For small businesses with limited budgets, investing in expensive accounting software may not be feasible. Pre-designed documents provide an affordable alternative, allowing business owners to create professional billing statements at no extra cost. These tools can often be found for free or at a low one-time cost, making them an ideal option for businesses that need an efficient solution without the high overhead.

- Customizable: Even with a standard layout, these documents can be tailored to suit the needs of your business, including adding logos, adjusting details, or modifying fields.

- Easy to Use: Most billing formats are intuitive and user-friendly, requiring no special technical skills, which is especially useful for business owners who may not have a background in accounting.

By using ready-made billing solutions, small business owners can streamline their operations, reduce administrative burdens, and present a polished image to clients.

How to Customize Your Invoice Template

Personalizing your billing documents is a crucial step in ensuring they represent your brand and meet your business’s specific needs. Customization allows you to add elements that reflect your company’s identity, while also making sure all the necessary information is clearly presented. Adjusting these formats is simple and can be done without much technical expertise.

Adding Your Branding Elements

One of the first things to customize is the visual aspect of your document. This includes incorporating your business logo, adjusting color schemes, and choosing fonts that align with your brand identity. A well-branded document can enhance professionalism and leave a lasting impression on your clients.

- Logo Placement: Insert your company logo at the top for easy recognition.

- Color Scheme: Match the colors to your brand palette to ensure consistency across all communications.

- Font Style: Choose fonts that are clear and professional, yet in line with your brand’s tone.

Customizing Fields and Layout

Another important aspect of personalization is modifying the document layout to suit your business’s needs. This includes adding or removing specific fields, such as tax rates, payment terms, or service descriptions. You can also rearrange sections to ensure your most critical information stands out.

- Additional Information: Add custom fields for specific details like project numbers, client IDs, or special instructions.

- Layout Adjustments: Modify the arrangement of sections to prioritize what matters most to your business, such as payment methods or itemized services.

By tailoring your billing documents, you ensure they are not only functional but also reflect your brand’s unique identity, contributing to a more professional image and smoother communication with clients.

Understanding Invoice Template Formats and Types

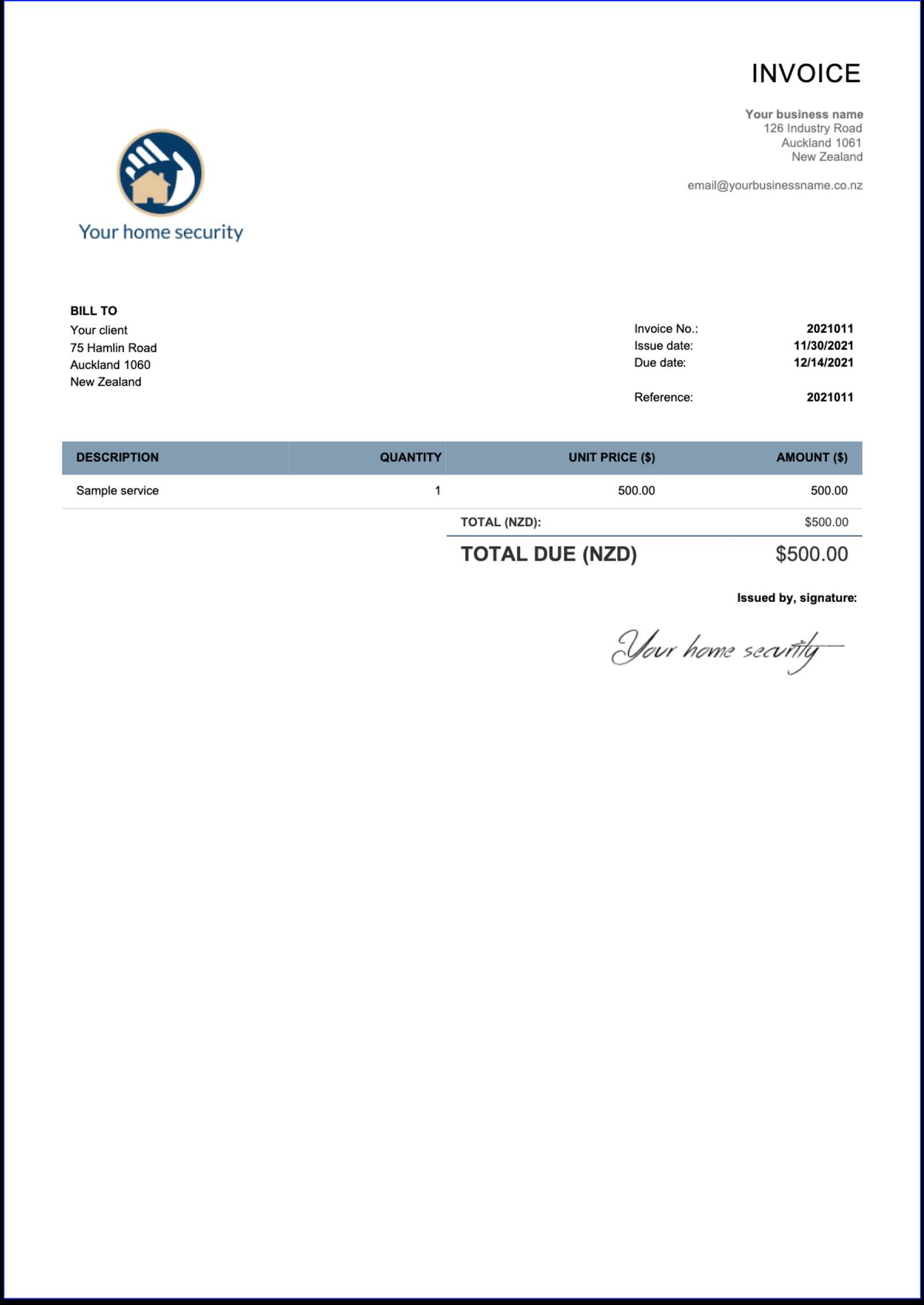

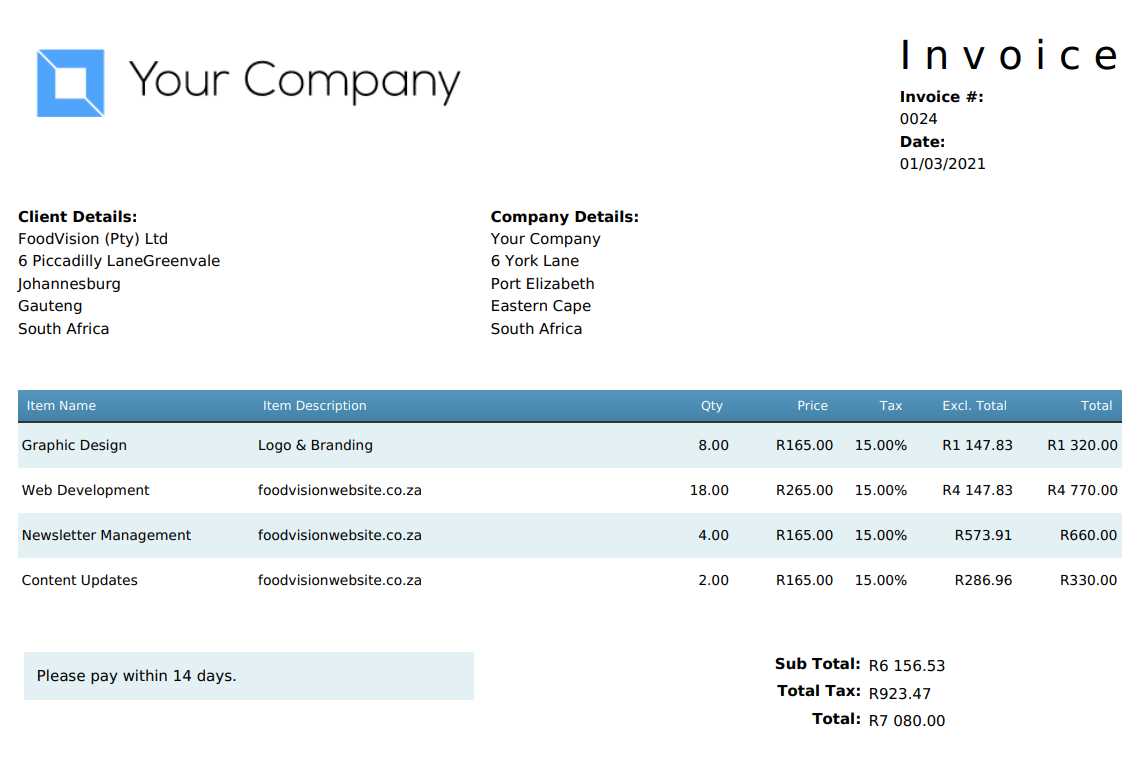

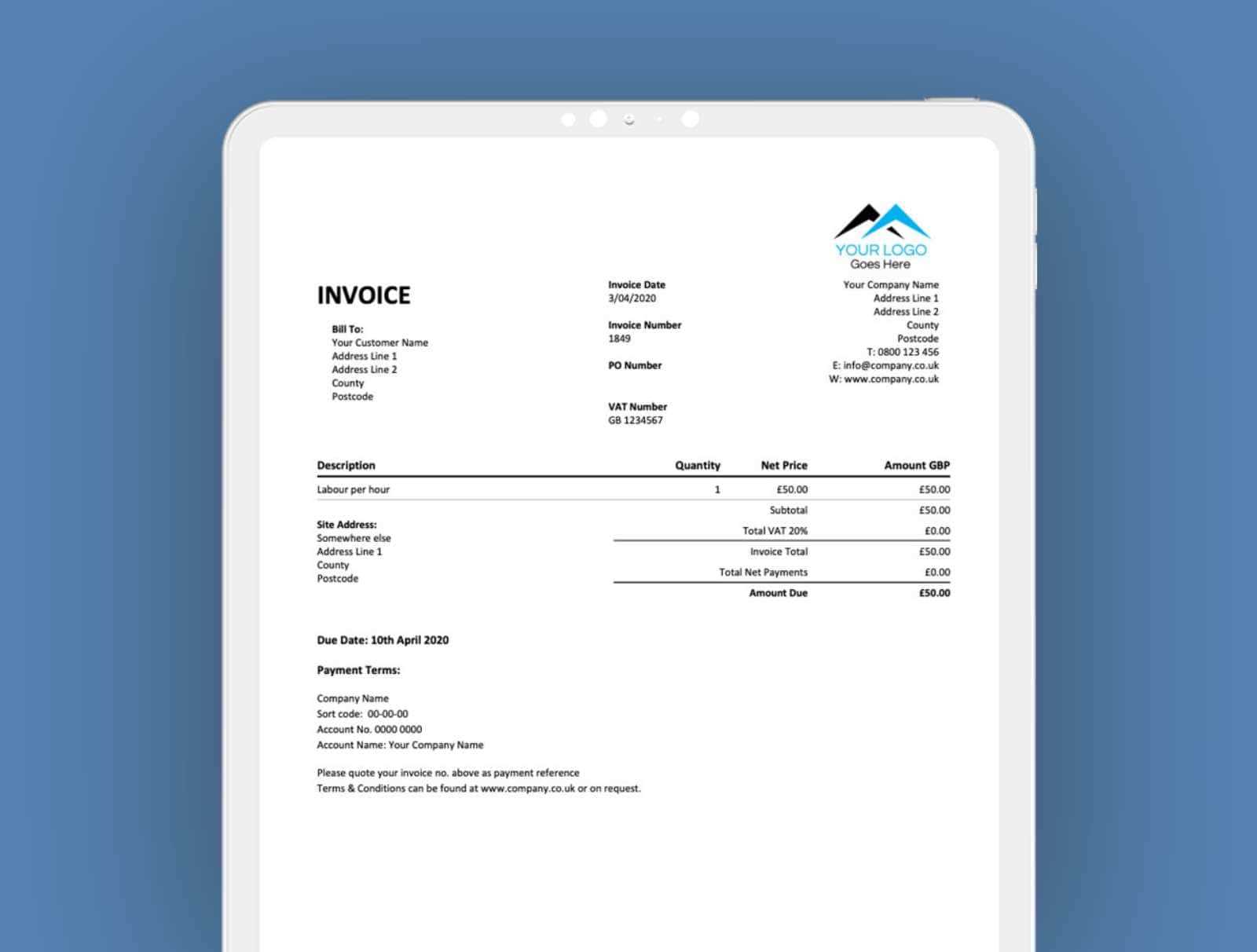

Choosing the right format for your billing documents is essential for maintaining clarity and efficiency in financial transactions. Different formats serve different purposes, depending on the nature of your business and the complexity of the services or products provided. Understanding the various types available can help you select the one that best suits your needs.

| Format Type | Description | Best For |

|---|---|---|

| Basic Format | Simple, clean layout with essential fields like amount, date, and payment terms. | Freelancers, small businesses, and individuals with straightforward transactions. |

| Itemized Format | Includes detailed breakdowns of products or services, quantities, and unit prices. | Businesses selling multiple items or services, such as retailers or consultants. |

| Professional Format | Highly polished with custom branding, advanced fields, and structured layout. | Larger businesses or companies looking to project a professional image. |

| Recurring Format | Designed for subscription-based services, with fields for recurring payments and terms. | Subscription-based services, memberships, or businesses with ongoing clients. |

Each format offers unique features tailored to different business needs. Whether you’re sending a simple payment request or managing complex billing for multiple products, selecting the right layout will ensure your documents are clear, professional, and effective.

Free vs Paid Invoice Templates

When choosing a solution for creating billing documents, businesses often face the decision between using free or paid options. Both have their advantages, but they come with different levels of customization, features, and support. Understanding the key differences can help you decide which option best fits your business needs.

Advantages of Free Options

Free billing formats are often an appealing choice for small businesses, freelancers, or those just starting. These solutions are usually simple, easy to use, and accessible without any upfront cost. However, they typically come with basic features and fewer customization options.

- No upfront cost: Free options require no financial investment, making them ideal for businesses on a tight budget.

- Ease of use: Basic layouts and minimal features make free solutions easy to understand and quick to implement.

- Good for simple needs: If you only need a basic document with essential fields, a free option may be all you require.

Advantages of Paid Options

On the other hand, paid solutions offer more advanced features, customization options, and professional support. These tools typically come with a broader range of templates, enhanced functionality, and the ability to integrate with accounting or CRM systems.

- Advanced features: Paid versions often include automatic calculations, recurring billing, and multi-currency support.

- Customization: Paid solutions allow for more flexibility in design and functionality, enabling you to create documents that align with your brand and specific needs.

- Technical support: Paid options often include customer support or access to tutorials, which can help resolve issues faster.

While free options may be sufficient for basic needs, paid solutions offer more comprehensive tools that can scale with your business as it grows.

Integrating Invoice Templates with Accounting Software

Integrating your billing documents with accounting software can drastically improve the efficiency of your financial processes. By automating the transfer of data between billing and accounting systems, businesses can reduce the risk of errors, save time, and ensure that financial records are always up to date. This integration allows for seamless tracking of payments, invoicing, and expense management.

Benefits of Integration

- Automation of Data Entry: Integrating your billing system with accounting software reduces the need for manual data input, minimizing the risk of errors and saving time.

- Real-Time Financial Tracking: When the data flows automatically between systems, your financial records are updated in real-time, providing you with the most current overview of your business’s cash flow.

- Improved Accuracy: By linking billing and accounting tools, you ensure that numbers and transaction details are consistent across both systems, leading to more accurate financial reports.

How to Integrate Billing Solutions

Integrating your billing solution with accounting software typically involves selecting tools that are compatible with each other. Many modern platforms offer built-in integration features, making the setup process relatively simple. Here are a few steps to consider:

- Choose Compatible Software: Ensure that your billing system and accounting platform can work together. Many cloud-based tools offer native integrations.

- Set Up Automatic Data Transfer: Configure the systems to automatically transfer key information, such as payment status, client details, and amounts due, between platforms.

- Customize Data Fields: Tailor the integration to match the specific data you need for your business, whether it’s tax rates, discounts, or project numbers.

With the right integration, managing your financial processes becomes faster, more accurate, and more efficient, giving you more time to focus on growing your business.

Common Mistakes in Invoice Creation

Creating billing documents may seem straightforward, but many businesses fall into common traps that can lead to errors, payment delays, or confusion. These mistakes not only affect your financial records but can also damage relationships with clients. Recognizing these errors and addressing them early can ensure smoother transactions and a more professional image for your business.

| Mistake | Description | Impact |

|---|---|---|

| Missing or Incorrect Client Details | Omitting or incorrectly entering client information such as names, addresses, or contact details. | Leads to confusion, delayed payments, and possible misunderstandings. |

| Unclear Payment Terms | Failure to specify payment due dates, late fees, or payment methods. | Leads to late payments, unclear expectations, and unnecessary follow-ups. |

| Calculation Errors | Incorrectly adding or multiplying amounts, taxes, or discounts. | Results in overcharging or undercharging clients, causing financial discrepancies. |

| Lack of Itemization | Not breaking down the services or products provided with clear descriptions and prices. | Creates confusion for the client and may lead to disputes over charges. |

| Inconsistent Formatting | Using different fonts, colors, or layouts in the billing document. | Can appear unprofessional and may create difficulties for clients when reviewing or paying. |

By paying attention to these common mistakes and taking the time to ensure that all details are accurate and clear, businesses can improve their billing process, enhance client satisfaction, and maintain a professional image.

How to Automate Invoicing with Templates

Automating your billing process can save time, reduce errors, and ensure timely payments. By integrating pre-designed solutions with your business workflows, you can streamline the creation and sending of payment requests. This process eliminates the need for manual entry and allows for more efficient tracking of financial transactions.

Steps to Automate Your Billing Process

To successfully automate your payment request system, follow these essential steps:

- Choose a Compatible Solution: Select a billing solution that supports automation and integrates easily with your existing systems, such as accounting software or customer management tools.

- Set Up Recurring Billing: For subscription-based services, set up automatic billing for clients on a regular schedule. This ensures that payments are sent out without requiring manual intervention each month.

- Customize for Client Information: Personalize the pre-designed document by adding client-specific data (e.g., names, addresses, payment terms) to ensure accuracy and a professional appearance.

Benefits of Automating Billing

Automating your billing not only makes the process faster and more accurate but also improves the customer experience. With automatic reminders, clients are less likely to miss payment deadlines, leading to improved cash flow for your business.

- Time-saving: Automating repetitive tasks reduces the time spent on manual data entry and document creation.

- Consistency: Pre-configured solutions ensure that each payment request follows the same structure, maintaining professionalism.

- Improved Accuracy: Automation reduces the risk of human error, ensuring that amounts, dates, and details are correct every time.

By incorporating automation into your billing system, you can focus more on growing your business and less on administrative tasks.

Invoice Templates for Freelancers and Contractors

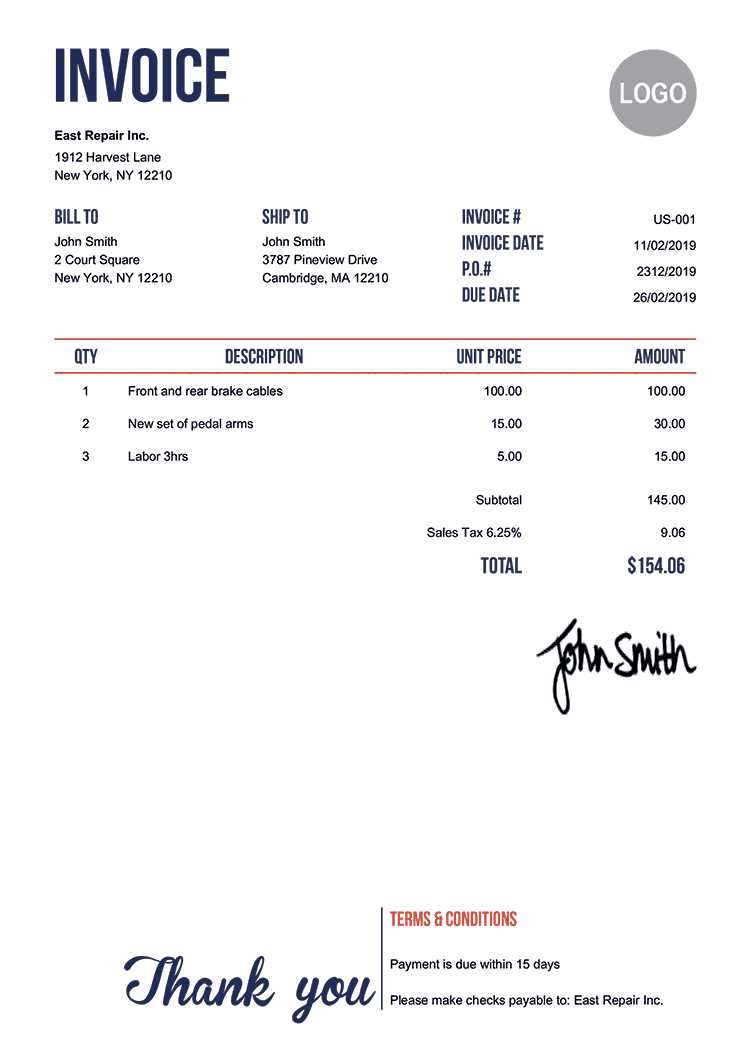

Freelancers and contractors often juggle multiple clients and projects, making it essential to have an efficient system for creating and sending billing documents. Using structured and easy-to-use payment request formats can simplify the process, ensuring timely payments and maintaining professionalism in all client communications.

Key Features for Freelancers and Contractors

For independent workers, certain features are particularly valuable when creating payment requests. These tools not only ensure that the documents look professional but also help track work and manage client expectations effectively.

- Client Information Fields: Easily add client names, contact details, and project references to maintain clear records of each transaction.

- Service Breakdown: Include detailed descriptions of the work completed, including hourly rates, project milestones, or deliverables, to provide transparency and avoid disputes.

- Payment Terms: Set clear payment due dates, accepted methods, and any late fees, ensuring that both you and your clients are on the same page.

- Tax and Discount Calculations: Automate tax calculations and offer discounts where applicable, ensuring accurate billing every time.

Why Freelancers and Contractors Benefit from Structured Formats

For freelancers and contractors, using a standardized format for every project helps keep work organized and minimizes errors. The consistency of using the same structure for each payment request makes the process more efficient, while also giving clients a professional impression of your business operations.

- Efficiency: Standardized forms make it quicker and easier to create payment requests, especially for recurring clients or projects.

- Professionalism: A clean, well-organized document enhances your reputation and shows clients that you are detail-oriented and reliable.

- Tracking and Record-Keeping: With every payment request having the same format, it’s easier to maintain a clear record of your earnings and transactions.

For freelancers and contractors, using customized billing solutions is a key step toward professional growth, improving both productivity and client relationships.

Creating Professional Invoices in Minutes

Generating professional payment requests doesn’t have to be a time-consuming task. With the right tools and approach, you can create clear, well-organized billing documents in just a few minutes. By using pre-designed formats, you can streamline the process and ensure that every detail is accurate and professional, saving you valuable time while maintaining a polished appearance.

The key to creating professional billing documents quickly lies in understanding the essential components that need to be included. By having a consistent format with all necessary fields, you eliminate the need for manual adjustments every time you create a new document. This allows you to focus on the work itself rather than the administrative overhead.

Steps to Create a Professional Payment Request

Follow these simple steps to generate a professional document in minutes:

- Select a Pre-designed Layout: Choose a ready-made structure that fits your business style and includes all required fields (such as client name, services rendered, payment terms).

- Fill in the Details: Input client information, a description of the services or products provided, payment amounts, and any applicable taxes or discounts.

- Customize Your Branding: Add your company logo, adjust fonts, and choose colors that align with your brand to give the document a personal touch.

- Review and Send: Double-check all the details for accuracy and send the document to your client with just a click of a button.

By following these steps, you can ensure that your payment requests look professional and are delivered on time, while minimizing the effort required to create them. In just a few minutes, you can produce a document that reflects your professionalism and helps maintain smooth business operations.

Best Invoice Templates for Online Businesses

For online businesses, efficient and professional billing is crucial to maintaining a smooth cash flow and building client trust. A well-structured payment request format helps streamline the process, ensuring accurate calculations, clear communication, and timely payments. Depending on your business model, the right format can make all the difference in enhancing the client experience and minimizing administrative work.

Key Features to Look for in Billing Formats

When selecting a format for your online business, consider these essential features to ensure it meets your needs and is tailored to your industry:

- Automated Calculations: Look for solutions that automatically calculate totals, taxes, and discounts, reducing the chance of errors.

- Recurring Payment Support: For subscription-based services, ensure the format can handle recurring billing with ease, including options for automatic scheduling.

- Multi-Currency and Multi-Language Options: If you deal with international clients, choose a format that supports multiple currencies and languages to accommodate diverse markets.

- Custom Branding: The ability to add your logo, company colors, and personalized fields ensures your billing documents align with your brand identity.

Top Billing Formats for Online Businesses

Several solutions are particularly well-suited to online businesses, offering flexibility and user-friendly features:

- Simple Online Sales Billing: Ideal for eCommerce shops and one-time purchases, this format includes a basic layout with product descriptions, quantities, and pricing, making it easy to create a document quickly.

- Subscription-Based Billing: Perfect for SaaS and membership services, this format includes sections for recurring charges, terms, and renewal dates, helping you automate monthly or annual payment requests.

- Project-Based Billing: Best for freelancers and contractors, this format allows you to break down services by project or milestone, adding detailed line items and customizable payment terms.

By selecting a format that suits your online business model, you can enhance efficiency, reduce errors, and improve the overall professionalism of your client communications.

How Invoice Templates Improve Cash Flow

Effective billing plays a vital role in ensuring a healthy cash flow for any business. By using structured and consistent billing formats, businesses can streamline their payment processes, reduce delays, and maintain financial stability. Timely and accurate payment requests not only help ensure that clients pay on time but also create a more professional impression, leading to faster payments and fewer disputes.

When businesses use standardized billing formats, they eliminate the guesswork involved in creating documents and minimize the chances of errors. With automated calculations, clear payment terms, and professional layouts, businesses can send invoices more quickly and avoid common mistakes that lead to delayed payments. By reducing friction in the payment process, these formats help improve cash flow.

Additionally, a well-organized format helps businesses maintain a systematic approach to tracking payments, which is crucial for forecasting future income and managing expenses. The ability to clearly track outstanding payments and follow up efficiently ensures that funds are collected promptly, reducing the risk of overdue accounts and improving the overall financial health of the business.

Invoice Template Best Practices for Accuracy

Ensuring accuracy in payment requests is essential for maintaining smooth business operations and building trust with clients. Mistakes in billing can lead to delays, misunderstandings, and even disputes. By following best practices when creating and sending billing documents, businesses can minimize errors, improve professionalism, and ensure that payments are processed correctly and on time.

Key Practices for Accurate Payment Requests

There are several essential practices to follow to maintain the accuracy of your billing documents:

- Double-Check Client Details: Always verify client names, addresses, and contact information before sending a request. Small mistakes here can lead to confusion and delays in payments.

- Confirm Service Descriptions: Clearly describe the products or services provided, ensuring that the quantities, rates, and specifications are correct. This will help prevent disputes and ensure clients understand exactly what they are paying for.

- Use Automated Calculations: To avoid human errors in calculations, use automated tools that can handle totals, taxes, discounts, and other financial elements. This helps reduce the chance of mistakes.

- Set Clear Payment Terms: Specify payment due dates, methods, and any late fees clearly to avoid confusion and ensure clients know what to expect.

Review and Double-Check Before Sending

Before sending a payment request, it’s always a good idea to review the document thoroughly. Double-check all fields and calculations to ensure everything is accurate. If possible, have another person look over the document to catch any errors you may have missed. A final review is key to ensuring that your payment request reflects your professionalism and attention to detail.

By following these best practices, businesses can maintain high standards of accuracy, which will help streamline the payment process and enhance client satisfaction.