Customizable Invoice Templates for Cleaning Services

Managing payments and financial records can be time-consuming, but having the right tools in place can simplify the process significantly. Whether you’re a freelancer or run a larger operation, organizing the way you charge clients is key to maintaining professionalism and streamlining cash flow. A well-structured document can ensure that all necessary details are communicated clearly and that transactions proceed smoothly.

Customizable financial documents offer a flexible solution for businesses, making it easy to add specific details such as pricing, job descriptions, and payment terms. The right format ensures that your clients understand the costs involved and what is expected of them. With minimal effort, you can create a polished, consistent document that reflects your business values and enhances client trust.

Improving the invoicing process not only saves time but also helps avoid mistakes that can lead to confusion or delayed payments. By implementing a professional approach, businesses can focus on providing excellent work while ensuring that financial matters are handled efficiently and effectively.

Choosing the Right Invoice Template for Cleaning

Selecting the right billing document for your business is crucial for maintaining professionalism and ensuring smooth transactions. The right document not only reflects your brand but also clearly communicates the necessary details about the job, pricing, and payment expectations. A well-designed format can help reduce confusion and speed up the payment process, creating a better experience for both you and your clients.

Factors to Consider

When choosing the right billing document, consider factors such as simplicity, customizability, and functionality. The ideal document should be easy to use, clear in its structure, and adaptable to different types of work and pricing models. Look for a solution that allows you to add all the essential details without cluttering the page, ensuring that clients can quickly understand the terms of the transaction.

Key Features to Look For

A good financial document should include the following features:

| Feature | Description |

|---|---|

| Clear layout | Easy to read and navigate with sections for each important detail. |

| Custom fields | Allow you to personalize the document with specific job descriptions and pricing. |

| Professional design | Reflects your brand and adds credibility to your work. |

| Payment terms | Includes clear payment instructions, deadlines, and methods of payment. |

Choosing the right document helps ensure that you remain organized, reduce administrative burden, and keep clients satisfied with an easy-to-understand, transparent billing process.

Benefits of Using Professional Invoice Templates

Utilizing a professionally designed document for billing can have a significant impact on your business. These tools not only save time but also improve the overall efficiency of financial processes. When used correctly, they help streamline operations, reduce human error, and enhance communication with clients. Adopting a polished format for all transactions is essential for maintaining a consistent and trustworthy image.

Advantages for Your Business

Here are some key benefits of using a professional solution to handle your billing:

| Benefit | Description |

|---|---|

| Time-saving | Reduces the amount of time spent creating and organizing financial documents. |

| Consistency | Ensures that every transaction follows the same format, promoting professionalism. |

| Reduced errors | Prevents mistakes in calculations and details that can lead to confusion or delayed payments. |

| Branding | Customizable to reflect your company’s identity, helping build brand recognition. |

| Clear communication | Clarifies payment terms and expectations, leading to faster resolution of any potential issues. |

By adopting a professional solution for your financial documents, you not only enhance the efficiency of your operations but also build trust with your clients, ensuring smoother transactions and long-term business relationships.

How to Customize Your Cleaning Service Invoice

Personalizing your billing document is essential for making a lasting impression on clients while ensuring all relevant details are clearly communicated. Customization allows you to align the document with your brand, provide tailored information, and simplify the payment process for your clients. A well-structured document not only saves time but also enhances professionalism and trust.

Steps to Personalize Your Billing Document

Here are the key elements you can adjust to match your business needs:

| Customization Element | How to Customize |

|---|---|

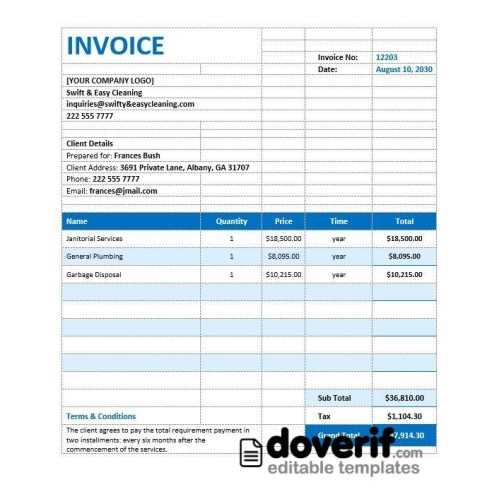

| Business Information | Add your company name, logo, address, and contact details to make the document professional and easily identifiable. |

| Client Details | Ensure that the recipient’s name, address, and contact information are clearly stated to avoid any confusion during payment. |

| Job Description | Provide a detailed description of the work completed, including the date, hours worked, and type of tasks performed to make it easy for the client to understand what they are paying for. |

| Pricing Structure | Clearly break down charges, including hourly rates, flat fees, or any additional costs to ensure transparency. |

| Payment Terms | Include clear payment instructions, such as due dates, accepted payment methods, and any penalties for late payments. |

By taking the time to customize your billing document, you ensure that every transaction is organized, transparent, and aligned with your business’s professional standards. This personalized approach can also make the payment process smoother, leading to faster and more reliable cash flow.

Essential Information to Include in Invoices

To ensure smooth transactions and avoid misunderstandings, it’s crucial to include all necessary details in your billing documents. A well-organized statement helps both you and your clients stay on the same page regarding expectations and payment terms. By including the right information, you not only facilitate timely payments but also enhance your professionalism and transparency.

Key Elements to Include

Here are the essential pieces of information that should be present in every billing document:

| Information | Description |

|---|---|

| Business Details | Your company name, address, phone number, and email address should be clearly visible. |

| Client Information | Include the client’s name, address, and contact details to ensure the document reaches the right person. |

| Unique Reference Number | Each document should have a unique number for easy tracking and future reference. |

| Job Description | A detailed breakdown of the work completed, including dates and specific tasks performed, helps clarify the charges. |

| Pricing Breakdown | List charges clearly, whether they are hourly, flat rates, or based on specific tasks, to ensure full transparency. |

| Payment Terms | State the total amount due, due date, and any payment methods you accept, along with instructions for completing the payment. |

| Late Fees | If applicable, outline any late fees or penalties for overdue payments to encourage timely settlement. |

By including these essential details, you can ensure that your billing process is clear, transparent, and efficient. This not only helps prevent disputes but also promotes trust and reliability between you and your clients.

Design Tips for an Effective Invoice

The appearance of your billing document can significantly impact the way clients perceive your professionalism. A clean, organized design not only makes it easier for clients to understand the charges but also conveys a sense of order and reliability. By following some basic design principles, you can create a document that is both functional and visually appealing, ensuring smooth transactions and positive client experiences.

Keep It Simple and Organized

One of the most important design principles is simplicity. A cluttered document can confuse clients and make it difficult to locate important information quickly. Use clear sections and enough white space to separate different parts of the document, such as job details, pricing, and payment terms. Avoid overwhelming the reader with unnecessary elements and focus on what is essential.

Focus on Readability

To ensure that your document is easy to read, choose a clean, professional font and keep the font size consistent throughout. Highlight key information, such as the total amount due or payment due date, by using bold text or larger font sizes. Avoid using too many different font styles or colors, as this can distract from the content and make it harder to follow.

By incorporating these design tips, you can create a well-organized and visually appealing document that reflects your brand and makes it easier for clients to process their payments. A clear, effective design not only boosts your professionalism but also improves the client experience, leading to faster and smoother transactions.

Streamlining Payments with Invoice Templates

Efficient payment processing is a crucial element of any successful business. By using an organized and consistent method for documenting charges, you can make it easier for clients to pay on time while minimizing confusion. Streamlining the payment process helps ensure quicker settlements, better cash flow, and stronger client relationships. A well-designed billing document can make all the difference in achieving this goal.

How to Simplify the Payment Process

To speed up payments, it’s important to structure your documents in a way that is clear and easy for clients to understand. Here are some strategies to streamline the payment process:

| Strategy | How It Helps |

|---|---|

| Clear Payment Terms | Clearly state the due date and available payment methods, reducing the chances of confusion and delays. |

| Detailed Payment Breakdown | Provide a clear breakdown of the costs involved so the client knows exactly what they’re paying for. |

| Easy-to-Find Total | Make sure the total amount due stands out so there’s no confusion about the final payment. |

| Late Fee Information | Include any late fee policies upfront to encourage timely payments and avoid misunderstandings. |

Utilizing Automation for Faster Payments

Many businesses find that integrating automated solutions into their billing system makes it even easier to streamline payments. With features such as online payment links or integrated payment processing, you can give clients the option to pay directly through the billing document. This can speed up payment collection and reduce administrative overhead.

By organizing your documentation and providing easy payment options, you can ensure that clients know exactly how to settle their accounts quickly and efficiently. Streamlining this process not only boosts your cash flow but also enhances client satisfaction, encouraging repeat business.

Creating Branded Invoices for Cleaning Services

Establishing a strong brand presence goes beyond just your website or business cards. Every client interaction, including the way you bill them, contributes to your company’s image. By incorporating your unique branding into your billing documents, you not only reinforce your professionalism but also leave a lasting impression on clients. A well-branded financial document helps your business stand out, improving client retention and boosting your credibility.

Elements to Include in Your Branded Document

Incorporating key elements of your brand into your financial documents ensures consistency across all client touchpoints. Here are some essential components to include:

| Branding Element | How It Enhances Your Document |

|---|---|

| Logo | Place your logo prominently at the top to make your business easily recognizable. |

| Brand Colors | Use your brand’s color palette throughout the document to create a cohesive, professional look. |

| Typography | Choose fonts that align with your brand’s style for consistency across all communications. |

| Tagline or Slogan | Include your business slogan or a brief value statement to reinforce your brand’s mission. |

| Contact Information | Ensure your business contact details are easily visible to encourage quick communication. |

Why Branded Documents Matter

Adding personalized touches to your financial documents communicates more than just the cost of services rendered; it strengthens your brand identity and builds trust with clients. A branded document signals professionalism and helps clients recognize your business in a crowded marketplace. Furthermore, consistency in branding across invoices reinforces your company’s reliability and attention to detail.

Incorporating branding elements into your billing documents not only improves client perception but also contributes to a more professional and organized business image. With the right design and attention to detail, your financial communications can be an extension of your brand’s values and quality.

How to Automate Your Invoicing Process

Automating your financial documentation process can significantly reduce manual work, eliminate errors, and improve the speed of payment collections. By implementing an automated system, you free up valuable time that can be spent on other aspects of your business. Whether you’re handling one-time projects or ongoing contracts, automation streamlines the entire process, ensuring consistency and accuracy across every transaction.

Steps to Automate Your Billing Process

Here are the key steps to get started with automation:

- Choose the Right Software: Select an accounting or billing platform that fits your needs. Many tools offer features like recurring billing, customizable forms, and integration with payment systems.

- Set Up Recurring Payments: For clients with ongoing agreements, set up automatic billing cycles to send out charges at specified intervals.

- Personalize Your Documents: Even when automating, ensure your financial documents carry your brand’s identity by incorporating custom fields, logos, and other details specific to each transaction.

- Link Payment Options: Integrate payment gateways directly into your billing documents to enable clients to pay quickly online, reducing delays and increasing convenience.

- Automate Reminders: Set up automated email reminders for upcoming due dates or late payments, ensuring clients are always informed without extra manual effort.

Advantages of Automation

By automating your financial documentation, you can enjoy several key benefits:

- Time Efficiency: Reduce the time spent on manual calculations and sending documents.

- Improved Accuracy: Automation minimizes the risk of human error, ensuring correct calculations and consistent formatting.

- Faster Payments: With integrated payment options and reminders, clients are more likely to pay promptly.

- Professional Appearance: Automation ensures that your billing process is streamlined and polished, creating a more professional experience for your clients.

- Better Cash Flow: With timely, automated billing, you can improve your cash flow and reduce delays in receiving payments.

Automating your billing process is an investment in efficiency that pays off by saving time, increasing accuracy, and helping you maintain a steady cash flow. By taking advantage of the right tools and systems, you ensure that your business runs smoothly while providing clients with a

Why Invoices Matter for Cleaning Businesses

For any business, clear and efficient billing is essential to maintaining a healthy cash flow, ensuring clients understand their financial obligations, and promoting trust between both parties. In particular, for those in the cleaning industry, having a well-structured billing document is vital for tracking completed work, setting expectations, and managing payments in a professional manner. It serves as the official record of the transaction and helps prevent misunderstandings that could lead to delays or disputes.

Importance of Proper Billing in the Cleaning Industry

For cleaning businesses, a detailed financial document does more than just request payment. It provides a clear breakdown of what has been delivered, ensuring transparency and accountability. Here’s why these documents are so crucial for your business:

- Professionalism: Sending a well-organized and clear financial statement presents your business as credible and trustworthy, making clients more likely to pay on time.

- Clarity of Services Rendered: A well-detailed document outlines what tasks were completed, how long they took, and what the total charge is, helping clients understand exactly what they are paying for.

- Tax and Legal Compliance: Proper billing ensures that you have the correct records for tax purposes and can provide evidence of work completed if needed for legal reasons.

- Tracking Payments: Billing records help you track what has been paid and what remains outstanding, making it easier to manage your finances and follow up on overdue payments.

- Building Trust: Clear and accurate financial documents reflect your professionalism, which builds stronger relationships with clients and leads to repeat business.

How Proper Billing Can Benefit Your Business

When you make sure your billing process is efficient and transparent, you also stand to gain several benefits:

- Faster Payment Turnaround: Clients are more likely to pay quickly if they understand what they owe and have clear instructions for payment.

- Reduced Disputes: Clear documentation helps reduce the chances of misunderstandings or disputes over charges.

- More Organized Finances: Proper records make managing cash flow and taxes much easier.

- Better Client Relations: Transparency in billing strengthens client relationships, resulting in higher retention rates and positive word-of-mouth referrals.

In summary, for businesses in the cleaning industry, a properly structured billing document is not just a tool for collecting payment. It’s a vital element in creating a professional image, building trust with clients,

Key Features to Look for in Templates

When selecting a structure for your billing documents, it’s important to choose one that simplifies the process while maintaining professionalism. The right design ensures that you can present your charges clearly and efficiently, leaving a positive impression on your clients. To make this process seamless, certain features should be prioritized to enhance usability, organization, and accuracy.

Essential Features for Your Billing Document

Here are some important features to consider when choosing the right structure for your business:

| Feature | Benefit |

|---|---|

| Customizable Fields | Allows you to adjust information based on each transaction, such as client names, dates, and specific tasks completed. |

| Clear Layout | A simple, well-organized design ensures all critical information is easy to locate and read. |

| Branding Options | Integrate your company logo, colors, and fonts to reinforce your brand identity and maintain consistency across documents. |

| Automated Calculations | Features that automatically calculate totals and apply taxes or discounts reduce errors and save time. |

| Payment Terms Section | Clearly displays due dates, accepted payment methods, and any late fee policies to ensure clients understand their obligations. |

| Itemized List of Charges | Provide a detailed breakdown of charges, making it easier for clients to understand what they are paying for and reducing the likelihood of disputes. |

By focusing on these key features, you can ensure that your billing documents are not only functional but also professional, helping to streamline your financial processes and foster positive client relationships.

Best Practices for Accurate Billing

Accurate billing is crucial for maintaining trust with clients, ensuring timely payments, and avoiding potential disputes. Whether you’re managing one-time projects or recurring contracts, consistency and attention to detail in your financial documentation are key to fostering professional relationships. Implementing best practices for accuracy not only minimizes errors but also helps in streamlining your entire billing process.

Key Tips for Accurate Documentation

To ensure that every billing document you send out is clear, correct, and efficient, follow these best practices:

- Double-Check Client Information: Always verify the client’s name, address, and contact details before finalizing any document to avoid sending it to the wrong recipient.

- Break Down Services Clearly: Provide a detailed list of services rendered, including dates, hours worked, and specific tasks completed. This helps clients understand the charges and reduces the likelihood of misunderstandings.

- Use Accurate Pricing: Ensure that the rates you list are up-to-date and reflect any agreements made with the client. Double-check for any discounts, taxes, or additional fees that should be applied.

- Maintain Consistent Formatting: Stick to a consistent layout for all your billing documents, with clear headings and sections. This makes it easier for clients to review and pay promptly.

- Set Clear Payment Terms: Include specific due dates, accepted payment methods, and any penalties for late payments. Clear payment instructions help eliminate confusion and encourage timely payments.

- Use Automation for Accuracy: Implement automated tools to minimize human error. These can help with calculations, reminders, and even sending out recurring bills without the risk of mistakes.

Why Accuracy Matters

Accuracy in billing goes beyond preventing disputes. By ensuring your financial documentation is correct, you build credibility and professionalism, which strengthens client trust. Clients are more likely to pay promptly when they receive a document that is easy to understand, transparent, and free from errors. Additionally, accurate records make it easier to track payments, manage cash flow, and stay compliant with tax regulations.

By following these best practices, you can create a reliable and efficient billing process that helps your business thrive and fosters long-lasting relationships with clients.

Integrating Invoice Templates with Accounting Software

Seamlessly connecting your financial documentation system with accounting software can greatly enhance the efficiency of your billing process. By automating data transfer between the two systems, you eliminate manual entry errors, reduce administrative work, and ensure consistency across all business records. This integration streamlines workflows, saves time, and helps maintain accurate financial records, leading to improved business management and faster payment cycles.

Benefits of Integration

Integrating your billing structure with accounting software brings several advantages, making the process smoother and more reliable for both you and your clients:

- Automated Data Entry: Integration automatically populates necessary fields in your financial documents, reducing the need for manual data entry and preventing errors.

- Improved Accuracy: Data synchronization between billing and accounting systems ensures that the information in both places is accurate and up-to-date, preventing discrepancies.

- Real-Time Updates: Changes made in one system–such as adjustments to payment status or client details–are reflected instantly across all related documents, ensuring consistency in real-time.

- Time-Saving: Integration eliminates the need for duplicate data entry, allowing you to focus on other important tasks while saving time on administrative work.

- Efficient Tracking and Reporting: Integrated systems make it easier to track outstanding payments, generate reports, and stay on top of financial records, ensuring better decision-making and compliance.

How to Integrate Your Billing System with Accounting Software

To successfully integrate your billing structure with your accounting software, follow these steps:

- Select Compatible Tools: Ensure that your billing system and accounting software can be integrated either natively or through third-party connectors.

- Sync Client Information: Set up synchronization between your client database and the accounting software to ensure that customer details are automatically updated in both systems.

- Automate Billing and Payment Updates: Enable automatic billing creation and updates when payments are received, reducing manual tracking and entries.

- Customize Reports: Customize financial reports to pull data from both systems, allowing for detailed insights into your revenue and outstanding balances.

- Monitor Regularly: Regularly review the integration to ensure that ever

Tracking Payments Using Invoice Templates

Efficiently managing and tracking payments is crucial for maintaining cash flow and ensuring financial stability. By using a well-organized billing structure, businesses can easily monitor which payments have been made, which are overdue, and which are yet to be processed. Proper tracking not only helps with managing finances but also ensures that no payment slips through the cracks, enabling timely follow-ups and better financial planning.

How to Track Payments Effectively

Tracking payments can be a seamless process when your billing documents include the right features. Here are some key practices to follow:

- Include Payment Status: Always include a clear “Payment Status” section, which can indicate whether a payment is pending, completed, or overdue.

- Set Clear Due Dates: Make sure that payment due dates are clearly visible on the document to help clients understand when payments are expected.

- Use Unique Invoice Numbers: Assign a unique number to each document to make it easier to track individual payments and keep a detailed record of all transactions.

- Record Payment Methods: Include information about the method of payment (e.g., bank transfer, credit card) to ensure clarity and facilitate any necessary follow-ups.

- Offer Multiple Payment Options: Providing various payment methods increases the likelihood of timely payments, making it easier for clients to settle their balances promptly.

Benefits of Tracking Payments

Properly tracking payments through your billing system offers several advantages:

- Improved Cash Flow: By staying on top of which payments are outstanding, you can follow up promptly, reducing delays in cash flow.

- Better Financial Planning: Knowing the payment schedule helps in planning future expenses and investments.

- Clear Record Keeping: Accurate payment tracking provides clear records for future reference, making it easier for audits, tax preparation, and financial reporting.

- Reduced Errors: Automated tracking minimizes the risk of human errors in financial records, ensuring that all payments are recorded correctly.

By ensuring that your billing documents clearly track the payment process, you enhance the overall management of your business finances, making it easier to follow up with clients, ensure timely payments, and maintain a steady flow of revenue.

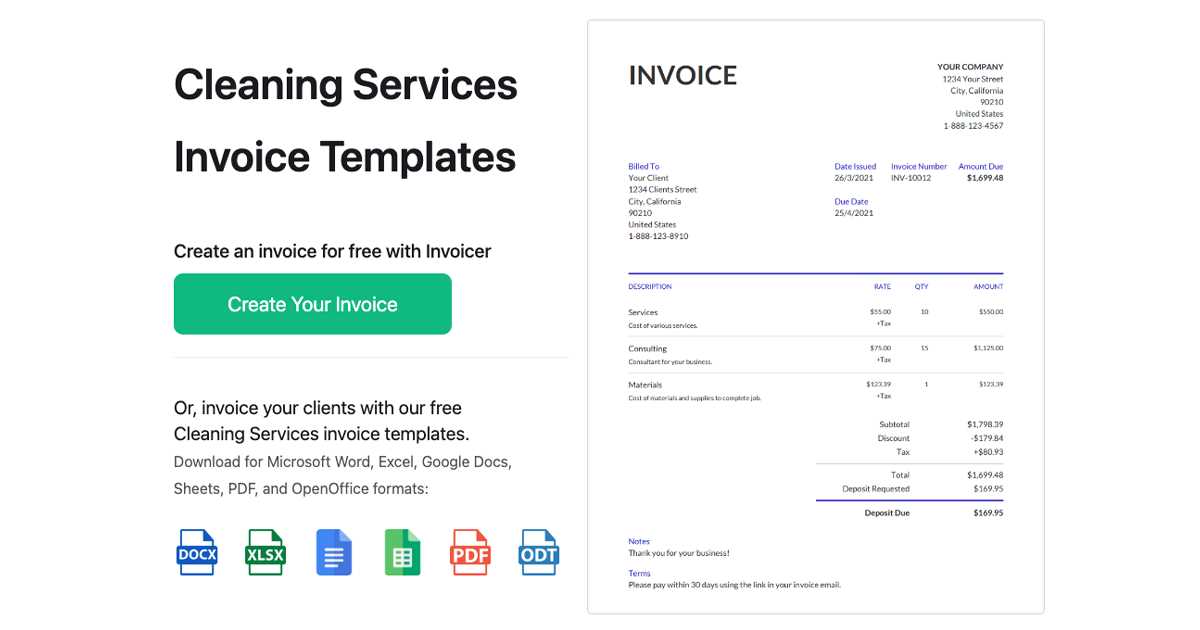

Choosing Between Free and Paid Invoice Templates

When selecting a billing structure for your business, one of the key decisions is whether to go with a free option or invest in a paid solution. Both choices have their benefits, but the right one for your business will depend on your specific needs and budget. Free options are often sufficient for small, one-person businesses or startups, while paid solutions offer advanced features and customization that can benefit growing companies with more complex financial needs.

Advantages of Free Options

Free billing structures are widely available, and they can be a great starting point for businesses that are just getting off the ground. Here are some key benefits:

- No Cost: The obvious benefit is that these structures are free, making them a great option for businesses with a tight budget.

- Simple to Use: Many free options are easy to set up and use, providing a quick solution for those who don’t need advanced features.

- Basic Features: While limited, free options usually offer enough features to create simple and clear billing documents, suitable for small transactions and minimal customization.

Advantages of Paid Options

For businesses with larger operations or specific requirements, paid solutions offer several advantages:

- Customization: Paid structures often come with customizable fields, allowing you to tailor the design and content to better reflect your brand and specific needs.

- Advanced Features: These options may include automated calculations, the ability to add tax rates, and integration with accounting software, which can save time and reduce errors.

- Professional Appearance: Paid solutions typically offer more polished designs, contributing to a more professional and credible image for your business.

- Support and Updates: With paid options, you often get customer support, as well as regular updates and new features to keep your financial documents up to date.

Ultimately, the choice between free and paid billing structures depends on your business’s needs. If you’re just starting out or have a limited budget, a free solution may be all you need. However, as your business grows, investing in a paid option can provide more flexibility, featu

Common Mistakes to Avoid in Invoicing

Creating accurate and professional billing documents is essential for maintaining smooth business operations. However, even the most experienced professionals can make mistakes that lead to delays in payments, confusion, or loss of trust with clients. By recognizing and avoiding common errors, you can streamline your billing process, improve cash flow, and maintain strong client relationships.

Key Mistakes to Avoid

Here are some of the most frequent mistakes businesses make when generating billing documents and how to avoid them:

- Incorrect or Missing Client Details: Always double-check the recipient’s name, address, and contact information before sending any billing document. Small errors like this can cause confusion and delay payments.

- Ambiguous Payment Terms: Ensure that payment deadlines, methods, and any penalties for late payments are clearly stated. Unclear terms can lead to delayed or missed payments.

- Failure to Track Payments: Keep a record of all payments received and ensure that the payment status is updated regularly. Not tracking payments can lead to confusion and unpaid bills.

- Not Providing Enough Detail: Vague descriptions of the work completed or products provided can lead to questions from clients. Always include clear, itemized details for each service rendered, such as dates, quantities, and individual charges.

- Forgetting to Include Taxes: Missing out on taxes or incorrectly applying tax rates can cause problems both with clients and tax authorities. Always verify tax rates and include them in your document as needed.

- Inconsistent Formatting: Consistent formatting helps your clients easily understand the document. Using different fonts, font sizes, or layouts can make your billing documents look unprofessional and difficult to read.

- Not Following Up on Overdue Payments: Failing to send reminders for overdue payments can result in prolonged delays. Be proactive and send polite reminders as soon as payments are overdue.

How to Prevent These Mistakes

To minimize errors in your billing documents, consider implementing these best practices:

- Use Automation: Consider using software to automate the generation and tracking of your billing documents. This reduces the risk of human error and helps you maintain consistency.

- Regularly Review Your Documents: Take the time to review your billing documents before sending them out. A quick check for accuracy can prevent many common errors.

- Provide Clear Instructions: Make sure all payment instructions and terms are easy to understand. Clarity ensures that your clients know exactly