Invoice Template for Canadian Businesses

Efficient and organized financial records are essential for any business looking to maintain a professional image and build strong client relationships. One key element in this process is preparing clear and accurate billing documents that both meet legal requirements and simplify transactions with clients. These documents streamline payment processes, ensure transparency, and help track all financial exchanges effectively.

For entrepreneurs and small business owners, having a reliable format to document transactions helps in reducing administrative burdens. By selecting the right billing layout, business owners can save valuable time and reduce the chances of errors. Consistent and professional documentation strengthens the credibility of the business, making it easier for clients to understand charges and settle payments promptly.

Finding a suitable solution that aligns with industry standards while also being adaptable to specific needs can greatly benefit businesses. Additionally, proper structure and clarity in these documents not only enhance communication but also help comply with national financial standards, making ta

Invoice Solutions for Canadian Entrepreneurs

For business owners, handling transactions efficiently is key to maintaining a strong reputation and consistent cash flow. Selecting an appropriate system for organizing and tracking payments can streamline workflows, saving both time and resources. Various solutions offer flexible formats, customizable layouts, and essential tools that cater to the diverse needs of entrepreneurs.

Whether a business is just starting out or expanding, using structured approaches for documenting transactions can significantly enhance record-keeping and compliance. By leveraging digital tools, entrepreneurs can improve accuracy, reduce paperwork, and stay organized. Choosing the right option involves considering factors like ease of use, compatibility with accounting software, and adaptability to specific business requirements.

Key Features to Look For

| Feature | Benefit | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Customizable Layouts | Allows

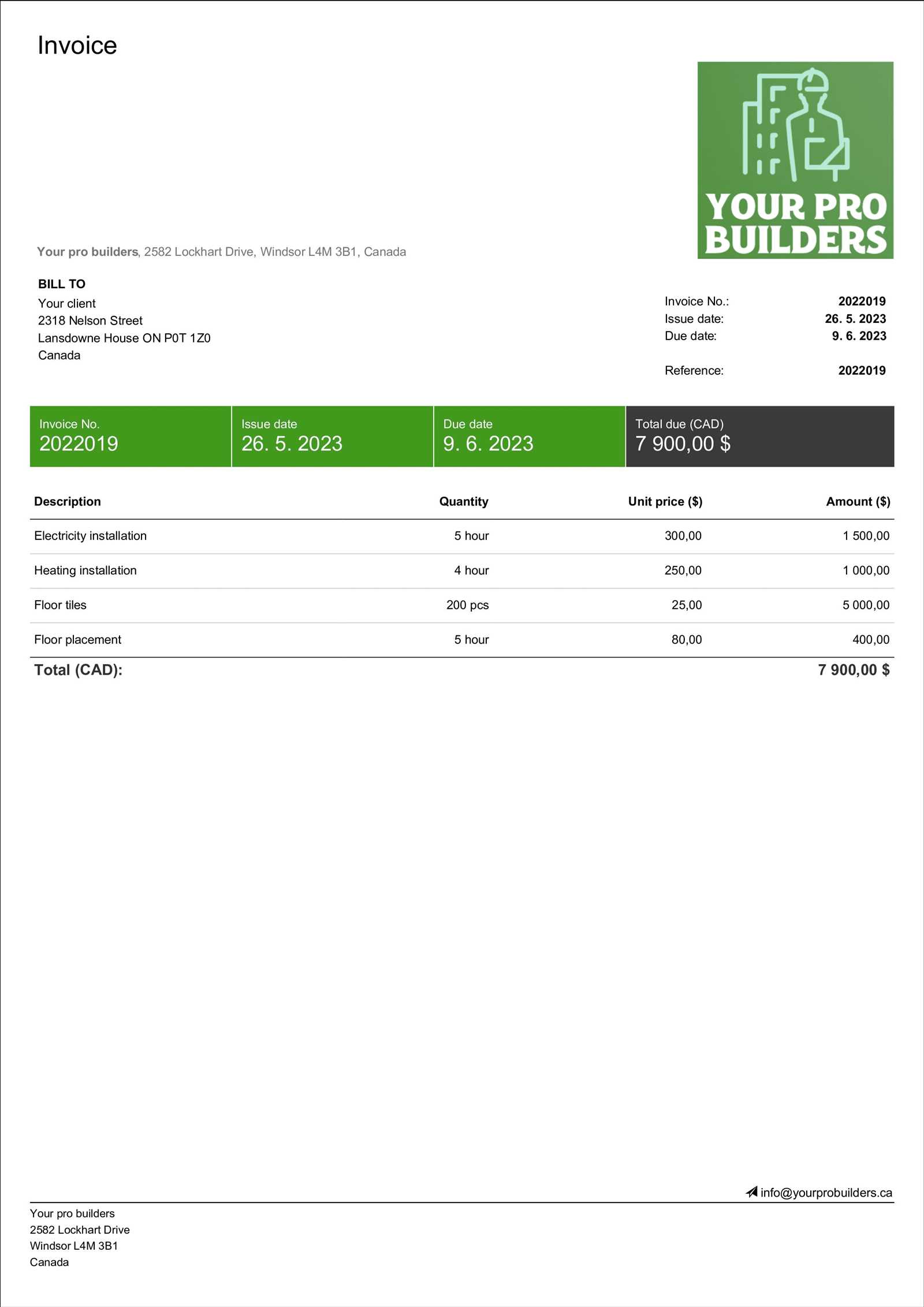

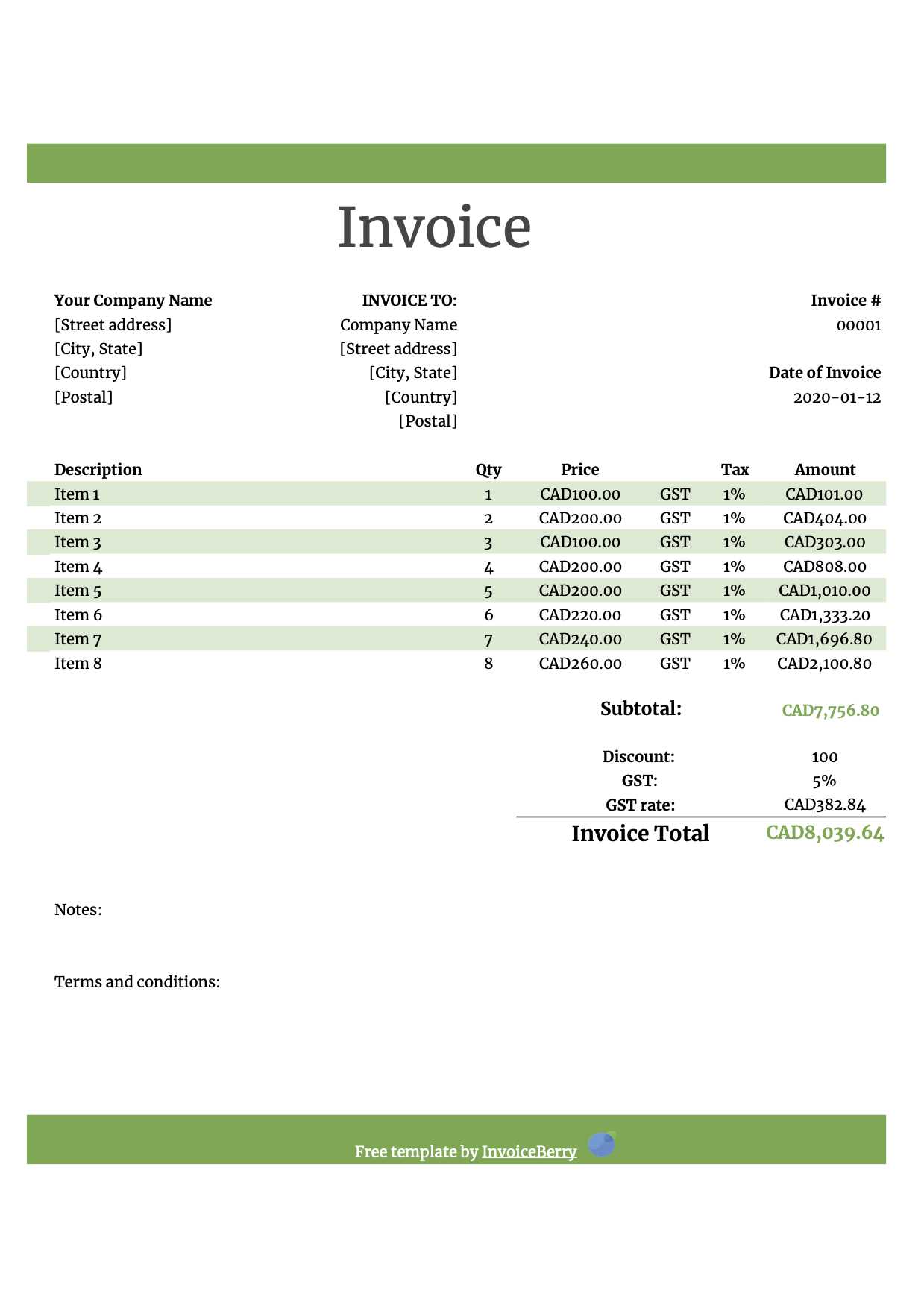

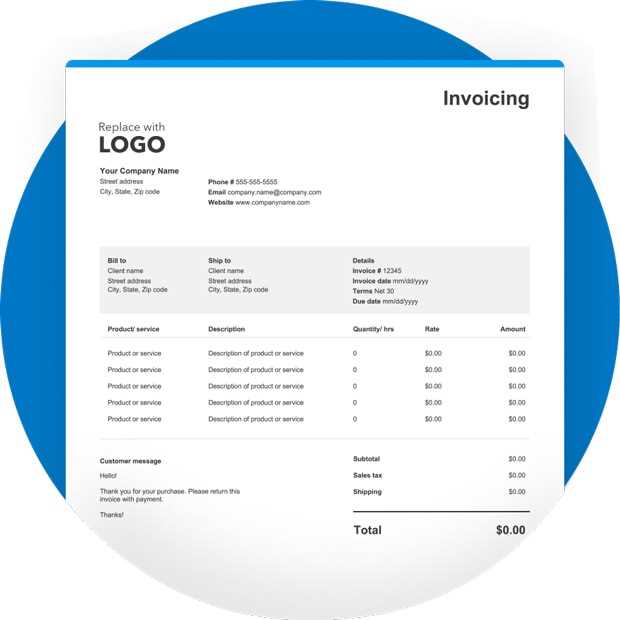

Understanding Essential Invoice Components

Organizing transaction details clearly and concisely helps businesses communicate effectively with clients and ensures smooth payment processes. A well-structured document should contain key sections that make it easy for both parties to understand the specifics of the transaction. Including all necessary elements can reduce misunderstandings and streamline record-keeping. Basic Information for Business IdentificationEach transaction document should start with clear business identification, including the company’s name, address, and contact information. This section may also include a logo or brand colors to maintain a professional appearance. Contact details allow clients to reach out easily if they have questions, contributing to transparent communication. Detailed Itemization

|

| Tax Type | Required Information |

|---|---|

| Goods and Services Tax (GST) | The percentage applied to the total cost of goods or services, and the total GST amount charged. |

| Harmonized Sales Tax (HST) | Indicate if HST applies, and include the applicable rate and total amount charged for HST. |

| Provincial Sales Tax (PST) | For provinces that charge PST, state the rate and the amount added to the subtotal of the transaction. |

It’s important to clearly break down the tax amounts and indicate them separately from the cost of goods or services to maintain clarity. Additionally, ensuring that the correct tax rates are applied based on location and transaction type is vital for compliance and accuracy.

Managing Payment Processing Efficiently

Efficient management of payment processing is crucial for maintaining healthy cash flow and fostering good relationships with clients. Ensuring that payments are collected on time and accurately can streamline business operations, reduce errors, and prevent disputes. A well-organized approach to managing payments helps businesses stay financially stable and improve customer satisfaction.

To manage payments effectively, it’s important to outline clear expectations, provide easy-to-follow instructions, and offer multiple payment options. Additionally, keeping track of payment deadlines and maintaining organized records can prevent delays and confusion. Below are some strategies to help manage payment collection efficiently:

| Strategy | Benefits |

|---|---|

| Set Clear Payment Terms | Ensures that customers know when and how to make payments, reducing the likelihood of late payments. |

| Offer Multiple Payment Methods | Providing options like credit cards, bank transfers, or online payment systems increases convenience for clients and encourages timely payments. |

| Track Payments Regularly | Helps identify overdue payments early and take action before issues arise, ensuring consistent cash flow. |

By implementing these strategies, businesses can streamline the payment process and maintain a smooth financial operation. Setting up reminders, automating processes, and maintaining clear communication are all steps that contribute to efficient payment management.

Using Digital Documents for Faster Transactions

Adopting digital documentation for financial transactions is an excellent way to speed up the payment process and improve efficiency. These electronic records not only reduce the time spent on manual entry but also allow for quicker processing, helping businesses get paid faster. By shifting away from traditional paper-based methods, businesses can enhance their workflow and reduce delays in payments.

Benefits of Digital Documents

There are several advantages to switching to electronic records for your business transactions:

- Speed: Digital documents can be sent instantly via email or cloud services, ensuring that they reach clients without delay.

- Convenience: Both businesses and clients can access and review records at any time, from anywhere, on various devices.

- Cost savings: Reduces the need for paper, postage, and physical storage, helping save resources and money.

- Accuracy: Automated systems reduce the risk of human error that may occur with manual processes.

How to Implement Digital Documents Effectively

To take full advantage of electronic transactions, businesses should consider the following steps:

- Choose an appropriate platform: Select a digital solution that aligns with your business needs and offers secure, user-friendly features.

- Integrate with payment systems: Linking your digital records to payment gateways enables clients to pay quickly and easily.

- Ensure proper security: Use encryption and secure connections to protect sensitive financial data.

By implementing digital documentation, businesses can streamline their financial processes, reduce errors, and speed up transactions, leading to improved cash flow and better customer satisfaction.

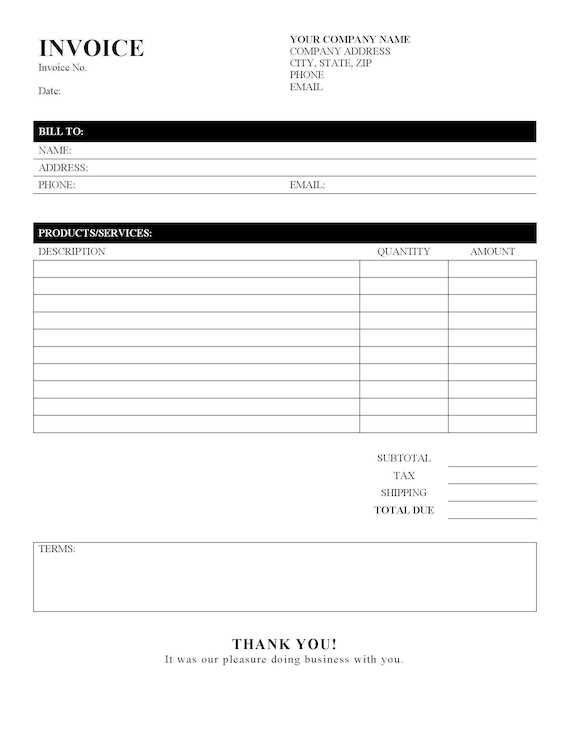

Best Practices for Structuring Billing Documents

Creating well-structured financial documents is essential for ensuring clarity and professionalism in business transactions. A well-organized record not only helps with tracking payments but also creates a positive impression for clients. By following best practices, businesses can ensure their documents are both easy to understand and legally compliant, which can reduce errors and disputes.

Key Elements to Include

Every financial document should contain specific elements to maintain consistency and clarity. Here is a list of the most important components:

| Component | Description |

|---|---|

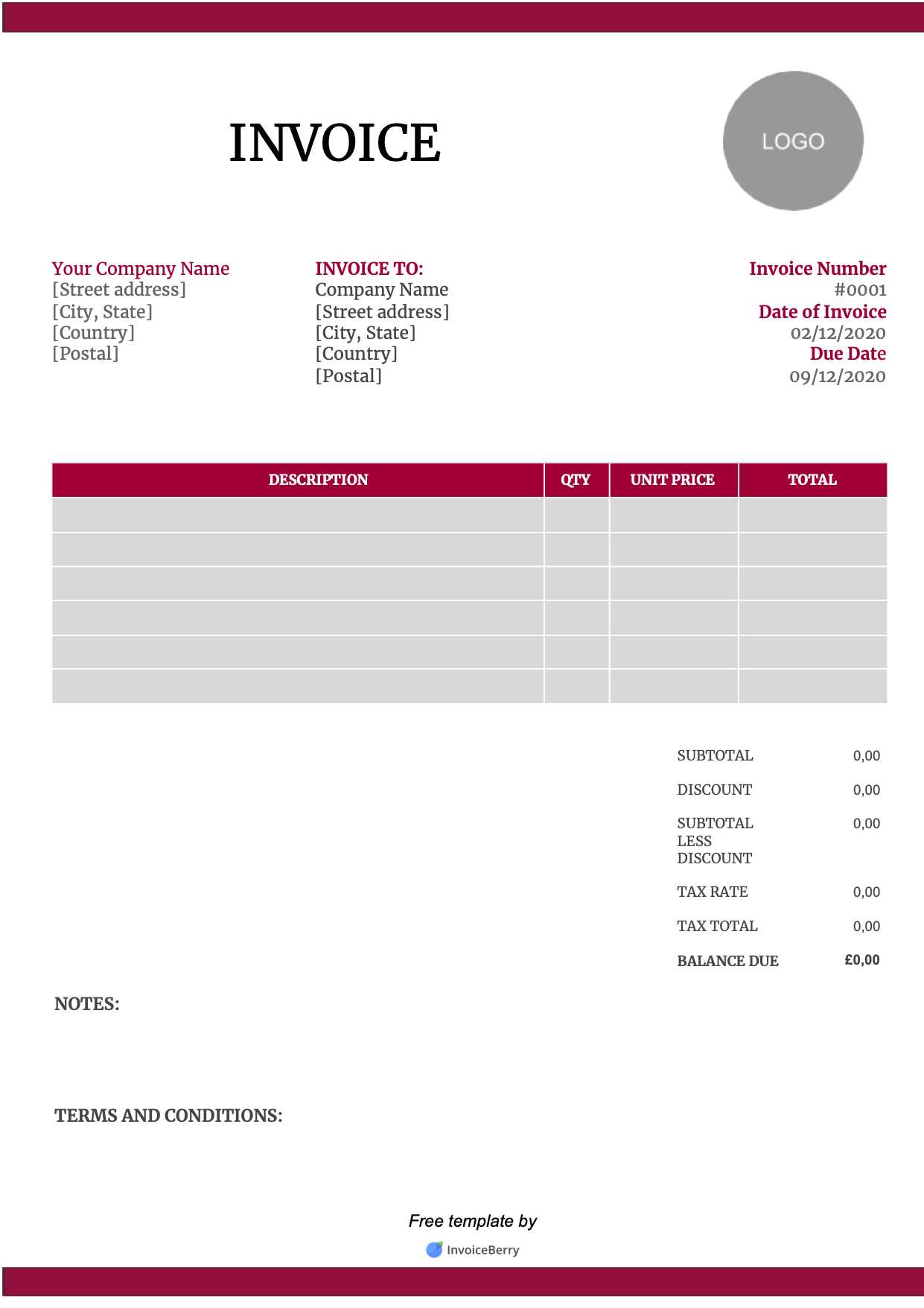

| How to Customize Billing Documents for Branding

Customizing financial records to reflect your brand identity is a key way to enhance the professional image of your business. By incorporating brand colors, logos, and personalized elements into these documents, you create a cohesive experience for your clients. This not only strengthens your brand presence but also adds a personal touch to business transactions. Incorporating Brand ElementsThere are several ways to integrate your company’s branding into a financial document. These visual cues reinforce your identity while ensuring that your document remains functional and professional. Here are some ways to personalize:

Ensuring a Professional LookWhile personalization is important, it is equally crucial to maintain a professional appearance. Here are some additional tips to balance branding with professionalism:

Customizing financial documents with your business branding enhances client trust and recognition. By following these simple steps, you can effectively showcase your brand in every transaction. Exploring Software Options for BillingFor businesses seeking to streamline their financial transactions, leveraging software solutions can greatly enhance efficiency and accuracy. These tools help automate and organize the process, reducing the time spent on manual tasks and minimizing errors. By choosing the right software, companies can easily manage their billing, track payments, and improve client communication. Key Features to Look ForWhen selecting a software solution for managing financial records, it’s important to focus on the features that will best meet your business needs. Here are some essential attributes:

Popular Software ChoicesThere are numerous software tools available, each with unique features and pricing plans. Some of the most popular solutions include:

Selecting the right software depends on your business size, requirements, and budget. These tools not only simplify the process but also provide valuable insights to support your business growth. Organizing

Efficient organization of financial documents is key to ensuring smooth operations for any business. By maintaining an orderly system for tracking transactions, businesses can easily manage cash flow, monitor outstanding payments, and avoid unnecessary confusion. Proper organization also supports accurate record-keeping for tax purposes and ensures that all financial details are easily accessible when needed. Digital Tools for Organization Utilizing digital tools for sorting and categorizing financial data can significantly reduce the time spent on administrative tasks. Software solutions designed for business management allow you to:

Physical Organization While digital systems are highly efficient, physical organization remains essential, especially for businesses that deal with large volumes of paper documents. Establishing a filing system with clear labels for various financial categories ensures easy retrieval and reduces the risk of misplacement. Implementing regular audits and maintaining an organized storage space can further streamline this process. By combining digital and physical organization methods, businesses can stay on top of their financial records, ensuring smooth operations and informed decision-making. |