Invoice Template Book for Streamlined Billing Solutions

Efficient record-keeping is crucial for any business or freelancer looking to maintain smooth financial operations. With the right resources, creating accurate and professional documents can be quick and hassle-free. This guide explores how structured formats can help manage payments, transactions, and client communications effortlessly.

By utilizing ready-made structures, you can ensure consistency, accuracy, and professionalism across all your dealings. These formats are designed to save time, reduce errors, and provide a polished look that impresses clients and partners alike. Whether you’re a small business owner or a freelancer, having the right tools can streamline your workflow.

Organizing your financial documents with pre-designed structures offers convenience and security. Customization options allow you to adjust fields according to your specific needs while ensuring that each document meets industry standards. Embracing this approach enhances productivity, ensuring you never miss critical details in your transactions.

Invoice Template Book: An Overview

Managing financial documents effectively is essential for businesses of all sizes. The ability to generate accurate and professional records can simplify payment processing and improve client relations. With the right tools, creating well-structured documentation becomes a straightforward task, helping maintain clear and organized financial communications.

Pre-designed formats offer a practical solution for businesses to streamline their operations. These structures are designed to be easily customizable, enabling users to adapt them to their specific needs while maintaining consistency and clarity. Whether you’re handling large transactions or smaller day-to-day activities, such documents serve as a reliable resource.

Having access to these organized resources ensures that you can quickly create records that meet all necessary standards. These solutions not only save time but also reduce errors, ensuring that all essential details are captured accurately and professionally. With these ready-made formats, businesses can stay focused on growth while managing finances effortlessly.

Why You Need an Invoice Template

Having a structured format for financial documentation is essential for any business or freelancer. It simplifies the process of recording transactions, ensuring consistency and professionalism in every document issued. Without a reliable system in place, creating accurate records can become time-consuming and prone to errors.

- Time Efficiency: Using a pre-designed structure allows you to quickly generate necessary records without starting from scratch.

- Accuracy: These formats help you capture all important details, minimizing the risk of mistakes and omissions.

- Professionalism: Well-organized documents convey credibility and trustworthiness to clients, improving business relationships.

- Legal Compliance: Standardized documents ensure you meet industry and legal requirements, protecting you in case of disputes.

- Customization: Easily adjust fields to fit your unique needs while keeping everything structured and easy to understand.

By utilizing such systems, businesses can save valuable time and focus on growth, knowing that all their records are in order and ready for any purpose, whether it’s client payments, audits, or financial planning.

Benefits of Using Pre-Made Templates

Utilizing ready-made structures for creating financial documents offers numerous advantages, helping streamline the entire process. By choosing pre-designed formats, businesses can avoid the complexities of manual creation while ensuring consistency and accuracy in every record. Here are some key benefits:

- Time Savings: Pre-made structures save you time by providing a quick and efficient way to generate essential documents without starting from scratch.

- Consistency: These formats help maintain a consistent look and feel across all your records, reinforcing your brand image.

- Ease of Use: User-friendly designs make it easy for anyone to create professional documents, regardless of technical skill or experience.

- Reduced Errors: By following a structured approach, the likelihood of making mistakes is minimized, ensuring that all necessary details are included.

- Customization Flexibility: Pre-designed formats are easily customizable, allowing you to adjust fields and details to suit your specific needs.

- Professional Appearance: Ready-made structures offer a polished, professional look that can enhance your reputation and credibility.

- Compliance Assurance: Standardized designs ensure that your records meet industry regulations and legal requirements, providing peace of mind.

By using these pre-designed solutions, businesses can improve their workflow, maintain consistency, and focus on other important aspects of their operations while ensuring that all documentation is in order.

Choosing the Right Invoice Format

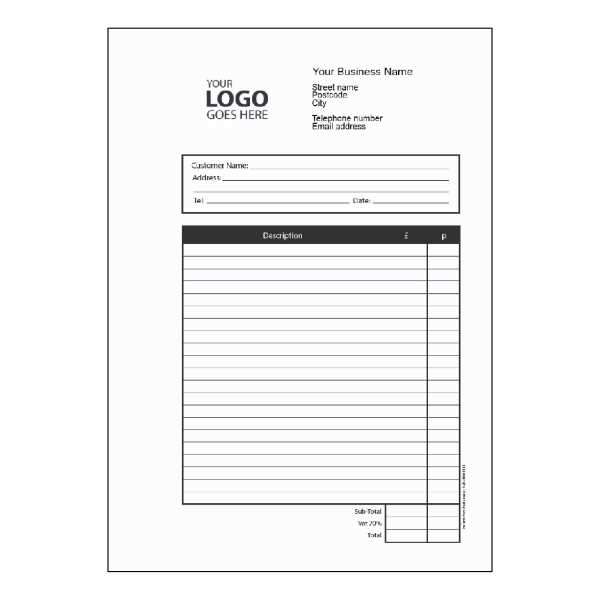

Selecting the appropriate structure for financial documents is crucial for ensuring clear communication and effective record-keeping. The right layout not only ensures that all necessary details are captured but also contributes to the professional appearance of the document. Here are a few factors to consider when choosing the best format:

- Business Needs: Consider the type of transactions your business handles. Some formats are designed for simple transactions, while others are suited for more complex billing needs.

- Customization: Ensure the layout can be easily customized to include fields specific to your business, such as product descriptions, tax rates, or payment terms.

- Readability: A well-organized document is easier to read and understand. Choose a format that presents information in a clear and logical manner.

- Legal Requirements: Depending on your location and industry, there may be legal guidelines for the information that must be included in financial documents.

- Client Expectations: Different clients may expect different types of records. Choose a format that aligns with their preferences and the nature of your relationship.

- Branding: The chosen layout should allow for easy incorporation of your brand elements, such as logos, colors, and fonts, to maintain consistency across all communications.

Choosing the right structure ensures that your documentation is not only functional but also aligns with your business goals, client expectations, and industry standards.

How to Customize Your Invoice

Adapting your financial documents to suit your business’s needs is essential for maintaining clarity and professionalism. Customization allows you to incorporate specific details and features that align with your brand while ensuring all necessary information is presented accurately. Here are a few steps to effectively tailor your records:

Adjusting the Layout

The first step in customization is modifying the layout to suit your style and requirements. You can adjust the size, positioning, and alignment of text and fields. This ensures that key information such as payment terms, item descriptions, and totals are easily visible. Keep the design clean and organized to maintain readability.

Adding Branding Elements

Incorporating your logo, color scheme, and fonts into the design reinforces your business identity. Personalizing your records with these elements ensures that every document you send out carries your brand’s image. It’s important to keep the design professional while reflecting your company’s tone and style.

With these adjustments, your records will not only meet your business needs but also provide a consistent and professional appearance that resonates with your clients. Customizing these documents enhances both functionality and brand recognition, leading to better client relationships.

Top Features of an Invoice Template

When creating a document for billing, certain elements are essential for ensuring clarity, accuracy, and professionalism. A well-designed structure not only streamlines the process but also ensures that important details are not overlooked. Here are some of the key features that make a financial document effective and functional:

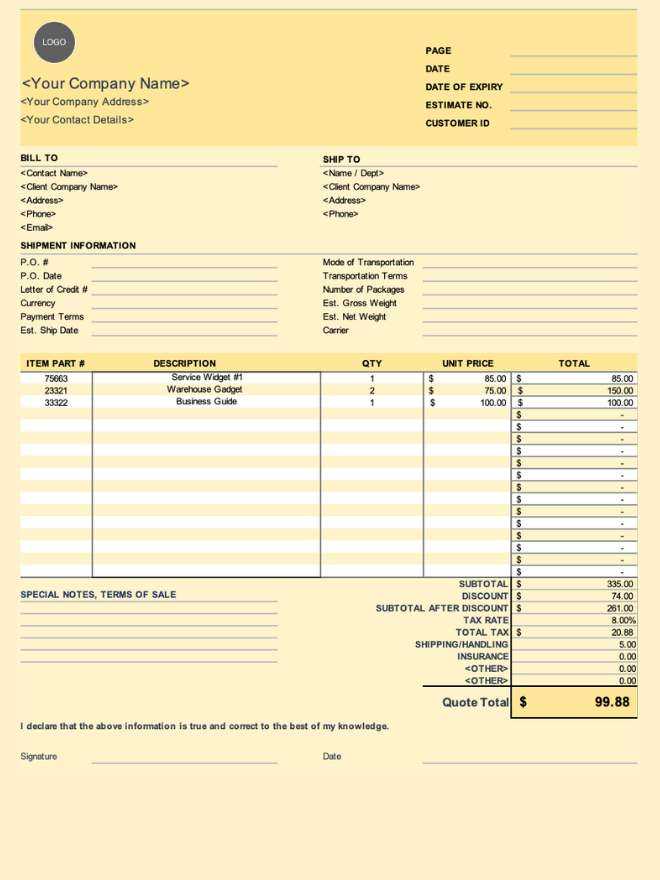

Key Elements for Functionality

- Header Information: Includes your business name, address, contact details, and logo, ensuring that clients know exactly who is sending the document.

- Client Details: Clearly display the recipient’s information, including their name, address, and contact information, to avoid any confusion.

- Unique Document Number: Each record should have a unique identification number for easy tracking and reference.

- Clear Payment Terms: Specify due dates, payment methods, and any applicable late fees to make the terms of the transaction clear.

Enhancing Professionalism and Clarity

- Itemized List: A detailed breakdown of services or products provided, including quantities, descriptions, and prices, helps avoid misunderstandings.

- Subtotal and Taxes: Clearly marked totals, including applicable taxes and discounts, should be easily visible to ensure transparency.

- Total Due: The final amount due should be prominent and easy to locate for the recipient.

- Additional Notes or Instructions: This section allows for any specific information or terms that need to be communicated to the client.

Including these features helps ensure that every document you send is organized, professional, and easily understood by clients. A well-structured document builds trust and enhances communication between you and your clients, making the payment process smoother and more efficient.

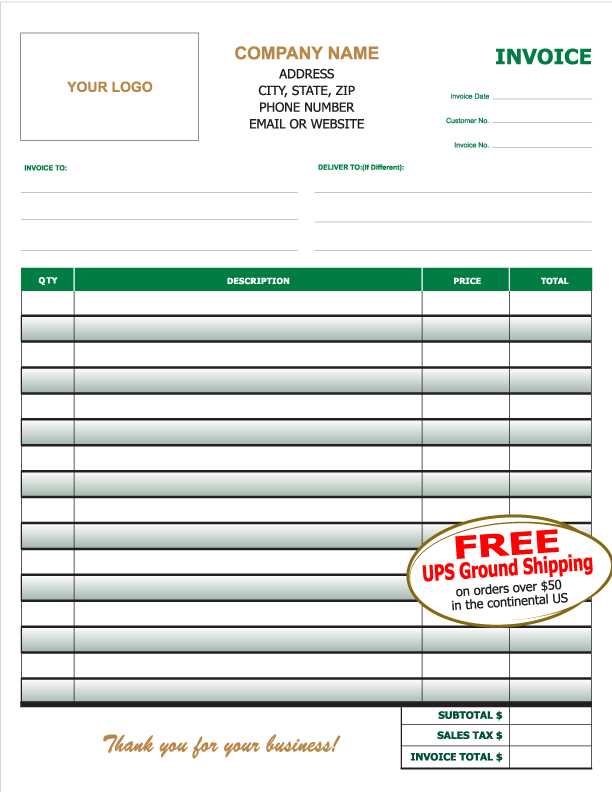

Free vs Paid Invoice Templates

When choosing a structure for financial documents, businesses often face the decision between using free or paid options. Both offer advantages and drawbacks, depending on your specific needs and the level of customization you require. Here’s an overview of what to consider when deciding between the two options:

Benefits of Free Options

Free structures are widely available and a great starting point for businesses on a tight budget. These documents are typically easy to use and can be customized to a certain extent. However, they often come with limitations in design flexibility and may not include advanced features needed for more complex transactions.

- Cost-effective: No upfront payment, ideal for startups or small businesses.

- Easy Access: Ready to use with minimal setup required.

- Basic Features: Includes the essential details like itemization, totals, and contact information.

Benefits of Paid Options

Paid structures provide greater flexibility, professional designs, and additional features that can help streamline the billing process. These options are typically designed to meet higher standards of branding and legal compliance, offering a more polished and customizable experience.

- Advanced Features: Includes customizable fields, automated calculations, and more.

- Customization Options: Greater control over design, allowing you to match the document with your brand identity.

- Professional Appearance: Designed to meet industry standards and provide a more polished look.

The choice between free and paid options largely depends on your business’s budget, the level of professionalism required, and the complexity of the transactions you deal with. While free options work well for simple needs, paid solutions offer more comprehensive benefits for businesses looking to make a strong impression and streamline their processes.

Understanding Invoice Layouts and Design

Creating a professional and organized billing document requires careful attention to the layout and overall design. The structure of your document plays a crucial role in making the information clear and accessible, while the design ensures that it aligns with your brand’s identity. A well-designed document not only reflects professionalism but also helps in maintaining transparency with clients.

The layout should prioritize clarity and ease of use, ensuring that all critical details are presented in an easy-to-follow format. Key elements, such as item descriptions, pricing, and payment terms, should be clearly separated to avoid confusion. The use of a clean, straightforward design enhances readability and minimizes the risk of errors.

In terms of design, a good layout incorporates elements like consistent font choices, ample white space, and well-defined sections. It’s important to strike a balance between a polished, visually appealing look and functional design. The overall style should not overshadow the information but should rather complement it to create a professional and trustworthy document.

Whether for small businesses or large enterprises, understanding the right approach to layout and design is essential for creating effective documents that communicate important details to clients and improve the billing experience.

How to Manage Invoice Templates Effectively

Managing billing documents efficiently is key to ensuring a smooth and professional workflow. By organizing your documents well, you can save time, reduce errors, and improve your overall client experience. Proper management involves not just storing the files but also keeping them up to date, easily accessible, and customized to your needs.

One of the first steps in effective management is setting up a clear and consistent naming system. This makes it easier to find and differentiate between documents, especially when dealing with multiple clients or projects. Keeping folders organized by client or project can also streamline your workflow and prevent confusion.

Additionally, consider maintaining a central location for all your documents, such as cloud storage or a secure digital system. This allows for easy access, sharing, and updating from any device. Regularly reviewing and updating your files ensures they stay current and in line with your business’s evolving needs.

Lastly, make use of digital tools to automate repetitive tasks, such as populating common fields or calculating totals. By doing so, you reduce the chances of errors and improve your efficiency. With the right strategies in place, managing your billing documents can be an easy and effective part of your business operations.

Common Invoice Mistakes to Avoid

Billing documents are an essential part of any business transaction, and making mistakes can lead to confusion, delays, and even financial discrepancies. Avoiding common errors can help ensure that the process remains smooth, professional, and free from misunderstandings. By being aware of the typical mistakes, you can take the necessary steps to prevent them and improve your overall efficiency.

One frequent mistake is failing to include all necessary information, such as the correct contact details, due dates, or descriptions of services provided. Missing these elements can result in delays or questions from clients. Another common issue is incorrect calculations, which can lead to disputes or incorrect payments. It’s crucial to double-check figures, including taxes and discounts, before sending any documents.

Additionally, using unclear terms or vague descriptions can lead to confusion. Being specific about what is being billed and the terms of payment helps avoid any misunderstanding. Finally, not keeping a consistent format or structure can make your documents look unprofessional. Consistency is key to creating a reliable and trustworthy impression.

Legal Considerations for Invoice Templates

When creating billing documents, it’s important to consider the legal aspects to ensure that your documents are not only professional but also compliant with the law. Properly formatted documents can protect both parties involved in a transaction and help avoid legal disputes. Understanding the necessary legal elements to include can help you safeguard your business and maintain clear communication with clients.

One of the key legal considerations is ensuring that the document contains all the required information, such as payment terms, due dates, and the names and addresses of both parties. Failing to include these details can lead to misunderstandings or disputes down the line. Additionally, it’s crucial to be transparent about any taxes, fees, or additional charges that may apply to the transaction.

Another important legal aspect is ensuring that your billing documents comply with local regulations. Different regions may have specific requirements for invoicing, such as VAT inclusion or particular formats for certain industries. By staying informed about the legal requirements in your area, you can avoid potential fines and ensure your documents are valid.

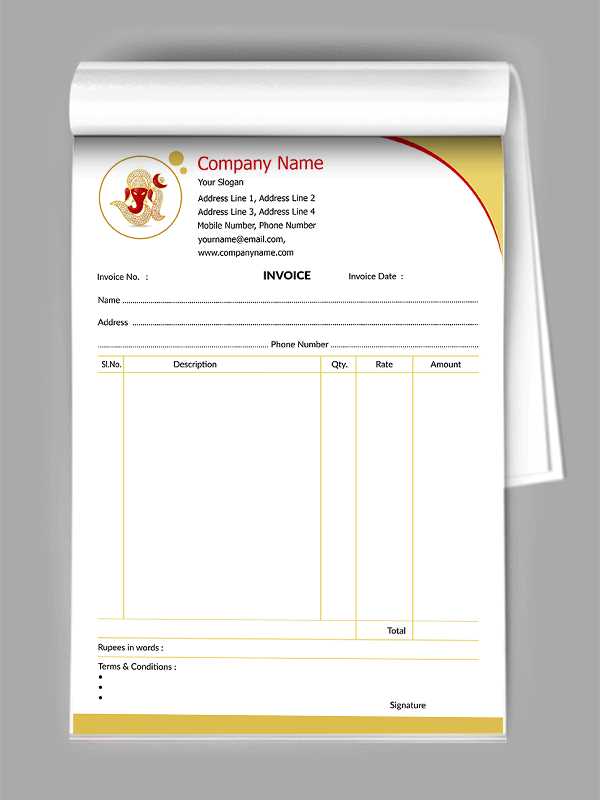

Incorporating Branding into Your Invoice

Adding your company’s branding to your billing documents is an effective way to reinforce your business identity and create a professional, cohesive image. Consistency across all communication materials, including financial documents, can help build trust with clients and promote brand recognition. Incorporating your logo, colors, and font styles into your billing documents allows you to maintain a unified brand presence across all touchpoints.

Here are some elements to consider when incorporating branding into your documents:

| Element | Branding Tip |

|---|---|

| Logo | Place your company logo prominently at the top to create immediate recognition. |

| Colors | Use your brand colors in headings, borders, or background sections for a polished look. |

| Typography | Choose fonts that align with your brand’s style guide to ensure consistency. |

| Contact Information | Ensure your contact details (phone number, email, website) are easy to find, reflecting your professional image. |

By integrating these elements, you make your documents not only functional but also a part of your overall branding strategy. This approach enhances your professionalism and can leave a lasting impression on your clients, reinforcing your brand with every transaction.

Making Invoices Look Professional

Creating polished and professional-looking billing documents is crucial for maintaining a strong business reputation. A well-designed billing statement not only reflects your brand’s identity but also helps foster trust with your clients. A neat, easy-to-read layout, with clear itemization and contact details, can leave a positive impression and encourage prompt payment.

Here are a few tips to ensure your billing documents appear professional:

- Use a Clear Structure: Organize the information in a logical, easy-to-follow manner. Include sections for client details, transaction summary, and payment terms.

- Consistent Fonts: Stick to a clean and readable font. Avoid using too many different font styles, as it may make the document appear cluttered.

- Professional Language: Use formal and respectful language when describing services or products. Avoid slang or overly casual phrases.

- Provide Necessary Details: Ensure that all required information, such as payment due dates and method of payment, is clear and visible. This minimizes confusion and encourages timely payments.

- Brand Identity: Incorporate elements of your brand, like your company logo, color scheme, and contact information, to create consistency across all your communication materials.

By following these practices, you can ensure that your billing statements look not only professional but also reflect the quality and reliability of your services. This attention to detail is key to building lasting relationships with clients.

Saving Time with Invoice Templates

Streamlining administrative tasks is essential for any business, especially when it comes to billing procedures. By utilizing pre-designed billing forms, you can drastically reduce the amount of time spent on repetitive tasks, allowing more focus on core business activities. This efficiency is achieved by eliminating the need to manually create new documents from scratch each time a transaction occurs.

How Pre-Designed Forms Save Time

- Consistency: Pre-designed documents ensure that every statement follows the same format, reducing the time spent reformatting or checking for errors.

- Quick Customization: With the necessary fields already in place, you can simply enter the details specific to each transaction, saving you the effort of starting from a blank page.

- Reduced Errors: By using a standardized structure, the chances of missing important details or making mistakes are minimized, saving time on corrections.

- Efficient Billing Process: With templates that automatically calculate totals and taxes, billing becomes much faster, reducing the chances of delays in payment collection.

Additional Benefits

- Consistency in Professionalism: Every statement will look polished and professional, reinforcing your business’s reliability.

- Easy Storage: Once filled out, these documents can be stored digitally, making them easy to reference and manage in the future.

By adopting pre-designed formats, businesses can significantly reduce the time spent on billing and administrative tasks. This leads to improved efficiency, fewer mistakes, and more time for growth and customer service.

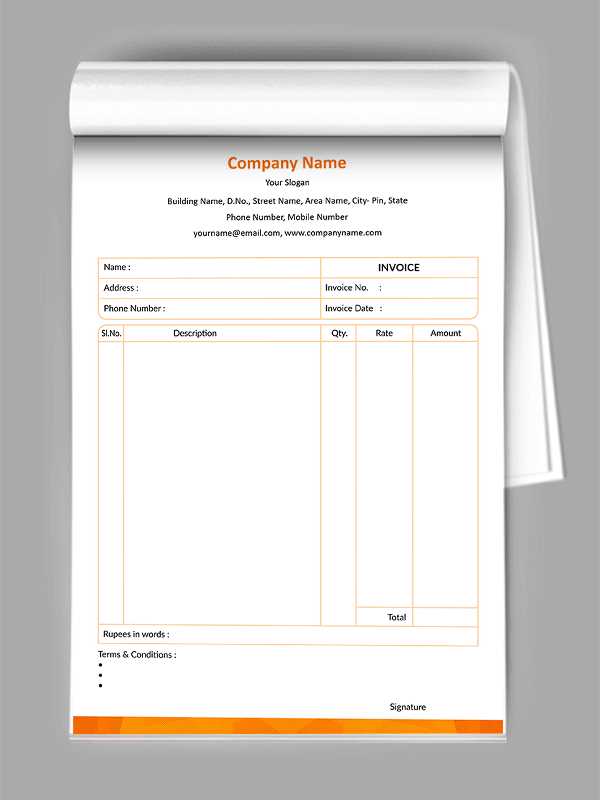

Invoice Templates for Small Businesses

For small businesses, managing financial transactions efficiently is essential for smooth operations. A well-structured document can simplify billing, enhance professionalism, and ensure timely payments. Pre-designed billing forms are particularly beneficial for smaller companies that might not have dedicated accounting staff, as they reduce the effort and time spent on creating customized documents for each transaction.

Why Small Businesses Benefit from Pre-Designed Billing Documents

- Time-Saving: Ready-to-use formats streamline the process, allowing business owners to quickly generate the necessary paperwork without starting from scratch each time.

- Cost-Effective: By using free or low-cost options, small businesses can avoid investing in expensive accounting software or hiring additional staff for billing tasks.

- Accuracy: Standardized documents help reduce human error, ensuring that all critical details, such as amounts and payment terms, are included consistently.

Key Features to Look for in Pre-Designed Documents

- Customizable Fields: Look for formats that allow you to personalize the document with your business name, logo, and specific terms, enhancing your company’s brand image.

- Professional Appearance: A clean, well-organized layout projects credibility and fosters trust with clients.

- Tax and Total Calculations: Many pre-designed forms automatically calculate totals, taxes, and discounts, minimizing the chances of errors in complex financials.

By using pre-made forms, small businesses can simplify their billing process, maintain accuracy, and improve their financial workflow without the need for extensive resources.

Digital vs Paper Invoice Templates

When it comes to generating billing documents, businesses often face the decision between digital or paper formats. Each method has its own set of advantages and drawbacks, depending on the needs of the business and its clients. The choice between the two can affect efficiency, cost, and the overall customer experience.

Advantages of Digital Billing Forms

- Speed: Digital formats allow for instant creation, editing, and sending, making the process quicker and more efficient.

- Cost-Effective: There are no printing or postage costs with digital forms, making it a more affordable choice for many businesses.

- Environmentally Friendly: Using digital formats reduces paper waste, aligning with sustainability goals and corporate responsibility.

- Easy Record Keeping: Digital documents can be stored, backed up, and organized in a way that makes them easy to search and retrieve when needed.

Advantages of Paper Billing Forms

- Personal Touch: Sending physical documents can feel more personal to some clients, enhancing the business relationship.

- Client Preference: Certain customers may prefer or require physical documents for their own record-keeping practices.

- Reliability: Physical documents are not reliant on internet access or digital tools, which can sometimes be prone to technical issues.

- Legal Requirements: In some cases, a hard copy may be required for compliance or legal purposes.

Ultimately, the choice between digital and paper formats depends on business priorities, client preferences, and operational needs. A combination of both methods can also be a viable solution for businesses looking to balance efficiency and personal touch.

How to Use Templates for Tax Purposes

Organizing financial documents is essential for businesses, especially when it comes to tax season. Utilizing structured forms can help streamline record-keeping and ensure compliance with tax regulations. These documents not only assist with tracking income and expenses but also provide a clear audit trail when it’s time to file taxes or prepare financial reports.

Ensure Accurate Data Entry: Using standardized forms can reduce errors in data entry, ensuring that all necessary information, such as dates, amounts, and tax rates, is included. This can help avoid mistakes that could lead to delays or discrepancies during tax filing.

Track Deductible Expenses: By including detailed breakdowns of costs and expenses on each form, businesses can easily identify items eligible for tax deductions. This makes it simpler to claim the correct deductions, reducing the overall tax liability.

Maintain Consistency Across Records: Consistent use of pre-designed forms helps maintain uniformity across financial records, which is critical for accurate reporting. This consistency is essential for both tax audits and general financial analysis, making it easier to verify and cross-check information when needed.

Store for Future Reference: Well-organized records allow businesses to quickly access historical information for tax filing purposes or in case of an audit. Digital or physical copies of these documents serve as valuable references for future tax periods.

By integrating the use of organized forms into your financial workflow, you can ensure that your records are not only tax-compliant but also easily accessible and accurate, reducing the stress and complexity of tax preparation.