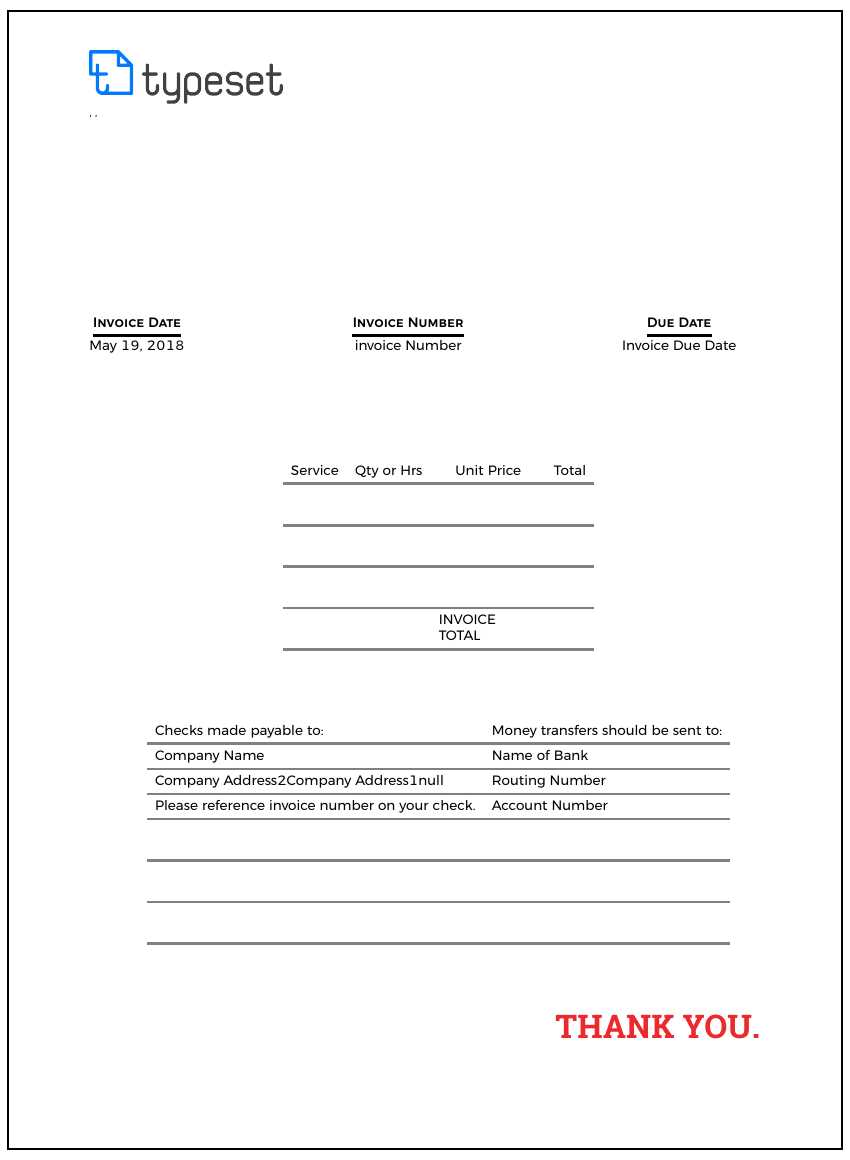

Invoice Template for Bank Transfer Payments

Managing financial transactions efficiently is a key aspect of any business operation. To ensure clarity and accuracy, it’s important to have a structured approach to documenting payments. Having a well-organized document that outlines the necessary details can streamline the payment process and help avoid misunderstandings.

Customizing your financial documents to suit your specific needs is crucial. By including the correct details such as payment instructions, due dates, and reference numbers, you create a clear record for both parties involved. This helps in tracking payments and resolving any issues that may arise during the transaction.

Ensuring the document is professional adds an extra layer of trust to the process. A properly formatted and easy-to-understand document not only reflects well on your business but also supports smooth communication with your clients and partners. This approach is especially valuable when dealing with various payment methods and cross-border transactions.

Invoice Template for Bank Transfers

When managing payments, it’s essential to have a well-organized document that clearly outlines the financial details between the payer and payee. This ensures smooth processing and reduces the chances of confusion. A well-crafted document includes key information, making the payment process easier for both parties.

Key Information to Include

Critical elements such as the payer’s and recipient’s names, payment amount, and the relevant due date must be clearly displayed. Additionally, including account details for completing the transaction ensures that there are no errors during payment processing. Including payment methods or instructions can also enhance the clarity of the document.

Customizing for Your Needs

Every business or individual may have specific requirements for documenting payments. It’s important to personalize the structure to suit your needs while keeping the essential details intact. Adding notes, special terms, or even discount offers can be a great way to make the document more relevant to the transaction at hand.

Why You Need an Invoice Template

Having a structured document for financial transactions is crucial for maintaining clarity and professionalism. Such documents ensure that all necessary details are captured in a consistent manner, which helps in tracking payments, reducing errors, and ensuring smooth business operations. Without a clear structure, misunderstandings can easily arise between the parties involved.

Ensuring Accuracy in Payments

Accurate details are essential to avoid mistakes during the payment process. By using a standardized format, you reduce the likelihood of omitting critical information such as amounts, due dates, and payment methods. This not only simplifies communication but also provides both the sender and recipient with a reliable reference for future queries.

Enhancing Professionalism

Using a well-organized document adds a level of credibility to your business. Clients and partners will appreciate the clarity and structure, which can foster trust and improve your relationship. A professional approach to managing financial transactions helps build a strong reputation and instills confidence in your processes.

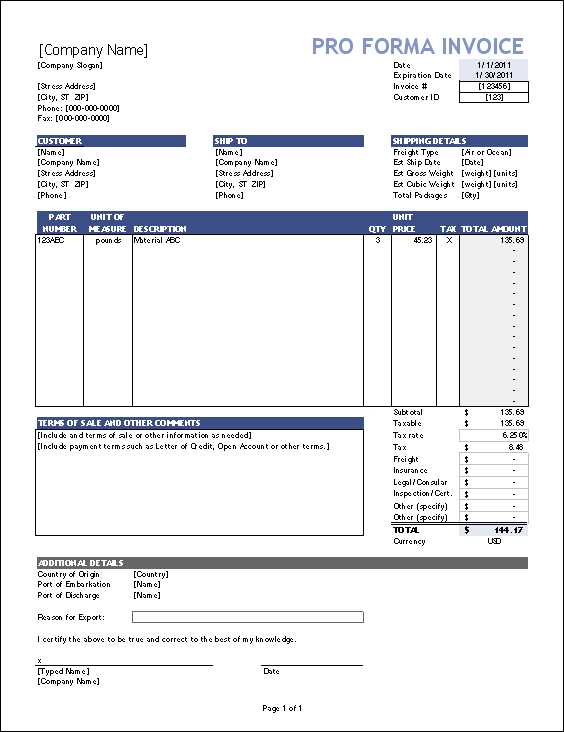

How to Customize Your Invoice Template

Customizing your payment document is essential for making it fit your unique business needs. A personalized approach ensures that the document includes all relevant details and reflects your brand identity. Tailoring the layout and content allows you to maintain consistency across all transactions while providing the necessary information clearly.

Steps for Personalization

To make your document more effective, follow these simple steps to customize it:

- Adjust the layout: Choose a structure that suits your business style and makes the details easy to read.

- Include branding elements: Add your company logo, contact information, and any other visual elements that reflect your brand.

- Modify fields: Ensure that all the required sections, such as payment details and deadlines, are included. You can add or remove sections based on your needs.

- Set payment instructions: Clearly state how payments should be made, whether through an online system, check, or another method.

Enhancing Clarity and Functionality

To further enhance the functionality, consider the following:

- Payment terms: Specify whether discounts are available for early payments or penalties for late ones.

- Currency details: If you deal internationally, make sure to specify the correct currency and include conversion rates if applicable.

- Notes or messages: Leave space for any additional information that may be relevant, such as special offers or additional contact points.

Essential Elements of a Bank Transfer Invoice

When creating a document for a payment made through an electronic system, it’s crucial to include all the necessary components that ensure the transaction is processed smoothly. The right details help both the payer and the recipient confirm the payment information, reducing confusion and ensuring accuracy in the transaction.

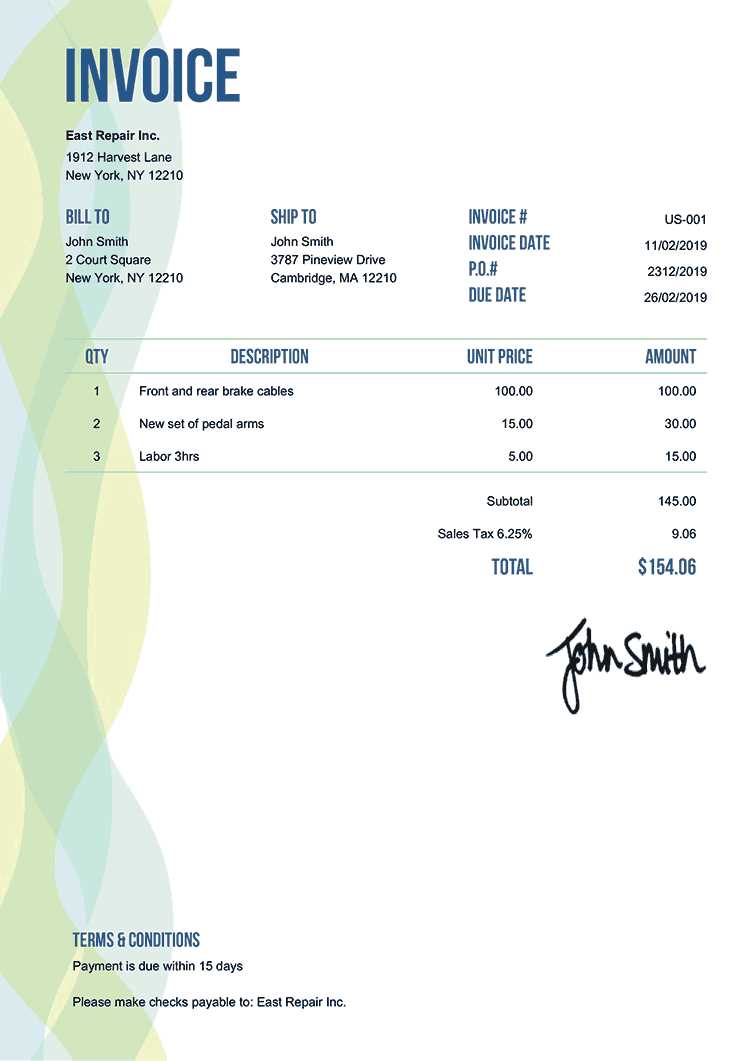

Key details to include in such a document are the names of the payer and recipient, the amount being paid, and the agreed-upon due date. These elements create a clear record for both parties, ensuring there are no discrepancies regarding the payment terms.

Additional information that can enhance clarity includes payment instructions, such as specific account numbers or codes, as well as any relevant transaction references. These small but crucial details provide both sides with everything they need to complete the payment successfully and without error.

Choosing the Right Format for Invoices

Selecting the appropriate layout for your payment document is essential for ensuring it is both professional and functional. The right format ensures that all critical details are easy to find and well-organized, making the payment process more efficient for both parties involved. It also contributes to a smoother transaction by minimizing confusion and enhancing clarity.

Factors to Consider When Choosing a Format

Clarity and ease of use are key when determining the layout. A clean, structured document allows the recipient to quickly find the necessary information, such as payment amounts, terms, and due dates. Additionally, the format should be adaptable to different types of transactions, ensuring versatility across various business needs.

Choosing Between Digital and Physical Formats

With the rise of digital transactions, choosing between a physical or electronic format depends on your business needs. For electronic systems, using formats like PDFs or spreadsheets is ideal for quick delivery and record-keeping. On the other hand, traditional printed formats may still be preferred for clients who are not familiar with or do not use digital methods for handling payments.

Tips for Creating a Professional Invoice

Creating a well-organized and professional payment document is essential for maintaining a positive relationship with clients. A clear, detailed record helps avoid misunderstandings and ensures that payments are processed smoothly. By following some simple guidelines, you can craft a document that conveys professionalism and clarity.

Key Considerations for a Professional Document

Here are some important tips for making your document stand out:

| Tip | Description |

|---|---|

| Use Clear Formatting | Ensure that each section is clearly defined, with bold headers and easy-to-read fonts. |

| Include All Essential Details | Make sure to list all relevant information, such as amounts, dates, and contact details, so that no questions arise. |

| Brand Consistency | Incorporate your company logo and branding elements to create a cohesive and recognizable document. |

| Double-Check for Accuracy | Ensure that all numbers, dates, and names are correct to prevent any issues during the payment process. |

Final Touches

Adding a personal note or a thank you message can also enhance your professional image. A little appreciation goes a long way in building long-term client relationships.

Common Mistakes to Avoid in Invoices

When preparing payment documents, it’s easy to overlook small but important details. However, these mistakes can cause confusion, delays, or even payment disputes. By recognizing and avoiding common errors, you can ensure a smooth and efficient process for both you and your clients.

Incorrect or Missing Details

Inaccurate information can lead to significant issues, especially when it comes to contact details, amounts, or dates. Double-check all entries, including the recipient’s name, payment amounts, and any associated references to ensure the document is correct. Missing details can create unnecessary delays and frustration for the recipient.

Poor Formatting and Layout

A disorganized document can make it difficult for the recipient to find key information. Use a clean, consistent layout with well-defined sections, including clear headings for each part of the document. A messy or unclear format can result in misunderstandings and affect the professionalism of the document.

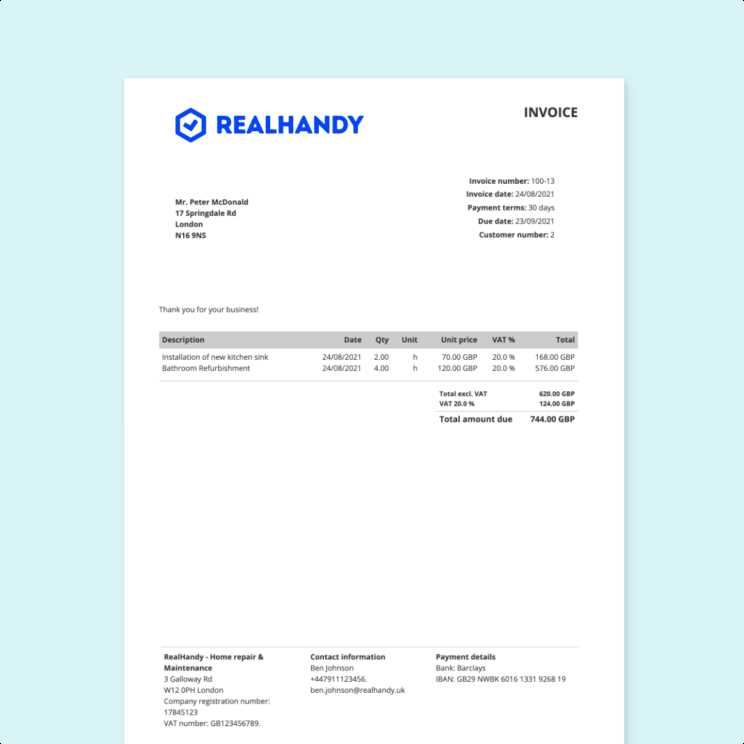

How to Add Payment Terms to Invoices

Including clear and concise payment conditions in your financial documents is crucial for ensuring that both parties understand their responsibilities. Setting out when payments are due, any penalties for late payments, and the accepted methods of payment helps prevent confusion and ensures smooth transactions.

Key Payment Terms to Include

Due Date – Clearly state the exact date by which payment must be made. This helps set clear expectations and allows the recipient to plan accordingly.

Late Payment Fees – If applicable, mention any fees that will be charged if the payment is not received by the due date. This encourages prompt payment and discourages delays.

Accepted Payment Methods – List the available ways to make the payment, whether by check, online payment, or direct deposit. This removes any ambiguity about how the funds should be transferred.

Formatting Payment Terms Clearly

For clarity, place the payment terms in a dedicated section that is easy to locate within the document. Make sure the terms are written in plain language to avoid any misunderstandings.

Including Bank Details in Your Template

When preparing financial documents, it’s essential to provide clear information on how clients can make payments. Including the necessary details for payments ensures that there are no obstacles in processing the transaction. Properly displaying this information helps both parties avoid delays and miscommunication.

What to Include

The following details should be included to ensure smooth payment processing:

| Information | Description |

|---|---|

| Account Holder’s Name | The name of the person or business receiving the payment. |

| Account Number | The unique number associated with the recipient’s account. |

| Sort Code/IBAN | The code used for identifying the bank branch or international account number. |

| SWIFT/BIC Code | The identifier for international transfers between different financial institutions. |

Ensure that all this information is accurate and up-to-date to prevent any issues during payment processing. By clearly listing these details, you provide clients with the necessary tools to make a seamless payment.

Best Practices for Sending Invoices

Successfully managing financial requests is crucial for any business. Sending clear and timely payment requests helps ensure that transactions are completed efficiently and professionally. Following best practices when sending these documents can help you maintain a strong relationship with clients and avoid unnecessary delays.

Timing and Delivery

Ensure that payment requests are sent promptly after services are rendered or products are delivered. Ideally, documents should be sent immediately or within a few days, as delays in sending them can lead to delayed payments. It’s also important to choose an appropriate delivery method–email is generally faster and more efficient, while physical copies may be preferred by some clients.

Clear Communication

Ensure that the payment details, due date, and any terms are clearly outlined in the document. Double-check for accuracy to prevent confusion. Adding polite reminders, such as “Thank you for your business,” can also create a positive impression and encourage prompt payment.

Tracking Payments with Invoice Templates

Efficiently monitoring payments is a key part of maintaining smooth financial operations for any business. By using organized documentation, you can easily track amounts owed, received, and pending. This process helps businesses stay on top of their finances, reduce confusion, and improve cash flow management.

Organizing Payment Information

Including clear payment sections in your documents allows for easy tracking of each transaction. Make sure to list all relevant details, such as the payment date, amount, and method, as well as any outstanding balances. This information can help you quickly identify any overdue payments or discrepancies.

Using Software to Automate Tracking

Incorporating financial software or spreadsheet tools can further streamline payment monitoring. Many software solutions offer automatic tracking features, which allow you to log and manage payments efficiently. This minimizes the risk of human error and ensures that all transactions are recorded accurately.

Security Measures for Online Bank Payments

As digital transactions become more common, ensuring the safety of online payments has never been more important. Protecting sensitive financial information from cyber threats is a priority for both businesses and customers. Implementing robust security measures can help minimize risks and secure payment processes.

Using Secure Payment Gateways

To protect personal and financial information, it’s crucial to use secure online payment platforms. Look for payment gateways that utilize SSL encryption and adhere to strict security protocols. These technologies help ensure that all data transmitted between the user and the service provider is encrypted and secure from unauthorized access.

Two-Factor Authentication (2FA)

Another effective measure is enabling two-factor authentication (2FA) for online transactions. By requiring an additional verification step, such as a code sent to a mobile device or email, 2FA adds an extra layer of security. This makes it significantly harder for unauthorized users to access payment systems, even if they have compromised login credentials.

How to Handle Late Payments

Dealing with overdue payments is a common challenge for many businesses. Late payments can disrupt cash flow and affect operations. However, it is essential to address such situations professionally and effectively, while maintaining a good relationship with clients. Understanding how to manage delays can help mitigate the impact and encourage prompt payment in the future.

Establish Clear Payment Terms

One of the best ways to avoid delays is to set clear payment terms from the outset. Specify due dates, payment methods, and penalties for late payments in contracts or agreements. When clients are aware of the expectations and consequences, they are more likely to pay on time. Clear communication can prevent misunderstandings and help maintain a smooth workflow.

Send Friendly Payment Reminders

If a payment is overdue, sending a gentle reminder can often resolve the issue without confrontation. It’s important to be polite and professional in your message. A friendly nudge reminding the client of the outstanding amount and due date can often prompt them to settle the payment quickly.

Automating Invoice Generation and Delivery

In today’s fast-paced business environment, streamlining administrative tasks is crucial for maintaining efficiency. Automating the creation and distribution of payment documents can save valuable time and reduce errors. By integrating automated systems, companies can ensure timely and accurate delivery without manual intervention, allowing businesses to focus on core operations while enhancing client satisfaction.

Benefits of Automation

Automating payment document generation and sending offers a range of advantages, such as:

| Advantage | Impact |

|---|---|

| Reduced Manual Errors | Automation ensures that details like amounts, dates, and client information are always accurate. |

| Time Efficiency | Save time on repetitive tasks and focus on other important business areas. |

| Improved Client Experience | Clients receive their documents promptly, improving your professional image. |

Choosing the Right Automation Tools

When selecting a system to automate the creation and delivery process, consider factors such as user-friendliness, integration with existing software, and customization options. Modern solutions can easily integrate with your accounting or CRM systems, creating a seamless workflow that automatically updates client information and generates accurate documents in real-time.

Integrating Invoice Templates with Accounting Software

Streamlining financial processes is essential for any business, and one of the most effective ways to do so is by connecting your payment documents with accounting systems. This integration not only reduces the chances of errors but also ensures that all your records are kept up-to-date automatically. By linking these two systems, you can improve accuracy, save time, and enhance overall operational efficiency.

Benefits of Integration

- Reduced Manual Entry: By connecting your payment document generation system with your accounting software, you eliminate the need for manual data entry, minimizing human error.

- Real-Time Updates: Changes made in your accounting system will be reflected immediately, ensuring consistency across all records.

- Improved Financial Tracking: With automatic syncing, you can easily track outstanding payments, monitor cash flow, and generate reports without extra effort.

- Increased Productivity: Automating routine tasks allows your team to focus on more strategic activities that contribute to growth.

Steps for Successful Integration

- Choose a compatible accounting software solution that offers integration features with your payment document system.

- Set up the connection between both systems, ensuring that all necessary fields (such as client details, amounts, and due dates) are mapped correctly.

- Test the integration thoroughly to ensure smooth data flow and accurate document generation.

- Train your team to use the integrated system, focusing on areas like automation triggers and error handling.

- Regularly monitor and update the integration as needed to accommodate any changes in either system.

Legal Considerations for Payment Invoices

When it comes to managing financial transactions, ensuring that your documentation complies with legal requirements is crucial. Properly structured records are not only essential for smooth business operations but also protect you in case of disputes. Understanding the legal obligations associated with payment documentation can help you avoid potential liabilities and maintain a trustworthy relationship with your clients.

Different jurisdictions have specific regulations governing the content, format, and delivery of payment documents. These may include rules about including mandatory details such as payment terms, tax information, and the recipient’s contact information. Failure to adhere to these requirements can result in penalties or complications in legal proceedings, should they arise.

Additionally, it’s important to consider aspects like data protection laws when sharing sensitive financial information. Ensuring that your payment records are secure and that personal details are handled appropriately is not just good practice but also a legal obligation in many regions. Be sure to stay informed about any updates to relevant regulations to keep your practices up-to-date and compliant.

How to Handle Multiple Currencies in Invoices

Managing transactions in various currencies requires careful attention to detail and consistency. When dealing with international clients or suppliers, it’s important to clearly present financial amounts and ensure that the correct conversion rates are applied. A well-structured approach helps avoid confusion, ensures transparency, and maintains professionalism in cross-border dealings.

Key Considerations for Currency Management

- Currency Symbols: Always use the correct currency symbol (e.g., $, €, £) alongside the amount to avoid ambiguity.

- Exchange Rates: Ensure that you apply the current exchange rate when converting amounts. Specify the date of conversion to clarify any discrepancies in rate fluctuations.

- Tax Calculations: Different regions may have specific tax requirements. Be sure to reflect any applicable taxes in the appropriate currency and mention any conversion rates used in calculations.

Practical Steps for Handling Multiple Currencies

- Clearly specify the currency next to each amount on your records to avoid misinterpretation.

- Ensure exchange rates are updated regularly and provide the date of conversion if necessary.

- If possible, allow clients to select their preferred currency and display equivalent amounts for ease of understanding.

By keeping these considerations in mind, you can manage multi-currency transactions effectively, ensuring clarity and preventing potential issues related to currency conversion and payment discrepancies.

Creating Invoices for International Transactions

Handling cross-border financial transactions requires a clear and structured approach to ensure both parties understand the terms of payment. When dealing with international clients or suppliers, it’s crucial to include specific details that address various regional regulations, currencies, and tax laws. This helps prevent confusion and ensures smooth processing of payments and settlements.

Important Elements for Global Transactions

- Currency Selection: Always specify the currency in which the payment is due, whether it is USD, EUR, GBP, or any other currency relevant to the transaction.

- Customs and Duties: If applicable, clarify who will be responsible for customs duties or other import taxes to avoid unexpected charges.

- Payment Methods: Offer multiple payment options to accommodate different preferences, such as credit cards, PayPal, or wire payments, making it easier for international clients to settle their accounts.

- Legal Requirements: Ensure compliance with international regulations, including VAT, GST, or other regional taxes, and provide proper documentation to support them.

Steps for Efficiently Handling International Payments

- Clearly list the terms of payment, including the currency and exchange rate if necessary, to avoid confusion.

- Ensure tax details are correctly included based on the buyer’s location and applicable laws.

- Consider adding a statement that covers potential delays due to customs or other border-related processes.

- Provide all relevant information regarding transaction costs, such as fees for wire transfers or service charges, so both parties are informed upfront.

By paying attention to these key factors, you can ensure smooth transactions and maintain a professional relationship with your international clients or vendors.