How to Use Invoice Template Aynax for Simplified Billing

Managing finances efficiently is crucial for any business, whether large or small. The ability to generate professional, accurate documents for transactions is a key element of maintaining good relationships with clients and ensuring smooth financial operations. With the right tools, you can simplify this process and focus on what truly matters: growing your business.

There are various options available today for creating clear, customizable billing records, which help you keep track of payments, deadlines, and outstanding balances. These tools offer numerous features, from easy-to-use interfaces to seamless integration with payment gateways, making it simpler than ever to manage your financial documentation.

In this guide, we will explore how a well-designed invoicing solution can enhance your business’s workflow, save time, and reduce errors. Whether you’re a freelancer, a small business owner, or part of a larger enterprise, this system provides the flexibility and accuracy needed to stay organized and professional in every transaction.

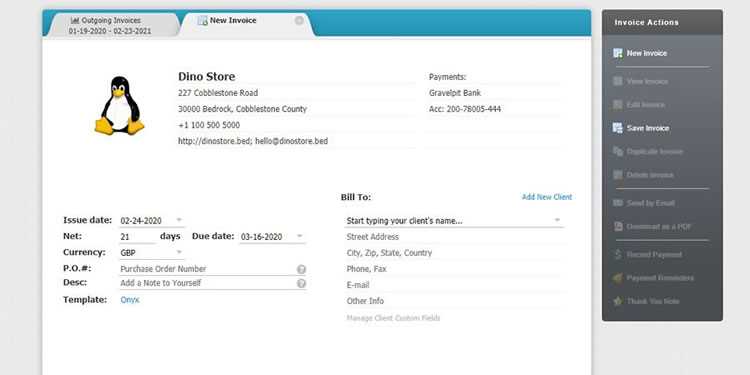

Invoice Template Aynax Overview

Efficient billing solutions are essential for businesses of all sizes. Having a structured and easy-to-use system for generating financial documents can streamline operations and minimize errors. The tool we are discussing offers a comprehensive and customizable platform designed to simplify the way you manage and track payments, ensuring professionalism and accuracy in every transaction.

This system provides a wide range of features that make the process smoother and more efficient. It is built to cater to different types of users, from freelancers to small businesses, offering various customization options for tailoring documents to specific needs. Below is an overview of the key aspects that make this platform an essential tool for anyone looking to optimize their financial workflows.

| Feature | Description |

|---|---|

| Customizable Layouts | Design and personalize your documents to match your branding and specific requirements. |

| Easy-to-Use Interface | A simple and intuitive user interface allows you to create and manage records with minimal effort. |

| Automated Calculations | Automatic tax and total calculations reduce manual errors and speed up the process. |

| Client Management | Store and organize client details for quick access when generating financial documents. |

| Payment Integration | Easily connect with payment gateways for direct transaction processing. |

| Export Options | Download and share your financial documents in multiple formats like PDF or Excel. |

By utilizing this platform, businesses can save time, reduce administrative tasks, and ensure that financial documentation is always accurate and professional. Whether you’re handling a handful of clients or managing multiple transactions, this tool offers the flexibility needed to maintain an organized and efficient billing process.

Why Choose Aynax for Invoicing

Selecting the right tool to manage financial documentation can make a significant difference in the smoothness of business operations. A reliable solution should offer not only ease of use but also a high level of customization and integration with various payment systems. The platform in question provides all these features, making it an ideal choice for businesses looking to simplify their financial processes while maintaining professionalism.

This tool stands out for its versatility and user-friendly design, which allows anyone–from freelancers to large enterprises–to create precise and visually appealing documents in minutes. The ability to customize various aspects and automate key tasks helps users save time and avoid errors, ensuring that every transaction is handled smoothly.

| Feature | Benefit |

|---|---|

| Ease of Use | The intuitive interface makes it accessible to users of all skill levels, reducing the learning curve. |

| Customizable Design | Personalize documents to reflect your business identity, making each record unique and professional. |

| Time-Saving Automation | Automated calculations for totals and taxes save time and eliminate human error. |

| Payment Integration | Direct integration with payment systems allows for seamless transaction processing and tracking. |

| Multi-Format Export | Easily export documents to various formats (PDF, Excel) for sharing or record-keeping. |

| Client Management | Store and access client information quickly for efficient document generation and follow-up. |

The combination of powerful features and user-centric design makes this platform an invaluable tool for anyone looking to streamline their billing processes and ensure every financial document is accurate and professional.

Key Features of Invoice Template Aynax

To manage financial records effectively, it’s crucial to have access to a set of tools that make document creation, tracking, and payment management simple. The platform we are discussing offers a wide range of features that cater to businesses of all sizes, streamlining operations and ensuring accuracy in every step of the process. Below are some of the most important aspects that make this tool stand out in the competitive landscape of business solutions.

Customization and Personalization

One of the standout features of this system is its flexibility. Users can easily tailor the design and layout of their documents to suit their specific needs. Whether you’re creating records for a small business or handling complex transactions, you can customize every element–from text fields to color schemes–ensuring the final result reflects your brand identity.

Efficient Calculation and Automation

Another key advantage of this platform is its ability to automate crucial tasks such as tax calculations, discounts, and total amounts. By reducing manual calculations, the system helps eliminate human error and saves valuable time. This feature is especially beneficial for businesses that need to process multiple transactions or handle complex pricing models.

Additional features include:

- Integrated payment processing for smooth transactions

- Ability to store client information for quick access

- Export options in various formats, including PDF and Excel

- Multi-currency support for international transactions

With these capabilities, this platform ensures that your financial documents are always accurate, professional, and easy to manage, no matter the scale of your operations.

How to Customize Your Invoice Template

Creating a personalized and professional financial document is essential for any business. Customization options allow you to tailor the layout, design, and content of your records to align with your brand and meet specific business requirements. This platform offers a simple and intuitive process for adjusting various elements, ensuring that each document reflects your unique identity while maintaining accuracy.

To begin customizing your financial documents, follow these basic steps:

- Select a layout: Choose a design that best suits the style and complexity of your transactions, from simple structures to more detailed formats.

- Modify text fields: Adjust headings, labels, and descriptions to match your specific business needs or industry terminology.

- Add your logo: Upload your company’s logo to give the document a

Benefits of Using a Digital Invoice

In today’s fast-paced business environment, having a digital system for managing financial documents offers numerous advantages over traditional paper-based methods. Going digital not only simplifies the process but also enhances efficiency, reduces errors, and streamlines communication. By adopting electronic records, businesses can take advantage of a wide range of features designed to save time and improve accuracy in every transaction.

Some key benefits include:

- Speed and Efficiency: Creating and sending records digitally is far quicker than preparing paper-based ones. You can generate and dispatch financial documents in just a few clicks, reducing the time spent on administrative tasks.

- Reduced Errors: Automated calculations and pre-set fields minimize the risk of human error, ensuring your records are accurate every time. This helps prevent costly mistakes and improves overall reliability.

- Environmental Impact: By going paperless, you contribute to sustainability efforts by reducing paper waste and the energy required to produce and store physical documents.

- Easy Tracking and Management: Digital systems allow for effortless organization and retrieval of past records. You can search, filter, and access information in seconds, making it easier to

How Aynax Saves Time in Billing

Efficient billing is essential for maintaining a smooth workflow and ensuring that payments are processed promptly. The right system can significantly reduce the amount of time spent on generating, managing, and tracking financial documents. By automating key tasks, offering intuitive design tools, and simplifying record-keeping, this platform allows businesses to focus on their core activities while handling billing with ease.

Automation Features

One of the main time-saving features of this platform is its automation capabilities. With automatic calculations for totals, taxes, and discounts, users can eliminate manual calculations, reducing both time and the risk of errors. Furthermore, recurring charges and payment reminders can be set up in advance, freeing you from constantly needing to generate new records for repeat clients.

Effortless Document Management

Managing multiple financial records becomes easy with a well-organized system. The ability to store client information, access previous transactions quickly, and generate new documents from saved data ensures that creating and sending records is fast and simple. You can create and send new documents without the need to re-enter client details, drastically reducing preparation time.

Feature Time-Saving Benefit Automatic Calculations Reduces the need for manual entry and ensures quick, accurate financial totals. Recurring Payment Setup Automates repeat transactions, saving you from creating new documents each time. Client Data Storage Access stored client details instantly to speed up document generation. Pre-Formatted Designs Quickly select from templates to create professional records without starting from scratch. Export Options Save and share documents in different formats with a single click, reducing the need for manual editing. By automating routine tasks and simplifying document creation, this platform helps businesses minimize time spent on administrative work, allowing for faster billing cycles and improved operational efficiency.

Understanding the Invoice Creation Process

The process of generating financial records can be straightforward when you have a clear structure in place. Whether you’re billing clients for services, products, or other transactions, a consistent approach ensures that all necessary details are captured accurately. From entering basic information to finalizing and sending the document, each step plays a crucial role in maintaining professionalism and clarity.

Step 1: Entering Basic Information

The first step in creating a billing document is to input key information, such as your business details, the client’s information, and the items or services provided. This data serves as the foundation of your record. It’s important to ensure all contact details are correct, as this ensures proper communication and avoids confusion when processing payments.

Step 2: Adding Transaction Details

Once the basic information is entered, the next step is to provide a breakdown of the transaction. This includes detailing each service or product, quantity, price, and any applicable discounts. It’s essential to be thorough and clear in this section, as it directly impacts the client’s understanding of the charges and the payment they are expected to make.

Additional elements to consider include:

- Tax calculations: Ensure that local taxes are correctly applied to the total amount based on your business’s location or industry regulations.

- Due dates: Clearly state the due date for payment to avoid delays and help with financial planning.

- Payment instructions: Include your preferred payment methods and any necessary account details or links for easier transaction processing.

Once all the details are filled in, you can finalize the document, preview it for accuracy, and send it off to the client with just a few clicks. This streamlined process saves time and ensures that you’re consistently providing clear, professional documents.

Step-by-Step Guide to Using Aynax

Creating professional financial records doesn’t have to be complicated. With the right platform, the process can be quick, intuitive, and customizable to your specific needs. This guide will walk you through the essential steps to start using the system effectively, ensuring that you can generate and manage your documents with ease from day one.

Follow these simple steps to get started:

- Sign Up and Log In: Begin by creating an account on the platform. Once your account is set up, log in to access the dashboard, where you can start creating new records.

- Set Up Your Business Profile: Enter your business details, such as name, address, and contact information. This will be automatically included in all documents you generate, saving you time on each transaction.

- Customize Your Layout: Choose a design that suits your business’s style. Customize the layout, colors, and fonts to match your branding. You can also add your logo to make your documents look more professional.

- Add Client Information: Store client details for easy access when creating new documents. This includes their name, address, and contact information, which can be automatically filled in each time you generate a record.

- Enter Transaction Details: For each transaction, input the necessary information, such as products or services provided, quantities, prices, taxes, and discounts. The system will automatically calculate totals, saving you time and reducing errors.

- Set Payment Terms: Specify your payment terms, such as the due date and preferred methods. You can also set up recurring payments if your business model requires them.

- Preview and Finalize: Before sending, preview the document to ensure everything is correct. Once satisfied, you can save, download, or send it directly to your client via email.

By following these simple steps, you can efficiently create and manage financial documents for your business. The platform’s user-friendly design and customizable options make it easy to adapt to your needs, saving time and enhancing professionalism.

Creating Professional Invoices with Aynax

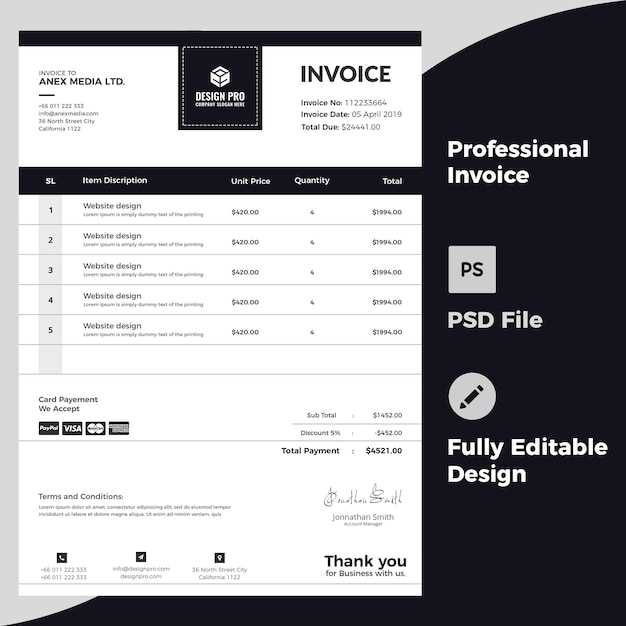

Creating high-quality financial documents is a key element of maintaining professionalism and credibility in any business. A well-designed record not only helps convey a clear message but also builds trust with clients. This platform allows you to easily craft polished, professional documents that reflect your brand and meet all necessary business requirements, ensuring that every transaction is documented accurately and efficiently.

Here are the essential steps to create polished financial documents that will impress your clients:

- Select a Professional Layout: Choose a clean, modern design that aligns with your brand’s image. The platform offers several customizable templates that are suitable for businesses of all types, from freelancers to larger enterprises.

- Customize with Branding: Add your company logo, adjust colors, and select fonts that match your branding guidelines. This helps your documents look cohesive and enhances your business’s professional image.

- Include Detailed Transaction Information: Provide a clear breakdown of products or services offered, their quantities, rates, and any applicable discounts. This transparency ensures that your clients can easily understand what they’re being charged for.

- Automate Calculations: The system automatically calculates totals, taxes, and any other financial figures. This reduces human error and speeds up the process, so you can focus on other aspects of your business.

- Set Clear Payment Terms: Specify payment due dates, late fees, and preferred payment methods. Clear terms reduce the chance of confusion and ensure timely payments.

- Preview and Finalize: Always preview your document before sending it. Ensure all details are correct, and make any necessary adjustments. Once satisfied, you can easily download or email the document directly to your client.

By following these steps, you can quickly create professional and error-free financial records that are ready to be sent out. The flexibility and customization options available on this platform help ensure that every document you generate aligns with your business standards and builds confidence with your clients.

Common Mistakes to Avoid with Invoices

Even small errors in financial documents can lead to misunderstandings, delayed payments, or even damage to client relationships. Whether you’re a freelancer or managing a larger business, it’s important to avoid common mistakes that could create confusion or inefficiencies. By paying attention to the details and ensuring accuracy in every document, you can maintain professionalism and smooth business transactions.

1. Incorrect or Missing Client Information

One of the most common mistakes is neglecting to correctly enter client details. Whether it’s a typo in the name, an incorrect address, or missing contact information, these errors can cause delays in communication and payments. Always double-check that your client’s details are accurate and up-to-date before finalizing any document.

2. Ambiguous Payment Terms

Another frequent mistake is not being clear about payment terms. Vague statements such as “Pay soon” or “Due in a few weeks” can lead to confusion and late payments. It’s essential to specify the exact due date, any late fees, and acceptable payment methods. Clear payment terms ensure that both parties know exactly when and how payment should be made, reducing misunderstandings.

Other common errors to watch out for include:

- Missing Item Details: Failing to provide a complete description of the products or services can lead to confusion about the charges. Be specific about quantities, prices, and any additional costs.

- Calculation Errors: Manual calculations can lead to mistakes. Double-check any totals, taxes, or discounts to ensure everything adds up correctly.

- Not Following a Consistent Format: Inconsistent formatting can make your documents look unprofessional. Use a standard layout that includes all the necessary sections and is easy to read.

Avoiding these common mistakes will not only make your documents more professional but also streamline the payment process, helping you maintain a positive relationship with your clients.

Integrating Payment Methods in Aynax

Efficient payment processing is a critical aspect of any business, allowing for faster transactions and improved cash flow management. By integrating various payment methods into your financial management system, you can streamline the payment collection process and provide your clients with more flexibility in how they settle their accounts. This platform makes it simple to connect multiple payment gateways, ensuring seamless transactions with just a few clicks.

Setting Up Payment Gateways

To start receiving payments through your financial documents, you’ll first need to set up one or more payment gateways. These platforms allow you to accept a range of payment options, including credit and debit cards, bank transfers, and even digital wallets. Setting up is usually as simple as linking your business account to the payment provider, which can be done directly through the system’s settings.

Providing Payment Options for Clients

Once payment methods are integrated, clients can choose how they want to pay directly from the financial documents you send them. Whether they prefer to pay via credit card, bank transfer, or an online payment platform, offering these options improves the convenience and likelihood of timely payments. You can even set up recurring payments for long-term clients, reducing the need for manual invoicing.

Additional features to consider:

- Automatic Payment Reminders: Set up automated reminders to notify clients of upcoming or overdue payments, reducing the chances of late settlements.

- Payment Confirmation: Receive instant notifications when a payment has been made, allowing you to easily track transactions.

- Multiple Currency Support: For international clients, you can integrate payment gateways that support multiple currencies, ensuring smooth cross-border transactions.

By integrating various payment options, you can enhance the efficiency of your billing process, reduce administrative effort, and improve client satisfaction by providing them with flexible, convenient ways to pay.

How to Track Invoice Payments

Accurate tracking of payments is essential for maintaining healthy cash flow and managing your business finances. By keeping a clear record of which transactions have been paid and which are still outstanding, you can avoid confusion, ensure timely follow-ups, and improve your financial management. With the right tools, tracking payments becomes an effortless task, allowing you to focus on other areas of your business.

1. Use Automated Payment Tracking Tools

Many financial management platforms come with built-in payment tracking features that automatically update the status of each transaction. Once a payment is received, the system marks the related record as paid and updates the balance accordingly. This feature minimizes human error and ensures that your records are always up to date without manual intervention.

2. Set Payment Due Dates and Reminders

Another useful feature is setting payment due dates and automated reminders for both you and your clients. By clearly indicating when a payment is due, and sending timely reminders before and after the due date, you can reduce late payments and keep clients on track. This proactive approach improves your chances of receiving payments on time and reduces the risk of outstanding balances.

Additional Tips for Tracking Payments:

- Organize Payment Records: Ensure all transactions are categorized and organized in your system for easy reference. Keeping records sorted by due date, client, or status allows you to quickly assess the payment status of any document.

- Monitor Partially Paid or Overdue Amounts: Regularly check for any unpaid balances or partial payments. This helps you stay on top of overdue accounts and follow up promptly.

- Use Payment Logs: Some systems allow you to track payment history by logging every action taken–whether it’s a payment received, a reminder sent, or an adjustment made. This gives you a clear, transparent view of your payment activities.

By implementing these tracking strategies and utilizing the right tools, you can ensure timely payments, minimize administrative errors, and maintain a clear overview of your financial health.

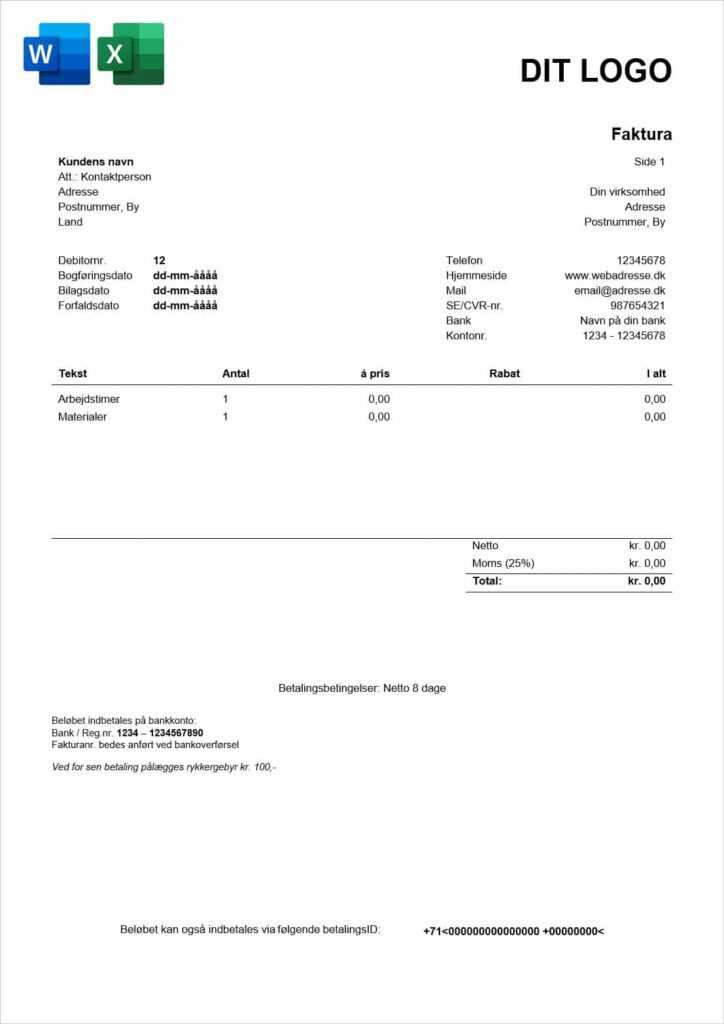

Exporting and Sharing Invoices Easily

Efficiently sharing financial documents is essential for ensuring timely payments and keeping clients informed. A streamlined process for exporting and sending these records can save you valuable time and help maintain clear communication. With modern platforms, sharing your documents is quick and hassle-free, whether you prefer to send them via email, download them in various formats, or share through cloud storage.

Exporting Your Documents

Exporting financial records from your system allows you to store or share them in formats that suit your needs. The most common formats include PDF, which is universally accepted, and Excel or CSV, which can be used for detailed analysis or record-keeping. Exporting these documents is simple and typically involves just a few clicks.

- PDF Format: Ideal for sharing with clients, as it preserves the layout and design of your records and can be opened on almost any device.

- Excel/CSV Format: Perfect for users who want to manage or analyze financial data in spreadsheets. This format allows for easy sorting, editing, and importing into accounting software.

- Online Link: Some platforms offer the option to generate a shareable link for your documents, which clients can access directly from their browser without needing attachments.

Sharing Your Documents

Once your financial records are exported, sharing them with clients is just as easy. Many platforms provide integrated email functionality, allowing you to send documents directly from the system. Alternatively, you can download the file and send it via your preferred communication method.

- Email: Send the exported document directly via email. You can usually add a custom message to explain the details and next steps, ensuring that the client is aware of the payment terms.

- Cloud Storage: Upload the document to cloud storage platforms like Google Drive, Dropbox, or OneDrive, and share a link with your client. This method is especially useful for clients who prefer accessing documents through shared folders.

- Direct Client Portal: Some systems allow you to share documents directly through a secure client portal, where clients can view, download, or make payments directly within the platform.

By using these export and sharing methods, you ensure that your financial records are delivered quickly, securely, and in the preferred format, making it easier for your clients to view and settle payments.

Using Aynax for Small Business Invoicing

Managing billing processes efficiently is essential for the growth and success of any small business. Simplifying the creation, tracking, and management of financial records can save time, reduce errors, and improve cash flow. By leveraging a dedicated platform, small business owners can generate professional documents, manage client payments, and ensure timely transactions–all with minimal effort.

1. Streamlining Document Creation

For small business owners, time is valuable, and creating financial records doesn’t need to be a time-consuming task. With a dedicated platform, you can easily generate professional documents without starting from scratch each time. The system allows you to quickly fill in transaction details, automatically calculate totals, and customize the layout to reflect your business’s branding, helping you look polished and professional with minimal effort.

2. Automating Payment Tracking and Reminders

One of the most challenging aspects of running a small business is keeping track of outstanding payments. By using an integrated solution, you can automatically track which clients have paid and which have outstanding balances. The system can send payment reminders to clients, reducing the need for manual follow-ups and helping you maintain healthy cash flow.

- Automated Reminders: Set up automatic reminders to notify clients of upcoming or overdue payments, improving the likelihood of timely payments.

- Payment History: Keep a clear record of all payments received and outstanding balances in one place for easy reference and accounting.

- Reports: Generate financial reports to analyze your business’s cash flow and identify areas for improvement.

For small businesses, staying on top of financial processes is critical. By using an efficient platform, business owners can focus on growing their operations while ensuring smooth and timely transactions with clients.

Invoicing for Freelancers with Aynax

For freelancers, managing payments and billing can be a significant challenge, especially when juggling multiple clients and projects. An efficient system for creating and tracking payment requests is essential to ensure timely compensation and maintain a professional image. With a user-friendly platform, freelancers can streamline the entire billing process, from document creation to payment collection, without the need for complicated tools or administrative overhead.

Freelancers benefit from simplified workflows, allowing them to focus on their core work instead of spending unnecessary time on financial tasks. Here’s how a dedicated platform can assist freelancers in managing their payment requests:

1. Simple Document Creation

Creating clear and professional documents is essential for maintaining trust and clarity with clients. The system allows freelancers to easily generate accurate and customized payment requests, specifying the scope of work, rates, and payment terms. By automating many of the calculations, freelancers can save time and avoid errors.

2. Tracking and Managing Payments

Tracking payments and ensuring timely follow-ups is often a challenge for freelancers. A robust platform helps freelancers monitor which clients have paid and which are still outstanding, reducing the chances of missed payments and ensuring steady cash flow.

Feature Description Payment Reminders Automatically send reminders to clients for overdue payments, reducing the need for manual follow-ups. Client Management Store client details and track the status of each payment in a centralized system for easy reference. Recurring Billing For ongoing work, set up automated billing for regular payments, reducing the administrative burden. By utilizing these features, freelancers can ensure timely payments and avoid unnecessary stress, allowing them to focus on delivering quality work to their clients.

How to Improve Invoice Accuracy

Ensuring accuracy in your billing documents is crucial for maintaining professionalism and avoiding discrepancies that could delay payments. Inaccurate records can lead to confusion with clients, missed payments, and even damage to your business’s reputation. By implementing certain best practices, you can reduce errors and ensure that your financial records reflect the correct details every time.

Here are several strategies to help you enhance the accuracy of your financial documents:

- Double-Check Client Details: Always verify that client information, such as names, addresses, and contact details, is correct before sending out any document. A small mistake here can cause delays in payment or confusion.

- Use Automatic Calculations: Leverage software that automatically calculates totals, taxes, and discounts based on the information you input. This minimizes human error and ensures that all amounts are correctly computed.

- Clearly Define Payment Terms: Be explicit about payment due dates, late fees, and acceptable payment methods. This ensures that both you and your clients are on the same page, helping to prevent misunderstandings later on.

- Include Itemized Details: Provide a detailed breakdown of products or services rendered, along with the corresponding costs. This transparency not only improves accuracy but also helps clients understand exactly what they’re paying for.

By following these steps, you can greatly reduce the likelihood of errors in your financial documentation, which will lead to smoother transactions and better relationships with your clients.

Customer Support for Aynax Users

For any business or freelancer using a dedicated platform for generating financial documents, reliable customer support is crucial. Having access to expert assistance ensures that users can overcome challenges, resolve issues quickly, and get the most out of the system. A strong support team offers guidance, answers questions, and helps troubleshoot any technical difficulties, allowing users to focus on their work without interruption.

Here are some key aspects of the customer support experience for platform users:

- 24/7 Assistance: Many platforms offer round-the-clock support, ensuring that users can get help whenever they need it, regardless of time zone differences.

- Comprehensive Knowledge Base: A well-organized collection of articles, tutorials, and FAQs can help users resolve common issues independently. This allows for quick problem-solving and empowers users to navigate the platform more effectively.

- Live Chat and Email Support: For more complex queries, live chat and email support can provide direct, personalized help from the platform’s support team. This ensures that users receive tailored assistance for their unique needs.

- Community Forums: Some platforms also provide forums where users can connect with one another, share tips, and discuss best practices. This creates a valuable network of peers who can offer insights and solutions based on their experiences.

With these support options in place, users can feel confident that they have the resources to address any issues that arise, helping them work more efficiently and effectively.