Easy to Use Invoice Template for Auto Repair Services

Running a service-based business requires efficient ways to manage payments and track transactions. One of the most effective ways to ensure clear communication and timely payments is by providing customers with a well-structured billing document. This simple tool not only reflects the professionalism of your business but also helps in organizing financial records seamlessly.

Creating custom forms for each job allows you to detail the work completed, list any parts used, and include the appropriate charges. These documents can be tailored to fit the specific needs of your business, ensuring accuracy and clarity in every transaction. With the right design, they can also help build trust with clients and encourage prompt payment.

In this article, we will explore how businesses can benefit from using a structured payment document, the key elements it should contain, and how easy it is to adapt it to your particular field. Whether you’re new to the process or looking to improve your current system, there are numerous advantages to implementing a streamlined approach to billing and record-keeping.

Why Use an Invoice Template for Auto Repair

Efficient billing is crucial for maintaining a smooth workflow in any service-oriented business. When it comes to vehicle services, having a standardized document to outline the charges for labor and materials can save time and reduce errors. A well-structured payment form not only enhances professionalism but also ensures clarity for both the provider and the customer.

Clarity and Accuracy

Providing clients with a clear breakdown of services helps avoid misunderstandings and fosters transparency. By outlining each part of the job performed and the associated costs, both parties are on the same page about the scope of work and the final price. This also minimizes the chances of disputes over charges, leading to smoother transactions and faster payments.

Time and Effort Savings

Using a pre-designed document helps save significant time compared to manually creating one for every job. With a pre-formatted system, service providers can focus on their core tasks, knowing that all essential details will be included automatically. This efficiency translates into better time management and improved productivity.

| Benefit | How It Helps |

|---|---|

| Consistency | Standardizes the process for every customer |

| Efficiency | Reduces the time spent on creating documents |

| Accuracy | Ensures all details are captured without omissions |

| Professionalism | Gives customers confidence in your business |

Incorporating such a system into your daily operations can greatly streamline the billing process, improve communication with clients, and contribute to the overall growth of your business.

Benefits of Customizable Invoice Templates

Customizing your billing documents to suit the specific needs of your business brings numerous advantages. With a personalized approach, you can ensure that every detail reflects your services and branding, ultimately creating a more professional and efficient process. The ability to tailor the format and content helps to maintain consistency and accuracy in each transaction.

Here are some key benefits of using flexible billing documents:

- Branding: Personalizing the design allows you to include your business logo, contact information, and colors, creating a consistent brand image.

- Flexibility: Custom fields allow you to adjust the document to include specific job details, making it easier to reflect unique service offerings or pricing structures.

- Time-saving: Having a reusable, personalized format eliminates the need to start from scratch each time, reducing the time spent on administrative tasks.

- Professionalism: A polished, well-organized document gives clients a sense of confidence and credibility in your business.

- Accuracy: Customizable fields help ensure that all relevant information is included, preventing mistakes and omissions.

By leveraging the power of customized forms, service providers can streamline their operations, build a stronger relationship with clients, and enhance their overall business performance.

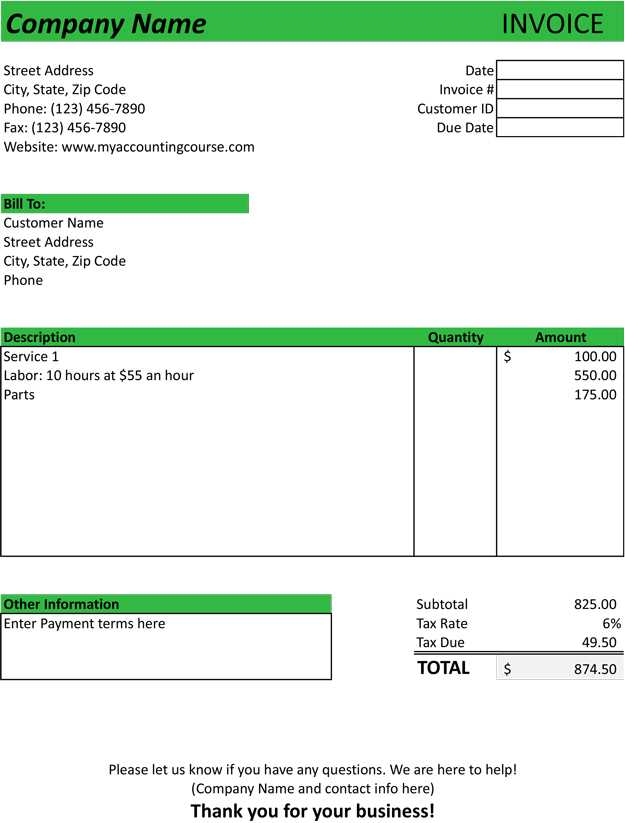

How to Create an Invoice for Auto Services

Creating a detailed billing document for vehicle-related services is an essential step in ensuring accurate payments and clear communication with clients. Whether you’re working on maintenance, upgrades, or repairs, a well-organized bill helps both parties understand the work performed and the charges incurred. Below are key steps to follow when crafting a professional document for your services.

1. Include Your Business Information

Start by adding your business details at the top of the document. This includes your company name, logo, contact information, and business address. Providing this upfront not only adds professionalism but also makes it easy for clients to reach out with any questions or follow-up inquiries.

2. Add Customer Details

Include the customer’s name, contact information, and service address. This ensures the document is specific to each transaction, reducing the chance of confusion or errors later on.

3. List Services Provided

Clearly describe the tasks completed, including labor, parts used, and any additional services offered. Each item should be detailed enough to explain what was done, ensuring full transparency. This helps customers understand exactly what they are paying for.

4. Specify Prices

Break down the cost of each service or part, followed by the total cost. Be sure to include any taxes or additional charges. The total amount should be clearly visible, so customers know the exact amount due.

5. Set Payment Terms

Define your payment terms, such as the due date, any late fees, and accepted payment methods. It’s important to set clear expectations about when and how payments should be made.

6. Add Additional Notes

Provide any extra information that might be relevant, such as warranty details, follow-up instructions, or reminders for future services. These notes can help build customer trust and promote ongoing business.

By following these steps, you ensure that your billing process is clear, organized, and professional, helping to maintain good relationships with your clients and improve your business efficiency.

Essential Elements of an Auto Repair Invoice

Creating a clear and comprehensive billing document is essential for both the service provider and the customer. A well-organized document not only ensures that clients understand the costs associated with the work completed, but it also protects your business from potential disputes. The following elements are crucial for making sure your billing documents contain all the necessary information.

- Business Information: Include your company name, address, phone number, and email. This establishes your identity and allows the customer to contact you easily if they have any questions.

- Customer Details: Clearly list the customer’s name, address, and contact information to avoid any confusion and ensure the document is correctly assigned.

- Service Description: Detail the work performed, including labor, parts used, and any additional services. Each task should be described clearly, with enough information for the customer to understand the work that was done.

- Pricing Breakdown: List the cost of labor, parts, and any other charges individually. It’s important to provide a transparent view of the pricing so the client knows exactly what they are paying for.

- Tax Information: Include any taxes applied to the services or materials. This ensures that the document is legally compliant and helps your client understand the final cost.

- Total Amount Due: Clearly display the total cost that the client is required to pay. This should include the service, parts, taxes, and any other applicable charges.

- Payment Terms: Define the payment due date, any late fees, and accepted payment methods. Make sure to clarify when the payment is expected and how it can be made.

- Job Completion Date: Indicate when the work was completed to provide a reference for when the charges apply and for record-keeping purposes.

- Additional Notes: Include any warranties, follow-up instructions, or special terms related to the service. This can help foster customer trust and satisfaction.

By ensuring these essential elements are included in your billing documents, you not only enhance the professionalism of your business but also improve communication with your clients and streamline the payment process.

Top Features to Look for in Invoice Templates

When selecting a structured document for billing, it’s important to ensure that it includes certain features that enhance both its functionality and professionalism. A well-designed document should be flexible, easy to use, and capable of capturing all relevant details in a clear and organized manner. The following are key features that can help streamline the billing process and improve the overall experience for both the business and the client.

- Customizable Fields: The ability to modify the content and structure allows you to tailor the document to your specific needs. You should be able to adjust sections like job descriptions, itemized charges, and payment terms easily.

- Professional Design: A clean, organized layout makes the document easy to read and presents your business in a polished, professional light. Consistent fonts, clear headings, and well-spaced content contribute to a positive impression.

- Automatic Calculations: Integrated tools that automatically calculate totals, taxes, and discounts save time and reduce errors. This feature ensures the final amount is accurate every time.

- Service Descriptions: A feature that allows you to clearly describe the work performed and items used, including parts and labor costs, is essential for transparency and clarity.

- Payment Tracking: The ability to track payments and outstanding balances directly within the document can help keep your finances organized and reduce the risk of missed payments.

- Multiple Payment Methods: Including options for different payment methods (e.g., credit cards, checks, online transfers) makes it easier for clients to pay on their preferred platform, improving the likelihood of timely payments.

- Tax Calculations: Built-in tax calculation tools that automatically apply the correct rates based on your location or business type are invaluable for compliance and accuracy.

- Professional Branding: A feature that lets you include your logo, business name, and contact information ensures that your document aligns with your overall brand identity, contributing to a more professional appearance.

- File Export Options: The ability to export the document in different formats such as PDF, Word, or Excel makes sharing and storing easy. It’s essential for providing clients with a digital copy or for keeping internal records.

- Mobile Compatibility: The option to access and generate the document on mobile devices can be a significant time-saver for businesses on the go.

By selecting a solution with these key features, you can create a more efficient and effective process for generating and managing billing documents, ultimately improving both customer satisfaction and your business operations.

Free Invoice Templates for Auto Repair Businesses

For service-based businesses, especially those offering vehicle-related work, having an organized and professional document to handle transactions is essential. Fortunately, there are many free resources available that provide ready-to-use, customizable billing documents. These tools can help businesses save time, reduce errors, and ensure clear communication with clients without the need for expensive software or services.

Advantages of Using Free Billing Documents

- Cost-Effective: Free options allow businesses to create professional documents without any financial investment, making them ideal for small or startup companies.

- Easy to Customize: Many free resources allow for easy adjustments, letting you add your business details, modify layout, and include specific service descriptions or pricing structures.

- Quick Setup: With most free options, you can begin generating documents almost immediately, without the need for lengthy setup processes or technical expertise.

- Multiple Formats: Free solutions often offer documents in a variety of formats such as Word, Excel, or PDF, making it easy to store, print, or send invoices digitally.

Where to Find Free Resources

Several online platforms provide free resources tailored to businesses that specialize in vehicle services. These resources offer easy-to-fill-in forms with the necessary fields to input customer details, job descriptions, parts used, and total charges. Websites like Invoice Generator, Zoho Invoice, and Canva offer no-cost options that cater specifically to small businesses in the service industry.

By using free resources, small businesses can quickly adopt efficient billing practices, ensuring they maintain a professional image while streamlining their payment processes. These tools are especially valuable for entrepreneurs looking to minimize overhead while managing essential financial documentation with ease.

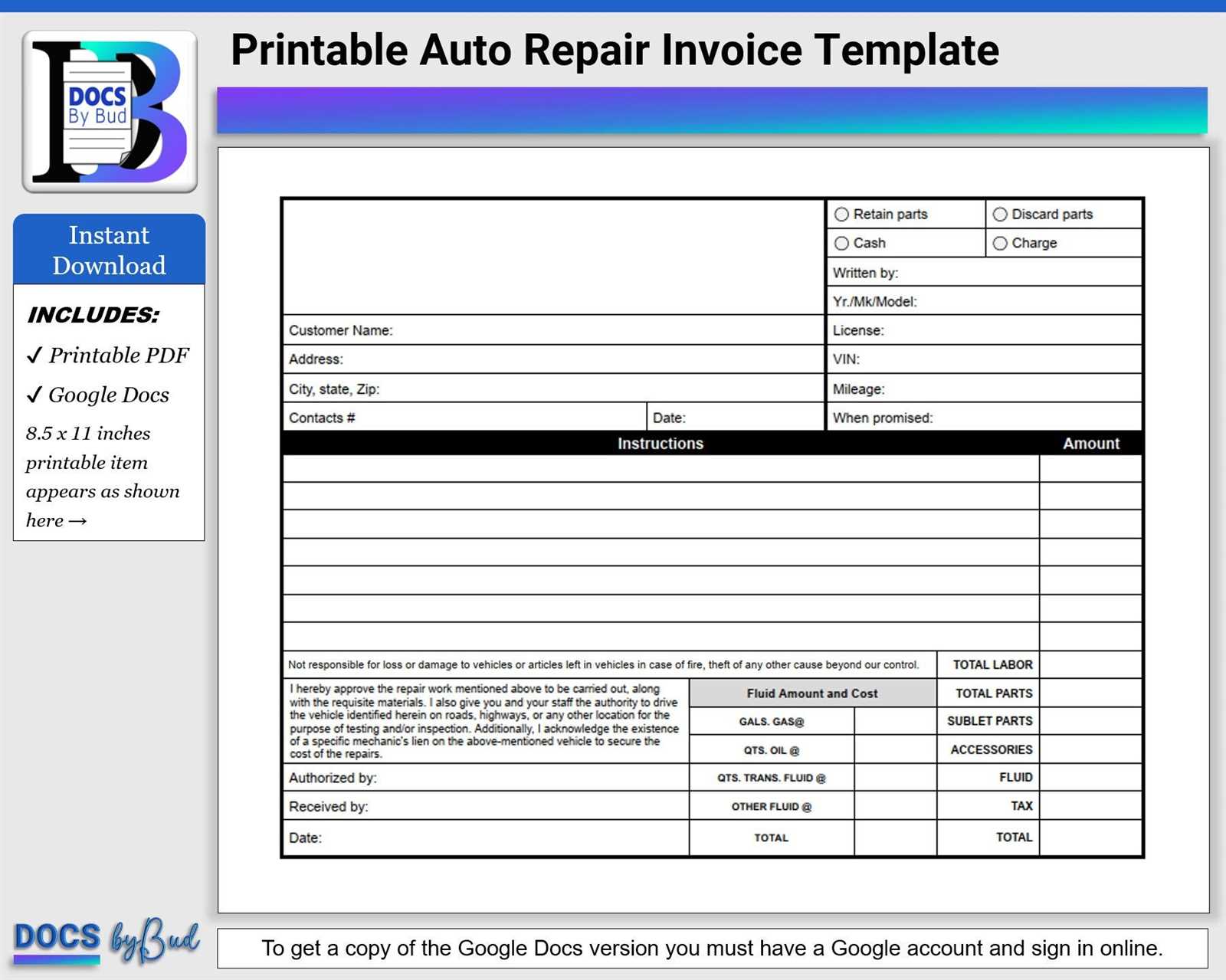

How to Customize Your Auto Repair Invoice

Customizing your billing document is essential to ensure it meets your business’s unique needs and accurately reflects the services you provide. A well-tailored document not only makes your business look more professional but also streamlines communication with customers, ensuring clarity and transparency in every transaction. Here are key steps you can follow to personalize your billing forms and make them work for you.

1. Add Your Business Details

Start by including your company name, logo, and contact information at the top of the document. This establishes your identity and makes it easier for clients to contact you in case they need any further assistance.

2. Customize the Service Descriptions

Each service provided should be listed with clear descriptions. Be sure to break down the work done into separate items such as labor, parts, and any additional services offered. This helps customers understand what they are paying for.

3. Adjust the Layout

Many tools allow you to modify the layout to suit your preferences. You can change the column headings, rearrange the sections, or add new ones to ensure all relevant details are included. Make sure the final design looks organized and easy to read.

4. Set the Payment Terms

It’s crucial to specify your payment terms, including the due date, any late fees, and acceptable payment methods. Customizing this section helps set expectations clearly with your clients, making the payment process smoother.

5. Include Special Notes

To further personalize your document, you can add a section for any additional notes, such as warranties, maintenance reminders, or promotional offers. These extra touches show clients that you value their business and may encourage repeat visits.

| Section | Customization Tips | ||

|---|---|---|---|

| Business Information | Add logo, address, contact details | ||

| Service Descriptions | Include clear, itemized lists of tasks and parts | ||

| Pricing | Ensure accurate costs for each service, part, and tax | ||

| Payment Terms | Clearly state due dates, payment methods, and penalties | ||

| Notes | Provide any additional customer reminders or discounts |

| Payment Date | Amount Paid | Payment Method | Remaining Balance |

|---|---|---|---|

| 2024-10-15 | $150 | Credit Card | $350 |

| 2024-10-25 | $200 | Cash | $150 |

This simple table allows you to track payments over time, ensuring you know exactly where you stand with each client. It can also serve as a quic

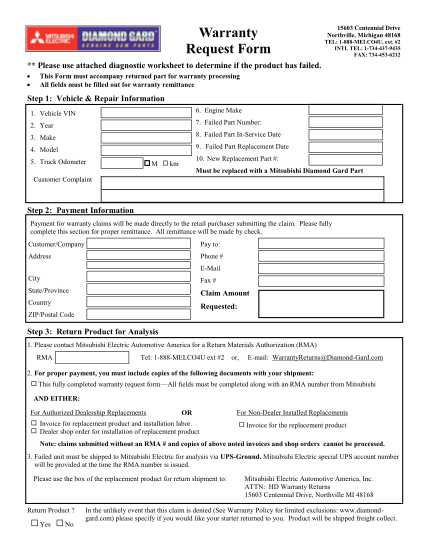

Legal Requirements for Auto Repair Invoices

When providing vehicle services and issuing billing documents, it’s important to ensure that your paperwork complies with local regulations. Legal requirements for billing documents help protect both your business and your customers, ensuring transparency and fairness in all transactions. Understanding and adhering to these guidelines is essential to avoid potential legal issues and ensure the smooth operation of your business.

Essential Information for Legal Compliance

To meet legal standards, your billing documents must contain certain key elements. These elements not only help ensure transparency but also prevent misunderstandings or disputes down the road.

- Business Information: Include your business name, address, phone number, and email. This helps establish your identity and ensures that clients can reach you if needed.

- Customer Details: Include the client’s name, address, and contact information. This ensures that the document is assigned correctly and helps avoid any confusion regarding the service or payment.

- Detailed Description of Services: Clearly outline the work performed, including the labor, parts used, and any additional services offered. This is important for both client clarity and legal protection.

- Itemized Costs: Break down the costs for each service, part, and labor charge separately. Taxes and fees should also be included. This prevents any ambiguity about pricing and ensures accurate charges.

- Payment Terms: Specify your payment terms, including the payment due date, any late fees, and the accepted methods of payment. This establishes the client’s financial responsibility and ensures both parties understand the terms.

- Warranty Information: If applicable, include any warranties or guarantees on parts or labor. This helps protect your business and ensures that your customers are aware of their rights in case a service issue arises.

State-Specific Regulations

Legal requirements can vary depending on your state or country. It’s crucial to stay informed about local regulations that might apply to vehicle services. Some regions require specific disclosures, like a right to a written estimate or limitations on the amount a service provider can charge without customer approval. Researching these local laws ensures your business remains compliant.

By including the necessary legal details in your billing documents and staying informed about regional regulations, you can minimize the risk of legal disputes, build trust with clients, and maintain a professional reputation in the industry.

How Invoice Templates Help Maintain Professionalism

Having a well-structured document for billing is a vital aspect of any business, particularly in service-based industries. A clear, consistent document not only ensures accuracy but also communicates professionalism to your clients. Whether you are a small business owner or part of a larger company, using organized and polished documents can help you build credibility and trust with your customers.

Consistency in Communication

Using a standardized format for every transaction ensures that your communication with clients is consistent and easy to understand. A professional-looking document reflects your business’s commitment to detail and organization, reinforcing your reliability in the eyes of customers. The more consistent and organized your documents are, the easier it becomes for clients to process and track their expenses, enhancing their overall experience with your service.

Streamlined Workflow and Time-Saving

By using pre-designed billing formats, businesses can significantly reduce the time spent on creating documents from scratch. This streamlined process allows you to focus on delivering services rather than getting bogged down in administrative tasks. Moreover, the time saved can be redirected toward improving other areas of the business, such as customer service or marketing.

Having a professional document also minimizes the likelihood of errors. With all the necessary fields and formatting already set, you can simply fill in the details of each service provided. This not only improves the accuracy of the billing process but also reduces misunderstandings with clients regarding charges or expectations.

Ultimately, by using a well-organized document system, your business is able to maintain a high level of professionalism, making it easier to build long-lasting client relationships and achieve greater success in your industry.

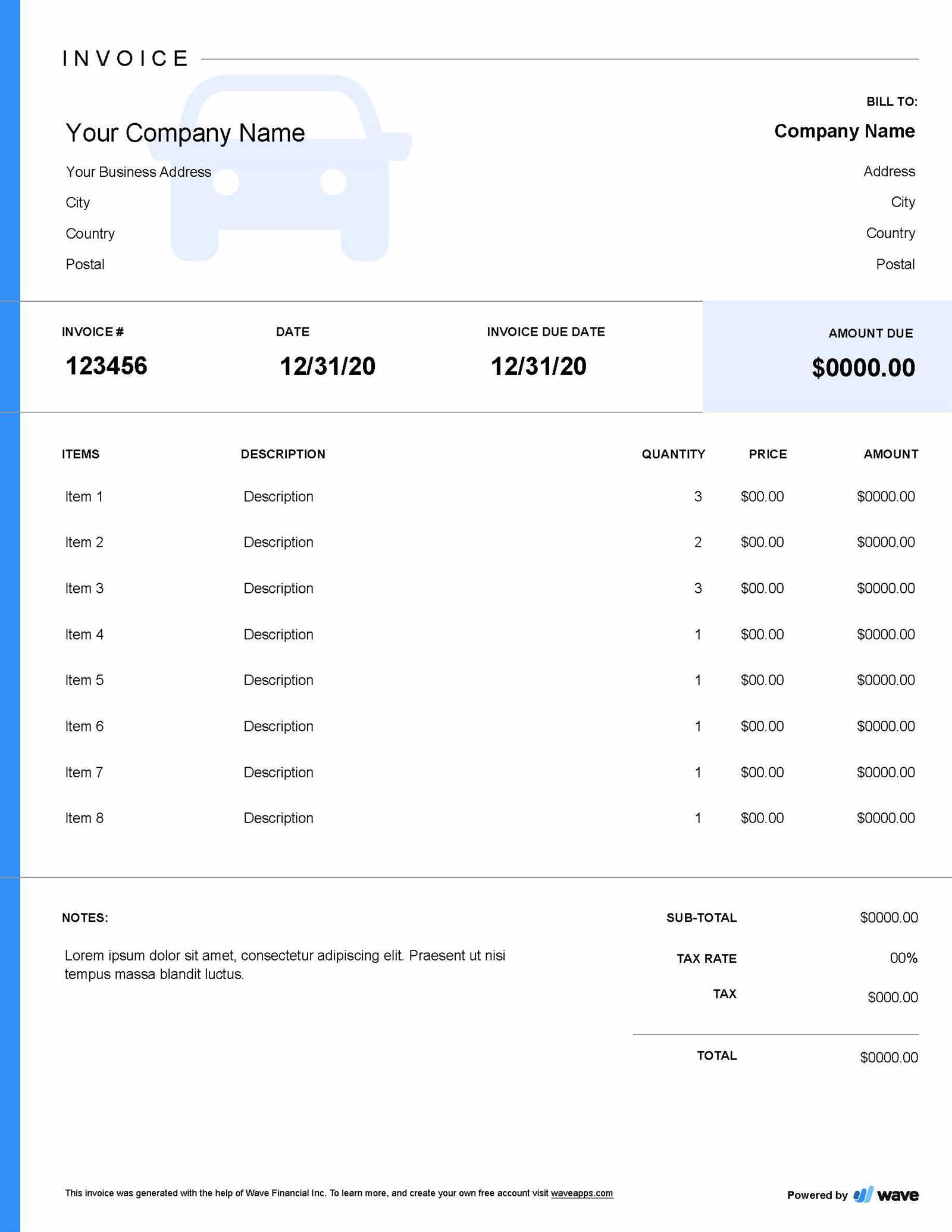

Managing Multiple Services in One Invoice

When providing several services to a client in one transaction, it’s essential to present all the details clearly and concisely. Combining multiple services into a single document ensures that your customer understands exactly what they are being charged for, while also keeping your financial records organized. Effectively managing and displaying these details helps reduce confusion and improves the overall customer experience.

The key to managing multiple services in one document is clear organization. Each service should be itemized with a brief description, associated costs, and any applicable taxes or fees. This transparency not only prevents misunderstandings but also ensures your client knows exactly what they are paying for, leading to smoother communication and prompt payments.

Additionally, it’s helpful to categorize different services if applicable–such as labor, parts, and additional services–so that each section is easily distinguishable. Providing a clear total at the bottom of the document, which includes all charges and taxes, further helps clients review and understand the final cost.

By structuring your documents in a way that clearly outlines each service, you demonstrate professionalism and attention to detail. Whether the work involved routine maintenance or complex tasks, having a well-organized document ensures that your client feels confident in the work performed and the charges applied.

Incorporating Tax and Discounts in Invoices

When creating billing documents, it’s crucial to include taxes and discounts accurately to ensure transparency and prevent any confusion with clients. Properly incorporating these elements not only ensures that your pricing is in compliance with local laws but also helps maintain a professional and trustworthy relationship with your customers. By itemizing taxes and offering clear discount structures, you make it easier for clients to understand their total charges.

Including Taxes

Taxes are an essential part of most transactions and should be carefully calculated and added to the total cost. Different regions may have varying tax rates, so it’s important to ensure that the appropriate tax rate is applied based on your location and the type of service provided. Here’s how to include taxes correctly:

- Specify the Tax Rate: Clearly state the tax rate applied to the subtotal, whether it’s a percentage or flat fee.

- Itemize the Tax Amount: Break down the tax separately from the service costs so that your clients can see how much they’re being charged for taxes alone.

- Calculate Tax on Subtotal: The tax should be applied to the subtotal amount, not including any discounts. Ensure that this is correctly reflected in your document.

Applying Discounts

Offering discounts is a great way to reward loyal customers or incentivize repeat business. However, it’s important to apply discounts accurately to avoid confusion or dissatisfaction. Here are a few tips for incorporating discounts into your billing:

- State the Discount Percentage or Amount: Clearly indicate whether the discount is a fixed amount or a percentage of the total price.

- Apply Discount to Subtotal: The discount should be applied to the subtotal before taxes are calculated to ensure that the correct amount of tax is charged on the adjusted price.

- Specify the Discount Reason: If applicable, provide a brief explanation for the discount, such as “seasonal promotion” or “loyalty discount.” This helps clarify the reason for the reduction.

By incorporating taxes and discounts properly, you can avoid errors and build greater trust with your clients. Transparency in billing not only makes your transactions clearer but also fosters positive relationships and ensures compliance with legal requirements.

Automating Invoice Generation for Auto Shops

For businesses offering vehicle services, streamlining the billing process is key to saving time and reducing the risk of errors. Automating the creation of financial documents can significantly increase efficiency, allowing businesses to focus more on providing services and less on administrative tasks. Automation tools help eliminate manual data entry, making the process faster, more accurate, and consistent across all transactions.

By using software that generates billing documents automatically, auto shops can easily input client details, service descriptions, and pricing information. The system can then generate a completed document with minimal effort, ensuring that all necessary fields are filled correctly. This not only saves time but also ensures that each document maintains a professional appearance, regardless of how many transactions are processed each day.

Furthermore, automated systems can help with tracking payments, sending reminders for overdue bills, and maintaining organized records for financial reporting. This integration of automated tools helps businesses stay on top of their cash flow while reducing the administrative burden, allowing shop owners and staff to focus on more important tasks like customer service and expanding their services.

How to Avoid Common Invoice Mistakes

Creating accurate and professional billing documents is crucial for maintaining a smooth financial workflow and fostering positive relationships with clients. However, mistakes in these documents can lead to misunderstandings, delays in payment, and damage to your reputation. Understanding the common errors and taking steps to avoid them can help ensure that your documents are clear, complete, and legally compliant.

1. Double-Check Client and Service Details

One of the most common mistakes is incorrect client information or service descriptions. This can cause confusion and result in the client disputing charges or delaying payment. To avoid this, always double-check the following before finalizing any document:

- Client Information: Ensure that the customer’s name, address, and contact details are accurate.

- Service Descriptions: Clearly describe the services provided, including parts used, labor, and any additional fees. Ambiguous or incomplete descriptions can lead to misunderstandings about what was actually delivered.

- Pricing Accuracy: Verify that the rates for services and products are correct and match any previously agreed-upon quotes or estimates.

2. Check for Mathematical Errors

Simple math errors, such as incorrect calculations for subtotals, taxes, or discounts, can result in incorrect totals. Even minor discrepancies can cause frustration for clients and lead to delayed payments. To minimize errors:

- Use Automated Tools: Relying on automated billing systems or software that perform calculations for you can reduce the risk of human error.

- Cross-Verify Totals: Always double-check the final amount to ensure that the correct taxes, discounts, and other fees are applied.

By taking a little extra time to check these details, you can significantly reduce the risk of errors that may harm your business’s reputation and cash flow.

Using Invoices to Build Customer Trust

Properly structured billing documents can be powerful tools in building trust with your clients. They not only serve as a record of the services provided but also demonstrate professionalism, transparency, and reliability. When customers receive clear, detailed, and accurate documentation, it instills confidence in your business practices, making them more likely to return and recommend your services to others.

Here are several ways that well-organized billing documents contribute to building stronger customer relationships:

1. Demonstrating Transparency

Clients appreciate when they can easily understand what they are being charged for. By providing a detailed breakdown of services, labor, parts, and any applicable taxes or fees, you eliminate any confusion about the costs. Transparency in your documents shows clients that you have nothing to hide and helps to avoid misunderstandings.

- Clear Itemization: Break down each service or product with a detailed description and the cost associated with it. Clients feel more in control when they can see exactly what they’re paying for.

- Itemized Costs for Parts and Labor: If you offer various services or use multiple parts, include a specific price for each item to show that you’re charging fairly and accurately.

2. Establishing Professionalism

Providing clients with a well-organized, consistent document conveys professionalism. It reassures them that your business is legitimate, reliable, and capable of handling transactions in an efficient manner. A professional document also helps differentiate your business from others that may not provide the same level of detail or clarity.

- Consistent Branding: Use your business’s logo, contact information, and color scheme to reinforce your brand identity on every document.

- Clear Payment Terms: Specify the payment due date, accepted payment methods, and any late fees. Clear terms avoid confusion and set proper expectations for both parties.

3. Building Accountability

By providing accurate and timely documentation, you also set the stage for accountability. Clients know they can refer back to the document if they have questions about the work performed or need to verify the charges. This accountability ensures a smoother, more professional experience and can help resolve any disputes quickly and amicably.

Ultimately, consistently providing well-detailed billing documents helps reinforce your business’s reputation as trustworthy, transparent, and professional, which can lead to greater customer loyalty and more referrals in the future.

Integrating Invoice Templates with Accounting Software

Integrating billing documents with accounting software is a smart way to simplify your financial management. By linking these two systems, businesses can automate the process of tracking transactions, generating reports, and maintaining up-to-date records. This integration helps reduce manual data entry, minimize errors, and ensure that all your financial information is consistently aligned with your business operations.

1. Streamlining Financial Tracking

When billing records are automatically synced with your accounting software, it becomes easier to track payments, manage outstanding balances, and generate accurate financial reports. This integration eliminates the need for double entry of data and ensures that every transaction is reflected correctly in both systems.

- Automated Updates: As soon as a document is created and sent, it is automatically logged in your accounting software, saving you time and effort.

- Real-Time Data: Any changes or updates made to financial records, such as payments or adjustments, are reflected in real-time, ensuring accurate reporting.

2. Simplifying Tax and Financial Reporting

Integrating billing documents with accounting tools can help simplify tax calculations and financial reporting. By having all transactions in one place, you can quickly generate accurate tax reports, track income, and ensure that you meet your legal obligations. This integration can also help you avoid common mistakes when preparing for tax season, as all data is automatically synchronized and ready for review.

- Easy Tax Calculation: Your accounting software can automatically calculate taxes based on the information from your billing documents, ensuring compliance with local tax laws.

- Centralized Reporting: Generate comprehensive reports that include sales, taxes, payments, and any other financial metrics in a few clicks.

By integrating billing documents with accounting software, businesses can save time, improve accuracy, and ensure their financial records are always up to date, enabling them to focus more on their core services and less on administrative tasks.

Best Practices for Auto Repair Invoice Management

Effective management of billing documents is essential for ensuring smooth business operations and maintaining positive client relationships. Implementing best practices for organizing, tracking, and following up on these documents can streamline your workflow, reduce errors, and improve cash flow. A well-organized system helps prevent delays, enhances professionalism, and ensures that all financial transactions are properly recorded.

1. Keep Records Organized

Organization is key when it comes to managing billing documents. Properly storing and categorizing each document will make it easier to access information when needed, whether for auditing, customer inquiries, or reporting purposes. Consider using a digital system to store all records in one place, categorized by client, service date, or transaction type.

- Use a Digital System: Storing documents electronically allows for quick access, reduces physical clutter, and ensures better security.

- Categorize by Client and Date: Group records by customer name and service date to quickly retrieve the necessary details when a customer calls or requests information.

- Regular Backups: Ensure that your digital records are regularly backed up to avoid loss of important information due to technical failures.

2. Automate Follow-Ups and Reminders

Staying on top of outstanding balances is critical for maintaining healthy cash flow. Automating follow-up reminders for overdue payments can help reduce delays and ensure timely payment. This process can be easily integrated into many digital billing systems or accounting software.

- Set Up Automatic Reminders: Use software to send automatic reminders to clients when payments are due or past due, helping to reduce administrative workload.

- Clearly Define Payment Terms: Ensure that payment terms are clear and easily accessible for clients, reducing the likelihood of misunderstandings or disputes.

- Track Payment Status: Monitor the status of each payment, noting when it’s received, overdue, or partially paid, to stay organized and ensure timely follow-ups.

By implementing these best practices, businesses can improve efficiency, maintain accuracy, and foster stronger relationships with clients through professional and effective document management. This will help ensure that financial transactions are processed smoothly, reducing errors and boosting client confidence.