Professional Invoice Template for Australia

Creating clear and professional billing documents is essential for any business looking to maintain smooth financial transactions. These documents not only help ensure prompt payments but also reflect your company’s professionalism. Properly formatted records can save time and avoid confusion, making it easier to manage accounts receivable.

There are various tools available to help businesses generate accurate and polished financial documents. By using the right tools, you can automate much of the process, reducing human error and providing a more efficient solution for tracking payments. Whether you’re a freelancer, small business owner, or part of a larger enterprise, adopting a consistent approach to creating these essential records can bring long-term benefits.

Adapting these solutions to your specific needs allows for customization, ensuring that all the relevant details–such as taxes, terms, and itemized services–are included. The flexibility of these systems enables you to tailor documents in a way that best suits your business model and client base.

Invoice Template Australia Guide

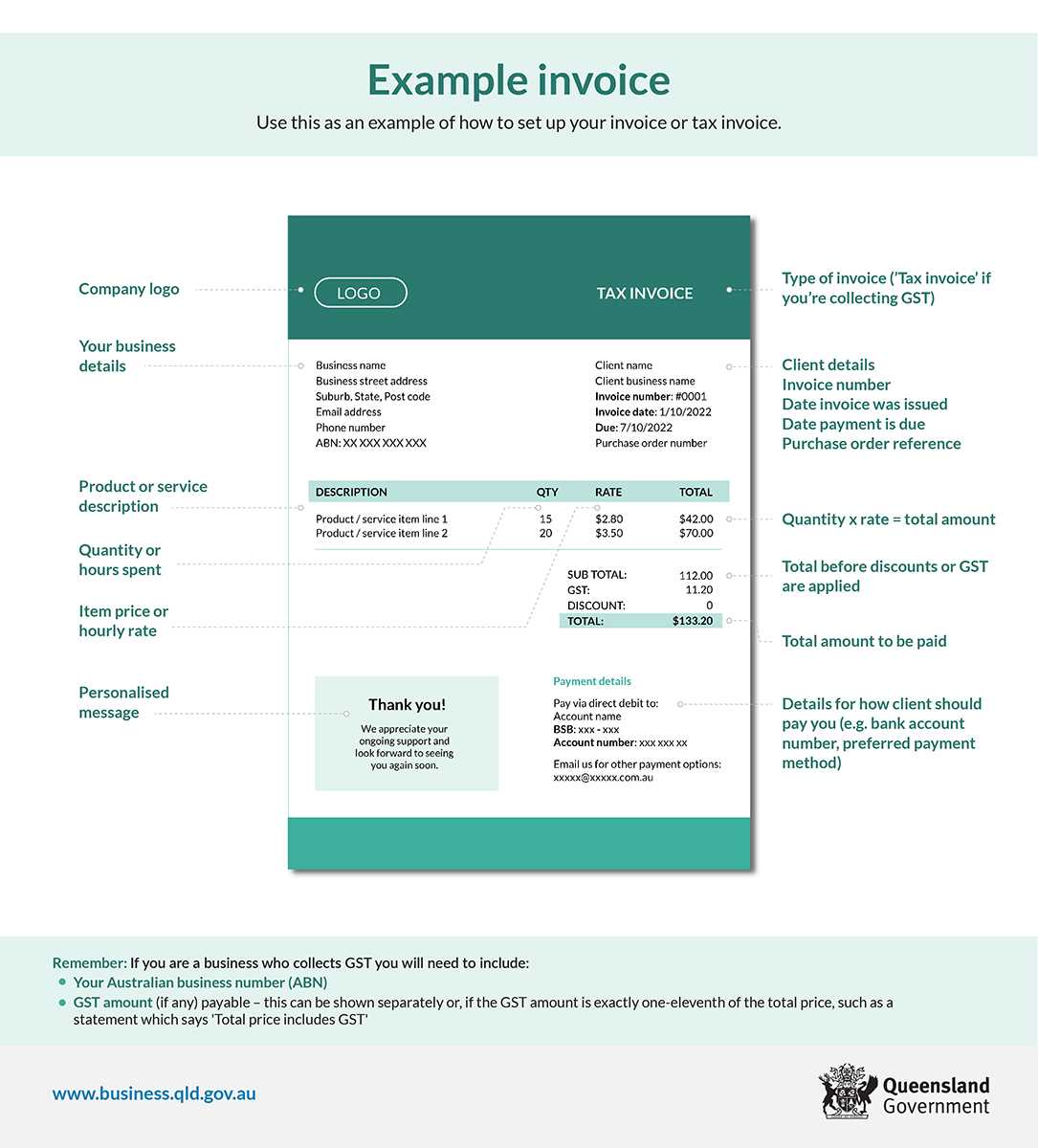

Effective billing documents are essential for maintaining accurate financial records and ensuring timely payments. They serve as the official record of transactions between a business and its clients, making it important to use a clear and organized format. The right format not only aids in communication but also complies with legal and tax requirements.

When creating these documents, it’s crucial to include key details such as itemized services, the agreed payment terms, and tax information. This ensures both parties have a mutual understanding of the transaction. Consistency in format helps avoid confusion and facilitates smooth processing on both sides.

Customizing these documents to suit the needs of your business or industry can further streamline your operations. From freelancers to large enterprises, having a standardized method for generating these documents helps reduce the time spent on administrative tasks and minimizes errors.

Benefits of Using an Invoice Template

Utilizing a standardized document format for billing offers numerous advantages for both small businesses and large enterprises. By streamlining the process, it allows for quicker preparation and reduces the chance of errors. This consistency not only saves time but also enhances the professional image of your business.

One of the key benefits is the ability to maintain a clear and organized record of transactions, making it easier to track payments, follow up on overdue amounts, and stay compliant with local regulations. With all the necessary fields included in a predefined structure, there’s no need to manually create each document from scratch.

Time-Saving and Efficiency

By using a pre-designed format, businesses can generate multiple documents quickly. This minimizes administrative time, freeing up resources for other important tasks. Instead of spending valuable time formatting each document, the system automates much of the process.

Professional Appearance and Consistency

A well-organized, uniform document reflects positively on your brand. A standardized approach helps ensure that every client receives the same professional experience, contributing to long-term trust and credibility.

| Benefit | Explanation |

|---|---|

| Time Efficiency | Automating the process allows for quicker document creation, saving time on manual input. |

| Consistency | Using the same format for every transaction reduces confusion and errors. |

| Professional Image | A standardized look enhances business credibility and fosters client confidence. |

How to Customize Your Invoice Template

Personalizing your billing documents to meet the unique needs of your business is essential for creating a professional and efficient system. Customization allows you to include all necessary details while reflecting your brand’s identity. From adding your company logo to adjusting payment terms, tailoring these documents ensures they work for your specific needs.

To make the process easier, focus on key elements that should be modified. The structure should remain consistent, but certain aspects can be adjusted to align with your business model, such as the addition of specific service categories, payment instructions, or contact information.

| Customization Element | Why It Matters |

|---|---|

| Company Logo | Incorporating your logo helps to reinforce your brand image and adds a professional touch. |

| Payment Terms | Customizing payment terms ensures clarity between you and the client, reducing misunderstandings. |

| Item Descriptions | Providing detailed descriptions helps clients understand the services or products they are paying for. |

| Client Information | Personalizing client details ensures accurate communication and helps prevent errors in billing. |

Top Features in Australian Invoice Templates

When creating professional billing documents, certain features can make the process smoother and more efficient. These key elements ensure that all the necessary information is included and presented in a clear, concise manner. From providing accurate tax details to organizing service descriptions, these features help avoid confusion and streamline payment processing.

Understanding which elements are essential for your specific needs can help you create the most effective and user-friendly documents. Here are the top features that every well-organized billing document should include.

| Feature | Description |

|---|---|

| Tax Information | Including the correct tax details is crucial for compliance with local regulations and ensures accurate calculations. |

| Payment Terms | Clearly outlining the terms helps set expectations for payment deadlines, avoiding confusion with clients. |

| Itemized List of Services | Breaking down each product or service offered provides transparency and clarity for both parties. |

| Client Contact Information | Including accurate contact details ensures that clients can easily reach you for any questions or follow-up. |

| Unique Reference Number | A unique identifier makes it easy to track and reference documents in your financial records. |

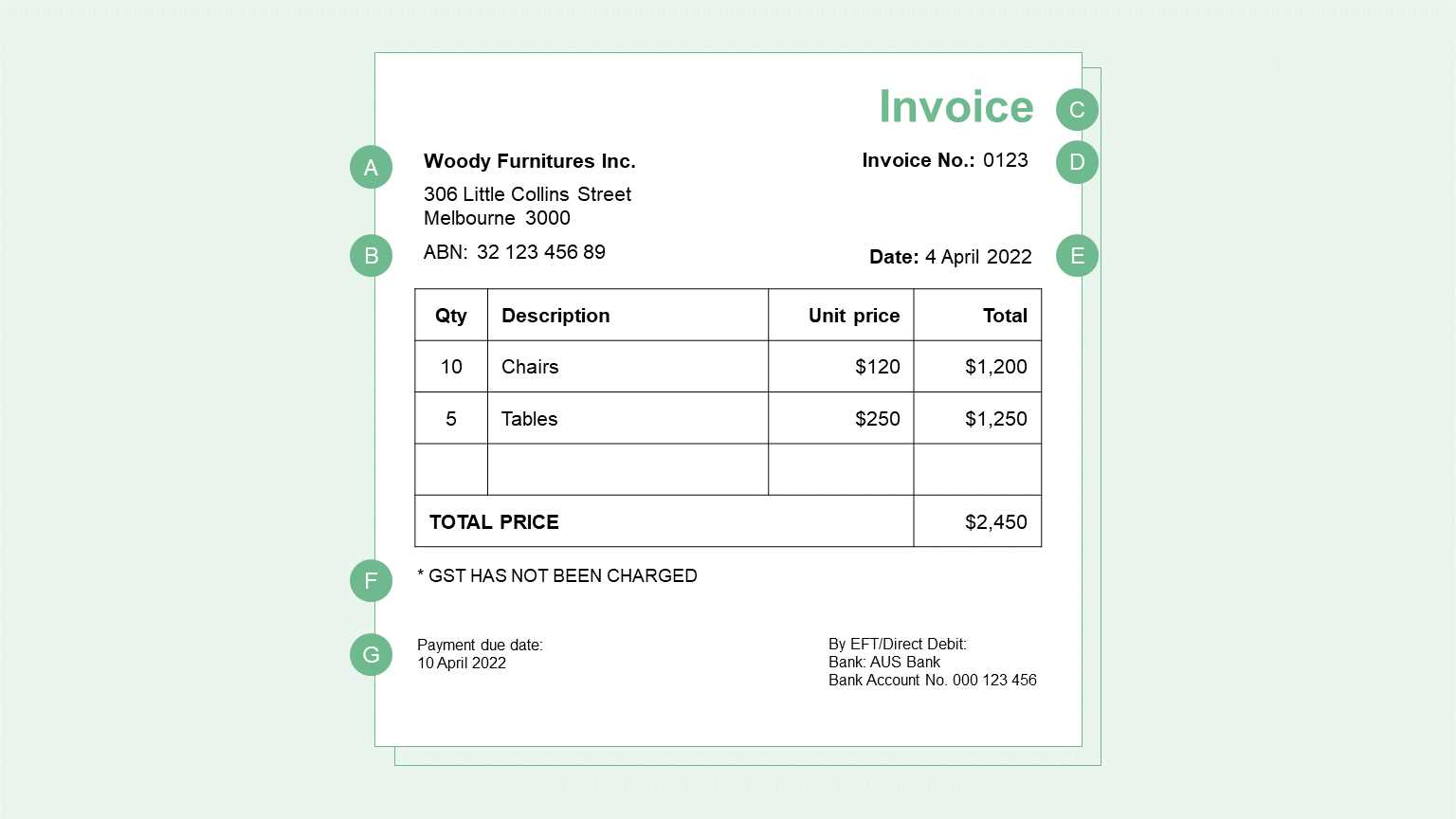

Legal Requirements for Invoices in Australia

In any country, it’s important to ensure that your billing documents meet the necessary legal standards. In Australia, there are specific regulations that govern the creation and content of these documents to ensure compliance with tax laws and business practices. Understanding these requirements is crucial for avoiding legal issues and maintaining smooth business operations.

Among the most important requirements is the inclusion of certain key details that both businesses and clients need for record-keeping and tax purposes. These details help clarify the nature of the transaction and ensure transparency between both parties.

Essential Information to Include

For your documents to comply with legal standards, they must include a few mandatory pieces of information. This includes things like your business details, client information, and specifics about the goods or services provided. Including these elements helps safeguard your business against potential disputes or non-compliance with tax authorities.

Tax and GST Considerations

When issuing such documents in Australia, it’s crucial to understand the role of Goods and Services Tax (GST). If your business is registered for GST, this tax must be clearly stated, and the applicable rates need to be shown. This ensures your business is adhering to the necessary tax regulations and that clients are aware of the tax amount they are being charged.

| Required Information | Explanation |

|---|---|

| Your Business Details | Must include business name, address, and ABN (Australian Business Number) for identification. |

| Client’s Information | Includes the client’s name and address, ensuring correct delivery and tracking. |

| Transaction Date | Accurate date of the transaction helps establish timelines for payment and tax reporting. |

| Tax Details | Clearly state any taxes applied, especially GST, if applicable. |

How to Add Tax Information on Invoices

Including accurate tax details in billing documents is essential for both compliance and transparency. In many regions, including Australia, businesses are required to clearly state tax charges, such as Goods and Services Tax (GST), to ensure that both parties are aware of the amounts being charged. Properly displaying tax information also helps prevent any misunderstandings and ensures that your records are in line with local regulations.

To ensure that tax details are correctly included, certain fields need to be filled out in a specific way. For example, it’s important to list the applicable tax rate and the total tax amount separately. This makes it clear to your client how much of the total sum is being charged as tax and what rate is being applied.

| Tax Information | Explanation |

|---|---|

| Tax Rate | Clearly indicate the applicable tax rate (e.g., 10% GST) to avoid confusion. |

| Tax Amount | Show the total amount of tax applied to the transaction, separate from the product/service cost. |

| Business Registration Number | If your business is registered for GST, you must include your GST registration number. |

| Taxable Amount | Indicate the amount before tax is applied, ensuring clarity about the taxable portion of the transaction. |

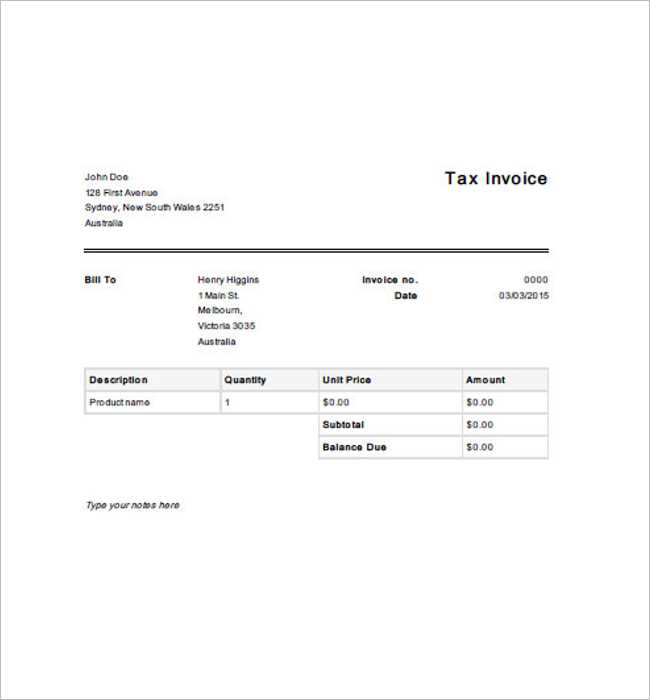

Creating Professional Invoices for Small Businesses

For small businesses, producing clear and professional billing documents is essential for maintaining a positive reputation and ensuring timely payments. These documents reflect the professionalism of the business and can also play a critical role in financial management. Creating such documents that are well-organized and easy to understand helps prevent any confusion and enhances the customer experience.

To create effective documents for your business, there are key elements that should be consistently included. Ensuring that each document follows a uniform structure not only saves time but also establishes a reliable and professional image for your company.

Key Elements to Include

- Business Information: Always include your company name, address, and contact details to make it easy for clients to reach you.

- Client Information: Include the client’s name and contact details to avoid any mix-ups.

- Details of Products/Services: Clearly list the services or goods provided, along with quantities, descriptions, and individual prices.

- Payment Terms: Specify due dates, any early payment discounts, or late payment penalties to clarify expectations.

- Tax Details: Include the applicable tax rate and total tax amount, as this is necessary for both legal compliance and client understanding.

Best Practices for Small Businesses

For small businesses, consistency and clarity are key. Ensuring your documents have a professional format will help set you apart from competitors. Following best practices will make the process of billing more efficient and will help build trust with your clients.

- Use a clear and readable layout: A simple design with clear fonts makes it easier for clients to understand the details.

- Number your documents: Give each document a unique reference number for easy tracking and organization.

- Stay organized: Keep a record of all billing documents and ensure they are easily accessible for future reference.

Free vs Paid Invoice Templates for Australia

When selecting billing documents for your business, you may wonder whether to choose free or paid options. Both have their advantages, but each comes with its own set of features and limitations. Deciding which one to use depends on your business needs, the level of customization you require, and how much you’re willing to invest in your administrative tools.

Free options are typically accessible and can be a good starting point for small businesses with minimal requirements. However, paid solutions often offer more robust features, including advanced customization, professional designs, and customer support. Understanding the differences between free and paid options will help you make an informed choice for your business operations.

Advantages of Free Options

- Cost-effective: No financial investment is required, making it ideal for startups or small businesses with limited budgets.

- Basic Features: Free documents usually include the essential fields such as company details, item descriptions, and totals.

- Quick Access: You can find various free versions online and start using them immediately without any setup or subscription.

- Simple Designs: Free versions typically offer simple, clean formats that can be easily customized for basic needs.

Benefits of Paid Solutions

- Customization: Paid versions allow for extensive customization, including branding elements, custom fields, and more complex layouts.

- Professional Appearance: These options often come with polished, modern designs that enhance your business’s image.

- Advanced Features: Additional features such as integration with accounting software, recurring billing, and payment tracking are typically available with paid solutions.

- Support: Paid options often provide customer support, ensuring that any issues are quickly resolved by a professional team.

Best Software for Invoice Templates in Australia

Choosing the right software to create professional billing documents can significantly improve your business operations. The right tool not only saves time but also ensures that your records are organized and compliant with legal requirements. Various software solutions offer different levels of customization, ease of use, and additional features tailored to business needs. Whether you’re a freelancer, small business owner, or a larger company, selecting the right tool will help streamline your accounting processes and ensure a smooth invoicing experience.

There are numerous options available, ranging from simple tools to more advanced software with additional features like integration with accounting platforms, automated payment reminders, and more. To choose the best one, consider factors such as cost, functionality, ease of use, and the specific needs of your business.

Top Software Options for Businesses

- QuickBooks: A popular choice for businesses, offering a comprehensive set of tools for creating professional billing documents, tracking payments, and managing financial reports.

- FreshBooks: Known for its user-friendly interface, this software is perfect for small businesses and freelancers. It offers customizable documents, automatic tax calculations, and expense tracking features.

- Zoho Books: A cloud-based accounting tool that allows businesses to generate professional documents, manage GST/VAT, and keep track of client details in one place.

- Wave: A free option for small businesses, Wave offers customizable documents, easy tax calculations, and the ability to track both payments and expenses.

Factors to Consider When Choosing Software

- Customization: Look for software that allows you to easily customize your documents, adding logos, branding elements, and custom fields.

- Integration: Choose software that integrates with your existing accounting or financial systems for seamless management.

- Ease of Use: The best software should be intuitive, allowing you to create and send documents with minimal effort.

- Support and Resources: Reliable customer support is essential, especially if you encounter any issues with the software.

How to Automate Your Invoicing Process

Automating your billing procedures can save your business time and reduce the risk of errors. With automated systems, you can streamline the process, ensuring that clients receive accurate and timely statements without manual input each time. Automation also helps you stay organized by keeping track of payments, due dates, and outstanding balances, which ultimately improves your cash flow management.

By leveraging modern software and tools, you can eliminate the need for repetitive tasks like manually creating, sending, and tracking payments. Automation can be set up to generate billing documents based on predefined parameters, and even send reminders or receipts automatically to clients. In this section, we will explore how to implement an automated system for your business and the benefits that come with it.

Steps to Automate Your Billing Process

- Choose the Right Software: Select a billing solution that offers automation features such as recurring billing, payment reminders, and automatic generation of documents based on client data.

- Set Up Recurring Billing: For businesses with repeat clients, set up automated recurring invoices to be sent at regular intervals (e.g., weekly, monthly). This reduces the need for manual entry each time.

- Link Payment Methods: Integrate your software with various payment processors like PayPal, Stripe, or bank accounts to automatically mark invoices as paid when payments are received.

- Automate Payment Reminders: Set up automatic reminders to notify clients of upcoming or overdue payments, reducing the need for manual follow-ups.

Advantages of Automation

- Time Savings: Automating repetitive tasks frees up valuable time for other important business activities.

- Consistency: Automation ensures that all documents are consistent and meet your standards, reducing the risk of mistakes or inconsistencies.

- Improved Cash Flow: Timely invoicing and automatic payment tracking helps maintain a steady cash flow and minimizes the chances of missed payments.

- Enhanced Client Relationships: Clients appreciate the efficiency and professionalism that come with automated billing, which can contribute to posit

Common Mistakes in Invoice Creation

Creating billing documents can be a straightforward task, but small mistakes can lead to confusion, delayed payments, or even lost revenue. Whether it’s missing essential information or errors in calculations, each mistake can have a significant impact on your business’s financial health. In this section, we will explore some of the most common errors businesses make when preparing billing statements and provide tips on how to avoid them.

Recognizing and correcting these mistakes early can ensure smoother transactions with your clients, faster payments, and better record-keeping for your business. Paying attention to detail and implementing best practices can help maintain professionalism and avoid unnecessary complications.

Top Mistakes to Avoid

- Missing or Incorrect Contact Information: Ensure that both your company’s and the client’s contact details, including addresses, phone numbers, and email addresses, are accurate and complete. Incorrect or incomplete contact information can lead to confusion or delays.

- Not Including Payment Terms: Always specify the payment due date, late fees (if applicable), and accepted payment methods. Failure to include these details can lead to misunderstandings about when payments are expected.

- Omitting Itemized List of Services or Products: A clear breakdown of what has been provided helps the client understand the charges and verify that everything is correct. Failure to list items in detail can result in disputes or confusion.

- Calculation Errors: Double-check all numbers before sending any documents. Simple errors in adding up totals or applying taxes can make your business look unprofessional and lead to incorrect payment amounts.

- Using Unclear or Unprofessional Formatting: A disorganized layout or poor formatting can make your billing document hard to read and unprofessional. Stick to a clean and easy-to-understand structure to present your information clearly.

- Not Including Tax Information: Always include applicable tax rates, especially if you’re operating in regions with specific tax requirements. Omitting tax details could lead to misunderstandings or legal issues.

How to Avoid These Mistakes

- Review Everything: Always review the details of your billing documents before sending them to clients. A fresh look can help you spot pot

Why Consistency Matters in Invoices

Maintaining uniformity in the creation of billing documents is essential for several reasons. Consistency ensures that each document is easy to read and understand, promoting trust between your business and your clients. It also helps streamline internal processes, making it easier to track payments, identify discrepancies, and manage accounts. A consistent format reduces confusion, avoids errors, and presents a professional image of your business.

When your billing documents follow a clear and uniform structure, both you and your clients know what to expect, which can lead to faster payments and fewer misunderstandings. Inconsistent layouts or missing details can raise doubts or lead to delays in the payment process, which could negatively impact your cash flow. This section explores why consistency is key and how it can benefit your business in the long run.

Key Areas Where Consistency is Crucial

- Layout and Design: A uniform layout makes it easier for your clients to quickly find important details, such as amounts due, payment terms, and due dates. It creates a cohesive visual experience that is familiar and easy to navigate.

- Language and Terminology: Use consistent language across all your documents, ensuring that terms like “total amount,” “due date,” and “payment method” are used the same way every time. This helps avoid confusion and ensures clarity.

- Formatting and Structure: Stick to a specific format for listing items, charges, and other important details. This can include consistently using tables to organize data or applying the same font and font size throughout your documents.

How Consistency Improves Your Business Operations

- Professionalism: A consistent and well-organized presentation of billing statements portrays your business as professional and reliable, which helps build stronger relationships with clients.

- Efficiency: Standardized processes reduce the time spent reviewing and correcting documents, leading to faster invoicing and reduced administrative costs.

- Fewer Errors: By following the same format each time, there is less room for missing information or miscalculations, which ultimately reduces the risk of disputes or payment delays.

Benefit Impact on Business Professionalism Tracking Payments Using Invoice Templates

Efficiently managing and monitoring payments is essential for maintaining healthy cash flow in any business. Using a structured approach to document payments allows for better tracking, quicker identification of overdue amounts, and ensures that your financial records are accurate. A well-organized system provides transparency and minimizes the risk of missing payments or overlooking outstanding balances.

By implementing a system for tracking payments directly within your billing documents, you can easily maintain an up-to-date record of all transactions, making the reconciliation process much smoother. In this section, we explore how to effectively monitor and track payments with a standardized approach, ensuring you stay on top of your financial situation.

How to Organize Payment Tracking

When setting up a system for tracking payments, consistency in format and structure is key. Ensure that each billing document includes the following elements to help monitor payments effectively:

- Payment Status: Clearly indicate whether the payment has been received, is pending, or overdue. This can be done with a simple checkbox or text marker to easily differentiate statuses.

- Payment Date: Include the date the payment was made or is due. This allows for quick reference and prevents confusion around payment timelines.

- Outstanding Balance: If the full amount hasn’t been paid, specify the remaining balance to be paid. This helps you track partial payments and ensures you know exactly how much is left to collect.

Benefits of Tracking Payments

- Quick Identification of Overdue Payments: With clear indicators of payment status, overdue amounts can be flagged and followed up promptly.

- Improved Cash Flow Management: Real-time tracking of payments allows you to better predict your cash flow and make more informed financial decisions.

- Reduced Risk of Errors: Standardizing payment tracking reduces the chances of missing payments or accidentally double-charging clients.

How to Include Payment Terms Effectively

Clearly stating the conditions under which payments are to be made helps both businesses and clients understand expectations, avoid misunderstandings, and promote timely payments. Defining payment terms ensures that both parties are on the same page regarding due dates, methods of payment, and any penalties for late payments. In this section, we’ll explore how to include these important details in a way that is clear, concise, and professional.

When structuring payment terms, it’s important to use precise language and a format that’s easy for your clients to follow. This allows you to maintain a professional reputation while ensuring smooth transactions. Below are key elements to include when outlining payment terms in your billing documents.

Key Elements of Payment Terms

Here are the most important details to include when specifying payment terms:

- Due Date: Clearly state when the payment is expected, whether it’s a set number of days from the date of service or a specific calendar date.

- Accepted Payment Methods: List the methods you accept for payment, such as bank transfers, credit cards, or online payment platforms.

- Late Payment Fees: Specify any charges that will be applied if payment is not made within the agreed timeframe. This encourages clients to make timely payments.

- Early Payment Discounts: If applicable, mention any discounts clients can receive for paying early. This can be an incentive for faster payments.

Best Practices for Clear Payment Terms

To ensure clarity and avoid confusion, consider these best practices:

- Be Specific: Avoid vague language. Instead of saying “Payment is due soon,” specify “Payment due within 30 days of receipt.”

- Use Bold or Highlight: Emphasize important details, such as the due date or late fees, by formatting them with bold text or a distinct color.

- Keep it Simple: Use simple, straightforward language to ensure your terms are easy to understand.

Design Tips for an Attractive Invoice

A well-designed billing document not only communicates professionalism but also helps ensure that your clients understand the details clearly and quickly. The layout, colors, and structure you choose can make a significant impact on how your client perceives the transaction. By following a few design tips, you can create a document that is not only functional but also appealing and easy to navigate.

Here are some key tips to enhance the design of your billing document:

- Use a Clean Layout: A clutter-free layout with clear sections for contact details, payment terms, and the list of services or products will make it easier for clients to read and understand.

- Choose Legible Fonts: Select fonts that are easy to read, even at smaller sizes. Stick to classic fonts like Arial or Times New Roman to ensure clarity and avoid using too many font styles or sizes.

- Incorporate Your Brand Colors: Include your company’s colors in the design to make the document consistent with your brand identity. Use these colors for headings, borders, or logo placement, but avoid overuse to maintain professionalism.

- Add Visual Hierarchy: Use bold text, underlining, or larger font sizes to highlight important details such as the due date, total amount, and contact information. This makes the document more scannable and guides the reader’s eye to the most crucial information.

By applying these tips, you can create a billing document that not only looks appealing but also serves its primary purpose of delivering clear, concise, and professional information to your clients.

Sending and Managing Invoices Digitally

In the digital age, managing billing documents electronically offers significant advantages in terms of speed, organization, and accessibility. Sending and tracking payments digitally eliminates much of the hassle associated with paper-based processes, allowing businesses to streamline their operations and improve cash flow management.

Benefits of Digital Billing

Digital communication methods enable faster delivery, reducing the time it takes for a client to receive the billing document. With just a few clicks, you can send an email with an attachment, or use cloud-based tools that automatically generate and send the document. This can speed up payment cycles and improve overall efficiency.

Managing Your Records Online

By storing your records in a digital format, you can easily organize, search, and retrieve previous transactions. Cloud storage services allow for secure backups, making sure that all documentation is protected from loss due to physical damage or misplacement. This also enables easy access from anywhere, facilitating quicker resolutions for any disputes or inquiries.

Embracing digital methods not only makes your billing process faster but also reduces costs associated with printing and mailing. It provides a more professional experience for your clients, aligning your business practices with modern standards of efficiency and sustainability.

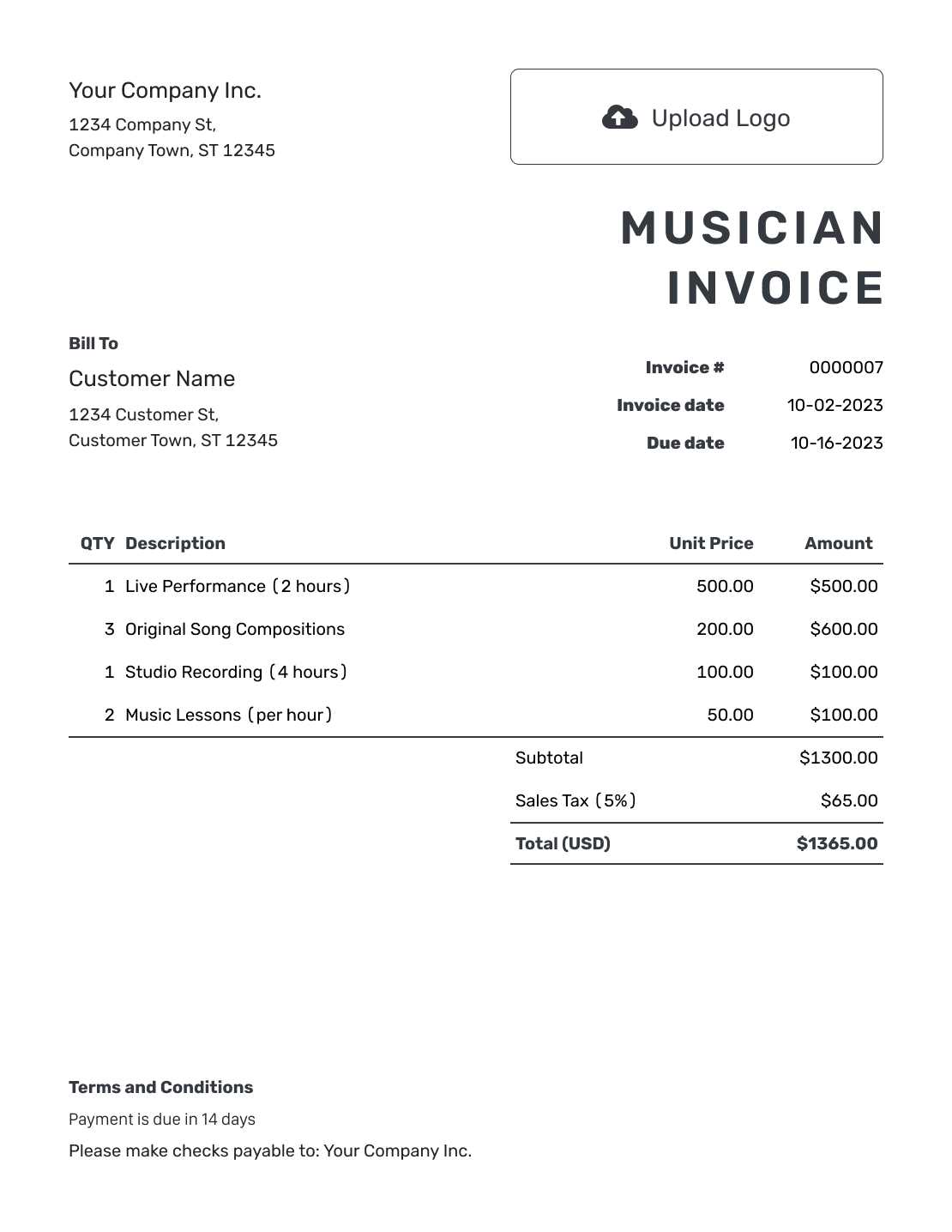

Invoice Formats for Different Industries

Every industry has its own set of requirements and expectations when it comes to billing documents. Tailoring your billing documents to meet the specific needs of your business sector ensures clarity, professionalism, and compliance with relevant regulations. Understanding the various formats for different industries can make the invoicing process smoother and more effective for both businesses and clients.

For instance, the creative sector, such as graphic design or freelance writing, often requires more flexibility in terms of itemization and detailed descriptions. In contrast, industries like construction or wholesale may require more structured formats to include project milestones, labor costs, or bulk goods listings.

In some sectors, such as legal or consulting, billing documents might need to reflect time-based charges or retainers, while in retail, they often focus on listing products, quantities, and prices. Recognizing the unique requirements of your industry and tailoring your billing documents accordingly helps foster a more efficient workflow and a better customer experience.