Top Invoice Template AU for Easy and Professional Billing

Efficient and accurate billing is a critical aspect of running a successful business in Australia. Whether you’re a freelancer, a small business owner, or a large enterprise, having the right tools to create professional financial documents is essential for maintaining smooth cash flow and fostering trust with clients. In this section, we explore practical solutions to streamline your invoicing process and ensure that you are always on top of your financial transactions.

Customizable billing formats can simplify the process, making it easier to generate and manage records that comply with Australian regulations. With the right approach, you can save time, reduce errors, and keep your focus on growing your business. This guide offers insights into the best practices and tools to enhance your invoicing routine, ensuring you meet both your clients’ expectations and legal requirements.

From freelancers to established companies, adopting a streamlined approach to creating financial documents ensures a professional presentation and timely payments. By choosing the right format and adjusting it to suit your specific needs, you can optimize your accounting workflow and maintain a polished image in the eyes of your clients.

Invoice Template AU for Businesses

For any business in Australia, having a reliable and consistent way to request payment for goods or services is crucial. A well-organized billing document not only ensures clarity but also helps maintain professionalism in every transaction. The right format can simplify the accounting process, improve cash flow management, and build trust with clients by presenting a clear record of services rendered and amounts due.

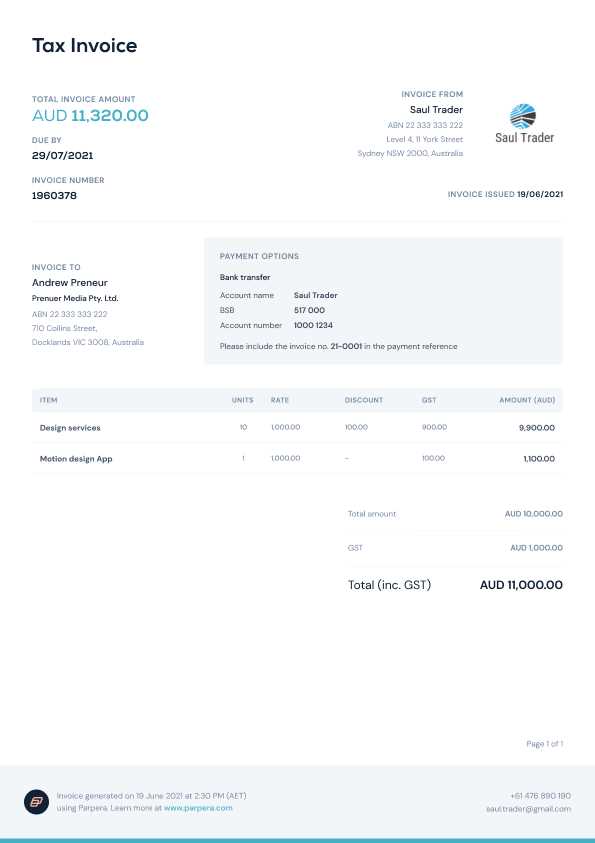

For Australian businesses, it is essential to use a document structure that aligns with local standards and tax regulations. This includes clear details such as business identification, payment terms, GST amounts, and a breakdown of the work completed. Adopting a standard format tailored to these requirements saves time and reduces the risk of errors, allowing you to focus more on your business’s core operations.

Whether you’re a freelancer or managing a larger company, adopting a simple, yet professional, billing system will help establish credibility. Customizing such a document to fit your specific needs can also streamline your administrative tasks, ensuring that every transaction is recorded properly and in a timely manner.

Why Choose an Invoice Template?

Having a structured, pre-designed document for requesting payment is essential for any business. A standardized approach not only saves time but also ensures consistency across all transactions. With the right structure in place, you can reduce human error, stay organized, and maintain a professional image when interacting with clients. Using a set format allows businesses to efficiently track payments, handle disputes, and comply with local regulations.

Benefits of Using a Standardized Payment Document

Utilizing a pre-set design for your billing process offers several advantages. It simplifies the workflow, ensuring that all necessary details are included and presented in a clear, easy-to-understand format. For businesses in Australia, this includes mandatory information such as the business’s ABN (Australian Business Number), GST amounts, and clear payment terms. With all elements in place, you can focus on running your business instead of worrying about creating new documents for every transaction.

Key Features to Look for in a Billing Document

When selecting a structure for your financial requests, ensure that it includes the following key elements:

| Feature | Description |

|---|---|

| Business Information | Ensure your business name, ABN, and contact details are included for transparency. |

| Client Details | Clearly list the client’s name, address, and contact details for reference. |

| Payment Terms | State clear terms, such as due date and late fees if applicable. |

| Itemized List | Provide a breakdown of services or products offered, with associated costs for clarity. |

| GST Calculation | Include the relevant GST amounts to comply with Australian tax regulations. |

With these essential components, the process of requesting payment becomes streamlined and straightforward, allowing you to stay focused on what matters most–growing your business.

Benefits of Using Invoice Templates

Adopting a consistent and efficient approach for generating billing documents brings numerous advantages for any business. A well-organized structure simplifies the process, making it faster and more accurate to request payments. By eliminating the need to start from scratch with each transaction, businesses save time and reduce the chance of errors. This can lead to more professional interactions with clients, improved cash flow management, and enhanced productivity across various tasks.

Using a pre-designed format ensures that all the necessary details are included in each transaction record, helping businesses comply with legal and tax requirements. In Australia, for example, it’s important to include specific elements such as GST calculations and business registration details, which can all be managed effortlessly with the right structure in place.

Key Advantages of Using a Standardized Billing Structure

Here are some of the main benefits of using a pre-structured payment request format:

| Advantage | Description |

|---|---|

| Time Efficiency | Pre-designed formats allow for faster creation, reducing the time spent on manual adjustments. |

| Professional Appearance | Consistent documents help create a polished, credible image for your business in the eyes of clients. |

| Improved Accuracy | Using a set structure reduces the chances of omitting critical details or making mistakes in calculations. |

| Regulatory Compliance | Incorporates necessary legal elements, ensuring your billing complies with local regulations, such as GST. |

| Better Organization | With a standardized approach, businesses can easily track and store records of transactions for future reference. |

By integrating these advantages into your workflow, you not only save time but also ensure your billing process is consistent, professional, and aligned with both client expectations and legal obligations.

How to Customize Your Invoice Template

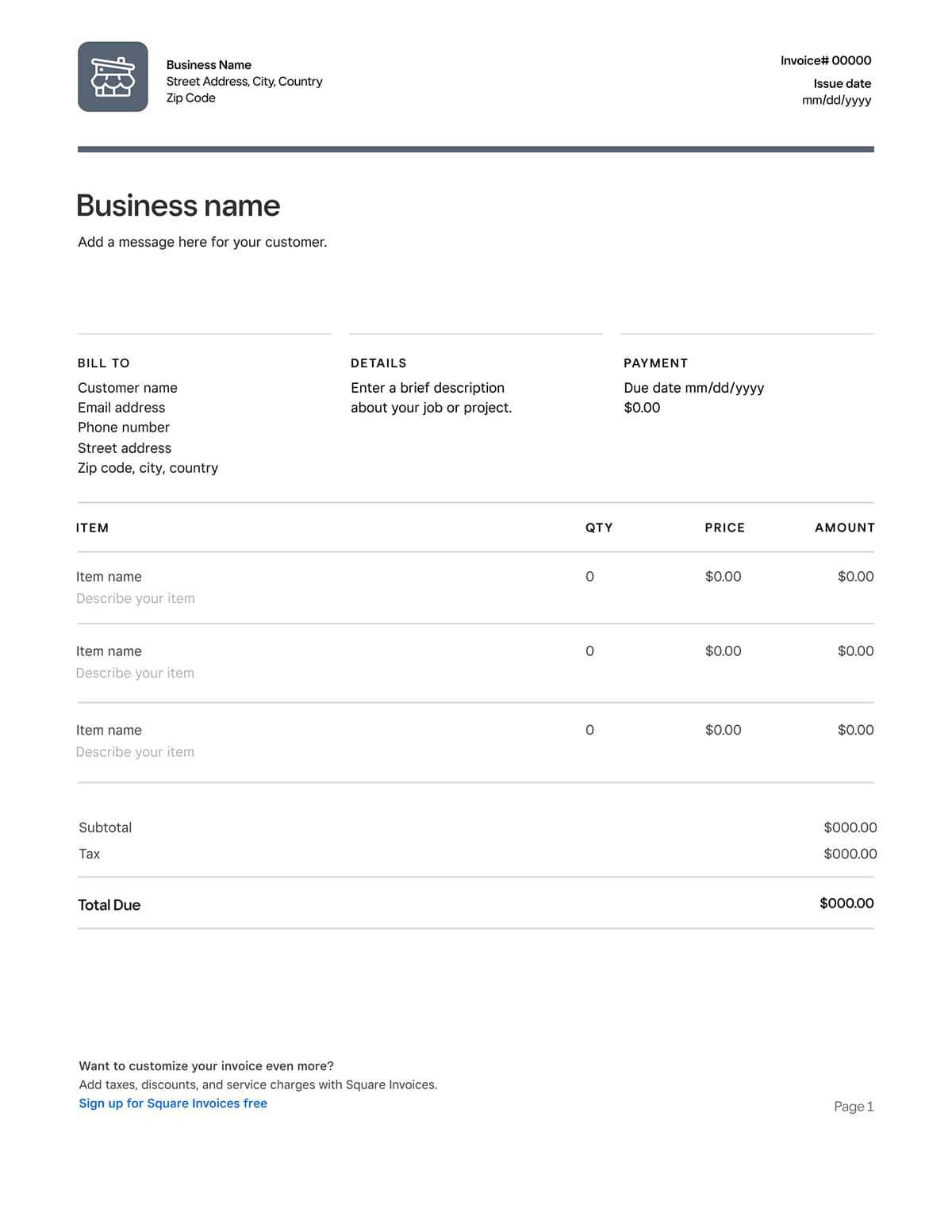

Customizing your billing document is essential to ensure that it reflects your business’s unique identity and meets specific client needs. A personalized format allows you to include essential details, such as your business logo, payment terms, and any other specific requirements. Customization not only helps maintain a professional appearance but also ensures that all necessary information is presented clearly and efficiently.

To create a personalized document, you need to adjust key sections that match your business operations. Here are some steps you can follow to modify your structure and make it work best for you:

- Include Your Branding: Add your business logo, name, and contact information at the top of the document to enhance brand recognition.

- Adjust the Layout: Organize the layout to suit the nature of your services or products, ensuring easy readability for clients.

- Set Payment Terms: Specify clear payment deadlines, penalties for late payments, and preferred methods of payment.

- Define Service Descriptions: Be detailed when listing the products or services provided, including quantities, rates, and any additional fees.

- Include Tax Information: Make sure you incorporate any necessary tax details, such as GST, to comply with Australian regulations.

Additionally, here are some specific elements you may want to customize:

- Currency: If you operate in multiple regions, ensure that the correct currency symbol is used for payments.

- Discounts and Promotions: Add any discount codes, special offers, or promotional pricing if applicable.

- Terms and Conditions: Customize legal disclaimers or other contractual terms relevant to your services.

By following these steps and focusing on the details that matter to your clients, you can ensure that every financial document you send is professional, clear, and in line with your business goals.

Free Invoice Templates for Australian Users

For Australian businesses, finding a free and reliable way to generate professional billing documents is essential, especially for small businesses or freelancers. Fortunately, there are many online resources offering customizable formats at no cost. These ready-made solutions are designed to meet the specific needs of businesses operating in Australia, making it easier to comply with local tax laws, including GST requirements.

Using these free resources, Australian entrepreneurs can access a wide variety of options that fit their business style and industry. From basic documents to more detailed structures, these tools can help create clear, professional records without the need for expensive software or complicated design work. Below are some key advantages of using free solutions:

- Cost-Effective: No need to spend money on software or subscription services, making it ideal for startups and small businesses.

- Customizable: You can easily adjust the document’s details, from adding business logos to modifying payment terms and tax information.

- Compliant with Australian Standards: Many free resources are tailored to meet Australian tax regulations, including the correct GST formatting.

- Time-Saving: Ready-made formats speed up the billing process, allowing you to focus more on your work and less on document creation.

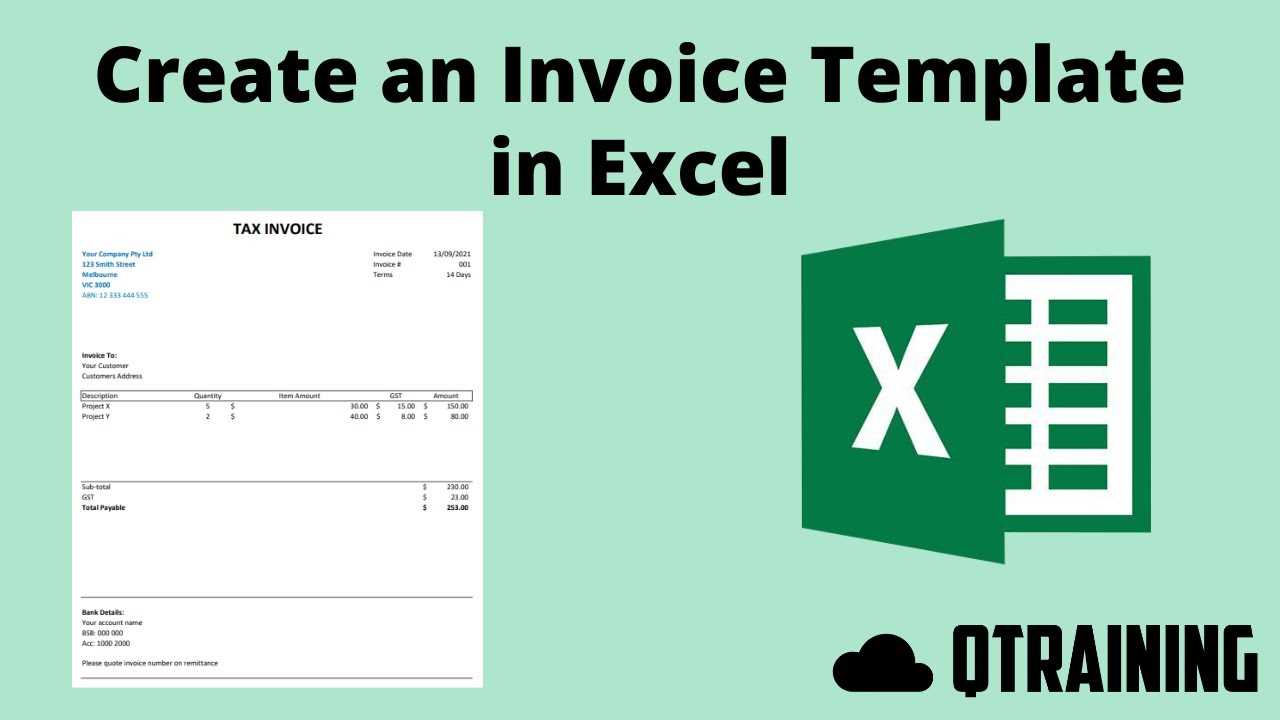

Here are a few options for obtaining free billing documents for your business:

- Online Generators: Websites that allow you to fill in details and generate a fully formatted document ready for download.

- Microsoft Word or Google Docs: Free downloadable formats that can be customized in word processing software.

- Excel Spreadsheets: Pre-built spreadsheets that can auto-calculate totals, taxes, and due dates for you.

- PDF Templates: Fillable PDFs that off

Common Mistakes to Avoid in Invoices

While preparing billing documents, it’s easy to overlook certain details that can cause confusion or delays in payment. These oversights can lead to misunderstandings with clients, delays in receiving payments, or even issues with tax compliance. Avoiding common mistakes when drafting payment requests is crucial for maintaining professionalism and ensuring smooth financial transactions.

To help you stay on track, here are some common errors that businesses should watch out for when creating payment documents:

Mistake Explanation Missing Contact Information Failing to include your business name, address, and contact details can cause confusion or delays in communication. Incorrect Payment Terms Not specifying clear payment deadlines or methods can lead to misunderstandings and late payments. Failure to Include Tax Details Not correctly including GST or other tax-related information may result in non-compliance with Australian tax regulations. Omitting Itemized Breakdown Not providing a detailed list of products or services delivered can make it difficult for clients to understand charges and cause disputes. Wrong or Missing Dates Including the wrong invoice or due date can create confusion, leading to delays in payment. Being mindful of these potential pitfalls can ensure that your billing documents are clear, professional, and compliant with legal requirements. By taking the time to check for these common mistakes, you can maintain good relationships with clients and ensure timely payments.

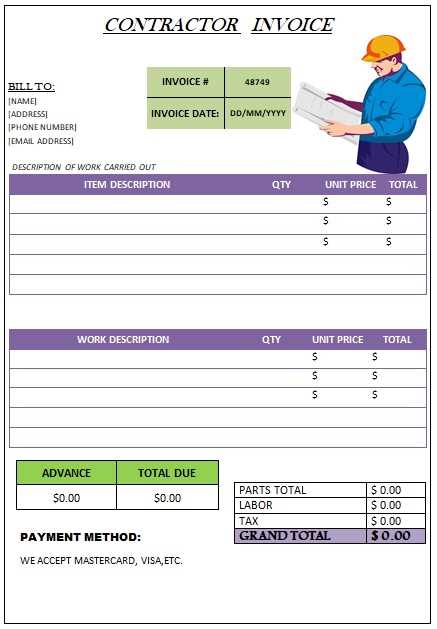

Top Features of an Effective Invoice Template

An effective billing document is more than just a request for payment–it’s a professional representation of your business and a critical tool for managing financial transactions. The key to success lies in ensuring that the document is both comprehensive and clear, containing all the necessary information in an organized format. This not only helps maintain client trust but also ensures that payments are processed efficiently and accurately.

Here are some essential features that make a billing document effective:

- Clear Business Information: Your business name, contact details, and ABN (Australian Business Number) should be easily visible, ensuring clients know who they are dealing with.

- Accurate Client Details: Always include the correct name and address of your client to avoid any confusion or errors during payment processing.

- Unique Reference Number: Assigning a unique identification number to each document helps with organization and simplifies tracking for both you and your client.

- Itemized Breakdown: Clearly list the products or services provided, including quantities, rates, and individual costs, so your client understands what they are being charged for.

- Payment Terms: Specify when payment is due, including any discounts or late fees that apply. This ensures both parties are clear on expectations.

- Tax Information: In Australia, ensure that GST is clearly marked, and that tax calculations are accurate, ensuring compliance with local tax laws.

- Professional Design: The layout and design should be clean, organized, and easy to read. Use headings, sections, and bullet points to break up information and make the document user-friendly.

- Payment Methods: Include available payment options (bank transfer, credit card, etc.) to make it as easy as possible for clients to settle the amount due.

- Due Date:

How to Create Professional Invoices Fast

Creating billing documents quickly and professionally is a valuable skill for any business. With the right tools and a streamlined process, you can prepare accurate and clear payment requests in a fraction of the time. Efficiency is key–whether you’re managing a small business, freelancing, or handling multiple clients, reducing the time spent on paperwork allows you to focus on other important tasks.

Step-by-Step Process for Quick and Professional Billing

To speed up the process without compromising quality, follow these steps to create a polished payment request quickly:

- Use a Pre-Designed Structure: Start with a ready-made format that meets your needs. Choose one that includes all the essential fields and is easy to customize.

- Fill in the Details: Input the key information such as client name, products/services, prices, and your business details. Use a clear and consistent layout to avoid confusion.

- Double-Check Calculations: Ensure all figures, including taxes and totals, are correct. Many software tools offer auto-calculation features to reduce errors.

- Specify Payment Terms: Clearly state due dates, acceptable payment methods, and any penalties for late payments to avoid misunderstandings.

Tools and Resources to Speed Up the Process

To further reduce the time spent on creating financial documents, consider using the following tools:

- Invoice Software: Online platforms or apps designed to automatically generate billing documents with just a few clicks.

- Spreadsheet Tools: Pre-configured Excel or Google Sheets documents that can quickly calculate totals and tax.

- Pre-Made PDF Forms: Fillable PDFs that allow for easy data entry while maintaining a professional layout.

By utilizing these tools and following a straightforward process, you can quickly generate professional payment requests and stay on top of your business finances.

Understanding Australian Tax Requirements in Invoices

For businesses operating in Australia, ensuring that payment documents are compliant with tax regulations is essential. Australian businesses must adhere to specific requirements when including tax-related information in their records, particularly regarding the Goods and Services Tax (GST). Understanding these obligations not only helps maintain legal compliance but also ensures that clients are properly informed about the amounts due and taxes applied.

When preparing financial documents, it’s important to include the necessary details related to GST and other tax requirements. This ensures that the transaction is properly documented for tax purposes and helps prevent misunderstandings with clients. Below are the key aspects to consider when creating tax-compliant payment requests in Australia:

Key Australian Tax Information to Include

Tax Requirement Description GST Registration Number If your business is registered for GST, include your Australian Business Number (ABN) and GST registration status on the document. GST Amount Clearly state the GST amount charged on goods or services provided. This should be shown as a separate line item to avoid confusion. Total Amount Ensure that the total amount due reflects the sum of the goods/services price, plus any applicable GST. Tax Invoice If your business is registered for GST, the document should be clearly labeled as a “Tax Invoice” to differentiate it from standard invoices. Tax Rate Specify the GST rate being applied, which is typically 10% in Australia. Be sure to indicate this rate in the breakdown of costs. How to Ensure Compliance

To ensure your documents meet Australian tax standards, follow these guidelines:

- Stay Up to Date: Regularly check the Australian Taxation Office (ATO) for any updates to GST laws or requirements.

- Accurate Calculations: Double-check that the GST amounts are correct and that they align with the applicable rate.

- Clear Labeling: Clearly mark the document as a “Tax Invoice” and include all necessary information such as ABN, GST am

How to Add Payment Terms on Invoices

Clearly defining payment terms is a crucial aspect of any billing process. By outlining when and how payment should be made, businesses can reduce the risk of delayed or missed payments, while also setting clear expectations with clients. Including detailed payment terms in your financial documents helps both parties understand their responsibilities and ensures a smoother transaction process.

When adding payment terms, it’s important to include key details that leave no room for confusion. These terms can vary based on the nature of the transaction, the client relationship, and the payment method. Here’s how to effectively include payment terms in your documents:

Key Elements to Include in Payment Terms

Consider the following points when drafting clear payment terms:

- Due Date: Specify the exact date by which payment is expected. This could be a specific day of the month or a set number of days after the date of issue (e.g., “Due in 30 days”).

- Accepted Payment Methods: List the payment options available to your clients, such as bank transfers, credit cards, or online payment platforms like PayPal.

- Late Fees: If applicable, mention any penalties for late payments. For example, you could specify a fixed late fee or a percentage added to the total amount for each day the payment is overdue.

- Discounts for Early Payment: If you offer any discounts for clients who pay early, be sure to clearly state the terms. For example, “2% discount if paid within 10 days.”

- Currency: Indicate the currency in which payment should be made, especially if you do business internationally.

Where to Place Payment Terms in the Document

The placement of your payment terms can also make a difference in ensuring they are noticed. Ideally, these terms should be clearly visible and located in a section where clients can easily refer to them. Here’s where you can include payment terms:

- Near the Top: Some businesses prefer to add payment terms immediately below the client’s contact information, so they are noticed right away.

- At the Bottom: Others place the payment terms at the bottom of the document, often in a section labeled “Payment Details” or “Terms and Conditions.”

- As a Standalone Section: If the payment terms are complex, consider giving them a dedicated section in the document for clarity.

By setting clear and precise payment terms, you help ensure that both you and your client are on the same page, leading to a smoother and more professional financial interaction.

Best Invoice Software for Australia

For businesses in Australia, using reliable software to manage payment requests can significantly streamline the billing process. With a variety of options available, the right tool can help you create professional documents, track payments, and ensure compliance with local tax laws. Whether you’re a freelancer, a small business owner, or a large enterprise, choosing the best software will save you time, reduce errors, and improve your cash flow management.

Here are some of the top-rated software solutions for generating and managing payment records in Australia:

Xero

Xero is a popular accounting software that offers an easy-to-use interface for managing business finances. It’s particularly known for its seamless invoicing features, including customizable templates, automatic reminders, and tax-compliant calculations for GST. Xero integrates with many third-party apps and banks, making it a great choice for businesses that need more than just billing functionality.

QuickBooks Online

QuickBooks Online is a comprehensive accounting solution that’s well-suited for businesses in Australia. It provides a variety of invoicing options, from simple payment requests to detailed, itemized records. With QuickBooks, you can easily apply GST, track overdue payments, and accept online payments. It’s a great option for businesses of all sizes looking for an all-in-one financial management tool.

FreshBooks

FreshBooks is designed with small business owners and freelancers in mind. The software allows users to create and send personalized payment requests in minutes. FreshBooks offers a range of useful features such as time tracking, recurring billing, and easy expense management. It also supports Australian GST, ensuring that businesses stay compliant with local tax regulations.

Zoho Invoice

Zoho Invoice is an affordable yet feature-rich solution for Australian businesses. It offers customizable payment request designs, time tracking, and automated reminders for overdue payments. Zoho Invoice supports multi-currency billing and integrates well with other Zoho apps, making it a great choice for companies that need a versatile invoicing tool with global reach.

Choosing the right software depends on your specific needs, such as the size of your business, the complexity of your billing process, and your budget. The tools mentioned above offer powerful features that can help Australian businesses streamline their payment processes and stay compliant with local regulations.

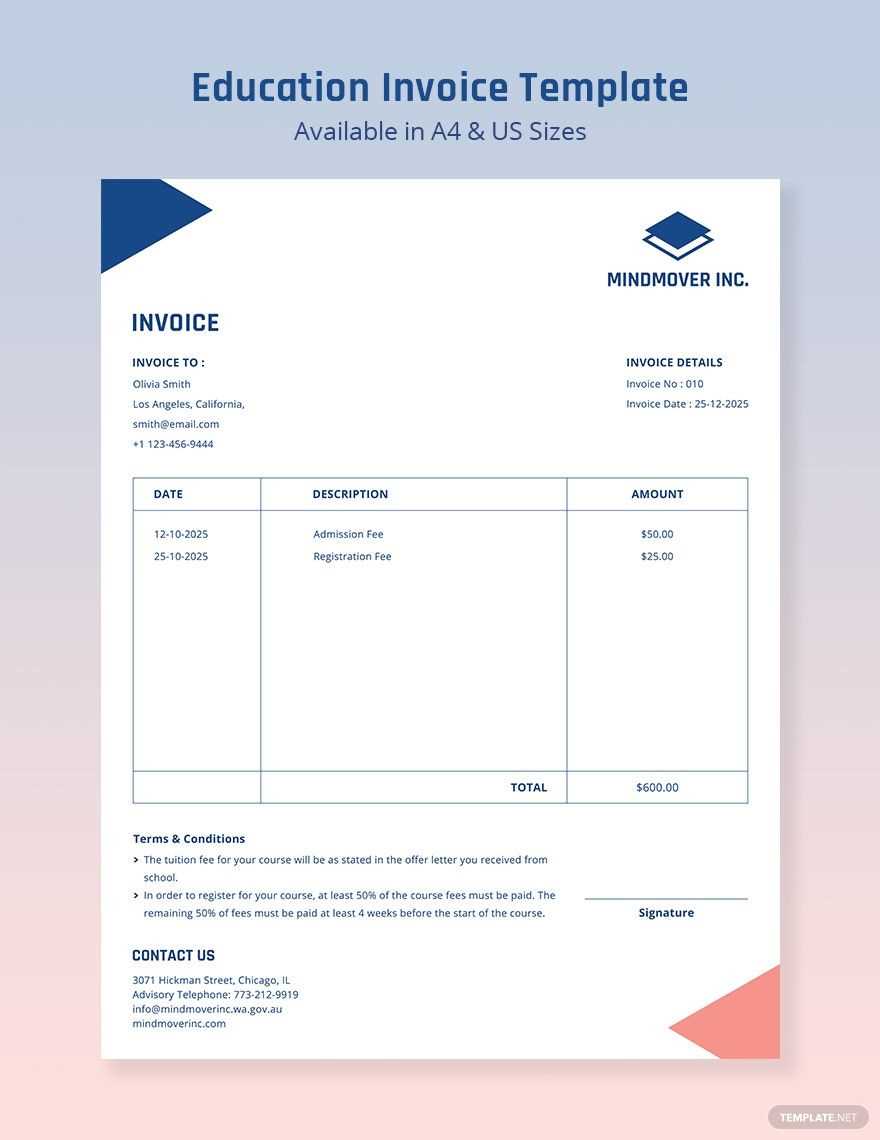

Invoice Template for Freelancers in AU

Freelancers in Australia often need to create billing documents that are professional, clear, and legally compliant. These documents are not only a way to request payment but also serve as a record of the services provided, the agreed-upon terms, and the tax details. Having a consistent and easy-to-use format can make this task quicker and more efficient, allowing freelancers to focus on their work while ensuring they are paid on time.

When creating a payment request, there are several key elements that must be included to ensure clarity and compliance with Australian tax laws. Here’s a guide on how to structure a billing document that meets the needs of freelancers and their clients in Australia:

Essential Elements for Freelance Billing

- Client Details: Always include your client’s full name, address, and contact details. This makes the document clear and professional.

- Freelancer’s Information: Your business name (if applicable), ABN (Australian Business Number), and contact details should be included, as this is necessary for tax compliance.

- Description of Services: Clearly itemize the services provided, including the time spent (if applicable), rate, and total cost for each task. This ensures that your client understands exactly what they are paying for.

- Payment Due Date: Clearly state when payment is due, whether it’s in 14, 30, or another number of days. You can also include penalties for late payments, if applicable.

- GST Information: If registered for GST, make sure to include the tax amount and GST percentage (currently 10% in Australia). This will ensure your document is compliant with local tax laws.

Customizing Your Billing Record

As a freelancer, it’s important that your payment requests reflect your unique business style and practices. Customizing the design of your document can help reinforce your brand identity, whether through a simple logo or personalized fonts. Additionally, making sure the document is user-friendly for your clients–such as by organizing details clearly and providing clear payment methods–can make it easier for them to process your payment promptly.

With the right structure and clear, concise information, freelancers in Australia can create billing records that are professional, tax-compliant, and ensure they are paid on time.

How to Save Time with Invoice Templates

For businesses, freelancers, and professionals, preparing payment requests can often be a time-consuming task. However, with the right structure in place, you can streamline this process, saving both time and effort. By using pre-designed formats, you can quickly generate documents that are accurate, professional, and ready to send to your clients, without the need to start from scratch each time.

Here are some ways to save time when creating financial documents:

Efficient Steps for Faster Billing

- Pre-Formatted Structures: Using pre-made designs with fields already set up allows you to simply fill in the necessary details, such as client name, products/services, and amounts. This eliminates the need to create a new format every time you issue a request.

- Save Client Information: Keep a database of your regular clients’ contact details and previous transactions. Many software tools allow you to store this information, so you don’t need to input the same details over and over again.

- Automated Calculations: Utilize software with automatic calculation features for taxes, discounts, and totals. This reduces the risk of errors and speeds up the process significantly.

- Predefined Payment Terms: Create a set of standard payment terms that can be reused in every request. This eliminates the need to type them out each time and ensures consistency in your business dealings.

Additional Tips to Further Speed Up the Process

- Batch Processing: If you have multiple clients to bill, consider generating and sending documents in batches rather than one by one. Many tools allow you to create several records at once, saving valuable time.

- Use Cloud-Based Tools: Using cloud-based solutions can enable you to generate and send documents from anywhere, allowing you to work more efficiently and on the go.

- Save Frequently Used Information: Save common services, rates, and taxes in your software. This will allow you to select the relevant options instead of entering them manually each time.

By implementing these time-saving strategies, you can automate much of the billing process, ensuring you spend less time on paperwork and more time focusing on your business and clients.

Invoice Template for Small Businesses in AU

For small businesses in Australia, creating professional and accurate payment requests is essential for maintaining cash flow and ensuring timely payments. Whether you’re providing services, selling goods, or working with multiple clients, having a standardized approach to your financial documents can simplify your administrative tasks and ensure compliance with local regulations.

A well-structured payment request document not only helps convey professionalism but also provides transparency for your clients. It clearly outlines the agreed-upon amounts, the due date, and any applicable taxes, making it easier for both parties to track and manage payments. Here’s how small businesses can benefit from using a standardized billing document:

Essential Elements for Small Business Billing

When preparing payment requests for your clients, make sure to include the following key details to ensure clarity and professionalism:

- Client Details: Include the client’s full name or business name, address, and contact information to ensure proper identification.

- Business Information: Your business name, ABN (Australian Business Number), and contact details must be listed clearly for transparency and compliance with Australian tax laws.

- Description of Goods/Services: Clearly list the products or services provided, including quantities and unit prices. Be detailed to avoid confusion and ensure your client knows exactly what they are being charged for.

- Payment Terms: State the payment due date and any terms, such as late fees or discounts for early payment. This helps set expectations and can prevent delayed payments.

- GST Details: If your business is registered for GST, include the applicable tax rate and the amount charged. This ensures that your document is compliant with the Australian tax system.

Customizing Your Billing Document

As a small business owner, it’s important that your payment requests reflect your brand. Customizing your billing document by adding your logo, choosing a consistent layout, and using professional fonts can create a lasting impression with clients. Additionally, ensuring your document is easy to read and navigate can lead to quicker payment processing and fewer errors.

By including the essential information and customizing your documents to suit your brand, you can create a streamlined and professional process for managing payments in your small business.

Tracking Payments with Your Invoice Template

Efficiently managing and tracking payments is a key part of running any successful business. By incorporating tracking features into your billing documents, you can easily monitor which clients have paid, which are overdue, and ensure you’re following up promptly. A well-structured payment record can simplify this process, reduce mistakes, and help you maintain a steady cash flow.

Tracking payments becomes much easier when you use a standardized format that includes clear fields for payment status, due dates, and outstanding amounts. Below are some strategies and tools to help you keep track of payments effectively:

Key Features for Payment Tracking

When setting up your financial documents, ensure they include the following elements to make payment tracking more efficient:

- Payment Status: Include a section where you can mark the payment status (e.g., “Paid”, “Pending”, “Overdue”). This allows you to quickly identify outstanding payments.

- Due Date and Reminders: Clearly display the payment due date and set reminders for follow-ups on overdue payments. You can automate reminders in some software tools, which will notify clients when payments are approaching or overdue.

- Payment Method: Indicate the method of payment used by your client (e.g., bank transfer, credit card, PayPal). This helps you track how payments were made and reconcile your accounts accurately.

- Outstanding Amount: Show the balance due after partial payments are made. This feature is particularly useful for clients who pay in installments or in multiple transactions.

Using Software for Better Tracking

While manually tracking payments in documents can work, using invoicing software can make this process even more efficient. Many tools offer built-in tracking features that automatically update the payment status, send reminders, and generate reports. This can save time and reduce the risk of human error.

- Automated Payment Tracking: Many software programs allow you to automatically update the status of a payment when it’s received, removing the need for manual updates.

- Reports and Analytics: Some tools also generate reports that show your payment history, outstanding balances, and trends over time, helping you better manage cash flow.

By integrating these tracking features into your financial records, you can maintain a clear overview of your incoming payments, ensure timely follow-ups, and improve your overall financial management.

How to Handle Late Payments in Invoices

Dealing with overdue payments is a common challenge for many businesses. Late payments can affect cash flow, disrupt operations, and lead to unnecessary stress. However, by establishing clear payment terms and knowing how to handle overdue accounts, you can minimize the impact of late payments and maintain a healthy financial situation for your business.

One of the best ways to address late payments is by setting clear expectations from the outset. By including detailed payment terms in your billing documents, such as the due date, late fees, and penalties for overdue payments, you can encourage prompt payment and avoid confusion. Below are some tips for managing late payments effectively:

Strategies to Address Late Payments

To handle overdue payments effectively, consider the following approaches:

- Clearly Define Payment Terms: Make sure your clients know when payment is due and the consequences of late payments. This might include specifying the number of days the client has to pay (e.g., “Net 30”), and any penalties or interest charges for overdue balances.

- Set Late Fees: Include a late fee policy in your payment terms. This provides an incentive for clients to pay on time, and ensures that you’re compensated for any delay. Common fees range from 1-5% of the total amount per month for overdue payments.

- Offer Payment Reminders: A friendly reminder can sometimes be enough to prompt payment. Send out a reminder before the due date, and follow up promptly if the payment is late. Some tools even allow for automatic reminders, making this process easier and more consistent.

- Communicate Clearly: If payments are delayed, reach out directly to the client to discuss the situation. Keep the conversation professional and courteous, and try to understand any issues the client might be facing. You can then negotiate new terms if needed or discuss a payment plan.

Legal and Professional Considerations

If late payments continue despite your efforts, you may need to consider taking further action. In Australia, businesses are entitled to charge interest on overdue accounts, as long as this is specified in the payment terms. If the issue persists, legal action or involving a collections agency could be a final resort. However, always try to resolve the issue amicably and professionally first.

By setting clear terms and addressing late payments with professionalism and consistency, you can minimize delays, maintain good client relationships

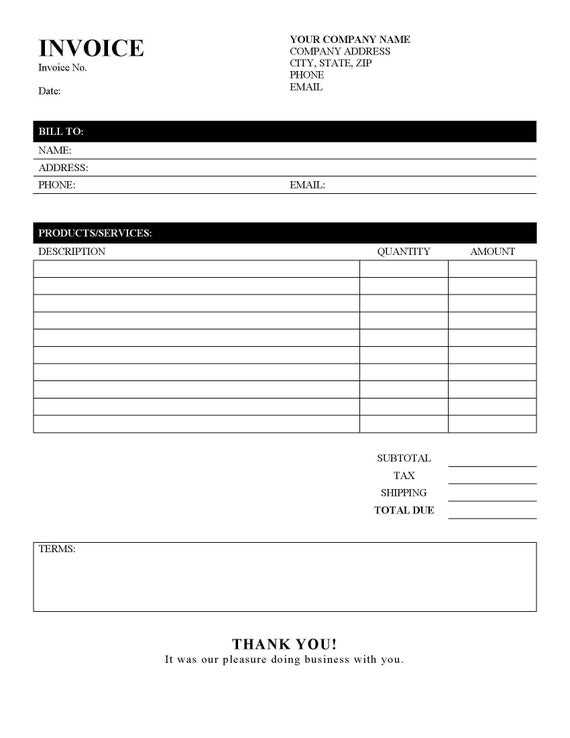

How to Format Your Invoice Correctly

Properly formatting your payment request document is crucial for ensuring clarity, professionalism, and compliance with legal standards. A well-structured document not only helps you get paid on time but also avoids confusion for your clients. By following a clear format, you make it easier for both parties to review and understand the charges, payment terms, and any other essential details.

The key to an effective payment request is simplicity and organization. A consistent format with all necessary information ensures that the client can quickly process the document, and it also makes it easier to track your payments and manage records. Below are essential formatting tips to help you structure your billing documents correctly:

Key Elements for Correct Formatting

- Header Information: Always start with your business name, contact details, and Australian Business Number (ABN). Follow this with your client’s name and contact information. This helps establish the identity of both parties and provides clarity for record-keeping.

- Document Title: Clearly label your document as a “Payment Request” or “Bill” so that your client can easily recognize it. This should be prominently displayed at the top.

- Unique Identification Number: Assign a unique reference number to each document. This will help both you and your clients track the transaction and reduce the chance of any confusion or duplication.

- Details of Services or Products: List each item or service you provided, including a description, quantity, unit price, and total cost for each. This ensures full transparency and helps avoid any potential disputes.

- GST and Tax Information: If you are registered for GST, clearly indicate the applicable tax rate (usually 10% in Australia) and the amount charged. Ensure this is shown separately from the total cost to comply with tax regulations.

- Payment Terms: Specify when payment is due and any penalties for late payments. If offering payment methods (bank transfer, credit card, etc.), list these as well.

Formatting Tips for Easy Reading

- Use Simple Fonts and Layouts: Keep your font read

Integrating Invoices with Accounting Tools

Integrating your payment request documents with accounting tools is a powerful way to streamline your financial processes. By automating the flow of information between your billing system and accounting software, you can reduce manual data entry, minimize errors, and gain real-time visibility into your business’s financial health. This integration ensures that your records are always up to date, making tax reporting and financial analysis simpler and more accurate.

Using accounting software to manage and track payments allows for automatic synchronization of transactions, which saves time and ensures consistency across your business operations. By linking your payment requests to your accounting tools, you can track payments, manage cash flow, and generate reports with ease. Below are some of the benefits and methods for integrating these two systems:

Benefits of Integration

- Automatic Data Sync: Integrating your billing process with accounting software ensures that the data from your payment requests is automatically transferred, reducing the need for manual input and decreasing the risk of mistakes.

- Real-Time Updates: Your accounting system will always reflect the most current payment status, helping you keep track of overdue balances, paid invoices, and upcoming payments more effectively.

- Efficient Reporting: Integration simplifies the generation of financial reports, allowing you to quickly assess revenue, expenses, tax obligations, and cash flow without needing to reconcile data manually.

- Improved Tax Compliance: Automatic syncing helps ensure that your tax information, such as GST, is accurately recorded in both your payment requests and financial records, making tax filing easier and more accurate.

How to Integrate Payment Requests with Accounting Software

There are several ways to integrate your payment request documents with accounting tools, depending on the software you use. Here are a few common methods:

- Use Built-in Integration Features: Many modern accounting tools like Xero, QuickBooks, and MYOB offer built-in features for generating and managing payment requests directly within the software. These features often allow you to customize your documents, send them to clients, and track payments automatically.

- Third-Party Integrations: If your accounting software doesn’t offer native integration, you can use third-party tools or Zapier to connect your billing system with your accounting software. These tools can automatically transfer data between the two platforms, ensuring synchronization.

- Manual Import/Export: If direct integration isn’t an option, many accounting tools allow you to import payment request documents manually by uploading CSV or PDF files. This method is less automated but still helps keep your records updated.

Example: Invoice Data in Accounting Software