Top Invoice Template App for Streamlined and Professional Invoicing

Managing financial transactions efficiently is essential for any business, whether you’re a freelancer or running a small enterprise. With the rise of digital tools, there are now more effective ways to generate and track payments, ensuring you stay organized and professional. These digital solutions are designed to simplify the invoicing process, reduce errors, and save valuable time.

By using specialized software, you can quickly create professional documents, customize them to fit your brand, and easily send them to clients. These tools allow you to stay on top of outstanding payments, manage client information, and even automate recurring charges. The result is a smoother workflow and less time spent on administrative tasks.

Embracing this technology offers a significant advantage for anyone looking to enhance their billing operations. Whether you’re just starting or already established, utilizing the right tools can help you streamline financial management and improve client relationships. Explore how these solutions can benefit your business and make your daily tasks more efficient.

Why Use an Invoice Template App

Streamlining the billing and payment process is crucial for any business, big or small. The right tools can save you time, reduce human error, and make your financial operations more professional. With modern digital solutions, generating well-organized documents has never been easier. These tools help you manage your finances with minimal effort, ensuring that your clients receive clear and accurate records every time.

Here are some key reasons why you should consider using a digital solution for creating and managing financial documents:

- Efficiency: Quickly generate documents and send them with just a few clicks, saving valuable time compared to manual creation.

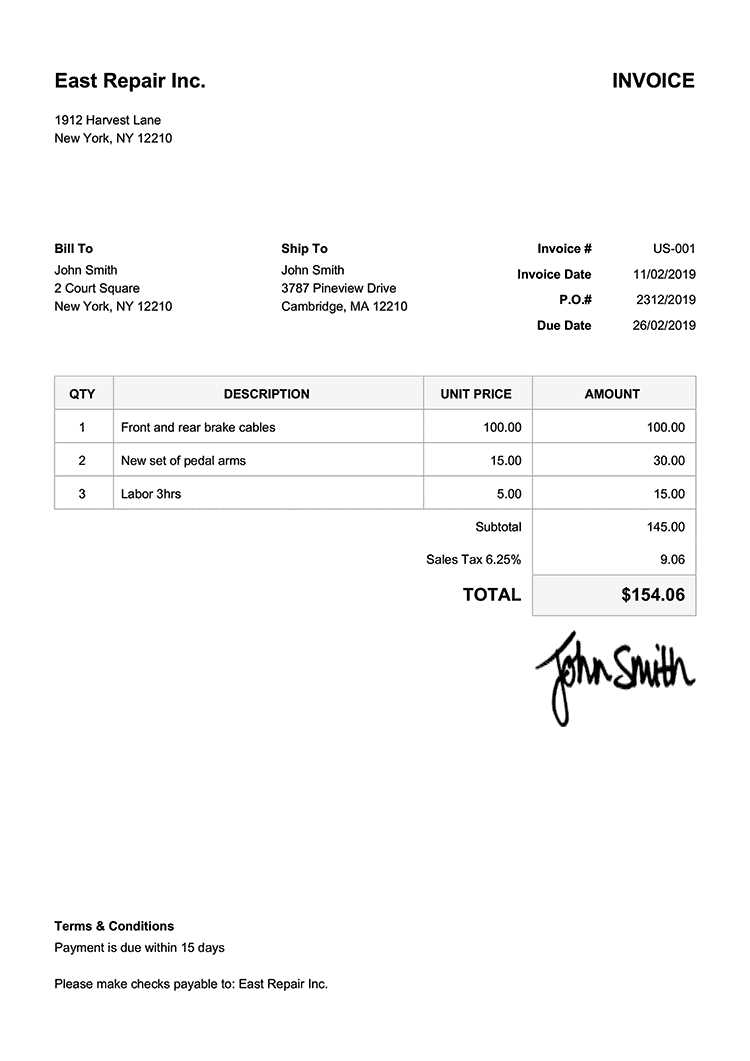

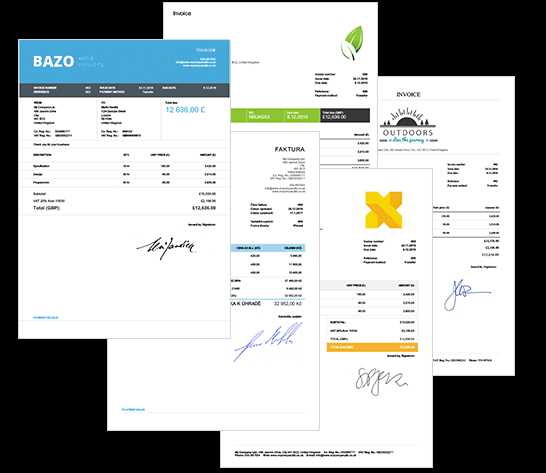

- Consistency: Using predefined formats ensures that all documents follow a professional, uniform style, enhancing your credibility.

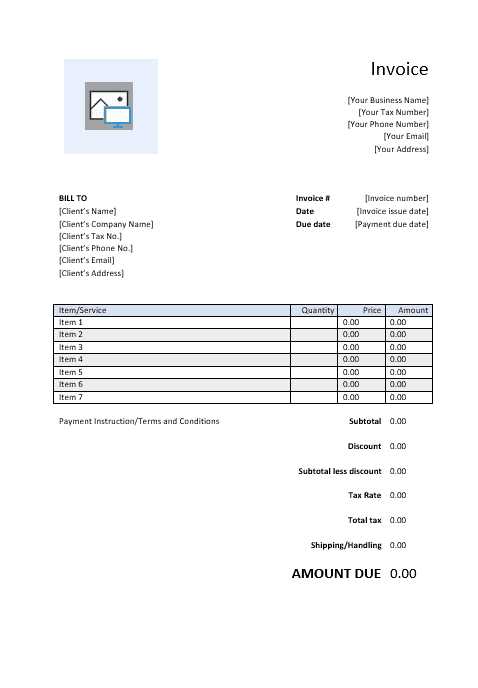

- Customization: Tailor each document to meet your specific needs, from including your branding to adjusting the layout.

- Automation: Set up recurring charges or reminders for clients, reducing the need for manual intervention and ensuring you get paid on time.

- Tracking: Easily monitor outstanding payments and manage overdue invoices, helping you stay on top of finances.

- Accessibility: Access your documents from anywhere, whether you’re in the office or on the go, making it easier to stay organized and respond quickly to clients.

By utilizing a digital solution, you can enhance your workflow, improve communication with clients, and focus more on growing your business rather than spending time on administrative tasks. The advantages are clear, and adopting these tools will help ensure your financial processes are smooth, efficient, and professional.

Benefits of Digital Invoice Templates

In today’s fast-paced business world, efficiency is key. Using digital tools for generating and managing billing documents offers a wide range of advantages. These solutions not only speed up the process but also reduce errors and ensure consistency across your financial records. By shifting from paper-based methods to digital platforms, businesses can significantly improve their operations and client interactions.

Here are some of the major benefits of switching to digital solutions for creating and sending financial records:

| Benefit | Description |

|---|---|

| Time-Saving | Automating document creation speeds up the process, allowing you to focus on more important tasks. |

| Accuracy | Minimize human errors by using pre-set formats, ensuring all necessary details are included correctly. |

| Professionalism | Generate clean, well-organized documents that reflect positively on your business. |

| Easy Customization | Quickly adjust document styles, add logos, or change contact information based on client needs. |

| Cloud Accessibility | Access your documents from anywhere, anytime, and easily share them with clients or colleagues. |

| Environmentally Friendly | Reduce paper waste by going digital, contributing to a more sustainable business practice. |

Digital tools for managing financial documentation help businesses stay organized and efficient, offering a streamlined way to handle financial transactions with greater reliability and ease. By adopting these solutions, you can save time, reduce errors, and provide better service to your clients.

How to Choose the Right Invoice App

Selecting the right tool to manage your financial documents is crucial for ensuring smooth operations in your business. With so many options available, it can be overwhelming to determine which one will best meet your needs. Factors like ease of use, features, and integration capabilities should all play a role in your decision-making process. Here are some important considerations to help you choose the most suitable solution for your business.

- User-Friendliness: Look for a platform that is intuitive and easy to navigate. A tool that simplifies the process will save you time and frustration.

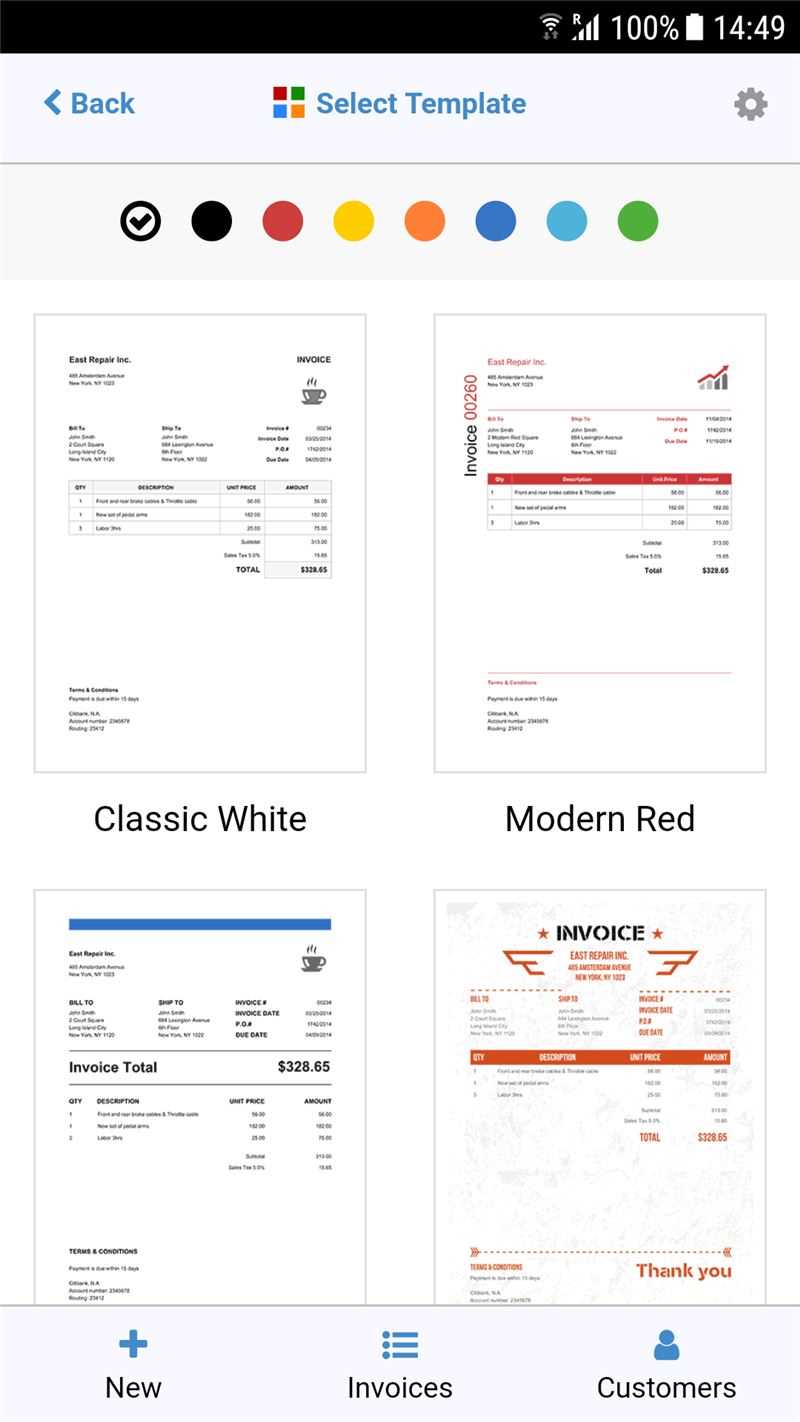

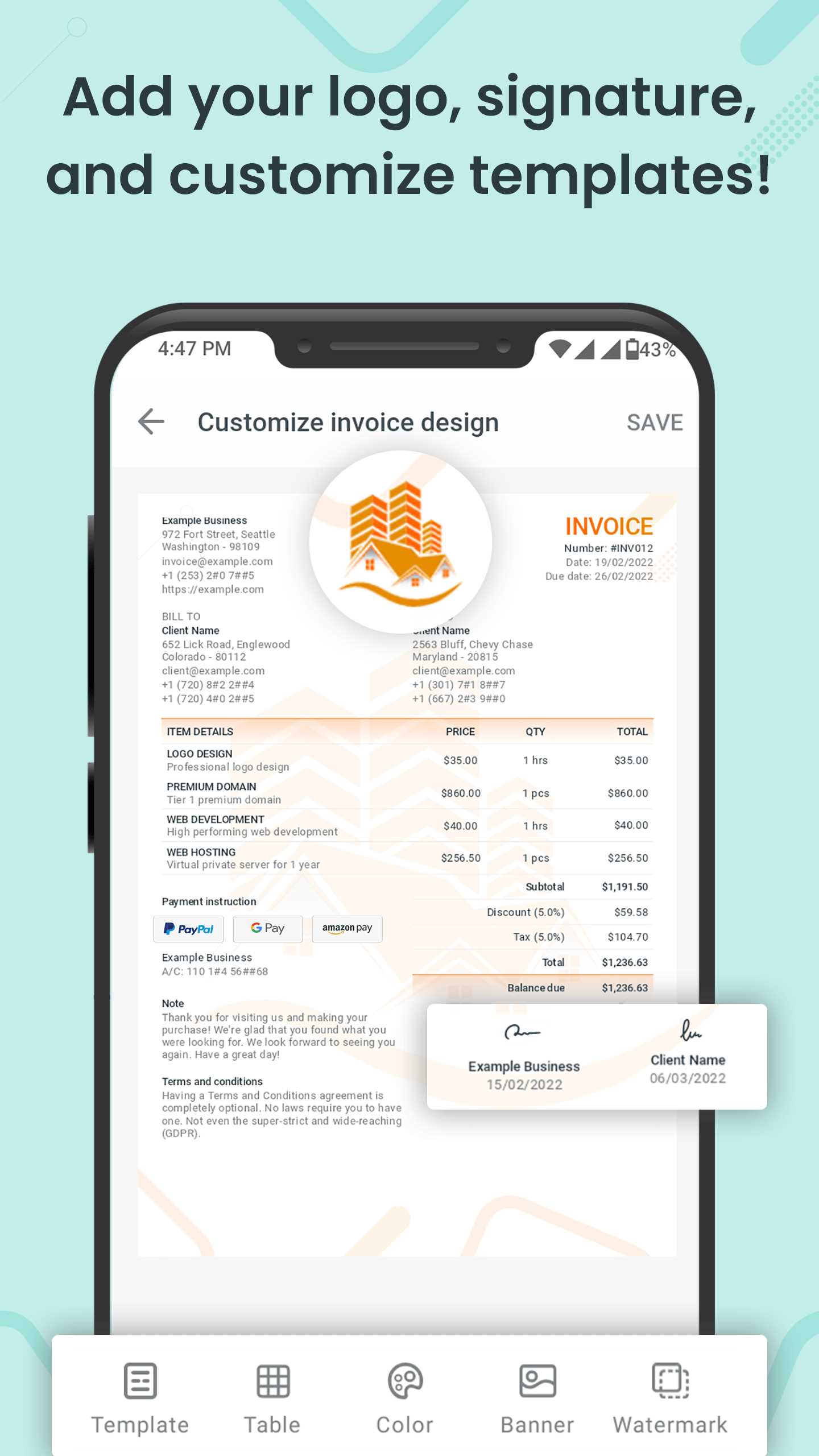

- Customization Options: Choose a tool that allows you to personalize documents according to your brand, such as adding logos or adjusting layout designs.

- Automation Features: Consider tools that offer automated features like recurring payments or automatic reminders to clients. This can save you valuable time and reduce human error.

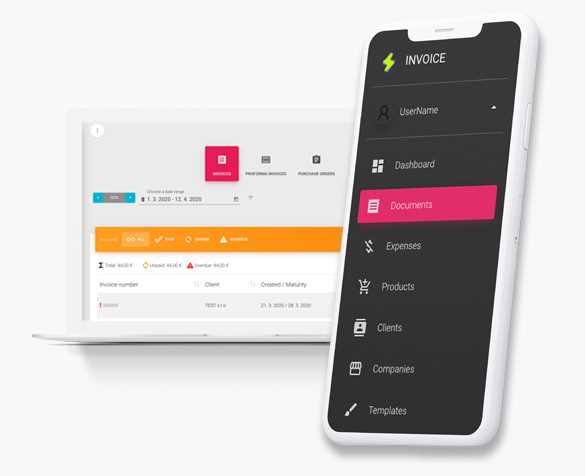

- Mobile Compatibility: Ensure the solution works well on mobile devices, allowing you to manage documents on the go.

- Security: Verify that the platform offers robust security features to protect sensitive financial data.

- Integration with Other Tools: Look for a solution that can integrate with your existing software, such as accounting platforms or CRM systems.

- Customer Support: Consider the level of support provided by the service. Responsive customer service can be invaluable if you encounter any issues.

- Pricing: Compare pricing plans to ensure the tool fits within your budget. Some tools offer free versions with basic features, while others offer premium options with additional capabilities.

Taking these factors into account will help you find the right solution that aligns with your business needs and improves your overall workflow. Choose a platform that enhances your efficiency and helps you maintain a professional image with minimal effort.

Key Features of Top Invoice Apps

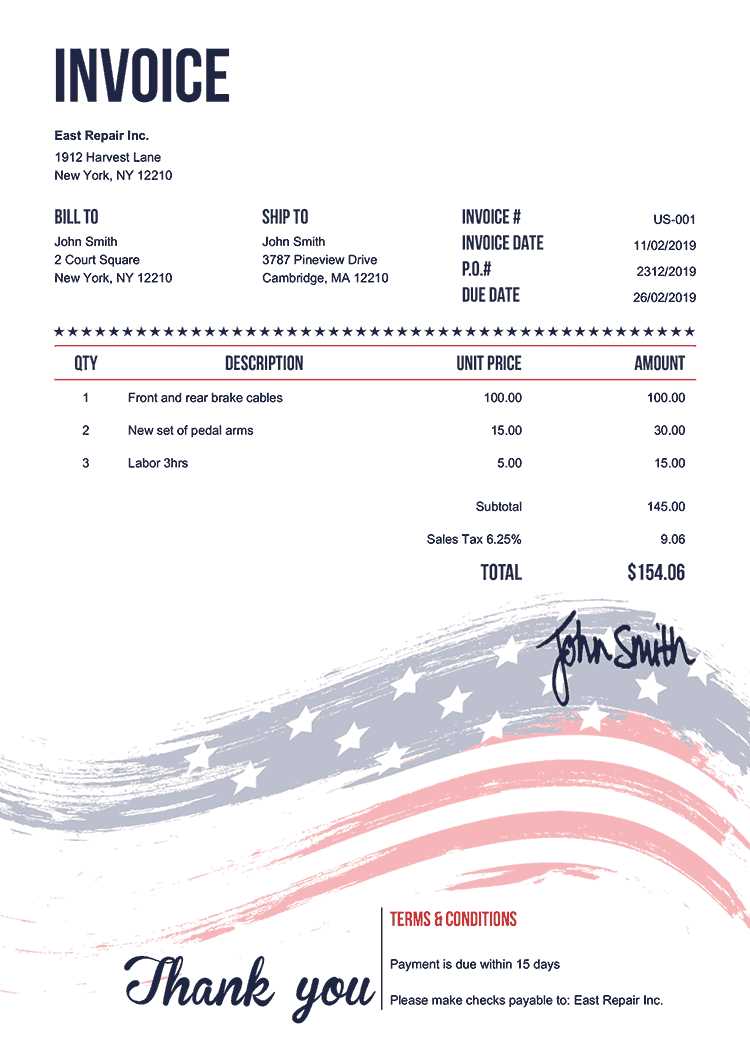

The best digital tools for managing financial documents come with a variety of features designed to streamline your business operations. These solutions provide flexibility, efficiency, and accuracy, helping you save time while maintaining a professional image. Whether you’re a freelancer or a growing business, the right tool can greatly simplify your billing process and improve overall productivity.

Essential Functions for Managing Financial Documents

Top platforms for creating and tracking transactions include several critical features that set them apart from basic tools. These features not only enhance efficiency but also contribute to a more organized and effective business operation.

| Feature | Description |

|---|---|

| Customizable Documents | Flexibility to adjust the layout, colors, logos, and other details to reflect your branding and specific business needs. |

| Recurring Charges | Automate repeat billing cycles for clients, reducing the need for manual input each time a payment is due. |

| Multiple Payment Options | Allow clients to pay via different methods, such as credit card, bank transfer, or online payment systems like PayPal. |

| Real-Time Tracking | Monitor payment status in real-time, including upcoming, paid, and overdue transactions. |

| Mobile Accessibility | Access and manage your financial documents from any device, making it easy to handle transactions on the go. |

| Client Management | Store and organize client information, including payment history and contact details, for easy access. |

Advanced Features for Enhanced Efficiency

As your business grows, you may want to use more advanced functionalities that allow for better integration and automation of your financial processes. Here are some additional features commonly found in top-tier tools:

| Feature | Description | ||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Integration with Accounting Software | Seamlessly connect with your accounting platforms to automate bookkeeping and ensure consistent records. |

| Client Information | Benefits of Digital Management |

|---|---|

| Contact Details | Store client names, email addresses, phone numbers, and physical addresses for easy reference when preparing documents. |

| Payment History | Track past transactions, including amounts paid and dates, to better understand your clients’ payment behaviors. |

| Account Preferences | Save specific preferences for each client, such as payment terms, discounts, or recurring billing schedules. |

| Tax Information | Store tax IDs or exemption statuses to ensure accurate calculations on all related documents. |

| Notes and Special Instructions | Record any special agreements, preferences, or reminders related to each client, making future transactions easier to handle. |

By organizing and maintaining comprehensive client information in one central location, you can enhance the efficiency of your financial workflows and ensure consistent communication. This helps build stronger client relationships and reduces administrative overhead, allowing you to focus more on growing your business and serving your customers.

Tracking Payments with Invoice Templates

Effectively tracking payments is essential for maintaining a smooth cash flow and staying on top of financial operations. With the right tools, you can easily monitor payment statuses, identify overdue amounts, and ensure timely follow-ups with clients. These solutions offer a simple and efficient way to keep track of all transactions, from initial billing to final payment, helping you maintain an organized and transparent financial process.

By using digital tools for managing your billing records, you can quickly track which payments have been received and which are still pending. This visibility allows you to take appropriate actions, such as sending reminders or making updates to client accounts, ensuring that no payments are overlooked.

- Real-Time Payment Status: Instantly view which payments have been made, which are still outstanding, and which are overdue.

- Automated Payment Reminders: Set up automatic reminders to notify clients about upcoming or overdue payments, reducing manual effort and ensuring timely collections.

- Overdue Notifications: Automatically alert clients when payments are overdue, helping you follow up without missing any deadlines.

- Payment History Tracking: Keep a complete record of all payments, including dates and amounts, for easy reference and auditing.

- Integration with Payment Systems: Connect your financial records with payment gateways to track payments directly through the platform, minimizing the chance for discrepancies.

Using these features, you can effectively track the flow of payments and ensure that your business remains financially healthy. Having all this information organized in one place not only saves time but also helps you make more informed decisions when managing cash flow.

How Invoice Apps Improve Accuracy

Maintaining accuracy in financial records is critical for any business. Manual entry of data is prone to human error, which can lead to discrepancies, delays, or misunderstandings with clients. Digital tools designed for managing billing documents help eliminate these risks by automating calculations, ensuring consistency, and providing built-in checks to prevent mistakes. These solutions significantly improve the accuracy of your transactions and financial reporting.

Eliminating Human Error

One of the primary ways digital platforms enhance accuracy is by reducing the chances for manual errors. By automating calculations for totals, taxes, and discounts, these tools minimize the risk of miscalculations that could affect your revenue or client relationships. Furthermore, features like pre-set fields and drop-down options ensure that the correct information is entered consistently, reducing mistakes that typically occur during manual data entry.

- Automated Calculations: Automatically calculate totals, taxes, and discounts to ensure the correct amounts are reflected on every document.

- Pre-Set Fields: Use predefined fields for common items, prices, and tax rates to avoid inconsistencies and errors in repetitive tasks.

- Data Validation: Built-in checks flag any missing or incorrect information before documents are finalized, preventing incomplete or inaccurate records.

Consistency Across Documents

Consistency is another critical factor in ensuring accuracy, especially when managing multiple clients or transactions. Digital tools allow you to create standardized formats that maintain uniformity in how information is presented, which helps avoid confusion and ensures that all essential details are included in every document. Whether it’s the layout, the wording, or the structure of the content, consistency across all records enhances accuracy and professionalism.

- Standardized Formatting: Use uniform templates to create consistent documents that meet your business’s professional standards.

- Pre-Filled Information: Quickly populate client details, payment terms, and services provided, ensuring that all necessary data is included every time.

- Automated Reminders: Reduce the chance of missed or delayed payments by automating follow-up reminders for both you and your clients.

By integrating these features, digital tools not only save time but also ensure that all financial records are error-free and aligned with your business standards. With improved accuracy, businesses can avoid costly mistakes and improve client trust and satisfaction.

Integrating Your Invoice App with Accounting Software

Integrating billing and financial record management tools with accounting software is one of the most efficient ways to streamline business operations. By connecting these platforms, you can eliminate the need for manual data entry, reduce the risk of errors, and ensure that all financial data is consistently updated in real time. This integration allows for seamless communication between your billing records and financial statements, making it easier to track revenue, expenses, and profits without redundant work.

Benefits of Integration

Connecting your financial document management tools with accounting software offers several advantages that can significantly improve the efficiency of your business processes:

- Time Savings: Automated synchronization between the two platforms eliminates the need to manually enter payment details, reducing the amount of time spent on data entry.

- Reduced Errors: By automating data transfer, you minimize the chances of mistakes that could occur during manual record-keeping, ensuring more accurate financial reporting.

- Real-Time Updates: Changes made in either system are automatically reflected in the other, keeping both your billing records and financial reports up to date without additional effort.

- Improved Financial Visibility: Integration allows you to gain a complete picture of your finances in one place, making it easier to track cash flow, outstanding payments, and financial health.

- Streamlined Tax Filing: With integrated systems, all your revenue and expense data are already organized and ready for tax reporting, reducing the stress and complexity of filing taxes.

How to Set Up Integration

Setting up the connection between your billing and accounting tools is generally a simple process, especially with platforms that offer built-in integration features. Here are the basic steps to integrate these systems:

- Choose Compatible Software: Ensure that the tools you’re using for billing and accounting are compatible with each other. Many modern platforms offer pre-built integrations with popular accounting software like QuickBooks, Xero, or FreshBooks.

- Connect Your Accounts: Link your billing platform to your accounting software by providing the necessary login credentials or API keys. This is often done within the settings or integrations section of both platforms.

- Sync Your Data: Once the accounts are connected, initiate a data sync to ensure that all past transactions, client information, and financial records are transferred accurately to the accounting system.

- Set Up Preferences: Adjust settings to determine which data should be synchronized, how often it should update, and any specific details you want to include in your reports.

- Monitor and Adjust: After the integration is complete, monitor the system for any issues and make adjustments as needed to e

Invoice Apps for Freelancers and Small Businesses

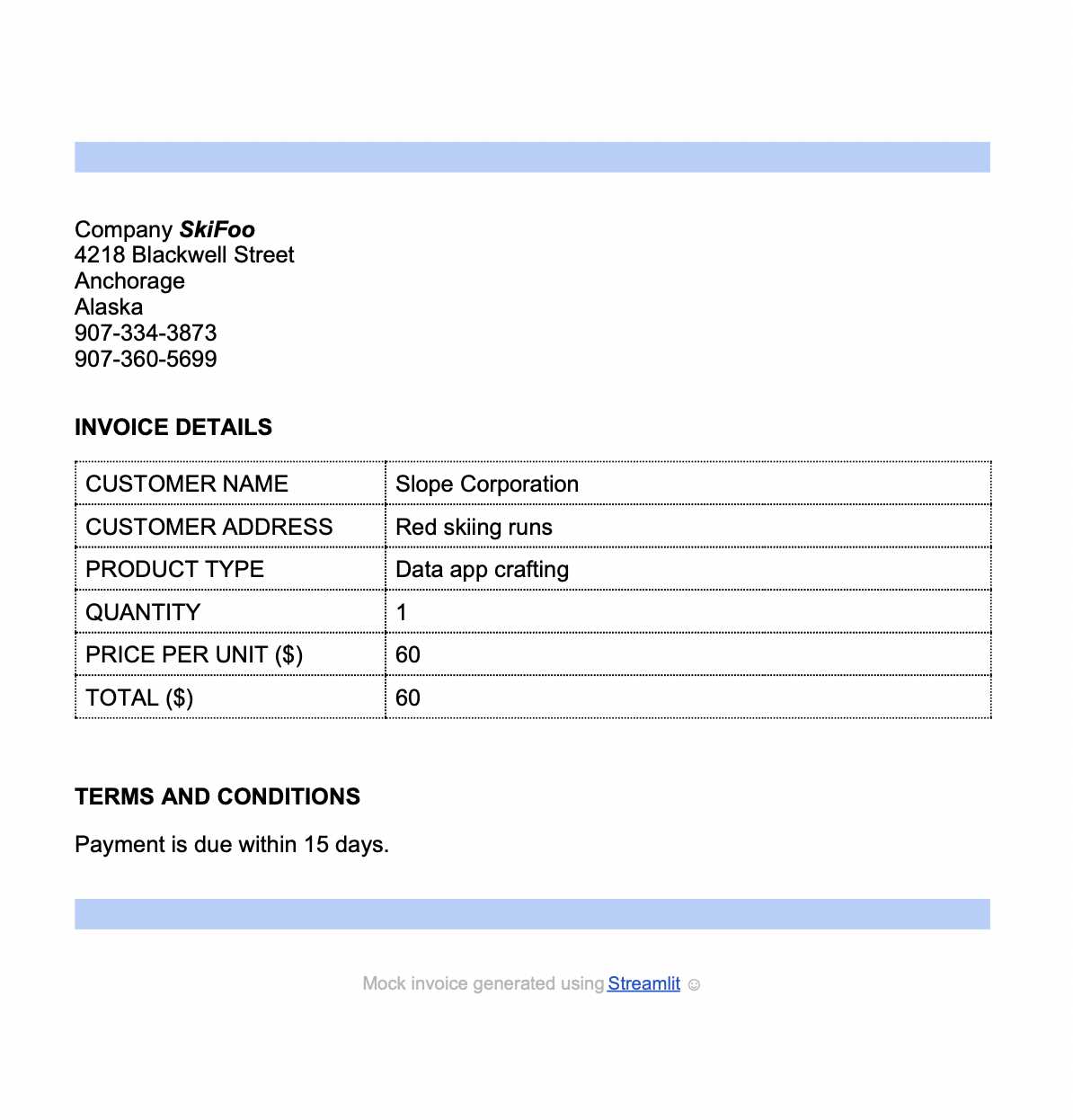

For freelancers and small businesses, managing financial documents can be a time-consuming and often complex task. However, with the right digital solutions, the process becomes much easier, allowing you to focus on what matters most–growing your business. These tools offer a simple and efficient way to create, send, and track client bills while maintaining a professional appearance and ensuring timely payments.

Whether you are providing services or selling products, digital platforms designed for managing financial documents are tailored to meet the unique needs of smaller enterprises. They offer flexibility, ease of use, and functionality that can scale as your business grows, making them ideal for entrepreneurs looking for cost-effective solutions.

Why Choose Digital Solutions for Freelancers and Small Businesses?

- Ease of Use: These platforms are designed with simplicity in mind, allowing even those with little technical expertise to create professional documents in minutes.

- Cost-Effective: Many solutions offer affordable pricing tiers or even free options for small businesses or freelancers who need essential features without breaking the bank.

- Customizable Features: Customize your documents to reflect your branding, ensuring that every client interaction maintains a professional, consistent image.

- Time-Saving Automation: Automate recurring billing, set up payment reminders, and sync client data to save valuable time while reducing manual effort.

- Mobile Accessibility: With many platforms offering mobile versions, freelancers and small business owners can manage their billing on the go, from anywhere.

By using digital tools, freelancers and small businesses can streamline their financial management processes, ensuring accuracy, consistency, and professionalism while saving time. With customizable templates, automated reminders, and real-time payment tracking, managing client relationships becomes much simpler, allowing you to focus on growing your business instead of getting bogged down in paperwork.

How to Automate Recurring Invoices

Automating regular billing processes is a game-changer for businesses that deal with repeat clients or subscription-based services. Instead of manually generating the same documents every month, automation tools allow you to set up schedules for automatic creation and delivery. This saves valuable time, reduces the risk of errors, and ensures timely payments without needing constant attention.

By setting up automation, you can ensure that your clients receive their billing statements on the same date every period, without you having to remember or manually trigger the process. This not only streamlines your operations but also builds a professional relationship with your clients by ensuring consistency and reliability in your transactions.

Step Action 1. Choose a Platform Select a digital tool or service that supports automatic billing. Look for features like recurring billing, payment tracking, and customizable intervals. 2. Set Up Recurring Schedules Define how often the document should be generated (weekly, monthly, annually) and the due date for payment. Input client information, including pricing and billing terms. 3. Customize the Document Tailor the billing document to reflect your brand by adding logos, payment terms, and any personalized notes for your clients. 4. Enable Automated Delivery Set the system to automatically send the documents to clients via email or preferred communication method on the specified date. 5. Monitor Payments Track when payments are made and follow up with automated reminders for overdue balances, ensuring timely collections. With recurring billing set up, you can save time and reduce the manual effort needed to manage your accounts. This automation also improves cash flow by ensuring that payments are processed consistently and on time, allowing you to focus on delivering excellent service to your clients.

Mobile-Friendly Invoice Apps for On-the-Go Users

For entrepreneurs and small business owners who are always on the move, managing billing tasks from a mobile device is crucial. Mobile-optimized platforms provide the flexibility to create, send, and track financial documents anytime, anywhere. Whether you’re meeting clients, traveling, or working remotely, having a solution that works seamlessly on your phone or tablet can significantly enhance productivity and efficiency.

These mobile-friendly tools are designed to be intuitive, with user-friendly interfaces that allow you to quickly generate professional records without needing access to a desktop computer. With real-time syncing, you can keep your financial documents up-to-date, making it easy to monitor payments and send reminders without being tied to an office.

Key benefits of mobile-friendly tools include:

- Portability: Create and manage billing documents on-the-go, ensuring that your business runs smoothly no matter where you are.

- Ease of Access: Access client details, billing histories, and payment statuses at any time with just a few taps.

- Real-Time Updates: Sync your data instantly between devices, ensuring that all records are current and up-to-date.

- Customizable Documents: Easily tailor your financial documents with logos, payment terms, and personalized messages directly from your mobile device.

- Secure Cloud Storage: Store your documents in the cloud, providing secure access from any mobile device and ensuring that your data is always protected.

With the right mobile-friendly solution, managing your financial documents becomes more convenient and efficient, allowing you to focus on growing your business rather than getting bogged down with administrative tasks.

How Secure Are Invoice Apps

When managing business finances, security is a top priority. Digital tools for managing financial documents often handle sensitive client and payment information, making it crucial to ensure that these platforms are secure. Whether you’re sending payment requests, tracking transactions, or storing client details, understanding the security measures in place is essential for protecting your data and maintaining client trust.

Most modern solutions use a range of advanced security protocols to safeguard your information, from encryption to secure cloud storage. However, it’s important to know what features to look for and what measures are in place to protect your business data from potential risks.

Key Security Features to Look For

When selecting a platform for managing billing and financial data, ensure that it includes the following security measures:

- Encryption: Look for end-to-end encryption, which ensures that your data is securely transmitted and stored, making it unreadable to unauthorized parties.

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring two forms of identification before accessing your account, such as a password and a verification code sent to your phone.

- Secure Payment Processing: If the platform integrates with payment gateways, ensure that they comply with PCI-DSS standards for secure payment processing, protecting credit card and transaction data.

- Cloud Storage Security: Check if the platform uses reputable cloud services with strong security protocols, including regular backups and disaster recovery options.

- Access Controls: The ability to control who has access to sensitive data within your account, including permissions to view, edit, or delete information, ensures that only authorized users can make changes.

Best Practices for Enhancing Security

In addition to choosing a secure platform, follow these best practices to further protect your business and client data:

- Use Strong Passwords: Create complex, unique passwords for your accounts and change them regularly to reduce the risk of unauthorized access.

- Regular Software Updates: Ensure that the software or platform you are using is up-to-date, as updates often include security patches to address new vulnerabilities.

- Monitor Activity: Keep track of account activity and set up alerts to notify you of any unusual transactions or access attempts.

- Backup Your Data: Regularly back up your financial records to ensure that you don’t lose critical information in the event of a system failure or breach.

By selecting a secure platform and following these best practices, you can confidently manage your business finances while minimizing the

Common Mistakes When Using Invoice Apps

While digital tools for managing financial documents offer tremendous convenience, they can also lead to mistakes if not used properly. These errors can range from minor oversights to more significant issues that affect business operations, cash flow, and client relationships. Understanding the common pitfalls can help you avoid them and ensure smooth, error-free transactions.

Here are some of the most frequent mistakes businesses make when using these tools, along with tips for avoiding them:

- Not Double-Checking Client Details: Failing to verify client information such as names, addresses, and payment terms can lead to inaccurate records and delayed payments. Always double-check the details before sending out any documents.

- Using Generic or Inconsistent Documents: Using the same document design for every client, without customizing for branding or specific needs, can make your communications look unprofessional. Personalize your documents to reflect your business identity and ensure consistency.

- Ignoring Payment Terms: Some users forget to clearly define payment due dates or conditions, leading to confusion and delays. Always include clear payment terms and any late fees to ensure clients understand their obligations.

- Failing to Track Payments: Relying solely on manual methods to track payments can lead to missed invoices or unpaid balances. Use the payment tracking feature in your platform to keep accurate records of received and pending payments.

- Neglecting Automated Features: Many digital tools offer automation for recurring billing and payment reminders. Not utilizing these features means you’re missing out on time-saving opportunities and leaving yourself vulnerable to missed payments.

- Not Backing Up Data: It’s easy to forget about backing up important records. Not having regular backups can leave you at risk of losing crucial business data. Ensure that your tool offers cloud storage and that you regularly back up your documents.

- Overcomplicating the Process: While it’s tempting to add too many features or complicated designs, simplicity often works best. Overcomplicating documents can confuse clients and lead to delays in payment. Stick to a clean, clear, and straightforward layout.

By being aware of these common mistakes and taking the necessary precautions, you can ensure that you

How to Get the Most Out of Your Invoice App

To maximize the benefits of digital tools for managing financial records, it’s important to use them to their full potential. These platforms offer a variety of features designed to streamline your billing process, save time, and reduce errors. By understanding all the features available and integrating them into your daily workflow, you can significantly enhance efficiency and improve cash flow management.

Here are some key strategies to help you get the most out of your digital billing platform:

1. Take Advantage of Customization Features

Many platforms offer the ability to customize your documents to suit your branding and client preferences. Personalizing invoices and statements not only makes them look more professional but also helps build brand recognition. Ensure that your business logo, color scheme, and payment terms are consistently included in all generated records.

2. Automate Regular Transactions

Set up automation for recurring billing to save time and ensure consistency. This feature is particularly useful for subscription-based businesses or clients with ongoing contracts. Automation eliminates the need to manually create and send documents, allowing you to focus on other important tasks.

Strategy Benefit Track Payments in Real Time Monitoring payments as they are made allows you to stay on top of your cash flow and follow up on overdue payments more efficiently. Use Mobile Access Manage your billing documents on the go, ensuring you can send, track, and update financial records from anywhere. Integrate with Accounting Tools Link your digital billing tool with accounting software to create a seamless workflow, saving time on manual data entry and ensuring accurate financial records. Set Up Payment Reminders Automate payment reminders to prompt clients about upcoming due dates or overdue balances, ensuring timely payments and reducing follow-up work. By taking full advantage of automation, customization, and integration features, you can simplify your business operations, reduce administrative burdens, and improve financial management. The more you explore and use the platform’s capabilities, the more time and effort you save in the long run.