How to Use an Invoice Template in Adobe Acrobat

For businesses of all sizes, having a consistent and professional way to bill clients is essential. Properly formatted documents can streamline financial processes and create a lasting impression. Whether you’re an independent freelancer or managing a large company, using the right tools for generating financial statements can save time and enhance your credibility.

Customizable solutions allow for easy adjustments, ensuring your documents reflect your brand identity while meeting legal and business requirements. With the right software, crafting professional-looking bills and receipts becomes quick and simple. By exploring efficient ways to create and modify these documents, you can ensure accuracy and consistency in your financial transactions.

Utilizing digital tools provides the flexibility to personalize various sections, add necessary details, and even automate certain aspects. This approach not only improves productivity but also enhances the overall experience for both the sender and the recipient. Having the capability to manage multiple documents in one place ensures that your billing system remains organized and easily accessible.

Invoice Template Adobe Acrobat Guide

Creating well-organized and professional financial documents is a crucial step for any business. The process involves selecting the right layout, ensuring the necessary details are included, and customizing the document to suit your specific needs. By utilizing efficient software tools, you can craft documents that not only look professional but are also functional and easy to manage.

One of the most effective methods is using customizable forms that allow you to modify fields, add details, and personalize the design. This approach saves time and ensures that all required information is present, from payment terms to contact details. The software also makes it easy to update or revise documents as needed, offering flexibility and control over the billing process.

Streamlining financial documentation has never been simpler, thanks to digital tools that help you create, edit, and manage your paperwork in a more efficient way. Whether it’s adjusting font styles, including business logos, or applying tax rates, these tools offer the ability to tailor the document exactly to your specifications. The ease of use and ability to automate repetitive tasks improves workflow and ensures consistency in your billing process.

Benefits of Using Invoice Templates

Having a consistent and structured approach to creating financial documents brings numerous advantages. By using pre-designed solutions, businesses can avoid errors, save time, and maintain a high level of professionalism. These tools ensure that all necessary elements are included and formatted correctly, streamlining the entire process of document creation.

Time-saving is one of the primary benefits of using pre-built forms. Instead of starting from scratch each time, you can simply fill in the required information, significantly speeding up the process. This is especially helpful for businesses that handle multiple transactions, allowing them to quickly generate and send statements without delay.

Consistency is another important factor. With customizable options, you can ensure that all your documents follow the same format and design, reinforcing your brand’s identity. Additionally, using these tools reduces the chances of missing key details, such as payment instructions, dates, or billing terms, making the documents more reliable and professional.

Furthermore, these tools often offer features that can automate certain aspects, such as tax calculations or recurring payments, reducing the amount of manual work needed. This increases efficiency and minimizes human error, making it easier to maintain accurate records.

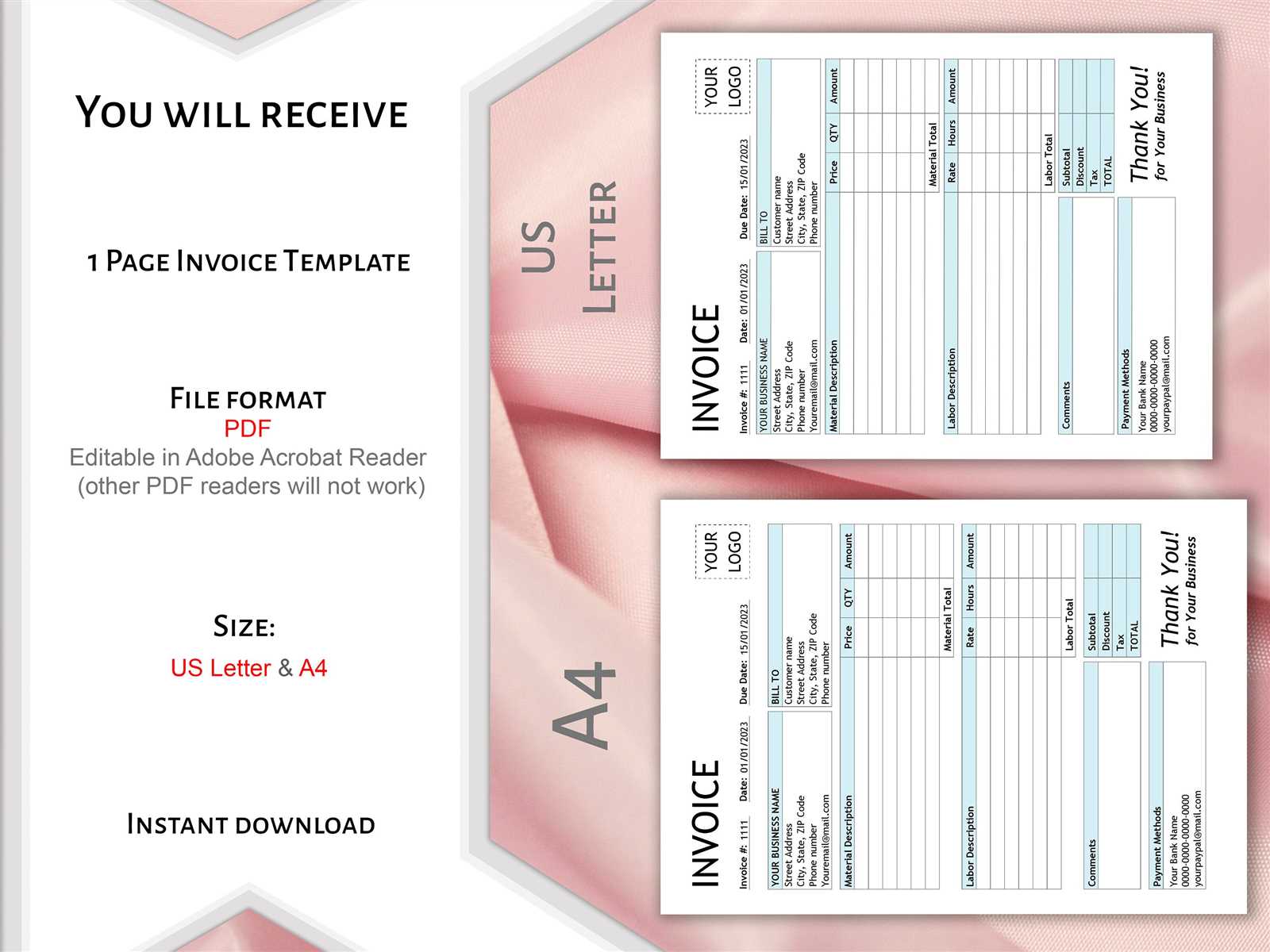

How to Download Adobe Acrobat Templates

Obtaining pre-designed forms for financial documents is simple and can significantly improve the workflow for businesses. These ready-made files are available from various sources and can be downloaded quickly, allowing you to get started without the need to design everything from scratch. Below is a step-by-step guide on how to access and download these resources.

- Start by visiting a trusted website or online marketplace that offers document creation tools and resources.

- Search for the type of document you need, specifying the format and design that best suits your business needs.

- Once you find the right file, check the preview to ensure it meets your requirements in terms of structure and style.

- Click the download button to obtain the file, and save it to your device for easy access.

- If needed, sign up for an account to access premium templates or to receive updates on new resources.

Once downloaded, the document is ready for customization. You can easily add your company details, client information, and other necessary elements directly into the file. This flexibility ensures that you can tailor the document to suit your specific needs.

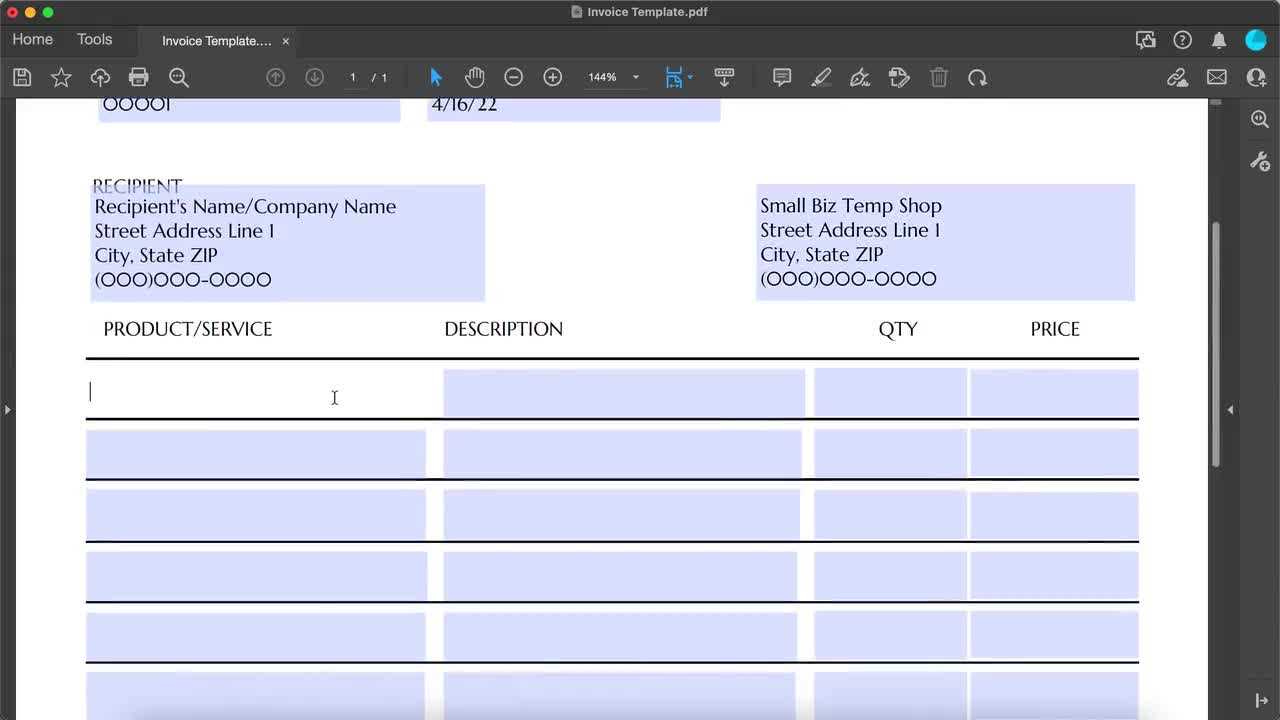

Customizing Your Invoice Template in Acrobat

After downloading a pre-designed document, the next step is to personalize it to reflect your brand and specific needs. Customizing your forms ensures that each document is aligned with your business identity, while also including all necessary information, such as payment terms, contact details, and transaction specifics. This process is simple and can be done within minutes using digital tools that allow for easy editing.

Modifying Document Layout and Design

To create a professional look, start by adjusting the layout and design elements. You can change the font style, size, and color to match your branding. Additionally, adding your business logo or adjusting the header section helps reinforce your company’s identity. Consistency in design across all your documents builds credibility and helps clients easily recognize your communications.

Filling in Essential Information

Next, add the required details, including your business name, address, contact information, and payment instructions. Make sure to adjust fields for client details, such as name, address, and transaction number, ensuring they are clear and easy to read. Accuracy in the information you provide is crucial, as it helps to avoid confusion and ensures a smooth transaction process.

Adding Payment Details to Your Invoice

Including accurate payment information in your documents is essential for ensuring smooth transactions between your business and clients. Clearly outlining payment terms, methods, and deadlines prevents confusion and establishes expectations upfront. By carefully adding these details, you create a professional document that reflects your business’s commitment to clarity and efficiency.

Specifying Payment Terms

Clearly stating payment terms is one of the most important aspects of your financial documents. Make sure to include the due date, late fees, and any applicable discounts for early payments. This ensures that your clients are fully aware of the payment expectations and avoids any potential misunderstandings regarding timing or costs. Clear payment terms also help maintain healthy cash flow for your business.

Providing Accepted Payment Methods

Next, list the payment methods you accept. Whether it’s bank transfers, credit cards, or online payment systems, make sure to include all the relevant details such as account numbers or payment links. This gives your clients a variety of options and makes it easier for them to settle their accounts. Offering flexibility in payment methods can increase the likelihood of prompt payments.

Using Form Fields in Invoice Templates

Integrating interactive fields into your financial documents allows for quick and accurate data entry, making it easier for you and your clients to fill in the necessary information. These fields help automate and streamline the document creation process, ensuring that all required details are included in the right places. By utilizing form fields, you can enhance the document’s functionality and reduce the risk of errors.

Creating Fillable Fields

One of the main advantages of using fillable fields is that they allow for easy data input. By adding text boxes, dropdown menus, or checkboxes, you can customize your forms to fit your specific needs. Whether you need to input dates, amounts, or client information, these fields make it simple to fill out the document without the need for manual editing. Editable fields not only save time but also ensure consistency in the details provided.

Automating Calculations

Some advanced forms allow you to automate certain calculations, such as totals or taxes, based on the inputted data. This eliminates the need for manual math, reducing the chances of mistakes. For example, you can set up fields that automatically calculate the final amount based on unit prices and quantities. Automation makes it easier to handle large volumes of transactions while maintaining accuracy and efficiency.

Setting Up Your Business Information

Having your business information properly set up within your documents is crucial for creating professional and legally compliant records. This includes adding key details such as your company name, contact information, registration numbers, and other identifiers. Properly structuring these elements ensures that clients can easily contact you and understand who is issuing the document.

Company Name and Contact Details

The first step in setting up your business details is to include your full company name, address, and phone number. This helps establish your identity and ensures that clients can reach you if necessary. Additionally, consider adding an email address or website URL for digital communication. Accurate contact information is essential for building trust and making it easy for clients to follow up.

Business Registration and Tax Information

For official records, include any relevant business registration numbers, tax IDs, or VAT numbers where applicable. This is particularly important for businesses operating in countries with strict tax regulations. Providing these details adds credibility to your documents and helps ensure compliance with local laws. Incorporating legal information also helps prevent any confusion regarding payment or business operations.

Incorporating Tax Rates into Invoices

When creating financial documents, including the correct tax information is vital for ensuring compliance with local laws and regulations. Properly incorporating applicable tax rates helps your clients understand the breakdown of charges and ensures that your business meets its legal obligations. This process can be easily managed with the right tools and knowledge, making it straightforward to include tax details in your documents.

Identifying Applicable Tax Rates

Before adding tax information to your document, it’s important to know the tax rates that apply to your business and the specific goods or services being provided. These rates can vary based on location, industry, and the type of transaction. Make sure to research the relevant tax regulations for your area to avoid errors. Accurate tax identification ensures that both you and your clients are adhering to the proper legal requirements.

Applying Tax to Line Items

Once you’ve identified the applicable tax rates, you can apply them to individual line items or the total amount of the transaction. This can be done manually or through automated calculation fields in your document, depending on the tool you’re using. Make sure to clearly show the tax amount for each item or service, as well as the total tax applied at the bottom of the document. Transparency in tax calculations helps avoid confusion and ensures that your clients are fully aware of the costs involved.

Designing a Professional Invoice Layout

Creating a well-structured and visually appealing document is key to making a lasting impression on your clients. A professional layout not only enhances the readability of the document but also reflects the quality of your business. When designing the layout, it’s important to balance clarity and style while ensuring that all essential information is easy to find and understand.

Key Elements of a Professional Layout

To create an effective and organized document, include the following elements:

- Header Section: Display your business name, logo, and contact details prominently.

- Client Information: Include the recipient’s details clearly, such as name, address, and contact information.

- Itemized List: Present each product or service clearly with a description, quantity, price, and total amount.

- Footer Section: Include any additional information like payment terms, thank-you notes, and contact details for follow-up.

Choosing the Right Fonts and Colors

Choosing appropriate fonts and colors is crucial for creating a clean, professional look. Stick to one or two fonts, with one used for headings and the other for body text. Avoid overly ornate or hard-to-read fonts. For colors, keep them neutral and simple, ensuring that there’s enough contrast between text and background to make everything easy to read. Simplicity and consistency in your design will help convey professionalism and clarity.

How to Save and Export Invoices

Once your document is complete, saving and exporting it in the right format is essential for sharing and storing your records efficiently. Whether you need to send it to clients, store it for future reference, or integrate it into accounting systems, knowing how to properly save and export the document ensures smooth operations. Different formats provide varying levels of accessibility and security, so it’s important to choose the right one for your needs.

Saving Your Document Locally

To save your file on your computer for later editing or storage, follow these steps:

- Select the right file format: Choose a format that suits your needs, such as PDF for sharing or DOCX for further editing.

- Use meaningful file names: Give your document a clear, descriptive name that makes it easy to locate later.

- Save in the right location: Organize your files in folders based on categories like client names or dates for easy access.

Exporting Documents for Sharing

If you need to send your document to clients or partners, exporting it to a format that ensures compatibility is key. Popular export options include:

- PDF: A widely accepted format that preserves your document’s layout and is easy to share via email or online platforms.

- Excel or CSV: Useful for integration with accounting software or when you need to manage data in a spreadsheet format.

- Image formats (PNG, JPG): Ideal for sharing a snapshot of your document in a simple, non-editable form.

By understanding how to properly save and export your documents, you ensure that your records are organized, secure, and easy to distribute when necessary.

Managing Multiple Invoices in Acrobat

When handling a large volume of documents, effective organization and management become essential to maintain efficiency and prevent errors. Having the ability to organize, track, and update several records at once is crucial for businesses with multiple clients or ongoing transactions. By utilizing the right tools and techniques, managing numerous files can be streamlined, saving time and reducing the likelihood of mistakes.

One useful method is grouping similar documents together in an organized folder structure. This can be done by client name, date, or project, which makes finding and updating specific records easier. Additionally, batch processing allows you to apply changes across multiple files simultaneously, such as updating business information or adding payment details.

Another essential aspect of managing multiple files is naming conventions. By using a consistent naming system, you can quickly identify documents without opening them. For example, naming a file with the client’s name and the date helps maintain order, especially when dealing with hundreds of records. Furthermore, using bookmarks or tags within the documents can make navigation easier, allowing you to jump directly to important sections without scrolling through entire files.

Security Features in Acrobat Invoices

When dealing with sensitive financial information, ensuring the security of your documents is critical. Protecting your data from unauthorized access, tampering, or loss is a priority, and there are various features available to help safeguard your files. Implementing these security measures not only protects your business but also helps maintain the trust of your clients.

Encrypting Your Documents

One of the most effective ways to protect your documents is through encryption. By encrypting your files, you make them accessible only to those with the correct password or encryption key. This ensures that sensitive information remains secure even if the file is intercepted during transmission. Password protection is a simple yet powerful way to prevent unauthorized access.

Adding Digital Signatures

Another important security feature is the use of digital signatures. A digital signature verifies the authenticity of a document and proves that it has not been altered since it was signed. This adds an extra layer of protection against fraud and tampering. Using digital signatures ensures that both you and your clients can trust the integrity of the document.

Printing and Sending Invoices via Email

Once your document is complete and ready for distribution, you may need to print it for physical records or send it electronically to clients. Printing provides a tangible copy, while sending via email is a quick and efficient way to reach your recipients. Both methods are important for streamlining your billing process and ensuring your clients receive the necessary information in a timely manner.

Printing Your Document

If you prefer to keep a physical copy or send a printed version to your client, follow these steps:

- Select a printer: Choose the correct printer for your needs, ensuring it’s connected and functioning properly.

- Set print preferences: Adjust settings such as paper size, orientation, and quality to match the document’s requirements.

- Print a test page: Before printing the entire batch, print a test copy to check the layout and formatting.

Sending via Email

Sending your completed document via email is a fast and eco-friendly method. Here’s how to do it:

- Save the document in a compatible format: Ensure the file is in a format that can be easily opened by your client, such as PDF.

- Attach the file: Attach the document to an email, ensuring the file size is within the recipient’s limit.

- Write a clear subject and message: Include relevant details in the subject line, such as “Payment Due” or “Billing for Services,” and provide a short message explaining the attachment.

- Double-check the recipient: Verify the email address to avoid sending it to the wrong person.

By utilizing these methods, you can efficiently distribute your documents, wheth

Creating Recurring Invoice Templates

For businesses with ongoing transactions or regular payments, creating reusable documents can save time and ensure consistency. These documents can be automatically generated at regular intervals, eliminating the need for manual input each time a new payment cycle begins. By setting up a template that suits your needs, you can streamline the process and maintain accuracy over time.

Setting Up a Recurring Document

To create a document that can be used repeatedly, follow these steps:

- Define the frequency: Decide how often the document will need to be generated (e.g., weekly, monthly, quarterly).

- Include standard details: Ensure that the essential information, such as business details, payment terms, and service descriptions, are included in the document layout.

- Set placeholders for dynamic data: Leave space for client-specific information, such as the amount due, invoice number, or service dates, which will change each time the document is generated.

Automating the Process

Once the initial layout is created, you can automate the generation process using certain tools. This reduces the need for manual input and ensures that the document is sent on time without any mistakes.

- Use scheduling tools: Set up reminders or automatic scheduling to generate the document at the designated time.

- Integrate with accounting software: Many accounting systems offer recurring document creation, which can pull client data directly and generate the document automatically.

By setting up a recurring document structure, you can easily manage repeat transactions and ensure that your clients receive the necessary information on time without repetitive effort. This process also reduces the risk of errors and streamlines your billing procedures.

Integrating Acrobat with Accounting Software

Seamless integration between document management tools and accounting platforms can drastically improve business efficiency. By linking the two systems, you can automate data entry, reduce errors, and ensure that financial records are updated in real time. This integration can save both time and effort, allowing businesses to focus more on their core activities.

Benefits of Integration

- Automatic Data Sync: Once linked, all transaction data, such as amounts and client details, can be automatically imported into your accounting software, minimizing the need for manual entry.

- Enhanced Accuracy: With automated processes, the risk of human error is significantly reduced, ensuring that all data entered is accurate and up-to-date.

- Time Efficiency: The time spent on administrative tasks is drastically reduced, as the integration eliminates the need to manually update accounting records after generating documents.

How to Set Up Integration

To integrate your document software with an accounting platform, follow these steps:

- Choose compatible tools: Ensure that both your document management tool and accounting software are compatible with integration features or APIs.

- Set up API connections: Many accounting platforms offer API support, which allows you to connect the two tools and automate the transfer of information.

- Map the data: Identify which data needs to be transferred and create mapping rules to ensure that the information flows correctly from one tool to the other.

- Test the integration: Before fully implementing the system, run tests to make sure the integration works smoothly and no data is lost or misplaced.

Integrating document management with accounting software is a smart strategy for businesses looking to streamline operations and maintain accurate financial records with minimal effort.

Best Practices for Invoice Formatting

Properly formatting your billing documents is essential for ensuring clarity, professionalism, and efficiency. A well-structured layout helps clients easily understand the charges, payment terms, and other relevant information. This can prevent delays, reduce confusion, and streamline the payment process.

Key Elements to Include

- Clear Header: Your document should have a clear and visible heading that indicates it is a billing document. This ensures the recipient knows exactly what it is at first glance.

- Consistent Structure: Maintain a logical flow of information. Begin with company details, followed by client information, a breakdown of services or products, and finally, payment instructions.

- Detailed Breakdown: Always list individual items or services, their quantities, prices, and total amounts. This transparency helps avoid misunderstandings.

- Payment Terms: Clearly state the due date, payment methods accepted, and any penalties or discounts for early or late payment.

Formatting Tips for Clarity

- Use Readable Fonts: Choose easy-to-read fonts like Arial or Helvetica in a legible size. Avoid overly decorative fonts that may make the document hard to follow.

- Highlight Important Information: Use bold or italics to emphasize key details, such as total amounts or due dates, ensuring they stand out.

- Organize with Tables: Tables are a great way to present itemized costs clearly. Ensure there is enough spacing between rows to avoid clutter.

- Keep It Professional: Use a clean and minimalist design with a consistent color scheme and alignments that are easy on the eyes.

Following these best practices will ensure your billing documents look professional and are easy for your clients to understand, improving your chances of timely payments and long-term business relationships.

Common Issues with Acrobat Invoice Templates

Despite the convenience of using pre-designed documents for financial transactions, users often encounter certain challenges. These issues may range from formatting problems to functionality errors that can hinder the efficiency of generating professional records. Recognizing and addressing these common pitfalls can help streamline the process and ensure that every document meets your standards.

Inconsistent Formatting is one of the most frequent problems that users face. Elements like text size, column alignment, and spacing can sometimes shift when editing, leading to a disorganized or unprofessional appearance. This issue can be caused by incompatible software versions or inconsistent application of layout settings.

Missing Fields or Incorrect Data is another common challenge. Sometimes, required fields such as payment details or client information may be omitted or incorrectly entered, leading to confusion or delayed payments. This can occur when manually updating the details in the document without verifying all necessary fields are filled out correctly.

Compatibility Issues can arise when attempting to open or edit documents across different software platforms. For example, a document designed on one system may not display properly or may lose its functionality when opened on another, particularly if the original formatting was not properly embedded.

Saving and Exporting Problems can also cause frustration. In some cases, after editing, the document may not save in the desired format, or the saved file may appear corrupted. This often happens due to errors in the software or when choosing incompatible export settings.

To overcome these common problems, it is important to ensure that the document is regularly checked for accuracy, formatting is consistent across all sections, and that software compatibility is maintained. By understanding these issues, you can save time and reduce errors, ensuring your financial documents remain professional and effective.