Free Invoice Template for 1099 Contractors

As a freelancer or independent professional, having a well-structured billing document is essential for clear communication with clients. A proper billing format ensures that both parties understand the payment terms, amounts, and due dates, helping to maintain a smooth business relationship. With the right tools, freelancers can create polished statements that reflect professionalism and attention to detail.

Whether you’re offering services or completing projects for various clients, using an efficient system for billing can save time and reduce the risk of errors. This document acts as a formal request for payment, detailing the services rendered, payment deadlines, and any relevant financial terms. Having a consistent format helps ensure that payments are processed accurately and promptly.

In this guide, we’ll explore the key components of an effective billing statement, how to tailor it for different types of work, and best practices for managing your finances as a self-employed professional. With the right approach, you can streamline your billing process and keep your records organized, making tax season much easier to navigate.

Understanding 1099 Contractor Invoices

When working as an independent professional, providing clients with a clear, organized request for payment is crucial. This document serves as a formal record of the work completed and the amount owed. It is essential to outline the terms of payment, itemize services or products, and provide the client with everything they need to process the payment accurately. These documents are not only important for your client but also for your own financial tracking, especially when it comes to tax reporting.

Key Information to Include

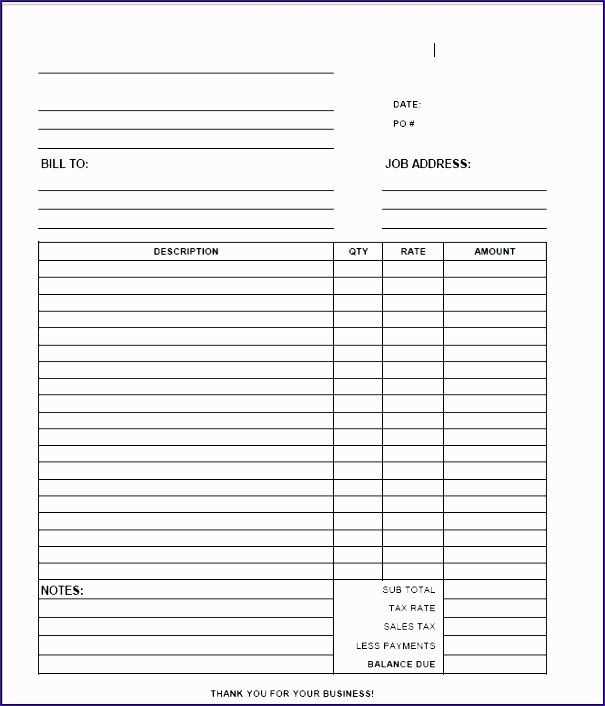

To ensure that your billing is both professional and effective, it’s important to include specific details. This includes your name or business name, the client’s information, a description of the services provided, the amount due, and the due date. Payment terms should be clearly stated, such as the acceptable methods of payment and any late fees that may apply. Additionally, keep track of the unique reference number for each statement to make future follow-ups easier.

Why These Documents Matter

Having a proper record of payments is not just about receiving money, but also about staying organized. These records are necessary for financial management and for ensuring compliance with tax laws. Independent workers must report earnings accurately, and without clear, itemized records, it can be difficult to track income or prove the work completed for each client. For tax purposes, these documents play an important role in differentiating between employee and freelance income, especially when submitting annual tax returns.

Why Contractors Need an Invoice Template

For any independent professional, having a consistent and organized method for requesting payments is essential. A well-designed document ensures clarity in financial transactions and helps avoid misunderstandings with clients. By using a structured format, freelancers can streamline their billing process and focus on delivering quality work rather than worrying about administrative tasks.

Here are some reasons why using a structured payment request is vital for freelancers:

- Professionalism: A clean, organized format reflects well on your business and shows clients that you are serious about your work.

- Accuracy: A defined structure reduces the likelihood of missing or incorrect information, ensuring that all details are clear for both you and the client.

- Efficiency: Having a predefined format makes the billing process faster and more efficient, allowing you to focus more on your work rather than spending time creating a new document for each client.

- Financial Management: An organized document helps keep track of payments, making it easier to manage cash flow, follow up on unpaid bills, and prepare for tax season.

- Compliance: Clear financial records are essential for meeting tax obligations and ensuring that all income is reported correctly.

By having a predefined system in place, freelancers can ensure smoother transactions, maintain positive relationships with clients, and manage their financials more effectively.

Key Elements of a 1099 Invoice

For independent professionals, a well-structured billing document is essential for receiving timely payments and keeping accurate records. Including the right information ensures that both parties are on the same page regarding the services provided, payment amount, and terms. A comprehensive document not only helps maintain professionalism but also assists in tax reporting and financial tracking.

Essential Information to Include

To make sure your billing is complete and clear, the following details should always be present:

- Your Contact Information: Include your name or business name, address, phone number, and email address.

- Client Details: Ensure the client’s full name, company name, and contact information are clearly listed.

- Description of Services: Itemize the services provided, including the date, duration, and any relevant details for each task completed.

- Total Amount Due: Clearly state the amount owed, breaking it down by service or product, if necessary.

- Payment Terms: Outline when payment is due, acceptable methods of payment, and any applicable late fees or discounts.

- Unique Reference Number: Each document should have a distinct number for easy tracking and future reference.

Why These Details Matter

Including these components ensures that the document is professional, reduces the chances of payment delays, and protects both you and your client in case of disputes. Clear terms and a well-organized format make it easier for clients to process the payment without confusion, and it helps you keep track of outstanding bills for accounting purposes.

How to Customize Your Invoice Template

Personalizing your billing document allows you to maintain a professional image while tailoring it to your specific needs. By making the document reflect your unique branding, you ensure consistency and clarity in your communications with clients. Customization also helps to streamline the payment process by adding any additional information that may be important for both you and your clients.

Steps to Personalize Your Document

Customizing your payment request is simple when you focus on key details. Here are some areas to consider:

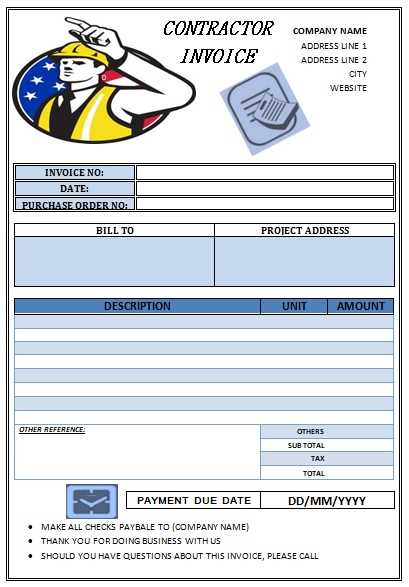

- Company Branding: Include your business logo, choose fonts and colors that reflect your brand identity, and ensure the document layout is clean and easy to read.

- Service Descriptions: Modify the description section to clearly reflect the services you offer. If needed, break down tasks into categories or phases for better understanding.

- Payment Terms: Adjust the payment terms based on your specific needs. Include any discounts, late fees, or preferred payment methods (e.g., bank transfer, PayPal, check).

- Contact Information: Double-check that your contact details are up-to-date, including your email, phone number, and physical address. This ensures your clients can easily reach you if necessary.

- Additional Notes: Add a notes section for any special instructions, terms, or additional agreements related to the work performed. This can help avoid future misunderstandings.

Tools to Simplify the Customization Process

There are several tools available that allow you to easily modify your documents, whether you prefer using online platforms, word processors, or spreadsheet software. Some tools offer pre-designed structures that only require you to plug in specific information, while others give you full creative control over the design. Choose the tool that best fits your workflow and the level of personalization you need.

Choosing the Right Invoice Format

When managing payments for freelance or independent work, selecting an appropriate document format is essential for ensuring clear communication and professional transactions. The structure of this document not only provides a record of services rendered but also helps streamline the payment process for both parties involved.

Several factors should be considered when choosing a format that suits your needs. These include the type of work, the frequency of billing, and the preferences of the client. A well-designed layout can help prevent confusion and delays in payment.

- Work Type: The complexity and nature of the services provided may require more detailed descriptions or simple line items. For example, a creative project might need a breakdown of hours spent, while a straightforward task could be summarized in a few lines.

- Clarity: A clear and organized design makes it easier for clients to understand the charges. Avoid cluttering the document with unnecessary information, and focus on what is relevant to the payment.

- Consistency: Using a consistent format for all your submissions helps create a professional image. This includes using the same style for the header, layout for itemized lists, and the same language for descriptions.

- Legal and Tax Considerations: Ensure that the document meets any regulatory requirements specific to your region or industry. This could include including tax identification numbers, payment terms, and other legal details.

Ultimately, the goal is to create a document that is both functional and professional, allowing for smooth financial transactions without confusion or delay. Choose a format that aligns with your business style and meets the needs of your clients for the best results.

Common Mistakes in 1099 Contractor Invoices

When preparing documents to request payment for services rendered, it’s easy to overlook details that can delay processing or cause confusion. Even minor errors can complicate the financial exchange, leading to miscommunications or, in some cases, payment issues. Understanding common pitfalls and how to avoid them can help streamline the process and ensure timely compensation.

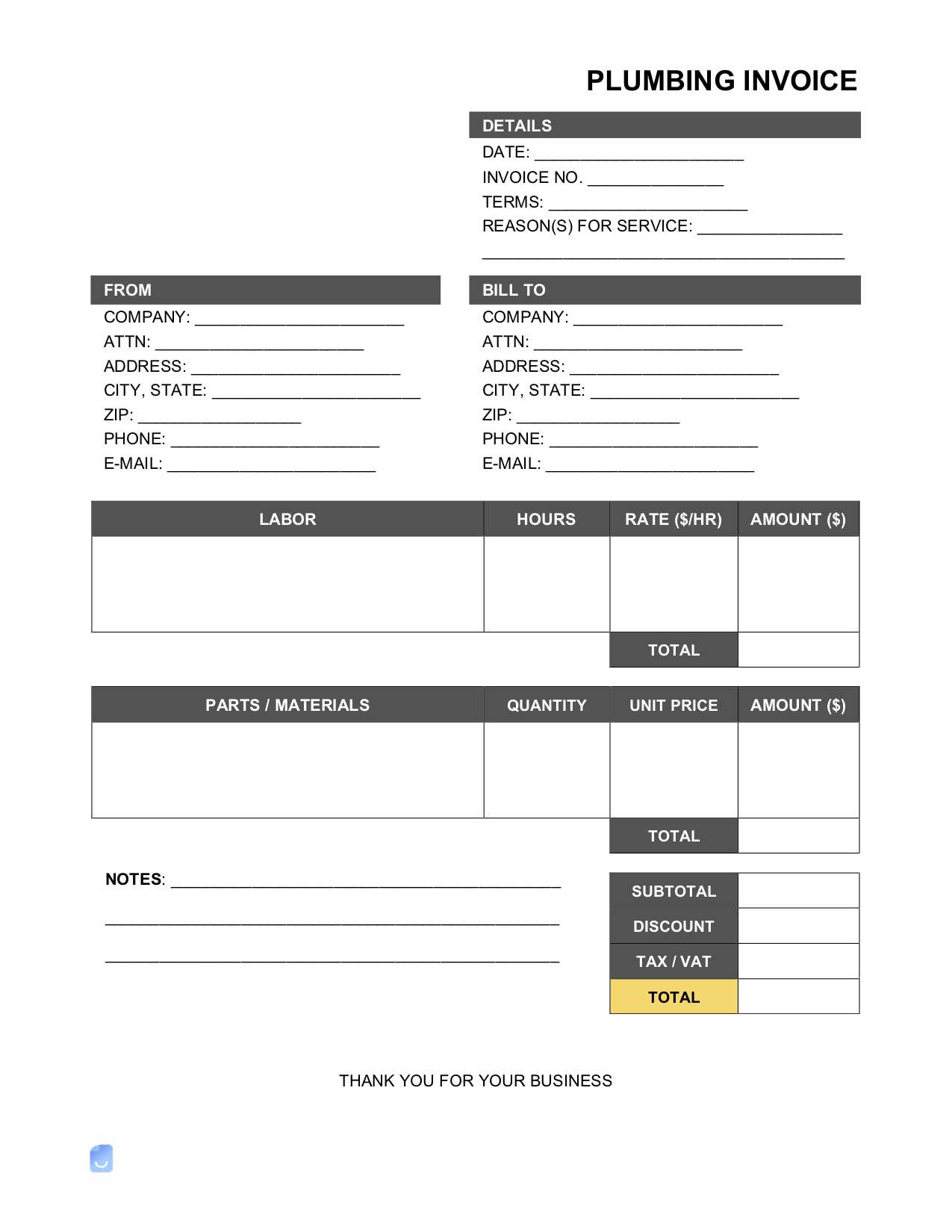

Missing or Incorrect Information

One of the most frequent issues is failing to include essential information or providing incorrect details. These can range from basic contact information to missing tax identification numbers or payment instructions. If any of this information is inaccurate or incomplete, it may cause delays in the payment cycle.

- Omitting business or personal details: Ensure your name, address, or business name is clear and correctly listed.

- Incorrect payment terms: Double-check payment deadlines, late fees, and other terms that should be clear to the client.

Unclear or Vague Descriptions

Another mistake is failing to clearly outline the services provided. Ambiguous or overly brief descriptions can lead to misunderstandings about the work done, which may cause unnecessary disputes over payment amounts.

- Vague service descriptions: Include a detailed breakdown of tasks performed, hours worked, or milestones achieved. This helps the client verify the charges and reduces potential confusion.

- Inconsistent itemization: Organize charges logically, ensuring each service is clearly separated with corresponding rates and totals.

By carefully checking for these common mistakes, you can avoid unnecessary complications and ensure that your payment requests are processed efficiently and accurately. Simple attention to detail can make all the difference in maintaining a smooth financial relationship with clients.

How to Calculate Invoice Amounts

Accurately determining the total amount due for services rendered is crucial to ensure fair compensation and prevent any disputes. Properly calculating the charges involves considering the scope of work, rates, time spent, and any applicable taxes or additional fees. Knowing how to break down these elements will help you arrive at the correct amount and provide clarity for both you and your client.

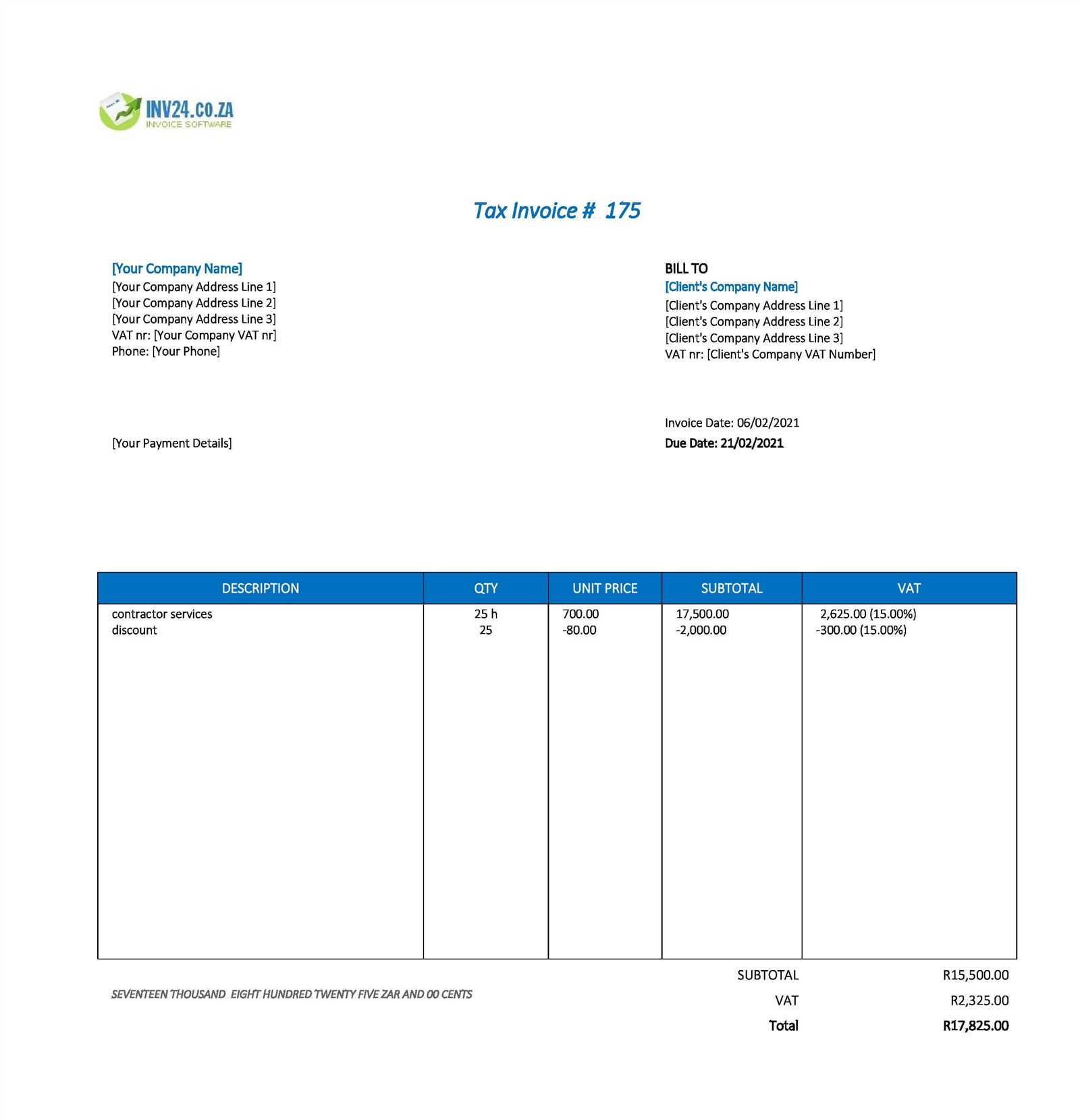

The basic steps to calculate the total amount typically involve multiplying the hours worked by the hourly rate, adding any additional costs, and factoring in taxes or discounts where applicable. Here’s how to structure it:

| Description | Quantity | Rate | Amount |

|---|---|---|---|

| Hourly Work | 30 hours | $50/hour | $1,500 |

| Materials | 1 | $200 | $200 |

| Travel Expenses | 1 | $50 | $50 |

| Total | $1,750 | ||

In this example, the total amount is calculated by adding up the individual amounts for hourly work, materials, and any additional costs such as travel. After all charges are listed, you can apply any discounts or include taxes if required by your local tax regulations.

Always ensure that each cost is clearly justified and that the final amount is easy to understand. This will help avoid misunderstandings and keep your financial transactions transparent.

Best Tools for Creating 1099 Invoices

For freelancers and independent professionals, having reliable tools to generate payment requests is essential for smooth business operations. The right software or platform can simplify the process, ensure accuracy, and save valuable time. Whether you need to create a detailed document or just a simple record of work completed, using the best tools available can make a big difference in your financial management.

Below is a list of some of the top tools that can help you generate professional and error-free payment requests, with an emphasis on flexibility, ease of use, and additional features like tracking payments or generating tax documents:

| Tool | Features | Best For |

|---|---|---|

| QuickBooks | Customizable documents, expense tracking, automated reminders | Freelancers needing integrated accounting with payment requests |

| FreshBooks | Simple interface, time tracking, recurring billing options | Professionals who want an easy-to-use, cloud-based solution |

| Wave | Free platform, financial reports, tax support | New freelancers or small businesses looking for a budget-friendly option |

| Zoho Invoice | Multilingual support, mobile access, expense management | Freelancers working with international clients or in multiple languages |

Each of these tools offers unique features to meet different needs. Some prioritize simplicity and user experience, while others focus on integrating payment requests with overall financial management. Selecting the right tool depends on your specific requirements, whether you need advanced accounting features, ease of use, or just the ability to quickly generate and send payment records.

By utilizing one of these platforms, you can ensure that your payment documents are professional, accurate, and compliant with any legal or tax requirements.

What to Include in Payment Terms

Clear and precise payment terms are vital to ensuring smooth financial transactions between freelancers and clients. Well-defined terms help prevent misunderstandings, ensure timely payments, and set expectations from both sides. By specifying payment deadlines, methods, and potential penalties for late payments, you protect your interests and promote transparency in your business dealings.

When drafting payment terms, certain key elements should always be included to make the agreement clear and enforceable. These elements help both you and the client understand when and how payments are expected, as well as what actions will be taken in case of delays.

| Payment Term | Description |

|---|---|

| Due Date | Clearly specify the date by which payment should be made. This could be a specific calendar date or a set number of days after the work is completed. |

| Accepted Payment Methods | List the methods you accept for payment (bank transfer, credit card, PayPal, etc.). This ensures that the client knows how to send the funds. |

| Late Fees | If applicable, outline any penalties or interest for late payments. This can help incentivize clients to pay on time. |

| Deposits or Prepayments | State whether a deposit or advance payment is required before starting the work. This is especially important for larger projects. |

| Payment Schedule | For larger or ongoing projects, break the payment into installments or milestones. Define when each installment is due and the amount for each. |

| Tax Considerations | If taxes are applicable, specify whether they are included in the total amount or if they will be added separately to the final payment. |

Including these elements in your payment terms will create a clear agreement that both you and your client can follow. This will help avoid confusion and reduce the risk of delayed or missed payments, fostering a professional and reliable business relationship.

Tracking Payments with Invoice Templates

Keeping track of payments is an essential part of managing any freelance or independent business. Having a structured way to record and monitor payments helps ensure that you stay on top of your financials, avoid missing payments, and maintain a professional relationship with your clients. A well-organized system for tracking outstanding and completed payments can save you time and prevent potential disputes.

Using a payment tracking system within your documents can help you stay organized and maintain clear records of when payments are due, when they were made, and any outstanding balances. Below are key elements that can assist in tracking payments effectively:

- Payment Status: Always include a section that clearly indicates whether the payment is “Paid,” “Unpaid,” or “Pending.” This helps both you and the client quickly identify the payment’s current status.

- Due Date: Specify a clear due date for each payment. This allows both parties to stay aligned on when payment is expected, making it easier to follow up if necessary.

- Payment Method: Note the payment method used (bank transfer, credit card, check, etc.) for each completed payment. This ensures transparency and helps reconcile any discrepancies later on.

- Outstanding Balances: Keep a record of any amounts that have not yet been paid. By tracking unpaid amounts, you can quickly follow up with clients if needed.

- Payment History: Include a summary of all previous payments made for the same project or services. This gives a complete picture of the client’s payment behavior and helps ensure all payments are accounted for.

By incorporating these elements into your documents, you can maintain an accurate, up-to-date record of payments and ensure you are paid promptly and in full. An organized tracking system will save you time, reduce the risk of missing payments, and provide clarity for both you and your client.

How to Handle Late Payments

Late payments are a common issue for independent professionals and freelancers, but they don’t have to be a source of stress. Having a clear plan for addressing overdue payments is essential to maintaining cash flow and protecting your business. By establishing firm guidelines and taking the right steps when a payment is delayed, you can reduce the impact on your finances and keep your professional relationships intact.

When dealing with overdue payments, it is important to remain professional and organized. Below are steps you can take to handle late payments effectively:

- Send a Reminder: When a payment is overdue, sending a polite reminder is often the first step. This should be a friendly but clear message about the missed payment and a request for prompt resolution.

- Check for Errors: Before taking further action, confirm that there are no issues with the payment details (e.g., incorrect amounts, wrong payment method, or missing information). This can help avoid unnecessary follow-ups.

- Implement Late Fees: If your payment terms include penalties for late payments, it’s important to apply them consistently. Ensure the client understands the charges and the reasons for them, referencing the agreed-upon terms.

- Offer Payment Plans: For larger outstanding balances, consider offering a payment plan. This can make it easier for the client to pay off the debt over time while ensuring you receive compensation.

- Send a Formal Notice: If reminders and late fees don’t resolve the issue, send a more formal letter outlining the outstanding balance and the consequences of continued non-payment. Be firm but professional.

- Know When to Escalate: If the issue persists and your attempts to resolve it are unsuccessful, you may need to consider involving a collections agency or pursuing legal action. However, this should be a last resort after all other options have been exhausted.

By taking these steps, you can ensure that overdue payments are handled in a way that minimizes the negative impact on your business while preserving a positive relationship with clients. A proactive approach helps maintain professionalism and encourages clients to honor their fina

Tax Implications of 1099 Invoices

When you’re working as an independent professional, it’s important to understand the tax implications of the payment documents you submit. These records not only serve as a way to track your earnings but also play a significant role in your tax filings. As a freelancer or small business owner, being aware of the tax responsibilities associated with the work you perform can help you avoid penalties and ensure you’re properly reporting your income.

Several key tax-related aspects need to be considered when managing payments and earnings, particularly if you’re self-employed or receiving payments from clients who don’t withhold taxes on your behalf. Below are important points to keep in mind:

- Self-Employment Taxes: If you’re not employed by a company and work as an independent provider, you are responsible for paying both the employer and employee portions of Social Security and Medicare taxes. These taxes are collectively referred to as self-employment taxes.

- Quarterly Estimated Taxes: Unlike salaried employees, independent professionals must typically make quarterly estimated tax payments. Failing to make these payments can result in penalties at the end of the year.

- Tax Deductions: As a self-employed individual, you can deduct certain business-related expenses from your taxable income. This may include office supplies, travel expenses, and other necessary costs directly related to your work.

- Reporting Income: The income you earn from clients should be reported accurately to avoid issues with the IRS. Keep detailed records of all payments received, including the dates and amounts, to ensure you report everything correctly when filing your taxes.

- Form 1099-MISC or 1099-NEC: If you earn over a certain threshold from any one client, they are required to send you a tax form detailing the amount they paid you during the year. This form is then used to report your income to the IRS.

- State Taxes: In addition to federal taxes, don’t forget that state tax laws may require you to pay income taxes depending on your location. Be sure to check your state’s specific tax requirements.

Being proactive about your tax obligations as an independent professional can save you from potential legal and financial issues. It’s recommended to consult with a tax professional who can guide you through the process and help you maximize your deductions while ensuring full compliance with tax laws.

Digital vs. Paper Invoices for Contractors

When it comes to submitting payment requests for services rendered, one of the key decisions is whether to use digital or paper methods. Both approaches have their benefits and drawbacks, and the choice often depends on factors such as client preferences, convenience, and the overall efficiency of your business. Understanding the advantages of each can help you decide which method best suits your workflow and client base.

Each method of submitting payment records has unique characteristics, which can influence how quickly and easily you receive payment. Below are some considerations when choosing between digital and paper records:

- Speed and Efficiency: Digital records can be delivered instantly, speeding up the payment process. On the other hand, paper records require postage, which can introduce delays, especially for clients in different locations.

- Cost-Effectiveness: Sending digital documents is generally free, aside from any platform or service fees, while paper records incur printing and postage costs. Over time, digital submissions can result in significant savings.

- Environmental Impact: Digital submissions are eco-friendly, eliminating the need for paper and reducing the overall carbon footprint. Paper submissions, on the other hand, contribute to waste and consume resources.

- Organization and Tracking: Digital records are easier to store, organize, and search through, especially if using cloud-based tools. Paper records require physical storage space and are harder to manage or retrieve quickly when needed.

- Client Preference: Some clients may prefer receiving physical records for their own internal processes, while others may be more comfortable with digital formats. It’s important to understand and accommodate client preferences where possible.

- Legal Considerations: While digital documents are legally binding in many regions, some jurisdictions may require physical documents for certain types of transactions. Be sure to understand any legal requirements for your specific location or industry.

Ultimately, the decision between digital and paper records depends on your business needs, client preferences, and the convenience of the method you choose. Many businesses find a combination of both methods works best, allowing flexibility while embracing the efficiencies of digital tools.

Creating Recurring Invoices for Contractors

For businesses working with independent workers or freelancers, generating regular billing documents can be a time-consuming task. Automating the process of issuing periodic payments can save valuable time and reduce the likelihood of errors. With a properly structured system in place, businesses can ensure that their partners receive timely and consistent payments without manual intervention each cycle.

Setting Up Automatic Billing Cycles

To streamline payment procedures, it’s essential to establish a clear schedule for regular disbursements. This typically involves deciding on a fixed frequency for payments, such as weekly, bi-weekly, or monthly. Once the schedule is set, you can configure a system to automatically generate the necessary documentation based on the agreed-upon terms. By doing so, both parties are clear about when to expect payments, and the need for manual tracking is minimized.

Key Elements to Include

While setting up these regular billing arrangements, it’s important to ensure that all relevant details are consistently included. A well-structured document should contain information such as the total amount due, the payment cycle, and a breakdown of services or hours worked. This not only fosters transparency but also helps in maintaining a professional relationship.

| Item | Description |

|---|---|

| Payment Amount | Clearly state the agreed payment for the service rendered, whether fixed or hourly. |

| Billing Period | Define the start and end dates for each billing cycle. |

| Service Breakdown | Include details of work performed, such as hours worked or milestones completed. |

| Payment Method | Specify how the payments should be made, whether through bank transfer, PayPal, etc. |

With a well-organized approach to regular billing, businesses and independent professionals can ensure a smooth financial arrangement that benefits both parties involved. By automating these processes, everyone can focus on the work at hand, rather than the administrative tasks of tracking payments.

Benefits of Professional Invoice Design

A well-crafted billing document can make a significant difference in the way clients perceive a business. The design and presentation of these documents not only reflect professionalism but also contribute to smoother financial transactions. When the structure is clear, aesthetically pleasing, and easy to understand, it fosters trust and encourages prompt payments.

Enhancing Professional Image

The first impression matters in any business relationship. A polished and consistent billing format communicates that the provider values their work and respects the client’s time. A visually appealing document helps to reinforce the perception of reliability and professionalism.

- Creates a sense of credibility

- Strengthens brand identity

- Shows attention to detail and commitment

Improving Payment Efficiency

A well-organized bill is not only easier to read, but it also makes the payment process simpler for the client. Clear breakdowns of services, costs, and payment terms help avoid confusion and reduce the likelihood of delays due to misunderstandings.

- Reduces questions or disputes about charges

- Streamlines processing for quicker payments

- Minimizes administrative follow-up and delays

Increasing Client Satisfaction

Clients appreciate clarity and transparency. When a billing document is easy to navigate and includes all the necessary details, it makes it simpler for them to track the status of their payments. This level of clarity fosters a positive working relationship and can lead to repeat business.

- Improves client trust and satisfaction

- Demonstrates respect for the client’s time and financial processes

- Promotes long-term partnerships

By investing in a professional billing design, businesses can enhance both the client experience and the efficiency of their financial transactions, ultimately contributing to smoother operations and a better bottom line.

How to Send Your Invoice to Clients

Once a financial document is prepared, the next step is ensuring it reaches the right recipient in a timely and professional manner. Sending this document correctly is crucial for ensuring that payments are processed quickly and without complications. Choosing the right delivery method and including all relevant details helps foster a smooth transaction and positive client relationship.

Choosing the Right Delivery Method

There are several ways to deliver your billing document, each with its own benefits. The method you choose should depend on the client’s preferences, your business practices, and the level of formality required. Below are the most common options:

| Method | Advantages |

|---|---|

| Fast, cost-effective, and allows for easy tracking and record-keeping. | |

| Postal Mail | More formal and may be necessary for clients who prefer paper copies. |

| Online Payment Platforms | Offers direct payment links and is convenient for both parties. |

Including Necessary Information

Regardless of the method used to send the financial document, it’s important to include all essential information to avoid delays in processing payments. Make sure the recipient has everything they need to review and approve the details quickly. Key elements include:

- Client name and contact details

- Clear breakdown of services or work completed

- Total amount due, including any applicable taxes or fees

- Payment terms (due date, late fees, etc.)

- Your contact information for any questions or clarifications

Following Up on Sent Documents

After sending the document, it’s important to follow up if you do not receive a response within a reasonable period. A polite reminder can help ensure that the payment is processed promptly. Consider including a friendly message asking if there are any issues with the details or if further clarification is needed.

By taking care to select the appropriate method and ensuring that all necessary details are included, you can make the process of sending financial documents smooth and efficient, leading to faster payments and stronger client relationships.

Keeping Your Invoices Organized for Taxes

Staying organized with your financial documentation is essential, especially when it comes time to file taxes. Properly tracking your earnings, expenses, and payments helps ensure that you meet legal requirements and can take advantage of any eligible deductions. By maintaining a well-organized record of your transactions, you can save time, reduce stress, and avoid costly errors when filing your tax returns.

Tracking Earnings and Payments

To maintain accurate records, it’s important to keep a detailed log of all payments received. This includes noting the date, amount, and purpose of each payment. Keeping such records organized ensures you won’t miss out on reporting any income or overstate your revenue. It’s also useful for tracking overdue payments or resolving discrepancies with clients.

- Use a spreadsheet or accounting software to track all incoming funds.

- Include relevant details, such as client names, dates, and amounts, in a consistent format.

- Organize by month or quarter to make your financial review easier during tax season.

Storing Supporting Documentation

In addition to the main records of payment, it’s crucial to store any supporting documents, such as receipts, contracts, or communication with clients. These documents provide proof of the work completed and help back up your earnings in the event of an audit. Proper storage of this documentation can be done digitally or in physical form, but consistency is key.

- Keep digital backups of contracts, receipts, and other important documents.

- Use cloud storage to make sure files are easily accessible and safe from loss or damage.

- Organize by year to simplify the tax filing process each year.

Preparing for Tax Season

As tax deadlines approach, having an organized system in place ensures that you are prepared and can complete your filings quickly. Keep an updated summary of all your payments, expenses, and any applicable taxes collected. This will allow you to calculate your total income with ease, ensuring compliance and minimizing potential errors or omissions.

- Set aside time each month or quarter to update and review your records.

- Review your tax obligations regularly to ensure that you are saving for any taxes due.

- Consult a tax professional if you’re unsure about any deductions or filings.

By staying organized and diligent with your record-