Invoice Summary Report Template for Efficient Financial Management

Managing business transactions efficiently is crucial for maintaining smooth operations. By adopting a well-structured method for tracking payments and outstanding balances, you can ensure better financial oversight. A clear system not only helps with keeping accurate records but also saves valuable time when reviewing past transactions.

Having a standardized document that summarizes key financial details can significantly simplify this process. It offers a quick overview of income and expenses, making it easier to stay on top of billing cycles and ensure timely payments. With the right approach, this system helps business owners and accountants save effort while maintaining a high level of organization and professionalism.

Customizing such documents to fit specific needs further enhances their effectiveness. This customization allows businesses of all sizes to tailor their financial tracking system according to their unique requirements. The flexibility to adjust and update these documents is key to keeping financial operations accurate and responsive to any changes in the business environment.

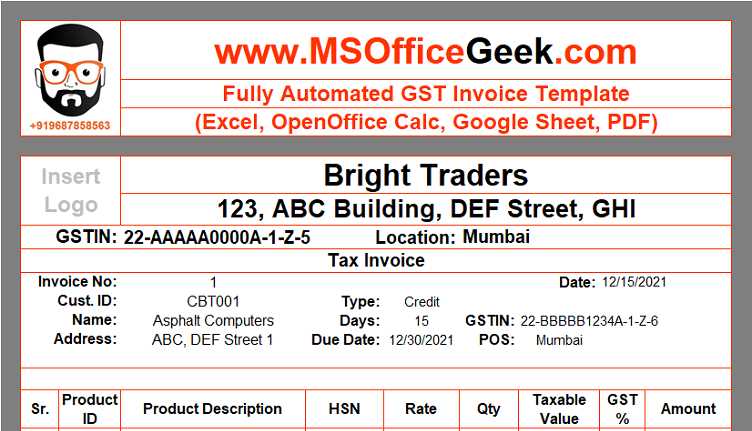

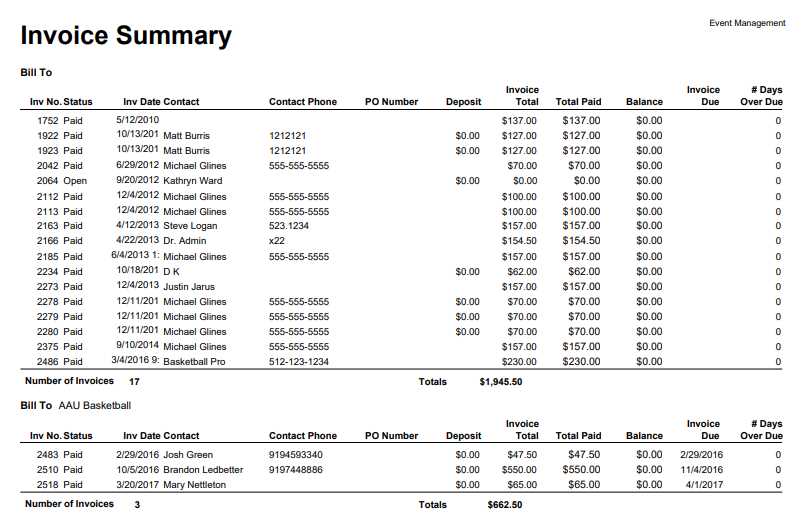

Invoice Summary Report Template Overview

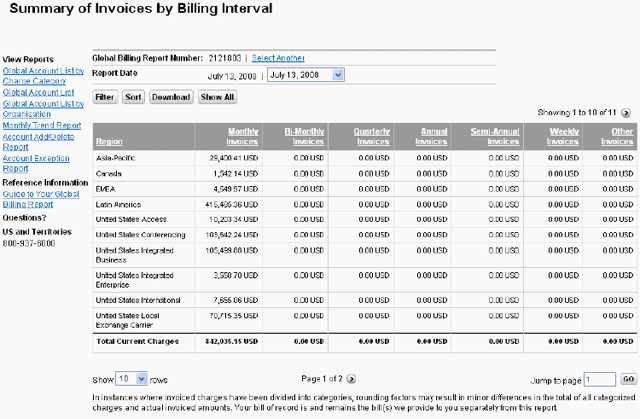

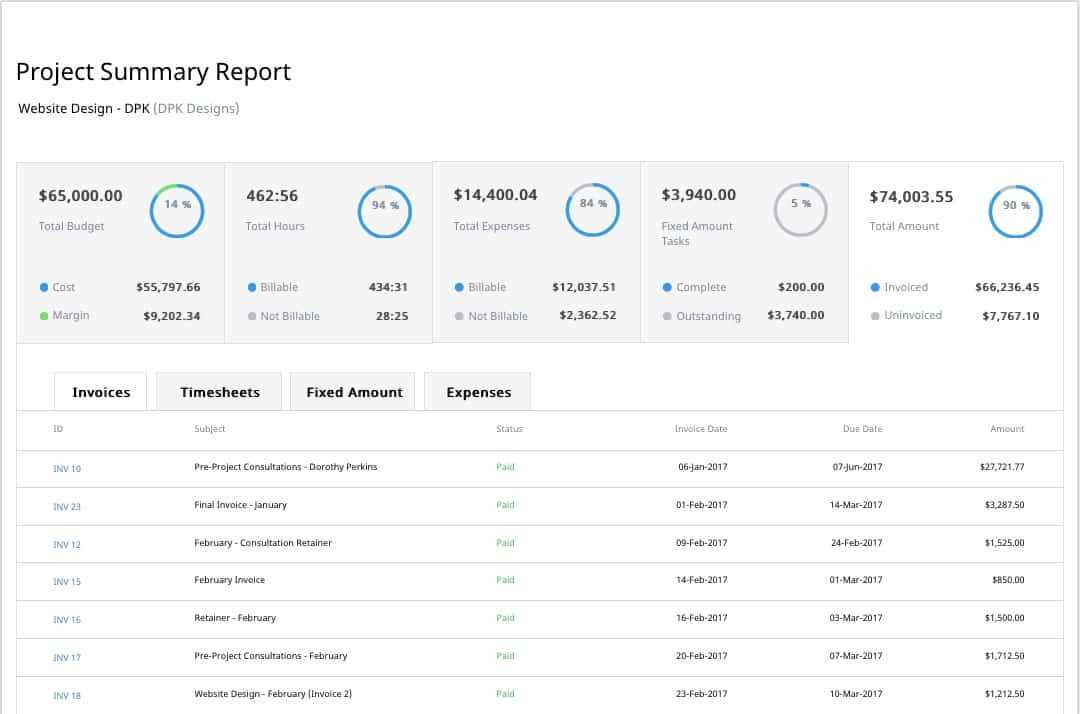

Efficient financial tracking is essential for businesses to ensure smooth operations and clear understanding of cash flow. By organizing key financial information into a single, easy-to-read document, businesses can quickly assess their financial health, track payments, and streamline invoicing. This type of document provides a concise view of all the essential data, helping business owners or accounting teams to stay on top of outstanding balances and incoming payments.

Key Features of a Well-Designed Document

- Clarity and Simplicity: The document should present the most important details without unnecessary complexity, making it easy to interpret at a glance.

- Comprehensive Overview: A good format will include essential information such as transaction dates, amounts due, paid, and outstanding balances.

- Customizable Sections: Flexibility to adapt the layout to business-specific needs, whether for a single client or a large number of transactions.

- Easy-to-Update: As business transactions change, this document should allow quick adjustments to reflect new payments or additional charges.

Benefits of Using This Type of Document

- Time-Saving: Saves time during financial reviews by consolidating key details in one document.

- Accuracy: Helps eliminate human error when tracking multiple payments or managing outstanding debts.

- Improved Cash Flow: Facilitates faster invoicing and ensures payments are tracked properly, reducing delays.

- Professional Presentation: Provides a polished and professional appearance to clients, enhancing trust and transparency.

Key Benefits of Using Invoice Templates

Implementing a well-organized document structure for managing financial transactions offers numerous advantages to businesses of all sizes. These tools streamline the process of tracking and managing payments, ensuring that critical details are easily accessible and up-to-date. By using a standardized format, businesses can enhance efficiency, reduce errors, and maintain a consistent approach to financial reporting.

Time Efficiency: Using a pre-designed structure significantly reduces the amount of time spent creating new records from scratch. This allows businesses to quickly generate the necessary paperwork for clients, saving valuable hours that can be redirected toward more strategic tasks.

Improved Accuracy: By relying on a consistent format, the risk of missing important data or making mistakes decreases. Every necessary field is accounted for, and updating figures becomes a straightforward task. This leads to more accurate and reliable financial documentation.

Professional Image: A polished and uniform document gives clients the impression of a well-organized and professional business. This attention to detail can improve client trust and foster stronger business relationships.

Customization and Flexibility: These documents can be easily adapted to fit specific business needs. Whether adjusting fields for additional information or creating variations for different clients, customization ensures that the document meets every requirement without excessive effort.

Consistency in Financial Tracking: A standardized format ensures that all transactions are recorded in the same manner, making it easier to review financial performance and track overdue balances. This consistency helps maintain better control over cash flow.

How to Create an Effective Invoice Report

To create an effective document for tracking financial transactions, it’s essential to focus on clarity, accuracy, and ease of use. The goal is to present key financial data in a structured manner that allows for quick analysis and decision-making. The process involves organizing necessary details, ensuring proper formatting, and customizing the structure to meet specific business needs.

Here are the steps to create an effective document:

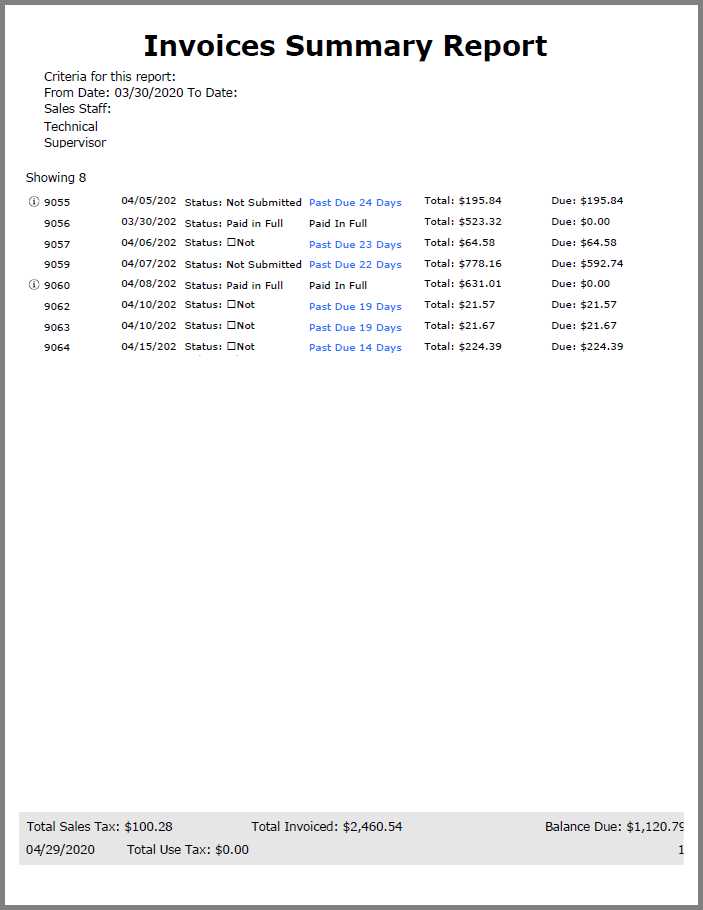

- Gather Relevant Data: Collect all necessary details, including transaction dates, amounts, client information, and payment statuses.

- Choose a Clear Layout: Organize the information in a logical order. Group related data together to help users quickly locate key figures.

- Ensure Accuracy: Double-check all numbers and figures to avoid discrepancies. Small errors can lead to confusion and damage your business’s reputation.

- Use Consistent Formatting: Stick to one font style and size, and ensure that headers, footers, and section titles are clearly defined. Consistency helps with readability.

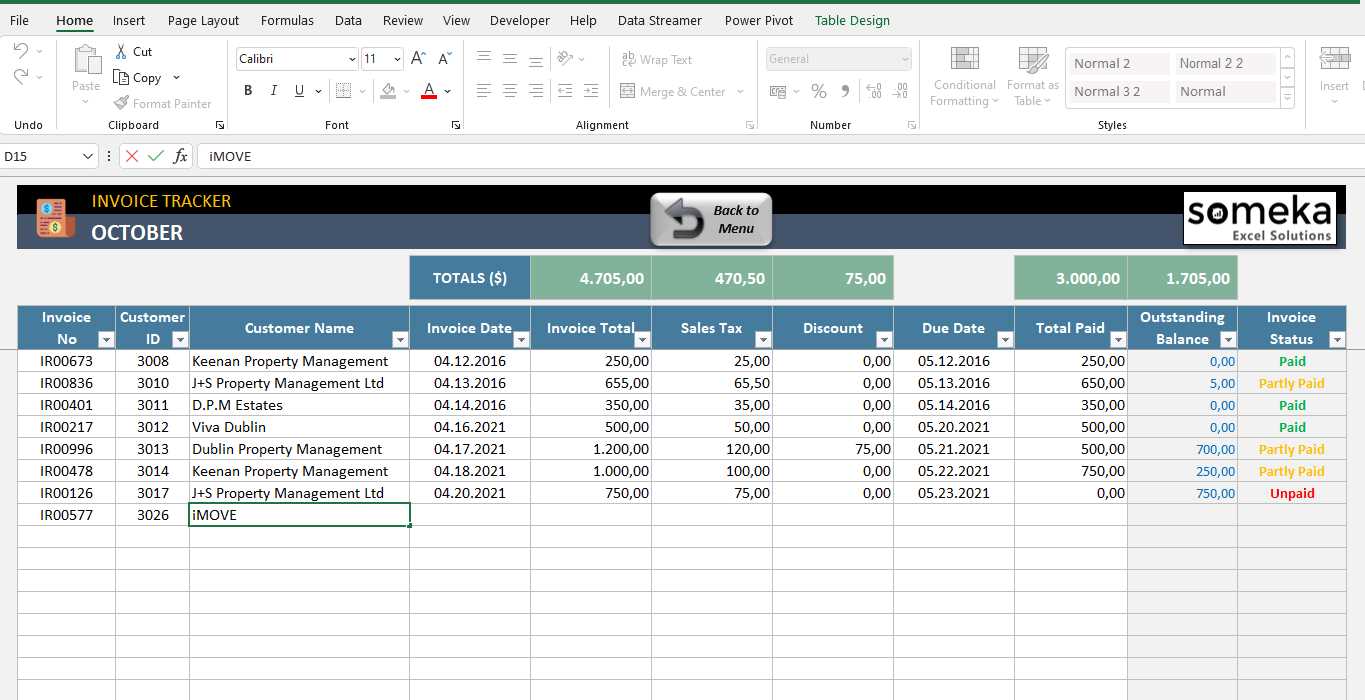

Here’s an example of a basic layout for such a document:

| Client Name | Transaction Date | Amount Due | Amount Paid | Outstanding Balance | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Client A | 2024-10-01 | $500 | $300 | $200 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Client B | 2024-10-05 | $750 | $750 | $0 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Client C | 2024

Essential Elements in a Summary ReportCreating a well-organized document for tracking financial transactions requires including key elements that make it easy to understand and actionable. The core goal is to highlight critical data points that provide a clear overview of the financial situation, enabling quick decision-making and proper follow-up actions. Every important detail should be clearly displayed, with sections dedicated to specific information for ease of review. Key Data Points to Include

Additional Considerations for Clarity

By incorporating these essential elements, you ensure that the document is both comprehensive and easy to navigate, allowing for better tracking, analysis, and management of financial activities. Choosing the Right Template for Your BusinessSelecting the right structure for managing financial details is crucial for ensuring efficiency and accuracy. The format you choose should align with the specific needs of your business, taking into account factors like the size of your operations, the volume of transactions, and the level of detail required. A well-suited format allows for easy tracking, simplifies your financial workflow, and supports better decision-making. Understand Your Needs: Consider what information needs to be tracked. If your business involves frequent, small transactions, a simple and straightforward layout might be best. For larger operations or those with more complex billing processes, you may need a more detailed format that can handle various categories of data, such as multiple clients, projects, or payment schedules. Consider Customization: Flexibility is key. Choose a structure that can be easily adapted to reflect changes in your business needs. For instance, you may want the ability to add or remove sections as your business grows or modify fields to suit different types of transactions. Look for Readability and Simplicity: The layout should be easy to read and understand. A clean, simple design helps you quickly identify key information without confusion. Avoid overly complex formatting or unnecessary clutter, which can lead to mistakes or missed details. Evaluate Software Compatibility: If you plan to integrate the financial document with accounting or management software, ensure the structure is compatible. Some software solutions offer specific formats that can be imported directly, streamlining your workflow even further. By considering these factors, you can select the right structure that meets the unique needs of your business, helping you maintain organized and accurate financial records with minimal effort. Customizing Your Invoice Summary TemplateTailoring your financial document layout to suit your specific business needs is a crucial step in enhancing efficiency and accuracy. Customization allows you to include or exclude relevant sections, add unique details, and adjust the format for better readability and tracking. A well-customized structure makes it easier to monitor your transactions and align the document with your business goals. Key Customization Options

Automation and Software Integration

By customizing your financial tracking layout, you not only make the document more functional and efficient but also ensure it reflects the unique needs and style of your business, ultimately improving your workflow and client communication. How to Organize Invoice Data EfficientlyEffective organization of financial data is essential for maintaining accurate records and ensuring smooth business operations. By structuring transaction information in a clear and logical manner, you can streamline your workflow, reduce the risk of errors, and easily access crucial details when needed. Proper data organization helps improve decision-making, timely payments, and overall financial management. Steps to Organize Data

|