Effective Invoice SMS Template for Quick Payment Reminders

In the modern business world, timely reminders are essential for ensuring that payments are made on schedule. One of the most efficient methods to reach clients is through quick and direct messaging, which can serve as an effective nudge for overdue bills or upcoming dues. These concise notifications offer a fast and reliable way to communicate financial matters with customers.

By crafting clear and professional messages, businesses can streamline their collections process and reduce late payments. Well-written reminders can enhance customer satisfaction while also maintaining a strong financial flow. The right approach can make all the difference in how clients perceive and respond to payment requests.

In this guide, we will explore how to create such messages, including tips for personalization, tone, and key details. Whether you’re looking to automate the process or manually send reminders, understanding the best practices will help you improve response rates and maintain positive client relationships.

Why Use Messaging for Payment Reminders

In today’s fast-paced world, reaching clients quickly and effectively is crucial when it comes to managing financial transactions. Traditional methods of communication, such as emails or letters, may not always deliver the urgency required to prompt timely payments. Short and direct messages offer an efficient solution, providing a quick way to remind customers about upcoming or overdue payments.

One of the main reasons businesses opt for this method is its high open and response rate. Unlike emails that can be easily ignored or lost in crowded inboxes, text messages are typically seen almost immediately, ensuring that important information reaches the customer without delay. This increases the likelihood of prompt action and reduces the time spent chasing late payments.

Additionally, using direct messaging allows for a more personal and immediate connection with clients. It shows that the business is attentive and professional, enhancing the overall customer experience. The simplicity and convenience of these reminders make them an ideal tool for businesses looking to streamline their payment collection process and improve cash flow.

Top Benefits of Messaging Reminders for Payments

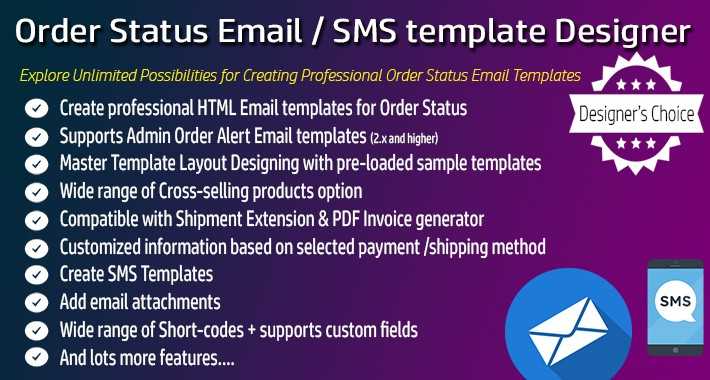

Automated messaging for payment reminders offers several advantages that make it an essential tool for businesses aiming to improve their collections process. These pre-written notifications not only save time but also ensure consistency and professionalism when communicating with clients. The ability to send concise, clear, and timely reminders can have a significant positive impact on cash flow and customer relationships.

Increased Efficiency and Time-Saving

One of the primary benefits of using automated reminders is the time it saves. By relying on a pre-made structure, businesses can quickly send multiple notifications without the need to craft each one individually. This process can be automated to trigger reminders at set intervals, reducing manual workload and allowing teams to focus on other essential tasks.

Enhanced Professionalism and Consistency

Using standardized reminders helps maintain a consistent tone and message across all client communications. This professional approach ensures that clients receive clear and respectful notifications every time, which can enhance the overall brand image. Additionally, businesses can tailor these reminders to fit the company’s voice, ensuring the right balance between formality and approachability.

By leveraging these messaging tools, companies not only reduce the risk of late payments but also foster stronger, more reliable relationships with their clients. With the ability to customize and automate, businesses can handle collections more effectively while maintaining a high level of professionalism.

How to Write an Effective Payment Reminder Message

Crafting a clear and effective message for payment reminders is crucial to ensuring timely responses from clients. A well-written message not only serves as a gentle nudge but also maintains professionalism while conveying all necessary details. The goal is to prompt action without sounding pushy or aggressive. Below are key steps to follow when creating an efficient payment reminder.

- Keep it Short and Clear: The message should be concise and to the point. Clients appreciate brevity, especially when it comes to financial matters. Avoid unnecessary details and focus on the essentials.

- State the Purpose Early: Begin the message by clearly stating the reason for the communication. Let the recipient know upfront that it’s a reminder about a payment, so they know exactly what to expect.

- Include Key Information: Make sure to mention the payment amount, due date, and any relevant reference number. Providing clear details helps avoid confusion and ensures that the client knows exactly what is expected.

- Offer a Call to Action: Encourage the client to take immediate action by including a clear call to action, such as a link to pay or instructions for transferring the funds. Make the payment process as easy as possible.

- Maintain a Professional Tone: While the message should be polite and respectful, it should also convey urgency where necessary. Strike a balance between being courteous and clear about the importance of timely payment.

- Personalize When Possible: If you can, add a personal touch, such as the client’s name or specific payment details. Personalized messages tend to get more attention and show that you care about the relationship.

By following these simple guidelines, you can write a payment reminder that is not only effective but also fosters trust and professionalism in your client relationships. Clear communication can make the difference between a delayed payment and a timely one.

Customize Your Payment Reminder Message for Clients

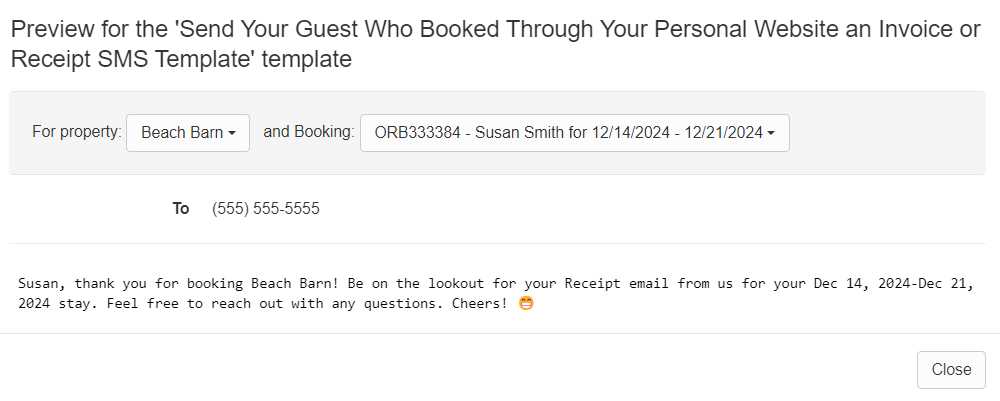

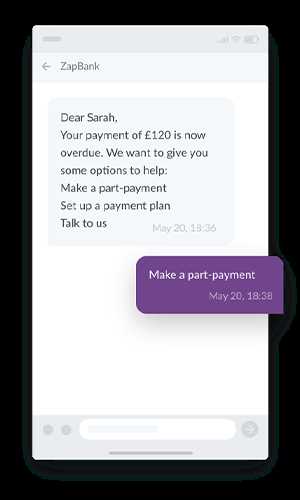

Personalization is key when it comes to sending payment reminders. A message that feels tailored to the recipient can build stronger connections and increase the likelihood of prompt action. Customizing your communication ensures that clients feel valued, and it also allows you to align the message with your brand’s tone and style. Whether you’re reaching out to a long-time customer or a new client, adding personalized touches can make your reminder more effective and engaging.

Include Client-Specific Details

To make the message feel more personal, always include important details such as the client’s name, the outstanding amount, and the specific due date. For example, instead of a generic reminder, you could write: “Hello [Client Name], just a reminder that your payment of [$XXX] is due on [Date].” This small detail helps clients feel that the message is meant specifically for them and not just a mass notification.

Adjust the Tone for the Client

The tone of the reminder should reflect the nature of your relationship with the client. For long-standing clients, a friendly and casual tone might be appropriate, whereas for new customers or those with overdue payments, a more formal and polite tone might be better suited. You can adjust the level of formality based on your knowledge of the client’s preferences and past interactions.

Customizing your payment reminders not only improves communication but also fosters trust and professionalism. Clients are more likely to respond positively when they feel they are being treated with respect and attention. By taking the time to personalize each message, you enhance your overall customer experience and encourage timely payments.

Best Practices for Sending Payment Reminders

Sending payment reminders is an essential part of maintaining a smooth cash flow, but it’s important to approach it strategically to maintain positive relationships with your clients. Effective reminders should be timely, professional, and clear, while also offering clients an easy way to act on the information. Adopting best practices ensures that your reminders are both effective and respectful, resulting in timely payments and minimal follow-up.

Timing is Key

One of the most important factors in sending payment reminders is timing. A reminder should be sent well before the due date to give clients enough time to prepare. Sending a follow-up message shortly after the due date can prompt quicker action if the payment has not yet been made. However, be careful not to send too many reminders or send them too frequently, as this can annoy clients and damage relationships.

Be Clear and Concise

Effective communication is crucial in payment reminders. Your message should be direct, without unnecessary details. Include the exact amount due, the due date, and any relevant reference numbers or information to help clients easily identify the payment. Ensure the call to action is clear–whether it’s a link to make the payment, bank account details, or instructions for the next steps.

By following these best practices, you can ensure that your payment reminders are effective, timely, and professional. Clear, respectful communication will not only encourage faster payments but also maintain strong and positive relationships with your clients.

Common Mistakes to Avoid in Payment Reminder Messages

Sending reminders for payments is a necessary part of business, but how you craft and send those messages can significantly impact their effectiveness. Many businesses make simple but costly mistakes that can result in late payments, miscommunications, or damaged client relationships. Avoiding these common errors ensures that your messages are both professional and effective in prompting timely action.

| Common Mistake | Consequences | How to Avoid |

|---|---|---|

| Vague or unclear message | Clients may not understand the specifics of the payment request, leading to confusion and delayed payments. | Be clear and concise. Include the exact amount due, due date, and any relevant payment instructions. |

| Sending reminders too late | Clients may not have enough time to process the payment, resulting in overdue bills. | Send reminders a few days before the due date and follow up shortly after if payment is not received. |

| Overloading the message with information | Too much information can overwhelm clients, making it difficult for them to find key details quickly. | Keep the message brief and focused on the essential payment details–amount due, due date, and payment method. |

| Using a harsh or aggressive tone | Clients may feel offended or pressured, which could damage the business relationship. | Maintain a polite and professional tone, even when the payment is overdue. Respectful language fosters cooperation. |

| Not providing payment options | Clients may be unsure of how to make the payment, leading to delays or confusion. | Clearly state the payment method options, and include any necessary links or instructions for easy payment. |

By avoiding these common mistakes, you can ensure your payment reminders are clear, effective, and professional. Properly crafted messages not only help improve cash flow but also strengthen client trust and satisfaction.

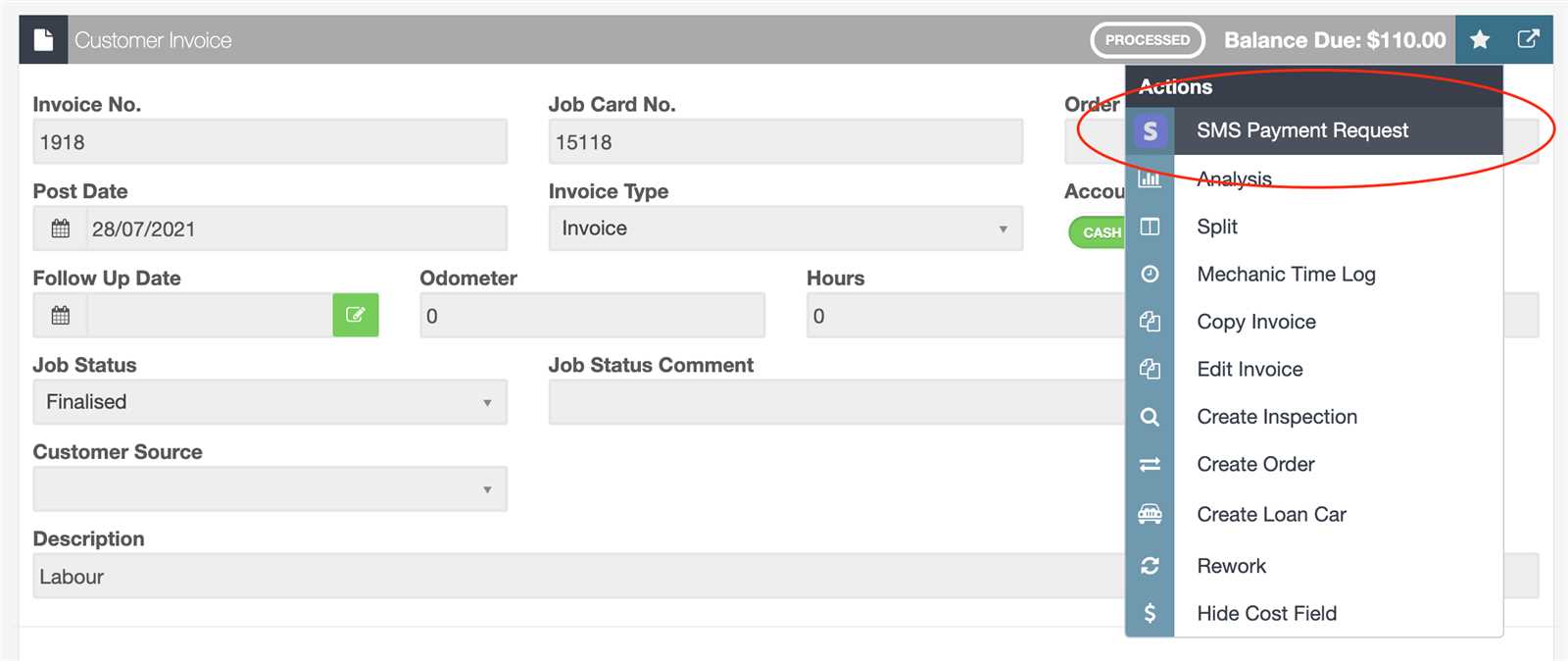

How to Automate Payment Reminder Notifications

Automating payment reminders is a powerful way to streamline your collections process, reduce manual work, and ensure timely follow-ups with clients. By setting up an automated system, you can schedule messages to be sent at specific intervals, allowing you to focus on other aspects of your business while still maintaining effective communication. Automation helps ensure that no client is missed and that reminders are sent consistently.

Steps to Automate Payment Notifications

Setting up an automated system for payment reminders involves several key steps. Here’s how you can get started:

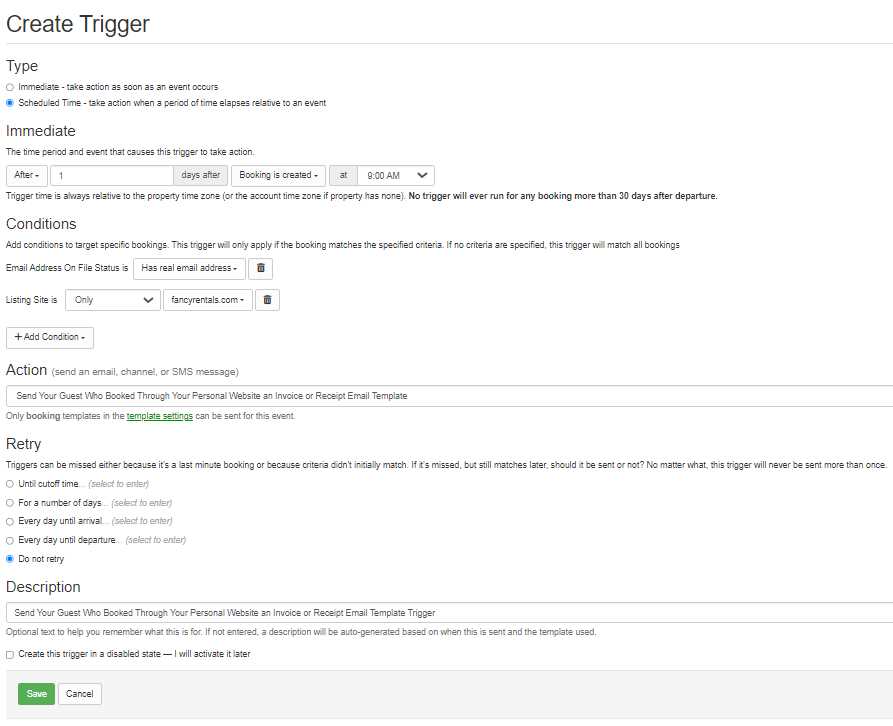

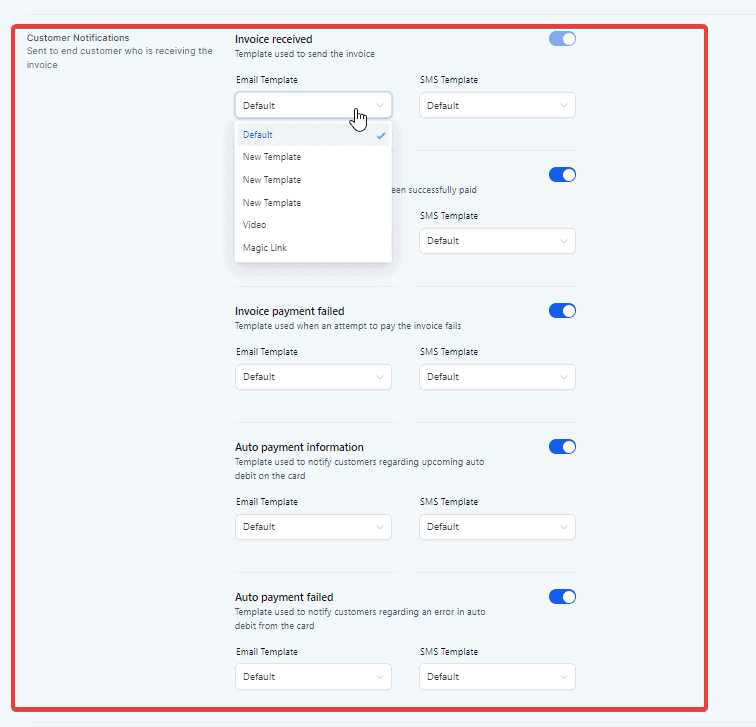

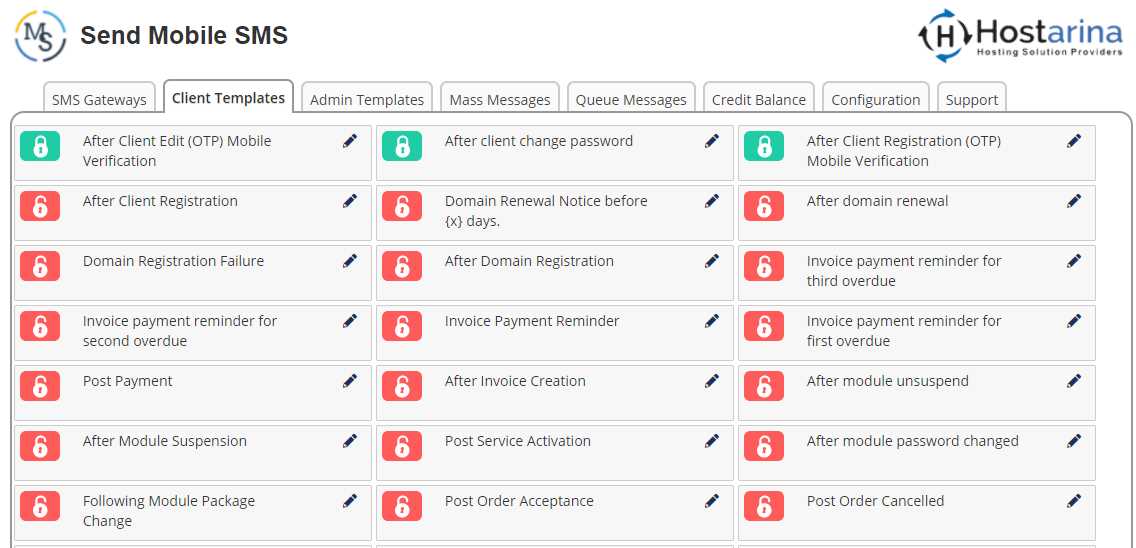

- Choose the Right Software or Platform: Select a tool that integrates with your accounting or CRM software to automatically pull payment details such as amounts due and due dates.

- Set Up a Trigger System: Define when you want reminders to be sent. You can set reminders a few days before the payment due date, the day it’s due, and a follow-up reminder after the due date has passed.

- Customize Your Messages: Even though the process is automated, make sure the messages are personalized for each client. Include their name, amount due, and relevant payment information to maintain professionalism.

- Monitor and Adjust: Regularly review the performance of your automated reminders. Adjust the frequency or message content as needed to improve response rates.

Benefits of Automation

Automating payment reminders offers several advantages:

- Time Savings: Automation eliminates the need to manually send messages, freeing up your time for other tasks.

- Consistency: Automated reminders ensure that no client is overlooked, and reminders are sent on time every time.

- Reduced Errors: Automation reduces the risk of human error, ensuring that payment details and deadlines are always correct.

- Improved Cash Flow: With timely, consistent reminders, clients are more likely to pay on time, leading to a healthier cash flow.

By automating payment reminder notifications, businesses can save time, reduce stress, and improve the efficiency of their collections process. This system not only helps maintain consistent communication but also boosts the likelihood of timely payments from clients.

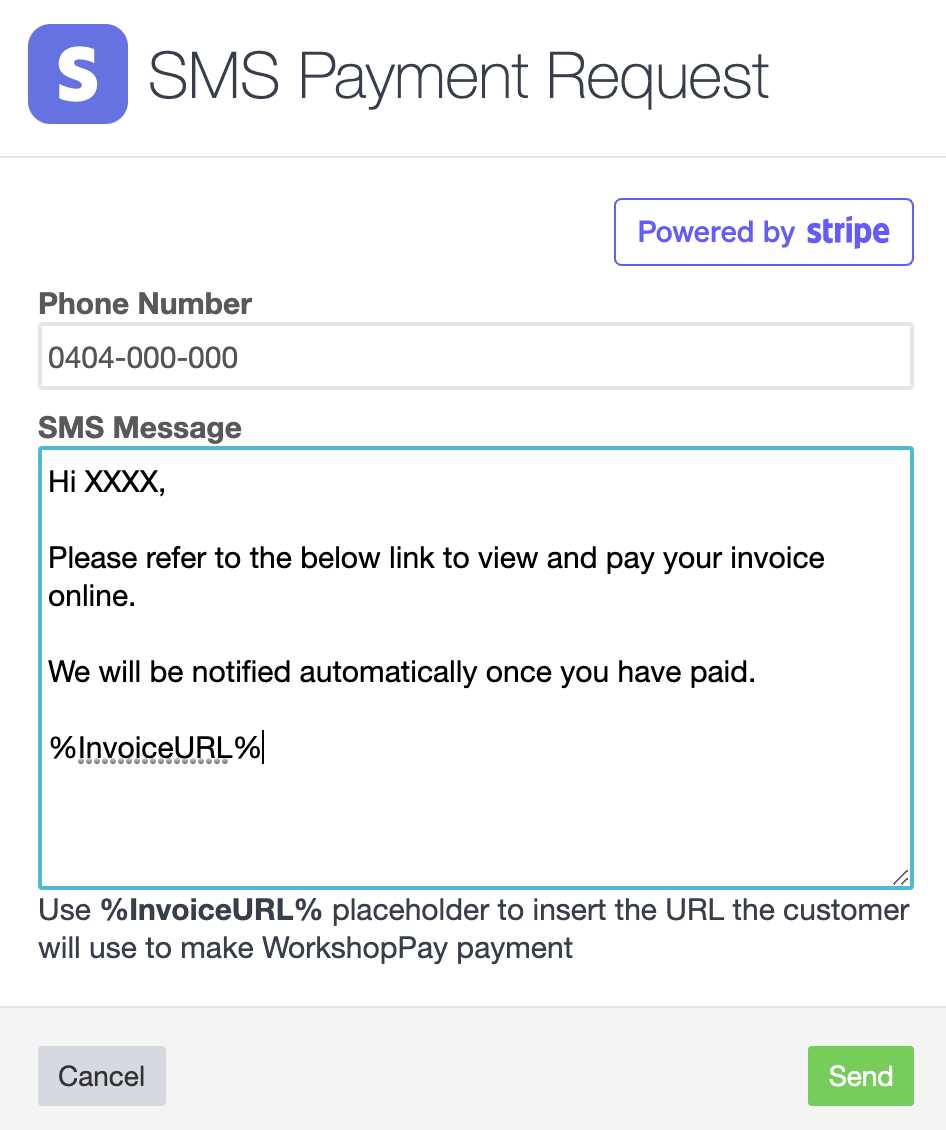

Why Text Messaging is Better Than Email for Payment Reminders

When it comes to reminding clients about outstanding payments, the method of communication plays a crucial role in ensuring timely responses. While email has long been a standard for business correspondence, text messaging offers distinct advantages that make it a superior choice for payment reminders. Understanding why this method is more effective can help businesses improve their collections process and boost cash flow.

Higher Open Rates

One of the main reasons text messaging outperforms email is its significantly higher open rate. Studies show that text messages are read within minutes of being received, with over 90% of messages being opened and read compared to emails, which can easily get lost in crowded inboxes. This immediate visibility means that clients are more likely to see a payment reminder quickly, increasing the chances of timely payment.

Faster Response Time

Text messages generally result in quicker responses. Clients are more likely to act on a payment reminder sent via text, simply because it’s more convenient and immediate. The simplicity of receiving a short message on their phone encourages faster action than reading through a longer email, which may be ignored or delayed. This can make a significant difference when it comes to minimizing late payments.

More Personal and Direct

Text messaging offers a direct, personal form of communication. A reminder sent via text feels more immediate and personal than an email, which can sometimes feel impersonal or formal. It helps businesses maintain a closer relationship with clients by communicating in a way that aligns with how people interact with their phones daily. The personal touch can encourage a positive response and foster goodwill with customers.

Convenience and Accessibility

Clients are more likely to have their phone on them at all times, making it easier to respond to a payment reminder via text, regardless of their location. Unlike emails, which may require access to a computer or specific apps, a text message can be read and responded to anywhere, at any time. This added convenience leads to better engagement and more timely payments.

In summary, while email remains an important communication tool, text messaging provides a faster, more effective way to ensure clients receive and act on payment reminders. With higher open rates, faster response times, and greater convenience, text messages are an invaluable tool for businesses seeking to streamline their payment collection process.

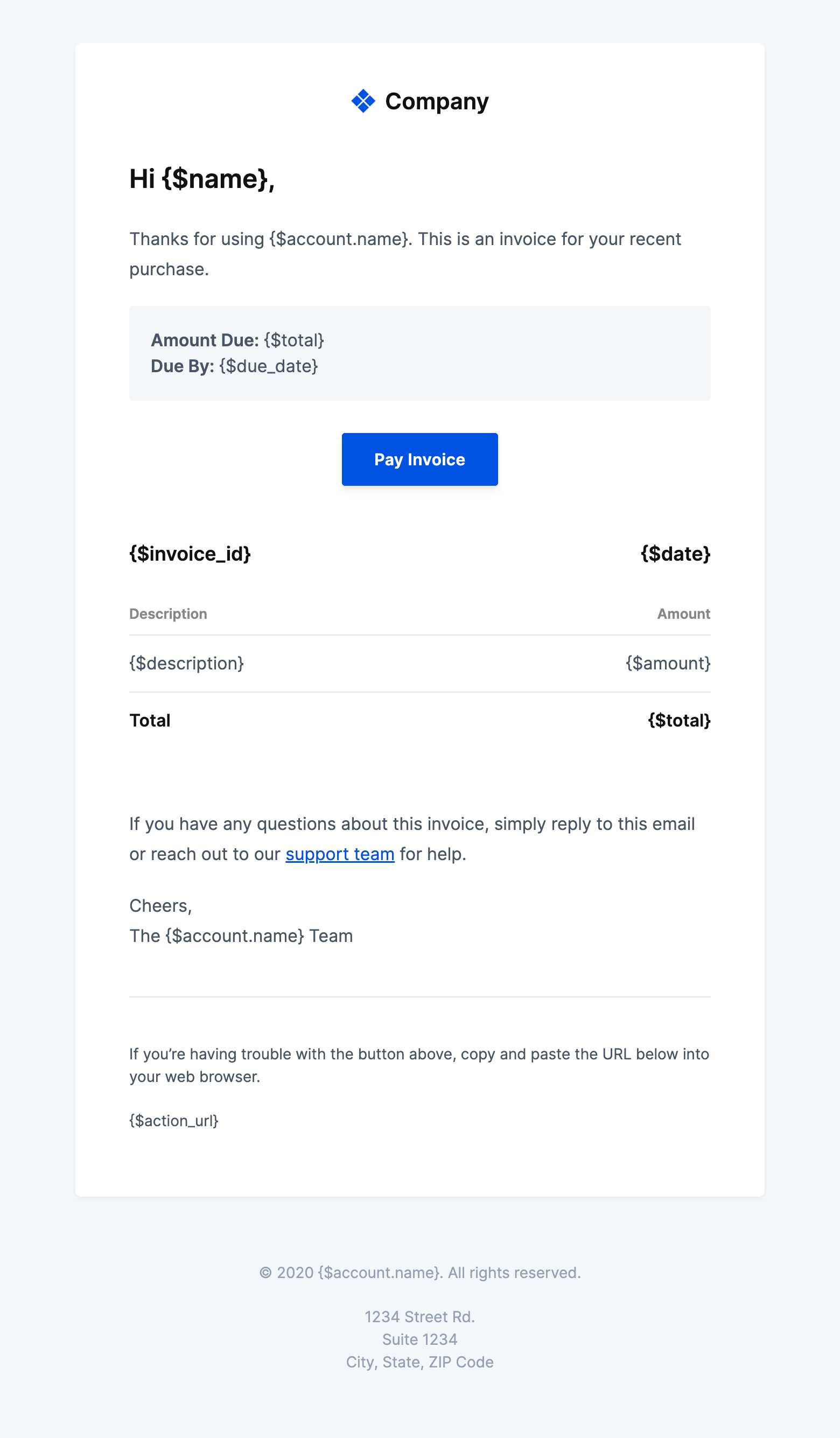

Creating a Professional Payment Reminder Message

When it comes to sending payment reminders, the way you communicate with clients plays a significant role in ensuring a positive response. A professional and well-structured message not only conveys the necessary details but also maintains your brand’s credibility and fosters trust. Crafting an effective payment reminder involves clarity, a polite tone, and all relevant information, without overwhelming the recipient.

The key to creating a professional message lies in maintaining a balance between being concise and thorough. A good reminder should include the following elements: the client’s name, the amount due, the due date, and payment instructions. Additionally, the message should be polite and respectful, avoiding any harsh language or demands, while still conveying the importance of timely payment.

Here are some tips for creating an effective payment reminder:

- Start with a Greeting: Address the recipient by name to make the message feel more personal.

- State the Purpose Clearly: Early in the message, mention the payment request, so the client knows the purpose of the communication immediately.

- Include Payment Details: Provide the exact amount due and any relevant details (invoice number, service rendered, etc.) to avoid confusion.

- Provide Easy Payment Instructions: Clearly explain how the client can pay (e.g., payment link, bank details, or phone number).

- Keep the Tone Polite and Professional: Even if the payment is overdue, maintain a respectful and friendly tone to preserve the client relationship.

By following these guidelines, you can craft messages that are both effective and professional, ensuring a higher chance of prompt payment while maintaining strong customer relationships.

Legal Considerations for Sending Payment Reminder Messages

When sending payment reminders via text or other messaging platforms, businesses must be mindful of various legal regulations to ensure compliance and avoid potential penalties. It’s important to recognize that communication related to payments is not only a business practice but also a matter governed by privacy laws and consumer protection regulations. Understanding these legal aspects can help prevent legal disputes and protect both your business and your clients.

Here are some key legal considerations to keep in mind when sending payment reminders:

- Consent for Communication: Always ensure that clients have agreed to receive payment reminders via text. This is often done through opt-in agreements, where clients explicitly agree to receive communications from your business via text message.

- Data Protection Laws: Be aware of privacy regulations like the GDPR (General Data Protection Regulation) in the EU or CCPA (California Consumer Privacy Act) in the U.S. These laws govern how you collect, store, and use client data. Ensure that any personal or financial information shared in messages is handled securely and in accordance with the law.

- Frequency and Timing of Reminders: Avoid excessive communication. Sending too many reminders or messages at inappropriate hours (e.g., late at night or early morning) could be considered harassment or an invasion of privacy. It’s important to respect clients’ time and avoid overwhelming them with constant reminders.

- Clear and Transparent Language: Ensure that the content of your messages is transparent and does not mislead the client in any way. Be clear about the amount due, the due date, and any applicable penalties or late fees. Misleading or deceptive language could lead to legal claims or regulatory scrutiny.

- Compliance with Debt Collection Laws: If you’re sending reminders for overdue payments, make sure you comply with applicable debt collection laws. In many countries, there are strict rules governing how businesses can communicate with clients regarding outstanding debts. This includes rules about tone, frequency, and the language used in communications.

By staying informed about these legal considerations and following best practices, businesses can reduce the risk of legal issues while maintaining a professional and respectful relationship with their clients. Always seek legal advice if you’re unsure about the regulations that apply to your specific industry or location.

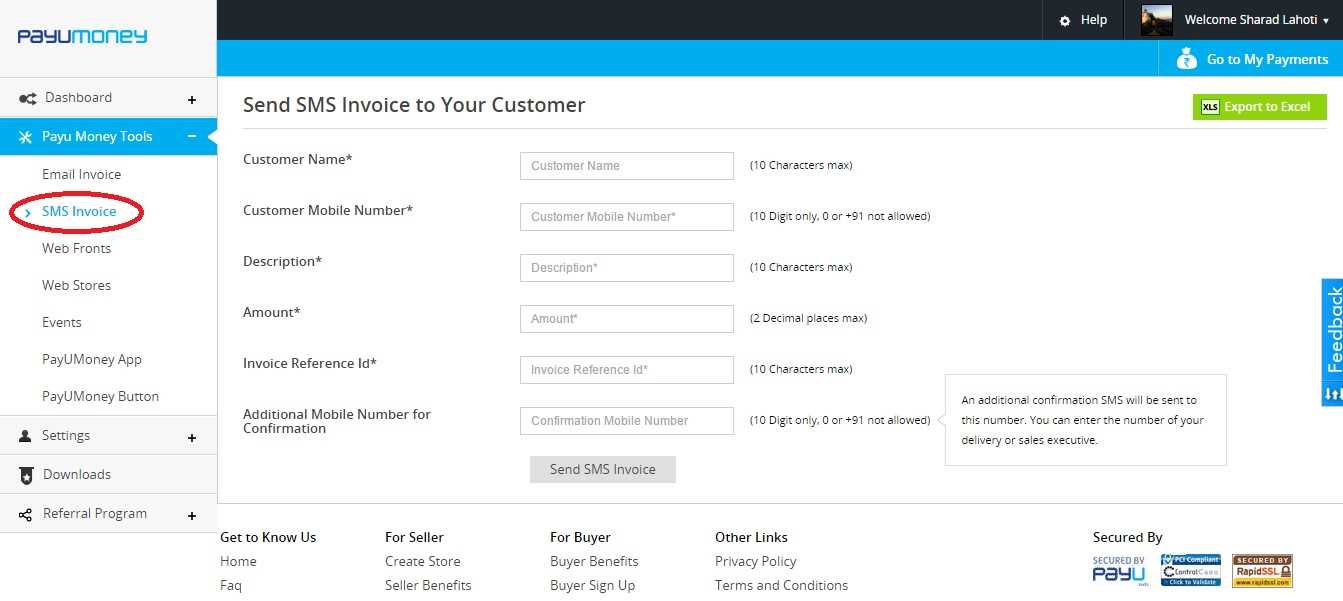

How to Include Payment Details in Payment Reminder Messages

When sending payment reminders via text, it’s crucial to include all necessary payment details in a clear and concise manner. Providing clients with all the relevant information they need to make a payment ensures that they can take action quickly and easily. The key is to avoid clutter while still covering all essential elements, such as the amount due, due date, and payment instructions.

Key Elements to Include

To ensure your payment reminder is complete and easy to follow, consider the following key elements to include in your message:

| Information | Why It’s Important |

|---|---|

| Amount Due | Clearly state the exact amount the client owes, so there’s no confusion. |

| Due Date | Provide the due date to remind the client of the deadline for the payment. |

| Payment Method | Include the payment options (bank details, link to online payment portal, etc.) to make it easy for the client to pay. |

| Invoice Number or Reference | Include any relevant reference numbers so the client can easily identify the payment. |

Best Practices for Clarity

When including payment details in a message, make sure the information is easily digestible:

- Be concise: Avoid overloading the message with unnecessary details. Keep the message to the point, focusing only on the essentials.

- Use a clear structure: Organize the details in a way that makes it easy for the recipient to find what they need (e.g., use bullet points or short sentences).

- Provide clear instructions: If clients need to take action, include a clear call to action, such as “Click here to pay now” or “Transfer to account number XYZ.”

By following these guidelines, you can ensure that your payment reminders are informative and straightforward, making it easier for clients to make prompt payments without confusion.

Personalizing Payment Reminders for Better Response

Personalization in communication can significantly improve client engagement and response rates, especially when it comes to payment reminders. By tailoring your messages to the individual needs and preferences of your clients, you can create a more positive and effective communication experience. Personalized messages feel more respectful and considerate, which can motivate clients to act quickly and settle outstanding amounts.

Why Personalization Matters

Personalizing your payment reminders shows your clients that you value them as individuals. It helps build stronger relationships and fosters trust, making clients more likely to respond promptly. A generic, impersonal message can feel like a mass notification, which may be ignored or delayed. In contrast, a personalized message conveys that the reminder is specifically meant for them, increasing the chances of a timely payment.

How to Personalize Your Messages

There are several ways you can personalize your payment reminders:

- Address the client by name: Start the message with the client’s name to create a personal connection and make the communication feel more human.

- Include relevant details: Refer to the specific product or service that was provided, and include the relevant transaction or reference number. This makes the message feel more individualized and prevents confusion.

- Tailor the tone: Adjust the tone of the message based on your relationship with the client. For instance, a long-term client may appreciate a friendly, informal reminder, while a newer or less familiar client may respond better to a more professional tone.

- Offer flexible payment options: If possible, provide tailored payment options that cater to the client’s preferences, such as different payment methods or installment plans. This can make the payment process easier and more convenient for them.

By incorporating personalization into your payment reminders, you can foster goodwill, improve communication, and increase the likelihood of prompt payments. A little extra effort in tailoring your messages goes a long way in building stronger, more positive relationships with your clients.

Integrating Payment Reminder Messages with Software

Integrating payment reminder messages with your business software can streamline your billing process and enhance communication with clients. By automating the creation and sending of reminders through your existing systems, you can save time, reduce errors, and ensure timely communication without needing to manually craft each message. This integration allows for a seamless workflow, improving efficiency and customer experience.

Benefits of Integration

Integrating payment reminder messages with your accounting, CRM, or ERP software offers numerous benefits:

- Automation: Automating the process of generating and sending reminders reduces manual work, enabling you to focus on more strategic tasks.

- Accuracy: Data pulled directly from your system ensures that the payment details are accurate, avoiding mistakes like incorrect amounts or outdated due dates.

- Consistency: Automated messages ensure that reminders are sent on time, every time, maintaining a consistent communication schedule with your clients.

- Customization: Integration allows you to personalize each reminder based on the client’s data, improving the relevance of your communication.

How to Integrate Payment Reminders with Software

Here’s a basic overview of how you can integrate payment reminders into your existing business systems:

| Step | Action |

|---|---|

| 1. Choose the Right Software | Select a CRM, ERP, or accounting software that supports message automation or integrates with third-party messaging services. |

| 2. Set Up Integration | Use API integrations or pre-built connectors to link your software with an SMS or email messaging platform. |

| 3. Define Triggers | Set up triggers within your software, such as due dates or payment status changes, to automatically generate and send reminders. |

| 4. Personalize Messages | Leverage customer data from your system to automatically fill in personalized details, such as names, amounts due, and due dates. |

| 5. Test and Monitor | Test the integration to ensure everything is functioning properly and monitor the effectiveness of your reminders over time. |

By integrating payment reminders with your business software, you can significantly improve the efficiency and effectiveness of your collections process. Automation and personalization not only reduce the burden on your team but also create a smoother, more streamlined experience for your clients.

Tracking and Analyzing Payment Reminder Message Effectiveness

To ensure that your payment reminder messages are achieving the desired outcomes, it’s crucial to track and analyze their effectiveness. By monitoring key metrics and gathering feedback, you can adjust your strategies to improve response rates, enhance customer satisfaction, and optimize your payment collection process. Tracking allows you to identify what’s working, what needs improvement, and where to focus your efforts for better results.

Key Metrics to Track

There are several important metrics that can help you assess the success of your payment reminders:

- Open Rate: This refers to the percentage of clients who open and read the message. A high open rate typically indicates that the message is reaching its intended audience.

- Response Rate: Track how many clients take action based on the reminder, such as making a payment or contacting your team for clarification.

- Payment Completion Rate: This metric reflects how many recipients of the reminder actually complete the payment. A high completion rate suggests that the reminder is effective in motivating clients to pay.

- Time to Payment: Measure the time it takes for clients to make a payment after receiving the reminder. A shorter time frame indicates that the message is prompting quick action.

- Client Satisfaction: If possible, collect feedback from clients about their experience with the payment reminder process. Understanding their satisfaction can help you refine your approach.

Methods for Tracking and Analyzing Effectiveness

To track and analyze the effectiveness of your payment reminders, consider the following methods:

- Use Analytics Tools: Many messaging platforms and CRM systems offer built-in analytics to track delivery rates, open rates, and responses. Leverage these tools to monitor performance.

- Monitor Payment Trends: Analyze your payment data to see if there is a noticeable improvement in the speed and frequency of payments after sending reminders.

- A/B Testing: Test different message formats, tones, or timing to see which variations yield the best results. This helps you fine-tune your strategy over time.

- Feedback Surveys: After receiving payment, consider sending a short survey asking clients about their experience with the reminder process. This will provide insights into how effective and user-friendly the communication was.

By consistently tracking these metrics and adjusting your approach based on the data, you can continually improve the effectiveness of your payment reminder messages, ensuring a higher success rate and better client relationships.

Improving Customer Experience with Payment Reminder Messages

Effective communication plays a key role in improving customer experience, especially when it comes to handling payment reminders. By providing clear, timely, and personalized reminders, businesses can create a more positive interaction that not only helps clients stay on track with their payments but also strengthens their overall relationship with the company. When done correctly, these messages can enhance satisfaction, reduce friction, and foster trust between your business and its clients.

How Payment Reminders Enhance Customer Experience

Sending well-crafted payment reminders can have a significant impact on your customers’ experience in several ways:

- Clarity: Payment reminders provide clear, concise information about what’s owed and how to pay. This reduces confusion and ensures that customers know exactly what is expected of them.

- Convenience: By offering reminders in a format that is easy to access and act on–such as via mobile–clients can quickly take action without having to search through emails or paperwork.

- Timeliness: Sending reminders at the right time–well before the due date and with sufficient lead time–ensures customers aren’t caught off guard, giving them enough time to process the payment and avoid late fees.

- Professionalism: Consistent, professional communication helps reinforce the business’s reputation and assures clients that they are working with a reliable and organized company.

Best Practices for Enhancing Customer Experience with Payment Reminders

To truly elevate the customer experience with payment reminders, follow these best practices:

| Best Practice | Benefit |

|---|---|

| Personalize the Message | Tailoring messages with the client’s name and relevant payment details fosters a more personal, respectful experience. |

| Provide Clear Payment Instructions | Including simple, actionable steps to complete the payment minimizes confusion and frustration. |

| Offer Multiple Payment Methods | Flexibility in payment options (e.g., credit cards, bank transfers, or online portals) increases convenience for the client. |

| Use Friendly Language | A polite, friendly tone in the reminder helps maintain a positive customer relationship while avoiding feelings of pressure. |

| Timing is Key | Sending reminders at optimal times–well before the due date and with ample notice–helps customers plan ahead and avoid late fees. |

By implementing these strategies, you can transform your payment reminders from simple notices into opportunities to improve your customer experience, building stronger, more positive relationships with clients while enhancing your overall paymen