Invoice Slip Template for Easy Billing and Customization

When managing finances, clear and structured billing is essential for maintaining smooth transactions between businesses and clients. A well-designed financial record not only ensures accuracy but also fosters professionalism. Whether you’re a small business owner or a freelancer, having a reliable system for generating and tracking payments is crucial to your workflow.

Designing custom forms for invoicing allows for easier data entry, quicker processing, and a consistent look that clients can trust. By choosing a suitable format and layout, you can streamline your accounting processes and improve your cash flow management. Such tools save time, reduce errors, and help you maintain organized records for future reference.

In this guide, we’ll explore how to create an efficient and professional billing document. You’ll learn how to customize your forms, adapt them to different industries, and avoid common mistakes that could cause delays or confusion. By following a few simple steps, you can create a system that works for you and your business needs.

Invoice Slip Template: A Comprehensive Guide

Managing financial records efficiently is key to smooth business operations. A structured document for billing ensures that all necessary details are captured and presented clearly. Whether you’re dealing with products, services, or both, having a professional document to outline the transaction can make a significant difference in how your business is perceived and how smoothly payments are processed.

In this guide, we will walk you through the essential elements of creating an effective financial statement. From layout design to customization options, you will learn how to adapt the document to meet your specific business needs. Additionally, we’ll cover the benefits of using a pre-made format, saving you time and reducing the chances of errors in your documentation.

With the right tools and a clear understanding of what to include, you can create a reliable record that facilitates smoother payments and helps maintain transparency with your clients. This guide will ensure that you know exactly what components to consider and how to use them effectively in your day-to-day operations.

What Is an Invoice Slip?

A billing document is a crucial part of any transaction between businesses and clients. It serves as a formal record that outlines the details of a sale or service rendered. This document not only ensures transparency but also facilitates payment tracking and accounting. The information included helps both parties keep accurate records for financial purposes and legal compliance.

Key Components of a Billing Document

Understanding the key components of a billing document is essential to ensure it serves its intended purpose. Each section provides critical information that helps clarify the terms of the transaction. Below is a table of common elements included in most professional billing documents:

| Section | Description |

|---|---|

| Header | Contains the business name, logo, and contact details for easy identification. |

| Client Information | Includes the name, address, and contact information of the recipient. |

| Details of Goods or Services | A breakdown of what was sold or performed, including quantities, rates, and descriptions. |

| Total Amount Due | Shows the total sum that the client owes, including any applicable taxes and fees. |

| Payment Terms | Specifies the due date, accepted payment methods, and any late fees or discounts. |

Why It’s Important

These records provide clarity and act as a legal proof of transaction, which can be referenced in case of disputes or audits. Having a well-organized billing document can help businesses maintain professionalism and build trust with their clients. Additionally, it helps streamline accounting and makes it easier to track payments, manage cash flow, and handle taxes.

Key Features of an Invoice Slip

Effective billing documents are designed to capture all necessary transaction details in a clear, organized manner. These records serve not only as a summary of the sale but also as a tool for tracking payments, preventing misunderstandings, and ensuring financial accuracy. The right format and key elements can make the difference between a smooth payment process and potential delays or confusion.

Clear Identification of both the seller and the client is essential. The document should prominently feature the business name, contact information, and logo, as well as the recipient’s details. This ensures that both parties can easily identify the transaction and communicate if needed.

Accurate Breakdown of the products or services is another critical aspect. Each item, its quantity, and its rate must be clearly listed. This allows the client to verify the purchase and helps avoid disputes over incorrect amounts. The inclusion of taxes and additional fees ensures transparency and completeness.

Payment Terms are another crucial feature that should never be overlooked. These terms outline when the payment is due, any penalties for late payment, and acceptable payment methods. This section helps set clear expectations and prevents confusion later on.

Total Amount Due should be clearly marked and easy to find. This section should include the sum of all items, taxes, and any additional charges, ensuring that the client knows the exact amount owed and can make timely payments. The document should also make allowances for any discounts or special offers that may apply.

Professional Design is just as important as the content. A well-structured, clean layout that is easy to read and navigate enhances the overall effectiveness of the document. The design should balance formality with clarity, making it both professional and user-friendly for both the issuer and the recipient.

Benefits of Using an Invoice Template

Adopting a standardized approach to billing offers numerous advantages for businesses of all sizes. A well-structured billing document helps streamline the process, reduces errors, and enhances the overall efficiency of financial transactions. By utilizing a ready-made format, you can save time, maintain consistency, and improve your professionalism in every transaction.

One of the primary benefits is time-saving. With a pre-designed structure, you don’t need to manually create each document from scratch. This allows for quicker generation of records and ensures that all necessary details are included, reducing the chances of forgetting important information.

Another significant advantage is accuracy. Using a predefined structure minimizes the risk of human error in data entry. A clear, consistent format ensures that all critical fields, such as quantities, prices, and total amounts, are correctly recorded every time. This reduces the likelihood of disputes with clients or delays in payments.

Additionally, a professional, cohesive layout enhances your brand image. A consistent, well-organized document reflects your commitment to detail and professionalism, which can improve client trust and satisfaction. It also allows you to easily customize the format to match your brand’s visual identity.

Below is a table outlining some of the key benefits:

| Benefit | Description |

|---|---|

| Time Efficiency | Pre-designed formats allow for faster document creation, saving time on repetitive tasks. |

| Consistency | Using the same format every time ensures consistency in your records and makes them easier to process. |

| Accuracy | Pre-filled fields help eliminate errors, ensuring that all data is correctly captured. |

| Professional Appearance | A well-designed document enhances your business image and builds trust with clients. |

| Customization | Formats can be easily tailored to meet specific business needs or to reflect your company’s branding. |

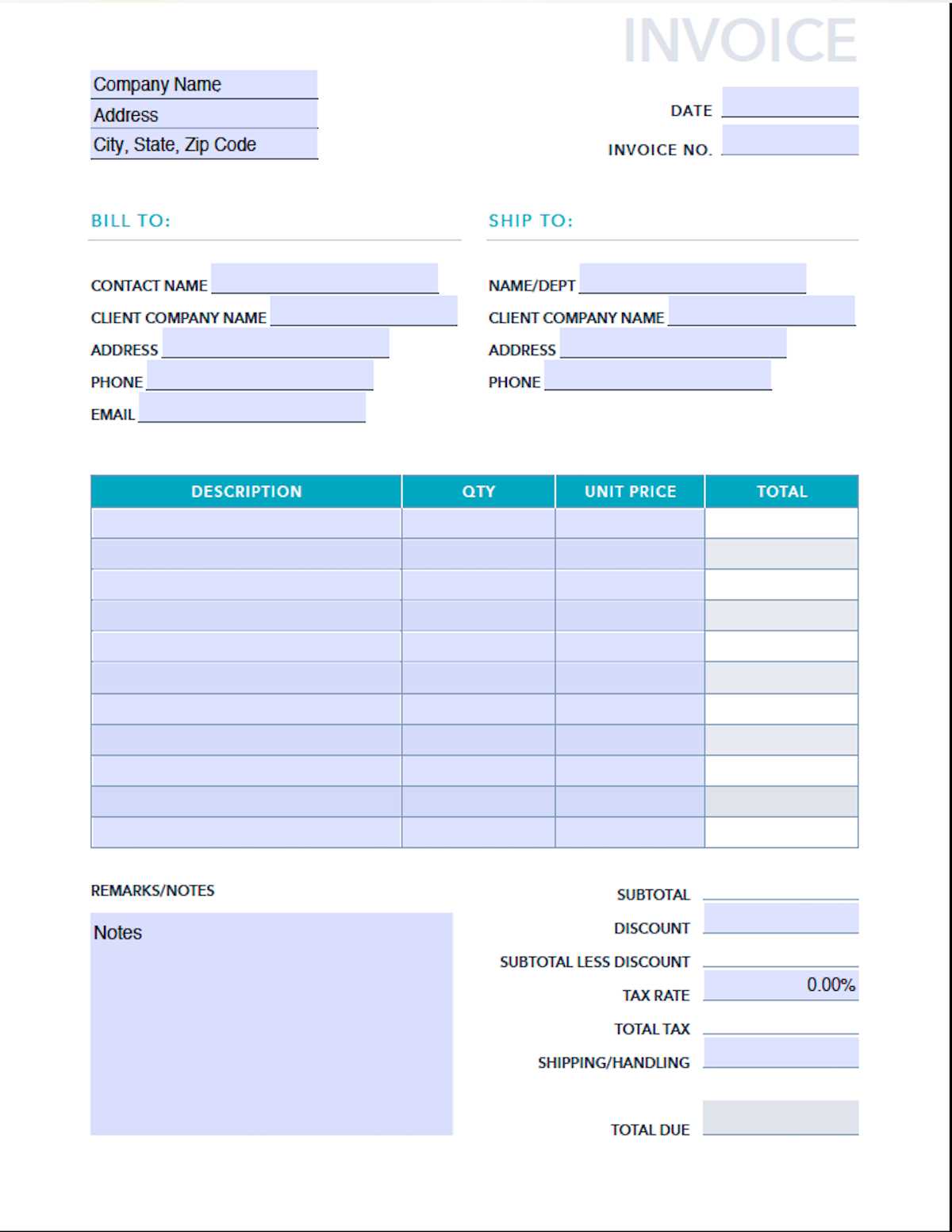

How to Create an Invoice Slip

Creating a professional billing document involves several key steps to ensure clarity and accuracy in your financial transactions. Whether you are handling a small-scale business or managing large accounts, the process of preparing a billing statement should be straightforward and efficient. A well-crafted document not only helps ensure smooth payments but also enhances your credibility with clients.

Step 1: Choose the Right Layout

The first step in creating a billing record is to choose a layout that suits your business needs. Many companies opt for simple, clean formats that display all essential details in an organized manner. Focus on the key sections such as your business information, the client’s details, the items or services provided, and the total amount due. A professional appearance and logical flow make the document easier to read and understand.

Step 2: Include Essential Information

Ensure that all necessary details are included to make the billing process transparent. This should cover:

- Business Information: Your company name, address, contact details, and logo should be clearly visible.

- Client Details: The client’s name, address, and contact information should also be listed accurately.

- Transaction Details: Provide a breakdown of services or products, including quantities, prices, and descriptions.

- Total Amount: Clearly state the total amount due, including applicable taxes, discounts, and any additional fees.

- Payment Terms: Indicate the due date, accepted payment methods, and any penalties for late payments.

By including all of these details, you create a comprehensive document that will serve as a clear record for both you and your client.

Step 3: Customize for Your Brand

Customizing the layout and design of your billing document can help reinforce your brand identity. Choose colors, fonts, and styles that match your company’s logo and overall aesthetic. This small touch can leave a lasting impression on your clients and make the document appear more professional.

Once you have the right layout and details in place, save your document in a reusable format, such as a PDF, to make it easy to generate for future transactions. Regularly update the document to reflect any changes in your business, such as new services or updated contact information, ensuring accuracy and professionalism with every use.

Choosing the Right Template for Your Business

Selecting the appropriate format for your billing documents is an essential part of maintaining a professional and efficient payment process. The right design can save time, reduce errors, and ensure that all necessary information is clearly presented. When choosing a format, it’s important to consider your business type, the complexity of your transactions, and your brand identity.

Consider Your Business Needs

The first step is to evaluate the specific requirements of your business. Not all companies need the same type of document. For example, freelancers and small businesses may require a simpler format, while larger companies with complex transactions may need more detailed layouts. Here are some factors to keep in mind when selecting the best format:

- Business Size: A small business might only need a basic document with minimal fields, while a larger organization may require additional sections for taxes, payment terms, or discounts.

- Type of Products or Services: If you sell a wide range of items, it may be necessary to have a more detailed breakdown with descriptions, quantities, and prices. For service-based businesses, a simple list of hours worked or services provided may suffice.

- Branding Requirements: Your document should align with your brand’s visual identity. Choose a design that reflects your logo, colors, and style, making it more recognizable and professional to your clients.

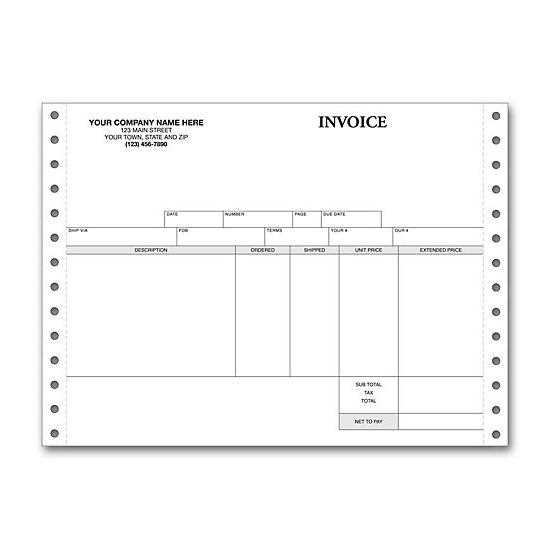

Choosing the Right Format

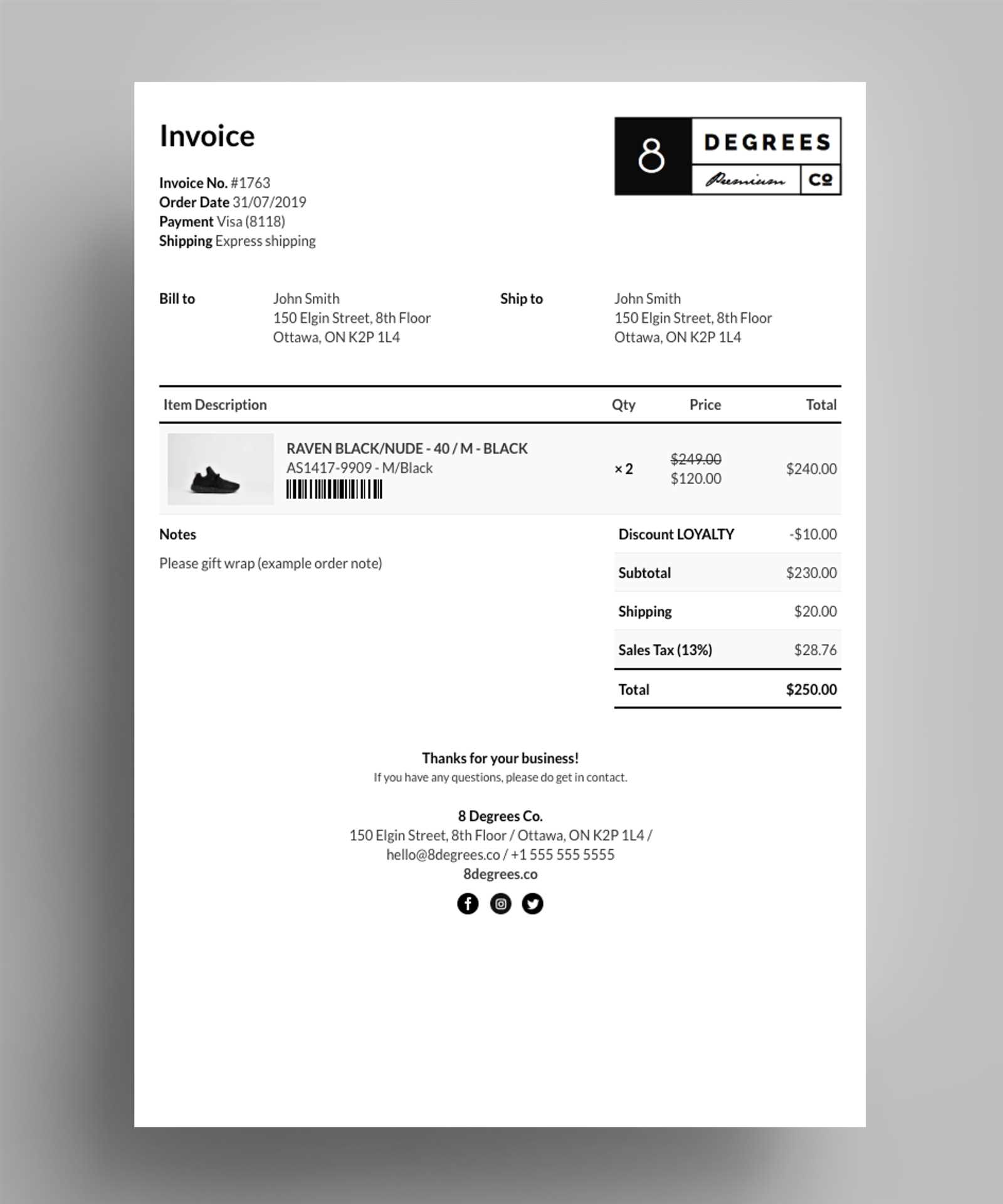

Once you’ve identified your business needs, the next step is selecting a format that supports those requirements. There are several types of formats available, from simple and straightforward to more detailed and complex designs. Here are a few options to consider:

- Simple Design: Ideal for small businesses or freelancers. It includes basic fields like business and client information, service details, and total amount due.

- Detailed Design: Best for larger companies or those with multiple services or products. This format often includes itemized lists, tax calculations, and sections for payment terms, discounts, and additional fees.

- Customizable Designs: If your business has unique needs, look for a design that can be easily customized. Many formats offer editable sections where you can add or remove details based on each transaction.

Choosing the right format ensures that your documents are not only professional but also effective in communicating the right information to your clients. Keep your design consistent and update it as needed to reflect changes in your business operations or legal requirements.

Customizing an Invoice Slip Template

Tailoring your billing document to suit your specific business needs is essential for creating a professional and effective communication tool. Customizing the layout and content not only helps you align with your brand but also ensures that all relevant details are easy to read and understand. By making adjustments to the design and structure, you can improve efficiency and create a document that works seamlessly for your transactions.

The process of customization begins with evaluating your business requirements. Whether you need to add additional fields, adjust the design to match your branding, or modify the structure for specific types of transactions, personalizing the format allows you to meet these needs. The goal is to create a document that is both functional and visually aligned with your company’s identity.

Here are some key areas to focus on when customizing your billing records:

- Branding: Incorporate your company’s logo, color scheme, and font style to create a cohesive, professional look that reflects your brand identity.

- Content Sections: Tailor the content sections to include any specific details relevant to your business. For example, you might want to add fields for discount codes, promotional offers, or specific service descriptions.

- Layout Adjustments: Adjust the layout to ensure clarity and ease of reading. You can rearrange sections, adjust font sizes, or add borders and lines to differentiate between key pieces of information.

- Legal and Payment Information: Customize the legal sections, such as payment terms or tax information, to ensure they are accurate and reflect your business practices and local regulations.

Once the customization is complete, ensure that the document remains simple and functional. Overcomplicating the design can detract from the purpose of the document, which is to communicate important details clearly. A clean, organized layout is always preferred over one that is cluttered or confusing.

Regularly review and update your documents to stay current with any changes in your business processes or legal requirements. With the right customization, your billing records can enhance your business image while streamlining your financial processes.

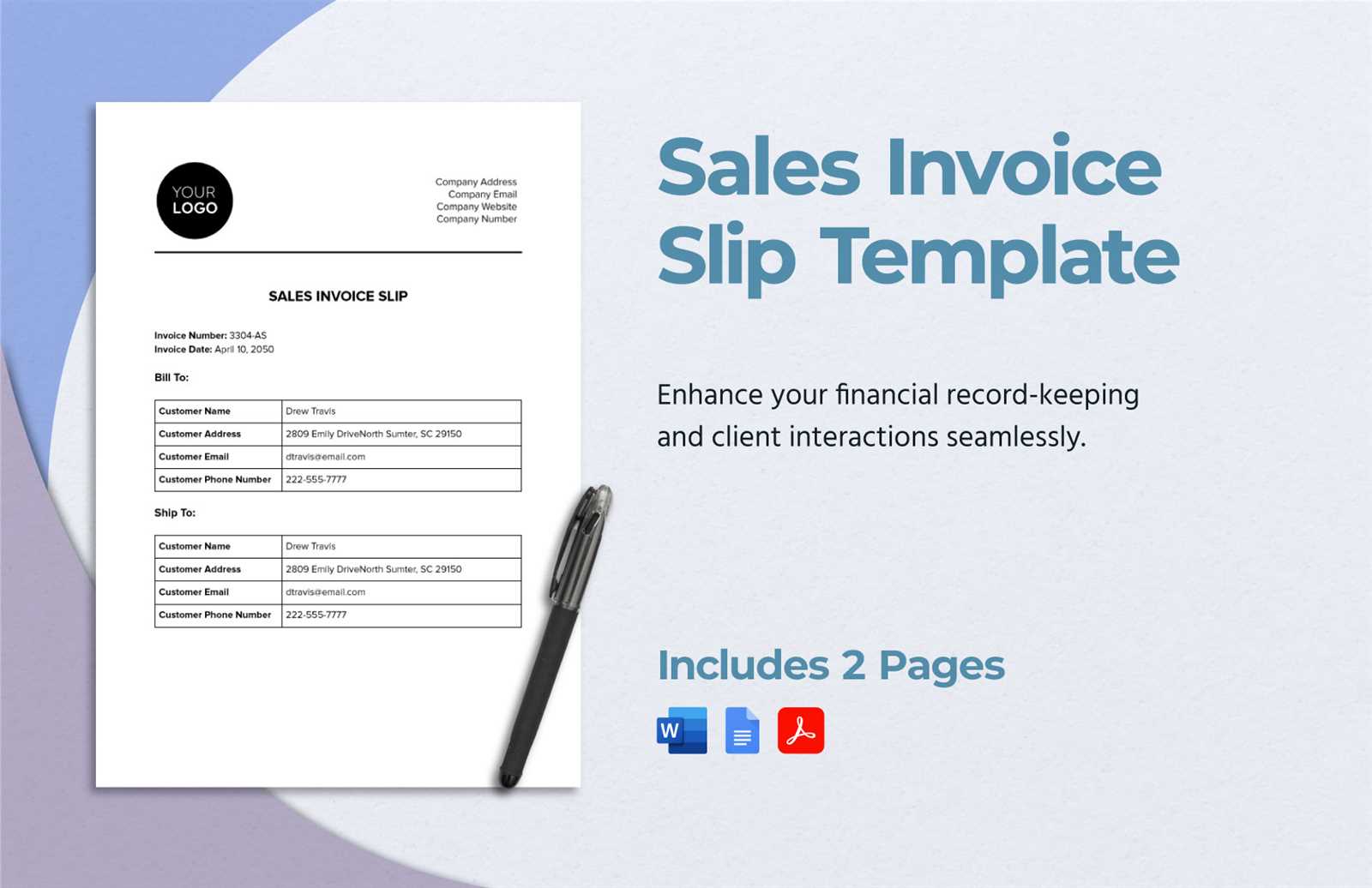

Free Invoice Slip Templates to Download

If you are looking to simplify your billing process without starting from scratch, there are numerous free resources available online to help you create professional records for your transactions. These downloadable formats are pre-designed and ready for use, saving you time and ensuring that you maintain a polished, consistent appearance in all your client communications. Whether you’re a freelancer, small business owner, or large enterprise, free formats can be customized to fit your specific needs.

Using a pre-made format can streamline your workflow by providing a simple, structured layout that includes all essential sections, such as client information, transaction details, and payment terms. These formats are designed to be user-friendly and adaptable, so you can modify them as necessary to suit your business style and requirements.

Below is a table that highlights some of the best free formats available for download:

| Resource | Description | Link |

|---|---|---|

| Simple Business Record | A straightforward layout perfect for small businesses or freelancers. Includes basic fields for transaction details and payment terms. | Download |

| Detailed Transaction Report | For larger businesses, this format includes additional fields for itemized lists, taxes, and special payment conditions. | Download |

| Customizable Professional Design | A highly customizable format that allows you to adjust fonts, colors, and sections to match your brand’s identity. | Download |

| Minimalistic Modern Style | A sleek, minimalist design for those who prefer a clean and contemporary layout without unnecessary embellishments. | Download |

By downloading and using these free formats, you can quickly generate well-organized documents for your business without having to invest in expensive software or spend excessive time on design. Simply choose the one that best fits your needs, customize it as necessary, and you’re ready to start streamlining your billing process.

How to Use an Invoice Slip Effectively

To maximize the impact of your billing documents, it’s crucial to use them effectively in your business operations. A well-structured document can streamline payment processes, improve client relationships, and ensure financial accuracy. The key is not only to create an accurate document but also to ensure it’s used consistently and in a manner that supports your business goals.

Here are some steps to help you use your billing records more effectively:

1. Ensure Clarity and Accuracy

- Double-check details: Always verify that all fields are filled in correctly, including client information, item descriptions, and payment terms. Mistakes can lead to confusion and delays in payment.

- Be transparent: Provide a detailed breakdown of services or products to avoid any ambiguity. This includes listing quantities, rates, taxes, and any discounts or additional charges.

- Use clear payment terms: Specify the due date, accepted payment methods, and any late fees or early payment discounts to avoid misunderstandings.

2. Consistent Use Across Transactions

- Standardize your format: Use the same layout for every transaction to ensure consistency and professionalism. This consistency makes it easier for clients to process and understand their payments.

- Regular updates: Keep your document up to date with any changes in your business, such as new services, adjusted prices, or updated terms and conditions.

- Track payments: Use your billing documents to track incoming payments. This helps you monitor outstanding balances and follow up with clients when necessary.

3. Delivering in the Right Manner

- Choose the right delivery method: Send your documents promptly after the transaction is completed, either by email or physical mail, depending on your client’s preference.

- Follow up on unpaid bills: If a payment has not been made by the due date, send a polite reminder with a copy of the document for reference.

- Store copies for records: Keep a digital or physical copy of all issued documents for your accounting records. This will help you in case of audits, disputes, or for tracking your cash flow.

By adhering to these steps, you can ensure that your documents are not only functional but also contribute to a smoother, more professional transaction process. Effective use of your billing records will not only help your business maintain its financial health but also build trust and reliability with your clients.

Common Mistakes to Avoid in Invoices

Even the most well-intentioned billing documents can sometimes contain errors that cause confusion or delay payments. These mistakes not only impact your cash flow but can also damage your relationship with clients. It’s essential to ensure that every detail is accurate and clearly presented. Here are some of the most common mistakes to avoid when creating a billing document.

1. Missing or Incorrect Contact Information

One of the simplest yet most critical mistakes is failing to include correct contact details. Both your business information and the client’s details should be clearly visible. Incorrect or missing addresses, phone numbers, or email addresses can lead to miscommunication and delayed payments.

- Ensure Accuracy: Double-check all contact details, including your business name, address, phone number, and email, as well as your client’s contact information.

- Use Clear Formatting: Display the contact details prominently at the top of the document to make them easy to find for both parties.

2. Lack of Detailed Descriptions

Another frequent mistake is not providing a clear breakdown of the goods or services provided. When you list only vague descriptions or omit essential information, clients may not fully understand what they are paying for. This can lead to misunderstandings or disputes.

- Provide Clear Descriptions: Make sure each product or service is described accurately with details such as quantities, unit prices, and relevant dates.

- Include Itemized Lists: If applicable, include an itemized list that separates the different goods or services provided, along with their corresponding rates.

3. Incorrect or Missing Total Amount

Another mistake is not clearly stating the total amount due or incorrectly calculating it. This is one of the easiest ways to cause confusion or delay in payment. Always ensure that the final total is prominently displayed, and the calculation is correct.

- Verify Calculations: Double-check the math to ensure that the sum of items, taxes, and additional charges are accurate.

- Highlight the Total: Make sure the total amount due is easily visible, ideally in bold or a larger font, so there’s no ambiguity.

4. Failing to Include Payment Terms

Many business owners overlook the importance of clearly stating payment terms. These terms set expectations around when the payment is due, how it should be made, and any penalties for late payments. If left unclear, it can lead to confusion and late payments.

- Clearly Define Payment Terms: Specify the payment due date, accepted payment methods, and any penalties for overdue payments.

Essential Information for an Invoice Slip

To ensure that your billing documents are clear, professional, and legally compliant, it is important to include specific key details. The right information helps both parties understand the scope of the transaction, sets expectations, and promotes timely payments. Whether you are billing a client for services rendered or products sold, certain elements are crucial for every document.

1. Business and Client Information

One of the most basic yet important sections is the contact information for both your business and the client. This ensures that both parties are correctly identified and can reach each other if needed. It’s essential for the document to include:

- Your Business Name: The full name of your business, as registered, should appear at the top of the document.

- Business Address: Include the physical address where your business operates, as well as any secondary contact details like email or phone number.

- Client Information: The recipient’s full name or business name, along with their address and contact details, should be clearly listed to avoid confusion.

2. Detailed Description of Goods or Services

Clear, detailed descriptions of the items or services provided are vital. This section helps your client understand exactly what they are being charged for, ensuring transparency and minimizing disputes. Key points to include are:

- Itemized List: A breakdown of each product or service with quantities and unit prices.

- Descriptions: A brief but clear explanation of each product or service to avoid misunderstandings.

- Dates: Include the date of delivery or service provision, especially for recurring services or long-term projects.

By providing detailed descriptions, you ensure that your client can easily understand the charge and verify the services or products they’ve received.

3. Payment Terms and Total Amount

It’s essential to make payment terms crystal clear to avoid any confusion. This section includes:

- Due Date: Clearly state when the payment is expected to be made. Typically, this is 30 days after the document date, but it can vary depending on the agreement.

- Payment Methods: Indicate the preferred payment methods, such as bank transfer, credit card, or online payment platforms.

- Total Amount Due: Highlight the final sum, including taxes, discounts, and any additional fees. Ensure the total is easy to find, possibly by bolding or underlining it.

Having a section that clearly lays out payment expectations will reduce misunderstandings and encourage prompt payments from clients.

Including all of these essential details ensures that your billing documents are both clear and professional. A well-structured document not only promotes smooth transactions but also enhances trust between you and your clients.

Design Tips for Professional Invoice Slips

A well-designed billing document not only looks professional but also makes the payment process easier for both you and your clients. A clean, organized layout can improve clarity, reduce errors, and create a lasting impression. The key is to balance aesthetics with functionality, ensuring that your document is both visually appealing and easy to read.

1. Keep It Clean and Simple

When it comes to design, simplicity is key. A cluttered document can confuse clients and obscure critical information. Focus on creating a layout that is easy to follow and doesn’t overwhelm the reader.

- Use Clear Sections: Divide the document into distinct sections (e.g., client information, itemized list, total amount). This helps the reader navigate easily.

- Avoid Overuse of Fonts: Stick to one or two fonts for consistency and readability. Too many different fonts can make the document look chaotic.

- Whitespace is Important: Don’t be afraid of blank space. Adequate spacing between sections and text makes the document more legible and visually pleasing.

2. Prioritize Readability

Making sure the document is easy to read is crucial. The design should facilitate quick understanding of the key details–especially the total amount due and the due date.

- Choose Legible Fonts: Select fonts that are easy to read, even at smaller sizes. Sans-serif fonts like Arial or Helvetica are good choices for clarity.

- Font Size and Weight: Use larger font sizes for headings and the total amount due. Make sure important information stands out.

- Align Properly: Ensure that text is properly aligned and that items are listed in a way that makes it easy to compare information (e.g., price per unit and total cost).

3. Use Your Brand Colors and Logo

Incorporating your business’s branding is an important part of professional document design. It reinforces your company’s identity and creates consistency across all your communications.

- Include Your Logo: Place your company logo at the top to create a strong brand presence. Make sure it’s clear and high quality.

- Color Scheme: Use colors that match your brand identity. Keep it subtle and professional–too many colors can distract from the content.

- Brand Fonts: If your brand has a designated font, use it to maintain consistency across all documents.

4. Add Necessary Legal and Payment Information

In addition to making the document visually appealing, it must contain all the required legal and payment details. This helps ensure compliance and sets clear expectations for both parties.

- Include Terms and Conditions: Clearly outline payment terms, such as due dates, late fees, and any discounts for early payment.

Invoice Slip Template for Small Businesses

For small businesses, maintaining professional billing documents is crucial for cash flow, organization, and customer trust. These documents serve as a formal request for payment and a record of transactions. Having a consistent and efficient structure is important, especially when managing multiple clients and small budgets. Customizing a billing document to fit the unique needs of your business can streamline your processes and ensure smooth operations.

Creating a straightforward, customizable document that meets your business needs doesn’t have to be difficult. By including all necessary details in a well-organized format, you can simplify the billing process and reduce errors. Whether you’re a freelancer, consultant, or product-based small business, having a clear, easy-to-understand format will help ensure that payments are processed without delay.

Here are a few essential features to consider when creating a billing document for your small business:

- Business Branding: Include your business name, logo, and contact details at the top to ensure your documents align with your brand identity.

- Client Information: Clearly list the client’s name, address, and contact details for easy reference.

- Service/Product Breakdown: Itemize the goods or services provided with accurate descriptions, quantities, and prices to avoid misunderstandings.

- Payment Terms: State your payment terms, including due dates and accepted methods of payment. Be clear about any penalties for late payments.

- Total Amount: Clearly display the total amount due, including any taxes, discounts, or additional charges.

By using a well-structured billing document, small businesses can stay organized, maintain a professional image, and avoid payment delays. Whether you use a template or create your own design, having a consistent, easy-to-read format is key to making the process seamless for both you and your clients.

How to Save Time with Templates

Running a business involves many time-consuming tasks, and creating billing documents is no exception. However, using pre-designed structures can significantly reduce the time spent on generating these documents. Instead of starting from scratch every time, templates allow you to automate and streamline the process, enabling you to focus more on your core business activities.

By using a standardized layout, you can avoid repetitive data entry, ensure consistency, and eliminate the risk of forgetting important details. Whether you’re billing multiple clients or managing ongoing projects, having a ready-to-use format can save you hours of administrative work each week.

1. Streamline Repetitive Tasks

One of the main advantages of using a pre-built document format is the ability to streamline repetitive tasks. Key information such as business contact details, tax IDs, and payment terms can be automatically inserted, saving time on each document.

- Fill in the Gaps: Only need to update specific fields like client names, dates, and amounts.

- Eliminate Redundant Work: No need to manually retype details that remain the same across documents.

- Consistency: Every document will have the same professional layout, ensuring consistency across all communications.

2. Improve Efficiency with Digital Tools

With the rise of digital tools, using electronic formats has become even more efficient. Instead of manually creating documents, you can input the data into software that automatically generates the final document in seconds.

- Use Software or Apps: Many platforms offer billing solutions where you can create, customize, and send documents in just a few clicks.

- Automate Client Information: Some tools allow you to store client information and recall it with a few clicks, further reducing the time spent on manual entry.

- Instant Updates: Make changes to your document template once and automatically apply them to all future bills.

3. Reduce Errors and Improve Accuracy

Using a pre-designed structure not only saves time but also improves the accuracy of your documents. Templates reduce the chances of human error, ensuring that important details like totals, tax rates, and client information are consistently correct.

- Reduce Typos: A template eliminates the risk of manual errors when entering information.

- Quick Calculations: Many digital templates come with built-in calculators, automatically updating totals and taxes as you input data.

- Minimize Omissions: Templates ensure that you don’t forget critical sections, such as payment terms or descriptions of

Invoice Slip Templates for Freelancers

For freelancers, managing administrative tasks like billing can quickly become overwhelming, especially when juggling multiple projects. Having a standardized billing format helps streamline the process, saving valuable time and ensuring that clients receive clear, professional documentation. With a reliable structure, you can focus more on delivering high-quality work and less on the details of each billing cycle.

A customized billing format allows freelancers to maintain consistency in their invoicing, making it easier to track payments and keep records organized. Whether you work in design, writing, or consulting, using a pre-made layout tailored to your needs simplifies the creation of accurate and timely requests for payment.

Key Elements for Freelance Billing Documents

When selecting a suitable document layout, freelancers should ensure it includes all relevant details that not only outline the services provided but also establish clear payment terms. Some important features to consider are:

- Personal Branding: Include your business name, logo, and contact information so clients can easily identify you and get in touch with any questions.

- Detailed Breakdown of Services: List each service you’ve provided with the corresponding rates to give the client a transparent view of what they’re paying for.

- Due Date and Payment Terms: Set clear expectations for when the payment is due and outline any late fees or discounts for early payments.

- Payment Methods: Include the preferred payment methods, such as bank transfers, PayPal, or credit card payments, for the convenience of your clients.

Why Freelancers Should Use Standardized Formats

Using a consistent, ready-made layout provides several benefits for freelancers. It helps maintain professionalism, reduces errors, and accelerates the invoicing process. With a pre-structured document, you don’t have to worry about forgetting critical information or retyping the same details over and over again.

- Consistency: A standardized format ensures that every invoice looks the same, which strengthens your brand’s image and provides clients with familiarity.

- Time Efficiency: Save time by using a pre-designed structure that can be quickly customized for each client.

- Reduced Risk of Errors: Having a consistent format minimizes the chances of making mistakes with payment details, client information, or totals.

By using a reliable billing document structure, freelancers can ensure they get paid on time while also presenting themselves as organized and professional. This simple tool can make a significant difference in how you manage your business finances.

Best Software for Creating Invoice Slips

When it comes to managing your business’s financial documents, using the right software can make all the difference. With the right tools, you can easily create, customize, and send professional billing documents to clients. These tools help streamline the process, save time, and ensure that every detail is accurate. The best software solutions provide an intuitive interface, templates, and automation features to make the entire billing process more efficient.

Choosing the right software depends on your specific needs, whether you’re a freelancer, small business owner, or part of a larger company. Here are some of the most popular and reliable software options for creating billing documents that can simplify the process and boost your business’s efficiency.

1. QuickBooks

QuickBooks is one of the most well-known accounting software solutions, offering a comprehensive suite of tools for invoicing, accounting, and financial reporting. It’s ideal for small business owners who need a powerful and easy-to-use platform to manage their finances.

- Features: Customizable invoices, automatic tax calculations, recurring billing, and integration with bank accounts.

- Benefits: QuickBooks offers cloud-based access, which means you can create and send documents from anywhere, and it syncs with other financial tools.

- Best For: Small to medium-sized businesses that need an all-in-one solution for accounting and invoicing.

2. FreshBooks

FreshBooks is a popular choice for freelancers and small business owners who need a simple and intuitive tool for creating billing documents. It allows you to generate professional invoices quickly and offers additional features like expense tracking and time management.

- Features: Customizable templates, time tracking, online payments, and recurring invoicing.

- Benefits: FreshBooks allows you to send invoices directly from the platform and track when they’ve been viewed by the client, ensuring timely payments.

- Best For: Freelancers and service-based businesses that need a straightforward invoicing and payment solution.

3. Zoho Invoice

Zoho Invoice is a user-friendly solution designed to help small businesses and freelancers create professional billing documents without the complexity of larger accounting tools. It’s available both online and as a mobile app, offering flexibility for users on the go.

- Features: Professional templates, automatic reminders, multi-currency support, and time tracking integration.

- Benefits: Zoho Invoice helps businesses stay organized with detailed reporting and analytics features, which help track income and expenses.

- Best For: Small businesses and freelancers looking for a free, easy-to-use tool with robust customization options.

4. Wave

Wave is a free accounting and invoicing software ideal for small businesses and freelancers looking for an affordable solution. It provides all the essential features needed to create professional documents and manage basic fin

How to Organize Your Invoices

Keeping track of your billing documents is essential for maintaining a well-run business. An organized system ensures that you can quickly access information when needed, stay on top of payments, and maintain accurate financial records. Whether you handle a few transactions or manage a larger volume, having a streamlined organization system will save you time and reduce the risk of errors.

To effectively organize your documents, consider implementing a method that fits your business needs. From digital tools to physical filing systems, there are various strategies to help you stay on top of your financial records. Below are some tips to help you get started with organizing your billing paperwork.

1. Choose a Clear Categorization System

It’s important to categorize your documents in a way that makes sense for your business. Clear categorization helps you easily locate any billing document when needed. Some common categories to consider include:

- By Client: Organize all documents related to a specific client together. This can help you track a client’s payment history and outstanding balances.

- By Date: Organizing by the issue date can help you track due dates and follow up on late payments.

- By Status: Divide your documents into categories like “Paid,” “Unpaid,” or “Pending,” so you can quickly see where each document stands.

2. Utilize Digital Tools for Better Tracking

Digital solutions offer a more efficient way to organize and track your documents. With the right software, you can create, store, and track all of your documents in one place. Key features of digital tools include:

- Automatic Sorting: Many software tools can automatically categorize and organize your documents based on criteria like client name, date, or payment status.

- Cloud Storage: Cloud-based systems allow you to store documents securely and access them from anywhere, which is ideal for businesses that are on the go.

- Searchable Archives: With digital systems, you can quickly search for a document by keywords or dates, saving you time compared to searching through physical files.

3. Keep Backup Copies

Whether you store your documents digitally or physically, it’s important to have backup copies in case of technical issues or data loss. Consider keeping both physical and digital copies for extra security. Here’s how you can ensure proper backups:

- Cloud Backup: For digital records, always ensure you have automatic cloud backups to prevent data loss.

- External Storage: Keep a physical backup of important documents in a safe, accessible place, such as a filing cabinet or external hard drive.

- Regular Updates: Make it a habit to periodically back up your data to ensure that you’re not missing any recent records.

4. Set Up a Regular Review System

Maintaining an organized system is an ongoing process. Set up a routine to regularly review your documents, ensure everything is properly categorized, and check for any overdue payments. By regularly reviewing your billing documents, you can stay ahead of potential issues and avoid accumulating a backlog of unpaid invoices.

- Monthly Reviews: Check all documents at the end of each month to ensure everything is up to date and no payments are missed.

- Quarterly Audits: Every few months, conduct a deeper audit of your billing system to identify any patterns, errors, or opportunities for improvement.

By implementing a simple and efficient organization strategy, you can ensure that your financial documents are easy to access, well-maintained, and up to date. This will help reduce stress, prevent payment issues, and

Legal Considerations for Invoice Templates

When creating and using billing documents, it’s essential to understand the legal requirements to ensure that your business remains compliant with relevant laws and regulations. These documents serve as official records of transactions and may be subject to specific rules depending on your location, industry, and business model. Failing to include the necessary details or using improper formats can result in legal complications or disputes with clients.

In this section, we’ll cover some of the key legal considerations to keep in mind when crafting professional billing documents. From ensuring correct tax calculations to safeguarding your business’s interests, being aware of these aspects will help you create legally sound documents that protect both you and your clients.

1. Essential Legal Information

Certain legal details must be included in your billing records to comply with business regulations. Missing information can create confusion and may even affect payment collection. Here are some critical components to ensure your documents meet legal standards:

- Business Identification: Include your official business name, address, and any relevant identification numbers such as tax IDs, VAT registration numbers, or business license numbers.

- Clear Payment Terms: Specify when payments are due, any late fees or penalties, and acceptable payment methods to avoid disputes.

- Tax Information: Depending on your location, it may be necessary to include applicable tax rates, tax amounts, and tax registration details to ensure compliance with tax laws.

- Invoice Number: Each billing document must have a unique number to avoid confusion and to assist with tracking payments for accounting purposes.

2. Compliance with Local Laws and Regulations

Different jurisdictions have different legal requirements when it comes to financial documents. Whether you operate locally or internationally, it’s important to understand and follow the specific laws that apply to your business. This includes things like:

- Tax Requirements: Tax laws vary by country, and in some cases, even by state or region. Be sure to apply the correct sales tax or VAT rates and follow rules about how taxes must be reported on billing documents.

- Record Keeping Obligations: Some countries require businesses to retain billing documents for a certain number of years for auditing and tax purposes. Make sure you keep your records in accordance with local regulations.

- Cross-Border Transactions: If you’re dealing with international clients, ensure your documents comply with international standards, including currency conversions, tax laws, and specific legal language.

3. Protecting Your Business Interests

Billing documents are not only a tool for tracking payments but also a way to protect your business from misunderstandings and legal disputes. Consider including these additional elements to safeguard your interests:

- Payment Deadlines: Clearly outline the expected payment date and any penalties for overdue payments. This can help prevent clients from delaying payments.

- Dispute Resolution Clause: Adding a clause specifying how disputes will be handled (such as arbitrat