Invoice Services Template for Efficient Billing Solutions

Efficient billing is a cornerstone of any successful business. A well-organized system can simplify the management of transactions, ensuring that payments are processed smoothly and clients remain satisfied. Adopting a standardized approach to documenting charges helps businesses save time and reduce the risk of errors, ultimately improving cash flow and operational efficiency.

Creating professional billing documents that are both clear and accurate is essential for maintaining strong client relationships. Whether you are a freelancer, a small business owner, or a large company, using a structured format for requests can help convey professionalism and trustworthiness. In addition, having a consistent system allows for easier tracking and management of payments.

Automation tools and pre-designed formats can simplify the process, allowing you to focus on more important aspects of running your business. These solutions offer customizable features that align with specific needs and preferences, ensuring that all critical details are included without the need for constant manual effort.

Invoice Services Template Overview

Creating consistent and professional billing documents is crucial for managing payments efficiently. An effective solution allows businesses to produce clear, accurate statements that streamline the financial side of operations. By using standardized formats, organizations can ensure that all necessary information is captured, reducing mistakes and speeding up payment processing.

Why Standardization Matters

Standardized billing documents offer several key advantages for businesses of all sizes. These include:

- Minimized errors in data entry and calculations

- Faster and more efficient payment processing

- Improved professionalism and client trust

- Easier integration with accounting systems

Core Features of Effective Billing Formats

An ideal system for managing financial requests includes several important features:

- Customizability: Ability to adapt the format to fit specific needs, such as adding or removing fields.

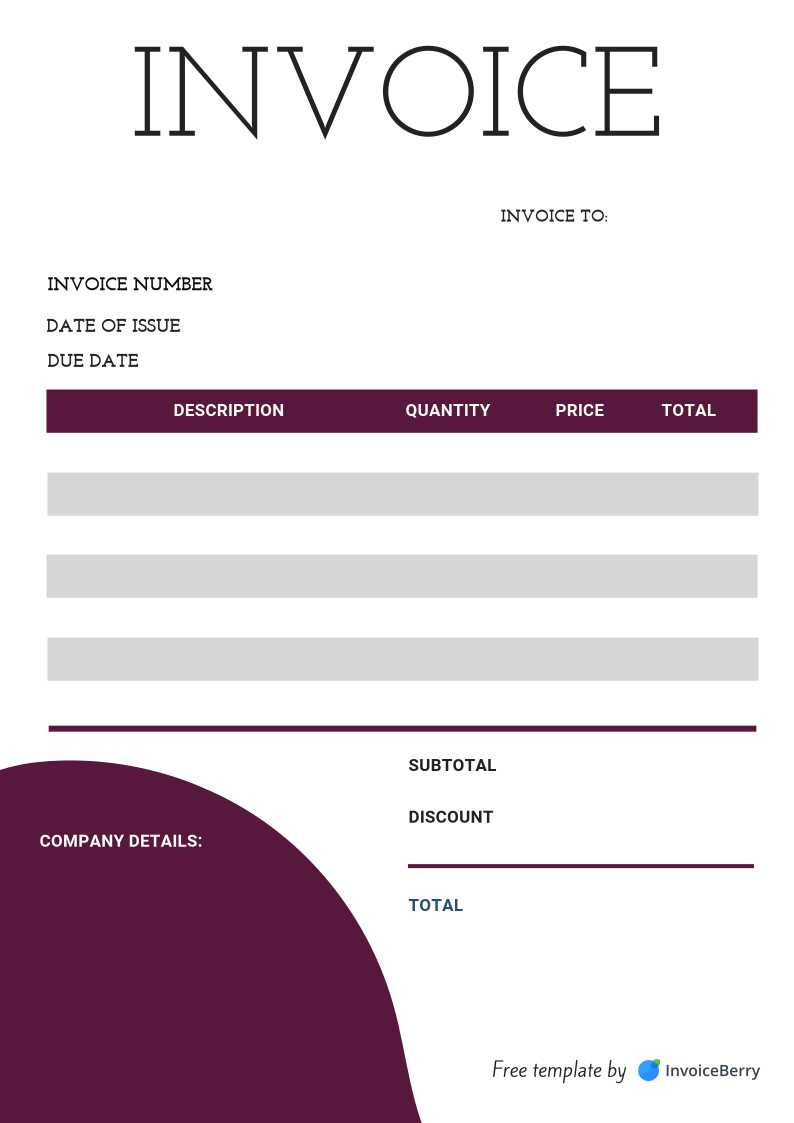

- Clear Layout: A structured, easy-to-read design that ensures all relevant information is clearly presented.

- Automated Calculations: Built-in functions that automatically calculate totals, taxes, and discounts.

- Consistency: Uniform structure across all documents, making it easier to track and manage finances.

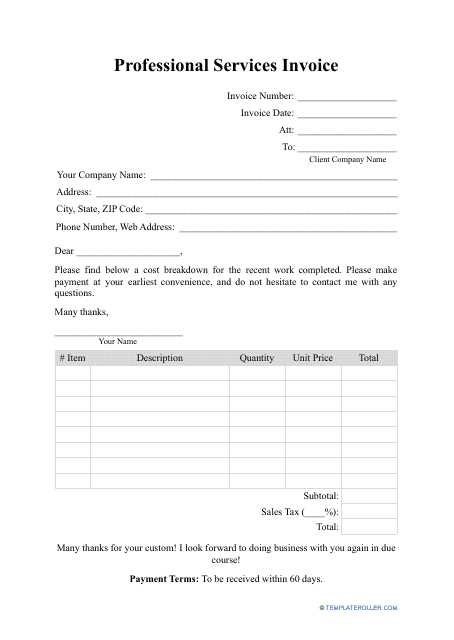

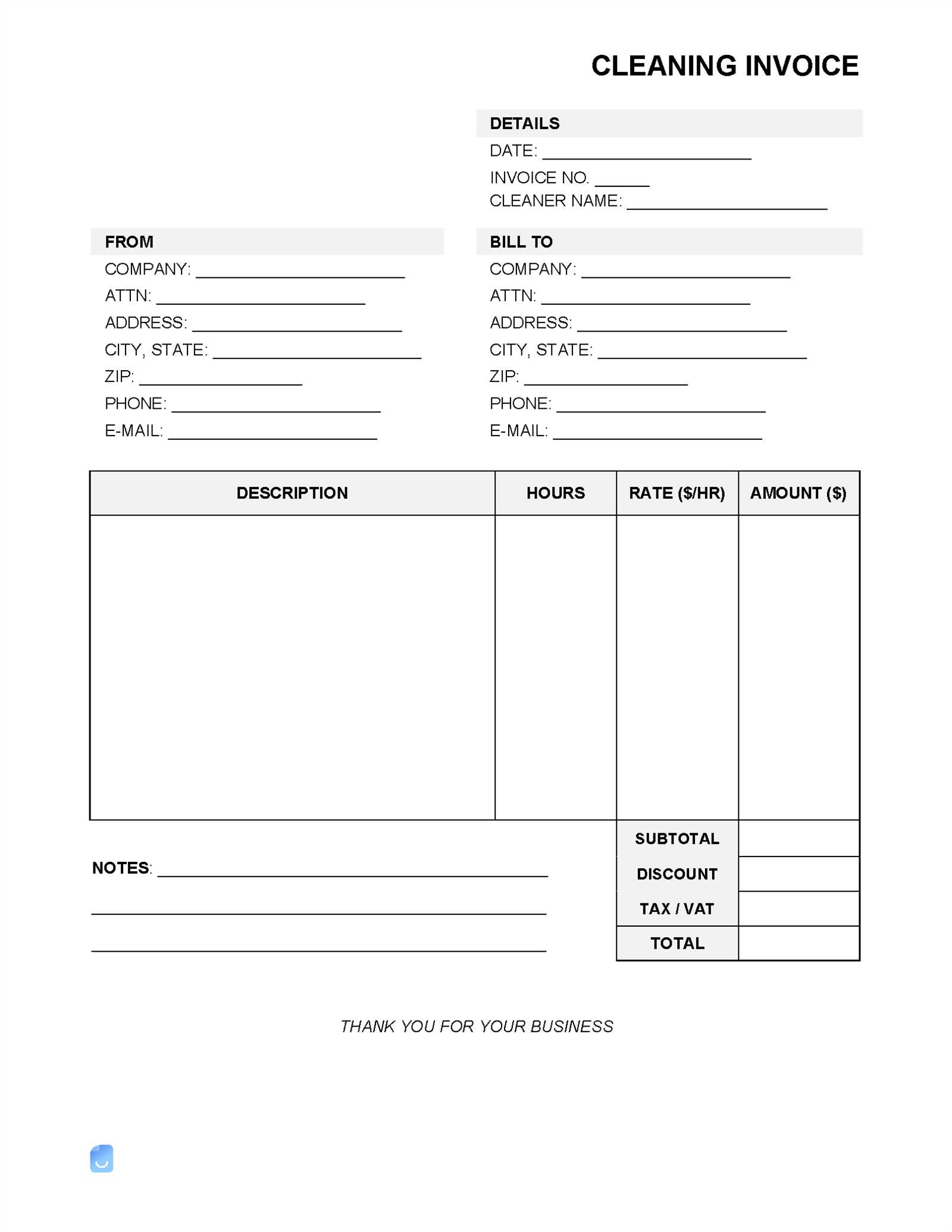

Key Features of an Invoice Template

When creating professional financial documents, it’s essential to include certain elements that ensure clarity, accuracy, and functionality. A well-designed billing document should contain specific features that facilitate both business operations and client communication. These characteristics help in presenting all necessary information in an easily digestible format.

Essential Elements for Clarity

To ensure that the document is straightforward and clear, it should contain:

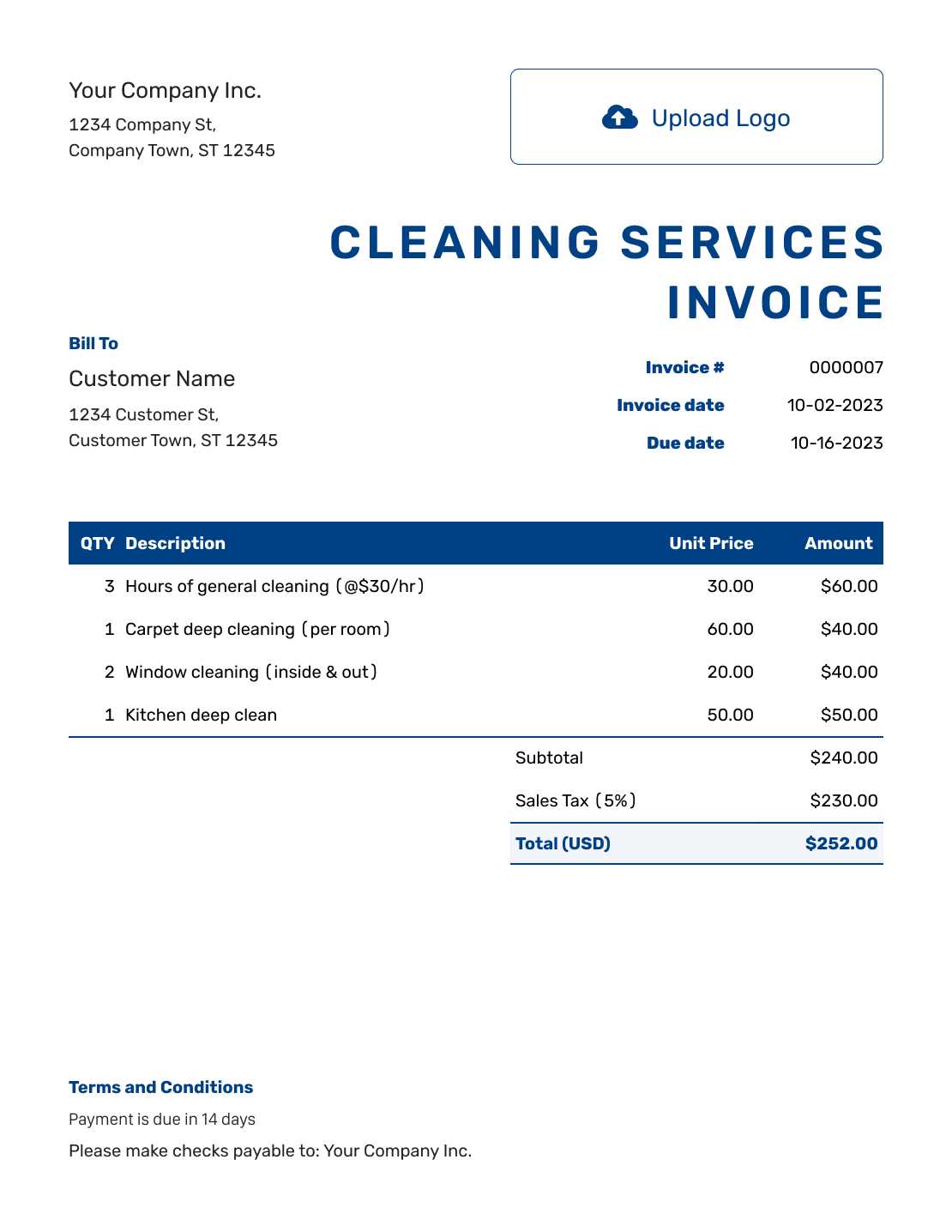

- Client and Company Information: Clear details about both parties, including contact information, are crucial for proper identification.

- Breakdown of Charges: A comprehensive list of services or products with itemized costs helps avoid confusion.

- Payment Terms: Explicit instructions about due dates, late fees, and acceptable payment methods are vital.

Functionality and Customization

For ease of use and adaptability, the document should also offer the following:

- Automated Calculations: Built-in formulas that automatically calculate totals, taxes, and discounts help eliminate errors.

- Customizable Layout: The ability to adjust fields to meet the specific needs of your business or client preferences.

- Professional Design: A clean and consistent layout that enhances credibility and makes a positive impression.

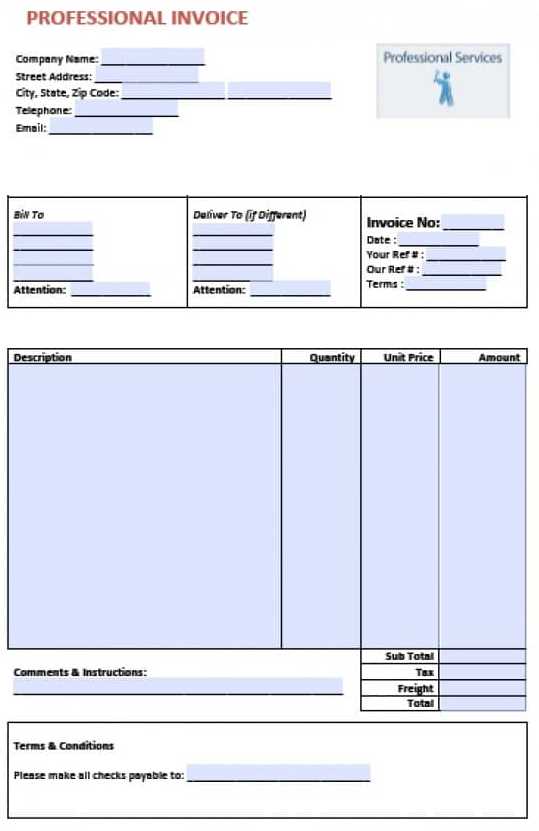

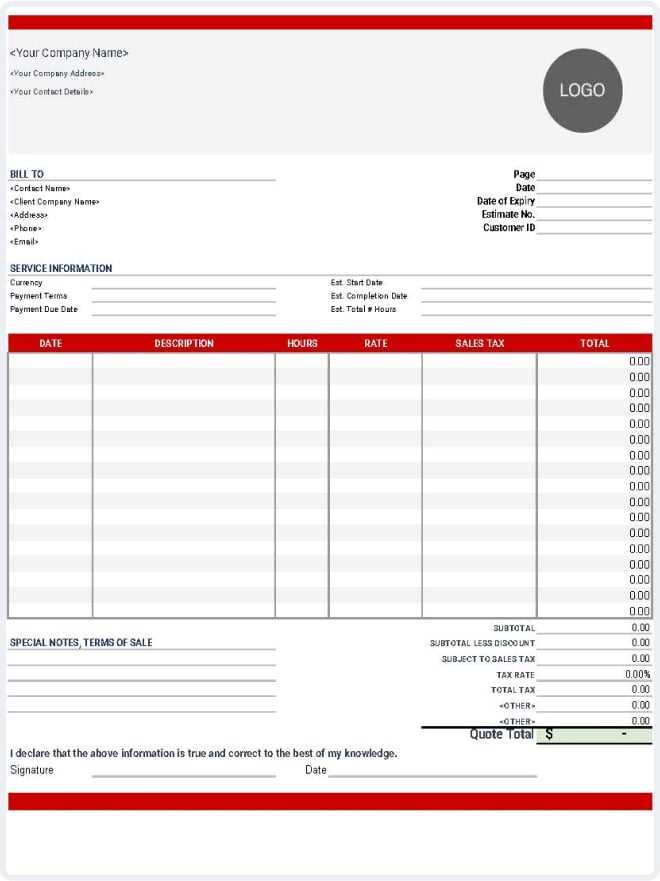

How to Customize Your Invoice Template

Adapting a billing document to fit your specific business needs can significantly enhance its functionality and presentation. Customization allows you to include relevant details and adjust the layout to suit both your preferences and your client’s expectations. This process not only ensures consistency across all documents but also helps maintain a professional image.

Adjusting the Layout and Design

One of the first steps in personalizing your billing document is to modify its design and layout. Consider the following:

- Logo and Branding: Add your company logo and adjust colors to match your brand identity.

- Text Alignment: Ensure all text is aligned properly for readability and a clean look.

- Font Styles: Choose fonts that are easy to read and consistent with your overall branding.

Customizing Fields and Information

Personalizing the information included in the document is key to ensuring it meets your specific requirements. Focus on:

- Additional Fields: Include extra fields for discounts, custom payment terms, or specific tax rates.

- Item Descriptions: Customize the item descriptions to provide more detail for each charge or service rendered.

- Client-Specific Details: Adjust the format to include unique client information, such as purchase order numbers or special instructions.

Benefits of Using an Invoice Template

Utilizing a standardized format for your financial documents brings numerous advantages, helping businesses streamline their billing processes. By relying on pre-designed formats, companies can save time, reduce errors, and ensure consistency in their communication. This approach not only improves efficiency but also enhances p

Choosing the Right Invoice Service Provider

Selecting the right solution for creating and managing your billing documents is a critical decision for any business. A reliable provider can streamline your financial operations, offering tools that enhance accuracy, reduce manual effort, and support a professional image. When choosing a provider, it’s essential to consider several key factors to ensure their offerings meet your specific business needs.

Key Considerations When Choosing a Provider

Before committing to a particular solution, evaluate these important aspects:

- Customization Options: Ensure the solution allows for flexibility in adjusting fields, layout, and design to suit your needs.

- Ease of Use: Look for a provider that offers a user-friendly interface with minimal learning curve for your team.

- Integration with Other Systems: Choose a provider whose platform integrates seamlessly with your accounting or payment processing tools.

- Customer Support: Make sure they offer reliable customer service and support channels in case of any issues.

Evaluating Additional Features

Besides the core features, consider these added benefits when choosing a provider:

- Automated Reminders: Some platforms offer automated payment reminders to reduce overdue payments.

- Multiple Payment Options: A good provider should enable your clients to pay via various methods, such as credit cards, bank transfers, or online gateways.

- Data Security: Ensure the provider follows best practices in securing sensitive client and financial data.

Common Mistakes in Invoice Creation

Creating financial documents might seem straightforward, but several common mistakes can lead to confusion, delayed payments, and even strained client relationships. Understanding and avoiding these errors is crucial for maintaining professionalism and ensuring smooth transactions. Below are some of the most frequent issues that arise during the creation of billing documents.

Missing or Incomplete Information

One of the most common mistakes is failing to include all necessary details. This can lead to delays in processing or even disputes with clients. Key items that are often overlooked include:

- Client Contact Information: Failing to list the correct details can cause confusion and delays in communication.

- Clear Item Descriptions: Not clearly describing the goods or services provided can lead to misunderstandings.

- Payment Terms: Omitting payment terms or unclear instructions can lead to late payments.

Calculation Errors

Another common issue is incorrect calculations, which can result in overcharging or undercharging. These errors may damage trust with clients. To avoid these mistakes, consider the following:

- Double-Check Totals: Always verify the total amount due, including taxes, discounts, and shipping costs.

- Automatic Calculations: Utilize automated tools to reduce human error in mathematical computations.

- Tax Rate Confusion: Ensure that the correct tax rates are applied based on the client’s location or industry standards.

Steps to Automate Invoice Generation

Automating the process of creating and sending financial documents can greatly improve efficiency, reduce human error, and save valuable time. By setting up an automated system, businesses can streamline their billing process, ensuring timely and accurate deliveries with minimal effort. Below are the key steps to help you set up automation for generating and sending your billing documents.

Step 1: Choose the Right Automation Software

The first step in automating the creation of financial documents is selecting the appropriate software. Look for a platform that suits your business needs, with features such as:

- Customizable templates: Ability to create unique documents tailored to your business style and client requirements.

- Integration with accounting systems: Ensure the software can sync with your existing tools for smooth data transfer.

- Automated data entry: Software that can pull customer and transaction details directly from your database to populate documents automatically.

Step 2: Set Up Billing Triggers

Once the software is in place, define the conditions under which your billing documents will be automatically generated. This may include:

- Payment Due Dates: Automatically trigger document creation when a payment is due or a project is completed.

- Recurring Payments: Set up automated generation for subscription-based or repeat transactions.

- Custom Triggers: Create personalized rules, such as generating documents after a specific milestone or customer action.

Step 3: Automate Delivery and Follow-Up

Automation doesn’t stop at document creation. The next step is to automate the delivery process:

- Email Notifications: Set up automatic email notifications to send completed documents directly to clients.

- Payment Reminders: Automate reminder emails or alerts when payments are due or overdue.

- Tracking and Reporting: Enable tracking features to monitor sent documents and follow up with clients as necessary.

How Invoice Templates Save Time

Using a predefined structure for creating billing documents significantly speeds up the process, allowing businesses to focus on other important tasks. By eliminating the need to design each document from scratch, time is saved at every stage of the creation process, from drafting to sending out. This efficiency translates into fewer administrative hours and faster transaction completion.

Faster Document Creation

One of the primary advantages of using a standardized structure is the time saved on document creation. Instead of manually formatting every new bill or statement, you can quickly fill in the necessary details such as client information, items, and amounts. The benefits include:

- Pre-set Layouts: Ready-to-use designs save time on organizing the layout each time a document is needed.

- Instant Data Population: Fields such as client name, address, and purchase details can be automatically filled based on the database or previous entries.

- Reduced Input Errors: With a set structure, you minimize mistakes that often occur when creating documents manually.

Streamlined Communication and Delivery

Once a document is created, the next step is delivering it to the client. With automated systems linked to predefined structures, businesses can speed up the communication process:

- Automated Sending: Pre-configured systems can automatically send completed documents to clients without manual intervention.

- Scheduled Follow-ups: Set up reminders or automatic follow-up emails to clients for payment tracking.

- Consistent Messaging: Using standardized formats ensures clear and professional communication every time.

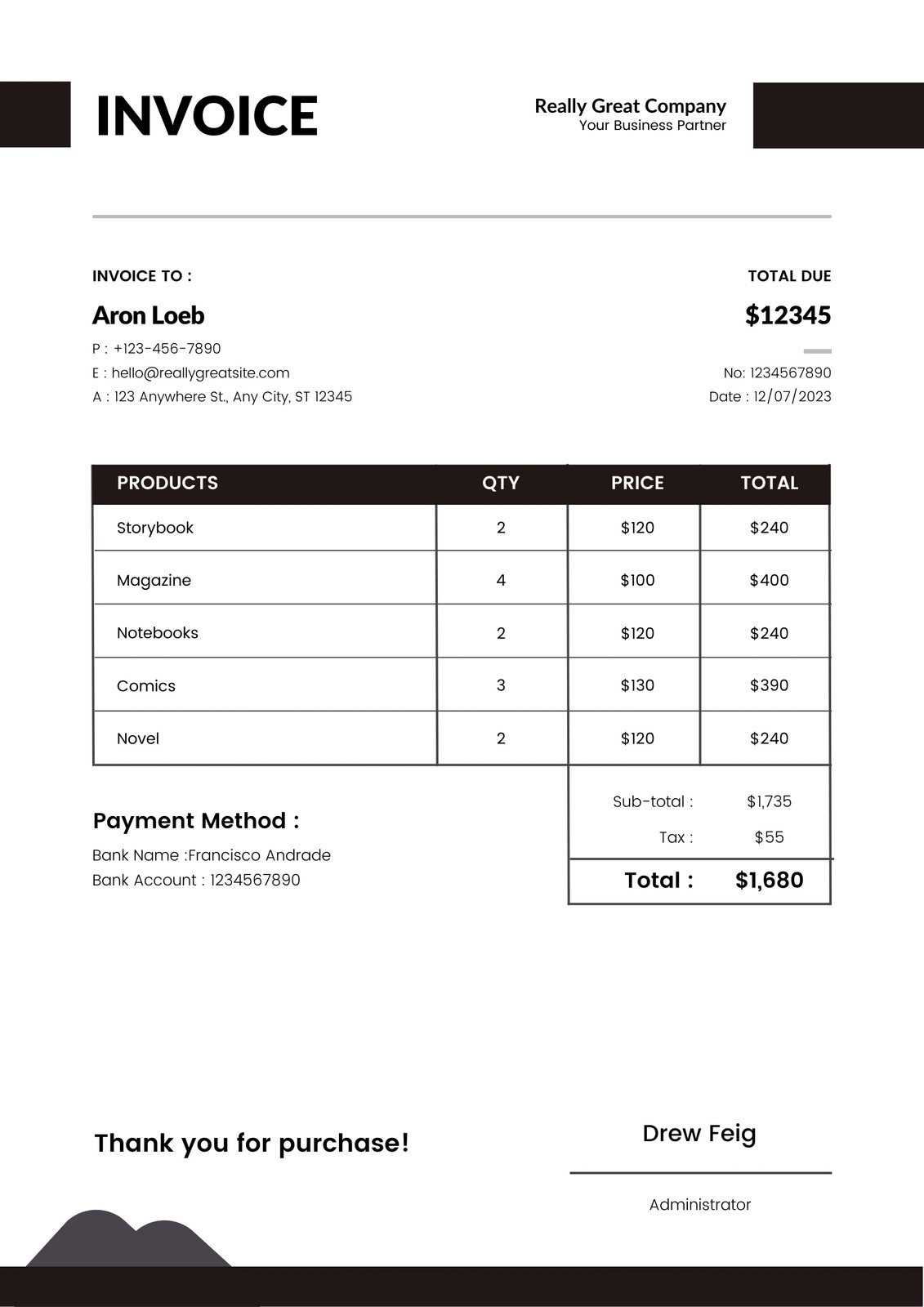

Best Practices for Professional Invoices

Creating well-structured and professional financial documents is essential for establishing trust with clients and ensuring smooth business transactions. By following best practices, you can enhance the clarity and efficiency of your billing processes. Proper formatting, clear details, and consistent branding contribute to a professional image and help avoid potential misunderstandings.

Essential Elements to Include

To maintain professionalism, every document should include specific key elements to ensure clarity and reduce disputes. These include:

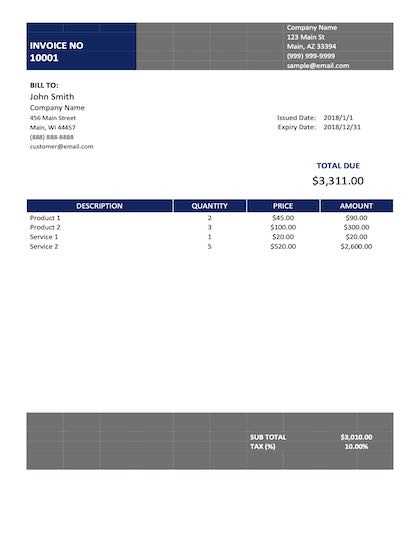

| Element | Description |

|---|---|

| Contact Information | Ensure both your business and client contact details are clearly displayed. |

| Unique Reference Number | Assign a distinct identifier to each document for easy tracking and reference. |

| Itemized List | Break down the products or services provided with clear descriptions and amounts. |

| Payment Terms | Include the due date, accepted payment methods, and late payment penalties if applicable. |

| Legal Information | If required, include tax numbers, business registration details, or other legal disclaimers. |

Maintaining Consistency and Clarity

Consistency is key in building a professional image. Be sure to use the same structure, fonts, and colors for all documents. The layout should be clean and easy to read, with a logical flow that guides the reader through the details. Remember to:

- Use clear headings and subheadings to organize information.

- Avoid clutter by leaving enough white space between sections.

- Double-check for any spelling or formatting mistakes before sending.

Integrating Invoice Templates with Accounting Software

Connecting billing document templates with accounting systems allows businesses to automate the transfer of financial data, reducing the chances of errors and speeding up the overall process. Integration ensures a seamless flow of information, enabling quick updates to financial records and easy tracking of payments. This connection offers businesses the efficiency they need to stay organized and responsive.

Advantages of Integration

By integrating billing document templates with accounting software, businesses can enjoy several benefits:

- Automatic Data Synchronization: Automatically populate billing documents with accurate client and transaction data directly from the accounting system.

- Reduced Manual Input: Decrease the need for manual entry, saving time and minimizing errors in both the documents and the financial records.

- Improved Accuracy: Integration ensures that all details, such as tax calculations and payment terms, are correctly transferred to the billing documents.

- Real-Time Updates: Changes made in the accounting system are reflected in the billing documents, ensuring that all information is up to date.

Steps to Integrate

To effectively integrate billing document templates with accounting software, follow these key steps:

- Choose Compatible Software: Ensure the accounting software supports integration with your preferred billing system or template tool.

- Enable Syncing Features: Activate the integration features within both platforms to allow for seamless data exchange.

- Map Data Fields: Match the relevant data fields in the accounting software (such as client names, amounts, and due dates) with those in the billing documents.

- Test Integration: Run tests to verify that the system is transferring the correct data and that all formats are correctly applied.

- Monitor and Adjust: Periodically check the integration for errors or updates, and adjust settings as needed to ensure smooth operation.

How to Ensure Invoice Accuracy

Ensuring the accuracy of billing documents is essential for maintaining a professional reputation and avoiding costly mistakes. Accurate records not only prevent payment disputes but also help to maintain transparency with clients. To achieve this, businesses must implement reliable checks and processes that ensure every detail is correct before sending out financial documents.

One of the best ways to ensure accuracy is by automating parts of the process. Using systems that auto-fill known information from previous records can reduce the risk of human error. It’s also important to regularly review documents and cross-check key details, such as amounts, dates, and client information. Establishing a systematic review process helps detect and correct discrepancies early.

Finally, always double-check the calculations, especially when taxes, discounts, or additional fees are involved. Taking time to verify each section can prevent mistakes that might otherwise lead to delays or miscommunications with clients.

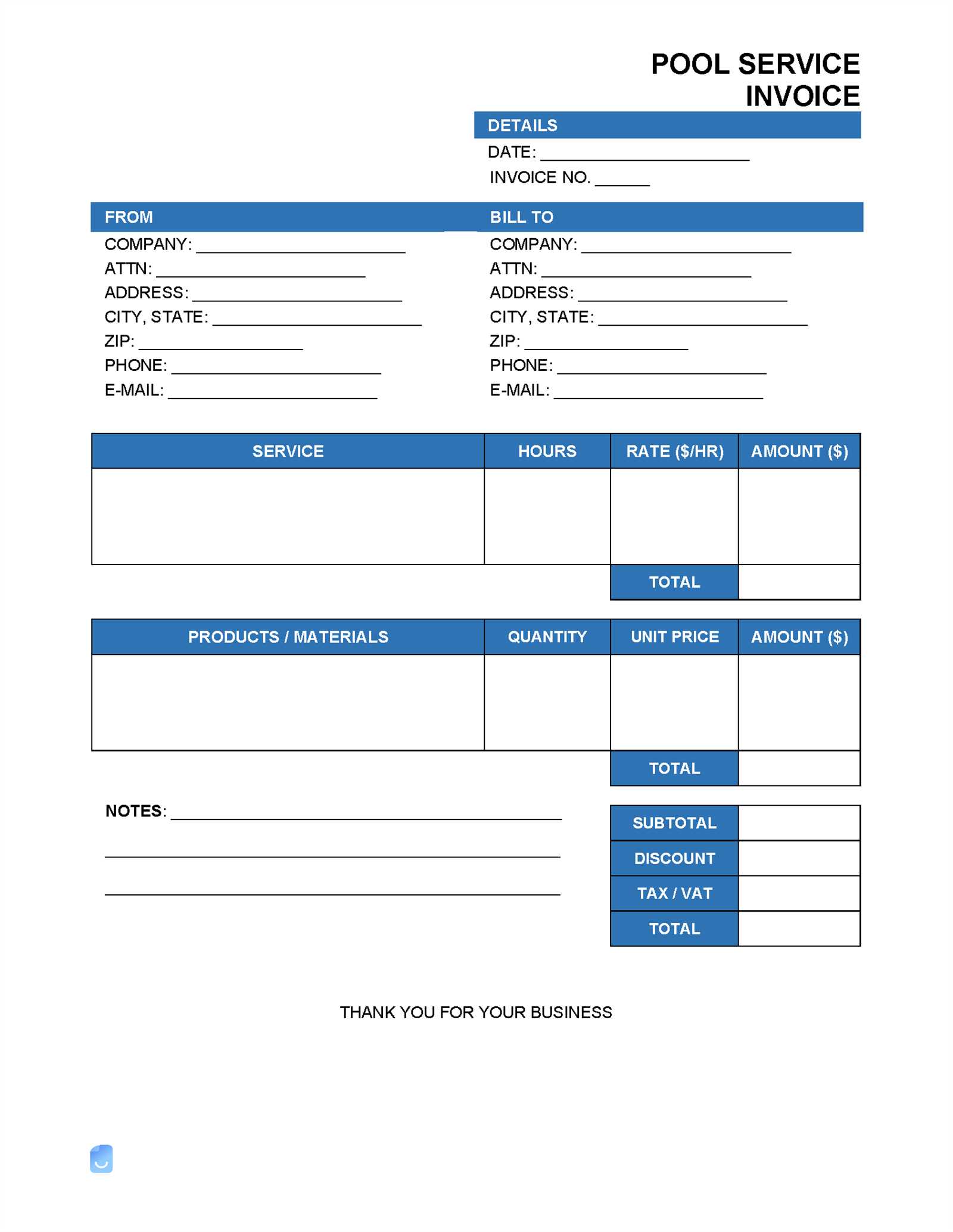

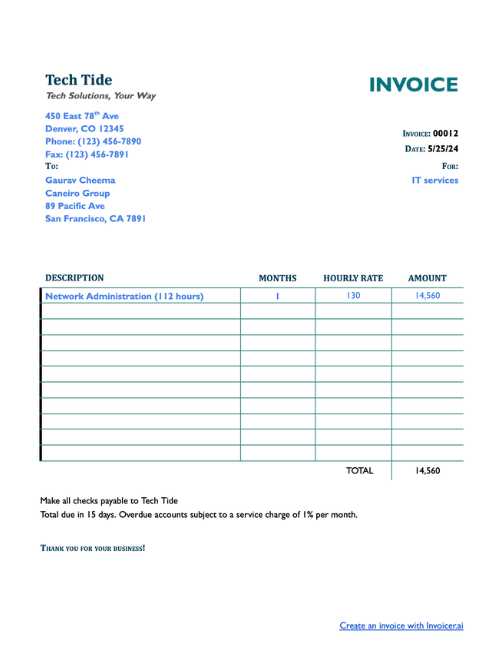

Invoice Template for Small Businesses

For small businesses, managing billing documents efficiently is crucial to ensure timely payments and proper record-keeping. A well-structured document that clearly outlines transaction details helps maintain a professional image and ensures smooth financial operations. By using the right format, small businesses can simplify the process, reduce errors, and save valuable time.

Benefits of Using a Structured Document

Adopting a standardized approach to creating financial documents offers several advantages for small business owners:

- Consistency: Using a consistent format for all documents strengthens the business’s brand and helps clients easily recognize official records.

- Efficiency: With a pre-designed structure, creating new records becomes a faster and more streamlined process.

- Professionalism: Well-organized documents reflect the business’s attention to detail and build trust with clients.

Key Elements to Include

For small businesses, every financial document should contain specific elements to ensure accuracy and transparency:

- Business Details: Include your company’s name, address, and contact information.

- Client Information: Clearly state the client’s name and contact details.

- Clear Breakdown: Provide a detailed list of products or services provided, including quantities and prices.

- Payment Terms: Clearly mention the due date, any applicable taxes, and accepted payment methods.

Understanding Payment Terms in Invoices

Payment terms are a vital part of any billing document, as they define the expectations for when and how payment should be made. These terms establish the rules for financial transactions, ensuring that both the business and the client are clear about deadlines, fees, and the consequences of late payments. Having well-defined terms helps avoid confusion and protects both parties’ interests.

Setting appropriate payment terms also fosters trust and professionalism in business relationships. By clearly outlining the due dates, payment methods, and penalties for late payments, businesses can avoid misunderstandings and streamline their financial processes.

Common Payment Terms

Different businesses may use various terms depending on their industry and payment preferences. Here are some of the most common terms used in financial documents:

- Net 30: Payment is due 30 days after the invoice date.

- Due on Receipt: Payment is expected immediately upon receipt of the document.

- Net 60: Payment is due 60 days after the date of the document.

- COD (Cash on Delivery): Payment must be made at the time of delivery.

- Advance Payment: Full or partial payment is required before the service or goods are provided.

Importance of Clear Payment Terms

Clearly stated payment terms help to:

- Prevent Delays: By specifying deadlines, businesses encourage timely payments.

- Minimize Disputes: Both parties have a clear understanding of what is expected, reducing the potential for disagreements.

- Improve Cash Flow: By setting firm payment dates, businesses can predict income and better manage their finances.

How to Handle Invoice Disputes

Disagreements over billing documents are not uncommon in business, but addressing them promptly and professionally is key to maintaining strong client relationships. Whether it’s due to discrepancies in charges, misunderstandings about terms, or delayed payments, it’s essential to have a clear process for resolving these issues. By handling disputes efficiently, businesses can avoid escalating conflicts and ensure timely payment settlements.

The first step is to review the details carefully and identify the source of the issue. Once the cause is determined, clear communication with the client is critical. Keeping a calm and professional tone during discussions helps foster a positive resolution and can prevent the situation from becoming adversarial. It’s important to listen to the client’s concerns, provide necessary clarifications, and offer solutions to any valid issues raised.

Finally, always document the dispute and its resolution for future reference. Having a written record ensures that both parties are on the same page and can be referred to in case of any further disagreements. Being transparent, fair, and consistent with dispute management will help build trust and a reputation for reliability in the long run.

Tips for Maintaining a Clean Invoice Record

Keeping an organized and accurate record of financial documents is essential for any business. A well-maintained record helps avoid confusion, ensures smooth transactions, and makes it easier to track payments. By following a few simple practices, you can ensure your financial documentation is consistently clear and up-to-date, which will save you time and effort in the long run.

First, it’s important to establish a consistent system for documenting all transactions. This can include assigning unique reference numbers to each document, ensuring that all necessary details are included, and setting clear due dates for payment. Organizing records chronologically or by client can also help streamline future reference.

Regularly review and reconcile your accounts to ensure there are no discrepancies between the records and actual payments. Automated tools can also assist with this process, making it quicker and more accurate. Keeping both digital and physical copies of key documents is helpful, but digital records are often easier to manage and retrieve.

Lastly, always maintain a backup of your records in case of system failure or other issues. Having redundant copies stored in a secure location, such as cloud storage, will safeguard your financial data and allow for easy recovery when needed.

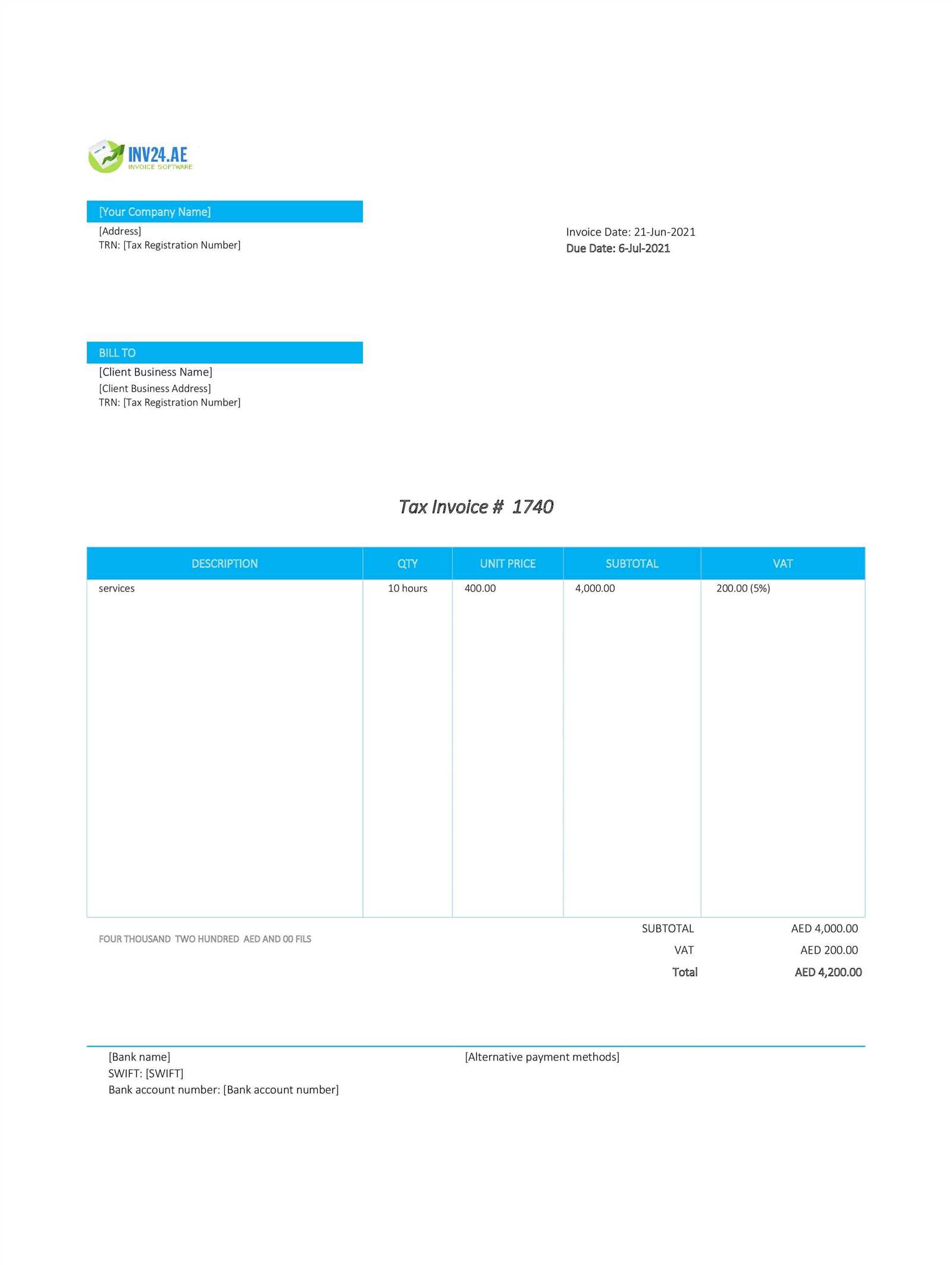

Invoice Template for International Transactions

When conducting business across borders, it’s essential to create financial documents that adhere to international standards. These documents must account for varying currencies, taxes, and legal requirements, making them more complex than domestic transactions. A well-structured document is key to ensuring smooth and clear communication between international partners and prevents misunderstandings or payment delays.

One of the first considerations when handling cross-border transactions is the inclusion of the correct currency. Be sure to clearly specify the currency type, using international symbols or currency codes (such as USD or EUR), to avoid confusion. Additionally, if different tax rates apply based on the country of the client, ensure those details are accurately included. Providing a clear breakdown of costs will help both parties understand the exact charges.

For businesses that deal with international customers, providing payment options that are accessible to people across various regions is crucial. Offering multiple payment methods like wire transfers, PayPal, or international credit cards can simplify the process for clients. Furthermore, always consider the inclusion of clear payment terms and deadlines to avoid delays, especially in international transactions where time zones can complicate communication.

Lastly, always keep track of legal requirements for invoicing in different countries. This includes ensuring compliance with tax laws, using proper language or translation services, and following local financial guidelines to prevent any legal complications. By following these practices, businesses can efficiently manage global transactions and maintain strong relationships with clients worldwide.

Top Invoice Template Tools to Try

Creating professional and accurate financial documents can be a daunting task, but with the right tools, the process becomes much more efficient. There are various software and online platforms designed to help you generate customized records that meet your business needs. These tools offer features that simplify the process of creating, sending, and tracking documents, saving you time and ensuring accuracy.

Here are some of the best tools you can explore to streamline your financial documentation process:

- FreshBooks – A popular platform offering customizable templates and easy tracking of payments and expenses, ideal for freelancers and small businesses.

- Zoho Invoice – An intuitive tool that lets you create professional-looking invoices with a wide range of templates, integrated with other accounting features.

- Wave – A free and user-friendly platform for generating invoices, accounting, and managing financial tasks all in one place.

- QuickBooks – Known for its comprehensive accounting features, QuickBooks allows for seamless document creation and integration with your accounting records.

- PayPal Invoicing – A simple solution for small businesses, offering customizable invoice templates that integrate with your PayPal account.

These tools not only provide easy-to-use templates, but they also offer additional features like payment tracking, automated reminders, and integration with accounting systems. Depending on the size and needs of your business, you can choose the one that best suits your workflow and helps you maintain a smooth financial operation.

How to Improve Client Communication with Invoices

Clear and effective communication is essential for maintaining strong client relationships, especially when it comes to managing financial transactions. Providing well-organized and easy-to-understand documents can significantly enhance transparency and prevent misunderstandings. By ensuring that every detail is clearly outlined, you foster trust and facilitate smoother business interactions.

Here are some strategies to improve communication with your clients through financial documents:

- Be Clear and Detailed – Ensure that all information is accurate and easy to follow. Include a breakdown of services, costs, and due dates. This helps clients understand exactly what they are being charged for.

- Use Professional Language – Maintain a polite, professional tone in all correspondence. Avoid using jargon that could confuse the client, and opt for language that is straightforward and respectful.

- Offer Multiple Payment Methods – Provide clients with various payment options to make the transaction as convenient as possible. This can lead to faster payments and reduce potential delays.

- Provide Clear Payment Terms – Include payment due dates, late fees, and any other relevant terms. This sets clear expectations and avoids confusion later on.

- Follow Up Reminders – Send gentle reminders for upcoming or overdue payments. A well-timed reminder shows professionalism and helps maintain positive client relations.

By adopting these practices, you ensure that your financial documentation becomes a tool for enhancing communication, rather than causing unnecessary confusion or delays. The result is a more positive experience for both you and your clients, helping to build trust and a smoother workflow.