Download Free Invoice Sample Excel Template for Easy Billing

Managing financial records can often be a tedious task, but having the right tools can simplify the process significantly. When it comes to keeping track of payments and client interactions, digital solutions are a game-changer. These tools help maintain clarity, reduce errors, and ensure that every transaction is properly recorded and easy to access.

For small business owners and freelancers, organizing billing details is essential to maintaining professional relationships and ensuring timely payments. By using a structured approach, you can create documents that meet legal and business standards without unnecessary complexity. This method also enables quick updates, easy customization, and a consistent format for all transactions.

Customizable solutions offer flexibility, allowing you to adjust the structure according to your specific needs, whether you’re handling multiple clients or varying services. These tools can also integrate with other software, automating calculations and saving you time. With a well-organized system in place, you can focus on growing your business while keeping finances under control.

Invoice Sample Excel Template Overview

For businesses of all sizes, managing financial documentation in an organized and efficient way is crucial. Using digital tools to generate and track payment records can help streamline this process and improve overall efficiency. These tools allow for customization, ease of use, and quick access to necessary information. They are designed to meet the needs of professionals who require clear and concise records of their transactions.

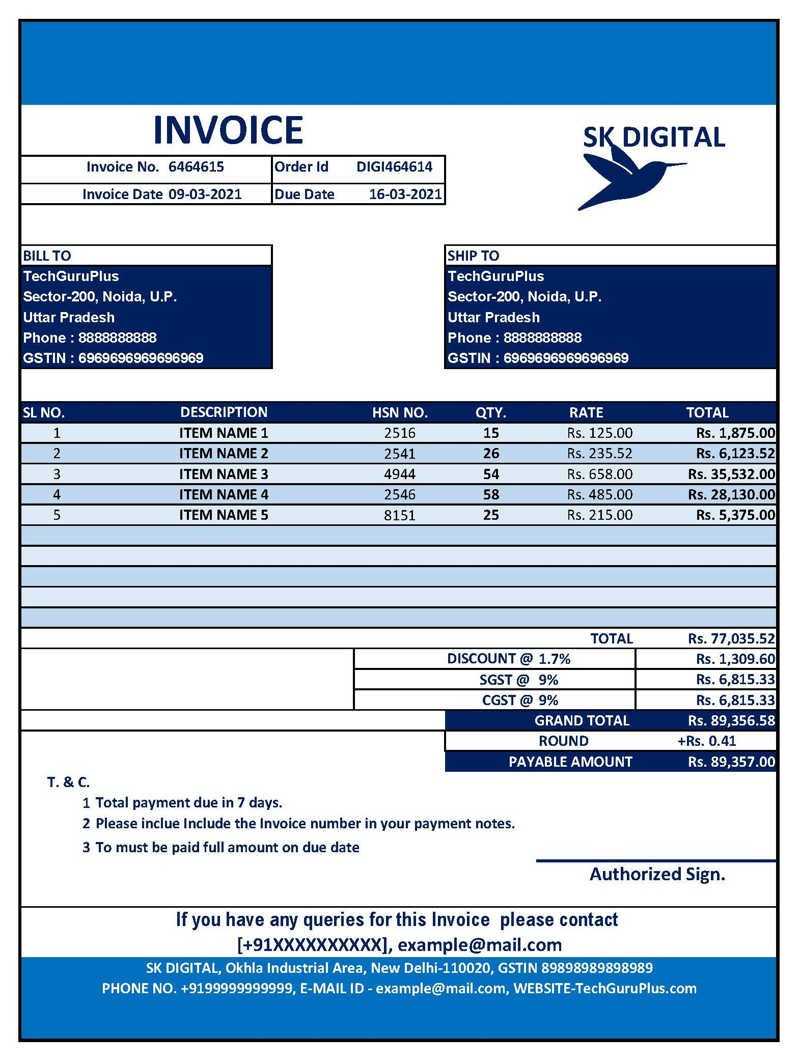

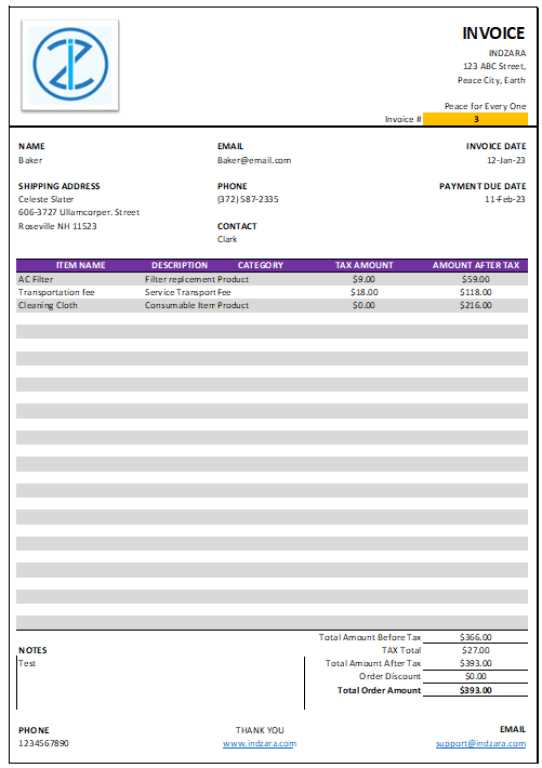

Such solutions typically come in a pre-built format, which can be customized to suit individual preferences. These structures enable users to input relevant details, such as dates, amounts, and client information, with automatic calculations to reduce errors. The format ensures that all necessary elements are included, making it easy to create consistent documents for multiple clients.

Key Features of the Tool

The most common features included in these solutions are the ability to:

- Quickly input itemized lists of services or products.

- Automatically calculate totals, taxes, and discounts.

- Customize fields for client information and payment terms.

- Track outstanding balances and payment statuses.

How to Use the Tool Effectively

Once you have your document setup, it’s important to follow a few simple guidelines to ensure everything is correctly recorded:

- Enter accurate details for each transaction, ensuring that all information is current and complete.

- Review calculations and check for any discrepancies before finalizing the document.

- Store your completed records in a dedicated folder for easy retrieval.

- Use the built-in features to monitor payment progress and follow up with clients as needed.

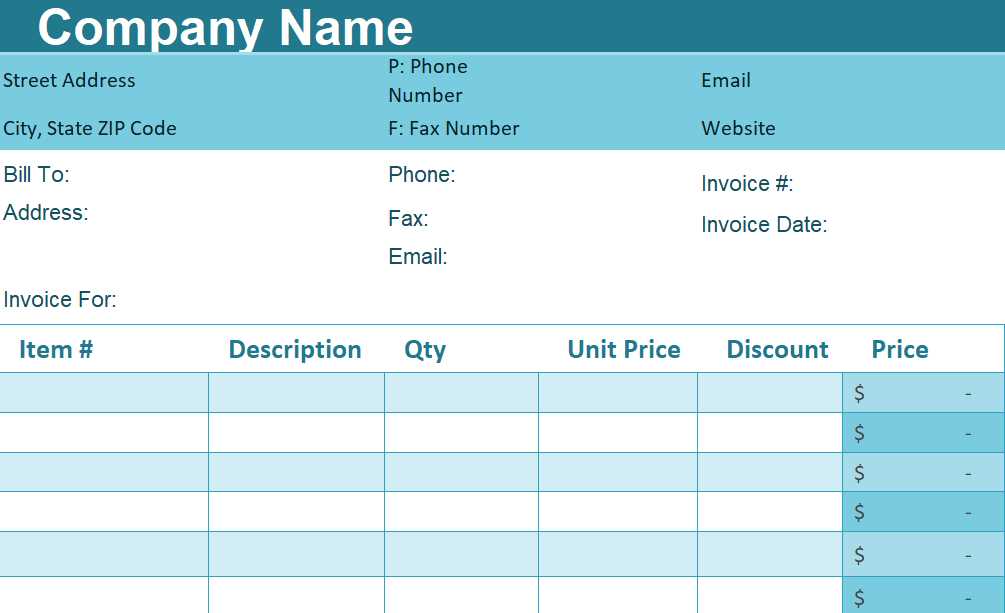

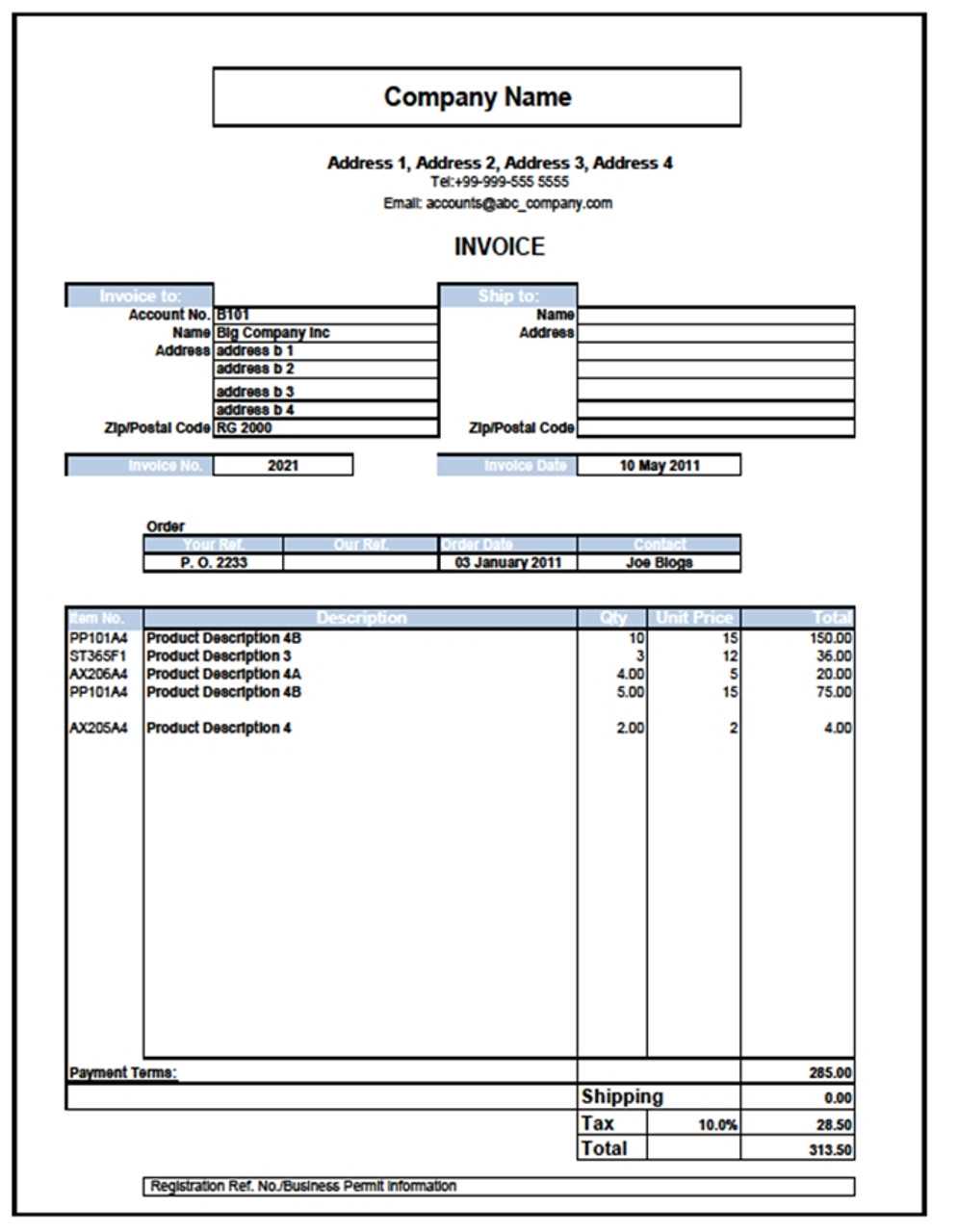

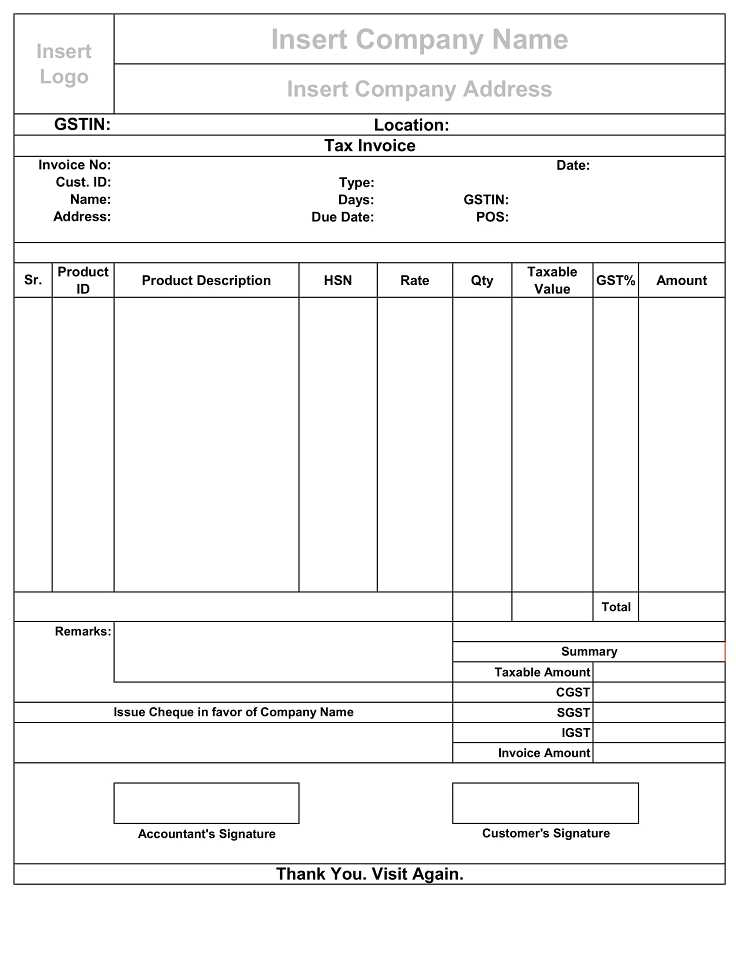

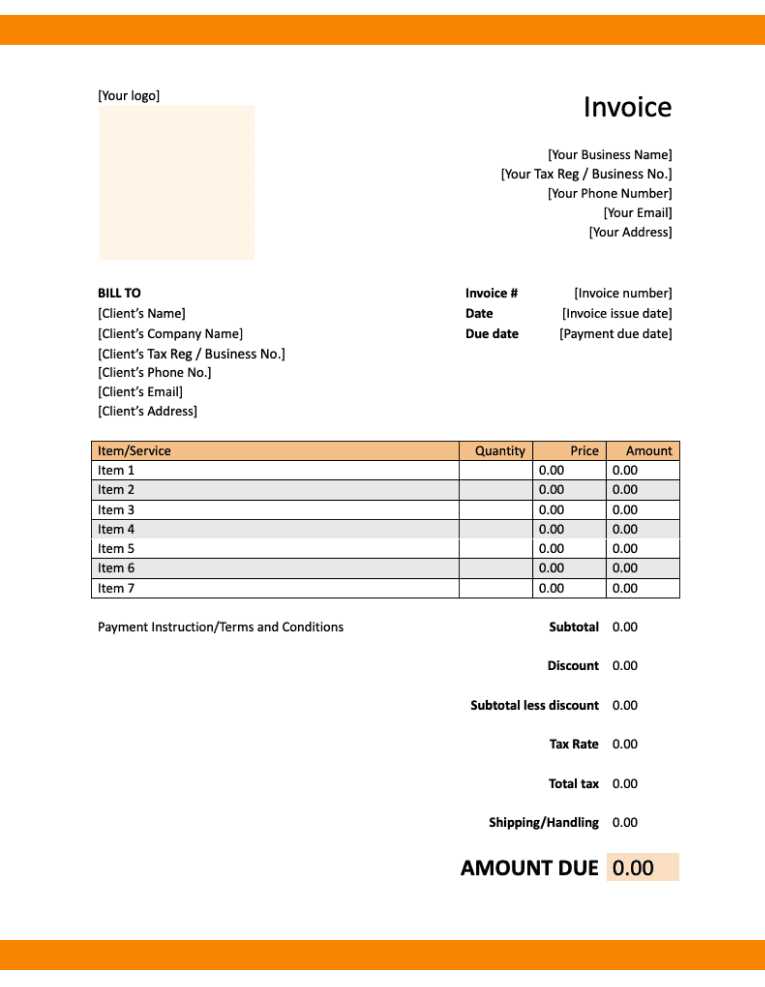

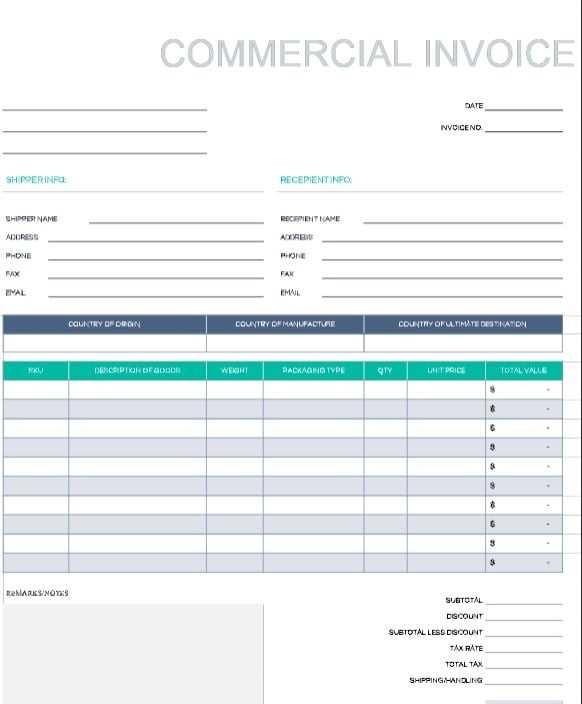

Below is an example of a typical structure for such documents:

| Item | Description | Unit Price | Quantity | Total |

|---|---|---|---|---|

| Service 1 | Consulting for Website Development | $100 | 2 | $200 |

| Service 2 | SEO Optimization | $75 | 1 | $75 |

| Subtotal | $275 | |||

| Tax (10%) | $27.50 | |||

| Total Due | $302.50 | |||

Why Use an Excel Invoice Template

Managing financial records efficiently is essential for any business. Having a well-organized method for creating, tracking, and updating payment requests simplifies the process and reduces errors. A digital solution designed for this purpose offers significant advantages over manual methods, providing users with both convenience and flexibility. Such tools allow for streamlined data entry and ensure that all necessary details are included, making the entire process more efficient.

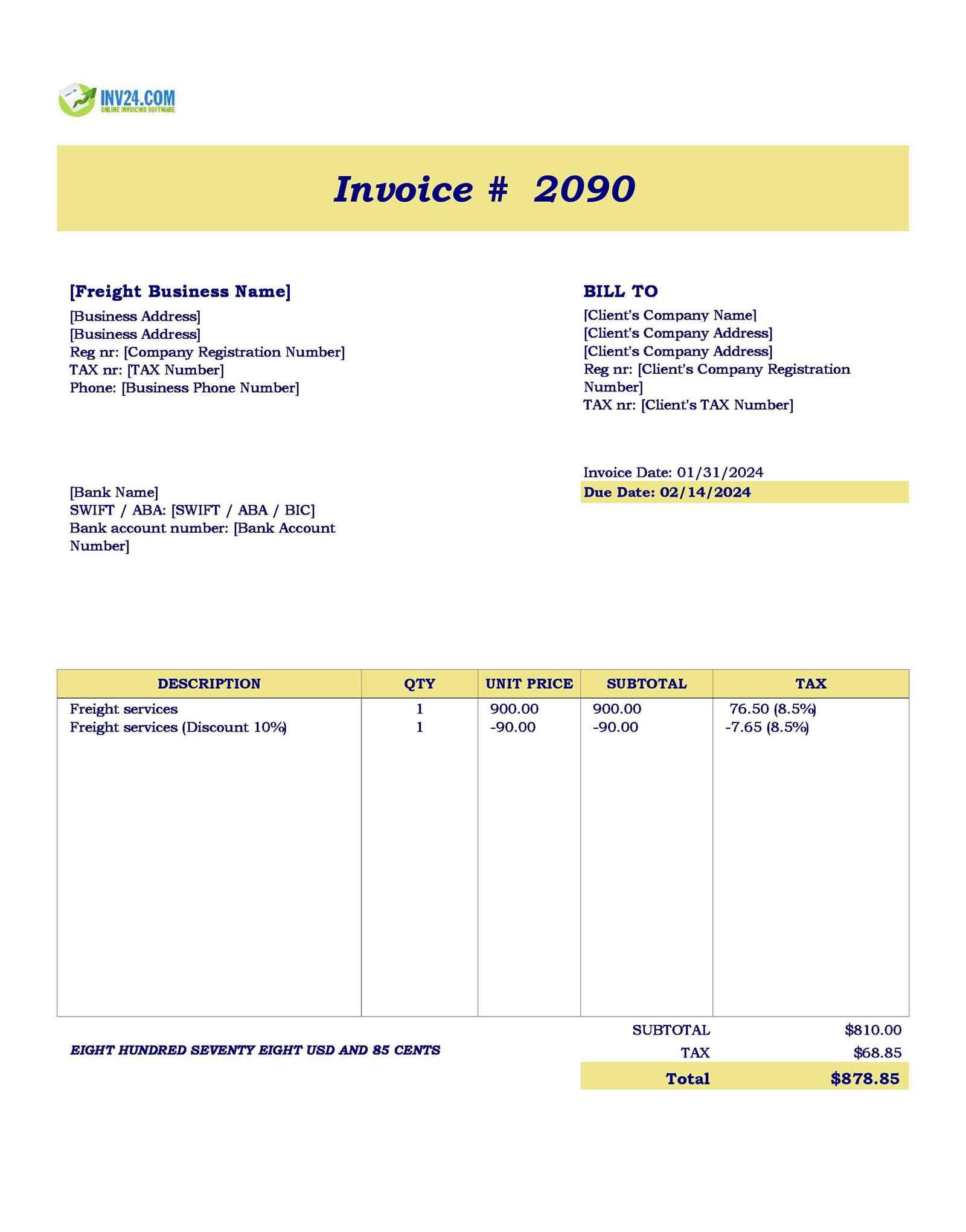

One of the key reasons to use a digital document format is the ability to automate many tasks, such as calculations, totals, and taxes. This eliminates the risk of human error and ensures that every transaction is processed correctly. Additionally, these solutions are highly customizable, allowing users to adjust the layout, fields, and formulas to meet specific needs. Whether you’re managing a single client’s payment or handling multiple accounts, these tools help maintain consistency and accuracy.

Another advantage is the ability to track outstanding balances and payment statuses in real-time. This not only helps maintain better cash flow but also makes it easier to follow up on overdue amounts. With an organized system, you can quickly access past records, reducing the time spent searching through paper files or various applications.

Overall, using a digital solution designed for creating financial records brings both efficiency and organization, helping businesses stay on top of their transactions and focus more on growth. The flexibility and accuracy provided by such tools make them an indispensable asset for managing day-to-day financial operations.

Benefits of Using Excel for Invoices

Using digital tools for creating and managing payment records offers numerous advantages for businesses. These tools simplify the process of generating accurate documents, ensuring that important financial details are properly organized and easy to access. Leveraging such solutions reduces manual errors, saves time, and helps maintain a professional appearance with minimal effort.

Time-Saving Features

One of the primary benefits is the time-saving aspect. When creating payment requests, the built-in features of these tools allow for quick calculations, automatic totals, and tax calculations. This removes the need for manual arithmetic and minimizes the risk of human error. Furthermore, once the document is created, it can easily be reused and adjusted for future transactions, streamlining the entire process.

Customization and Flexibility

Another significant benefit is the high level of customization these tools offer. Users can modify the structure of the document to fit their specific needs, adding or removing fields as necessary. Whether it’s adjusting the design or tailoring the format to include extra client details, the flexibility of digital tools ensures that every document matches the requirements of the business.

Below is an example of how a typical financial document might be structured using such tools:

| Item | Description | Unit Price | Quantity | Total |

|---|---|---|---|---|

| Product A | Consultation Service | $150 | 1 | $150 |

| Product B | Web Design | $500 | 1 | $500 |

| Subtotal | $650 | |||

| Tax (10%) | $65 | |||

| Total Due | $715 | |||

By utilizing these solutions, businesses can ensure consistency in their financial documents while maintaining accuracy and efficiency throughout the billing process.

How to Customize an Invoice Template

Personalizing your financial documents to reflect your business’s needs is essential for maintaining a professional appearance. Customization allows you to modify the layout, add specific details, and adjust sections according to your preferences. With the right approach, you can ensure that each document aligns perfectly with your brand and operational requirements.

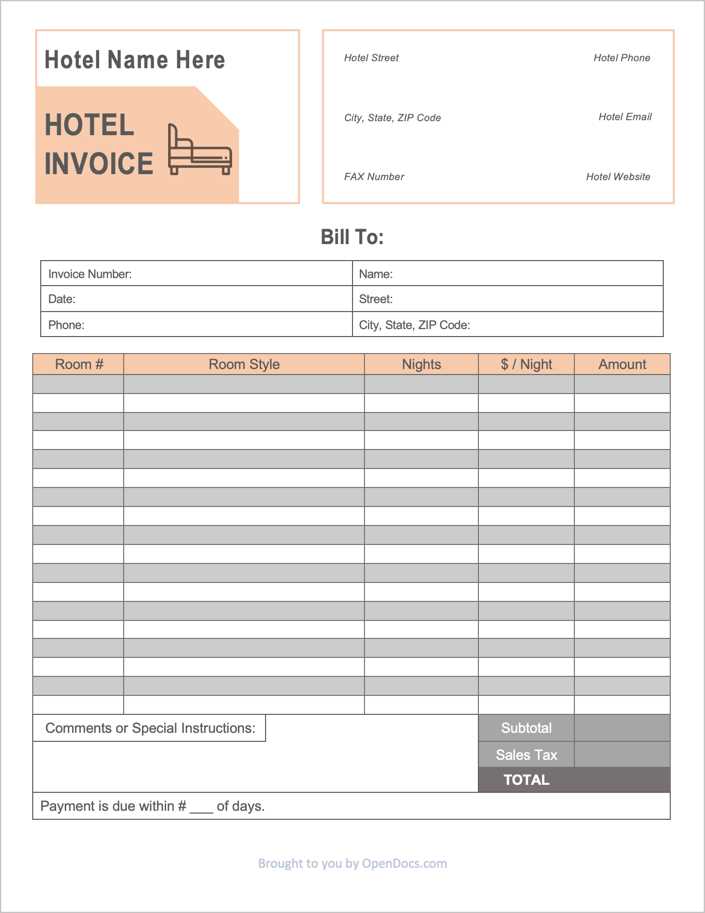

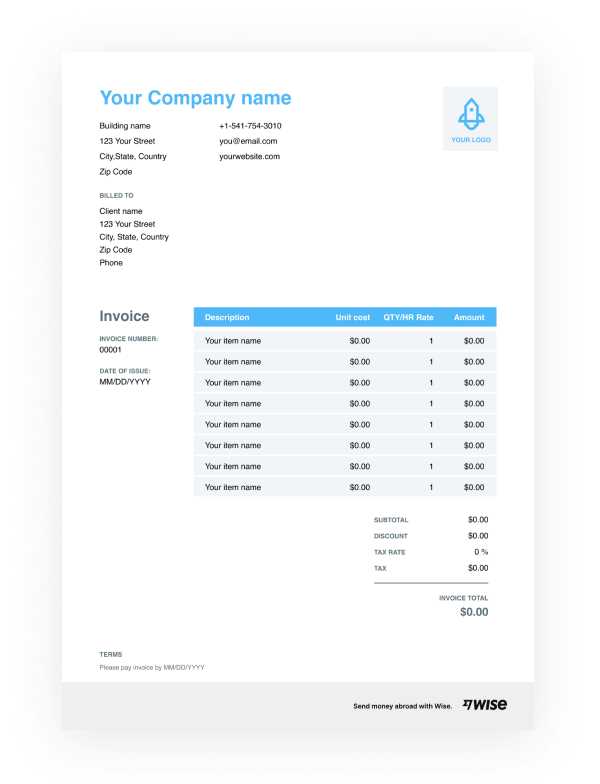

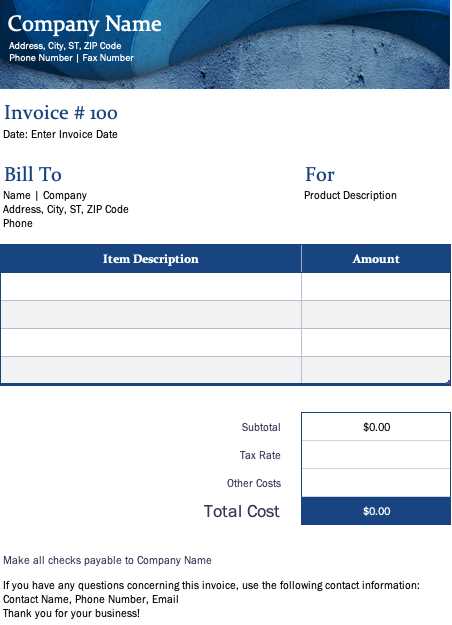

To get started, first choose a structure that suits your business. Many digital tools offer pre-built formats that you can easily modify. The key to customization lies in understanding what information you need to include, such as client details, payment terms, and itemized descriptions of services or products.

Adjusting Layout and Design

The layout is one of the most important aspects to customize. This includes adjusting column widths, font sizes, and adding company logos or branding colors. A clean, well-organized structure enhances readability and professionalism, helping clients quickly review the necessary details.

Adding Custom Fields

Another useful customization is adding specific fields that are relevant to your business. You may want to include extra details such as project numbers, order references, or payment deadlines. This helps ensure that both you and your clients have all the information needed for a smooth transaction process.

Example of customizable sections:

- Client Name and Address

- Services Provided or Products Sold

- Unit Prices and Discounts

- Tax and Total Amount Due

Remember, the goal of customization is to create a document that works seamlessly for your business operations while maintaining a professional, consistent format. By making these adjustments, you ensure that every financial record is tailored to meet your needs and reflect your business’s identity.

Free Invoice Templates for Small Businesses

For small businesses, keeping financial records organized can be a challenge, especially when it comes to creating clear and professional payment documents. Fortunately, there are many free tools available that provide customizable structures, helping you generate the necessary documents without the need for expensive software. These solutions are ideal for businesses that need a simple yet effective way to manage transactions.

Using a pre-designed structure allows small business owners to quickly create and send payment requests, ensuring consistency across all documents. With these tools, you can easily input details such as client information, services rendered, and payment terms, all while keeping a professional format. The best part is that many of these resources are available at no cost, making them accessible to businesses with limited budgets.

Advantages of Free Tools

Free solutions often come with several benefits:

- Easy to Use: User-friendly interfaces make it simple for anyone to create professional documents without prior experience.

- Customizable: You can adjust the layout and content to suit your unique business needs, including adding logos or modifying fields.

- Cost-Effective: There’s no need to invest in expensive software or services, making it perfect for startups and small enterprises.

- Time-Saving: Pre-built structures help you quickly generate the required documents, reducing the time spent on manual formatting.

Where to Find Free Resources

Many websites offer free, downloadable resources that are designed to meet the needs of small businesses. Whether you’re looking for a basic format or something more specialized, you can find numerous options that can be tailored to your industry. These tools help ensure that your financial records are both accurate and professional, giving your clients confidence in your business.

By taking advantage of these free solutions, small business owners can streamline their payment processes, stay organized, and focus on what really matters–growing their business.

Best Practices for Invoice Creation

Creating clear, accurate, and professional payment requests is essential for maintaining good business relationships and ensuring timely payments. Following a few best practices when preparing these documents can help avoid confusion, reduce errors, and make the entire billing process more efficient. These practices not only enhance the appearance of your financial records but also improve overall communication with clients.

One of the key aspects of effective document creation is consistency. By using the same structure for all your transactions, clients can easily understand the information presented, leading to fewer disputes and misunderstandings. Additionally, making sure to include all necessary details, such as payment terms, due dates, and itemized lists of services or products, helps ensure nothing is overlooked.

Essential Elements to Include

When creating a payment request, certain information should always be included to make the document clear and complete:

- Client Details: Include the client’s name, address, and contact information for easy reference.

- Unique Reference Number: Assign a unique number to each document for better tracking and record-keeping.

- Clear Itemization: Break down the products or services provided, including descriptions, quantities, and prices, to avoid confusion.

- Payment Terms: Specify the due date, acceptable payment methods, and any late fees to encourage timely payment.

Maintaining Professionalism and Accuracy

It’s also important to keep your documents professional and error-free. Double-check all the details, especially financial amounts, calculations, and client information, before sending the document. Any mistakes can lead to delays in payment or cause unnecessary back-and-forth with clients. Additionally, maintaining a clean, organized layout with easy-to-read fonts and proper spacing can improve the client’s experience when reviewing the document.

By following these best practices, businesses can ensure they are always presenting accurate, professional, and easy-to-understand documents. This not only helps in getting paid on time but also builds trust and strengthens client relationships.

Steps to Create an Invoice in Excel

Creating a professional payment request using a digital tool is an essential skill for any business owner. The process is simple and can be customized to fit your specific needs. By following a few straightforward steps, you can quickly generate a document that includes all necessary details and looks professional. These steps will help ensure that every document is accurate, clear, and ready for delivery.

Step 1: Set Up the Basic Structure

Start by opening a new file in your preferred digital tool. Begin by setting up your document layout, dividing it into sections for key information such as client details, services or products, payment terms, and totals. Make sure you leave enough space to list each item clearly. You can adjust column widths and row heights to fit your content properly.

Step 2: Add Necessary Information

Next, input all the essential details. This includes the name and address of your client, your business details, and a unique document number for tracking purposes. Then, proceed to list the services or items provided, along with their respective prices. Include quantities, rates, and any applicable taxes or discounts. Don’t forget to specify the payment due date and terms clearly to avoid any confusion.

Here is an example of how your document might look after entering the information:

| Item | Description | Unit Price | Quantity | Total | |||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Service 1 | Consulting for Web Development | $120 | 2 | $240 | |||||||||||||||||||||||||||||||||||||||||

| Service 2 | SEO Optimization | $80 | 1 | $80 | |||||||||||||||||||||||||||||||||||||||||

| Subtotal | $320 | ||||||||||||||||||||||||||||||||||||||||||||

| Tax (10%) | $32 | ||||||||||||||||||||||||||||||||||||||||||||

Total Due

How to Track Payments with ExcelTracking payments is a crucial aspect of managing business finances. With the right tools, you can easily monitor which transactions have been completed and which are still pending. Using a digital tool allows for quick updates and organized tracking, ensuring you always have an accurate record of payments and outstanding balances. By setting up a simple system, you can avoid confusion and ensure timely follow-ups with clients. Step 1: Set Up a Payment Tracking SystemTo get started, create a dedicated spreadsheet for tracking all transactions. Begin by setting up columns for essential information such as:

This system will help you track payments for each client, ensuring that you can quickly see which transactions are complete and which still require action. Be sure to update the status and balance columns each time a payment is made or a new document is created. Step 2: Use Formulas to Automate CalculationsTo make the process even easier, you can use basic formulas to automate the calculation of outstanding balances and payment statuses. For example, you can set up a formula to subtract the amount paid from the amount due and display the remaining balance. This way, you won’t have to calculate it manually each time.

This simple automation will save you time and help maintain consistency in your records. You can easily track payments at a glance and see which accounts need follow-up. Step 3: Update and Review RegularlyMake it a habit to update the payment tracking sheet regularly. As soon as a payment is received, record it in the appropriate row and update the status. Reviewing the document periodically will ensure you stay on top of your cash flow and can promptly addre Invoice Template Features to Look ForWhen choosing a solution for creating financial documents, it’s important to ensure that the tool you select meets the specific needs of your business. A well-designed document generator can help streamline your billing process, maintain accuracy, and give a professional impression to clients. Here are key features to consider when selecting a system for generating payment requests. Essential Features for Effective DocumentsTo ensure the document creation process is efficient, look for these essential features:

Additional Features to Enhance FunctionalityFor businesses that need more advanced capabilities, consider the following additional features:

|

|||||||||||||||||||||||||||||||||||||||||||||