Invoice Request Form Template for Streamlined Billing

Efficient financial transactions are essential for maintaining smooth business operations. One key component in managing payments is having a clear and structured way to communicate amounts owed to clients or partners. With the right tools in place, the process of requesting payments becomes simpler, more professional, and much less prone to errors.

In this section, we explore how having a well-designed document can make all the difference in getting paid on time and avoiding misunderstandings. From its layout to the critical details it includes, each element plays a vital role in ensuring the process is both effective and transparent. A carefully crafted request document helps to ensure that nothing is overlooked and that both parties are aligned in their expectations.

Understanding the importance of this tool can help you adopt practices that streamline your payment procedures, saving you time and reducing administrative costs. Whether you’re a small business owner or part of a larger enterprise, implementing a well-organized method for requesting payments can significantly impact your overall financial health.

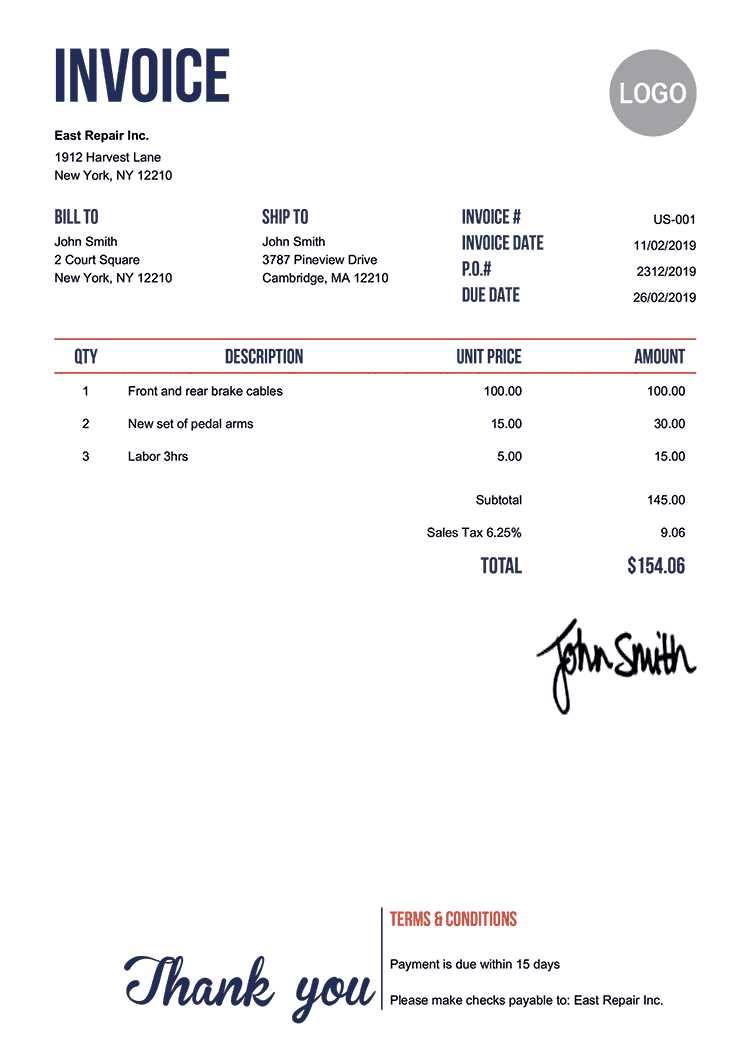

Invoice Request Form Template Overview

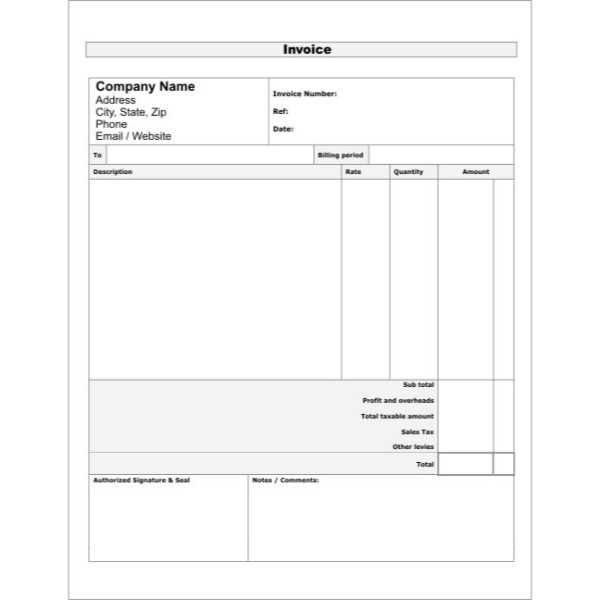

When managing payments for goods or services, having a structured document to outline the necessary details can streamline the entire process. This document serves as a formal means to notify clients or partners of the amount due, the terms of payment, and other essential information. Its purpose is to ensure clarity between both parties and avoid any confusion regarding financial transactions.

In this section, we’ll provide an overview of what such a document includes and how it can be customized to suit different business needs. A well-designed document can increase professionalism, improve cash flow management, and reduce the chances of payment delays.

Key Components of the Document

The core elements of the document typically consist of several important fields that help to clearly communicate the specifics of the financial obligation. These fields include the recipient’s details, description of the product or service, total amount due, and payment terms. Customizing these sections allows businesses to tailor the document according to their needs.

Benefits of Using This Document

Utilizing a professional document template brings multiple advantages to businesses. It standardizes the way payments are requested, improves organization, and ensures that important information is not overlooked. Below is a simple table showcasing some of the common sections you may encounter in this type of document.

| Section | Description |

|---|---|

| Recipient Details | Information such as the name and address of the entity being billed. |

| Service/Product Description | A brief summary of what was provided or sold, including quantities and pricing. |

| Amount Due | The total sum that needs to be paid, including any taxes or discounts. |

| Payment Terms | Details about the due date and payment methods accepted. |

Why You Need an Invoice Request Form

Having a structured method for communicating payment expectations is crucial for any business. It helps formalize the transaction process, ensuring that both parties are clear on what is owed and when it should be paid. A professional document that outlines all necessary details fosters trust and minimizes the chance of misunderstandings.

Using such a document is more than just a way to ask for payment. It acts as a legal record of the transaction, detailing the specifics of the agreement. It ensures that all essential information – from amounts owed to payment deadlines – is clearly presented, reducing the risk of disputes later on. Additionally, it serves as a reminder for clients or partners, encouraging timely payments and helping businesses maintain a steady cash flow.

Having a well-organized method for tracking payments also simplifies bookkeeping, as it provides a clear reference for financial records. This is especially important for small businesses or freelancers who may need to keep close tabs on their income and expenses. The use of such a document can ultimately contribute to smoother, more efficient business operations.

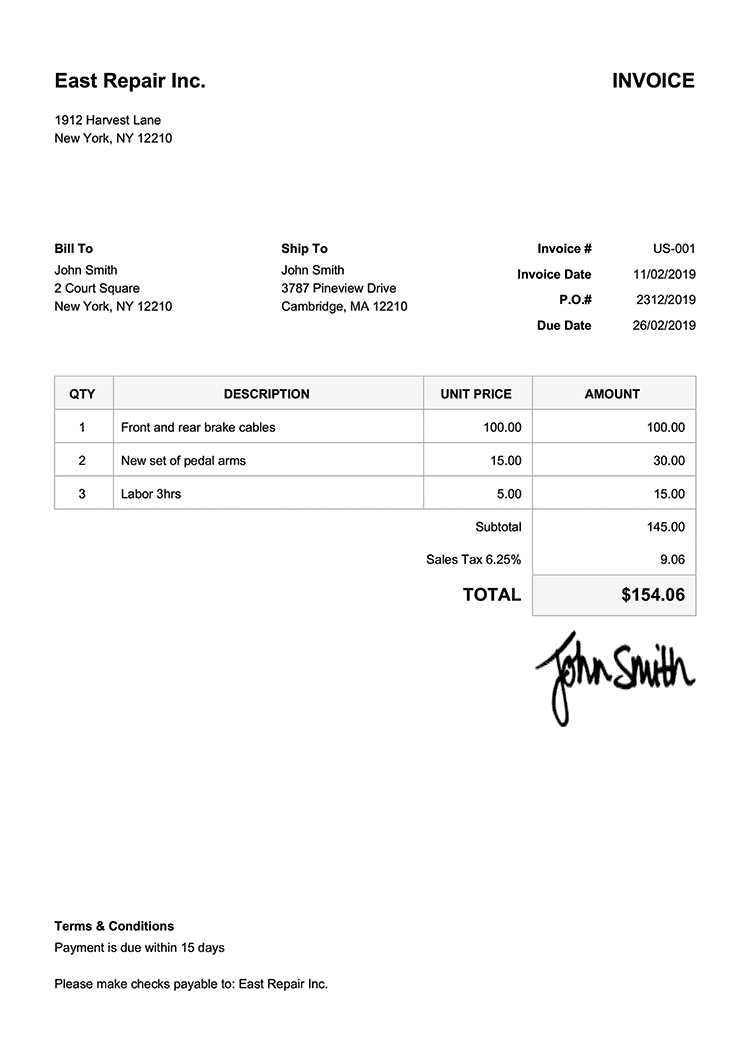

Key Elements of an Invoice Request

When preparing a document to communicate payment obligations, there are several essential details that must be included to ensure clarity and professionalism. These components not only inform the recipient of the financial requirements but also protect both parties by outlining the specifics of the transaction.

Essential Information to Include

To create an effective document, certain elements are necessary to cover all bases. These details help avoid confusion and make it easy for the recipient to understand the amount due and the terms of payment. Here are the critical sections:

- Recipient Information: Includes the name, address, and contact details of the party being billed.

- Provider Information: Information about the business or individual requesting payment, including contact details.

- Description of Services or Products: A clear breakdown of what was provided, including quantities, prices, and any additional charges.

- Total Amount Due: The full amount owed, clearly marked, including taxes or discounts if applicable.

- Payment Terms: Payment due date, acceptable methods, and any penalties or late fees if applicable.

Why These Elements Matter

Each of these sections serves a specific purpose. Including detailed descriptions and clear terms helps to avoid confusion or disputes over payment. By providing all the necessary information upfront, both parties can proceed with confidence, knowing exactly what is expected and when. Proper documentation also facilitates smooth financial tracking and accurate record-keeping for future reference.

How to Customize an Invoice Request

Customizing a payment request document allows businesses to better reflect their unique needs and branding. By adjusting the layout, content, and design, you can make sure the document fits the specific transaction and professional standards of your company. Tailoring this document can help enhance clarity, build trust, and ensure all critical details are included in a way that works best for your business.

Steps for Customization

When customizing this type of document, there are several aspects to consider. From adjusting the format to adding specific details relevant to each transaction, here are some steps to follow:

- Choose the Right Layout: Decide whether a simple layout or a more complex design best suits your business style.

- Modify the Content: Ensure the information, such as product/service description and payment terms, aligns with each specific transaction.

- Add Business Branding: Incorporate your company logo, colors, and fonts to give the document a professional touch.

- Include Legal Terms: Make sure the payment terms and conditions are clear and legally sound to avoid any potential issues.

- Adapt for Different Clients: Adjust details based on the client, such as their billing address, payment options, and special instructions.

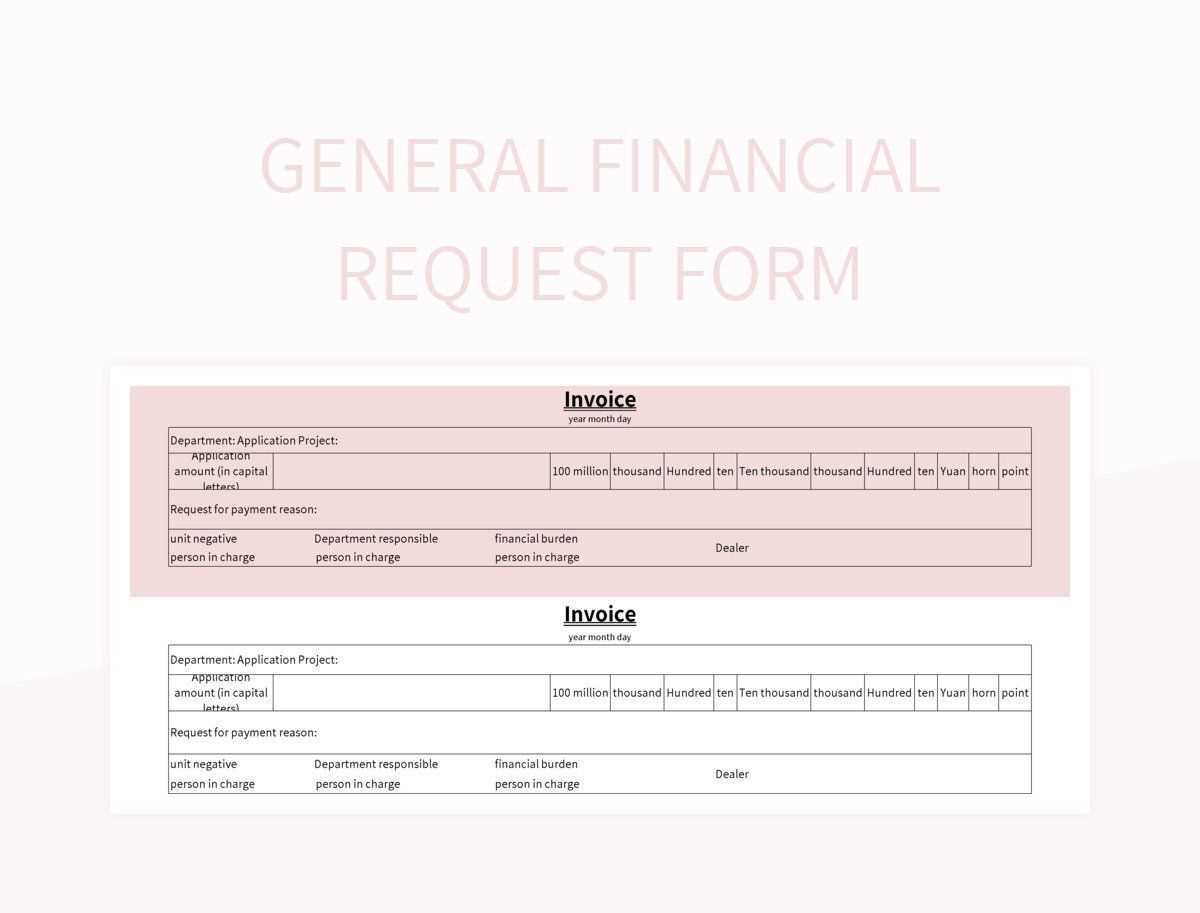

Example of a Customized Document Layout

Here’s an example of how the sections in the document might be laid out when customized for a specific client:

| Section | Custom Details |

|---|---|

| Business Information | Logo, company name, address, contact details |

| Client Information | Client name, billing address, contact details |

| Service/Product Description | Detailed breakdown, including quantities and unit prices |

| Payment Terms | Due date, payment methods, any special instructions |

Customizing each section like this ensures the document aligns perfectly with your business’s needs and maintains a professional appearance for every transaction.

Benefits of Using a Request Form

Implementing a structured document to communicate payment details provides numerous advantages for businesses. By using a consistent and professional approach, companies can streamline their financial processes, reduce errors, and improve overall efficiency. The clarity and organization this document offers can greatly benefit both the business and the client, creating a smoother transaction experience.

Here are some key benefits of using such a document:

- Increased Professionalism: A well-organized document demonstrates a high level of professionalism, which can build trust and credibility with clients.

- Faster Payments: By clearly outlining payment terms and amounts, the recipient is more likely to act quickly, reducing delays.

- Reduced Errors: A standardized document ensures that all necessary details are included, minimizing the risk of mistakes or missing information.

- Better Record-Keeping: Having a formal document makes it easier to track and reference payments, improving financial transparency.

- Improved Cash Flow: Clear communication of payment expectations can lead to more timely payments, helping businesses maintain a healthy cash flow.

- Legal Protection: This document serves as a legal record of the agreement, which can be important in case of disputes or misunderstandings.

Using a well-designed document not only simplifies payment processing but also enhances the overall customer experience by providing clear and professional communication. It is a simple yet powerful tool for managing financial transactions effectively.

Creating a Professional Invoice Template

Designing a professional document for payment requests is crucial for businesses aiming to maintain a polished image and efficient operations. A well-crafted layout not only makes it easier for clients to understand payment terms but also reinforces your brand identity. This document should convey all necessary details in a clear and concise manner, ensuring that both parties are aligned on the expectations and terms of the transaction.

Key Features for a Professional Document

To achieve a professional look, there are several key features that should be included. These elements help to create a cohesive and easily understood document, ensuring that the information is both accessible and thorough.

- Clear Contact Information: Include your business name, address, phone number, and email address at the top to make it easy for the recipient to get in touch.

- Structured Layout: Organize the document with distinct sections for item descriptions, amounts, and due dates to keep everything neat and legible.

- Simple and Elegant Design: Avoid clutter and unnecessary decoration. A clean, minimalist design ensures that the focus remains on the details of the transaction.

- Branding: Incorporate your company’s logo and color scheme to add a personal touch and enhance brand recognition.

- Legal and Payment Terms: Include any legal disclaimers or specific payment terms to ensure both parties are aware of their responsibilities and rights.

Ensuring Clarity and Precision

Every section should be straightforward and easy to understand. The clearer the document is, the fewer opportunities there are for confusion or mistakes. Use simple language, avoid jargon, and be precise with amounts, dates, and other relevant details. This will not only help speed up the payment process but also create a professional impression on your clients.

Common Mistakes to Avoid in Forms

While preparing a document for payment communication, certain errors can undermine its professionalism and effectiveness. These mistakes often lead to confusion, delayed payments, or misunderstandings between parties. By avoiding common pitfalls, businesses can ensure that the document is clear, accurate, and efficient in facilitating timely transactions.

Top Mistakes to Watch Out For

- Missing or Incorrect Information: Omitting essential details such as amounts, payment due dates, or client information can result in delays and confusion.

- Unclear Descriptions: Vague or overly complicated descriptions of products or services can make it difficult for clients to understand the charges, leading to disputes.

- Unprofessional Layout: A cluttered or disorganized document can create a negative impression. Ensure the content is arranged in a clear and readable format.

- Inconsistent Formatting: Using different fonts, sizes, or colors can make the document look unprofessional and difficult to follow.

- Not Including Payment Terms: Failing to clearly outline payment methods, deadlines, and penalties for late payments can lead to confusion and missed deadlines.

How to Avoid These Mistakes

To ensure the document is effective, always double-check the details before sending it out. Keep the language clear and concise, and ensure that the layout is simple and easy to navigate. Consistency in formatting is key to maintaining a professional appearance, and outlining all payment terms helps avoid any confusion down the line. By being thorough and attentive to these details, businesses can ensure smoother financial transactions and maintain positive client relationships.

Choosing the Right Format for Your Template

Selecting the appropriate structure for a payment document is crucial for ensuring ease of use and clarity. The format you choose can influence how easily your clients can read, understand, and respond to the payment request. Whether you opt for a simple layout or a more sophisticated design, the format should align with your business needs and provide a professional appearance.

There are several factors to consider when choosing the format for your document, including the type of business, the complexity of the transaction, and your clients’ preferences. The right format helps maintain organization, minimizes confusion, and ensures the payment process flows smoothly.

Factors to Consider

- Client Preferences: Some clients may prefer digital formats like PDFs, while others may prefer printed versions. Understanding their preferences can improve the user experience.

- Ease of Customization: Choose a format that can easily be modified for different clients or transactions. This will save time and effort when adapting the document for each new request.

- Level of Detail: Depending on the nature of the transaction, you may need a more detailed layout or a simpler one. Choose the format that best reflects the complexity of the services or goods provided.

Comparison of Common Formats

| Format | Pros | Cons |

|---|---|---|

| Professional appearance, easy to email, consistent layout across devices | Not editable without specific software, may require software to view | |

| Word Document | Easy to edit, customizable for various clients | Layout may vary depending on software, may look unprofessional if poorly formatted |

| Online Form | Instant submission, easy to track responses | Requires internet access, may lack a personal touch |

By carefully considering these factors and comparing available options, you can select the most suitable format for your payment communication. This decision ensures that your document not only looks professional but also serves the functional needs of both your business and your clients.

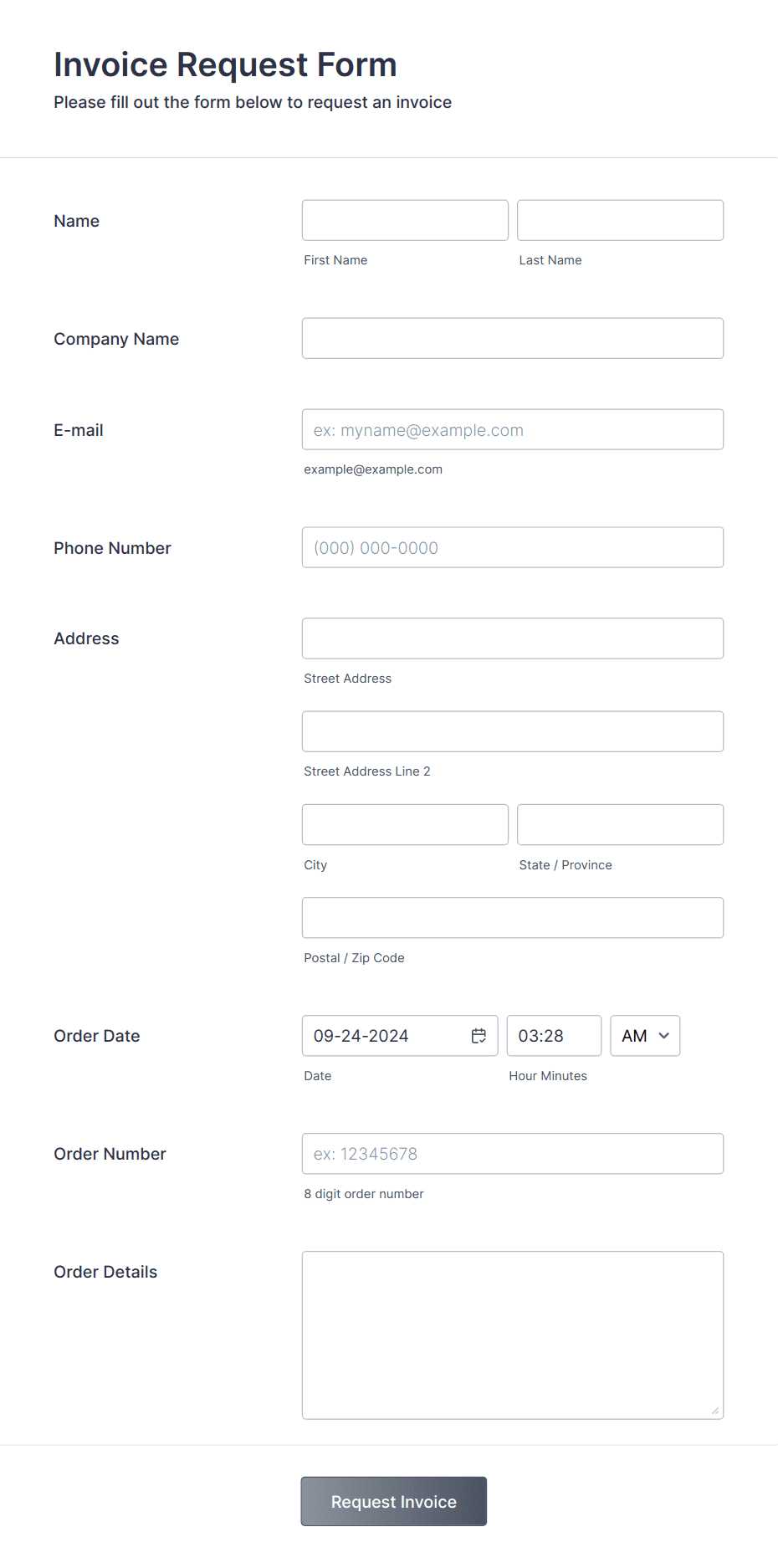

Steps to Fill Out the Request Form

Completing a payment document correctly is essential to ensure that all necessary details are captured and the payment process is smooth. By following a clear and systematic approach, you can ensure that the document is properly filled out, reducing the risk of errors and delays in the transaction.

Here are the steps to follow when filling out this type of document:

- Enter Your Business Information: Start by providing your company’s name, contact details, and address. This information helps the recipient identify the sender and makes it easier to reach out if needed.

- Include Client Information: Make sure to include the recipient’s name, address, and contact details. Accurate information ensures that the document reaches the right person and avoids any confusion.

- Provide a Unique Reference Number: Assign a reference number to the transaction for easy tracking and record-keeping. This number will help both parties identify and track the payment request.

- List the Services or Goods Provided: Detail the products or services delivered, including quantities, descriptions, and individual prices. Be clear and specific to avoid any misunderstandings.

- Specify the Total Amount: Calculate and clearly state the total amount due, including any taxes, discounts, or additional charges. This ensures transparency and helps the recipient know exactly what is owed.

- Include Payment Terms: Clearly outline the payment due date, accepted payment methods, and any applicable penalties for late payments. This section helps set expectations and promotes timely payment.

- Review and Confirm: Double-check all the information for accuracy before sending. Ensure there are no errors or missing details that could lead to confusion or delayed payments.

By following these steps carefully, you can create a complete and professional document that ensures a smooth transaction process. Clear communication of the details will help both parties stay on the same page and facilitate faster processing.

How Payment Documents Improve Cash Flow

Properly structured payment documents are essential tools for maintaining consistent cash flow in any business. By clearly outlining payment expectations and facilitating easy transactions, these documents help streamline the invoicing process and ensure that businesses receive payments on time.

When businesses use well-organized documents to request payments, they reduce delays and confusion. These documents act as clear reminders of owed amounts and payment deadlines, which encourages prompt settlement. This efficiency helps businesses manage their finances, reducing the risk of overdue payments and maintaining a steady cash flow.

Key Benefits for Cash Flow

- Faster Payment Collection: Clear and professional documents reduce misunderstandings and make it easier for clients to process payments quickly.

- Improved Record Keeping: Well-structured documents help businesses track payments, making it easier to monitor outstanding balances and forecast future cash flow needs.

- Minimized Delays: By specifying due dates and payment terms, businesses can reduce the chances of late payments, which often disrupt cash flow.

- Enhanced Client Trust: Using organized and transparent documents promotes trust with clients, which can lead to quicker and more reliable payments in the future.

- Better Cash Flow Forecasting: Consistent and timely payments improve the accuracy of financial forecasting, allowing businesses to plan and manage their finances more effectively.

Strategies for Maximizing Cash Flow

- Set Clear Payment Terms: Always specify payment deadlines, accepted methods, and late fees to make the terms unambiguous and encourage timely payments.

- Follow Up on Overdue Payments: Send reminders promptly when payments are overdue to prevent cash flow disruptions.

- Offer Multiple Payment Options: Make it easier for clients to pay by offering different payment methods, such as credit cards, bank transfers, or online payment platforms.

By adopting these practices and leveraging structured payment documents, businesses can effectively manage their cash flow and ensure that financial operations run smoothly. This not only improves overall business health but also supports growth and stability in the long run.

Legal Considerations for Invoice Requests

When creating and sending payment documents, it is essential to be aware of the legal implications involved. Ensuring that your payment requests are compliant with applicable laws can help avoid potential disputes, delays, or financial penalties. Properly structured documents not only protect your business but also establish clear terms between you and your clients.

Understanding the legal aspects of these documents is vital for ensuring they meet regulatory requirements and are enforceable in case of a dispute. Key elements, such as payment terms, tax obligations, and the inclusion of relevant details, play a significant role in making these documents legally binding. It is important to follow the appropriate legal practices to ensure the smooth and lawful operation of your transactions.

For example, including essential details such as your business name, registration number, and clear payment deadlines can protect your rights and provide your clients with the necessary information to process the payment correctly. Additionally, understanding the relevant tax laws and ensuring proper documentation is in place is crucial for compliance.

Best Practices for Organizing Requests

Effective management of payment documents is essential for maintaining smooth business operations. By keeping these requests well-organized, businesses can avoid confusion, reduce errors, and ensure timely processing. Proper organization not only streamlines communication but also supports accurate record-keeping and financial management.

Here are some best practices to consider when organizing your payment-related documents:

- Use Consistent Naming Conventions: Ensure that each document is named in a way that is easy to identify and reference. For example, using a combination of client name, transaction number, and date helps keep records organized and easily searchable.

- Maintain Clear and Detailed Records: Always ensure that the relevant details, such as item descriptions, prices, and payment terms, are clearly stated in each document. This helps avoid confusion and ensures that all parties are on the same page.

- Track Deadlines and Due Dates: Keep track of due dates for each request. Setting reminders for upcoming deadlines helps prevent delays in payment and ensures you stay on top of your financial obligations.

- Implement a Filing System: Organize documents into categories, such as “Paid,” “Pending,” and “Overdue.” This simple system helps you quickly locate documents and monitor payment statuses.

- Automate Where Possible: Use accounting or invoicing software to automate the creation, tracking, and management of these documents. Automation reduces the risk of human error and saves time.

- Regularly Review and Update Records: Set a regular schedule to review and update your financial records to ensure accuracy and completeness. Regular updates help maintain a clear view of outstanding payments and prevent issues with overdue balances.

By following these practices, businesses can better manage their financial transactions, improve cash flow, and reduce the potential for mistakes. An organized approach not only makes the process more efficient but also fosters stronger business relationships with clients and partners.

How to Automate Invoice Request Process

Automating the process of managing payment-related documents can significantly enhance efficiency, reduce errors, and streamline workflow. With the help of modern tools and software, businesses can eliminate manual entry, track payments automatically, and ensure timely billing without the need for constant oversight.

Here are the steps to successfully automate the payment request process:

1. Choose the Right Software

Select a software solution that integrates well with your existing business systems. Look for features that allow for automatic creation of documents, reminders, and tracking. Some software platforms also support integration with payment gateways, providing end-to-end automation.

2. Set Up Templates and Payment Terms

Most automation software allows users to create custom templates for payment documents. Set up templates with standard details such as payment terms, client information, and product or service descriptions. This reduces the need for repeated data entry and ensures consistency across all documents.

3. Implement Automated Reminders

Set automated reminders to notify clients about upcoming or overdue payments. This reduces the need for follow-up emails or phone calls, ensuring that reminders are sent at the right time and with consistent messaging.

4. Integrate with Payment Gateways

Integrating your document management system with online payment gateways allows clients to pay directly from the document. This speeds up the payment process and reduces delays.

5. Monitor and Adjust Processes

Regularly monitor the automated system to identify any issues or areas for improvement. Over time, you can adjust templates, reminders, and automation rules to better fit your business needs and improve efficiency.

By implementing automation, businesses can reduce manual workload, ensure consistent communication with clients, and accelerate cash flow management.

Design Tips for a Clear Request Form

Designing an effective payment-related document requires careful attention to both form and function. A well-structured document not only ensures clarity but also helps clients and vendors easily navigate the information. By focusing on layout, consistency, and readability

How to Handle Discrepancies in Requests

Occasionally, issues may arise between what has been provided and what is expected in a payment-related document. Whether it’s an error in the amounts, missing information, or incorrect terms, discrepancies can cause delays and confusion. Handling these inconsistencies effectively is key to maintaining good relationships and ensuring smooth operations.

Here are the steps to resolve discrepancies efficiently:

1. Review the Information Carefully

Before taking any action, carefully review the entire document. Ensure that all details, such as amounts, descriptions, and dates, are accurate. Mistakes can sometimes be simple clerical errors, which can be easily fixed upon a quick review.

2. Contact the Other Party Promptly

Once you identify a discrepancy, contact the other party promptly. Keep the communication professional and focused on resolving the issue. Ensure that you’re both on the same page regarding the incorrect information, and seek clarification where needed.

3. Provide Clear Documentation

When addressing the discrepancy, provide clear evidence or documents that support your case. This might include emails, receipts, or previous agreements. Being transparent about the issue will help the other party understand your perspective and facilitate a quicker resolution.

4. Offer a Fair Solution

Instead of focusing on the problem, focus on finding a fair and balanced solution. Offer a compromise or suggest adjustments to the document that work for both parties. Keep the conversation open and avoid placing blame.

5. Keep Records of All Communications

Document all correspondence related to the discrepancy, including emails, phone calls, or meetings. This will provide a record of the issue and its resolution, which can be helpful in case any future issues arise.

By addressing discrepancies quickly and professionally, you can ensure that the process remains smooth and that misunderstandings are kept to a minimum. This approach fosters trust and cooperation between all parties involved.

Frequently Asked Questions About Payment Documents

When dealing with payment-related documents, it’s common to encounter questions or uncertainties. Understanding the key aspects and procedures can help clarify these doubts. Here are some of the most frequently asked questions regarding these documents.

1. What information should be included in a payment document?

- Business name and contact details

- Details of the transaction, such as services rendered or goods provided

- Payment terms, including due dates and late fees

- Amount owed or requested

- Identification number or reference number for the transaction

2. How do I create a legally binding document?

To ensure a payment document is legally binding, it must include clear terms of service, a defined payment schedule, and must be agreed upon by both parties. Both sides should retain a copy of the signed document for future reference.

3. Can payment documents be amended after they’ve been issued?

Yes, changes can be made to payment documents, but both parties must agree to any amendments. These adjustments should be documented and confirmed in writing to avoid misunderstandings.

4. How do I handle disputes over a payment document?

- First, review the document thoroughly to identify any discrepancies.

- Contact the other party promptly and explain the issue professionally.

- Provide supporting documentation to clarify the misunderstanding.

- Seek a fair resolution, and keep records of all communications.

5. When is the best time to send a payment document?

It’s best to send a payment document as soon as the service is completed or goods are delivered, to ensure timely processing and avoid delays in payment. Clear and prompt communication helps facilitate a smoother transaction.

By addressing common questions, you can better navigate the process of creating, sending, and managing payment-related documents with confidence and clarity.